Gold World News Flash |

- Doug Casey on the Chinese 21st Century and the US following Roman Empire decline

- WTF Chart Of The Day: VIX Smackdown Edition

- The Matrix (2014 version)

- 10 Signs That Reveal Mounting Panic In The Banking System

- Gold Daily and Silver Weekly Charts - Comex Quiet On Option Expiration

- Gold Daily and Silver Weekly Charts - Comex Quiet On Option Expiration

- Pump... And Dump

- An Historical Look at Some Precious Metals Stocks

- Silver Linings Playbook

- Pick and Shovel Plays in the Gaming Gold Rush

- Gold: Big Picture Focus

- Lassonde spouts disinformation and Kitco’s Cambone just smiles prettily through it

- Germany, Russia, China, the US, Gold & World Dominance

- China’s gold imports from Hong Kong slip as demand weakens

- Canadian stocks beating the world’s best on gold surge

- US attitude to gold changing from selling to investing

- SWOT: India may cut import tax on gold soon

- Prudent, aggressive management needed for good gold investments in 2014

- Randgold still on gold growth track to 1 million ounces/year

- US Mint gold coin sales head for worst month since Sep

- Predictably enough, Wall Street Journal shills for gold price rigging

- Gold Bullion Premium in Shanghai Goes Negative as China's Yuan Sinks, World Stock Markets Rise

- Bitcoin exchange Mt. Gox disappears in blow to virtual currency

- The Gold Price Closed Higher at $1,338

- Paul Renken: For 2014 Gains, Look to Uranium, PGMs and Gems

- Paul Renken: For 2014 Gains, Look to Uranium, PGMs and Gems

- Paul Renken: For 2014 Gains, Look to Uranium, PGMs and Gems

- Equilibrium Gold Price Model

- Richard Russell - World To Witness A Terrifying Hyperinflation

- The Gold Price Closed Higher at $1,338

- Metal delivery failure complaints piling up against Tulving

- Embry praises Dimitri Speck's book 'The Gold Cartel'

- The London Gold Fix: the saga continues

- Ukraine Matters - Investment Implications

- 'Pony' botnet steals bitcoins, digital currencies, security firm says

- FT Removes Article “Gold Price Rigging Fears Put Investors On Alert”

- Silver Price Breaks $22 But Analysts See "Substantial" Risks

- Silver Price Breaks $22 But Analysts See "Substantial" Risks

- Gold and Silver Sentiment Improving Significantly

- Embry on KWN: Call it the World Anti-Gold Council

- Breaking News: Shady Payment System Now Compulsory

- Gold Daily and Silver Weekly Charts - Option Expiry Tomorrow - Remembering Baghdad Bob

- Gold Daily and Silver Weekly Charts - Option Expiry Tomorrow - Remembering Baghdad Bob

- Is Lassonde really so ignorant of his own organization's work?

- A Number Of Frightening Black Swans Will Surface In 2014

- Focus on Stable Platinum and Palladium Miners in N. America

- Jim’s Mailbox

| Doug Casey on the Chinese 21st Century and the US following Roman Empire decline Posted: 25 Feb 2014 02:00 PM PST from Boom Bust: Our lead story: Erin looks at a landmark deal between Comcast and Netflix this past weekend that gives Netflix direct access to Comcast’s broadband network. This agreement removes Internet middlemen like Cogent Communications and Level 3, which Netflix previously used to send its content to broadband providers. Now Netflix has cut out these middle players so that it has a direct pipeline to Comcast. So instead of public pipes for the Internet at large, Netflix got its own pipe, and set a terrible precedent. Doug Casey calls in from Punta del Este, Uruguay to give us his assessment of China and why he thinks that 21st Century is a Chinese century. In this segment, he explains why he thinks central banks will lead to greater higher inflation and economic volatility in the near future; extols gold and explains why you should buy it; and warns why economic nationalism by governments could threaten economies throughout the world. After the break, Casey talks about water scarcity, the rising price of oil extraction, and how financialization and militarization hurt the US economy. | ||||

| WTF Chart Of The Day: VIX Smackdown Edition Posted: 25 Feb 2014 02:00 PM PST Today's pump-and-dump that failed to hold the S&P 500 in the green for 2014 was an almost perfect deja vu all over again of yesterday's. However, today saw a very rapid after-hours 6 point melt-up in S&P 500 futures thanks to a WTF-inspiring collapse in VIX (from 14.4% to 13.7%!!)

The pump-and-dumps...

and the WTF-inspiring smackdown in VIX...

Totally "normal"...

Charts: Bloomberg | ||||

| Posted: 25 Feb 2014 01:50 PM PST Few noises emitted by the U.S. (and Western) mainstream media have been as shrill or as sustained as the endless accusations that "China is a currency-manipulator". Every time the renminbi falls in value versus the dollar (and sometimes merely because it doesn't rise); we hear the U.S.'s political puppets burst into a familiar chorus. China is (supposedly) deliberately manipulating the value of the renminbi lower (versus the dollar) in order to make its own exports cheaper – and thus steal U.S. jobs. This, in turn, has led to endless saber-rattling by the same puppets, threatening to punish China with assorted economic sanctions . We've seen so many episodes of this farce that those who follow U.S. political theater closely should have that script memorized. First, the moment the renminbi slides by any significant amount; we have Republican drones hurling accusations at China because – true or not – it makes them appear "strong" when it comes to "protecting U.S. jobs". Then we have the Democrat drones chiming-in with their agreement. Because whether or not they actually believe what they are saying; if they don't echo the accusations, they know they will be painted by Fox "News" and the rest of the lunatic-fringe on the Right as being soft on protecting U.S. jobs. Yet, incredibly, the moment the calendar clicked-over from 2013 to 2014, we see a brand-new paradigm. As "the Matrix (2013 version)" becomes the Matrix (2014 version); suddenly the mainstream media has new propaganda priorities. In this new paradigm, where the Federal Reserve is pretending to begin its long-promised Exit Strategy; portraying China as "a currency manipulator" is against the interests of the Master of Ceremonies, the One Bank. Here's how the Matrix (2014 version) works. For four years we were told by this same mainstream media that U.S. bond and equity markets were being (literally) "pumped up" by the exponentially increasing money-printing of the Federal Reserve. This was nothing more than stating the obvious. If you pump air into a tire, it will inflate. But now with the Federal Reserve pretending to let the air out of the tire(s), it needs to sell two, new, huge lies. First it must convince the Sheep (and the brain-dead "experts") that "tapering" is actually taking place. This is a challenge, because back in September, this same Federal Reserve (and same, media propaganda machine) acknowledged that it could not throttle-back its money-printing – at all – because merely talking about doing so was putting too much upward pressure on U.S. long-term interest rates. So three months later, at the end of 2013; the One Bank made a second attempt to sell the lie that the Fed could "taper", reducing the principal fuel of the Treasuries market Ponzi-scheme (and U.S. equities market bubbles), without those bubbles bursting. What changed as the One Bank launched a second version of the same propaganda campaign, timed to coincide with the New Year? The One Bank created a distraction this time: the (supposed) "crisis with Emerging Market currencies", and the plunge in the markets of those nations which was (supposedly) caused by the crash in those currencies. How did the One Bank prevent U.S. interest rates from spiking as it made its second attempt to sell the lie of "tapering"? It did so by sabotaging confidence in all the other markets of the world – with the exception of its few, remaining friends in the Corrupt West. | ||||

| 10 Signs That Reveal Mounting Panic In The Banking System Posted: 25 Feb 2014 01:29 PM PST Dear Depositor: We don't want to cause you unnecessary stress or worry, but it might be prudent to pay attention to a series of unusual news reports recently emanating from the banking world. Viewed independently, each event might be rather insignificant. However, when examined collectively, these events paint a very dire warning for the safety of bank deposits everywhere. Naturally, most all of these have received little to no coverage by the mainstream media. That is to be expected. The mainstream media's job one is to always obfuscate any potentially dangerous news that has a chance of frightening investors or depositors. After all, the goal of the world banking cartel/equities Ponzi scheme is to keep depositors and investors relaxed and passive in their comfort zones until the complete collapse of their positions is unavoidable. Here is a timeline of these very disturbing banking events that have occurred since last fall: 1 – October 3, 2013: US banks fearing default stock up on cash. The Financial Times reported today that two of the country's biggest banks are putting into place a "play book" as preparation for a possible banking panic. A senior banking executive reported that his bank has delivered 20 – 30% more cash than usual in cash panicked customers try to withdraw cash in mass. 2 – October 12, 2013: Food stamp card malfunction causes riots at Walmart stores in Louisiana. The technical problem that eliminated spending limits on food stamp debit cards sets off a bizarre shopping frenzy at Walmart stores in Louisiana. 3 – November 2 – 8, 2013: A reputed computer glitch wipes out ATMs and online banking on a massive scale. Major shutdowns of online banking occurred in Alabama, Arizona, and California and affected such banks as Wells Fargo, Chase, Bank of America, Compass, Chase Fairwinds Credit Union, American Express, and others. Tellers reportedly had a hard time with even simple transactions such as check cashing and checking balances. Rumors circulated on the internet that the banks are using this temporary shutdown as a beta test for a future full bank "holiday" closure. 4 – November 17, 2013: JP Morgan Chase halts international wire transfers from the US for many small businesses. Also, Chase alerted it small business customers that the total cash activity (the combined total of cash deposits and withdrawals made at Chase branches and ATMs, including money orders and cashier's checks) is hereby limited to a total of $50,000 per business customer per billing cycle. 5 – January 16, 2014: Reports from Hong Kong indicate another HSBC scandal: an $80B capitalization shortfall. Forensic Asia, a Hong Kong based research firm, issued a "sell recommendation" on HSBC because of "questionable assets" on its balance sheet. The London Telegraph reported Forensic Asia's warning that HSBC "had between $63.6B and $92.3B of 'questionable assets' on its balance sheet, ranging from loan loss reserves and accrued interest to deferred taxes." 6 – January 24, 2014: HSBC imposes restrictions on cash withdrawals in Britain. Reports circulated that British HSBC customers have been suddenly refused cash withdrawals as low as 3,000 pounds. HSBC admitted that it did not inform its customers of the abrupt policy change. HSBC officers putatively suggested that it is "only for the protection of its customers." 7 China's Banking Problems are Escalating Fast. Beijing based ICBC, the world's largest bank by assets, announced it will not take full responsibility for a trust investment equivalent to US $500 million that may go bust. ICBC, one of China's "Big Four" banks, may be linked to a loan default very similar to the type that precipitated the Lehman Brothers crisis in 2007. In fact, this may be only the tip of the iceberg that has an outside chance of bringing down the entire Chinese banking world. This ICBC "trust investment" is actually one of a vast array of loans that comprises China's secret shadow banking system. It is estimated that China's total shadow banking debt is now in excess of $4.7 trillion – a staggering figure for any market, let alone an unregulated one. It is believed that much of this secret lending system is fraught with high interest, high risk loans that contain a strong possibility of default. Any major failure in this market can only have catastrophic outcomes, for not only markets in China, but for all types of markets worldwide. 8 – January 28, 2014: One of Russia's top two hundred lenders, "My Bank," introduces a one week complete ban on cash withdrawals. The reputed reason is customer wishing to exit the declining ruble in exchange for other currencies. 9 – February 17, 2014: Chase imposes imposes new capital controls on cash deposits. Chase alerted customers that they must now present a valid ID when making any cash deposit and that the bank will now only accept cash deposits in the customer's own account. As of February 1, 2014, Chase customers are asked for ID for cash deposits for their account while cash deposits for another customer's account will be completely banned after March 3, 2014. Some analysts speculated that such measures are a sign that banks are getting ready for economic turmoil and possible bank runs. 10 – February 20, 2014: Royal Bank of Scotland group announces lay-offs of 30,000 employees in coming months. The Financial Times reported that Britain's largest state owned lender will shrink its work force by 30,000 and also pull out of "dozens of the 38 countries" in which it does business. As initially reported in Bloomberg (but later revised for online posting), this dramatic pull-back by RBS (which is 80% government owned), was strongly encouraged by British Prime Minister David Cameron, who undoubtedly has become concerned by the bank's overextension in non-British markets. (A special thanks to David Lenihan of Wavesync Research LLC, for the tip on this story) Our question, dear reader, is why any sane person would wish to risk their hard earned money in any of today's banking institutions, especially when they are paying ridiculously low returns substantially below the real rate of inflation. From our perspective, another Lehman Brothers, Iceland banking collapse, or Cyprus depositor bail-in confiscation is in the making. Do you really want to entrust your hard earned savings to these completely irresponsible institutions? If you don't, please consider precious metals investment as an excellent alternative. To learn more about the rewards of precious metals investing, including how to fund your existing IRA with gold or silver, call Liberty Gold and Silver seven days a week at 888.751.3330. To learn about the most generous referral program in the precious metals industry, please visit the Liberty Gold and Silver Referral Program. We’re happy to spend as much time as you need to discuss the details with you. | ||||

| Gold Daily and Silver Weekly Charts - Comex Quiet On Option Expiration Posted: 25 Feb 2014 01:12 PM PST | ||||

| Gold Daily and Silver Weekly Charts - Comex Quiet On Option Expiration Posted: 25 Feb 2014 01:12 PM PST | ||||

| Posted: 25 Feb 2014 01:03 PM PST Despite a late-day (very sudden) shellacking in silver, commodities rallied with gold pressing up towards Sept 2013 levels (over $1340). Treasury bonds rallied all day to end near the low yields of the day (-3 to 4bps from Friday). The USD's early losses were unwound as the US day-session continued to leave the greenback modestly lower on the week. And that leaves us with stocks... in almost the exact same pattern as yesterday (except with an overall downward bias) the US open sparked some JPY selling which sent stocks careening to highs only for the European close to smash that hope to smithereens and send stocks limping lacklustrously lower into the close (recoupling with JPY and Credit). All indices closed red with Trannies underperforming and the S&P (yet again) unable to hold a green year-to-date close.

Yesterday's pump-and-dump...

Today's pump-and-dump

Leaving Trannies down for the week...

And the S&P unable to close green for the year once again...

And as a gentle reminder - this year has been led by (drum roll please) Healthcare (Biotechs) and Utes...

Bonds decoupled in a very non-snow-related, slow-growth-is-a-reality manner...

Stocks recoupled once again with credit's less exuberant perspective...

Commodities rallied with gold leading the way but it seems someone was in a hurry to dump their silver in the last few minutes... interestingly WTI and Silver end practically unch on the week...

Volumepicked up considerably on the dump in Silver in the late-day...

Charts: Bloomberg | ||||

| An Historical Look at Some Precious Metals Stocks Posted: 25 Feb 2014 01:00 PM PST by Rambus, Gold Seek:

When you view these precious metals stocks you will see a lot of potential looking double bottoms that have formed from the June and December lows of last year. Keep in mind in order for these possible double bottoms to complete the price action has to trade above their double bottom humps to complete their bottom reversal patterns. Also look at the RSI at the top of the charts for a positive divergence in many cases. At the bottom of the charts you will see the MACD and the Histogram along with the slow stochastic. Again, on many of the precious metals stocks you will see the MACD getting ready to crossover which will give a buy signal with the blue Histogram, which is approaching the zero line, also helping confirm the buy signal. | ||||

| Posted: 25 Feb 2014 12:00 PM PST by Captain Hook, Silver Seek:

Because as you will see below, there's a great deal of 'misplaced inflation' sitting in the stock market just waiting to find a home in silver. Why would this happen? And why silver? At some point in the not too distant future, American's are going to discover that unlike their favorite movie, or any other dream in which they may exist, there is no silver lining for both the economy and the stock market, as their stories are false and flawed, and they will be looking for a new home for their savings, where silver will 'fit this bill' for many. | ||||

| Pick and Shovel Plays in the Gaming Gold Rush Posted: 25 Feb 2014 11:35 AM PST There are two ways to make money during a "gold rush." Mine for gold, or sell picks and shovels. History has shown that you can make money doing both. But selling picks and shovels provides solid returns with less risk. The thing is, there's a modern-day gold rush taking place right now… …the "gaming story" has yet to be written. In my humble opinion, there's still gold in them hills… …And today we're going to show you a "picks and shovels" company that could be a great way to play it. Up until 18 months ago, electronic gaming companies could do no wrong. In just 5 years, for example, Zynga (ZNGA), rose from a private valuation of $0.05 per share… all the way to a publicly-traded stock worth $14.69 per share. That's nearly a 290x increase in value –29,000%. However, the "new penny shine" wore off quickly. Zynga is now sitting at just $5.00 per share. (The one bright spot is that $5.00 is up from its low of $2.33 – the company might actually be regaining its footing.) Zynga aside, the "gaming story" has yet to be written. In my humble opinion, there's still gold in them hills… Not all gaming companies are having as tough of a time as Zynga. Take the current gaming leader as an example: King.com. King is the maker of the hyper-addictive game, Candy Crush Saga. Candy Crush is a mobile game where users create combinations of candy-colored blocks in order to earn points. It may sound silly, but this is serious business. Last year King earned an estimated $875,382 per day in sales from users purchasing Candy Crush game enhancements. In total, King generated 2013 sales of $1.9 billion. This level of financial success led King to file with the SEC to go public. The company plans to raise $500 million. Analysts estimate it could command a valuation of $5 billion. When it comes to IPOs, a rising tide tends to lift all ships. So this could be a catalyst for increasing stock prices for many gaming companies – both public and private. In other words, the "gold rush" for gaming could be on again. Which brings me back to my main point today. In a gold rush, we can choose to invest in gold mines… In the case of gaming, companies like Zynga or King, would be the "gold mines." These companies produce and make money through their games. But I'm not a big fan of this approach. I'd prefer to stick with my picks and shovels companies. Plenty of upside potential, lower risk. In the case of gaming, "pick and shovel" companies are generally infrastructure providers – in other words they provide technologies the gaming companies use to build their games. And it just so happens that there's a gaming "pick and shovel" company raising money on an equity crowdfunding platform right now… The name of the company is Nextpeer. You can see more details about it on its funding page OurCrowd.com's platform. Nextpeer provides a technology that allows game developers to quickly enhance their games. Specifically, it allows them to easily add competitive and social elements to the gaming experience. Imagine playing solitaire and then being able to compete against another solitaire player (whoever finishes first, wins) – that's what Nextpeer allows game publishers (like Zynga and King) to do quickly and cheaply. The company has already raised two rounds of financing, has thousands of games using its technology, and commands over 50 million monthly active users. A similar company called OpenFeint was acquired a couple of years ago for $104 million – at the time OpenFeint had 75 million monthly active users. Nextpeer is only 33% shy of that monthly user metric. I'm a fan of the sector, and a fan of Nextpeer's business model. If you choose to invest, remember that, as with any early-stage business, this is a high-risk investment. You can't put all of your eggs in one basket. You need to build a portfolio of these businesses if you don't want to lose your shirt. Please note: this is not a solicitation to invest. We have no financial interest or relationship with Nextpeer or OurCrowd. This report simply reflects our opinion. Happy investing! Best Regards, Wayne Mulligan Ed. Note: Wayne clearly sees a lot of upside potential in the electronic gaming industry… if you know where to look. But there are plenty of other sectors Wayne’s currently following, and with his expertise in the crowdfunding space, he’s provided some invaluable insight to readers of the Tomorrow in Review email edition. To read more of Wayne’s incredible research – which is featured regularly in Tomorrow in Review – you can sign up for FREE right here. In each issue, you’ll also find regular opportunities to discover real, actionable investment advice. So don’t wait. Click here now to get started. | ||||

| Posted: 25 Feb 2014 11:31 AM PST Graceland Update | ||||

| Lassonde spouts disinformation and Kitco’s Cambone just smiles prettily through it Posted: 25 Feb 2014 11:00 AM PST by Chris Powell, GATA:

Dear Friend of GATA and Gold: In an interview with Daniela Cambone of Kitco News posted today, Franco-Nevada Corp. Chairman Pierre Lassonde, a member of the Board of Directors of the World Gold Council, repeats his assertion, made last year in an interview with MineWeb’s Geoff Candy – http://www.gata.org/node/13105 – that central banks “spend no time whatsoever thinking about gold.” Lassonde thereby contradicts what he told Cambone just seconds earlier about all the effort the German Bundesbank lately has spent lately fending off complaints that there’s something fishy about the slow pace of repatriation of the German gold purportedly vaulted at the Federal Reserve Bank of New York. | ||||

| Germany, Russia, China, the US, Gold & World Dominance Posted: 25 Feb 2014 10:28 AM PST  With gold drifting higher and the US Dollar Index barely clinging to the critical 80 level, today an acclaimed money manager spoke with King World News about Germany, Russia, the US, gold and global chess moves taking place involving world dominance. Below is what Stephen Leeb had to say in this fascinating and timely interview. With gold drifting higher and the US Dollar Index barely clinging to the critical 80 level, today an acclaimed money manager spoke with King World News about Germany, Russia, the US, gold and global chess moves taking place involving world dominance. Below is what Stephen Leeb had to say in this fascinating and timely interview.This posting includes an audio/video/photo media file: Download Now | ||||

| China’s gold imports from Hong Kong slip as demand weakens Posted: 25 Feb 2014 09:05 AM PST Mainland Chinese buyers purchased a total of 102.6 tons in January compared with 126.6 tons a month earlier, shows data from Hong Kong. | ||||

| Canadian stocks beating the world’s best on gold surge Posted: 25 Feb 2014 09:05 AM PST Gold stocks in the S&P/TSX have benefited as rising prices and cost cuts look poised to deliver wider operating margins. | ||||

| US attitude to gold changing from selling to investing Posted: 25 Feb 2014 09:05 AM PST We believe that the attitude to gold in the US is changing from selling, to invest in equities, to one of a more global outlook, says Julian Phillips. | ||||

| SWOT: India may cut import tax on gold soon Posted: 25 Feb 2014 09:05 AM PST India's gold demand remained buoyant in 2013, rising 13% from 2012, despite the government introducing several restrictions to curb imports, says Frank Holmes. | ||||

| Prudent, aggressive management needed for good gold investments in 2014 Posted: 25 Feb 2014 09:05 AM PST Benjamin Asuncion and Geordie Mark of Haywood Securities forecast 2014 gold and silver prices of $1,300/oz and $21.50/oz, respectively. An interview with The Gold Report. | ||||

| Randgold still on gold growth track to 1 million ounces/year Posted: 25 Feb 2014 09:05 AM PST Randgold CEO, Mark Bristow, maintains his positive assessment of the company's 2014 gold output plans when it should exceed 1 million ounces per year. | ||||

| US Mint gold coin sales head for worst month since Sep Posted: 25 Feb 2014 09:05 AM PST The volume climbed to 24,500 ounces so far this month from 91,500 ounces in January, which was the highest since April, mint data shows. | ||||

| Predictably enough, Wall Street Journal shills for gold price rigging Posted: 25 Feb 2014 08:03 AM PST Physical Gold Buyers Say Fix Is Vital Commodity's Benchmark Price Is Key to Stability of Global Transactions By Francesca Freeman LONDON -- The London gold benchmark is vital to Grant Phillips's business. In workshops behind a highly secure store front in London's jewelry district, the firm that Mr. Phillips manages, Refined Precious Metals, melts gold scrap and sells it on to refiners. The price of gold on financial markets is constantly fluctuating. Mr. Phillips avoids that volatility by doing his buying and selling at the twice-daily London gold "fix." "It just makes life a lot easier. If everyone is using it, it's not a gamble," said Mr. Phillips. "The market just wouldn't function without it. With the benchmark, you know where you are." ... ... For the full story: http://online.wsj.com/news/articles/SB1000142405270230342630457940474021... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... | ||||

| Gold Bullion Premium in Shanghai Goes Negative as China's Yuan Sinks, World Stock Markets Rise Posted: 25 Feb 2014 06:36 AM PST GOLD BULLION prices in China today fell below the world's London benchmark for the first time since November as the Yuan sank at its fastest pace in 3 years on the currency markets. Despite rising 0.8% in Yuan terms, the most active contract on the Shanghai Gold Exchange closed Tuesday at a discount of $3.60 per ounce to London spot. That compares with the Shanghai premium's 3-year highs above $50 per ounce hit when world prices first sank to $1180 last summer. Shanghai's gold trading volumes today nearly doubled yesterday's levels by value, just lagging last Monday's 3-month high, while the city's stock market dropped 2%. World stock markets in contrast rose to 6-year highs overall on the MSCI index, with Japan's Nikkei adding 1.4%. Priced in US Dollars, spot gold bullion prices for London settlement rallied from a brief dip to recover $1337 per ounce, a fraction shy of yesterday's new 4-month highs. Silver prices continued to slip, however, edging back below last week's finish at $21.85. "I think the price is a little bit too high for Asians to buy gold," said Standard Bank's Tokyo manager Yuichi Ikemizu at the weekend. "Because we were below $1300 for a long time, and people bought a lot." Gold bullion imports through Hong Kong to mainland China eased 5% in January to below 90 tonnes net, new data from the Hong Kong Census and Statistics Department said today. Full-year 2013 imports totaled a record 1,108.8 tonnes net of re-exports. China's identified end-consumer demand last year overtook India's to become the world's No.1. "The Chinese were sellers once again on the SGE open," says a note from Swiss refining and finance group MKS's Asian desk. Noting the first Shanghai discount on gold bullion "for a long time", that drop below global prices "drew out more selling" it adds. "The Yuan move has some relation to the slowdown in the Chinese economy," reckons Societe Generale strategist Alvin Tan, "but it looks more that it has been orchestrated by the PBoC [central bank]," either by selling Yuan or encouraging rumors that it will. Falling Tuesday for the 6th session running, and hitting new all-time Dollar highs only in January, the Yuan today hit a 6-month low. "[That's] wiped out pretty much all of the speculators' recent gains" in the Chinese currency, Tan tells Reuters. Gold bullion holdings at the Central Bank of Turkey meantime showed a drop of 31.2 tonnes for January on new IMF data, equal to a 6% cut in its physical reserves. The world's fourth largest consumer market for gold, Turkey has seen its official bullion reserves rise 4-fold in the last 2.5 years, thanks to new rules allowing commercial banks to hold some of their capital requirements as gold on deposit with the central bank. Retreating to 488 tonnes on data for January – which ended with the central bank hiking interest rates sharply to pull the Lira higher from all-time lows on the currency market – Turkey's official gold bullion holdings remained the world's 11th largest. | ||||

| Bitcoin exchange Mt. Gox disappears in blow to virtual currency Posted: 25 Feb 2014 05:10 AM PST By Ruairidh Villar and Sophie Knight TOKYO -- Mt. Gox, once the world's biggest bitcoin exchange, looked to have essentially disappeared on Tuesday, with its website down, its founder unaccounted for, and a Tokyo office empty except for a handful of protesters saying they had lost money investing in the virtual currency. The digital marketplace operator, which began as a venue for trading cards, had surged to the top of the bitcoin world, but critics -- from rival exchanges to burned investors -- said Mt. Gox had long been lax over its security. It was not clear what has become of the exchange, which this month halted withdrawals indefinitely after detecting "unusual activity." A global bitcoin organization referred to the exchange's "exit," while angry investors questioned whether it was still solvent. ... ... For the full story: http://www.reuters.com/article/2014/02/25/us-mtgox-website-idUSBREA1O079... ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||

| The Gold Price Closed Higher at $1,338 Posted: 25 Feb 2014 01:46 AM PST Gold Price Close Today : 1338.00 Change : 14.40 or 1.09% Silver Price Close Today : 22.05 Change : 0.27 or 1.23% Gold Silver Ratio Today : 60.68 Change : -0.09 or -0.15% Franklin didn't publish commentary today, if he publishes later it will be available here. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||

| Paul Renken: For 2014 Gains, Look to Uranium, PGMs and Gems Posted: 25 Feb 2014 12:00 AM PST Paul Renken, senior geologist and analyst with VSA Capital, calls 2014 a soft year for gold and silver prices, but foresees stronger prices—and demand—for nickel, copper and tech metals as the year progresses. In this Mining Report interview, he lists the three commodities investors should feel good about and digs into the details of the Indonesian ban on exports of raw ore. | ||||

| Paul Renken: For 2014 Gains, Look to Uranium, PGMs and Gems Posted: 25 Feb 2014 12:00 AM PST Paul Renken, senior geologist and analyst with VSA Capital, calls 2014 a soft year for gold and silver prices, but foresees stronger prices—and demand—for nickel, copper and tech metals as the year progresses. In this Mining Report interview, he lists the three commodities investors should feel good about and digs into the details of the Indonesian ban on exports of raw ore. | ||||

| Paul Renken: For 2014 Gains, Look to Uranium, PGMs and Gems Posted: 25 Feb 2014 12:00 AM PST | ||||

| Posted: 24 Feb 2014 11:05 PM PST | ||||

| Richard Russell - World To Witness A Terrifying Hyperinflation Posted: 24 Feb 2014 09:03 PM PST  With continued chaos and uncertainty in global markets, today KWN is publishing an incredibly powerful piece that was written by a 60-year market veteran. The Godfather of newsletter writers, Richard Russell, is now warning that the world is going to witness a terrifying hyperinflation. He also discussed how this hyperinflation will impact major global markets, including stocks, gold, silver and other hard assets. With continued chaos and uncertainty in global markets, today KWN is publishing an incredibly powerful piece that was written by a 60-year market veteran. The Godfather of newsletter writers, Richard Russell, is now warning that the world is going to witness a terrifying hyperinflation. He also discussed how this hyperinflation will impact major global markets, including stocks, gold, silver and other hard assets. This posting includes an audio/video/photo media file: Download Now | ||||

| The Gold Price Closed Higher at $1,338 Posted: 24 Feb 2014 07:26 PM PST Gold Price Close Today : 1338.00 Change : 14.40 or 1.09% Silver Price Close Today : 22.05 Change : 0.27 or 1.23% Gold Silver Ratio Today : 60.68 Change : -0.09 or -0.15% Franklin didn't publish commentary today, if he publishes later it will be available here. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||

| Metal delivery failure complaints piling up against Tulving Posted: 24 Feb 2014 05:57 PM PST 8:55p ET Monday, February 24, 2014 Dear Friend of GATA and Gold: King World News tonight calls attention to growing complaints of delivery failures against the well-known gold and silver dealer The Tulving Co. in Newport Beach, California, as reported this month by the Orange County Register -- http://www.ocregister.com/articles/coins-601179-tulving-gold.html -- and quotes Stephen Quayle, founder of Renaissance Precious Metals in Bozeman, Montana, as cautioning monetary metals investors that "delivery is everything," far more important than price: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/2/24_Is... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair plans seminars in Los Angeles and San Diego Gold advocate Jim Sinclair's next market analysis seminars will be held in Los Angeles from 11 a.m. to 2 p.m. on Saturday, March 8, and in San Diego from 2 to 6 p.m. the following day, Sunday, March 9. Details, including registration information, are posted at Sinclair's Internet site, JSMinset.com, here: http://www.jsmineset.com/qa-session-tickets/ Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Embry praises Dimitri Speck's book 'The Gold Cartel' Posted: 24 Feb 2014 05:42 PM PST 8:40p ET Monday, February 24, 2014 Dear Friend of GATA and Gold: In his latest commentary for Investor's Digest of Canada, Sprott Asset Management's John Embry praises GATA consultant Dimitri Speck's book "The Gold Cartel." Embry's commentary is headlined "Book Lays Bare Chicanery of Western Governments" and it's posted in PDF format here: http://www.gata.org/files/InvestorsDigestEmbrySpeck.pdf Information about ordering "The Gold Cartel" is here: http://us.macmillan.com/thegoldcartel/DimitriSpeck CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair plans seminars in Los Angeles and San Diego Gold advocate Jim Sinclair's next market analysis seminars will be held in Los Angeles from 11 a.m. to 2 p.m. on Saturday, March 8, and in San Diego from 2 to 6 p.m. the following day, Sunday, March 9. Details, including registration information, are posted at Sinclair's Internet site, JSMinset.com, here: http://www.jsmineset.com/qa-session-tickets/ Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:

This posting includes an audio/video/photo media file: Download Now | ||||

| The London Gold Fix: the saga continues Posted: 24 Feb 2014 04:46 PM PST The Real Asset Co | ||||

| Ukraine Matters - Investment Implications Posted: 24 Feb 2014 04:00 PM PST | ||||

| 'Pony' botnet steals bitcoins, digital currencies, security firm says Posted: 24 Feb 2014 03:11 PM PST By Jim Finkle BOSTON -- Cyber criminals have infected hundreds of thousands of computers with a virus called "Pony" to steal bitcoins and other digital currencies in the most ambitious cyber attack on virtual money uncovered so far, according to security firm Trustwave. Trustwave said on Monday that it has found evidence that the operators of a cybercrime ring known as the Pony botnet have stolen some 85 virtual "wallets" that contained bitcoins and other types of digital currencies. The firm said it did not know how much digital currency was contained in the wallets. "It is the first time we saw such a widespread presence of this type of malware. It was on hundreds of thousands of machines," said Ziv Mador, security research director with Chicago-based Trustwave. ... ... For the full story: http://www.reuters.com/article/2014/02/24/us-bitcoin-security-idUSBREA1N... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... | ||||

| FT Removes Article “Gold Price Rigging Fears Put Investors On Alert” Posted: 24 Feb 2014 02:57 PM PST In an article published on Sunday, a Financial Times editor explains how the London Gold Fix could be structurally manipulated. An important “break through” for a mainstream media outlet to release this type of info, as it is a confession that the last market standing (gold and silver) is also manipulated, after having evidence that almost every other market appears to be manipulated (think of LIBOR, energy markets, aluminium, currency markets, credit derivatives, and so on). In a myserious way, however, the article disappeared shortly after getting published. Too late for Google’s spider who already registered the article in its memory.

Google’s cache still has the article available. For archiving purposes, we release it through the screenshots below:

Courtesy of GATA for bringing this to our attention (source). | ||||

| Silver Price Breaks $22 But Analysts See "Substantial" Risks Posted: 24 Feb 2014 02:34 PM PST UBS bucks trend, SocGen says Indian silver imports "will fall" if gold rules eased... SILVER PRICE gains of 6% last week and 12% so far in February have yet to convince precious metals analysts that the trend will prove more than a blip. According to French bank Natixis, the silver price rally is likely to be short-lived. "We would expect US economic data to improve," they further add in their latest note, "as we move beyond the current bout of extreme weather which has dampened economic activity since December." Looking ahead, Natixis' analysis says "This should help to raise US interest rates and strengthen the Dollar, both of which would be negative for gold and silver prices." Turning to silver ETFs, which bucked the trend in gold investment trust funds and continued to grow by weight last year even as the silver price dropped 28%, "If these guys start selling like they did with gold," says Walter De Wet of Standard Bank, "we could see substantial downside pressure on silver." Again pointing to forecasts of a rising US Dollar and higher US bond yields, "Over the past couple of years," de Wet concludes, "we have seen that the silver price does ultimately tend to follow the same path as gold so we do think that is a substantial risk." French investment and London market-making bullion bank Societe Generale conversely points to India, where 2013 imports rose sharply. That's because strict gold import regulations "diverted some traditional gold demand to silver," says precious metals specialist Robin Bhar. Additionally, the sharply lower silver price last year encouraged opportunistic purchases by Indian households. Now however "there have been signs in mid-February that the silver price recovery has caused demand to drop back," Bhar believes. Overall, silver investment "is set to dissipate," he says, "particularly if the Indian government loosens restrictions on gold imports." SocGen now expects the silver price to average $19 in 2014, well below last year's $23.79 per ounce and almost a dollar below the London market's average analyst forecast. Only Swiss investment and bullion bank UBS breaks consensus, raising its analysts 2014 average silver price forecast from $20.50 per ounce to $22.30. "The improvement in gold sentiment should have a considerable positive spillover effect on silver," write strategist Edel Tully and analyst Joni Teves. Moreover, "Silver should benefit from a global economic recovery more than gold." | ||||

| Silver Price Breaks $22 But Analysts See "Substantial" Risks Posted: 24 Feb 2014 02:34 PM PST UBS bucks trend, SocGen says Indian silver imports "will fall" if gold rules eased... SILVER PRICE gains of 6% last week and 12% so far in February have yet to convince precious metals analysts that the trend will prove more than a blip. According to French bank Natixis, the silver price rally is likely to be short-lived. "We would expect US economic data to improve," they further add in their latest note, "as we move beyond the current bout of extreme weather which has dampened economic activity since December." Looking ahead, Natixis' analysis says "This should help to raise US interest rates and strengthen the Dollar, both of which would be negative for gold and silver prices." Turning to silver ETFs, which bucked the trend in gold investment trust funds and continued to grow by weight last year even as the silver price dropped 28%, "If these guys start selling like they did with gold," says Walter De Wet of Standard Bank, "we could see substantial downside pressure on silver." Again pointing to forecasts of a rising US Dollar and higher US bond yields, "Over the past couple of years," de Wet concludes, "we have seen that the silver price does ultimately tend to follow the same path as gold so we do think that is a substantial risk." French investment and London market-making bullion bank Societe Generale conversely points to India, where 2013 imports rose sharply. That's because strict gold import regulations "diverted some traditional gold demand to silver," says precious metals specialist Robin Bhar. Additionally, the sharply lower silver price last year encouraged opportunistic purchases by Indian households. Now however "there have been signs in mid-February that the silver price recovery has caused demand to drop back," Bhar believes. Overall, silver investment "is set to dissipate," he says, "particularly if the Indian government loosens restrictions on gold imports." SocGen now expects the silver price to average $19 in 2014, well below last year's $23.79 per ounce and almost a dollar below the London market's average analyst forecast. Only Swiss investment and bullion bank UBS breaks consensus, raising its analysts 2014 average silver price forecast from $20.50 per ounce to $22.30. "The improvement in gold sentiment should have a considerable positive spillover effect on silver," write strategist Edel Tully and analyst Joni Teves. Moreover, "Silver should benefit from a global economic recovery more than gold." | ||||

| Gold and Silver Sentiment Improving Significantly Posted: 24 Feb 2014 01:57 PM PST This article is based on the latest premium edition of the Sentimentrader report (click here for a free trial). Market sentiment towards gold and silver are analyzed and put into perspective. Early February, we showed the sentiment report for gold and silver. In Silver Price To Break Out Or Break Down In ComingDays, readers can see how gold sentiment had a score of 40 (on a scale to 100) while silver stood at 20. From the latest sentiment report, released over the weekend, it appears that sentiment towards both gold and silver has improved significantly.

Gold sentimentSentimentrader recently discussed the fact that gold finally crossed above its 200-day moving average for the first time in a year. The other times that has happened, gold tended to do well going forward. Another positive sign is that sentiment has climbed above 50% and the metal has not pulled back significantly. During bear markets, sentiment tends to stay below 50% during rallies. At 70%, sentiment is elevated but not especially troubling yet. Above-average and rising sentiment is good, as long as it doesn’t get excessive, which would occur on a move closer to 80%. Even in a bull market, that would suggest that at least some nearer-term caution would be warranted.

Silver sentimentWe aren’t yet seeing excessive optimism in silver, but at this pace it’s not going to take long. Over the past two weeks, large speculators in silver futures added to their positions at one of the fastest rates in 8 years. The last time they did so was right before the peak in mid-2012. We’re seeing a similar phenomenon in Public Opinion, which went from barely 20% in late December to nearly 60% this week. Such a fast turnabout in sentiment isn’t necessarily a bad sign – a commodity needs improving sentiment in order to rally. The key will be watching how silver reacts to this quick shift. If it’s still mired in a multi-year bear market, then it shouldn’t be able to rally much more before rolling over. If it continues to rally (which we think it will), then we’ll likely see sentiment move to a new regime of generally higher levels of bullishness.

| ||||

| Embry on KWN: Call it the World Anti-Gold Council Posted: 24 Feb 2014 01:51 PM PST 4:50p ET Monday, February 24, 2014 Dear Friend of GATA and Gold: Sprott Asset Management's John Embry tells King World News today that the World Gold Council should be called the World Anti-Gold Council because of the disinformation it distributes. The monetary metals, Embry adds, are doing pretty well fighting both the central planners and the disinformation campaign. An excerpt from his interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/2/24_A_... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||

| Breaking News: Shady Payment System Now Compulsory Posted: 24 Feb 2014 01:40 PM PST World governments announced a plan today to allow citizens to anonymously carry parts of their wealth on their person and exchange it with others using small pieces of colourful paper. The paper is printed with nationalistic and Masonic imagery, along with numbers that purportedly represent the amount of wealth each piece of paper represents (if the paper is not a counterfeit). Each of these pieces of paper is formally a 'note' from each nation's central bank, but they are also attracting the term 'cash'. This is a technical matter that is too complex to cover in our basic primer. Suffice it to say, that it is representative of the complexity and user-unfriendliness of this new system. "What type of idiotic wealth and payment system doesn't maintain transaction and ownership records?" These pieces of papers (also known as 'bills', 'dollar bills', 'George Washingtons' or 'Dead Presidents' among the shadowy community of anti-banking libertarians who have been the primary users of cash to date) will differ from country to country and are not redeemable outside national borders. The question is, are these "bills" too complex? In what will come as a surprise to generations who have grown up with calculators and computers, bills only come in fixed denominations, requiring users to maintain a large number of these pieces of paper that must be aggregated to execute a transaction and then re-aggregated to 'make change'. The latter is a complex process of returning to the payee the excess of the payment using yet other bills. (Don't worry if this sounds complex, we had trouble understanding it ourselves at first and it is certainly not ready for the average consumer in its current form.) Mike Smith, VP of Employee Training at Sears has said:

The launch of cash has provoked an immediate reaction from law-enforcement agencies worldwide that universally condemned the development. "It's the perfect tool for criminals", they say. Mike Smith, the recently confirmed FBI Director, had this to say:

Even officials within the banking system have their doubts about the new plan. Banking Superintendent of New York State Mike Smith said: "I can't think of any reason that a law-abiding individual would want to use 'cash'. At a bare minimum, we believe there should be a licensing procedure for individuals or businesses that plan to use cash – a 'cash license', as it were." This license would limit cash to trustworthy individuals who keep detailed, auditable records of all their cash transactions in order to keep New York safe from criminals, he added. Others have concerns about forgery and counterfeiting. "Ultimately, even with all the fancy inks, 'cash' is just a piece of paper. We fully expect criminal groups and rogue nation states to print fake cash in order to profit or to disrupt the economies of their enemies," said Mike Smith, an analyst at Stratfor.

Though hard to imagine, even more concerning is the fact that cash operates with no consumer protection at all. If your 'bills' are stolen or lost, they are gone forever. "I just don't understand why there is nobody that I can call to reinstate my 'cash' if I lose it," says Mike Smith, a businessman from Toledo. "What type of idiotic wealth and payment system doesn't maintain transaction and ownership records?" Moreover, there appears to be no authentication mechanism associated with cash payments or transfers, let alone one that matches modern security standards. Once someone has gained physical control of your 'bills', they are free to spend or use them as they wish and there is no way to reverse the transaction, stop them or even identify who has stolen them. Even simple destruction of a bill, which, as you recall, is just a piece of paper, could result in losses. According to the Director of the newly founded Bureau of Engraving and Printing, mutilated bills that are more than 51% destroyed must be mailed in for a special investigation that will determine if they should be replaced or not. Proponents of cash have dismissed these concerns saying that various hardware manufacturers, such as Coach and Gucci, will shortly be releasing 'hardware wallets' in leather and suede. These wallets are meant to hold the bills and fit into a pocket or purse. "Once your bills are safely ensconced in your Gucci wallet and securely placed in your pants pocket [the front pocket is recommended as a 'best practice' for security], it is almost impossible for them to be stolen, lost or destroyed," said Mike Smith, VP of Communications for Gucci NA. Some early adopters, however, have reported that the hardware wallets have security flaws. "I was out in Bangkok two weeks ago, at a bar, and I forgot my Gucci wallet there," said Mike Smith, a visiting tourist. "When I returned the next morning, my wallet was there but my cash was gone!" We contacted Gucci regarding this hacking attack, but a spokesperson would not comment "about confidential customer financial matters". Even criminals have not been immune to the risks of cash. The notorious 'Silk Road' drug-dealing marketplace mysteriously closed last week, after vendors and customers left envelopes full of cash (on which they had very clearly written their names) in an anonymous drop-box managed by the exchange. "Theft of the cash due to a bug in the envelope-sealing process," was cited as the cause. While technical experts believe that it might be possible that the glue on the envelope was not correctly applied, they also warn that a 'bill' is basically a private and public key at the same time, and note that there might be dangers involved in letting anonymous criminals hold the private keys to your wealth. But the most unusual limitation on cash might be that it only works for payments within 26 inches or less (the so-called 'arm's length transaction', as hackers in the community have colourfully dubbed it), because it has to be handed from one (human) party to another to execute the transaction. This requirement for the exchange of cash is widely thought to be a fatal flaw by traditionalists. Mike Smith, VP of Retail Banking at Chase said:

He added: "Furthermore, given cash's association with criminal activities, we will be refusing to offer banking services and terminating the accounts of any customer that uses cash in a business or personal capacity. It is the only way we can ensure we remain compliant with our regulatory obligations." Remarkably, if you attempt to use cash in a different country from the one that issued it, it will categorically be rejected. In order to use cash abroad, you will have to go to designated points, usually in airports or certain banks, with limited hours of operation, that will 'exchange' your bills for others printed by the country that you are visiting. These 'exchanges' have high fees – usually 2-3% for each exchange, meaning that tourist will lose 5% of their cash or more on a typical trip just in these exchange costs. This seems extraordinarily high for what is, ultimately, an exercise in multiplication or division. Economists are flabbergasted that lawmakers have allowed cash to be adopted despite their strong objections. A key policy tool of central banks has been the use of positive and negative interest rates to manage economic growth. It appears that this will not be possible with cash. Mike Smith, a leading economics blogger for The New York Times said: "This is a sad day for macro-economics. If cash ever catches on in any meaningful sense, it will reduce our control over the levers of the economy significantly, by providing a mechanism for depositors to opt out of negative interest rates. Given the fact that it might keep us from preventing the next depression and will definitely reduce tax collections, one could even consider it 'evil'." "Children, the elderly and immuno-compromised individuals should not handle cash under any circumstances." Environmentalists unsurprisingly expressed concerns too about the impact of cash on the environment. Mike Smith, recently appointed Executive Director of the Sierra Club said: "You would have thought that in 2014, we would have moved beyond pesticide- and water-intensive cotton farming [retracted: cutting down trees], treating the cotton with dangerous inks, and transporting it with fossil fuels, only to represent a value, such as '20', that can be represented electronically at effectively no cost to the environment. When will we ever learn?" Public health officials also warned that cash could be an excellent vector for disease transmission. "We tested several 'bills' in our labs recently and discovered that the average bill has 20 times more bacteria than a toilet seat," said Mike Smith, Director of Research at the Mayo Clinic. "Our advice is that people should avoid cash in general and only handle it if absolutely necessary." "Children, the elderly and immuno-compromised individuals should not handle cash under any circumstances." Proponents of cash think it will ultimately be a widely adopted technology that will spread around the world, enabling in-person, mid-tier transactions (not micro-payments, but not mega-payments either) in a manner that is invulnerable to electric or Internet outages and that will usher in a new era of more 'human' commerce. We try to keep an open mind at this publication toward new technology, but, to date, we have a hard time seeing the positive case for cash. Certainly criminal groups will take advantage of cash's perfect anonymity to wreak havoc on law enforcement and tax collection, something that is deeply undesirable. Among law-abiding citizens, we can envision some possible adoption in dense urban hipster communities like Williamsburg, where 'wallets', 'cash' and 'making change' could be yet another reflection of their tongue-in-cheek view of modern societal systems. Other than that, it would be hard to recommend that the average consumer or merchant becomes involved in what is still today a very buggy system, filled with risk, inconvenience, high transaction costs, and possible disease transmission. Even if handled perfectly, cash will certainly tar your business and personal life with the seedy reputation of the drug dealers, terrorists, money launderers and anti-establishment anarchists who use it today, threatening business and banking relationships, and raising eyebrows among law enforcement and your community. Regards, Antonis Polemitis Ed. Note: However ridiculous it may be, the faith-based monetary system we currently “enjoy” isn’t going anywhere. At least, not any time soon. So it’s imperative that you know how to put those pieces of paper to good use. In today’s issue of The Daily Reckoning, readers were treated to several chances to do just that – including one opportunity that shows you what to do as the U.S. government plans to deliberately devalue the U.S. dollar. So don’t wait. Sign up for the FREE Daily Reckoning email edition, and never miss out on another great profit opportunity. | ||||

| Gold Daily and Silver Weekly Charts - Option Expiry Tomorrow - Remembering Baghdad Bob Posted: 24 Feb 2014 01:35 PM PST | ||||

| Gold Daily and Silver Weekly Charts - Option Expiry Tomorrow - Remembering Baghdad Bob Posted: 24 Feb 2014 01:35 PM PST | ||||

| Is Lassonde really so ignorant of his own organization's work? Posted: 24 Feb 2014 01:14 PM PST 4:23p ET Monday, February 24, 2014 Dear Friend of GATA and Gold: GATA's researcher, consultant, and friend R.M. had to laugh at World Gold Council board member Pierre Lassonde's insistence in his interview today with Kitco News that central bankers "spend no time whatsoever thinking about gold": http://www.gata.org/node/13683 For if central bankers really don't bother with gold at all, R.M. wonders, why does the World Gold Council spend so much time talking to them about it? And how can a World Gold Council board member be so ignorant of his organization's work? Or is Lassonde really not ignorant at all but working hard at disinformation for people who are not central bankers? R.M.'s commentary is appended. CHRIS POWELL, Secretary/Treasurer * * * While Pierre Lassonde may maintain the fiction that central banks "spend no time whatsoever thinking about gold," the evidence from the World Gold Council, on whose Board of Directors he sits, suggests otherwise, and the highly paid gold council staffers who specialize in dealing with central banks might be forgiven for raising an eyebrow or two at his strange remark. A few minutes of research into the organization Lassonde purportedly is helping to supervise would show him the following: 1. The World Gold Council says its "government affairs team works with policymakers and influencers globally, such as central bankers, politicians, regulators, academics, and the financial services industry, equipping them with tools and research to make an informed decision about the role of gold": http://www.gold.org/government_affairs/what_we_do/ A review of the council's government affairs publications shows 68 research reports especially relevant to central banks: https://www.gold.org/media/publications/#start/0/limit/10/ordering/date/... ... Dispatch continues below ... ADVERTISEMENT Jim Sinclair plans seminars in Los Angeles and San Diego Gold advocate Jim Sinclair's next market analysis seminars will be held in Los Angeles from 11 a.m. to 2 p.m. on Saturday, March 8, and in San Diego from 2 to 6 p.m. the following day, Sunday, March 9. Details, including registration information, are posted at Sinclair's Internet site, JSMinset.com, here: http://www.jsmineset.com/qa-session-tickets/ 2. The World Gold Council jointly sponsors a program called the Executive Program in Gold Reserves Management in conjunction with the University of California at Berkeley. This program is held exclusively for central bank and finance ministry representatives. The program says about itself: "The Executive Program in Gold Reserves Management is a joint initiative between the UC Berkeley Center for Executive Education and the World Gold Council. Led by distinguished faculty from UC Berkeley and experts from the World Gold Council, this program will lead central bankers and finance ministry officials through an intensive four-day program that will equip each participant with the skills necessary to return home as an expert in the management of gold reserves." "As central banks collectively hold $1.7 trillion in gold reserves, it is essential that central bank executives understand the underpinnings of the global gold market." See: http://executive.berkeley.edu/programs/executive-program-gold-reserves-m... 3. In May 2011 in Shanghai, Central Banking Publications and the World Gold Council held a three-day seminar for central bank delegates titled "Gold as a Reserve Asset: The Role of Gold in Modern Central Bank Reserve Management." The course was introduced this way: "The return of central banks as active purchasers in 2009 represented a sea change in official sector attitudes to gold. Now perhaps more than ever in the past three decades, central banks are reviewing not just their holdings but also their understanding of gold and its role in a reserve portfolio." See: The detailed course schedule is here: http://www.garashanghai.com/digital_assets/4601/GARA_brochure.pdf A list of more than a hundred central banks that previously sent representatives to the course is here: http://www.garashanghai.com/static/past-delegates 4. In 2013 the World Gold Council commissioned a report by the Official Monetary and Financial Institutions Forum, which concluded that "as the world heads toward a multi-currency reserve system, demand for gold is likely to rise." "The Official Monetary and Financial Institutions Forum is an independent globally-operating financial think tank and a platform for confidential exchanges of views between official institutions and private sector counterparties. OMFIF cooperates with central banks, sovereign funds, regulators, debt managers, and other public and private sector institutions around the world." http://www.omfif.org/about/ Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| A Number Of Frightening Black Swans Will Surface In 2014 Posted: 24 Feb 2014 12:33 PM PST  With gold and silver surging, oil remaining over $100, and the US Dollar Index desperately trying to cling to the 80 level, today a man who has been involved in the financial markets for 50 years, and whose business partner is billionaire Eric Sprott, warned King World News that a number of black swans are going to surface in 2014. John Embry also discussed the implications of the coming chaos for investors around the world. With gold and silver surging, oil remaining over $100, and the US Dollar Index desperately trying to cling to the 80 level, today a man who has been involved in the financial markets for 50 years, and whose business partner is billionaire Eric Sprott, warned King World News that a number of black swans are going to surface in 2014. John Embry also discussed the implications of the coming chaos for investors around the world.This posting includes an audio/video/photo media file: Download Now | ||||

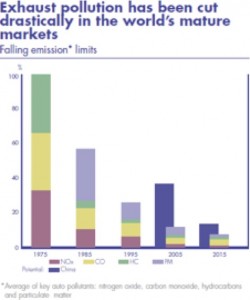

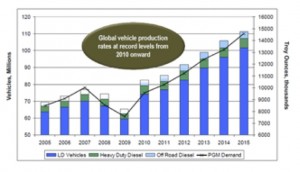

| Focus on Stable Platinum and Palladium Miners in N. America Posted: 24 Feb 2014 11:58 AM PST The platinum and palladium market has grown substantially in the past generation in its use in catalytic converters to reduce noxious air emissions such as carbon monoxide and particulate matter from automobiles. The use of catalytic converters in the developed countries has reduced emissions drastically. However, demand is rising for catalytic converters in China as the government may be instituting increased regulations to reduce toxic air emissions. There is a major health concern in major cities in China due to thick and dark smog. The large cities are increasing regulations to control air emissions to alleviate this dangerous problem.

Labor prices are soaring and these mines may not be mechanized due to the costly risks. Due to the resource nationalism in South Africa and Zimbabwe, smart investors will look for great assets in politically stable jurisdictions. For months I have alerted you to build a position in platinum and palladium and was even more bullish on PGM's then gold and silver. This is when platinum was cheaper than gold. Now platinum is more than $200 higher than gold.

Stillwater may gain investment interest and benefit from this rebound in PGM's. Unfortunately, the company is revamping itself after the prior management made a stupid move to buy a copper-gold deposit in Argentina. I believe they may write that mine off and buy Wellgreen Platinum (WG.V or WGPLF) in the Yukon. The deficit in mine production combined with a greater degree of investment interest could put M&A mode back into the PGM complex. We just witnessed Goldcorp and Osisko. I sent the above chart to my premium subscribers back in January. The stock has made a nice breakout move. Could Wellgreen Platinum be the next major PGM winner? Look at this breakout as a clue.