saveyourassetsfirst3 |

- Swiss govt. urges voters to reject ban on SNB gold sales

- Can't-miss headlines - Copper at a low, palladium in a cross and more

- Euromax: low grade copper/gold but potential ‘cash cow’

- Is Silver Likely to Decline from Here?

- Who Wins?

- Kirkland Lake: A Shareholder Friendly Gold Miner With High Grades, Big Upside

- Gold coins back on sale in India

- Gold Drops $10 In 10 Seconds As Britain Announces Gold Manipulation Investigation

- China & Japan Buying Treasuries Again?

- China's Big GDP Gold Secret

- Gold & Silver Crushed as Fed Minutes Claim Taper Imminent

- Gold mine output set to reach record, disappointing bulls

- Gold bears return before Yellen signals more easing

- The Only Chart That Matters

- The Greatest Opportunity in 30 Years by Jeff Clark

- Weak U.S. inflation sees gold at five-week low on western disdain

- Silver Fundamentals – The Historian Perspective

- Jim Rogers Expects A Buying Opportunity In Gold And Silver

- Is bitcoin better than gold?

- China Gold output up 6.8% to 307.8 tons in Jan Sep Y Y

- Precious Metals – The Wheels are Turning and You Can’t Slow Down

- Jim Rogers on Why Gold Could Go Lower

- Jim Rogers on Why Gold Could Go Lower

- Ron Paul: Federal Reserve Steals From the Poor and Gives to the Rich

- ECB to move to Negative Interest Rates

- Caption Contest Wednesday!

- $1 million gold stash found in airplane toilet

- Dressed to the nines with gold

- Alasdair Macleod: Fiat Money Quantity hits new record

- Silver Fundamentals – The Historian Perspective

- 28 Miles of AGEs

- Bill Bonner: Bitcoin Bull (Can Peter Schiff Be Far Behind?)

- Chinas gold imports are likely far greater than reported from Hong Kong

- Zero Hedge: Another gold slamdown looks like the work of the BIS

- 2014 Should Be A Catch-Up Year and the Bull Will Be Back In Charge

- Gold Crashes through Chart Support

- Take It To The Bank!

- Comex suspended gold trading for 20 seconds after price slump

- Gold market needs new catalysts as traditional assets outperform

- BoE Survey Shows Growing Fears Of House Price Crash

- Heat, Light & Venezuela in London Gold Manipulation

- Jim Rogers Expects A Buying Opportunity In Gold And Silver

- Why did the gold price plunge $10 in 10 seconds?

- China Imported An Additional 133 Tonnes Of Gold Directly in 2013

- BoE Survey Shows Growing Fears Of House Price Crash

- Venezuela Reported Planning to Pawn Its Gold Through Goldman Sachs

- OECD calls Europe's crisis policy unworkable, fears 'virulent episodes' in emerging markets

- Three King World News Blogs

- Jim Rickards and Max Keiser: Interview

- Patrick Heller: What’s Correct Gold/Silver Ratio?

| Swiss govt. urges voters to reject ban on SNB gold sales Posted: 20 Nov 2013 02:24 PM PST The Swiss government is urging voters to reject a popular initiative to ban the Swiss National Bank from selling any of its gold reserves. |

| Can't-miss headlines - Copper at a low, palladium in a cross and more Posted: 20 Nov 2013 02:12 PM PST While copper hits a three-month low, Gold Fields manages to claw its way back into profit and analysts point to a "golden cross" for palladium. |

| Euromax: low grade copper/gold but potential ‘cash cow’ Posted: 20 Nov 2013 02:10 PM PST Junior European mine explorer/developer, Euromax, run by former European Goldfields executives has high hopes for its Ilovitza copper/gold porphyry in Macedonia. |

| Is Silver Likely to Decline from Here? Posted: 20 Nov 2013 01:03 PM PST SunshineProfits |

| Posted: 20 Nov 2013 01:00 PM PST I got to thinking about “who wins” when the global monetary and banking system goes down? Hardcore gold bugs will tell you “only those who have metal.” I think that this is wrongheaded thinking because when this ship goes down we will all lose. The words of one of the world’s biggest metals money manager to me several years back will ring true I believe, “Who wants to be the richest guy in a world where it’s not safe to walk the streets and can’t enjoy life because nothing’s open?” Don’t get me wrong, owning metal will “ease your pain” but it will not be a magic lamp you can rub to make everything better. From a macro standpoint, who wins? In this case I think it will be a different story. Here I believe that the winners will be the countries who have accumulated gold and the losers will be those that divested. I also believe that there will be (are) countries that do not know they have “divested” but will soon find out. Germany being the prime example here as they were told that it would take 7 years to repatriate a measly 300 tons from N.Y., in this case Germany already knows that they have had some “leakage.” My original thoughts on this topic came from reading a Zerohedge article this morning that said “China warns of big bank failures.” I thought to myself this is the third or fourth time that overnight rates have spiked out of fear that some banks would lock up. They have levered their real estate market and banking system as high as or even higher than ours so risk of a black swan event from China is as high as anywhere else. Ah…but, they have imported massive amounts of gold over the last 3-5 years. I would be shocked if they haven’t accumulated at least 5,000-6,000 tons. In fact, I would not even be surprised if we eventually found out that they have 8,000 or even 10,000 tons. Going back to the title “Who Wins,” China does. If (when) it turns out that the current monetary system collapses in a heap, the clear sovereign winner WILL be whoever has the most gold. Think about it this way, if “everything paper is worth nothing” then the winner will be whoever has the most of whatever is worth “something.” This “something” when it comes to “money” is and has been for 5,000 years, gold. For years the West has quietly and secretly divested gold in an effort to prop up their currencies and retain “power.” Some (many) countries were a part of this effort without even knowing about it. Germany comes to mind, Portugal, Finland and others also as they have leased out a major portion yet still believe they “own” gold. Much of this gold is simply gone and will never come back. Britain, Canada and Australia also make this list as they outright have already sold much or all of their gold. Even though China has levered itself beyond “survival capacity” they have done something very smart. I equate what they have done with gold as something similar to a homeowner taking on huge amounts of debt yet have physical metal equal to or more what their debt totals. In this manner a homeowner can “sleep at night.” Yes I know the leverage in China is far and above the value of their gold holdings…currently…and at today’s prices. This leads me to just a little bit more to explain. I have read several opinions that suggest the Chinese themselves may be a part of the current metals price suppression scheme, this does make some sense and I believe it is quite possible. China has every motive I can think of to keep gold prices “low.” They know that there is only so much gold to be had, why would they “pull the plug” on their reserve holdings while they could still accumulate more gold by using them? This topic I believe was part and parcel of the mid and late 2011 high level meetings between the U.S. and China. It would not surprise me one bit if a deal was struck where the Chinese would not liquidate Treasury holdings in size as long as gold was still being delivered. This could also explain the meltdown of inventories at the COMEX, GLD and 1,300 tons “disappearing” from London. In any case, as I mentioned above, the “current” gold holdings of China. China doesn’t care “what it's worth” NOW. They only care how much “weight” they have because in my opinion the old story of “he who has the gold makes the rules” will apply. THEY will re price gold to much much higher levels once there is no more in any sizeable quantity to be had. They won’t care what their dollar holdings will be worth, they will only care about what their gold holdings will be “worth”…AND they will essentially “dictate” this. Is this speculation on my part? Yes of course it is. Does it make sense? I think so, I think it is just basic common sense which the Chinese have and we lost as a nation or even a culture many years ago. No matter what, it is clear that the Chinese now have at a minimum the second largest gold holding in the world if you believe that the U.S. still has 8,300 tons. If we do not have this stash (which I entirely believe that we do not) then the Chinese have amassed the largest holding. Which… if history is any guide makes them the “winners.” It will also allow them to “make the rules.”Similar Posts: |

| Kirkland Lake: A Shareholder Friendly Gold Miner With High Grades, Big Upside Posted: 20 Nov 2013 12:41 PM PST I've been looking for investments in the gold sector that have the most potential to rebound and do so strongly once the price of gold finally does rise back to the $1,500 level (which I believe it will do so in 2014 on strong physical demand). One junior gold miner that has been grabbing my attention of late is a company called Kirkland Lake Gold (OTC:KGILF), which I feel not only has the potential to double in 2014, but also holds long-term multi-bagger potential. Kirkland Lake Gold has a lot of things going in its favor - from its location of operations in mining-friendly Canada, to its super-high grades, tight share structure and recent arrangement with Franco Nevada. Here, I will try to make the case that Kirkland Lake is among one of the best junior gold mining stocks on the market. Why Kirkland Lake? Kirkland Lake is an operating |

| Gold coins back on sale in India Posted: 20 Nov 2013 12:30 PM PST Smarting at the huge loss in sales, retailers across India are offering smaller denomination gold coins. |

| Gold Drops $10 In 10 Seconds As Britain Announces Gold Manipulation Investigation Posted: 20 Nov 2013 12:20 PM PST With investigations by the CFTC into the silver market fading in the US, regulators in Britain have decided to review whether global benchmarks tied to gold trading were manipulated. This investigations is a part of a larger investigation of potential manipulation of the $5 trillion a day currency market, Libor. The morning the investigation was announced traders in London saw a considerable rapid-fire spell of selling in the gold market. The price dropped $10 immediately. It fell throughout the rest of the day, finding some padding at the $1250 level. IG Markets commented that the drop in price came suddenly following a 2,000-contracts sell order. This is a prime example of why regulators should be curious about the gold market. It trades like no other market. It is counter-intuitive. Gold does not comply to the logic of traders.

Is this investigation likely to go much further than the US investigations? I don’t believe so. |

| China & Japan Buying Treasuries Again? Posted: 20 Nov 2013 12:15 PM PST

Both China and Japan added a substantial amount of US Treasuries in September, according to the latest TIC-data released by the Federal Reserve on Monday. The total foreign holdings of US debt increased as well in September, ending a five-month selling spree of US debt. Compared to August, foreign countries added a net amount of [...] The post China & Japan Buying Treasuries Again? appeared first on Silver Doctors. |

| Posted: 20 Nov 2013 12:09 PM PST Watching China's GDP data, you'll see that one man's investor is another's middle-aged housekeeping auntie... The MOST IMPORTANT person buying gold in China today? asks Adrian Ash at BullionVault. Bloomberg would have you think it's a middle-aged "auntie". And they might just be right.

Yes, of course the sub-editors got to this article. Yes, we should never take such "slice-of-life" reporting as anything serious. But that distinction, between the middle-aged Chinese "auntie" (as women of Ms.Cuiyan's age are apparently known) and the "investor" smacks loudly of a West-centric view. Clearly, she's dumb to buy gold jewelry in the hope of retaining her savings when investors here in the West are "deserting" the metal. Nevermind that Ms.Cuiyan, and the army of Chinese aunties, is an investor herself. Nevermind that, buying only an ounce each (as she has), that army of 120 million Chinese women in their 40s today (the prime age for China's stereotypical "goldbug" according to brokerage Nomura, although it says he's male and buys at his bank) would outweigh the gold sales from Western ETF contracts in 2013 five times over. And nevermind that the world's still-fastest growing major economy is now the world's No.1 private gold buyer too, finally overtaking India in 2013.  Of course, that army of aunties doesn't have the cash to buy 1 ounce of gold each at will. Nor will they all choose to buy gold, let alone all at once. But nor are those women alone in buying gold in greater quantities, and at greater values, as prices fell for Chinese and Western households alike this year. Unlike here in the West, precious metals are not a minority sport in China today. And as Marcus Grubb at market-development organization the World Gold Council notes in a recent interview, the 2013 slowdown in China's economic growth has NOT seen a slowdown in China's gold demand. It's been a while since we looked at China's gold demand in depth, or the share of China's household savings going to gold. But as our chart above shows, there was indeed something of a 2012 gold panic in China. It has only grown greater this year, pulling the gross spend on jewelry, coins, investment bars and gold trinkets still higher. You don't need to misread the available, well-established and rigorous data to reach a startling conclusion. Based on the World Gold Council's numbers, produced by the GFMS consultancy (now part of Thomson Reuters), private consumer spending on gold, in Yuan terms, has risen up to 18 times over in the last decade. Crunching the numbers today, we reckon 0.8% of China's entire GDP was spent by private households on physical gold in the first quarter – which includes the peak seasonal demand of lunar New Year – of both 2012 and 2013. Whether for jewelry, bars or coin, it's very hard – and very old-skool colonial – to deny the investment motive in that world-beating demand today. But one man's investor is another's housekeeping auntie. Making it all the easier to dismiss her impact, within the hardest-saving and fastest-growing big economy, on the world's flow of physical gold. |

| Gold & Silver Crushed as Fed Minutes Claim Taper Imminent Posted: 20 Nov 2013 12:04 PM PST

Gold and silver have just been absolutely hammered on the Fed minutes release in which Fed MOPE claimed a taper is likely in the coming months. Gold has plunged through $1250 to $1240, and silver has just broken support at $20 and now has a $19 handle plunging to $19.73! Sunshine Mint Silver Eagles As [...] The post Gold & Silver Crushed as Fed Minutes Claim Taper Imminent appeared first on Silver Doctors. |

| Gold mine output set to reach record, disappointing bulls Posted: 20 Nov 2013 12:04 PM PST This record production is disappointing gold bulls who are impatiently waiting for production cuts following this year's 24% plunge in prices. |

| Gold bears return before Yellen signals more easing Posted: 20 Nov 2013 11:42 AM PST Gold rallied as Janet Yellen said on November 14 she's ready to back stimulus until she sees robust economic growth. |

| Posted: 20 Nov 2013 11:00 AM PST The Winklevoss twins believe Bitcoin should be worth $400 billion, going so far as to call it "gold 2.0." Conversely, Peter Schiff deems it "Tulip mania II," referring to the rank speculation occurring under the guise of a structural change in monetary perception. After watching it rise fivefold in two weeks, then crash 45% last night in three hours, debate on this topic will continue into the foreseeable future. As for me, I two weeks ago said that no matter what Bitcoin trades at, it will never have the monetary properties that have sustained gold and silver demand through six millennia. And therefore, as the Bitcoin hype reaches a fever pitch, I can only warn you to be extremely careful. It may be a brand new technology; but like fiat currency, is "digitally printed" out of thin air; and moreover, depends heavily on whether the Chinese government accepts it. That said the fact that Bitcoin is breaking out – quite obviously, in un-manipulated fashion; speaks volumes of the emerging mindset regarding fiat currency; as ultimately, Bitcoin is a "play" on rejection of the dollar, euro, yen – and 179 other intrinsically empty mediums of exchange. The reasons for fiat skepticism are myriad; and if history even "rhymes," guaranteed to be repeated. To wit, in observing the extreme speculation overtaking financial markets, I feel awed by the pending financial catastrophe the Fed has spearheaded. Even Larry Summers advocated NIRP at a speech this weekend – i.e., Negative Interest Rate Policy; and compared to Summers, Janet Yellen is vastly more dovish, per the below headlines, hot off the presses…

After five years of maniacal money printing and monetization, the "only chart that matters" depicts a Fed desperate to kick the can the extra mile. In expanding its balance sheet fivefold since 2008, it has simply caused America's debt load to explode; while in the process, destroying investment capital, exporting inflation, creating historic wealth inequality, weakening the economy, and last but not least, fostering the most rampant speculation since 1999; not to mention, the same shoddy lending practices that led to the 2008 crisis.

Per these graphs, the real U.S. economy is in steep decline; as validated by this survey depicting how one-third of all major cities anticipate flat or weaker economic growth. In fact, just 14% of all global companies plan on hiring new employees in 2014; as the same issues crippling America are affecting the entire world. Today alone, we saw dire earnings outlooks from bellwether retailers Best Buy and Campbell's Soup; and in fact, the third quarter earnings season has been one of the worst ever, with the proportion of companies reducing earnings expectations at its highest level on record. And thus, it should be no surprise that survey after survey forecasts abysmal holiday sales; again, to levels last experienced at the height of the 2008-09 crisis. Heck, Wal-Mart is initiating a food drive for its own employees in Ohio; and if that doesn't depict just how badly the average American is faring, nothing will. Historically, the government response to hopeless economic situations has always been the same; particularly when unfettered by real money. That is, deploying epic levels of money printing, market manipulation, and propaganda. For example, most readers are aware that the BEA, or Bureau of Economic Analysis, recently "rejiggered" U.S. GDP calculations to make the economy look $500 billion larger. The methods used were shallow at best, but the BEA correctly assumed no one would pay attention to the details. And thus, it should be no surprise that today, it was announced that China plans on doing the exact same thing – as worldwide, governments are doing everything in their power to obfuscate reality. However, no one can manipulate data with the impunity of the U.S. government; and today's bombshell report of a BEA whistleblower exposes such activities front and center. To wit, I'm sure you remember the incredulous September 2012 NFP report – you know, the last one published before the Presidential election. Incorporating some of the most questionable data on record, it enabled the "unemployment rate" to miraculously fall 0.1% below the level it was at when Obama took office. At the time, Jack Welch – among others – said the Obama Administration was "cooking the books"; and now, it turns he was right. According to this article from Jon Crudele of the NY Post, BEA contractor Julius Buckmon was ordered to fabricate jobs; thus, dealing a critical blow to those that still believe economic data (and for that matter, financial markets) are not manipulated. On that note, let's go back to the "only chart that matters" – in our search for the likely conclusion to the ongoing, global economic calamity. At this point, so much money has been printed – worldwide – that frankly, it matters not if another dollar, euro, or yen is ever created again. In other words, the damage has already been done, and the "point of no return" long ago passed. That said it needs to be pointed out just how egregious official efforts have been to mask reality this year; which in my view, will be viewed as an historical inflection point in TPTB's war against real money. And by inflection point, I mean the end of their ability to influence perception by manipulating markets. To that point, below is a chart overlaying the S&P 500 with the size of the Fed's balance sheet. As you can see, since the post-Global Meltdown I money printing frenzy, the correlation has been an astounding 90%. Using the obscure r-squared statistical measure – i.e., the coefficient of determination – more than 80% of all S&P 500 movement over the past four years is directly attributed to Federal Reserve asset monetization. In other words, buying toxic assets from banks, which in turn deploy such capital to the markets?

Essentially, the Fed created the current equity bubble all by itself; although rest assured, it had plenty of aid from the President's Working Group on Financial Markets. Not only are U.S. equities up 20%-30% this year – amidst the worst financial and economic fundamentals in generations – but the Dow has only had one 2% down day all year – and that, on June 19th, just after the FOMC initially hinted at QE "tapering." Frankly, I wouldn't be surprised if that downside move wasn't orchestrated as well; you know, to "scare" the Fed from further taper talk. From the get-go, the Fed's goal has been to reduce nominal interest rates to record low levels; in it, an amazing accomplishment given surging inflation and record debt. And until recently, their plan was working, as the correlation between the Fed's Treasury holdings and the 10-year Treasury yield was nearly perfect. In other words, until the Fed started to lose control following its ill-advised "taper" comment in June, this correlation was a whopping 94%. In other words, it was even higher than the correlation between its balance sheet and the S&P 500. I could take up several pages posting charts depicting correlations between the Fed's balance sheet and various financial market parameters. However, in the interest of brevity, let me simply say, there are many. In fact, the prices of gold and silver have been particularly heavily correlated to the Fed's activity, which makes this year's suppression that much more blatant. Below, for instance, is an overlay of the U.S. debt limit versus gold; which until April's "Alternative Currencies Destruction," had a 98% correlation over the past 13 years. This by the way is not much different than the 94% correlation between gold and the Fed's balance sheet over that period.

Bringing the point home – of just how blatant recent interventions have been – I present the defining, damning chart of what "markets" have done since the Fed announced QE3 and QE4 last fall. Yes, while the Dow has rocketed more than 30% higher – whilst worldwide economic activity has faltered significantly, per the dramatic table I published last week – gold has plunged more than 25%.

In due time, such "anomalistic" behaviors will return to the mean – and then some. TPTB may have won a temporary battle against the forces of economic and market reality, but such rear-guard actions increase the odds that the overarching war will not only be lost decisively, but much quicker than anticipated. In the case of gold and silver, the physical supply and demand responses have already been dramatic; and trust me, they will only become more so as this treacherous fiat game enters its terminal phase. As far as I'm concerned, the only remaining question is how and when the end game starts; and given the enormous amount of "black swans" lurking around, nothing would surprise me at this point. Remember, when it finally commences, the odds are that your opportunity to protect financial assets with real money will have already passed. And thus, I suggest you take advantage of the opportunity to so before it's too late.Similar Posts: |

| The Greatest Opportunity in 30 Years by Jeff Clark Posted: 20 Nov 2013 10:59 AM PST The Greatest Opportunity in 30 Years |

| Weak U.S. inflation sees gold at five-week low on western disdain Posted: 20 Nov 2013 10:51 AM PST Wholesale gold fell to new five-week lows Wednesday lunchtime in London, dropping below $1,257 for a 2.5% loss so far this week after new data showed U.S. consumer prices falling last month from September. |

| Silver Fundamentals – The Historian Perspective Posted: 20 Nov 2013 10:48 AM PST Ryan Jordan, Ph.D. is a professional historian, author and college professor. He is the author of "Silver – The Peoples Metal" which I highly recommend. Mr Ryan Jordan sees silver fundamentals from the perspective of a historian. Besides, he looks at it as an astute observer of present conditions. In his analysis, he takes the following area's into account: drivers of the silver market, supply and demand forces, silver mining, inflation, investment sentiment, central bank monetary policies (in particular, bond monetization policies), politics. Before looking into the details of his work, we summarize the conclusions of his analysis.

His recent work offers more detailed thoughts about silver. Below are several quotes and thoughts from his research. 1) Demand for silver is strongFrom his article: Silver Demand As Guide for Silver's Next Price Move "The US Mint confirmed a record year for sales of silver coins– and we still have six weeks in the year to go. Yes, the roughly 40 million ounces of silver only accounts for maybe 5% of overall demand, but it also represents a huge increase from a decade ago when it comes to investor interest in physical metal. In fact, globally, silver investment demand is up essentially from ZERO just 10 short years ago (take some time to allow that to sink in when thinking about the change in investor sentiment toward precious metals in recent years.) And demand for silver isn't just an American phenomenon. Last month, somewhat surprising news came out of India of a roughly 130 million ounces of silver imported into that country in just the first six months of the year. This was in response to the shutdown of gold imports into that country." 2) Inflation will be increasingly importantAs long as the world monetary systems are run by central banks, particularly the Federal Reserve, we can expect inflation in the money supply, debt, and consumer prices. The weakness in gold and silver since 2011 is, in our opinion, a temporary correction in the four decade uptrend for debt, spending, and gold and silver prices. "Gold and Silver: The Big Picture" "Another long term, fundamental factor in the rise of gold and silver comes from the belief of central planners that inflation is nonexistent currently and actually needs to increase. This is the view held by many among western central bankers, and is part of the reason why FED bond purchases will not decline much from the nearly 1 trillion a year mark, as made clear this week by the US central bank. FOMC statements released Wednesday continue to affirm that the deflationary threats from the 2008 crisis remain. The ultra-loose stance of the world's largest central bank should be of concern to anyone who wonders if inflation might one day get out of hand. And in India, known as one of the world's leading gold markets, inflation is already making its presence felt. The Indian central bank continues to raise interest rates while attempting to curtail demand for gold among Indian citizens. Many observers note the similarity to policies once adopted by the US government in the late 1960s and 1970s, and how those policies failed to dampen demand for gold as both inflation and interest rates rose strongly. My question for any gold or silver bear is this: if gold and silver went up nearly 7 times over the last 10 years with no meaningful inflation in western nations, how much more will the metals go up when inflation is officially recognized as a problem by those in charge?" 3) Precious metals have been largely ignored for over 30 yearsYes, they are occasionally mentioned in the mainstream media and on financial television, but the media's primary focus is on stocks and bonds – paper promises and paper debt – not on something real like a gold bar or a stack of silver coins. Dr. Jordan thinks that gold and silver will become an increasingly important part of more investment plans and that this transition will accelerate. "Precious Metals: The Emerging Asset Class" "Over the past year, the cult of equities has made a return, as indices roar to all-time highs, and as many look to cash in on new IPOs like they did in the last tech boom 15 years ago." "But I'd like to make some historical comparisons between the two periods, to explain how even with stocks catching all the attention, this hardly means that gold and silver will continue to be left out in the cold. Here are three main reasons why I do not believe gold, silver, PGMs, or mining shares will behave as they did in the 1980s and 90s: 1) Just last month, President Obama actually made reference to the reserve status of the U.S. dollar as being in jeopardy based on current dysfunctional behavior in Washington, D.C. I don't ever recall Presidents Reagan through Clinton saying something similar– and for good reason. To take the case of President Reagan's first term in office, the US Dollar rallied something like 50% at one point. While I don't expect the dollar to crash anytime soon, too many players globally are looking to diversify away from the greenback for the dollar to re-enter a secular bull market. A big question mark remains over the US dollar's reserve status and this represents one of the most powerful reasons to continue to own precious metals– or even to acquire more. 2) The challenges facing mining companies these past couple of years signals a downshift in global gold and silver production. This decline won't happen immediately, since it takes a while to shudder mine projects – but ore grades can only decline so much before it becomes uneconomical to attempt to increase overall mine output. This reality stands in marked contrast to the 1980s and 1990s, where mine output for both metals made significant increases during those decades. Supply constraints – especially if they are coupled with new industrial demand for the white precious metals – will eventually lead to higher prices. 3) The growth in the global middle class outside of the West is a trend that began 20 years ago, but the trend has accelerated in recent years. Many commentators believe that the shift in wealth from west to east will mean that upwards of 50% of new entrants to the global middle class in future years will come from areas outside the U.S. and Western Europe. As has been seen all year, buyers in Asia and the Middle East possess an attachment to physical gold- ranging from the person buying jewelry to the central banker buying bullion bars– that is hard to break. Oftentimes these attachments speak to the cultural memory of volatile local currencies or political malfeasance in these nations. Overall there remain some big differences between today and 20 or 30 years ago when it comes to precious metals. While faith in central planners and their ability to levitate equity markets is strong among some, there are others like myself who do feel that 2008 mattered–and not in a good way. Zero percent interest rates, a stagnant economy for upwards of 80% of people in the U.S. and Western Europe, continued discussion of unsustainable debt levels, and the existence of a black hole of derivatives and other "off balance sheet" financial sleights of hand are just a few issues facing investors currently. It may be hard to believe it now, but I don't think the precious metals will remain under-owned forever." 4) The conventional investment perspective is not the only valid one"Don't Drink Too Deeply From the Well of Conventional Thought" "The inability of people to see the world for what it is was quite apparent with the nonsensical discussion of Fed tapering over the last several months. Many in positions of power sought to convince the unwashed that somehow these extreme monetary measures can be undone, or taken back. And many still believe them. As part of this naivety we then get people believing that entire asset classes, like gold, silver and mining shares are only for crazy people- that genuine tangible asset investing need not play any role in a given portfolio. My only advice for people is to please be very careful about drinking too deeply from the well of conventional thought. It is not that the world is going to end, but by the same token the days of 4 or 5% economic growth coupled with a strong and growing middle class are gone for a long time. This new reality requires a new attitude towards investing. Don't let the recent weakness in the precious metals sector mislead you." |

| Jim Rogers Expects A Buying Opportunity In Gold And Silver Posted: 20 Nov 2013 10:47 AM PST This is an interview with Jim Rogers, conducted by Birch Gold Group. The topics that are covered range from monetary policy, the stock market frenzy, currency wars and precious metals. Jim Rogers his observations and predictions about how the currency war will unfold:

Jim Rogers about whether Larry Summers could have stopped Quantitative Easing:

Which signs would reveal a collapse would be approaching:

Jim Rogers said in an interview in Barrons that he is holding gold right now and expects maybe a buying opportunity to come up. Is that still the case?

Jim Rogers about silver's prospects:

|

| Posted: 20 Nov 2013 10:36 AM PST In a relatively short period of time people are declaring that bitcoin is gold 2.0. These declarations originate from bitcoin's climb whilst gold drops, despite ongoing central bank easing and a distinct lack of global recovery. Conditions in which traditionally gold is expected to outperform currencies. |

| China Gold output up 6.8% to 307.8 tons in Jan Sep Y Y Posted: 20 Nov 2013 10:33 AM PST The country's total gold output in the first nine months of this year was up 6.8% compared with the same period a year ago, the Association said. |

| Precious Metals – The Wheels are Turning and You Can’t Slow Down Posted: 20 Nov 2013 10:05 AM PST

Those lucky enough to experience the physical weight of wealth of precious metals understand the broader, more abstract implications. We are aboard a speeding train that cannot speed up – neither can it slow down – due to fiat, default, and what will be remembered as the greatest credit fiasco in history. And the road [...] The post Precious Metals – The Wheels are Turning and You Can’t Slow Down appeared first on Silver Doctors. |

| Jim Rogers on Why Gold Could Go Lower Posted: 20 Nov 2013 10:04 AM PST

Click here for more from Jim Rogers on why gold may go lower over the short term: |

| Jim Rogers on Why Gold Could Go Lower Posted: 20 Nov 2013 10:01 AM PST

The Indian politicians are now trying to do their best to destroy the gold market. They've put on huge controls and taxes on the Indian gold market. India's the largest buyer of gold in the world, and it's already having an effect. So the Indians are now trying to figure out a way to make [...] The post Jim Rogers on Why Gold Could Go Lower appeared first on Silver Doctors. |

| Ron Paul: Federal Reserve Steals From the Poor and Gives to the Rich Posted: 20 Nov 2013 09:40 AM PST

Two days before the Janet Yellen confirmation hearings, Andrew Huszar, an ex-Fed official, publicly apologized to the American people for his role in QE. Mr. Huszar called QE “the greatest backdoor Wall Street bailout of all time." As recently as five years ago, it would have been unheard of for a Wall Street insider and [...] The post Ron Paul: Federal Reserve Steals From the Poor and Gives to the Rich appeared first on Silver Doctors. |

| ECB to move to Negative Interest Rates Posted: 20 Nov 2013 09:10 AM PST Several news sources are reporting that the European Central Bank is considering moving to Negative Interest Rates in yet another attempt to combat sluggish economic growth in the Eurozone. Keep in mind that this comes on the heels of their surprise interest rate cut two weeks ago which caught the markets completely off guard. That hit the Euro hard back then and once again, it is getting slammed today as a result. Gold seemed to catch a bit of a bid on this news but the moves higher are running into selling thus far. One way of looking at this is that DEFLATION fears are becoming so serious to monetary officials that they are effectively nocking their last arrow on the string to fire. If this move fails to generate any lending/economic activity/growth, what then?? Here is a good story to read dealing with the news....keep in mind that this is not a done deal, yet... the idea is probably being floated to gauge market reaction. http://www.bloomberg.com/news/2013-11-19/nikkei-futures-gain-on-weak-yen-after-u-s-stocks-retreat.html |

| Posted: 20 Nov 2013 09:00 AM PST

Somehow we suspect an encased gold futures contract might have slightly less of a draw… 2013 Gold Maples As Low As $37.99 Over Spot at SDBullion! The post Caption Contest Wednesday! appeared first on Silver Doctors. |

| $1 million gold stash found in airplane toilet Posted: 20 Nov 2013 08:58 AM PST The 24 gold bars were found by cleaners on an airliner in India This posting includes an audio/video/photo media file: Download Now |

| Dressed to the nines with gold Posted: 20 Nov 2013 08:22 AM PST While paper gold is getting the cold shoulder in the West, the Love Trade buyers in the East are wrapping their arms around all the physical gold they can get their hands on. |

| Alasdair Macleod: Fiat Money Quantity hits new record Posted: 20 Nov 2013 08:00 AM PST

QE3 is running at $85bn, and directly increases FMQ by double that amount, or $170bn, indicating that other factors contributed $57bn to the FMQ total. This suggests that the current rate of QE was insufficient to provide the liquidity required in money markets consistent with current interest rates, at least for the month of September. [...] The post Alasdair Macleod: Fiat Money Quantity hits new record appeared first on Silver Doctors. |

| Silver Fundamentals – The Historian Perspective Posted: 20 Nov 2013 07:56 AM PST Ryan Jordan, Ph.D. is a professional historian, author and college professor. He is the author of "Silver – The Peoples Metal" which I highly recommend. Mr Ryan Jordan sees silver fundamentals from the perspective of a historian. Besides, he looks at it as an astute observer of present conditions. In his analysis, he takes the following area’s into account:

Before looking into the details of his work, we summarize the conclusions of his analysis. His work is not about moment moving averages, technical analysis, relative strength indicators, partial differential equations, Federal Reserve economic models. By contrast, he provides only a perspective as an historian:

His recent work offers more detailed thoughts about silver. Below are several quotes and thoughts from his research. 1) Demand for silver is strongFrom his article: Silver Demand As Guide for Silver's Next Price Move "The US Mint confirmed a record year for sales of silver coins– and we still have six weeks in the year to go. Yes, the roughly 40 million ounces of silver only accounts for maybe 5% of overall demand, but it also represents a huge increase from a decade ago when it comes to investor interest in physical metal. In fact, globally, silver investment demand is up essentially from ZERO just 10 short years ago (take some time to allow that to sink in when thinking about the change in investor sentiment toward precious metals in recent years.) And demand for silver isn't just an American phenomenon. Last month, somewhat surprising news came out of India of a roughly 130 million ounces of silver imported into that country in just the first six months of the year. This was in response to the shutdown of gold imports into that country." 2) Inflation will be increasingly importantAs long as the world monetary systems are run by central banks, particularly the Federal Reserve, we can expect inflation in the money supply, debt, and consumer prices. The weakness in gold and silver since 2011 is, in our opinion, a temporary correction in the four decade uptrend for debt, spending, and gold and silver prices. "Gold and Silver: The Big Picture" "Another long term, fundamental factor in the rise of gold and silver comes from the belief of central planners that inflation is nonexistent currently and actually needs to increase. This is the view held by many among western central bankers, and is part of the reason why FED bond purchases will not decline much from the nearly 1 trillion a year mark, as made clear this week by the US central bank. FOMC statements released Wednesday continue to affirm that the deflationary threats from the 2008 crisis remain. The ultra-loose stance of the world's largest central bank should be of concern to anyone who wonders if inflation might one day get out of hand. And in India, known as one of the world's leading gold markets, inflation is already making its presence felt. The Indian central bank continues to raise interest rates while attempting to curtail demand for gold among Indian citizens. Many observers note the similarity to policies once adopted by the US government in the late 1960s and 1970s, and how those policies failed to dampen demand for gold as both inflation and interest rates rose strongly. My question for any gold or silver bear is this: if gold and silver went up nearly 7 times over the last 10 years with no meaningful inflation in western nations, how much more will the metals go up when inflation is officially recognized as a problem by those in charge?" 3) Precious metals have been largely ignored for over 30 yearsYes, they are occasionally mentioned in the mainstream media and on financial television, but the media's primary focus is on stocks and bonds – paper promises and paper debt – not on something real like a gold bar or a stack of silver coins. Dr. Jordan thinks that gold and silver will become an increasingly important part of more investment plans and that this transition will accelerate. "Precious Metals: The Emerging Asset Class" "Over the past year, the cult of equities has made a return, as indices roar to all-time highs, and as many look to cash in on new IPOs like they did in the last tech boom 15 years ago." "But I'd like to make some historical comparisons between the two periods, to explain how even with stocks catching all the attention, this hardly means that gold and silver will continue to be left out in the cold. Here are three main reasons why I do not believe gold, silver, PGMs, or mining shares will behave as they did in the 1980s and 90s: 1) Just last month, President Obama actually made reference to the reserve status of the U.S. dollar as being in jeopardy based on current dysfunctional behavior in Washington, D.C. I don't ever recall Presidents Reagan through Clinton saying something similar– and for good reason. To take the case of President Reagan's first term in office, the US Dollar rallied something like 50% at one point. While I don't expect the dollar to crash anytime soon, too many players globally are looking to diversify away from the greenback for the dollar to re-enter a secular bull market. A big question mark remains over the US dollar's reserve status and this represents one of the most powerful reasons to continue to own precious metals– or even to acquire more. 2) The challenges facing mining companies these past couple of years signals a downshift in global gold and silver production. This decline won't happen immediately, since it takes a while to shudder mine projects – but ore grades can only decline so much before it becomes uneconomical to attempt to increase overall mine output. This reality stands in marked contrast to the 1980s and 1990s, where mine output for both metals made significant increases during those decades. Supply constraints – especially if they are coupled with new industrial demand for the white precious metals – will eventually lead to higher prices. 3) The growth in the global middle class outside of the West is a trend that began 20 years ago, but the trend has accelerated in recent years. Many commentators believe that the shift in wealth from west to east will mean that upwards of 50% of new entrants to the global middle class in future years will come from areas outside the U.S. and Western Europe. As has been seen all year, buyers in Asia and the Middle East possess an attachment to physical gold- ranging from the person buying jewelry to the central banker buying bullion bars– that is hard to break. Oftentimes these attachments speak to the cultural memory of volatile local currencies or political malfeasance in these nations. Overall there remain some big differences between today and 20 or 30 years ago when it comes to precious metals. While faith in central planners and their ability to levitate equity markets is strong among some, there are others like myself who do feel that 2008 mattered–and not in a good way. Zero percent interest rates, a stagnant economy for upwards of 80% of people in the U.S. and Western Europe, continued discussion of unsustainable debt levels, and the existence of a black hole of derivatives and other "off balance sheet" financial sleights of hand are just a few issues facing investors currently. It may be hard to believe it now, but I don't think the precious metals will remain under-owned forever." 4) The conventional investment perspective is not the only valid one"Don't Drink Too Deeply From the Well of Conventional Thought" "The inability of people to see the world for what it is was quite apparent with the nonsensical discussion of Fed tapering over the last several months. Many in positions of power sought to convince the unwashed that somehow these extreme monetary measures can be undone, or taken back. And many still believe them. As part of this naivety we then get people believing that entire asset classes, like gold, silver and mining shares are only for crazy people- that genuine tangible asset investing need not play any role in a given portfolio. My only advice for people is to please be very careful about drinking too deeply from the well of conventional thought. It is not that the world is going to end, but by the same token the days of 4 or 5% economic growth coupled with a strong and growing middle class are gone for a long time. This new reality requires a new attitude towards investing. Don't let the recent weakness in the precious metals sector mislead you." GE Christenson | The Deviant Investor |

| Posted: 20 Nov 2013 07:40 AM PST While we sit and watch JPM roll their Dec13 position and smash price in the process, I thought we should have some fun by putting this year's GLD pillaging into context. |

| Bill Bonner: Bitcoin Bull (Can Peter Schiff Be Far Behind?) Posted: 20 Nov 2013 07:35 AM PST

|

| Chinas gold imports are likely far greater than reported from Hong Kong Posted: 20 Nov 2013 07:31 AM PST GATA |

| Zero Hedge: Another gold slamdown looks like the work of the BIS Posted: 20 Nov 2013 07:31 AM PST GATA |

| 2014 Should Be A Catch-Up Year and the Bull Will Be Back In Charge Posted: 20 Nov 2013 07:15 AM PST In today's Featured Articles section below, we present an excellent article from LeMetropole Café by Michael Noonan. They are one of my favorite newsletters. You should check them out. Their newsletters is unique, and very valuable. Michael Noonan's article makes a good point. Even though the fundamentals we present to you should make for higher prices, Technical Analysis is setting the price – at least for now. All that's necessary is to short gold (and silver) to key technical levels and then the hedge funds jump in and sell. Ted Butler and Ed Steer (two of my favorite writers) maintain that at some point, JPMorgan will start to manipulate the market UP instead of down and the hedge funds will join in and the prices will rise dramatically. Since JPMorgan is heavily long in physical gold, that day will come. Here is an interesting article from Ted Butler:

A decade ago, Jim Sinclair wrote that the same banks that are currently on the short side will be the ones on the long side when the price turns up. They will be the ones to make a fortune on the up move. I know it seems unlikely now, but it will happen. My best guess, and it is a guess, as is any prediction, is that everything turns around before the end of the first quarter. At that point, Janet Yellen will be in place as Fed Head and the key delivery months of December and February will be history. Bill Holter and Andy Hoffman have written numerous articles that the Comex gold inventory is very low and if they can't meet the delivery demand in December or February, game over. Currently, the Comex inventory is too low to meet any meaningful physical settlement. If even a small percentage of the holders of the contracts demand delivery instead of a dollar settlement, the price of gold will take off like a rocket. Where will the banks get the bullion to deliver with inventories so low?” All traders who hold futures or options contracts for December have to sell, roll, or stand for delivery. Where will the banks get the gold to deliver? Here is a strong candidate. Below is an article from GATA:

Ed Steer wrote the following below about the manipulated gold trading on the COMEX –

I asked my friend, Trader David R where he thinks gold is going? He told me, "I think we will continue to drift lower or stay around here, as stop loss selling and producer hedging will come into play, but I think we see new all time highs next year…. unless we get more data manipulation from the government and keep dreaming of tapering and recovery…… it's tough call these days as the data and markets are disconnected!" He makes his living trading, not selling newsletter subscriptions, and I have found him to be very accurate. As you can see from his comments, he discusses government "data" manipulation. There is no question but the government does manipulate the inflation, employment and GDP numbers and the result is an over-valued Dow and undervalued gold. 2013 has not been kind to precious metals, but 2014 should be a catch-up year and the bull will be back in charge.Similar Posts: |

| Gold Crashes through Chart Support Posted: 20 Nov 2013 07:11 AM PST So much for quiet trading ahead of today's release of the FOMC minutes from their last meeting! Volume had just dried up with the market killing time as the hour of the release drew near when a batch of large sell orders came out of nowhere and caught the market sleeping. The intention was to run the stops sitting down below yesterday's lows - guess what? They got them! The surge in volume caused a temporary halt in trading. When trading resumed, momentum based selling then entered in large size dropping gold further. It fell through $1258 which was acting as a temporary floor. Here is another example of how hedge funds can push price by taking advantage of lulls in liquidity. I am sure some in the gold camp will once again credit this "takedown" to the big bullion banks but that is simply not the case. They continue to lift their existing short positions and add to their exposure on the long side of the market. It is hedge funds who continue to reduce long side exposure and add to their growing, and profitable, number of short positions. We will get to see this as the December contract enters its delivery period soon. I suspect we will see J P Morgan taking delivery of a rather large amount of gold. Either way, we will see. One bummer is the fact that this move lower through support occurred today, Wednesday, so unfortunately this week's CFTC report ( Commitment of Traders ) will not pick up the positioning of players. Silver is dangerously flirting with the $20 level. If it loses support there, another 50 cent drop will come rather quickly with potential for further losses down towards $19. More later today after the release of the FOMC minutes. Let's see what they might say and whether or not it has an impact on the markets or if they have correctly anticipated the contents. Crude oil is sinking further today having bounced back above $93 yesterday. That seems to be a general pivot region with the market oscillating around this level. |

| Posted: 20 Nov 2013 07:00 AM PST

The top ten biggest banks, in addition to holding the vast majority of deposits, mortgages and credit card accounts, operate 33% of all the bank branches in the country. The very same banks that have paid out $66 billion in criminal settlement charges over the last three years and have incurred $103 billion of legal [...] The post Take It To The Bank! appeared first on Silver Doctors. |

| Comex suspended gold trading for 20 seconds after price slump Posted: 20 Nov 2013 06:57 AM PST CME Group Inc.'s Comex halted trading in December gold futures for about 20 seconds today at 6:26:41 a.m. New York time, said Damon Leavell, a spokesman for the exchange. |

| Gold market needs new catalysts as traditional assets outperform Posted: 20 Nov 2013 06:41 AM PST According to the CFTC, the combined net gold positions by managed money declined about 37% during the week ending Nov. 12, led by a 104% jump in the short contracts. |

| BoE Survey Shows Growing Fears Of House Price Crash Posted: 20 Nov 2013 06:31 AM PST gold.ie |

| Heat, Light & Venezuela in London Gold Manipulation Posted: 20 Nov 2013 05:42 AM PST No-news flash! Regulator the FCA is looking at London gold prices. News-sites are chasing "manipulation" traffic... MORE heat than light in a story from Bloomberg overnight, writes Adrian Ash at BullionVault. Certain parts of the London gold market are being "reviewed" by the UK's financial regulator, the Financial Conduct Authority. Because London trade sets the world's gold benchmarks for price (notably the London Fix) as well as lending rates (known as GOFO). And where there are benchmarks, regulators must now follow. It's not an "investigation" however. So the source won't give their name, nor anything else, let alone a blunt accusation of "manipulation". Which doesn't make them much of a "source". Nor is any of this news. Reuters had a better report 3 weeks ago about how the London gold trading industry, heart of the world's wholesale bullion trade, is addressing the rising temperature of regulatory interest. And at last month's London Bullion Market Association shindig in Rome, we in fact got this short presentation straight from the horse's mouth, plus this interview (via our friends at Kitco) with the FCA's Don Groves during a conference coffee break. So what's the likely impact of whatever is, or isn't, now under review? In London's wholesale gold market, GOFO is the lending rate (in fact, it's the interest rate which current owners will pay a borrower to take their gold away). Rather than being directly visible to the world at large, it is reported by the banks to trade association the LBMA, in much the same way individual banks' Libor interest rates (the interbank interest rates which banks charge each other to borrow) are reported to the British Bankers Association, which then produces a single Libor figure for the cash lending market as a whole. So with GOFO, there's lots of scope for the regulator, the FCA, to ask questions. Because like Libor, the reported GOFO rate is used in other, off-the-shelf products more widely available to market participants. The value will be very much smaller than the value of business done with reference to interbank cash rates. Not least thanks to the collapse in gold lending and swapping, starting in 2003, brought about by the long bull market in prices. But you can smell the story here, if not the facts. Manipulation of Libor has, to date, led to fines worth some $5 billion. The gold and silver prices Fixes, in contrast, are a market price set by client business through the 5 member banks of the London Gold Fixing Ltd, as we explained in this article earlier this year. Or alternatively, market participants can deal "spot". Although commonly cited, this doesn't in fact exist as a single, firm price. Instead, it represents the average mid-price of the 11 bullion market-making banks' firm bid/ask quotes, plus the quotes from all the hundreds of other gold and silver dealing banks, brokerages and trading houses centered in London. You can see this average tracked on BullionVault's reference gold price chart here. As regards prices on BullionVault's order board, where consumers (like you and me) can trade wholesale gold and silver for instant settlement, they're freely quoted and set by our users in open competition. No other retail investment service lets you set your own bid/ask prices as you choose with any market depth or liquidity. None also lets you trade at the Daily Price, if you so wish, as achieved by the London Fixes. Again, the Fix offers a separate route to price discovery. To learn more about that global benchmark, please see the Fixing Limited's own site. Meantime, and away from news-sites chasing Google hits for "London gold manipulation", there's much more important events for gold happening in Venezuela. Because the socialist paradise, of all places, is having to pawn its gold reserves to raise cash, according to local press. And it's using investment bank Goldman Sachs of all people to do it! El Banco Central de Venezuela is said to have entered into a "gold swap" agreement with Goldmans for some 45 tonnes of its 367-tonne gold reserves. Part of the 14th largest national hoard in the world is apparently being swapped for cash (which will then be swapped back, sometime in the future) because the country's foreign-exchange reserves have run down to a 10-year low, with only enough money left to fund 10 days of imports, according to a local economist. Why the cash crunch? Because El Banco is desperately selling foreign currency, and buying its own money back, trying to defend the Venezuelan Bolivar Fuerte's value against the US Dollar on the FX markets. The central bank slashed the VEF's official peg to the imperialist greenback by one third at the start of this year. But the black market price (ie, the only market price, where private individuals buy and sell away from the politicos' diktat) puts the devaluation nearer 90%. So after making such a fuss about "taking its gold home from London" under the late Hugo Chavez, the Central Bank of Venezuela is now turning back to the London gold market to mobilize the value of its reserves. London regulator the FCA is part of the Bank of England. Maybe Venezuela will email the Market Abuse team about the swap rate it got in that deal with Goldmans, you might ask. But that was, by all accounts, a direct deal between two consenting parties. Enquiring minds might further wonder who's playing the end-borrower of those 45 tonnes of gold apparently swapped out by El Banco. With gold prices falling so hard in 2013, many smaller mining companies have reportedly been looking to sell gold now, borrowing it with a view to repaying that bullion debt with forward mine production in the future. And with gold prices down so hard after emerging-market economies started to build their reserves during the metal's unstoppable 12-year rise, many more of those central banks might also be looking to "mobilize" their holdings, getting a rate of return via the gold lending market in London. |

| Jim Rogers Expects A Buying Opportunity In Gold And Silver Posted: 20 Nov 2013 05:38 AM PST This is an interview with Jim Rogers, conducted by Birch Gold Group. The topics that are covered range from monetary policy, the stock market frenzy, currency wars and precious metals. Jim Rogers his observations and predictions about how the currency war will unfold:

Jim Rogers about whether Larry Summers could have stopped Quantitative Easing:

Which signs would reveal a collapse would be approaching:

Jim Rogers said in an interview in Barrons that he is holding gold right now and expects maybe a buying opportunity to come up. Is that still the case?

Jim Rogers about silver’s prospects:

|

| Why did the gold price plunge $10 in 10 seconds? Posted: 20 Nov 2013 05:35 AM PST Sudden drop in the precious metal on the day it emerges the UK regulator is investigating alleged rigging of the price raises questions about the market This posting includes an audio/video/photo media file: Download Now |

| China Imported An Additional 133 Tonnes Of Gold Directly in 2013 Posted: 20 Nov 2013 05:14 AM PST In early November we reported that China's net gold imports from Hong Kong totalled 854.2 tonnes between January and September 2013. More or less at the same period of time, based on the latest official gold market data, we concluded that the Chinese gold figures are merely reflecting part of reality, as explained in “World Gold Council Reports Significant Error In China's Gold Holdings.” Today’s news from Reuters shows that things are even more “complicated.” Over the course of this year, China would have imported an additional 133 tonnes directly, i.e. not through Hong Kong. This figure is a calculation by Reuters based on top 20 gold exporters in the world. From Reuters:

Moreover, the same article says that the calculcation probably understates the total direct imports as Britain and Switzerland do not provide complete details.

In addition, the 133 tonnes do not include the gold that was purchased by China’s central bank. The official reserves of the country have not been updated in the last 4 years (approximately). There are estimate that the real Chinese gold reserves are closer to 4,000 tonnes. |

| BoE Survey Shows Growing Fears Of House Price Crash Posted: 20 Nov 2013 04:03 AM PST "This is different" and "this location is different" is the mantra of every property bubble. We will soon see if the London property bubble is truly different or will suffer the fate of bubbles throughout history. Of the four charts in our market update today, which ones do you think show characteristics of a bubble? Those diversifying and buying gold in the UK today will be rewarded in the coming years. The smart money is reducing exposure to overvalued London property and increasing exposure to undervalued gold. Today's AM fix was USD 1,271.50, EUR 939.69 and GBP 787.11 per ounce. Gold fell $0.30 or 0.02% yesterday, closing at $1,273.40/oz. Silver slipped $0.09 or 0.44% closing at $20.32/oz. Platinum climbed $3.40 or 0.2% to $1,411.40/oz, while palladium rose $3.75 or 0.5% to $718.47/oz.

Gold in sterling terms is testing strong support at the £775/oz level. A breach of this level could lead to gold testing the next level of support at £740/oz and below that at £700/oz which was resistance in 2009 (see 5 year chart below). Gold was trading in a tight range until it suffered another very sharp concentrated sell off at 1126 GMT which led to prices falling from $1,272/oz to $1,259/50 in seconds. The selling was so furious and concentrated that it led the CME to stop trading for a significant twenty seconds. Some entity appeared determined to get the gold price lower and they succeeded – for now. Gold failed to make any headway despite dollar weakness after more dovish comments from exiting Fed Chairman Ben Bernanke about the bank’s bond purchases. Bernanke said yesterday that the Fed will maintain an ultra loose U.S. monetary policy for as long as needed and will only begin to taper bond buying once it is assured that labour market improvements would continue. The assumption that QE will be trimmed is like a lot of assumptions wrong. There are strong grounds for believing that the weak state of the U.S. economy may lead to Bernanke's even more dovish successor, Yellen, increasing the QE programme. Physical demand continues at these levels but is not at the very high levels seen in recent months. Many bullion coin and bar buyers have accumulated their allocation of gold and silver and are waiting for higher prices. There is a real sense of the calm before the storm in the gold market. How that will manifest and the catalysts for a resumption of the bull market is yet to be seen.

The Bank of England's Systemic Risk Survey semi annual report to quantify and track market participants' views of risks to, and their confidence in, the UK financial system shows increasing concerns of a house price crash. The report presents the results of the 2013 H2 survey, which was conducted between 23 September and 24 October 2013 with 76 financial services companies. Fears that a house price crash could damage the financial system have risen sharply in the last year, the key Bank of England survey shows. Increased concerns were expressed by the participants over ultra loose monetary policies and the extended low interest rate period. Concerns about a property price bubble rose and were mentioned by 36% of respondents, up 21% from 14% since the previous survey in the second half of 2012. Concerns were concentrated almost exclusively on the residential market, where responses focused on the risk of a house price correction. As we know house price corrections tend to feed on themselves and often lead to house price crashes. Other Key Risks To The UK Financial System: • For the second survey in succession, risk surrounding the low interest rate environment was the fastest growing, with 43% of respondents citing it, up 17 percentage points since May 2013. Over half of the responses emphasised risks around low rates, with the remainder referring to risks associated with a snapback in those low rates to more normal levels. Perceived risk around property prices also rose, being mentioned by 36% of respondents, up 11 percentage points since the previous survey. Concerns were concentrated almost exclusively on the residential market, where responses focused on the risk of a house price correction. • Other top risks include regulation/taxes (cited by 41% of respondents, up 1 percentage point since May 2013), financial institution failure/distress (+4 percentage points to 30%) and operational risk (+1 percentage point to 25%). Outside of the top seven, geopolitical risk has grown in prominence, with concern focusing on instability in the Middle East. The report may have led to GBP weakness upon its release as the pound fell against the dollar, euro and gold.

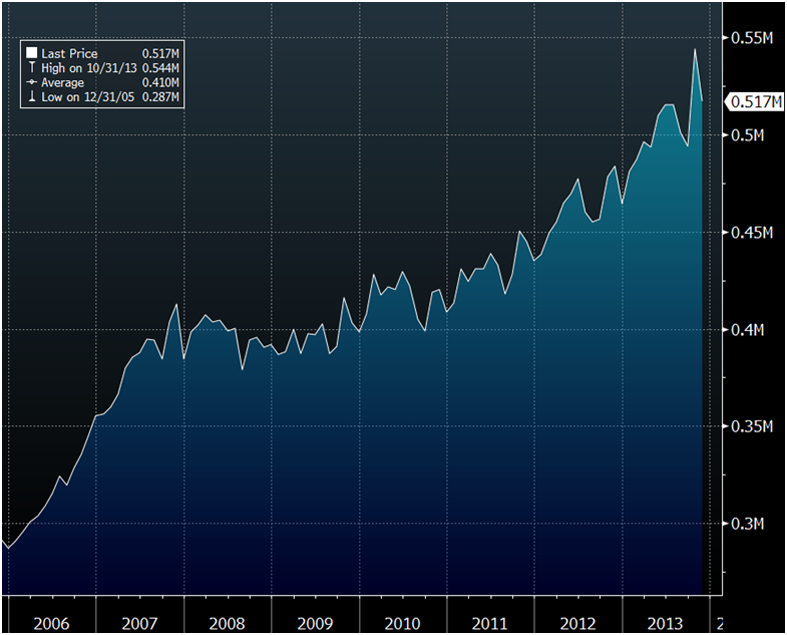

Interestingly, also on Monday came news of a sharp 5% drop in London property prices in what could portend a bust of the London property bubble. Values in the U.K. capital dropped 5%, or 26,956 pounds ($43,500), from the previous month to an average 517,276 pounds, Rightmove PLC said Monday. Across England and Wales, average prices declined by 2.4%. Estate agents and property industry blamed the falls on a seasonal pre-Christmas decline, however valuations are extremely stretched with very low yields and the hot money that has fueled the huge increase in London property prices may be pulling back.

"This is different" and "this location is different" is the mantra of every property bubble. We will soon see if the London property bubble is truly different or will suffer the fate of bubbles throughout history. Of the four charts in our market update today, which ones do you think show characteristics of a bubble? Those diversifying and buying gold in the UK today will be rewarded in the coming years. The smart money is reducing exposure to overvalued London property and increasing exposure to undervalued gold. Click Gold News For This Week's Breaking Gold And Silver News |