saveyourassetsfirst3 |

- More gold curbs in India as RBI cracks down on special economic zones

- What gold's first annual fall in over a decade could imply

- ASX Wrap: High grade gold from Beadell and Ramelius, as Whitehaven lands in hot water

- Can’t-miss headlines: Republicans on gold, art spikes and more

- Paulson’s and Soros’ views on gold positive

- Unusual chart shows when the decline of the U.S. dollar could end

- Pay attention... One of the last sectors you'd expect could be starting a MASSIVE new rally

- Allied Nevada Is Not A Walking Dead

- Playing The Long Game: How Big Are China's Real Gold Reserves?

- The Zero Hedge of Precious Metals

- Indian Gold Dealer: “Gold Demand Cannot Go Down; By End Of December, All Jewelers Will Need To Replenish Stock”

- Will gold drop to $1,000 or was the bottom formed this summer?

- Molycorp Multi-Bagger Potential In 18 Months

- Gold Investment & the Flow of Money

- The Best #AskJPM Tweets

- Gold rebounds as China vows market reforms

- NSA Spying Crushes US Tech Companies in Emerging Markets (“An Industry Phenomenon,” Says Cisco’s Chambers)

- The Physical Pressure Cooker

- Janet Yellen’s gold knowledge

- Cooperation between central banks

- SILVER BEARS: You Have Been Warned!

- Gold flows east As three pieces of Bacon sell for €105 million

- Gold Flows East As Three Pieces Of Bacon Sell For €105 Million

- G+ Hangout with Jan Skoyles and Koos Jansen

- USD & Euro Indices Correct – What About Gold?

- Gold Stocks: ?W? or IHS?

- Chart of the Day: Obama’s Job’s Recovery

- Gold cheered by Yellen’s dovishness and policy continuity

- Popularity of Bitcoins

- Market Report: Have we reached a selling climax?

- Gold Flows East As Three Pieces Of Bacon Sell For €105 Million

- Jim Willie: The Financial System is Imploding, 50% Overnight Dollar Devaluation Coming!

- The Stock Market Has Become Insane

- Yellen’s Senate Testimony in Less Than Two Minutes

- Gold Rebounds as China Vows Market Reforms, US Fed Blamed for Shanghai Rates Spike

- Comex Registered Gold Falls To 587,235 Ounces - Claims at 63 to 1 - The Karma of Buddhas Palm

- Chris Powell: Central Banks Know the Vulnerability of Fractional-Reserve Gold

- The New York Sun: Yellen Strikes Out

- Tocqueville Gold Fund Managers: Gold Isn't in Exile, It's Just on Vacation

- World Gold Council just shrugs at India's financial repression

- Will 2014 mark the return of the gold ETF investor?

- ETF outflows pull gold demand lower in Q3 - WGC

- Chart demonstrating gold's inexorable move east

- Billionaire Paulson Sticks With Gold Wager as Prices Rebound

- Investors Flock to Silver Coins

- Gold Making People Crazy in Search for Sunken Treasure

- Indian temple to glitter with 300kg of Thai gold

- GATA's Chris Powell: Central banks know vulnerability of fractional-reserve gold

- India Gold Premium Hits Record 21.6%

- Gold Price Analysis- Nov. 15, 2013

| More gold curbs in India as RBI cracks down on special economic zones Posted: 15 Nov 2013 05:14 PM PST In a new missive, the country's reserve bank has directed these gold importing agencies and trading houses to import gold exclusively for the purpose of exports. |

| What gold's first annual fall in over a decade could imply Posted: 15 Nov 2013 05:04 PM PST Unless something big happens, 2013 will mark the first year in more than 10 in which gold prices will end the year lower than they started. |

| ASX Wrap: High grade gold from Beadell and Ramelius, as Whitehaven lands in hot water Posted: 15 Nov 2013 02:14 PM PST Conflicting views from Australia's groups paint a mixed picture for Australia's mining scene while Ramelius and Beadell announce strong drill results. |

| Can’t-miss headlines: Republicans on gold, art spikes and more Posted: 15 Nov 2013 01:43 PM PST Headlines that impact the mining sector, today we look at the Republicans' love affair with gold, the LME warehouse saga and Barrick's lukewarm share placement. |

| Paulson’s and Soros’ views on gold positive Posted: 15 Nov 2013 12:40 PM PST John Paulson retaining his gold holdings last quarter and George Soros buying back into gold shares was positive news for US investors, says Julian Phillips. |

| Unusual chart shows when the decline of the U.S. dollar could end Posted: 15 Nov 2013 12:26 PM PST From Chart in Focus: It should not be surprising that there is a relationship between interest rates and the value of the dollar. What may be surprising is precisely how long it takes for movements in interest rates to actually show up in the dollar. This week's chart looks all the way back to the beginning of the data for the U.S. Dollar Index back in 1971. A comparison is made to the 10-year T-Note yield, and the key insight is that shifting bond yields forward by... More on the U.S. dollar: |

| Pay attention... One of the last sectors you'd expect could be starting a MASSIVE new rally Posted: 15 Nov 2013 12:26 PM PST From Jeff Clark in Growth Stock Wire: One day doesn't make a trend. Heck, two days may not do it, either. But the action in mining stocks over the past week is bullish. Mining stocks staged a major reversal last Friday. The price of gold dropped $20 on the opening – gapping down below important support at $1,300 per ounce. Gold stocks cratered along with it. The Market Vectors Gold Miners Fund (GDX) opened down 3%, and it looked like it was going to be another miserable day for the mining sector. But by midday, many mining stocks started to climb off their lows. A few, such as Allied Nevada (ANV) and Silver Standard Resources (SSRI), turned positive on the day. Meanwhile, gold closed near the low of the day, around $1,285 per ounce. GDX ended the day with a gain of 0.6%. That's not much. But it marked an important reversal off the morning lows and an important divergence from the price of gold. Remember... this is how gold stocks typically bottom. They gap sharply lower, reach an exhaustive low, and then rally back and close at the highs of the day. That they were able to do this while the price of gold was falling just adds strength to the argument that the sector is "sold out." We saw this sort of action back in... More on gold stocks: |

| Allied Nevada Is Not A Walking Dead Posted: 15 Nov 2013 11:52 AM PST The Nutshell In this recent article on precious metal mining company Allied Nevada (ANV) our fellow author Ben Kramer Miller has attempted to analyze the implications of this company's debt load. According to this article, this company's debt load is unsustainable through 2014 assuming the current gold price environment. In fact, in the comments section of this article the author states when asked for a valuation of the company:

Some strong wording, indeed. Unfortunately based on false numbers, shonky methodology and |

| Playing The Long Game: How Big Are China's Real Gold Reserves? Posted: 15 Nov 2013 11:47 AM PST There is much speculation over the quantification of China's gold reserves. Are they only 1,054 metric tons as the official figures would have us believe? Or are they considerably higher as many gold analysts suggest? And what game is China playing if they are? The Chinese impact on global gold demand is key to likely gold price performance in the months and years ahead and thus of major significance for the investor in gold bullion, ETFs and gold stocks. China is already almost certainly the world's largest consumer of gold this year and is likely to absorb at least 1,500 metric tons of the yellow metal purely through imports through Hong Kong plus its own gold output - it is currently the world's No. 1 producer with 2013 output estimated as likely to be in the order of 430 metric tons by the China Gold Group. Deep down the Chinese |

| The Zero Hedge of Precious Metals Posted: 15 Nov 2013 11:30 AM PST Long time readers know Zero Hedge is my "go to" website for real-time economic information; and more importantly, truthful commentary. That is, except for the Precious Metals sector; which until recently was its "blind spot." Today, Zero Hedge no longer ignores Precious Metals suppression, that's for sure. However, they don't dedicate a great deal of effort to discussing it – as Zero Hedge's operators are not in the business of discussing PMs per se; but instead, the flaws of the entire global financial system. Precious Metals itself are but a microcosm of a much broader realm; and thus, for expert, unadulterated analysis, one needs to search a bit more deliberately. There are a number of "good, smart people" in our space – each with varying degrees of expertise, motivation, and agenda. Obviously, Eric Sprott, James Turk, and Jim Sinclair come immediately to mind; as do Egon von Greyerz, Andrew Maguire, Jeff Nielson, Bix Weir, Jay Taylor, Chris Duane, and a handful of others. And let's not forget Bill Murphy and Chris Powell of GATA, who jump started the crusade to expose PM corruption before most realized it existed. However, not all commentary is free; and few, if any sources, offer it daily. As for the bullion industry itself, it remains one of the most opaque financial businesses in the Western Hemisphere. In large part, the lack of transparency is a function of four decades of brainwashing Americans – and even Europeans – that dollar, euros, and other fiat trash represent "money," whilst gold and silver are "barbarous relics." Moreover, as is the case with the mining industry itself, bullion dealers have been woefully lacking in the marketing of not just their products, but business models. And thus, the average person not only has no clue how to purchase precious metals, but where they can be found. As gold and silver have been in bull markets since the turn of the century – notwithstanding this year's vicious Cartel attacks – the bullion industry's cumulative marketing efforts have been, to say the least, subpar. Trust me, I know; as I've been purchasing physical gold and silver since 2008. There are only a handful of names I've entrusted my capital to, and fewer still that deploy significant capital to market themselves. And no, I'm not speaking of advertising on Precious Metals-specific websites; but appearing at investor conferences, writing blogs, appearing on radio shows and podcasts, hosting Webinars and Audio Blogs, and having Marketing personnel specifically devoted to education and customer service. More than a decade ago, David Schectman had the vision to write economic newsletters for Miles Franklin clients. Fortunately, he's darn good at it; and thus, gained a significant following. Remember, as difficult as Precious Metals retailing is now, it was a lot more difficult than; and thus, the ability to differentiate Miles Franklin in this manner was crucial not just to its success, but survival. Fortunately, global communications have become vastly more accessible to small businesses in recent years; particularly as internet usage and protocol expanded. All bullion dealers to some extent have utilized this opportunity, but some more than others. Over the years, Miles Franklin's quarterly newsletters became daily; and once the capability was available, we started emailing them to clients and archiving on our website. And with the hiring of myself in 2011 and Bill Holter in 2012, we garnered a broad, diverse team of writers with decades of experience in economics and financial markets – particularly, precious metals. When I joined the firm in October 2011, we started publishing two daily newsletters – and dramatically increasing our public speaking and podcast appearances. However, earlier this year, we realized that our efforts needed to be better coordinated to optimize the result; and hence, the current Miles Franklin Blog was born. Not only are our writings more concise, but published simultaneously – and uploaded in real time to our website. A great deal of time and cost has been expended in these efforts, which we hope you appreciate. And as anyone that has had an issue with the blog knows, we take all criticisms – and compliments – seriously, addressing them in as timely a fashion as possible. As the blog gained momentum, we have been adding new features to its "product line"; such as Audio blogs and the new "Miles Franklin Minute." Thus, at any given point in the day, you're likely to see new postings of all kinds – from blogs, to interviews and appearances, to informational videos. In my vision, the Miles Franklin Blog will become the "Zero Hedge of Precious Metals" – where PM enthusiasts congregate to learn about not only new developments on the economic front, but the bullion industry itself. And as always, our brokers – and officers – are available daily to answer your questions – at 800-822-8080.Similar Posts: |

| Posted: 15 Nov 2013 11:30 AM PST

When asked his thoughts on reports of Indian consumers switching to silver in response to high gold premiums, the head of operations at one of Inda’s top bullion dealers, Vishal Vyas concluded that, Whenever there are gold shipments available…say half a ton or 300-400 kilos, the premium comes down…but otherwise again, the premium will go [...] The post Indian Gold Dealer: "Gold Demand Cannot Go Down; By End Of December, All Jewelers Will Need To Replenish Stock" appeared first on Silver Doctors. |

| Will gold drop to $1,000 or was the bottom formed this summer? Posted: 15 Nov 2013 11:04 AM PST The blogosphere seems to have gotten the idea that I am predicting $1,000 as a sure thing. I've said many times in the past that I think there are parties trying to push gold to that level. Will they succeed is anyone's guess, but I think they are clearly trying.... |

| Molycorp Multi-Bagger Potential In 18 Months Posted: 15 Nov 2013 11:02 AM PST Overview Of the multitude of opportunities in the mining space cluttering my desk in preparation of the upcoming investor rotation into mining-from coal to black gold to gold-rare earths intrigue me right now, in that, the space really has a single 'big boy', Molycorp (MCP), whose stock has been knocked hard, down 94 percent from its high of $79.16 in May 2011. With the exception of, maybe, 2011, lousy earnings commensurate with lousy operating costs atop lousy spot REE prices have conspired to seriously whack this stock into the ground since the second half of 2011. Fears of inadequate supplies of REE in 2010 and 2011 soared demand and created a stockpiling effect among large buyers. But, as buyers reached their limit, demand collapsed in the second half of 2011, causing a plummet in prices. Delays and cost overruns at the company's Mountain Pass facility merely added to its woes. |

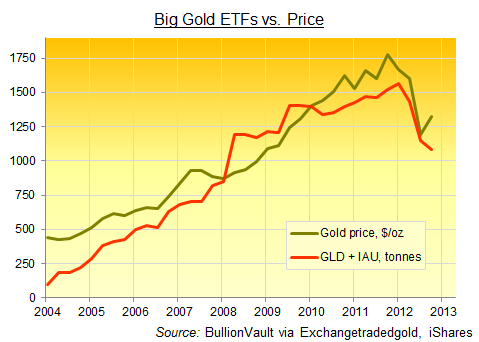

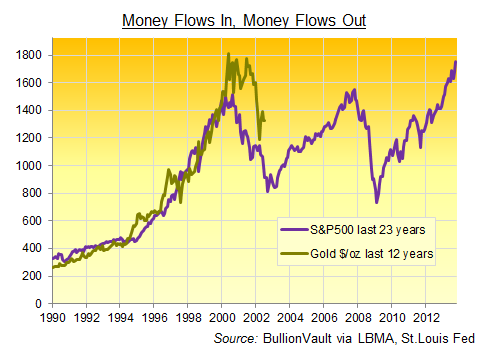

| Gold Investment & the Flow of Money Posted: 15 Nov 2013 10:47 AM PST Gold investment has receded in 2013. But money could flow back as quickly..._ WHICH number is greater? wonders Adrian Ash at BullionVault. The number of economists who were "the only person to forecast the financial crisis", or the number of people who claim that they alone dreamt up the idea of gold ETFs at the start of last decade? Either way, the crisis struck, and gold ETF holdings leapt as investment money flowed in...  "In a sense," says a note from Swiss investment bank and London bullion-market maker UBS, "these [2013] out-flows are a reversal of the trend that occurred five years ago when gold ETF investment – particularly in the GLD – increased sharply. "Back then, concerns over a weak US economy and the impact of QE on inflation were key motivators driving investors towards gold ETFs. With the macro outlook shifting this year, those positions are now being unwound." The impact on global supply and demand in 2013 for gold has been dramatic. Because these exchange-traded gold products – legal trusts whose debts are denominated in gold bullion, and which then own physical bullion to back their shares' value – have flowed from one side of the ledger to the other. Adding an average 45 tonnes to their collective hoard every 3 months as investment flowed in between 2005 and late 2012, the giant SPDR Gold Trust (GLD) and its smaller competitor from iShares (IAU) have turned net sellers this year. Together, they've sold back some 160 tonnes per quarter, accounting for two-thirds of 2013's total gold ETF liquidation of 700 tonnes. What goes up, right? Well, yes. The ETFs revolutionized how institutional investors, most especially US mutual funds who can't own physical property, could access gold price exposure. No, these shareholders don't own gold. No single gold ETF product is open for trade 24/7 either. Nor do they offer a choice of vaulting locations. Settlement to a broker takes 2 or 3 days, rather than being instant. Such benefits are, for the moment, restricted to private investors seeking the smartest way to buy gold outright. But for those institutional investment dollars which otherwise had to chase mining stocks or play the futures market, gold ETFs provided cash-price exposure, and also took physical metal off-market to keep in allocated bank accounts instead. And fast as this year's second-quarter liquidation was (285 tonnes from the GLD and IAU alone), the peak accumulation on the way up was faster (348 tonnes in Q1 2009).  Where next for gold investment flows then? The world is awash with money. Inflation cannot dent gold, nor can credit default tarnish it. But whether or not inflation shows up or crisis returns soon, the money of Western households being run by the City and Wall Street needs a home. So does the pile of rich Western promises held by emerging-market central banks. Right alongside the fast-growing savings of their fast-growing middle classes. Stocks have now offered managed money a very warm welcome 3 times in the last 15-odd years. Gold, to date, has surged and peaked out as well, but once. Investment dollars have now ebbed out of gold for 12 months after flooding in for 12 years straight. With interest rates stuck at zero, and QE money printing the only monetary tool left to hand, there's little beyond sentiment, perhaps, to stop a flood of fresh money washing back in. |

| Posted: 15 Nov 2013 10:30 AM PST

As we reported, JPMorgan’s PR team Wednesday made the epically bad decision to host a public twitter Q&A with Vice Chairman Jimmy Lee. While the entire #AskJPM thread would make for excellent entertainment this weekend, award-winning actor Stacy Keach…the voice from American Greed picked out a few of the best, and read them verbatim. The [...] The post The Best #AskJPM Tweets appeared first on Silver Doctors. |

| Gold rebounds as China vows market reforms Posted: 15 Nov 2013 09:43 AM PST The price of gold rose Friday lunchtime in London, regaining last week's closing level of $1,288 per ounce as European stock markets turned higher and the US Dollar slipped. |

| Posted: 15 Nov 2013 09:42 AM PST Cisco CEO John Chambers had a euphemism for it during the earnings call: the "challenging political dynamics" in China. But same thing in India and others, including Russia where NSA leaker Edward Snowden is holed up, and where sales crashed much worse than in China. So Cisco chopped its guidance by "11% sequentially," as an analyst pointed out, the worst since January 2009 when "the world was about to collapse." It was between the lines everywhere, but never once did Chambers, or anyone else on his team, mouth the acronym NSA. It was off limits. And that's exactly how another tech giant, IBM, had dealt with its own China revenue fiasco. Because they don't want to point the finger at one of their largest customers. |

| Posted: 15 Nov 2013 09:35 AM PST What we are currently seeing in global equity markets is truly historic. And I'm not talking "internet mania" historic; but worse yet, a blaring precursor of hyperinflation. In recent weeks, I've noted how Venezuela has been a "Zimbabwe-like" poster child of how monetary inflation can destroy a nation; and now, the same "fiat cancer" is starting to spread. To wit, the Caracas stock exchange is up nearly 500% year-to-date – whilst its "massaged" Consumer Price Index is up an incredible 50%. The Bolivar has been officially devalued by 200% in the past three years – the latest, 32% devaluation in February; resulting in price controls, product shortages, and looting, with Martial Law clearly coming. And thus, the early Weimar-like surge in its stock market; which, by the way, is exactly what happened in Zimbabwe. In both cases, such hyperbolic gains were eventually consumed by inflation; and in my mind, it's difficult to envision a more obvious "red flag." In Japan, where yesterday it was reported that GDP growth "unexpectedly" fell from 0.9% in the second quarter to 0.4% in the third – again, utilizing a negative deflator despite Tokyo being the world's most expensive city; the stock market has since surged 700 points due to, believe it or not, rising expectations of additional QE. As if the BOJ's current plan to double the money supply in two years – following nine successive, unsuccessful QE failures – isn't enough. Consequently, the Yen is now back above the 100/dollar level again; and as I wrote six months ago, don't be surprised if "The Real Yen Bomb – Starts now." In Europe, the ECB just lowered its benchmark rate from 0.50% to an even more pathetic 0.25% amidst essentially zero continental GDP growth, record unemployment and bad loans, and a new downgrade of France's credit rating. The UK is experiencing slightly higher "growth," but an historic real estate bubble has fostered a powerful inflationary impact on the cost of living. And today, we learned that just €3 billion of LTRO (essentially free) bank bailout loans are being paid back this week, bringing the total returned to less than a third of the more than €1 trillion lent out two years ago. No doubt, the rest of that money is going into the stock market; as for the same reason as in Japan, the growing belief in expanded QE is going mainstream. Just yesterday, an ECB governor called for as much; fueling further a "Japan-like" rally, fueled solely by anticipated "liquidity." Obviously, the markets could care less about what ECB governors also called for yesterday; that is, an earlier introduction of continental "bail-in" rules. And then you have the U.S., where yesterday's earnings miss of Wal-Mart tells you all you need to know of the trajectory of the global economy – per the chart below. And not just Wal-Mart, but other low-end retail chains like Kohl's, depicting exactly how strained the average American's budget has become. Even Lockheed Martin announced it was laying off 4,000 workers; an ominous sign indicating just how badly the U.S. needs ongoing wars to generate economic "growth." And last but not least, Federal, we learned that Federal student loans surpassed the $1 trillion level for the first time – up from $750 billion two years ago; whilst the student loan default rate rocketed up to an all-time high of 12% – from 8% two years ago, when the latest Fed money printing lunacy commenced (i.e., "Operation Twist," QE3, and QE4). As I edit, by the way, the Empire State Manufacturing Index came in negative for the first time in six months, versus consensus estimates of a strong positive result.

As all of these "horrible headlines" emerged yesterday, the Senate Banking Committee was "Yellen for Moar" – lobbing softball questions to our next Fed Chairman, to which she simply stated that QE has not only been effective, but needs to be continued indefinitely – as clearly, monetizing 70% of all Treasury issuance is not enough!

Better yet, the new "QEeen" believes there is absolutely no bubble-like behaviors occurring in the financial sector – as amidst the lowest Labor Participation rate in 35 years, the S&P 500 achieved an all-time high. And oh yeah, the two sectors hedge funds are now most bullish about are the two most likely to be positively affected by QE; i.e., tech stocks and long-dated Treasury bonds. And in third place; yep, you guessed it – bearish bets on the dollar; as simultaneously, the largest-ever trade deficit with China was reported. Paper PMs couldn't help but rise on such news, but of course, were prevented from rising more than 1.0% by a typical Cartel Herald algorithm at 10:00 AM EST; i.e., "Key Attack Time #1" – followed by the 116th appearance of the 2:15 AM suppression algo in the past 128 trading days. Of course, what's occurring in the physical market is entirely different, as the "pressure cooker" continues to tighten. As discussed above, the hyperinflationary trend is "gaining steam"; and whilst Wall Street, Washington, and the MSM focus your attention on soaring equities, the scant remaining gold and silver supply is rapidly waning. The third quarter mining earnings catastrophe I warned of has come to fruition; and as miners continue to cut capital expenditure plans with reckless abandon, the outlook for physical supply continues to weaken. Moreover, attempts by India's government to slow gold buying have not only catalyzed the emergence of a thriving black market, but pushed physical premiums to record highs; hitting an incredible 22% yesterday, representing a real price closer to $1,600/oz. than $1,300/oz.

And finally, the coup de grace; as last night alone, COMEX registered inventories lost an incredible 51.6 million ounces, or 8% of the total; in the process, plunging such "deliverable" inventories to a new all-time low of just 587,000 ounces – or just $750 million at current prices.

Hopefully, today's article helps you see just how compromised the global financial system has become; and conversely, how dire the official attempts to suppress real money, amidst burgeoning hyperinflation – have become. The "physical pressure cooker" will exponentially tighten in the coming years – perhaps, months; and when it blows, the "world as we have known it" will be forever changed. And thus, the big question is – are you prepared?Similar Posts: |

| Posted: 15 Nov 2013 09:04 AM PST Nevada Senator Dean Heller asked Yellen what she thought of gold prices and what made them tick, "Well, I don't think anybody has a very good model of what makes gold prices go up or down," she replied (meanwhile, we're screaming at the screen 'You, you are the model!'). |

| Cooperation between central banks Posted: 15 Nov 2013 09:02 AM PST Zerohedge recently drew attention to the growing level of foreign bank cash deposits, tucked away at the bottom of the Fed's H.8 statement.Foreign banks' cash balances have increased by $518.7bn since September 2012, accounting for almost all of the increase in these banks' total assets in the H.8 table. The implication is that these cash balances are held as reserves on the Fed's balance sheet, the counterpart of quantitative easing. This naturally raises the reasonable question posed by Zerohedge's article as to why the Fed appears to be benefiting foreign banks with QE. The answer is either these deposits have been transferred to them from US banks in the normal course of business or the Fed is prepared to provide liquidity to foreign banks: after all the US dollar is the reserve currency. And this liquidity is most needed by the weakest banks in the international banking system, many of which are in the eurozone. The ECB's room for manoeuvre with respect to money-printing is more limited, and it is the only central bank of the big four not to have overtly quantitatively eased. Furthermore, the eurozone is still in trouble even though it has disappeared from the headlines. The chart below of bank lending figures supplied by the ECB illustrates the problem.

Bank lending peaked in mid-2012, and by mid-2013 it had contracted over €1 trillion. By now, the ECB should have advance knowledge of the yet-to-be-released Q3 bank lending total, which if it has continued the downward trend explains why the ECB unexpectedly reduced interest rates recently. Meanwhile, the Bank of England has finally admitted that the UK's economy is growing. Conventional wisdom suggests the BoE should permit interest rates to return to more normal levels, but it refuses to do so for at least another year. The fact that the UK continues with current interest rate polices is due in part to policy coordination with the Fed, the ECB and to a lesser extent perhaps the Bank of Japan. The logical implication from the Fed's and the BoE's actions is that interest rate policies are being managed with the weakest in mind. Therefore the course of prices and bank lending in the eurozone could be regarded as the current determinant of when tapering will be introduced by the Fed. However there is still an overriding problem: if the stimulant of monetary inflation is reduced, rates along the yield curve will rise rapidly from today's wholly artificially suppressed levels. The two cannot be divorced. The Fed knows this, and it is central to its internal debate. The fact of the matter is that just as zero interest rates flatter bank balance sheets and government borrowing costs, the reverse is also true. Add into the mix the deflationary implications of more normal interest rates and it is obvious that the Fed and the BoE are trapped. They will not be looking forward to the day when they run out of excuses for this dilemma. But for now at least there is a rescue mission in place for the eurozone, and the Fed will continue to lend its support to foreign banks. |

| SILVER BEARS: You Have Been Warned! Posted: 15 Nov 2013 09:00 AM PST

THERE'S NOTHING LEFT but a huge ride down. And when I mean a ride down, it will be like a roller coaster. As I have mentioned before, the FIAT-MONETARY-US TREASURY-PAPER-PONZI SCHEME gets its power from a rising energy supply. It is this energy supply that has been able to allow them to kick the can [...] The post SILVER BEARS: You Have Been Warned! appeared first on Silver Doctors. |

| Gold flows east As three pieces of Bacon sell for €105 million Posted: 15 Nov 2013 08:58 AM PST Yesterday, the World Gold Council released its Gold Demand Trends 2013 Report which demonstrates quite clearly that the Chinese continue to accumulate gold; Gold continues to flow east. |

| Gold Flows East As Three Pieces Of Bacon Sell For €105 Million Posted: 15 Nov 2013 08:49 AM PST World Gold Council reports Chinese continue to accumulate gold and elsewhere three pieces of Francis Bacon sells for €105 million or 3.78 tons of gold at today’s price of €953/oz.

Today's AM fix was USD 1,281.75, EUR 953.99 and GBP 797.65 per ounce. Gold rose $14.40 or 1.13% yesterday, closing at $1,294.07/oz. Silver hit a high $20.90 and closed the day with a gain of $0.25 closing at $20.81. Yesterday, the World Gold Council released its Gold Demand Trends 2013 Report which demonstrates quite clearly that the Chinese continue to accumulate gold; gold continues to flow east to both government and consumer channels. The report also showed that central banks continue to accumulate and there is positive news that jewellery trade is up. Key findings: Continued consumer growth in China. Central banks continue to be strong buyers of gold, albeit at a slower rate. Jewellery consumption in South East Asia, outside China, was also strong. Government regulations in India are dampening demand figures. Francis Bacon's ‘Three Studies of Lucian Freud’ In another vote of confidence in the world of art, a triptych by Francis Bacon, titled ‘Three Studies of Lucian Freud,’ sold for €105 million ($142 million), a world record price for a painting. However, Felix Salmon at Reuters believes that there is a speculative play in place and there is a number of people selling big-ticket contemporary art works at auction who have only owned these pieces for a short time and this is a key indicator that there is flipping in the market. Salmon opines that there is signs of a speculative bubble, one that has been going on for years, even through the darkest hours of the financial crisis but that this latest burst of record selling prices could be the tipping point. The price was pushed up by €44 million ($60 million) more than the auction house had estimated it would sell for. Believe it or not, but the price was decided after just ten minutes of bidding. This price smashes the previous record set when ‘The Scream’ by Edvard Munch sold for €89 million ($120 million.) The auction also set a record for the highest amount ever made at one auction with €687 million (€511 million) worth of paintings were sold and included artists such as Andy Warhol, Jackson Pollock, Roy Lichtenstein and Mark Rothko. Lucian Freud, who died in 2011, was also the subject of a second full-length Bacon triptych, painted in 1966. That work, however, is missing. Whilst owning a Francis Bacon painting is out of the reach for most people, you can visit his studio where all these 'expensive' paintings were created. In keeping with the aura that surrounds Bacon's life, his studio and its entire contents were moved from London to Dublin in 1998, and is on display in the Hugh Lane Gallery in Parnell Square, Dublin. The Hugh Lane Gallery has its own amazing story in that Sir Hugh Percy Lane, its founder, died on board the RMS Lusitania in 1915 when she was torpedoed and sunk by a German U-boat. No trip to Dublin is complete unless you visit this stunning exhibition; Bacon's studio is a revelation and you can marvel at how three pieces of Bacon were sold for an incredible €105 million or 3.78 tons of gold at today’s price of €953/oz. Click here for this month's Insight 'Talking Real Money: World Monetary Reform' |

| G+ Hangout with Jan Skoyles and Koos Jansen Posted: 15 Nov 2013 08:13 AM PST To celebrate their acclaimed series of reports investigating the Chinese gold market Jan Skoyles and Koos Jansen are welcoming investors from around the world to join them for a Google+ Hangout to discuss their research and the latest trends in the precious metals.

What's being talked about?These four reports:

Not forgetting their accompanying infographics, found here and here. Why join?Tune in to enjoy unprecedented access to the experts. Ask your questions and gain fascinating insights into their research and to find out what's really happening in China when it comes to gold. Where?Right here on Google+. When?The Hangout will take place at 19:00 UK time on Wednesday 20th of November 2013. How to join?

See you there! |

| USD & Euro Indices Correct – What About Gold? Posted: 15 Nov 2013 08:02 AM PST SunshineProfits |

| Posted: 15 Nov 2013 08:02 AM PST Biwii |

| Chart of the Day: Obama’s Job’s Recovery Posted: 15 Nov 2013 08:00 AM PST

Today’s MUST SEE chart of the day depicts the labor force participation rate for white males over 20 in the US from 1955-present. Perhaps Obama was holding the chart upside down when touting his supposed jobs recovery? Looks more like a cliff dive to us, but what do we know about charts and economic data? [...] The post Chart of the Day: Obama’s Job’s Recovery appeared first on Silver Doctors. |

| Gold cheered by Yellen’s dovishness and policy continuity Posted: 15 Nov 2013 07:30 AM PST The gold and stock markets cheered on the words of Janet Yellen, the Fed chairman nominee. In her testimony on Wednesday, she said that the Fed should not withdraw the stimulus too soon in the face of a fragile recovery. |

| Posted: 15 Nov 2013 07:29 AM PST Bix Weir wrote the following yesterday:

What I take from this is not that Bitcoin is going vertical – the reason that Bitcoin is popular is because an increasing number of people have decided to leave the system, at least with part of their wealth. Of course, there are also those who are chasing profit, but the bottom line is "Bitcoin" could not have gained traction without a "need" to get outside of the system. We address that with gold and silver and with offshore investing, but it's all a response to the same problem. Thursday evening, Bill Holter sent me a copy of his short article, Rule of Law. I told him to submit it and it was fine with me. Even though we try NOT to write about politics, there are some things going on that have nothing to do with Liberal or Conservative or Republican or Democrat views. What ever happened to the Constitution? Doesn't it matter anymore? I had a long conversation with a friend of mine, a brilliant and very well-read New York attorney and he pointed something out to me that I had not thought about – and it goes well with Holter's essay. Did you know that the President is NOT the Commander in Chief? According to the Constitution, the President only becomes the Commander in Chief of the military if Congress declares war. Since FDR, no President has legally been the Commander in Chief, (according to our Constitution, since Congress has not declared we are at war since WW2) though they all have said they are. It’s so screwed up… Jefferson and Adams are turning over in their graves. But who can blame Americans for not knowing this? It is not taught in school and the press never goes there. We have strayed far away from the framework that our founding fathers gave us to keep our freedoms. And no one cares. Onto another topic, one that I wish I didn't have to address. Earlier this week, one of our staff members wrote a very unflattering essay directed primarily at Jordan Roy-Byrne and we published it in our daily. Well, I am ashamed that it got by our editors. It was wrong and inappropriate. We don't have to agree with what others say, but we do have to respect their right to see things in a different way than we do. We are not Gods and all we have are opinions. We also have to show more respect than this article does to others who write in our industry. We are above something like this, or should be. I sent a sincere apology to Jordan and he graciously accepted it. But I am not satisfied with that. I want to publically apologize for what was written and take full responsibility for the article myself. As our last great president said, "The buck stops here."Similar Posts: |

| Market Report: Have we reached a selling climax? Posted: 15 Nov 2013 07:28 AM PST Gold started on Monday with a continuation of last Friday's fall, bottoming out on Tuesday at $1261 in US trading. From then on the price rallied to close $25 higher at $1287 on Thursday.Sentiment for gold and silver in Western capital markets is now extremely bearish, and this has been reflected in an increase in open interest on Comex as prices fell, illustrated in the charts below.

It is unusual to see open interest increase substantially on falling prices. In gold, it represents additional short sales amounting to 72.4 tonnes since 6th November, and in silver nearly 2,600 tonnes. So far it has failed to drive the gold price below $1200, but if last week was anything to go by then a bear-raid later today cannot be ruled out, when Far Eastern buyers are absent from the market. However, if the recent low at $1261holds this action will be judged with hindsight as a selling climax, which is ultimately bullish. The other side of the gold trade for many dealers is the dollar and US Treasury yields, both of which have been rising recently. These rises began to reverse ahead of Janet Yellen's confirmation hearing at the Senate yesterday. We learned from that there will be little change in Fed monetary policy, and importantly, Ms Yellen confirmed to us she sees no bubbles in stocks and property. She also evaded attempts to get her to commit to tapering or admit that the Fed was boxed into a corner. This week the World Gold Council released its estimates of gold demand for Q3 2013. Their figures for Greater China (including Hong Kong and Taiwan) show this to have been 220.1 tonnes, which compares with physical deliveries of 573.4 tonnes on the Shanghai Gold Exchange alone. The disparity between the WGC version and other hard statistics was questioned by Eric Sprott in an open letter to the WGC recently. In the WGC's reply they cited differences due to stocking/destocking and round-tripping (presumably arbitrage), but the gap between Sprott's figures based on import/export statistics and theirs appears to be too great to be explained in this way. Furthermore, earlier data releases by the WGC claimed Chinese demand peaked at 306.4 tonnes in Q1, falling to 294.6 tonnes for Q2. This cannot be the case, because the acceleration in demand occurred in Q2 after the April price smash. This is confirmed by physical deliveries through the Shanghai Gold Exchange which totalled 641 tonnes for Q2, against 458 tonnes for Q1. Next week Monday. Eurozone: Current Account. Tuesday. Japan: Leading Indicator (final). Wednesday. Japan: All Industry Activity Index. Thursday. Eurozone: Flash Composite PMI. Friday. Japan: Monthly Economic Repost for November.

|

| Gold Flows East As Three Pieces Of Bacon Sell For €105 Million Posted: 15 Nov 2013 07:02 AM PST gold.ie |

| Jim Willie: The Financial System is Imploding, 50% Overnight Dollar Devaluation Coming! Posted: 15 Nov 2013 07:01 AM PST

Dr. Jim Willie, financial writer and Editor of the Hat Trick Letter, says, "I've been getting overwhelmed in the last month or two at the plethora, the litany of signals the financial system is imploding. U.S. dollar is in a sell-off. Treasury bonds are rapidly losing their integrity . . . and both banking and [...] The post Jim Willie: The Financial System is Imploding, 50% Overnight Dollar Devaluation Coming! appeared first on Silver Doctors. |

| The Stock Market Has Become Insane Posted: 15 Nov 2013 07:00 AM PST

We might not see the immediate affects of inflation tomorrow when we go buy food at the grocery store, because those dollars being printed are piling blindly and foolishly into the stock market. Why? Because the demand for mortgages for buying homes and refinancing existing mortgages is quickly disappearing, so all that printed money has [...] The post The Stock Market Has Become Insane appeared first on Silver Doctors. |

| Yellen’s Senate Testimony in Less Than Two Minutes Posted: 15 Nov 2013 05:00 AM PST

Miss Old Yellen’s Senate Confirmation testimony Thursday? Yellen discusses her plans for “unconventional monetary policy tools“, her plans (or lack thereof) of implementing a taper to QE, and how even a temporary US default would be “catastrophic” in this 2 minute recap of her Senate testimony. Sunshine Mint Silver Eagles As Low As $.79 [...] The post Yellen’s Senate Testimony in Less Than Two Minutes appeared first on Silver Doctors. |

| Gold Rebounds as China Vows Market Reforms, US Fed Blamed for Shanghai Rates Spike Posted: 15 Nov 2013 04:00 AM PST Bullion Vault |

| Comex Registered Gold Falls To 587,235 Ounces - Claims at 63 to 1 - The Karma of Buddhas Palm Posted: 15 Nov 2013 04:00 AM PST Le Cafe Américain |

| Chris Powell: Central Banks Know the Vulnerability of Fractional-Reserve Gold Posted: 15 Nov 2013 02:23 AM PST "We're still not out of the woods yet as far as the precious metal prices are concerned" ¤ Yesterday In Gold & SilverThe attempted rally in gold during the Far East trading session certainly blew out the open interest by the London open as it was obvious the HFT boyz were out and about. The gold price got sold down a bit once London began to trade, and the low price tick came at 1 p.m. GMT right on the button, and 20 minutes before the Comex open in New York. The subsequent rally ran into obvious opposition, and the vertical price spike about 10:20 a.m. EST got dealt with in the usual manner. From that high, the gold price got sold down until shortly after 2 p.m. in electronic trading, and the smallish rally off that low didn't amount to much. The CME recorded the low and high ticks at $1,277.30 and $1,293.80 in the December contract. Although the gold price traded in a fairly tight price range, it only did so because it was being micromanaged; much like it is everyday. But some days are more obvious than others. Gold finished the Thursday session in New York at $1,287.30 spot, which was up an even $5.00 from Wednesday's close. Net volume of 137,000 contracts was 30% higher than it was on Wednesday, and although not heavy, it wasn't exactly light, either. Here's the New York Spot Gold [Bid] chart on its own so you can see the price action in North America in much more detail. Silver rallied a bit in Far East trading on their Thursday, and then faded into the 10:20 a.m. price spike visible on the chart below. Silver's price spike wasn't anywhere near as impressive as the one for gold, and silver traded quietly after that into the close of electronic trading. Since silver traded in such a tight price range yesterday, the highs and lows aren't worth mentioning. Silver closed yesterday at $20.745 spot, up 13.5 cents from Wednesday. Once again, gross volume was very heavy, but net volume was 'only' 38,000 contracts, down 10% from Wednesday's net volume figures. Platinum jumped up fifteen bucks in the first two hours of trading in the Far East on their Thursday. After that it chopped sideways. The two subsequent rally attempts during Comex trading hours in New York yesterday weren't allowed to go anywhere. Palladium rallied five bucks early on, and then traded flat for the rest of the day. Here are the charts. The dollar index closed on Wednesday afternoon in New York at 80.80, and then climbed to its 81.19 high around 11:20 a.m. GMT in London. From there it chopped lower, with the low tick of 80.87 coming at 11:15 a.m. EST in New York. Then it rallied a bit into the close, finishing the Thursday session at 81.03, which was up 23 basis points from Wednesday. Not surprisingly, the gold stocks gapped up a bit at the open, and then rallied unsteadily for the rest of the day. The HUI finished almost on its high, up 2.65%. The same can be said for the silver equities, except that they performed even better. Nick Laird's Intraday Silver Sentiment Index closed up 3.47%. The CME's Daily Delivery Report showed that zero gold and 15 silver contracts were posted for delivery within the Comex-approved depositories on Monday. Jefferies was the short/issuer on all 15, and JPMorgan was the long/stopper on 13 of them, all for its client's account. The link to yesterday's Issuers and Stoppers Report is here. There were no reported changes in GLD yesterday, but SLV reported another withdrawal. This time it was 1,637,392 troy ounces. So far this month, 3.51 million ounces have been withdrawn from SLV. There was no sales report from the U.S. Mint. Joshua Gibbons, the "Guru of the SLV Bar List" had this to say about the prior week's SLV in/out activities for the week ending on Wednesday, November 13: "Analysis of the 13 November 2013 bar list, and comparison to the previous week's list -- No bars were added, removed, or had a serial number change. As of the time that the bar list was produced, it was over-allocated 8.8 troy ounces. There was a withdrawal of 1,733,842.8 troy ounces on Monday that has not yet been reflected on the bar list, and which should appear on the next bar list [as it normally takes a day or two for the bar list to get updated." There was no sales report from the U.S. Mint. Once again there was little gold in/out activity over at the Comex-approved depositories on Wednesday. Nothing was reported received, and only 160 troy ounces were reported shipped out. And as is almost always the case, it was much busier in silver, as 300,925 troy ounces were reported received, and 601,137 troy ounces were shipped out the door on Wednesday. The link to that activity is here. Here's the latest Monetary Base chart from FRED that's published by the St. Louis Fed, and I thank Casey Research's own Jeff Clark for sending it our way. It's "Print, or die!" -- and that's precisely what they're doing. I have quite a few stories for you today, and I hope you find the time to read the ones that most interest you. ¤ Critical ReadsYellen to Defend Fed's Ultra-Easy Monetary PolicyFed Vice Chair Janet Yellen on Thursday robustly defended the Federal Reserve's bold steps to spur economic growth, calling efforts to boost hiring an "imperative" at a hearing into her nomination to become the first woman to lead the U.S. central bank. Answering questions before the Senate Banking Committee, Yellen made plain she would press forward with the Fed's ultra-easy monetary policy until officials were confident a durable economic recovery was in place that could sustain job creation. "I consider it imperative that we do what we can to promote a very strong recovery," Yellen told the panel. I note that this Reuters story from yesterday, which is very much worth reading, has had a headline change by the 'Thought Police', as it now reads "Yellen says stronger job growth a Fed imperative". I thank West Virginia reader Elliot Simon for today's first news item. The New York Sun: Yellen Strikes OutWhat needs to be confronted is the scandal of Federal Reserve independence. Where in the Constitution does it say that monetary policy is supposed — or permitted — to be independent of politics? If the Founders of America had wanted the monetary power to be given to a body independent of politics, they could have given it to the Army or the Navy or the Supreme Court. But they sat down in Philadelphia and gave the power to “coin money and regulate the value thereof and of foreign coin” to, in the Congress, the single most political institution in the entire constitutional system. So where in the world does Mrs. Yellen come off lecturing the Congress on the need for independence? It’s not as if independence and opacity have produced much in the way of results. The value of the dollar has collapsed to levels that would have appalled not only the Founders of America but the congress that founded the Federal Reserve. Even after rising a bit in the past year or so, the value of the dollar is still, at a 1,250th of an ounce of gold, less than half of its value on the day Mr. Bernanke acceded to the chairmanship and a shadow of what it was when the Fed was founded. This editorial comment was posted on The New York Times website yesterday...and I found it buried in a GATA release that Chris Powell filed from New Orleans late last night. It's worth reading as well. HUD Said to Fail in Bid to Sell $450 Million of FHA MortgagesThe U.S. Department of Housing and Urban Development for the first time failed to sell some of the soured mortgages it’s auctioning off in the wake of the housing crisis, according to four people with knowledge of the results. HUD deemed bids on about $450 million of home loans too low to accept at an Oct. 30 sale, said the people, who asked not to be named because the details are private. Since 2010, the agency has sold about 50,000 non-performing single-family loans insured by the Federal Housing Administration to investors willing to either help keep the borrowers in their homes or rehab the properties for sale. The sales are an attempt by HUD to simultaneously stem losses at the financially troubled FHA and pursue its public mission of averting foreclosures on the underlying properties. The refusal to accept bids on some of the pools may reflect that the FHA reached its limit on the losses it was willing to realize to keep some borrowers in homes or stabilize markets. This Bloomberg news item was posted on their Internet site late on Wednesday evening MST...and it's the second contribution to today's column from Elliot Simon. Federal Student Loans Surpass $1 Trillion; Delinquency Rate Soars to All Time HighThere is a reason why U.S. consumer revolving (credit card) credit growth is getting lower and lower and lower and at last check posted a mere 0.2% annual increase. That reason is that as the N.Y. Fed disclosed moments ago, federal student loans officially crossed the $1 trillion level for the first time ever. Notably: the quarterly student loan balance has increased every quarter without fail for the past 10 years! This short Zero Hedge article from yesterday contains three excellent charts...and I consider it a must read. I thank Manitoba reader Ulrike Marx for her first contribution of the day. Moody's Lowers Ratings of Four U.S. Banks After ReviewMoody’s Investors Service cut its ratings on four of the biggest U.S. banks after deciding the government would be less likely to help them repay creditors in a crisis. Morgan Stanley, Goldman Sachs Group Inc., JPMorgan Chase & Co. and Bank of New York Mellon Corp. had their senior holding company ratings lowered one level yesterday after Moody’s concluded a review of eight U.S. banks that began in August. Spokesmen for the four companies declined to comment. U.S. banking regulators have been preparing rules and procedures that seek to allow the government to wind down even the largest financial companies without providing taxpayer assistance. The plans would require investors to accept losses and could require bonds to be converted into equity capital. JPMorgan's Fruitful Ties to a Member of China's EliteTo promote its standing in China, JPMorgan Chase turned to a seemingly obscure consulting firm run by a 32-year-old executive named Lily Chang. Ms. Chang’s firm, which received a $75,000-a-month contract from JPMorgan, appeared to have only two employees. And on the surface, Ms. Chang lacked the influence and public name recognition needed to unlock business for the bank. But what was known to JPMorgan executives in Hong Kong, and some executives at other major companies, was that “Lily Chang” was not her real name. It was an alias for Wen Ruchun, the only daughter of Wen Jiabao, who at the time was China’s prime minister, with oversight of the economy and its financial institutions. This interesting story was posted on The New York Times website late on Wednesday evening...and I thank reader Lou Horner for bringing it to our attention. U.S. Investigates Currency Trades by Major BanksFrom their desks at some of the world’s biggest banks, traders exchanged a series of instant messages that earned them the nickname “the cartel.” Much like companies that rigged the price of vitamins and animal feed, the traders were competitors that hatched alliances for their own profits, federal investigators suspect. If those suspicions are correct, the group of traders shared a mission to alter the price of foreign currencies, the largest and yet least regulated market in the financial world. And ultimately, they flooded the market with trades that potentially raised the cost of currency for clients but aided the banks’ own investments. “The manipulation we’ve seen so far may just be the tip of the iceberg,” the United States Attorney General, Eric H. Holder Jr., said in a rare interview discussing an active investigation. “We’ve recognized that this is potentially an extremely consequential investigation.” What about the precious metal markets, along with copper and oil, Mr. Holder? This story was posted on The New York Times website late yesterday evening...and I thank Phil Barlett for sharing it with us. With France stalling, euro zone recovery comes to near haltThe euro zone economy all but stagnated in the third quarter of the year with France's recovery fizzling out and growth in Germany slowing. The 9.5 trillion euro economy pulled out of its longest recession in the previous quarter but record unemployment, lack of consumer confidence and anemic bank lending continue to prevent a more solid rebound. In the three months to September, the combined economy of the 17 countries sharing the euro grew by a slower than expected 0.1 percent. In the previous quarter it rose 0.3 percent - the first expansion in 18 months. This Reuters news item, co-filed from Brussels and Paris, was posted on their website early yesterday morning EST...and it's the first contribution of the day from Roy Stephens. ECB ready to print, Germany ready to screamThe doves are seizing control of the European Central Bank. They are already laying the ground work for a blitz of Anglo-Saxon QE, whatever the Germans, Dutch, Austrians, and Finns (?) have to say about such wicked Latin conduct. Welcome to the next fascinating phase of the EMU opera buffa, opera tragica. The ECB's Peter Praet – the board member in charge of setting economic policy debates – has given an astonishing interview to Brian Blackstone at The Wall Street Journal, opening the floodgates for bond purchases. It is clear that the slide towards deflation and Euroland's fizzling recovery have caused a revolt at long last. The ECB's Latin (plus) majority simply refuses to accept Bundesbank orders any more. Ambrose Evans-Pritchard is at it again! This blog was posted on the telegraph.co.uk Internet site sometime yesterday...and it's worth reading. My thanks go out to Roy Stephens for his second offering in a row. Go and invest! European banks to be 'punished' for deposits with negative interest rateHaving run out of traditional tools to boost economic growth and push inflation towards the 2 percent target, the European Central Bank is considering to introduce a negative interest rate or purchase assets from the banks. "If our mandate is at risk we are going to take all the measures that we think we should take to fulfill that mandate. That's a very clear signal", Peter Praet, the ECB executive board member, told the Wall Street Journal. The negative rate on bank holdings at the ECB means that banks will receive back less than they initially deposited. It is a sort of “penalty” for holding money on account at the central bank. The measure is intended to stimulate banks to plough money back into economy rather than to hold it in reserve. This very short news items is on the same subject as Ambrose Evans-Pritchard wrote about in the previous story, but with a Russia Today spin. It was posted on their Internet site late yesterday afternoon Moscow time...and it's courtesy of South African reader Bob Visser. Greece returns to haunt euro ministersEurozone finance ministers will meet on Thursday (14 November) with the currency union's four bailout programmes dominating an otherwise quiet agenda. Officials are, once again, becoming frustrated by Greece. The Greek government and its creditors are "billions apart" on the country's 2014 budget, an EU official with knowledge of the programmes told reporters earlier this week. The Greek government believes that it needs to find spending cuts worth a further €500 million, while the Troika - composed of officials from the European Commission, the International Monetary Fund and the European Central Bank - estimates the current shortfall to be &euro |

| The New York Sun: Yellen Strikes Out Posted: 15 Nov 2013 02:23 AM PST What needs to be confronted is the scandal of Federal Reserve independence. Where in the Constitution does it say that monetary policy is supposed — or permitted — to be independent of politics? If the Founders of America had wanted the monetary power to be given to a body independent of politics, they could have given it to the Army or the Navy or the Supreme Court. But they sat down in Philadelphia and gave the power to “coin money and regulate the value thereof and of foreign coin” to, in the Congress, the single most political institution in the entire constitutional system. So where in the world does Mrs. Yellen come off lecturing the Congress on the need for independence? It’s not as if independence and opacity have produced much in the way of results. The value of the dollar has collapsed to levels that would have appalled not only the Founders of America but the congress that founded the Federal Reserve. Even after rising a bit in the past year or so, the value of the dollar is still, at a 1,250th of an ounce of gold, less than half of its value on the day Mr. Bernanke acceded to the chairmanship and a shadow of what it was when the Fed was founded. This editorial comment was posted on The New York Times website yesterday...and I found it buried in a GATA release that Chris Powell filed from New Orleans late last night. It's worth reading as well. |

| Tocqueville Gold Fund Managers: Gold Isn't in Exile, It's Just on Vacation Posted: 15 Nov 2013 02:23 AM PST Gold may be on vacation, but it will come back soon, according to John Hathaway and Doug Groh, co-portfolio managers of the Tocqueville Gold Fund, because extreme monetary policies seen across the major economies in the world — namely Japan, Europe and the United States — are pouring a foundation of support beneath the yellow metal and its miners. |

| World Gold Council just shrugs at India's financial repression Posted: 15 Nov 2013 02:23 AM PST China is this year set to usurp India as the world's biggest gold consumer by a convincing margin as strict import rules introduced by New Delhi bite, forecasts from the World Gold Council showed on Thursday. The industry body cut its outlook for Indian demand in 2013 to around 900 tonnes from the 1,000 tonnes predicted previously, while keeping its forecast for China unchanged at 1,000 tonnes. Plummeting demand from India could further pressure global prices that have dropped around 24 percent this year on fears the U.S. Federal Reserve would cut its economic stimulus. "The administrative measures that the Indian government has imposed on the market have proven to be quite effective and imports have slowed down," Albert Cheng, the WGC's managing director for the Far East told Reuters. This Reuters story is another news item I found in a GATA release from yesterday. It was filed from Singapore yesterday afternoon IST. The real headline reads "WGC sees China well ahead of India as world's No. 1 gold consumer". |

| Will 2014 mark the return of the gold ETF investor? Posted: 15 Nov 2013 02:23 AM PST In the first nine months of the year, physical gold ETFs saw almost 700 tonnes in redemptions. But, according to Marcus Grubb, MD Investments at the World Gold Council, recently "We have almost seen a cessation of outflows and, in fact, we had some net inflows globally in the last two to three weeks into November." Speaking to Mineweb on the release of the Council’s Gold Demand Trends for Q3 2013 report, Grubb said, "It was striking to me that despite considerably stronger-than-expected economic numbers on Friday last week - Non farm payroll and GDP - we have not seen significant ETF redemptions since then, a couple of tonnes at the most... what that means is a lot of the commodity super cycle investors have exited gold and also those investors were fearful of a collapse of the banking and financial system." The implication of this, Grubb says, is that those investors now holding ETFs "are strategically committed to gold and have it as a unique hedge asset and a diversifier in their portfolio." This article was posted on the mineweb.com Internet site yesterday...and I thank Ulrike Marx for sending along. |

| ETF outflows pull gold demand lower in Q3 - WGC Posted: 15 Nov 2013 02:23 AM PST Gold demand fell 21% in volume terms during the third quarter of 2013, the World Gold Council says, driven lower by continued outflows from ETFs. Writing in its Gold Demand Trends report for the three months to end September, the Council said, gold demand fell to 868.5 tonnes. This translated, in value terms to US$37bn, down 37% on the quarter. While this was lowest quarter in value terms since the first three months of 2010, the figures continue to follow the two key themes that have emerged during the year the council says - "the rising level of consumer demand off-setting outflows from ETFs, and the geographical flow of gold from western to eastern markets. This commentary, which is worth reading, was also posted on the mineweb.com Internet site yesterday...and it's also another offering from Ulrike Marx. |

| Chart demonstrating gold's inexorable move east Posted: 15 Nov 2013 02:23 AM PST The graph below is from The World Gold Council's latest Gold Demand Trends report and is appropriately titled West to east. The Council makes the point in its commentary that this flow can also be marked in the volume of the metal being converted from London Good Delivery bar-form into smaller, 'Asian consumer-friendly denominations of kilo-bars and below'. According to the WGC, "Eurostat show exports of gold from the UK to Switzerland for the January – August period grew more than tenfold, to 1,016.3t.1 This compares with a total of just 85.1t for the same period in 2012." This is another story by Geoff Candy over at the mineweb.com yesterday...and it dovetails nicely with the precious story. The embedded graph is worth a look, but tiny numbers and words will be a challenge to read for some. It's the third story in a row from Ulrike Marx. |

| Billionaire Paulson Sticks With Gold Wager as Prices Rebound Posted: 15 Nov 2013 02:23 AM PST Billionaire hedge fund manager John Paulson, who cut his gold holdings by more than half in the second quarter, maintained his bet on the metal over the next three months as prices rebounded. Paulson & Co., the largest investor in the SPDR Gold Trust, the biggest exchange-traded product for the metal, held 10.23 million shares as of Sept. 30, unchanged from June 30, according to a government filing yesterday. Billionaire George Soros took a stake in the Market Vectors Gold Miners ETF. This longish Bloomberg story was posted on their website yesterday evening MST...and I thank reader Ken Hurt for digging it up for us. |

| Investors Flock to Silver Coins Posted: 15 Nov 2013 02:23 AM PST Silver coins are gaining favor among investors and sales could rise to a record high in 2013, thanks to a sharp fall in the precious metal’s price. Demand for silver, which is sought after by investors and industrial users alike, is expected to rise, consultancy Thomson Reuters GFMS said in a recent report. The industrial sector accounts for about 45% of global silver consumption, it said. Already, sales of the U.S. Mint’s American Eagle silver coins have surpassed 2012 levels, as investors are snapping silver coins up “at a breakneck pace,” said Dallas-based precious metals dealer Dillon Gage Inc. The dealer expects American Eagle silver coin sales in the U.S. to exceed a record of 39.868 million troy ounces set in 2011. Silver coin sales totalled 39.17 million ounces in the 10 months ended Oct. 31, eclipsing the 33.74 million ounces sold in 2012, it said. This news item was posted on the blogs.wsj.com Internet site in the wee hours of yesterday morning...and it's certainly worth skimming. I thank Elliot Simon for his last contribution to today's column. |

| Gold Making People Crazy in Search for Sunken Treasure Posted: 15 Nov 2013 02:23 AM PST Captain Robert Mayne stands at the wheel as he guides the steel-hulled Aqua Quest from the docks in the Florida Keys, pointing the vessel toward what he’s been assured is a gold-laden shipwreck that may be worth tens of millions of dollars. Mayne, 60, says experience has taught him such gold hunts can be perilous: inspiring obsession, sending treasure hunters on endless journeys and blinding them to reason. “Gold makes people crazy,” says Mayne, who in his youth smuggled marijuana, and now has neatly combed, greying hair. “They become lost in their dream.” Even he finds the pull irresistible. Investors who hold rights to the site southwest of Key West say it may be the resting place of a galleon sunk by a 1622 hurricane. Mayne has agreed to cover the cost of the excursion in exchange for half of any treasure. This very interesting story was posted on the Bloomberg Internet site late Wednesday evening Mountain Time...and I thank Ken Hurt for sharing it with us. |

| Indian temple to glitter with 300kg of Thai gold Posted: 15 Nov 2013 02:23 AM PST The precious metal arrived late Monday on a special flight from Bangkok and is under armed guard at the temple in Bodh Gaya, a holy town about 100 kilometres from Patna, the capital of Bihar state. "A 40-member team including experts and two dozen commandos from Thailand have arrived at Bodh Gaya with gold in 13 boxes," Arvind Kumar Singh, a member of the temple management committee, said. The Mahabodhi Temple, built about 1,500 years ago, is a UNESCO world heritage site and marks the place where the Buddha is said to have attained enlightenment in 531 B.C. This is another very interesting story. It was filed from Patna, India...and posted on the Bangkok Post website late yesterday evening local time. And I thank Ulrike Marx for her final contribution to today's column. |

| GATA's Chris Powell: Central banks know vulnerability of fractional-reserve gold Posted: 15 Nov 2013 02:23 AM PST Central bankers are aware of the fractional-reserve nature and vulnerabilities of the international gold banking system, your secretary/treasurer told King World News yesterday in an interview about his recent presentations in Asia, Australia, and New Zealand. The gold price suppression scheme, Powell added, could collapse abruptly as the London Gold Pool did in 1968 or, more likely, will end in an international currency revaluation that prices gold at a much higher level. This interview was posted under the King World News blogs further up in this column, but because of its importance, I thought it worth posting on its own just to make sure you didn't miss it. It's a must read for sure. |

| India Gold Premium Hits Record 21.6% Posted: 15 Nov 2013 02:21 AM PST |

| Gold Price Analysis- Nov. 15, 2013 Posted: 15 Nov 2013 02:20 AM PST dailyforex |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment