Gold World News Flash |

- Asian Metals Market Update

- Gold Fear Buy VS Gold Ecstasy Buy

- Get Informed: 4 QE Myths Debunked

- Venezuela Reported Planning to Pawn its Gold Through Goldman Sachs

- The Money Bubble Gets Its Grand Rationalization

- Everything goes up except gold, Tocqueville's Hathaway laments to KWN

- Guest Post: The American Model Of "Growth": Overbuilding And Poaching

- Jim Rogers: "Own Gold" Because "One Day, Markets Will Stop Playing This Game"

- Dressed to the Nines with Gold

- Gold Price Climbed $1.20 to $1,273.40

- Gold Price Climbed $1.20 to $1,273.40

- Warning - NSA To Oversee Individual Bank Accounts & Wealth

- Morgan: Over The Long Run Gold & Silver Will Be The Ultimate Currency

- SILVER BEARS: You Have Been Warned

- Gold Seeker Closing Report: Gold and Silver End Slightly Lower

- Gold Daily and Silver Weekly Charts - Artificial Intelligence

- Gold Daily and Silver Weekly Charts - Artificial Intelligence

- Gold vs. the State: A Comedian Writes...

- Gold vs. the State: A Comedian Writes...

- Where Flat Tax Leads, Gold Standards Follow

- Where Flat Tax Leads, Gold Standards Follow

- Taking delivery of gold and silver from your retirement account

- FCA launches gold benchmark rigging review

- Dressed to the Nines with Gold

- Once they discover that central banks do the gold rigging, the regulators will back off

- The Daily Market Report: Gold Underpinned By Global Headwinds

- Venezuela reported planning to pawn its gold through Goldman Sachs

- Gold Fear Buy VS Gold Ecstasy Buy

- Venezuela reported planning to pawn its gold through Goldman Sachs

- GATA consultant Dimitri Speck's new book is 'The Gold Cartel'

- The Fourth Reich

- A Requiem for The Bond Market

- China, India, Gold & An Ace In The West’s Hand

- Gold Fear Buy VS Gold Ecstasy Buy

- 19 ‘tough’ questions for Eric Sprott on gold and silver

- The faces behind China’s gold market

- China gold consumption running at over 2,000 tonnes this year – Jansen

- Gold no “slam-dunk sell” in China as aunties pounce

- Gold and Silver

- Jim Rogers on QE, Currency Wars, Gold and Inflation

- Gold No Slam-Dunk Sell in China as Aunties Buy Bullion

- Gold Swings as Investors Weigh Stimulus After Rally in Equities

- Understanding High-Grade Lump Graphite

- Silver: The Key Support at 20.50 Has Been Broken

- Gold Prices "Bearish" But Invite "Uptick" in Asian Buying as US Fed Members Disagree on Stimulus

- Gold better at 1276.00 (+1.87). Silver 20.37 (-0.012). Dollar and euro steady. Stocks called easier. US 10yr 2.68% (+1 bp).

- "Uptick" in Asian Demand as Gold Hits 1-Week Low, Flirts with 3-Year Low in Sterling

- Bitcoin Surges Over $900 As Gold Vulnerable Of Fall To $1,200/oz

- Australian interview of GATA secretary covers gold market manipulation

- NYPost's John Crudele: Census 'faked' 2012 jobs report

| Posted: 19 Nov 2013 11:02 PM PST This is the time best time for gold and silver to make another big upward move and more so after Bernanke's comments on interest rates. Federal Reserve Chairman Ben S. Bernanke said the labor market has shown "meaningful improvement" since the start of the central bank's bond-buying program and that the benchmark interest rate will probably stay low long after the purchases end. | |||

| Gold Fear Buy VS Gold Ecstasy Buy Posted: 19 Nov 2013 09:46 PM PST Graceland Update | |||

| Get Informed: 4 QE Myths Debunked Posted: 19 Nov 2013 09:36 PM PST The Fed continues to assert that its Quantitative Easing bond purchases will boost The above are edited excerpts by Scott Grannis, the Calafia Beach Pundit, (scottgrannis.blogspot.ca) from his original article* entitled Quantitative Easing Myths. The following is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here). The excerpts may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.The Fed is guilty of misleading the public; it should be arguing that its QE efforts have been successful because they have boosted long-term interest rates [as can be seen in the chart below]. Interest rates are up because the outlook for the economy has improved, and QE has likely contributed to that improvement by satisfying the world’s huge demand for safe assets. Myth #1: Effect of QE on 10-year Treasury Yields The chart below shows the yield on 10-yr Treasuries (blue), overlaid by shaded areas representing periods of Quantitative Easing (darker green) and the one period of Operation Twist (light green). Note that:

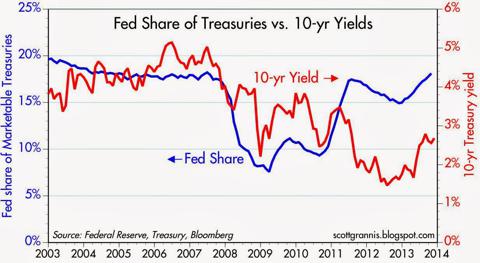

Myth #2: Effect of QE on Bond Prices/Yields The chart below compares the yield on 10-yr Treasuries (red line) with the percent of marketable Treasuries held by the Fed as a result of its QE purchases (blue line). Note that:

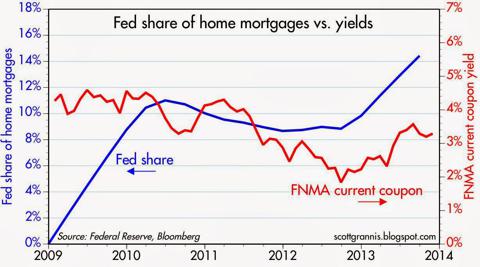

There is no evidence in either of the two charts above to support the notion that QE bond purchases have inflated bond prices or depressed bond yields. Myth #3: Effect of QE on Mortgage-backed Securities The same arguments apply to the Fed’s purchases of mortgage-backed securities as the chart below shows. The Fed has dramatically increased its ownership of MBS over the past several years, yet there is no indication that increased purchases have had a depressing effect on mortgage yields. Over the past year, during which the Fed has purchased $40 billion of MBS per month, mortgage yields have actually increased by about 100 bps. One explanation for why the Fed’s QE efforts have not produced their promised results is relatively simple.

The outstanding supply of marketable Treasuries and MBS is almost $21 trillion, while the Fed owns only about $3.6 trillion. More important is the fact that there are tens of trillions of corporate and non-U.S. bonds that are effectively priced off of Treasuries. To artificially depress the yield on Treasuries the Fed would have to not only buy a huge portion of outstanding Treasuries but also a significant portion of corporate and non-U.S. bonds. Myth #4: QE Means Fed Is Printing Money with Abandon It’s also a myth that the Fed has been “printing money” with abandon as a result of its QE bond purchases. This myth persists, despite strong evidence to the contrary (i.e., the fact that inflation remains very low despite four years of massive QE purchases), because the majority of observers fail to understand the mechanics of Quantitative Easing.

[Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://scottgrannis.blogspot.ca/2013/11/quantitative-easing-myths.html Related Articles: 1. Noonan: The Fed Will Never Ever Taper & What That Means For Gold

The Ponzi bubble is bigger than most can imagine. Western central planners… [continue to try to] suppress gold and silver in order to keep their sorry lives alive. In the process, the destruction of people's financial well- being is unabated… Read More » 2. What Will Happen If (and probably when) the U.S. Debt Bubble Bursts? The madmen who are responsible for the coming economic disaster continue to behave as if they can manage to avoid it. Violating Einstein's definition of insanity, they continue to apply the same poison that caused the problem. These fools believe they can manage complexities they do not understand. The end is certain, only its timing is unknown, and, once interest rates begin to rise, and they will, it’s game over so it begs the questions “How much longer this can possibly go on?” and “What will happen to the U.S. and the world when it does?” Read More » The post Get Informed: 4 QE Myths Debunked appeared first on munKNEE dot.com. | |||

| Venezuela Reported Planning to Pawn its Gold Through Goldman Sachs Posted: 19 Nov 2013 08:40 PM PST by Chris Powell, GATA:

The Venezuela newspaper El Nacional, the voice of that tortured country’s political opposition, reports today in the story appended here that, after triumphantly repatriating its gold reserves two years ago, Venezuela has sunk so much economically under its predatory socialist regime that it will raise cash by pawning its gold through Goldman Sachs. That gold almost surely will be delivered by Goldman Sachs to the use of the Western central bank gold price suppression scheme. | |||

| The Money Bubble Gets Its Grand Rationalization Posted: 19 Nov 2013 06:11 PM PST Late in the life of every financial bubble, when things have gotten so out of hand that the old ways of judging value or ethics or whatever can no longer be honestly applied, a new idea emerges that, if true, would let the bubble keep inflating forever. During the tech bubble of the late 1990s it was the "infinite Internet." Soon, we were told, China and India's billions would enter cyberspace. And after they were happily on-line, the Internet would morph into versions 2.0 and 3.0 and so on, growing and evolving without end. So don't worry about earnings; this is a land rush and "eyeballs" are the way to measure virtual real estate. Earnings will come later, when the dot-com visionaries cash out and hand the reins to boring professional managers. During the housing bubble the rationalization for the soaring value of inert lumps of wood and Formica was a model of circular logic: Home prices would keep going up because "home prices always go up." Now the current bubble – call it the Money Bubble or the sovereign debt bubble or the fiat currency bubble, they all fit – has finally reached the point where no one operating within a historical or commonsensical framework can accept its validity, and so for it to continue a new lens is needed. And right on schedule, here it comes: Governments with printing presses can create as much currency as they want and use it to hold down interest rates for as long as they want. So financial crises are now voluntary. They only happen if a country decides to stop depressing interest rates – and why would they ever do that? Here's an article out of the UK that expresses this belief perfectly:

Some thoughts So this is the end of history. Interest rates will stay low and stock prices high and governments will keep on piling up debt with impunity – because they control the financial markets and get to decide which things trade at which price. Breathtaking! Why didn't humanity discover this financial perpetual motion machine earlier; it would have saved thousands of years of turmoil. At the risk of looking like a bully, let's consider another peak-bubble gem: "The simple point is that since countries like the UK have a free-floating currency, the Bank of England doesn't have to vary interest rates to keep the exchange rate stable. Therefore it, as an independent central bank, can prevent a debt crisis by controlling the cost of government borrowing directly. Investors understand this, and so don't flee British government debt in the first place." The writer is saying, in effect, that the value of the British pound – and by extension any other fiat currency – can fall without consequence, and that the people who might want to use those currencies in trade or for savings will continue to do so no matter how much the issuer of those pieces of paper owes to others in the market. If holders of pounds decide to switch to dollars or euros or gold, that's no problem for Britain because it can just buy up all the paper thus freed up with new pieces of paper. This illusion of government omnipotence is no crazier than the infinite Internet or home prices always going up, but it is crazy. Governments couldn't stop tech stocks from imploding or home prices from crashing, and when the time comes, the Bank of England, the US Fed, and the Bank of Japan won't be able to stop the markets from dumping their currencies. Nor will they be able to stop prices from soaring when the global markets lose faith in their promises. It's just a matter of time. | |||

| Everything goes up except gold, Tocqueville's Hathaway laments to KWN Posted: 19 Nov 2013 06:02 PM PST 9:06p ET Tuesday, November 19, 2013 Dear Friend of GATA and Gold: Interviewed today by King World News, Tocqueville Gold Fund manager John Hathaway marvels and laments about how everything these days can go up sharply in price except gold. "The only explanation," Hathaway says, "is the wild West of macroeconomic trading that takes place in paper gold." He adds: "I think there will be a reconciliation of this disconnect, and it will have something to do with the failing of these financial intermediaries such as the Comex, LBMA, and the banking system. It is something that is inevitable but I just don't know when." An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/11/19_W... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | |||

| Guest Post: The American Model Of "Growth": Overbuilding And Poaching Posted: 19 Nov 2013 06:01 PM PST Submitted by Charles Hugh-Smith of OfTwoMinds blog, Why has this doomed model of overbuilding and poaching sales become so dominant? Look no farther than the cheap-money policies of the Federal Reserve. The rising Gross Domestic Product (GDP) and other simulacra of "growth" are masking the real model of growth in America: overbuilding and poaching, as in poaching customers and sales from competitors. No matter how many outlets a company has, there's always room for a few hundred more somewhere. Now that there's a Starbucks on every corner, you might think the opportunities for expansion are limited. No way--now there are Starbucks in bookstores, Safeway supermarkets, subway stations (BART), etc. Not only is there a coffee outlet of some sort everywhere you look (hey, how about a Starbucks in every Home Depot?), Starbucks is getting into everybody else's business as well--even occasionally hawking music CDs, for example, at least until CD sales plummeted to the point it wasn't worth poaching the declining sales. Dollar stores are proliferating at a phenomenal rate, as are drug stores in various sizes and iterations--all aimed at poaching customers from WalMart and Target. There is a certain irony in this, as WalMart and Target expanded rapidly by poaching customers from the entire spectrum of retail competitors--supermarkets, department stores, drug stores, sporting goods, and so on. Everybody's getting into everybody else's business. If there is a profit to be made, suddenly every gas station mini-mart is stocking the line of goods, as are dollar stores and drug stores coast-to-coast. In the department store/luxury outlet space, the scrimmage for the top 10% and "aspirational" consumers is fierce. Macys, Nordstrom, et al. successfully poached the upper-middle class and "aspirational" consumers with credit (if they could buy luxury brands with discretionary cash, they wouldn't be aspiring to look wealthy, they would bewealthy) from mid-range retailers such as Sears and J.C. Penny. Countless catalog retailers have opened discount outlets while still poaching customers from other bricks-and-mortar retailers with blizzards of catalogs pitching "crazy low prices" to the marginalized middle class who cannot afford luxury outlets but seek brands above the WalMart level. Look no further than the enormous success of surf-watersports brands as evidence that an "active youth" brand can sell millions of units to paunchy shark-bait couch potatoes, effectively poaching customers from other sectors on the middle-class retail spectrum. Specialty retailers are busy poaching customers from competitors, and if that fails then they merge. Witness the absurdly overcapacity office supply space. The fleeting success of BBQ World quickly spawns BBQ Galaxy and BBQ Universe, a manic cycle of overbuilding/poaching that ends in ruination of all three retailers, which then merge and close hundreds of (mostly empty) stores.

That is the operative model of "growth" in America: rapid expansion/overbuilding in pursuit of poaching customers from existing competitors, a strategy that leads to massive overcapacity/redundancy and declining profits that then leads to mergers and shuttering hundreds of redundant outlets. This overbuilding is especially nonsensical given that the "Brown Truck Store" delivers virtually anything you want to your doorstep: The Inevitable Decline of Retail(September 19, 2012). Why has this doomed model of overbuilding and poaching become so dominant?Look no farther than the cheap-money policies of the Federal Reserve: Take It To The Bank (The Burning Platform):

If this is the engine of "growth" in America, a period of degrowth will be needed to clear the system of unprofitable deadwood and Fed-incentivized malinvestment. | |||

| Jim Rogers: "Own Gold" Because "One Day, Markets Will Stop Playing This Game" Posted: 19 Nov 2013 05:33 PM PST Jim Rogers hope-driven wish is that the politicians were smart enough at some point to say (to the central bankers), "we've got to stop this, this is going to be bad." He adds, on the incoming QEeen, "she’s not going to stop it, first of all she doesn't believe in stopping it, she thinks printing money is good." However, Rogers warns in this excellent interview with Birch Gold, "eventually the markets will just say, "We're not going to play this game anymore", and we'll have a serious collapse." The world is blinded by central bank liquidity, and as Rogers somewhat mockingly notes "if everybody says the sky is blue, I urge you to look out the window and see if it's blue because I have found that most people won't even bother to look out the window..." Rogers concludes, "everybody should own some precious metals as an insurance policy," because as he ominously warns, when 'it' collapses, "there will be big change.

Transcript (via Birch Gold Group) Rachel Mills, Birch Gold Group (BGG): This is Rachel Mills for Birch Gold, and I am very pleased to be joined today by Jim Rogers, legendary investor. Thank you so much Jim for joining me. Jim Rogers: I am delighted to be here Rachel. BGG: So today I wanted to talk a little about stock market highs and Quantitative Easing and inflation and a little bit of Federal Reserve and when is the taper is going to happen and currency wars. But there is one question that I don’t have to ask you, which you get asked a lot, I know, and that is what your secret to being so prescient in the marketplace?

JR: As far as I know, I’m not quite sure. I do know that I have learned over the years, always, when nearly everybody is thinking the same way that means somebody’s not thinking that means we got to start thinking about it and see if there’s not another way, another approach. Because if everybody says the sky is blue, I at least urge you to go and look out the window and see if it’s blue because I have found that most people won’t even bother to look out the window. If they see on the television or in the newspaper or something that everybody says the sky is blue, I at least urge them to look out the window. I find that most people don’t want to do their homework, that’s the first problem that many people have, is just doing simple homework.

Second, I have learned that if everybody says the sky is blue and I go and look out the window and see that it is blue, I have also learned that, well wait a minute, if everybody knows the sky is blue, is that going to change? Now that everybody knows something, is it time to start thinking about “Well maybe tomorrow the sky will not be blue?” And again, most people say “Well everybody knows the sky is blue and that’s all we need to know.” No, it’s not all you need to know because another thing I have learned in my life is that no matter what we all know today, it’s not going to be true in 10 or 15 years. You pick any year in history and go back and then look to see what everybody thought was true in that year, 15 years later the world had changed enormously. Enormously. And yet in that particular year everybody was convinced that this is the way the world was. Pick 1900, 1930, 1950, any year you want to pick, and you will see that 15 years later, the world was totally, totally different from what everybody thought it was at that time. So I have learned, for whatever reason, to know that change is coming, to know to think against the crowd, that the crowd is nearly always wrong and to try to think for myself. Now, I certainly make plenty of mistakes and have made plenty of mistakes in my life, but these are some of the things that I have learned, to try to think around the corner, try to think to the future if you want to be successful. BGG: Yeah that’s right. And I read somewhere, tell me if this is true, that you were shorting real estate in 2006? JR: Yes, yes, 2006, 2007, 2008. Yes, yes. I was short Fannie Mae, I was short all of the investment banks. I was short all the banks. BGG: And I bet, were people rolling their eyes at you, were they laughing at you?

JR: Oh very much so. I went on television quite a lot in those days saying it’s crazy. And I was on CNBC and I explained that I was short Fannie Mae and had been short Fannie Mae and Fannie Mae finally started to collapse. And the lady said to me, “Well it’s your fault that Fannie Mae is going down, it’s the short sellers that are causing problems with Fannie Mae.” And I explained to her, “Listen lady, if you really think that short sellers are making Fannie Mae collapse, you better get another job, because that’s not the way the world works.” Short sellers do not make Fannie Mae go from $70 to $0, I assure you, the only thing that can make that happen is serious fundamental problems. So yes, everybody knew I was nuts back in those days! And then, they started blaming it on me and on the short sellers, all of the problems. Nobody likes to take responsibility for their mistakes, certainly not politicians, but it was clear that first they laugh at you, then they ridicule you and say it’s your fault and blame it on you. Eventually they all say, “Oh, well we knew that. We thought of it ourselves! We knew that Fannie Mae was a fraud.” But that’s a difficult and sometimes painful process. BGG: Sounds like they were attributing more power to you than you actually have! JR: It’d be wonderful if all I had to do was sell something short and it would go down. Unfortunately it usually goes up when I sell it short, my timing is usually pretty wrong. BGG: I want to talk a little bit about currencies. It seems that all the major countries in the world are in this race to the bottom to devalue their currency relative to all the others to appease their export industry. Meanwhile, workers and savers are getting killed by the cost of living increases that this is causing. Do you have any observations or predictions about how this currency war is going to end, or can it continue somehow indefinitely? And who wins in a currency race to the bottom?

JR: Well, the first thing you need to know is that nobody ever wins a trade war, a currency war, which is just another kind of trade war. Everybody loses in the end, some may temporarily come out ahead but it’s temporary if nothing else. As you have pointed out, the cost of living of many people is going up, and it certainly is, my gosh, in Japan you have a currency that’s down 25% in a year. Well I assure you the Japanese are feeling that because everything that Japan imports has gone up fairly substantially AND even the things that they don’t import are up because the Japanese manufacturers and the Japanese producers can raise prices because they don’t have to worry about competing with the foreigners any more.

So we’re all losing in currency wars. How long can it go on? Well, it can go on as long as politicians can continue to print money. The problem is, of course, eventually the markets will just say, “We’re not going to play this game anymore” and we’ll have a serious collapse. You and I can print money all day long, but at some point, you, I and everybody else is going to say, “Wait a minute, guys, this money is getting worse and worse and more and more worthless, so why don’t we stop playing this game?” I wish the politicians were smart enough at some point to say, “We’ve got to stop this, this is going to be bad.” But unfortunately they never have, and probably never will. Mr. Bernanke is certainly not going to stop it, because he doesn’t want to go down in history as causing the collapse. Mrs. Yellen, when she comes in, she’s not going to stop it, first of all she doesn’t believe in stopping it, she thinks printing money is good. And she knows – I hope she’s smart enough to know – that if she stops, oh my gosh, it’s going to collapse. So she’s not going to stop. Nobody wants to go down as causing the collapse of the world. So I’m afraid this is going to go on until the market eventually says to them, “Okay, enough is enough,” we have a big collapse and then they’re all thrown out and we can start over.

BGG: Wow, that’s a painful scenario actually. Do you think there is any chance that Larry Summers would have stopped Quantitative Easing at all? JR: Well, first of all it’s irrelevant because he’s not going to be Federal Reserve Chairman. Second, even if he started, you know, if somebody came in and said, “Okay, we’ve got a terrible problem, we’ve made horrible mistakes, now let’s change things.” And even if everybody in the world said, “You know, he’s right, we’ve got to do something” and they started, well, within a few months or a year or two, the pain would be pretty horrible and then everybody’s going to say, “Well we didn’t know the pain was going to be this bad, this is not what we signed up for.” And then the guy would either be thrown out or assassinated or who knows what! BGG: Oh yeah, they would blame everything on whoever stopped the party. JR: Yeah. At first they say “It’s fine, we want to do it”, but once the pain comes, the pain is going to get pretty serious. We had Mr. Volcker who came in, was told “stop the madness” back in the 1970s and he did. Well, Jimmy Carter got thrown out, because he was who had told him to do that, because the pain was so bad. Reagan of course thought it was wonderful, that pain was taking place because that got him elected. And it was help to clean up the problems. That’s what happens, you cause the pain and they throw you out. BGG: So, you don’t think there is any way they’re gonna make good on their threats or promises to taper?

JR: They might, no I don’t. They might start, as I said, somewhere along the line they’re going to start doing it. But when the pain gets pretty serious, the lady or the person or whoever it is, is going to have real problems. Let’s say that in 2015, Yellen says, “We’ve got to stop this” and they start stopping it, well, at that point it’s going to be pretty serious for the parties in power and they’re going to get thrown out and the next guys will continue to taper because, as I’ve said, they got power because of the tapering and the problems, and they’ll clean up the problems. But that’s the only way that you’re going to see it stop someday. The market is just going to say, “We don’t want to play.” That’s what happened with Jimmy Carter when he was in, everything was collapsing: bond yields were falling apart, you know, inflation was everywhere. “Thank you Mr. Carter, we don’t want to play this game anymore. It’s absurd.” BGG: What tip-offs are you looking for for where the top of the market is and when would you start to see the collapse coming? Are there signs that you’re looking for? JR: Well, I wish I was that smart or it was that easy. Back in the late 1970s, Mr. Volcker was told and he came in and said: “I am going to kill inflation because Mr. Carter has told me to.” And Mr. Carter was very clear that he had to stop inflation. I doubt if we’ll have that kind of scenario again but we would think, we would hope, that the Federal Reserve will announce, you know, that they publish their numbers so we can all see what’s happening. At the moment they are buying a trillion dollars a year – that’s a trillion with a “T” – of assets. Eventually we will see that they stop that if they do or slow it down. What will probably happen is that they will slow it down at first to see what happens, and if things aren’t too bad at first – and they probably won’t be too bad at first – well what is likely to happen is they will slow it down, things will drop, and then they will rally and the Federal Reserve will say “Hey, this is not so bad, we can do it.” And they’ll cut some more. Things will drop again and then rally, because it will take a while for people to really believe how bad it can get, or will get. And so eventually they will try to cut [QE], it will finally cause the collapse, at that point we will have a big change, because they will throw them out, whether it’s the politicians or the central bankers or whoever … will continue because they like it, they got the job because of the collapse and then we’ll finally start over. But it may be really painful in the meantime.

BGG: Sure. And when we do begin the process of starting over, whenever that happens, it will be really good to have something substantial, something real, something other than paper in your portfolio. And that’s what Birch Gold is trying to help people figuring out how to do. So, we’ve always said that precious metals are a type of insurance for the long term. I read in your interview in Barrons that you are holding gold right now and expecting maybe a buying opportunity to come up. Do you still feel that way? JR: Yes, I’ve owned gold for many years, I’ve never sold any gold and I can’t imagine I ever will sell gold in my life because it is somewhat of an insurance policy. I hope that my daughters own my gold someday, I mean I owned gold, I’ve never sold any gold and if gold comes down and I expect it to go down, doesn’t mean it will, I’ll buy more. I’m certainly not going to sell.

BGG: Right. So what advice would you give someone who as of yet has no precious metals in their portfolio right now? JR: Well, everybody should own some precious metals as an insurance policy. So if they don’t have any right now, I would urge them to go buy something, buy themselves a gold coin if nothing else, and see that it’s not going to hurt. It won’t hurt you to buy the first gold coin, the first silver coin, and from that you start accumulating as your own situation dictates. First, do your homework, don’t buy gold because you heard me say it or even because you hear you say it. But if people don’t own they should start after they have done their homework. And then they will probably, if they do their homework, most people will then realize, “Oh my gosh, I better have insurance, and gold and silver may get me through serious problems ahead.” BGG: Yeah. How do you feel about silver? Do you favor silver over gold? How do you feel? JR: Well, silver is historically down 60% from its all-time highs, so yes, I would prefer silver at the moment because gold is down only what, 30 or 40% from its all-time highs. BGG: Well, thank you so much for talking with me today. I think we will leave it there. Thank you so much, Jim Rogers. JR: Thank you Rachel, anytime. Let’s do it again. BGG: I would love to. JR: Bye bye. BGG : Bye, thank you! | |||

| Dressed to the Nines with Gold Posted: 19 Nov 2013 04:40 PM PST While paper gold is getting the cold shoulder in the West, the Love Trade buyers in the East are wrapping their arms around all the physical gold they can get their hands on. In the third quarter, gold jewelry demand was at the highest ... Read More... | |||

| Gold Price Climbed $1.20 to $1,273.40 Posted: 19 Nov 2013 04:33 PM PST Gold Price Close Today : 1273.40 Change : 1.20 or 0.09% Silver Price Close Today : 20.326 Change : -0.023 or -0.11% Gold Silver Ratio Today : 62.649 Change : 0.130 or 0.21% Silver Gold Ratio Today : 0.01596 Change : -0.000033 or -0.21% Platinum Price Close Today : 1518.10 Change : 8.90 or 0.59% Palladium Price Close Today : 721.60 Change : 5.20 or 0.73% S&P 500 : 1,787.87 Change : -3.66 or -0.20% Dow In GOLD$ : $259.20 Change : $ -0.39 or -0.15% Dow in GOLD oz : 12.539 Change : -0.019 or -0.15% Dow in SILVER oz : 785.55 Change : 0.45 or 0.06% Dow Industrial : 15,967.03 Change : -8.99 or -0.06% US Dollar Index : 80.674 Change : 0.055 or 0.07% Silver fell 2.3 cents to 2032.6c while the GOLD PRICE climbed $1.20 to $1,273.40. That was on a 23 cent range for silver and a $7 range on the gold price, dead as a ball-peen hammer. I'm starting to get suspicious. Markets have a way of slapping you in the back of the head with surprises. What's keeping them up? Both appear to be dead. I have to suspect some big move, up or down, will emerge soon. However, this time of year is often very slow as investors wind down positions toward the Thanksgiving holiday. No point in chafing. Silver and GOLD PRICES will resolve soon enough, and resolve upward since the bull markets in both are still alive. Markets were pretty quiet today. Stocks kept on arching in that trajectory from yesterday that suggests a correction has begun. The US dollar index lost more ground, leaving me to doubt to outcome prophesied by the optimists. And silver and gold marked time. Stocks made tiny moves -- Dow lost 8.99 (0.06%) to 15,967.03 and S&P500 lost 3.66 (0.2%) to 1,787.87 -- but it wasn't the size of the moves that speak. Rather, it was their direction, confirming what looked yesterday like a key reversal in some indices. Stocks are way overdue for a correction. When any market piles up new highs day after day and the optimists run hog wild, the days of the move are numbered, and I don't give two hoots how many "experts" tell me "It's different this time." They always say that, right before a crash. Dow in Gold and Dow in Silver continue to hang in the balance, the DiG near its June high -- mmmm, with gold much higher but stocks higher, too, and not by a lower gold price -- while the DiS stubbornly refuses to rise that high. DiG closed 12.539 oz, down 0.15% while the DiS gained 0.6% to 785.55 oz. Keep watching them, because that's where we'll see the turn of stocks and the turn of metals first. If the dollar index is not forming a bullish flag or pennant (a downsloping correction that looks like a flag), then its in trouble. Lost another 5.5 basis points today to 80.675. Euro rose 0.23% to $1.3539 and the Yen fell 0.18% back below 100c to 99.88 cents/Y100. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||

| Gold Price Climbed $1.20 to $1,273.40 Posted: 19 Nov 2013 04:33 PM PST Gold Price Close Today : 1273.40 Change : 1.20 or 0.09% Silver Price Close Today : 20.326 Change : -0.023 or -0.11% Gold Silver Ratio Today : 62.649 Change : 0.130 or 0.21% Silver Gold Ratio Today : 0.01596 Change : -0.000033 or -0.21% Platinum Price Close Today : 1518.10 Change : 8.90 or 0.59% Palladium Price Close Today : 721.60 Change : 5.20 or 0.73% S&P 500 : 1,787.87 Change : -3.66 or -0.20% Dow In GOLD$ : $259.20 Change : $ -0.39 or -0.15% Dow in GOLD oz : 12.539 Change : -0.019 or -0.15% Dow in SILVER oz : 785.55 Change : 0.45 or 0.06% Dow Industrial : 15,967.03 Change : -8.99 or -0.06% US Dollar Index : 80.674 Change : 0.055 or 0.07% Silver fell 2.3 cents to 2032.6c while the GOLD PRICE climbed $1.20 to $1,273.40. That was on a 23 cent range for silver and a $7 range on the gold price, dead as a ball-peen hammer. I'm starting to get suspicious. Markets have a way of slapping you in the back of the head with surprises. What's keeping them up? Both appear to be dead. I have to suspect some big move, up or down, will emerge soon. However, this time of year is often very slow as investors wind down positions toward the Thanksgiving holiday. No point in chafing. Silver and GOLD PRICES will resolve soon enough, and resolve upward since the bull markets in both are still alive. Markets were pretty quiet today. Stocks kept on arching in that trajectory from yesterday that suggests a correction has begun. The US dollar index lost more ground, leaving me to doubt to outcome prophesied by the optimists. And silver and gold marked time. Stocks made tiny moves -- Dow lost 8.99 (0.06%) to 15,967.03 and S&P500 lost 3.66 (0.2%) to 1,787.87 -- but it wasn't the size of the moves that speak. Rather, it was their direction, confirming what looked yesterday like a key reversal in some indices. Stocks are way overdue for a correction. When any market piles up new highs day after day and the optimists run hog wild, the days of the move are numbered, and I don't give two hoots how many "experts" tell me "It's different this time." They always say that, right before a crash. Dow in Gold and Dow in Silver continue to hang in the balance, the DiG near its June high -- mmmm, with gold much higher but stocks higher, too, and not by a lower gold price -- while the DiS stubbornly refuses to rise that high. DiG closed 12.539 oz, down 0.15% while the DiS gained 0.6% to 785.55 oz. Keep watching them, because that's where we'll see the turn of stocks and the turn of metals first. If the dollar index is not forming a bullish flag or pennant (a downsloping correction that looks like a flag), then its in trouble. Lost another 5.5 basis points today to 80.675. Euro rose 0.23% to $1.3539 and the Yen fell 0.18% back below 100c to 99.88 cents/Y100. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||

| Warning - NSA To Oversee Individual Bank Accounts & Wealth Posted: 19 Nov 2013 03:57 PM PST  Today a 42-year market veteran warned King World News that the NSA is going to be overseeing individual bank accounts and wealth. Hathaway, who is one of the most respected institutional minds in the world today, and whose fund was awarded a coveted 5-star rating by Morningstar, also discussed the NSA's invasion of privacy, the skyrocketing price of Bitcoins, as well as what all of this means for the gold and silver markets. Today a 42-year market veteran warned King World News that the NSA is going to be overseeing individual bank accounts and wealth. Hathaway, who is one of the most respected institutional minds in the world today, and whose fund was awarded a coveted 5-star rating by Morningstar, also discussed the NSA's invasion of privacy, the skyrocketing price of Bitcoins, as well as what all of this means for the gold and silver markets.This posting includes an audio/video/photo media file: Download Now | |||

| Morgan: Over The Long Run Gold & Silver Will Be The Ultimate Currency Posted: 19 Nov 2013 02:26 PM PST In his latest interview, David Morgan from The Morgan Report gives his view on the gold and silver outlook for 2014, how the dollar is steadily losing trust, why mainstream loves to talk down gold, and whether this is a good time to accumulate physical precious metals. The gold and silver outlook for 2014:

What to think of the anecdotal evidence that foreigners increasingly do not want to hold the dollar (for isntance, in Europe and even Israel):

Morgan’s view on why the mainstream keeps on talking gold down:

Whether it is good time to accumulate metals now:

The Morgan Report is offering 30 days free trial plus 16 special reports for free to all new premium service subscribers.

| |||

| SILVER BEARS: You Have Been Warned Posted: 19 Nov 2013 02:24 PM PST | |||

| Gold Seeker Closing Report: Gold and Silver End Slightly Lower Posted: 19 Nov 2013 01:20 PM PST Gold dipped $4.55 to $1269.15 by a little after 6AM EST before it climbed to as high as $1278.76 in morning New York trade, but it then dropped back off midday and ended with a loss of 0.02%. Silver slipped to $20.219 before it bounced back to $20.493, but it then fell back off in late trade and ended with a loss of 0.44%. | |||

| Gold Daily and Silver Weekly Charts - Artificial Intelligence Posted: 19 Nov 2013 01:15 PM PST | |||

| Gold Daily and Silver Weekly Charts - Artificial Intelligence Posted: 19 Nov 2013 01:15 PM PST | |||

| Gold vs. the State: A Comedian Writes... Posted: 19 Nov 2013 01:05 PM PST What does is mean when the best financial analysis doesn't come from finance specialists...? IT SAYS a lot about the financial establishment that the most revelatory coverage of the worst financial crisis in living memory has appeared, not in the pages of the Financial Times or the Wall Street Journal, but in those of Vanity Fair and Rolling Stone, writes Tim Price at ThePriceofEverything. In the first example, former bond salesman Michael Lewis displayed the finest characteristics of investigative journalism whilst exploring the more ridiculous examples of modern greed and credit-based insanity in forensic detail. In the second, Matt Taibbi broke new ground in gonzo journalism as he tilted against the previously impregnable windmills of Wall Street, giving us in the process the immortal description of the taxpayer-rescued brokerage firm Goldman Sachs as "a giant vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money". In the latest iteration of serious economic and cultural analysis arising from a non-mainstream source, we now have Life After The State – a critique of government written by a stand-up comedian. In Dominic Frisby's defence, he wears multiple hats. As his Twitter profile puts it, he is an "Accidental financial bod, MoneyWeek writer, comedian, actor of unrecognized genius, voice of many things, & presenter." And now an author. Published by the crowd-funding website Unbound, 'Life After The State' follows hot on the heels of Douglas Carswell's The End Of Politics and Guy Fraser-Sampson's The Mess We're In, and each attempts to address a nagging feeling from a slightly different perspective. That feeling was well expressed recently by the outspoken investor Paul Singer of Elliott Management when he remarked, almost in passing, that

Or to put it another way, what the hell just happened, and why? The answer, and the beast that has to be slaughtered for any hope of progress and recovery, is Big Government. Many readers will doubtless respond that any retrenchment by an over-mighty State is simply wishful thinking. Some of us might respond in turn that it is actually a mathematical certainty. But Dominic, early on, spikes the guns of scepticism by citing the anonymous internet poster known as 'Injin':

Frédéric Bastiat's broken window fallacy also gets an early airing, which is entirely justifiable – it's one of the most powerful ideas in the history of economics. We can 'see' what in the economy gets spent (by Big Government, having raided our wallets first, or worse, the wallets of those as yet unborn), but we cannot 'see' how that money might have been spent in the absence of Big Government. And there are only three ways of spending money. We can spend it on ourselves. Which is nice. Or we can spend it on other people. Which is quite nice. Or we can spend other people's money on other people, which is what government actually does, and which tends to lead to malinvestment, waste, zombie banking, and so on. Happily, although there's no shortage of economics in Life After The State, it's all painlessly incorporated into the general argument, which makes for a highly readable and engaging book. Another powerful idea arises in Chapter 8, and it's a killer – quite literally. If governments had been separated from their monopoly control to print money, World War I would have been over by Christmas 1914...

And the same holds for almost all wars. "No war has ever been fought on a cash basis. Costs are concealed by deficit spending. If taxes had to rise concomitantly in the same year that wars were being fought, people would not pay. Instead, the cost is added to the national debt. People don't have to pay £10 billion this year; instead they pay an extra £500 million every single year for eternity in interest on the national debt. Take away this power to create money and run deficits, and you suddenly limit the scope of the war to the amount of money the government has. In other words you limit government power – and you limit the damage that they can do. That alone is reason enough to separate money and state." Life After The State is particularly good as a primer on gold, sound money and inflation. The anecdotal always helps, for context. "But the price of oil in US dollars has gone from $3.50 a barrel in 1972 to around $100 now. That's something like a 96% loss in purchasing power. The same goes for all modern government currencies, which buy you less and less each year: less house, less chocolate bar, less anything.

The State is so entrenched in our lives it is sometimes difficult to imagine life without it. It "looks after the birth of the baby, educates the child, employs the man, cares for the aged, and buries the dead." But in doing so it also spends £700 insuring each birth against negligence claims; while it educates the child, there can be no guarantee that it does so well – no matter, the examination pass rates, like the currency, can easily be inflated; the man may be employed, but not gainfully so. On Thursday last week, the newspaper of the neo-Keynesian financial establishment, the Financial Times, had room for three stories on its front page. One of them covered the resignation of Barclays' head of compliance, Sir Hector Sants, on the grounds of stress and exhaustion (cue mass playing by an orchestra of the world's smallest violins). Sir Hector was previously chief executive of the Financial Services Authority, an arm of Big Government in other words, if not a particularly successful one, if current financial scandals and the health of the banking system are any guide. Another FT story detailed how a Prime Minister evidently deeply committed to free markets was pressing mobile phone companies to cut their bills to customers. If David Cameron were really serious about inflation, though, he would be advised to pay closer attention to what Mark Carney has been up to at the Bank of England. The FT's main story, "Rate rise signalled for 2014 as UK recovery takes hold", was accompanied by a photograph of Mr. Carney looking for all the world like an evil little elf (for all we know, perhaps he is one). Apparently the Bank of England is now considering a UK rate hike as soon as next year, and 18 months sooner than previously expected by the market. One wonders what all those first-time buyers lured into buying property by the government, the Bank of England and their easy money policies, might make of that. | |||

| Gold vs. the State: A Comedian Writes... Posted: 19 Nov 2013 01:05 PM PST What does is mean when the best financial analysis doesn't come from finance specialists...? IT SAYS a lot about the financial establishment that the most revelatory coverage of the worst financial crisis in living memory has appeared, not in the pages of the Financial Times or the Wall Street Journal, but in those of Vanity Fair and Rolling Stone, writes Tim Price at ThePriceofEverything. In the first example, former bond salesman Michael Lewis displayed the finest characteristics of investigative journalism whilst exploring the more ridiculous examples of modern greed and credit-based insanity in forensic detail. In the second, Matt Taibbi broke new ground in gonzo journalism as he tilted against the previously impregnable windmills of Wall Street, giving us in the process the immortal description of the taxpayer-rescued brokerage firm Goldman Sachs as "a giant vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money". In the latest iteration of serious economic and cultural analysis arising from a non-mainstream source, we now have Life After The State – a critique of government written by a stand-up comedian. In Dominic Frisby's defence, he wears multiple hats. As his Twitter profile puts it, he is an "Accidental financial bod, MoneyWeek writer, comedian, actor of unrecognized genius, voice of many things, & presenter." And now an author. Published by the crowd-funding website Unbound, 'Life After The State' follows hot on the heels of Douglas Carswell's The End Of Politics and Guy Fraser-Sampson's The Mess We're In, and each attempts to address a nagging feeling from a slightly different perspective. That feeling was well expressed recently by the outspoken investor Paul Singer of Elliott Management when he remarked, almost in passing, that

Or to put it another way, what the hell just happened, and why? The answer, and the beast that has to be slaughtered for any hope of progress and recovery, is Big Government. Many readers will doubtless respond that any retrenchment by an over-mighty State is simply wishful thinking. Some of us might respond in turn that it is actually a mathematical certainty. But Dominic, early on, spikes the guns of scepticism by citing the anonymous internet poster known as 'Injin':

Frédéric Bastiat's broken window fallacy also gets an early airing, which is entirely justifiable – it's one of the most powerful ideas in the history of economics. We can 'see' what in the economy gets spent (by Big Government, having raided our wallets first, or worse, the wallets of those as yet unborn), but we cannot 'see' how that money might have been spent in the absence of Big Government. And there are only three ways of spending money. We can spend it on ourselves. Which is nice. Or we can spend it on other people. Which is quite nice. Or we can spend other people's money on other people, which is what government actually does, and which tends to lead to malinvestment, waste, zombie banking, and so on. Happily, although there's no shortage of economics in Life After The State, it's all painlessly incorporated into the general argument, which makes for a highly readable and engaging book. Another powerful idea arises in Chapter 8, and it's a killer – quite literally. If governments had been separated from their monopoly control to print money, World War I would have been over by Christmas 1914...

And the same holds for almost all wars. "No war has ever been fought on a cash basis. Costs are concealed by deficit spending. If taxes had to rise concomitantly in the same year that wars were being fought, people would not pay. Instead, the cost is added to the national debt. People don't have to pay £10 billion this year; instead they pay an extra £500 million every single year for eternity in interest on the national debt. Take away this power to create money and run deficits, and you suddenly limit the scope of the war to the amount of money the government has. In other words you limit government power – and you limit the damage that they can do. That alone is reason enough to separate money and state." Life After The State is particularly good as a primer on gold, sound money and inflation. The anecdotal always helps, for context. "But the price of oil in US dollars has gone from $3.50 a barrel in 1972 to around $100 now. That's something like a 96% loss in purchasing power. The same goes for all modern government currencies, which buy you less and less each year: less house, less chocolate bar, less anything.

The State is so entrenched in our lives it is sometimes difficult to imagine life without it. It "looks after the birth of the baby, educates the child, employs the man, cares for the aged, and buries the dead." But in doing so it also spends £700 insuring each birth against negligence claims; while it educates the child, there can be no guarantee that it does so well – no matter, the examination pass rates, like the currency, can easily be inflated; the man may be employed, but not gainfully so. On Thursday last week, the newspaper of the neo-Keynesian financial establishment, the Financial Times, had room for three stories on its front page. One of them covered the resignation of Barclays' head of compliance, Sir Hector Sants, on the grounds of stress and exhaustion (cue mass playing by an orchestra of the world's smallest violins). Sir Hector was previously chief executive of the Financial Services Authority, an arm of Big Government in other words, if not a particularly successful one, if current financial scandals and the health of the banking system are any guide. Another FT story detailed how a Prime Minister evidently deeply committed to free markets was pressing mobile phone companies to cut their bills to customers. If David Cameron were really serious about inflation, though, he would be advised to pay closer attention to what Mark Carney has been up to at the Bank of England. The FT's main story, "Rate rise signalled for 2014 as UK recovery takes hold", was accompanied by a photograph of Mr. Carney looking for all the world like an evil little elf (for all we know, perhaps he is one). Apparently the Bank of England is now considering a UK rate hike as soon as next year, and 18 months sooner than previously expected by the market. One wonders what all those first-time buyers lured into buying property by the government, the Bank of England and their easy money policies, might make of that. | |||

| Where Flat Tax Leads, Gold Standards Follow Posted: 19 Nov 2013 01:00 PM PST Gold standard systems are likely to ape the way that small countries led the way with flat tax... BETWEEN 2000 and 2010, writes Nathan Lewis at New World Economics, the number of countries which adopted some kind of "flat tax" income tax system expanded from nine to over forty. Why did this happen? How did this happen? Of course, each country had its own visionaries and thinkers and policymakers that made it happen. But, on a global basis, it went something like this: First, the idea was expressed in concrete, specific and practical terms, not just vague airy-fairy principles. Then it spread and was widely embraced. Then, those countries that were in a position, politically and in terms of their own history and aspirations, to put it into place, did so. Who could have known that the governments of Mongolia (2007, 10%) or the Seychelles (2010, 15%) would embrace a Flat Tax? The "flat tax" idea was adopted by Hong Kong in 1947, and was more recently revived in the early 1980s, by people like Alvin Rabushka and Jack Kemp. However, I attribute much of its later blooming to the efforts of Steve Forbes, who made it a centerpiece of two high-profile presidential campaigns in 1996 and 2000. It was also broadly adopted among the Republican party intelligentsia, such as conservative think tanks, during this time. The Flat Tax made no political progress in the United States itself. It is more politically remote today than it was in 1988, when the Reagan Revolution was in full force. But the idea – basically the Steve Forbes proposal verbatim – flowered in dozens of other countries worldwide. I say that the Magic Formula is: Low Taxes and Stable Money. A "flat tax" is one proven approach to Low Taxes, although there are other methods that might work. A gold standard system is a proven approach to Stable Money. As has been the case for the Flat Tax, I don't think a gold standard approach has much political chance of being implemented in the U.S. at this time. The United States is just not in a situation — politically, historically and intellectually — for that to happen now. But, there are over a hundred other governments in the world, and they might find that it is just the right idea at the right time – for them. It could be a government we would have never thought of as embracing a gold-based approach. It could be Nepal, Trinidad, Cameroon or Croatia. Oddly enough, I have heard that nobody in, for example, Belarus (2009, 12%), contacted any of the U.S. Flat Tax thought leaders before they implemented the idea into policy. They just did it themselves, without that kind of direct interaction. Thus, it is possible that the parliament of Gabon or Sri Lanka will just implement a gold standard system some day, to the surprise of everyone including people like me who pay a lot of attention to this stuff. It might be a parallel currency-type framework, as espoused by Ron Paul (and myself), which would be very appropriate for today's still very dollar-centric world. However, just as dozens of countries looked for inspiration to the United States and its thought leaders like Steve Forbes, they may again turn to the United States for inspiration regarding new monetary systems. Thus, I think of what we do here as a kind of theater. I am building a base of economic understanding, in English, in the United States, because that is the stage upon which these things are done. But, I expect the results to be seen somewhere else. Probably a small and insignificant country. Among the first countries to adopt a Flat Tax system were Latvia, Lithuania, and Estonia, in 1994. Estonia has a population of 1.3 million. These are tiny countries, smaller than some US counties, in both land area and population. But, their fantastic success caught the attention of other former Soviet governments. Russia followed with its 13% Flat Tax in 2001, the first large country to adopt this policy. Then, the horses left the gate and began running free. It will probably be the same with the world's next gold standard system. A half-dozen small countries will try it, find success, and then China or Brazil will follow. Dozens of governments will be close behind. By then it will seem obvious and inevitable. | |||

| Where Flat Tax Leads, Gold Standards Follow Posted: 19 Nov 2013 01:00 PM PST Gold standard systems are likely to ape the way that small countries led the way with flat tax... BETWEEN 2000 and 2010, writes Nathan Lewis at New World Economics, the number of countries which adopted some kind of "flat tax" income tax system expanded from nine to over forty. Why did this happen? How did this happen? Of course, each country had its own visionaries and thinkers and policymakers that made it happen. But, on a global basis, it went something like this: First, the idea was expressed in concrete, specific and practical terms, not just vague airy-fairy principles. Then it spread and was widely embraced. Then, those countries that were in a position, politically and in terms of their own history and aspirations, to put it into place, did so. Who could have known that the governments of Mongolia (2007, 10%) or the Seychelles (2010, 15%) would embrace a Flat Tax? The "flat tax" idea was adopted by Hong Kong in 1947, and was more recently revived in the early 1980s, by people like Alvin Rabushka and Jack Kemp. However, I attribute much of its later blooming to the efforts of Steve Forbes, who made it a centerpiece of two high-profile presidential campaigns in 1996 and 2000. It was also broadly adopted among the Republican party intelligentsia, such as conservative think tanks, during this time. The Flat Tax made no political progress in the United States itself. It is more politically remote today than it was in 1988, when the Reagan Revolution was in full force. But the idea – basically the Steve Forbes proposal verbatim – flowered in dozens of other countries worldwide. I say that the Magic Formula is: Low Taxes and Stable Money. A "flat tax" is one proven approach to Low Taxes, although there are other methods that might work. A gold standard system is a proven approach to Stable Money. As has been the case for the Flat Tax, I don't think a gold standard approach has much political chance of being implemented in the U.S. at this time. The United States is just not in a situation — politically, historically and intellectually — for that to happen now. But, there are over a hundred other governments in the world, and they might find that it is just the right idea at the right time – for them. It could be a government we would have never thought of as embracing a gold-based approach. It could be Nepal, Trinidad, Cameroon or Croatia. Oddly enough, I have heard that nobody in, for example, Belarus (2009, 12%), contacted any of the U.S. Flat Tax thought leaders before they implemented the idea into policy. They just did it themselves, without that kind of direct interaction. Thus, it is possible that the parliament of Gabon or Sri Lanka will just implement a gold standard system some day, to the surprise of everyone including people like me who pay a lot of attention to this stuff. It might be a parallel currency-type framework, as espoused by Ron Paul (and myself), which would be very appropriate for today's still very dollar-centric world. However, just as dozens of countries looked for inspiration to the United States and its thought leaders like Steve Forbes, they may again turn to the United States for inspiration regarding new monetary systems. Thus, I think of what we do here as a kind of theater. I am building a base of economic understanding, in English, in the United States, because that is the stage upon which these things are done. But, I expect the results to be seen somewhere else. Probably a small and insignificant country. Among the first countries to adopt a Flat Tax system were Latvia, Lithuania, and Estonia, in 1994. Estonia has a population of 1.3 million. These are tiny countries, smaller than some US counties, in both land area and population. But, their fantastic success caught the attention of other former Soviet governments. Russia followed with its 13% Flat Tax in 2001, the first large country to adopt this policy. Then, the horses left the gate and began running free. It will probably be the same with the world's next gold standard system. A half-dozen small countries will try it, find success, and then China or Brazil will follow. Dozens of governments will be close behind. By then it will seem obvious and inevitable. | |||

| Taking delivery of gold and silver from your retirement account Posted: 19 Nov 2013 12:40 PM PST One question that comes up quite often regarding an IRA with physical coins and bars is whether the investor has the ability to take physical delivery. The answer is an unequivocal “yes”. In fact, more and more clients are opting for such an option when they are required to take a distribution. This situation arises primarily when a client turns 70.5 years of age, which triggers the required minimum distribution or RMD as it is known in the trade. The other situation is when a person inherits an IRA in stocks and then moves it into gold or silver. This is termed a Beneficiary IRA. The IRS offers a choice here: (1) Either the beneficiary must take the entire amount as income within five years of the owner’s death, or (2) the beneficial owner is required to withdraw a certain percentage every year based on the age of the beneficiary. Taking physical delivery is not as daunting as it may sound. The first step is to contact your representative at USAGOLD to discuss the timing and amount of the distribution, especially if the distribution needs to be taken before the end of the year. The next step is to contact the trust company which is acting as trustee. Normally, there is a form entitled “Distribution Request” on the website that instructs the person what to do. A request must be submitted ahead of time in order to allow processing of the request. Because we are dealing with physical metals, a person should allow at least two weeks for the request to be processed and the metals to be shipped. There will be a small amount charged to ship and insure the metals. These fees can be handled by either sending a check ahead of time, paying by credit card, or by using whatever cash in sitting in the account. A signature will be required before the package is released. A large segment of our IRA clientele purchased gold and silver within their plans as a hedge against economic uncertainties. For those who wish to maintain that hedge, an in-kind distribution of the metal makes a great deal of sense, particularly at what many feel to be cyclical lows. We can help you accomplish that goal. | |||

| FCA launches gold benchmark rigging review Posted: 19 Nov 2013 11:55 AM PST Financial Conduct Authority launches preliminary review into possible rigging of gold benchmarks This posting includes an audio/video/photo media file: Download Now | |||

| Dressed to the Nines with Gold Posted: 19 Nov 2013 11:54 AM PST While paper gold is getting the cold shoulder in the West, the Love Trade buyers in the East are wrapping their arms around all the physical gold they can get their hands on. In the third quarter, gold jewelry demand was at the highest level since 2010. Buying out of love in the East was significantly higher during the first nine months of the year compared to demand the same time last year, according to the World Gold Council (WGC). As the chart shows, buyers in Hong Kong and China went on a shopping spree for gold jewelry, as demand rose 40 percent and 35 percent, respectively, on a year-to-date basis in 2013 compared to the same period last year. | |||

| Once they discover that central banks do the gold rigging, the regulators will back off Posted: 19 Nov 2013 11:40 AM PST Gold Benchmarks Said to Be Reviewed in U.K. Rates Probe By Suzi Ring http://www.bloomberg.com/news/2013-11-19/gold-benchmarks-said-to-be-unde... LONDON -- The U.K. Financial Conduct Authority is reviewing gold benchmarks as part of its wider probe of how global rates are set, a person with knowledge of the matter said. The FCA review is preliminary and hasn't risen to the level of a formal investigation, said the person, who asked not to be identified because the matter isn't public. The person declined to say which gold benchmarks were under scrutiny. One of the key benchmarks is the London gold fixing, which determines the spot price for physical gold and is set twice daily by a panel of five banks. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Regulators around the world are examining alleged abuses of a number of financial benchmarks by companies that play a central role in setting them after it emerged the London interbank offered rate, or Libor, the benchmark interest rate for more than $360 trillion of securities worldwide, was being manipulated. The scandal also sparked reviews of how to improve how rates are set to prevent them from being rigged in the future, and which ones should have formal oversight. Lara Joseph, a spokeswoman for the FCA, declined to comment on the review. In addition to Libor, regulators including the FCA are investigating rate-rigging in the $5.3 trillion-a-day foreign-exchange market, and ISDAfix, a benchmark for interest-rate swaps. Separately, the FCA will publish an update on its approach to supervision of commodities markets, including gold, before the end of the year, Joseph said. Commodities traders who buy and sell as much as $5.67 trillion of raw materials a year say the benchmark prices for everything from oil to iron ore to gasoline are wrong as often as 27 percent of the time, according to a Bloomberg survey completed this year. Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... | |||

| The Daily Market Report: Gold Underpinned By Global Headwinds Posted: 19 Nov 2013 11:09 AM PST

The OECD negatively revised their 2014 growth forecast for the global economy from +4.0% to +3.6%. The OECD specifically cites the “uncertain future of U.S. fiscal and central bank policies,” according to an article today in The Wall Street Journal. Folks that have been lured into the stock market recently should heed this warning, as it marks a distinct shift in the organization’s main area of concern. The OECD’s previous primary concern was the eurozone, but suddenly they view the U.S. as the most immediate threat to the global recovery. The OECD advised that the U.S. debt ceiling should be abolished and replaced by “a credible long-term budgetary consolidation plan with solid political support.” Like that’s going to happen any time soon, given our politically divided country and government… However, it is a reminder that we are in fact operating without a debt ceiling until February 7. Early in the new year, the whole debate about the debt ceiling and default risks will start anew, just as the Fed is engaged in a transition to new leadership. The latest thinking is that the taper might be announced at the March FOMC meeting, the first that would be presided over by Janet Yellen. Of course, if Congress and the White House are wrangling once again over spending cuts in exchange for another hike to the debt ceiling, well the odds of a taper diminish substantially. | |||

| Venezuela reported planning to pawn its gold through Goldman Sachs Posted: 19 Nov 2013 10:43 AM PST The Venezuela newspaper El Nacional, the voice of that tortured country's political opposition, reports today in the story appended here that, after triumphantly repatriating its gold reserves two years ago, Venezuela has sunk so much economically under its predatory socialist regime that it will raise cash by pawning its gold through Goldman Sachs. | |||

| Gold Fear Buy VS Gold Ecstasy Buy Posted: 19 Nov 2013 10:39 AM PST I'm becoming increasingly concerned by emails that I'm receiving from amateur investors. These emails tout a fabulous future for the American stock market. Many stock buybacks have occurred, but actual earnings growth for American ... Read More... | |||