saveyourassetsfirst3 |

- Embry senses change of tone in gold market, fears stink bids for junior miners

- Buy a copy of The Gold Cartel and send it to a gold mining company executive

- Western central banks cant have much gold left, Eric Sprott says

- Jan 13/GLD and SLV constant/Comex gold rises a bit/gold rises above 1250 dollar resistance level/silver rises above the 20 dollar mark/

- Consumer Retail Stocks – Return of the Bear?

- Bear Creek Announces Start Of Phase I Drilling At Its Carito Gold Project, Peru

- Declining economy, currency devaluation will boost gold in 2014, Turk says

- Goldcorp bids C$2.6b for Osisko Mining

- Gold Stocks Price to Book Value

- ECONOMIC WORLD WAR: “He Who Owns the Gold Makes the Rules” – DAVID MORGAN

- Asanko Gold: Shares Trade At Cash And Have Multi-Bagger Potential After The PMI Gold Deal

- Can't-miss headlines: Gold holds to $1,245+, Platinum Group's WBJV back on track & more

- Sprott's John Embry: 'Feds Have Lost Control Over Monetary Policy'

- Gold at One Month High; December High is at 1267.75

- Bitcoin UPDATE: The first "alternative currency" ATMs are now coming to the U.S.

- Gold Price Analysis- Jan. 13, 2014

- This remarkable technology "shift" could solve a $1.7 trillion problem

- Seven simple ways to start 2014 on the right financial track

- Why Is Goldman Sachs Warning That The Stock Market Could Decline By 10 Percent Or More?

- Stocks Drop on Goldman Note - Safe Haven Plays come on

- Blue Nile Inc. And King Solomon's Mines

- U.S. Government: If We Don’t Like The Score, We’ll Change The Rules Of The Game

- Investors should bank on balance sheets while waiting for the next wave in gold

- Is Sub-$1000 Gold in the Cartel’s Script?

- PGMs to battle higher as firmer-footed gold trends lower - Barclays

- Forex Trading Alert: U.S. Dollar Remains Mixed Against Major Currencies

- US selling of gold likely nearing exhaustion

- Has the new gold bull market cycle started?

- High Level Chernobyl Cover up reveals identical playbook concerning Fukushima

- Retired Indian customs officials to train present staff on tackling gold smuggling

- U.S. gold coin sells for $4.5 million

- China's gold output up 7% in first 11 months of 2013

- Gold coin and bar shortages likely to lead to rationing

- China believed to want as much gold reserves as U.S.

- Bears Losing Grip On Gold Market

- Dutch Central Bank Tight-lipped About Gold Policy

- Throwing It All on the Table

- Gold mine stirs hope and anger in shattered Greece

- Second-Greatest Opportunity To Buy Gold

- After Seven Lean Years, Part 1: US Residential Real Estate: The Present Position and Future Prospects

- China Gold output climbs 7.01% to 392.141 tons in Jan Nov

- The Curious Case of DrC

- Big COMEX Gold Withdrawals & New Record Low Dealer Inventory

- Mercenary Links Jan 13th: Number One Trader

- Anatomy of an MSM Hit Piece

- Non farms payroll gives a boost to Gold, short covering to support: Barclays

- It Can’t Be Both?…It Shouldn’t Be Either One

- Gold set for Goldilocks 2014 with 4% growth

- Gold Coin And Bar Shortages Likely To Lead To Rationing

- Monex Precious Metals Review: Gold rises to $1248, silver $20.30 oz

| Embry senses change of tone in gold market, fears stink bids for junior miners Posted: 13 Jan 2014 04:03 PM PST GATA |

| Buy a copy of The Gold Cartel and send it to a gold mining company executive Posted: 13 Jan 2014 04:03 PM PST GATA |

| Western central banks cant have much gold left, Eric Sprott says Posted: 13 Jan 2014 04:03 PM PST GATA |

| Posted: 13 Jan 2014 03:43 PM PST |

| Consumer Retail Stocks – Return of the Bear? Posted: 13 Jan 2014 03:42 PM PST Ever since the post-crisis lows and S&P 500 bottom of March 2009, the consumer retail sector has been a juggernaut. Time and again, predictions of the US consumer’s demise have not just been countered, but steamrolled. And yet now, in the early days of 2014, retail names are showing meaningful signs of weakness for the first time in years. An accumulation of earnings misses and poor guidance — coupled with extreme negative price reaction — threatens a sentiment sea change, which could in turn lead to investor exodus and lowered multiples for the whole sector. XRT, the Spider S&P Retail ETF, is the premier bellwether for consumer retail. Let’s first consider the XRT monthly chart, to demonstrate the relentless rise: Now consider the same vehicle — XRT, the bellwether retail ETF — on a daily level, after enduring recent damage. The key concern here is penetration of the 50 day exponential moving average (the green line), and secondarily the broader trend. (There is nothing magical in a technical chart development — but charts are useful as a statistical and psychological proxy for investor positioning and sentiment.) XRT saw only three breaches of the 50 day EMA (exponential moving average) in 2013. Each instance resolved higher relatively quickly, ultimately proving to be a buying opportunity. These breaches also coincided with broader macro weakness — points where the entire market was in temporary “risk off” mode (prior to verbal central bank support). This latest breach is far more serious, for multiple reasons: It is much later in the trend – and trends have lifespans. The breach is volatility expansive, on surging volume – the largest volume for a downside day in roughly a year. The major trend is definitively broken – with a potential double top in place. The bearish drivers are internal to retail – rather than external to the broad market. The retail sector is getting hit by downside blowouts on earnings misses and poor guidance. The threat to retail stocks at this juncture is not just mounting fear of downside (which will be the next widely held apparel name to be taken out and shot?), but a potential sentiment shift that results in steady capital outflows and follow-on multiple compression for the entire sector. If this shift occurs, it will be rooted in a steady drumbeat of high profile disappointments… and the beat has already grown loud. On January 10th, Bed Bath & Beyond (BBBY) kicked off the carnage with a violent drop on poor guidance. The WSJ gave an overview in its piece, “Sour Outlooks Slam Retail Stocks:”

The bloodbath really got underway on January 13th, though, when the yoga apparel maker Lululemon (LULU) took a swan dive: In the case of LULU, the retailer’s troubles were readily apparent. On November 16th we wrote up the short case for LULU in our Strategic Intelligence Report, titling the piece: “LuluLemon is a Downward Facing Dog.” You can read the full analysis here — including the conclusion as follows: LULU has been an excellent case of "right place, right time" as the company masterfully rode the yoga craze to dizzying heights over the past few years. All hot growth stocks eventually flame out, however – such is the nature of things – as markets mature, competition muscles in, and customers move on. We are short LULU as of this writing and see good potential for extended downside decline, on the order of 20% in a conservative scenario and possibly much more if broad market drivers turn bearish. - November 16th Strategic Intelligence Report We were short LULU heading into this week’s precipitous drop, and have established “starter position” shorts in a number of other faltering high-flyers like Ulta Cosmetics (ULTA) and Five Below (FIVE). All of these are prime examples of what we call “Icarus Stocks” — one-time growth darlings subject to flameout, and substantial decline, as overly lofty expectations inevitably adjust back toward reality. For the bulk of the Bernanke years, “shorting” stocks — positioning to profit from declines — was an exercise in pain and wasted time. The combined driving forces of Quantitative Easing (QE), corporate share buybacks fueled by low-interest borrowing, robust sentiment, profit gains from suppressed wages and corporate cost-cutting, and a gradually improving US economy, all combined to create a seemingly bulletproof environment for longs. Positive sentiment was further reinforced by quick resolution to any and all downdrafts via central bank intervention (if only psychological). But like the seasons, all trends end, and a season of shorting may soon be upon us. All the key drivers that propelled stocks to higher climes are either ending or exist in some stage of twilight. Bernanke himself is stepping down. Corporate profit margins well above historic highs are juxtaposed with a strong outpacing of negative versus positive pre-announcements. And a break in the stride of the retail juggernaut could be an early sounding of the alarm. One thing makes our Strategic Intelligence Report unique — apart from providing some of the best market research available anywhere — is our ability to go short as readily as long, and to highlight attractive bear-side names along with bullish long ideas. This skill set was in our back pocket for most of 2013… but as our LULU write-up shows, access to high quality shorting opportunities (and longs too) could have tremendous value in the year ahead. If you see benefit from excellent market research, and like the idea of finding a “ten-bagger” in 2014 you might otherwise have missed, there is simply no reason to pass up the Strategic Intelligence Report. You can find out more about the SIR, and take advantage of our special “Beta 1,000″ pricing, by following this link (or clicking the box below).

|

| Bear Creek Announces Start Of Phase I Drilling At Its Carito Gold Project, Peru Posted: 13 Jan 2014 03:03 PM PST Vancouver, B.C. – Bear Creek Mining (TSX Venture: BCM/ BVL: BCM) (“Bear Creek” or the “Company”) is pleased to announce that drilling is underway at the Carito gold – copper project (See News Release dated March 18, 2013 andhttp://www.bearcreekmining.com/s/caritogold.asp). The Phase I drill program, consisting of seven drill holes for an estimated total of 2,500 meters, is primarily designed to test the two targets defined to date; an outcropping disseminated gold epithermal system hosted within sedimentary rocks and an underlying, intrusive-hosted, copper – gold porphyry system. Andrew Swarthout, Chief Executive Officer, states “The commencement of drilling at Carito follows our philosophy that has been the foundation of our success; namely, that selective drilling programs in high-quality, untested grass-roots prospects provides the potential for the highest rewards to our shareholders. Our methods continue to be cost-effective, first phase drilling to establish the upside before committing substantial funding. Fortunately, we have the treasury to allow surgical exploration programs such as Carito, without jeopardizing our longevity or the work necessary to further Corani and Santa Ana.” Carito is located in north central Peru within the prolific Antamina – Magistral thrust fault belt, Ancash Department. The district’s potential was unrecognized until recently when prospectors discovered high-grade gold mineralization beneath thin coluvial cover. The Carito project is an undrilled Au – Cu system resembling the La Arena deposit, a robust open pit gold mine with significant potential for underlying, porphyry-style copper and gold mineralization currently under exploration. Gold mineralization is controlled by fractured and crackle-brecciated quartzites and sandstones of the Cretaceous Chimu formation. The Chimu formation is a well-known host for disseminated gold deposits in north central Peru (La Arena, Lagunas Norte, Santa Rosa). The sedimentary unit is intruded by at least two pervasively altered porphyries phases. Importantly, hydrothermal breccias and a phreatic-diatreme breccia have been identified which indicate abundant sources for mineralizing, hydrothermal fluids. Values derived from one-hundred-nineteen (119) rock chip samples from the quartzites / sandstones, and intrusives range from trace to 22.1 g/t gold. Eighty-three (83) samples from the above one-hundred-nineteen samples contain greater than 50 ppb gold. Associated favorable trace elements include strongly anomalous Ag, As, Hg, Sb and W. The two altered intrusives observed to date exhibit values up to 1.06 g/t gold and 0.59% copper, indicating a possible target for a mineralized Cu-Au porphyry at depth coincident with strong Induced Polarization response suggesting high sulfide mineralization. Drill hole assay results will be released upon completion of Phase I drilling in February/ March. Consistent with the Company’s aggressive generative exploration philosophy, several additional prospects in the portfolio are being evaluated for future acquisition or drilling. “Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.” - End - Andrew Swarthout – CEO, or Lisa May – Investor Relations The post Bear Creek Announces Start Of Phase I Drilling At Its Carito Gold Project, Peru appeared first on The Daily Gold. |

| Declining economy, currency devaluation will boost gold in 2014, Turk says Posted: 13 Jan 2014 03:03 PM PST GATA |

| Goldcorp bids C$2.6b for Osisko Mining Posted: 13 Jan 2014 02:56 PM PST The gold miner has launched an unsolicited cash and stock bid for Osisko Mining that values its rival at C$2.6bn. |

| Gold Stocks Price to Book Value Posted: 13 Jan 2014 02:38 PM PST The chart below is from six months ago. It shows that according to book value, the gold stocks are trading at 32-year lows and perhaps even 40 or 50 year lows.

The post Gold Stocks Price to Book Value appeared first on The Daily Gold. |

| ECONOMIC WORLD WAR: “He Who Owns the Gold Makes the Rules” – DAVID MORGAN Posted: 13 Jan 2014 02:35 PM PST

David Morgan from Silver-Investor.com home of the Morgan Report joins the SGTReport to talk about recent flash crashes in silver and gold, the Comex nearing default and the outlook for precious metals in 2014, which David thinks could yield as much as a 50% return for Ag. 2014 Silver Canadian Maple With New Security [...] The post ECONOMIC WORLD WAR: "He Who Owns the Gold Makes the Rules" – DAVID MORGAN appeared first on Silver Doctors. |

| Asanko Gold: Shares Trade At Cash And Have Multi-Bagger Potential After The PMI Gold Deal Posted: 13 Jan 2014 02:28 PM PST Since acquiring PMI Gold (OTC:PMVGF) nearly a month ago, Asanko Gold (AKG) shares are down roughly 20%. On the one hand this isn't surprising given that the deal nearly doubles the number of Asanko shares outstanding. However the stock's weakness in the face of an increased share supply runs counter to the fundamental observation that the deal is accretive to Asanko on a per-share basis. There are two reasons for this.

|

| Can't-miss headlines: Gold holds to $1,245+, Platinum Group's WBJV back on track & more Posted: 13 Jan 2014 02:20 PM PST The latest morning headlines, top junior developments and metal price movements. Today the gold price holds to last week's gains and Platinum Group outlines plans after a massive financing. |

| Sprott's John Embry: 'Feds Have Lost Control Over Monetary Policy' Posted: 13 Jan 2014 02:15 PM PST In a recent interview, John Embry, Chief Investment Strategist for Sprott Asset Management, argued that the Fed has lost control over monetary policy, that rising interest rates are a question of when, not if, and that gold, silver, mining stocks and hard assets are excellent buys right now. Interest Rates With the ten year Treasury note holding steady at about a 3% yield, Embry argued that "the tide has changed dramatically already, but because of the very, very arcane derivative strategies, they've been able to hold the rate steady." However, he said, given the possibility of ultimate default and inflation, bond and note investors "are not getting paid for the risk" involved over the 10 year period of the notes. He said, "As more and more foreigners realize that this is not a good investment, the Fed is going to have to have buy more and more of |

| Gold at One Month High; December High is at 1267.75 Posted: 13 Jan 2014 02:11 PM PST |

| Bitcoin UPDATE: The first "alternative currency" ATMs are now coming to the U.S. Posted: 13 Jan 2014 02:01 PM PST From Zero Hedge: With over 1,000 new merchants adopting Bitcoin every week, it is perhaps not surprising that, as NY Post reports, the first Bitcoin ATM is about to debut in New York City. Following success in Canada and Europe, Brooklyn native Willard Ling, 30, is set to introduce the first bitcoin ATM to New York City at the East Village bubble tea shop 'Just Sweet'. State regulators with the Department of Financial Services are expected to hold hearings later this month to discuss how the digital currency should be regulated; and until then, Ling’s bitcoin ATM will sit in his apartment. Via NY Post, Josh Harvey, co-founder of Lamassu, showed off the first bitcoin dispenser at last week’s Consumer Electronics Show and has found quite a bit of interest for the $5,000 machines. How does the ATM work? The machine, designed and manufactured in Portugal, looks like a typical deli ATM — but functions more like... Crux note: Bitcoin is becoming more and more popular in the U.S., and for good reason... Folks are waking up to the problems of the U.S. dollar and other government-controlled currencies, and looking alternatives. But before you buy Bitcoin yourself, there's something you should know... There's another "alternative" currency you probably haven't considered. Like Bitcoin, it's completely anonymous... but that's where the similarities end. This alternative is actually backed by gold and silver, works even during a power outage, and is beyond the reach of any government or corporation. For the full explanation, click here. |

| Gold Price Analysis- Jan. 13, 2014 Posted: 13 Jan 2014 01:55 PM PST dailyforex |

| This remarkable technology "shift" could solve a $1.7 trillion problem Posted: 13 Jan 2014 01:34 PM PST From Frank Curzio, editor, Phase I Investor: Amid millions of e-mails, uploaded pictures, and Facebook "likes," one specific activity accounts for over 50% of online traffic in North America. Watching videos. Netflix – the popular streaming service – accounts for one-third of all downstream traffic by itself. ("Downstream" traffic refers to data that is received by a computer or network – like receiving e-mails or downloading files.) Google's YouTube comes in second at 19%. In short, millions of households are using their Internet connections to download massive data files. Watching one hour of standard definition video is the equivalent of downloading a one-gigabyte (GB) file. When everyone in your neighborhood is simultaneously watching videos, it can put a lot of stress on the access network that everyone connects to. (An "access network" is the part of a telecom network that connects a group of nearby subscribers to their service provider like AT&T or Verizon.) You've probably heard the term "fiber optic" before. Most of us don't care what a fiber-optic cable is... But it's an important part of this month's opportunity. Put simply, fiber-optic cable is the alternative to the traditional copper wires used in communications since the days of the telegraph. As you probably guessed already, optical fiber is a major improvement over copper.  A Rush to Provide the "Last Mile" There's a huge opportunity developing for companies that can provide the "last mile." In the telecom industry, the last mile refers to the final segment of wiring that brings high-speed Internet access to households. It includes the cables that run along your street, either underground or across telephone poles. The last mile represents a major issue for service providers. Their ability to follow through on promises of high-speed Internet depends on how long the "last mile" is for each customer. In many cases, it acts as a bottleneck, with customers experiencing much slower speeds. Most large telecom companies have the main infrastructure in place for delivering high-speed services. But customers want their own superfast highway delivered straight to their homes. Most Americans need this type of connection if they want to stream movies, television shows, or live sports on websites like Netflix and ESPN. People living in major cities like New York and Chicago don't have a last-mile problem. However, it's a big problem in rural areas in the U.S. – where high-speed Internet access is required to watch videos and download music. It's also a big problem for millions of households outside of the U.S. You see, roughly 75% of Americans have access to high-speed Internet today. However, only 60% of people living in Europe – and fewer than 30% of in Asia and 17% in Africa – can access high-speed Internet, according to research site Internet World Stats. Telecom companies are searching for a solution to their last-mile problem. Connectivity (high-speed access) is important. But so is cost. For example, when you build a house, the frame and the rooms (main infrastructure) are usually the easiest and quickest to build. But the hardest work and expenses occur when you build the water pipes, sewage systems, and electricity cables (last mile). The "superhighways" that carry data from one end of the U.S. to the other were converted to fiber-optic cable years ago. However, the "last mile" of wiring that links your neighborhood to the nearest fiber-optic network is probably still made of copper. Copper worked great for decades. Many readers probably remember when Digital Subscriber Line (DSL) connections meant high-speed Internet. ("DSL" is a method of transmitting data over traditional phone lines that are made of copper.) The critical problem with copper has to do with distance. Without getting too technical, the longer a copper wire is, the worse it becomes at transmitting data. Once a copper wire gets longer than 250 meters (about 800 feet), things start to really slow down. Phone and cable companies have worked around the problem by installing more "nodes." (A node is a small terminal where the old copper telephone lines stop and the heavier-duty transmission lines start. If you've ever noticed a green or grey box on the side of the road somewhere in your neighborhood... it's probably a node.) If they want to advertise blazing Internet speeds, they have to shorten the length of copper wiring between their fiber optic networks and their customers. Of course, this is just a temporary solution. If you started your own telecom company today, you wouldn't bother using any copper wires. You'd use 100% fiber-optic cable, knowing that it could handle your customers' needs for decades into the future. In a world where millions of households are downloading more and more data – via Netflix, YouTube, or social media – copper's days are numbered. The simple fact is... big telecom companies around the world need to upgrade the "last mile" of their networks. Their customers have a growing appetite for data. Everyone wants their own data-superhighway. And as I mentioned earlier, that means billions of dollars in sales for the companies that make the next generation of fiber-based equipment. Keep in mind, this build-out involves hundreds of millions of households around the world. More importantly, there are hundreds of companies that compete to offer telephone, cable, and Internet services to customers. Even small, little-known foreign carriers rake in billions in annual revenue. They're happy to invest in next-generation equipment, especially if it means avoiding a technology that's becoming obsolete, like copper wires. Crux note: Frank has discovered a little-known company ready to capitalize on this technology shift. Its next generation equipment is becoming the industry standard in a multibillion-dollar global telecom market. To learn more about Phase 1 Investor – and get all the details on the company that has figured out a "faster and more cost-efficient way" to bring fiber optics into households – click here. More on technology: |

| Seven simple ways to start 2014 on the right financial track Posted: 13 Jan 2014 01:34 PM PST From The Wall Street Journal: There's nothing like the start of a new year to prompt an urge to improve our finances, but all too often our best-laid plans fall apart. Luckily, an approaching deadline might be useful for spurring action: tax time. Your return isn't due until April 15, but getting ready now has a number of benefits. And the process of reviewing your money situation in 2013 may help prime your mind for getting your finances on track in 2014. Here are seven strategies to consider to get to firmer financial footing this year. 1. File your taxes. The Internal Revenue Service won't accept returns until Jan. 31, but some tax-prep websites are accepting customers now, and might offer access to electronic W-2s before those forms get to you in the mail. For its part, Intuit's TurboTax unit says it will hold completed tax returns and then e-file them when the IRS opens its doors. Early filers reduce the risk of... Crux note: The New Year is a great time to get your finances in order... but it's also the perfect time to get your investment plans on track. But if you're like many investors, you have some big concerns for 2014... questions like: What's the likelihood of a big market correction this year? What's going to happen next with gold and silver? Where are the best opportunities for income? What are the absolute best buys in the financial world right now... and which investments should you absolutely, positively stay away from? If so, you'll want to check out our latest research... a brand-new project so comprehensive and valuable, S&A Editor-in-Chief Brian Hunt calls it the most important product we've ever launched. Click here for the details. More on personal finance: |

| Why Is Goldman Sachs Warning That The Stock Market Could Decline By 10 Percent Or More? Posted: 13 Jan 2014 01:29 PM PST

This report that has just been released by Goldman Sachs has gotten a lot of attention. In fact, an article about this report was featured at the top of the CNBC website for quite a while on Monday. Needless to say, news of this report spread on Wall Street like wildfire. The following is a short excerpt from the CNBC article...

Of course Goldman Sachs is quite correct to be warning about an imminent stock market correction. Right now stocks are overvalued according to just about any measure that you could imagine...

There is a lot of technical jargon in the paragraph above, but essentially what it is saying is that stock prices are unusually high right now according to a whole host of key indicators. And in case you were wondering, stocks did fall dramatically on Monday. The Dow fell by 179 points, which was the biggest decline of the year by far. So is Goldman Sachs correct about what could be coming? Well, the truth is that there are many other analysts that are far more pessimistic than Goldman Sachs is. For example, David Stockman, the Director of the Office of Management and Budget under President Reagan, believes that the U.S. stock market is heading for "a pretty rude day of awakening"...

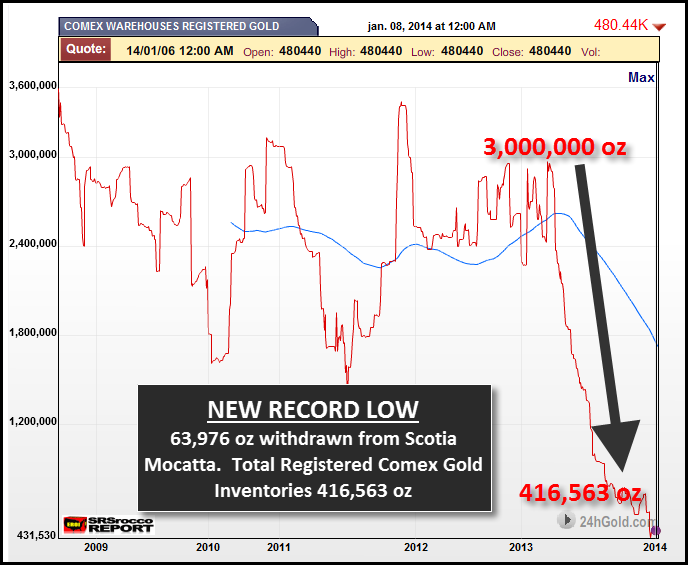

For many more forecasts that are similar to this, please see my previous article entitled "Dent, Faber, Celente, Maloney, Rogers – What Do They Say Is Coming In 2014?" There are also some other signs that we are rapidly heading toward a major "turning point" in the financial world in 2014. One of those signs is the continual decline of Comex gold inventories. Someone out there (China?) is voraciously gobbling up physical gold. The following is a short excerpt from a recent article by Steve St. Angelo...

And of course the overall economy continues to get even weaker. The Baltic Dry Index (a very important indicator of global economic activity) has fallen by more than 40 percent over the past couple of weeks...

So does this mean that tough times are just around the corner? Maybe. Or perhaps things will stabilize again and this little bubble of false prosperity that we have been enjoying will be extended for a little while longer. The important thing is to not get too caught up in the short-term numbers. If you look at our long-term national "balance sheet numbers" and the long-term trends that are systematically destroying our economy, it becomes abundantly clear that a massive economic collapse is on the way. Our national debt is on pace to more than double during the Obama years, our "too big to fail" banks are now much bigger and much more reckless than they were before the financial crash of 2008, and the middle class in America is steadily shrinking. In other words, our long-term national "balance sheet numbers" are worse than ever. We consume far more wealth than we produce, and our entire nation is drowning in a massive ocean of red ink that stretches from sea to shining sea. This is not sustainable, and it is inevitable that the stock market will catch up with economic reality at some point. It is just a matter of time. |

| Stocks Drop on Goldman Note - Safe Haven Plays come on Posted: 13 Jan 2014 01:26 PM PST Goldman was the catalyst for a near seismic wave that struck the US equity markets in today's session. Their analysts felt stocks were overpriced and that earnings were going to have to be quite strong to push stocks signficatnly higher based on my reading of their notes. Surprise... sounds like maybe some are waking up to smell the coffee. My comments have to do however more with the reaction of some of the other various markets, rather than the equities. Stocks needed a significant correction but no one was sure from what level it would come or at what point. Well, we got a decent correction today. If it turns around and goes right back up tomorrow, who knows? What struck me about the safe haven trades that went right back on, in typical knee-jerk fashion, was the US Dollar was left out of the party. We had bonds moving higher today with interest rates on the Ten Year dropping down to 2.827. That is no surprise given the steep fall in the equity world. What we usually see happening on a day like this did not occur today. What I mean by that is that while the Japanese Yen moved sharply higher ( I will never understand why the Yen can remotely be considered a safe haven currency), the US Dollar did not rise but fell instead! That is rather remarkable when one is used to seeing the Dollar benefitting from any sort of risk aversion/save haven trade. I am not sure what that might mean but it is only a one day affair at this point so I do not want to read too much into it. Gold seemed to experience another one of those "melt up's" as I have dubbed them with some safe haven buying coming into the market, especially as the US Dollar weakened but also somewhat in response to news of Goldcorp's unsolicited takeover attempt of another mining outfit. Some are thinking that the gold shares, which have been beaten with the proverbial ugly stick, might have been mangled severely enough that the long-anticipated consolidation/ acquisition phase is now at hand in the sector. That would tend to benefit some likely takeover candidates which generally lifted the sector higher even while some of the majors were weaker, notably GG, which was down over 1% at one point today. The news tended to lift some of the pall that has been hanging over the sector. Of course it did not hurt any to see a near 1.4% plunge in the S&P 500 as part of a safe haven bid. I have mixed emotions about this stock market fall today. If it is coming on expectations that while the US economy might be improving it is not going to be growing fast enough to justify multiples on equities near current levels, then I can see where it would actually tend to bring more selling pressure into gold as deflationary forces reassert themselves. Then again, we might be back into that nightmarish scenario where we are sitting around on pins and needles waiting for every single economic data release and reading the entrails to discern whether the Fed will taper or back off and not taper. I am still of the view that if the latest round of MBS and Treasury bond buying by the Fed has not generated solid growth, then what will? If the Fed were to be forced to put any tapering on hold, would it not signify that deflationary forces are reasserting themselves? Why would that not put downward pressure on the gold price? Yes, I know that many in the gold market would view any Tapering on Hold action by the Fed as bullish gold but pray tell, for what reason? Two years have done nothing to generate any significant inflation in the mind of the market - why would another 4-6 months or another year or more do anything different? From a technical perspective, the volume in gold trading today was quite lackluster - another reason I referred to today's move higher as a melt up. It just seemed that the eager sellers were not there today more so than eager buyers were chasing prices higher. The result was a lack of offers over the market and that allowed prices to "melt" higher. The market did run into some selling near $1,255. That is the bottom of the resistance zone noted on the chart. The top is close to the $1260 number but also extends a tad above that. If gold can push past that level and keeps its footing there, it would turn the chart friendly in my view and portend a test of $1,280. Above that would be psychological round number $1,300 where the "handle" would change. I personally do not see what the reason might be for gold to reach that point given the apparent resurgence of deflationary views ( the last jobs number got the ball rolling which Goldman kicked down the hill today) but the key in my mind still remains the US Dollar. If it weakens further, gold will stay supported. If the Dollar rebounds and begins moving higher, look for selling to intensify in gold, especially at these levels. We'll see what the market gives us. |

| Blue Nile Inc. And King Solomon's Mines Posted: 13 Jan 2014 01:10 PM PST The Historic Past Since its earliest days the Internet appeared to be like King Midas, the legendary Greek monarch, because everything touched, either by the King or by the Internet, turned into gold. During the era when King Midas transformed all that he touched into gold, a story tells us about a fabulous hoard of gold and diamonds that lay in Africa and belonged to King Solomon. The happenstance of golden value created by the Internet and of diamonds sold by an Internet vendor, Blue Nile Inc. (NILE) reminds me about an intriguing investment opportunity with the company. Investors still hold to the legend of the Internet's magical powers for creating riches. Their belief prevails whether investing is done through the Internet's social networking, search engine or retail selling sectors. Unimaginable Wealth Anticipation of bequeathed riches has been motivated by the great success of Internet entities such as Facebook |

| U.S. Government: If We Don’t Like The Score, We’ll Change The Rules Of The Game Posted: 13 Jan 2014 01:00 PM PST

Buried in the January BLS report is a metric that shows the number of people in this country not in the labor force. The report shows that 535,000 people dropped out of the labor force in December. 91.8 million people in this country – roughly 29% – are not considered part of the labor force. [...] The post U.S. Government: If We Don’t Like The Score, We’ll Change The Rules Of The Game appeared first on Silver Doctors. |

| Investors should bank on balance sheets while waiting for the next wave in gold Posted: 13 Jan 2014 12:40 PM PST For over a decade, mining companies have relied on a rising gold price to reward their decisions, regardless of whether they were good decisions. Those days are over, and Chen Lin says that investors must embrace companies that can grow their balance sheets even with gold as low as $1,000/ounce.... |

| Is Sub-$1000 Gold in the Cartel’s Script? Posted: 13 Jan 2014 12:30 PM PST

As gold broke below the psychologically important level of $1,200 an ounce late in December of 2013, the mainstream financial media burst with headlines like this one from Marketwatch, “Gold's Safe-Haven Role is Over“. The Nobel prize winning economist from The NY Times, Paul Krugman, penned a wicked missive on the 'barbarous relic' by invoking [...] The post Is Sub-$1000 Gold in the Cartel’s Script? appeared first on Silver Doctors. |

| PGMs to battle higher as firmer-footed gold trends lower - Barclays Posted: 13 Jan 2014 12:19 PM PST According to Barclays, precious metals are likely to be driven more by demand than supply in 2014 which will give gold a firmer footing, but also see it trend downwards. |

| Forex Trading Alert: U.S. Dollar Remains Mixed Against Major Currencies Posted: 13 Jan 2014 12:13 PM PST SunshineProfits |

| US selling of gold likely nearing exhaustion Posted: 13 Jan 2014 12:10 PM PST Julian Phillips reckons the next two weeks will either confirm or deny whether US selling of gold is nearing exhaustion and is close to completion. |

| Has the new gold bull market cycle started? Posted: 13 Jan 2014 11:48 AM PST Gold and gold stocks crashed last year in the summer. They have since been going through a stage one base. This suggests that 2014 will mark the start of a new bull market for gold, gold mining stocks and commodities. |

| High Level Chernobyl Cover up reveals identical playbook concerning Fukushima Posted: 13 Jan 2014 11:30 AM PST

In April 2013, Gina McCarthy, the acting EPA director, signed a revised version of the EPA's Protective Action Guide (PAG) for radiological incidents, which radically relaxed the safety guidelines agencies follow in the wake of a nuclear-reactor meltdown. Meaning, the guidelines the agency NOW follows- the identical playbook followed by USSR officials in the aftermath [...] The post High Level Chernobyl Cover up reveals identical playbook concerning Fukushima appeared first on Silver Doctors. |

| Retired Indian customs officials to train present staff on tackling gold smuggling Posted: 13 Jan 2014 11:30 AM PST The Air Intelligence Unit (AIU) of Indian Customs and the Directorate of Revenue Intelligence (DRI) has sought help from retired and experienced Customs officers to curb increasing incidents of gold smuggling acts. |

| U.S. gold coin sells for $4.5 million Posted: 13 Jan 2014 11:19 AM PST The prices realized for U.S. coins at public auctions this past year totaled nearly $393 million, the highest aggregate total anyone can recall. |

| China's gold output up 7% in first 11 months of 2013 Posted: 13 Jan 2014 11:15 AM PST Data from the China Gold Association shows that output rose 7.01 percent from a year ago to reach 392.141 tonnes. |

| Gold coin and bar shortages likely to lead to rationing Posted: 13 Jan 2014 11:11 AM PST Today's gold prices continued last week's rally, strengthened by a disappointing U.S. jobs number which creates doubts about the strength of the U.S. economic recovery. |

| China believed to want as much gold reserves as U.S. Posted: 13 Jan 2014 11:02 AM PST GATA |

| Bears Losing Grip On Gold Market Posted: 13 Jan 2014 10:57 AM PST The action in the Gold pits this Friday was definitely positive, even bullish. If Gold were still locked in a bear market downtrend, Friday would have provided a great opportunity for the bears. With price still below the current Cycle’s day 4 peak, yet $65 higher than the prior Cycle Low, the setup was ripe for the bears to take control and push Gold back below the 10dma.

Instead, the opposite occurred. On Friday, we saw a rush of fresh buying which pushed Gold comfortably off the 10dma and up to a new Daily Cycle high. This was the kind of move that we would expect from a 1st Daily Cycle, so it pushes us much further down the path to confirming that a new Investor Cycle is underway. Along with the favorable price action, the oscillators have responded well. The MACD has begun to show separation, and the RSI is approaching short term overbought territory. And, as reported last week, there have never been 6 Daily Cycles in 1 Investor Cycle. The bullish confirmations we’re seeing at present serve to bolster the case that Gold is in the 1st DC of a new IC. Gold is still a few confirmations from a final declaration that this is a 1st Daily Cycle, but the evidence is mounting. For now, we’ll treat the first DC scenario as primary. “If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck”.

|

| Dutch Central Bank Tight-lipped About Gold Policy Posted: 13 Jan 2014 10:00 AM PST

I have heard second hand information that the Dutch Central Bank (DNB) and the Federal reserve (the custodian of the Dutch gold in New York) had some correspondence in recent years about monetary gold, but the Dutch did not decide to repatriate any gold because the subject was rather sensitive, according to my source. On [...] The post Dutch Central Bank Tight-lipped About Gold Policy appeared first on Silver Doctors. |

| Posted: 13 Jan 2014 10:00 AM PST Lately, I feel like I'm living in the "Bizarro World." The media has been so dumbed down by rising stock markets, they have literally stopped reporting the news. And not just "bad news," but any news – as frankly, they are so confused by the mixed signals of strong stock markets and weak economic activity, they simply don't know what to say anymore. Sadly, such ineptitude has become most obvious on weekends; when lately, essentially zero news is reported. Which is probably why I'm having trouble latching on to a single topic this morning; instead, "throwing it all on the table." Encouragingly, the majority of Americans no longer use mainstream media to learn "what's going on"; and thus, traditional outlets like CNBC and even Fox News and MSNBC are experiencing dramatic ratings declines. Regarding the former, its ratings plunge to 20-year lows is more of a function of the "average Joe" having lost his shirt in equities – and real estate – over the past decade. And regarding the latter, we believe Americans are so fed up with politicians, even die hard "democrats" and "republicans" are experiencing dramatically weaker interest in partisan propaganda. Record low approval ratings for politicians everywhere – from the U.S. to Europe to Japan – reflect a rising "revolution" of anger; and thus, the money printing, market manipulation, and propaganda utilized to maintain the status quo is rapidly waning in its effect. Even such "Joes" and "Janes" are starting to realize that – per below – the only reason stocks are rising is accelerated "QE" programs; most of which, like the Fed's "QE3" scheme, commenced between late 2012 and early 2013. Unfortunately, the inflation such programs export – as exemplified by collapsing currencies in the "fragile five" economies, where 25% of the world's population reside, is more than offsetting the gains achieved for "the 1%" privy to oversized equity holdings. And thus, it's only a matter of time before the majority not only realizes how deceptive such gains have been – when measured in REAL terms – but how bleak the long-term outlook has become. In fact, the harder TPTB fight reality, the harder it pushes back. I mean, seriously, think of what the average European thinks when it sees Mario Draghi just won "Central banker of the year" – when in the real world, Europe is on the verge of economic collapse. This weekend alone, I read of the disastrous UK holiday season, the catastrophic Portuguese debt situation and even the French President getting caught having an affair – amidst already record low approval ratings. Not a single shred of real data suggests anything other than bad times ahead for Europe. Yet, the year started with equity stock rallies in the weakest of the weak links which are Portugal, Greece and Spain. We cannot emphasize how alarming this trend has become; as global stock markets increasingly appear to be signaling the coming hyperinflation, that John Williams projects to emerge this year. Right now, Venezuela's Caracas Exchange is the poster child of this ominous trend; but with each passing day, this financial cancer is spreading further and more rapidly. Except, interestingly, in China; where either its "plunge protection team" is not as active, or its financial situation dramatically weaker than purported. Few realize China's corporate sector is more indebted than any on Earth – thus, offsetting the government's relatively low debt load; and consequently, it's difficult to judge exactly where its economy stands. Some believe its massive currency reserves and manufacturing market share guarantee above average growth – and social stability – for the foreseeable future. However, others believe the strains of supporting 1.5 billion people amidst a dramatically weakening global economy will be too much for China's still Communist government. As for us, we could not be more bullish about China's long-term role in global politics and economics. However, anything can happen in the near-term; and gauging by the continuing crash of the Shanghai stock exchange – to its lowest level since the 2008 crisis bottom – it's getting increasingly difficult to ignore this giant pink elephant in the room.

Here in the states, the MSM is reeling from Friday's "much worse than expected" NFP report. Clearly, the Fed is terrified of rates rising – particularly above the obvious "line in the sand" they have drawn at 3.0% for the benchmark 10-year Treasury bond. As we wrote on Friday, they will do anything to prevent this level from being breached – as the entire world is dependent on ultra-low interest rates and no rate has more influence than the U.S. 10-year Treasury. Throughout 2014, we expect calls to "end tapering" to grow stronger; and eventually, to actually increase treasury and mortgage bond monetization. Hearing supposed Fed "hawk" Jeffrey Lacker claim the Fed is watching Obamacare closely – fearing a significant negative economic impact from its implementation – should make it crystal clear just how terrified they are, grasping at any straw possible to justify accommodative monetary policy. Rest assured, the pressure on Janet Yellen to step up QE to unprecedented levels will be intense; and frankly, the only question remaining is whether such increases will be catalyzed by a 2008-like crisis, or otherwise. Consequently, the upward pressure on PHYSICAL precious metal demand should significantly expand in 2014; quite obviously in the East, and likely the West as well. Keep your eyes on the COMEX registered inventories; which still haven't reflected the withdrawal of more than 200,000 ounces that stood for delivery of the December contract two weeks ago. Irrespective, such inventories are still 86% lower than the April 2013 level, at an all-time low; and the February contract may well have more delivery demands than the 650,000 or so ounces in December. Thus, with just 416,000 ounces in registered inventory as we speak (with 200,000+ already spoken for), something may well "give" in the very near-term. This is why the Cartel perpetrated its 21st "Sunday night sentiment" attack in the past 22 Sundays last night – yet again, as gold attempted to cross its current "line in the sand" at $1,250/oz. Not to mention, its 151st "2:15 AM" attack of the past 168 days; again, as gold attempted to cross the taboo level of $1,250/oz., and silver to hold above its own "line in the sand" at $20/oz.

Both metals are holding up beautifully as I write, with $20/oz. silver increasingly starting to look more like a "floor" than a "ceiling" (and $1,250/oz. gold on the verge of being taken out). And why shouldn't they, given they're trading well below their respective costs of production, with public sentiment at an ALL-TIME LOW? Yes, not only is sentiment lower than at the bottom of late 2008 – but much lower!

I guess that's enough for today; as frankly, after having not missed a single day of writing in perhaps a year, I'm having a bit of "writer's cramp" this morning. However, despite my "throwing it all on the table," I think some very important points were made; namely, the reality of a collapsing global economy and surging PM fundamentals are very likely to become universally understood during 2014. Which is why you must consider your financial options now, while you still can; particularly, regarding a plan to protect yourself from the inevitable, global hyperinflation. Similar Posts: |

| Gold mine stirs hope and anger in shattered Greece Posted: 13 Jan 2014 09:42 AM PST The Skouries gold mine has set Greece's desperate need for investments to rebuild the economy against the interests of its vital tourism industry. |

| Second-Greatest Opportunity To Buy Gold Posted: 13 Jan 2014 09:34 AM PST This article contains excerpts from Nick Barisheff’s latest presentation at the Annual Empire Club in Canada. Nick Barisheff is the President from Bullion Management Group (www.bmginc.ca). Last year the COMEX futures exchange distorted gold prices, and provided investors with the second-greatest opportunity to buy gold since 2002. Investors in the futures market incited precipitous drops triggered sell stops and margin calls, and the Western media jumped in to declare that the bull market in gold was over. In sharp contrast to the falling price of paper gold, the demand for physical gold soared. Many retail coin stores ran out of stock, and premiums rose as much as 20% for gold and 40% for silver. The lower gold price presents a problem for miners. Because average mine production costs exceed $1,200 per ounce, many high-cost producers will be forced to shut down, causing supply and demand pressure. Clearly, the physical price of gold cannot decline further for any length of time, and the correction is close to a bottom. In addition, the days of COMEX dominance in gold price setting are numbered, since monthly deliveries on the Shanghai Exchange already surpass mine supply. Expanding money supply and unsustainable debt levelThe main driver of the gold price is, and always has been, increasing money supply. “An increase in the money supply” is the very definition of inflation, as it devalues currency and destroys purchasing power. If increasing money supply led to prosperity, Zimbabwe would be the richest country in the world.

This chart shows that gold and U.S. government debt have shared a lock-step relationship since 2001. Despite the divergence in 2013, over the longer term, gold and U.S. debt should return to the mean. Official U.S. public debt currently stands at $17.3 trillion. In order to bring the debt-to-gold relationship back into equilibrium, gold should be at $1,800 today. Since there is no political will to curtail debt increases or introduce austerity measures, I believe gold will surpass $1,800 and likely set new highs in 2014. Without the stability of gold backing, this has encouraged unbridled currency creation and reckless credit expansion at an exponentially increasing rate, taking fewer and fewer years to double. Interest rates are keyThe debt build up is not limited to the US but includes most western economies. The systemic risks that caused the financial meltdown in 2008 have gotten worse. The world’s financial system was almost destroyed because of $1.2 trillion in mortgage derivatives. Today interest rate derivatives alone are 450 times higher at $561trillion or 7 times global GDP. What could possibly go wrong? Long-term Treasuries ended 2013 pushing 3 percent, and will likely rise if the Fed’s tapering measures increase. In the U.S., a one percent rise in interest rates translates to an additional $170 billion in additional annual interest costs, and increases both the debt and the deficit. All other Western central banks face similar situations. Interest rates at 3% in Japan will consume all the country’s tax revenues just to service interest payments. The bigger problem will be the decline in bond portfolios. In Europe, most banks hold significant amounts of sovereign debt as part of their capital. As interest rates increase, the value of their holdings will decrease incrementally. Due to high leverage ratios, some banks may need either bail-outs or bail-ins to shore up those capital ratios, and those same banks may find their interest rate derivatives have unexpected counterparty risks. The debilitating effect of the growing debt is clearly illustrated by the next chart. It shows that in the 1950s, for every dollar of debt increase, the economy grew by about $4. In 2013, for every dollar of debt increase, the economy has only grown by fifty cents. In real GDP over the last decade it has only grown by $0.08. You don’t need to be a mathematician to understand that this trend is not a recovery, and is unsustainable over the long term. Dollar’s hegemony cannot last foreverThe movement away from the U.S. dollar is intensifying. China has signed as many as 25 trade agreements that circumvent the U.S. dollar, and settle trade imbalances with the participants’ own currencies. This will continue to place downward pressure on demand for U.S. dollars. If the dollar loses its reserve currency status, America’s ability to print unlimited amounts of dollars without consequences will be over.

This chart shows the lifespan of the six reserve currencies that preceded the U.S. dollar; the average is 94 years. Gold’s lifespan as stable money is 3,000 years and counting. If we take the demise of the British pound as the world’s reserve currency in 1920 as our starting point, 2014 will mark the 94th year of the U.S. dollar’s lifespan. During this time it has lost 97% of its purchasing power. I firmly believe we are in the late stages of the U.S. dollar’s reign as world reserve currency. Considering the strengthening fundamentals we witnessed for gold in 2013, despite its poor price performance, it appears that an opportunity similar to that of 1976 is a strong possibility. Gold rose 450% from 1971 to 1974. It then retreated 43% over the next 18 months. Many investors lost confidence and sold their holdings vowing never to invest in gold again. At the bottom of the correction, the New York Times declared unequivocally, “the end of the gold bull.” However, during the next four years gold climbed 750%. A similar percentage increase from today’s price would see gold trading above $10,000 an ounce. ConclusionWhile there may still be price declines, I feel today’s situation is similar to that of the 1970s, and that we have the second-greatest opportunity to buy gold since 2002. Today many investors are tempted to sell their underperforming precious metal holdings and use the proceeds to purchase U.S. equities. But remember–the old Wall Street saying is “Buy low, sell high” NOT “Sell low, buy high.” While no one knows with absolute certainty the exact timeframe for developing events, the most conservative route for portfolio protection is diversification with a 10% allocation to gold. Gold is the most negatively correlated asset to financial assets, and acts as portfolio insurance in a decline or a crisis. This means physical gold bullion to which you hold clear title, bullion stored in allocated storage or in your own vault. It is critical that your bullion holdings have no counterparty risks, and are not proxies or derivatives like gold certificates, futures contracts, or ETFs.

Nick Barisheff is President and CEO of Bullion Management Group Inc., a bullion investment company that provides investors with a cost-effective, convenient way to purchase and store physical bullion. Widely recognized in North America as a bullion expert, Barisheff is an author, speaker and financial commentator on bullion and current market trends. He is interviewed monthly on Financial Sense Newshour, an investment radio program in USA. For more information on Bullion Management Group Inc. or BMG BullionFund, visit: www.bmginc.ca . |

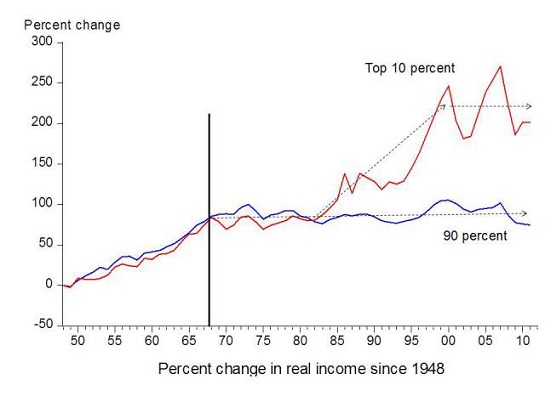

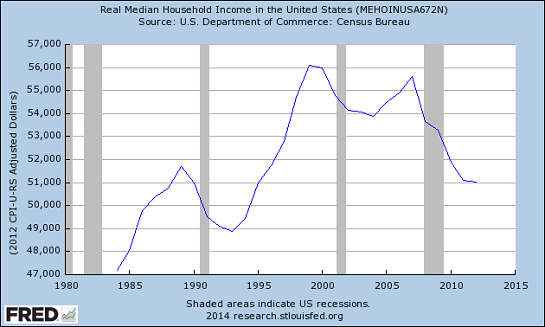

| Posted: 13 Jan 2014 09:34 AM PST “Prosperity” based on serial asset bubbles and near-zero interest rates is neither real nor sustainable. Longtime readers know I have been covering residential housing since mid-2005. In those 8+ years, housing has proceeded through a cycle of bubble-bust-echo-bubble: now the echo bubble is crumbling, for all the same reasons the 2006-7 bubble burst: a prosperity based on asset bubbles and low interest rates is a phantom prosperity that cannot last. Correspondent Mark G. has written a three-part series on the current state of the residential and commercial real estate (CRE) markets. Part 1 addresses residential real estate. The broad context of this analysis is straightforward: an economy based on ever-rising consumption falters when real household incomes stagnate or decline. Real income for the bottom 90% has been stagnant for forty years, and has declined since 1999.

The only way to keep consumption rising when incomes are stagnant is to boost the borrowing power (i.e. collateral and creditworthiness) of households by inflating asset bubbles that create temporary (i.e. phantom) collateral and by lowering interest rates so the stagnant income can support more debt. This is why the Federal Reserve and the other agencies of the Central State have been reduced to blowing serial assets bubbles: there is no other way to keep a consumption-based economy from imploding.

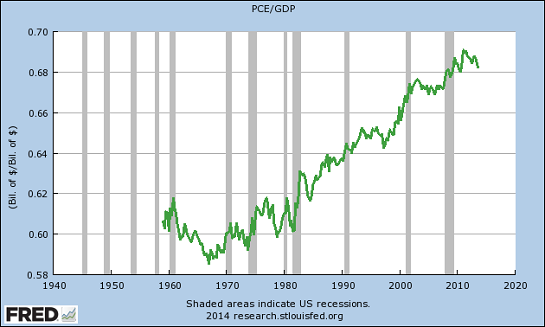

But “prosperity” based on serial asset bubbles and near-zero interest rates is neither real nor sustainable: real prosperity is based on rising real incomes, not debt leveraged on phantom collateral. Here is Part 1 of Mark’s series on U.S. real estate. Today consumer spending represents approximately 68% of the total gross domestic product and the annual economy of the United States.  PCE = Personal Consumption Expenditures. GDP = Gross Domestic Product. The ratio of these numbers times 100 produces the percentage figure. PCE includes food, entertainment, residential housing, automobiles, clothes and iPads. The consumer broadly has two ways to obtain the money needed to support this spending. The first method is to earn it and the second method is to borrow it.

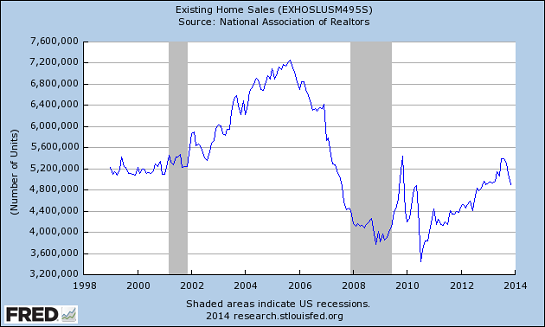

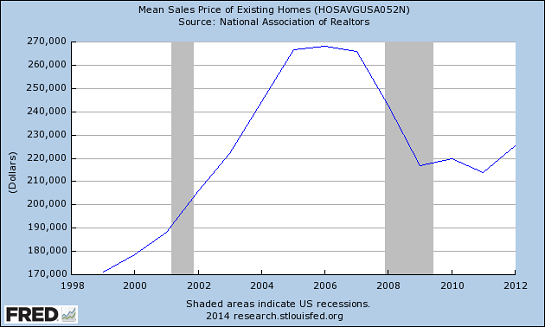

Since 1999 average real household income in the USA has declined by 10%. This real decline was only temporarily reversed during the peak bubble years. From 2000 to 2008 the full effects of this decline were masked by a vast expansion of household debts of all kinds, a collapse in mortgage and consumer lending standards and a concurrent decline in household net worth. Exactly which 90% of the population is bearing the brunt of this collapse, and why it is occurring, is beyond the scope of this overview. This trend culminated in the financial crisis of 2007 – 2009. This began in the subprime mortgage sector, spread to the entire residential real estate market and progressively engulfed commercial real estate, banking, the stock markets, commodity markets and finally all of international trade. In response the Federal Reserve multiplied its balance sheet five times from $800 billion to $4 trillion dollars. And the US Government concurrently ran peak fiscal deficits up to $1.8 trillion. The US Government also extended many trillions more in direct guarantees of minimum prices of financial assets of all kinds. US Residential Real Estate The observed result of all this monetary and fiscal stimulus, combined with the lowest mortgage interest rates in the post World War II era, was to only slow the rate of decline of median US household income. In the combined residential US real estate market this set of policies had the following results: Existing Home Sales

The rate of existing home sales has yet to recover to the levels of the mid-1990s. Since the most recent decline in sales rate is paralleling the upward spike in mortgage rates it is reasonable to believe they probably will not recover.

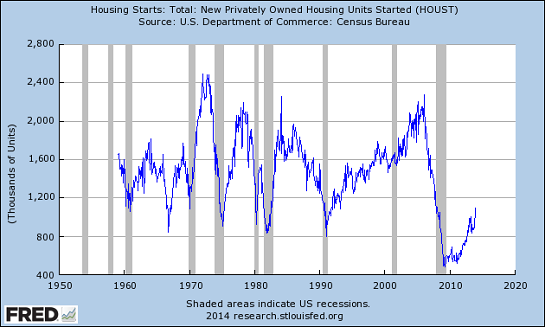

The average sales price of existing homes has recovered to approximately 2003 levels. (Note: Whether increasing average home prices for a population still experiencing declining real average household incomes is an intelligent public policy goal is a second question. This question deserves far more critical discussion than it currently receives.) New Home Sales: (This time it really is different)

Those interested in detailed numbers for single and multifamily housing construction can find them here: New Privately Owned Housing Units Authorized by Building Permits in Permit-Issuing Places(Census Bureau) New-Home Production Tops 1 Million in November (NAHB) The National Association of Homebuilders (NAHB) announced in mid-December 2013 that new starts in single and multi-family housing had finally exceeded an annualized rate of 1 million units. In other words, the actual 2013 new construction number will be approximately 935k. Prior to 2008 these sub 1 million total new build numbers were only seen in the six years of 1991,1981, 1980, 1975, 1966 and 1960. They have subsequently occurred six straight years in a row from 2008-2013. It will not be known for another year whether new builds will finally exceed 1 million in 2014. Note that US population has been continuously increasing over the entire time period. Therefore the present era represents the lowest per capita rate of new construction on record for six decades. Near Term Prospects There are two primary reasons that residential real estate has not recovered more that it has. These are very straightforward: 1. Real US household incomes continue to decline. 2. Residential mortgage lending standards have been significantly tightened since 2007. These charts represent averages and sums across most of a continent. Within this expanse some areas are already experiencing new record bubbles while many others continue to fall deeper into local depressions. There are several other factors that have affected and will continue to affect the residential real estate recovery. Factor One: Habitable Vacant Dwellings AMERICA'S 14.2 MILLION VACANT HOMES: A NATIONAL CRISIS (RealtyTrac) "As of the first quarter of 2013, there are just over 133 million housing units in America and 10.7 percent of them — more than 14. 2 million — are vacant all year round for some reason or another, according to the Census Bureau.” To this 14.2 million empty dwellings we can add several million additional vacation homes that are only occupied for a few months a year. Factor Two: Cultural Shift To Multigenerational Households At least one person is required to create a household and occupy a dwelling. A related question is, what is the average number of empty bedrooms per occupied dwelling in the US? It is at least 1.0 and very probably much higher. During recent years there has been an increase in average household size and a corresponding drop in the total number of households. This is the result of adult children and grandchildren moving back in with the "folks" to weather the economic storm. Whenever this occurs, two households become one household and residential housing demand is sensibly reduced. A related trend is adult children who are economically unable to ever leave their parents household. To the extent these shifts are permanent trends rather than temporary expedients this will permanently reduce the per capita demand for residential housing. Based on results the decline in real household incomes has proven insensitive to a variety of economic theories and policies. Neither the Republican-Bush era tax rate cuts nor the Democratic-Obama Keynesian pump priming at fire hydrant pressures has succeeded in reversing this long term trend. Nor has anything appeared recently to suggest an abrupt reversal is at hand in this key trend of average household income. In these circumstances the only other possibility for further residential real estate "recovery" would be for government regulators to foster another bubble by effectively relaxing residential mortgage lending standards again. Three Possible Future Outcomes For U.S. Residential Real Estate In order, these are: go up further, stay the same or resume declining. 1. Up. The Federal Reserve has already begun withdrawing from its bond buying program, albeit at a slow rate of 'taper'. This has accordingly led to mortgage rate increases which were accompanied by a prompt decline in existing home sales. It is mathematically impossible for a population with declining real household incomes to propel residential real estate markets higher in the face of higher interest costs. 2. Steady State. At a minimum, this outcome requires that average household income cease declining and that mortgage rates not rise significantly. Neither of these outcomes is likely. The following review of commercial real estate will examine clearly visible economic trends that make further household income declines a certainty. If we cannot go up and even staying the same becomes doubtful this leaves; 3. Down Again. Thank you, Mark. Part 2 of Mark’s series will examine the exceedingly fragile commercial real estate (CRE) market. |

| China Gold output climbs 7.01% to 392.141 tons in Jan Nov Posted: 13 Jan 2014 09:07 AM PST The country produced 392.141 metric tons of gold during the January-November period 2013, advanced by 25.681 metric tons or 7.01% compared to the same period a year ago, the association said. |

| Posted: 13 Jan 2014 09:00 AM PST As the new week begins, I thought it might be fun to take a longer look at the recent price trend in copper. You'll note that, as of late, there has been a rather stark divergence from gold and silver. |

| Big COMEX Gold Withdrawals & New Record Low Dealer Inventory Posted: 13 Jan 2014 08:45 AM PST

After a brief pause in the decline of Comex Gold inventories, it looks like it has continued once again as there were several big withdrawals over the past few days. Not only was there a large removal of gold from the Comex today, the Registered (Dealer) inventories are now at a new record low. 100 [...] The post Big COMEX Gold Withdrawals & New Record Low Dealer Inventory appeared first on Silver Doctors. |

| Mercenary Links Jan 13th: Number One Trader Posted: 13 Jan 2014 08:20 AM PST Mercenary Links Jan 13th: China surpasses US as largest trading nation (maybe)… Lululemon plummets… banks refuse legal marijuana money… a blogger in jail, the flying tomato’s haircut, and more.

~~~ ~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

Recent Mercenary Links (scroll for archives)

p.s. Like this article? For more, visit our Knowledge Center! p.p.s. If you haven't already, check out the Strategic Intelligence Report! |

| Posted: 13 Jan 2014 08:14 AM PST A brief description of the methods of rhetorical manipulation and techniques of misinformation in a typical MSM drive-by on gold. |

| Non farms payroll gives a boost to Gold, short covering to support: Barclays Posted: 13 Jan 2014 07:55 AM PST Investor demand for gold continues to be weak with holdings in exchange traded funds down 18.8 tons down for the year-to-date. Outflows from ETFs are expected to slow as the year evolves. |

| It Can’t Be Both?…It Shouldn’t Be Either One Posted: 13 Jan 2014 07:00 AM PST We had several news items last week that boggled the mind. The most astonishing was the Bundesbank doing a 180 degree U-turn and saying that the gold that was delivered to them last year was not refined in the U.S.; it was done in Germany after the arrival. This of course raises many more questions than already existed. Originally when it was “told” that the U.S. refined the gold, the simple question of “why?” was out there. This was passed off by Germany by explaining that these bars needed to be “LGD” (London Good Delivery) 400 ounce bars. This really did not pass the smell test but it was what it was. Questions arose that maybe this gold was “coin melt” and commentators speculated that Germany needed to take the heat off of the Fed by making their “refined in the U.S.” statement. This now is apparently not the truth as Germany now says that they refined the gold? But now there are more questions. Where in Germany was it refined? Could we maybe see some sort of “chain of custody” or bill of lading showing the movement of the gold? Why hasn’t anyone come forward and cleared this up, someone surely at the refinery or a part of the transport plans could step up and “swear" that they touched the gold, handled the gold or even “saw the gold?” But no, so far no one knows nuthin.’ As I explained in my article last week “Monkey Business,” gold has a fingerprint if it is not 99.999% pure. Based on purity and whatever other elements are mixed in, its origin or previous ownership can be narrowed down quite precisely. THIS is the problem that Germany is attempting to avoid (for the Fed) by making and then reversing their statements. Obviously by reversing their statement, “credibility” now comes into question…because the gold was both refined in the US…or in Germany but…it can't be both and in reality if it was the SAME, original gold, it shouldn’t be either one! By reversing their statement they announced to the world “we are liars.” One of the two statements is a lie by common logic, which one you ask? Does it matter? They can’t even fall back on the old “it was a mistake” line because we are not talking about whether this gold was in “the front right pocket or left pocket.” Do you realize the logistics that had to have been undertaken? 37.5 tons? 75,000 pounds? 2 billion dollars? The guards and armored trucks involved? The chain of custody? And they want us to believe that “oops we made a mistake,” it was refined 5,000 miles away in a different country, different continent, different time zone in a different refinery? Oops! Really? Getting to the meat of the matter and forgetting that when you lie once you’ll need to lie bigger and then even BIGGER to cover the first lie(s), why did this gold even need to be refined? Again, because it apparently had a “bad” fingerprint. “Bad” meaning it was not the original fingerprint, shape or size that this German gold was originally delivered in. It’s really quite simple, it’s NOT the same gold that was originally delivered and you don’t have to be Sherlock Holmes to come to this conclusion. So…what’s the big deal, they got this gold back right? Well, us conspiracy nuts were screaming a year ago when the deliveries were originally announced that there was no way it could take 8 years to get 20% of their gold back…if it was really there and held in the NY Fed’s vault. Right now it’s looking pretty good for the conspiracy nuts huh? In a nutshell, Germany’s gold is obviously not there any longer…something has happened to it. Was it leased out? Sold? Melted down and given away as Valentines gifts? Who knows? It really doesn’t matter; the only thing that absolutely positively does matter is that the NY Fed did something it wasn’t supposed to do with the gold, the wealth of another sovereign nation that they were entrusted to the safekeeping of…period, end of story. Of course there are a few other nagging questions like “this was only 37.5 tons, what about the other 262.5 tons that are supposed be shipped?” Oh, yes I know, the real whackos might even ask, “What about the OTHER 1,462.5 tons that are supposedly ‘held’ in safekeeping?” Did Cupid get a hold of any (all?) of this gold and go on a “giving spree?” I have to ask, why are the Germans blowing their credibility to cover for something that they didn’t do? It IS THEIR gold after all. They didn’t do anything wrong except deposit the gold in the first place and now are making false statements. As with pretty much any and all lies, this one will come to a head. 2014 will be all about “deliveries” or the lack of. It won’t matter whether it’s COMEX, the LBMA, GLD or anywhere else. A failure can be hidden or swept under the rug depending on “whom” it is that gets failed to deliver to, the Germans are a prime example. The Chinese however are a different story and most probably one that we will hear about very loudly!Similar Posts: |

| Gold set for Goldilocks 2014 with 4% growth Posted: 13 Jan 2014 06:57 AM PST It has been uncommon for gold to score single-digit percentage moves either way over the last decade; we see 2014 being an exception. Gold could be described as the 'Marmite' asset class — investors love it or hate it. |

| Gold Coin And Bar Shortages Likely To Lead To Rationing Posted: 13 Jan 2014 05:33 AM PST gold.ie |

| Monex Precious Metals Review: Gold rises to $1248, silver $20.30 oz Posted: 13 Jan 2014 04:21 AM PST Monex spot gold prices opened the week at $1,241 . . . traded as high as $1,248 on Friday and as low as $1,221 on Wednesday . . . and the Monex AM settlement price on Friday was $1,247, up $6 for the week. Gold support is now anticipated at $1,234, then $1,222, and then $1,208 . . . with resistance anticipated at $1,250, then $1,267, and then $1,289. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment