Gold World News Flash |

- War On Gold Heats Up As Global Markets Continue To Plunge

- S&P lowers gold price assumption to $1,250/oz

- Bargain Bin Shopping in the Gold Market

- Japanese Stocks In Freefall - TOPIX Plunges Almost 5% To 4-Month Lows; Nikkei Down 15% In 2014

- Gold Sector in January: Most Hated Sector, Best Performer

- International Silver IRA / Gold IRA

- Silver’s Rally Could Mean Another 1,000% Run

- Economic Collapse 2014 -- The Economy Is Now Showing Signs Of Collapsing

- Spanish Suicides Rise To Eight-Year High

- The Taliban Is Tapped-Out

- Citi Fears The Emerging Market Volatility "May Just Be The Beginning"

- Perth Mint and U.S. Mint See Higher January Gold Sales

- You Can Buy A House For One Dollar Or Less In Economically Depressed Cities All Over America

- The Gold Price Shot Up $20.30 or 1.6 Percent to $1,260.40

- The Gold Price Shot Up $20.30 or 1.6 Percent to $1,260.40

- Don't pretend that the gold market is anything but central banking's most desperate project

- Embry - Global Markets Are Now Subject To Total Collapse

- What Wll Happen In Coming Collapse? How Will Governments Try to Fix Things?

- Gold Daily and Silver Weekly Charts - Baby It's Cold Outside

- Gold Daily and Silver Weekly Charts - Baby It's Cold Outside

- Jesse Ventura, Matthew Mills -- The Alex Jones Show - Monday, February 03, 2014 (Full Show)

- Gold Bottom "Been & Gone"

- Gold Bottom "Been & Gone"

- A Speculator's Dream in Junior Gold

- A Speculator's Dream in Junior Gold

- Celente - No Way Out As Global Ponzi Scheme Collapse Begins

- Jim’s Mailbox

- S&P and Gold: Extremes and Reversals

- 5 Signs Confirming It Is Time to Buy Gold

- Nu Yu’s Market SectorTA Weekly Update – 2nd Feb, 2014The Broad Stock Market is at a Critical Point

- Central bankers clueless, Embry says; Jansen finds China's master plan for gold

- The Keynesian Multiplier – Does it Exist?

- 3 Boring Billion-Dollar Ideas

- Could Gold Surprise Investors in 2014?

- Channeling Kurt Richebacher…

- ECONOMIC COLLAPSE 2014 -- Fiat Currency Printing, Inflation, Deflation, Gold Manipulation

- Embry - Global Markets Are Now Subject To Total Collapse

- Economic Collapse 2014 -- Current Economic Collapse News Brief

- Bargain Bin Shopping in the Gold Market

- War On Gold Heats Up As Global Markets Continue To Plunge

- Silver Moneys Historic Problem

- China Goes On Vacation, Gold Rally Stalls

- Now Is the Time to Buy Gold

- Gold Prices Edge Higher as Nikkei Drops 10% for 2014, Safe-Haven Demand "Lacks Follow Through"

- Gold price in a range of currencies since December 1978 XLS version

- Economic Collapse 2014 -- Bankers STEAL From Greece, Gain Billions!

- Fractional reserve bullion banking and gold bank runs - the setup

- Extent of Management ‘Skin in the Game’ & ‘Smart Money’ Involvement In Junior Miners Is CRUCIAL! Here’s Why

- Economic Collapse 2014 -- Rob Kirby: The Economy is Not in Recovery but Financial War

- Randgold eyes acquisitions and higher gold production

| War On Gold Heats Up As Global Markets Continue To Plunge Posted: 03 Feb 2014 10:30 PM PST from KingWorldNews:

Prior to the beginning of QE1, the historic correlation between the balance sheet of the Federal Reserve and the S&P 500 Index was 20%. Since 2009, this correlation has increased to 86%. The expansion of the money supply thus has had a bigger effect on the stock market than the trend of corporate profits. This relationship has been acknowledged by the Federal Reserve who argued in a study that, absent intervention by the central bank, the S&P 500 would be 50% lower. | ||||||||||||||||||||||||||||||||||||||||

| S&P lowers gold price assumption to $1,250/oz Posted: 03 Feb 2014 09:40 PM PST by Dorothy Kosich, MineWeb.com:

"By contrast, we are not changing our assumptions for copper, nickel or iron ore," said S&P analysts. "We expect favorable prices for copper and iron ore to persist over our forecast period, but our flat-to lower long-term assumptions incorporate the risk of incremental capacity over the next 18-24 months." "Nickel, for its part, continues to suffer from oversupply over our forecast horizon, as do aluminum and zinc, but prices could get a lift over the next several years as potential supply reductions from marginal producers and the uncertain effects of Indonesian export restrictions affect inventories," they suggested. | ||||||||||||||||||||||||||||||||||||||||

| Bargain Bin Shopping in the Gold Market Posted: 03 Feb 2014 09:00 PM PST by Byron King, Daily Reckoning.com:

What's a good, productive, working gold mine worth? Is the market valuing these kind of things "right"? Now's the time to take a look… | ||||||||||||||||||||||||||||||||||||||||

| Japanese Stocks In Freefall - TOPIX Plunges Almost 5% To 4-Month Lows; Nikkei Down 15% In 2014 Posted: 03 Feb 2014 08:46 PM PST UPDATE: USDJPY has re-tumbled back below 101.00, recoupling with S&P 500 futures from the tried-and-failed attempt to ramp stocks overnight. It seems the short-JPY-driven carry traders have backed away from risk for now, no matter how much the BoJ primes the pump. Nikkei futures are under 14,000 and down 15% from Dec 31st highs.

Despite the hope-driven exuberance exhibited immediately post the Abe/Kuroda show, the USDJPY-pumping stock-momentum fest has ended - abruptly. Japan's Nikkei 225 has lost all its gains and is now trading below US day-session lows (3-month lows) but it is the broader TOPIX index (more akin to the S&P 500) that is collapsing. Down almost 5% on the day (its biggest drop since the May collapse), the TOPIX is at 4-month lows. The TOPIX Real Estate index just hit a bear-market - down 20% from Dec 31st highs. Japanese sell-side shops are in full panic desparation mode as "suggestions" that a sub-14,000 Nikkei will prompt an acceleration of Japan's QQE money-printing idiocy. This is getting ugly fast. TOPIX collapses to 4-month lows... As Bloomberg notes, the sell-side is in full panic mode...

But this won't help as the ramp in USDJPY is not helping...

and The TOPIX Real Estate Index is in Bear market territory - down 20% from Dec 31st highs... and 6 month lows...

Charts: Bloomberg | ||||||||||||||||||||||||||||||||||||||||

| Gold Sector in January: Most Hated Sector, Best Performer Posted: 03 Feb 2014 08:40 PM PST by Pater Tenebrarum, Acting-Man.com:

Zerohedge recently published a year-to-date performance chart of different market sectors. The gold juniors ETF GDXJ tops the list with a rally of roughly 13% this year. The Nasdaq Biotech Index is in second place, closely followed by the XAU (Philadelphia Gold & Silver Index) in third place. Only ten out of 54 sectors have exhibited a positive performance so far this year. However, this credible performance has failed to impress mainstream observers, possibly because gold itself hasn’t done all that much so far (although it is at the time of writing still up about $65 from its late December low). It is still not possible to find any gold bulls in the mainstream financial press. A smattering of headlines from late last week: | ||||||||||||||||||||||||||||||||||||||||

| International Silver IRA / Gold IRA Posted: 03 Feb 2014 07:53 PM PST Goldsilver | ||||||||||||||||||||||||||||||||||||||||

| Silver’s Rally Could Mean Another 1,000% Run Posted: 03 Feb 2014 07:40 PM PST by Peter Krauth, SilverBearCafe.com:

The precious metal started out the year at $31, and ended at $19.50, continuing an overall slump dating back roughly to mid-2011. That, however, obscures a massive run, like gold, that silver embarked on in 2001 when it was near $4, eventually topping out around $49 in April 2011. At its peak it generated a return of 1,091%. Heading into 2014, I’ve pinpointed a number of key drivers – some often missed – that say silver may be poised for another spectacular run… | ||||||||||||||||||||||||||||||||||||||||

| Economic Collapse 2014 -- The Economy Is Now Showing Signs Of Collapsing Posted: 03 Feb 2014 07:08 PM PST The Greek government needs the third bailout and it looks like they will get it Auto sales are in and they have declined in the month of January. Global manufacturing is down and the DOW slid 326 points today. The first month of 2014 the DOW has slid over 1000 points.The US postal service is... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||

| Spanish Suicides Rise To Eight-Year High Posted: 03 Feb 2014 06:43 PM PST Europe has an odd definition of recovery: we already knew that in Greece "recovery" means record high unemployment, an entire generation unable to find work, the return of neo-nazism, no ink with which to print tax forms, and even instances where people infect themselves with HIV to get medical benefits. That, and of course, soaring suicides. Now it is Spain's turn. While the Iberian nation is furiously scrambling to catch up to Greece in terms of sheer economic collapse, even if the government has changed the definition of GDP so many times, somehow Spain dares to look people in the eye and claim its GDP is growing with 26% total, and 54% youth unemployment, one statistic Spain can't change is that the suicide rate has soared and is now the highest in eight years. The Local reports, using figures from Spain's National Institute of Statistics that in the most recent data from 2012, released on Friday, 402,950 people died in Spain, some 15,039 (3.9 percent) more than in 2011. Of these deaths, there were 3539 suicides (2,724 men and 815 women), up 11.3 percent from the year before, a rate of 7.6 per 100,000 inhabitants. The figures were the highest since 2005. According to official broadcaster RTVE, suicide was second only to cancer (15 percent of deaths) in the overall 25-34 age group, but the leading cause of death in young men (17.8 percent). Fatalities as a result of traffic accidents fell by 9.5 percent, to 1,915 - that's probably because so few young men and women can afford to buy a car. Or gas. Or both. Finally in tangential news, a 21 percent spike in the death rate in February and March compared with the previous year was attributed to a late-breaking flu epidemic. The same period saw deaths as a result of respiratory failure rise 53.6 percent year-on-year. So the next time you hear about the PIIGS much trumpeted "recovery" (which now is finished even before it started courtesy of the sharp relapse of the global economy courtesy of EMs, and in the case of Greece, quite literally based on the latest growth forecasts), think: | ||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Feb 2014 06:11 PM PST Afghanistan's insurgents have endured hard times before, but nothing quite like this. At first glance the war might seem to be turning in their favor. Hundreds of Taliban foot soldiers - the heart and soul of the armed struggle against the U.S.-backed Kabul government - are running out of food, money and ammunition. As Vocative reports, their plight is unlikely to improve anytime soon - people familiar with the Taliban's finances say the organization's main sources of revenue have dried up. Wealthy Arab donors, Afghan businessmen and even Pakistan's powerful and secretive spy agency have all reduced or stopped funding, each for their own reasons.

Yaseen needed to requisition supplies and ammunition for the fighting season ahead.

Nevertheless, Mullah Yaseen and hundreds of Taliban foot soldiers like him—the heart and soul of the armed struggle against the U.S.-backed Kabul government—are running out of food, money and ammunition.

As the financial crisis continues, Afghan civilians say they aren't merely disappointed with the Taliban—they're fed up.

The group isn't totally destitute...

Death is fine - but dying with a debt!! not acceptable...

| ||||||||||||||||||||||||||||||||||||||||

| Citi Fears The Emerging Market Volatility "May Just Be The Beginning" Posted: 03 Feb 2014 05:35 PM PST Via Citi FX Technicals, Up the escalator, down the elevator shaft

We can’t help but feel that the current pressure being felt in Local Market currencies and equity indices may only be starting. As we pointed out yesterday (and re-printed here), the backdrop over the last decade is very similar to that seen from 1989-1998 when:

The carry trade and capital flow into emerging markets (Asia in particular) is center stage:

History may not repeat…..but it sure RHYMES In the years since the Financial Crisis, major Central Banks have been engaged in incredible easing programs that included the injection of massive amounts of liquidity into the financial system. That liquidity had to go somewhere, and in a search for yield, much of it went indiscriminately into Local Markets. The announcement by the Fed in May 2013 that it would be looking to reduce its bond buying program was the first indication by a major Central Bank that the period of free money/excess liquidity was going to start winding down. The immediate reaction was panic and volatility across all “risk” assets, with Local Market currencies and equities being especially vulnerable. Soon after, though, markets began to adjust to the reality that this was the beginning of the end of the “Bernanke/Yellen put” (at least for now) and since then we have seen Local Markets come under pressure. So far, the exodus of money from Local Markets has been “tame” compared to previous EM crises and it has also been selective since countries with weaker economies and foreign reserves have been the ones taking the largest hits. However, our bias is that this is just the beginning. We have only begun to see “volatile” price action and the charts in the following pages show just how far some of these Local Market currencies and equities can go. In focus for now is LatAm and select CEEMEA countries as they have come under the most pressure. However, the bigger danger over the next few months/years is that the markets begin to ‘throw out the baby with the bathwater” and Local Market investors begin to exit through the same small door.

Though Asia Local Markets have been rather calm in comparison to other regions, we still think caution should be maintained The ADXY Index is testing very good support at 115, the 55 month moving average, and a close below there on a monthly basis would be bearish. If seen, it would also be the first close below the 55 month moving average since 2008. There is good support closely below there around 113.58-113.68, the 2012 and 2013 lows which also serve as the 76.4% retracement pivots of the 2011-2012 decline A break below there would further suggest even larger losses are likely, potentially towards the 200 month moving average which is currently at 106.75 (there is support before there at 108.77, the 2010 low,that would be worth keeping an eye on). It is important to note that 49% of the Index is made up by CNY and HKD. As we are not currently of the bias that these currencies would see significant (if any) depreciation even if the EM sell-off were to become more aggressive in Asia (as a reminder, during the major ADXY collapse in 2008, USDCNY and USDHKD remained essentially unchanged) As a result, if we were to see a continued bearish development in the ADXY, it would suggest the other currencies in the Index (INR, IDR, KRW, MYR, PHP, SGD, TWD and THB) would see greater weakness then the overall weakness. We will be watching for any developments closely... | ||||||||||||||||||||||||||||||||||||||||

| Perth Mint and U.S. Mint See Higher January Gold Sales Posted: 03 Feb 2014 05:02 PM PST Today's AM fix was USD 1,246.50, EUR 922.58 and GBP 762.39 per ounce. Gold rose $1.90 or 0.15% Friday to $1,244.90/oz. Silver fell $0.04 or Gold is marginally lower in all major currencies today except

Gold rose 3.2% in January, its first monthly advance in five, as Australia's Perth Mint, which refines most of the bullion from the Sales of gold coins by the U.S. Mint rose 63% in January to the Part of the reason for the surge in demand is due to dealers Find out why Singapore is now one of the safest places in the world to store gold in our latest gold guide - Essential Guide To Storing Gold In Singapore | ||||||||||||||||||||||||||||||||||||||||

| You Can Buy A House For One Dollar Or Less In Economically Depressed Cities All Over America Posted: 03 Feb 2014 04:57 PM PST Submitted by Michael Snyder of The Economic Collapse blog, Would you like to buy a house for one dollar? If someone came up to you on the street and asked you that question, you would probably respond by saying that it sounds too good to be true. But this is actually happening in economically-depressed cities all over America. Of course there are a number of reasons why you might want to think twice before buying any of these homes, and I will get into those reasons in just a little bit. First, however, it is worth noting that many of the cities where these "free houses" are available were once some of the most prosperous cities in the entire country. In fact, the city of Detroit once had the highest per capita income in the entire nation. But as millions of good jobs have been shipped overseas, these once prosperous communities have degenerated into rotting, decaying hellholes. Now homes that once housed thriving middle class families cannot even be given away. This is happening all over America, and what we are witnessing right now is only just the beginning. The photo that I have posted below was sent to me by a reader just the other day. It is a photo of a house in Yakima, Washington that is apparently being given away for free. At one time it was probably quite a lovely home, but now nobody seems to want it... This piqued my curiosity, so I started doing some research and I discovered that homes all over the nation are being sold off for a dollar or less. The following are just a few examples... -Buffalo, New York: "The Urban Homestead Program that is offered by the City of Buffalo enables qualified buyers to purchase a home that has been deemed 'homestead eligible' for $1.00 and there are plenty of properties left. There are three main requirements when purchasing a homestead property; the owner must fix all code violations within 18 months, have immediate access to at least $5000, and live there for at least three years. You also have to cover the closing costs of the purchase." -Gary, Indiana: "Officials say that a third of the houses in Gary are unoccupied, hollowed dwellings spread across a city that, like other former industrial powerhouses, has lost more than half its population in the last half-century. While some of those homes will be demolished, Gary is exploring a more affordable way to lift its haggard tax base and reduce the excess of empty structures: sell them for $1." -South Bend, Indiana: "How could you refuse this offer? The city of South Bend, Indiana wants to give this handsome circa-1851 Italianate farmhouse away to anyone willing to properly restore it. Aside from the boarded up windows (the boards are painted to look like real windows), the place is in pretty good shape, with a completely restored exterior, new roof, and all new HVAC, plumbing and electrical systems. All you'll need to do is restore the gutted (but clean as can be) interior." -Detroit, Michigan: "Now that the motor city has effectively run out of gas and declared bankruptcy, some rather eye-popping deals are presenting themselves to first time home buyers who appreciate the challenge of a fixer-upper. Hundreds of Detroit homes currently listed on Zillow have asking prices below $5,000, with at least one seller so desperate as to offer his house for just $1, ABC News reported." ----- And guess who is selling more "one dollar homes" than anyone else? If you guessed "the federal government" you would be correct. Right now, the federal government is selling foreclosed homes to low income families all over the country for just one dollar...

Before you get too excited, there are a whole bunch of reasons why you wouldn't want to actually buy any of these one dollar homes. First of all, most of them have been totally trashed. Just to get them up to livable condition would take thousands of dollars in most cases. Many of them are full of asbestos, and severe wiring and plumbing issues are quite common. Secondly, you assume all of the liability for a home when you buy it. So if a homeless person stumbles in and injures himself, you could be liable for his injuries. Thirdly, many of these homes are in very high crime neighborhoods. In some of these areas, people will literally rip up and carry away anything that is not bolted down. Fourthly, property taxes are very high in many of these cities. Local governments are desperate to get people into these homes so that they can get the taxes flowing again. In many cases, what you would pay in taxes for a year is more than the true value of the home itself. So, like I said, these homes are not the "great deal" that they may appear to be at first glance. But that is not really the issue. The real question is this: What is causing our communities to decay so dramatically? And of course a big part of the answer is that the middle class in America is dying. According to Time Magazine, one new report has discovered that nearly half the country is constantly living in a state of "persistent economic insecurity"...

That same report also found that 56 percent of all Americans now have "subprime credit". We are a nation that is losing our independence and sinking into poverty. Right now, 49.2 percent of all Americans are receiving benefits from at least one government program, and the U.S. government has spent an astounding 3.7 trillion dollars on welfare programs over the past five years. Millions of our jobs have been shipped overseas, the control freak bureaucrats that are running things are absolutely killing "the little guy", and poverty in the United States is exploding at a frightening pace. Things are "changing" in this country, and not for the better. One way that the death of the middle class is manifesting itself is in the death of shopping malls all over America. The following is an excerpt from a recent Business Insider article...

According to that same article, one prominent retail analyst believes that we could see up to 50 percent of the shopping malls in America close within 20 years...

And did you catch that last part? Only the shopping malls in wealthy areas will survive because the wealthy will be the only ones with enough money to support them. For much more on this phenomenon, please see my previous article entitled "What Recovery? Sears And J.C. Penney Are DYING". At this point, things have already gotten so bad that now even Wal-Mart is having trouble. In fact, Wal-Mart is blaming the recent slowdown in sales on cuts to the federal food stamp program...

This is how far the middle class in America has fallen. So many people are now on food stamps that even a slight reduction in benefits has a huge impact on the largest retailer in the entire country. And actually, many rural communities could end up losing their Wal-Mart stores in the years ahead as the economy continues to deteriorate. In a recent CNBC article entitled "Time to close Wal-Mart stores? Analysts think so", it was suggested that Wal-Mart should close about 100 "underperforming" supercenters in rural locations around the nation. We are rapidly becoming "two Americas". In the "good America", the wealthy will still have plenty of retail stores to choose from within easy driving distance from their million dollar homes. In the "bad America", which will include most of us, our shopping malls will be closing down and the rotting, decaying homes of our neighbors will be sold off for next to nothing. So which America do you live in? | ||||||||||||||||||||||||||||||||||||||||

| The Gold Price Shot Up $20.30 or 1.6 Percent to $1,260.40 Posted: 03 Feb 2014 04:21 PM PST Gold Price Close Today : 1260.40 Change : 20.30 or 1.64% Silver Price Close Today : 19.389 Change : 0.284 or 1.49% Gold Silver Ratio Today : 65.006 Change : 0.096 or 0.15% Silver Gold Ratio Today : 0.01538 Change : -0.000023 or -0.15% Platinum Price Close Today : 1385.00 Change : 10.90 or 0.79% Palladium Price Close Today : 702.50 Change : -0.50 or -0.07% S&P 500 : 1,741.89 Change : -11.60 or -0.66% Dow In GOLD$ : $252.13 Change : $ -6.62 or -2.56% Dow in GOLD oz : 12.197 Change : -0.320 or -2.56% Dow in SILVER oz : 792.86 Change : -19.62 or -2.42% Dow Industrial : 15,372.80 Change : -149.76 or -0.96% US Dollar Index : 81.140 Change : -0.240 or -0.29% Whoa. Stocks got whupped today with a big knobbly stick. Silver and GOLD PRICES reversed. My, my. The GOLD PRICE shot up $20.30 to $1,260.4, higher by 1.6%. Silver gained 28.4 cents (1.5%) to 1938.9 cents. But look closer. Friday gold made a tiny reversal by closing slightly higher than Thursday. Today it defended about the same low, then rocketed to the downtrend line and closed near there, above all its moving averages except the 200 DMA. That last is now at $1,317.29, and slowly turning up, a good sign, plus this two day upward tergiversation. Gold prices have now thrice beat on the door of this downtrend line, and today's reversal begs the conclusion that it will pierce that line tomorrow or the next day. Twould be extremely bad taste if it didn't, not to mention weak. Ought to run up at least $100 or so. The SILVER PRICE hath bounced off that support line left by December lows, and like gold, strengthened on Friday and closed higher today. All that said, silver remains below its 20 and 50 DMAs (now 1982c and 1977c). Must cross them, but more strategically, 2050c. All indicators pointing toward the sun today. To escape the shadow of one last possible plunge to a new low, gold needs to close above this downtrend line from April and the resistance at $1,267.50, then jump higher to $1,361.80, the October high. How high could this rally carry gold? If the height of what I take to be an upside down head and shoulders reversal (Nov - Jan) measures the gain, then it should run at least to that $1,361.80 October high. But first, confirmation by puncturing that downtrend line and support at $1,267.50. Dow fell 326.05 (2.08%) to 15,372.80, below the 200 DMA (15,469.68). S&P500 lost 2.28% (40.7) to 1741.89. Too early to judge whether the January top was the ultimate -- another may come later in the year -- but for now stocks are headed firmly down, perhaps to 14,760-14,720, the September and October lows. A genuine waterfall today. Today's stock weakness and metals strength drew the Dow measured in metals down. Dow in gold sank 3.06% to 12.23 oz (G$252.82 gold dollars) and drew nearer the 200 dma (11.79 oz or G$243.72). It falleth ever nigher its long term downtrend line. Dow in silver dropped 2.66% to 796.52 oz, well below the 816.54 50 DMA but still way above the 200 DMA (731.61). Rolling over, over, over. US Dollar index fell today 24 basis points (0.3%) to 81.14, but like a pouty child still refuses to confirm any rally. Yen rose 1.04% to 99.04 and certainly is rallying. Euro at 1.3525 still looks sick as a snake-bit cur. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||

| The Gold Price Shot Up $20.30 or 1.6 Percent to $1,260.40 Posted: 03 Feb 2014 04:21 PM PST Gold Price Close Today : 1260.40 Change : 20.30 or 1.64% Silver Price Close Today : 19.389 Change : 0.284 or 1.49% Gold Silver Ratio Today : 65.006 Change : 0.096 or 0.15% Silver Gold Ratio Today : 0.01538 Change : -0.000023 or -0.15% Platinum Price Close Today : 1385.00 Change : 10.90 or 0.79% Palladium Price Close Today : 702.50 Change : -0.50 or -0.07% S&P 500 : 1,741.89 Change : -11.60 or -0.66% Dow In GOLD$ : $252.13 Change : $ -6.62 or -2.56% Dow in GOLD oz : 12.197 Change : -0.320 or -2.56% Dow in SILVER oz : 792.86 Change : -19.62 or -2.42% Dow Industrial : 15,372.80 Change : -149.76 or -0.96% US Dollar Index : 81.140 Change : -0.240 or -0.29% Whoa. Stocks got whupped today with a big knobbly stick. Silver and GOLD PRICES reversed. My, my. The GOLD PRICE shot up $20.30 to $1,260.4, higher by 1.6%. Silver gained 28.4 cents (1.5%) to 1938.9 cents. But look closer. Friday gold made a tiny reversal by closing slightly higher than Thursday. Today it defended about the same low, then rocketed to the downtrend line and closed near there, above all its moving averages except the 200 DMA. That last is now at $1,317.29, and slowly turning up, a good sign, plus this two day upward tergiversation. Gold prices have now thrice beat on the door of this downtrend line, and today's reversal begs the conclusion that it will pierce that line tomorrow or the next day. Twould be extremely bad taste if it didn't, not to mention weak. Ought to run up at least $100 or so. The SILVER PRICE hath bounced off that support line left by December lows, and like gold, strengthened on Friday and closed higher today. All that said, silver remains below its 20 and 50 DMAs (now 1982c and 1977c). Must cross them, but more strategically, 2050c. All indicators pointing toward the sun today. To escape the shadow of one last possible plunge to a new low, gold needs to close above this downtrend line from April and the resistance at $1,267.50, then jump higher to $1,361.80, the October high. How high could this rally carry gold? If the height of what I take to be an upside down head and shoulders reversal (Nov - Jan) measures the gain, then it should run at least to that $1,361.80 October high. But first, confirmation by puncturing that downtrend line and support at $1,267.50. Dow fell 326.05 (2.08%) to 15,372.80, below the 200 DMA (15,469.68). S&P500 lost 2.28% (40.7) to 1741.89. Too early to judge whether the January top was the ultimate -- another may come later in the year -- but for now stocks are headed firmly down, perhaps to 14,760-14,720, the September and October lows. A genuine waterfall today. Today's stock weakness and metals strength drew the Dow measured in metals down. Dow in gold sank 3.06% to 12.23 oz (G$252.82 gold dollars) and drew nearer the 200 dma (11.79 oz or G$243.72). It falleth ever nigher its long term downtrend line. Dow in silver dropped 2.66% to 796.52 oz, well below the 816.54 50 DMA but still way above the 200 DMA (731.61). Rolling over, over, over. US Dollar index fell today 24 basis points (0.3%) to 81.14, but like a pouty child still refuses to confirm any rally. Yen rose 1.04% to 99.04 and certainly is rallying. Euro at 1.3525 still looks sick as a snake-bit cur. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||

| Don't pretend that the gold market is anything but central banking's most desperate project Posted: 03 Feb 2014 03:11 PM PST 8:09p SRT Monday, February 3, 2014 Dear Friend of GATA and Gold: The Perth Mint's Bron Suchecki today evaluates the prospects for gold bank runs in a fractional-reserve gold banking system. His commentary is headlined "Fractional Reserve Bullion Banking and Gold Bank Runs -- the Setup" and it's posted at his Internet site, Gold Chat, here: http://goldchat.blogspot.com/2014/02/fractional-reserve-bullion-banking-... Suchecki writes: So a bullion bank's risk toward a run on its unallocated accounts depends on its: -- Physical fractional reserves. -- Extent of maturity transformation. -- Credit-worthiness of unsecured counterparties. -- Collateral and gold price exposure for secured counterparties. He adds that bullion banks know that "you can't print gold" and suggests that, as a result of this knowledge, they proceed more responsibly than banks operating on a fractional-reserve basis in other respects. But presumably bullion banks also know whether central banks or international organizations like the International Monetary Fund or Bank for International Settlements, to quote former Federal Reserve Chairman Alan Greenspan's testimony to Congress in July 1998, "stand ready to lend gold in increasing quantities should the price rise" -- http://www.federalreserve.gov/boarddocs/testimony/1998/19980724.htm -- and whether central banks are prepared, to use the sanitizing phrase of CPM Group's Jeff Christian, to provide "liquidity" to the gold market, a service that for some reason central banks don't yet seem ready to provide to the markets in soybeans, cotton, and pork bellies. Suchecki's distinctions within bullion banking are all valid but they also are all completely subsidiary to the one great fact about the gold market: that central banks are its biggest participants and that, while they are nominally public institutions, they operate in the gold market largely in secret every day, directly or through their broker, the Bank for International Settlements, for policy purposes that are never explicitly explained. (Of course a little research can discern what those purposes are -- gold price suppression and support of government currencies and bonds.) Bullion banks and gold-mining companies that hedge their production are merely the agents and playthings of central banks, as the great hedger Barrick Gold confessed in U.S. District Court in New Orleans as it tried to escape from Blanchard & Co.'s market-rigging lawsuit in 2003: Suckechi is more or less off the hook here because a few days ago he called for transparency in the gold operations of central banks -- http://goldchat.blogspot.com.au/2014/01/central-bank-gold-reserves-trans... -- something that will never happen because, as the staff of the International Monetary Fund explained in a secret memorandum in March 1999, transparency would explode the gold price suppression scheme: http://www.gata.org/node/12016 Even so, one shouldn't get or give the impression that the gold "market" is, for the time being, anything except central banking's most desperate project. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... | ||||||||||||||||||||||||||||||||||||||||

| Embry - Global Markets Are Now Subject To Total Collapse Posted: 03 Feb 2014 02:48 PM PST With continued uncertainty around the globe, today a man who has been involved in the financial markets for 50 years, and whose business partner is billionaire Eric Sprott, warned King World News that global markets are now subject to “total collapse.” John Embry also discussed the implications of what this means for investors around the world in his powerful KWN interview. Embry: “I honestly believe | ||||||||||||||||||||||||||||||||||||||||

| What Wll Happen In Coming Collapse? How Will Governments Try to Fix Things? Posted: 03 Feb 2014 02:13 PM PST Most people deal in the present, rarely questioning the future beyond what they consider to be the very next So says Jeff Thomas (caseyresearch.com) in edited excerpts from his original article* entitled A Glimpse into the Coming Collapse. [The following is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]Thomas goes on to say in further edited excerpts: Well, the primary events are fairly predictable. They would include:

The secondary events will be less certain, but likely:

Along the way there will be numerous surprises—actions taken by governments that may be as unprecedented as they would be unlawful. Why? Because, again, such actions are the norm when a government finds itself losing its grip over the people it perceives as its minions. Here are a few:

The above list is a sampling of eventualities that, should they occur, will almost definitely come unannounced. As the decline unfolds, they will surely happen with greater frequency. The value in projecting what the collapsing governments may do to their citizens is not merely an exercise in speculation. By anticipating the likelihood of any of the above, you would be well-advised to:

[Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://www.caseyresearch.com/articles/a-glimpse-into-the-coming-collapse (© 2014 Casey Research, LLC, All rights reserved) Related Articles: 1. I Repeat: "Economic disaster of unprecedented scale is coming!" Here's Why I get tired of preaching economic disaster and I am sure readers are just as tired of reading about it. Yet, it is coming regardless. The disaster will be of such importance that one cannot overemphasize it or warn too often about it. It will be a disaster of unprecedented scale. Read More » 2. 5 Red Flags of Imminent Economic Collapse These 5 red flags will give you anywhere from a few days to a few months of warning that things are about to change drastically…and well before those around you grasp the full extent of what is going on. This is hopefully a scenario that never happens as this will truly be the end of the world as you knew it. Read More » 3. Another Crisis Is Coming & It May Be Imminent – Here's Why Is there going to be another crisis? Of course there is. The liberalised global financial system remains intact and unregulated, if a little battered…The question therefore becomes one of timing: when will the next crash happen? To that I offer the tentative answer: it may be imminent…[This article puts forth my explanation as to why that will likely be the case.] Read More » 4. 14 Prognoses of Doom & Gloom for Economy Starting in '14 Some of the most respected prognosticators in the financial world are warning that what is coming in 2014 and beyond is going to shake America to the core. Many of the quotes that you are about to read are from individuals that actually predicted the sub-prime mortgage meltdown and the financial crisis of 2008 ahead of time so they have a track record of being right. Does that guarantee that they will be right about what is coming in 2014? Of course not. In fact, as you will see below, not all of them agree about exactly what is coming next but, without a doubt, all of their forecasts are quite ominous. Read More »

The post What Wll Happen In Coming Collapse? How Will Governments Try to Fix Things? appeared first on munKNEE dot.com. | ||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Baby It's Cold Outside Posted: 03 Feb 2014 01:22 PM PST | ||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Baby It's Cold Outside Posted: 03 Feb 2014 01:22 PM PST | ||||||||||||||||||||||||||||||||||||||||

| Jesse Ventura, Matthew Mills -- The Alex Jones Show - Monday, February 03, 2014 (Full Show) Posted: 03 Feb 2014 01:21 PM PST On this Monday, February 3 edition of the Alex Jones Show, Alex breaks down the fraud of government security theater and the disappearance of civil duty as a concern for many Americans. Last night, a 30-year-old exposed the fallacy of the multi-million dollar Super Bowl security ring by... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||

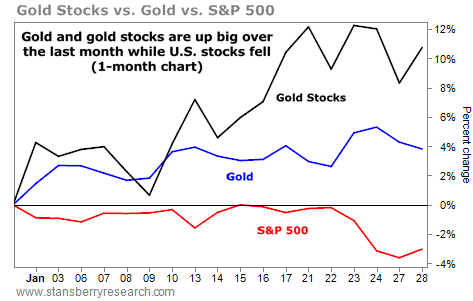

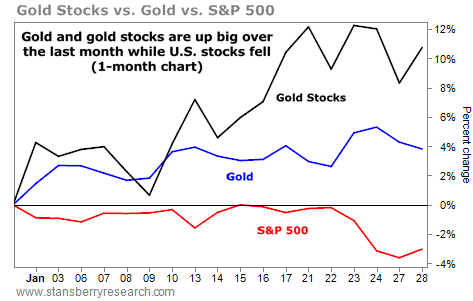

| Posted: 03 Feb 2014 12:45 PM PST Gold mining stocks too, reckons this analyst. The bottom is in... IT'S OFFICIAL, reckons Steve Sjuggerud in his Daily Wealth email. Gold has bottomed. And gold mining stocks have, too. Take a look. Gold and gold stocks have taken off this year, while the stock market has done nothing...  I think this move is legitimate. Gold bottomed in December. The bottom made total sense, for two major reasons:

Specifically, "precious-metals sentiment dropped close to zero" in December, my friend Jason Goepfert of SentimenTrader wrote. (His scale is 0 to 100.) As far as investors were concerned, gold was as HATED as it gets. When something can't get any more hated, it eventually gets less hated... and that's when you want to own it! That is where you can make real money. Also, gold stocks were as CHEAP as they get... "Gold stocks are 48% undervalued" relative to the price of gold as of December 31, John Doody of theGold Stock Analyst newsletter wrote. (That's the biggest discount in history for gold stocks.) I spoke with John on the phone a few weeks ago about this. He told me back then that "everyone who wanted to sell has now sold. Now is the time." He was right. In my True Wealth newsletter, we stepped up. We bought gold stocks a few weeks ago. And as you can see in the chart above, buying gold stocks a few weeks ago was the right call... We now have an UPTREND in gold stocks. (The "safe" play we made in my newsletter has actually outperformed gold stocks.) Gold and gold stocks are now beating the stock market. Gold has bottomed. Gold stocks have bottomed. And now we have our True Wealth "trifecta"... Gold stocks are CHEAP, HATED, and IN AN UPTREND. We have everything we want to see in an investment right now. This is when you want to buy. As John Doody said, "now is the time." I think he's right... The setup doesn't get any better than this. Don't let this moment pass you by... Buy gold and gold stocks now... For the safest trade, use a stop loss at recent lows... Otherwise, let 'er rip! | ||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Feb 2014 12:45 PM PST Gold mining stocks too, reckons this analyst. The bottom is in... IT'S OFFICIAL, reckons Steve Sjuggerud in his Daily Wealth email. Gold has bottomed. And gold mining stocks have, too. Take a look. Gold and gold stocks have taken off this year, while the stock market has done nothing...  I think this move is legitimate. Gold bottomed in December. The bottom made total sense, for two major reasons:

Specifically, "precious-metals sentiment dropped close to zero" in December, my friend Jason Goepfert of SentimenTrader wrote. (His scale is 0 to 100.) As far as investors were concerned, gold was as HATED as it gets. When something can't get any more hated, it eventually gets less hated... and that's when you want to own it! That is where you can make real money. Also, gold stocks were as CHEAP as they get... "Gold stocks are 48% undervalued" relative to the price of gold as of December 31, John Doody of theGold Stock Analyst newsletter wrote. (That's the biggest discount in history for gold stocks.) I spoke with John on the phone a few weeks ago about this. He told me back then that "everyone who wanted to sell has now sold. Now is the time." He was right. In my True Wealth newsletter, we stepped up. We bought gold stocks a few weeks ago. And as you can see in the chart above, buying gold stocks a few weeks ago was the right call... We now have an UPTREND in gold stocks. (The "safe" play we made in my newsletter has actually outperformed gold stocks.) Gold and gold stocks are now beating the stock market. Gold has bottomed. Gold stocks have bottomed. And now we have our True Wealth "trifecta"... Gold stocks are CHEAP, HATED, and IN AN UPTREND. We have everything we want to see in an investment right now. This is when you want to buy. As John Doody said, "now is the time." I think he's right... The setup doesn't get any better than this. Don't let this moment pass you by... Buy gold and gold stocks now... For the safest trade, use a stop loss at recent lows... Otherwise, let 'er rip! | ||||||||||||||||||||||||||||||||||||||||

| A Speculator's Dream in Junior Gold Posted: 03 Feb 2014 12:40 PM PST Junior gold miners were the #1 performing asset class in January. Yes, really... IT'S HARDLY news that gold mining stocks have been in a slump for more than two years, writes Doug Hornig, senior editor at Doug Casey's research group. Many investors who owned them have thrown in the towel by now, or are holding simply because a paper loss isn't a realized loss until you sell. For contrarian speculators like Doug Casey and Rick Rule, though, it's the best of all scenarios. "Buy when blood is in the streets," Victorian investor Nathan Rothschild allegedly said. And buy they do, with both hands – because, they assert, there are definitive signs that things may be turning around. So what's the deal with junior mining stocks, and who should invest in them? I'll give you several good reasons not to touch them with a 10-foot pole...and one why you maybe should. First, you need to understand that junior gold miners are not buy-and-forget stocks. They are the most volatile securities in the world – "burning matches," as Doug calls them. To speculate in those stocks requires nerves of steel. Let's take a look at the performance of the juniors since 2011. The ETF that tracks a basket of such stocks – Market Vectors Junior Gold Miners (GDXJ) – took a savage beating. In early April of 2011, a share would have cost you $170. Today, you can pick one up for about $36...that's a decline of nearly 80%. There are something like 3,000 small mining companies in the world today, and the vast majority of them are worthless, sitting on a few hundred acres of moose pasture and a pipe dream. It's a very tough business. Small-cap exploration companies (the "juniors") are working year round looking for viable deposits. The question is not just if the gold is there, but if it can be extracted economically – and the probability is low. Even the ones that manage to find the goods and build a mine aren't in the clear yet: before they can pour the first bar, there are regulatory hurdles, rising costs of labor and machinery, and often vehement opposition from natives to deal with. As the performance of junior mining stocks is closely correlated to that of gold, when the physical metal goes into a tailspin, gold mining shares follow suit. Only they tend to drop off faster and more deeply than physical gold. Then why invest in them at all? Because, as Casey chief metals & mining strategist Louis James likes to say, the downside is limited – all you can lose is 100% of your investment. The upside, on the other hand, is infinite. In the rebound periods after downturns such as the one we're in, literal fortunes can be made; gains of 400-1,000% (and sometimes more) are not a rarity. It's a speculator's dream. When speculating in junior miners, timing is crucial. Bear runs in the gold sector can last a long time – some of them will go on until the last faint-hearted investor has been flushed away and there's no one left to sell. At that point they come roaring back. It happened in the late '70s, it happened several times in the '80s when gold itself pretty much went to sleep, and again in 2002 after a four-year retreat. The most recent rally of 2009-'10 was breathtaking: Louis' International Speculator stocks, which had gotten hammered with the rest of the market, handed subscribers average gains of 401.8% – a level of return Joe the Investor never gets to see in his lifetime. So where are we now in the cycle? The present downturn, as noted, kicked off in the spring of 2011, and despite several mini-rallies, the overall trend has been down. Recently, though, the natural resource experts here at Casey Research and elsewhere have seen clear signs of an imminent turnaround. For one thing, the price of gold itself has stabilized. After hitting its peak of $1921.50 in September of 2011, it fell back below $1190 twice last December. Since then, it hasn't tested those lows again and is trading about 6.5% higher today. The demand for physical gold, especially from China, has been insatiable. The Austrian mint had to hire more employees and add a third eight-hour shift to the day in an attempt to keep up in its production of Philharmonic coins. "The market is very busy," a mint spokesperson said. "We can't meet the demand, even if we work overtime." Sales jumped 36% in 2013, compared to the year before. Finally, the junior mining stocks have perked up again. In fact, for the first month of 2014, they turned in the best performance of any asset, as you can see here:  The writing's on the wall, say the pros, that the downturn won't last much longer – and when the junior miners start taking off again, there's no telling how high they could go. To present the evidence and to discuss how to play the turning tides in the precious metals market, Casey Research is hosting a timely online video event titled Upturn Millionaires. Register to watch it here... | ||||||||||||||||||||||||||||||||||||||||

| A Speculator's Dream in Junior Gold Posted: 03 Feb 2014 12:40 PM PST Junior gold miners were the #1 performing asset class in January. Yes, really... IT'S HARDLY news that gold mining stocks have been in a slump for more than two years, writes Doug Hornig, senior editor at Doug Casey's research group. Many investors who owned them have thrown in the towel by now, or are holding simply because a paper loss isn't a realized loss until you sell. For contrarian speculators like Doug Casey and Rick Rule, though, it's the best of all scenarios. "Buy when blood is in the streets," Victorian investor Nathan Rothschild allegedly said. And buy they do, with both hands – because, they assert, there are definitive signs that things may be turning around. So what's the deal with junior mining stocks, and who should invest in them? I'll give you several good reasons not to touch them with a 10-foot pole...and one why you maybe should. First, you need to understand that junior gold miners are not buy-and-forget stocks. They are the most volatile securities in the world – "burning matches," as Doug calls them. To speculate in those stocks requires nerves of steel. Let's take a look at the performance of the juniors since 2011. The ETF that tracks a basket of such stocks – Market Vectors Junior Gold Miners (GDXJ) – took a savage beating. In early April of 2011, a share would have cost you $170. Today, you can pick one up for about $36...that's a decline of nearly 80%. There are something like 3,000 small mining companies in the world today, and the vast majority of them are worthless, sitting on a few hundred acres of moose pasture and a pipe dream. It's a very tough business. Small-cap exploration companies (the "juniors") are working year round looking for viable deposits. The question is not just if the gold is there, but if it can be extracted economically – and the probability is low. Even the ones that manage to find the goods and build a mine aren't in the clear yet: before they can pour the first bar, there are regulatory hurdles, rising costs of labor and machinery, and often vehement opposition from natives to deal with. As the performance of junior mining stocks is closely correlated to that of gold, when the physical metal goes into a tailspin, gold mining shares follow suit. Only they tend to drop off faster and more deeply than physical gold. Then why invest in them at all? Because, as Casey chief metals & mining strategist Louis James likes to say, the downside is limited – all you can lose is 100% of your investment. The upside, on the other hand, is infinite. In the rebound periods after downturns such as the one we're in, literal fortunes can be made; gains of 400-1,000% (and sometimes more) are not a rarity. It's a speculator's dream. When speculating in junior miners, timing is crucial. Bear runs in the gold sector can last a long time – some of them will go on until the last faint-hearted investor has been flushed away and there's no one left to sell. At that point they come roaring back. It happened in the late '70s, it happened several times in the '80s when gold itself pretty much went to sleep, and again in 2002 after a four-year retreat. The most recent rally of 2009-'10 was breathtaking: Louis' International Speculator stocks, which had gotten hammered with the rest of the market, handed subscribers average gains of 401.8% – a level of return Joe the Investor never gets to see in his lifetime. So where are we now in the cycle? The present downturn, as noted, kicked off in the spring of 2011, and despite several mini-rallies, the overall trend has been down. Recently, though, the natural resource experts here at Casey Research and elsewhere have seen clear signs of an imminent turnaround. For one thing, the price of gold itself has stabilized. After hitting its peak of $1921.50 in September of 2011, it fell back below $1190 twice last December. Since then, it hasn't tested those lows again and is trading about 6.5% higher today. The demand for physical gold, especially from China, has been insatiable. The Austrian mint had to hire more employees and add a third eight-hour shift to the day in an attempt to keep up in its production of Philharmonic coins. "The market is very busy," a mint spokesperson said. "We can't meet the demand, even if we work overtime." Sales jumped 36% in 2013, compared to the year before. Finally, the junior mining stocks have perked up again. In fact, for the first month of 2014, they turned in the best performance of any asset, as you can see here:  The writing's on the wall, say the pros, that the downturn won't last much longer – and when the junior miners start taking off again, there's no telling how high they could go. To present the evidence and to discuss how to play the turning tides in the precious metals market, Casey Research is hosting a timely online video event titled Upturn Millionaires. Register to watch it here... | ||||||||||||||||||||||||||||||||||||||||

| Celente - No Way Out As Global Ponzi Scheme Collapse Begins Posted: 03 Feb 2014 12:29 PM PST  Today the man who remarkably predicted months ahead of time that the Fed would taper in December, then again in January, and who also predicted the global market plunge that we are now seeing, warned KWN that there is no way out this time for central planners as the global Ponzi scheme has now begun to collapse. He also discussed the incredible turmoil taking place around the world. Below is what Gerald Celente, founder of Trends Research and the man considered to be the top trends forecaster in the world, had to say in this remarkable interview. Today the man who remarkably predicted months ahead of time that the Fed would taper in December, then again in January, and who also predicted the global market plunge that we are now seeing, warned KWN that there is no way out this time for central planners as the global Ponzi scheme has now begun to collapse. He also discussed the incredible turmoil taking place around the world. Below is what Gerald Celente, founder of Trends Research and the man considered to be the top trends forecaster in the world, had to say in this remarkable interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Feb 2014 12:01 PM PST Dear reader, Gold is often cited as a good hedge against inflation, but it would be more accurate to state that gold is a hedge against a devaluation. Sudden drops in the value of a currency are a nightmare for savers, but not for those owning physical gold. Gold stores value in an environment with... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||

| S&P and Gold: Extremes and Reversals Posted: 03 Feb 2014 11:51 AM PST Michael Lombardi has written many good articles about gold, the economy and the stock market. A few are listed below: Why I'm So Cautious About 2014 A few quotes from his articles:

He has looked at the gold market and the stock market and commented on issues that are important for understanding our complicated financial world. He thinks it is time for reversals in both the gold and stock markets. I agree with Michael Lombardi. The following are my comments – based on logic, my analysis, best estimates, and an unfortunate lack of central bank transparency and valid data on the gold in storage.

The implications are important. In very simple terms we can view the world and invest based on option A or option B. Option A: (Mainstream media view as I interpret it)

Option B: (Alternate media view as I interpret it)

GE Christenson | ||||||||||||||||||||||||||||||||||||||||

| 5 Signs Confirming It Is Time to Buy Gold Posted: 03 Feb 2014 11:46 AM PST Gold has been in a downturn for more than two years now, resulting in the lowest investor sentiment in many years. Hardcore goldbugs find no explanation in the big picture financial numbers of government deficits and money creation, which should be supportive to gold. I have an explanation for why gold has been down—and why that is about to reverse itself. I’m convinced that now is the best time to invest in gold again. Gold Is the Alternative to Non-Convertible Paper MoneyIf you’ve been a Casey reader for any length of time, you know why gold is a good long-term investment: central banks are expanding paper money to accommodate the deficits of profligate governments—but they can’t print gold. Since the beginning of the credit crisis, the world’s central banks have “invented” $10 trillion worth of new currencies. They are buying up government debt to drive interest rates down, to keep countries afloat. The best they can do is buy time, however, because creating even more debt does not solve a credit crisis. Asia Is Accumulating Gold for Good ReasonSince 2010, China has been buying gold and not buying US Treasuries. China’s plan seems to be to acquire a total of 6,000 tonnes of gold to put its holdings on a par with developed countries and to elevate the international appeal of the renminbi. In 2013, China imported over 1,000 tonnes of gold through Hong Kong alone, and it’s likely that as much gold came through other sources. For example, last year the UK shipped 1,400 tonnes of gold to Swiss refiners to recast London bars into forms appropriate for the Asian market.

China mines around 430 tonnes of gold per year, so the combination could be 2,430 tonnes of gold snatched up by China in 2013, or 85% of world output. India was expected to import 900 tonnes of gold in 2013, but it may have fallen short because the Indian government has been taxing and restricting imports in a foolish attempt to support its weakening currency. Smugglers are having a field day with the hundred-dollar-per-ounce premiums. Other central banks around the world are estimated to have bought at least 300 tonnes last year, and investors are buying bullion, coins, and jewelry in record numbers. Where is all that gold coming from? COMEX and GLD ETF Inventories Are Down from the DemandThe COMEX futures market warehouses dropped 4 million ounces (over 100 tonnes) in 2013. The COMEX uses two classes of inventories: the narrower is called “registered” and is available for delivery on the exchange. There are other inventories that are not available for trading but are called “eligible.” I don’t think it’s as easy to get holders of eligible gold to allow for its conversion to registered to meet delivery as the name implies. Yes, that might occur, but only with a big jump in the price. The chart below shows the record-low supply of registered COMEX gold.

Meanwhile, SPDR Gold Shares (GLD), the largest gold ETF, lost over 800 tonnes of gold to redemptions. At the same time, central banks have provided gold through leasing programs (but figures are not made public). Why Has Gold Fallen $700 Since 2011?In our distorted world of debt-ridden governments and demand from Asia, gold should continue rising. What’s going on? The gold price quoted all day long comes from the futures exchanges. These exchanges provide leverage, so modest amounts can be used to make big profits. Big players can move markets—and the biggest player by far is JPMorgan (JPM). For the first 11 months of 2013, JPM and its customers delivered 60% of all gold to the COMEX futures market exchange; that, surely, is a dominant position that could affect the market. By supplying so much gold, they are able to keep the price lower than it would otherwise be. A key question is why a big bank would take positions that could drive gold lower. Answer: Banks gain by borrowing at zero rates. But the Federal Reserve can only continue its large quantitative easing programs that bring rates to zero if gold is not soaring, which would indicate weakness in the dollar and the need to tighten monetary policy. Voilà—we have a motive. Also, suppressing the price of gold supports the dollar as a reserve currency. The chart below shows the month-by-month number of contracts that were either provided to the exchange or taken from the exchange by JPM. For a single firm, the numbers are large, but the effect across all gold markets is greater because so many gold transactions follow the price set in the paper futures market.

What jumps out from the chart above is the fact that while JPM had been selling gold into the futures market for most of the year, it made a major shift in December, absorbing 96% of all gold delivered. That is a radical shift and, I believe, an indicator that JPM‘s policy has shifted. In my opinion, their deliveries of gold were suppressing the price during 2013, but now their policy has shifted in a way that will support gold going forward. This leaves a vital question unanswered: Why? Has the motivation to suppress the price of gold gone away? Not likely, and we may never know the full truth of what is happening, but I suspect the main reason for the shift is that they have done their damage. The $740 drop from top to bottom, a 39% decline, has shaken confidence in gold as a financial “safe haven” among many investors, especially those new to precious metals. At the same time, continuing to lean on gold at this point could become very costly. JPM delivered $3 billion (about 2 million ounces of gold) into the market up to December in 2013, and may not have ready sources of gold to keep that up. It is dangerous to put on big short positions unless you have gold or some future gold deliveries as a hedge. By now, everyone knows of the shortages in the gold market; JPM has to be as aware of that as the rest of us. It just isn’t safe for them to continue to lean on the market. Being aware, it looks like they are taking the bet that gold will rebound, so they could do well on the other side of the trade. Another confirmation of the shift by big banks comes from data provided by the US Commodity Futures Trading Commission (CFTC) that shows the net positions of the four biggest US banks in the futures market. There has been a dramatic change from being short the market to now being long.

Crisis Brewing in the Gold MarketGermany claims to hold 3,390.6 tonnes of gold, about half of which is held by foreign central banks. Over a year ago, they announced a plan to repatriate 674 tonnes of gold from France and the United States. The US said it would comply, but told the German government that it would have to wait seven years for all the gold to be delivered. The news out last week was that after a year, Germany had only obtained 37 tonnes of its gold—and only five of them were from the US. That is a trivial amount (only 160,000 ounces). So why can’t Germany get its gold? Explanations of having to melt down existing gold and recast it just don’t make sense. The most logical conclusion, and the one I’ve come to, is that the United States simply doesn’t have the gold it says it has—neither Germany’s nor its own. Of course, the US government isn’t going to admit that there’s a problem, but I say there is. More evidence: JPMorgan’s COMEX warehouse contained 3.0 million ounces of gold in 2012, but that had dropped to 0.5 million ounces by mid-2013. Its registered inventories are a razor-thin 87,000 ounces. These kinds of swings are indicative of shortages and instability. Further, JPMorgan sold its gold vault in New York City—located next to the Federal Reserve’s vault—to the Chinese. The banking giant also just announced the sale of its commodities trading business (although it may not have sold the precious metals part of that business). Perhaps they were concerned about new regulations of banks with deposit insurance from the government. In another relevant development, Deutsche Bank recently surprised the gold community by quitting its position on the committee that sets the London a.m. and p.m. fixings. This came a few weeks after a German regulatory body called BaFin started investigating how these prices were set. BaFin also gave an indication that the process appeared worse than the LIBOR fixing scandal, which resulted in billions in fines. Putting Inventories and Traders TogetherThe futures market looks fragile to me. The basic problem is that there are many more transactions that could put a claim on gold than there is gold registered for delivery in the COMEX warehouses. The chart below gives a dramatic picture by simply dividing the open interest of all futures contracts by the registered inventories. The black line at the bottom shows the big jump in the ratio as the registered inventories declined. There are 107 times more open-interest positions than there is registered gold.

The futures markets operate on the expectation that only a few big traders will demand delivery. JPMorgan has shown that it is in a position to demand almost all (96%) of the gold for delivery. They are big enough that they could cause a collapse of the market, if they were to force delivery of more than is available. They know better than to do so, though, and I would guess that they will just manage to try to gain back what gold they have been delivering over the last several years. That should support the price of gold. Gold Will Rise, and It’s on Sale NowNow is the time to stake your claim in gold. In the long term, we know that paper money will become worthless; in the short term, the biggest seller has just shifted its actions to becoming a buyer. That makes this a good time to accumulate gold and gold mining stocks before a major shift upward in price.

| ||||||||||||||||||||||||||||||||||||||||

| Nu Yu’s Market SectorTA Weekly Update – 2nd Feb, 2014The Broad Stock Market is at a Critical Point Posted: 03 Feb 2014 11:17 AM PST As the stock markets of Russia, Brazil, China, Hong Kong, Japan, and UK went under water, the Wilshire 5000 index closed January on a negative note. The January Barometer gives a cautious sign for the market in 2014. The Broad Market Instability Index (BIX) has breached the panic threshold and has surged up to 7-month high. For last 5 trading days, the Wilshire 5000 index has chopped right above the 89-day exponential moving average (EMA89). The U.S. stock market is at a critical point to test if it holds above the EMA89 or breaks it down for immediately further decline. Broad Market Instability Surged up to 7-Month HighThe LWX (Leading Wave Index) is Nu Yu's proprietary leading indicator for US equity market. LWX>+1 indicates bullish (green); LWX< -1 indicates bearish (red); The LWX between +1 and -1 indicates neutral (yellow). The LWX Indicator in Last Four Weeks (Actual) The LWX Indicator in Next Four Weeks (Forecast) The Broad Market Instability Index (BIX), measured from over 8000 U.S. stocks, surged up and closed at 152 on 1/31/2014 (up from 74 the previous week) which is above the panic threshold level of 42 and indicates a bearish market. The reading of 152 on the BIX is the highest level since June 25, 2013. As the Wilshire 5000 index closed January on a negative note, the January Barometer gives a cautious sign for the market in 2014. For last 5 trading days, the Wilshire 5000 index has chopped right above the 89-day exponential moving average (EMA89). The broad market is at a critical point to test if it holds above the EMA89 or breaks it down. Based on the forecast of the Leading-Wave Index (LWX), the short-term time-window for the broad market should turn from bearish to neutral next week (see the second table above). However, the bearish time-window may extend to 2/10/2014 if sell-off continues. The daily chart below has the Wilshire 5000 index with both the BIX and the Momentum indicators. The current market status is summarized as follows: Short-Term Cycle: downward Long-Term Picture: Elliott Wave Count on S&P 500 IndexThe following chart is a weekly chart of the S&P 500 index, with Elliott Wave count, in a five-year time span. There are three degrees of waves: Primary, Intermediate, and Minor waves in this weekly chart. The SPX currently is in primary wave [3], intermediate wave (4), and minor wave A. A long-term price target for primary wave [3], projected at 1796 by using 0.618 extension of wave [1], has been reached. Primary wave [3] currently is in an extension and it could extend to the next price target at 2063 based on 1.0 extension of wave [1]. Please note that primary wave [3] indicates a long-term bullish uptrend while intermediate wave (4), and minor wave A present bearish corrective waves in the intermediate-term and the short-term, respectively. Short-Term Picture: S&P 500 Index Forming Ascending Broadening TriangleAs shown in the daily chart below, after it broke down the 5-month-long ending diagonal, the S&P 500 index is forming a 3-month ascending broadening triangle pattern. This pattern could be a precursor for a roof pattern as projected by a descending dash line on the chart. Also the horizontal support line of the triangle could serve as a neckline for a potential Head-and-Shoulders Top if another shoulder (or a partial rising) develops at the right side. The long awaited intermediate corrective wave (4) has just started. It should contain a A-B-C structure for the minor waves. Minor wave A would have a five-wave structure with the minute waves. Minute wave 1 should have developed. Now we wait to see where minute wave 2 ends. According to Bulkowski's measure rule on downward breakouts of either rising wedges or ascending broadening triangles, a downside price target for the S&P 500 index is estimated around 1740. But a full range decline may go down to 1640 because the correction could end in the area of the previous minor wave 4 in terms of Elliott Waves. Sector Performance Ranking with Home Construction Sector LeadingThe following table is the percentage change of sectors and major market indexes against the 89-day exponential moving average (EMA89). The Wilshire 5000 index, as an average or a benchmark of the total market, is 0.76% above the EMA89. Outperforming sectors are Home Construction (10.44%), Biotech (8.53%), and Internet (5.76%). Underperforming sectors are Energy (-2.70%), Consumer Goods (-2.62%), and Telecommunication (-2.14%). A firm rebound of the U.S. treasury bond in January has been beneficial to those interest-rate-sensitive sectors such as Home Construction, Utilities, and Real Estate. Major Global Market Performance RankingThe table below is the percentage change of major global stock market indexes against the 89-day exponential moving average (EMA89). Currently the Canadian and German markets are outperforming. The US, Indian, and Australian markets are neutral. The Russian, Brizilian, Chinese, Hong Kong, Japanese, and UK markets are under water. Gold in 15-Month Descending Broadening Wedge PatternThe gold index is in a 15-month Descending Broadening Wedge pattern on the daily chart. Inside this broadening wedge, gold is also forming a potential "W" or double bottom between July and December. Currently the gold index retreated from the upper boundary of the broadening wedge. Gold could become bullish if prices break above the upper boundary of the wedge. Long-Term Picture: Silver in a 3-Year Falling Wedge PatternThe silver index has formed a 3-year falling wedge pattern. Although silver will remain bearish with range-bounded swings before a breakout from the wedge, a potential "W" or double bottom pattern in developing near $19 level could set up a potential bullish reversal. Gold/Silver Mining Stocks Forming 10-Month Descending TriangleGold/silver mining stocks are forming a 10-month descending triangle pattern. They are neutral before they make a breakout from the triangle. Crude Oil in 3-Month Trading Range Crude oil is forming a 3-month trading range between 92 and 100. Recently it has been in an upswing towards the upper boundary of the trading range. It is neutral before it break out of the trading range. US Dollar Forming 3-Month Ascending Triangle PatternThe U.S. dollar is forming a 3-month ascending triangle pattern. It should be neutral before it breaks out from the triangle. Last week the dollar was sharply up and approached the upper boundary of the triangle. Watch for a bullish breakout from the upper boundary of the triangle. A bullish breakout of the triangle could make the dollar shoot up to 83. US Treasury Bond in 7-Month Trading RangeThe following chart is a daily chart of the 20-year U.S. treasury bond ETF. It is forming a 7-month horizontal trading range between 101 and 108. It also forms a potential "W" or double bottom pattern. The treasury bond had a firm rebound in January, and outperformed other asset classes. Currently it is testing the upper boundary of the trading range. Asset Class Performance Ranking with U.S. Treasury Bond LeadingThe following table is the percentage change of each asset class (in ETFs) against the 89-day exponential moving average (EMA89). Currently U.S. treasury bond is outperforming and gold is underperforming. The post Nu Yu's Market SectorTA Weekly Update – 2nd Feb, 2014 | ||||||||||||||||||||||||||||||||||||||||