Gold World News Flash |

- Gold shares are lowest relative to gold in 70 years, Stoferle tells KWN

- Lassonde spouts disinformation and Kitco's Cambone just smiles prettily through it

- After the EMP comes Nuclear Meltdown

- The Big Difference Between the Chinese and Americans? SEE VIDEO — WEEKLY Chinese Gold Demand Transcends GLOBAL MINING PRODUCTION, Again

- Weekly Sentiment Report: The Smart Money is Bearish

- Zombie Dance Party: Its Only a Monopoly, But I Like It

- This Is One Of The Biggest Financial Opportunities In 70 Years

- The NY Fed Is Hiring: A Gold Vault Custody Analyst, Must Be "Able To Physically Lift Valuables"

- 7 Vital Lessons from a Perfect Speculation

- 4 Countries to Watch in 2014

- Gold And Silver Rise For 3rd Straight Week

- The Popsicle Index – Catherine Austin Fitts Interview

- Koos Jansen: Precious metals aspirations of the biggest bank in the world

- Gold Prices Touch 4-Month High, Silver Volatile, "Bucks Seasonal Pattern" as Big Investors "Reverse" Positions

- Gold and Silver Juniors Mining Stocks Outperformance

- The Coming Silver Storm:Â The Public Is Not Prepared

- GDXJ Signals Imminent Breakout Into Major Gold and Silver Stocks Sector Uptrend...

- An Historical Look at Gold and Silver Stocks

- A World of Manipulated Markets

- Gold price in a range of currencies since December 1978 XLS version

- Benjamin Asuncion and Geordie Mark: Six Gold and Silver Leaders at Today's Prices

- Benjamin Asuncion and Geordie Mark: Six Gold and Silver Leaders at Today's Prices

- Jim’s Mailbox

- London gold fix may be manipulating half the time, research concludes

- The Counter-Intuitive Gold Play

- A World of Manipulated Markets

- Marin Katusa -- The American Way of Life Will Be Destroyed -- Inflation to Exceed 100%...

- Gold and Crude Oil Short-term Outlook

| Gold shares are lowest relative to gold in 70 years, Stoferle tells KWN Posted: 24 Feb 2014 10:26 AM PST 1:25p ET Monday, February 24, 2014 Dear Friend of GATA and Gold: Market analyst Ronald-Peter Stoferle of Incrementum AG Liechtenstein today tells King World News that gold mining company shares are trading at their lowest level relative to gold itself in 70 years: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/2/24_Th... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair plans seminars in Los Angeles and San Diego Gold advocate Jim Sinclair's next market analysis seminars will be held in Los Angeles from 11 a.m. to 2 p.m. on Saturday, March 8, and in San Diego from 2 to 6 p.m. the following day, Sunday, March 9. Details, including registration information, are posted at Sinclair's Internet site, JSMinset.com, here: http://www.jsmineset.com/qa-session-tickets/ Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||

| Lassonde spouts disinformation and Kitco's Cambone just smiles prettily through it Posted: 24 Feb 2014 10:06 AM PST 1:14a ET Monday, February 24, 2014 Dear Friend of GATA and Gold: In an interview with Daniela Cambone of Kitco News posted today, Franco-Nevada Corp. Chairman Pierre Lassonde, a member of the Board of Directors of the World Gold Council, repeats his assertion, made last year in an interview with MineWeb's Geoff Candy -- http://www.gata.org/node/13105 -- that central banks "spend no time whatsoever thinking about gold." Lassonde thereby contradicts what he told Cambone just seconds earlier about all the effort the German Bundesbank lately has spent lately fending off complaints that there's something fishy about the slow pace of repatriation of the German gold purportedly vaulted at the Federal Reserve Bank of New York. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata And having achieved great respectability in the financial world, Lassonde must believe that he can overlook the dozens of documents collected and published by GATA establishing both the historic and current interest of central banks in the gold price. Maybe Lassonde thinks that those documents, collected here -- http://www.gata.org/taxonomy/term/21 -- are all forgeries, though some of them remain posted in the Internet archives of government agencies. Or maybe Lassonde thinks that all those documents have been misconstrued, like the presentation made by the director of market operations of the Banque de France to the conference of the London Bullion Market Association in Rome last September, wherein the French central banker said the bank trades gold for its own account "nearly on a daily basis": http://www.gata.org/node/13373 That is, maybe the Banque de France trades gold just for fun and "spends no time whatsoever thinking about it." Maybe Lassonde thinks the same goes for the Bank for International Settlements, whose annual report for 2013 -- http://www.gata.org/node/12717 -- declares: "The bank transacts foreign exchange and gold on behalf of its customers, thereby providing access to a large liquidity base in the context of, for example, regular rebalancing of reserve portfolios or major changes in reserve currency allocations. The foreign exchange services of the bank encompass spot transactions in major currencies and Special Drawing Rights (SDR) as well as swaps, outright forwards, options, and dual currency deposits (DCDs). In addition, the bank provides gold services such as buying and selling, sight accounts, fixed-term deposits, earmarked accounts, upgrading and refining, and location exchanges." Yes, maybe the BIS also gives no thought to the gold trading it does on behalf of its member central banks. Maybe it's just fun for the BIS too. As a member of the World Gold Council's board, Lassonde is plainly in the disinformation business. But then all these documents have been sent many times to Cambone herself, who, interviewing Lassonde, just sits there smiling and looking pretty while he spouts nonsense, never posing even one critical question based on the documentation. Whatever business Cambone is in, it's not journalism. Her interview with Lassonde is eight minutes long and can be viewed at the Kitco News Internet site here: http://www.kitco.com/news/video/show/GSA-Investor-Day-2014/558/2014-02-2... CHRIS POWELL, Secretary/Treasurer Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... | ||||||||||||||||||||||||||||||||||||||||

| After the EMP comes Nuclear Meltdown Posted: 24 Feb 2014 09:40 AM PST by Ken Jorgustin, Modern Survival Blog:

A large weaponized nuclear EMP detonation (or group thereof) high in the atmosphere will cause a wide ranging debilitating EMP. A solar super flare (X-50+) and accompanying CME (Coronal Mass Ejection) will zap the surface of the earth with an even longer lasting EMP as it did during 1859 (the Carrington event). | ||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Feb 2014 09:35 AM PST by Koos Jansen, In Gold We Trust:

Here’s a video from Chinese state TV network CCTV on the gold buying spree around the Lunar Year. Although I didn't manage to produce subtitles (working on it!), I think the images speak for themselves. It seems the Chinese are in a state to buy all the physical gold that can be supplied. The beauty of internet is that I have a lot of sources in the mainland, and Chinese that live in other parts of the world, that sent me regular updates on what's happening in Chinese jewelry stores, in the paper gold market, on the SGE and in the Chinese media if they happen to stumble on something newsworthy. | ||||||||||||||||||||||||||||||||||||||||

| Weekly Sentiment Report: The Smart Money is Bearish Posted: 24 Feb 2014 09:33 AM PST In an interesting and sudden turn, the "smart money" has turned bearish. I say "interesting and sudden" because our "smart money" indicator (see figure 3 below) was quasi bullish just a week ago and this past week, the numbers are coming in bearish. Furthermore, equity prices (i.e., SP500) were fairly flat for the week putting a degree of caution into the data. Typically, the "smart money" will be sellers as prices rise, so it is reasonable to ask why were insiders selling when prices weren't up? TACTICAL-BETA OFFERS ACTIONABLE TRADING STRATEGIES AND IT IS 100% FREE.....GO NOW!! So how should we interpret this going forward? From my perspective, this is bearish. Higher equity prices will bring in greater number of insiders selling their shares, and this will push the indicator to an even more extreme level. This is a headwind we shouldn't ignore. In essence, if company insiders are selling their shares presumably because the prospects for the underlying business don't support the valuations, then why should you be buying them? Ahh, but do what you want. Over here at TacticalBeta, we have been NEUTRAL on the equity markets for 2 weeks now. Our equity model turned bearish 2 weeks ago, yet the technicals remain constructive. We sold our equity positions 2 weeks ago, but we recognize we are in a NEUTRAL investing environment that historically (i.e., 23 years of data) has had little edge. However, over the past 2 years such environments have been kind to investors as QE announcements and Fed jawboning have seem to come during these periods after the bullish market mojo has fallen, but prior to a sell off in prices. This is just another way of saying that the dips have been shallow as investors have learned to anticipate Fed intervention and that the equity markets really haven't sold off for quite some time. I don't believe this is healthy bull market action, and I am sure that I am in the minority opinion on this one, but then again, I don't whine or angst on every 2-3% correction. Let's return to our NEUTRAL investing environment. So what does it mean? One, it defines a market environment where the SP500 has underperformed over the entirety of the data, and there is no predictable edge to the price action. Two, the price action tends to be ruled by overbought and oversold signals. Three, it gives investors an opportunity to reduce - -as opposed to being all in or all out like a light switch -- their allocation to equities. With little predictive edge, why be in the markets full throttle? Look at investing this way. You are a card counting black jack player. You cannot predict the next winning hand or cards that come out of the shoe, but you can determine (and this is the sole purpose of card counting) when is the best time to bet heavy. A neutral market environment may or may not produce a winning trade, but it is not a time to be betting heavy. Got it? To summarize, the "smart money" indicator has turned bearish. This is more in alignment with the other sentiment indicators, which have been showing too many bulls for quite some time. These indicators, like the "dumb money" (figure 2 below) and the Rydex data (not shown), have been un-winding for several weeks now. Higher prices should see more corporate insiders selling, and this is a headwind.

The Sentimeter | ||||||||||||||||||||||||||||||||||||||||

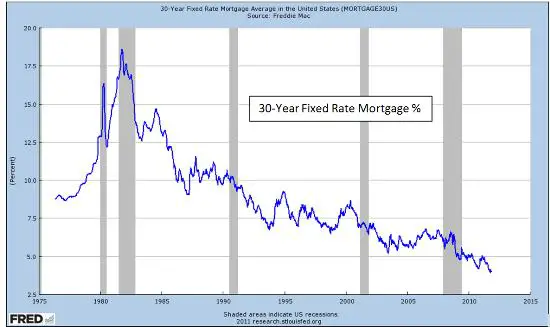

| Zombie Dance Party: Its Only a Monopoly, But I Like It Posted: 24 Feb 2014 09:05 AM PST In my last post on Zero Hedge, we talked about why the shareholders of Fannie Mae and Freddie Mac don't deserve any special consideration – except perhaps the sympathy of a priest or bartender. When you as a private investor are dumb enough to do business with a sovereign entity, don't be surprised if you get screwed. See: "Don't Cry for the Shareholders of Fannie Mae and Freddie Mac" http://www.zerohedge.com/contributed/2014-02-17/dont-cry-shareholders-fa... This week, let's talk about the release of the 2008 minutes from the Federal Open Market Committee and what they suggest for the future of the US economy. While it is pretty clear that the members of the FOMC eventually did the right thing five years ago in terms of reducing the cost of credit, the reasons behind the change in policy are less clear. Five years ago, most of the Fed's policy making body did not have a clue about the significance of what was happening in real markets and they still don't. Just read the parts about Fed governors fretting about saving Lehman Brothers, a firm that could not be sold or saved. As Gretchen Morgenson wrote in the Sunday New York Times: http://www.nytimes.com/2014/02/23/business/a-new-light-on-regulators-in-... [T]hey paint a disturbing picture of a central bank that was in the dark about each looming disaster throughout 2008. That meant that the nation's top bank regulators were unprepared to deal with the consequences of each new event. Specifically, it seems that Fed Chair Janet Yellen et al did not then and still don't really understand today why the markets fell apart in 2008-2009. Accordingly, they also don't appreciate that raising rates without a concurrent increase in the demand for credit is a really bad idea. The whole push to lessen QE seems to be more about pleasing the talking heads in the financial media and boosting "confidence," rather than effecting substantial change in the structure of the economy. For a while now, we have been talking about how the negative effects of quantitative easing on savers are hurting the US economy. Robbing savers of $100 billion per quarter to subsidize the banks (and hundreds of billions more for subsidies to leveraged investors outside the banking system) is unfair and deflationary. The vast flow of subsidies going to debtors also illustrates the extreme situation in which the US economy now stands, because even a modest increase in the cost of credit could also provoke a sharp downward spiral in stock and bond prices, albeit for different reasons. The crucial concern is that the level of demand in the US economy is still not sufficient to justify a significant rise in rates. In fact, if the Fed raises the cost of credit too fast and before we see significant reforms in the US economy, the value of financial assets could start to fall. That is, too much taper could lead to deflation because we still have not fixed what is wrong with the financial markets. So while a modest adjustment in policy is good to give some relief to savers, the FOMC needs to help Congress understand what needs to happen in terms of structural market reform in order to restore credit demand. What reforms? The Fed needs to lead the national discussion about what to do next. See my comment in The National Interest in that regard, "What Quantitative Easing Couldn't Do" http://nationalinterest.org/commentary/what-quantitative-easing-couldnt-... Now you are probably wondering, Chris, what is this about not enough reforms? Wasn't Dodd-Frank enough reform from Washington? No, the trouble with Congress and the FOMC alike is that they don't understand that the key reform needed in the US economy is not just to restrain acts of fraud and stupidity on Wall Street, which was a good idea, but to also end the monopoly on credit creation that exists between the TBTF banks and the US government. The chief obstacle to economic revival in the US is the monopoly over housing finance that exists between the top five commercial banks and the housing GSEs, including Fannie Mae, Freddie Mac and Ginnie Mae. I am currently finishing a new book with my friend and mentor Fred Feldkamp, a retired partner of the Foley & Lardner law firm. The working title of the book is "Financial Stability: Fraud, Confidence & the Wealth of Nations." The idea for the book and the concept of using credit spreads to judge the efficacy of public policy belongs to Fred, who is arguably the father of the "true sale" in the world of asset securitizations, at least in the period since the 1925 Supreme Court ruling written by Justice Louis Brandeis in Benedict v. Ratner. Below are some excerpts from our upcoming book. When Fred got out of law school in the late 1960s, his first task was to find a way for private non-bank issuers of ABS to work a way around the draconian test for transparency and sale treatment in Benedict. If you don't know of what I speak, read the first part of the paper I just completed for Indiana State University, "Dodd-Frank and the Great Debate: Regulation vs. Growth." http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2399614 Let's start with a very short version of US financial history since WWII, something about which most market participants and FOMC members seem to know precious little. If you take the Benedict decision in 1925 as the starting point for the collapse of private finance in the U.S. economy, the ability of the private sector to create leverage outside of the broader government monopoly populated by large banks and corporations was limited until the early 1970s. WWII, the Cold War and a lot of government spending got us out of the Great Depression and through three decades after the Second World War. By 1968, though, growth was slowing, inflation was rising and there was a battalion of paratroopers from the 82nd Airborne Division camped across the street from my parents' house in the Cleveland Park section of Washington DC as cities from Chicago to Baltimore burned following the assassination of Martin Luther King. In the 1970s, we saw the re-birth of private finance in the US with some of the earliest ABS deals based upon accounts receivable finance. Non-bank firms led the way, in part because of the continued regulation on the banks dating back to the Great Depression and partly because of non-financial firms were not required to consolidate their financing units. Firms such as GM, Ford as well as many home builders could transfer ownership of assets to a 100% owned subsidiary in a "true sale" that was consistent with the Supreme Court's decision in Benedict and raise money more easily than borrowing from a bank. Even though the interest paid on these bonds was taxed just like other securities, the advantage for non-bank firms was decisive and helped the US economy grow. As today, commercial banks were not willing or able to lend. Because financial firms were required to consolidate debt issued by financial subsidiaries and homebuilders were not, that difference gave an advantage to the creative home builders that invented the structure. That advantage ended, however, in 1986 when the "Real Estate Mortgage Investment Conduits" or "REMIC" opened the housing finance market to financial firms. Wall Street firms successfully lobbied Congress to do away with double taxation of mortgage securities and adopted one model as the standard for pass through securities. The resulting legislation created the REMIC, which had much higher after-tax yields than other forms of mortgage-backed securities. By no coincidence, REMICs displaced other types of mortgage-backed securities and soon became the dominant choice of entity for such transactions issued by banks and federal housing agencies. By the exclusivity REMIC required a few years later, the law closed out competition from non-financial firms for banks and broker dealers for issuing ABS such as collateralized mortgage obligations ("CMOs"). The REMIC, in effect, provides a monopoly position to financial firms in the world of housing finance and is really the underlying cause of the significant problems which have occurred since. Borden and Reiss (2013) note that in the 2000s Wall Street firms often abused the Internal Revenue Service rules regarding the tax exemption of REITS, bringing into question whether the vehicles were properly constructed to qualify for tax exempt treatment. A 2012 suit filed by the New York Attorney General also details in its allegations how loan originators and REMIC sponsors on Wall Street colluded to populate REMICs with mortgages that did not comply with the REMIC rules. Builders soon saw that financial firms were using REMIC CMOs to bid down spreads between newly originated mortgage securities and 10-year Treasury bonds to levels that made the deals less profitable than other opportunities. The business, therefore, became monopolized by a few large banks and housing GSEs in Washington, a monopoly that the SEC affirmed and compounded by also granting banks "monopsony" power over the CMO market in 1998. The changes to the ABS market created via the bank/GSE monopoly granted by the REMIC soon destabilized the US economy. This market was severely disrupted by events in October 1987, then recovered near-equilibrium by 1990 and generally "flat-lined" for until the enactment of Rule 3a-7 by the SEC. In 1992, the SEC adopted Rule 3a–7 under the Investment Company Act specifically to exclude from the definition of investment company certain asset-backed issuers. The markets responded favorably to this change, but the revival of non-bank finance lasted just six short years. The forces of market monopolization led by the largest banks and GSEs started to "bubble up" in the late 1990s and won a total monopoly over the US mortgage markets following the amendments to the SEC's Rule 2a-7 amendments in 1998. In a very real sense, the SEC under Arthur Levitt set the stage for the subprime debacle a decade later. Even today, the SEC does not even understand the significance of their actions a decade ago. It is important to understand the context behind two key rule changes made by the SEC in the 1990s, the adoption of Rule 3a-7 in 1992 and the amendments to Rule 2a-7 in 1998. The financial markets had struggled for balance from the 1987 crash throughout the presidency of George H. W. Bush despite resolving many issues. A group of lawyers that included Fred Feldkamp was asked to assess the reasons for the market dysfunction. The group told then SEC Chairman Richard Breeden that the mortgage finance markets were balancing because of CMOs, but that this same stabilizing effect was not available for non-mortgage assets. The shorter maturity tranches of non-mortgage securitizations needed access to money market funds and the same legal exemptions that made mortgage deals work. CMOs for residential mortgages got the necessary legal exemption because they involved real estate -- an offshoot of the REIT exception to the Securities Act of 1940. Eventually the SEC adopted Rule 3a-7 and new shelf-registration rules in December 1992, before Chairman Breeden left the SEC and after President Bill Clinton was elected. This change broke the logjam in the markets for non-mortgage securitizations and in the process helped make the Clinton Presidency one of the most successful in terms of economic growth in the past half century. The combination of vast cash inflows from payroll contributions by baby boomers to Social Security, which pushed down the federal deficit, and the changes to the rules for ABS, helped propel a remarkable period of private capital formation and growth in the US economy. Within months of the adoption of Rule 3a-7, people were able to bring CMO technology to non-mortgage assets and short-term mortgage tranches to money market funds. The implementation of Rule 3a-7 by the SEC enabled the rescue of General Motors and its GMAC financing unit after the parent lost $23 billion in 1992 and was literally within weeks of filing Chapter 11. Market professionals created asset backed securities ("ABS") and MBS-backed commercial paper using creativity and lots of bells and whistles. The change enabled non-bank firms to safely compete with banks for selling this paper to money market funds. Abuses, however, allowed lots of scammers to exploit the rule changes made by the SEC. The creation of exceptions to the rule of prohibition carries with it both benefits and also dangers for the market and society. Dishonest market participants were able to create financial instruments that behaved like the type of safe, "current assets" required for backing commercial paper in money market funds -- but ONLY when interest rates were low. By creating financial instruments which contained massive amounts of hidden negative convexity, these market participants sponsored instruments that looked fine under a low rate environment, but "blew up" when the Fed caused a jump in mortgage rates early in 1994. Among the casualties of that period was the firm Kidder Peabody, which was owned by General Electric at the time and following heavy losses was subsequently sold to PaineWebber in 1994. The SEC did not understand what happened. They tried to convict one of the worst offenders of the Kidder Peabody scandal, but the SEC's lawyers never understood negative convexity sufficiently to explain to a jury that the guy was obviously a crook. The media portrayed the Kidder Peabody debacle as a case of insider trading, but the real cause of the collapse was the creation of toxic securities. Rather than fix what was really wrong with Rule 3a-7, the SEC enacted amendments to Rule 2a-7 amendments in 1998. These changes gave a monopoly to banks when it came to issuing non-mortgage securitizations. Not only were all non-bank types of ABS-backed commercial paper effectively cut off by the SEC's adoption of amendments to Rule 2a-7, the rules were written so any bank could get 5% of a money market for each structured investment vehicle they created to issue commercial paper. A large bank, for example Citibank, could exploit this loophole and create 20 SIVs so that the bank could supply 100% of the assets owned by a money market fund. In order to compete with the advantage given to major banks, other firms found they needed to resort to scams (e.g., Lehman Brothers' infamous "Repo-105" fraud) to get around the monopoly/monopsony created by the SEC's 1998 amendments to Rule 2a-7. Both Bear, Stearns and Lehman committed corporate suicide trying to compete with the TBTF/GSE monopoly. But no private company can compete with a GSE. As a result of the SEC's 1998 amendments to Rule 2a-7, diversified, non-bank asset-backed securitizations that had neutralized the pricing power of bank conduits between 1992 and 1998 were cut off. In addition, despite rules intended to prevent credit concentrations at money market funds, the 1998 rules allowed a single sponsor to be the sole source of credit deficiency support behind 100 percent of all assets of all money market funds, merely by creating many conduits. It is, therefore, understandable that bank-controlled conduits came to dominate short-term commercial paper issuance in U.S. financial markets. Creation of this bank monopoly led to a series of market bubbles and crashes that the inherent stability of non-bank CMOs could not rectify. Financial crises occurred with regularity after the SEC's 1998 policy error. The SEC let a few large banks and the GSEs take near-total control of mortgage markets just as the mercantilist instincts of several major exporting nations began to flood the US with unprecedented (and, arguably, unneeded) liquidity. As risk spreads fell when foreign investors flooded US markets to support ages-old policies of mercantilists, "too big to fail" entities began to reduce the quality of underlying loans so they could buy them more cheaply and make front-ended profits. Most builders dared not do that because they were not "too big to fail" banks and would go broke buying back the loans in a slump. By slipping "risk" in at the front end and using "off balance sheet" liabilities to pretend risk did not exist when selling CMOs, financial firms succeeded in driving this "magical" product into the ground, along with the world's economy. As other investors learned how to "short" low-quality deals using derivatives, a "race to the bottom" began. That's how modern history's greatest financial invention – the non-bank CMO -- ended up nearly destroying the world in 2008. As a consequence, CMOs issued after 1998 generally increase market volatility whenever an opportunity for abuse existed. CMOs are instruments designed to be held to maturity. That design characteristic cannot be sustained if a crisis necessitates the sale of CMOs by initial holders of the instruments. Therefore, when markets are de-stabilized by abuse, CMOs convert from "counter-cyclical" assets to "pro-cyclical" instruments that actually intensify market instability. Think of it this way: If the duration of a security jumps from 12 months to 12 years in a matter of weeks, the price of that bond is going to fall proportionately. In short, that instability converts COMs into financial weapons of mass destruction. To fix the mess, Congress must end the bank/GSE monopoly that has dominated the US financial markets since 1998. We need to end the monopoly created by the adoption of the REMIC as the exclusive vehicle for MBS. Specifically, Congress needs end the exclusivity of the REMIC and reverse the changes made by the SEC in 1998 with respect to Rule 2a-7. Congress ought to emphatically support efforts to reduce the instability that fraud creates whenever possible and also exercise its exclusive power to permit debt forgiveness with respect to bankruptcies. The 20-30 percent of Americans who today live in homes that are worth less than the mortgage face this dire situation be | ||||||||||||||||||||||||||||||||||||||||

| This Is One Of The Biggest Financial Opportunities In 70 Years Posted: 24 Feb 2014 08:34 AM PST  With crude oil still trading well above $100, and gold and silver surging, today a man out of Europe who has been extremely accurate with his calls on the gold market sent King World News a tremendous piece which reveals that right now investors around the world have one of the biggest opportunities in more than 70 years to make outsized gains. Below is what Ronald-Peter Stoferle of Incrementum AG out of Liechtenstein had to say. With crude oil still trading well above $100, and gold and silver surging, today a man out of Europe who has been extremely accurate with his calls on the gold market sent King World News a tremendous piece which reveals that right now investors around the world have one of the biggest opportunities in more than 70 years to make outsized gains. Below is what Ronald-Peter Stoferle of Incrementum AG out of Liechtenstein had to say.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||

| The NY Fed Is Hiring: A Gold Vault Custody Analyst, Must Be "Able To Physically Lift Valuables" Posted: 24 Feb 2014 08:26 AM PST This is about as funny as it gets, and certainly no commentary needed. From a job posting in efinancialcareers.co.uk Area Overview The Financial Services Group (FSG) operates and oversees payments system processing for the Federal Reserve Bank of New York. The FSG provides depository institutions with various payment services, including electronically transferring funds and distributing and receiving currency and coin and other valuables, as part of its central banking mission to ensure an efficient, effective and accessible payments system. Its goal is to be the most trusted and respected provider of financial services in the world. An important and unique service provided by the New York Fed is safekeeping Gold. Various foreign governments, central banks, and international organizations entrust the FRBNY with safeguarding and storing their monetary gold reserves. The Gold Vault is currently the world's largest accumulation of gold, is visited by over 25,000 members of the public each year, and is part of the Cash and Custody Function. The Gold Vault is currently looking to fill the position of Gold Vault Custody Analyst. A Gold Vault Custody Analyst is charged with performing all of the critical responsibilities associated with safekeeping, accounting for, and displaying all gold entrusted to the FRBNY. Job Responsibilities

Qualifications:

h/t Ro | ||||||||||||||||||||||||||||||||||||||||

| 7 Vital Lessons from a Perfect Speculation Posted: 24 Feb 2014 07:41 AM PST Dear Reader, As many of you know, I just moved to Puerto Rico to take advantage of the recently enacted tax incentives designed to attract investors and employers. I’m happy to report that I just received my official government decree, granting me zero capital gains taxes. With my arrival coinciding with the precious metals markets turning upward, the timing couldn’t be better. More about that later, after I get all set up here on this beautiful, crazy island. Today, I want to tell you a story about one of my best speculations ever, and how I see similar opportunities in our market today. I may have to give up my membership card in the Calm and Rational as Mr. Spock Club; I’m actually quite excited about our sector. But don’t worry—I’ll stay disciplined and focused on buying low so we can sell high. Sincerely, Louis James

7 Vital Lessons from a Perfect SpeculationLouis James, Chief Metals & Mining Investment Strategist In October of 2005, when I was still learning the business from my friends and mentors Doug Casey and David Galland, my bosses brought me an interesting idea for a speculation. It was a little-known company called AuEx Ventures, run by a veteran geo who had found and brought several major gold and silver deposits into production—something most geologists never achieve once. I looked into it and found the story quite compelling; the company’s new geological interpretation at a place called Long Canyon had resulted in a first set of terrific drill holes intersecting near-surface gold in an “off-trend” area no one else was exploring. Two of the holes hit 20-plus meters of 6.0 grams per tonne (g/t) and 6.5 g/t gold in a type of mineralization that is relatively cheap and easy to process. If there was more where that came from, it could not only lead to a world-class mine, but open up a whole new gold district in mine-friendly Nevada. I applied Doug’s tried and true 8 Ps formula and found a well-run company with a tight share structure (only nine million shares outstanding) that would add leverage to the upside, and no major red flags. The stock was trading in the 50-cent range, giving the company a market capitalization of only $5 million—not a micro-cap, but a nano-cap. I could see the potential was truly explosive. We decided to recommend the company and issued a buy alert in our Casey Investment Alert on October 25, 2005, at 55 cents. After more successful drilling made the play a little less speculative, subscribers to our monthly publication, Casey International Speculator, were able to get in at C$1.32. Today, our overall gain on the initial recommendation comes close to a 20-bagger (2,000% gain) and a sevenfold return for monthly readers. On the ground, gold mining major Newmont is building the multimillion-ounce Long Canyon gold mine that resulted from little AuEx’s discovery. Much of this formerly off-trend region of Nevada is now a new trend, staked from top to bottom by many mining companies, large and small. But there’s more to the story—and of particular importance today. Note that it’s Newmont that’s building the mine. If you’ve been reading these weekly observations on metals and mining for some time, you know that a takeover of a successful junior company by one of the majors is usually the ideal exit for us as speculators. Not only does the bigger company bring people, experience, and cash to the task of building a large mine and running it profitably, they are often willing to pay a premium for our shares. The price boost is gratifying, but even more important can be the liquidity, especially if we own a large number of shares as compared to average daily trading volumes. AuEx, however, was not a simple discovery-takeover-done story. You see, due to a government screwup, a problem developed with some of AuEx’s land claims; another small company called NewWest might have had mineral rights to some of the same property. The conflict was solvable, and we’d had a chance to take profits on a double just six weeks after our initial recommendation, so we held on. That’s the beauty of a “Casey Free Ride.” Meanwhile, there was a company called Fronteer Development (later Fronteer Gold) that I researched and we recommended in April of 2006, at C$4.96. We took profits almost exactly one year later at C$14.91. Fronteer had its own ups and downs, but management was smart enough to raise a couple hundred million dollars when things were hot, and ended up taking over NewWest, becoming AuEx’s partner on Long Canyon. Long Canyon continued delivering a steady flow of excellent results. With Fronteer sitting on a very large pool of cash and only earning into 60% of the project, I thought it was only a matter of time before it took AuEx over, and I was right. When the deal closed, our 55-cent AuEx shares were trading at C$6.47, and we not only got more shares in Fronteer, we got shares in a spin-out company that inherited AuEx’s non-Long Canyon assets, management, and a bunch of cash. Sewing up 100% of Long Canyon made Fronteer itself a very attractive takeover target, a factor I pointed out in the International Speculator at the time. Apart from that, the company got so cheap in the crash of 2008, I put a new buy on it at C$2.38 in December of that year. I was right again: Fronteer got taken over by Newmont in April of 2011, primarily for Long Canyon, with a final share price of C$14.78. We again got free shares in a spin-out company that inherited Fronteer’s other assets, management, and a bunch of cash. With both spin-out companies still going and making new discoveries, this is like the Energizer bunny of stock speculations: more than eight years later, it just keeps on going and going and going. As of the 1/30/2014 prices of our free spin-out shares, our gain on our initial AuEx recommendation was 1,816.8% (excluding warrants, but including having taken profits). There are many lessons to be drawn from this spectacular success in a near-perfect speculation, including:

And, the big one for today:

Why do I emphasize that last lesson? They are all important, but the very thing that gives a company with a tight share structure and tiny float such explosive upside can make it hard to sell your shares without damaging your gains on the way out. A takeover often provides the best possible exit for investments in thinly traded stocks. There’s a lot more I could say about the anatomy of a takeover, but the first question most people have is: How can I tell which companies will get taken over? A full answer would get very technical. A simpler answer is that I’ve devoted my professional life to doing so; it’s why I fly all over the world, kicking rocks and asking hard questions. I have accumulated a great deal of experience and a track record of picking winners. That sounds boastful, I know, but it’s the truth: Since I started in 2004, I have researched or made recommendations to buy stock in 52 companies that were taken over, or merged with companies that were taken over. Key TakeawayI’m telling you this story today, and making the case for focusing on potential takeover targets, because of the industry-rocking hostile bid for Osisko Mining (OSK.TO) by Goldcorp (GG, G.TO) last month. By the way, Osisko was another stock I recommended back near the bottom of 2008, initially at C$1.82, and sold at C$10.19 in May of 2010 (a good move, before the meltdown of recent years; even now with the takeover, OSK is still only in the $7 range). The critical element today is that Goldcorp’s $2.6 billion offer has proven to be an “all clear” signal to other mining companies and investors in the sector. There has been a slew of financings and other corporate activity, and industry insiders are buzzing with speculation on which companies will be next. Think about it. While gold was falling, why should any potential buyer have been in a hurry to take even a juicy target over? The price might well have been lower the next day, or the next week, and no one else was buying… But now, Goldcorp has clearly shown that it doesn’t think prices will be going lower, and that has lit a fire under other companies that have been considering acquisitions. And it’s not just about avoiding higher prices; if they wait too long, their competitors could beat them to the punch. If it’s going to be shopping season for the majors this year, those who get in to the right stocks first should do very well indeed—and benefit from the ideal exit points to be able to lock in their gains. Of course, I kept takeover potential in mind as I compiled my 10-Baggers for 2014 list, and our 7 Must-Own Stocks for 2014 special report. I’m happy to say that I can tell from correspondence from longtime and new readers alike, that our subscribers are building positions in many companies that have The Right Stuff. The basics I outline above are a good starter kit; any smart and dedicated investor should be able to do well by keeping these ideas in mind and continuing to learn and accumulate experience. Of course, I’d also like to invite anyone intrigued by this true story of an 1,800% return on investment to take advantage of this opportunity with the benefit of my years of research by subscribing now, before the wave of takeovers passes. Try a risk-free subscription to my monthly newsletter, the Casey International Speculator, today, and you’ll get instant access to my 10-Bagger List for 2014 and 7 Must-Own Stocks for 2014 report today. We’ll give you your money back, no questions asked, if you’re not completely satisfied with the quality and value of the research I do for you every month. We’ll give you three months to evaluate your subscription, during which you can cancel for a full refund at any time. However you decide to proceed, I hope you will act to take advantage of this opportunity while shares in good companies are still relatively cheap. Good hunting! | ||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Feb 2014 07:40 AM PST by James Corbett, The International Forecaster:

Nonetheless, it’s a good question, and one with real relevance to our financial and political landscape. So, in the spirit of a publication with the word "Forecaster" and "International" in the title (not necessarily in that order), let’s take a look at four countries that are hovering on the edge of financial crisis this year. First, the ground rules for this analysis: I have excluded any countries that are currently undergoing revolution or political crisis (Ukraine, Venezuela, Turkey, Thailand, Syria etc.) since their economic fortunes rest largely on the outcome of these ongoing events and require too much speculation to accurately forecast. It should be assumed that such countries are going to face significant economic and market turmoil as a result of the political events on the ground. | ||||||||||||||||||||||||||||||||||||||||

| Gold And Silver Rise For 3rd Straight Week Posted: 24 Feb 2014 07:00 AM PST Prices for both gold and silver rose for the third straight week, the first time this has happened in a year-and-a-half, as demand for precious metals continues to stabilize in the West while physical demand in the East remains strong. The latest data from the World Gold Council showed record gold [...] | ||||||||||||||||||||||||||||||||||||||||

| The Popsicle Index – Catherine Austin Fitts Interview Posted: 24 Feb 2014 07:00 AM PST from CaseyResearch.com

| ||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: Precious metals aspirations of the biggest bank in the world Posted: 24 Feb 2014 06:58 AM PST 9:56a ET Monday, February 24, 2014 Dear Friend of GATA and Gold: Gold researcher and GATA consultant Koos Jansen today publishes an English translation of an interview with the head of the precious metals department of the world's largest bank, Industrial and Commercial Bank of China, outlining the bank's ambition to become a major participant in the gold market so that China might gain influence in "international price fluctuations." The interview is headlined "Precious Metals Aspirations of the Biggest Bank in the World: ICBC" and it's posted at Jansen's Internet site, In Gold We Trust, here: http://www.ingoldwetrust.ch/precious-metals-aspirations-of-the-biggest-b... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Feb 2014 06:30 AM PST GOLD PRICES fell but held near new 4-month highs in London trade Monday lunchtime, holding above $1330 per ounce as European stock markets reversed earlier losses. Asian equities closed the day lower after new data showed inflation in China's house prices slowing from 9.9% to 9.6% per year in January. Gold trading volumes in Shanghai eased back from last week's 3-month highs as prices initially fell overnight. Silver followed and extended the moves in gold prices, first dropping 1.5% before jumping to new 4-month highs above $22 per ounce. "Gold is bucking its typical seasonality pattern month," says Swiss investment and bullion bank UBS, noting that February typically sees gold prices fall. Pointing to weak economic data and "political uncertainty" in Ukraine after President Yanukovych fled the violent protests in Kiev at the weekend, "Gold looks likely to break out above $1340 in the coming days," reckons Jonathan Butler at Japanese conglomerate Mitsubishi. Gold bullion holdings needed to back shares in exchange-traded trust funds "have increased by almost 2 tonnes since the beginning of February," adds a note from investment bank and London bullion bank J.P.Morgan. "Though relatively small" against last year's outflows of 880 tonnes, "this reversal is a new and positive addition to demand," says the bank's precious metals team. Total gold ETF holdings now stand around 1,828 tonnes. "An increase in speculative net length [in gold futures] in the past week is currently keeping gold well supported," says Mitsubishi's Butler. Latest data from US regulators show the number of bullish contracts held by speculative traders in gold futures reaching its largest level last week since early April 2013. That was just before the first leg down in gold prices' big 2013 crash. However, the number of bullish speculative bets now outweighs the number of bearish contracts by only the widest margin since October last year. With much of this new money "short term" however, "The temptation to book profits is very strong," says UBS, "and we expect this to dominate up ahead." Gold prices rise "when you are very nervous about the world," says the Wall Street Journal, quoting Wells Fargo Advisors' senior international strategist Sameer Samana. But with gold prices now 20% below the start of 2013, Wells is advising that "clients use gold's rebound to sell anything they have left," says the Journal. | ||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Juniors Mining Stocks Outperformance Posted: 24 Feb 2014 05:05 AM PST In short: In our opinion short positions (half): gold, silver, and mining stocks are justified from the risk/reward perspective. Gold, silver and mining stocks didn't do much on Friday, so what we wrote in Friday's alert is generally up-to-date. However, since the week is over, we have weekly closing prices and volume levels. One of the ratios that we monitor provides a very significant indication as far as weekly price changes are concerned. Let's take a closer look (charts courtesy of http://stockcharts.com). | ||||||||||||||||||||||||||||||||||||||||

| The Coming Silver Storm:Â The Public Is Not Prepared Posted: 24 Feb 2014 04:41 AM PST The financial sky is growing dark. The stock markets are experiencing volatile trade winds. The barometer of the economy grows weak as indicators point to another recession looming on the horizon. The Precious Metal Storm is coming... unfortunately, the public is not prepared. | ||||||||||||||||||||||||||||||||||||||||

| GDXJ Signals Imminent Breakout Into Major Gold and Silver Stocks Sector Uptrend... Posted: 24 Feb 2014 04:03 AM PST A lot of investors are going to miss out on the huge bullmarket advance in the Precious Metals sector that is just starting as this is written, because they are frightened of the impact of the broad market on the sector, but as we will see, the sector itself is signaling that it is going up, big time. | ||||||||||||||||||||||||||||||||||||||||

| An Historical Look at Gold and Silver Stocks Posted: 24 Feb 2014 03:44 AM PST In this Report would like to show you some very long term charts for some of the precious metals stocks that shows us where we’re at in the big picture. For me it’s important to know where a stock has been so I can have and idea if it’s close to a previous low or high or is it just trading in the middle of no mans land. It just provides perspective that one can use as they can then start to reduce the time lines down to the daily and even hourly charts to help make a decision on where to buy or sell a stock. | ||||||||||||||||||||||||||||||||||||||||

| A World of Manipulated Markets Posted: 24 Feb 2014 03:18 AM PST “There are no markets anymore, just interventions.” — Chris Powell, Gold Anti-Trust Action Committee Once upon a time, a handful of countries sometimes described as “capitalist” claimed to operate on the principal that consenting adults should be free to buy, sell, build and consume what they wanted, with little interference or guidance from the authorities. The idea, derived from Adam Smith’s 1776 classic Wealth of Nations, was that all of these self-interested actions would in the aggregate form an “invisible hand” capable of guiding society towards the greatest good for the greatest number of people. Coincidentally, the political framework for such a society was envisioned the same year on the other side of the Atlantic, when Thomas Jefferson penned in the American Declaration of Independence that in addition to life and liberty, there was a third inalienable right for every individual – the pursuit of happiness. The resulting “market-based” societies were messy but brilliant, producing more progress in two centuries than in the previous 50. | ||||||||||||||||||||||||||||||||||||||||

| Gold price in a range of currencies since December 1978 XLS version Posted: 24 Feb 2014 02:03 AM PST Excel file of gold price charts and data - Updated weekly in 19 curriences: US dollar, Euro, Japanese yen, Pound sterling, Canadian dollar, Swiss franc, Indian rupee, Chinese renmimbi, Turkish lira, Saudi riyal, Indonesian rupiah, UAE dirham, Thai baht, Vietnamese dong, Egyptian pound, Korean won, Russian ruble, South African rand, Australian dollar | ||||||||||||||||||||||||||||||||||||||||

| Benjamin Asuncion and Geordie Mark: Six Gold and Silver Leaders at Today's Prices Posted: 24 Feb 2014 12:00 AM PST  Benjamin Asuncion and Geordie Mark of Haywood Securities forecast 2014 gold and silver prices of $1,300/ounce and $21.50/ounce, respectively. In this interview with The Gold Report, they argue that the gold and silver companies that will thrive in 2014 will be those blessed with the prudent but aggressive management that can post good margins at today's prices. And they suggest a half-dozen gold and silver miners poised to do just that. Benjamin Asuncion and Geordie Mark of Haywood Securities forecast 2014 gold and silver prices of $1,300/ounce and $21.50/ounce, respectively. In this interview with The Gold Report, they argue that the gold and silver companies that will thrive in 2014 will be those blessed with the prudent but aggressive management that can post good margins at today's prices. And they suggest a half-dozen gold and silver miners poised to do just that. | ||||||||||||||||||||||||||||||||||||||||

| Benjamin Asuncion and Geordie Mark: Six Gold and Silver Leaders at Today's Prices Posted: 24 Feb 2014 12:00 AM PST  Benjamin Asuncion and Geordie Mark of Haywood Securities forecast 2014 gold and silver prices of $1,300/ounce and $21.50/ounce, respectively. In this interview with The Gold Report, they argue that the gold and silver companies that will thrive in 2014 will be those blessed with the prudent but aggressive management that can post good margins at today's prices. And they suggest a half-dozen gold and silver miners poised to do just that. Benjamin Asuncion and Geordie Mark of Haywood Securities forecast 2014 gold and silver prices of $1,300/ounce and $21.50/ounce, respectively. In this interview with The Gold Report, they argue that the gold and silver companies that will thrive in 2014 will be those blessed with the prudent but aggressive management that can post good margins at today's prices. And they suggest a half-dozen gold and silver miners poised to do just that. | ||||||||||||||||||||||||||||||||||||||||

| Posted: 23 Feb 2014 08:59 PM PST Dear David, I am glad the provider got back to you. In relation to the storage of your precious metals perhaps you should consider these short points. The following items are worth remembering when selecting a bullion storage provider: Avoid pooled,paper and digital gold and silver opting only for fully allocated storage of physical metal. You... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||

| London gold fix may be manipulating half the time, research concludes Posted: 23 Feb 2014 04:39 PM PST Fears Over Gold Price Rigging Put Investors on Alert; German and UK Regulators Investigate By Madison Marriage Global gold prices may have been manipulated on 50 percent of occasions between January 2010 and December 2013, according to analysis by Fideres, a consultancy. The findings come amid a probe by German and UK regulators into alleged manipulation of the gold price, which is set twice a day by Deutsche Bank, HSBC, Barclays, Bank of Nova Scotia, and Societe Generale in a process known as the London gold fixing. Fideres' research found the gold price frequently climbs (or falls) once a twice-daily conference call between the five banks begins, peaks (or troughs) almost exactly as the call ends, and then experiences a sharp reversal, a pattern it alleged may be evidence of "collusive behavior." ... Dispatch continues below ... ADVERTISEMENT A Personal Touch in Buying Precious Metals If you've not secured your allocation of precious metals and numismatic coins, 2014 may be the last year to get them at affordable and undervalued prices. With huge amounts of gold leaving the West for Asia, the future availability of precious metals is very much in doubt. All Pro Gold has competitive pricing on all bullion and numismatic products -- and offers prompt delivery too. Long-time GATA supporters Fred Goldstein and Tim Murphy are glad to answer any questions or concerns about acquiring the monetary metals. All Pro Gold has an extensive electronic library of articles from the world's top market analysts. Learn more at www.allprogold.com or write to Fred and Tim at info@allprogold.com or telephone them at 1-855-377-4653. This "is indicative of panel banks' pushing the gold price upwards on the basis of a strategy that was likely predetermined before the start of the call in order to benefit their existing positions or pending orders," Fideres concluded. "The behavior of the gold price is very suspicious in 50 percent of cases. This is not something you would expect to see if you take into account normal market factors," said Alberto Thomas, a partner at Fideres. Alasdair Macleod, head of research at GoldMoney, a dealer in physical gold, added: "When the banks fix the price, the advantage they have is that they know what orders they have in the pocket. There is a possibility that they are gaming the system." Pension funds, hedge funds, commodity trading advisers, and futures traders are most likely to have suffered losses as a result, according to Mr. Thomas, who said that many of these groups were "definitely ready" to file lawsuits. Daniel Brockett, a partner at law firm Quinn Emanuel, also said he had spoken to several investors concerned about potential losses. "It is fair to say that economic work suggests there are certain days when [the five banks] are not only tipping their clients off but also colluding with one another," he said. Matt Johnson, head of distribution at ETF Securities, one of the largest providers of exchange-traded products, said that if gold price collusion is proven, "investors in products with an expiry price based around the fixing could have been badly impacted." Gregory Asciolla, a partner at Labaton Sucharow, a U.S. law firm, added: "There are certainly good reasons for investors to be concerned. They are paying close to attention to this and if the investigations go somewhere, it would not surprise me if there were lawsuits filed around the world." All five banks declined to comment on the findings, which come amid growing regulatory scrutiny of gold and precious metal benchmarks. BaFin, the German regulator, has launched an investigation into gold-price manipulation and demanded documents from Deutsche Bank. The bank last month decided to end its role in gold and silver pricing. The U.K.'s Financial Conduct Authority is also examining how the price of gold and other precious metals is set as part of a wider probe into benchmark manipulation following finding of wrongdoing with respect to LIBOR and similar allegations with respect the foreign exchange market. Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Jim Sinclair plans seminars in Los Angeles and San Diego Gold advocate Jim Sinclair's next market analysis seminars will be held in Los Angeles from 11 a.m. to 2 p.m. on Saturday, March 8, and in San Diego from 2 to 6 p.m. the following day, Sunday, March 9. Details, including registration information, are posted at Sinclair's Internet site, JSMinset.com, here: http://www.jsmineset.com/qa-session-tickets/ | ||||||||||||||||||||||||||||||||||||||||

| The Counter-Intuitive Gold Play Posted: 23 Feb 2014 04:00 PM PST | ||||||||||||||||||||||||||||||||||||||||

| A World of Manipulated Markets Posted: 23 Feb 2014 03:57 PM PST The following is excerpted from The Money Bubble, by James Turk and John Rubino "There are no markets anymore, just interventions." Once upon a time, a handful of countries sometimes described as "capitalist" claimed to operate on the principal that consenting adults should be free to buy, sell, build and consume what they wanted, with little interference or guidance from the authorities. The idea, derived from Adam Smith's 1776 classic Wealth of Nations, was that all of these self-interested actions would in the aggregate form an "invisible hand" capable of guiding society towards the greatest good for the greatest number of people. Coincidentally, the political framework for such a society was envisioned the same year on the other side of the Atlantic, when Thomas Jefferson penned in the American Declaration of Independence that in addition to life and liberty, there was a third inalienable right for every individual – the pursuit of happiness. The resulting "market-based" societies were messy but brilliant, producing more progress in two centuries than in the previous 50. But those days are long gone. After four decades of unrestrained borrowing, the developed world is in a constant state of near-collapse and governments everywhere feel compelled (or perhaps liberated) to tinker with markets, sometimes overtly and sometimes secretly, but of late with an increasingly heavy hand. The system that is evolving does not yet have a modern name but certainly looks like the central planning that failed so miserably for the Soviet Union and Social Democratic Europe in decades past. What follows is a brief overview of the manipulations that now dominate the global economy. Artificially low interest rates. Interest rates are, in effect, the price of money and as such they're a crucial signal to virtually everyone in every market. When rates are high, that's an incentive to save, because the resulting yield is attractive. Low rates, meanwhile, are a signal that money is cheap and borrowing is potentially more profitable than saving. Prior to the World War II interest rates were set mostly by supply and demand. When there were lots of productive uses for a limited supply of money, demand for it went up and interest rates rose, and vice versa. Market participants had a fair idea of what the economy was asking for and government generally let them respond to these signals. (The term "laissez faire," French for "let [them] do," is aptly used to describe this version of capitalism.) When the Fed began playing a bigger role in the economy in the 1950s and 60s, it chose as its main policy tool the Fed Funds Rate, the rate at which it lent short-term money to banks. Long-term interest rates (i.e., the bond market) remained free to fluctuate according to the supply and demand for loans. But following the crisis of 2008 the Fed and other central banks expanded their focus from short-term rates to all rates, including long-term. Today, the Fed intervenes aggressively "across the yield curve," pushing short rates down to zero and buying enough bonds to push long-term rates down to historically-low levels. These interventions have preempted the market's price-signaling mechanism, encouraging borrowing and speculation and discouraging saving… Dishonest interest rates. While governments have been actively depressing rates, the world's major banks have been manipulating the London Interbank Offered Rate (Libor) for their own ends. Libor is the reference rate for trillions of dollars of loans world-wide. And in a scandal that is still escalating as this is written in late 2013, it has been revealed that the banks responsible for setting this rate have been arbitrarily moving it around and then trading on the advance knowledge of the movement, enhancing their profits and yearend bonuses. Other banks lied about the rates at which they were borrowing to make them appear less fragile during the 2008 financial crisis, misleading market participants as well as government regulators. Meanwhile, many of the loans based on sham Libor rates disadvantaged the entity on one side of the transaction, costing, in the aggregate, hundreds of billions of dollars. Artificially high stock prices. Until very recently share prices, by general consensus, were set purely by market forces (though they were influenced somewhat by the Fed's control of short term-interest rates and government tax and spending laws). Whether the market went up or down was not generally seen as a pressing policy matter for the federal government or central bank. Then in 1988 – presumably in response to the previous year's flash-crash that had sliced about 30 percent from US stock prices in a single month – the Reagan Administration created the Working Group on Financial Markets to either prevent or manage such events in the future. This shadowy organization came to be known as “Plunge Protection Team (PPT)," and is now thought by many to funnel government money into the market to boost share prices when it perceives the need. The origin of this idea goes back to 1989 when former Federal Reserve Board member Robert Heller told the Wall Street Journal that, “Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole.” In August 2005, Canadian hedge fund Sprott Asset Management released a report arguing that the PPT was indeed manipulating stock prices. Cheap mortgages, inflated home prices. For most of the 20th century, homes were bought with either cash or 30-year, fixed-rate mortgages. And because long-term interest rates were not set by the Fed, the price of money with which to buy a house was determined by the market. But after the 2008 financial crisis, when the Fed began forcing down long-term rates, cheap mortgages and rising home prices became government policy objectives. The Fed now buys mortgage backed bonds in addition to government bonds, which both lowers mortgage rates and funnels money into the mortgage market, generally making home loans easier to obtain. Here again, rising home prices are just a means to a positive wealth effect, which it is hoped will induce more borrowing and spending. And individuals are signaled by the market to buy the biggest house possible using the most aggressive mortgage possible. Suppressed gold price. We cover gold in much greater detail in Section IV, but for now suffice it to say that because the metal is a competing form of money, when it rises in dollar terms it makes the dollar and the dollar's managers look bad. So for nearly two decades the US, along with several other governments and their central banks, has been systematically intervening in the gold market to push down its exchange rate to the dollar. They do this by covertly dumping central bank gold onto the market and instructing large commercial banks to sell huge numbers of gold futures contracts into thinly traded markets. Together, these secret machinations have held gold's exchange rate far below where a free market would have taken it. Gold's ability to signal market participants that inflation is rising and/or national currencies are being mismanaged is being short-circuited. As a result, market participants who might otherwise be converting those currencies into hard assets are not doing so. All of the above. The Exchange Stabilization Fund (ESF) was established in 1934 to enable carte blanche market intervention by the federal government, outside of Congressional oversight. As Dr. Anna J. Schwartz, at the time a Distinguished Fellow of the American Economic Association explained in a 1998 speech, "The ESF was conceived to operate in secrecy under the exclusive control of the Secretary of the Treasury, with the approval of the President, [quoting here from the 1934 legislation] 'whose decisions shall be final and not subject to review by any other officer of the United States'." The ESF now functions as a "slush fund" available to the Treasury Department for wide-ranging, frequently-secret market interventions. It provides "stabilization" loans to foreign governments. It influences currency exchange rates – including that of gold. It was used to offer insurance to money market funds. Most recently it was drained to provide the government some breathing room during the late 2013 debt ceiling impasse. As for the stock market, well, why not? Perhaps the ESF is the real – or at least another – Plunge Protection Team. Distorted Signals and Lost Trust Along the way, people begin to notice that the markets they thought were more-or-less honest are being secretly manipulated for the benefit of others, and trust begins to erode. The next chapter explains what happens then. | ||||||||||||||||||||||||||||||||||||||||

| Marin Katusa -- The American Way of Life Will Be Destroyed -- Inflation to Exceed 100%... Posted: 23 Feb 2014 12:00 PM PST Stock up on as many necessities as you can. Gold , Silver, Food, ammunition for your gun, heirloom seeds, learn how to garden, buy some livestock, toilet paper, flashlight, coffee, sugar, tobacco if you smoke, gasoline or diesel, batteries, pay off all your debts if you can afford to without... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||

| Gold and Crude Oil Short-term Outlook Posted: 23 Feb 2014 06:56 AM PST Gold has moved well above 1300 mark, and is forming an extended leg from 1251, triangle low. Notice that we have adjusted the wave count, but we see a corrective advance from 1181 now at 1330 resistance. We are observing more simple count now this time; a zigzag with a triangle placed in wave (b). We also know that wave (b) pattern CANNOT be labeled as wave two, because triangles never occur in wave two position. So, because of that situation we are even more confident that rally is a contra-trend and that gains will be limited. A decline beneath 1290 area could be an important sign for a confirmed top. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

An EMP (electro magnetic pulse), if strong enough (and regardless of the source – weaponized or solar), will potentially fry electronics and electronic systems within its invisible sphere of destruction. Many expert opinions and reports suggest that our electrical power grid could go down.

An EMP (electro magnetic pulse), if strong enough (and regardless of the source – weaponized or solar), will potentially fry electronics and electronic systems within its invisible sphere of destruction. Many expert opinions and reports suggest that our electrical power grid could go down. All over the media we have seen extreme gold shopping sprees

All over the media we have seen extreme gold shopping sprees

International Speculator

International Speculator When Joyce Riley asked me on my latest appearance on The Power Hour to name the four or five countries that are closest to financial collapse, I found it difficult to articulate a response. Being so used to watching the knock-on effects of one economy on another (like the repatriation of US capital bringing about the emerging currency crisis), it’s difficult to see the trees (countries) for the forest (international economy).

When Joyce Riley asked me on my latest appearance on The Power Hour to name the four or five countries that are closest to financial collapse, I found it difficult to articulate a response. Being so used to watching the knock-on effects of one economy on another (like the repatriation of US capital bringing about the emerging currency crisis), it’s difficult to see the trees (countries) for the forest (international economy). Host Andy Duncan speaks to the publisher of the Solari Report and President of Solari Inc, Catherine Austin Fitts. Topics include quality of life indicator – The Popsicle Index, the selective efficiency of government, the debt ceiling, and investing in gold.

Host Andy Duncan speaks to the publisher of the Solari Report and President of Solari Inc, Catherine Austin Fitts. Topics include quality of life indicator – The Popsicle Index, the selective efficiency of government, the debt ceiling, and investing in gold.

No comments:

Post a Comment