Gold World News Flash |

- Silver Slices Through $24 in Overnight Trading

- Criminal Gold Dealer Gets 5 Years for Fraud

- American Women Rampages Over Syria Propaganda, No wait… Sorry… Over McNuggets

- Give Our Gold Back campaign launched in Poland

- Gold Opens On the US Globex Trade With a Sharp Zig Zag Headfake

- Gold Opens On the US Globex Trade With a Sharp Zig Zag Headfake

- Asian bonds tumble below par in capital flight

- Aye, Me Hearties–Why There’s Still Old-Fashioned Treasure Out There

- Doug Pollitt: Of bullion, backwardation, and Buffett

- GATA secretary to speak at two Australian conferences in October

- Gold & Silver Surging After Globex Open Waterfall

- New York Sun: The class-backed dollar

- India’s Holy Mary: Converting Sacred Temple Gold Into Dollars

- In The News Today

- Gold market manipulation pleases financial letter writer Faber

- Gold advocate Sinclair's next market seminar this week in Tarrytown, N.Y.

- SEC Whistleblower Blows the Whistle on Revolving Door Fraud (Khuzami: You're Outed)

- Fat Fingers: Everbright

- Crude "Flash-Crash" As Stocks Open Higher

- Will Congress Endorse Obama's War Plans? Does it Matter?

- Gold – What To Expect in September?

- India's Holy Mary: Converting Sacred Temple Gold Into Dollars

- George Osborne on stealing from Savers, create Asset Bubbles (01Sept13)

- Market Forces Will Destroy Central Banks – Marc Faber

- Fukushima Nuclear Disaster Radioactive Groundwater Crisis Worsens - Fully Unsolvable

- Who Benefits From A War Between The United States And Syria?

- Guest Post: Who Benefits From A War Between The United States And Syria?

- SUNDAY SPECIAL REPORT

- Crash Alert! IMF to Get Big Boost

- Crash Alert! IMF to Get Big Boost

- Emerging Markets in Trouble from Oil

- Emerging Markets in Trouble from Oil

- Gold To Test Recent Support—And A Chance To Learn With Two Resource Billionaires

- Gold And Silver Market Says 1 -2 Years Sideways, Not Up

- India pushes 'shock and awe' currency plan to save BRICs

- Gold Price Trend - Time for a Brief Pause

- Investing in a Stock Market to Hate, The Silver Lining

- Gold And Silver Prices – Market Says 1 to 2 Years Sideways, Not Up

| Silver Slices Through $24 in Overnight Trading Posted: 01 Sep 2013 11:05 PM PDT

Globex overnight trading: Ag rocks. Sorry Blythe. SILVER: The Achilles’ Heel | ||||

| Criminal Gold Dealer Gets 5 Years for Fraud Posted: 01 Sep 2013 11:00 PM PDT Goldsilver | ||||

| American Women Rampages Over Syria Propaganda, No wait… Sorry… Over McNuggets Posted: 01 Sep 2013 10:49 PM PDT [Ed Note: Um, this one's too easy. Good luck during the coming collapse America.] from nazzchannel: Toledo woman, Melodi Dushane, loves McNuggets. According to a Toledo police report, she loves them so much that when she found out a local McDonald’s was not serving them at 6:30 AM that’s breakfast menu time, sister, she became outraged and punched the drive-thru attendant. | ||||

| Give Our Gold Back campaign launched in Poland Posted: 01 Sep 2013 10:30 PM PDT GATA | ||||

| Gold Opens On the US Globex Trade With a Sharp Zig Zag Headfake Posted: 01 Sep 2013 09:54 PM PDT | ||||

| Gold Opens On the US Globex Trade With a Sharp Zig Zag Headfake Posted: 01 Sep 2013 09:54 PM PDT | ||||

| Asian bonds tumble below par in capital flight Posted: 01 Sep 2013 09:49 PM PDT By David Yong http://www.bloomberg.com/news/2013-09-02/asian-bonds-tumble-below-par-in... SINGAPORE -- Asia dollar-denominated bonds have dropped below par for the first time since 2011 as investors pull money out of the region amid concerns that growth is slowing and as currencies from the rupee to rupiah plunge. Average prices of company debentures in the region fell to 98.61 cents on the dollar on Aug. 22, the least since October 2011, Bank of America Merrill Lynch indexes show. Dollar bonds globally have held above 100 cents since September 2009. Both investment- and non-investment-grade debt in Asia were below par on Aug. 22. The last time that happened was in September 2008, when Lehman Brothers Holdings Inc. collapsed. Investor sentiment toward Asia is shifting as economic growth in China slows and currencies in India and Indonesia -- the two countries with the biggest external funding needs in the region -- plunge. About $44 billion has been pulled from emerging-market stock and bond funds globally since the end of May, data provider EPFR Global said on Aug. 23. ... Dispatch continues below ... ADVERTISEMENT Is your gold safe, secure, and guaranteed? Canada is one of the safest places to store bullion because of its prosperity and economic and political stability. By vaulting your bullion with Sprott Money's Canadian storage program, you guarantee that your metals are stored securely and privately with little risk. -- We store with Brink's, a private and non-bank storage facility renowned for its integrity, security, and efficiency. -- Your precious metals will be safe under the protection of Brink's world-class technology and infrastructure. -- Your precious metals will be fully insured by Brink's and Sprott Money. In the unlikely event of loss, theft, or physical damage to your metal, you will be fully compensated. Sprott Money is a recognized and trusted name in the precious metals industry. For more information, please visit: http://www.sprottmoney.com/store-with-us "You risk being swept away by fund outflows even if you buy bonds from the best companies in Asia," said Ben Bennett, a global credit strategist in London at Legal & General Investment Management, which manages $670 billion. "You'd need to be very brave to add credit risk before currencies show signs of stabilization." India's rupee fell the most in 20 years last week as the government said the nation's economy expanded at the weakest pace since 2009 last quarter, or 4.4 percent from a year earlier. August was the worst month for Indonesia's rupiah since the global financial crisis. Slowing economic growth is raising concern that Asian companies will have a harder time servicing higher levels of leverage after they boosted U.S. currency bond sales by 94 percent in 2012 to a record $124.7 billion. Morgan Stanley predicted on Aug. 22 corporate defaults in Asia excluding Japan will climb to 1.8 percent over the next 12 months from 0.8 percent in December, as three years of binge borrowing saddles the region with the most indebted balance sheets in the world. Globally, about $20.5 billion has been withdrawn from emerging-market bond funds since May 22, Cambridge, Massachusetts-based EPFR said. That was after Federal Reserve Chairman Ben S. Bernanke told Congress the central bank could cut back on the $85 billion it is injecting into the financial system every month through its purchases of Treasuries and mortgage bonds if U.S. economic growth showed signs of being sustained. Emerging-market debt has since lost 6.4 percent, according to Bloomberg's USD Emerging Market Corporate Bond Index. Elsewhere in credit markets, the extra yield investors demand to hold investment-grade corporate bonds globally rather than government debentures widened for the second week. Global bond sales increased for the first time in three weeks, capping the slowest month for issuance this year. Loan prices declined for a sixth week to complete the third monthly drop since April. Relative yields on investment-grade bonds from the U.S. to Europe and Asia expanded 1 basis point to 148 basis points, or 1.48 percentage points, according to the Bank of America Merrill Lynch Global Corporate Index. Spreads narrowed 2 basis points for the month as yields rose to 3.09 percent from 2.99 percent on July 31. The cost of protecting corporate bonds from default in the U.S. jumped. The Markit CDX North American Investment Grade Index, a credit-default swaps benchmark that investors use to hedge against losses or to speculate on creditworthiness, increased 5.5 basis points last week to a mid-price of 84.1 basis points, according to prices compiled by Bloomberg. The measure rose 9.4 basis points in August, the biggest monthly increase since May 2012. In London, the Markit iTraxx Europe Index of 125 companies with investment-grade ratings added 6.2 last week to 107.2, extending August's increase to 7.3 basis points. In the Asia-Pacific region, the Markit iTraxx Asia index of 40 investment-grade borrowers outside Japan dropped 2 to 162 as of 8:59 a.m. in Singapore, Australia & New Zealand Banking Group Ltd. prices show. The indexes typically rise as investor confidence deteriorates and fall as it improves. Credit swaps pay the buyer face value if a borrower fails to meet its obligations, less the value of the defaulted debt. A basis point equals $1,000 annually on a swap protecting $10 million of debt. The Bloomberg Global Investment Grade Corporate Bond Index (BCOR) declined 0.8 percent in August, bringing losses for the year to 3.3 percent. Bonds of Fairfield, Connecticut-based General Electric Co. (GE) were the most actively traded dollar-denominated corporate securities by dealers last week, accounting for 3.3 percent of the volume of dealer trades of $1 million or more, according to Trace, the bond-price reporting system of the Financial Industry Regulatory Authority. Orange SA (ORA), France's largest phone company, and luxury carmaker Bayerische Motoren Werke AG led $38.9 billion of corporate bond sales worldwide last week, a 13 percent increase from $34.5 billion in the period ended Aug. 23, Bloomberg data show. Paris-based Orange, previously known as France Telecom, raised 1.5 billion euros in a two-part sale, including 850 million euros of 1.875 percent, five-year notes to yield 60 basis points more than the mid-swap rate. BMW's 1.25 billion-euro offering included 750 million euros of 2 percent, seven-year bonds to yield 35 basis points more than swaps. The S&P/LSTA U.S. Leveraged Loan 100 index fell 0.02 cent to 97.65 cents on the dollar last week, extending August's slump to 0.6 cent. The measure, which tracks the 100 largest dollar-denominated first-lien leveraged loans, reached a seven-week low of 97.62 cents on Aug. 28. It has returned 2.97 percent this year. In emerging markets, relative yields widened 11.6 basis points last week to 375.1 basis points, according to JPMorgan Chase & Co.'s EMBI Global index. The measure, which has expanded from this year's low of 245.4 on Jan. 3, jumped 32.1 basis points in August. Bond prices in Asia peaked this year on Jan. 15 at 108.39 cents on the dollar, a 14 percent rise from the trough in October 2011. The rally owed its momentum to Operation Twist in late September, a Fed program to lower long-term borrowing costs. As markets unraveled, bond prices slid below par on Aug. 22, the average yield rose to a 13-month high of 5.205 percent, and spread widened to 358 basis points from January's low of 273, according to Bank of America Corp. U.S. corporate debt averaged 105.49 on Aug. 30 and yielded 3.46 percent. Asia's role as the world's growth engine is diminishing as economies from China to Malaysia and Indonesia cooled while Thailand fell into a recession. The International Monetary Fund in July cut its forecast for 2013 growth in developing Asia by 0.3 percentage point to 6.9 percent. At the same time, the Federal Open Market Committee may trim monthly bond purchases, which has benefited risky assets globally as investors search for high yields, by $10 billion at its meeting this month, and end the buying by mid-2014, based on the median estimate in a Bloomberg survey of 48 economists conducted Aug. 9-13. The FOMC next meets on Sept. 17-18. "There's no question that if we see a September tapering, there'll be a market response and there's going to be a lot of short-term volatility on the back of that across all markets," Amanda Stitt, a London-based investment director at Legg Mason Global Asset Management, said in an interview in Singapore on Aug. 16. "Everything is taking direction from U.S. tapering talk. It's hard to pick the bottom." Bonds sold by Baidu Inc. (BIDU), the operator of China's most popular search engine, are among the casualties. Its $750 million of 3.5 percent notes due November 2022 have declined 7 percent this year to 90.86 cents on Aug. 30. Losses accelerated in May as the price fell below par, dipping to as low as 87.61 cents in June. The company is rated A3, or four levels above junk, by Moody's Investors Service. PT Perusahaan Listrik Negara's debt is trading below 70 cents on the dollar. The Jakarta-based state-owned power utility's $1 billion of 5.25 percent notes due October 2042 have slumped 30 percent this year as the price slumped to 68.22 on Aug. 28. The notes are rated Baa3, the lowest level of investment grade at Moody's. Asia's troubles come at a time when investors are finding comfort in developed markets, as the euro-area economy emerges from the longest recession on record and growth in the world's biggest economy last quarter surpassed economists' expectations. "We've been more cautious about emerging-market risk for a few months now and have been looking more toward improvements in developed-market economies for opportunities," Legal & General's Bennett said. "This is particularly the case in Europe, with consumer-facing companies and even some of the banks in a position to benefit from economic tailwinds." Borrowers in Asia outside Japan have raised $94.5 billion from dollar bond sales since Dec. 31, with 91 percent of that amount issued in the first five months of the year, according to Bloomberg-compiled data. As sentiment soured, 155 of the 186 securities were trading below their issue price as of Aug. 29. "Risk appetite for Asian bonds is anemic at the moment," said Keith Chan, a Hong Kong-based credit analyst at HSBC Holdings Plc. "Investors will most likely stay cautious until we see some stability in the primary market and new deals begin to perform in secondary trading." Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Aye, Me Hearties–Why There’s Still Old-Fashioned Treasure Out There Posted: 01 Sep 2013 09:30 PM PDT by Louis James, SilverBearCafe.com:

Don’t we all dream of digging a hole because we just know there’s something there, and hearing that telltale clunk of our spade striking the lid of a treasure chest filled with gold doubloons? Fact is, the precious metals mining sector—although by many derided, as Doug Casey says, as a “choo-choo” industry—is one of the last bastions where wannabe daredevils can still dream big. | ||||

| Doug Pollitt: Of bullion, backwardation, and Buffett Posted: 01 Sep 2013 09:22 PM PDT 12:30a ET Monday, September 2, 2013 Dear Friend of GATA and Gold: Taking over the market letter of Pollitt & Co. in Toronto from his much-missed father, Murray Pollitt, who died last year (http://www.gata.org/node/10981), Douglas Pollitt has written what may be the most incisive analysis yet of the lengthening phenomenon of backwardation in gold. Much gold recently has been dishoarded from exchange-traded funds and mining companies have resumed hedging, Pollitt observes, but gold lease rates keep rising, implying scarcity. "One of the main push-backs we get when peddling gold," Pollitt writes, "is that there is so much of it. Many bulls feel this way too; for them gold is going up not because it is not plentiful but rather because paper money is more plentiful. Market behavior corroborates this: Producer margins in the gold sector pale in comparison to producers of base metals and petroleum -- why provide a profit incentive to produce more when we already have vaults full of the stuff? ... Dispatch continues below ... ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... "But vaults can and do empty. Let's go back to [Warren] Buffett: In early February 1998 Berkshire Hathaway came out of the woodwork and announced that it was they who had been buying silver; the company had taken delivery of 87 million ounces and it was standing for delivery of an additional 43 million ounces. The market reacted violently, especially the front-month contract. Those short immediately appreciated that this was not just another bluff -- they'd have to find the metal! All hell broke loose. "It turns out Buffett likely never did take delivery of the entire 130 million ounces. The 1997 Berkshire annual report showed holdings of only 110 million ounces. It is fair to speculate he settled for the rest in cash. The cupboard was, apparently, bare. "Gold is certainly a deeper market than silver but the notion of there being infinite supplies is a mirage just the same." As his dad so often did, Pollitt has kindly allowed GATA to post his commentary in PDF format, complete with charts. It's headlined "Of Bullion, Backwardation, and Buffett" and it can be found here: http://www.gata.org/files/PollittMarketLetter-08-26-2013.pdf CHRIS POWELL, Secretary/Treasurer Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata

This posting includes an audio/video/photo media file: Download Now | ||||

| GATA secretary to speak at two Australian conferences in October Posted: 01 Sep 2013 08:48 PM PDT 11:51p ET Sunday, September 1, 2013 Dear Friend of GATA and Gold: GATA's first expedition to Australia will include not only your secretary/treasurer's presentation to the annual Gold Symposium in Sydney on Wednesday and Thursday, October 16 and 17 -- -- but also a presentation to the Mines and Money Australia conference two weeks later, from Tuesday, October 29, to Friday, November 1, in Melbourne: http://www.minesandmoney.com/australia/ Also speaking at the Gold Symposium in Sydney will be John Butler of Amphora Capital in London, who has raised suspicion about gold market manipulation -- http://www.gata.org/node/12610 -- Rick Rule of Sprott Asset Management, and Louis Boulanger, a financial adviser in New Zealand and a prominent gold advocate there. Rule also will be speaking at the Mines and Money Australia conference, along with many fund managers. Your secretary/treasurer is much looking forward to spreading the word in a great and gold-producing country that inconvenient geography has caused us to neglect. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... | ||||

| Gold & Silver Surging After Globex Open Waterfall Posted: 01 Sep 2013 08:23 PM PDT from Silver Doctors:

Silver plunged over $.50 on the open to test $23, and subsequently surging nearly $1, currently closing in on $24. | ||||

| New York Sun: The class-backed dollar Posted: 01 Sep 2013 08:22 PM PDT 11:24p ET Sunday, September 1, 2013 Dear Friend of GATA and Gold: Noting a New York Times report that supporting the middle class is being advocated as a policy objective for the Federal Reserve and its new chairman, the New York Sun today makes an editorial observation that is wonderfully ironic in the Keynesian climate of Washington. That is, the middle class in the United States did better not when really smart people were in charge of money creation on a day-to-day basis but when the dollar was defined quite primitively by gold. The Sun's editorial is headlined "The Class-Backed Dollar" and it's posted here: http://www.nysun.com/editorials/the-class-backed-dollar/88395/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| India’s Holy Mary: Converting Sacred Temple Gold Into Dollars Posted: 01 Sep 2013 08:20 PM PDT from Zero Hedge:

| ||||

| Posted: 01 Sep 2013 08:13 PM PDT Jim Sinclair’s Commentary An interesting article on what Fed governors are invested in. Stock picks from Fed officials By Annalyn Censky @CNNMoney February 2, 2012: 10:00 AM ET NEW YORK (CNNMoney) — One Fed official owns thousands of acres of farmland and at least $1 million in gold. Many own individual blue chip stocks, while... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||

| Gold market manipulation pleases financial letter writer Faber Posted: 01 Sep 2013 08:12 PM PDT 11:12p ET Sunday, September 1, 2013 Dear Friend of GATA and Gold: Interviewed by Lars Schall for Matterhorn Asset Management's GoldSwitzerland Internet site, financial letter writer Marc Faber joins those who do not believe that time is money and who are indifferent to the cheating of investors generally. Faber, who writes the Gloom Boom Doom Report -- http://new.gloomboomdoom.com/portalgbd/homegbd.cfm -- remarks: "There are lots of theories about manipulation in the gold market. I always say this doesn't concern me, and I hope that the central banks manipulate the price down because if that is the case, don't forget that every manipulation eventually leads to a move in the opposite direction that is very violent. So in other words, if someone manipulates the price down, in my view eventually the price will shoot up very dramatically. It's like if you have wage control -- eventually the wage control falls apart and wages go through the roof. Similarly if you have in the commodities market price supports for coffee or oil or whatnot, eventually the price falls through the price support and so forth and so on. Market force is always more powerful, so I hope the gold price was manipulated down because then it will go through the roof eventually." Those of Faber's subscribers whose active lifespans are encompassed by "eventually" may be glad of his insight here. Faber subscribers and others who have been investing in the monetary metals for some time in the hope of free-market pricing and whose active lifespans don't leave much more room for "eventually" may think: Thanks for nothing. Schall's interview with Faber is posted at GoldSwitzerland here: http://goldswitzerland.com/market-forces-will-destroy-central-banks-marc... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair plans Westchester County seminar Sept. 4 Mining entrepreneur and gold advocate Jim Sinclair plans a gold investing seminar from 1 to 5 p.m. on Wednesday, Sept. 4, in Tarrytown in Westchester County, New York. For information on attending, please visit his Internet site, JSMineSet.com, here: http://www.jsmineset.com/qa-session-tickets/ Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Gold advocate Sinclair's next market seminar this week in Tarrytown, N.Y. Posted: 01 Sep 2013 07:54 PM PDT 10:50p ET Sunday, September 1, 2013 Dear Friend of GATA and Gold: Here's a reminder that the next financial market seminar planned by gold advocate and mining entrepreneur Jim Sinclair will be held from 1 to 5 p.m. this Wednesday, September 4, in Tarrytown in Westchester County, New York. Details are posted at Sinclair's Internet site, JSMineSet, here: http://www.jsmineset.com/qa-session-tickets/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. Join GATA here: Gold Investment Symposium 2013 New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| SEC Whistleblower Blows the Whistle on Revolving Door Fraud (Khuzami: You're Outed) Posted: 01 Sep 2013 06:18 PM PDT We're not going to waste pixels on an elongated introduction for this one. If you want to find out just how dysfunctional our regulatory structure was before the crisis (and still is), here's a Prime Example. Jump headfirst in at 1:02 for our conversation with SEC Whistleblower, Gary Aguirre: We begin with the deferential/preferential treatment for the elite (one John Mack) 3:37: Why insider trading prosecution is B[L?]S 4:42 "The crackdown has gone beyond the needs of law enforcement." 5:05: Why no Corzine or Dimon? Seriously. 7:50 Khuzami! Stay tuned, because we spend a lot of time on this guy. 9:15 Revolving door is systemic (not cyclical) at the SEC. Yes, this includes the general counsel's office (whoops). It's all about the Rolodex (and Rolex?). 9:48 How Khuzami went from 200k to 5MM. Nice work, if you can find it. "At some point you start thinking about that five million dollar a year job and how cushy it's going to be...I think it happens while people are at the SEC. They start planning where they're going to land when they get on the outside. They take all they're connections with them. They go into private practice, and they're set up to call back to the SEC to their former subordinates to get favors." 10:41 Esquire Aguirre's representation of the latest SEC whistlebloer, Darcy Flynn. And yes, we're still talking about Khuzami. 11:43: Dick Walker (seriously), and why the case sat on his desk. 13:10 How Khuzami supervised the creation of a John Paulson's "designed to fail" credit default swap. 14:05 "You would think that Mr. Khuzami would be disqualified from serving as the enforcement director at the SEC. But that was not the case..." 14:45: "You'd have to be investigating your former bosses. Maybe even yourself. That's not going to happen" We couldn't agree more. Hats off to you, Mr. Aguirre. Best, Bob (Twitter: EnglishPI) | ||||

| Posted: 01 Sep 2013 04:02 PM PDT Fingers have two things which are common to them all over the world, wherever we come from. They are all different, which at least is one thing in common. Then they are prone to being fat and clumsy whether that be from New York to Hong Kong; especially in the financial world. There was one such individually gorged finger that pushed the wrong button in Hong Kong on August 16th 2013 and the Chinese Securities Regulatory Commission has just issued a fine worth $85 million (523 million Renminbi) to a brokerage firm that resulted in a short burst of trading, which meant there was a 6%-rise in the Shanghai Composite. It ended the day down by 0.6%, however. Everbright Securities, thefat-fingering brokerage firm committed "a number of legal and regulatory violations" according to the China Securities Regulatory Commission, as reported by the state-run news agency, Xinhua. Beyond the fine, the brokerage firm will be banned from all proprietary trading (betting its own money) for a three-month period and there are also four members of staff that have been banned from trading for life. If the USA doesn't watch out, the People's Republic of China will soon be abiding by the law more than it has ever intended to let people believe. The Shanghai Composite suddenly jumped by 5.96% at 11.05 am for a very brief two-minute period. Denial is always the very best line of attack when something hits the fan usually and is what normally happens at any rate. It's an old technique that politicians are well acquainted with and that spin doctoring has taught them for many moons now. Both banks and energy companies saw their shares skyrocket to the limit that is imposed on daily trading that currently stands at 10%. 16 companies out of the 20 largest in the country surged on that morning of August 16th. There was no apparent reason. Everbright saw its shares get suspended on the very same day as it was discovered that they were at the origin of the problem. They had, according to statements issued, internal technical problems. The Chinese press alluded to the fact that a whopping Chinese fat-finger had input the wrong number, or committed anoolong in Chinese. Sounds like a cup of chai to me, usually to be stored in a cool dark place. I wonder if that's where the four traders are right now. Probably in hot water or something along those lines. Everbright was suspended from trading on the very same day. The 5.96%-increase had been caused by the traders that had made buy and sell orders that were incorrect and to the value of $3.8 billion. Although, it certainly begs the question as to how on earth four people can have fat fingers at the same time. It must really be in the water, I guess. The downside was that Everbright Securities had successfully executed trades that were worth 7.3 billion Renminbi. The market did an about-turn however and dropped immediately after the two-minute period causing a loss to the tune of 194 million Renminbi. They had originally intended to place an order for 24 stocks, with an automatic repeat on the purchase. The error in the computer system resulted in buying all stock that had 24 different exchange traded funds. Everbright therefore purchased to the value of 68.6 billion Renminbi. 7.3 billion Renminbi went through before it was discovered and they were suspended from trading. There has never been such a high level of fine that has been slapped on a company in the past in China for fat-finger trading. The company was given a fine of 523 million Renminbi; they only had a net profit of 810 million Renminbi for this first half year. Fat fingers can do a lot of damage, but it seems that things are really going topsy-turvy these days in the world. The US spies on us all. The National Security Agency respects no civil rights that should maintain our privacy and the Chinese are now being tough on people that are playing with the financial markets. What is happening to this world; where the West was synonymous with good and kind and the East was bad and Communist? Well, they are still Communist but the West has gone into state surveillance and fascist overtones of controlling its people. Everbright Securities dropped by 8.5% as a result. Trading volumes increased on August 16th by 53% and that was the highest surges since 2009. But, it is true to say that because the Chinese equity market is fueled by retail investors it is open to panics that are driven by rumor alone. Perhaps the fine given to Everbright is an attempt to show that the market is controlled by the state and that it can be relied upon.

Computer glitches, which was the original reason that Everbright had provided as to why the spike had occurred, are always a good source of an excuse. It wasn't me, it was only my PC. But, Everbright apparently exploited the situation by bagging on the fact that when discovered the Shanghai Composite would fall. They subsequently off-loaded shares and made a profit, until banned from trading. Nothing was known for an hour allowing Everbright to trade on the knowledge (that only they had) as to the cause of the spike in the Shanghai Composite. Panic all around, but an apparent trading calm at Everbright for a cool hour of trading. Traders ended up taking advantage of the fact that they knew what was happening before reporting it. The Shanghai Composite closed for a lunch break at 11.30 am and when it resumed business at 1pm they shorted 6, 240 stock index future contracts. ThePresidentof Everbright Xu Haoming has resigned as a consequence. The company has also been banned from getting any new business activities approved by the Chinese administration for the moment. This will mean that it will not be able to expand outside brokerage. A statement issued by the company said: "brings negative impact to the company's brand reputation and market image". But, it seems that people will do anything these days. Do they really think that they won't get caught? We had better as the NSA and President Obama right now for their own views on this particular question. People who work on financial markets would get away with things much better if they (instead of having obese fat fingers) just had podgy porkers.Everbright Securities is one of the biggest securities brokerage firms in terms of assets in China. It is owned by the parent company China Everbright Group and was founded in 1996. It was launched on the Shanghai Composite in2009 (capital raising of $10.9 billion Renminbi). US Bankrupt! | Septaper Will Open Floodgates | How Sinister is the State? | Food: Walking the Breadline | Obama NOT Worst President in reply to Obama: Worst President in US History? New Revelations: NSA and XKeyscore Program | Obama's Corporate Grand Bargain Death of the Dollar | Joseph Stiglitz was Right: Suicide | China Injects Cash in Bid to Improve Liquidity Technical Analysis: Bear Expanding Triangle | Bull Expanding Triangle | Bull Falling Wedge | Bear Rising Wedge | High & Tight Flag

| ||||

| Crude "Flash-Crash" As Stocks Open Higher Posted: 01 Sep 2013 03:53 PM PDT S&P futures are up 10 points (thouhg below Friday's highs) as they open amid better-than-average volume for the Sunday evening session. Treasury futures prices have dropped notably implying around a 6-7bps yield increase with the 10Y trading around 2.84% (above Friday's high yield). The USD is modestly higher as JPY weakens but it is oil complex that saw early chaos as it flash-crashed over $3.50 at the open before bouncing back. WTI is now holding steady at around $106. Gold and Silver followed WTI's lead with the yellow metal dropping over $20 at the open before bouncing back. WTI collapsed at the open only to bounce back above $106...

Gold is following a similar trajectory...

but bonds are notably weaker as stocks push higher...

Charts: Bloomberg | ||||

| Will Congress Endorse Obama's War Plans? Does it Matter? Posted: 01 Sep 2013 03:13 PM PDT Sadly, this sounds like a summary of Obama's speech over the weekend. We are rapidly headed for the same collapse as the Roman Empire if we continue down the president's war path. What we desperately need is an overwhelming Congressional ... Read More... | ||||

| Gold – What To Expect in September? Posted: 01 Sep 2013 02:58 PM PDT There are some opposing forces at work for the short term outlook of gold. First, the gold price tends to rise strongly in September, at least from a seasonality point of view. The chart below shows the gold price seasonality at work over 30 years. It shows generally a spike higher. Chart courtesy: Seasonalcharts.com. Furthermore, a military attack on Syria could initially send the gold price higher. As we wrote earlier, a comparison with previous military or terrorist attacks resulted in a rise of gold right before and after the event, but that effect evaporated one or two months later.

On the other hand, there are several key events upcoming in September which could potentially (!) generate downward pressure on gold. The following events were cited by Bank of America and published by Zerohedge:

In terms of chart analysis, it is clear that the metals don’t have a solid base yet for a significant move higher, no matter how bullish some expectations are long term and how hard some bulls are yelling in the online communities. The facts are what they are. In closing, we should point to the fact that inflation is still quite absent in the minds of large investors and in the official statistics. As long as that is the case, we should not expect too much solidarity from the speculative community. Conclusion: One could expect increasing volatility in the precious metals market in the very short run. It seems almost impossible to come up with a reliable prediction. | ||||

| India's Holy Mary: Converting Sacred Temple Gold Into Dollars Posted: 01 Sep 2013 02:39 PM PDT Ten days ago, it was a tongue in cheek suggestion that the Royal Bank of India should lease their gold in a last ditch effort to procure much needed USD and keep the economic engine going. Then it was an offer so good, the citizens could simply refuse (or maybe not if it was enforced) that the millions of ounces of local wealth preserving gold be converted into Rupees in a wholesale gold purchasing campaign by the domestic banks. Now, the India Times, reports that as the dollar-starved desperation deepens, the local central bank is "discussing with banks on how to convince temple trusts to deposit their hoard of idle jewellery that could be converted into bullion." In other words, the government is going for the sacred gold which will be sold to keep the petrodollar economy functioning for another several months. Surely, yet another "transitory" measure. From the Times of India:

The gold in question is copious:

Still, such a proposal will hardly be met with enthusiasm:

It would be ironic if the central bank religion suddenly finds itself under the control and sway of trua religion, in this case that of Hindusim. The only question that remains is on whose side would any specific enforcer of such a plan - in this case the military - be should the RBI indeed proceed down this path. | ||||

| George Osborne on stealing from Savers, create Asset Bubbles (01Sept13) Posted: 01 Sep 2013 02:19 PM PDT Conservative chancellor George Osborne denies he's creating an asset bubble by stealing from savers. Another economic collapse looms. Recorded from BBC1 HD, Andrew Marr Show, 01 September... [[ This is a content summary only. Visit http://FinanceArmageddon.blogspot.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

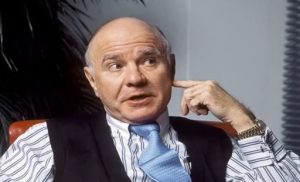

| Market Forces Will Destroy Central Banks – Marc Faber Posted: 01 Sep 2013 01:36 PM PDT THE MATTERHORN INTERVIEW – 1 September, 2013: Marc Faber"The Market Forces Will Destroy Central Banks"In this conversation for Matterhorn Asset Management, financial journalist Lars Schall talked with internationally known investment advisor/fund manager Marc Faber about, inter alia: the main beneficiaries of the current monetary policies undertaken by central banks around the globe; the Fed's tapering; why Faber does still believe in gold; and his bullish view on crude oil.

Dr. Marc Faber was born in Zurich, Switzerland. He studied Economics at the University of Zurich and obtained a PhD in Economics magna cum laude. Between 1970 and 1978, Dr Faber worked for White Weld & Company Limited in New York, Zurich and Hong Kong. Since 1973, he has lived in Hong Kong. From 1978 to 1990, he was the Managing Director of Drexel Burnham Lambert (HK) Ltd. In June 1990, he set up his own advisory and fund management firm, Marc Faber Limited. Marc is also on the board of Sprott Asset Management.

He publishes the monthly investment newsletter “The Gloom Boom & Doom Report," an in depth economic and financial publication, which highlights unusual investment opportunities around the world. Moreover, he is the author of several books including " Tomorrow's Gold: Asia’s Age of Discovery," which was first published in 2002, and is also a regular contributor to several leading financial publications around the world. By Lars Schall Dr. Faber, what do you think is the most important question in our days in the world of finance that is rarely raised? M.F.: Well I think we have unprecedented government interventions with fiscal and monetary policies. For me it’s not really a question, it won't work but miracles do happen, and maybe based on the bailouts and huge monetary inflation that the central bankers have created, maybe it is possible that the financial system heals and that the global economy resumes a, say, trend line growth such that we had in the 90's and the early parts in 2000 and 2005. But I very much doubt that. L.S.: Who are the main beneficiaries? M.F.: That’s pretty much a philosophical question whether the intervention by the government will have a long-term positive or rather negative impact on the global economy. L.S.: Yes, but who are the main beneficiaries of the current monetary policies undertaken by central banks around the globe? M.F.: Very clearly – and this was already observed by Copernicus and later by David Hume and Adam Smith and also Irving Fisher – when you change money, when you have essentially an increase in the balance sheet of central banks and an increase in the quantity of money, the problem is that the money doesn’t flow evenly into the system but it flows into some sectors at different times and it creates booms in some sectors of the economy.

The major beneficiaries of the most recent monetary inflation based in 2008 have been people closest to the source of the liquidity. In other words the financial sector, hedge fund and bond managers, private equity firms and large asset holders; because if you look at, say, who owns shares in the U.S.; the majority of people have no shareholding to speak of. It's the minority, maybe five percent of the population, that holds the majority of shares. So the money printing has actually been very beneficial to well-to-do people. L.S.: What could be done to solve a systemic crisis? M.F.: Recently, there was a professor in Germany who argued that the problem are the well-to-do people and that they should be taxed, very heavily penalized and that part of their assets should be taken away. I don’t think that the well-to-do people per se are the problem. I think the money trading by central banks is the problem and the expected debt growth, credit growth by governments and also on the household sector level and the unfunded liability. So, essentially, one of the solutions to the problem – and there is not going to be a solution that is not very painful – there will be pain and people will have to cut back on their consumption and also review their future benefits from pension funds and from social security, health care and so forth and so on. We’ve lived beyond our means in most countries and to solve that problem is not going to be without significant pain. But effecting the right direction would be to take the depression away from central bankers to increase and cut the money supply and to intervene into the free market essentially with monetary measures. I think that would be the first step in the right direction because if you look at what has happened in the economy, one of the safest goals of central banks is price stability. Well where has there been price stability over the last 15 years? We had a colossal NASDAQ problem and then a collapse and then a colossal credit bubble and housing bubble and then a collapse and then we had a colossal bubble in commodities in 2008 when the oil price went to 147 Dollars, and so if the goal is price stability, basically the fiscal and in particular the monetary interventions have actually led to more instability rather than stability. L.S.: Are the financial elites interested in solutions at all according to your experience? M.F.: I would say basically we have democracies but it should be clear to anyone who lives in Western Europe or in the U.S. that the individual on paper he has plenty of rights but in reality he can be stopped by an authority at the airport and kept in custody for a day or two and harassed and so forth and so on. So his rights are actually very limited. And we have today governments in Brussels and also in Germany and in Switzerland, basically everywhere, where they do not represent the will of the people. In other words they don’t care about the people. They care about themselves. We have a government bureaucracy class that essentially pursues its own interests and within that class you have the treasury department and you have the central banks. The thing is, I know quite a few members and former members of the Fed, this is an institution, it’s a club of, say on paper, educated people but with no business experience. They are not familiar with the problems of the businessmen and they have developed group thinking. All of them are money traders. Now, some are maybe larger money traders like Eric Rosengren of Boston Fed or Yellen, and some are maybe less money traders. Basically they all trade money or intervene with monetary measures if the economy slows down or has a recession, a recession of degree. And my sense is that the government and the central bank will not solve the problem of central banks, only a major crisis that completely discredits the central bankers and the banking system will solve the problem. L.S.: While you’re bearish when it comes to the stock market in general, you seem to be optimistic with regards to gold mining shares. Why so? M.F.: Well, basically the U.S. market is in the sky, we have a very strong outperformance of U.S. stock vis-à-vis Europe until a year ago and vis-à-vis emerging markets until now. But the European economies are a large portion of the U.S. corporate earnings, but they’re not growing. The U.S. is hardly growing. Growth came from emerging markets and these emerging economies are essentially today in a no-growth environment. I live in Asia, so I am quite familiar on my observations on the ground. We have no recession that is visible. It is often seen like a pain. But we’re just at the high level of economic activity; no longer growing. So in my view, the earnings of multinationals will disappoint, and don’t forget, we had this huge increase, it integrates on a percentage rise. The 10-year Treasury note has now gone up from July 2012, from 1.43% to now 2.88. So we have essentially doubled in yield. This is remarkable, especially in view of the fact that in September 2012 Mr. Bernanke said, the purpose of QE 3, which then became QE 4, is to lower interest rates. So the safest goal of the Fed has badly expired in the sense that interest rates are up essentially, and not down. That is for the first time in many years that the market forces are more powerful than the central bank action. And so the U.S. market is high, relative to other markets. There’s no earning growth to speak of at the present time. There has been a lot of speculation and evaluations are relatively stretched. So, I don't think that U.S. stocks offer great value and that they could easily drop. 20, 30 percent wouldn’t surprise me at all. Gold shares are in a different position because they’ve been correcting essentially since 2011 and many gold shares are down 50 percent from those highs. So like emerging stock markets they have grossly underperformed the overall indices in the U.S. and with all the money printing – and I have to point out, I don’t believe in any tapering – maybe they reduce asset purchases somewhat, but I think it’s actually quite likely that they will increase asset purchases. For the simple reason that the economy doesn’t recover, stock market goes down, the bond market goes down, and then the people at the Fed will say, we didn’t do enough. And then they will go and increase their asset purchase. Including the Fed in theory would buy you off the stock markets. So I think that in this environment of money printing you want to own some physical gold held outside the U.S. I don’t understand why it would take eight years for the U.S. to deliver the gold. The German Bundesbank would be possible to do it in one week, but maybe the gold is not there. L.S.: Yes. M.F.: All I want to say, I would hold physical gold. Preferably probably in Singapore, Hong Kong or other Asian countries. And gold shares are a trading opportunity because they’re so oversold and along with the performance of gold prices they should re-bounce quite strongly. L.S.: Since you already mentioned it, besides the repatriation of some of the German Gold from the New York Fed and the Banque de France, the Bundesbank will leave a huge amount of its gold in New York City and London to have in the event of a currency crisis the ability to exchange gold for foreign currency within a short space of time – does this argument convince you? M.F.: No, because that’s complete nonsense, because if the gold would be held in Germany, in a vault, and if there was a financial panic and they really needed to draw loans against the gold that they hold in Germany, they could obtain loans at any time from a bank or from another central bank or whatever it is. So they could have the gold in Germany and if they wish to obtain a large loan against those gold reserves and they wouldn’t be that much anyway, but if they wanted to obtain a loan, they could have an auditor come and check the gold and then a bank or a central bank would essentially lend them money against that gold. All I want to say is, something is fishy about the gold market in the sense that if the Germans demand to have a part of the gold received in Germany, I think it would take eight years, we should put gold on three Boeings 747′s and you ship it to Germany and that’s it. L.S.: Yes. What things have to be in place before you talk about a bubble in gold? M.F.: Well, I lived through the bubble in gold in the 1970′s and by 1979, November, the gold price was around 450 Dollars and within three months it went up to 850 Dollars, so within three months, actually two months, November, December and early January, we made it big. It went up almost 50 percent. So a bubble usually characterized by a terminal upwards move in these real estate or gold or stocks or collectables that is almost vertical. In other words, an acceleration on the upside. And that hasn’t happened yet. Moreover, one of the symptoms of a bubble is widespread public market invasion, in other words most people are one way or the other involved in the market, in real estate, like in the U.S. in 2007 or in NASDAQ stocks in 2000 or on other … Or in the 70′s, in the 70′s, when I was running Drexel Burnham at that time, our office was like a casino; people came in to trade gold 24 hours a day. That doesn't happen today. Okay, we have now better communication so we have the internet on which you can place orders through the internet and through phones and others but if I go to conferences and I talk about investments, I frequently ask the audience, how many of you own gold and how many have, say more than five percent of your assets in gold? Most, I mean, if at most three to five percent of the audience owns any gold, that’s about it. So where, say 12 years ago, if I had asked, who of you owns NASDAQ stocks, maybe 80 percent would have said, yes. So based on the ownership of gold from financial institutions and also based on the public participation, I don’t think we’re in a bubble. L.S.: In turn would you say that gold is still cheap? M.F.: Well, the problem with zero interest rate policies and money printing is that it distorts all evaluation models, it's very difficult to value something. I could say, okay, this house in Mayfair or on Park Avenue or Madison Avenue in New York is expensive if I compare it to, say a quantity of money that’s been floating around the world, but maybe it isn’t. Is a Warhol painting expensive or cheap? Well it’s up, say 12 times over the last ten years, so it's gone up a lot but the quantity of money has also gone up a lot and the number of billionaires around the world has also expanded and so forth and so on. So I can say, maybe gold relative to a Warhol painting or relative to the U.S. stock market is not that expensive or relative to Hampton property. Obviously those are up from 250 Dollars in 1999 to now over 1.300, so, expensive or cheap is a very difficult concept in the present environment. L.S.: Yes, I agree. M.F.: I think all the investors should consider, what is actually the downside. Say you have a billion Dollars; under normal conditions maybe the safest is to keep everything in cash. Now because under normal conditions, say little inflation and the purchasing power of money is maintained, the banking system is down. So you keep it in cash. But under the present condition, cash could be very dangerous, say if banks had another bailout, I think that the public opinion would shift to penalizing large depositors. In other words, if you have 100.000 Dollars on deposit with Deutsche Bank, maybe you get your money back but if you have a billion Dollars, maybe they take the haircut of 50 percent. So in this environment you can ask yourself if you have a billion Dollars. Well, what is relatively safe? So I would imagine that real estate is relatively safe because it’s widely owned by a large portion of the population. It may go down in value and it may be taxed away but it’s feasibly safe. If you look at Germany in 1928, the large and the more stable companies from Siemens to whatever it is, say, BASF, they survived. And so you were better off in stocks in the long run to wars and hyperinflation than in cash and bonds. When you look at gold, well, gold is very safe. It often has a high return in the long run, per se based provided and this is the proviso, the governments don’t take it away. That is a big issue. L.S.: What are your thoughts on China’s gold policy? M.F.: Basically, the Chinese are encouraging Chinese people to own gold and the government has probably been a heavy buyer of gold because China is probably the world's largest producer. So they buy the gold maybe directly from their own mines and it’s obviously a source of demand. That’s why it’s interesting that the price of gold fell so sharply from 1.921 Dollars in September 2011 to below 1.200 when actually the physical demand was relatively high. L.S.: Yes. Do you think so that the dominant factor in the West regarding gold is the paper gold market? M.F.: Well, I don’t know. There are lots of theories about manipulation in the gold market. I always say, this doesn’t concern me, and I hope that the central banks manipulate the price down because if that is the case – don’t forget that every manipulation eventually leads to a move in the opposite direction that is very violent – so in other words, if someone manipulates the price down, in my view eventually the price will shoot up very dramatically. It’s like if you have wage control, eventually the wage control falls apart and wages go through the roof. Similarly if you have in the commodities market price support like coffee or oil or what not, eventually the price falls through the price support and so forth and so on. Market force is always more powerful, so I hope the gold price was manipulated down because then it will go through the roof eventually. L.S.: Yes. What do you see as the main challenges for China going forward? M.F.: Well I mean there are many challenges. Basically they have a misallocation of resources, they have a credit growth, there’s a lot of (expected?) capacities in some industries. And that present time the economy, in my view and based on some corporate results, it would appear that the economy is hardly growing. So, this very strong growth we had in the last say 10, 20 years is going to slow down regardless, to a range in my view of between four to six percent. If you’re lucky they grow at that rate. But the question is, from this ten-percent growth rate plus minus to say your range to four to six percent is that transition going to be a smooth transition or interrupted by some kind of a crisis? I think some kind of a crisis scenario quite likely. L.S.: You think that investing in crude oil is very attractive among commodities. Why so? M.F.: Well, we have to break that commodities into soft, into grains, into essentially industrial commodities, precious metals and so forth and so on. Life stock also … And they move in general in the similar direction but maybe at different times. Now, say if the price of corn goes up substantially, the farmers can right away increase the production of corn and a year later the additional supplies will then essentially contain further price increase and the price will go down. In the case of the oil industry and also for copper, once you have shortages developing, until new large reserves come on stream and until new mines essentially produce, the response time is very long and we have essentially in the world, coming from emerging economies – those would be China and India – very rapidly rising | ||||

| Fukushima Nuclear Disaster Radioactive Groundwater Crisis Worsens - Fully Unsolvable Posted: 01 Sep 2013 01:35 PM PDT Tracy Turner submits: LATEST: The coriums are still hot enough to volatilize all sorts of isotopes, more proof now confirms: Evidence that Ag110m is still being volatilized by corium. It's not just radioactive silver. Per our conclusion to Chapter 12, strontium, cesium and plutonium are still being vaporized fairly effectively. Quote: 'Note that the temperatures of the corium at several of the reactors at Fukushima are probably still high enough to continue volatilizing strontium, plutonium and dozens of other isotopes for years; this corium won't cool down, or be properly contained, for years or decades.' | ||||

| Who Benefits From A War Between The United States And Syria? Posted: 01 Sep 2013 11:33 AM PDT Submitted by Michael Snyder via The Economic Collapse blog, Someone wants to get the United States into a war with Syria very, very badly. Cui bono is an old Latin phrase that is still commonly used, and it roughly means “to whose benefit?” The key to figuring out who is really behind the push for […] | ||||

| Guest Post: Who Benefits From A War Between The United States And Syria? Posted: 01 Sep 2013 11:04 AM PDT Submitted by Michael Snyder via The Economic Collapse blog, Someone wants to get the United States into a war with Syria very, very badly. Cui bono is an old Latin phrase that is still commonly used, and it roughly means "to whose benefit?" The key to figuring out who is really behind the push for war is to look at who will benefit from that war. If a full-blown war erupts between the United States and Syria, it will not be good for the United States, it will not be good for Israel, it will not be good for Syria, it will not be good for Iran and it will not be good for Hezbollah. The party that stands to benefit the most is Saudi Arabia, and they won't even be doing any of the fighting. They have been pouring billions of dollars into the conflict in Syria, but so far they have not been successful in their attempts to overthrow the Assad regime. Now the Saudis are trying to play their trump card - the U.S. military. If the Saudis are successful, they will get to pit the two greatest long-term strategic enemies of Sunni Islam against each other - the U.S. and Israel on one side and Shia Islam on the other. In such a scenario, the more damage that both sides do to each other the happier the Sunnis will be. There would be other winners from a U.S. war with Syria as well. For example, it is well-known that Qatar wants to run a natural gas pipeline out of the Persian Gulf, through Syria and into Europe. That is why Qatar has also been pouring billions of dollars into the civil war in Syria. So if it is really Saudi Arabia and Qatar that want to overthrow the Assad regime, why does the United States have to do the fighting? Someone should ask Barack Obama why it is necessary for the U.S. military to do the dirty work of his Sunni Muslim friends. Obama is promising that the upcoming attack will only be a "limited military strike" and that we will not be getting into a full-blown war with Syria. The only way that will work is if Syria, Hezbollah and Iran all sit on their hands and do nothing to respond to the upcoming U.S. attack. Could that happen? Maybe. Let's hope so. But if there is a response, and a U.S. naval vessel gets hit, or American blood is spilled, or rockets start raining down on Tel Aviv, the U.S. will then be engaged in a full-blown war. That is about the last thing that we need right now. The vast majority of Americans do not want to get embroiled in another war in the Middle East, and even a lot of top military officials are expressing "serious reservations" about attacking Syria according to the Washington Post...

For the United States, there really is no good outcome in Syria. If we attack and Assad stays in power, that is a bad outcome for the United States. If we help overthrow the Assad regime, the rebels take control. But they would be even worse than Assad. They have pledged loyalty to al-Qaeda, and they are rabidly anti-American, rabidly anti-Israel and rabidly anti-western. So why in the world should the United States get involved? This war would not be good for Israel either. I have seen a number of supposedly pro-Israel websites out there getting very excited about the prospect of war with Syria, but that is a huge mistake. Syria has already threatened to attack Israeli cities if the U.S. attacks Syria. If Syrian missiles start landing in the heart of Tel Aviv, Israel will respond. And if any of those missiles have unconventional warheads, Israel will respond by absolutely destroying Damascus. And of course a missile exchange between Syria and Israel will almost certainly draw Hezbollah into the conflict. And right now Hezbollah has 70,000 rockets aimed at Israel. If Hezbollah starts launching those rockets, thousands upon thousands of innocent Jewish citizens will be killed. So all of those "pro-Israel" websites out there that are getting excited about war with Syria should think twice. If you really are "pro-Israel", you should not want this war. It would not be good for Israel. If you want to stand with Israel, then stand for peace. This war would not achieve any positive outcomes for Israel. Even if Assad is overthrown, the rebel government that would replace him would be even more anti-Israel than Assad was. War is hell. Ask anyone that has been in the middle of one. Why would anyone want to see American blood spilled, Israeli blood spilled or Syrian blood spilled? If the Saudis want this war so badly, they should go and fight it. Everyone knows that the Saudis have been bankrolling the rebels. At this point, even CNN is openly admitting this...

And Assad certainly knows who is behind the civil war in his country. The following is an excerpt from a recent interview with Assad...

And shortly after the British Parliament voted against military intervention in Syria, Saudi Arabia raised their level of "defense readiness" from "five" to "two" in a clear sign that they fully expect a war to happen...

And guess who has been supplying the rebels in Syria with chemical weapons? According to Associated Press correspondent Dale Gavlak, it has been the Saudis...

And this is someone that isn't just fresh out of journalism school. As Paul Joseph Watson noted, "Dale Gavlak's credibility is very impressive. He has been a Middle East correspondent for the Associated Press for two decades and has also worked for National Public Radio (NPR) and written articles for BBC News." The Voice of Russia has also been reporting on Gavlak's bombshell findings...

Yes, the Saudis were so desperate to get the Russians to stand down and allow an attack on Syria that they actually threatened them. Zero Hedge published some additional details on the meeting between Saudi intelligence chief Prince Bandar bin Sultan and Russian President Vladimir Putin...

Are you starting to get the picture? The Saudis are absolutely determined to make this war happen, and they expect us to do the fighting. And Barack Obama plans to go ahead and attack Syria without the support of the American people or the approval of Congress. According to a new NBC News poll that was just released, nearly 80 percent of all Americans want Congress to approve a strike on Syria before it happens. And according to Politico, more than 150 members of Congress have already signed letters demanding that Obama get approval from them before attacking Syria...

However, is is clear that he is absolutely determined to attack Syria, and he is not going to let the U.S. Congress - even if they vote against it - or the American people stop him. Let's just hope that he doesn't start World War III in the process. | ||||

| Posted: 01 Sep 2013 10:44 AM PDT I've been studying the markets all weekend since publishing the weekend report. The conclusions I have come to demanded that I publish two additional reports this weekend. I think they are required reading for all gold bugs invested in the precious metals sector. I will reopen the $1 two day trial so everyone can have access to the weekend reports. | ||||

| Crash Alert! IMF to Get Big Boost Posted: 01 Sep 2013 09:13 AM PDT Fresh crash alert for more trouble ahead as the IMF is urged to gain new powers... WE HOISTED our 'Crash Alert' flag last week, writes Bill Bonner in his Daily Reckoning. So far, no crash. The flag is not a prediction. It's merely a warning – like the flag at the beach that warns of a dangerous riptide. You can still go in the water. But watch out. You could get washed out to sea. Syria? Tapering? The return of the debt-ceiling debate? Anemic real economic growth? A preponderance of negative earnings guidance? Rising Treasury yields? A panic in the emerging markets? And here's the Financial Times warning that central bankers may not be willing to protect investors from every danger:

Dear readers are urged not to pay too much attention to the FT. Its news is solid. But its editorials are mush. Robin Harding continues:

What 'new kind of international financial system' does he propose? Boosting the IMF's resources and handing more voting power to emerging markets so they can rely on it in time of need... The plan is to turn the IMF into a kind of super central bank...with lots of 'international reserve assets' that it can hand out to any country that seems to need them. Readers don't need to ask too many questions. We'll just put it into simple words. The world's money system would be based on paper money and managed by global bureaucrats. You see immediately that it is hopeless. A super bank run by super economists? How long would it take for them to blow up the whole world's financial system? But don't worry about it. The system will blow up anyway. No paper-money system has ever survived a full credit cycle. Why not? Because paper money (a form of primitive, credit-backed money) is unlimited...and undisciplined. That – and not a lack of international monetary reform – is why there are so many bubbles now. When interest rates are falling – often pushed by central banks to artificially low levels and held there for an extremely long time – credit expands and the burden of debt grows. That has been happening for the last three decades. And now, the entire economy depends on something that can't possibly continue. Debt can't grow forever. As long as rates stay low, the system holds together. But as the quantity of debt increases, the quality of it decreases. Debtors' balance sheets get weaker and weaker. Eventually, the credit markets change direction. Rates start going up again. Then the weight of all that debt comes crashing down like an avalanche. And when it gets started, there is no stopping it. All you can do is make sure you're not in the way! | ||||

| Crash Alert! IMF to Get Big Boost Posted: 01 Sep 2013 09:13 AM PDT Fresh crash alert for more trouble ahead as the IMF is urged to gain new powers... WE HOISTED our 'Crash Alert' flag last week, writes Bill Bonner in his Daily Reckoning. So far, no crash. The flag is not a prediction. It's merely a warning – like the flag at the beach that warns of a dangerous riptide. You can still go in the water. But watch out. You could get washed out to sea. Syria? Tapering? The return of the debt-ceiling debate? Anemic real economic growth? A preponderance of negative earnings guidance? Rising Treasury yields? A panic in the emerging markets? And here's the Financial Times warning that central bankers may not be willing to protect investors from every danger:

Dear readers are urged not to pay too much attention to the FT. Its news is solid. But its editorials are mush. Robin Harding continues:

What 'new kind of international financial system' does he propose? Boosting the IMF's resources and handing more voting power to emerging markets so they can rely on it in time of need... The plan is to turn the IMF into a kind of super central bank...with lots of 'international reserve assets' that it can hand out to any country that seems to need them. Readers don't need to ask too many questions. We'll just put it into simple words. The world's money system would be based on paper money and managed by global bureaucrats. You see immediately that it is hopeless. A super bank run by super economists? How long would it take for them to blow up the whole world's financial system? But don't worry about it. The system will blow up anyway. No paper-money system has ever survived a full credit cycle. Why not? Because paper money (a form of primitive, credit-backed money) is unlimited...and undisciplined. That – and not a lack of international monetary reform – is why there are so many bubbles now. When interest rates are falling – often pushed by central banks to artificially low levels and held there for an extremely long time – credit expands and the burden of debt grows. That has been happening for the last three decades. And now, the entire economy depends on something that can't possibly continue. Debt can't grow forever. As long as rates stay low, the system holds together. But as the quantity of debt increases, the quality of it decreases. Debtors' balance sheets get weaker and weaker. Eventually, the credit markets change direction. Rates start going up again. Then the weight of all that debt comes crashing down like an avalanche. And when it gets started, there is no stopping it. All you can do is make sure you're not in the way! | ||||

| Emerging Markets in Trouble from Oil Posted: 01 Sep 2013 09:05 AM PDT Surging oil and energy costs only make this worse for emerging markets... EMERGING MARKETS are in all sorts of trouble, writes Greg Canavan in the Australian Daily Reckoning, and with the oil price preparing for another Middle Eastern war, centred this time in Syria, their problems are about to get worse. A collapsing currency combined with a rising US Dollar oil price is a big tax on economic growth, and it comes at precisely the wrong time for the global economy. But we do feel slightly assuaged that UK Prime Minister David Cameron tells us that the coming conflict is not actually about the Middle East or even Syria, and Gareth Evan's opinion piece in today's Financial Reviewalso provides comfort when he explains that a strong moral case justifies war even though international law doesn't. That's good to know. What's also handy to know (especially for these power hungry warmongers) is that the last place where there was an overwhelming moral justification to wage war (based on the suspicion of the presence of chemical weapons, which were never found) was Iraq. And how's that going? Yesterday, explosions killed 80 people in Bagdad as sectarian violence continues a decade after the West felt morally compelled to improve the prospects of a country that, among other wicked deeds, threatened to price their oil in Euros. The Associated Press tells us that: