Gold World News Flash |

- The Peerless Way to Precious Metal Profits

- It Is All Coming To A Head!

- Petrol Increase because Traders Can’t Read

- Debt Ceiling, Schmedt Ceiling…

- Interview of James Rickards About Central Bank Manipulation of Gold and Silver Markets

- The Depression, War & A Market Which Is Poised To Collapse

- James Rickards On Manipulation of Gold and Silver Markets

- China Enjoying Gold Clearance Sale

- Today's Gold Price Closed at $1,276.40 Up $8.40

- Today's Gold Price Closed at $1,276.40 Up $8.40

- 22 Reasons To Be Concerned About The U.S. Economy As We Head Into The Holiday Season

- China Enjoying Gold Clearance Sale

- Gold and Silver

- Colluding big bank currency traders called themselves 'bandits' and 'cartel'

- Is Casey Research peeking out from behind its ideological blinders?

- Bankrupt Governments Likely To Confiscate Wealth And Independence

- Hathaway's gold market manipulation complaint emboldens MineWeb's Williams

- Derivatives let central banks suppress gold longer this time, Turk tells KWN

- After sudden plunge, gold traders cry conspiracy

- Watching the End of US Empire with Doug Casey

- Watching the End of US Empire with Doug Casey

- Gold: A Tool, Not an Idol

- Gold: A Tool, Not an Idol

- New Fed Boss Yellen: No Change

- New Fed Boss Yellen: No Change

- Marc Faber: Gold Between $1200 And $1250 Is Entering A Buying Range

- Mining Stock Myths Exposed

- Mining Stock Myths Exposed

- Hopeless, Not Serious

- Hopeless, Not Serious

- Busting Economic and Natural-Resource Myths

- ECB Head Mario Draghi On Gold & Banking

- Gold Daily and Silver Weekly Charts - Through the Looking Glass

- Gold Daily and Silver Weekly Charts - Through the Looking Glass

- Gold Seeker Closing Report: Gold and Silver End Near Unchanged

- Een gouden (Sand)storm?

- ECB Head Mario Draghi On Gold & Banking; Admits “Central Bankers Are Powerful—They Are Also Not Elected”

- Gold and Silver Through the Looking Glass

- Yellen Heading Fed very Bullish for Gold-Peter Schiff

- Historic Events Unfolding As West Becomes More Desperate

- China Enjoying Gold Clearance Sale

- The direct economic impact of gold

- Born Libertarian: Doug Casey on Ron Paul and the Price of Freedom

- The Daily Market Report

- The Most Qualified Fed Chair Since Arthur Burns

- Gold recovers more than $20 of last week’s $50 drop

- Gold prices to be very volatile this week

- Nord Gold Q3 revenue up 1% year-on-year

- St. Augustine restructures Philippines copper-gold project

- The US Dollar Is Now Set To Plunge

| The Peerless Way to Precious Metal Profits Posted: 15 Oct 2013 07:00 AM PDT Tom Szabo, an investment strategist and principal of MetalAugmentor.com, does not believe that you can judge all gold companies the same. In this interview with The Gold Report, Szabo uses the Peerless concept to rank companies qualitatively, but dynamically as their circumstances change. |

| Posted: 15 Oct 2013 12:30 AM PDT by Bill Holter, MilesFranklin.com:

There are many more possibilities and questions but the point is this; China has now publicly spoken of stripping the U.S. of the privilege of issuing the worlds reserve currency. |

| Petrol Increase because Traders Can’t Read Posted: 15 Oct 2013 12:10 AM PDT We all know that it's not actually the message that is important but the way that the words are interpreted by those reading them. Never has that been more important than with Twitter. You only get 140 characters, which might be too much when we read some of the comments on there. But, for others it's far from enough. Traders look like they could be needing a few more pages to get the full picture. Just a few days ago traders made a mistake when they read the tweet posted by the Israeli army on October 10th 2013. The tweet was to celebrate the 40th anniversary of the end of the Yom Kippur War in 1973. But traders in the world believed it was actually happening and acted immediately.

Oil PriceThe traders of the financial markets thought that Israel was indeed bombing airports in Syria so as to stop weapons getting to the Syrian army (that in itself is telling that we are still in the same set-up and scenario as we were 40 years ago. We haven't moved on an inch, have we?). But, over and beyond the fact that the Israeli army was pretty backward in actually posting a 40th anniversary celebration in this way, the traders should also have read the entire tweet and seen that Soviets don't exist anymore and haven't done for the past 22 years. We call them Russians now. Do traders actually know that? Nothing had actually happened, but because of the Tweet traders started panic buying petrol thinking that there was going to be a major hike in prices. They caused the hike themselves by buying up as much as possible and oil rose. Just how good is it to take decisions like buying petrol on the say-say of a tweet? When the traders realized what had happened, the prices didn't drop immediately. I guess they needed time to cash in on their error and make some money for the banks before the prices came back down to normal.

Just like everyone, the traders are hooked in drip-feed fashion on their Twitter accounts grappling for every snippet of information that might have an effect on the markets. Might be a good idea for someone to make a mint. If you have friends somewhere in a high place, then get them to tweet, buy the commodity and then sell it at a profit. Easy. Twitter Typos?But, what country would gain anything more than propaganda votes from a tweet that celebrates the bombarding of airports in Syria, whether that be in the past or the present? That's the trouble with Twitter and the fact that you are your own worst enemy sometimes, able to post what you like and when you like. At least there is Politwoops that allows us to see the tweets that are posted and then deleted by our politicians in the US.

Ambiguity is a splendid thing especially if it has a twist of humour thrown in for good measure. Except this time, the twitter account of the Israeli army should have been read with greater care. We could end up with another price rise in petrol that we could do without because a couple of traders can't read English correctly somewhere in the offices of investors. Traders should pay more attention to what they are doing as they have a direct effect on our lives. The Israeli army should also watch out what they post in memory of their wars and gaining benefit from the bombarding of an airport, wherever that may be is no cause for rejoicing. It's no longer a Tweet if that happens it's just a Twit, with all the foolishness of that trait of character rolled into one.Other than that the traders of the financial markets have proved themselves to be nothing more than limmings in the purchase of their wished-for-articles after reading a simple post, however enthusiastic it may have been. They lost all of their skills in the individual-thought process long ago and just act in groups these days. What the others do, they have to do for fear of being left out. FOMO (Fear Of Missing Out) Twits; that's what they are. Originally posted: Petrol Increase because Traders Can't Read You might also enjoy: Darfur: The Land of Gold(s) | Obamacare: I've Started So I'll Finish | USA: Uncle Sam is Dead | Where Washington Should Go for Money: Havens | Sugar Rush is on | Human Capital: Switzerland or Yemen? | Wonderful President of USA and Munchkins | Last One to Leave Turn Out the Lights | Crisis is Literal Kiss of Death | Qatar's Slave Trade Death Toll | Lew's Illusions | Wal-Mart: Unpatriotic or Lying Through Their Teeth? | Food: Walking the Breadline | Obama NOT Worst President in reply to Obama: Worst President in US History? | Obama's Corporate Grand Bargain Death of the Dollar | Joseph Stiglitz was Right: Suicide | China Injects Cash in Bid to Improve Liquidity Technical Analysis: Bear Expanding Triangle | Bull Expanding Triangle | Bull Falling Wedge | Bear Rising Wedge | High & Tight Flag

|

| Debt Ceiling, Schmedt Ceiling… Posted: 14 Oct 2013 10:30 PM PDT by Bill Rice, Jr., Silver Seek:

I for one have yet to lose any sleep over this situation as I simply assume that at the last minute Congress will extend the debt ceiling and send all furloughed federal workers back to their jobs. In fact, Congress simply reminds me a lot of my procrastinating self – why act today when you can furiously act in the moments right before a deadline kicks in? Going back to my school term-paper days and carrying forward to my newspaper days, I've always subscribed to this philosophy. I don't necessarily recommend this habit to young people, but I can report from experience that great and big tasks can indeed be accomplished at the last moment. |

| Interview of James Rickards About Central Bank Manipulation of Gold and Silver Markets Posted: 14 Oct 2013 10:00 PM PDT GoldBroker.com |

| The Depression, War & A Market Which Is Poised To Collapse Posted: 14 Oct 2013 09:12 PM PDT  With global markets around the world waiting for an outcome to the ongoing chaos in the United States, today KWN is publishing a second piece with 60-year market veteran, legend, and the man I call "The Godfather" of newsletter writers. Richard Russell has been writing about the markets for six decades and there is nobody who is better at it. This one is a classic because it covers the Great Depression, war, and a major market in trouble. With global markets around the world waiting for an outcome to the ongoing chaos in the United States, today KWN is publishing a second piece with 60-year market veteran, legend, and the man I call "The Godfather" of newsletter writers. Richard Russell has been writing about the markets for six decades and there is nobody who is better at it. This one is a classic because it covers the Great Depression, war, and a major market in trouble.This posting includes an audio/video/photo media file: Download Now |

| James Rickards On Manipulation of Gold and Silver Markets Posted: 14 Oct 2013 09:00 PM PDT by Fabrice Drouin Ristori, Value Walk:

Here is the third interview with James Rickards.

James Rickards is the author of the national bestseller, "Currency Wars: The Making of the Next Global Crisis" and a Partner in Tangent Capital Partners, a merchant bank based in New York. He is a counselor and investment advisor and has held senior positions at Citibank, Long-Term Capital Management and Caxton Associates. In 1998, he was the principal negotiator of the rescue of LTCM sponsored by the Federal Reserve. His clients include institutional investors and government directorates. |

| China Enjoying Gold Clearance Sale Posted: 14 Oct 2013 08:50 PM PDT by John Rubino, Dollar Collapse:

|

| Today's Gold Price Closed at $1,276.40 Up $8.40 Posted: 14 Oct 2013 08:14 PM PDT Gold Price Close Today : 1,276.40 Change : 8.40 or 0.66% Silver Price Close Today : 21.31 Change : 0.10 or 0.45% Gold Silver Ratio Today : 59.897 Change : 0.128 or 0.21% Silver Gold Ratio Today : 0.0167 Change : -0.00000 or -0.21% Platinum Price Close Today : 1,380.60 Change : 3.00 or 0.22% Palladium Price Close Today : 714.25 Change : 5.45 or 0.77% S&P 500 : 1,710.14 Change : 6.94 or 0.41% Dow In GOLD$ : $247.81 Change : $ -0.60 or -0.24% Dow in GOLD oz : 11.99 Change : -0.03 or -0.24% Dow in SILVER oz : 718.03 Change : -0.19 or -0.03% Dow Industrial : 15,301.26 Change : 64.15 or 0.42% US Dollar Index : 80.26 Change : -0.04 or -0.05% I'm going to say something that might surprise y'all: silver & GOLD PRICES did NOT break down last week. Yes, yes, I know they tumbled on Wednesday & Friday, but they did not "break down." By that I mean "break down through any significant line in the sand or change direction (first you have to HAVE direction to change direction). Look, I'll show y'all what I mean. Today's gold price closed at $1,276.40, up $8.40, while silver rose 9.5 cents to 2131c. The gold price remains in an upside-down head and shoulders building a right shoulder. Last weeks lows did NOT close below the support line connecting the shoulders' tops. More, that right shoulder has built a bullish falling wedge, which rouses expectations of a breakout toward the sun. The SILVER PRICE hath done likewise. That top of the shoulders line caught silver, too, and it also has built a falling wedge. Yet I will climb only so far out on this limb. If the gold price cannot hold above $1,272 at the close or silver cannot remain above 2090c, they'll take one more tumble down toward the June lows, which were 1817 & $1,179.40. That means that if you buy here and they drop further, you'll look foolish If you buy here & silver and GOLD PRICES rocket upward, you'll have bragging rights to your brother-in-law. I repeat, lest y'all missed my NGM comments above, if I were the NGM, I would be steady suppressing silver & gold while this debt-ceiling farce plays out. & I remind y'all again that whichever way this silly negotiation flops, it will still be a flop because nothing is being done to address the real problem, that the government debt has grown too big ever to pay off. Therefore, the government will most surely default, either by outright default, i.e., repudiating the bonds, or by severe inflation. I can't say WHEN it will happen, only that it WILL.Durn! Y'all let the market go to pot while I was gone! Last Wednesday 10 October everything turned, stocks up & metals down. Dollar turned up then, too, but hasn't been able to hang on to the gains. Metals have not resolved their uncertainty, but stocks have. US dollar's hanging on by a gnat's ear. Dow fell plumb to its 200 DMA & that bottom support line at 14,719.43 (intraday) before it turned up. Since has rallied plumb straight up, gained 323 points last Thursday alone, & busted through its 50 and 20 DMAs (15,180 & 15,230). S&P500 didn't drop as far at the Dow, but hit an uptrend line from its June & August lows, pierced it to 1,646.47 (intraday), then turned slap around & headed up. It also has closed through its 50 & 20 DMAs (1,678 & 1,694). So stocks are just a rallying away, but since I am a natural born fool from Tennessee, I keep asking, "Why?" I could see 'em rallying like mad on news of a debt ceiling deal, but why BEFORE a deal? If they're rallying without news, what happens when the news appears & they've already burned up all their buying power? Logical target for this move is to the top channel line, call it 15,800 & 1,735. Of course, that's not guaranteed by any means. Both the S&P500 & the Dow have painted out head & shoulders top formations since April. For both, the neckline was the point where they turned around last week. If that H&S is ruling action, then I wouldn't expect this present rally to reach much further. But I expect this is the last hurrah, so they might even throw over the top of the channel. Internal measures like market breadth & margin debt make this stock market look like Grandpa on a walker & carrying an oxygen bottle. As you would expect given last week's performance, the Dow in Gold & the Dow in Silver have risen. Both stand above their 50 & 20 day moving averages, so momentum for now lies skyward. Neither has yet reached the June highs at 12.514 oz or 816.77 oz. Today the Dow in gold closed at 11.988 oz (G$247.81 gold dollars), down 0.24% on the day, while the Dow in Silver ended at 718.03 oz, down a nothing 0.03% today. Downtrends from June highs remain unbroken, although both indicators are in a short term uptrend. I recall vividly that after August 1999 when stocks peaked against gold, i.e., the Dow in Gold peaked, how anxiously I watched that chart day after day. It fell into October, then rose into January, but never could reach that August peak. Then it went sideways for the rest of twelve months. Sometimes the turn ain't obvious, & you have to bite nails a while to see what turns out. Until the US dollar index climbs above 81, we've got nothing to talk about. It did trade up through its 20 DMA (now 80.43) last week, but fell back under it today, trading now at 80.259. The dollar has no net below 79.50 but 73. Just keep remembering that. The euro wrapped up the day at $1.3564, up 0.17%, but even with a week to work, it hasn't made any progress & is actually lower than it was the week before I left -- notwithstanding its breakout above its top channel line that week. When a market breaks out & ought to move higher but doesn't, it points to a dearth of supporters & all the weakness that implies. Yen also last week lost all the previous weeks gains. Today it shuttered at 101.37, down 0.1%, or, in plain English, no place. Now if I were the Nice Government Men with a whole economy & all sorts of markets to manipulate, what would I do? Why, I'd have worked my government fingers to the bone, dialing up my yellow running dogs who do my bidding in markets & working their bones to death. I'd have kept that dollar up, the euro & the yen down, I'd have bought stocks like my government pension depended on it, and I would have slapped silver & gold silly every chance I got. Wow, here's something odd. That's just what happened. Shucks, just a coincidence. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Today's Gold Price Closed at $1,276.40 Up $8.40 Posted: 14 Oct 2013 08:14 PM PDT Gold Price Close Today : 1,276.40 Change : 8.40 or 0.66% Silver Price Close Today : 21.31 Change : 0.10 or 0.45% Gold Silver Ratio Today : 59.897 Change : 0.128 or 0.21% Silver Gold Ratio Today : 0.0167 Change : -0.00000 or -0.21% Platinum Price Close Today : 1,380.60 Change : 3.00 or 0.22% Palladium Price Close Today : 714.25 Change : 5.45 or 0.77% S&P 500 : 1,710.14 Change : 6.94 or 0.41% Dow In GOLD$ : $247.81 Change : $ -0.60 or -0.24% Dow in GOLD oz : 11.99 Change : -0.03 or -0.24% Dow in SILVER oz : 718.03 Change : -0.19 or -0.03% Dow Industrial : 15,301.26 Change : 64.15 or 0.42% US Dollar Index : 80.26 Change : -0.04 or -0.05% I'm going to say something that might surprise y'all: silver & GOLD PRICES did NOT break down last week. Yes, yes, I know they tumbled on Wednesday & Friday, but they did not "break down." By that I mean "break down through any significant line in the sand or change direction (first you have to HAVE direction to change direction). Look, I'll show y'all what I mean. Today's gold price closed at $1,276.40, up $8.40, while silver rose 9.5 cents to 2131c. The gold price remains in an upside-down head and shoulders building a right shoulder. Last weeks lows did NOT close below the support line connecting the shoulders' tops. More, that right shoulder has built a bullish falling wedge, which rouses expectations of a breakout toward the sun. The SILVER PRICE hath done likewise. That top of the shoulders line caught silver, too, and it also has built a falling wedge. Yet I will climb only so far out on this limb. If the gold price cannot hold above $1,272 at the close or silver cannot remain above 2090c, they'll take one more tumble down toward the June lows, which were 1817 & $1,179.40. That means that if you buy here and they drop further, you'll look foolish If you buy here & silver and GOLD PRICES rocket upward, you'll have bragging rights to your brother-in-law. I repeat, lest y'all missed my NGM comments above, if I were the NGM, I would be steady suppressing silver & gold while this debt-ceiling farce plays out. & I remind y'all again that whichever way this silly negotiation flops, it will still be a flop because nothing is being done to address the real problem, that the government debt has grown too big ever to pay off. Therefore, the government will most surely default, either by outright default, i.e., repudiating the bonds, or by severe inflation. I can't say WHEN it will happen, only that it WILL.Durn! Y'all let the market go to pot while I was gone! Last Wednesday 10 October everything turned, stocks up & metals down. Dollar turned up then, too, but hasn't been able to hang on to the gains. Metals have not resolved their uncertainty, but stocks have. US dollar's hanging on by a gnat's ear. Dow fell plumb to its 200 DMA & that bottom support line at 14,719.43 (intraday) before it turned up. Since has rallied plumb straight up, gained 323 points last Thursday alone, & busted through its 50 and 20 DMAs (15,180 & 15,230). S&P500 didn't drop as far at the Dow, but hit an uptrend line from its June & August lows, pierced it to 1,646.47 (intraday), then turned slap around & headed up. It also has closed through its 50 & 20 DMAs (1,678 & 1,694). So stocks are just a rallying away, but since I am a natural born fool from Tennessee, I keep asking, "Why?" I could see 'em rallying like mad on news of a debt ceiling deal, but why BEFORE a deal? If they're rallying without news, what happens when the news appears & they've already burned up all their buying power? Logical target for this move is to the top channel line, call it 15,800 & 1,735. Of course, that's not guaranteed by any means. Both the S&P500 & the Dow have painted out head & shoulders top formations since April. For both, the neckline was the point where they turned around last week. If that H&S is ruling action, then I wouldn't expect this present rally to reach much further. But I expect this is the last hurrah, so they might even throw over the top of the channel. Internal measures like market breadth & margin debt make this stock market look like Grandpa on a walker & carrying an oxygen bottle. As you would expect given last week's performance, the Dow in Gold & the Dow in Silver have risen. Both stand above their 50 & 20 day moving averages, so momentum for now lies skyward. Neither has yet reached the June highs at 12.514 oz or 816.77 oz. Today the Dow in gold closed at 11.988 oz (G$247.81 gold dollars), down 0.24% on the day, while the Dow in Silver ended at 718.03 oz, down a nothing 0.03% today. Downtrends from June highs remain unbroken, although both indicators are in a short term uptrend. I recall vividly that after August 1999 when stocks peaked against gold, i.e., the Dow in Gold peaked, how anxiously I watched that chart day after day. It fell into October, then rose into January, but never could reach that August peak. Then it went sideways for the rest of twelve months. Sometimes the turn ain't obvious, & you have to bite nails a while to see what turns out. Until the US dollar index climbs above 81, we've got nothing to talk about. It did trade up through its 20 DMA (now 80.43) last week, but fell back under it today, trading now at 80.259. The dollar has no net below 79.50 but 73. Just keep remembering that. The euro wrapped up the day at $1.3564, up 0.17%, but even with a week to work, it hasn't made any progress & is actually lower than it was the week before I left -- notwithstanding its breakout above its top channel line that week. When a market breaks out & ought to move higher but doesn't, it points to a dearth of supporters & all the weakness that implies. Yen also last week lost all the previous weeks gains. Today it shuttered at 101.37, down 0.1%, or, in plain English, no place. Now if I were the Nice Government Men with a whole economy & all sorts of markets to manipulate, what would I do? Why, I'd have worked my government fingers to the bone, dialing up my yellow running dogs who do my bidding in markets & working their bones to death. I'd have kept that dollar up, the euro & the yen down, I'd have bought stocks like my government pension depended on it, and I would have slapped silver & gold silly every chance I got. Wow, here's something odd. That's just what happened. Shucks, just a coincidence. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| 22 Reasons To Be Concerned About The U.S. Economy As We Head Into The Holiday Season Posted: 14 Oct 2013 07:15 PM PDT Submitted by Michael Snyder of The Economic Collapse blog, Are we on the verge of another major economic downturn? In recent weeks, most of the focus has been on our politicians in Washington, but there are lots of other reasons to be deeply alarmed about the economy as well. Economic confidence is down, retail sales figures are disappointing, job cuts are up, and American consumers are deeply struggling. Even if our politicians do everything right, there would still be a significant chance that we could be heading into tough economic times in the coming months. Our economy has been in decline for a very long time, and that decline appears to be accelerating. There aren't enough jobs, the quality of our jobs continues to decline, our economic infrastructure is being systematically gutted, and poverty has been absolutely exploding. Things have gotten so bad that former President Jimmy Carter says that the middle class of today resembles those that were living in poverty when he was in the White House. But this process has been happening so gradually that most Americans don't even realize what has happened. Our economy is being fundamentally transformed, and the pace of our decline is picking up speed. The following are 22 reasons to be concerned about the U.S. economy as we head into the holiday season... #1 According to Gallup, we have just seen the largest drop in U.S. economic confidence since 2008. #2 Retailers all over America are reporting disappointing sales figures, and many analysts are very concerned about what the holiday season will bring. The following is an excerpt from a recent Zero Hedge article...

#3 Domestic vehicle sales just experienced their largest "miss" relative to expectations since January 2009. #4 One of the largest furniture manufacturers in America was recently forced into bankruptcy. #5 According to the Wall Street Journal, the 2013 holiday shopping season is already being projected to be the worst that we have seen since 2009. #6 The Baltic Dry Index recently experienced the largest 4 day drop that we have seen in 11 months. #7 Merck, one of the largest drug makers in the nation, has announced the elimination of 8,500 jobs. #8 Overall, corporations announced the elimination of 387,384 jobs through the first nine months of this year. #9 The number of announced job cuts in September 2013 was 19 percent higher than the number of announced job cuts in September 2012. #10 The labor force participation rate is the lowest that it has been in 35 years. #11 As I mentioned the other day, the labor force participation rate for men in the 18 to 24 year old age bracket is at an all-time low. #12 Approximately one out of every four part-time workers in America is living below the poverty line. #13 Incredibly, only 47 percent of all adults in America have a full-time job at this point. #14 U.S. consumer delinquencies are starting to rise again. #15 The Postal Service recently defaulted on a 5.6 billion dollar retiree health benefit payment. #16 The national debt has increased more than twice as fast as U.S. GDP has grown over the past two years. #17 Obamacare is causing health insurance premiums to skyrocket and this is reducing the disposable income that consumers have available. #18 Median household income in the United States has fallen for five years in a row. #19 The gap between the rich and the poor in the United States is at an all-time record high. #20 Former President Jimmy Carter says that the middle class in America has declined so dramatically that the middle class of today resembles those that were living in poverty when he was in the White House. #21 According to a Gallup poll that was recently released, 20.0% of all Americans did not have enough money to buy food that they or their families needed at some point over the past year. That is just under the record of 20.4% that was set back in November 2008. #22 Right now, one out of every five households in the United States is on food stamps. There are going to be a lot of struggling families out there this winter, so please be generous with organizations that help the poor. A lot of people are really going to need their help during the cold months ahead. |

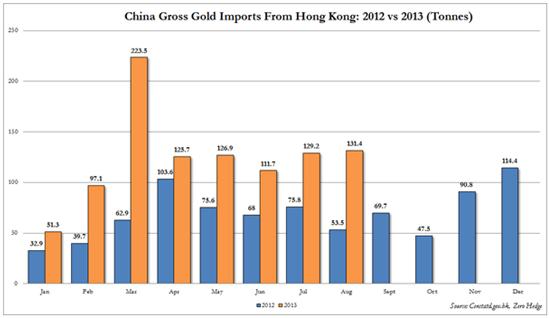

| China Enjoying Gold Clearance Sale Posted: 14 Oct 2013 06:24 PM PDT Analyses of China's massive appetite for gold are everywhere lately. But the following chart, which appeared today in a GoldCore market update was especially striking because it compares 2013 demand with that of 2012 ... Read More... |

| Posted: 14 Oct 2013 06:22 PM PDT Precious Metals bull market continues and is moving step by step closer to the final parabolic phase (could start in summer 2014 & last for 2-3 years or maybe later)... Price target DowJones/Gold Ratio ca. 1:1 ... Read More... |

| Colluding big bank currency traders called themselves 'bandits' and 'cartel' Posted: 14 Oct 2013 05:07 PM PDT Currency Probe Looks at J.P. Morgan Trader By David Enrich, Jenny Strasburg, and Katie Martin LONDON -- A U.K. investigation into potential manipulation of currency markets is looking at a J.P. Morgan Chase Co. trader who participated in electronic chat sessions with traders at other banks, according to people familiar with the investigation. Richard Usher, currently J.P. Morgan's London-based head of spot trading for Group of 10 currencies in the region covering Europe, the Middle East, and Africa, took part in the chat sessions with top traders from various financial institutions when he was an employee of Royal Bank of Scotland Group, these people said. The group of traders in the chat rooms was known by various monikers including "The Bandits' Club" and "The Cartel," the people said. J.P. Morgan hired Mr. Usher from RBS in 2010. He remains employed by the New York-based bank, according to a person familiar with the matter. ... For the full story: http://online.wsj.com/news/articles/SB1000142405270230433090457913560391... ADVERTISEMENT Jim Sinclair Plans Seminar in Washington on Oct. 19 Gold mining entrepreneur and gold advocate Jim Sinclair will hold a seminar with questions and answers on Saturday, October 19, at a hotel at the international airport for Washington, D.C. To register for the seminar and learn more about it, including the discounted rate available at the hotel, please visit Sinclair's Internet site, JSMineSet, here: http://www.jsmineset.com/qa-session-tickets/ Gold Investment Symposium 2013 Luna Park Conference Center, Sydney, Australia Wednesday-Thursday, October 16-17, 2013 The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Is Casey Research peeking out from behind its ideological blinders? Posted: 14 Oct 2013 04:29 PM PDT 10:35a AEST Tuesday, October 15, 2013 Dear Friend of GATA and Gold: New commentary by Louis James of Casey Research suggests that the organization is finding gold market manipulation more plausible and perhaps not disparaging the idea so much anymore. In "Shutdowns, Smackdowns, and Touchdowns," James writes that the recent frequent bombing of the gold market at counterintuitive times "prompts many gold enthusiasts to embrace theories of market manipulation." He adds: "There certainly have been days this year when some entities dumped large amounts of gold onto the market with clear disregard for getting a good selling price. It's hard to see that as normal market behavior, but it does not prove that governments are suppressing the price of gold; it's just as plausible that major players with short positions acted to profit from the ensuing extreme fluctuations." ... Dispatch continues below ... ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Yes, the counterintuitive bombings just support suspicions that central banks are intervening surreptitiously against the gold price. What proves those suspicions are the documents and statements extracted from central banks and central bankers by GATA, like this secret report of the staff of the International Monetary Fund disclosing that central banks conceal their gold swaps and leases to facilitate their secret interventions in the gold and currency markets: http://www.gata.org/node/12016 There's a lot more proof in GATA's "Documentation" file here: http://www.gata.org/taxonomy/term/21 The libertarian aspects of Casey Research founder Doug Casey's ideology are probably pretty congenial to the general outlook of many GATA supporters, though not Casey's nihilist inclinations. So why has Casey himself long been so dismissive of concerns about gold market manipulation? Maybe it is because, like many people, Casey has been blinded by his ideology and made smug by his financial success. Many such people figure that if something was happening they would know it already and that if they don't know it, it can't be happening. Casey's ideology holds that the markets are supreme. Maybe markets should be supreme, but when central banks have the power to create infinite money and debt, they can destroy any and all markets openly or surreptitiously -- and, indeed, now are doing so in a desperate effort to preserve their power. Only one thing is superior to such power -- enough exposure so that people begin to refuse to be so exploited. When people realize that markets are no longer markets, they will not participate in them and market rigging will fail. Casey Research could be a powerful help to GATA in that effort if it would remove its ideological blinders and consider the evidence. That would be research, rather than Casey's usual mere pontification. James' commentary is posted at the Casey Research Internet site here: http://www.caseyresearch.com/cdd/shutdowns-smackdowns-and-touchdowns CHRIS POWELL, Secretary/Treasurer Join GATA here: Gold Investment Symposium 2013 The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| Bankrupt Governments Likely To Confiscate Wealth And Independence Posted: 14 Oct 2013 04:21 PM PDT The first Liberty Forum will take place between December 4th and 8th. The conference has a focus on asset protection, wealth preservation and the preservation of liberty. Some off-the-chart successful investors, metals and resource experts, offshore service providers, and international legal and accounting professionals will be on hand to help with personal preservation strategies. Keynote speakers are Peter Schiff, Doug Casey and Mark Skousen. One of the many lectures will be held by Claudio Grass, a passionate advocate of free-market thinking and libertarian philosophy. Mr. Grass is convinced that sound money, i.e. gold and silver, and human freedom are inextricably linked to each other. In his function as Managing Director at Global Gold in Switzerland he offers investors a safe, convenient and competitive Swiss solution for buying, selling, storing and delivering a variety of physically allocated bullion coins and bars, completely outside of the banking system and protected under Swiss law. Claudio Grass has written several white papers, research notes and articles. In them, he has clearly explained that the most likely outcome of the current global debt situation is that governments will try to inflate their debts away. That is what has always happened throughout history. The current evolution of events has not changed his view. The latest actions by Bernanke, in particular his decision not to stop QE, underlines the validity of Claudio Grass' view. "Taking Yellen's history into account, I am certain she will follow in the footsteps of her predecessor. Therefore, nothing has changed from my point of view." The Liberty Forum conference brings up some fundamental statistics about the debt situation

The true US financial situation remains remarkably underexposed as the mainstream media is mainly concentrating on Europe and increasingly the emerging markets. We asked Claudio Grass about his opinion on that. German economist Wilhelm Röpke once said: "The theories men construct, and the words in which they are framed, often influence their mind more strongly than the facts presented by reality".

Bankrupt governments likely to confiscate wealth and independenceClaudio Grass goes on to point to a concerning trend: as governments run out of money, people's sovereign rights to wealth and independence get increasingly trampled. What the world is experiencing for the last 100 years is an ongoing centralization especially in terms of credit – the so called monetary system – and political power in the hands of a few. This is only financeable if existing wealth is redistributed from the bottom to the top, through inflation and taxation. Since 2007 the average U.S. family wealth plunged 40%. Back in 1913 the average government quota was less than 10%. Today, depending on the country, government quotas are between 50-70%. The trend is obvious! This system can go on until the remaining 50-30% is nationalized. The result is simple: Slavery!

The first signs of these trends are already visible. Politicians and mainstream media say that things are improving which does not reflect the above mentioned trends. Most economic reports even expect economic growth. How can expectations be so different while everyone is looking at the same data? Claudio Grass answers that question with a quote of Edward Bernays, Father of Propaganda.

Include a monetary crash in your risk assessmentClaudio Grass looks at the mess the world is in today and suggests to include a possible crash of the actual system as part of one's risk assessments. Therefore, an investment into a tangible asset, without having any counterparty-risk, makes absolutely sense. It is impossible to foresee when the system will crash. Inevitable does not necessarily mean eminent. However, "I am convinced that this world will look very different in the coming years and what can be said, too, is that it is not developing in the right direction." Anthony C. Sutton (British and American economist, historian and notable author, answered this question once by stating: "It will not stop until we act upon one simple axiom: that the power system continues only as long as individuals want it to continue, and it will continue only so long as individuals try to get something for nothing. The day when a majority of individuals declares or acts as if it wants nothing from government, declares it will look after its won welfare and interest, then on that day power elites are doomed."

Claudio Grass will be talking at the St. Kitts Liberty Forum Conference about facts and fiction about buying and holding gold in Switzerland. More info about the Liberty Forum Conference or register now.

|

| Hathaway's gold market manipulation complaint emboldens MineWeb's Williams Posted: 14 Oct 2013 03:55 PM PDT 9:50a AEST Tuesday, October 15, 2013 Dear Friend of GATA and Gold: MineWeb's Lawrence Williams seems emboldened by the Tocqueville Gold Fund John Hathaway's recent complaining about gold market manipulation to do more complaining of his own. So much unbacked "paper gold" has been sold and so much central bank gold has been leased, Williams says, that a short squeeze is likely. His commentary is headlined "Bullion Banks 'Selling Gold They Don't Possess' -- Squeeze Alert!" and it's posted at MineWeb here: http://www.mineweb.com/mineweb/content/en/mineweb-gold-analysis?oid=2085... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Join GATA here: Gold Investment Symposium 2013 The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Derivatives let central banks suppress gold longer this time, Turk tells KWN Posted: 14 Oct 2013 03:45 PM PDT 9:40a AEST Tuesday, October 15, 2013 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk today explains to King Worldl News why the latest central bank gold price suppression scheme is taking so long to be overthrown. "What we are seeing today is a lot like what happened in the 1960s," Turk says. "Back then the U.S. government dishoarded over 12,000 tons of gold from Fort Knox to keep the price at $35 per ounce. ... But all of that dishoarding did not change gold's underlying fundamentals. ... Buying this gold was an easy decision by those who understood gold because they recognized that it was very undervalued. "There is one thing different today from back then: The central planners back in the 1960s did not have all the derivative instruments at their disposal to cap the gold price." But the fundamentals of the market will overwhelm price suppression again, Turk says, just as they did in the late 1960s. An excerpt from Turk's interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/10/14_H... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. Join GATA here: Gold Investment Symposium 2013 The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| After sudden plunge, gold traders cry conspiracy Posted: 14 Oct 2013 03:22 PM PDT By Alex Rosenberg http://www.cnbc.com/id/101110403 Gold dropped $25 in two minutes Friday morning following what appeared to be a single massive sell order, and professional traders are now pronouncing the sale a deliberate attempt to manipulate the market. At 8:42 a.m. ET Friday morning a firm appeared to sell 5,000 gold futures contracts "at the market," meaning at whatever price was available. The massive order was more than the market could take at once and led the CME to automatically halt trading for 10 seconds. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Eric Hunsader of Nanex told CNBC.com on Friday that 2,700 contracts were sold, which triggered the halt, and that the remaining 2,300 were sold once the market resumed trading. Since one futures contract controls 100 troy ounces of gold, and each troy ounce was worth $1,285 at the time of the sale, this party was selling some $640 million worth of gold in one shot. And it overwhelmed the liquidity in the market. "Anyone with knowledge of the size and volume in the market would absolutely never, ever place a 5,000 [contract] sell [order] at market, because you could not estimate the offset price," said iiTrader CEO Rich Ilczyszyn. If Ilczyszyn's firm were placing the order, he said, "we generally would piece the order in to work a better price." That's why he believes the trade was "an error." But Euro Pacific Capital CEO Peter Schiff, a longtime gold fan, infers darker motives. "Someone's obviously trying to move the market lower," he told CNBC.com. "A legitimate seller would work a limit over time to get a good price." Jim Iuorio, managing director at TJM Institutional Services, sees similarities between what happened to gold Friday and what happened Sept. 12, when a big gold sale at 2:54 a.m. ET similarly caused a trading halt and hurt the market. "There is only one conclusion that seems logical regarding Friday's gold trade and the one from a month ago, and that's that they were designed to manipulate prices," Iuorio said. "They were slightly different, in that the one from a month ago was done when the market was illiquid in order to get the biggest prices movement. Friday's was done around the opening to ensure that there was maximum visibility." Jeff Kilburg of KKM Financial noted that the trade was done when gold was at $1,285. But not everyone is on the conspiracy train. George Gero of RBC Capital Markets, precious metals strategist and a veteran of the gold market, says what we saw could have simply have been a fund changing its mind. So is that how Gero would have sold $640 million worth of gold? "Absolutely not," he said with a laugh. "But I don't know who the fund was, and I don't know who managed their order room." When reached for comment, CME Group spokesperson Damon Leavell said: "Our markets functioned properly, and price discovery continued throughout the move." Join GATA here: Gold Investment Symposium 2013 The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Watching the End of US Empire with Doug Casey Posted: 14 Oct 2013 03:08 PM PDT Libertarian Doug Casey sits back to watch the decline of the US empire... DOUG CASEY, chairman of Casey Research LLC, is the international investor personified. With 11 investment titles now being published by his group, Doug Casey has spent substantial time in more than 175 different countries so far in his lifetime, residing in 12 of them. And Casey literally wrote the book on crisis investing. In fact, he's done it twice. After The International Man: The Complete Guidebook to the World's Last Frontiers in 1976, he came out with Crisis Investing: Opportunities and Profits in the Coming Great Depression in 1979. Speaking here to The Gold Report, Doug Casey details his libertarian view of the US economy, politics and investing. All told, it looks more like ancient Rome in its final days. But he's planning for the coming crisis – in another country, and watching on TV... The Gold Report: Doug, we are at your conference in Tucson, Arizona, the day after former Congressman and presidential candidate Dr.Ron Paul gave the keynote speech to a sold-out crowd. How did you two first meet? Doug Casey: It was about 30 years ago. Ron used to attend my Eris Society (named after the Greek goddess of discord) meetings in Aspen, Colorado. Everyone from Sonny Barger of the Hells Angels motorcycle club to Burt Rutan, inventor of SpaceShipOne, would meet to discuss ideas. TGR: In those 30 years have Ron Paul's ideas changed much? Doug Casey: Ron believes he was born a libertarian. He's right. I believe in Pareto's Law, the 80-20 rule. I prefer to think that 80% of humans are basically decent, which is to say that they were born libertarian oriented. But it takes a while to crystallize what that means. Ron and I, and many others, have moved beyond gut libertarianism to a structured, intellectual libertarianism. Some people see the same things we see through a totally different lens, however. Those people tend to be the other 20%, or perhaps 20% of that 20%, or even 20% of that 20% of that 20%. They range from being wishy-washy on ethical subjects to being sociopaths or even outright criminals. These people are at the opposite end of the spectrum from us in every way. TGR: One of the things Ron Paul mentioned last night is that a true libertarian advocates for the freedom of everyone to do what he or she wants as long as it's not hurting someone else. This includes people who don't agree with your views. Doug Casey: Exactly. As opposed to busybodies who want to tell everybody else what to do. They think they know best and are perfectly willing to put a gun to your head to make sure that you do what they think is right. TGR: We are meeting in the midst of a government shutdown. Ron Paul called it a paid holiday for federal workers. Are we doomed to an endless cycle of these man-made crises? Doug Casey: I would like nothing better than to see the shutdown go on forever, but unfortunately the government is only shutting down things that inconvenience people, like monuments and national parks, things that should not be owned by the government to start with. I wish they would shut down all their praetorian agencies, like the FBI, the CIA and the NSA. Shut down the IRS. I am much more concerned about Silk Road being shutdown than I am the US government being shut down. TGR: Do you think regular people care whether government is shut down or not? Doug Casey: Over half of Americans are living off the state, receiving more from the state than they're putting into it, which makes them receivers of stolen property. They see the government as a cornucopia and therefore a good thing so they want it to be open and sending them checks. The situation is fairly hopeless at this point and it's likely to get a lot worse before it gets better. Trends in motion, in whatever direction, tend to stay in motion until they hit a crisis at which point they transform into something else. This trend is not only in motion, but it's accelerating in the wrong direction. TGR: Ron Paul said that the charade on the American people is that the two parties are different, that actually it's not that we need a third party, but we need a second party. Your presentation compared the end of the Roman Empire to the state of the US today. Is the current political system doing a better or worse job of protecting freedom and liberty in the US compared to ancient Rome? Doug Casey: The founders consciously modeled the US after Rome, everything from the way government buildings looked to having an assembly and a senate. We are similar right down to the Latin mottos. When you model yourself after something, you eventually tend to resemble it. That partly explains why we are on the slippery slope of constant wars, less freedom, more power for the executive, destruction of the currency and barbarians at the gate. Another part is the natural tendency of all empires to reach their level of incompetence and then decline. It's to be expected. Entropy dictates all things wind down and degrade. As I pointed out in my speech, America has gone through periods of what paleontologists call punctuated disequilibrium. Things evolve gently in one direction and then experience massive change very quickly. I'm afraid that the US might be approaching a phase similar to the one the Romans experienced before Diocletian made himself emperor. He completely changed the character of Rome; he believed that in order to save Rome, he had to destroy it. As we go deeper into this crisis, of which we're just currently in the early stages, there's every chance that the American people are going to look for a savior, a strong man, probably a military person because Americans love and trust their military for some reason. I see the military as not much more than a heavily armed version of the post office, but I suspect that we'll find someone who is the equivalent of Diocletian, who will change the whole nature of society radically in the wrong direction. TGR: Do you believe in changing from within the system or just getting out from under the system? Would you ever run for public office? Doug Casey: I think the situation is beyond retrieval at this point. People generally get the government they deserve. At this point, Americans are much more interested in freebies than they are in personal freedom. They are like scared little rabbits. They're much more interested in safety than they are in personal liberty. I think they're going to get what they deserve good and hard over the years to come. I would much rather watch what goes on in the US on my widescreen TV in the lap of luxury in another country than be in the epicenter of things here. The system is beyond the point where it can be reformed. And, no, I have zero desire to run for office. Plus, anyone who runs for office disqualifies himself for being in a position of power by the very fact that he wants to be in that position. My friend Harry Browne always used to say that when he ran for president on the Libertarian ticket the first thing he'd do if he were elected would be to quit – at least after rescinding all outstanding Executive Orders and recalling all the troops. Anyway, even if Ron Paul had been elected president and if he tried to make the necessary changes, the public would have rioted, Congress would have impeached him, and the heads of the CIA, FBI and the military would have sat him down and subtly intimated that they have the power and he shouldn't do anything they don't want done – or undone. I don't think a change can be made at this point. I'm just interested in seeing what happens when we really get involved in a really big crisis, which I think is going to happen in the next couple of years as we go back into the trailing edge of the economic hurricane that started in 2007. TGR: One of the things that has come up as part of the shutdown debate is healthcare. Do you have health insurance? And, how would you control healthcare costs? Doug Casey: First of all, I don't call it health insurance because it doesn't insure your health. That's something that you're personally responsible for, not some third party. I call it medical insurance. Just as I call the FDA the Federal Death Authority because it probably kills more people every year than the Department of Defense does in a typical decade by slowing down the approval and hugely raising the cost of new drugs and technologies. Getting to back to your question, no, I don't have medical insurance. If anything goes wrong with my body, I'll treat it as I would if something goes wrong with my car. I'll find the best doctor elsewhere in the world where medical costs can be 20% of what they are in this country. I'll pay for it in cash. I don't want to have to fight with an insurance company, or the government, about what's covered or not. The whole idea of everybody having medical insurance is a corruption that arose during World War II when companies used insurance to attract workers. Then we had Medicare and then Medicaid. These are the reasons costs have escalated. In a free market society, medical costs should have collapsed and gone down in the same way as the cost of computers have collapsed and gone down even as they've gotten vastly better. People think they need the government in medicine, but it's been totally counterproductive. It's done the opposite of what was intended. TGR: One of the things Ron Paul mentioned is that his speeches on college campuses, including UC Berkeley, have been some of the most well received. Do you have hope for the next generation? Doug Casey: Yes, there is reason for hope over the longer term. Generally, older people in this country have voted all these "benefits" for themselves, and they don't want to have their rice bowls broken. The younger people are being turned into indentured servants to pay for these benefits. Young people are figuring this out. Another worrisome thing is that a lot of young people have indentured themselves by taking on huge amounts of college debt; $1.2 trillion is the current number. They can't even discharge it through bankruptcy, although many are unable to pay it. More and more are deciding that doing four years in a college, to experience indoctrination from wrongheaded professors, is a complete misallocation of both their time and their money. If I had to do it again, I definitely would not go to college. I recommend others skip college, unless they need to learn a specific technical set of skills, such as doctoring or lawyering or engineering or a science where you need lab work. Most kids today, however, are going off to college for things like gender studies, political science and English. These are things you should learn on your own, on your own time, at no cost. Meanwhile, avoid the indoctrination of the creatures who hang out in university faculty rooms who teach because they are incapable of doing anything else. TGR: Ron Paul intimated that we're in a middle of a revolution. You said that the solution to our problems would be less command and control and more entrepreneurs. Are the small business owners the real revolutionaries? Doug Casey: They could and should be, but it is becoming increasingly difficult to start a business because of the regulatory and tax environment in the US Smart people are leaving in droves. There just aren't enough left to change things. I'm afraid we're just going to have to let things take their course. The main function that Ron Paul has served was educating people, which is necessary and laudable. But, the odds of him succeeding in changing things are close to zero. TGR: You talked about the role of education and Ron Paul mentioned the power of the Internet to circulate new ideas based on the theory that ideas have consequences. Your ideas are having an impact thanks to the power of the internet. Does that bode well for the future? Doug Casey: It does. The internet is the best thing that's happened since Gutenberg invented movable type and the printing press; it's a marvelous thing. That's exactly why the government wants to regulate the internet. It sees it as a huge danger. TGR: Does suppressing ideas ever work? Is it working in China? Doug Casey: Actually, in many ways China is freer than the US, but that's not one of them. If you are a businessman and you keep your nose out of politics, it actually is freer. You'll have less taxes, less regulation in China than you would in the US But instead of emulating the free part of China, the US government is trying to copy the Internet restrictions because it sees the Internet as a danger to the existing order. And they're right. TGR: But didn't the governments of Middle Eastern countries find out that ideas have a life of their own and they find a way to spread despite attempts to shut them down? Doug Casey: They do, so let's hope for the best. TGR: Finally, Ron Paul said that things are worse than the government will admit and the idea of economic growth this year is a dream. He said we need to be serious, but not despondent. Make financial plans, but have fun doing it. Do you agree and are you having fun yet? Doug Casey: I am having fun. I'm doing this not because I need the money, but because it's amusing and it's good karma to sow dissention in the ranks of the enemy. TGR: Thank you for sharing your thoughts. Doug Casey: Thank you. The audio recordings of the Casey Research 2013 Summit are available here. |