Gold World News Flash |

- TSA multimillion dollar program as effective as random searches

- Why the Sell-Off in Gold Bullion Is Based on Faulty Logic

- Wi-Fi Spy Network Installed In Los Angeles?

- Silver Market Facts

- Precious Metals IRAs and What To Do With Gold

- Bull Market for Silver and Gold Prices Has Not Ended

- Bull Market for Silver and Gold Prices Has Not Ended

- The Numbers Game

- Art Cashin - Enormous Danger Facing US & The World

- No Inflation To See Here...

- USD and Euro Indices Correct - What About Gold?

- Silver and Technical Analysis -Painting a Masterpiece

- Gold Daily and Silver Weekly Charts - Claims Per Ounce at 69 to 1

- Gold Daily and Silver Weekly Charts - Claims Per Ounce at 69 to 1

- Stockman appalled by Yellen's testimony

- Gold Investment & the Flow of Money

- Gold Investment & the Flow of Money

- Gold Investment & the Flow of Money

- Miners Reporting Serious Progress

- Indian Gold Dealer: “Gold Demand Cannot Go Down; By End Of December, All Jewelers Will Need To Replenish Stock”

- Sprott comments on WGC gold demand data, Yellen's remarks on gold

- The Daily Market Report: Gold Stemmed by Stocks’ Love of QE

- Cooperation between central banks

- David Stockman - Lunatic Fed Engineering Global Collapse

- Gold Analysts More Bullish on Fed Stimulus Outlook

- ASX Wrap: High grade gold from Beadell and Ramelius, as Whitehaven lands in hot water

- Can’t-miss headlines: Republicans on gold, art spikes and more

- Paulson’s and Soros’ views on gold positive

- What gold’s first annual fall in over a decade could imply

- Codelco buys Cat trucks for major new copper/silver mine

- Republicans assert reliance on gold as world loses faith

- Gold refiners recasting bars for sizes preferred in Asia

- Silver coin supplies buckle on fever-pitch retail buys

- Market Report: Have we reached a selling climax?

- Gold Stocks: 'W' or IHS?

- 3 Potholes in the End-of-Year Rally

- Gold Lower on Yellen’s QE Assurances

- The Comex Fraud Is Growing Larger - 69 Times More Paper Than Gold

- The Comex Fraud Is Growing Larger - 69 Times More Paper Than Gold

- Gold Prices Rebound as China Gets "Unprecedented" Market Reforms, Fed QE Blamed for Shanghai Interest-Rate Spike

- A Resource Reserved for Contrarians

- Gold easier at 1283.36 (-3.30) Silver 20.64 (-0.104) Dollar and euro steady. Stocks called mixed. US 10yr 2.72% (+3 bps).

- Gold Flows East As Three Pieces Of Bacon Sell For €105 Million

- Gold and Silver Wheels are Turning and You Can't Slow Down

- Reasons to be Bullish on Gold

- God Wants an Economic Collapse

- Why the Sell-Off in Gold Bullion Is Based on Faulty Logic

- Gold - Will it Drop to $1000 or Was a Bottom Formed in Summer?

- Gold To Begin a Parabolic Rise In 2014 – Here’s Why

- Chilling Warning Coming From China & The Elites

| TSA multimillion dollar program as effective as random searches Posted: 16 Nov 2013 12:00 AM PST from RTAmerica: |

| Why the Sell-Off in Gold Bullion Is Based on Faulty Logic Posted: 15 Nov 2013 11:30 PM PST by Sasha Cekerevac, Investment Contrarians:

Many are pointing to talk that the Federal Reserve is about to reduce its monetary stimulus, and this has led some investors to adjust their investment strategy by reducing their gold bullion holdings. There are several interesting points to make about the argument for this investment strategy. Firstly, members of the Federal Reserve, along with other central bankers around the world, have explicitly stated that inflation is far too low—the opposite of what these investors who are bearish on gold believe. |

| Wi-Fi Spy Network Installed In Los Angeles? Posted: 15 Nov 2013 11:00 PM PST by Paul Joseph Watson, InfoWars:

As we reported earlier this week, the $2.7 million dollar system, funded by a Department of Homeland Security grant, consists of a series of white wi-fi boxes affixed to utility poles with which authorities eventually plan to blanket the entire city of Seattle. According to promotional material from Aruba Networks, the manufacturer behind the devices, the grid has the capability to track "rogue" or "unassociated" devices that are not even connected to the network. |

| Posted: 15 Nov 2013 08:40 PM PST by Jason Hommel, Silver Stock Report:

On the demand side, most all or more of the silver that is mined each year is consumed and used up by industry. Only 100 million oz. is bought by investors. At $20/oz., that’s $2 billion physical silver bought per year by investors. These numbers don’t change much from year to year, and two companies produce similar numbers, which you can look up at the silver survey companies cpmgroup.com and silverinstitute.com. |

| Precious Metals IRAs and What To Do With Gold Posted: 15 Nov 2013 05:45 PM PST Have Questions About Precious Metals IRAs? Miss our latest webinar? You're in luck! Get your questions answered in this video. [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Bull Market for Silver and Gold Prices Has Not Ended Posted: 15 Nov 2013 05:25 PM PST Gold Price Close Today : 1,287.80 Gold Price Close 8-Nov-13 : 1,284.50 Change : 3.30 or 0.3% Silver Price Close Today : 20.717 Silver Price Close 8-Nov-13 : 21.307 Change : -0.59 or -2.8% Gold Silver Ratio Today : 62.162 Gold Silver Ratio 8-Nov-13 : 60.285 Change : 1.88 or 3.1% Silver Gold Ratio : 0.01609 Silver Gold Ratio 8-Nov-13 : 0.01659 Change : -0.00050 or -3.0% Dow in Gold Dollars : $ 256.22 Dow in Gold Dollars 8-Nov-13 : $ 253.66 Change : $2.56 or 1.0% Dow in Gold Ounces : 12.395 Dow in Gold Ounces 8-Nov-13 : 12.271 Change : 0.12 or 1.0% Dow in Silver Ounces : 770.46 Dow in Silver Ounces 8-Nov-13 : 739.75 Change : 30.72 or 4.2% Dow Industrial : 15,961.70 Dow Industrial 8-Nov-13 : 15,761.78 Change : 85.48 or 0.5% S&P 500 : 1,798.18 S&P 500 8-Nov-13 : 1,770.61 Change : 7.56 or 0.4% US Dollar Index : 80.818 US Dollar Index 8-Nov-13 : 81.243 Change : -0.425 or -0.5% Platinum Price Close Today : 1,437.10 Platinum Price Close 8-Nov-13 : 1,441.10 Change : -4.00 or -0.3% Palladium Price Close Today : 732.30 Palladium Price Close 8-Nov-13 : 757.35 Change : -25.05 or -3.3% Pretty hard to makes sense of silver and GOLD PRICES. They disagreed even with each other this week, gold rising 0.3% and silver losing 2.8%. Today the GOLD PRICE inched up $1.10 to $1,287.30. The SILVER PRICE gained -- get out your jeweler's loupes -- one-half cent to 2071.7c. Something big and dispositive's gonna happen here. In spite of the last two day's rally, silver and gold prices remained locked in a downtrend, but then at reversals markets are always trending down. Talking to a friend today reinforced an idea that's been working in my mind that both metals might make a surprise turnaround here. Oh, they've turned up for at least a short run, but they have to do better than that. We have to see silver better 2309c and then 2512c before it will redeem itself out of that downtrend. Gold price must beat $1,361.80 and $1,434. But one step at a time. Y'all, I know I've said this a thousand times, but y'all need to keep hearing it to rinse all that central bank hogwash out of your ears. THE BULL MARKET IN SILVER and GOLD HAS NOT ENDED. NOT ENDED. If the 2011-2013 correction low was not posted in June, we ought to see it by the end of this month. This is not the time to go to sleep. Regardless what the Washington apparatchiki say, the Millennium has not yet arrived. Y'all can jot down 5 November 2013 as "the day the rule of law died." I heard on the radio this morning that Bernard O'Bama has taken upon his own stout shoulders to "delay" applying that part of Obamacare that cancelled some folk's health insurance, and he's ordered the insurance companies to re-instate them. What a dolt I am! I though we had a CONGRESS to make laws, and the president merely executed them. I thought once a law was passed, the president had no option save to execute it. I also thought, durned Tennessee constitutional fool that I am, that only under a dictatorship did the president make or repeal laws on his own hook. If any of y'all have been to court in the past 20 or 30 years, especially on tax matters, you already know that the rule of law is dead. But this nails down the coffin lid, if the president can by his mere arbitrary word make or break existing contracts or set laws aside, why, the rule of law is dead. That means, of course, that no man's life, property, or livelihood is safe from government. No law, no safety. But y'all do have a bang-up new health care system. Meanwhile, in China they are instituting reforms to make their economy freer. Back on Wall Street, stocks were foaming at the mouth over Fed-Head-Criminal-Designate Janet Yellen's senate testimony yesterday she would continue Bernanke's inflation until the cows come home and then a couple of light years further. Let's see, the Chinese Communists abandon communism for free markets while the US abandons free markets for centralized economic control in the hand of goofs that wouldn't recognize an economic truth if it bit 'em on the leg. Enough of this fun, on to markets. Dow and S&P500 hit new all time highs today, rising on the strength of Yellen's hot air. Dow gained 85.48 (0.54%) to 15,961.70. S&P500 added 7.56 (0.42%) to 1,798.18. Yea, write it down in thy book: The Moneychanger is speechless. How could words describe my feelings as I view these numbers, knowing that the entire US economy has been transferred into La-La Land, where numbers mean exactly what we need them to mean, everybody is good-looking, and we ALL feel good about the future. With the economy conquered and tamed, the Fed and the government can now move on to eliminating BO. New all time highs in the Dow and S&P500 didn't show much in the Dow in Gold and Dow in Silver. They edged up -- DiG rose 0.5%. to 12.399 oz (G$256.32) and the DiS climbed 0.5% to 770.46. If I was piloting that boat labeled "US Dollar Index" I'd be holding my breath. Dollar Index lost 21 basis points today (0.27%) to 80.818. Long as it stays above 80.75 it will probably keep rising toward 83. Euro have formed a bearish rising wedge while filling gaps on the chart. Would have to close above its 50 DMA ($1.3530) to change my mind. 'Pears the Nice Nipponese Government Men intend to knock their currency down again. Lost 0.12% today to 99.86 cents/Y100. 99.55 was the last low. Break though that throws the yen out of the boat. Y'all better keep watching those interest rates. They're liable to turn Janet Yellen's legs to jelly if they rise too much. Ten Year treasury note yield rose today 0.26% to 2.709%. Look out, Janet! Whoa! We weren't expecting Volume 2 of At Home In Dogwood Mudhole to arrive until early December, but a truckload of the new books showed up day before yesterday! Y'all have to help me (and yourselves -- you'll laugh yourself goofy) by buying a copy for yourself and your friends for Christmas. Listen, use the code word "Hogwild" when you order and you save up to $8 in shipping (sorry, not available outside the US). We already have orders from 19 states, New Zealand, and the UK. What's hindering you folks in Minnesota? Alaska? Arizona? Connecticut? Delaware and Florida? Hawaii? Idaho? Indiana, Iowa, Kansas? Louisiana and Maine? Mississippi, Missouri, Montana, Nebraska, and Nevada? What about the News, New Mexico and New York? Oklahoma? What about you folks in the rectilinear states, Utah, South Dakota, and Wyoming? Vermont, Washington, West Virginia? And my favorite yankees up in Wisconsin? I double-dog dare y'all to buy a copy! Y'all enjoy your weekend! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Bull Market for Silver and Gold Prices Has Not Ended Posted: 15 Nov 2013 05:25 PM PST Gold Price Close Today : 1,287.80 Gold Price Close 8-Nov-13 : 1,284.50 Change : 3.30 or 0.3% Silver Price Close Today : 20.717 Silver Price Close 8-Nov-13 : 21.307 Change : -0.59 or -2.8% Gold Silver Ratio Today : 62.162 Gold Silver Ratio 8-Nov-13 : 60.285 Change : 1.88 or 3.1% Silver Gold Ratio : 0.01609 Silver Gold Ratio 8-Nov-13 : 0.01659 Change : -0.00050 or -3.0% Dow in Gold Dollars : $ 256.22 Dow in Gold Dollars 8-Nov-13 : $ 253.66 Change : $2.56 or 1.0% Dow in Gold Ounces : 12.395 Dow in Gold Ounces 8-Nov-13 : 12.271 Change : 0.12 or 1.0% Dow in Silver Ounces : 770.46 Dow in Silver Ounces 8-Nov-13 : 739.75 Change : 30.72 or 4.2% Dow Industrial : 15,961.70 Dow Industrial 8-Nov-13 : 15,761.78 Change : 85.48 or 0.5% S&P 500 : 1,798.18 S&P 500 8-Nov-13 : 1,770.61 Change : 7.56 or 0.4% US Dollar Index : 80.818 US Dollar Index 8-Nov-13 : 81.243 Change : -0.425 or -0.5% Platinum Price Close Today : 1,437.10 Platinum Price Close 8-Nov-13 : 1,441.10 Change : -4.00 or -0.3% Palladium Price Close Today : 732.30 Palladium Price Close 8-Nov-13 : 757.35 Change : -25.05 or -3.3% Pretty hard to makes sense of silver and GOLD PRICES. They disagreed even with each other this week, gold rising 0.3% and silver losing 2.8%. Today the GOLD PRICE inched up $1.10 to $1,287.30. The SILVER PRICE gained -- get out your jeweler's loupes -- one-half cent to 2071.7c. Something big and dispositive's gonna happen here. In spite of the last two day's rally, silver and gold prices remained locked in a downtrend, but then at reversals markets are always trending down. Talking to a friend today reinforced an idea that's been working in my mind that both metals might make a surprise turnaround here. Oh, they've turned up for at least a short run, but they have to do better than that. We have to see silver better 2309c and then 2512c before it will redeem itself out of that downtrend. Gold price must beat $1,361.80 and $1,434. But one step at a time. Y'all, I know I've said this a thousand times, but y'all need to keep hearing it to rinse all that central bank hogwash out of your ears. THE BULL MARKET IN SILVER and GOLD HAS NOT ENDED. NOT ENDED. If the 2011-2013 correction low was not posted in June, we ought to see it by the end of this month. This is not the time to go to sleep. Regardless what the Washington apparatchiki say, the Millennium has not yet arrived. Y'all can jot down 5 November 2013 as "the day the rule of law died." I heard on the radio this morning that Bernard O'Bama has taken upon his own stout shoulders to "delay" applying that part of Obamacare that cancelled some folk's health insurance, and he's ordered the insurance companies to re-instate them. What a dolt I am! I though we had a CONGRESS to make laws, and the president merely executed them. I thought once a law was passed, the president had no option save to execute it. I also thought, durned Tennessee constitutional fool that I am, that only under a dictatorship did the president make or repeal laws on his own hook. If any of y'all have been to court in the past 20 or 30 years, especially on tax matters, you already know that the rule of law is dead. But this nails down the coffin lid, if the president can by his mere arbitrary word make or break existing contracts or set laws aside, why, the rule of law is dead. That means, of course, that no man's life, property, or livelihood is safe from government. No law, no safety. But y'all do have a bang-up new health care system. Meanwhile, in China they are instituting reforms to make their economy freer. Back on Wall Street, stocks were foaming at the mouth over Fed-Head-Criminal-Designate Janet Yellen's senate testimony yesterday she would continue Bernanke's inflation until the cows come home and then a couple of light years further. Let's see, the Chinese Communists abandon communism for free markets while the US abandons free markets for centralized economic control in the hand of goofs that wouldn't recognize an economic truth if it bit 'em on the leg. Enough of this fun, on to markets. Dow and S&P500 hit new all time highs today, rising on the strength of Yellen's hot air. Dow gained 85.48 (0.54%) to 15,961.70. S&P500 added 7.56 (0.42%) to 1,798.18. Yea, write it down in thy book: The Moneychanger is speechless. How could words describe my feelings as I view these numbers, knowing that the entire US economy has been transferred into La-La Land, where numbers mean exactly what we need them to mean, everybody is good-looking, and we ALL feel good about the future. With the economy conquered and tamed, the Fed and the government can now move on to eliminating BO. New all time highs in the Dow and S&P500 didn't show much in the Dow in Gold and Dow in Silver. They edged up -- DiG rose 0.5%. to 12.399 oz (G$256.32) and the DiS climbed 0.5% to 770.46. If I was piloting that boat labeled "US Dollar Index" I'd be holding my breath. Dollar Index lost 21 basis points today (0.27%) to 80.818. Long as it stays above 80.75 it will probably keep rising toward 83. Euro have formed a bearish rising wedge while filling gaps on the chart. Would have to close above its 50 DMA ($1.3530) to change my mind. 'Pears the Nice Nipponese Government Men intend to knock their currency down again. Lost 0.12% today to 99.86 cents/Y100. 99.55 was the last low. Break though that throws the yen out of the boat. Y'all better keep watching those interest rates. They're liable to turn Janet Yellen's legs to jelly if they rise too much. Ten Year treasury note yield rose today 0.26% to 2.709%. Look out, Janet! Whoa! We weren't expecting Volume 2 of At Home In Dogwood Mudhole to arrive until early December, but a truckload of the new books showed up day before yesterday! Y'all have to help me (and yourselves -- you'll laugh yourself goofy) by buying a copy for yourself and your friends for Christmas. Listen, use the code word "Hogwild" when you order and you save up to $8 in shipping (sorry, not available outside the US). We already have orders from 19 states, New Zealand, and the UK. What's hindering you folks in Minnesota? Alaska? Arizona? Connecticut? Delaware and Florida? Hawaii? Idaho? Indiana, Iowa, Kansas? Louisiana and Maine? Mississippi, Missouri, Montana, Nebraska, and Nevada? What about the News, New Mexico and New York? Oklahoma? What about you folks in the rectilinear states, Utah, South Dakota, and Wyoming? Vermont, Washington, West Virginia? And my favorite yankees up in Wisconsin? I double-dog dare y'all to buy a copy! Y'all enjoy your weekend! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Posted: 15 Nov 2013 05:00 PM PST The Gold Speculator |

| Art Cashin - Enormous Danger Facing US & The World Posted: 15 Nov 2013 02:31 PM PST  Today 50-year veteran Art Cashin warned King World News about the enormous dangers facing the US and the rest of the of the world, which could wind up creating tremendous turmoil around the globe. Cashin, who is Director of Floor Operations at UBS ($650 billion under management), also spoke with KWN about gold. Today 50-year veteran Art Cashin warned King World News about the enormous dangers facing the US and the rest of the of the world, which could wind up creating tremendous turmoil around the globe. Cashin, who is Director of Floor Operations at UBS ($650 billion under management), also spoke with KWN about gold.This posting includes an audio/video/photo media file: Download Now |

| Posted: 15 Nov 2013 02:23 PM PST Submitted by Simon Black of Sovereign Man blog, One of the biggest lies in finance is this perpetual deception that inflation is good. Ben Bernanke, the current high priest of US monetary policy, recently remarked that it’s “important to prevent US inflation from falling too low.” Well of course, we wouldn’t want that, would we? Just imagine the chaos and devastation that would ensue if the cost of living actually remained… you know… the same. One shudders at the mere thought of price stability. Of course I jest. Fact is, inflation benefits those who are in debt up to their eyeballs at the expense of people who have been financially responsible. Yet economists have somehow managed to convince people that inflation is just and necessary. We all know inflation exists. But we’ve been programmed to shrug it off as if it’s a natural part of the system. The even greater deceit is how they report the figures. Governments all over the world lie about inflation; they do this because inflation has such a huge impact in monetary policy. The playbook they all use is very simple– as long as inflation is ‘low’, then central bankers can print money. So they have a big incentive to underreport it. Quoting a report from the US Department of Labor, for example, a recent headline from Reuters stated “U.S. consumer prices rise, but underlying inflation benign”. I’m not entirely sure how inflation can be ‘benign’ while consumer prices are simultaneously rising. Yet this is the modern day doublethink coming from the Ministry of Truth that we are all expected to unquestioningly believe. Inflation does exist. I’ve seen it all over the world as I travel. In India right now, the reported inflation figure just hit 10% at a time when the economy is sagging. In Bangladesh, workers are now rioting over rising cost of living, which far exceeds the proposed wage hikes that are on the table. In the Land of the Free, the average price of a movie ticket is $8.38 earlier this year, another record high. Walnut farmers in California are now reaping record high prices on their crop. And of course, McDonald’s is now killing their once popular dollar menu as they can no longer afford to sell anything at that price. There are examples everywhere. And this also goes for asset price inflation. We can see many stock and bond markets near their all-time highs. But then there are other asset classes… like farmland in Illinois, which is now selling for $13,600 per acre. With an average yield of 160 bushels per acre, the net financial return after paying variable costs is less than 2%. It just doesn’t make any sense. And in the art world, a Francis Bacon triptych just sold for a record $142 million at Christie’s in New York. Everywhere you look, there’s overwhelming evidence of bubbles and price hikes. It’s simple. There’s too much money in the system. Not only is this destructive, it’s the height of deceit to tell people that there’s no inflation. |

| USD and Euro Indices Correct - What About Gold? Posted: 15 Nov 2013 01:30 PM PST n our most recent article on gold, USD and Euro Indices we wrote that the outlook for the yellow metal was bearish just as the outlook for the Euro Index and just as it was bullish for the USD Index. Read More... |

| Silver and Technical Analysis -Painting a Masterpiece Posted: 15 Nov 2013 01:03 PM PST Jeffrey Lewis |

| Gold Daily and Silver Weekly Charts - Claims Per Ounce at 69 to 1 Posted: 15 Nov 2013 01:03 PM PST |

| Gold Daily and Silver Weekly Charts - Claims Per Ounce at 69 to 1 Posted: 15 Nov 2013 01:03 PM PST |

| Stockman appalled by Yellen's testimony Posted: 15 Nov 2013 11:04 AM PST 2:04p ET Friday, November 15, 2013 Dear Friend of GATA and Gold: Former U.S. Budget Director David Stockman today tells King World News that Federal Reserve chair nominee Janet Yellen's testimony to the Senate yesterday suggested that the Fed soon will be taking the world economy over a cliff. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/11/15_D... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

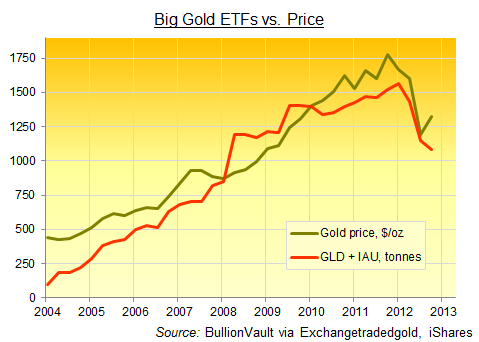

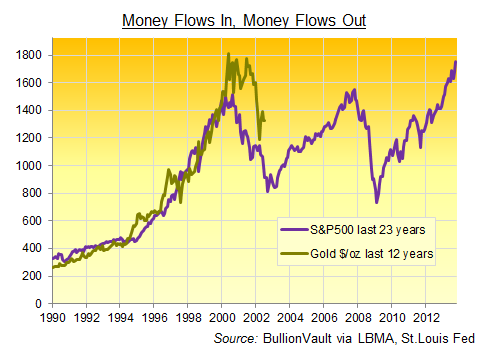

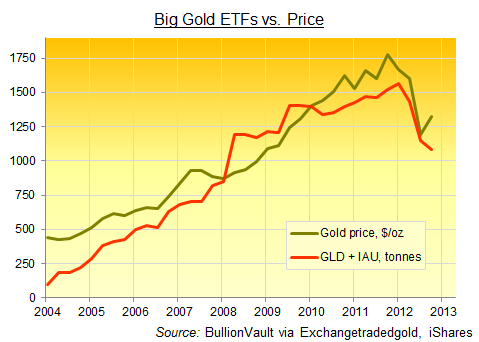

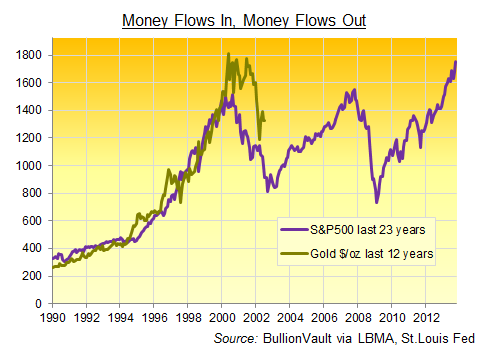

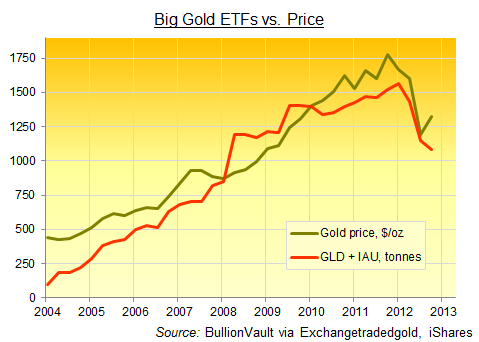

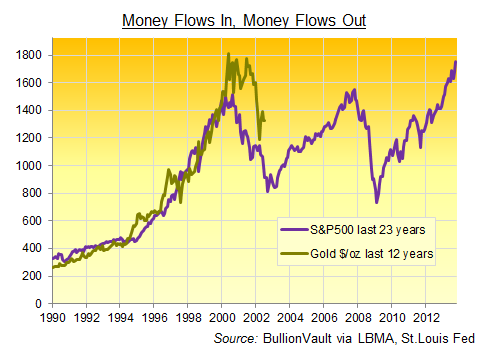

| Gold Investment & the Flow of Money Posted: 15 Nov 2013 10:47 AM PST Gold investment has receded in 2013. But money could flow back as quickly..._ WHICH number is greater? wonders Adrian Ash at BullionVault. The number of economists who were "the only person to forecast the financial crisis", or the number of people who claim that they alone dreamt up the idea of gold ETFs at the start of last decade? Either way, the crisis struck, and gold ETF holdings leapt as investment money flowed in...  "In a sense," says a note from Swiss investment bank and London bullion-market maker UBS, "these [2013] out-flows are a reversal of the trend that occurred five years ago when gold ETF investment – particularly in the GLD – increased sharply. "Back then, concerns over a weak US economy and the impact of QE on inflation were key motivators driving investors towards gold ETFs. With the macro outlook shifting this year, those positions are now being unwound." The impact on global supply and demand in 2013 for gold has been dramatic. Because these exchange-traded gold products – legal trusts whose debts are denominated in gold bullion, and which then own physical bullion to back their shares' value – have flowed from one side of the ledger to the other. Adding an average 45 tonnes to their collective hoard every 3 months as investment flowed in between 2005 and late 2012, the giant SPDR Gold Trust (GLD) and its smaller competitor from iShares (IAU) have turned net sellers this year. Together, they've sold back some 160 tonnes per quarter, accounting for two-thirds of 2013's total gold ETF liquidation of 700 tonnes. What goes up, right? Well, yes. The ETFs revolutionized how institutional investors, most especially US mutual funds who can't own physical property, could access gold price exposure. No, these shareholders don't own gold. No single gold ETF product is open for trade 24/7 either. Nor do they offer a choice of vaulting locations. Settlement to a broker takes 2 or 3 days, rather than being instant. Such benefits are, for the moment, restricted to private investors seeking the smartest way to buy gold outright. But for those institutional investment dollars which otherwise had to chase mining stocks or play the futures market, gold ETFs provided cash-price exposure, and also took physical metal off-market to keep in allocated bank accounts instead. And fast as this year's second-quarter liquidation was (285 tonnes from the GLD and IAU alone), the peak accumulation on the way up was faster (348 tonnes in Q1 2009).  Where next for gold investment flows then? The world is awash with money. Inflation cannot dent gold, nor can credit default tarnish it. But whether or not inflation shows up or crisis returns soon, the money of Western households being run by the City and Wall Street needs a home. So does the pile of rich Western promises held by emerging-market central banks. Right alongside the fast-growing savings of their fast-growing middle classes. Stocks have now offered managed money a very warm welcome 3 times in the last 15-odd years. Gold, to date, has surged and peaked out as well, but once. Investment dollars have now ebbed out of gold for 12 months after flooding in for 12 years straight. With interest rates stuck at zero, and QE money printing the only monetary tool left to hand, there's little beyond sentiment, perhaps, to stop a flood of fresh money washing back in. |

| Gold Investment & the Flow of Money Posted: 15 Nov 2013 10:47 AM PST Gold investment has receded in 2013. But money could flow back as quickly..._ WHICH number is greater? wonders Adrian Ash at BullionVault. The number of economists who were "the only person to forecast the financial crisis", or the number of people who claim that they alone dreamt up the idea of gold ETFs at the start of last decade? Either way, the crisis struck, and gold ETF holdings leapt as investment money flowed in...  "In a sense," says a note from Swiss investment bank and London bullion-market maker UBS, "these [2013] out-flows are a reversal of the trend that occurred five years ago when gold ETF investment – particularly in the GLD – increased sharply. "Back then, concerns over a weak US economy and the impact of QE on inflation were key motivators driving investors towards gold ETFs. With the macro outlook shifting this year, those positions are now being unwound." The impact on global supply and demand in 2013 for gold has been dramatic. Because these exchange-traded gold products – legal trusts whose debts are denominated in gold bullion, and which then own physical bullion to back their shares' value – have flowed from one side of the ledger to the other. Adding an average 45 tonnes to their collective hoard every 3 months as investment flowed in between 2005 and late 2012, the giant SPDR Gold Trust (GLD) and its smaller competitor from iShares (IAU) have turned net sellers this year. Together, they've sold back some 160 tonnes per quarter, accounting for two-thirds of 2013's total gold ETF liquidation of 700 tonnes. What goes up, right? Well, yes. The ETFs revolutionized how institutional investors, most especially US mutual funds who can't own physical property, could access gold price exposure. No, these shareholders don't own gold. No single gold ETF product is open for trade 24/7 either. Nor do they offer a choice of vaulting locations. Settlement to a broker takes 2 or 3 days, rather than being instant. Such benefits are, for the moment, restricted to private investors seeking the smartest way to buy gold outright. But for those institutional investment dollars which otherwise had to chase mining stocks or play the futures market, gold ETFs provided cash-price exposure, and also took physical metal off-market to keep in allocated bank accounts instead. And fast as this year's second-quarter liquidation was (285 tonnes from the GLD and IAU alone), the peak accumulation on the way up was faster (348 tonnes in Q1 2009).  Where next for gold investment flows then? The world is awash with money. Inflation cannot dent gold, nor can credit default tarnish it. But whether or not inflation shows up or crisis returns soon, the money of Western households being run by the City and Wall Street needs a home. So does the pile of rich Western promises held by emerging-market central banks. Right alongside the fast-growing savings of their fast-growing middle classes. Stocks have now offered managed money a very warm welcome 3 times in the last 15-odd years. Gold, to date, has surged and peaked out as well, but once. Investment dollars have now ebbed out of gold for 12 months after flooding in for 12 years straight. With interest rates stuck at zero, and QE money printing the only monetary tool left to hand, there's little beyond sentiment, perhaps, to stop a flood of fresh money washing back in. |

| Gold Investment & the Flow of Money Posted: 15 Nov 2013 10:47 AM PST Gold investment has receded in 2013. But money could flow back as quickly..._ WHICH number is greater? wonders Adrian Ash at BullionVault. The number of economists who were "the only person to forecast the financial crisis", or the number of people who claim that they alone dreamt up the idea of gold ETFs at the start of last decade? Either way, the crisis struck, and gold ETF holdings leapt as investment money flowed in...  "In a sense," says a note from Swiss investment bank and London bullion-market maker UBS, "these [2013] out-flows are a reversal of the trend that occurred five years ago when gold ETF investment – particularly in the GLD – increased sharply. "Back then, concerns over a weak US economy and the impact of QE on inflation were key motivators driving investors towards gold ETFs. With the macro outlook shifting this year, those positions are now being unwound." The impact on global supply and demand in 2013 for gold has been dramatic. Because these exchange-traded gold products – legal trusts whose debts are denominated in gold bullion, and which then own physical bullion to back their shares' value – have flowed from one side of the ledger to the other. Adding an average 45 tonnes to their collective hoard every 3 months as investment flowed in between 2005 and late 2012, the giant SPDR Gold Trust (GLD) and its smaller competitor from iShares (IAU) have turned net sellers this year. Together, they've sold back some 160 tonnes per quarter, accounting for two-thirds of 2013's total gold ETF liquidation of 700 tonnes. What goes up, right? Well, yes. The ETFs revolutionized how institutional investors, most especially US mutual funds who can't own physical property, could access gold price exposure. No, these shareholders don't own gold. No single gold ETF product is open for trade 24/7 either. Nor do they offer a choice of vaulting locations. Settlement to a broker takes 2 or 3 days, rather than being instant. Such benefits are, for the moment, restricted to private investors seeking the smartest way to buy gold outright. But for those institutional investment dollars which otherwise had to chase mining stocks or play the futures market, gold ETFs provided cash-price exposure, and also took physical metal off-market to keep in allocated bank accounts instead. And fast as this year's second-quarter liquidation was (285 tonnes from the GLD and IAU alone), the peak accumulation on the way up was faster (348 tonnes in Q1 2009).  Where next for gold investment flows then? The world is awash with money. Inflation cannot dent gold, nor can credit default tarnish it. But whether or not inflation shows up or crisis returns soon, the money of Western households being run by the City and Wall Street needs a home. So does the pile of rich Western promises held by emerging-market central banks. Right alongside the fast-growing savings of their fast-growing middle classes. Stocks have now offered managed money a very warm welcome 3 times in the last 15-odd years. Gold, to date, has surged and peaked out as well, but once. Investment dollars have now ebbed out of gold for 12 months after flooding in for 12 years straight. With interest rates stuck at zero, and QE money printing the only monetary tool left to hand, there's little beyond sentiment, perhaps, to stop a flood of fresh money washing back in. |

| Miners Reporting Serious Progress Posted: 15 Nov 2013 10:27 AM PST This was supposed to be the year that gold and silver miners pretty much imploded. The story in a nutshell is that during the boom years of 2009 -2011, the markets threw so much cash at the industry that a lot of CEOs went a little crazy, racing to accumulate the most ounces in the ground without regard for whether those ounces could be gotten out profitably at prevailing prices. When the metals got whacked in 2012 and 2013, the miners that had gone the craziest found themselves with uneconomic mines, way too many people and equipment, costs that had doubled in just a few years, and in many cases serious doubts about their future existence. But one of the nice things about an easy-money binge is that it leaves an industry with a plenty of fat that can be trimmed right away. The miners have spent the past six months in survival mode, firing non-essential people, closing uneconomic mines and cancelling big development projects. Based on the most recent numbers it’s going better than the expected. The following table compares Q3 2013 silver mining costs to the year-ago number for three companies that just reported. Silver Mining Costs These are serious reductions. Only Silvercrest looks strongly profitable at today’s silver price, but Pan American and Great Panther look a lot less ugly than they did a year ago. So, a few questions: • What did they have to cut to get such big cost savings? If they’ve pared their exploration and development wisely and are now focused on just the best projects, that’s good. If they fired a bunch of people they’ll need back when silver goes to $30 next year, that’s bad but not horrendous. If they’ve been “high-grading,” mining and processing the best ore and leaving the lower quality stuff for later, that opens the door to disappointment down the road. • How much further can costs be cut? Assuming the low-hanging fruit was picked first, progress will be a lot slower going forward. But it’s hard to believe that everything got done in just a couple of quarters, so maybe Q4 – looking past the big write-downs – will feature some more pleasant surprises. Suddenly, there’s a 2014 scenario that’s not depressing: Let precious metals prices start to rise a bit and miners come in with lower than expected costs, and these stocks, at record lows versus their underlying metals, might have a big year. Note: This originally appeared at Safehaven.com P.S. Our resource expert, Byron King, had a hot tip about Barrick Gold back on November 7 you can check out here. Readers of The Daily Reckoning get all kinds of great information about where the next big buying opportunity in gold is coming from. Subscribe now and don’t miss it! |

| Posted: 15 Nov 2013 10:20 AM PST By Tekoa Da Silva It was a powerful conversation, as Vishal indicated that the Indian Government and Central Bank are now stepping back in their fight against gold, allowing select bullion & jewelry merchants to import the metal on a highly controlled basis. This loosening of policy according to Vishal, isn't eliminating market bottlenecks, but to a certain extent, is reducing domestic premiums. …An interesting element of the new import scheme according to Vishal, is that, "There are a lot of procedures to go through. It is not very easy to procure gold under this scheme. …"I personally feel that silver has become the poor man's gold for investment, for short-term investment especially…[and] people have shifted to silver up to a certain extent, but gold is gold. Overall demand cannot come down. Now is the festive season where people will start buying gold in the form of jewelry. So by the end of December, all jewelers will need gold to replenish their original stock and get new jewelry manufactured, because there will be huge sales happening in this wedding season." [source] |

| Sprott comments on WGC gold demand data, Yellen's remarks on gold Posted: 15 Nov 2013 10:08 AM PST 12:05p ET Friday, November 15, 2013 Dear Friend of GATA and Gold: Sprott Asset Management CEO Eric Sprott discusses his recent criticism of the World Gold Council's gold demand data in an audio interview with the new Sprott Money Weekly Wrapup program. Sprott also discusses Federal Reserve Board chairwoman nominee Janet Yellen's remarks on gold in her Senate testimony yesterday. The interview is posted at the Sprott Money Internet site here: https://soundcloud.com/sprottmoney/sprott-money-weekly-wrap-up-ep07 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair Plans Seminar in Boston on Dec. 7 Gold advocate and mining entrepreneur Jim Sinclair will hold his next seminar from 1 to 5 p.m. on Saturday, December 7, in the Boston suburb of Cambridge, Mass., at the Boston Marriott Cambridge at 50 Broadway in Cambridge. The admission fee will be $50. Details are posted at Sinclair's Internet site, JSMineSet, here: http://www.jsmineset.com/2013/11/14/boston-qa-session-announced/ Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| The Daily Market Report: Gold Stemmed by Stocks’ Love of QE Posted: 15 Nov 2013 09:36 AM PST

However, the biggest beneficiary of past — and presumed continued — central bank largess has been the stock market, driving the DJIA within striking distance of the 16,000 level. Ms. Yellen acknowledged that Fed policy has boosted stocks “to some extent,” which may have been the biggest understatement of her entire testimony. Nonetheless, the gravitational pull of a stock market being relentlessly driven higher by massive central bank liquidity operations month in and month out, has diminished the appeal of gold for Western investors for the time being. Eastern investors on the other hand continue to snap up every available physical ounce. The World Gold Council’s Gold Demand Trends Q3 2013 came out yesterday and confirmed that Asian markets are “absorbing the outflow of gold from western ETFs.” China’s total gold demand through Q3 was 797.8 metric tonnes, which is already nearly 22 tonnes more than the 776 tonnes of reported demand for all of last year. Despite intense official efforts to curb gold demand this year, Indian demand was 715.7 tonnes through Q3. That’s 113.7 tonnes (19%) more than the first three-quarters of 2012. That would not take into consideration the tonnage smuggled into India as a result of various regulations and taxes imposed on imports. Central banks continued to accumulate gold in Q3 as well, to the tune of 93 tonnes. “Year-to-date, global central bank gold reserves have increased by almost 300 tonnes,” the WGC reported. On the supply side of the equation: Gold supply fell 3% in Q3, versus the same period in 2012. While mine production was up 4%, there was a sharp contraction in recycling. So, very strong demand and a tighter supply environment, would suggest that the price of gold is quite the bargain at these levels. If the stock market takes a pause to assess the true economic fundamentals of the U.S. and global economy, or if “frothiness” in equities becomes a concern, the gold market could get really interesting really fast. |

| Cooperation between central banks Posted: 15 Nov 2013 09:02 AM PST Zerohedge recently drew attention to the growing level of foreign bank cash deposits, tucked away at the bottom of the Fed's H.8 statement.Foreign banks' cash balances have increased by $518.7bn since September 2012, accounting for almost all of the increase in these banks' total assets in the H.8 table. The implication is that these cash balances are held as reserves on the Fed's balance sheet, the counterpart of quantitative easing. This naturally raises the reasonable question posed by Zerohedge's article as to why the Fed appears to be benefiting foreign banks with QE. The answer is either these deposits have been transferred to them from US banks in the normal course of business or the Fed is prepared to provide liquidity to foreign banks: after all the US dollar is the reserve currency. And this liquidity is most needed by the weakest banks in the international banking system, many of which are in the eurozone. The ECB's room for manoeuvre with respect to money-printing is more limited, and it is the only central bank of the big four not to have overtly quantitatively eased. Furthermore, the eurozone is still in trouble even though it has disappeared from the headlines. The chart below of bank lending figures supplied by the ECB illustrates the problem.

Bank lending peaked in mid-2012, and by mid-2013 it had contracted over €1 trillion. By now, the ECB should have advance knowledge of the yet-to-be-released Q3 bank lending total, which if it has continued the downward trend explains why the ECB unexpectedly reduced interest rates recently. Meanwhile, the Bank of England has finally admitted that the UK's economy is growing. Conventional wisdom suggests the BoE should permit interest rates to return to more normal levels, but it refuses to do so for at least another year. The fact that the UK continues with current interest rate polices is due in part to policy coordination with the Fed, the ECB and to a lesser extent perhaps the Bank of Japan. The logical implication from the Fed's and the BoE's actions is that interest rate policies are being managed with the weakest in mind. Therefore the course of prices and bank lending in the eurozone could be regarded as the current determinant of when tapering will be introduced by the Fed. However there is still an overriding problem: if the stimulant of monetary inflation is reduced, rates along the yield curve will rise rapidly from today's wholly artificially suppressed levels. The two cannot be divorced. The Fed knows this, and it is central to its internal debate. The fact of the matter is that just as zero interest rates flatter bank balance sheets and government borrowing costs, the reverse is also true. Add into the mix the deflationary implications of more normal interest rates and it is obvious that the Fed and the BoE are trapped. They will not be looking forward to the day when they run out of excuses for this dilemma. But for now at least there is a rescue mission in place for the eurozone, and the Fed will continue to lend its support to foreign banks. |

| David Stockman - Lunatic Fed Engineering Global Collapse Posted: 15 Nov 2013 08:50 AM PST  Today David Stockman told King World News that the "lunatic policies of the Fed" were engineering a global "collapse." Stockman stunned KWN when he warned that "panic will set in," ... "and the central banks won't have the ability to forestall the collapse." KWN takes Stockman's warning very seriously because he is the man former President Reagan called on in 1981, during that crisis, to become Director of the Office of Management and Budget. Below is what Stockman had to say in part I of a series of powerful interviews that will be released today. Today David Stockman told King World News that the "lunatic policies of the Fed" were engineering a global "collapse." Stockman stunned KWN when he warned that "panic will set in," ... "and the central banks won't have the ability to forestall the collapse." KWN takes Stockman's warning very seriously because he is the man former President Reagan called on in 1981, during that crisis, to become Director of the Office of Management and Budget. Below is what Stockman had to say in part I of a series of powerful interviews that will be released today.This posting includes an audio/video/photo media file: Download Now |

| Gold Analysts More Bullish on Fed Stimulus Outlook Posted: 15 Nov 2013 08:03 AM PST 15-Nov (Bloomberg) — Gold analysts are the most bullish in six weeks as Janet Yellen, the nominee to run the Federal Reserve, signaled the U.S. central bank is in no hurry to curb economic stimulus, reviving demand for the metal as a haven. Eighteen analysts surveyed by Bloomberg News expect prices to gain next week, nine are bearish and two neutral, the largest proportion of bulls since Oct. 4. Gold rose 70 percent from December 2008 to June 2011 as the Fed pumped more than $2 trillion into the financial system, fueling expectations of accelerated inflation and a weaker dollar. President Barack Obama nominated Yellen, the bank's vice chairman, last month to succeed Chairman The economy and labor market are performing "far short of their potential" and must improve before the Fed will consider curbing its $85 billion of monthly bond purchases, Yellen said at her nomination hearing yesterday. [source] |

| ASX Wrap: High grade gold from Beadell and Ramelius, as Whitehaven lands in hot water Posted: 15 Nov 2013 07:52 AM PST Conflicting views from Australia's groups paint a mixed picture for Australia's mining scene while Ramelius and Beadell announce strong drill results. |

| Can’t-miss headlines: Republicans on gold, art spikes and more Posted: 15 Nov 2013 07:52 AM PST Headlines that impact the mining sector, today we look at the Republicans’ love affair with gold, the LME warehouse saga and Barrick's lukewarm share placement. |

| Paulson’s and Soros’ views on gold positive Posted: 15 Nov 2013 07:52 AM PST John Paulson retaining his gold holdings last quarter and George Soros buying back into gold shares was positive news for US investors, says Julian Phillips. |

| What gold’s first annual fall in over a decade could imply Posted: 15 Nov 2013 07:52 AM PST Unless something big happens, 2013 will mark the first year in more than 10 in which gold prices will end the year lower than they started. |

| Codelco buys Cat trucks for major new copper/silver mine Posted: 15 Nov 2013 07:52 AM PST Caterpillar dealer Finning International is to supply 10 Caterpillar 797F trucks to Codelco's Ministro Hales mine in Chile. The mine, due to start up next year will be a major copper and silver producer. |

| Republicans assert reliance on gold as world loses faith Posted: 15 Nov 2013 07:52 AM PST While many analysts say gold will continue to decline as the economy grows, some leading Republicans continue to urge a special role for bullion. |

| Gold refiners recasting bars for sizes preferred in Asia Posted: 15 Nov 2013 07:52 AM PST In Europe, gold is being refined from larger bars suitable for local users into smaller sizes preferred in Asia, says the World Gold Council. |

| Silver coin supplies buckle on fever-pitch retail buys Posted: 15 Nov 2013 07:41 AM PST 15-Nov (MarketWatch) — Silver prices have dropped more than 30% year to date and demand for the physical metal has reached a fever pitch: United States Mint sales of the American Eagle Silver Bullion Coins have already hit a record this year. But as supplies of the coin tighten, analysts and bullion dealers said there are still many options for those interested in buying silver. Many predicted all along that sales of those coins would reach a record this year — and they expect the metal's popularity to continue to grow. "Private investor demand for physical silver in 2013 has been staggering," said Adrian Ash, head of research at BullionVault, an online physical gold-and-silver exchange headquartered in London. In fact, it's amazed the industry, he said. "Refiners can't mint enough product and they're seeing none of it come back for melt." [source] |

| Market Report: Have we reached a selling climax? Posted: 15 Nov 2013 07:28 AM PST Gold started on Monday with a continuation of last Friday's fall, bottoming out on Tuesday at $1261 in US trading. From then on the price rallied to close $25 higher at $1287 on Thursday.Sentiment for gold and silver in Western capital markets is now extremely bearish, and this has been reflected in an increase in open interest on Comex as prices fell, illustrated in the charts below.

It is unusual to see open interest increase substantially on falling prices. In gold, it represents additional short sales amounting to 72.4 tonnes since 6th November, and in silver nearly 2,600 tonnes. So far it has failed to drive the gold price below $1200, but if last week was anything to go by then a bear-raid later today cannot be ruled out, when Far Eastern buyers are absent from the market. However, if the recent low at $1261holds this action will be judged with hindsight as a selling climax, which is ultimately bullish. The other side of the gold trade for many dealers is the dollar and US Treasury yields, both of which have been rising recently. These rises began to reverse ahead of Janet Yellen's confirmation hearing at the Senate yesterday. We learned from that there will be little change in Fed monetary policy, and importantly, Ms Yellen confirmed to us she sees no bubbles in stocks and property. She also evaded attempts to get her to commit to tapering or admit that the Fed was boxed into a corner. This week the World Gold Council released its estimates of gold demand for Q3 2013. Their figures for Greater China (including Hong Kong and Taiwan) show this to have been 220.1 tonnes, which compares with physical deliveries of 573.4 tonnes on the Shanghai Gold Exchange alone. The disparity between the WGC version and other hard statistics was questioned by Eric Sprott in an open letter to the WGC recently. In the WGC's reply they cited differences due to stocking/destocking and round-tripping (presumably arbitrage), but the gap between Sprott's figures based on import/export statistics and theirs appears to be too great to be explained in this way. Furthermore, earlier data releases by the WGC claimed Chinese demand peaked at 306.4 tonnes in Q1, falling to 294.6 tonnes for Q2. This cannot be the case, because the acceleration in demand occurred in Q2 after the April price smash. This is confirmed by physical deliveries through the Shanghai Gold Exchange which totalled 641 tonnes for Q2, against 458 tonnes for Q1. Next week Monday. Eurozone: Current Account. Tuesday. Japan: Leading Indicator (final). Wednesday. Japan: All Industry Activity Index. Thursday. Eurozone: Flash Composite PMI. Friday. Japan: Monthly Economic Repost for November.

|

| Posted: 15 Nov 2013 07:28 AM PST The weekly chart of the HUI Gold Bugs index asks a question we have been reviewing in NFTRH for some time now; is the bottoming situation implied by the up-triggered weekly MACD (and confirming TRIX) a 'W' bottom in the making ... Read More... |

| 3 Potholes in the End-of-Year Rally Posted: 15 Nov 2013 07:26 AM PST If you’ve ignored the whines of the top-calling bears this year, you’ve done very well for yourself. Stocks are working. We saw more new highs again yesterday. Momentum has swung in favor of the illusive end-of-year rally I’ve been yammering about since last month. All is right with the world. Or is it? Today, I’m going to show you what’s not working. While the broad market has been kind to you, there are still a few nooks and crannies in this market that you must avoid. Let’s tackle the market’s awful, ugly and downright terrible investments in three charts. First up are emerging markets… 2013 has not been kind to emerging markets. After bottoming out in July and attempting a late-summer rally, these names are rolling over yet again. The iShares Emerging Markets ETF is down more than 6.5% year-to-date, while the S&P 500 is up more than 25%. There’s no reason to take a chance on any of the emerging markets right now. They all have room to drop even further… Next up is one of this year’s big winners: small-caps. Small stocks have been a great trade so far this year. But they’re starting to fall behind the broad market. While the major indexes were all posting new highs this week, the Russell 2000 failed to top its October highs. While I think you should avoid broad investment in the small-cap sector right now, I still see plenty of individual names that could continue to dominate the market. Last (and least) is gold… Gold tried to get something started in October with a quick jump from $1,260 to $1,360. But the big move never materialized, sellers swooped in and we’re back near the lows. The spot price has dropped more than 9% since Sept. 1. Now’s not the time to be a buyer… Regards, Greg Guenthner Ed. Note: In every type of market there will be winners and there will be losers. Greg can help you discover some of the winners. Every morning he sends his Rude Awakening readers an important message that includes a rundown of the day’s likely moves, 5 specific numbers to watch and at least 3 chances to discover real, actionable investment opportunities. Start your morning off right. Sign up for The Rude Awakening, for FREE, right here. (Don’t worry… You can cancel any time and there is never any obligation.) |

| Gold Lower on Yellen’s QE Assurances Posted: 15 Nov 2013 07:19 AM PST 15-Nov (FoxBusiness) — Gold edged lower on Friday as investors took profits after two days of gains sparked by assurances from the likely new Federal Reserve chief that the U.S. central bank will continue its easy monetary policy for now. Fed Chair nominee Janet Yellen said on Thursday she would press forward with the central bank’s ultra-easy policy until officials were confident a durable economic recovery was in place that could sustain job creation. Answering questions before the Senate Banking Committee, Yellen defended the Fed’s steps to spur growth, calling efforts to boost hiring an “imperative” at a hearing on her nomination to become the first woman to lead the U.S. central bank. “Gold prices have the tendency to edge higher on dovish central bank messages but the impact is rather limited,” ABN Amro analyst Georgette Boele said. “Everyone knows this is just a delay and the tapering will happen sooner or later,” she added. “When you have a stronger economy, the market will start anticipating an increase in interest rates, and that’s not positive for gold.” [source] PG View: That last quote is just bizarre. Sure the Fed is likely to scale back asset purchases at some point, but in the meantime they could add another trillion dollars or more to their balance sheet. I doubt Ms. Boele really believes gold will stay down here if that ultimately proves to be the case. Bear in mind that Japan first initiated QE back in 2001, only to double-down this year with a massive expansion of QE thanks to the dynamic duo of Abe and Kuroda. The U.S. has only been engaged in this fiasco since 2008. |

| The Comex Fraud Is Growing Larger - 69 Times More Paper Than Gold Posted: 15 Nov 2013 07:15 AM PST The information in this report is taken from sources believed to be reliable; however, the Commodity Exchange, Inc. disclaims all liability whatsoever with regard to its accuracy or completeness. This report is produced for information purposes only.The above liability disclaimer was added to the Comex gold and silver warehouse stock reports about 5 months ago. I have a post on this blog about the time it showed up if you need an exact date. You can see the Comex stock report and disclaimer at the bottom here: Comex Gold Stock Report The question I had at the time was, "why now?" The CME completed its acquisition of the Comex in August 2008. It took nearly 5 years before the CME's lawyers decided to add that disclaimer to its Comex gold/silver warehouse stock reports. Having worked on corporate finance deals in my past and knowing how anal and attention-to-deal good lawyers are, I can assure you that it is not some capricious oversight that the CME decided to correct five years ex post facto, as one prominent silver newsletter seller would have us believe. Here's a graph of the stunning plunge in the "registered" gold sitting in Comex bank vaults - "registered" means gold that has been designated by its legal owners as being available for delivery to holders of futures contracts and has been certified as a bona fide gold bar per Comex standards (source of chart is 24hourgold.com, edits are mine): (click on chart to enlarge) There are 6 entities that operate designated Comex gold vaults: JP Morgan, Scotia Mocatta, HSBC, Brinks and a small private vault company, Manfra, Tordella & Brookes. The three banks account for 96.4% of the total amount of gold being "safekept" in Comex-designated vaults. They account for 78% of the "registered" gold on the Comex. As you can guess, most of the deliverable gold that has been removed from Comex since April has come from the vaults of JP Morgan, HSBC and Scotia. The "eligible" gold account is the gold this being kept for safekeeping at the Comex vaults by investors who theoretically have title that gold. For the record, knowing what I know about big bank fraud, unequivocally do not believe that the entire amount of gold being reported by the big banks who operate the depositories is actually either physically in the vaults or has not been hypothecated via lease obligations by the banks who control the vaults. If it has been hypothecated, it might actually be there but the owners had lost their physical claim on the metal. See the court decision in the MF Global bankruptcy if you do not believe me. The owners of silver held by MF Global were deprived of their bars and are being settled in cash. As of Wednesday's open interest report for Comex gold futures, there were a total of 403,947 open gold futures representing 40,394,70 ounces of gold. As of yesterday, there were 587,234 ounces of "registered," available for delivery ounces of gold. That's a mind-boggling 69x time more open interest of paper gold than available physical gold to deliver to the holders of those contracts. Thank about that for a minute. If more than 1.4% of those longs stands for delivery, the Comex defaults. Now, the majority of those contracts extend all the way out to December 2015. But there's 166,540 open gold contracts for delivery this December (first notice of delivery is 9 trading days away including today, on November 27). Those contracts represent 28x the amount of available gold to deliver on the Comex. If more than 3.5% of those contracts stand for delivery, the Comex defaults. Historically, maybe 1% of the open interest in a delivery month takes delivery. The odds are that will be the case this December. But at the rate that the gold is being drained from the Comex, this is going to be a real problem in the future. Now we know why Germany wants its gold back, why the Chinese and other BRIC countries are loading up on gold and demanding delivery and why the owners of Comex gold are taking delivery off the Comex. The Comex is a giant Ponzi scheme. "In paper we trust" is the motto of anyone who has a long position in Comex futures OR who safekeeps their gold at Comex vaults. As for the truth in reporting issue, does anyone out there besides Ted Butler actually trust those banks to send computer-generated reports that are accurate and honest to the CME. Have these big, Too Big To Fail bailed out banks given us any reason whatsoever to trust them? Ya, neither does the CME apparently, which is why they stuck that disclaimer on the inventory reports in June. In fact, we know that both HSBC and JPM have several criminal investigations for fraud and market manipulation going on against them by the "regulatory" authorities in both the UK and the U.S. They have both settled numerous others with big cash payments to make the charges go away. I can walk anyone carefully through JP Morgan's SEC-filed financials to show them where JP Morgan is committing fraud in reporting its financials to the SEC. I guess Butler trusts those financial filings just like he trusts the reports on open interest and warehouse stock filed with the CME by JPM, HSBC and Scotia. I do not trust those reports and neither should you. The Comex is living on the life-support of those who still trust them enough to conduct business on the Comex. Sooner or later that trust will be shattered. Judging by the current drain of gold from the Comex and from GLD, "later" is probably not too far away...When that happens, the world price of gold will go "bid without" (meaning all buyers, no sellers) and the dollar will drop off a cliff. |

| The Comex Fraud Is Growing Larger - 69 Times More Paper Than Gold Posted: 15 Nov 2013 07:15 AM PST The information in this report is taken from sources believed to be reliable; however, the Commodity Exchange, Inc. disclaims all liability whatsoever with regard to its accuracy or completeness. This report is produced for information purposes only.The above liability disclaimer was added to the Comex gold and silver warehouse stock reports about 5 months ago. I have a post on this blog about the time it showed up if you need an exact date. You can see the Comex stock report and disclaimer at the bottom here: Comex Gold Stock Report The question I had at the time was, "why now?" The CME completed its acquisition of the Comex in August 2008. It took nearly 5 years before the CME's lawyers decided to add that disclaimer to its Comex gold/silver warehouse stock reports. Having worked on corporate finance deals in my past and knowing how anal and attention-to-deal good lawyers are, I can assure you that it is not some capricious oversight that the CME decided to correct five years ex post facto, as one prominent silver newsletter seller would have us believe. Here's a graph of the stunning plunge in the "registered" gold sitting in Comex bank vaults - "registered" means gold that has been designated by its legal owners as being available for delivery to holders of futures contracts and has been certified as a bona fide gold bar per Comex standards (source of chart is 24hourgold.com, edits are mine): (click on chart to enlarge) There are 6 entities that operate designated Comex gold vaults: JP Morgan, Scotia Mocatta, HSBC, Brinks and a small private vault company, Manfra, Tordella & Brookes. The three banks account for 96.4% of the total amount of gold being "safekept" in Comex-designated vaults. They account for 78% of the "registered" gold on the Comex. As you can guess, most of the deliverable gold that has been removed from Comex since April has come from the vaults of JP Morgan, HSBC and Scotia. The "eligible" gold account is the gold this being kept for safekeeping at the Comex vaults by investors who theoretically have title that gold. For the record, knowing what I know about big bank fraud, unequivocally do not believe that the entire amount of gold being reported by the big banks who operate the depositories is actually either physically in the vaults or has not been hypothecated via lease obligations by the banks who control the vaults. If it has been hypothecated, it might actually be there but the owners had lost their physical claim on the metal. See the court decision in the MF Global bankruptcy if you do not believe me. The owners of silver held by MF Global were deprived of their bars and are being settled in cash. As of Wednesday's open interest report for Comex gold futures, there were a total of 403,947 open gold futures representing 40,394,70 ounces of gold. As of yesterday, there were 587,234 ounces of "registered," available for delivery ounces of gold. That's a mind-boggling 69x time more open interest of paper gold than available physical gold to deliver to the holders of those contracts. Thank about that for a minute. If more than 1.4% of those longs stands for delivery, the Comex defaults. Now, the majority of those contracts extend all the way out to December 2015. But there's 166,540 open gold contracts for delivery this December (first notice of delivery is 9 trading days away including today, on November 27). Those contracts represent 28x the amount of available gold to deliver on the Comex. If more than 3.5% of those contracts stand for delivery, the Comex defaults. Historically, maybe 1% of the open interest in a delivery month takes delivery. The odds are that will be the case this December. But at the rate that the gold is being drained from the Comex, this is going to be a real problem in the future. Now we know why Germany wants its gold back, why the Chinese and other BRIC countries are loading up on gold and demanding delivery and why the owners of Comex gold are taking delivery off the Comex. The Comex is a giant Ponzi scheme. "In paper we trust" is the motto of anyone who has a long position in Comex futures OR who safekeeps their gold at Comex vaults. As for the truth in reporting issue, does anyone out there besides Ted Butler actually trust those banks to send computer-generated reports that are accurate and honest to the CME. Have these big, Too Big To Fail bailed out banks given us any reason whatsoever to trust them? Ya, neither does the CME apparently, which is why they stuck that disclaimer on the inventory reports in June. In fact, we know that both HSBC and JPM have several criminal investigations for fraud and market manipulation going on against them by the "regulatory" authorities in both the UK and the U.S. They have both settled numerous others with big cash payments to make the charges go away. I can walk anyone carefully through JP Morgan's SEC-filed financials to show them where JP Morgan is committing fraud in reporting its financials to the SEC. I guess Butler trusts those financial filings just like he trusts the reports on open interest and warehouse stock filed with the CME by JPM, HSBC and Scotia. I do not trust those reports and neither should you. The Comex is living on the life-support of those who still trust them enough to conduct business on the Comex. Sooner or later that trust will be shattered. Judging by the current drain of gold from the Comex and from GLD, "later" is probably not too far away...When that happens, the world price of gold will go "bid without" (meaning all buyers, no sellers) and the dollar will drop off a cliff. |

| Posted: 15 Nov 2013 06:25 AM PST GOLD PRICES rose Friday lunchtime in London, regaining last week's closing level of $1288 per ounce as European stock markets turned higher and the US Dollar slipped. Following new Federal Reserve chief Janet Yellen's "dovish" testimony Thursday, "Market participants who anticipated a premature withdrawal from ultra-expansionary US monetary policy [and] bet on a falling gold price are forced to close these positions again," says a note from Germany's Commerzbank. But "Without some pick-up in non-Chinese demand," says London market-maker HSBC, "particularly investment demand, it may difficult for gold prices to hold rallies, at least in the near term." Dropping 1.5% for Chinese traders this week, gold prices on the Shanghai Gold Exchange closed Friday's business at a $7 premium per ounce to the world's benchmark London quote. That was up from $5 per ounce at the start of this week, but on lower trading volumes. "Unprecedented changes" will follow Beijing's decision at last week's 3rd plenum to "upgrade" the role of free markets in the world's second largest economy, according to new documents and comments from party officials today. Beijing has previously cast gold as a central part of China's market reforms, "play[ing] a very important role in the formation of the financial market system," according to Xie Duo, general director of the People's Bank of China, when presenting last year to the LBMA conference in Hong Kong. China's labor camps will now also be closed, newswires quote sources today, while the "one child policy" in the world's most populous nation will be abolished for the sake of "long-term balanced development". Back in Friday's action, and as gold prices slipped in Shanghai, China's interbank lending rates meantime jumped at the fastest pace since June's "credit crunch" spike, adding over one percentage point to the cost of 1-week money, which hit 5.33% as the central bank sold bonds to withdraw liquidity from the money market. Traders quoted by Reuters said the People's Bank wanted to offset "strong capital inflows into China as the US Federal Reserve continues its quantitative easing (QE) program." "We're using policies that have never really been tried before," said Fed nominee Janet Yellen yesterday to the Senate Banking Committee, discussing her likely appointment as Fed chair in February 2014. "It is a work in progress." Denying that zero rates and money printing had made the Fed "prisoner of the market", Yellen later said they could both "induce risky behaviour". Asked by Nevada's Republican Senator Dean Heller what makes gold prices move (a repeat of his July question to current Fed chair Ben Bernanke), "It is an asset that people want to hold when they're very fearful about potential financial market catastrophe or economic troubles and tail risks," Yellen replied. "And when there is financial market turbulence, often we see gold prices rise as people flee into them." Holding a position worth $4.6bn just before gold prices peaked in mid-2011, hedge fund group Paulson & Co., the single largest shareholder of the giant SPDR Gold Trust (GLD), the world's largest gold ETF, held its stock unchanged between July and October to end the third quarter with a position worth $1.3 billion, new regulatory filings said Thursday. John Paulson's hedge funds had slashed their GLD holdings in half over the previous quarter, as prices fell at the fastest pace in three decades. Gold prices then rallied 11% in the third quarter of 2013, even as global demand fell by one fifth according to the latest Gold Demand Trends report from market-development group the World Gold Council. Paulson's PFR Gold Fund, which trades gold mining stocks and gold derivatives, has now lost 65% for 2013 to date, reports Bloomberg. Revenue from the commodities markets has fallen by one fifth for the world's top 10 banks so far this year, reports Reuters, citing data from the Coalition consultancy. |