Gold World News Flash |

- USA’s World Police System is really a quest to steal other countries’ resources

- Gold Uptrend Pausing

- SocGen’s Albert Edwards: Gold Will Still Climb to $10,000 the Ounce When the Correction Comes

- More Evidence That JPM Has Cornered Comex Gold

- Micro-documentary: How Our Monetary System Works And Fails

- Gold And Silver - Market Says 1 -2 Years Sideways, Not Up

- Time for a Brief Pause?

- 10 Currency War Insights From Jim Rickards

- Gold 'will hit $1,500' as investors seek safe haven

- Guest Post: What To Expect During The Next Stage Of Collapse

- Gold Trader: “Prepare For Whipsaws Next Week As The Bulls Try To Defend $1400”

- Meanwhile In Fukushima: Multiple Leaks, Radiation Soars To 1.8 Sieverts/hr

- Market Monitor – August 31st

- TF Metals Report: More evidence that JPMorganChase has cornered Comex gold

- TIME FOR A BRIEF PAUSE?

- 'Give Our Gold Back' campaign launched in Poland

- What Will Happen If (and probably when) the U.S. Debt Bubble Bursts?

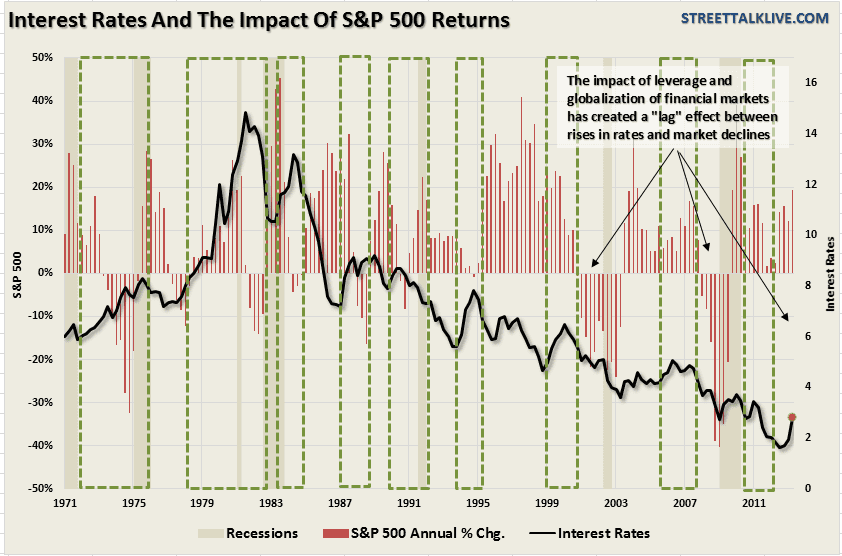

- What Affect, If Any, Will Rising Interest Rates Have On the Stock Market

- The Dow Jones Index is the Greatest of All Ponzi Schemes

- This Past Week in Gold

- Documentary program on Austrian TV addresses gold price suppression

- Gold Price Rally "Finished"

- Gold Price Rally "Finished"

- Bombed Out Gold Market is Bottoming

- China Loves West’s 99 Fine Gold

- Gold and the Return of Global Turmoil

| USA’s World Police System is really a quest to steal other countries’ resources Posted: 01 Sep 2013 12:30 AM PDT by S. D. Wells, Natural News:

Then, we went into Afghanistan, where our soldiers are still dying 12 years later, all in the name of furthering the heroin business (poppy fields) and stealing other natural resources from the country, which is a gold mine of mineral wealth, including copper and iron. (http://www.globalresearch.ca) |

| Posted: 01 Sep 2013 12:00 AM PDT from Dan Norcini:

Gains during the early part of this week, tied to concerns over the situation in Syria, have been fading as the refusal of the British Parliament to go along with the Obama administration’s plan to lob cruise missiles into Syria took some of the safe haven bid away from gold. Traders/investors have read this to mean that an imminent strike was less likely. |

| SocGen’s Albert Edwards: Gold Will Still Climb to $10,000 the Ounce When the Correction Comes Posted: 31 Aug 2013 10:00 PM PDT by Ed Steer, Casey Research:

Gold closed in New York on Friday at $1,396.50 spot, down another $10.70. Net volume was still pretty decent at 126,000 contracts, with over 25 percent of that amount occurring by 9 a.m. in London. Every attempt by silver to break above the $24 spot mark in Far East trading on Friday met with not-for-profit selling. Then the silver price got sold down until shortly after London opened before making another rally attempt to the $24 spot mark, and that got smacked shortly after Comex trading began, and that was pretty much it for the day. |

| More Evidence That JPM Has Cornered Comex Gold Posted: 31 Aug 2013 09:00 PM PDT from TF Metals Report:

If I can bring all of this together, it will go a long way toward proving correct Ted Butler’s theory on JPM’s current corner of the Comex gold futures market. So, let’s start with Uncle Ted and his assertions. Recall that Ted is a first-rate analyst who has been trading commodities for about 40 years. He has paid particular interest to the silver manipulation for the past 20. He writes an excellent newsletter to which you can subscribe by clicking here: http://www.butlerresearch.com Using the CFTC-issued weekly and monthly data (Commitment of Traders & Bank Participation Report), Ted has followed along over the past eight months of position changes and, over that time, the changes have been dramatic. As you know, The Bullion Banks were caught heavily short at the initiation of QE∞ last autumn. I contend that this entire manufactured correction scheme was initiated by The Bullion Banks to give them an opportunity to get out from under their naked short positions and move net long. Ted has concluded that it’s not the Bullion Banks per se. Instead, the scheme was initiated by JPM solely for the benefit of JPM and, from a net short gold position in excess of 50,000 contracts last December, JPM has now transitioned into a net long gold position of more than 65,000 contracts. IF THIS IS TRUE, there can be absolutely no doubt as to: |

| Micro-documentary: How Our Monetary System Works And Fails Posted: 31 Aug 2013 06:35 PM PDT from Gold Silver Profits: |

| Gold And Silver - Market Says 1 -2 Years Sideways, Not Up Posted: 31 Aug 2013 06:00 PM PDT Re 1 - 2 years of potentially moving sideways, we would be happy to be wrong. Read More... |

| Posted: 31 Aug 2013 04:00 PM PDT Now that gold has broken its daily cycle trend line I think we can assume that the daily cycle decline has probably begun. My best guess is that we will see gold drop into next week's employment report and test the support zone and ... Read More... |

| 10 Currency War Insights From Jim Rickards Posted: 31 Aug 2013 02:14 PM PDT In his latest TV interview, Jim Rickards gives an update on currency wars and explains several key principles. We have summarized them in this article in ten different insights:

|

| Gold 'will hit $1,500' as investors seek safe haven Posted: 31 Aug 2013 01:30 PM PDT Gold could climb to $1,500 (£968) an ounce if military action is taken against Syria, City analysts predict. This posting includes an audio/video/photo media file: Download Now |

| Guest Post: What To Expect During The Next Stage Of Collapse Posted: 31 Aug 2013 12:58 PM PDT Submitted by Brandon Smith of Alt-Market blog, For years now at Alt-Market (and Neithercorp.us) I have carefully outlined the most likely path of collapse to take place within the U.S., and a vital part of that analysis included economic destabilization caused by a loss of the dollar's world reserve status and petro-status. I have also always made clear that this fiscal crisis event would not occur in the midst of a political vacuum. The central banks and international financiers that created our ongoing and developing disaster are NOT going to allow the destruction of the American economy, the dollar, or global markets without a cover event designed to hide their culpability. They need something big. Something so big that the average citizen is overwhelmed with fear and confusion. A smoke and mirrors magic trick so raw and soul shattering it leaves the very population of the Earth mesmerized and helpless to understand the root of the nightmare before them. The elites need a fabricated Apocalypse. Enter Syria... I have been warning about the Syrian trigger point for a very long time. Syria's mutual defense pact with Iran, its strong ties to Russia, the Russian naval base off its coast, the advanced Russian weaponry in it's arsenal, its proximity to vulnerable oil shipping lanes, all make the nation a perfect catalyst for a global catastrophe. The civil war in Syria is already spreading into neighboring countries like Iraq, Jordan, and Lebanon, and if one looks at the facts objectively, the entire war is a product of covert action on the part of the U.S. and its allies. The U.S. trained, armed, and funded the insurgency using Al Qaeda operatives. Saudi Arabia has sent funding and arms as well. Israel has aided the rebels using air strikes within Syria's borders (even though this means that the Israeli government is essentially helping their supposed mortal enemies). This war would NOT be taking place today without the express efforts of the West. Period. If one takes more than a brief examination of the Syrian insurgency, they would find an organization of monsters. Wretched amoral wetwork ghouls whose crimes have been thoroughly documented, including the mass executions of unarmed captured soldiers, the torture and beheading of innocent civilians, the mutilation and cannibalism of dead bodies, and the institution of theological tyranny on a terrified populace. The U.S. created and unleashed these demons, and now, we the people are being asked by the White House to support them through force of arms. But what is the goal here...? The goal, I believe, is to utterly transform the world's political, economic, and social systems. The goal is to generate intense fear; fear that can be used as capital to buy, as the globalists call it, a “new world order”. Syria is the first domino in a long chain of calamities; what the Rand Corporation sometimes refers to as a “linchpin”. As I write this, the Obama Administration is moving naval and ground forces into position and clamoring in a painfully pathetic fashion to convince the American public that 90% of us are “wrong” and that a strike on Syria is, in fact, necessary. It appears that the establishment is dead set on starting this chain reaction and accelerating the global collapse. So, if a strike does occur, what can we expect to happen over the next few years? Here is a rundown... 1) Many U.S. allies will refrain from immediate participation in an attack on Syria. Obama will continue unilaterally (or with the continued support of Israel and Saudi Arabia), placing even more focus on the U.S. as the primary cause of the crisis. 2) Obama will attempt to mitigate public outcry by limiting attacks to missile strikes, but these strikes will be highly ineffective compared to previous wars in Iraq and Afghanistan. 3) A no fly zone will be established, but the U.S. navy will seek to stay out of range of high grade Russian missile technology in the hands of Syria, and this will make response time to the Syrian Air Force more difficult. Expect much higher American naval and air force casualties compared to Iraq and Afghanistan. 4) Iran will immediately launch troops and arms in support of Syria. Syria will become a bewildering combat soup of various fighting forces battling on ideological terms, rather than over pure politics and borders. Battles will spread into other countries, covertly and overtly, much like during Vietnam. 5) Israel will probably be the first nation to send official ground troops into Syria (and likely Iran), citing a lack of effectiveness of U.S. airstrikes. American troops will follow soon after. 6) Iran will shut down the Straight of Hormuz sinking multiple freighters in the narrow shipping lane and aiming ocean skimming missiles at any boats trying to clear the wreckage. Oil exports through the straight of Hormuz will stop for months, cutting 20% of the world's oil supply overnight. 7) The Egyptian civil war, now underway but ignored by the mainstream, will explode due to increased anger over U.S. presence in Syria. The Suez Canal will become a dangerous shipping option for oil exporters. Many will opt to travel around the Horn of Africa, adding two weeks to shipping time and increasing the cost of the oil carried. 8) Saudi Arabia will see an uprising of insurgency that has been brewing under the surface for years. 9) Gasoline prices will skyrocket. I am predicting a 75%-100% increase in prices within two-three months of any strike on Syria. 10) Travel will become difficult if not impossible with high gasoline costs. What little of our economy was still thriving on vacation dollars will end. Home purchases will fall even further than before because of the extreme hike in travel expenses required for families to move. 11) Russia will threaten to limit or cut off all natural gas exports to the EU if they attempt to join with the U.S. in aggression against Syria. The EU will comply due to their dependency on Russian energy. 12) Russia will position naval forces in the Mediterranean to place pressure on the U.S. I feel the possibility of Russia initiating direct confrontation with the U.S. is limited, mainly because countries like Russia and China do not need to engage the U.S. through force of arms in order to strike a painful blow. 13) China and Russia will finally announce their decision to drop the dollar completely as the world reserve currency. A process which already began back in 2005, and which global banks have been fully aware of for years. 14) Because of China's position as the number one exporter and importer in the world, many nations will follow suit in dumping the dollar in bilateral trade. The dollar's value will implode. China, Russia, and the war in Syria will be blamed, and global banks including the Federal Reserve will be ignored as the true culprits. 15) The combination of high energy prices and a devaluing dollar will strike retail prices hard. Expect a doubling of prices on all goods. Look for many imported goods to begin disappearing from shelves. 16) Homelessness will expand exponentially as cuts to welfare programs, including food stamps, are made inevitable. However, welfare will not disappear, it will merely be “adjusted” to fit different goals. The homeless themselves will be treated like criminals. The roaming bands of jobless drifters common during the Great Depression will not exist during a modern crisis. State and Federal agencies will pursue an “out of sight, out of mind” policy towards the indigent, forcing them into “aid shelters” or other bureaucratic contraptions designed to conditioning the homeless to accept refugee status, making them totally dependent on federal scraps, but also prisoners on federally designated camps. 17) Terrorist attacks (false flag or otherwise) will spread like wildfire. Israel is highly susceptible. The U.S. may see a string of attacks, including cyber attacks on infrastructure. Syria and it's supporters will be blamed regardless of evidence. The White House will begin broad institution of authoritarian powers, including continuity of government executive orders, the Patriot Act, the NDAA, etc. 18) Martial Law may not even be officially declared, but the streets of America will feel like martial law none the less. 19) False paradigms will flood the mainstream as the establishment seeks to divide American citizens. The conflict will be painted as Muslim against Christian, black against white, poor against rich (but not the super rich elites, of course). Liberty Movement activists will be labeled “traitors” for “undermining government credibility” during a time of crisis. The Neo-Conservatives will place all blame on Barack Obama. Neo-Liberals will blame conservatives as “divisive”. Liberty Movement activists will point out that both sides are puppets of the same international cabal, and be labeled “traitors” again. The establishment will try to coax Americans into turning their rage on each other. 20) The Homeland Security apparatus will be turned completely inward, focusing entirely on “domestic enemies”. The domain of the TSA will be expanded onto highways and city streets. Local police will be fully federalized. Northcom will field soldiers within U.S. border to deal with more resistant quarters of the country. Totalitarianism will become the norm. What Can We Do Right Now? The level of collapse, I suspect, will not be total. The government is not going to disappear, rather, it will become more dominant in its posture. Certain sections of the country will be maintained while others fall apart. The IMF will move in to “help” the ailing U.S. economy by tying funding to the SDR (Special Drawing Rights). America's economy will be absorbed by the IMF. Constitutional protections will be fully erased in the name of reestablishing “law and order”, with the promise that the loss of our civil liberties is “only temporary”. If the U.S. strikes Syria, and refuses to disengage, these things WILL happen. So, the next question is what can we do about it? 1) Given that this crisis is going to be riding a wave of extremely high energy prices, every single Liberty Movement activist (and every American for that matter) should be stockpiling energy reserves. Motor oil, gasoline (with gas saver), diesel fuel, propane, etc. should be at the top of your list right now. A generator should be next. Prices are only going to rise from here on out. Buy reserves now, before it is too late. 2) Everyone in the Liberty Movement should have at least minimal solar power capability. A couple of 100 watt panels, an inverter, a charge controller, and two-four deep cycle batteries can be had for under $1000. You may not be able to run your house on it, but you can at least charge important electronics, run a well pump, run some lights, a security system, etc. 3) The internet as we know it will no longer exist. The White House will apply preexisting executive orders on U.S. communications to restrict internet use, or, a convenient cyber attack will take place, opening the door for federal controls. The web will likely still operate, but only as a shell of its former greatness. Certain sites and email providers will be designated “safe”, while others will be designated “unsafe”. This leaves a gaping hole in our society's ability to communicate information quickly and efficiently, and, it removes the alternative media from the picture. The best solution I can present for this problem is Ham Radio, which is very difficult for the establishment to shut down. Ham Radio communication chains could take the place of the internet as a lower-tech but useful means of spreading information across the country. In the next few months, EVERYONE in the Liberty Movement should have a Ham Radio set, or handheld model, and they should know how to use it. 4) Harden your home during the next few months. Place security bars on windows, and replace weak doors with steel core doors. An internal lock bar will still frustrate entry by those who might blast hinges. Add a fire suppression system for good measure. This might sound like overkill, but if you want to be able to sleep at night during such an event, you must make your home your castle. No one should be able to enter your house without your permission. 5) Learn a useful trade right now. If you don't already know how to produce or fix a necessary item or commodity, take the next six months to learn how. If you don't know how to teach a valuable skill, get to work. Barter and trade will become the primary method of economy during a dollar collapse. Make sure you are sought after within your local economy. 6) Cache items before winter begins. Do not assume you will be able to stay on your homestead indefinitely. There are no guarantees during collapse. A wildfire could reduce your neighborhood to ashes in hours. Your home could be overrun. Make sure you have secondary supplies in a safe location just in case. 7) Find two friends (or more) right now that are willing to coordinate with you in the event that the worst happens. This means mutual aid and defense. This means predetermined arrangements for supplies, communications, meeting spots, and security. Do it now. Do not wait until our situation worsens. 8) Buy six months worth of food over the course of the next two months. Bulk food, freeze dried, MRE's, whatever. Just buy it. Have a lot of food already? I don't care. Buy six more months of supplies now. You'll thank me later. 9) Cultivate nutrient rich soil before winter begins. Buy a truckload of planting soil and manure and create a garden space if you have not already. Purchase extensive seed storage. Compile books on growing methods. 10) Gauge the temperament of your neighborhood. If all of your neighbors are mindless brain eating zombies, then perhaps it would be better to share a home with a prepared family member in another region now. If not, then start a neighborhood watch. Two or three families working together is far stronger than only one, and can change the temperament of an entire block of homes. 11) Train for tactical movement over the next three months. Learn how to move, shoot, and communicate as a team. Learn your strengths and weaknesses today or suffer the consequences tomorrow. 12) Prepare yourself mentally for conflict and self defense. Sign up for at least six months of hand to hand defense training. Learn how to deal with the mental and emotional strain of another person trying to harm you. Get used to the idea, because where we're headed, someone, at some point, will probably want to do you in. Always maintain your conscience and your principles, but never allow yourself to become a victim. The Tension Is Palpable As I have said many times before, a fight is coming. There is no way around it. But this fight must be fought intelligently, and we must never forget who the REAL enemy is. If a revolution ensues and Obama loses control, the establishment could simply trigger a Neo-Con or military coup in order to placate the masses and fool Constitutionalists into believing they have been saved. Useless solutions will be presented to the people, including new leadership composed of more old guard elitists, a disastrous Constitutional Convention, or limited secession (which will never be honored by the establishment anyway). The purpose of these false solutions will be to fool you into relaxing your vigilance, distracting you from seeking justice against globalist organizations, or, to redirect your energies away from self sufficient communities, counties, and states, ready to dispel aggressive establishment elements. Beware of those who grasp too readily for leadership over you. Real leaders stand as teachers, not oligarchs, and rarely do they take on the role without considerable reservations. Never trust anyone who does not immediately back their promises with tangible action. And, never forget that we fight not just for the removal of one particular tyrant, but for Constitutional liberty itself. One must follow the other, or there has been no victory. Though it is depressingly difficult to see in times like these, there is indeed good in this world. There are ideals, and aspirations, and visions, and loves worth standing up for, worth fighting for, and worth dying for. There is still a future worth striving for at the end of the long night. There are dreams here, in the hearts of men, worth realizing. We do not necessarily battle for what humanity is, but for what we have the potential to become. The tides of society may shift and storm, the chaos may become unbearable, and the world may tear apart until it is unrecognizable. The agents of dominion believe they are the only constant, but there is another. In time, the dim pale of tyranny will always break in the light of freedom's resolute. Get ready, honorable Liberty Movement, our work has just begun. |

| Gold Trader: “Prepare For Whipsaws Next Week As The Bulls Try To Defend $1400” Posted: 31 Aug 2013 10:58 AM PDT

|

| Meanwhile In Fukushima: Multiple Leaks, Radiation Soars To 1.8 Sieverts/hr Posted: 31 Aug 2013 10:47 AM PDT Remember when we said Tepco has lost all control of Fukushima? We weren't joking.

Perhaps the above, together with the terminal demographic social collapse, coupled with Abe's monetary experiment which will end in currency collapse, explains why for Japanese society, for which pretty much nothing matters anymore as a "happy ending" is out of picture, Syria is merely an opportunity to rerun the more glorious moments of WW II:

Unclear if Manchuria is next. * * * As posted here over a week ago, this is what is really going on: "Tepco Has Lost Control" - What Is Really Happening At Fukushima In Four Charts After a self-imposed gag order by the mainstream media on any coverage of the Fukushima disaster (ostensibly the last thing the irradiated Japanese citizens needed is reading beyond the lies of their benevolent government, and TEPCO, and finding out just how bad the reality is especially since the key driver behind Abenomics is a return in confidence at all costs), the biggest nuclear catastrophe in history is once again receiving the attention it deserves. This follows the recent admission by TEPCO of the biggest leak reported at Fukushima to date, which forced the Japanese government to raise the assessment of Fukushima from Level 1 to Level 3, even though this is merely the catalyst of what has been a long and drawn out process in which Tepco has tried everything it could to contain the fallout from the exploded NPP, and failed. And today, in a startling and realistic assessment of Fukushima two and a half years after the explosion, the WSJ finally tells the truth: "Tepco Has Lost Control." Here is how the mainstream media, in this case the Wall Street Journal, catches up with a topic covered extensively in the "alternative" media for the past several years:

What does "losing control" mean in practical terms?

The last statement bears repeating: "it is still not clear where the melted fuel cores are." Well as long as TEPCO is 100% confident there are no uncontrolled chain reactions taking place... Then again hundreds of tons of coolant must be cooling something.

Indeed the "worst-case scenario" is an appropriate topic because as covered here over the weekend, it involves the potential death of millions of largely oblivious Japanese citizens. As for the long overdue mea culpa by a nationalized TEPCO, which also speaks for the entire Japanese government, it sounds hollow at best and makes one wonder what else is left unsaid.

The concerns are piling up. Earlier today Reuters reported that TEPCO "admitted to new spots of high radiation had been found near storage tanks holding highly contaminated water, raising fear of fresh leaks as the disaster goes from bad to worse."

The bottom line, and what has become painfully clear, is that Japan simply can't fix the problem. Even China has now figured it out.

What is strangest of all is that the Japanese people are far less concerned about the government's cover up. Oh well: they have their distractions - like a plunging currency, and (transitorily) soaring stock market, in nominal terms of course. Finally the following four charts from the WSJ provide a full breakdown of the current state of play at the devastated nuclear power plant. Full interactive charts can be found here |

| Posted: 31 Aug 2013 10:12 AM PDT Top Market Stories For August 31th, 2013: COMEX Gold Drops To 702,000 Ounces - Jesse's Cafe Guess Which "Bearish" Bank Bought A Record Amount Of GLD In Q2 - Zero Hedge India might buy gold from citizens to ease rupee crisis - CNBC Jim Rogers Warns Syria War And "Market Panic" To |

| TF Metals Report: More evidence that JPMorganChase has cornered Comex gold Posted: 31 Aug 2013 10:10 AM PDT 1:05p ET Saturday, August 31, 2013 Dear Friend of GATA and Gold: The TF Metals Report's Turd Ferguson today analyzes gold futures market data and concludes that market analyst and silver market rigging whistleblower Ted Butler is right -- that JPMorganChase has cornered the Comex gold market. Ferguson further predicts that JPMorganChase will commence a short squeeze by December. Ferguson's analysis is headlined "More Evidence That JPM Has Cornered Comex Gold" and it's posted at the TF Metals Report's Internet site here: http://www.tfmetalsreport.com/blog/5018/evidence-gold-corner CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: Gold Investment Symposium 2013 New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| Posted: 31 Aug 2013 07:43 AM PDT Now that gold has broken its daily cycle trend line I think we can assume that the daily cycle decline has probably begun. My best guess is that we will see gold drop into next week's employment report and test the support zone and intermediate trend line between $1340-$1350. We knew this was coming, as gold will enter the timing band for a daily cycle low on Monday, so no one needs to freak out. That being said, daily cycle declines need to make traders freak out in order to reset sentiment and prepare for the next leg up. So I suspect what is going to happen is that the bulls will try to defend that $1400 level for a few days, followed by a very scary $30-$40 crash day that will bring gold back down to that support zone and a final daily cycle low possibly on the employment report or the following Monday. I don't pay as much attention to the point and figure charts as I used to. I probably should as it spotted the daily cycle top at the declining trend line perfectly. I think we will break through that trend line during the next daily cycle. The bullish percent chart is also suggesting it's time for a minor rest. It hasn't reached levels indicative of an intermediate top yet (80%-90%), but the big surge off the bottom needs to pull back and consolidate before the next push higher. Once we put this daily cycle bottom behind us I think the next daily cycle will test the April stop run level at $1523. Then depending on what unfolds in the dollar we could very well see a fourth daily cycle higher that tests the QE 4 manipulation level at $1700-$1800. |

| 'Give Our Gold Back' campaign launched in Poland Posted: 31 Aug 2013 07:35 AM PDT 10:39a ET Saturday, August 31, 2013 Dear Friend of GATA and Gold: Taking inspiration from Germany, Switzerland, and the United States, a movement to repatriate national gold reserves from vaulting with the market riggers at the Bank of England in London has arisen in Poland. The movement, Oddajcie Nasze Zloto ("Give Our Gold Back"), was brought to GATA's attention this week by its vice chairman, Piotr Wojda (piotr.wojda@mennicawroclawska.pl), who writes that it was started by two economists "worried about the safety of more than 100 tons of Polish gold held in the vaults of Bank of England for the last 70 years." Wojda adds that the movement "has been widely supported by organizations such as the Ludwig von Mises Institute (www.mises.pl), Business Center Club (www.bcc.org.pl), Mennica Wrocławska (The Mint of Wrocław, www.mennicawroclawska.pl), and many others. After several newspaper publications and TV shows we finally managed to persuade Polish politicians to listen to what we have to say." ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Wojda continues: "Representatives of the movement met with members of the Polish Parliament on August 29 to discuss doubts regarding the safety of Polish gold held abroad. During our presentation we used several examples of similar movements in Germany, Switzerland, and the United States. We also briefly presented achievements of the Gold Anti-Trust Action Committee and they impressed our members of Parliament. "The members of Parliament agreed that Polish gold reserves deserve an independent audit and they have already decided to inquire of the president of the Polish Central Bank, Professor Marek Belka, to establish facts such as: "-- What is the official amount of Polish gold reserves held at the Bank of England? "-- What are the amount and quality of bars held in the vaults (serial numbers, purity, are they 'good delivery' bars)? "-- Whether there have been independent audits within the last 70 years and their results. "-- Is the gold being leased to any financial institutions? If so, what are the terms and conditions of this leasing? "-- What is the procedure for buying and selling gold and how is this decision taken? "-- Why has the Polish central bank not decided to acquire more gold when the price dropped significantly although Polish gold reserves amount to only 4 percent of the bank's total currency reserves? "It seems that we Poles are getting closer to achieving financial safety by finally withdrawing from British vaults what belonged to our country for almost a century." GATA supporters really should check out the Polish "Give Our Gold Back" campaign's Internet site to see the illustration chosen to illustrate the campaign, a Polish translation of the illustration that represents GATA's work, the painting by Alain Despert found at the top of GATA's Internet site and every GATA Dispatch. The Polish "Give Our Gold Back" campaign's Internet site is here: CHRIS POWELL, Secretary/Treasurer Join GATA here: Gold Investment Symposium 2013 New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... -- ----- CHRIS POWELL, Secretary/Treasurer Office: 860-646-0500x307 |

| What Will Happen If (and probably when) the U.S. Debt Bubble Bursts? Posted: 31 Aug 2013 07:26 AM PDT The madmen who are responsible for the coming economic disaster continue to behave as if they can manage to avoid it. Violating Einstein's definition of insanity, they continue to apply the same poison that caused the problem. These fools believe they can manage complexities they do not understand. The end is certain, only its timing is unknown, and, once interest rates begin to rise, and they will, it’s game over so it begs the questions “How much longer this can possibly go on?” and “What will happen to the U.S. and the world when it does?” The following articles have been compiled from the archives of www.munKNEE.com (Your Key to Making Money!). Read them and you will have a broad diverse view of the predicament the U.S. and so many other countries find themselves in, why the situation is unsustainable and what is likely in store as a result. 1. Economics Can't Trump Mathematics & the Math Says US In a Debt Death Spiral The madmen who are responsible for the coming economic disaster continue to behave as if they can manage to avoid it. Violating Einstein's definition of insanity, they continue to apply the same poison that caused the problem. These fools believe they can manage complexities they do not understand. We are bigger fools for providing them the authority to indulge their hubris and wreak such damage. Read More » 2. When the Debt Bubble Bursts We're Going to See Economic Chaos So Get Ready – NOW! Never before has the world faced such a serious debt crisis. Yes, in the past there have certainly been nations that have gotten into trouble with debt, but we have never had a situation where virtually all of the major powers around the globe were all drowning in debt at the same time. Right now, confidence is being shaken as debt levels skyrocket to extremely dangerous levels. Many are openly wondering how much longer this can possibly go on. [Here's my take on the situation.] Read More » 3. U.S. Economy: Reduce Spending (Future Depression) OR Keep Spending (Future Hyperinflation) The U.S. government is in what is known as a “debt death spiral”. They must borrow money to repay prior debts. It is as if they are using their Visa Card to make an American Express payment. The rate of new debt additions dwarf any rate of growth the economy can possibly achieve. The end is certain, only its timing is unknown, and, once interest rates begin to rise, and they will, it’s game over. Read More » 4. Why the End of This Economic Death Spiral Is So Hard to Call Whether you are an investor, concerned citizen or merely someone trying to understand the current economic situation, you should be worried. Watch this video to get an outstanding overview of what is occurring. It is probably the best short explanation as to why the end of this economic death spiral is so hard to call. Read More » 5. A Practical Assessment of the U.S. Debt Problem Shows It to Be Absolutely Absurd The U.S. debt situation when broken down to one of family statistics really seems absurd. Yet it's true. It's a slow motion train wreck that can be seen coming miles away but which, like deer paralyzed in the headlights, everyone is unwilling to face up to and to take any meaningful corrective action – and it will be the downfall of them all. Words: 550 Read More » 6. Prefer Videos on the Dire State of the U.S. Economy? Then These Are for You Busy? No problem. Don’t bother taking the time to surf the internet in search of videos on the dire state of the U.S. economy. This post contains descriptions and links to 57 of the best. Read More » 7. U.S.A.: United States of Addiction – Our Insatiable Appetite for Debt 16 point 7 trillion dollars. That is our current national debt. 12 point 8 trillion dollars. That is the amount households carry in mortgage and consumer debt. We are now addicted to debt to lubricate the wheels of our financial system. There is nothing wrong with debt per se, but it is safe to say that too much debt relative to how much revenue is being produced is a sign of economic problems. At the core of our current financial mess is how we use debt as a parachute for any problem. [Unfortunately,] addictions are never easily cured and we have yet to come to terms with our insatiable appetite for debt. Words: 850 Read More » 8. Gov't Debt Will Keep Increasing Until the System Implodes! Are You Ready? Why are so many politicians around the world declaring that the debt crisis is "over" when debt-to-GDP ratios all over the planet continue to skyrocket? The global economy has never seen anything like the sovereign debt bubble that we are experiencing today. This insanity will continue until a day of reckoning arrives and the system implodes. Nobody knows exactly when that moment will be reached, but without a doubt it is coming. Are you ready? Words: 1270 9. A Practical Assessment of the U.S. Debt Problem Shows It to Be Absolutely Absurd The U.S. debt situation when broken down to one of family statistics really seems absurd. Yet it's true. It's a slow motion train wreck that can be seen coming miles away but which, like deer paralyzed in the headlights, everyone is unwilling to face up to and to take any meaningful corrective action – and it will be the downfall of them all. Words: 550 Many articles are being written these days that more or less scope the dire financial circumstances the U.S. is in. That being said, I had not been able to find one "analyst" – even one – who had the guts to outline the probable outcome and general hopelessness of the situation and to offer any meaningful prescription for investors to survive this coming catastrophe – until now. Words: 710 11. Economics of Gov't Are No Different Than Those of Typical American Family – Here's Why If Congress does not raise the debt ceiling, the result will be no different than the Jones family deciding that they have maxed out their credit cards and that, if they continue borrowing and spending over their means, there will be significant pain to the family at best and bankruptcy at worst. Any attempt to prove otherwise is futile because it's just not true! [To further make his point the author provides below 7 other examples of why the economics of government are no different than those of the typical American household.] Words: 585 12. U.S. Debt 101: If the U.S. Were A Stock Few Investors Would Own It – Here's Why There has been a lot of media coverage about the United States' debt issue these days. Why should we care? Because as U.S. citizens, we all own stock in this "company" called the United States of America (let's say the ticker symbol is USA). We purchased this stock through the various taxes we pay every year (income tax, payroll tax, corporate tax) and we receive dividends through the various benefits we receive every year (security provided by defense budget, Medicare/Medicaid benefits, Social Security benefits, etc.). This article attempts to explain the U.S. national debt in simple layman's terms by analyzing the United States and its debt issue as if it were a stock investment. Words: 1929; Charts: 5; Tables: 1 13. U.S.'s Runaway Financial Train is About to Destroy the Status Quo People riding a runaway train can party and remain oblivious to the fact that the train is about to crash into a huge obstacle. Our runaway financial train is about to destroy the status quo as it crashes into the obstacle of mathematical consequences – the inevitable financial train wreck. "If something cannot go on forever, it will stop." [Let me explain.] Words: 974 14. Take Note: Don't Say You Weren't Forewarned! It is relatively easy to predict further commodity price inflation as a result of the massive money printing going on worldwide and that hard assets, not paper assets, will help protect purchasing power but it is much more difficult to project where else this money printing leads and to what extent a crash is inevitable. What is the endgame? Will it be another financial crash such as in 2008 or will it be a more destructive financial and economic crash that causes a severe but temporary disruption in the delivery of goods and services? Words: 1470 15. A Must Watch Video On Why America Is In A "Death Spiral" The video* below is one of the best overviews of what is going on and one of the best explanations of what lies ahead that I have heard. As such, in my opinion, it is A Must Watch! 16. These 25 Videos Warn of Impending Economic Collapse & Chaos The internet is awash (drowning?) in hundreds of doom and gloom videos providing dire warnings of coming world depression, food shortages, rioting in the streets, rampant (hyper) inflation, deepening banking crisis, economic apocalypse, financial Armageddon, the demise of America – well, you get the idea. Below is a small sample of such videos with a hyperlink to each. Warning: New evidence points toward an imminent financial collapse and the destruction of American wealth. Income, investments, retirement, and even personal safety are now at severe risk. In this new video I lay it all out for you. Words: 515 18. The Top 18 Economic Documentaries Economic Reason has gathered together the Top 18 'reality' economic documentaries which are bought to you by www.munKNEE.com. 19. Almost 3 Million Views! Why U.S. Debt & Budget Will NEVER Balance This short video – on the sustainability of government spending – should be watched by everyone, including those not yet old enough to vote. It should be shown in every high school and college classroom. 20. The U.S. Economy is Going to Collapse…It is Unavoidable…It's a Mathematical Certainty…Here's Why The level of debt has surpassed the possibilities of being serviced. Mathematically, the debt problem cannot be solved, regardless of economic policies. That, unfortunately, is written. For it to be serviceable would be to violate the laws of mathematics and that cannot happen. [As such, America is quickly approaching a catastrophic economic collapse. As repelling as that sounds, it's in your own best interest to learn just how bad the situation is. This article is an attempt to do just that.] Words: 310 “The end of the world as we know it" is what David Korowicz predicts is coming sometime this decade – an "ultimate" crash that will be irreversible – TEOTWAWKI! Words: 1395 22. The Average U.S. Citizen Is Clueless Regarding the Desperate Shape the Country Is In! Are You? The corrosive nature of politics and government has destroyed the economy and the moral fiber of citizens. These issues are not insurmountable, but they are very close to being so. Their ramifications are potentially existential in nature: the average length of life, the very time span or cycle of a nation has been proven in history to be approximately 250 years. Since the USA was born in 1776 this says we have about 14 years of life remaining for America. The way things are going we don't doubt it. [Let me explain.] Words: 768 23. If You Are Not Preparing For a US Debt Collapse, NOW Is the Time to Do So! Here's Why Timing the U.S. debt implosion in advance is virtually impossible. Thus far, we've managed to [avoid such an event], however, this will not always be the case. If the U.S. does not deal with its debt problems now, we're guaranteed to go the way of the PIIGS, along with an episode of hyperinflation. That is THE issue for the U.S., as this situation would affect every man woman and child living in this country. [Let me explain further.] Words: 495 24. This Will NOT End Well – Enjoy It While It Lasts – Here's Why …The US Government and its catastrophic fiscal morass are now viewed by the world as a 'safe haven'. This would easily qualify for a comedy shtick if it weren't so serious….[but] the establishment is thrilled with these developments because it helps maintain the status quo of the dollar standard era. However, there are some serious ramification |

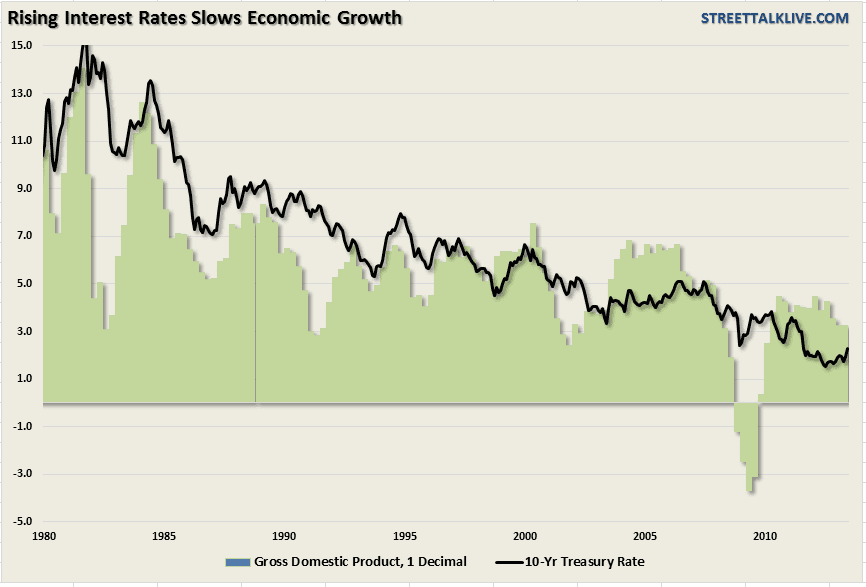

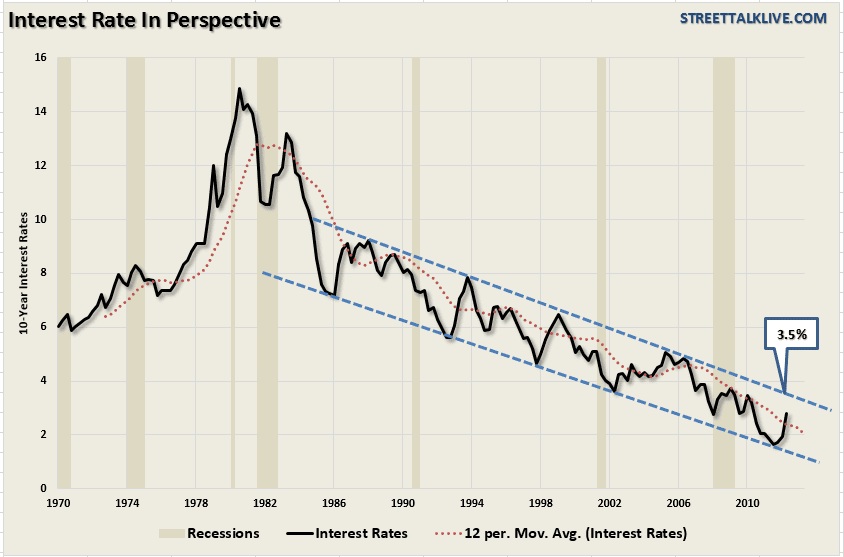

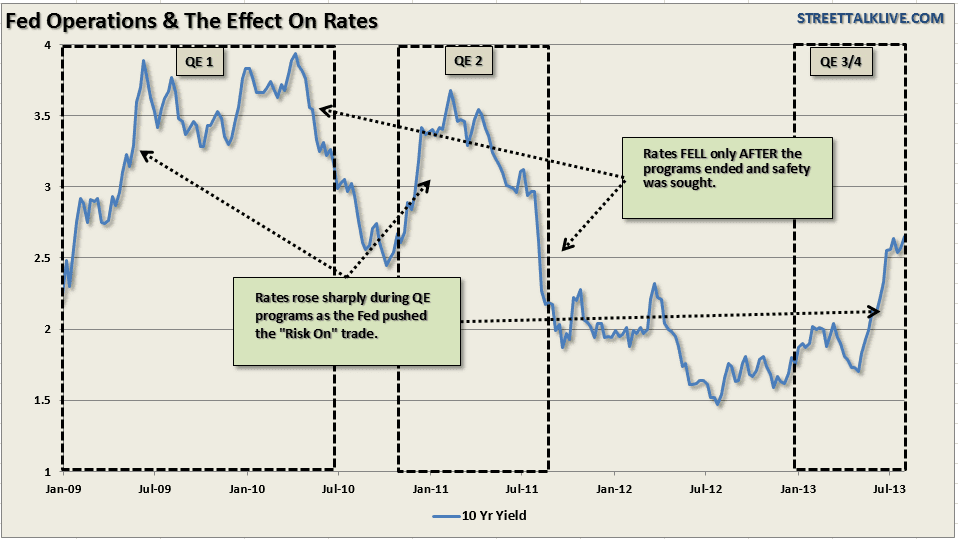

| What Affect, If Any, Will Rising Interest Rates Have On the Stock Market Posted: 31 Aug 2013 07:24 AM PDT The belief is that rising interest rates (as is currently occurring) are a sign that So says Lance Roberts (streettalklive.com) in edited excerpts from his original article* entitled Will Rising Rates Kill the Stock Market?. [The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]Roberts goes on to say in further edited, and in some places perhaps paraphrased, excerpts: The chart below shows the 10-year treasury rate versus the economy as represented by GDP. It is not surprising to find that rising interest rates negatively impact economic growth. As I discussed in a previous article entitled Evaluating 3 Bullish Arguments: "Rising interest rates are potentially a huge problem for the markets and the economy. Rising rates increase borrowing costs, carrying costs, and mortgages while reducing profitability, consumption and production. If the prognosticators of a bond market reversion are 'right,' like Bill Gross, it will not be good for stock market investors." Let me explain the above statement a little more thoroughly. The table below lists the various bullish arguments for the stock market and the impact caused by rising interest rates: As you can see above higher interest rates are not bullish for the economy or the market overall. However, it is important to remember that there is a significant lag effect between increases in interest rates and the impact on the markets and economy. The problem for investors, in general, is their inherent "immediacy bias." Investors assume that if "Event A" doesn't have an immediate impact on "Event B" that the analysis is wrong and that "this time is different." The reality is that the lag effect is generally discounted by emotional biases which ultimately leads to poor investment decision making. However, before I discuss the impact of rising rates as it specifically relates to the stock market, it is important to put the recent spike in rates into some context. The chart below shows the long term history of the 10-year interest rate. As you can see [in the chart above] the recent "spike" in rates is really nothing more than a "reversion" in rates from a historically low level back to the top of the long term downtrend. As with all things related to financial markets, and the economy, when things deviate well beyond their long term means (red dashed line) there is historically a "snap-back" that occurs. That "snap-back," or reversion, could currently take rates back to 3.5%. While such a level is still extremely low by historical standards it is potentially high enough to create sufficient drag on an already weak economic environment. While the current spike in rates has caught many participants by surprise; it is important to keep it in perspective. At the moment nothing has changed in overall long term down trend of interest rates. It will take increasing rates of economic growth, increases in wage growth and full-time employment, rising monetary velocity and upwardly trending inflation to change the long term trend of interest rates higher. Unfortunately, at the moment, the economic environment that currently exists is not supportive of such factors. What's Pushing Rates? If it really isn't economic growth driving rates higher then the question becomes what is? As I discussed in a previous article entitled Clues To Watch For The End Of QE Infinity: “During QE programs interest rates have risen as the 'risk' trade pushed money flows into stocks. However, the opposite occurred at the end of programs as money fled from stocks and into the perceived 'safety' of bonds." The current move higher in rates actually has much less to do with expectations of economic recovery, despite headlines to the contrary, but rather the impact of the Federal Reserve's monetary interventions, (QE), on money flows. The problem for stock market investors is that the impact of rising rates is a clear negative on the economy and the stock market. As shown in the chart below – historical spikes in interest rates have always led to weaker stock market performance. As discussed in the table above increases in interest rates slow economic activity, with a lag effect, which negatively impacts earnings, margins and forward guidance. Ultimately, and it may take several quarters to manifest itself fully, the fundamental deterioration leads to a reversion in stock market prices. As noted in the graph that "lag effect" has become much more pronounced since the turn of the century due to the impact of liquidity (from both the equity extraction during the housing bubble and QE programs currently), leverage via margin debt, and globalization of the markets through program trading. Regardless, the impact of higher interest rates will eventually negatively impact market returns which will then lead to the next decline in rates. There are two important considerations.

While the Federal Reserve may only slow their rate of bond purchases in the near future, less accommodative action is the same as "tightening" monetary policy. That decrease of policy accommodation will be amplified by the rise in interest rates which could, conceivable, create a bigger problem that the Fed and market participants are anticipating. While the current increase in interest rates hasn't created any issues just yet – it certainly doesn't mean that the pot won't boil over the minute we quit paying attention to it. [Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://www.streettalklive.com/daily-x-change/1793-will-rising-rates-kill-the-stock-market.html Related Articles: 1. Bonds Getting Slaughtered, Interest Rates to Rise Dramatically, Economic Bubbles to Implode

What does it look like when a 30 year bull market ends abruptly? What happens when bond yields start doing things that they haven’t done in 50 years? If your answer to those questions involves the word “slaughter”, you are probably on the right track. Right now, bonds are being absolutely slaughtered, and this is only just the beginning. So why should the average American care about this? Read More » The global financial system is potentially heading for massive amounts of trouble if interest rates continue to soar. So what does all this mean exactly? [Let me explain.] Read More » 3. What Will Cause Interest Rates to Rise? Will That Be Good or Bad? Don't get too worked up over interest on the national debt or what will happen when interest rates rise because, by then, we'll likely be talking about ways to cool down the economy. [Why?] Because interest rates on US government debt are really a function of economic growth. If the economy is weak the Fed will pin short rates to stimulate the economy and if rates rise it's going to be a function of better days ahead. Words: 525 4. A Rise in Interest Rates Would Derail An Economic Recovery – Yes or No? [While]… I am not currently predicting an acceleration in inflation [I believe]…that the risk of interest rate instability is very real [given that] core inflation is already above a key benchmark that the Fed has staked its credibility on,. It should be of concern to investors that, despite economic growth being so anemic and overall resource utilization being so low (including human resources), there is currently very little margin for error on the inflation front. [In this article the author evaluates the danger that rising interest rates could potentially have on the U.S. economy.] Words: 2050 At some point we are going to see another wave of panic hit the financial markets like we saw back in 2008. The false stock market bubble will burst, major banks will fail and the financial system will implode. It could unfold something like this: Words: 660 Read More » 6. U.S. Financial System Will Die When Interest Rates Rise! Here's Why Right now, interest rates are near historic lows. The U.S. government is able to borrow gigantic mountains of money for next to nothing. U.S. consumers are still able to get home loans, car loans and student loans at ridiculously low interest rates. When this low interest rate environment changes (and it will), it is going to absolutely devastate the U.S. economy. Without low interest rates, the U.S. financial system dies. [Let me explain.] Words: 1529 Read More » The post What Affect, If Any, Will Rising Interest Rates Have On the Stock Market appeared first on munKNEE dot.com. |

| The Dow Jones Index is the Greatest of All Ponzi Schemes Posted: 31 Aug 2013 07:21 AM PDT The Dow Jones Industrial Average (DJIA) Index – the oldest stock exchange in the So writes Wim Grommen in an article originally posted on www.FinancialArticleSummariesToday.com and www.munKNEE.com entitled Beware: The Dow 30′s Performance is Being Manipulated! Grommen goes on to say, and I quote: The Dow Index was first published in 1896 when it consisted of just 12 constituents and was a simple price average index in which the sum total value of the shares of the 12 constituents were simply divided by 12. As such those shares with the highest prices had the greatest influence on the movements of the index as a whole. In 1916 the Dow 12 became the Dow 20 with four companies being removed from the original twelve and twelve new companies being added. In October, 1928 the Dow 20 became the Dow 30 but the calculation of the index was changed to be the sum of the value of the shares of the 30 constituents divided by what is known as the Dow Divisor. While the inclusion of the Dow Divisor may have seemed totally straightforward it was – and still is – anything but! Why so? Because every time the number of, or specific constituent, companies change in the index any comparison of the new index value with the old index value is impossible to make with any validity whatsoever. It is like comparing the taste of a cocktail of fruits when the number of different fruits and their distinctive flavours – keep changing. Let me explain the aforementioned as it relates to the Dow. Companies Go Through 5 Transition Phases On one hand, generally speaking, the companies that are removed from the index are in either the stabilization or degeneration transition phases of which there are five, namely: 1. the pre-development phase in which the present status does not visibly change. 2. the take-off phase in which the process of change starts because of changes to the system 3. the acceleration phase in which visible structural changes – social, cultural, economical, ecological, institutional – influence each other 4. the stabilization phase in which the speed of sociological change slows down and a new dynamic is achieved through learning. 5. the degeneration phase in which costs rise because of over-capacity leading to the producing company finally withdrawing from the market. The Dow Index is a Pyramid Scheme On the other hand, companies in the take-off or acceleration phase are added to the index. This greatly increases the chances that the index will always continue to advance rather than decline. In fact, the manner in which the Dow index is maintained actually creates a kind of pyramid scheme! All goes well as long as companies are added that are in their take-off or acceleration phase in place of companies in their stabilization or degeneration phase. The False Appreciation of the Dow Explained On October 1st, 1928, when the Dow was enlarged to 30 constituents, the calculation formula for the index was changed to take into account the fact that the shares of companies in the Index split on occasion. It was determined that, to allow the value of the Index to remain constant, the sum total of the share values of the 30 constituent companies would be divided by 16.67 ( called the Dow Divisor) as opposed to the previous 30. On October 1st, 1928 the sum value of the shares of the 30 constituents of the Dow 30 was $3,984 which was then divided by 16.67 rather than 30 thereby generating an index value of 239 (3984 divided by 16.67) instead of 132.8 (3984 divided by 30) representing an increase of 80% overnight!! This action had the affect of putting dramatically more importance on the absolute dollar changes of those shares with the greatest price changes. But it didn't stop there! On September, 1929 the Dow divisor was adjusted yet again. This time it was reduced even further down to 10.47 as a way of better accounting for the change in the deletion and addition of constituents back in October, 1928 which, in effect, increased the October 1st, 1928 index value to 380.5 from the original 132.8 for a paper increase of 186.5%!!! From September, 1929 onwards (at least for a while) this "adjustment" had the affect – and I repeat myself – of putting even that much more importance on the absolute dollar changes of those shares with the greatest changes. How the Dow Divisor Contributed to the Crash of '29 From the above analyses/explanation it is evident that the dramatic "adjustments" to the Dow Divisor (coupled with the addition/deletion of constituent companies according to which transition phase they were in) were major contributors to the dramatic increase in the Dow from 1920 until October 1929 and the following dramatic decrease in the Dow 30 from then until 1932 notwithstanding the economic conditions of the time as well. Exponential Rise in the Dow 30 is Revealed The 1980s and '90s saw a continuation of the undermining of the true value of the Dow 30. Yes – you guessed correctly –further "adjustments" in the Dow Divisor kept coming and coming! As the set of constituents of the Dow changed over the years (almost all of them) and many shares were split the Dow Divisor kept changing. By 1985 the Dow Divisor was only 1.116 and today it is only 0.132129493. Indeed, a rise of $1 in share value of the 30 constituents actually results in 8.446 more index points than in 1985 (1.116 divided by 0.132129493). Had it not been for this dramatic decrease in the Dow Divisor the Nov.3/10 Dow 30 index value of 12,215 (sum total of the current prices of the 30 constituent shares of $1481.85 divided by 0.132129493) would only be 1327.82 ($1481.85 divided by 1.116) in 1985 terms. Were we still using the original formula the Dow 30 would actually be only 49.395 ($1481.85 divided by 30)! The crucial questions today are: 1. Is the current underlying economy strong enough to keep the Dow 30 at its present level? 2. Will the 30 constituents of the Dow remain robust or evolve into the stabilization and degeneration phases? 3. Will there be enough new companies to act as new "up-lifters" of the Dow? 4. When will the Dow Divisor change – yet again?? The Dow 30 is the Greatest of All Ponzi Schemes I call on the financial community to take a critical look at the Dow Divisor. If it is retained investors will continue to be deceived with every new transition from one phase to another and the greatest of all Ponzi schemes will have major financial consequences for every investor. (A version of this article, entitled Beurskrach 1929, mysterie ontrafeld?, was first published in Dutch in the January 2010 issue of "Technische en Kwantitatieve Analyse" magazine which is a monthly publication of Beleggers Belangen (Investment Interests) in the Netherlands and on several sites there including: Beurskrach 1929 mysterie ontrafeld? op Historiek.net)The post The Dow Jones Index is the Greatest of All Ponzi Schemes appeared first on munKNEE dot.com. |

| Posted: 31 Aug 2013 07:11 AM PDT Summary: Long term - on major sell signal since Mar 2012. Short term - on buy signals. Gold sector cycle - up as of 8/16. Read More... |

| Documentary program on Austrian TV addresses gold price suppression Posted: 31 Aug 2013 06:57 AM PDT 9:55a ET Saturday, August 31, 2013 Dear Friend of GATA and Gold: Awareness of gold price suppression continues to spread internationally. A financial documentary program broadcast this month by Servus TV in Austria (and seen in Germany as well) addresses gold price suppression and GATA's work at length. It interviews, among others, GATA Chairman Bill Murphy, GoldMoney founder and GATA consultant James Turk, market analyst and GATA consultant Dimitri Speck, GoldMoney research director Alasdair Macleod, Sprott Asset Management CEO Eric Sprott, "The Creature from Jeckyll Island" author G. Edward Griffin, market analyst Mike Maloney, and Euro Pacific Capital's Peter Schiff. The program is in German, is titled "Economic Crisis in the System," is 50 minutes long, begins its treatment of gold price suppression at about the 35-minute mark, and is posted at Servus TV's Internet site here: http://www.servustv.com/cs/Satellite/Article/Gier---Wirtschaftskrise-mit... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 31 Aug 2013 05:18 AM PDT That's your lot! The gold price rally since June will struggle, apparently... In the PAST 2 MONTHS, the gold price has dug in a "foothold" in the $1200 area...and rallied to just over $1400 an ounce, says Steve Sjuggerud's Daily Wealth. Given this move, should we worry about our claim that gold's amazing streak is over? Our answer is "no". Long-time readers know we've been outspoken bulls on gold since we began publishing DailyWealth in 2005. We were gold owners years before that. Since then, we've published hundreds of essays on the right ways to own gold. We even published a book on the stuff. We own gold and hope to never have to use it. Being bullish on gold was the right move. Since bottoming in 2001, gold registered 12 straight years of gains. No widely traded asset of the past 100 years has enjoyed that many consecutive winning years. After such a stupendous run, it was only reasonable to expect a big correction.  As you can see from the chart below, that big correction arrived. This year, gold plummeted from $1650 to $1200. And despite gold's rebound, we still say the streak is over. Gold is unlikely to climb back into winning territory by the end of the year. As gold owners, we'd love to be proven wrong...but we're confident we won't be. |

| Posted: 31 Aug 2013 05:18 AM PDT That's your lot! The gold price rally since June will struggle, apparently... In the PAST 2 MONTHS, the gold price has dug in a "foothold" in the $1200 area...and rallied to just over $1400 an ounce, says Steve Sjuggerud's Daily Wealth. Given this move, should we worry about our claim that gold's amazing streak is over? Our answer is "no". Long-time readers know we've been outspoken bulls on gold since we began publishing DailyWealth in 2005. We were gold owners years before that. Since then, we've published hundreds of essays on the right ways to own gold. We even published a book on the stuff. We own gold and hope to never have to use it. Being bullish on gold was the right move. Since bottoming in 2001, gold registered 12 straight years of gains. No widely traded asset of the past 100 years has enjoyed that many consecutive winning years. After such a stupendous run, it was only reasonable to expect a big correction.  As you can see from the chart below, that big correction arrived. This year, gold plummeted from $1650 to $1200. And despite gold's rebound, we still say the streak is over. Gold is unlikely to climb back into winning territory by the end of the year. As gold owners, we'd love to be proven wrong...but we're confident we won't be. |

| Bombed Out Gold Market is Bottoming Posted: 31 Aug 2013 03:25 AM PDT The war drums are beating. This has driven gold higher and the June lows look like a classic bottom. Think about it. Gold had been dribbling down all year, but when the Fed began its tapering talk in mid-June, it pushed gold down to new lows. The already bruised gold price broke down, plunging to the $1200 area in late June, only to zip back up above $1300 four weeks later. |

| China Loves West’s 99 Fine Gold Posted: 31 Aug 2013 03:21 AM PDT According to Bloomberg, whose calculations were based on Hong Kong customs data, net gold imports into China more than doubled in the first half of 2013 to 493 metric tons, up from roughly 239 tons over the same period in 2012. The China Gold Association said gold consumption in China jumped 54 percent to 706.36 metric tons in the first six months of 2013. Bloomberg reported takeovers and asset purchases by China's gold mining companies reached a record $2.24 billion this year, up considerably from 2012's record of $1.96 billion worth of M&A activity. |

| Gold and the Return of Global Turmoil Posted: 31 Aug 2013 03:13 AM PDT The last several weeks have seen a return of all the ingredients for a gold rally, from an "oversold" technical condition which sparked a short-covering rally to a spike in Treasury yields which caused investors to look for safe haven investments. Gold has benefited from the rising interest rates as well as the weakness in the U.S. dollar. Now a new set of factors is playing into gold's favor.... |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No country is allowed to fight at all without first getting permission from the United States of America! Plus, if any country has any kind of quarrel, civil war or even just a protest about their own government, chances are that the U.S. will bomb and/or invade them, in the name of peace, of course. Then that country must deal with the U.S. occupying their country to “monitor” everything while we “install democracy.” Of course, this is just a ploy while we scourge and flog all of their valuable natural resources. The invasion of Iraq, as we now all know, was all about stealing their oil by controlling their oil pipelines, because there were certainly no weapons of mass destruction. We could have easily just taken out Saddam Hussein (and his 6 palaces) with a few drone missile strikes and avoided the entire WAR, but, again, it wasn’t about war, world police or even helping another country “install democracy.” Rather, it was about U.S. politicians getting their hands on resources and profiting from the military (industrial) war complex.

No country is allowed to fight at all without first getting permission from the United States of America! Plus, if any country has any kind of quarrel, civil war or even just a protest about their own government, chances are that the U.S. will bomb and/or invade them, in the name of peace, of course. Then that country must deal with the U.S. occupying their country to “monitor” everything while we “install democracy.” Of course, this is just a ploy while we scourge and flog all of their valuable natural resources. The invasion of Iraq, as we now all know, was all about stealing their oil by controlling their oil pipelines, because there were certainly no weapons of mass destruction. We could have easily just taken out Saddam Hussein (and his 6 palaces) with a few drone missile strikes and avoided the entire WAR, but, again, it wasn’t about war, world police or even helping another country “install democracy.” Rather, it was about U.S. politicians getting their hands on resources and profiting from the military (industrial) war complex. Recent action in gold during the latter part of this week is suggesting a pause in the fledgling uptrend. The metal seems to have run into a heavy band of resistance near the $1440 level and is setting back.

Recent action in gold during the latter part of this week is suggesting a pause in the fledgling uptrend. The metal seems to have run into a heavy band of resistance near the $1440 level and is setting back. For the third day in a row the high tick of the day [such as it was] came in Far East trading, and for the third day in a row the gold price got sold down after that. On Friday the sell-off came right at the London open, and the smallish rally in New York trading back over the $1,400 price mark wasn’t allowed to last.

For the third day in a row the high tick of the day [such as it was] came in Far East trading, and for the third day in a row the gold price got sold down after that. On Friday the sell-off came right at the London open, and the smallish rally in New York trading back over the $1,400 price mark wasn’t allowed to last.

No comments:

Post a Comment