saveyourassetsfirst3 |

- Lydian surges on tentative solution to heap leach headache

- Harmony Gold’s quarterly output up around 12%

- Disappointing gold hits 3-month lows

- Politically inspired uncertainty underlines need for physical gold – Levenstein

- Indian demand keeping gold:silver ratio in check

- Volatile week ahead for gold – Phillips

- Glass-Steagall? Banking Strikes Gold on Columbus Day

- Stock Market Ready for New High? What Impact Could It Have on Gold?

- The Peerless way to precious metal profits – Szabo

- Debt Ceiling Crises – 2011 vs. 2013

- Housing Market Begins To Unravel On Fear Of Higher Interest Rates

- Gold Most Oversold since 1985

- If I Had To Pick Just 1 Silver Miner, SilverCrest Mines Is It

- 3 Year M2 Money Supply Growth At Highest Level Since 2003

- Busting the myths that could wipe out your investments

- Isn’t It Interesting

- Long gold, short silver and exponential demand

- Countdown

- The CME/Comex And Truth In Reporting: A Fraudulent Horror Show

- Gold hits 3-month low as U.S. finds short-term fix for debt limit

- India's proposed gold deposit scheme could spark a sell-off in the Rupee

- 12 Facts About The Epic Obamacare Launch Train Wreck That Every American Should Know

- How technology is improving the world of money

- Gold price suppression theory mainstream after single $650 million sell trade

- Gold price reaches the bottom of its six month head and shoulders formation – will it hold?

- Politicians Continue to Bankrupt Nations and Steal from Individuals

- Gold Wars

- Peter Schiff: Janet Yellen as Fed Chairman is Very Bullish for Gold

- 2 Days Away From Collapse – ‘US Default Could Bring Global Chaos’

- Price Suppression Theory Mainstream After Single $650 Million Sell Trade

- Alasdair Macleod: Valuing gold

- Price Suppression Theory Mainstream After Single $650 Million Sell Trade

- Ron Paul: New Fed Boss Same as the Old Boss

- QUEST UPDATE

- New World Order

- "Disappointing" Gold Hits 3-Month Low as US Finds Short-Term Fix for Debt Limit

- Price Suppression Theory Mainstream After Single $650 Million Sell Trade

- A Debt Deal is Nigh! A Debt Deal is Nigh! Or is It?

- Links 10/15/13

- Gold could gain on breach of Oct 17 debt ceiling:ETFS

- Gold and Silver

- Lawrence Williams: Bullion Banks ‘Selling Gold They Don’t Possess’—Squeeze Alert!

- The sun is setting on dollar supremacy, and with it, American power

- Inside Canada's top-secret billion-dollar spy palace

- Nine King World News Blogs/Audio Interviews

- After sudden plunge, gold traders cry conspiracy

- Casey Research: Shutdowns, Smackdowns, and Touchdowns

- China's Gold Obsession Goes Beyond Stocks and iPhone 5s

- India's Rajan: 'We Can Pay The World In Gold'

- Hathaway's gold market manipulation complaint emboldens MineWeb's Williams

| Lydian surges on tentative solution to heap leach headache Posted: 15 Oct 2013 08:22 PM PDT Lydian gets important backing on new proposal that could solve permitting issue over its Amulsar gold project in Armenia. |

| Harmony Gold’s quarterly output up around 12% Posted: 15 Oct 2013 04:12 PM PDT The South African gold producer said Tuesday its July-September production likely increased by 12% from the previous quarter. |

| Disappointing gold hits 3-month lows Posted: 15 Oct 2013 03:15 PM PDT The gold price bounced hard Tuesday from new 3-month lows, as European shares rose but US stock futures pointed lower. |

| Politically inspired uncertainty underlines need for physical gold – Levenstein Posted: 15 Oct 2013 03:01 PM PDT Gold's' recent upward momentum has been thwarted for now, writes David Levenstein, arguing that further sideways but volatile action in the gold market should be expected in the short-term. |

| Indian demand keeping gold:silver ratio in check Posted: 15 Oct 2013 01:12 PM PDT The huge demand for silver in India in the light of the government's specific crackdown on gold is helping the gold:silver ratio stay at levels it might not have managed in times past. |

| Volatile week ahead for gold – Phillips Posted: 15 Oct 2013 01:11 PM PDT There remains no default premium for the gold price, argues Julian Phillips, but says it is only a matter of time before Chinese demand reaches the market and impacts the gold price. |

| Glass-Steagall? Banking Strikes Gold on Columbus Day Posted: 15 Oct 2013 12:39 PM PDT Unhappy Columbus Day thoughts as the US bears the cost of the banks losing Glass-Steagall... COLUMBUS DAY is typically a happy and joyous celebration for Americans wherever they are, writes Miguel Perez-Santalla at BullionVault, not just in the United States, but on all continents. Inadvertently discovered by Europeans looking for Asia, the mess which resulted has become central to the world community, and critical to its economy. In the last century, and led by American ingenuity, the world has grown much smaller due to technology and improvements in transportation. In this last decade, and again led by North American entrepreneurs, mass communication through use of the internet and the lower costs of regular telephone systems has made the world a much smaller place again. You would think that North Americans were joyful for their history on Monday, Columbus Day 2013. But sadly there are many that are not happy. The truth is that the great experiment which is the United States of America is starting to falter. The government shutdown is only a symptom which carried into this holiday, pointing to all the deficits of our political and financial system. This Columbus Day there were protesters against the shutdown, but even more against how the US government and how it is running. It's no longer Democrat versus Republican as the media makes it appear. Both parties have been found untrustworthy in their responsibilities toward protecting their fellow citizens. And the driving force of American wealth and freedom over the last two centuries, the thrifty middle class, are subjected most to taxation and destruction of their economic liberties. So this Columbus Day an organization known as the LaRouche PAC was out in force trying to get support for their goal. This is to reinstate the Glass–Steagall act under HR 129.  What the Glass-Steagall act would do is what it did for more than six decades before its repeal. This 1930s' piece of US law would ring-fence the deposit areas of banking, so they could only be involved with traditional banking services. Investment banking services on the other hand, such as broker dealers, investment companies, underwriters and investment advisers would be completely separate entities. This is important because it is a structural change and would directly and immediately protect the public sector from any possible malfeasance and conflicts of interest. In addition I would go as far as to say that we should not have national banks. These giant organizations should be broken back down to independent state banks that may be owned by one parent company. In this way the State banking commissions would have greater power to police the industry. And at that level it would also be more manageable. There is no doubt in my mind that the current malaise which the US economy continues to suffer is in no small part due to the removal of this important piece of legislation in the late 1990s. It had been created during the time of the Great Depression, along with other changes, aimed at keeping banking in banking, and investment for investors. America's 21st century crash and depression has also spawned US legislation created to protect the public from banking-led chaos. But Dodd-Frank does not address these issues. In essence, it has changed very little of how the banks operated in the pre-crisis bubble, allowing them to continue down the same path. Most of this new legislation is toward the types of contractual business which banks can engage in. None address the issue of banks being too big to fail. And at this time they can still take regular savings depositors with them if they go bankrupt, not only those interested in investment risk for better returns. In other words, the American people continue to be responsible for the large banks and their possible poor investment scenarios. Indeed, what Dodd-Frank creates is even worse. Due to the new legislation, the financial jobs that did exist here domestically in the USA, are now being chased offshore. So now not only are the American people still paying for the poor judgment of our government and our bankers in the last two decades, but we are losing jobs to boot. The government, the Federal Reserve System and the leaders of the major banks in the US are directly responsible for past errors, and for those coming ahead. The reinstitution of Glass-Steagall would be a good first step in the right direction but by no means would it cleanup all problems in our system. The Federal Reserve System's current agenda is to protect the banking sector at all costs. That is why if you look since the beginning of the crisis in 2008 you will see that banks have come up from under the ashes and have performed better because of free money handed to them through the system. In the end the money is acquired from the public through an invisible form of taxation – the loss of value from their stocks or other holdings in the marketplace, and of course the well hidden devaluation of our currency against other goods. Without a fundamental change to the way our banking system works we are still open to another crisis. What is historically rare is that, unlike the changes forced by legislation after previous financial crises, we are still exposed to an exact repeat, as banks use depositors' money for higher-risk investments. The government shutdown has no teeth in finding solutions to the real underlying problems of this country. Many Americans are disenfranchised as we continue to see support for the status quo in the banking industry. Without solutions to how our banking system works, all other issues are but mere distractions. They hide the real illness behind the behemoth that has become the federal government bureaucracy. On Columbus Day I took a call from a prospective customer of BullionVault. She had never bought gold or silver in her life. She stated to me the reason she is going to invest in gold now. "I don't like the way things look in the US. There's too much unemployment and unrest." With Dodd Frank missing the chance to make structural changes, and instead focusing on increased regulation set to push key services abroad, the banking paradigm has not changed. Now the public is feeling less confident. When there is a lack of confidence there is always one asset which brings some security. From ancient Mayans to the Conquistadors, from central banks to sovereign wealth funds today, when you buy gold it remains gold, a form of value accepted all over the world and throughout history. That will not change no matter what financial crisis strikes the Americas next. |

| Stock Market Ready for New High? What Impact Could It Have on Gold? Posted: 15 Oct 2013 12:35 PM PDT SunshineProfits |

| The Peerless way to precious metal profits – Szabo Posted: 15 Oct 2013 12:32 PM PDT Tom Szabo does not believe that you can judge all gold companies the same, rather he uses the Peerless concept to rank companies qualitatively. An interview with The Gold Report. |

| Debt Ceiling Crises – 2011 vs. 2013 Posted: 15 Oct 2013 12:30 PM PDT Just two days from a "debt ceiling breach," I recall one of the first pieces I wrote upon joining Miles Franklin two years ago. With the "Teflon Dow" now subject to the same government algorithms that have been suppressing PAPER PM prices – and thus, unable to experience significant declines or volatility; it occurred to me TPTB are attempting to create a "Philosopher's Stone" for the financial markets. The Philosopher's Stone was said to have the ability to turn lead to gold; i.e., an allegory for bankers' current attempts to turn PAPER PMs into PHYSICAL metal. And, for that matter, stock indices that historically represented economic expectations to "digital financial weapons" programmed to rise in value, no matter the circumstances. In other words, a form of modern "alchemy"- in which the Philosopher's Stone is a combination of derivatives, government intervention, and illegal, but unregulated trading practices. Somehow, TPTB believes that, by influencing market prices, they can change the laws of "Economic Mother Nature." Or, in the case of Precious Metals, delete a 5,000-year history of monetary superiority. Of course, the one thing they can't produce is PHYSICAL metal; and the more they suppress gold and silver prices, the tighter their supply will become. Moreover, the longer their "game" plays out, the more detrimental the impact on the billions of global victims of their crimes. The INFLATION generated by creating unlimited money inevitably causes war, poverty, and strife; in the process, sowing the seeds of such evil's demise – per the great Richard Russell…

Today is yet another instance of the same PPT and Cartel tricks being utilized to mask the horror that is the global economic and financial situation. Every trick in the book is being utilized to drive down PMs – and drive up stocks – despite the ONLY news being the countdown to U.S. debt breach; a MASSIVE miss in the Empire State Manufacturing Index; an utterly abysmal – and fraudulent – Citigroup earnings report; the worst "same-store" retail sales in the past four years; an ALL-TIME LOW Obama approval rating; and an ALL-TIME HIGH Indian PHYSICAL gold premium…

Amongst this "perfect storm" of Precious Metals fundamentals – which will only accelerate as the global economic crisis expands; I put together a comparison table of where the world stands compared to the last "debt ceiling crisis" in August 2011. Back then, if you recall, global markets plunged amidst collapsing economies; exploding debt; and in America's case, an imminent debt-ceiling breach that ultimately yielded the first-ever stripping of its "triple-A" credit rating – for whatever that's worth – by Standard & Poor's. When you read the details below, consider just how criminal – and "influenced" – Standard & Poor's must have been when four months ago, it upgraded the "outlook" for America's credit rating from "negative" to "stable"…

Yes, in the two years since dollar-priced gold hit an all-time high, it's quite clear the very issues that catalyzed that move are dramatically worse today. For the past six months, I have written of how U.S. government-led attempts to "mask" such misery have been focused principally on MONEY PRINTING, MARKET MANIPULATION, and PROPAGANDA – as given the accelerated pace of worldwide economic and financial deterioration, they have exhausted ALL other options. Consequently, when reading this chart, it should be "crystal clear" that the only things that have since "improved" are equity indices and – by a much larger amount – P/E ratios. In other words, they are desperately trying to inflate favorable assets and deflate unfavorable ones. The fact that retail participation in stocks has fallen to multi-decade lows is immaterial; so long as the MSM dutifully reports a rising Dow to signify the ambiguous, amorphous "recovery" that will somehow save the day. By the way, one thing I couldn't find an exact number for was the pernicious mining cost inflation that has decimated operations since the Fed and other Central banks turned up the PRINTING PRESSES following 2008's Global Meltdown I. I'd guesstimate at least 20% cost inflation in the past two years alone; which is why – according to analyst Steve St. Angelo – the marginal cost of silver production has soared to roughly $26-$28/oz. And if you don't trust an "outsider" like St. Angelo, than how about an insider like Gold Fields CEO Nick Holland – who claims gold miners require $1,500/oz. to cover their all-in costs! No matter how you slice it, we are living in a world where a handful of bankers and politicians are DESTROYING the world in pursuit of the wealth and power that comes with maintaining the status quo. Unfortunately, REALITY is gathering momentum against them; as their fiat Ponzi scheme is clearly in its death throes. Only the when and how it collapses remain in question; and frankly, any of a dozen or more catalysts could emerge at any time. As for Precious Metals, NEVER in history have they been so historically cheap; as supply will continue to collapse whilst demand explodes. Given what you see ALL AROUND YOU – including worse U.S. credit risk than in 2011 – what are you waiting for to purchase them?Similar Posts: |

| Housing Market Begins To Unravel On Fear Of Higher Interest Rates Posted: 15 Oct 2013 12:00 PM PDT On Friday October 11, Wells Fargo (WFC) announced record third-quarter earnings. Beyond the astounding $5.3 billion in profits for the quarter was something far more notablet, the mortgage origination numbers. During the quarter originations declined 29%. As seen in the chart below this was a stark decline in the supposed long-term "recovery" in the housing market we were told to believe. In relation to the decline in originations, WFC also saw refinance applications plunge from 72% of mortgage applications to 36%. So what was to blame in this sudden collapse? As stated by WFCs Chief Financial Officer Tim Sloan, it was the roughly 1% rise in mortgage rates during the third quarter. (click to enlarge) As the United States' largest loan originator, WFC tends to be a key driver and indicator in the housing market. Currently Wells Fargo generates nearly a third of the U.S. mortgage business and |

| Posted: 15 Oct 2013 11:51 AM PDT Chart 1: Gold is now down almost 28% over the last 12 months Source: Short Side of Long According to at least one technical indicator, Gold is now most oversold since 1985. The indicator I am tracking here is the simple yearly rolling performance, also known as 52 week rate of change. Essentially we are looking at the performance of an asset over the last 12 months – and Gold is having one of the worst ones ever. Chart 2: Gold prices haven’t been this oversold since 1985 Source: StockCharts (edited by Short Side of Long)

The truth is, Gold is going through a correction it was meant to have earlier, but never did. Instead, it ended up going up 12 years in the row. Even the 30% bear market correction in 2008 wasn’t really meaningful, because within a few months the price recovered all the loses and went onto make new highs. This type of behavior is very rare. With such a strong run up, a possibility of a proper mean reversion was always in the cards. And mean reversion is what we are getting right now. Looking at the chart above, Gold is now down over 27% (including today’s decline) over the last 52 weeks, which is the worst annualised performance since 1985. Chart 3: Gold Miners are down over 57% over the last 12 months Source: Short Side of Long

Gold Miners have faired even worse, being the leveraged play on Gold via both the upside and downside. The chart above shows that the sector is incredibly oversold right now, as the price has lost over 57% in the last 52 weeks. Similar instances with such a dramatic decline were seen in 1998, 2000 and 2008. All of them eventually resulted in major bull markets. However, do note that this type of oversold level can persist for awhile longer, because the anomaly was how hard Gold rallied throughout the 2000s. Mean reversions don’t stop at equilibriums, as the markets always overshoot or undershoot. Having said that, these types of oversold conditions are over 2 standard deviations away from the multi-decade mean and rarely continue for a prolonged period. Usually the mean reversion occurs in the opposite direction as a major rallies occur from oversold levels. |

| If I Had To Pick Just 1 Silver Miner, SilverCrest Mines Is It Posted: 15 Oct 2013 11:47 AM PDT A friend of mine asked me the other day, "If you had to choose to invest in just one silver mining stock going forward, which would it be?" It didn't take me too long to respond to his question. I told him SilverCrest Mines (SVLC), with great confidence. I believe shares of SilverCrest mines present a great value at current prices and I think the best is yet to come. This is a silver/gold miner that will survive this period of depressed precious metals prices and will come out very strong when prices do eventually recover. Company Overview - SilverCrest Mines owns and operates the 100%‐owned Santa Elena Mine in the State of Sonora, México. The mine is a 2,500 tonnes per day open pit heap leach operation which is expected to yield 625,000 ounces of silver and 33,000 ounces of gold in 2013, for a total of 2.4 million |

| 3 Year M2 Money Supply Growth At Highest Level Since 2003 Posted: 15 Oct 2013 11:04 AM PDT One measure that I've kept an eye on over the past few years is M2 money supply. In the short-run, M2 can be somewhat meaningless, but over a longer period, surges in M2 tend to predict surges in inflation. Keep in mind, a "surge in inflation" could merely be inflation going from -2% to +2%, so this is not always bad, but it certainly can be in the wrong circumstances. One of the best examples to look at with M2 growth is Japan. In one of my prior articles, "14 Charts on Money Supply, Deficits, and Housing Prices", I examined Japan's M2 money supply, which began to collapse around 1990 and 1991. While it did somewhat rebound, it stayed at a very low level, with the 3-yr rolling average staying below 4% from 1992 onwards. Likewise, inflation has remained very low in Japan since then. |

| Busting the myths that could wipe out your investments Posted: 15 Oct 2013 10:35 AM PDT Louis James, Marin Katusa and Rick Rule debunk myths that range from quantitative easing to crowdfunding, and touch on an array of resource sectors, including gold, platinum, palladium and oil. Get insights about the work investors need to do to succeed and learn why age matters. |

| Posted: 15 Oct 2013 10:30 AM PDT That “it’s” happening again? “It” being that the GOFO rates which had gone slightly positive for the last month have collapsed again over the last 2-3 days as the price of gold was forced lower and are nearly negative again. Zero Hedge put out a piece this morning with some very neat NANEX charts which shows the gold market by the nanosecond and displays the big volume/price dumps over these last few days. This has truly become hilarious because unlike the “old days,” manipulation has become publicly blatant with zero effort to hide it other than having the CFTC give it their blessing with holy water. The move toward backwardation in the GOFO rates is significant in my mind because it is occurring at the same time that COMEX stands to lose roughly 60% of their registered gold. If no more gold enters the dealer side between now and Dec. we will have a disastrous “cash settlement” which of course will not be called a default…but in reality and practicality “default” it will be. December currently has contracts open representing 22 million ounces of gold while the registered gold is only 700,000 ounces. Once October is finished there will be only 300,000 ounces remaining unless the inventory is replenished. (Please keep in mind that JP Morgan has had exactly ZERO outside ounces delivered in since Jan. 1st). This is a default in the making! What has been done time after time looks to be happening again, supply has tightened up…and yes, exactly at the same time that “price” has been pushed down. This economically makes no sense whatsoever from a supply and demand standpoint. If actual gold was being sold…supply would be plentiful and there would be no pressure for GOFO rates to go negative. Friday’s dump in price was clearly new short selling as the open interest rose over 7,000 contracts or 700,000 ounces. Who has this amount of metal to either sell or sell short? The answer is NO ONE! I was away at the end of last week while Janet Yellen was nominated to become the new Fed chairperson. I am sure that she is a very nice person but by accepting the nomination (not to mention her career path) shows me she is delusional. Before going any further, Ms. Yellen studied at Brown University and Yale. She has taught at Harvard and UC Berkeley and worked almost her entire life at the Fed so she surely has the “pedigree” (which I surely don’t). OK, so why is she “delusional?” First and foremost BECAUSE she is accepting the job in the first place! If she cannot see that “it is completely over” then she is delusional. She has never as far as I know actually traded a bond or stock (except for her personal account) institutionally and doesn’t have ANY hands on experience in business. She has been one of THE most “dovish” of Fed Governors and has consistently voted to “ease.” “Easy money” is what got us into the mess we are in now. Easy money will not and cannot get us out of it no matter how many press conferences are held or how many PPT stock/bond rallies and Cartel gold smashes they can come up with. It is actually scary to me that she has accepted the nomination because she may really not see how close to collapse the entire system is. Who in their right mind would want to go down in history as the one running the show when the lights go out? History will have forgotten Greenspan and Bernanke’s role in all of this and she will take the blame…ALL OF IT! Before finishing I do want to add on to what I wrote over the last 2 days regarding the Chinese. As you know, they publicly talked about “de Americanizing” the financial system. They ALSO publicly dressed down the Japanese for pursuing “opposite policy” where they raise taxes next year while printing another 5 trillion more new Yen. These statements by the way came out on the heels of the G-20 meeting over the past weekend. It seems to me that they were emboldened somehow at this meeting. Maybe they were approached by other members in support or maybe they cut new deals (their last was last week with Europe) that further undercut the U.S./British/Japanese alliance. Whatever it was, the timing right after a G-20 meeting is curious and maybe quite telling. Keep your antennae up and do not be surprised by the doors being shut with some sort of “announcement.” There will be no advance notice whatsoever other than using your own common sense knowing that a currency reset is the coming objective.Similar Posts: |

| Long gold, short silver and exponential demand Posted: 15 Oct 2013 10:22 AM PDT Ted Butler announced the development of the long corner in gold months ago. He documented the short corner in silver for multiple decades. There have been no credible critique of how these calculations were made. |

| Posted: 15 Oct 2013 10:18 AM PDT Given the title of this commentary; it would be understandable if readers mistakenly assumed that this would be more yammering about the nauseating, U.S. Debt-Ceiling Farce. But that is a piece of staged theater, and this is an article about precious metals – and the two subjects have no connection. Of course one would never realize that fact in reading the pseudo-analysis of the mainstream media. In that fantasy realm; precious metals prices jump higher or lower every time a Republican or Democrat passes wind. This is despite the fact that none of these Drones can articulate how this Farce has any relevance to the gold or silver markets. Sure, a U.S. debt-default would be "bullish" for precious metals, but so would a million-and-one other things. "All roads lead to higher precious metals prices," not because gold and silver occupy some divine niche in the Universe; but because of the mindless, dead-end economic policies of our Clown Politicians. Nearly all of the economic problems across the West are caused by too much debt and too much money-printing; yet all the Clowns know how to do to "fix" our economies is to pile-on even more debt, and print-up even more paper. Indeed, what these Clowns have previously called "bail-outs" is where one of these Deadbeat Debtors is given a mountain of new debt, all of which originates out of newly-created banker-paper. As has been explained many times in the past; with the money-printing and debt now both well past any point-of-no-return, only two outcomes are possible for our economies (and societies) – and one or both of these outcomes must occur in the near future. A familiar chart articulates this better than any words can do.

This is the money-printing which B.S. Bernanke spent six months telling the world he was going to begin to taper. A vertical line. Pedal to the metal. Yet after six (more) months of "crying Wolf"; Bernanke couldn't bring himself to ease off the accelerator even the tiniest degree, warning the world the U.S. economy would collapse if he did so. The U.S. economy (and with it, the other Western dominoes) has become nothing but a surreal, real-life version of the movie "Speed". It's not going anywhere, but it has to go there as fast as it can – or it will blow up. There are two important differences between "Speed" and the U.S. economy, however. |

| The CME/Comex And Truth In Reporting: A Fraudulent Horror Show Posted: 15 Oct 2013 10:00 AM PDT

The information in this report is taken from sources believed to be reliable; however, the Commodity Exchange, Inc. disclaims all liability whatsoever with regard to its accuracy or completeness. This report is produced for information purposes only. The above legal disclaimer mysteriously, and with no explanation, showed up one day on the Comex gold and [...] The post The CME/Comex And Truth In Reporting: A Fraudulent Horror Show appeared first on Silver Doctors. |

| Gold hits 3-month low as U.S. finds short-term fix for debt limit Posted: 15 Oct 2013 09:49 AM PDT The wholesale price of gold bounced hard Tuesday lunchtime in London from new three-month lows, regaining $10 per ounce from $1,255 as European shares rose but U.S. stock futures pointed lower. |

| India's proposed gold deposit scheme could spark a sell-off in the Rupee Posted: 15 Oct 2013 09:45 AM PDT The latest research report published by Societe Generale warns that the gold deposit proposals by the Reserve Bank of India could have opposite effect to what the government intends. The special report cautions that if not handled carefully, the gold deposit scheme may spark a sell-off in the Rupee. |

| 12 Facts About The Epic Obamacare Launch Train Wreck That Every American Should Know Posted: 15 Oct 2013 09:20 AM PDT

Even though it is nearly impossible to get signed up for health insurance through the Obamacare websites, if you don't currently have health insurance you better get signed up by January 1st or you will get slapped with a fine. Is this fair? Of course not. But this is the way that the U.S. government [...] The post 12 Facts About The Epic Obamacare Launch Train Wreck That Every American Should Know appeared first on Silver Doctors. |

| How technology is improving the world of money Posted: 15 Oct 2013 09:20 AM PDT Since the arrival of the internet and digital world all this is beginning to change. Technology is enabling us to disintermediate the fiat currency structures imposed on us. Digital gold was just the start however, as new ways of decentralizing money arrived via technology communities. |

| Gold price suppression theory mainstream after single $650 million sell trade Posted: 15 Oct 2013 09:04 AM PDT The massive single sell trade on Friday, estimated to be worth a staggering $650 million is leading to more questions regarding price manipulation and suppression. |

| Gold price reaches the bottom of its six month head and shoulders formation – will it hold? Posted: 15 Oct 2013 08:58 AM PDT |

| Politicians Continue to Bankrupt Nations and Steal from Individuals Posted: 15 Oct 2013 08:43 AM PDT After bouncing off three-month lows on Monday, gold prices have dipped today, giving back a small part of the prior session's gains despite the persistent cloud of uncertainty that has settled over Washington. Over the weekend, the president of the World Bank, Jim Yong Kim, warned the United States was just “days away” from causing a global economic disaster unless politicians come up with a plan to raise the nation’s debt limit and avoid default. “We’re now five days away from a very dangerous moment. I urge U.S. policymakers to quickly come to a resolution before they reach the debt ceiling deadline…Inaction could result in interest rates rising, confidence falling and growth slowing,” World Bank President Jim Yong Kim said in a briefing following a meeting of the bank’s Development Committee. “If this comes to pass, it could be a disastrous event for the developing world, and that will in turn greatly hurt developed economies as well,” he said. Yet, despite the continuing political wrangling in Washington over the U.S. government shutdown and the debt ceiling, which one would expect to lower the value of the US dollar, the gold price has been under some selling pressure. And, last week the general sentiment toward gold was largely negative, with some investment banks like Goldman Sachs and Morgan Stanley issuing bearish views on gold's outlook. According to Jeffrey Currie head of commodities research at Goldman Sachs Group Inc.'s gold, is a "slam dunk" sell for next year because the U.S economy will extend its recovery after lawmakers resolve stalemates over the nation's budget and debt ceiling. The bank has a target for gold prices next year at $1,050 an ounce, Currie, Goldman Sachs's head of commodities research, said last week in London. The precious metal has tumbled 21% this year to $1,322.28 an ounce on speculation that the US Federal Reserve would reduce its $85 billion monthly bond-buying program, known as quantitative easing, as the economy recovers. Lawmakers probably will reach an agreement on raising the debt ceiling before the Oct. 17 deadline, Currie said. "Once we get past this stalemate in Washington, precious metals are a slam dunk sell at that point," Currie said. "You have to argue that with significant recovery in the U.S., tapering of QE should put downward pressure on gold prices." Currie and Ric Deverell, the head of commodities research at Credit Suisse AG, both said on a panel at the Commodities Week conference in London that selling gold is their top recommendation for trading in raw materials in the next year. I completely disagree. Even if the issue of the US debt ceiling is resolved, the fact remains that there is simply far too much debt in the global financial system. And, while bankers and politicians may be able to "kick the can down the road," at some point, something has to give… and it is not going to be the price of gold! The price of gold lost $25 in two minutes on Friday morning as "someone" decided to dump 800,000 ounces of notional gold into the London Fix (or COMEX open). In the space of 4 minutes, “someone” sold a whopping 2 million ounces of gold in one trade into the gold futures markets sending the price of gold to 3-month lows. The order was so big, then, that gold was automatically halted in the middle of the order being filled. The CME Group confirmed the halt. “We had what we call a stop logic event, which is a momentary pause in trading.” CME Group spokesman Chris Grams told CNBC.com. He noted that the halt started at 8:42:26 EDT, and trading resumed at 8:42:36. “All trades stand, and our technology performed as designed,” he said. Usually, when a seller has a sizable amount to sell, he tries to get the best possible price by off-loading parts of the total quantity during a period of time. But, in an action which we are now fully accustomed to, when it comes to gold the seller is simply determined to manipulate prices by slamming the bid until there are no buyers left. It used to occur just before close of trading, an illegal practice known as “banging the close.” However, now it appears that much of this selling happens soon after the opening of Comex. Yet, the CFTC constantly turns a blind eye to this action. While the CFTC deny that there is any manipulation of prices in the gold markets, there is enough evidence to the contrary. And, Friday's action is simply another example of this on-going price suppression of gold prices. It is now becoming more evident that Western central banks and the U.S. government in particular — the Federal Reserve and Treasury Department are involved in this action as they remain determined to support the U.S. dollar and maintain the current global fiat currency system. While the Fed does not intervene directly in the market, it operates through two primary ‘agent’ banks. These bullion banks in turn time naked short gold sales in the futures market to coordinate what the Fed is doing in the more opaque foreign exchange markets. This sale of gold futures contracts creates an artificial supply of gold which will never be delivered. However, the quantity sold has the effect of pushing prices lower. This is exactly what the Fed wants especially when the US dollar comes under attack. The Fed then tries to create the illusion that gold prices are falling against a weaker dollar and thereby undermine investors' confidence in the yellow metal. The reason for this is that gold remains a benchmark for the US dollar. If the dollar were to collapse, the prices of gold would surge. So, these bankers have to trick individuals around the world into believing that everything is just fine. What is even more outrageous is the measures these banks will go to in order to create this illusion. Recently, the Fed's number one 'agent bank,' Goldman Sachs, was up to their old tricks again – advising clients to 'sell gold.' But, while they encourage clients to sell, I would not be surprised in the least that in reality what they are doing is probably looking to go long in gold and that they actually need fresh supply to come in to cover their short positions. Meanwhile, many gold traders have opted to remain on the side-lines to avoid being caught in a volatile price move, while others said they expect this week's weakness to continue, especially after Friday's sell-off. Global finance chiefs have criticised the U.S. for the political gridlock they identified as the biggest threat to the world's economy and financial markets. As these policy makers arrived in Washington for the annual meetings of the International Monetary Fund and World Bank, many expressed their concern that failure by U.S. lawmakers to end a government shutdown and raise the nation's debt ceiling could trigger a default. The lack of resolution would have "very negative consequences for the U.S. economy and spill-over effects which mean negative consequences for the rest of the world," IMF Managing Director Christine Lagarde told Bloomberg Television in a recent interview on "Surveillance" with Tome Keene. "It could precipitate another crisis if it was to last longer." If the standoff persists "it is probably safe to say that this could cause severe damage to the U.S. economy and the world," European Central Bank President Mario Draghi said. "The world still does not believe that the United States will not find a way out. Both Lagarde and U.S. Treasury Secretary Jacob J. Lew warned that the political impasse could sap the safe-haven status of U.S. assets. "The world actually counts on us being responsible," Lew told the Senate Finance Committee, as he cautioned that the spat is "beginning to stress the financial markets." Lagarde said the U.S. should be wary that it is "not damaged because of what is going on" and also welcomed the proposal to buy more time. A U.S. debt default in the event that a politically divided Congress fails to raise the federal borrowing limit would imperil the entire global economic recovery, a senior International Monetary Fund official warned Wednesday. But Jose Vinals, the IMF's financial counsellor, said he sees the actual risk of such a default as very low. "It would be a worldwide shock," Vinals told a Washington news conference, at which the IMF released its Global Financial Stability Report. "This is something that would have very significant repercussions on financial markets around the world, not just on the United States," Vinals said. "So let's hope that we never get there." A report was released ahead of the IMF and World Bank's annual meeting which began last week. The IMF said that the partial U.S. government shutdown, now in its second week, is adding to uncertainty about the still-fragile global economic recovery. "While the damage to the U.S. economy from a short shutdown is likely to be limited, a longer shutdown could be quite harmful," the report said. "And even more importantly, a failure to promptly raise the debt ceiling, leading to a U.S. selective default, could seriously damage the global economy and financial system." On Saturday, the president of the World Bank warned the United States was just “days away” from causing a global economic disaster unless politicians come up with a plan to raise the nation’s debt limit and avoid default. “We’re now five days away from a very dangerous moment. I urge U.S. policymakers to quickly come to a resolution before they reach the debt ceiling deadline…Inaction could result in interest rates rising, confidence falling and growth slowing,” World Bank President Jim Yong Kim said in a briefing following a meeting of the bank’s Development Committee. “If this comes to pass, it could be a disastrous event for the developing world, and that will in turn Premier Li Keqiang yesterday told Secretary of State John Kerry that China was paying "great attention" to the U.S. debt ceiling, the official Xinhua News Agency reported today. China is the largest foreign owner of U.S. Treasuries, with $1.28 trillion worth of them at the end of July. "The market doesn't like uncertainties," Yi Gang, deputy governor of China's central bank, said in Washington. "They watch this drama very closely." China is “naturally concerned about the developments in the U.S. fiscal cliff,” the Asian country’s vice finance minister Zhu Guangyao said in a statement. If the U.S. fails to raise the debt ceiling, the government could run out of cash… Meaning China – and the rest of the world – won’t receive its interest payments. “We hope the United States fully understands the lessons of history,” Zhu said, referring to the last government deadlock in 2011, which led, in part, to the U.S. losing its triple-A credit rating. China isn’t the only country pressuring the U.S. to get its act together. Japan, the country’s second-largest creditor, is also worried the value of its $1 trillion investment in U.S. Treasuries could plummet if there is no agreement on the debt ceiling. “The U.S. must avoid a situation where it cannot pay and it's triple-A ranking plunges all of a sudden,” Japanese finance minister Taro Aso said at a press conference. “The U.S. must be fully aware that if that happens, the U.S. would fall into fiscal crisis.” The actions of US politicians have bolstered China's resolve to lessen the world’s reliance on the dollar, according to current and former Chinese government advisers. “You can’t hijack the global economy through political struggles. It’s not responsible,” says Yu Yongding, a member of the Chinese Academy of Social Sciences, a leading government think-tank. “We are angry but are not panicked. The consequences are bad for the reputation of the US because the credibility of debt is so important,” says Mr Yu, who is also a former adviser to the central bank’s monetary policy committee. “We need to continue to diversify. Even without this latest debt debate, it would still be necessary to diversify,” says Zhu Baoliang, an economist in the State Information Center, a research unit of the National Development and Reform Commission, a powerful planning agency. As the storm clouds gathered over Washington on Thursday, Beijing made another small move to increase the international use of the renminbi, signing a swap agreement with the European Central Bank. Now that Janet Yellen has been named to lead the Federal Reserve the global financial markets should factor out any possibility that the Fed will diminish their Quantitative easing program anytime soon. In fact, there is a good chance that the QE program is more likely to be perpetuated and expanded. While there are investors stupid enough to believe that debt issued by the world's largest debtor country (i.e. US Treasuries) should be treated as a risk-free asset they are obviously not concerned about the value of money. Yes, the Fed can expand its balance sheet indefinitely beyond the $3 trillion they have already conjured out of nowhere. The world need not fear a shortage of dollars. But in real terms, that's precisely the point. The Fed can control the supply of dollars, but it cannot control their value on the foreign exchanges. Until, fiscal and monetary discipline and sanity returns to the US and the world, gold will continue to be bought by prudent individuals in order to hedge the continuing debasement of paper currencies. Personally, I am certain that some type of cosmetic deal will be reached soon and it will be back to business as usual. The U.S. Debt Ceiling will be raised once again. It will be the 18th raise in the debt limit in 20 years. Raising the limit will happen and continuing imprudent fiscal and monetary policies in the U.S. are likely to lead to higher interest rates which will have dire consequences for the U.S. economy and indeed the global economy. Another increase in the debt ceiling will allow U.S. politicians to continue spending which will lead to a further loss in confidence as well as the value of the U.S. dollar. And, as this happens the price of gold will go much higher. While politicians continue to bankrupt nations and steal from individuals, I recommend that you own some physical gold and silver. Technical picture

Gold's' recent upward momentum has been thwarted for now, and I expect to see more sideways but volatile action in the short-term.

About the author: David Levenstein is a leading expert on investing in precious metals . Although he began trading silver through the LME in 1980, over the years he has dealt with gold, silver, platinum and palladium. He has traded and invested in bullion, bullion coins, mining shares, exchange traded funds, as well as futures for his personal account as well as for clients. For more information go to www.lakeshoretrading.co.za |

| Posted: 15 Oct 2013 08:16 AM PDT In 2001, the late Ferdinand Lips wrote the definitive expose on gold market manipulation. Many think gold manipulation is a conspiracy theory, only dreamed up in recent years. Those people are wrong and ignorant of history. Instead, gold price control and manipulation is a conspiracy FACT and it has been ongoing for over sixty years, since the introduction of the current, dollar-based global currency regime. |

| Peter Schiff: Janet Yellen as Fed Chairman is Very Bullish for Gold Posted: 15 Oct 2013 08:15 AM PDT

Money manager Peter Schiff thinks the nomination of Janet Yellen as Fed Chairman is "very bullish for gold." Yellen has admitted she did not see the 2008 financial meltdown coming which was caused by an enormous housing bubble. Schiff goes on to say, "Not only was she not warning about the housing bubble, she was [...] The post Peter Schiff: Janet Yellen as Fed Chairman is Very Bullish for Gold appeared first on Silver Doctors. |

| 2 Days Away From Collapse – ‘US Default Could Bring Global Chaos’ Posted: 15 Oct 2013 07:37 AM PDT

The United States is only two days away from financial collapse - unless lawmakers can strike a budget deal to avoid default. GOT PHYZZ?? Silver Bullet Silver Shield Collection at SDBullion! Rival Democrats and Republicans have been stuck in a loop for over two weeks, with most government work crippled. RT’s Anissa Naouai reports on [...] The post 2 Days Away From Collapse – ‘US Default Could Bring Global Chaos’ appeared first on Silver Doctors. |

| Price Suppression Theory Mainstream After Single $650 Million Sell Trade Posted: 15 Oct 2013 07:06 AM PDT

The massive single sell trade on Friday, estimated to be worth a staggering $650 million, which knocked prices $25 lower in three minutes and the poor performance of gold despite the appalling political chicanery in Washington and the U.S. fiscal and monetary position is leading to more questions regarding price manipulation and suppression. The Gold [...] The post Price Suppression Theory Mainstream After Single $650 Million Sell Trade appeared first on Silver Doctors. |

| Alasdair Macleod: Valuing gold Posted: 15 Oct 2013 07:02 AM PDT GATA |

| Price Suppression Theory Mainstream After Single $650 Million Sell Trade Posted: 15 Oct 2013 07:02 AM PDT gold.ie |

| Ron Paul: New Fed Boss Same as the Old Boss Posted: 15 Oct 2013 07:00 AM PDT

The news that Janet Yellen was nominated to become the next Chairman of the Board of Governors of the Federal Reserve System was greeted with joy by financial markets and the financial press. Wall Street saw Yellen’s nomination as a harbinger of continued easy money. Contrast this with the hand-wringing that took place when Larry [...] The post Ron Paul: New Fed Boss Same as the Old Boss appeared first on Silver Doctors. |

| Posted: 15 Oct 2013 06:41 AM PDT We're chipping away at the Quest portfolio. Current total $2655. Up almost 900%. This got a lot tougher once it became apparent gold's intermediate cycle turned down. Making money on the short side is much harder than on the long. Markets go down differently than they go up. |

| Posted: 15 Oct 2013 06:19 AM PDT However, as long-time readers know, I don't believe in "conspiracy theories"; that is, until they are proven. As regards government PM price suppression, for example, I think I've more than proven it exists; as have countless "good, smart people" in our "shadow world." That said, other such theories are far more opaque; so at best, we can only follow anecdotal evidence – and from them, draw "educated guesses." As for the phrase "new world order," it has been bastardized to suggest everything from an East-West war to a group of bankers plotting the demise of billions. Personally, I subscribe to neither; instead, opting for an "Occam's Razor" view that most likely, all public and private entities are simply looking out for themselves. I find it highly unlikely that a tiny group of bankers, politicians, or generals would even have the ability to influence the global dynamic; let alone, the mutual interest to do so. However, it's not just likely, but probable that governments "holding the cards" are preparing for the inevitable demise of the Western dollar-based fiat Ponzi scheme. As for "holding the cards," I am of course referring to the few nations wealthy enough to survive the coming economic Armageddon intact; specifically, the Chinese, Russians, and other nations with significant trade surpluses and resource-based reserves. In other words – as they say – "Those who own the gold, make the rules." We may never know exactly how much Western gold has been dishoarded to points East. However, it's quite clear the number is ENORMOUS; particularly the amount that has reached Chinese shores…

Not surprisingly, the Western MSM completely ignores such data, as it contradicts the current, self-serving "meme" of economic recovery; not to mention, their "CFTC-validated" belief in free market price discovery. However, they won't be able to do so much longer; as proof is SCREAMING at them loud and clear. To wit, China last week executed a MASSIVE currency swap agreement with the European Central Bank; in other words, loudly stating its intention to diversify from the dying U.S. "reserve currency." Moreover, PBOC Governor Zhou Xiaochuan publicly called for a NEW GLOBAL CURRENCY to replace the dollar, citing "inherent vulnerabilities and systemic risks in the existing international monetary system." Just days later, the Bank of Taiwan announced its intention to shift a significant portion of its $409 billion of currency reserves from U.S. to Chinese bonds; and for the coup de grace, this weekend the main Chinese government media outlet – Xinhua – called for a "de-Americanized world." Make no mistake, when Xinhua speaks, it is the Chinese government writing the copy. And thus, when they write such vitriolic words as the following, it's hard to view them in any other manner than a call for a NEW WORLD ORDER…

The GLOBAL economic and political tides are rapidly changing; and NOT due to small groups of conniving bankers, although undoubtedly, such groups are planning how to exploit this inevitability. The writing is on the wall as to what the next monetary system will be based on, as well as who will have the most say in its operation; and I ASSURE you, it is not the "traditional" Western powers. Empires are not forever, and reserve currencies certainly aren't – particularly when they are fiat based. Nearly 600 of the latter have failed throughout history – versus ZERO that have succeeded; and the current, parabolic trajectory of global debt accumulation should tip you off that the next "world order" is rapidly approaching…

When it does, you can be ASSURED it will be based on REAL MONEY; i.e, PHYSICAL gold and silver. However, if you haven't acquired it before the end game commences, you'll likely NEVER get another opportunity.Similar Posts: |

| "Disappointing" Gold Hits 3-Month Low as US Finds Short-Term Fix for Debt Limit Posted: 15 Oct 2013 06:00 AM PDT Bullion Vault |

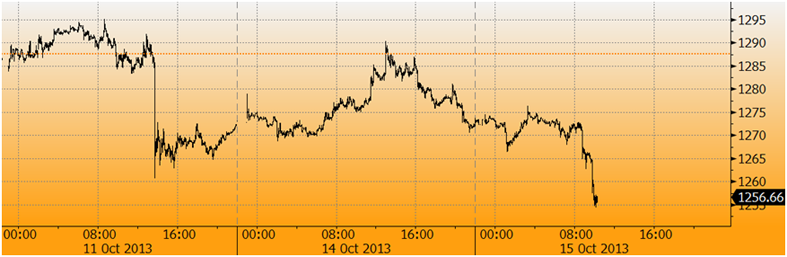

| Price Suppression Theory Mainstream After Single $650 Million Sell Trade Posted: 15 Oct 2013 04:37 AM PDT The massive single sell trade on Friday, estimated to be worth a staggering $650 million, which knocked prices $25 lower in three minutes and the poor performance of gold despite the appalling political chicanery in Washington and the U.S. fiscal and monetary position is leading to more questions regarding price manipulation and suppression. Today's AM fix was USD 1,255.50, EUR 929.59 and GBP 787.79 per ounce. Gold inched up $2.50 or 0.2% yesterday, closing at $1,272.70/oz. Silver slid $0.03 or 0.14% closing at $21.26. Platinum climbed $12.80 or 0.9% to $1,376.50 /oz, while palladium rose $0.09 or 0% to $711.59/oz. Gold In USD, 3 Days – (Bloomberg)

Gold snapped a four day losing streak yesterday but is under pressure again today. Gold traded in a narrow range overnight prior to aggressive selling that saw gold fall to $1,255/oz. Gold is hovering near three month lows despite the political shenanigans and impasse in Washington. Gold, whose safe-haven appeal is usually burnished during times of geopolitical and economic uncertainty, has failed to gain despite protracted wrangling over the fiscal deadlock in the United States. It has dropped about 5% towards $1,250/oz since a partial government shutdown began on October 1 and this is, in conjunction with frequently strange trading patterns is leading to deepening concerns about price suppression. The massive single sell trade on Friday, estimated to be worth a staggering $650 million, which knocked prices $25 lower in three minutes and the poor performance of gold despite the appalling political chicanery in Washington and the U.S. fiscal and monetary position is leading to more questions regarding price manipulation and suppression. Alex Rosenberg, a producer at CNBC (click on link for story) wrote the following: "Gold dropped $25 in two minutes Friday morning following what appeared to be a single massive sell order, and professional traders are now pronouncing the sale a deliberate attempt to manipulate the market. At 8:42 a.m. ET Friday morning, a firm appeared to sell 5,000 gold futures contracts “at the market,” meaning at whatever price was available. The massive order was more than the market could take at once and led the CME to automatically halt trading for 10 seconds. Eric Hunsader of Nanex told CNBC.com on Friday that 2,700 contracts were sold, which triggered the halt, and that the remaining 2,300 were sold once the market resumed trading. “Anyone with knowledge of the size and volume in the market would absolutely never, ever place a 5,000 [contract] sell [order] at market, because you could not estimate the offset price,” said iiTrader CEO Rich Ilczyszyn. If Ilczyszyn’s firm were placing the order, he said, “we generally would piece the order in to work a better price.” That’s why he believes the trade was “an error.” Jim Iuorio, managing director at TJM Institutional Services, sees similarities between what happened to gold Friday and what happened Sept. 12, when a big gold sale at 2:54 a.m. ET similarly caused a trading halt and hurt the market. “There is only one conclusion that seems logical regarding Friday’s gold trade and the one from a month ago, and that’s that they were designed to manipulate prices,” Iuorio said. “They were slightly different, in that the one from a month ago was done when the market was illiquid in order to get the biggest prices movement. Friday’s was done around the opening to ensure that there was maximum visibility.” Gold In USD, 20 Days – (Bloomberg) Meanwhile in Australia, Robin Bromby, veteran finance journalist, author and publisher wrote in The Australian (click on link for story) below: OCCASIONALLY it’s useful to be reminded that not everything in the metals markets revolves around China. That country has an interest in lower gold prices (making it cheaper to buy up much of the world’s supply) but Beijing seems unlikely to have been involved in “unusual” events on Friday in New York. Out of the blue, just after the opening at Comex, there was placed a sell order covering two million ounces, an order so big it triggered an automatic 10-second trading interruption (and a $US30 an ounce fall in the metal’s price). If you were to round up the usual suspects, your first instinct would be to pull in the Federal Reserve and other central bankers along with the funds that do their bidding. After all, gold is the enemy of the money printers. The more money being created out of thin air, the more people trust those yellow bars. There was a huge order unloaded on October 1, too, and then we had that episode in April when, within two hours, 13.4 million ounces was unloaded through Comex. Someone is determined to knock the stuffing out of gold. Gold in US Dollars 5 Years with Support and Resistance – (Bloomberg)

Gold's price falls are very counter intuitive and suggests that Wall Street banks, either independently or in unison with the U.S. authorities possibly through the Working Group On Financial Markets or the Plunge Protection Team, are suppressing gold lower. This appears to be being done through manipulation on concentrated selling on the COMEX. The Gold Anti Trust Action Committee's (GATA long asserted claim that gold is being manipulated in order to maintain faith in the dollar and erode confidence in gold as a safe haven is looking more and more plausible by the day and appears to be going mainstream. GoldCore’s 10th Anniversary Sovereign & Storage Offer |

| A Debt Deal is Nigh! A Debt Deal is Nigh! Or is It? Posted: 15 Oct 2013 04:20 AM PDT This is Naked Capitalism fundraising week. 791 donors have already invested in our efforts to shed light on the dark and seamy corners of finance. Join us and participate via our Tip Jar or another credit card portal, WePay in the right column, or read about why we're doing this fundraiser and other ways to donate, such as by check, as well as our current goal, on our kickoff post. And read about our current target here. If you make a quick scan of the headlines, which is the way a lot of people interact with the news, you’d see numerous reports stressing that Senate leaders had made “progress” in the “let’s try not to crash into the debt ceiling” talks and were hopeful of getting a deal done. Stock markets took cheer from these reports. We feel compelled to mention one matter: getting a debt ceiling/end the shutdown pact of some sort is merely a precursor to the hoped for performance of The Persecution and Assassination of What is Left of the American Middle Class, as Performed by the Inmates of the Beltway under the Direction of Barack Obama (more commonly described as the Grand Bargain or Great Betrayal). It is also important to recognize that even though the messaging was positive, anyone who has an eye on the calendar knows that things have to go close to without a hitch for bills to get through the Senate and House in time to avert putting the Treasury in the position of having to make do with existing cash flow until the debt ceiling is lifted. Mind you, only really serious pessimists doubt that the debt ceiling will be raised, and likely well before the real crunch time of October 31-November 1. And even then that does not a default on Treasury bonds; one analyst argues the drop dead date for Treasuries is November 15 (personally, I think there is no way an Administration so close heavily populated with acolytes of Bob Rubin would ever let that happen. Expect the Fed to invoke its unusual and exigent circumstances powers in the unlikely event that things go on that long). But it’s also critical to recognize that the sanguine reaction of equity markets represents the reactions of a particularly happy-go-lucky bunch that has had the Greenspan and Bernanke put protecting their backs for a very long time. Fixed income investors are a much more sober and quant-y bunch, and with good reason. As Goldman’s senior partner in the 1970s, Gus Levy, remarked, “In bonds, you eat like a bird and you shit like an elephant.” In other words, the upside is modest and the downside is considerable. Credit markets get much less reporting than equity markets; in part, it’s because they have long been dominated by institutional investors, in part, because the markets are over the counter, and hence less transparent than exchange traded stocks. And they are just less sexy from a news standpoint; most bonds are fungible. Investors buy them on their credit risks and specific attributes, while stocks are story paper. And those dour fixed income investors have been quietly preparing for possible nasty outcomes even as the US stock market has stayed comfortably within its recent trading range. One indicator: one month Libor is lower than comparable Treasuries. Remember that the mere effort to get out of the way of bad possible outcomes can produce serious dislocations. Fixed income markets were closed Monday due to the commercial bank holiday. We’ll have a much better reading on the sentiment of the investors who matter over the course of the day. Remember Jim Carville’s saying: “I used to think if there was reincarnation, I wanted to come back as the President or the Pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everyone.” Today, the New York Times is in particularly fine form, and its lead story on the debt negotiations is the best one-stop shopping on the status of the talks. Here’s the outline of the deal under discussion:

But keep in mind that the two Senators hashing out a possible deal, Harry Reid and Mitch McConnell, can’t make any binding commitments. They have to go back to their principals. One can assume that Reid is not too far out ahead of what Obama might accept. That is not a given on the Republican side, as the Times warns:

Now in fact, this Representative talk is bluster. Based on the public statements of Republican representatives, Democrats are highly confident that 19 to 21 Republicans in the House would go along with Democrats, which is enough to secure the passage of a clean continuing resolution and debt ceiling relief. But Boehner has clearly all this time felt the need to win some additional Republicans over before calling for a vote. Boehner has further, in the eyes of Democrats, dealt with Democrats in bad faith before. As Karen Tumulty wrote in the Washington Post:

Translation: Boehner asked for concessions from Senate Democrats, Reid and Obama reluctantly agreed (and other reports indicate that Reid had to push hard to secure the cooperation he needed from fellow Senators), then Boehner said he couldn’t deliver on what he proposed and asked for more. That sort of retrading does not go over well in negotiations. Even thought the Treasuries are not at immediate risk of default if the October 17 date comes and the deal is not finalized (and remember, that can happen simply due to procedural issues even if Obama and Boehner sign off on an outline agreed by Reid and McConnell), there can still be plenty of disruption and collateral damage if the deal is not looking like it will be in hand either by or very shortly after October 17. The Times explains:

So while the magnitude of the possible damage means it looks unlikely that the Tea Party can cow Boehner into delaying a vote. But the timing is still getting very tight even if Reid and McConnell sign off on terms early today. And any delay past the 17th won’t just fray nerves, it will further damage America’s already falling standing in the rest of the world. |

| Posted: 15 Oct 2013 03:59 AM PDT This is Naked Capitalism fundraising week. 790 donors have already invested in our efforts to shed light on the dark and seamy corners of finance. Join us and participate via our Tip Jar or another credit card portal, WePay in the right column, or read about why we're doing this fundraiser and other ways to donate, such as by check, as well as our current goal, on our kickoff post. And read about our current target here. Apes comfort each other ‘like humans’ BBC How Big Pharma Peddles Influence in FDA Panel Meetings Patient Safety Blog Think Dirty app for cleaner shopping (#SXSWEco) KIt O’Connell, Firedoglake (Chuck L) China’s State Press Calls for ‘Building a de-Americanized World’ BloombergBusinesweek Decisive Victory by Le Pen’s Eurosceptic National Front Party in Local Election Stirs Fear in Mainstream French Parties Michael Shedlock Time to take bets on Frexit and the French franc? Ambrose Evans-Pritchard, Telegraph. This is potentially a huge deal which has not gotten the attention it warrants due to the way the US debt ceiling wrangling has crowded out a lot of other finance news, at least in the US. Italy's Premier Calls Populism a Rising Threat to Europe New York Times 2500+ Killed by Drones in Pakistan, Names of Victims Now Available Real News Network Terror: The Hidden Source by Malise Ruthven New York Review of Books (furzy mouse) Afghans Flee Homes as U.S. Pulls Back Wall Street Journal Key Iran nuclear talks under way BBC Shutdown Showdown

Big Brother is Watching You Watch

Normalcy eludes many a year after Sandy hit NJ Courier-Post (Carol B) Amar Kaleka, son of slain founder of Wisconsin Sikh temple, to challenge Paul Ryan Raw Story (furzy mouse) Interview with an Adjunct Organizer: "People Are Tired of the Hypocrisy" Dissent Magazine (Carol B) Detroit Secures $350 Million Loan To Help Pay Off Debt During Bankruptcy Proceedings Huffington Post (Carol B) The artificial fuel for growth cannot last forever Mohamed El-Erian, Financial Times This Secular Bear Has Only Just Begun Big Picture Credit default swaps run out of road Financial Times The US still struggles with dilapidated roads and bridges Financial Times. Quelle surprise! What you learn about humanity from living on the streets Guardian Jesus Christ, Columbus, and the US Constitution CounterPunch (Carol B) Antidote du jour: |

| Gold could gain on breach of Oct 17 debt ceiling:ETFS Posted: 15 Oct 2013 03:55 AM PDT Europe continues to face structural issues and China commodities demand is not likely to be robut, gold could benefit from this scenario, ETFS said. |

| Posted: 15 Oct 2013 02:50 AM PDT The Silver GoldSpot |