Gold World News Flash |

- Market Monitor – December 11th

- Gold breaks Resistance

- QE To Infinity Out. Gold Demand To Infinity In

- China Hoards More Gold Than We’re Told…

- OUTLOOK 2014: Chart This! Looks at Gold in the New Year

- Guest Post: May The Odds Be Ever In Your Favor - Part 1: The Reaping

- The Gold Price Moved Up $27.10 Closing on the Comex at $1,262.40

- The Gold Price Moved Up $27.10 Closing on the Comex at $1,262.40

- Why Today's Gold Rally is Different From Last Week

- Metals War Rages & Today’s Rally In Gold & Silver

- Backwardation in gold continues/GLD and SLV inventories remain constant/gold and silver rise

- Gold Futures see First Loss Since 2000

- The Most Misunderstood Threat Of Economic Implosion

- JPMorgan Chase, the Foreign Corrupt Practices Act, and the corruption of America

- QE To Infinity Out. Gold Demand To Infinity In

- Alasdair Macleod: The relevance of Say's Law

- Jan Skoyles interviews Hinde's Ben Davies on 'Get Real' pilot

- Faber - The Asset Class Hated Even More Than Gold & Silver

- The World’s Only Popular Tax

- Gold Daily and Silver Weekly Charts - Follow Through Is Everything

- Gold Daily and Silver Weekly Charts - Follow Through Is Everything

- Look For Leverage To Rising Gold Prices With No Expiration

- White Flag for Gold

- White Flag for Gold

- Jan Skoyles Interviews Ben Davies On Gold and Silver

- Jan Skoyles Interviews Ben Davies On Gold and Silver

- NAV Premiums Of Precious Metal Trusts and Funds - Sprott Gold Has 19,200 Ounces Redeemed

- NAV Premiums Of Precious Metal Trusts and Funds - Sprott Gold Has 19,200 Ounces Redeemed

- 99 Problems… But Oil Ain’t One of Them

- Jim’s Mailbox

- Indian gold demand and market forces reasserting themselves, Turk says

- The Most Interesting Economist of All Time

- The Correction Isn't Over, But Gold's Headed to $20,000

- Gold Correction Isn’t Over, But Gold Price Heading to $20,000

- Peru silver mine strike ends after state intervention

- Inflation, US rates battle key to gold in 2014 – Analysts

- Brace yourself for another round of selling in gold – Shah

- Why gold prices won’t rise in 2014

- South Africa gold output soars almost 75% in Oct

- Can’t-miss headlines: Gold bullies up, C$175m financing & more

- 2014 Battle Over US Rates & Inflation Key to Gold

- Metals War Rages & Today’s Rally In Gold & Silver

- Bitcoin is Not the Enemy of Gold Investors

- Ageing Bull

- Ageing Bull

- 30%+ Gold in a Diversified Portfolio?

- Deposit Confiscation and Bail-In - Where Likely and When? (Part V)

- Gold Price Gains Amid US Fed Taper Talk on "Short-Covering & Bargain Hunting"

- Gold 30%+ Optimum Stocks, Bonds Portfolio Investment Allocation

- Silver Price Set to Double, According to… Apple?

| Market Monitor – December 11th Posted: 10 Dec 2013 08:06 PM PST Top Market Stories For November 11th, 2013: India Gold Price Premium at 23.2%, Equivalent US $1514 - Jesse's Cafe Welcome to the Third World, Part 12: Your Pension is an "Unsecured Obligation" - John Rubino QE To Infinity Out. Gold Demand To Infinity In. - 321 Gold GOLD PRODUCTION WARS: The East Slays The West - GoldSeek 30%+ Gold [...] | ||||||||||||||||||||||||

| Posted: 10 Dec 2013 07:40 PM PST from Dan Norcini:

There are a couple of things at work today. First, after expectations that the Fed was going to announce a tapering at next week’s FOMC meeting, traders have now largely dialed that back. Secondly, and more importantly, this is contributing to further US Dollar weakness. We saw that yesterday but it is more notable in today’s session as the USDX slid under the 80 level. | ||||||||||||||||||||||||

| QE To Infinity Out. Gold Demand To Infinity In Posted: 10 Dec 2013 07:17 PM PST Graceland Update | ||||||||||||||||||||||||

| China Hoards More Gold Than We’re Told… Posted: 10 Dec 2013 07:00 PM PST by Chuck Butler, Casey Research:

The Tapering Question remains a roadblock to currency gains getting moving with any authority. The Fed Heads' FOMC Meeting doesn't take place until next week 12/18, but yesterday we had a Fed Head talking about Tapering, so let's see what he had to say, and maybe we can get a glimpse of what will be the end result of next week's meeting… | ||||||||||||||||||||||||

| OUTLOOK 2014: Chart This! Looks at Gold in the New Year Posted: 10 Dec 2013 05:40 PM PST from KitcoNews: | ||||||||||||||||||||||||

| Guest Post: May The Odds Be Ever In Your Favor - Part 1: The Reaping Posted: 10 Dec 2013 05:23 PM PST Submitted by Jim Quinn of The Burning Platform blog, “Human history seems logical in afterthought but a mystery in forethought. In every prior Fourth Turning, the catalyst was foreseeable but the climax was not.” - The Fourth Turning – Strauss & Howe – 1997 We are five years into the Crisis that will not resolve itself until sometime in the 2020’s. No one can predict the specific events that will fundamentally change history over the next decade, but the catalysts of debt, civic decay and global disorder were evident sixteen years ago when Strauss and Howe wrote their prophetic generational history. The volcanic eruption occurred in 2008 when the worldwide financial system blew and the molten lava continues to spew forth and flow along the Federal Reserve created channels, protecting the corrupt establishment while incinerating senior citizens, the working middle class and Millennials. Deep within the volcano the pressure is building again as the mood of the country darkens. It will blow again and the economic, social, political and military distress will catalyze into a catastrophic emergency that will tear the fabric of the country asunder. The existing social order will be swept away and replaced by a new paradigm which could be better or far worse. “Imagine some national (and probably global) volcanic eruption, initially flowing along channels of distress that were created during the Unraveling era and further widened by the catalyst. Trying to foresee where the eruption will go once it bursts free of the channels is like trying to predict the exact fault line of an earthquake. All you know in advance is something about the molten ingredients of the climax, which could include the following:

The Fourth Turning – Strauss & Howe – 1997 Linear thinkers are incapable or unwilling to understand that history is cyclical, primarily driven by national mood changes and the interaction of generations entering different stages in their 80 year life cycle. We’ve seen this story before, but those who lived through the last Fourth Turning have mostly died out, and our techno-narcissistic populace has absolutely no interest in understanding history beyond last night’s episode of Duck Dynasty. The mood of the country during a Turning is often captured in literature and/or film produced during that period. The last Fourth Turning encompassed the period from the Great Crash in 1929 through the Great Depression and World War II, ending in 1946 with a new world order. Four novels written during this Crisis captured the dystopian nature of the time, reflecting the fear, pain, anger, brutality, and courageousness of the common man during that perilous period. Huxley’s Brave New World (1932), Steinbeck’s Grapes of Wrath (1939), Orwell’s 1984 (written during WWII), and Tolkien’s Lord of the Rings Trilogy (written from 1937 through 1949) are masterpieces of literature which captured the aura of the times in which they were penned. Only one of the novels was brought to film during the Crisis, with John Ford’s brilliant Grapes of Wrath screen adaptation capturing the suffering and desperation of common folk during the Great Depression. Most of what passes for literature and film these days is nothing more than glorified commercials or corporate created twaddle designed for narcissistic, mindless, teenage girls. Many will dismiss Suzanne Collins’ Hunger Games trilogy and the film adaptations as nothing more than run of the mill teenager nonsense. They are making a huge mistake. Decades from now, if we make the right choices during this Fourth Turning, The Hunger Games will be viewed as the novels and films that captured the darkening, rebellious mood of the Crisis. It is not a coincidence the first novel was published in September 2008. The worldwide financial meltdown initiated by the Wall Street financial elite and their paid for cronies in the nation’s capital, occurred in September 2008 and marked the commencement of this Fourth Turning. Collins has brilliantly created a dystopian nightmare that combines the shallowness and superficiality of our reality TV culture with our never ending wars of choice and rise of our surveillance state, while blending the decadence and debauchery of the declining Roman Empire. She also unwittingly places her characters in their proper generational roles during a Fourth Turning Crisis. Collins was a military brat who was fortunate enough to have a father that taught her the truth about historical events, not the propaganda taught in our public schools today. “He was career Air Force, a military specialist, a historian, and a doctor of political science. When I was a kid, he was gone for a year in Viet Nam. It was very important to him that we understood about certain aspects of life. So, it wasn’t enough to visit a battlefield, we needed to know why the battle occurred, how it played out, and the consequences. Fortunately, he had a gift for presenting history as a fascinating story. He also seemed to have a good sense of exactly how much a child could handle, which is quite a bit.” She learned lessons about war, poverty, oppression, and the brutality and corruption of the ruling classes. Her knowledge of history, the visual images of reality shows and the Iraq War displayed on TV created the idea for her Hunger Games trilogy. “I was channel surfing between reality TV programming and actual war coverage when Katniss’ story came to me. One night I’m sitting there flipping around and on one channel there’s a group of young people competing for, I don’t know, money maybe? And on the next, there’s a group of young people fighting an actual war. And I was tired, and the lines began to blur in this very unsettling way, and I thought of this story.” The central storyline of The Hunger Games is there are twelve districts subservient to the Capitol in the totalitarian nation of Panem. The country consists of the affluent Capitol, located in the Rocky Mountains, and twelve desperately poor districts ruled by the Capitol. The Capitol is lavishly opulent and technologically advanced, but the twelve districts are in varying states of poverty. As punishment for a past rebellion against the Capitol wherein twelve of the districts were defeated and the thirteenth purportedly destroyed, one boy and one girl from each of the twelve districts, between the ages of twelve and eighteen, are selected by lottery to compete in the “Hunger Games” on an annual basis.

The Games are a televised spectacle, with the participants, called “tributes”, being forced to fight to the death in a treacherous outdoor arena. It’s a combination of American Idol, Survivor, and Middle Eastern warfare. The victorious tribute and his or her home district are then remunerated with extra food and supplies. The objective of the Hunger Games is to provide superficial reality TV entertainment for the vacuous small-minded masses in the Capitol and serve as a constant reminder to the Districts of the Capitol’s supremacy and supposed omnipotence. The Capitol ruling with an iron fist over its 13 Districts is clearly founded upon the British Empire running roughshod over the 13 American colonies and harvesting resources and taxes to maintain their wealth, power and control. Collins utilizes her knowledge of ancient Greek and Roman history and merging it with our degraded shallow TV culture to meld a dystopian nightmare of brutality, child murder, voyeuristic sadism, and a fragile, rotting empire.

“A significant influence would have to be the Greek myth of Theseus and the Minotaur. The myth tells how in punishment for past deeds, Athens periodically had to send seven youths and seven maidens to Crete, where they were thrown in the Labyrinth and devoured by the monstrous Minotaur. Even as a kid, I could appreciate how ruthless this was. Crete was sending a very clear message: “Mess with us and we’ll do something worse than kill you. We’ll kill your children.” And the thing is, it was allowed; the parents sat by powerless to stop it. Theseus, who was the son of the king, volunteered to go. I guess in her own way, Katniss is a futuristic Theseus. In keeping with the classical roots, I send my tributes into an updated version of the Roman gladiator games, which entails a ruthless government forcing people to fight to the death as popular entertainment. The world of Panem, particularly the Capitol, is loaded with Roman references. Panem itself comes from the expression “Panem et Circenses” which translates into ‘Bread and Circuses’.” – Suzanne Collins Any similarities between propaganda posters in Panem and propaganda in America are purely coincidental, I’m sure.

“At least once every human should have to run for his life, to teach him that milk does not come from supermarkets, that safety does not come from policemen, that ‘news’ is not something that happens to other people. He might learn how his ancestors lived and that he himself is no different–in the crunch his life depends on his agility, alertness, and personal resourcefulness.” - Robert Heinlein The Reaping of Wealth “War, terrible war. Widows, orphans, a motherless child. This was the uprising that rocked our land. Thirteen districts rebelled against the country that fed them, loved them, protected them. Brother turned on brother until nothing remained. And then came the peace, hard fought, sorely won. A people rose up from the ashes and a new era was born. But freedom has a cost. When the traitors were defeated, we swore as a nation we would never know this treason again. And so it was decreed, that each year, the various districts of Panem would offer up in tribute, one young man and woman, to fight to the death in a pageant of honor, courage and sacrifice. The lone victor, bathed in riches, would serve as a reminder of our generosity and our forgiveness. This is how we remember our past. This is how we safeguard our future.” – President Snow – Hunger Games A major theme in the novels is the tremendous wealth inequality between the Capitol and most of the districts. District 12, the home of Katniss Everdeen the protagonist, is the most desperately poor. District 12 is located in the Appalachian region of the former USA. They are tasked with providing the Capitol resources obtained from dangerous mines. The population lives a bleak existence in poverty and squalor, with starvation always looming like an apparition of death. The districts are essentially slave plantations to be pillaged for whatever the dictatorial Capitol demands. The districts exist to harvest resources, such as fish, coal, lumber, crops, and gems, all sent to fulfill their quotas. Many districts, such as 12 and 11, don’t have enough coal to power their own district or enough food to feed their citizens. Districts 1, 2 and 4 are closer and more allied with the Capitol, resulting in them receiving more support, better food, consumer goods, and military protection. The wealth inequality between the ruling class and the working class in the districts is the primary cause of discontent and increasing rebelliousness. The parallels with our corporate fascist surveillance state are unmistakable. The wealth and power in our country is concentrated in the hands of ruling elite who primarily reside in the nation’s capital of Washington D.C. and the financial capital of New York City. The top 1% control 42% of the nation’s financial wealth, while the bottom 80% control less than 5% of the financial wealth. Table 1: Income, net worth, and financial worth in the U.S. by percentile, in 2010 dollars

From Wolff (2012); only mean figures are available, not medians. Note that income and wealth are separate measures; so, for example, the top 1% of income-earners is not exactly the same group of people as the top 1% of wealth-holders, although there is considerable overlap. The concentration of wealth in the hands of the few if achieved through superior work ethic and/or intellectual advantage would not cause discontent among the masses. Henry Ford, Steve Jobs and Bill Gates were admired for creating businesses and employing people. They earned their wealth. Today, it has become clear to all critical thinking people that a small cabal of super-rich men constituting an invisible ruling class have captured our financial and political system. They are the .1% who run the Wall Street banks, control the Federal Reserve, buy off the politicians of both parties, and pay lobbyists to write the laws and tax regulations. They use their ill-gotten wealth to maintain the status quo and further pillage the wealth of the working class through financial market manipulation, man-made inflation and outright theft. As 47 million Americans depend upon food stamps and other welfare programs to get by and real unemployment exceeds 20%, the wealth inequality in the nation has reached levels only seen in 1929, prior to the Great Crash outset of the last Fourth Turning. The mounting anger and discontent among the former working middle class is palatable. Those at the top of the food chain have rigged the system and get richer by the day. They bribe the lower classes with welfare benefits, taken from the working middle class, in an effort to stave off riots in the streets.

Rentier capitalism, the economic practice of parasitic monopolization of access to physical, financial, and intellectual property, has replaced free market capitalism, with the rentier class generating billions of illicit financialization profits while contributing nothing to society. We’ve become a modern day Panem, an imperialistic s | ||||||||||||||||||||||||

| The Gold Price Moved Up $27.10 Closing on the Comex at $1,262.40 Posted: 10 Dec 2013 04:26 PM PST Gold Price Close Today : 1262.40 Change : 27.10 or 2.19% Silver Price Close Today : 20.256 Change : 0.612 or 3.12% Gold Silver Ratio Today : 62.322 Change : -0.562 or -0.89% Silver Gold Ratio Today : 0.01605 Change : 0.000143 or 0.90% Platinum Price Close Today : 1387.80 Change : 20.20 or 1.48% Palladium Price Close Today : 738.00 Change : 3.50 or 0.48% S&P 500 : 1,802.62 Change : -5.75 or -0.32% Dow In GOLD$ : $261.56 Change : $ (6.61) or -2.47% Dow in GOLD oz : 12.653 Change : -0.320 or -2.47% Dow in SILVER oz : 788.56 Change : -27.23 or -3.34% Dow Industrial : 15,973.13 Change : -52.40 or -0.33% US Dollar Index : 79.979 Change : -0.177 or -0.22% Well, the silver and GOLD PRICE did it today. About 6:00 a.m. Eastern time while all y'all were still snugged up tight in bed, silver broke through 2000c and the gold price through $1,245. Time an old slugabed like me got to work, the gold price was already at $1260 and silver at 2030c. The GOLD PRICE ended the day on Comex at $1,262.40, up $27.10 or 2.2%. The SILVER PRICE finished up 61.2 cents (3.1%) at 2025.6c. Both jumped clean through resistance at $1,250 and 2000c. Better yet, both jumped o'er their 20 DMAs ($1,251 and 1999c). Folks, it don't get much stouter than this. Silver and gold prices fought off an attack at new lows for the move last week, reversed upward, and advanced steadily. MACD flashed a buy signal on Friday, and the Rate of Change for both has climbed sharply since 1 December and today entered POSITIVE territory. What's next? (Moneychanger, are you NEVER satisfied?) No, I want to see both close above their last highs ($1,295 and well, silver did that today) and their 50 DMAs (2115c and $1,288.80). What's more, I want both to close once again ABOVE that uptrend line from the June Low, for silver tomorrow 2160c and for gold $1,288. Wait -- did I mention that volume is rising with price, to confirm the price move? No, I didn't. Well, there 'tis. Friends, nothing in this life is sure except that we will all exit this world feet first, but this is the best price action I've seen in gold and silver for several months. I bought some more today. Stocks must have disappointed their cheerleaders. Every index fell. Dow lost 52.4 (0.33%) to 15,973.13 and punched into but closed not beneath its 20 DMA (15,966). S&P500 gave back 5.75 (0.32%) and ended at 1,808.62. Pattern in both indices is the same, a pair of descending tops. Not a good sign, unless they can turn around on the morrow and climb past the previous high. Otherwise, look out below. All this showed far more clearly in the Dow in Gold and Dow in Silver, which both tumbled sharply. Dow in Gold ended at 12.66 oz (G$261.70 gold dollars), down 2.03% AND below the 20 DMA at 12.77 oz. That crossing under the 20 DMA confirms what looked like a head and shoulders top. Dow in Silver did likewise. Closed down 3.21% at 782.61 oz and below the 20 DMA at 799.23. Mercy, y'all, look at this! If this pattern completes, it will be double tops in both the DiG and DiS, June and December, and 'twill signal that silver and gold have turned up against stocks. Hold on -- we need further confirmation, like closes below the 50 DMA. MACD has already flashed sell signals for both indicators, and 12 day Rate of Change went negative in both. All right! US DOLLAR INDEX broke 80 today. Lost 20 basis points or 0.25% to close at 79.94. There is what I take to be the neckline of a head and shoulders that started forming in 2011 that now hits the US dollar index about 79. It may be some other pattern, but since late 2011 a line from 78.10 in Spring 2013 through about 80 today has stopped every decline. Well, every decline except that dip down to 79.06 in October. Now the US Dollar Index, after a climb, is right back at that 80 support. Maybe if it falls through this time it will just keep on falling to 74.75, or 72.70? Little but air stands beneath it now. The Euro rose 0.17% to $1.3761, clearly on its way to $1.3825 or higher. It's the battle of the junk currencies for the title, "Sorriest Fiat Money On The Planet." Japanese yen rose 0.43% to 97.26 cents/Y100. If it breaks the last low at 96.41, who knows where it might perch? Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||

| The Gold Price Moved Up $27.10 Closing on the Comex at $1,262.40 Posted: 10 Dec 2013 04:26 PM PST Gold Price Close Today : 1262.40 Change : 27.10 or 2.19% Silver Price Close Today : 20.256 Change : 0.612 or 3.12% Gold Silver Ratio Today : 62.322 Change : -0.562 or -0.89% Silver Gold Ratio Today : 0.01605 Change : 0.000143 or 0.90% Platinum Price Close Today : 1387.80 Change : 20.20 or 1.48% Palladium Price Close Today : 738.00 Change : 3.50 or 0.48% S&P 500 : 1,802.62 Change : -5.75 or -0.32% Dow In GOLD$ : $261.56 Change : $ (6.61) or -2.47% Dow in GOLD oz : 12.653 Change : -0.320 or -2.47% Dow in SILVER oz : 788.56 Change : -27.23 or -3.34% Dow Industrial : 15,973.13 Change : -52.40 or -0.33% US Dollar Index : 79.979 Change : -0.177 or -0.22% Well, the silver and GOLD PRICE did it today. About 6:00 a.m. Eastern time while all y'all were still snugged up tight in bed, silver broke through 2000c and the gold price through $1,245. Time an old slugabed like me got to work, the gold price was already at $1260 and silver at 2030c. The GOLD PRICE ended the day on Comex at $1,262.40, up $27.10 or 2.2%. The SILVER PRICE finished up 61.2 cents (3.1%) at 2025.6c. Both jumped clean through resistance at $1,250 and 2000c. Better yet, both jumped o'er their 20 DMAs ($1,251 and 1999c). Folks, it don't get much stouter than this. Silver and gold prices fought off an attack at new lows for the move last week, reversed upward, and advanced steadily. MACD flashed a buy signal on Friday, and the Rate of Change for both has climbed sharply since 1 December and today entered POSITIVE territory. What's next? (Moneychanger, are you NEVER satisfied?) No, I want to see both close above their last highs ($1,295 and well, silver did that today) and their 50 DMAs (2115c and $1,288.80). What's more, I want both to close once again ABOVE that uptrend line from the June Low, for silver tomorrow 2160c and for gold $1,288. Wait -- did I mention that volume is rising with price, to confirm the price move? No, I didn't. Well, there 'tis. Friends, nothing in this life is sure except that we will all exit this world feet first, but this is the best price action I've seen in gold and silver for several months. I bought some more today. Stocks must have disappointed their cheerleaders. Every index fell. Dow lost 52.4 (0.33%) to 15,973.13 and punched into but closed not beneath its 20 DMA (15,966). S&P500 gave back 5.75 (0.32%) and ended at 1,808.62. Pattern in both indices is the same, a pair of descending tops. Not a good sign, unless they can turn around on the morrow and climb past the previous high. Otherwise, look out below. All this showed far more clearly in the Dow in Gold and Dow in Silver, which both tumbled sharply. Dow in Gold ended at 12.66 oz (G$261.70 gold dollars), down 2.03% AND below the 20 DMA at 12.77 oz. That crossing under the 20 DMA confirms what looked like a head and shoulders top. Dow in Silver did likewise. Closed down 3.21% at 782.61 oz and below the 20 DMA at 799.23. Mercy, y'all, look at this! If this pattern completes, it will be double tops in both the DiG and DiS, June and December, and 'twill signal that silver and gold have turned up against stocks. Hold on -- we need further confirmation, like closes below the 50 DMA. MACD has already flashed sell signals for both indicators, and 12 day Rate of Change went negative in both. All right! US DOLLAR INDEX broke 80 today. Lost 20 basis points or 0.25% to close at 79.94. There is what I take to be the neckline of a head and shoulders that started forming in 2011 that now hits the US dollar index about 79. It may be some other pattern, but since late 2011 a line from 78.10 in Spring 2013 through about 80 today has stopped every decline. Well, every decline except that dip down to 79.06 in October. Now the US Dollar Index, after a climb, is right back at that 80 support. Maybe if it falls through this time it will just keep on falling to 74.75, or 72.70? Little but air stands beneath it now. The Euro rose 0.17% to $1.3761, clearly on its way to $1.3825 or higher. It's the battle of the junk currencies for the title, "Sorriest Fiat Money On The Planet." Japanese yen rose 0.43% to 97.26 cents/Y100. If it breaks the last low at 96.41, who knows where it might perch? Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||

| Why Today's Gold Rally is Different From Last Week Posted: 10 Dec 2013 04:08 PM PST Gold is rallying similar to a move last week, but Grafite Capital's Mihir Dange tells TheStreet's Joe Deaux why this one may hold its gains. [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||

| Metals War Rages & Today’s Rally In Gold & Silver Posted: 10 Dec 2013 04:00 PM PST from KingWorldNews:

Now here we are over five months later, and those June lows are still holding, which is really sort of remarkable given everything that has been thrown at gold by the central planners to keep the gold price under their control. But I am a firm believer in the principle that markets eventually reflect value. They can be distorted by central planners and even trashed for a while with capital controls and other edits unfriendly to everyone's right to free choice, and to do what they want with their private property, in this case, their money. | ||||||||||||||||||||||||

| Backwardation in gold continues/GLD and SLV inventories remain constant/gold and silver rise Posted: 10 Dec 2013 03:40 PM PST by Harvey Organ, HarveyOrgan.Blogspot.ca:

Gold closed up $27.10 to $1262.40 (comex closing time ). Silver was up 62 cents at $20.26. In the access market today at 5:15 pm tonight here are the final prices: gold: $1262.00 First let us see how London set its GOFO rates this morning: negativity or backwardation is upon us for the first two months: GOFO numbers are now decreasing in the positive for all months Here are today’s readings with yesterday’s comparison: | ||||||||||||||||||||||||

| Gold Futures see First Loss Since 2000 Posted: 10 Dec 2013 03:38 PM PST Is today's bounce short covering or something setting up fundamentally for 2014? Alan Knuckman of Trading Advantage explains. [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||

| The Most Misunderstood Threat Of Economic Implosion Posted: 10 Dec 2013 03:17 PM PST Readers turning to alternative news sites often try to explain their concerns with others (friends, family, colleagues, business partners). Empirically we know that most people understand that “something is wrong” but they fail to understand the real underlying threats of our economic system. The real risk is inherently related to our monetary system, a topic that is not understood by the majority of people. There are even no classes at university researching the monetary system and monetary history. Even economists seem to have a hard time understanding and agreeing on how monetary issues and policy impact the economy and markets. An example of this is found in a compilation of TV appearances by Peter Schiff going back to 2006 and 2007 (between 29m03s and 40m). In it, one of the economic commentators starts laughing when Schiff argues that “the absence of lending standards” will lead to a “tightening of credits” which would be the cause of a collapse in the markets (scroll to 32m in the video). Small detail: this was a couple of months before the start of the worst financial collapse in history. Another example is in this Q&A between Rick Santelli and Noble prize winner Eugene Fama. The Noble laureate argues that shrinking a central bank’s balance sheet is a “neutral event.” Of course, it goes without saying that the “heavy weight experts” like Paul Krugman argue that much more monetary stimulus is needed. They think there is not enough economic progress because “not enough has been done,” which is an easy way to anticipate failure of course (but not admit it). Apart from economists and economic observers, more so the general public has a misunderstanding of the risks of the monetary system. Case in point: the Occupy Wall Street movement. Peter Schiff tried to explain the protesters that Wall Street is not the issue but rather the banking industry and the centrally planned system (source). His efforts had not much success. Readers who have an interest in precious metals or own them, even after the crash of April / June 2013, are likely to understand that there are two theories which explain monetary matters (or fail to explain). Austrian economics take the monetary system and policies into account as a potential risk, while Keynesian economics do not see a risk. Readers acquainted with these schools of thoughts can skip the following chapter and move on to the next ones. Readers who are not familiar with the consequences of monetary stimulus should first read the following chapter. The central problemNoble laureate Eugene Fama pretends that contracting the monetary base (the central bank’s balance sheet) is a “neutral event.” From an Austrian point of view, that does not make sense at all. Why? Because centrally planned expansion of debt based credit leads to economic bubbles. Excessive credit creation along with artificially suppressed interest rates lead to imbalances between investments and savings. In fact, it stimulates malinvestments. The housing bubble was the most recent manifestation of that dynamic. In a world with no limitations on the expansion of the money supply it is to be expected that a centrally planned expansion (boom) will be followed by a contraction of the money supply (bust). From that point of view, a shrinking monetary base (central bank balance sheet) will of course have a significant impact in the real world. Apart from economic theories, one could look at it in the most simplistic way: if monetary easing was invoked to have a real result (i.e. economic growth) then it implies that removing monetary easing will have the reverse effect … otherwise why was it invoked in the first place? That’s plain logic. Recent research shows that today’s Monetary System Is Responsible For The Growing Inequality and it concludes that ”it appears that several factors contribute to the growth of inequality, but at the heart is the operation of the banking system. To resolve inequality, it is mandatory to change the way money is created.” Also history provides confirmation of the central thesis that monetary expansion is risky and, potentially, a very destructive business. In Real vs False Money – Key Insights From Monetary History we published some excerpts from Claudio Grass his research note:

The central problem is of course that today’s monetary system suits the needs of the government. It allows for maximum intervention and control. It benefits its participants and allows the continuation of the “alliance” with the banking industry. The establishment that has been created is huge; its participants have a vested interested to keep this system going. Of course, Noble laureats and theorists associated with “the establishment” do not have anything at risk. They are no entrepreneurs and are not directly impacted by the destructive effects of monetary policies. They can continue their work-as-usual, also during a crash, as “the establishment” needs them. So why should they stop defending their theories? There must be a reason why Richard Cantillon’s Essay on Economic Theory (written in the 18th century) and Ludwig von Mises his Theory of Money and Credit (written in the 20th century) are never quoted by the Keynesians. It is no coincidence that those books explain in great detail how money is NOT neutral. Desperation or incompetence?Given the destructive effects of monetary policy, which have been repeated again and again in history, one should rightfully ask why the biggest monetary stimulus ever keeps on continuing. After all, as Mike Maloney (host of Hidden Secrets of Money) demonstrated in his latest educational video, the money museum at the Bundesbank in Germany exhibits the following quote :

The shape of the economy is not good, which is in sharp contrast to what the mainstream media wants us to believe. Things are probably so bad that removing monetary stimulus will result in an outright implosion. The next chart shows to which extent the monetary base M0 (blue line) needs to be expanded by the central bank in order to have the money supply M2 (red line) growing at a “normal” pace. There is something fundamentally wrong with this picture. The data are US only.

So central banks are supposed to know the risk associated with the expansion and contraction of the money supply. Are they incompetent? Most likely not. They have a vested interest in “their system” and must defend their positions. As Nomi Prins points out, the core objective of the US central bank is to help the banking industry: Nearly 10% of the residential mortgage loans of the Big Six banks are non-performing. This is not very different from the 11% highs in 2009 (compared to smaller banks whose ratios are 3.5% vs. 6% in 2009). In other words, the Big Six banks still hold near record high levels of bad mortgages, and in higher concentrations than smaller banks. That's why the Fed isn't tapering, not because it's waiting for a magic unemployment rate. Besides, there is hardly empirical evidence of a correlation between monetary easing and employment creation. Try searching for research on that matter. Jim Rickards takes this one step further. In his speech during the Casey Summit in October of this year, he explained how the Fed’s models are structurally wrong. He also pointed out that there is no correlation between monetary easing and employment. Last but not least, in his view the central banks are playing with a nuclear reactor while they think they are fully in control of the economy. He believes we are close to a tipping point in a “nuclear process” where there is no way back. Can we conclude then that central bankers are desperate? We believe so. Admittedly, given the absence of results, desperation is resulting in incompetence. Prospects: more of the sameGiven the above, the outlook is not really pretty. Starting with Japan, where Abenomics have not resulted in the intended effects. Besides, there are “unintended consequences” associated with the weakened Yen. More in this analysis from Asia Confidential. One could expect more monetary easing going forward. Competitive devaluation of currencies was initiated by the US Fed with its QE program. Japan fired back about a year ago with their version of QE, resulting in approximately a 15% devaluation of the Yen. As announced earlier this week by news agency Finmarket, the Russian central bank is preparing "a Russian variant of careful quantitative easing." Finmarket reports that Russian financial markets expect a devaluation of the ruble of up to 50 percent. Although the Russian central bank has spent several hundred billion dollars to strengthen its currency, the coming devaluation of the ruble is expected to lead to a boost in exports, particularly of raw materials. Obviously the devaluation will result in higher import prices, as we explained in Japan Experiencing The Ugly Effects Of Its Own Policy. With a global competition in currency debasements, with limitless monetary stimulus, with decreasing effects of monetary expansion, with a conscious infringement of the monetary rules, it should be clear that there is hardly a way back for our leaders. Given this outlook, we believe it is a matter of “when,” not “if” the next collapse occurs. Gold as a central bank insuranceJohn Mauldin said in his last interview with Steve Forbes that he sees gold as central bank insurance. “I buy fire insurance. I have health insurance. I hope I never use them. I’m particularly, aggressively working at never having to use my life insurance, although I do have it. And I hope I never use my gold insurance. But I do have some. I buy some every month. I believe that gold will prove to have been more of a store of value than putting a hundred dollars a month into a savings account that is going to be stuck in a low-interest-rate regime for a long time.” He also explained that gold will move up when real interest rates are severely suppressed. He sees a real potential for severe repression of interest rates, judging from the latest research papers written by members of the Federal Reserve economics team. “I don’t think things change under Janet Yellen. I think we get financial repression. And we’re going to see savers and retirees screwed. We talk about the problems that pension funds face. Every 60-40 portfolio – 60% stocks, 40% bonds – is required to get something close to 9% or 10%, maybe even 11%, out of their equity portfolios from today’s valuations, because the return on their bond fixed-income portfolio, that 40%, is so low. And yet they’re so dependent on those return projections and on growth reverting to trend, because the bulk of the money that’s supposed to be in those pension funds in 30 years is not the money that’s being put in now by employees; it’s the compound growth of that money. And if the growth on that money is not there, the pension that the person thought he was paying into is not going to be there.” | ||||||||||||||||||||||||

| JPMorgan Chase, the Foreign Corrupt Practices Act, and the corruption of America Posted: 10 Dec 2013 02:30 PM PST By Robert Reich The Justice Department has just obtained documents showing that JPMorgan Chase, Wall Street's biggest bank, has been hiring the children of China's ruling elite in order to secure "existing and potential business opportunities" from Chinese government-run companies. "You all know I have always been a big believer of the Sons and Daughters program," says one JP Morgan executive in an email, because "it almost has a linear relationship" to winning assignments to advise Chinese companies. The documents even include spreadsheets that list the bank's "track record" for converting hires into business deals. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata It's a serious offense. But let's get real. How different is bribing China's "princelings," as they're called there, from Wall Street's ongoing program of hiring departing U.S. Treasury officials, presumably in order to grease the wheels of official Washington? Timothy Geithner, Obama's first treasury secretary, is now president of the private-equity firm Warburg Pincus. Obama's budget director Peter Orszag is now a top executive at Citigroup. Or, for that matter, how different is what JP Morgan did in China from Wall Street's habit of hiring the children of powerful American politicians? (I don't mean to suggest that Chelsea Clinton got her hedge-fund job at Avenue Capital LLC, where she worked from 2006 to 2009, on the basis of anything other than her financial talents.) And how much worse is JP Morgan's putative offense in China than the torrent of money JP Morgan and every other major Wall Street bank is pouring into the campaign coffers of American politicians -- making the Street one of the major backers of Democrats as well as Republicans? The Foreign Corrupt Practices Act, under which JP Morgan could be indicted for the favors it has bestowed in China, is quite strict. It prohibits American companies from paying money or offering anything of value to foreign officials for the purpose of "securing any improper advantage." Hiring one of their children can certainly qualify as a gift, even without any direct benefit to the official. JP Morgan couldn't even defend itself by arguing it didn't make any particular deal or get any specific advantage as a result of the hires. Under the act, the gift doesn't have to be linked to any particular benefit to the American firm as long as it's intended to generate an advantage its competitors don't enjoy. Compared to this, corruption of American officials is a breeze. Consider, for example, Countrywide Financial's generous "Friends of Angelo" lending program, named after its chief executive, Angelo R. Mozilo, that gave discounted mortgages to influential members of Congress and their staffs before the housing bubble burst. No criminal or civil charges have ever been filed related to these loans. Even before the Supreme Court's shameful 2010 "Citizens United" decision -- equating corporations with human beings under the First Amendment and thereby shielding much corporate political spending -- Republican appointees to the court had done everything they could to blunt anti-bribery laws in the United States. In 1999, in United States vs. Sun-Diamond Growers, Justice Scalia, writing for the court, interpreted an anti-bribery law so loosely as to allow corporations to give gifts to public officials unless the gifts are linked to specific policies. We don't even require that American corporations disclose to their own shareholders the largesse they bestow on our politicians. Last year around this time, when the Securities and Exchange Commission released its 2013 to-do list, it signaled it might formally propose a rule to require corporations to disclose their political spending. The idea had attracted more than 600,000 mostly favorable comments from the public, a record response for the agency. But the idea mysteriously slipped off the 2014 agenda released last week, without explanation. Could it have anything to do with the fact that, soon after becoming SEC chair last April, Mary Jo White was pressed by Republican lawmakers to abandon the idea, which was fiercely opposed by business groups.? The Foreign Corrupt Practices Act is important, and JP Morgan should be nailed for bribing Chinese officials. But, if you'll pardon me for asking, why isn't there a Domestic Corrupt Practices Act? Never before has so much U.S. corporate and Wall-Street money poured into our nation's capital, as well as into our state capitals. Never before have so many Washington officials taken jobs in corporations, lobbying firms, trade associations, and on Wall Street immediately after leaving office. Our democracy is drowning in big money. Corruption is corruption, and bribery is bribery, in whatever country or language they're transacted in. ----- Robert Reich is professor of public policy at the University of California at Berkeley and was secretary of labor in the Clinton administration. Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... | ||||||||||||||||||||||||

| QE To Infinity Out. Gold Demand To Infinity In Posted: 10 Dec 2013 02:20 PM PST Bloomberg News reports that gold held in ETPs (exchange traded products) declined again, over the past week. To view a chart of these consistent outflows ... Read More... | ||||||||||||||||||||||||

| Alasdair Macleod: The relevance of Say's Law Posted: 10 Dec 2013 02:19 PM PST 5:18p ET Tuesday, December 10, 2013 Dear Friend of GATA and Gold: Pitting monetary philosopher Jean-Baptiste Say against the economist John Maynard Keynes, GoldMoney research director Alasdair Macleod predicts that Say will be vindicated, insofar as economics and economies will continue, if inconveniently, when those in charge of money manage to destroy it. Macleod's commentary is headlined "The Relevance of Say's Law" and it's posted at GoldMoney here: http://www.goldmoney.com/research/research-archive/the-relevance-of-say-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||

| Jan Skoyles interviews Hinde's Ben Davies on 'Get Real' pilot Posted: 10 Dec 2013 02:03 PM PST 5p ET Tuesday, December 10, 2013 Dear Friend of GATA and Gold: In what appears to be the pilot episode of a television program about the metals markets, "Get Real," Jan Skoyles of The Real Asset Co. in London interviews Hinde Capital CEO Ben Davies about the prospects for gold, silver, and bitcoin, the flow of gold from West to East, and the likely timing for physical demand for gold to overpower the fractional-reserve gold banking system. The program is 27 minutes long and is posted at YouTube here: http://www.youtube.com/watch?v=YlXOUW6fB4w&feature=youtu.be CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... | ||||||||||||||||||||||||

| Faber - The Asset Class Hated Even More Than Gold & Silver Posted: 10 Dec 2013 01:12 PM PST  As 2013 comes to a close, Marc Faber spoke with King World News about the asset class that is hated even more than gold and silver. Faber also gave his thoughts on where we are headed with regards to inflation/deflation. This is part III of a series of written interviews which have now been released on KWN. As 2013 comes to a close, Marc Faber spoke with King World News about the asset class that is hated even more than gold and silver. Faber also gave his thoughts on where we are headed with regards to inflation/deflation. This is part III of a series of written interviews which have now been released on KWN.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||

| Posted: 10 Dec 2013 01:12 PM PST The November 2013 Investment Outlook published by PIMCO caught my attention with an essay by Bill Gross entitled "Scrooge McDucks". Gross wrote remorsefully, "Having benefited enormously via the leveraging of capital since the beginning of my career and having shared a decreasing percentage of my income thanks to Presidents Reagan and Bush 43 via lower government taxes, I now find my intellectual leanings shifting to the plight of labor." I suppose that, by "the plight of labor", Gross is referring both to the decline of median household income in real terms over the last ten years or so, and to the collapse of labour's share of US national income since 2000. Personally, I am also concerned about the slump in the labour force participation rate. Addressing his wealthy colleagues directly, Gross writes:

Having written about rising wealth and income inequality for the last ten years or so, I have a lot of sympathy with Bill Gross's views. However, I am far from certain that the inequality was caused by lower tax rates on carried interest and capital gains. As an example, it is not only the "1%" who have increased their share of national income considerably over the last 30 years, but also the top 10% of income recipients. Moreover even if capital gains are excluded, the top decile's income recipients have increased their share of national income meaningfully. I simply cannot believe that the top decile of income earners would all have benefited from low taxes on carried interest. (This may be different for the "0.01%".) Therefore, other — possibly more important — factors than favourable taxes on carried interest and on capital gains may have led to the growing income inequality, such as education (rising cost), outsourcing of production to low labour-cost countries, low interest rates (substitution of labour with machines), rising debts, increasing entitlements, immigration of low-skilled workers, etc. I shall return to Gross's essay further below. However, I should first like to address some of the problems associated with taxation. First, we need to accept that there is no such a thing as a "perfect" system of taxation. As Andrew Jackson observed, "The wisdom of man never yet contrived a system of taxation that would operate with perfect equality." "In such experience as I have had with taxation… there is only one tax that is popular, and that is the tax that is on the other fellow". The Swedish Nobel Laureate, economist, sociologist, and politician Karl Gunmar Myrdal opined: "Taxation is the most flexible and effective but also dangerous instrument of social reform. One has to know precisely what one is doing lest the results diverge greatly from one's intentions." (He won the Nobel Prize in Economic Science with Friedrich Hayek in 1974 for their pioneering work on the theory of money and economic fluctuations, and for their analysis of the interdependence of economic, social, and institutional phenomena.) Everyone will agree that taxes should be fair, but what is fair is hard to determine. Your friend inherits a high income-producing property that allows him a lifestyle of leisure and pleasure, whereas you earn your living on the factory floor through hard work. Assuming your incomes are equal, is it fair that your fortunate friend's tax rate is the same as yours, or should it be higher or lower? On the surface, someone could argue that, since you work for your income, you should be taxed at a lower rate than your friend, who does not work for his income. Someone else might argue that, on the contrary, your friend should be taxed at a lower rate since his parents have already paid taxes on the income that allowed them to purchase the property. (This question also relates to taxes on dividends.) The English philosopher and political economist John Stuart Mill took the view that "unless … savings are exempted from income tax, the contributors are twice taxed on what they save, and only once on what they spend." Canadian politician and Cabinet Minister Sir Thomas White had it right when he said, "In such experience as I have had with taxation — and it has been considerable — there is only one tax that is popular, and that is the tax that is on the other fellow". Personally, I have spent a considerable amount of time on taxation issues. My doctoral thesis was on the financial reforms of Sir Robert Peel, which when implemented in 1842 included the introduction of an income tax as a permanent tax on high income earners. (The top rate was 7%.) At the same time, numerous indirect taxes and import duties were eliminated, which greatly simplified the tax system. In my humble opinion, the probably fairest tax is a flat tax on incomes (no deductibles such as the interest payments on debts, children allowances, or investment tax credits, and no subsidies for any interest groups) which is levied on all income earners and corporations, churches, missions, charities, pension funds, government officials (and governmental organisations), etc. at a maximum rate of between 10% and 15% per annum (no exceptions). Naturally, the approximately 49% of taxpayers who pay no federal income tax, as well as the entire industry of lawyers, accountants, and auditors who make a living from a complex tax regime, would object to a flat tax. In terms of indirect taxes, the fairest tax is a value added tax levied on all transactions at a maximum rate of 5%. Regarding property and capital gain taxes, the fairest taxes are most likely no taxes. I am aware that some readers will consider such a system of taxation to be radical. But I can assure them that, while not perfect, this system would be far fairer and more equitable than the tax system we currently have in most Western democracies, which is so complex and incomprehensible for ordinary people that it requires an army of costly and time-consuming lawyers, accountants, and auditors to calculate the taxes that are owed. This simplified tax system would also eliminate more than 90% of the IRS's more than 100,000 employees who have the power to arbitrarily harass people and small business owners ad infinitum, since most of these agents themselves do not have a full understanding of all the tax laws and regulations. (According to an IRS report entitled "Workforce of Tomorrow Task Force: Final Report August, 2009", the IRS has 88,203 full-time employees, but this number would have increased significantly since then.) The complexity of the tax system led the recently deceased British economist Barry Bracewell- Milnes, who was a champion of lower taxation (he argued for the abolition of the inheritance tax), to exclaim: "An economy breathes through its tax loopholes." It is easy to see that the more tax laws there are, the more corruption there will be. Complex tax laws also hurt small business owners far more than large corporations. The 19th-century British philosopher, individualist, and Member of Parliament Auberon Herbert (he advocated voluntarily funded government and was at times considered to be a libertarian anarchist) observed:

I don't wish to write a thesis on taxation, but there are a few more issues I need to bring up in order to highlight the complexity of the subject. More to come tomorrow… Regards, Marc Faber Ed. Note: Any conversation on the U.S. tax system is, naturally, a lengthy one. And so Marc Faber is wise enough to give the subject its due credit, returning in the pages of tomorrow’s Daily Reckoning email edition with more on the topic. That issue, which hits inboxes around 4 PM tomorrow, will be full of Mr. Faber’s insightful musings, as well as a special note from the managing editor and at 3 specific ways to discover real, actionable investment advice, completely free of charge. It’s just a small perk of subscribing to one of the industry’s most influential newsletters. So don’t wait. Sign up for free, right here, and start getting the full story. | ||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Follow Through Is Everything Posted: 10 Dec 2013 01:10 PM PST | ||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Follow Through Is Everything Posted: 10 Dec 2013 01:10 PM PST | ||||||||||||||||||||||||

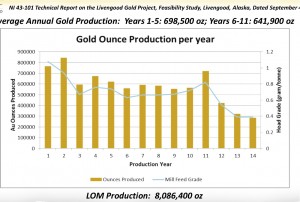

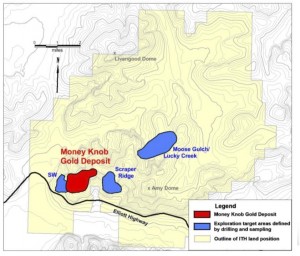

| Look For Leverage To Rising Gold Prices With No Expiration Posted: 10 Dec 2013 12:58 PM PST Gold and silver are moving higher as the record short position begins to unwind. Look for a powerful move and double bottom in gold and silver as demand is soaring in Asia and huge short positions are being covered in the West. When the majors are buying projects at a high premium like in early 2011, when Newmont bought our recommendation Fronteer Gold for top dollar that will once again be a time to be careful and raise cash. For right now, investors are ignoring undervalued situations such as International Tower Hill Mines (THM) which owns one of the best deposits in North America with over 20 million ounces of gold. But they may not ignore THM for much longer especially if gold turns higher. I have learned that the stories hated during a declining gold price become the largest gainers when the price moves higher. The long term trend in gold remains higher and this correction may provide opportunities for precious metals investors to gain exposure to highly leveraged vehicles to the gold price. International Tower Hill Mines is like an option on the gold price with no decaying time value or expiration. THM’s Livengood Asset is one of the largest undeveloped deposits in the world still 100% controlled by a junior. It could produce massive amounts of gold annually. Hundreds of millions of dollars have been spent on this asset with 792 drill holes yet investors can purchase the company for around a $40 million market cap way below its book value. One must remember that current resources are only on 1 sq mile of a 75 mile land package. I believe there may be additional high grade zones like Money Knob on the property. The project is located in a gold district which has mined precious metals since 1914 and the State of Alaska especially this region is incredibly supportive of this asset. Livengood coming into production over the next decade could provide thousands of jobs for the region and could really boost the economy in nearby Fairbanks. I have been blessed to be able to visit the property. It is located just off an all season highway. I have known some of the key technical people for several years and they are high caliber with strong moral ethics. They have the experience in permitting and starting up some of the top mines in Alaska such as Pogo and Ft. Knox which are cash cows for Teck Cominco and Kinross. THM released their feasibility study in one of the worst gold mining markets in history. The study showed that they will not be economic until $1500, however if gold should go higher the leverage to the price of gold is extremely impressive. The mine is massive and could produce over 500,000 ounces of gold per year if gold moves above $1500. With an advanced NI 43-101 feasibility study the management who previously built major Alaskan Mines such as Pogo and Ft. Knox, Tower Hill could attract strategic partners to advance this project. The company is also actively exploring other mine configurations to bring the Capex and cash costs down. It is important to remember that International Tower Hill Mines sports a market cap of around $40 million and has spent over $250 million advancing this project through feasibility. That sounds like a bargain to me. Listen to a recent interview with the CEO of International Tower Hill Mines Corp Don Ewigleben below. Disclosure:Author is long THM and the company is a sponsor on website. ___________________________________________________________________________ Sign up for my free newsletter by clicking here… Sign up for my premium service to see new interviews and reports by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here… Please forward this article to a friend. To send feedback or to contact me click here… Listen to other interviews with movers and shakers in the mining industry below or by clicking here… Listen to internet radio with goldstocktrades on BlogTalkRadio

| ||||||||||||||||||||||||

| Posted: 10 Dec 2013 11:52 AM PST Is it time for gold investors to admit defeat? No such luck... AFTER a 12-year run, it looks like gold's wave has truly crested, and many bears are arguing that it's all downhill from here, writes Jeff Clark at Casey Research. A quick glance at a long-term gold price chart can certainly seem to confirm this impression.  Gold's price has fallen by more than a third since its 2011 high. The downturn exceeds the 2008 waterfall selloff. Many technical analysts are saying that the "damage" on the charts is too great for gold to recover. The rout is so bad, even hardened goldbugs have grown quiet lately. Is it time for gold investors to admit defeat? Well, if it were true that "damage" on a chart such as we've seen signals the end of a bull market, perhaps it might be. But is it so? Or is this just a correction? One of the greatest bull markets in modern times was the Nasdaq in the 1990s. The Nasdaq composite rose a whopping 1,150% over the span of a decade. But did you know it had a major correction in the middle of that run? The same is true of oil's big surge in the mid-2000s. Consider this chart of the big corrections oil and the Nasdaq experienced:  After seeing prices crash in both the Nasdaq and oil, most investors assumed those bull markets were over – but they weren't. Here's the subsequent rise in each after prices bottomed:  The Nasdaq and oil did recover from their large corrections – despite all the technical "damage" many pointed to as proof that those bull markets were over. Investors who sold their positions during the downdrafts missed out on some fantastic profits. Given that all the reasons gold rose from 2001 to 2011 are still in force, I am convinced gold's current correction is the setup for a second big surge – and, ultimately, a true gold mania of historic proportions. Just because gold doesn't seem to be reacting to Fed money-printing at the moment doesn't mean it won't. Sooner or later, reality trumps fantasy. Reason says that you can't quintuple your balance sheet in five years and expect no repercussions. The Fed keeps hinting it will taper its money printing, but it still has not. We've had QE1, QE2, Operation Twist, and now QE3… none of them has worked, and the new Fed chair wants to print even more money. It's pure fantasy to believe there will be no consequences to these actions – and the reality is that whatever else happens, gold will react positively. Should gold investors admit defeat? I say it's reckless central bankers who should declare defeat. A gold recovery is inevitable. Prepare accordingly. Try BIG GOLD risk-free for 3 months. | ||||||||||||||||||||||||

| Posted: 10 Dec 2013 11:52 AM PST Is it time for gold investors to admit defeat? No such luck... AFTER a 12-year run, it looks like gold's wave has truly crested, and many bears are arguing that it's all downhill from here, writes Jeff Clark at Casey Research. A quick glance at a long-term gold price chart can certainly seem to confirm this impression.  Gold's price has fallen by more than a third since its 2011 high. The downturn exceeds the 2008 waterfall selloff. Many technical analysts are saying that the "damage" on the charts is too great for gold to recover. The rout is so bad, even hardened goldbugs have grown quiet lately. Is it time for gold investors to admit defeat? Well, if it were true that "damage" on a chart such as we've seen signals the end of a bull market, perhaps it might be. But is it so? Or is this just a correction? One of the greatest bull markets in modern times was the Nasdaq in the 1990s. The Nasdaq composite rose a whopping 1,150% over the span of a decade. But did you know it had a major correction in the middle of that run? The same is true of oil's big surge in the mid-2000s. Consider this chart of the big corrections oil and the Nasdaq experienced:  After seeing prices crash in both the Nasdaq and oil, most investors assumed those bull markets were over – but they weren't. Here's the subsequent rise in each after prices bottomed:  The Nasdaq and oil did recover from their large corrections – despite all the technical "damage" many pointed to as proof that those bull markets were over. Investors who sold their positions during the downdrafts missed out on some fantastic profits. Given that all the reasons gold rose from 2001 to 2011 are still in force, I am convinced gold's current correction is the setup for a second big surge – and, ultimately, a true gold mania of historic proportions. Just because gold doesn't seem to be reacting to Fed money-printing at the moment doesn't mean it won't. Sooner or later, reality trumps fantasy. Reason says that you can't quintuple your balance sheet in five years and expect no repercussions. The Fed keeps hinting it will taper its money printing, but it still has not. We've had QE1, QE2, Operation Twist, and now QE3… none of them has worked, and the new Fed chair wants to print even more money. It's pure fantasy to believe there will be no consequences to these actions – and the reality is that whatever else happens, gold will react positively. Should gold investors admit defeat? I say it's reckless central bankers who should declare defeat. A gold recovery is inevitable. Prepare accordingly. Try BIG GOLD risk-free for 3 months. | ||||||||||||||||||||||||

| Jan Skoyles Interviews Ben Davies On Gold and Silver Posted: 10 Dec 2013 11:39 AM PST | ||||||||||||||||||||||||

| Jan Skoyles Interviews Ben Davies On Gold and Silver Posted: 10 Dec 2013 11:39 AM PST | ||||||||||||||||||||||||

| NAV Premiums Of Precious Metal Trusts and Funds - Sprott Gold Has 19,200 Ounces Redeemed Posted: 10 Dec 2013 10:53 AM PST | ||||||||||||||||||||||||

| NAV Premiums Of Precious Metal Trusts and Funds - Sprott Gold Has 19,200 Ounces Redeemed Posted: 10 Dec 2013 10:53 AM PST | ||||||||||||||||||||||||

| 99 Problems… But Oil Ain’t One of Them Posted: 10 Dec 2013 10:42 AM PST America has some serious problems. Despite the fact that the United States spends $15,171 per student—more than any other country in the world—American students consistently trail their foreign counterparts, ranking 23rd in science and 31st in math. The US also spends more than twice as much on healthcare per capita than the average developed country, yet underperforms most of the developed world in infant mortality and life expectancy. The US rate of premature births, for example, resembles that of sub-Saharan Africa, rather than a First World country. And if you think Obamacare is going to change that… I have a bridge to sell you. K Street has a bigger influence on American politics now than Main Street, and economic key players like the TBTF banks, the insurance industry, etc., have nearly carte blanche to act in whichever way they see fit, with no negative consequences. The US government is spending more money to spy on Americans and foreigners than ever before. Since August 2011, the NSA has recorded 1.8 billion phone calls per day (!)—with the goal of creating a metadata repository capable of taking in 20 billion "record events" daily. More than one in seven Americans are on the Supplemental Nutrition Assistance Program (SNAP)—better known as "food stamps." The list goes on and on. But there is one problem that America doesn't have—getting oil out of the ground. After decades of declining domestic production, US producers finally figured out how to extract oil from difficult locations, whether that's the shale formations or deposits under thousands of feet of water… and they've kept going ever since. Today, the US is one of the few countries in the world that have seen double-digit growth in oil production over the past five years. This presents some great investment opportunities for the discerning investor. The oil industry's new treasure trove, the legendary Bakken formation, has turned formerly sleepy North Dakota into one of the hottest places in the United States. According to the Minneapolis Fed, "the Bakken oil boom is five times larger than the oil boom in the 1980s." Unemployment in the state with 2.7% is the lowest in the nation; in Dickinson, ND, even the local McDonald's offers a $300 signing bonus to new hires, on top of an hourly wage of $15. Here are some more fun facts, courtesy of the Fiscal Times: