Gold World News Flash |

- U.S. Silver-Coin Sales Top 2012 as Investors Buy at Record Pace

- Higher interest rates not always bad for the gold price think 2003-6

- Guest Post: Why Europe (Not The Fed) Is Crushing Emerging Market Economies

- What is a Person To Do?

- 540 Point Nikkei 'Olympic-Hope' Spike Fades On Japanese Data 'Reality' Miss

- Toby Connor: Is manipulation in gold about to begin again?

- Top Economist Predicts Increased Gov’t Theft & Surge In Gold

- Things That Make You Go Hmmm... Like Ben "Barrel'o'Monkeys" Bernanke

- Neighbors favor Romanian gold mine while those at a distance are opposed

- Government Theft, Gold, Silver & A Chart That Will Shock You

- Will Berlusconi Be Responsible For Another European Crisis?

- Gene Arensberg: U.S. bullion banks remain unusually long gold

- China Imports An Impressive 116.4 Tonnes Of Gold In July 2013

- Book Review of Gold, the monetary Polaris

- JIM ROGERS : 'PREPARE FOR FINANCIAL COLLAPSE' - FIAT MONEY WILL STOP BEING PRINTED

- If Australia's new government would revive mining, confront gold price suppression

- The real state of the world economy is dire

- Is Gold Price Manipulation About to Begin Again?

- Dr. Nu Yu’s Back With Analyses on Gold & Silver, USD, Crude Oil, HUI/XAU, U.S. Bonds

- Massive Debt Levels Will Push Silver To $150 And Beyond

- King Dollar…Will It be a Breakdown or a Breakout?

- Direction of U.S. Trade Deficit Indicates Direction of U.S. Dollar

- The Stock Market Is NOT About to Crash Any Time Soon! Here’s Why

- Gold strikes end in South Africa

- Jim Willie - Nations Need to Depart from Dollar or Enter Third World

- JIM ROGERS - TOTAL FINANCIAL COLLAPSE Will Be Here If They STOP PRINTING FIAT CURRENCY

- David Stockman: Collapse Could Lead To Reconstruction Of The System

- ROTHSCHILDS CONTROL WORLD GOLD & CAPITAL FROM LONDON

- Silver – Can $23 Hold? $26 Should.

- Gold And Silver – It Is Always About One Thing: Timing

- Will the Gold Price Retest Its June Low?

- Will the Gold Price Retest Its June Low?

- Cashing In Your Golden Insurance

- Should you join the buyers as the gold price rises?

| U.S. Silver-Coin Sales Top 2012 as Investors Buy at Record Pace Posted: 08 Sep 2013 11:30 PM PDT by Debarati Roy, Bloomberg:

About 33.75 million ounces of the silver coins were sold so far in 2013, compared with 33.74 million in 12 months last year, according to data on the mint's website. In January, sales reached an all-time high of 7.498 million, and averaged 3.65 million a month since then as demand heads closer to the annual record of 39.868 million reached in 2011. |

| Higher interest rates not always bad for the gold price think 2003-6 Posted: 08 Sep 2013 09:00 PM PDT from Arabian Money:

Think back to 2003-6 and then interest rates were heading up from a notable low. That might well be the prospect for the next few years if the Fed starts to unwind its QE program from the 18th of this month. Gold prices rose by 60 per cent from 2003 to 2006. You might have thought that higher interest rates meant a higher dollar and that would strike gold prices down, but that did not happen back then. $400 top!: ArabianMoney recalls a meeting held in Dubai with Credit Suisse's global expert on gold in 2004 at which we were told with great emphasis that $400 an ounce was the absolute top for gold. Only when gold sprinted above $450 did we realize this was complete nonsense. |

| Guest Post: Why Europe (Not The Fed) Is Crushing Emerging Market Economies Posted: 08 Sep 2013 07:38 PM PDT Authored by Daniel Gros, originally posted at Project Syndicate, Emerging markets’ currencies are crashing, and their central banks are busy tightening policy, trying to stabilize their countries’ financial markets. Who is to blame for this state of affairs? A few years ago, when the US Federal Reserve embarked on yet another round of “quantitative easing,” some emerging-market leaders complained loudly. They viewed the Fed’s open-ended purchases of long-term securities as an attempt to engineer a competitive devaluation of the dollar and worried that ultra-easy monetary conditions in the United States would unleash a flood of “hot money” inflows, driving up their exchange rates. This, they feared, would not only diminish their export competitiveness and push their external accounts into deficit; it would also expose them to the harsh consequences of a sudden stop in capital inflows when US policymakers reversed course. At first sight, these fears appear to have been well founded. As the title of a recent paper published by the International Monetary Fund succinctly puts it, “Capital Flows are Fickle: Anytime, Anywhere.” The mere announcement that the Fed might scale down its unconventional monetary-policy operations has led to today’s capital flight from emerging markets. But this view misses the real reason why capital flowed into emerging markets over the last few years, and why the external accounts of so many of them have swung into deficit. The real culprit is the euro. Quantitative easing in the US cannot have been behind these large swings in global current-account balances, because America’s external deficit has not changed significantly in recent years. This is also what one would expect from economic theory: in conditions approaching a liquidity trap, the impact of unconventional monetary policies on financial conditions and demand is likely to be modest. Indeed, the available models tell us that, to the extent that an expansionary monetary policy actually does have an impact on the economy, its effect on the current account should not be large, because any positive effect on exports from a weaker exchange rate should be offset by larger imports due to the increase in domestic demand. This is what has happened in the US, and its recent economic revival has been accompanied by an expansion of both exports and imports. The impact of the various rounds of quantitative easing on emerging markets (and on the rest of the world) has thus been approximately neutral. But austerity in Europe has had a profound impact on the eurozone’s current account, which has swung from a deficit of almost $100 billion in 2008 to a surplus of almost $300 billion this year. This was a consequence of the sudden stop of capital flows to the eurozone’s southern members, which forced these countries to turn their current accounts from a combined deficit of $300 billion five years ago to a small surplus today. Because the external-surplus countries of the eurozone’s north, Germany and Netherlands, did not expand their demand, the eurozone overall is now running the world’s largest current-account surplus – exceeding even that of China, which has long been accused of engaging in competitive currency manipulation. This extraordinary swing of almost $400 billion in the eurozone’s current-account balance did not result from a “competitive devaluation”; the euro has remained strong. So the real reason for the eurozone’s large external surplus today is that internal demand has been so weak that imports have been practically stagnant over the last five years (the average annual growth rate was a paltry 0.25%). The cause of this state of affairs, in one word, is austerity. Weak demand in Europe is the real reason why emerging markets’ current accounts deteriorated (and, with the exception of China, swung into deficit). Thus, if anything, emerging-market leaders should have complained about European austerity, not about US quantitative easing. Fed Chairman Ben Bernanke’s talk of “tapering” quantitative easing might have triggered the current bout of instability; but emerging markets’ underlying vulnerability was made in Europe. The fickleness of capital markets poses once again the paradox of thrift. As capital withdraws from emerging markets, these countries soon will be forced to adopt their own austerity measures and run current-account surpluses, much like the eurozone periphery today. But who will then be able – and willing – to run deficits? Two of the world’s three largest economies come to mind: China, given the strength of its balance sheet, and the eurozone, given the euro’s status as a reserve currency. But both appear committed to running large surpluses (indeed, the two largest in the world). This implies that, unless the US resumes its role as consumer of last resort, the latest bout of financial-market jitters will weaken the global economy again. And any global recovery promises to be unbalanced – that is, if it materializes at all. |

| Posted: 08 Sep 2013 07:00 PM PDT by argentus maximus, TF Metals Report:

Scarcity= higher value but availability = lower value. OK That's fine. Next, the even more obvious: fractional similarity of smaller units as a swop for larger units, or fungibility = a greater practicality of use as money. All moneys have it, bigger coins, smaller coins, cigarettes are divisional, so is booze via smaller bottles, or lower alcohol content. 2 x $5 = 1 x $10. And maybe 20 bottles of beer = 1 bottle of whisky. OK! Got that and it's obvious too! Quality counts. Cigarettes and booze …… hmmmm. |

| 540 Point Nikkei 'Olympic-Hope' Spike Fades On Japanese Data 'Reality' Miss Posted: 08 Sep 2013 06:08 PM PDT An exuberant Japanese investing public bid the open of equity trading in their oh so-penny-stock-like prestigious Nikkei 225 stock index by 540 points from Friday's close. That these 4% rips in major global stock markets have become ubiquitous is now no surprise to anyone but, sadly, for Abenomics supporters the world over, final Q2 GDP missed expectations modestly (+0.9% vs +1.0% exp.) with the 3rd worst trade balance (on a BoP basis ) ever not helping matters. Is that GDP hit enough to maintain Abe's decision to hike taxes? Maybe, maybe not. In thge hour since the data hit, the Nikkei has collapsed back 220 points and USDJPY, having surged up over 100.00 into the GDP print, is fading lower (stronger JPY). The rest of Asia is quiet for now, gold and Treasury bond prices are very slightly lower and amid very thin trading in S&P futures, equities are up 3 points.

Japanese data was a disappointment...with GDP missing...

and the 3rd worst trade balance in history...

As is clear from the FX...

and equity markets...

Charts: Bloomberg |

| Toby Connor: Is manipulation in gold about to begin again? Posted: 08 Sep 2013 05:03 PM PDT 8p ET Sunday, September 8, 2013 Dear Friend of GATA and Gold: Financial letter writer Toby Connor writes today that he's "not a big conspiracy buff" but he suspects that gold price suppression is about to resume in a big way. Of course GATA is not a "conspiracy buff" either and complaints of gold price suppression require no speculation or conspiracy theory, just some of the documentation GATA has collected over the years -- http://www.gata.org/taxonomy/term/21 -- documentation that Connor and most other gold market analysts never seem to get around to, preferring to speculate, since it requires no research. But maybe a little progress is signified when people who profess to be skeptical of gold price suppression acknowledge that evidence is starting to weaken their skepticism. Connor's commentary is headlined "Is the Manipulation in the Metals about to Begin Again?" -- of course the manipulation never stopped -- and it's posted at GoldSeek here: http://news.goldseek.com/GoldSeek/1378678864.php CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Precious Metals Round Table: On Tuesday, September 24, Sprott Asset Management will assemble four experts for a live Internet broadcast about the prospects for the precious metals. Participating will be Sprott's CEO, Eric Sprott; financial letter writer and internationally renowned conference speaker Marc Faber; Sprott's chief investment strategist, John Embry; and Sprott Asset Management President Rick Rule. To participate, please visit: https://event.on24.com/eventRegistration/EventLobbyServlet?target=regist... Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Top Economist Predicts Increased Gov’t Theft & Surge In Gold Posted: 08 Sep 2013 04:51 PM PDT Dear CIGAs, Today one of the top economists in the world warned King World News that we are going to see an increase in government theft of its citizens assets. Michael Pento, who heads Pento Portfolio Strategies, also made some incredibly bold predictions about what is coming in the bond, gold, silver, and mining shares... Read more » The post Top Economist Predicts Increased Gov’t Theft & Surge In Gold appeared first on Jim Sinclair's Mineset. |

| Things That Make You Go Hmmm... Like Ben "Barrel'o'Monkeys" Bernanke Posted: 08 Sep 2013 03:55 PM PDT "What's more fun than a Barrel of Monkeys? Nothing!" What could be better than assembling a long chain of tangled monkeys, each reliant on those either side of it for purchase, with just the one person holding onto a single monkey's arm at the top end of the chain, responsible for all those monkeys dangling from his fingers. Of course, with great power comes great responsibility; and that lone hand at the top of the chain of monkeys has to be careful - any slight mistake and the monkeys will tumble, and that, we are afraid, is the end of your turn. You don't get to go again because you screwed it up and the monkeys came crashing down. On May 22nd of this year, Ben Bernanke's game of Barrel of Monkeys was in full swing. It had been his turn for several years, and he looked as though he'd be picking up monkeys for a long time to come. The chain of monkeys hanging from his hand was so long that he had no real idea where it ended... Via Grant Williams, ...That day, in prepared testimony before the Joint Economic Committee of Congress in Washington, DC, Bernanke stated that the Fed could increase or decrease its asset purchases depending on the weakness or strength of data:

To assuage any lingering doubt, he continued:

Markets fluttered a little as they tend to do around these carefully stage-managed performances, but remained largely sanguine. However, in the Q&A session that followed his prepared remarks, Bernanke, in response to a fairly innocuous question, went a little offpiste, straying into some improv, making a suggestion that, within minutes, had given rise to a phenomenon which by the end of the day had earned its very own soubriquet: the "Taper Tantrum":

The statement contained the usual bit about the Fed being open to both decreasing OR increasing bond purchases; but it added one, as it turned out vital, piece of information:

Boom! That's all it took. The monkeys began to shiver, shake, and screech. Now, I have been saying for the longest time that these days nothing matters to anybody until it matters to everybody, and that is largely down to the Fed themselves (and their peers across the various oceans and borders who are complicit in this era of free money). The proof of my statement is seen in the fact that as soon as Bernanke mentioned that the "taper" — which, let's face it, EVERYBODY knows has to happen sooner or later — would possibly begin before the end of 2013, markets began to crumble. ... Forgotten in the localized euphoria over the S&P's remarkable resilience was the fact that we live in an ever-shrinking world and that there are lots of other monkeys on the long chain dangling from Bernanke's hand. Moves the Federal Reserve makes have repercussions far and wide. Like in Jakarta, for example...

Sigh... But wait, there's more...

The root cause of all this instability is, as I said at the beginning of this piece, Benny and the (Ink)Jets and their frivolous generosity. As emerging markets unravel in the face of a taper that was always inevitable at some point, the corner that the free-money Fed has painted other central banks into becomes ever more apparent as it shrinks. There really is no way out now, I'm afraid — not without some kind of organic growth allied with controlled inflation. Emerging-market central bankers need both. They have neither. Ambrose Evans-Pritchard nicely sums up the situation facing the Fed:

Amen again, Brother Ambrose. A rude surprise may well await the world. As Ben Bernanke eyes his own exit, Janet Yellen and Larry Summers wait in the wings to see which of them gets to take the handoff of the ominously swaying monkey chain from the incumbent chairman's hand. One false move and all the monkeys may end up in a heap on the floor.

Full Grant Williams Letter below: |

| Neighbors favor Romanian gold mine while those at a distance are opposed Posted: 08 Sep 2013 03:36 PM PDT Romanians Rally For and Against Planned Gold Mine By Alison Mutler http://news.yahoo.com/romanians-rally-against-planned-gold-181640432.htm... BUCHAREST, Romania -- Thousands of Romanians demonstrated on Sunday both for and against a planned gold mine that would use cyanide in the extraction process. The project would create the biggest gold mine in Europe, razing four mountains to make way for an open-pit mine. Supporters say the mine would bring vital jobs and investment to the deprived area in northwest Romania. But opponents say it will present an environmental risk. In the Romanian capital, thousands of people protesting against the mine shouted "Save Rosia Montana," referring to the town where it would be located and where gold has been mined for more than 2,000 years. ... Dispatch continues below ... ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... The anti-mine protesters in Bucharest's University Square urged lawmakers not to pass legislation that would approve the mine as a "special national interest" creating foreign investment and jobs in the deprived area. They later blocked a main road in the city. Some 6,000 people rallied in the city of Cluj, which is near the mine, also urging parliament to block the legislation, Mediafax news agency reported. In the town of Rosia Montana, thousands of miners used their annual rally on miner's day to urge Parliament to allow the mine to open, saying it would create jobs and investment, local authorities said. Rosia Montana Town Hall put the turnout at 10,000 people. For the past week there have been protests in Bucharest and other Romanian cities against the draft bill the government has put forward that would allow a Canadian company, Gabriel Resources, to mine gold and silver there. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| Government Theft, Gold, Silver & A Chart That Will Shock You Posted: 08 Sep 2013 03:05 PM PDT  On the heels of continued volatility in key global markets, today 40-year veteran, Robert Fitzwilson, put together another tremendous piece. Fitzwilson, who is founder of The Portola Group, sent an absolutely stunning chart to KWN that will shock readers around the world. Below is Fitzwilson's outstanding and exclusive piece. On the heels of continued volatility in key global markets, today 40-year veteran, Robert Fitzwilson, put together another tremendous piece. Fitzwilson, who is founder of The Portola Group, sent an absolutely stunning chart to KWN that will shock readers around the world. Below is Fitzwilson's outstanding and exclusive piece.This posting includes an audio/video/photo media file: Download Now |

| Will Berlusconi Be Responsible For Another European Crisis? Posted: 08 Sep 2013 02:57 PM PDT Sylvio Berlusconi is no stranger to being a catalyst for European crisis: in November 2011 it was his unwillingness to leave the PM post (and be replaced with a Goldman technocrat), that precipitated a bond crisis accented by the ECB's unwillingness to interject and buy Italian bonds until the career politician had left. Tomorrow, an Italian Senate committee is due to begin hearing arguments on whether to eject ex-PM Berlusconi from Parliament and on. The special Senate Elections and Immunities Committee will have its first hearing on Berlusconi's expulsion from the Parliament and six-year ban on 9 September. It seems now less likely that a vote will already take place on 9 September. The decision of the commission will be followed by a vote of the whole Senate. According to Deutsche Bank, the duration of the process is unclear. Indeed, it could be lengthened by several months if the commission (or the parliament) asks for a ruling of the Constitutional Court. However, a worst case scenario could see the government fail, early elections being called, and a repeat of this February's political circus all over again, only this time with even less political capital, if such a thing ever existed in Italy. As the Italian stock market already made clear on several occasions over the past two weeks, a political crisis in the coalition government which could see Berlusconi's PDL withdraw support from Letta, at a time when Europe is said to be recovering on the back of the peripheral countries (Germany has posted a slew of economic data misses recently) will hardly boost sentiment. Which is why all of Italy, and Europe will be following, the latest political spectacle in Italy quite closely.

Naturally. The only question is at what cost does stability come: it seems that in Italy legitimizing behavior that abuses child prostition, tax fraud and mafia racket is an acceptable price to preserve the illusion of "stability" as measured by the FTSE Mib, and of course, confidence - the most scarce commodity in Italy and the world over the past 5 years. Which is precisely what is at stake tomorrow.

A plan B is already being hatched to deal with the fallout of an unfavorable, for the stock market, decision:

So once again, justice is left at the door when the threat of a selloff is at stake. Because in a world built on the foundations of artificial confidence and kept together with central banker superglue, nothing can be allowed to shake the false reflexive myth that things are fine and getting better: why just look at stocks. As for our rhetorical title question: the answer, of course, is no. When a human decision, one "potentially" motivated by money has so much impact, one can be assured that nobody will vote with their conscience and everyone will vote with their offshore bank account. * * * For those curious for more, here is Deutsche Bank with a comprehensive step by step analysis of what may happen as the fate of European stock markets hinges on the decision of an Italian court: Italy: political and fiscal update As expected, political tension over the summer increased following ex-Berlusconi final conviction for tax fraud in July. Tension peaked at the end of last week with a communiqué from the PDL that seemed to suggest that a government collapse was imminent. But, in our view, since Monday 26 August the likelihood of the government survival has increased materially due to three main factors, which we discuss below in their chronological order:

After a weekend where it appeared that the hawks within the PDL had the upper hand, the very negative equity market reaction has led, in opinion, to a more prudent approach. On Monday evening, ex-PM released an official communiqué calling for a suspension of the statements from PDL members of the parliament that had heightened tensions.

One of the consequences of the final four-year tax fraud conviction for Berlusconi is the likely ban from holding public office. This is due to two parallel procedures: — First, the July ruling by the Court of Cassation that upheld the tax fraud conviction against Berlusconi ordered a new appeal to review the duration of the ban from public office, between one and three years. The decision of the Milan Appeal Court should come before the end of the year. According to Il Sole 24 Ore, it never occurred in the past that the Parliament disregarded the Court's decision, but there have been cases were it took time for the decision to be applied. — Second, a longer (six years) and more immediate ban could be triggered by the December 2012 anti-corruption law. The law establishes that a more-than-two year conviction forbids that person from standing for election to the Italian parliament for six years and her/his expulsion from the Parliament. A special Senate commission (Elections and Immunities Committee) will have its first hearing on Berlusconi's expulsion from the Parliament and six-year ban on 9 September. It seems now less likely that a vote will already take place on 9 September. The decision of the commission will be followed by a vote of the whole Senate. The duration of the process is unclear. Indeed, it could be lengthened by several months if the commission (or the parliament) asks for a ruling of the Constitutional Court. On 27 August in an interview with Il Corriere della Sera, ex-president of the Lower House Luciano Violante, a senior member of the PD, constitutional expert and close to the President of the Republic, opened the door to Berlusconi/PDL's request for a ruling of the Constitutional Court. The PDL's argument is that the law cannot be applied to Berlusconi's case as the crimes occurred before the law was approved. Hence, according to the PDL the law cannot be applied because of the non-retroactivity principle (Art 25 of the Constitution). However, the PD does not officially support Violante's proposal. Although the PD continues to be fragmented, the whole party would risk paying a hefty price in terms of electoral support in favour of Grillo's 5SM if it were to accept Berlusconi's request for a Constitutional Court hearing. Hence, we may have to wait until 9 September to know the position of the PD. In the meantime, political tension may increase again.

On 29 August the government reached a compromise to cancel the property tax (IMU) on primary residences for 2013 and completely replace it with a new\ levy from next year. his is an important step for Letta's government, at least in the short term for two reasons: — Importance of IMU in the PDL manifesto: It is now more difficult for Berlusconi to use a motivation about the economy to bring down the government. His economic reform programme was based on the cancellation of the property tax on primary residences. If he wanted to use an excuse, he could have found enough reasons to say that his requests/electoral promises were not fully respected. Instead, he released a very positive official statement welcoming the government decision. — Immediate early elections would jeopardize IMU cancellation: Note that the 29 August decree cancelled only the first tranche of property tax on primary residences due in June. The resources to cancel the second tranche will be finalized in a decree in mid October along with the 2014 budget law. This is potentially an important passage from a political point of view. Were either the government to fall before issuing the decree or the Parliament to be dissolved before it approves the decree, the December IMU tranche on first properties will have to be paid. Hence, from an electoral point of view, it would be difficult for Berlusconi to justify a sudden removal of his support to Letta government, above all after his and PDL's very positive reaction to the government announcement.

Although less fragile, the above considerations do not mean that the Government is safe. The PDL now expects a step forward from the PD on 9 September by at least delaying the decision on Berlusconi and ideally agreeing to ask for a Constitutional Court ruling. The PD faces a trade-off between the government survival and risking alienating part of its electorate. Hence, political volatility is likely to remain. Although Italian sovereign yields remain low relative to the average of the past two years, the cost of political uncertainty and the sharp slowdown in structural reforms is reflected in our view in the compression of the spread of Spain's sovereign yields versus Italy's. Time will be an important factor. In our view, the ex post credibility of Berlusconi's threat to trigger a fall of the government will decrease as time goes by as the ban from public office closes in. Berlusconi would need to trigger the fall of the government in the very short-term if he were to maximise his possibility to stand for election. Furthermore, going for early elections is a high risk strategy. By supporting the government the PDL and its leader will maintain a crucial role in determining Italy's policies. A fall of the government would lead to an improved position only if the PDL were to win the election and obtain the majority premium in the lower house. The PDL would then also gain the majority in the various Lower House commissions. Although the PDL appears to maintain a lead in opinion polls over the summer, there is also the risk the PD could unite behind the young mayor of Florence who, in our opinion, could increase materially the possibility that the centre-left obtains an improved electoral response above all among the centrist voters. Overall, we think that is now marginally more likely than not that the Government survives the next couple of months. The probability that the government then remains in charge for the whole of 2014 would increase materially. That said, the hawks within the PDL could regain centre stage were the current legal issues for the ex-PM to worsen. Furthermore, note that there are other pending trials involving the ex-PM Berlusconi. |

| Gene Arensberg: U.S. bullion banks remain unusually long gold Posted: 08 Sep 2013 02:23 PM PDT 5:20p ET Sunday, September 8, 2013 Dear Friend of GATA and Gold: The Got Gold Report's Gene Arensberg writes tonight that despite gold's 10 percent price increase over the last month, the big bullion banks that typically push the market around remain very unusually long gold in the U.S. futures market. Arensberg writes: "This, in a context of backwardation and negative GOFO, has got to be about the most bullish signal we can look at in this commitment-of-traders data." Arensberg's commentary is posted in the clear at the Got Gold Report here: http://www.gotgoldreport.com/2013/09/gold-and-silver-disaggregated-cot-r... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| China Imports An Impressive 116.4 Tonnes Of Gold In July 2013 Posted: 08 Sep 2013 11:05 AM PDT China just released their latest gold import figures for the month of July. China imported through Hong Kong 116.4 tonnes of physical gold in July of 2013. That figure comes on top of the 517.92 tonnes of gold imports in the first 6 months of this year. In total, between January and July of this year, China imported a staggering 633.94 tonnes of physical gold. The country is indeed on its way to reach 1,000 tonnes of imports over the whole year, as forecasted by the World Gold Council in their Q2 gold demand report. The chart shows how July saw the second largest gold imports in a single month since the start of this bull market (and probably in history). There is a reason why we are spending so much attention on these figures. In addition, Bloomberg noted that “Net imports, after deducting flows from China into Hong Kong, were 113 metric tons, from 101 tons a month earlier, according to calculations by Bloomberg. Mainland buyers purchased 129 tons in July, including scrap, compared with 113 tons in June, data from the Hong Kong government showed today.” The figures and following charts are courtesy of Sharelynx. More articles about China and its love for gold:

|

| Book Review of Gold, the monetary Polaris Posted: 08 Sep 2013 11:02 AM PDT New World Economics |

| JIM ROGERS : 'PREPARE FOR FINANCIAL COLLAPSE' - FIAT MONEY WILL STOP BEING PRINTED Posted: 08 Sep 2013 10:41 AM PDT United States President Barack Obama and officials within the administration are beating the drums of war. How will this affect the markets, specifically commodities like gold and oil? More than a... [[ This is a content summary only. Visit http://FinanceArmageddon.blogspot.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| If Australia's new government would revive mining, confront gold price suppression Posted: 08 Sep 2013 09:58 AM PDT 1:08p ET Sunday, September 8, 2013 Dear Friend of GATA and Gold: Australia has just elected a new government, switching from the Labor Party to the Liberal and National Party coalition, and Reuters today quotes the new government's likely trade minister, Andrew Robb, as saying the new government's objectives will include reviving the country's mining industry: http://www.reuters.com/article/2013/09/08/us-australia-election-idUSBRE9... Of course GATA has an idea of how to do that: End the Western central bank gold price suppression scheme particularly and the commodity price suppression scheme generally. Indeed, seven weeks ago your secretary/treasurer sent to the governor of the Reserve Bank of Australia, Glenn Stevens, an international express mail letter requesting an invitation to make a presentation to the bank about the gold price suppression scheme and the harm it does to Australia and other commodity-producing countries. Included with the letter were copies of some of the voluminous official documentation of the scheme -- http://www.gata.org/taxonomy/term/21 -- lest the RBI think GATA just makes this stuff up. Predictably enough the bank has not replied to the letter even to acknowledge its receipt, perhaps because the bank knows very well how the international currency markets are rigged and would prefer Australians not to know and begin wondering about the bank's complicity and failure to defend their country's interests. But your secretary/treasurer still plans to visit Australia next month to speak at the annual Gold Symposium in Sydney -- -- and the Mines and Money Australia conference in Melbourne -- http://www.minesandmoney.com/australia/?utm_source=Mines_and_Money_Porta... -- and would be delighted to make presentations to representatives of the new government as well as to Australian news organizations. So your secretary/treasurer will be grateful to any of GATA's Australian friends who could convey this to people in their new government or news organizations. I can be reached at CPowell@GATA.org. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| The real state of the world economy is dire Posted: 08 Sep 2013 09:51 AM PDT We are now back to the “green shoots” era of false hope and total misunderstanding of the real state of the world economy. There are minor tidbits of good news that combined with manipulated and seasonally adjusted economic figures are giving politicians worldwide reason for spreading their optimistic gospel of recovery that has nothing to do with reality. A world based on debtHow can a world with $250 trillion of debt and over $1 quadrillion of worthless derivatives ever recover? Of course it can’t, especially since this is a world that is supported by legs of worthless printed paper money – legs that are just getting longer and more unstable by the day as trillions are added to the debt every year. Wherever we turn Europe, USA, Japan and many other nations, the situation is totally beyond repair. But as I have said in recent interviews and articles, it is not just beyond repair but we are likely to be at the end of a major economic cycle that started at the end of the Dark Ages. I wrote about this already back in 2009 in my article “The Dark Years Are Here” . Major economic cycles take a long time to develop and if we are now at the beginning of a major downturn in the world economy, people living today will only experience the very beginning of the downturn. But sadly the beginning will be a major and very unpleasant upheaval that virtually nobody will escape. We have had a century of false prosperity based on printed money and credit. In the last 100 years we have seen the creation of the Fed in the US (a central bank owned, created and controlled by private bankers) combined with fractional reserve banking (allowing banks to leverage 10 to 50 times), exploding government debt and a derivatives market of $1.4+ quadrillion. These are the principal reasons why the world economy has expanded in the last century and particularly in the last 40 years. These four extremely shaky legs, Central bank printing, Bank leverage, Government borrowing and Derivatives manufacturing have created a world of delusional wealth and illusory prosperity. Also, there is a total absence of moral and ethical values. We are in the final stages of an era of extreme decadence, an era that sadly cannot and will not have a happy ending. Europe a hopeless caseBut still, governments and the media are continuing to feed us with good news which bears no resemblance to the real state of the world economy. In Europe the Mediterranean countries are expanding their debt at exponential rates. Government debt to GDP of Spain, Portugal, Italy and Greece is ranging from 100% to 180%. There are futile attempt at austerity but this only leads to lower growth and higher debts. There is sadly no way out for these countries whose population is suffering terribly. The best solution would be to leave the EU and the Euro, renege on the debts and devalue currencies. But the Eurocrats are unlikely to accept this and would rather add more debt and print more money, making the situation even worse. US debt will sink the worldThe situation in the US is no better. There is hardly one economic figure being published that has anything to do with reality. Real unemployment is 23% and not 7% as published. GDP using real inflation figures has been declining for years, and real wages have declined for 40 years. The perceived increase in living standards has only been achieved with a massive increase in debt. US government debt was $1 trillion in 1980, $8 trillion in 2006 when Bernanke became Chairman of the Fed and is now $17 trillion and growing by at least one trillion a year. So Bernanke has managed to create $9 trillion of debt during his brief 7 years as Chairman of the Fed. It took 230 years from 1776 to 2006 for the US to reach $8 trillion and Bernanke has beaten that in 7 years. An astonishing achievement. And this debt excludes unfunded government liabilities of around $220 trillion. Who in their right mind can believe that the US can get out of this hole! Yes the US and the rest of the world will print unlimited amounts of money. But printed money is printed worthless pieces of paper and has nothing to do with wealth creation. The worldwide printing will just add to the already unsustainable debt worldwide and not create one penny of added prosperity. Instead we are likely to see a hyperinflationary depression in many countries. For the privileged few that have financial assets to protect, physical gold stored outside the banking system is likely to be the best way to preserve wealth and purchasing power. Egon von Greyerz Some of the topics in this article and much more were discussed in my King World News interview on August 6. |

| Is Gold Price Manipulation About to Begin Again? Posted: 08 Sep 2013 09:18 AM PDT The answer to the question above unfortunately is maybe. There are definitely warning signs springing up. The first sign of trouble popped up last week when the miners generated a key reversal on huge volume, and on a day when gold was actually positive. Something about that day smells very fishy to me. It looks like big-money traders had advance notice that a false breakout to new highs was going to be manufactured to give insiders an exit after a two-month 40% rally. The high volume follow through the following day confirms that something is not right. |

| Dr. Nu Yu’s Back With Analyses on Gold & Silver, USD, Crude Oil, HUI/XAU, U.S. Bonds Posted: 08 Sep 2013 09:08 AM PDT Don’t undertake any buy or sell decisions regarding, physical gold and silver, the The excerpts below come from Dr. Nu Yu’s (www.marketweeklyupdate.com) Market Weekly Update and are presented by Lorimer Wilson, editor of www.munKNEE.com and www.FinancialArticleSummariesToday.com and the FREE Market Intelligence Report newsletter (sample here – register here). The excerpts may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement. Edited excerpts from Dr. Nu Yu’s newsletter are below: Short-Term Picture: S&P 500 Index in a 4-Month Uptrend Channel The S&P 500 index has formed a 4-month bullish uptrend channel. A pullback or a downwave towards the lower boundary of the channel around 1610 is expected.

Market Ratio and Competitive Strength Each week I talk about a pair of markets…[and this week we look at] the euro vs. the U.S. dollar. Euro vs. U.S. Dollar: The chart below is a weekly chart for the ratio of the euro to the U.S. dollar in last seven years. The ratio has been in a symmetrical triangle pattern for six years. The central line of the triangle is at 1.7. Currently the ratio swings up towards 1.70 to make Euro stronger than the US dollar.

Gold Forming 11-Month Descending Broadening Wedge Pattern The gold index is forming an 11-month Descending Broadening Wedge pattern on the daily chart. Last week price touched the upper boundary of the wedge and began falling again. Gold should become neutral before it breaks above the upper boundary of the wedge.

Long-Term Picture: Silver in a 2.5-Year Falling Wedge Pattern The silver index has formed a 2.5-year falling wedge pattern. Silver will remain bearish with range-bounded swings before a breakout from the wedge.

Gold/Silver Mining Stocks Forming 4-Month Inverted Roof Pattern Gold/silver mining stocks are forming a 4-month inverted roof pattern. They could become bullish once prices break above the horizontal resistance line of the inverted roof.

Crude Oil in 8-Week Trading Range Crude oil has been in consolidation and it has formed a 8-week trading range between 103 and 109. Last week an attempt to break above the upper horizontal resistance of the trading range failed. Prices should be in sideways range before a breakout from the trading range.

US Dollar in 5-Month Broadening Symmetrical Triangle Pattern The U.S. dollar formed a 5-month Broadening Symmetrical Triangle pattern. In August, the 2-month-long downward wave failed to touch the lower boundary of the triangle, and it formed a Partial Decline inside the Broadening Triangle. According to Bulkowski, a partial decline usually appears at the end of a broadening pattern, and there will be an increased chance for an upward breakout.

US Treasury Bond Forming a bump-and-run reversal bottom pattern The 30-year U.S. treasury bond is forming a Bump-and-Run Reversal Bottom Pattern. Now it is in the Bearish bump phase.

Asset Class Performance Ranking with Crude Oil Leading The following table is the percentage change of each asset class (in ETFs) against the 89-day exponential moving average (EMA89). Currently Crude Oil is outperforming, and U.S. treasury bond is underperforming.

[Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://marketweeklyupdate.com/2013/09/02/09022013-market-update/ (©2010-2013 MarketWeeklyUpdate.com. All Rights Reserved) Related Articles: 1. King Dollar…Will It be a Breakdown or a Breakout?

[As can be seen in the chart below] the U.S. Dollar has been trapped inside of a multi-year pennant pattern, which continues to narrow…[strongly suggesting that] the end of the pattern is near [one way or the other]! Read More » 2. The Stock Market Is NOT About to Crash Any Time Soon! Here's Why There's nothing to be bearish about regarding the stock market these days. US stocks are not overpriced or overleveraged, and remain more attractive than at prior peaks so pop a pill and relax. There's no immediate danger threatening stocks as the following market analyses clearly outline. Read More » We have experienced a huge bull market this year but any pundits are calling for the bullish move to end in a sharp downward correction…The bears have a case, historically and cyclically, but I am going to go out on a limb and say things are really different this time. Here are 5 reasons why. Read More » 4. Noonan: Gold & Silver Could Move Sideways for Another 1-2 Years – Here's Why Using past history of how price responds, it is likely that gold, and silver, could move sideways for another year or two. While this flies in the face of so many current, supposedly “expert”, opinions [mine is not based on opinion but, rather, is strictly based on the facts as conveyed by the charts. Take a look and you will see that too!] Read More » 5. How Will the Price of Gold Evolve Into 2014 and Beyond? A Perspective How will the price of gold develop into 2014 and in the following years? [Read on as] we try a look into the future. Words: 2600 Read More » 6. Here's How to Choose Gold & Silver Stocks With the GREATEST Chance of Major Returns Which gold/silver mining companies own quality undeveloped gold and silver deposits in safe stable countries – and are extremely well managed? Such companies offer exceptional value in that they provide the best exposure to a rising precious metals price environment. Below are a number of things to look for when considering an investment in such companies. Read More » 7. U.S. Energy Independence Is A Pipe Dream! I don’t want to kill the dream of U.S. energy independence but the fact is it won’t become a reality overnight. It’s entirely possible, however, that the North American continent [Canada, the U.S. and Mexico] can achieve energy independence within the next decade. [Let me explain.] Read More » 8. Eric Sprott: Gold & Silver Could Double Within a Year & PM Stock Gains Could Be Gargantuan In this exclusive interview, Eric Sprott answers questions about the gold and silver market in which he suggests that gold could double in a year and, in the case of silver, could go up even more than that. As for gold and silver equities, he believes gains could be gargantuan, because the equities always double or triple the performance of physical gold. Here’s his reasoning. Read More » 9. Will Major Decline of S&P 500 Adversely Affect Gold & Silver Stocks? Should gold stock investors and speculators worry about the effect of a deeper decline or cyclical bear market of the S&P 500 on the mining sector? [You'll be surprised at the answer!] Read More » The post Dr. Nu Yu’s Back With Analy |

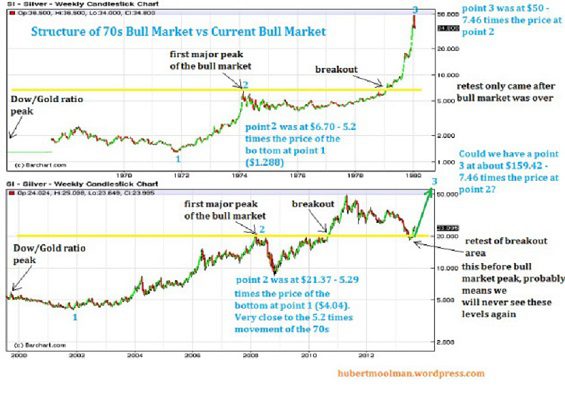

| Massive Debt Levels Will Push Silver To $150 And Beyond Posted: 08 Sep 2013 09:08 AM PDT The process of the devaluation of gold and silver, started by the demonetization of So says Hubert Moolman (hubertmoolman.wordpress.com) in edited excerpts from his original article* entitled Silver Price Forecast: Massive Debt Levels Will Push Silver To $150 And Beyond. [The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]Moolman goes on to say in further edited (and perhaps paraphrased in some places) excerpts: This era of dishonest money has filled the economic world with many promises that will never be fulfilled. There will be a massive flight out of paper promises into the ideal safe haven assets that would offer protection. In my opinion, silver will be the leading asset when this flight out of paper promises happens. This fraud started with the demonetization of silver and it will end with silver taking its place as money – the most marketable commodity. If silver only equals the performance of the 70s, it will reach $150. However, this cycle will only be over when silver and gold are not quoted in the current fiat currencies or any other fiat currency. Instead, most goods would be quoted in terms of silver and gold. Below, is a self-explanatory comparison of the current silver bull market and the 70s bull market: |

| King Dollar…Will It be a Breakdown or a Breakout? Posted: 08 Sep 2013 09:07 AM PDT [As can be seen in the chart below] the U.S. Dollar has been trapped inside of a multi-year pennant pattern, which continues to narrow…[strongly suggesting that] the end of the pattern is near [one way or the other]! So writes Chris Kimble (blog.kimblechartingsolutions.com) in edited excerpts from his original post entitled King Dollar…The End is near!. [The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]Kimble goes on to say in further edited (and perhaps paraphrased in some places) excerpts: [As mentioned in a post back on August 22nd] the U. S. Dollar continues to find a 9-year falling resistance line tough to break above. The small decline in the US$ of late has taken it [almost]down to a 2-year rising support line and driven bullish sentiment down along with it.CLICK ON CHART TO ENLARGE[Such a] pattern doesn’t usually tip its hat on the outcome/direction of the next big move, yet it usually pays to follow the breakout/breakdown. With the U.S. Dollar being trapped so long…the “ending of this pattern” could send important messages per portfolio construction for the upcoming months! [Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://blog.kimblechartingsolutions.com/2013/09/king-dollar-the-end-is-near/ Related Articles: 1. The Next Fed-created Catastrophe – a Currency Crisis – Has Already Begun There is no escaping the inevitable – if you aggressively debase your currency eventually you are going to have a currency crisis. The first one has now begun. Words: 350; Charts: 2 Read More » 2. Continuing U.S. Dollar Strength Depends on Asia's Self-interests Continuing – Here's Why In an odd twist of fate the future of the U.S. dollar is in the hands of Asian governments [and particularly China and Japan. Let's hope they continue to put their own interests first.] Here's why. Read More » 3. Japan's Role in the U.S. Dollar's Rise – and Gold's Fall Lately, the dollar has been making a comeback and, as usual, gold is tanking…[That being said,] however, the timing of the dollar's resurgence is a bit curious. Perhaps not coincidentally, gold began tanking just as the dollar was advancing against the yen. [Why do I say "Perhaps not coincidentally"? Read on.] Read More » 4. The U.S. Dollar – "King Dollar" – Is Kicking Ass! The return of the U.S. dollar – and the secular outperformance of the U.S. dollar vs. the rest of the world – is a HUGE, huge trend. HUGE. Read More » 5. The USD is HOT! What Gives? The US Dollar is HOT so what gives? It rallied in 2012 and has gone nuclear in 2013. According to Morgan Stanley it's because of…. Read More » 6. The Myth of the Rising U. S. Dollar Year-to-date, the dollar index, a trade weighted index comparing the U.S. dollar to a basket of six major currencies (Euro @ 57.6% weight, Japanese yen 13.6%, Pound sterling 11.9%, Canadian dollar 9.1%, Swedish krona 4.2% and Swiss franc 3.6%) is up 2.95% as of April 29, 2013 – but the U.S. Dollar Index is not the U.S. Dollar. To ascertain what may happen to the U.S. dollar, let's look at the greenback from a couple of different angles Read More » The post King Dollar…Will It be a Breakdown or a Breakout? appeared first on munKNEE dot.com. |

| Direction of U.S. Trade Deficit Indicates Direction of U.S. Dollar Posted: 08 Sep 2013 09:06 AM PDT The trade deficit has improved a lot since 2010 and the U.S. dollar strengthened So says Katchum (katchum.blogspot.ca) in edited excerpts from his original article* entitled Correlation: Trade Balance Vs. Currency Strength. [The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]Katchum goes on to say in further edited (and possibly paraphrased in some places) excerpts: As you know, a trade deficit means that imports exceed exports. Americans buy more stuff from foreigners and in exchange they give money to these foreigners. This money needs to be in the currency of the foreigners. Let’s say an American buys a Chinese TV. He will have to pay yuan to the Chinese merchant. To do this, he will convert U.S. dollars to yuan. This will lower the value of the U.S. dollar. The other way round is also true. China has a trade surplus and will sell its goods to America in exchange for U.S. dollars. These U.S. dollars will be converted to yuan, otherwise the Chinese merchant can’t do much with the U.S. dollars in his country. This will increase the value of the yuan. Of course, there is a lag between trade and currency conversion. This lag is approximately 1 year. As a consequence, the trade balance is a leading indicator for the strength of a currency. The higher the U.S. trade deficit, the more probable that the U.S. dollar will go down in value. The following chart gives the monthly U.S. trade deficit (red chart) Vs. the U.S. dollar index (blue chart). If the trade deficit widens (red line goes down), the U.S. dollar index will drop (blue line goes down). Conclusion Knowing that the extent of U.S. trade deficit is a leading indicator for currency weakness, you can predict the collapse of the U.S. dollar by just looking at the trade deficit trend and, as such, you can position yourself for this collapse in the U.S. dollar by buying precious metals and commodities. [Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://katchum.blogspot.ca/2013/09/correlation-trade-deficit-vs-currency.html Related Article: 1. Continuing U.S. Dollar Strength Depends on Asia's Self-interests Continuing – Here's Why In an odd twist of fate the future of the U.S. dollar is in the hands of Asian governments [and particularly China and Japan. Let's hope they continue to put their own interests first.] Here's why. Read More »

The post Direction of U.S. Trade Deficit Indicates Direction of U.S. Dollar appeared first on munKNEE dot.com. |

| The Stock Market Is NOT About to Crash Any Time Soon! Here’s Why Posted: 08 Sep 2013 09:05 AM PDT There's nothing to be bearish about regarding the stock market these days. US stocks are not overpriced or overleveraged, and remain more attractive than at prior peaks so pop a pill and relax. There's no immediate danger threatening stocks as the following market analyses clearly outline. 1. What Affect, If Any, Will Rising Interest Rates Have On the Stock Market The belief is that rising interest rates (as is currently occurring) are a sign that the economy is improving as activity is pushing borrowing rates higher. In turn, as investors, this bodes well for corporate profitability which supports the current valuations of stocks in the market. While this seems completely logical the question is whether, or not, this is really the case? Read More » 2. Stock Market to Continue Onwards & UPwards – Here's Why Too often investors focus on the negative, lose confidence in stocks and, as a result, they can miss great bull markets. I believe when it comes to finding investment opportunities it's all about both monetary and fiscal policy. As such, I encouraged investors to follow the money. With that in mind, here are two of my favorite charts that I believe demonstrate how investors can do exactly that. Read More » 3. Stock Market (Dow) Should Reach 20,000 By 2018 – Here's Why With the stock market up over 20% since we forecast in July, 2012 that we would see the Dow at 20,000…[by the end of the] decade, our forecast seems less ambitious than back then. US stocks are not overpriced or overleveraged, and remain more attractive than at prior peaks. As such, based on current conditions, we now project that…the Dow will reach 20,000 by late 2018. Read More » 4. Don't Worry About the Threat of Higher Interest Rates Hurting Stocks – Here's Why History clearly shows that stocks don't fall during periods of rising interest rates. Sure, they might fall a little when a rate hike is announced – maybe for a week or so – but they usually bounce back quickly – and then they go higher. Read More » 5. We Think the Prognosis for Stocks Looks Good – Here's Why Stocks have generally performed very well in rising-rate environments but the current rate cycle is unlike any other of the past 40 years, keeping investors on edge. A lot will depend on how inflation behaves. Read More » 6. Current Stock Market High Is NOT a Bearish Signal – Here's Why The Dow has begun a major rally 13 times over the past 112 years which equates to an average of one rally every 8.6 years so, as it stands right now, the current Dow rally that began in March 2009 would be classified as well below average in both duration and magnitude. Read More » 7. Correlation of Margin Debt to GDP Suggests Stock Market Has More Room to Run Are stocks in a bubble? While leverage has returned to the stock market driving up stock prices and aggregate demand in the process, margin debt is still shy of its all-time high as a percentage of GDP, so there is certainly some headroom for further rises. A look at the following 5 charts illustrate that contention quite clearly. Read More » 8. The Stock Market: There's NOTHING to Be Bearish About – Take a Look There's nothing to be bearish about regarding the stock market these days. I've reviewed my 9 point "Bear Market Checklist" of indicators and it is a perfect 0-for-9. Not even one indicator on the list is even close to flashing a warning sign so pop a pill and relax. There's no immediate danger threatening stocks. Read More » 9. Pop a Pill & Relax ! There's NO Immediate Danger Threatening Stocks Right now there's nothing to be bearish about. I say that with conviction, because my "Bear Market Checklist" is a perfect 0-for-9. Heck, not a single indicator on the list is even close to flashing a warning sign. We've got nothing but big whiffers! Take a look. Pop a pill and relax. There's no immediate danger threatening stocks. Read More » 10. Latest Action Suggests Stock Market Beginning a New Long-term Bull Market – Here's Why There are several fundamental reasons to believe that this week's stock market activity, where the S&P 500 has moved more than 4% above the 13-year trading range defined by the 2000 and 2007 highs, could mark the beginning of a long-term bull market and the end of the range-bound trading that has lasted for 13 years. Read More » 11. Sorry Bears – The Facts Show That the U.S. Recovery Is Legit – Here's Why Today, I'm dishing on the unbelievable rebound in residential real estate, pesky rumors about the dollar's demise and a resurgent U.S. stock market. So let's get to it. Read More » 12. Stocks Are NOT In Another Bubble – Here's Why U.S. stocks are off to one of their best starts in years. Most indices are up 10% year to date, prompting many investors to ask: "Are we in another bubble?" The answer is no, at least when it comes to equities. Here are three reasons why: 13. Research Says Stock Market Bull Should Continue Its Run Until… The mainstream financial press would like us to believe that because the S&P 500 and Dow 30 are at or near their record highs that it must mean we're nearing the end of the current bull market and, as such, now must be a terrible time to buy stocks. Let's not jump to any conclusions, though. Instead, let's do our own due diligence to find out. Hint: If you've been stuffing cash under the mattress since the last market crash, you might want to finally go deposit it in your brokerage account. Here's why… Words: 420 14. These 4 Indicators Say "No Stock Market Correction Coming – Yet" While I remain cautious on stocks and the risk trade, the technical picture shows that the uptrend to be intact and the bulls should still be given the benefit of the doubt for now. At this point, any call for a correction is at best conjecture [as evidenced by the following 4 indicators]. Words: 399; Charts: 4 The Swimsuit Issue Indicator says that U.S. equity markets perform better in years when an American appears on the cover of Sports Illustrated's annual issue as opposed to years when a non-American appears on the cover. [What is the nationality of this year's cover model? Can we expect returns above the norm or will we see a year of underperformance for the S&P 500 this year? Read on.] Words: 323 ; Table: 1 16. Bull Market in Stocks Isn't About to End Anytime Soon! Here's Why As we all know, money printing always leads to inflation. It's just a matter of figuring out which assets get inflated. This time around gold is not the only beneficiary, stocks are, too, and I'm convinced that the chart below holds the key to the end of the bull market. Words: 475; Charts: 1 17. QE Could Drive S&P 500 UP 25% in 2013 & UP Another 28% in 2014 – Here's Why Ever since the Dow broke the 14,000 mark and the S&P broke the 1,500 mark, even in the face of a shrinking GDP print, a lot of investors and commentators have been anxious. Some are proclaiming a rocket ride to the moon as bond money now rotates into stocks….[while] others are ringing the warning bell that this may be the beginning of the end, and a correction is likely coming. I find it a bit surprising, however, that no one is talking of the single largest driver for stocks in the past 4 years – massive monetary base expansion by the Fed. (This article does just that and concludes that the S&P 500 could well see a year end number of 1872 (+25%) and, realistically, another 28% increase in 2014 to 2387 which would represent a 60% increase from today's level.) Words: 600; Charts: 3 18. 5 Reasons To Be Positive On Equities For the month of January, U.S. stocks experienced the best month in more than two decades [and the Dow hit 14,009 on Feb. 1st for the first time since 2007]. Per the Stock Traders' Almanac market indicator, the "January Barometer," the performance of the S&P 500 Index in the first month of the year dictates where stock prices will head for the year. Let's hope so…. [This article identifies f more solid reasons why equities should do well in 2013.] Words: 453 19. Start Investing In Equities – Your Future Self May Thank You. Here's Why

|

| Gold strikes end in South Africa Posted: 08 Sep 2013 08:18 AM PDT From Agence France-Presse http://news.yahoo.com/gold-strikes-end-south-africa-132548807.html A South African gold miners' strike has ended after workers at Harmony Gold accepted a final wage offer, the country's third-largest producer of the precious metal said on Sunday. Tens of thousands of South African gold miners went on strike over pay on Tuesday night, but most had already returned to work after agreeing wage deals of between 7.5 and 8.0 percent. Workers at Harmony's mines in the central Free State and Northern Cape provinces had initially held out for a better deal, but the company said they had now accepted. ... Dispatch continues below ... ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. "Members of the National Union of Mineworkers have accepted the same offer made by other producers in the industry and have returned to work," Harmony Gold said in a statement. Gold remains a key industry in Africa's largest economy, employing around 140,000 people and accounting for 10 percent of export earnings and three percent of Gross Domestic Product. But falling gold prices, a declining grade of ore, and increased costs such as electricity and wages have drained revenues. Harmony chief executive Graham Briggs said the present wage agreement was "in the interests of long-term industrial relations stability," yet he warned such hikes could not be repeated. "Continued industrial action will make this increase unaffordable, and place the future viability of some of our operations under threat. This, in turn, could have an impact on jobs," he said. Negotiators resolved the wage dispute in a fairly short time after the strikes started, averting a repeat of the protracted and violent stoppages that shook the country a year ago. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Jim Willie - Nations Need to Depart from Dollar or Enter Third World Posted: 08 Sep 2013 07:09 AM PDT According to Dr. Jim Willie, the rest of the world is tired of the money printing by the Fed and wants to use a new currency to escape the coming global inflation of a dollar that can quickly lose... [[ This is a content summary only. Visit http://FinanceArmageddon.blogspot.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| JIM ROGERS - TOTAL FINANCIAL COLLAPSE Will Be Here If They STOP PRINTING FIAT CURRENCY Posted: 08 Sep 2013 06:35 AM PDT JIM ROGERS - TOTAL FINANCIAL COLLAPSE Will Be Here If They STOP PRINTING FIAT CURRENCY United States President Barack Obama and officials within the administration are beating the drums of war.... [[ This is a content summary only. Visit http://FinanceArmageddon.blogspot.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |