Gold World News Flash |

- Coutts adds gold as demand in China climbs

- Gold fix not manipulated – Norman

- Will China announce its new gold reserve position on April 24th?

- The dual income conundrum

- China gold demand seen falling 17% this quarter

- TF Metals Report: The latest bank participation report

- China Loan Creation Tumbles, Lowest Credit Growth In 20 Months

- Bill Holter: What would it really mean?

- Supply and Demand Report 9 Mar

- Gold Hedges Against Surge In Cost Of Bread, Eggs, Beer and Fuel

- 50 Years of U.S. Government Sponsored Terror — Mike Rivero

- Gold Set To Resume Its Long-Term Uptrend

- Gold Is Seasonal: When Is the Best Month to Buy?

- Economic Myth Busters – The Minimum Wage

- China's Demand to Buy Gold at Issue as Trade Deficit Shocks Analysts, Shanghai Trading Jumps

- China's Demand to Buy Gold at Issue as Trade Deficit Shocks Analysts, Shanghai Trading Jumps

- China's Demand to Buy Gold at Issue as Trade Deficit Shocks Analysts, Shanghai Trading Jumps

- Dr. Jim Willie – 80% Decline in Value of U.S. Dollar in Three Years

- Monday Morning Links

- SEC, CFTC said to probe whether forex rigging by banks distorted options

- Should Bitcoin Take The Place Of Gold In Your Retirement Portfolio?

- Gold price in a range of currencies since December 1978 XLS version

- Milton Friedman's Bitcoin Blunder

- Milton Friedman's Bitcoin Blunder

- Boom, Bust, Repeat: Junior Gold Miners

- Boom, Bust, Repeat: Junior Gold Miners

- U.S. Said to Have Grabbed Ukraines Gold Reserves

- Ukraine Gold Reserves Said To Be Put On Plane For Safekeeping in the US

- Ukraine Gold Reserves Said To Be Put On Plane For Safekeeping in the US

- WARNING -- Bonds Will be WORTHLESS in the Global Financial COLLAPSE

- Ukraine IMF False Flag

- Soft-touch FX regulation falls under harsh glare

- Koos Jansen: Chinese gold demand is 418 tonnes YTD but Western analysts are confused

- Bank of England to launch inquiry over forex fixing claims

- Gold, Commodities and Stock Trend Forecasts

- Gold And Silver Market Activity Will Always Trump News/Events/Fundamentals

- Economic Collapse News Brief

- The Rate Of This Worldwide Depression Will Only Get Worse

- Is this the End of the US$

- SHTF Top 5 Signs of ECONOMIC COLLAPSE - WARNING pay attention/they are happening now

- NEXT WEEK IN THE GOLD MARKET

- Gold Investors Weekly Review – March 7th

- The Ukraine Crisis & A Terrifying Global Economic Meltdown

- In The News Today

- Gold and silver dealer Tulving closes after complaints of delays

- Gold Stocks Bottom - What 10-Baggers (and 100-Baggers) Look Like

- Intensifying Currency War Investor Consequences

- Palladium Near Its Highest Level in Almost a Year

- Gold and Silver Market Activity Will Always Trump News and Fundamentals

- Selling Pressure on Gold Gone, Says Rick Rule

| Coutts adds gold as demand in China climbs Posted: 10 Mar 2014 09:07 AM PDT Coutts is adding gold for investors as rising wealth in China and increasing political risks including in Ukraine spur demand. | ||||||||||||||||||||||||||||||||||||||||

| Gold fix not manipulated – Norman Posted: 10 Mar 2014 09:07 AM PDT Sharps Pixley CEO, Ross Norman, cautions people not to fall for social stereotypes of chalk-striped English bankers all sitting cosily in an oak-panelled room. | ||||||||||||||||||||||||||||||||||||||||

| Will China announce its new gold reserve position on April 24th? Posted: 10 Mar 2014 09:07 AM PDT Five years ago, at this time, China released information that it had increased its reserves by 600 tonnes, says Julian Phillips. | ||||||||||||||||||||||||||||||||||||||||

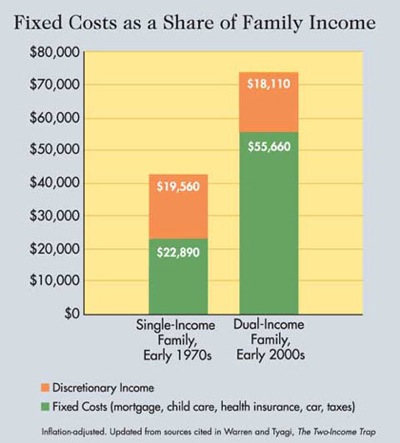

| Posted: 10 Mar 2014 09:00 AM PDT Americans need to work two jobs to make up for stagnant wages and the sinister impact of a middle class being eaten away by inflation. from MyBudget360.com:

In the United States the dual income household is the status quo. In the late 1960s dual income households were not common. Today however two income households are the majority largely because many Americans require two incomes just to stay afloat. This has been labeled as the "two income trap" and in many ways, it is more like the two income illusion. You would think that by adding two incomes you would be doubling your purchasing power but since the 1970s male wages have collapsed while more women entered the workforce. When household incomes combine these figures the collapse in income doesn't look so dramatic but it is. The added wage of another worker simply masks the impact inflation is having. It is a new reality for many families struggling to enter the middle class. Inflation has a powerful eroding impact on your purchasing power. If your income is stagnant and housing prices just went up by 10 percent that means more of your disposable income is going to be eaten up by this sector. If tuition is outpacing wage growth that means many people are going to finance higher education by going deep into debt. With the dual income household situation in the US, one plus one doesn't necessarily equal two. In many case the illusion is that one plus one equals one. | ||||||||||||||||||||||||||||||||||||||||

| China gold demand seen falling 17% this quarter Posted: 10 Mar 2014 08:52 AM PDT The China Gold Association reckons demand may decline 17% this quarter from a year earlier after a 2013 surge in purchases of bars and jewellery. | ||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: The latest bank participation report Posted: 10 Mar 2014 08:44 AM PDT 11:40a ET Monday, March 10, 2014 Dear Friend of GATA and Gold: The TF Metals Report's Turd Ferguson today examines the gold futures trading data for major banks going back to the prehistoric era and finds the most important development to have been JPMorganChase's switch from short to long in gold, even as most other investment houses remain short. Ferguson writes: "Clearly, the other 23 banks have a lot of ammo left to use to contain rallies. But the key to 2014 and beyond continues to be JPMorgan. What will they do with their net long position? Will they flip it back to net short? Will they stand for delivery? Will they [gasp] actually add to it on continued price strength? We'll see. The next few monthly bank participation reports will hold the clues." Ferguson's analysis is headlined "The Latest Bank Participation Report" and it's posted at the TF Metals Report here: http://www.tfmetalsreport.com/blog/5557/latest-bank-particiaption-report CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1 302 635 1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||

| China Loan Creation Tumbles, Lowest Credit Growth In 20 Months Posted: 10 Mar 2014 08:39 AM PDT One month ago, when we last looked at the incredible amount of Chinese new loan issuance, a topic which even the mainstream media is slowly starting to circle in on as the primary source of hot money flow creation in the world, we found the highest loan notional issued by the country's semi-sovereign banks since 2009, and the largest one-month ever monthly total in the largest aggregated, Total Social Financial, series, which rose by an unprecedented CNY2.6 trillion, or over $400 billion in one month! That was just before the tremors surrounding first the potential defaults of several Chinese shadow-banking Trusts, and certainly before the first official corporate bond default which took place last week. Overnight, the PBOC released its latest, February, loan data. As expected, it reveals something else entirely. In the month in which there were pervasive fears that China would let one or more Trusts go bankrupt (a fear which was unfounded as China did bail out two shadow trusts in February, only to finally allow a corporate bond default last week), loan creation ground if not to a halt, then certainly was significantly impacted, and its collapse may explain the abysmal February trade data as well, which far more than merely indicating calendar effects from the Chinese Lunar New Year, shows that something dramatically changed with the well-greased Chinese economic machine. That something was an abrupt drop in credit. To wit: Chinese banks made 644.5 billion yuan ($105.21 billion) worth of new yuan loans in February, lower than a forecast of 716 billion yuan and below the previous month's 1.3 trillion yuan, central bank data showed on Monday. Looking at the bigger picture, total social financing in February stood at 938.7 billion yuan, well below the previous month's 2.58 trillion yuan, and also well below expectations.

It gets worse: as SocGen calculates, Total social financing (TSF) recorded a gain of CNY 939bn in February. The sharp decline from the January level (CNY 2580bn) can be mostly attributed to seasonality but the TSF was also down yoy (1071bn last February), which dragged total credit growth down to a 20-month low of 17.1% yoy from 17.5% yoy, according to our estimate.

Breaking down the loan creation by various components, va SocGen: Yuan loans increased notably less than expected by CNY 645bn (Cons. 730bn, SG 750bn). Although it was still 25bn more yoy, growth of outstanding loans inched down to 14.2% yoy from 14.3% yoy. However, once again, non-bank credit saw a much bigger slowdown. Entrusted loans increased CNY 80bn, CNY 63bn less yoy and the lowest in 20 months. Probably due to easier interbank liquidity conditions lately, the net increase in bond financing was up to CNY 99.5bn from the very depressed levels in the past two months. However, the first bond default that occurred on 7 March will likely reverse this nascent improvement trend. New trust loans had a sharp fall of CNY 104bn from January to CNY 78bn, the second smallest monthly increase since mid-2012. Reportedly, formal banks have started to distance themselves from the trust sector by scaling back trust product distribution to banks' clients. It may also be the beginning of investors adjusting for the long over-due first defaults of trust products. Whichever the case, the near-term prospect for trust financing is not beautiful. This latest money and credit report again supports our view that credit growth is still sliding and will likely remain so in the near term. In H2 2013, the credit slowdown was mostly responding to higher interbank rates, as intended by the PBoC. From here onwards, the downward pressure will come from follow-up regulatory tightening of the Document 107 issued by the State Council in January and, more critically, from financial market participants' adjustments to fast rising default risk. Such adjustments are necessary for China in the long run to develop a healthy financial market, but are nothing if not risky in the short term. We think that the policymakers will run more default experiments, but at the same time stand ready to intervene so as to avoid a systemic financial crisis. Our central scenario remains that there will be disruptions but not a meltdown, but the risk is tilting to the downside.

Finally, the French bank's conclusion is hardly welcome for China bulls:

That's ok, all of the above, too, is priced into the USDJPY algos. | ||||||||||||||||||||||||||||||||||||||||

| Bill Holter: What would it really mean? Posted: 10 Mar 2014 08:28 AM PDT 11:25a ET Monday, March 10, 2014 Dear Friend of GATA and Gold: What would it really mean if it was ever acknowledged that gold and silver prices have been manipulated -- that is, suppressed -- for years? That's the question posted today by Bill Holter, analyst for GATA Chairman Bill Murphy's LeMetropoleCafe.com and bullion dealer Miles Franklin. Holter answers the question: It would mean that every other asset is overvalued. Holter's commentary is headlined "What Would It Really Mean?" and it's posted at the Miles Franklin Internet site here: http://blog.milesfranklin.com/what-would-it-really-mean CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... | ||||||||||||||||||||||||||||||||||||||||

| Supply and Demand Report 9 Mar Posted: 10 Mar 2014 08:16 AM PDT by Keith Weiner

Gold went up and silver went down this week. It's natural for most people to say, "gold went up", but it's the most unnatural phenomenon. The dollar is paper scrip issued by the Fed. The fine print tells you that it's irredeemable, which is like a promise to give you a kilo of sugar that will never be honored. The quantity of this paper is rising while its quality is falling. Everyone knows that its value is unstable, and over long periods of time its value falls alarmingly. And yet we still presume to use this paper to measure the value of gold! Amazing. Anyways, in comparison to the undefined unit known as the dollar—which we don't know if it moved up or down or sideways—gold moved up. Gold went up by fourteen pieces of paper, engraved with the picture of George Washington. Silver—by the moving and nonobjective reference point of copper clad zinc coins stamped with the image of Abraham Lincoln—moved even more. Silver went down, and now it can be bought with a stack of those copper colored slugs that's 26 shorter than last week. We could as well say that silver went down by an inch and a half, because a stack of 26 pennies is about that tall. Wouldn't it make more sense to say that the dollar went down by about a quarter of a milligram of gold? Here is the graph of the metals' prices. The Prices of Gold and Silver We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can't tell them whether the globe, on net, hoarding or dishoarding. One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic. Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil. With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here. Here is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio rose 1.44 points—2.3%. In other words, silver fell by about 11mg of gold. The Ratio of the Gold Price to the Silver Price The data has been showing for a long time that, while supply and demand in gold is slightly tight, it's loose in silver. Speculators are stretching the silver price higher by several dollars. When will they let go and let it snap back down to neutral, or even overshoot? It's hard to say, but the world seems to be in a credit contraction mode right now. There are ongoing declines in many currencies. Forget the Ukrainian hryvnia, Venezuelan bolivar, and Argentenian peso. It's also happening in the Brazilian real, Russian ruble, Indian rupee, and perhaps beginning in the Chinese yuan (and in many others too). We will get to the point where people are desperate to get gold and silver and dump paper. That buying frenzy—and accompanying collapse of almost everything else—is still ahead of us. In the meantime, we appear now to be firmly in a period of squeezing the debtors. The whole point of using leverage to buy gold or silver futures is speculation. The speculators are trying to front-run the real buyers of the metals—the people who buy to take it home, and not sell regardless of price. It may be due to the pressures of credit contraction. Or it's possible that silver demand is falling relative to gold because it has a substantial non-monetary (i.e. industrial) use and gold is almost purely monetary. Either way, the demand for silver metal, relative to the demand for gold metal, is quite a bit lower than it was a few years ago. The current silver price under $21 only partially reflects this fact. For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red. Here is the gold graph. The Gold Basis and Cobasis and the Dollar Price The cobasis went sideways while the dollar fell (i.e. the price of gold rose). This suggests buyers of real metal, not speculators, led the price action this week. The neutral price of gold went up another twenty-five bucks, to around $1470. Now let's look at silver. The Silver Basis and Cobasis and the Dollar Price Silver's pattern still hasn't really changed. We see a rise in the dollar price as measured in silver (i.e. a drop in the silver price as measured in dollars). And with this price move, we see the cobasis rise a bit. Silver futures were sold. The cobasis is still quite negative.

© 2014 Monetary Metals | ||||||||||||||||||||||||||||||||||||||||

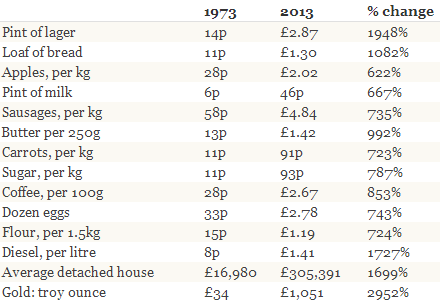

| Gold Hedges Against Surge In Cost Of Bread, Eggs, Beer and Fuel Posted: 10 Mar 2014 08:14 AM PDT Today's AM fix was USD 1,334.25, EUR 961.55 and GBP 800.87 per ounce. Gold fell $11.30 or 0.82% on Friday, to $1,339.20/oz. Silver dropped $0.65 or 2.2% at $20.89/oz. For the week, gold's positive momentum continued and gold eked out slight gains of 1.3%. Inflation history table: How the price of everyday items changed over 40 years - (Lloyds Private Banking via Daily Telegraph) Gold retreated in all currencies for a second day after U.S. jobs data was slightly better than expected. Bullion for immediate delivery fell 0.4 % to $1,336.00 in London. Gold sold off sharply on Friday after the data and was down $25 in minutes in concentrated selling. The sell off was unusual as the data did not merit such a sharp, sudden sell off especially given that the fundamentals, including the geopolitical situation, remain highly supportive.

Gold in US Dollars (Bloomberg) Prices posted a fifth weekly gain last week, climbing to a four-month high of $1,354.87 on March 3, as tension between Ukraine and Russia escalated. This has led to an increase in safe haven demand which has contributed to gold's 10% gains so far in 2014. Platinum lost $3.20, or 0.2%, to $1,483.60 an ounce, ending around 2.5% higher for the week, while palladium rose 65 cents, or 0.1%, to $781.80 an ounce, up roughly 5% for the week. Russia is among the world's biggest producers of platinum and palladium. Its conflict with Ukraine and tensions with the U.S. is leading to worries about supplies of the precious metals. Gold Hedges Against Massive Inflation In Bread, Beer, Eggs, Fuel and Property

Gold in British Pounds - 2000 to March 10 2013 (Bloomberg) The value of the pound has shrunk so rapidly over the last 40 years that a pound in 1973 is worth the equivalent of just nine pence today, the study by Lloyds Bank Private Banking has found. The study found £9.48 in 1973 would have the same spending power as £100 today. The rising cost of retail goods means someone who was a millionaire 40 years ago would need £10,553,000 today to enjoy the same spending power, according to Lloyds Bank, which analysed data from the Office for National Statistics. Everyday staples that we eat and consume now cost a huge amount more due to the massive 91% depreciation of the pound in the last 40 years. - Beer surged by more than 20.5 times in cost. A pint of a beer has shot up by 1,948% from 14p to £2.87 per pint. - Bread and the cost of a loaf of bread costs a whopping 12 times more - up 1,082% from 11p to £1.30. - Milk costs nearly 8 times more. A pint of milk went up 667% from 6p to 46p. - Coffee in its instant form (per 100g) cost nearly 10 times more from 28p to £2.67. - Apples cost 7 fold more. From 28p per kilo to £2.02 per kilo for a rise of 622%. - Sausages cost 8 times more. A kilo of sausages went from 58p to £4.84 or 735%. - Butter costs nearly 11 times more. A 250 gramme slab of butter went from 13p to $1.42 or 992%. - Carrots cost 8 times more. A kilo bag of carrots now costs 91p, up from 11p or a rise of 723%. - Sugar costs nearly 9 times more. A kilo bag of sugar now costs 93p, up from 11p - up 787%. - Eggs costs 8 times more. A dozen eggs now cost £2.78, up from 33p or a rise of 743%. - Flour costs 8 times more. A 1.5kg bag of flour went from 15p to £1.19 or a rise of 724%. - Petrol or diesel costs nearly 18 times more. A litre of diesel went from 8p to £1.41 or 1,727%. - Residential property costs 18 times more. The price of the average detached house went from £16,980 to £305,391. The family home now costs 1,699% more. Soaring inflation in recent months has put pressure on cash strapped households. However, the recent surge in inflation is less than that seen between 1973 and 1983, which saw the biggest rise in the cost of day-to-day items, at an annual average rate of a whopping 13.6%. The lowest increase in inflation came during the period 1993 to 2003, with an annual increase of 2.6%, according to official data. In the past ten years to 2013, inflation averaged 3.3% per year, with the highest levels coming post recession from 2008 and on. If retail prices were to rise by 2.8% annually – in line with government targets – the value of money would decline by a further 67% over the next 40 years. If inflation follows this pattern, consumers would need £311 in 2053 to have the same spending power as an individual with £100 today – or more than £3 million to enjoy the equivalent lifestyle of a millionaire today. Lloyds based the calculation on estimates that a 2.8% rise in Retail Prices Index (RPI) inflation would be consistent with the government's 2% target for Consumer Price Inflation. Conclusion Little attention or coverage was given to the fact that gold has risen in value by more than beer, bread, apples, milk, sausages, butter, carrots, sugar, coffee, eggs, flour, diesel and even the beloved residential property in the form of the average detached house. Therefore, gold had acted as a store of value and hedge against currency depreciation and inflation in the UK in the last 40 years, as it has done throughout recorded history. On the back of the study, banking giants Lloyds warned that in 40 years, an individual would need £3 million to enjoy the same lifestyle as a millionaire today. Alternatively, millionaires could allocate a portion of their hard earned cash to gold to hedge against inflation. Investors and savers would be prudent to do the same. Investing and saving are about protecting and growing one's wealth in the long term. The recent poor performance of gold has garnered much attention and negative comment. Gold's long term and historical performance as an important hedge against inflation continues to be unappreciated … for now. Our latest report, 'Gold Is Safe Haven According To Academic and Independent Research' looks at the academic and independent research on gold as a safe haven asset and hedge against inflation in more detail and can be read here. | ||||||||||||||||||||||||||||||||||||||||

| 50 Years of U.S. Government Sponsored Terror — Mike Rivero Posted: 10 Mar 2014 08:02 AM PDT

Friends, we are pleased to bring you this in-depth discussion with Republic Broadcasting radio show host Mike Rivero, the founder of WhatReallyHappened.com. As a 20-year veteran of the truth movement and a pioneer in alternative news media, Mike gives us his expert perspective on 50 years of government sponsored terror, the Western-backed Kiev Snipers, the very real Russian threat to destroy the dollar, and the radioactive nightmare in Fukushima. Thanks for tuning in. | ||||||||||||||||||||||||||||||||||||||||

| Gold Set To Resume Its Long-Term Uptrend Posted: 10 Mar 2014 08:01 AM PDT Headlines drove the gold price through multiple up and down cycles last week, first from geopolitical concerns in Ukraine and then from U.S. economic data, but the metal ended higher for the fifth straight week after notching a four-month high over $1,350 an ounce. A weaker U.S. dollar has played a [...] | ||||||||||||||||||||||||||||||||||||||||

| Gold Is Seasonal: When Is the Best Month to Buy? Posted: 10 Mar 2014 07:24 AM PDT Dear Reader, I’m just back from this year’s PDAC conference in Toronto, the biggest conference in the mineral exploration industry. The short version of what I found was that while smaller than last year’s conference, there was a great deal of positive energy present, driven, I’m sure, by the resurgence of the resource sector thus far this year. The key takeaway is that this was a deal-making event. Companies that have made discoveries but are low on cash were out in force, looking for alternatives to keep going. I expect to see a great deal more mergers and acquisitions activity going forward, in some cases bringing possibilities for us to profit. Meanwhile, Jeff Clark covers a more pressing opportunity, especially for those new to investing in gold. More soon, Louis James

Gold Is Seasonal: When Is the Best Month to Buy?Jeff Clark, Senior Precious Metals Analyst Many investors, especially those new to precious metals, don't know that gold is seasonal. For a variety of reasons, notably including the wedding season in India, the price of gold fluctuates in fairly consistent ways over the course of the year. This pattern is borne out by decades of data, and hence has obvious implications for gold investors. Can you guess which is the best month for buying gold? When I first entertained this question, I guessed June, thinking it would be a summer month when the price would be at its weakest. Finding I was wrong, I immediately guessed July. Wrong again, I was sure it would be August. Nope. Cutting to the chase, here are gold’s average monthly gain and loss figures, based on almost 40 years of data: Since 1975—the first year gold ownership in the US was made legal again—March has been, on average, the worst-performing month for gold. This, of course, makes March the best month for buying gold. But: averages across such long time frames can mask all sorts of variations in the overall pattern. For instance, the price of gold behaves differently in bull markets, bear markets, flat markets… and manias. So I took a look at the monthly averages during each of those market conditions. Here’s what I found. Key point: The only month gold has been down in every market condition is March. Combined with the fact that gold soared 10.2% the first two months of this year, the odds favor a pullback this month. And as above, that can be a very good thing. Here’s what buying in March has meant to past investors. We measured how well gold performed by December in each period if you bought during the weak month of March. Only the bear market from 1981 to 2000 provided a negligible (but still positive) return by year’s end for investors who bought in March. All other periods put gold holders nicely in the black by New Year’s Eve. If you’re currently bullish on precious metals, you might want to consider what the data say gold bought this month will be worth by year’s end. Regardless of whether gold follows the monthly trend in March, the point is to buy during the next downdraft, whenever it occurs, for maximum profit. And keep your eye on the big picture: gold’s fundamentals signal the price has a long climb yet ahead. Everyone should own gold bullion as a hedge against inflation and other economic maladjustments… and gold stocks for speculation and leveraged gains. The greatest gains, of course, come from the most volatile stocks on earth, the junior mining sector. Following our recent Upturn Millionaires video event with eight top resource experts and investment pros, my colleague Louis James released his 10-Bagger List for 2014—a timely special report on the nine stocks most likely to gain 1,000% or more this year. Click here to find out more. | ||||||||||||||||||||||||||||||||||||||||

| Economic Myth Busters – The Minimum Wage Posted: 10 Mar 2014 07:00 AM PDT by Andy Sutton, Silver Phoenix 500:

I am continually amazed, especially when I step outside the world of economics and finance, how LITTLE people really understand what is going on. It's all about paradigms and where your comfort zone is. At any rate, we're here to smash paradigms and hopefully encourage some critical thought in the process. | ||||||||||||||||||||||||||||||||||||||||

| China's Demand to Buy Gold at Issue as Trade Deficit Shocks Analysts, Shanghai Trading Jumps Posted: 10 Mar 2014 06:24 AM PDT BUY GOLD bids in London helped the price recover an early 0.9% fall Monday morning, rallying above last Friday's PM Fix of $1335 – the highest Friday close in 23 weeks – as China and other Asian stock markets closed sharply lower. New data at the weekend showed China's trade surplus plunging from above $31 billion in January to a deficit of $23bn last month on an 18% drop in exports. "The scale of the decline was truly surprising," says a note from French bank BNP Paribas. "It reawakens fears of a Chinese slowdown." February marked China's first trade deficit since March 2012. "I think some emerging economies may be submerging soon," said Swiss money manager and Hong Kong resident Marc Faber in an interview last week. "The question arises, 'Will they continue to buy gold? If the Chinese economy imploded, it is likely that the currency, the Yuan, would begin to weaken, or the government would devalue. "I think that Chinese investors would shift some of their money into gold rather than keep their funds in the local currency." The China Gold Association, in contrast, sees domestic demand to buy gold falling this quarter compared to the record level of January-March 2013, according to Bloomberg. Forecasting a 17% drop by weight, "Last year was a peculiar year when we saw a big fall in prices," says Zhang Yongtao, vice-chair of the producers, refiners, wholesalers and retailers body in the world's No.1 gold mining and consumer nation. "People bought a lot of gold, and I think demand will start climbing again once the festive and marriage season begin later this year." Trading in Shanghai's most active spot gold contract today jumped to a 6-month high by value, equal to more than 50 tonnes by weight, as the Yuan dropped on the currency markets back towards last week's new 6-month lows to the Dollar. Shanghai's local price to buy gold, typically quoted at a premium to the international guide of London settlement, held at a discount of $3.20 per ounce. "Orderly default is possible," says analysis of China's credit market from Barclays Capital, "and would be a good first step for reform in our view." Last week's default by Shanghai Chaori Solar Energy Science & Technology Co. – the first non-payment on a regulated bond since the People's Bank took over two decades ago – will see the company raise cash by selling foreign assets, press reports say. Having $14 million of interest payments, "Potential buyers aren't determined yet," says vice-president Liu Tielong. But valued at some $165m in total, solar plants being offered for sale in Greece, Bulgaria and Italy "are worth more than enough to cover the bond interest." | ||||||||||||||||||||||||||||||||||||||||

| China's Demand to Buy Gold at Issue as Trade Deficit Shocks Analysts, Shanghai Trading Jumps Posted: 10 Mar 2014 06:24 AM PDT BUY GOLD bids in London helped the price recover an early 0.9% fall Monday morning, rallying above last Friday's PM Fix of $1335 – the highest Friday close in 23 weeks – as China and other Asian stock markets closed sharply lower. New data at the weekend showed China's trade surplus plunging from above $31 billion in January to a deficit of $23bn last month on an 18% drop in exports. "The scale of the decline was truly surprising," says a note from French bank BNP Paribas. "It reawakens fears of a Chinese slowdown." February marked China's first trade deficit since March 2012. "I think some emerging economies may be submerging soon," said Swiss money manager and Hong Kong resident Marc Faber in an interview last week. "The question arises, 'Will they continue to buy gold? If the Chinese economy imploded, it is likely that the currency, the Yuan, would begin to weaken, or the government would devalue. "I think that Chinese investors would shift some of their money into gold rather than keep their funds in the local currency." The China Gold Association, in contrast, sees domestic demand to buy gold falling this quarter compared to the record level of January-March 2013, according to Bloomberg. Forecasting a 17% drop by weight, "Last year was a peculiar year when we saw a big fall in prices," says Zhang Yongtao, vice-chair of the producers, refiners, wholesalers and retailers body in the world's No.1 gold mining and consumer nation. "People bought a lot of gold, and I think demand will start climbing again once the festive and marriage season begin later this year." Trading in Shanghai's most active spot gold contract today jumped to a 6-month high by value, equal to more than 50 tonnes by weight, as the Yuan dropped on the currency markets back towards last week's new 6-month lows to the Dollar. Shanghai's local price to buy gold, typically quoted at a premium to the international guide of London settlement, held at a discount of $3.20 per ounce. "Orderly default is possible," says analysis of China's credit market from Barclays Capital, "and would be a good first step for reform in our view." Last week's default by Shanghai Chaori Solar Energy Science & Technology Co. – the first non-payment on a regulated bond since the People's Bank took over two decades ago – will see the company raise cash by selling foreign assets, press reports say. Having $14 million of interest payments, "Potential buyers aren't determined yet," says vice-president Liu Tielong. But valued at some $165m in total, solar plants being offered for sale in Greece, Bulgaria and Italy "are worth more than enough to cover the bond interest." | ||||||||||||||||||||||||||||||||||||||||

| China's Demand to Buy Gold at Issue as Trade Deficit Shocks Analysts, Shanghai Trading Jumps Posted: 10 Mar 2014 06:24 AM PDT BUY GOLD bids in London helped the price recover an early 0.9% fall Monday morning, rallying above last Friday's PM Fix of $1335 – the highest Friday close in 23 weeks – as China and other Asian stock markets closed sharply lower. New data at the weekend showed China's trade surplus plunging from above $31 billion in January to a deficit of $23bn last month on an 18% drop in exports. "The scale of the decline was truly surprising," says a note from French bank BNP Paribas. "It reawakens fears of a Chinese slowdown." February marked China's first trade deficit since March 2012. "I think some emerging economies may be submerging soon," said Swiss money manager and Hong Kong resident Marc Faber in an interview last week. "The question arises, 'Will they continue to buy gold? If the Chinese economy imploded, it is likely that the currency, the Yuan, would begin to weaken, or the government would devalue. "I think that Chinese investors would shift some of their money into gold rather than keep their funds in the local currency." The China Gold Association, in contrast, sees domestic demand to buy gold falling this quarter compared to the record level of January-March 2013, according to Bloomberg. Forecasting a 17% drop by weight, "Last year was a peculiar year when we saw a big fall in prices," says Zhang Yongtao, vice-chair of the producers, refiners, wholesalers and retailers body in the world's No.1 gold mining and consumer nation. "People bought a lot of gold, and I think demand will start climbing again once the festive and marriage season begin later this year." Trading in Shanghai's most active spot gold contract today jumped to a 6-month high by value, equal to more than 50 tonnes by weight, as the Yuan dropped on the currency markets back towards last week's new 6-month lows to the Dollar. Shanghai's local price to buy gold, typically quoted at a premium to the international guide of London settlement, held at a discount of $3.20 per ounce. "Orderly default is possible," says analysis of China's credit market from Barclays Capital, "and would be a good first step for reform in our view." Last week's default by Shanghai Chaori Solar Energy Science & Technology Co. – the first non-payment on a regulated bond since the People's Bank took over two decades ago – will see the company raise cash by selling foreign assets, press reports say. Having $14 million of interest payments, "Potential buyers aren't determined yet," says vice-president Liu Tielong. But valued at some $165m in total, solar plants being offered for sale in Greece, Bulgaria and Italy "are worth more than enough to cover the bond interest." | ||||||||||||||||||||||||||||||||||||||||

| Dr. Jim Willie – 80% Decline in Value of U.S. Dollar in Three Years Posted: 10 Mar 2014 06:00 AM PDT from USA Watchdog: Newsletter writer Dr. Jim Willie thinks the Ukraine crisis is an enormous struggle for financial power between East and West. Dr. Willie contends, "I believe what we got with Ukraine is an absolutely desperate situation where the U.S. government realizes we have to stop Ukraine from becoming a central transit point for energy pipelines in the fast developing Eurasian Trade Zone. They need to stop the Eurasian Trade Zone because the United States and England are largely going to be excluded. If you look behind the curtain to see what is really going on, I believe this is the third attack on Russia's Gazprom. It is a giant monopoly that Russia controls for natural gas. The first attack was veiled and it was Cyprus. Gazprom bank was gigantic and it was in Cyprus. . . . Furthermore, Russia was using Cyprus as a clearing house for buying gold bullion. . . . The second attack against Gazprom was Syria. Iran pipelines were to be connected with Syrian ports. . . . There is a war in the way. That's what the U.S. does. There is a war in the way. Now, we have the third attack against Russia Gazprom. The U.S. and Europe actually believe if they control the gas pipeline valves, they can control the flow on the Western corner (of Ukraine) that feeds Romania, Poland and Hungary. They actually believe if they control the valves, they can control the flow. What if the flow is cut off?" Dr. Willie, who has an earned PhD in statistics, thinks the manufactured Ukraine crisis is an act of desperation by the U.S. Dr. Willie explains, "Have you ever know someone truly desperate, who has no options, that did stupid things? That's what we are seeing now." | ||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Mar 2014 05:59 AM PDT MUST READS Klarman warns of asset price bubble – FT Copper plunges on Chinese company default – SBS Chinese Firm’s Bond Default May Not Be the Last – WSJ Disappointing China exports hammer stocks, commodities – Reuters Whistling Past The Graveyard After China’s Bond Default – Washington Post Merkel raps Putin as Russian forces tighten grip on Crimea – Reuters Ukraine Gold [...] | ||||||||||||||||||||||||||||||||||||||||

| SEC, CFTC said to probe whether forex rigging by banks distorted options Posted: 10 Mar 2014 05:35 AM PDT By Keri Geiger and Silla Brush The U.S. Securities and Exchange Commission is investigating whether currency traders at the world's biggest banks distorted prices for options and exchange-traded funds by rigging benchmark foreign-exchange rates, according to two people with knowledge of the matter. The SEC's inquiry adds to European and U.S. regulatory probes of possible manipulation in currency markets. The SEC's investigation is in the early stages, said the people, who asked not to be named because the matter isn't public. The Commodity Futures Trading Commission, which regulates foreign-exchange derivatives, is also investigating possible manipulation, another person said. ... ... For the full story: http://www.bloomberg.com/news/2014-03-10/sec-said-to-probe-whether-forex... ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||||||||||||||||||||||||||||||||||||||

| Should Bitcoin Take The Place Of Gold In Your Retirement Portfolio? Posted: 10 Mar 2014 05:25 AM PDT The issue of how to diversify your retirement portfolio is one that you need to take seriously. Once upon a time, gold IRA rollover was the hotcake. At present, Bitcoin is being touted to offer a safe haven. The argument is that Bitcoin is here to replace gold, as there have been a few occasions when the prices of both moved counter to each other. In here, we'll check if you should consider choosing Bitcoin over gold in your retirement portfolio. Relationships between gold and Bitcoin We can safely classify the relationship between gold and Bitcoin into two categories. I call the first a sentimental relationship. This deals with the fact that the price of gold has been moving counter to the price of Bitcoin over the past few months. To solidify this relationship, as gold gradually rose to the $1,300 level, Bitcoin was crashing slowly. With this, investors are beginning to expect Bitcoin to rally if gold plunges again. However, this particular relationship between gold and Bitcoin is artificial. Investors who withdrew their capital from gold in search of another "safe haven asset" are its originator. With time, this sentiment will die down. The second relationship between these two is economy-related. One of the reasons why people turned to precious metals like gold was to maintain financial privacy, as the government is always after taking this away from the citizens. According to financial advisor Kirk Elliott, Ph.D., "Gold frustrates the attempts of governments to completely control the finances and lives of their citizens." In the same vein, with the availability of anonymous wallets, Bitcoin also offers financial privacy. With relationships between gold and Bitcoin already established, let's consider the investment case for Bitcoin. Bitcoin's Investment Case The first and, arguably, the most attractive thing about Bitcoin is its limited supply, which it has in common with gold. The production of Bitcoins is limited to 21 million units, of which more than half have already been produced. That there is a maximum number of Bitcoins that can exist means that it can be more valuable than many currencies. At least, there won't be central banks to print more of it to tweak the economy. This could mean that in time when the US dollar is not doing fine, Bitcoin could help preserve the value of your savings. However, you should note that Bitcoin is just a digital currency, and not a legal tender. Another investment case for Bitcoin is that it is a good alternative in this period of stock market uncertainties. A stock market maxim has it that, "as goes January, so goes the rest of the year." Therefore, with the bad start that has befallen the stock market, it is possible that 2014 won't be great for stocks. As such, investors might want to look for means to safeguard their capital. Gold's performance over the last 12 months doesn't make it look like a safe haven – at least for the now. This brings about the idea of investing in Bitcoin. And in truth, if the stock market struggles this year, many people might consider Bitcoin. This will lead to an increase in demand of the limited e-currency. In the end, Bitcoin could perform greatly this year. But being a Foolish reader, you have to check if Bitcoin can be relied upon over the long-term. I don't think so. Bitcoin cannot take the place of Gold In the movie Head Of State, one of the guys in power said, "We're the government – we can do anything". One thing you need to know is that government is government – it can actually do whatever it wants and Bitcoin is no exception. Of a truth, the super-high financial privacy that comes with this e-currency would foster criminal activities. The CEO of Circle Internet Financial, Jeremy Allaire said at a senate hearing last year: Criminals and terrorists will seek to employ digital currency if it remains unregulated, leaving Bitcoin operators to operate without stringent controls and effective systems to verify identities, monitor transactions and report suspicious activity. Therefore, with time, the government would find a way to regulate this e-currency, which would make Bitcoin no different than the dollar. When this time comes, the Fed (and other central banks) would dictate the value of Bitcoin. However, if, in the end, governments cannot find a way to take charge of Bitcoin, they can resort to pronouncing it illegal, especially if a high amount of criminal transactions is taking place. By contrast, gold doesn't present this treat, since the government is able to regulate it. And with gold being a hard asset, it is still more reliable than Bitcoin. Gold will come good on the long term Gold has been rallying recently. Its price has risen for twelve straight days, rising above the $1,300 mark. However, we'll have to wait until the stock market stabilizes properly before we can say it has overcome its downtrend. An expert, Jeffrey Sica, founder and CIO of Sica Wealth Management, explained to Forbes last November that gold will have a hard time gaining any traction in 2014 unless the S&P start to fall. Therefore, that this has already happened and gold has responded positively to it makes one doubt that the metal has actually recovered. However, the long-term case for gold is still very positive. First, gold has been around for so long (and used widely) that it can't start being invaluable now. According to a King Bill's The King Report, since gold was stopped being pegged to world currencies in 1967, gold has outperformed the Dow – an index that feature gold miners like Goldcorp (NYSE: GG), Barrick Gold (NYSE: ABX) and Newmont Mining (NYSE: NEM – by over a 100%.).The point is if gold has performed so well over such a long period, it can still perform really well in future. In addition, I'd like to point out here that what makes gold valuable in the real world is its demand for jewelries and technology. As long as these demands don't die – something that doesn't seem possible – gold will always be valuable. You might want to say that the Fed's balance sheet controls the price of gold, which has been the case over the last five to six years. However, the Fed hasn't always controlled gold and it will certainly not control it forever. Some factors have controlled the price of the metal in the past, some are doing it at present (the Fed), and others will control it in future. Therefore, regardless of the factors that control gold, nothing can be taken away from the real-life value if this metal. Bottom Line Having established above that the long-term future of Bitcoin is uncertain and that, as such, it can't take the place of gold, it's advisable for retirement investors to steer clear of this digital-currency. As many analysts like to look at the matter, 2014 could actually be a Bitcoin year. However, 2014 is short-term, which is not enough for your retirement account. Even if gold still carry its poor performance from last year into this year – which is also short-term – history has proven to us that gold will come good with time. On a final note, you should always bear in mind that rally (Bitcoin) is temporary, while value (gold) is permanent. About the author: Craig Adeyanju is passionate about writing about financial topics and investing. He has been a contributor on sites like Fool.com and SeekingAlpha.com. His goal is to provide real world retirement investing opportunities for baby boomers and early retirees. You can connect with him on Twitter and Google plus. | ||||||||||||||||||||||||||||||||||||||||

| Gold price in a range of currencies since December 1978 XLS version Posted: 10 Mar 2014 04:02 AM PDT Excel file of gold price charts and data - Updated weekly in 19 curriences: US dollar, Euro, Japanese yen, Pound sterling, Canadian dollar, Swiss franc, Indian rupee, Chinese renmimbi, Turkish lira, Saudi riyal, Indonesian rupiah, UAE dirham, Thai baht, Vietnamese dong, Egyptian pound, Korean won, Russian ruble, South African rand, Australian dollar | ||||||||||||||||||||||||||||||||||||||||

| Milton Friedman's Bitcoin Blunder Posted: 10 Mar 2014 03:21 AM PDT A little trading sardine proposal for the US Dollar's base supply... BITCOIN, as I have said, is a junk currency, writes Nathan Lewis at NewWorldEconomics in this article, first posted at Forbes. But, it has gained a lot of attention, and has prompted people to think about these monetary issues. Thus, it serves as a good teaching tool. "Never before has the world seen a startup currency," claims bitcoin.org. Can you believe anyone could be so ignorant? Japan alone had over 1,600 independent currencies in 1850, most of them issued by private parties. The supply of bitcoins in the world, or what we call "base money", is a fixed number that grows a little each year. What about the demand? The demand naturally varies for all sorts of reasons, including pure speculation. The intersection of supply and demand produces the market value of Bitcoin, just as it does for anything else including vintage Superman comic books or muscle cars from the 1970s. If nobody "demanded" bitcoins, in other words if nobody had an interest in owning one, then they would have no value. I could draw a happy face on a piece of paper, and offer it for sale. The supply is one! It is unique. However, nobody wants my happyface drawing. So, the value is nil. Van Gogh made only one of his famous painting Starry Night. It is not much different than my happyface drawing, just some images on paper. Maybe my two-year-old would even prefer the one Dad made. During his lifetime, Van Gogh only sold one painting, the Red Vineyard at Arles. The demand for his paintings was about the same as the demand for my happyface drawing. But, today, there is a lot of demand for Starry Night, whose selling price might be over $50 million at auction today. So, we have a painting that was worthless at the start, and is now worth a ton of money. The supply is still the same. But, the demand has changed. It's a lot like Bitcoin. Before Bitcoin, there was another guy who proposed a currency whose supply grew at a slow, stable rate per year, perhaps around 4%. The guy's name was Milton Friedman. The currency would have been the US Dollar. Friedman even proposed a Constitutional Amendment basically forcing this condition upon the American public. He wrote about it in books like A Program for Monetary Stability (1960) and Free to Choose (1980). In A Program for Monetary Stability, Friedman proposed this wording:

The term "obligations of the government in the form of currency or book entries" clearly refers to base money, not "M2″ which is mostly bank deposits. Bank deposits are liabilities of banks, not the government (or Federal Reserve). What would have been the result? The result would have been a lot like Bitcoin. Extreme volatility – because, although supply grows in a slow and predictable fashion, demand can vary for all number of reasons, on a day-to-day basis. I'll let you decide for yourself if that degree of volatility would have been a good thing. Bitcoin is an entertaining little trading sardine, which might have within it some templates for use in the creation of a much better currency unit. But, to propose this for the US Dollar? And make it a Constitutional Amendment? Ha ha. Ha ha ha. Friedman was a dope. It's funny that decades have gone by, and practically nobody has figured this out. He said some nice things about Libertarian principles in general, which gained him some support. But, in terms of monetary understanding, he wasn't much better than the people now claiming Bitcoin is the future. Are you ready to move beyond this? I hope some of you are. | ||||||||||||||||||||||||||||||||||||||||

| Milton Friedman's Bitcoin Blunder Posted: 10 Mar 2014 03:21 AM PDT A little trading sardine proposal for the US Dollar's base supply... BITCOIN, as I have said, is a junk currency, writes Nathan Lewis at NewWorldEconomics in this article, first posted at Forbes. But, it has gained a lot of attention, and has prompted people to think about these monetary issues. Thus, it serves as a good teaching tool. "Never before has the world seen a startup currency," claims bitcoin.org. Can you believe anyone could be so ignorant? Japan alone had over 1,600 independent currencies in 1850, most of them issued by private parties. The supply of bitcoins in the world, or what we call "base money", is a fixed number that grows a little each year. What about the demand? The demand naturally varies for all sorts of reasons, including pure speculation. The intersection of supply and demand produces the market value of Bitcoin, just as it does for anything else including vintage Superman comic books or muscle cars from the 1970s. If nobody "demanded" bitcoins, in other words if nobody had an interest in owning one, then they would have no value. I could draw a happy face on a piece of paper, and offer it for sale. The supply is one! It is unique. However, nobody wants my happyface drawing. So, the value is nil. Van Gogh made only one of his famous painting Starry Night. It is not much different than my happyface drawing, just some images on paper. Maybe my two-year-old would even prefer the one Dad made. During his lifetime, Van Gogh only sold one painting, the Red Vineyard at Arles. The demand for his paintings was about the same as the demand for my happyface drawing. But, today, there is a lot of demand for Starry Night, whose selling price might be over $50 million at auction today. So, we have a painting that was worthless at the start, and is now worth a ton of money. The supply is still the same. But, the demand has changed. It's a lot like Bitcoin. Before Bitcoin, there was another guy who proposed a currency whose supply grew at a slow, stable rate per year, perhaps around 4%. The guy's name was Milton Friedman. The currency would have been the US Dollar. Friedman even proposed a Constitutional Amendment basically forcing this condition upon the American public. He wrote about it in books like A Program for Monetary Stability (1960) and Free to Choose (1980). In A Program for Monetary Stability, Friedman proposed this wording:

The term "obligations of the government in the form of currency or book entries" clearly refers to base money, not "M2″ which is mostly bank deposits. Bank deposits are liabilities of banks, not the government (or Federal Reserve). What would have been the result? The result would have been a lot like Bitcoin. Extreme volatility – because, although supply grows in a slow and predictable fashion, demand can vary for all number of reasons, on a day-to-day basis. I'll let you decide for yourself if that degree of volatility would have been a good thing. Bitcoin is an entertaining little trading sardine, which might have within it some templates for use in the creation of a much better currency unit. But, to propose this for the US Dollar? And make it a Constitutional Amendment? Ha ha. Ha ha ha. Friedman was a dope. It's funny that decades have gone by, and practically nobody has figured this out. He said some nice things about Libertarian principles in general, which gained him some support. But, in terms of monetary understanding, he wasn't much better than the people now claiming Bitcoin is the future. Are you ready to move beyond this? I hope some of you are. | ||||||||||||||||||||||||||||||||||||||||

| Boom, Bust, Repeat: Junior Gold Miners Posted: 10 Mar 2014 02:49 AM PDT Junior gold miner stocks fell 85% in 2011-13. Apparently they can also go up... NOW that it appears the bottom is in for gold prices, it's time to stop fretting about how low prices will drop and how long the correction will last – and start looking at how high they'll go and when they'll get there, reckons Jeff Clark at mining-stock advisory Casey Research. When viewing the gold market from a historical perspective, one thing that's clear is that the junior mining stocks tend to fluctuate between extreme boom and bust cycles. As a group, they'll double in price, then crash by 75%...then double or triple or even quadruple again, only to crash 90%. Boom, bust, repeat. Given that we just completed a major bust cycle – and not just any bust cycle, but one of the harshest on record, according to many veteran insiders – the setup for a major rally in gold miner stocks is right in front of us. This may sound sensationalistic, but based on past historical patterns and where we think gold prices are headed, the odds are high that, on average, gold producers will trade in the $200 per share range before the next cycle is over. With most of them currently trading between $20 and $40, the returns could be stupendous. And the percentage returns of the typical junior will be greater by an order of magnitude, providing life-changing gains to smart investors. What you're about to see are historical returns of both producers and juniors during three separate boom cycles. These are factual returns; they are not hypothetical. And if you accept the fact that this market moves in cycles, you know it's about to happen again. Gold had a spectacular climb in 1979-1980, and gold stocks in general gave a staggering performance at that time – many of them becoming 10-baggers (1,000% gains and more). While this is a well-known fact, few researchers have bothered to identify exact returns from specific companies during this era. Digging up hard data from before the mid-1980s, especially for the junior explorers, is difficult because the information wasn't computerized at the time. So I sent my nephew Grant to the library to view the Wall Street Journal on microfiche. We also include information we've had from Scott Hunter of Haywood Securities; Larry Page, then-president of the Manex Resource Group; and the dusty archives at the Northern Miner. Note: This means our tables, while accurate, are not at all comprehensive. The Quintessential Bull Market: 1979-1980 The granddaddy of gold bull cycles occurred during the 1970s, culminating in an unabashed mania in 1979 and 1980. Gold peaked at $850 an ounce on January 21, 1980, a rise of 276% from the beginning of 1979. (Yes, the price of gold on the last trading day of 1978 was a mere $226 an ounce.) Here's a sampling of gold producer stock prices from this era. What you'll notice in addition to the amazing returns is that gold stocks didn't peak until nine months after gold did.  Today, GDX is selling for $26.05 (as of February 26, 2014); if it mimicked the average 289.5% return, the price would reach $101.46. Keep in mind, though, that our data measures the exact top of each company's price. Most investors, of course, don't sell at the very peak. If we were to able to grab, say, 80% of the climb, that's still a return of 231.6%. Here's a sampling of how some successful junior gold mining stocks performed in the same period, along with the month each of them peaked.  If you had bought a reasonably diversified portfolio of top-performing gold mining juniors prior to 1979, your initial investment could have grown 23 times in just two years. If you had managed to grab 80% of that move, your gains would still have been over 1,850%. This means a junior priced at $0.50 today that captured the average gain from this boom would sell for $12 at the top, or $9.75 at 80%. If you own ten juniors, imagine just one of them matching Copper Lake's better than 100-bagger performance. Here's what returns of this magnitude could mean to you. Let's say your portfolio includes $10,000 in gold juniors that yield spectacular gains such as the above. If the next boom cycle matches the 1979-1980 pattern, your portfolio could be worth $241,370 at its peak...or about $195,000 if you exit at 80% of the top prices. Note that this does require that you sell to realize your profits. If you don't take the money and run at some point, you may end up with little more than tears to fill an empty beer mug. In the subsequent bust cycle, many junior gold stocks, including some in the above list, dried up and blew away. Investors who held on to the bitter end not only saw all their gains evaporate, but lost their entire investments. You have to play the cycle. Returns from that era have been written about before, so I can hear some investors saying, "Yeah, but that only happened once." Au contraire... The Hemlo Rally of 1981-1983 Many investors don't know that there have been several bull cycles in gold and gold stocks since the 1979-1980 period. Ironically, gold was flat during the two years of the Hemlo rally. But something else ignited a bull market.Discovery. Here's how it happened... Back in the day, most exploration was done by teams from the major producers. But because of lagging gold prices and the resulting need to cut overhead, they began to slash their exploration budgets, unleashing a swarm of experienced geologists armed with the knowledge of high-potential mineral targets they'd explored while working for the majors. Many formed their own companies and went after these targets. This led to a series of spectacular discoveries, the first of which occurred in mid-1982, when Golden Sceptre and Goliath Gold discovered the Golden Giant deposit in the Hemlo area of eastern Canada. Gold prices rallied that summer, setting off a mini bull market that lasted until the following May. The public got involved, and the results were impressive for such a short period of time. Gold producers, on average, returned over 70% on investors' money during this period. While these aren't the same spectacular gains from just a few years earlier, keep in mind they occurred over only about 12 months' time. This would be akin to a $20 gold stock soaring to $34.50 by this time next year, just because it's located in a significant discovery area. Once again, it was the juniors that brought the dazzling returns. The average return for these junior gold stocks that had a direct interest in the Hemlo area exceeded a whopping 4,000%. This is especially impressive when you realize that it occurred without the gold stock industry as a whole participating. This tells us that a big discovery can lead to enormous gains, even if the industry as a whole is flat. In other words, we have historical precedence that humongous returns are possible without a mania, by owning stocks with direct exposure to a discovery area. There are numerous examples of this in the past ten years, as any longtime reader of the International Speculator can attest. By May 1983, roughly a year after it started, gold prices started back down again, spelling the end of that cycle – another reminder that one must sell to realize a profit. The Roaring '90s By the time the '90s rolled around, many junior exploration companies had acquired the "intellectual capital" they needed from the majors. Another series of gold discoveries in the mid-1990s set off one of the most stunning bull markets in the current generation. Companies with big discoveries included Diamet, Diamond Fields, and Arequipa. This was also the time of the famous Bre-X scandal, a company that appeared to have made a stupendous discovery, but that was later found to have been "salting" its drill data (cheating). By the summer of '96, these discoveries had sparked another bull cycle, and companies with little more than a few drill holes were selling for $20 a share. The average producer more than tripled investors' money during this period. Once again, these gains occurred in a relatively short period of time, in this case inside of two years. And if you're the kind of investor with the courage to buy low and the discipline to sell during a frenzy, it can be worth a million Dollars via the junior gold mining market.  Many analysts refer to the 1970s bull market as the granddaddy of them all – and to a certain extent it was – but you'll notice that the average return of these stocks during the late '90s bull exceeds what the juniors did in the 1979-1980 boom. This is akin to that $0.50 junior stock today reaching $19.86...or $16, if you snag 80% of the move. A $10,000 portfolio with similar returns would grow to over $397,000 (or over $319,000 on 80%). Gold Stocks and Depression Those of you in the deflation camp may dismiss all this because you're convinced the Great Deflation is ahead. Fair enough. But you'd be wrong to assume gold stocks can't do well in that environment. The two largest producers in the US and Canada, Homestake and Dome, returned 475% and 558% respectively between 1929 and 1933, the depth of the Great Depression and a period that saw significant price deflation. During a period of soup lines, crashing stock markets, and a fixed gold price, large gold producers handed investors five and six times their money in four years. If deflation "wins," we still think gold equity investors can, too. History shows that precious metals stocks move in cycles. We've now completed a major bust cycle and, we believe, are on the cusp of a tremendous boom. The only way to make the kind of money outlined above is to buy before the boom is in full swing. That's now. For most readers, this is literally a once-in-a-lifetime opportunity. As you can see above, there can be great variation among the returns of the companies. That's why, even if you believe we're destined for an "all-boats-rise" scenario, you still want to own the better companies. My colleague Louis James, Casey's chief metals and mining investment strategist, has identified the nine junior mining stocks he believes are most likely to become 10-baggers this year in their special report, the 10-Bagger List for 2014. | ||||||||||||||||||||||||||||||||||||||||