Gold World News Flash |

- Indian gold imports slump 95% in August

- Despite Psychological War, Western Paper Scheme To Collapse

- TANSTAAFL, Butter and Silver

- Poll: More Americans Believe World Trade Center 7 Was Demolished On 9/11 than Believe the Government's Explanation

- Why PHYSICAL Gold and Silver Demand Have Surged

- Miners’ Hedging back in the News

- Despite Pullback, Gold & Silver To See Spectacular Surges

- The Polish Bail-In Changes Everything

- COMEX Deliverable Gold Bullion Continues to Slowly Bleed Out

- COMEX Deliverable Gold Bullion Continues to Slowly Bleed Out

- What is the Spot Gold Price?

- Putin Wins Again As Obama Puts Attack On Hold

- Silver and Gold Prices Closed Lower at $22.97 and $1,364.00

- Silver and Gold Prices Closed Lower at $22.97 and $1,364.00

- Christian Garcia: U.S. Mint hedges silver purchases with HSBC and JPM

- Obama Approval Rating Near Record Lows

- West Now Engaging In Psychological Warfare As It Implodes

- Selling Weapons: Eldorado

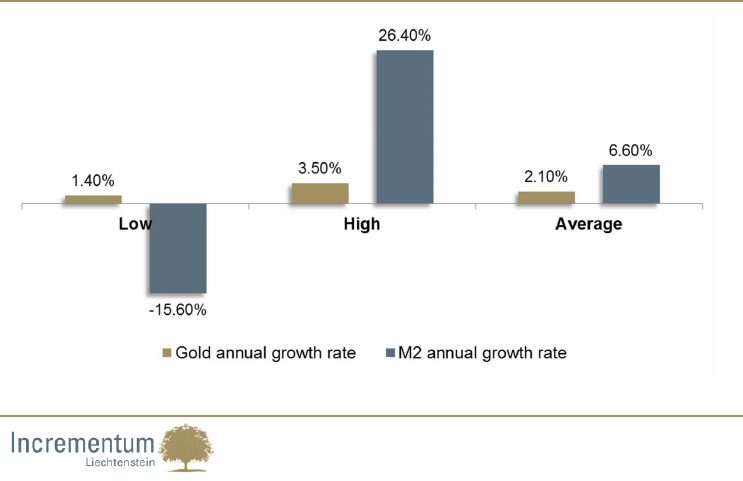

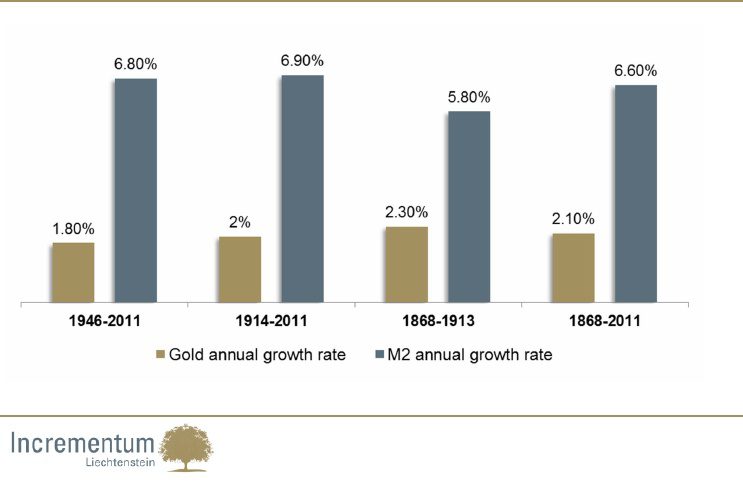

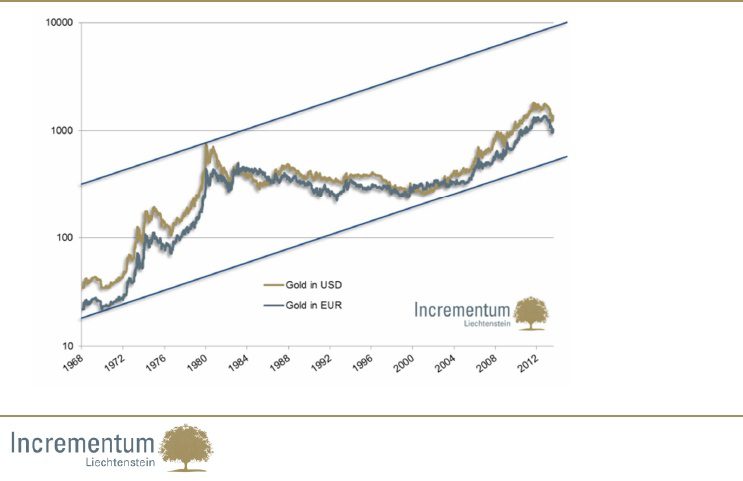

- Will gold protect you from inflation?

- The US Debt Ceiling Debate In The Light Of Monetary Fundamentals

- Marc Faber: The Bond Market Would Like A High Level Of Tapering

- Pan American Silver repudiates recent hedging

- Gold Daily and Silver Weekly Charts - Antics Will Continue Until Confidence Returns

- Gold Daily and Silver Weekly Charts - Antics Will Continue Until Confidence Returns

- David Franklin: A leaky fix

- Will Gold Follow Its Seasonal Pattern This Year?

- WORLD WAR 3 - Obama IS WORSE THAN GEORGE Bush

- Despite Psychological War, Western Paper Scheme To Collapse

- West Sells Gold, Asia Buys

- West Sells Gold, Asia Buys

- Gold Elliott Wave Technical Analysis

- Negative Sentiment Fuels Gold Bull

- West wages 'psychological war' on gold, Embry tells King World News

- This Is the Dow on Drugs

- Negative Sentiment Fuels Gold Bull

- Cash and Gold are Kings this Fall

- Bill Rice: I'm assuming manipulation is here to stay

- West Now Engaging In Psychological Warfare As It Implodes

- The Daily Market Report

- Timberline Resources Announces Closing of Public Offering of Common Stock

- Timberline Resources Announces Closing of Public Offering of Common Stock

- The “Domestic Terrorist” You Can Call a Hero

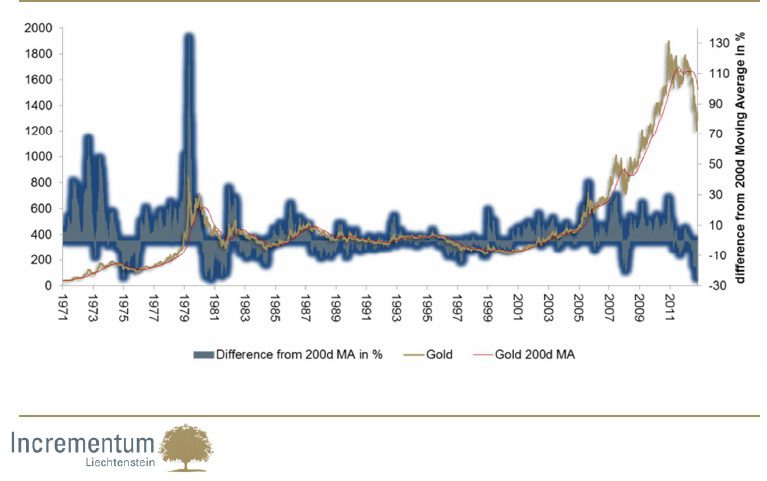

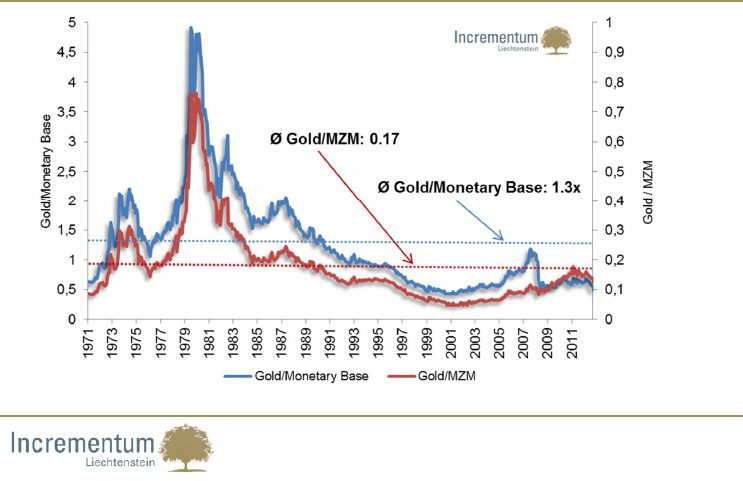

- Gold: These Charts Say It All!

- Amara Mining confident of bringing down costs

- Gold Fields subject of U.S. SEC probe

- Gold market tries to kill the ‘Syria’ factor

- Seabridge hits best grades ‘ever drilled’ at KSM gold-copper project

- Holding CEO, Loots FD for SA’s newest mid-tier gold miner

- What Western supply and Asian demand mean for gold – Lundin

- G-Resources: Profitable new Asian gold miner with big ideas

| Indian gold imports slump 95% in August Posted: 11 Sep 2013 01:00 AM PDT Even as some sections of the government termed India’s apex bank’s restrictions onerous, the gov’t readies further measures to cut gold imports. by Shivom Seth, MineWeb.com

The fall has eased pressure on the Indian government, which has been struggling to contain the widening current account deficit (CAD) and the depreciation of the Indian rupee to the US dollar. The Indian rupee has depreciated by more than 20 percent so far this fiscal. |

| Despite Psychological War, Western Paper Scheme To Collapse Posted: 10 Sep 2013 11:30 PM PDT from KingWorldNews:

Now they are using this reprieve in Syria as an excuse to smash gold and silver prices. |

| Posted: 10 Sep 2013 11:05 PM PDT TANSTAAFL is the acronym for "There ain't no such thing as a free lunch." The saying has been used for years, even prior to Robert Heinlein's use of it in "The Moon Is A Harsh Mistress." It is... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| Posted: 10 Sep 2013 10:32 PM PDT Preface: Americans have learned in the past decade that our government lied to us about:

But do Americans think that the government lied about 9/11? A new poll shows that they do. At least about World Trade Center Building 7. We’re not talking about the Twin Towers … although Building 7 was part of the same complex. No planes hit Building 7, no one was killed when Building 7 fell, no wars were launched on the basis of Building 7, and no civil rights were lost because of the destruction of Building 7. In other words, Building 7 is a “safe topic” we can discuss without heated emotion. And numerous high-level architects and engineers have already debunked the government’s claims. Following is a press release from ReThink911 and Architects and Engineers for 9/11 Truth – a group of more than 2,000 architects and engineers – concerning a new poll by YouGov. How would you answer the poll questions? On the 12th anniversary of 9/11, a new national survey by the polling firm YouGov reveals that one in two Americans have doubts about the government’s account of 9/11, and after viewing video footage of World Trade Center Building 7’s collapse, 46% suspect that it was caused by a controlled demolition. Building 7, a 47-story skyscraper, collapsed into its own footprint late in the afternoon on 9/11. The poll was sponsored by ReThink911, a global public awareness campaign launched on September 1. The campaign includes a 54-foot billboard in Times Square and a variety of transit and outdoor advertising in 11 other cities, all posing the question, “Did you know a third tower fell on 9/11?” Among the poll’s findings:

30-Second Video Shown to 1,194 Survey Respondents:

“The poll shows quite clearly what we already knew. Most people who see Building 7’s collapse have trouble believing that fires brought it down,” said Richard Gage, a member of the American Institute of Architects and founder of Architects & Engineers for 9/11 Truth, the campaign’s major sponsor. “It simply doesn’t look like a natural building collapse, and that’s because all the columns have been removed at once to allow it to come down symmetrically in free-fall. The evidence of controlled demolition is overwhelming. As more and more people learn about Building 7, public demand for a new investigation grows. People want the truth.” According to the National Institute of Standards and Technology (NIST), normal office fires caused the failure of a single column, starting a chain reaction that brought Building 7 down. More than 2,000 architects and engineers have signed the Architects & Engineers for 9/11 Truth petition that questions NIST’s explanation of the building’s collapse. “Even the government’s own computer model disproves its theory. It looks nothing like the actual collapse,” said Tony Szamboti, a mechanical engineer from the Philadelphia area. “Not only that, they refuse to release the data that would allow us to verify their model. In the world of science, this is as bad as it gets. I’m glad most people can look at the collapse and see the obvious.” The ReThink911 campaign calls for a new investigation into Building 7’s collapse, as well as the destruction of the Twin Towers. The YouGov poll and the ad campaign were financed with more than $225,000 in donations from thousands of supporters. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1194 adults. Fieldwork was undertaken between 27th – 29th August 2013. The survey was carried out online. The figures have been weighted and are representative of all US adults (aged 18+).

|

| Why PHYSICAL Gold and Silver Demand Have Surged Posted: 10 Sep 2013 10:00 PM PDT by Andy Hoffman, MilesFranklin.com:

|

| Miners’ Hedging back in the News Posted: 10 Sep 2013 09:20 PM PDT from Dan Norcini:

You might recall that I had recently written that I believed we were going to see the increased use of hedging among gold and silver miners in order to get themselves some downside price protection and to actually lock in some profits during a period in time of wildly unpredictable price swings in the precious metals. |

| Despite Pullback, Gold & Silver To See Spectacular Surges Posted: 10 Sep 2013 09:01 PM PDT  After some chaotic action in the gold, silver, oil and bond markets, today top Citi analyst Tom Fitzpatrick sent King World news 4 amazing gold, silver, and debt charts. Fitzpatrick had previously indicated to KWN that he expects a massive 150% surge in gold, and a staggering 300% move higher in silver. Below are his 4 astonishing charts & comments about what to expect next from the metals in this powerful interview. After some chaotic action in the gold, silver, oil and bond markets, today top Citi analyst Tom Fitzpatrick sent King World news 4 amazing gold, silver, and debt charts. Fitzpatrick had previously indicated to KWN that he expects a massive 150% surge in gold, and a staggering 300% move higher in silver. Below are his 4 astonishing charts & comments about what to expect next from the metals in this powerful interview.This posting includes an audio/video/photo media file: Download Now |

| The Polish Bail-In Changes Everything Posted: 10 Sep 2013 08:49 PM PDT by Jeff Nielson, Bullion Bulls Canada:

Case in point is the bail-in maneuver recently announced by the government of Poland, leading to the immediate question: when is a bail-in not a "bail-in"? The Polish government refused to characterize its taking control of financial assets as a bail-in when it defended this move. The Corporate Media (agents of the One Bank) refused to call it a bail-in in harshly criticizing the government's actions. |

| COMEX Deliverable Gold Bullion Continues to Slowly Bleed Out Posted: 10 Sep 2013 07:02 PM PDT |

| COMEX Deliverable Gold Bullion Continues to Slowly Bleed Out Posted: 10 Sep 2013 07:02 PM PDT |

| Posted: 10 Sep 2013 07:00 PM PDT gold.ie |

| Putin Wins Again As Obama Puts Attack On Hold Posted: 10 Sep 2013 06:27 PM PDT Starting just 1 minute late, the President gave a stirring apologetically conjured images of WWI and WWII and stuck to the line that "we know" Assad was responsible for killing his own people with Sarin. Then moved to fear-mongery over what Iran might do, adding that he was up for strikes. But, in giving Congress the hot potato he knew decision would be difficult. The US military does not do 'pin pricks' and a "targeted" strike will send a message to Assad. While recognizing the need for a diplomatic solution, Obama made it clear that those efforts would follow a military strike. But then, after all the angry banter, he then backed down and said, will work for peaceful solution by putting the strike on hold and will bring a resolution to UN. Ending on a more thoughtful note, he warned Republican and Democrat lawmakers to rethink their opposition to the strikes should they be needed.

Summation of President Obama's Speech *OBAMA SAYS SYRIA IN MIDST OF `BRUTAL CIVIL WAR'

Pre-Obama: S&P 1680.75, 10Y 2.9625%, JPY 100.25, Gold $1365.50, WTI $107.08 Initial reaction positive - risk-on... Post: S&P +2.5, 10Y +0.5bps, JPY +0.25, Gold -$5, WTI _$0.20 but quickly that is fading back to unch

Full transcript (via WaPo): My fellow Americans, tonight I want to talk to you about Syria, why it matters and where we go from here. Over the past two years, what began as a series of peaceful protests against the repressive regime of Bashar al-Assad has turned into a brutal civil war. Over a hundred thousand people have been killed. Millions have fled the country. In that time, America has worked with allies to provide humanitarian support, to help the moderate opposition and to shape a political settlement. But I have resisted calls for military action because we cannot resolve someone else's civil war through force, particularly after a decade of war in Iraq and Afghanistan. The situation profoundly changed, though, on August 21st, when Assad's government gassed to death over a thousand people, including hundreds of children. The images from this massacre are sickening, men, women, children lying in rows, killed by poison gas, others foaming at the mouth, gasping for breath, a father clutching his dead children, imploring them to get up and walk. On that terrible night, the world saw in gruesome detail the terrible nature of chemical weapons and why the overwhelming majority of humanity has declared them off limits, a crime against humanity and a violation of the laws of war. This was not always the case. In World War I, American GIs were among the many thousands killed by deadly gas in the trenches of Europe. In World War II, the Nazis used gas to inflict the horror of the Holocaust. Because these weapons can kill on a mass scale, with no distinction between soldier and infant, the civilized world has spent a century working to ban them. And in 1997, the United States Senate overwhelmingly approved an international agreement prohibiting the use of chemical weapons, now joined by 189 government that represent 98 percent of humanity. On August 21st, these basic rules were violated, along with our sense of common humanity. No one disputes that chemical weapons were used in Syria. The world saw thousands of videos, cellphone pictures and social media accounts from the attack. And humanitarian organizations told stories of hospitals packed with people who had symptoms of poison gas. Moreover, we know the Assad regime was responsible. In the days leading up to August 21st, we know that Assad's chemical weapons personnel prepared for an attack near an area they where they mix sarin gas. They distributed gas masks to their troops. Then they fired rockets from a regime-controlled area into 11 neighborhoods that the regime has been trying to wipe clear of opposition forces. Shortly after those rockets landed, the gas spread, and hospitals filled with the dying and the wounded. We know senior figures in Assad's military machine reviewed the results of the attack. And the regime increased their shelling of the same neighborhoods in the days that followed. We've also studied samples of blood and hair from people at the site that tested positive for sarin. When dictators commit atrocities, they depend upon the world to look the other day until those horrifying pictures fade from memory. But these things happened. The facts cannot be denied. The question now is what the United States of America and the international community is prepared to do about it, because what happened to those people, to those children, is not only a violation of international law, it's also a danger to our security. Let me explain why. If we fail to act, the Assad regime will see no reason to stop using chemical weapons. As the ban against these weapons erodes, other tyrants will have no reason to think twice about acquiring poison gas and using them. Over time our troops would again face the prospect of chemical warfare on the battlefield, and it could be easier for terrorist organizations to obtain these weapons and to use them to attack civilians. If fighting spills beyond Syria's borders, these weapons could threaten allies like Turkey, Jordan and Israel. And a failure to stand against the use of chemical weapons would weaken prohibitions against other weapons of mass destruction and embolden Assad's ally, Iran, which must decide whether to ignore international law by building a nuclear weapon or to take a more peaceful path. This is not a world we should accept. This is what's at stake. And that is why, after careful deliberation, I determined that it is in the national security interests of the United States to respond to the Assad regime's use of chemical weapons through a targeted military strike. The purpose of this strike would be to deter Assad from using chemical weapons, to degrade his regime's ability to use them and to make clear to the world that we will not tolerate their use. That's my judgment as commander in chief. But I'm also the president of the world's oldest constitutional democracy. So even though I possessed the authority to order military strikes, I believed it was right, in the absence of a direct or imminent threat to our security, to take this debate to Congress. I believe our democracy is stronger when the president acts with the support of Congress, and I believe that America acts more effectively abroad when we stand together. This is especially true after a decade that put more and more war-making power in the hands of the president, and more and more burdens on the shoulders of our troops, while sidelining the people's representatives from the critical decisions about when we use force. Now, I know that after the terrible toll of Iraq and Afghanistan, the idea of any military action, no matter how limited, is not going to be popular. After all, I've spent four and a half years working to end wars, not to start them. Our troops are out of Iraq, our troops are coming home from Afghanistan, and I know Americans want all of us in Washington, especially me, to concentrate on the task of building our nation here at home, putting people back to work, educating our kids, growing our middle class. It's no wonder, then, that you're asking hard questions. So let me answer some of the most important questions that I've heard from members of Congress and that I've read in letters that you've sent to me. First, many of you have asked: Won't this put us on a slippery slope to another war? One man wrote to me that we are still recovering from our involvement in Iraq. A veteran put it more bluntly: This nation is sick and tired of war. My answer is simple. I will not put American boots on the ground in Syria. I will not pursue an open-ended action like Iraq or Afghanistan. I will not pursue a prolonged air campaign like Libya or Kosovo. This would be a targeted strike to achieve a clear objective: deterring the use of chemical weapons and degrading Assad's capabilities. Others have asked whether it's worth acting if we don't take out Assad. As some members of Congress have said, there's no point in simply doing a pinprick strike in Syria. Let me make something clear: The United States military doesn't do pinpricks. Even a limited strike will send a message to Assad that no other nation can deliver. I don't think we should remove another dictator with force. We learned from Iraq that doing so makes us responsible for all that comes next. But a targeted strike can make Assad or any other dictator think twice before using chemical weapons. Other questions involve the dangers of retaliation. We don't dismiss any threats, but the Assad regime does not have the ability to seriously threaten our military. Any other -- any other retaliation they might seek is in line with threats that we face every day. Neither Assad nor his allies have any interest in escalation that would lead to his demise. And our ally Israel can defend itself with overwhelming force, as well as the unshakable support of the United States of America. Many of you have asked a broader question: Why should we get involved at all in a place that's so complicated and where, as one person wrote to me, those who come after Assad may be enemies of human rights? It's true that some of Assad's opponents are extremists. But al-Qaida will only draw strength in a more chaotic Syria if people there see the world doing nothing to prevent innocent civilians from being gassed to death. The majority of the Syrian people and the Syrian opposition we work with just want to live in peace, with dignity and freedom. And the day after any military action, we would redouble our efforts to achieve a political solution that strengthens those who reject the forces of tyranny and extremism. Finally, many of you have asked, why not leave this to other countries or seek solutions short of force? As several people wrote to me, we should not be the world's policemen. I agree. And I have a deeply held preference for peaceful solutions. Over the last two years, my administration has tried diplomacy and sanctions, warnings and negotiations, but chemical weapons were still used by the Assad regime. |

| Silver and Gold Prices Closed Lower at $22.97 and $1,364.00 Posted: 10 Sep 2013 05:32 PM PDT Gold Price Close Today : 1,364.00 Change : -22.70 or -1.64% Silver Price Close Today : 22.97 Change : -0.07 or -2.97% Gold Silver Ratio Today : 59.39 Change : 0.80 or 1.37% Franklin Sanders will be on vacation from the 6th through to 15th of September and will not be publishing any commentaries during this time. Daily gold and silver price closes will be published during this time. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Silver and Gold Prices Closed Lower at $22.97 and $1,364.00 Posted: 10 Sep 2013 05:32 PM PDT Gold Price Close Today : 1,364.00 Change : -22.70 or -1.64% Silver Price Close Today : 22.97 Change : -0.07 or -2.97% Gold Silver Ratio Today : 59.39 Change : 0.80 or 1.37% Franklin Sanders will be on vacation from the 6th through to 15th of September and will not be publishing any commentaries during this time. Daily gold and silver price closes will be published during this time. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Christian Garcia: U.S. Mint hedges silver purchases with HSBC and JPM Posted: 10 Sep 2013 05:29 PM PDT 8:16p ET Tuesday, September 10, 2013 Dear Friend of GATA and Gold: Christian Garcia of GoldSilver.com, who last year publicized the report from the South Carolina state treasurer's office that cited "artificial price suppression" in the gold and silver markets -- http://www.gata.org/node/11199 -- today discloses evidence that the U.S. Mint hedges its silver purchases with bullion banks HSBC and JPMorganChase, giving them valuable and tradeable inside information about metal demand and giving JPMorganChase cover for its assertions that its involvement in the monetary metals markets is entirely a matter of managing client accounts rather than the bank's own. Of course GATA long has taken JPMorganChase at its word in this, believing that the bank's primary client in the monetary metals markets indeed has been the U.S. government. Garcia presents his evidence, drawn largely from the U.S. Mint's own annual reports, in a video interview with GoldSilver.com proprietor Mike Maloney posted here -- http://goldsilver.com/video/silver-manipulation-hsbc-connection-to-us-mi... -- and at GoldSeek's companion site, SilverSeek, here: http://www.silverseek.com/article/silver-manipulation-hsbc-connection-us... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Obama Approval Rating Near Record Lows Posted: 10 Sep 2013 04:56 PM PDT With an hour until yet another "most important speech of his Presidency", we thought it useful to reflect on the nation's support. While we already know the nation's "representatives" were absolutely not behind him on the Syria vote, it appears the people themselves - poor lowly serfs though they are - are not approving in general. In fact, Obama's approval rating is practically at all-time lows - and consequently disapproval near all-time highs. Will a 'we-are-strong-but-diplomacy-won' speech help tonight? Or will Obama press the 'Strike' and risk a further collapse in his approval (with 63% of Americans against getting involved in Syria)?

The big question, of course, is - do the American people BFTD? or will all the Syria distractions be removed and we get back to NSA scandals? |

| West Now Engaging In Psychological Warfare As It Implodes Posted: 10 Sep 2013 04:52 PM PDT John Embry In the wake of the news regarding Syria, and the subsequent price action in gold, silver and major stock markets, today a man who has been involved in the financial markets for 50 years warned King World News that Western central planners are engaged in “psychological warfare” in key markets, and they now have the West headed “on a path to destruction.” This is another one of John Embry’s most powerful interviews ever as he takes KWN readers around the world on a trip down the rabbit hole once again. Embry: “The big news of the day is the fact they appear to have averted the Syrian war |

| Posted: 10 Sep 2013 04:49 PM PDT Follow ZeroHedge in Real-Time on FinancialJuice When we sit back and listen to France's President François Hollande banging out the reasons why the world needs to strike Syria and stop the al-Assad regime and we hear President Barack Obama of the USA trying to rally support from inside the country as to a possible missile attack on the already-war-torn country we might wonder why they are so dead set on it. There are many reasons that we could think of such as control of the region; ousting al-Assad would enable control of the country and the resources by the West, perhaps at a chance. But, that chance is pretty remote anyhow since the West prides itself on so-called democracy and how countries should have free elections and elected governments by the people for the people. Except the chances are that this will happen much later down the road. Before, there will only be greater strife and increased trouble for the Syrian people. The real reason might be more immediate. It certainly entails the need for war to increase the sale of arms and if there are two countries that are at the top of the list in terms of selling weapons in the world, it's France and the USA. So it's not going to shock anyone that they are pushing for gun-toting tank trails to bomb the hell out of Assad. France and USAFrance and the USA were very much isolated at the G20 summit in Russia over the past few days. But, today the EU has come around to agreeing that there was indeed a chemical-weapons attack on the Syrian people and that it was perpetrated by the Bachar-al-Assad regime. But, what is even more problematic in the story as it unfolds before our very eyes is that if there has been a chemical-weapons attack and if they are certain they all have the proof, then as a citizen of those countries shouldn't we been told in detail what that proof is and where and when and even how it managed to happen? The story is worse than the Septaper caper. It's coming, it's coming and it never gets here. But we hear about it all the time. The same goes for the Syrian debacle. Al-Assad used the chemical weapons that were forbidden, but we're waiting on the evidence, please. But it's probably not surprising after all that the EU has made a first step to backing Hollande and Obama. They announced in a joint statement from the G20 summit that they firstly agreed that there had been a chemical-weapons attack by al-Assad and that secondly they would wait for the UN report. But, it was underlined that a strike was possible. It's hardly a turn up for the books that will astound anyone in the world, when we look at how much those countries make from arms sales. Arms Sales in the World1. The USA exported $712, 265, 000-worth of weapons in 2009.

2. Russia sold arms to the value of $130, 350, 000 in 2009.

3. Germany is the biggest arms dealer in the EU however.

4. It's hardly surprising therefore that France is attempting to make sure that a strike goes ahead. It's one of the top sellers in arms in the world.

5. The UK is the 5th largest arms exporter today and rounds off the top 5 countries in the world, of which 4 are permanent members on the United Nations Security Council. The veto has a lot to answer for and brings with it the privilege that these countries have taken as their right.

They have all regularly played a dangerous game of selling arms and maintaining peace. Perhaps arms can maintain peace, but selling them to others, and sometimes arming the friend that turns into the foe in the end is not the card to play. It's a strange manner of providing the shovel to dig their own grave for these countries. They're the biggest arms dealers in the world; legalized dealing (and wheeling). But, selling arms is good business and so is war, despite what might be said. It's a grenade that someone has pulled the pin on and thrown into their own backyard. These countries are reaping the benefits of being the biggest arms dealers in the world and will continue to do so for many years to come. Why change a winning team? Those countries are not at the top economically for nothing. War means big business. Losses, certainly. But, the people will pay with their lives and the taxpayer will fund the wars. The benefits will be selling the arms to the other states, the rebels, the countries that are the enemies of Syria and al-Assad. The rewards outweigh the losses financially-speaking and a few lives here or there seem of little importance when the governments that run our countries have to weight up the pros and the cons of a strike. We hear that the strike will be with missiles, remote-located warfare with the promise of no troops on the ground and so no loss of life. War without loss of life? That's a new concept that has the merit of being invented. Reports show that it is developing nations that are the main focus of the top five countries that sell arms in the world today. But also the price of oil has resulted in cash-rich spending sprees for Middle Eastern oil-producing nations and the inability to curb weapon production and arms selling for the countries that consume that oil due to the same increase in prices and the financial crisis. Any money, it would seem, is good, whether it's clean or dirty greenbacks. Why have we been arming the country that is now the enemy of the world? If al-Assad did perpetrate the heinous crime of using chemical weapons on his people, then first of all there is a heinous crime in the texts that have outlawed that since it hierarchizes death and makes one way of dying more acceptable than another. It's ok to shoot you down, but not gas you up. But, surely both are contemptible. The second crime is that the West has been arming his regime to the hilt, so that he can fight back against any of the West with the weapons that have been produced here. We only have our governments to blame for that. But, the financial rewards were too great for them to stop doing that even when it was the most wanted man around. Selling weapons is the new Eldorado, the land where the sun never sets and the gold just keeps flowing into the pockets of the governments that deal.There's a neat little web site that enables you to track the sale of arms between sites that you can find. It details the mapping of arms data for small arms and ammunition in the world between 1992 and 2011. Septaper Will Open Floodgates | How Sinister is the State? | Food: Walking the Breadline | Obama NOT Worst President in reply to Obama: Worst President in US History? New Revelations: NSA and XKeyscore Program | Obama's Corporate Grand Bargain Death of the Dollar | Joseph Stiglitz was Right: Suicide | China Injects Cash in Bid to Improve Liquidity Technical Analysis: Bear Expanding Triangle | Bull Expanding Triangle | Bull Falling Wedge | Bear Rising Wedge | High & Tight Flag

|

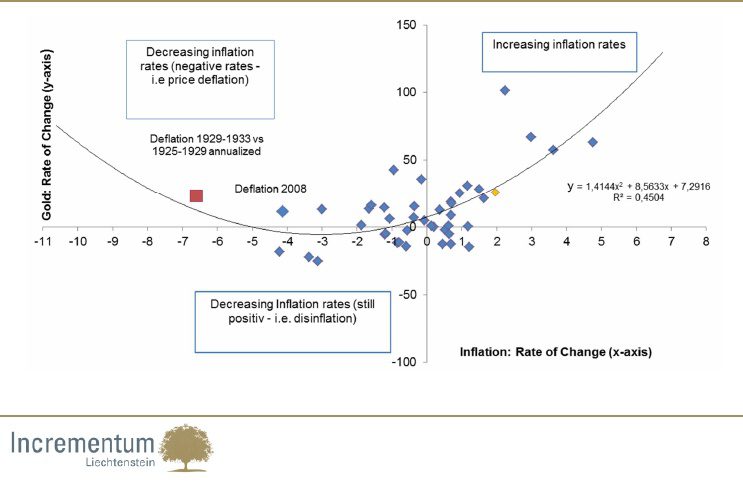

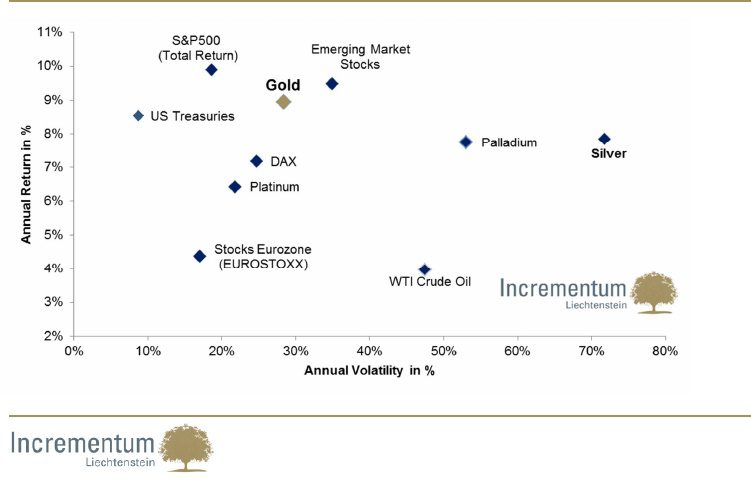

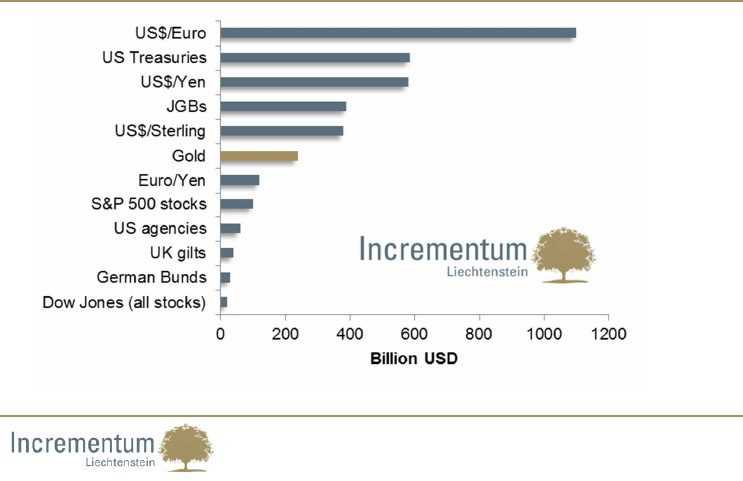

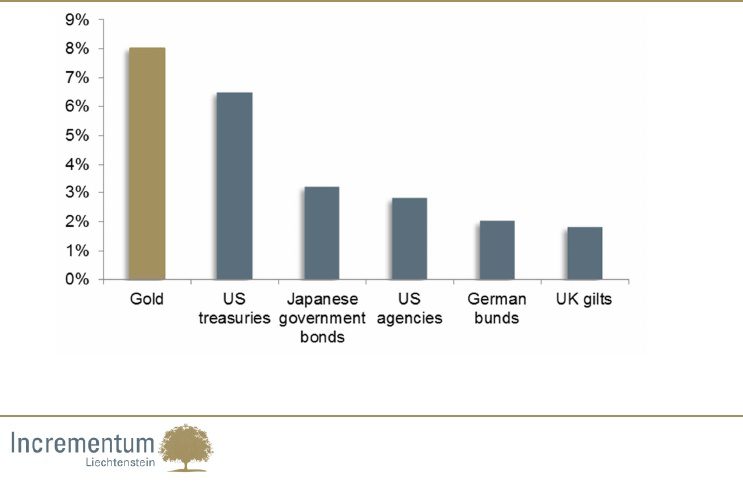

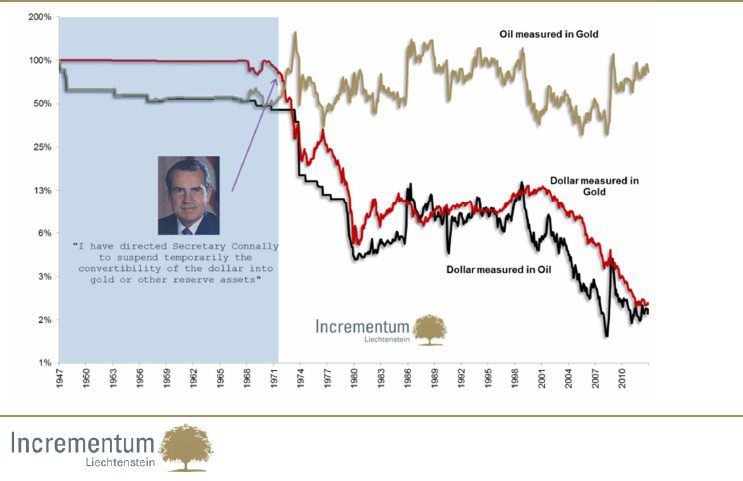

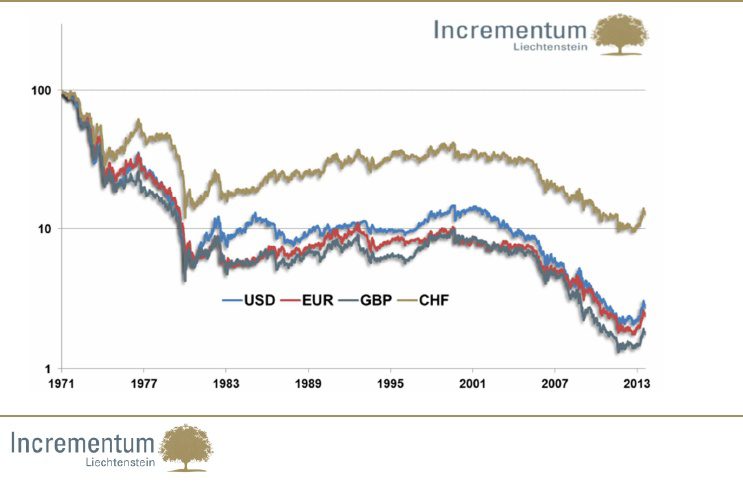

| Will gold protect you from inflation? Posted: 10 Sep 2013 04:47 PM PDT The Real Asset Co |

| The US Debt Ceiling Debate In The Light Of Monetary Fundamentals Posted: 10 Sep 2013 04:45 PM PDT By mid-October, the US will have reached its debt limit again. Most have lost count of the exact debt limit. Give or take a trillion, it is something close to 17 trillion US dollar. The following two quotes are from a recent Wall Street Journal article:

This story triggered some questions, which have been answered in the past on Gold Silver Worlds but make sense to review again. First, what are the risks associated with the increasing debt burden? Second, are the governments helping us [ordinary people] in providing protection? In other words, should we act before it is too late or believe that someone will take care for us? Third, how could this debt story end up? The basics: Money is backed by debt and created out of thin airIn order to answer the three aforementioned questions, it is wise to go back to the roots of today’s monetary system. The underlying question is: where does money come from in the first place? An answer to that question comes from Global Gold’s recent video How our monetary system works and fails. A short but valuable explanation comes from Positive Money who just released a video. In it, a ten year old child explains where money comes from and the problem associated with our money system (source):

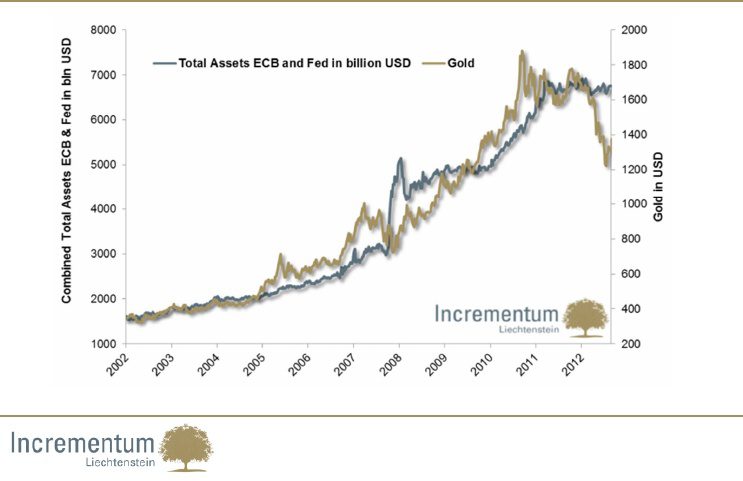

Moreover, as we all know in the meantime, the monetary base of Western economies has exploded since 2009. In an attempt to stimulate the economy by providing liquidity, central planners need increasing efforts to reach their goal. The following up-to-date chart shows the US central bank monetary base increase in blue and the money supply increase in red. Mind the pace to which the blue line must rise to keep the red line growing. Courtesy: St. Louis Fed.

As a sidenote, it seems unbelievable what the most powerful man on earth, when it comes to monetary matters, has to confess about the destination of the newly created money. Check it out in this video (listen for one minute). Boom and bust cycles are the underlying issueThe debt based monetary system we are living in, combined with the efforts of central planners to magically create wealth by increasing liquidity to the market, results in a misallocation of investments and economic resources. The following quote from Positive Money makes this point clear (source):

The essence of this monetary system is that it feeds a boom-bust cycle. Banks are the ones who CREATE money in our economy (hence increase the money supply) which they do by providing loans. The money associated with loans is almost entirely created out of thin air. The fundamental issue is that banks provide loans primarily to the public and not to productive businesses. Those “consumers” of the loans are able to spend more, and it goes on till a bubble is created which ultimately pops (think the real estate bubble, entirely created by foolish lending by banks). Then suddenly banks panic and stop lending which results in the contraction of the monetary supply. A recession is the result with rising unemployment and bankruptcies. All that can be avoided by a stable money supply and hence a stable economy. Boom bust cycles are the issue, not psychology of businesses. Central bank liquidity as the main driverThe power of central bankers goes beyond the power of politicians. In fact, they are the most powerful men on earth, especially the central bankers from the large economies (Mr. Bernanke, Mr. Draghi, Mr. Carney, Mr. Abe). By conjuring never seen amounts of (cheap) money they are perceived to have saved the economic system. The reality, however, is that they have postponed a fundamental issue to a later moment in time, making the issue bigger meantime. What none of these powerful men have talked about is the destructive consequences of their actions. In fact, they have ruined a lot of lives of innocent people. Savings do not yield anything anymore in real terms (a savings account is losing value), and some pension funds are cutting back the benefits of their retirees. One of those ordinary citizens in the UK testifies "I do not understand what Quantitative Easing is apart from printing money. What I do understand, however, is that I do hold 50% less as a result of that." (source) The central bankers have engineered a massive transfer of wealth from the old savers (who have no yields) to the young borrowers (who have cheaper debts). The Bank of England has admitted that Quantitative Easing has cost savers and pensioners in Britain 100 billion dollars so far. Mr. Mark Carney his answer basically points out that the unintended consequences of quantitative easing could indeed be painful, but the world would have been in a much worse shape WITHOUT quantitative easing. So we should still be happy! Listen to his answer in the video.

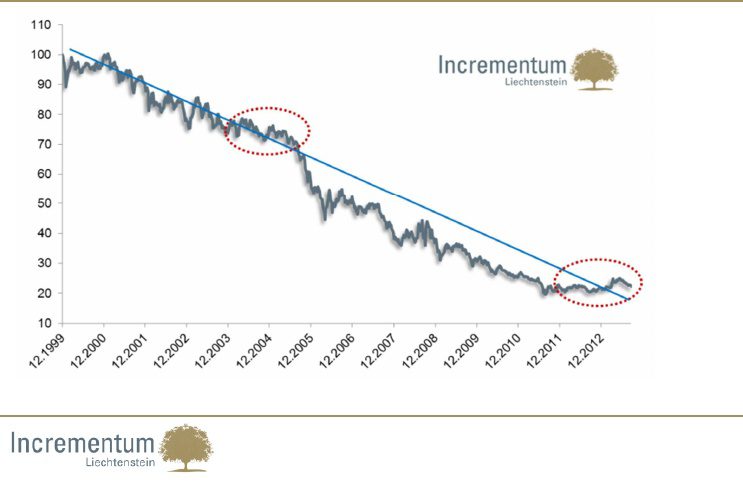

A nightmare scenario: our monetary system has reached its limitsWe are not into conspiracy nor do we like to talk about collapses. But, unfortunately, the facts and data all point to the real possibility of a nightmare scenario. That is centered around the idea that this debt based monetary system could be reaching its natural limits. Moreover, it is fed by the unprecedented monetary expansion which is showing signs of exhaustion in terms of its effectiveness. It is a fact, for instance, that every dollar of incremental debt is resulting in 0.08 dollars of economic output (GDP); the same dollar of debt yielded 4.61 dollars of economic output (GDP) in the fifties. Chart courtesy: Incrementum.

From a recent presentation by Darryl Schoon:

Gold, along with the other precious metals, is the only financial asset that is free of counterparty risk. If a nightmare type of scenario will occur, the metals in physical form will save your financial health (or wealth, for that matter). Are your prepared? Own physical precious metals outside the banking system! |

| Marc Faber: The Bond Market Would Like A High Level Of Tapering Posted: 10 Sep 2013 02:34 PM PDT Marc Faber explains in this interview the consequences of tapering and the potential motives of the US Fed. First, however, he expresses his concerns about the stock market. He compares the situation in Asia with the one in the US. The Asian markets were up some 20% between the beginning of the year and May but came down sharply since. On the other hand, the S&P500 reached its peak on August 2nd. Meantime many emerging markets are down 50% since their 2009 highs. Where would asset allocators put their money in: the S&P (which is in the sky) or the emerging markets (which are in the dumps)? If a decision is made to put money in equities, it would be in depressed markets. Marc Faber owns shares in countries like Malaysia, Singapore, Hong Kong, but he admits not being in the mood to increase those positions. In Thailand, among other countries, there is no growth at present time. There is a meaningful slowdown in many countries. Mr. Faber points to the fact that this stock bull market is 4 years old meantime. It started in March 2009. The global economy started slightly to recover in the summer of 2009 as well. Stocks are not the greatest bargain anymore. The treasury market is greatly oversold right now, so a bounce is possible. In case the US Fed would announce to taper off, let’s say from 85 to 65 billion USD per month, then the bond market would react strongest on this by rebounding. In such a case, rates would come down. Longer term, the bond market has to be concerned about the continuous asset purchases, which are basically monetization and, hence, symptoms of inflation would appear somewhere. All leaders have only interventions in their mind while the market has been proven to be a much better allocator of assets. When QE3 and QE4 had been implemented, the aim was to lower interest rates. The rates have been bottomed in July 2011 on 1.34% and are now standing at 3%. So the aim of the Fed has been totally missed. That’s why the bond market would like a high level of tapering. Although Mr. Faber has not been talking about gold in this particular interview, we know what a tapering decision would imply for the precious metals. We remind readers that next Wednesday and Thursday, an FOMC meeting with official press conference will take place. Expect a signficant volatility going forward, in all markets probably. |

| Pan American Silver repudiates recent hedging Posted: 10 Sep 2013 02:20 PM PDT Pan American Silver to Eliminate Silver and Gold Hedge Contracts Company Press Release http://finance.yahoo.com/news/pan-american-silver-eliminate-silver-12300... VANCOUVER, British Columbia -- Pan American Silver Corp. has decided to close out its outstanding silver and gold hedges. The company previously announced that it had entered into forward contracts for 5.3 million ounces of silver and 24,000 ounces of gold, at average prices of $20.43 per ounce of silver and $1,323 per ounce of gold, spread relatively equally over a period of 12 months. The amount of silver and gold under contract represented approximately 20% and 18% of the company's forecasted 12-month silver and gold production, respectively. Through accelerated physical metal delivery, and straight repurchase, Pan American now intends to close all of these forward contracts before the end of the current year. ... Dispatch continues below ... ADVERTISEMENT Precious Metals Round Table: On Tuesday, September 24, Sprott Asset Management will assemble four experts for a live Internet broadcast about the prospects for the precious metals. Participating will be Sprott's CEO, Eric Sprott; financial letter writer and internationally renowned conference speaker Marc Faber; Sprott's chief investment strategist, John Embry; and Sprott Asset Management President Rick Rule. To participate, please visit: https://event.on24.com/eventRegistration/EventLobbyServlet?target=regist... President and CEO Geoff Burns commented on the company's decision; "We decided to put the hedges in place as a short-term tactical response to reduce risk during a time of extreme price volatility. However, our action may have inadvertently sent the wrong message to the market and to our shareholders about our hedging philosophy and our view of the long-term prospects for silver and gold." Burns continued, "We have become more comfortable that we will realize the benefits of our cost-reduction initiatives and are considerably more optimistic about the short term prospects for both silver and gold, therefore negating the conditions that initially lead us to enter into the hedges. More importantly, we need to unequivocally reassure our shareholders that the company's fundamental philosophy is still that of not hedging our precious metal production, thereby providing maximum exposure to the price of silver." Pan American's vision is to be the world's pre-eminent silver producer, with a reputation for excellence in discovery, engineering, innovation, and sustainable development. The company has seven operating mines in Mexico, Peru, Argentina, and Bolivia. Pan American also owns several development projects in the United States, Mexico, Peru, and Argentina. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold Daily and Silver Weekly Charts - Antics Will Continue Until Confidence Returns Posted: 10 Sep 2013 01:20 PM PDT |

| Gold Daily and Silver Weekly Charts - Antics Will Continue Until Confidence Returns Posted: 10 Sep 2013 01:20 PM PDT |

| Posted: 10 Sep 2013 01:15 PM PDT 4:12p ET Tuesday, September 10, 2013 Dear Friend of GATA and Gold: In commentary headlined "A Leaky Fix," Sprott Asset Management market strategist David Franklin this week calls attention to evidence that the daily London gold "fixing" is leaking information that would be valuable to traders, signifying that the London fix may be manipulated as LIBOR and other market benchmarks. Franklin's commentary is headlined "A Leaky Fix" and it's posted at the Sprott Internet site here: http://www.sprottgroup.com/thoughts/articles/a-leaky-fix/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| Will Gold Follow Its Seasonal Pattern This Year? Posted: 10 Sep 2013 01:02 PM PDT I often talk about how the gold trade is really two separate trades. There's the Fear Trade that buys gold out of fear of war or poor government policies. This crowd sees the precious metal as a safe haven during times of crisis ... Read More... |

| WORLD WAR 3 - Obama IS WORSE THAN GEORGE Bush Posted: 10 Sep 2013 12:27 PM PDT From Wall Street, gold price and US finance to conspiracies, latest global news, Alex Jones, Gerald Celente, David Icke Illuminati, a potential World War 3, Elite government cover - ups and much... [[ This is a content summary only. Visit http://FinanceArmageddon.blogspot.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Despite Psychological War, Western Paper Scheme To Collapse Posted: 10 Sep 2013 12:26 PM PDT  With all sorts of fireworks going off in key global markets, today one of the legends in the business spoke with King World News about the ongoing war in the gold and silver markets, and the fact that the Western paper scheme is now set to collapse. Keith Barron, who consults with major companies around the world and is responsible for one of the largest gold discoveries in the last quarter century, also spoke about the psychological war that is going on in key markets. Below is what Barron had to say in his powerful interview. With all sorts of fireworks going off in key global markets, today one of the legends in the business spoke with King World News about the ongoing war in the gold and silver markets, and the fact that the Western paper scheme is now set to collapse. Keith Barron, who consults with major companies around the world and is responsible for one of the largest gold discoveries in the last quarter century, also spoke about the psychological war that is going on in key markets. Below is what Barron had to say in his powerful interview.This posting includes an audio/video/photo media file: Download Now |

| Posted: 10 Sep 2013 12:25 PM PDT What this meeting of supply & demand mean for gold prices long term... CEO of Jefferson Financial, Brien Lundin is publisher of the highly regarded Gold Newsletter, and host of the annual New Orleans Investment Conference, the oldest and most respected event of its kind. Now, with the global rally for gold prices underway since late June, Brien Lundin speaks here with The Gold Report about hunting out undervalued mining companies in safe North American jurisdictions... The Gold Report: Brien, judging from the tone of the September 2013 issue of Gold Newsletter, you have renewed excitement for precious metals equities. Why? Brien Lundin: You're absolutely right, and it's all based on the metals markets. In a typical year, the precious metals markets bottom out at the end of July to early August, when physical demand from Asia abates, before kicking back up in late August and September. This year, gold bottomed out in a final downward thrust at the end of June and then started building back up. At the same time, a lot of anecdotal evidence began to reveal an extremely tight supply situation in the global gold market. Taking all of that together, I was fairly confident in calling a bottom for gold prices. Then, the equities started to respond. However, the situation in Syria prompted some safe-haven demand in the last few days and the mining equities stepped back; with safe-haven demand, investors want the metal, not the paper. But that was just a brief blip. I see an open road ahead for gold metal and gold equities. TGR: Gold is moving higher, but without much of an explanation. What is your take on the situation? Brien Lundin: The market has had some strong performance, jumping $15, $25, even $35 in a day. I think those spikes are a result of the extremely tight demand situation in the gold market. In the spring, Western speculators and some of the big holders of SPDR Gold Trust (GLD), the gold exchange-traded fund (ETF), abandoned the market in anticipation of the imminent end of quantitative easing (QE). We also had some manipulation, notably on April 12 and April 15, in a blatant attempt to force the market through sell stops, thus benefiting from short positions. As a result of these speculative selloffs, the market was dramatically oversold. But this rapid price decline sparked tremendous bargain hunting in Asia. Asian demand more than overcame the selling by Western speculators. The supplies of gold in the Comex warehouses dropped to record low levels. We saw gold being transferred from vaults in the West to the East, causing the rare occurrence of a negative Gold Forward Offered (GOFO) rate – the interest rate difference between gold holdings and LIBOR. That has happened only twice in this bull market, at the beginning of the major bull trend around 2000, and in 2008. Both times it marked a major turnaround in the metal. There is a lot of evidence that this unprecedented supply situation was behind the sharp, brief upward spikes in the gold price. As you add up these sharp spikes, gold was gradually and then more rapidly coming off that bottom in late June. There are number of players in the East who want gold and are willing to pay higher prices. There also is a shortage of gold in the West. From a fundamental supply-demand standpoint, we still have some room to go in this oversold rebound. TGR: Could you expand on why you believe China will soon be "driving the bus" for the global gold market? Brien Lundin: The Shanghai Gold Exchange (SGE), putatively a futures exchange, is actually a physical delivery mechanism for the Chinese market. Most of the gold traded on the SGE is actually delivered to end-users. As of the end of June, SGE reported nearly 1,100 tons of gold have been traded so far this year. That equates to all of the metal that had been traded on the SGE in 2012, which itself was a record year. Put another way, at this rate of consumption, demand on the SGE this year will equal the entire newly mined global output projected for 2013. In effect, all of the new gold supply in the world is being consumed by a single exchange in a single nation. China will soon exceed India as the largest source of gold demand in the world. There are demographic factors behind this: a deep cultural affinity for gold, a growing population and a rapidly growing middle class. The per-capita use for gold in China is still relatively low but has a lot of upside. As incomes grow in China, gold demand will grow on a per-capita basis even as the population grows. The potential for growth in the demand for gold is almost exponential. TGR: Who in China is buying gold? Brien Lundin: The assumption is that the People's Bank of China is buying gold to build up the nation's gold reserves. China also has become the world's largest gold producer, yet none of the gold it produces ever gets exported. There is tremendous upside potential in central bank buying of gold in China, in that China holds a huge amount of US Dollars in its foreign currency reserves. If it were to increase its gold reserves to the average level of most developed nations, it would quickly absorb all of the available metal in the global gold market. TGR: Would the gold price be on an even stronger upward trajectory if India hadn't taken measures to curb gold buying? Brien Lundin: Yes, Indian demand would have been much stronger if its central bank hadn't increased the tariff in phases to 10%. Just as importantly, it imposed an 80/20 rule, which requires that 20% of all of the gold imported into India must be subsequently exported as finished goods. Those rules, imposed without explanation of how to follow them, effectively shut down Indian gold imports from the end of July through the end of August. TGR: You recently wrote "Gold has bottomed. The market is set up for a large sharp rally when and if a short covering stampede is sparked." What could those sparks be? Brien Lundin: One appears to be the situation in Syria, although we don't know how that will develop. A more important and fundamental driver for a short-covering rally would be the flow of economic data in the US, where economic growth had been showing signs recently of slowing. That slowdown, if it were confirmed, would eliminate any justification for tapering off the Federal Reserve's QE program. A growing consensus that QE will be here for a while will be the driver that gets the shorts to abandon their bearish gold positions. TGR: How does all this translate to gold equities? Brien Lundin: The majors had a fairly good rebound and were outperforming gold until the Syria situation erupted. That touched off broader equity market selloffs, and the gold stocks were victimized. Interest is just starting to filter down to the junior resource stocks. I'm not as negative on that subsector as some of my compatriots. Greed is the most powerful motivator in the investment markets, and greed will draw investors to the juniors like iron filings to a magnet if we see a sustained upward trend in gold and silver. TGR: What do patterns in the market trends tell you? Brien Lundin: This year the gold market has experienced a number of head fakes, where we thought we had a bottom, then it dropped to a lower plateau, then dropped again. I think the June 28 bottom will hold. The fundamental evidence argues for an extremely tight situation in the gold market, which will keep the prices from dropping to an even lower plateau. A lot of evidence, from stochastics to moving averages, is delivering very strong buy signals. There is anecdotal technical evidence like the negative GOFO rate and backwardation in the near-term futures. All this added together points to higher gold prices and a more sustained rally. Yet, in the broader market, sentiment is still not very positive for gold. We're still climbing a wall of worry in regard to sentiment, yet, for those willing to look, an increasing amount of evidence is pointing toward higher prices. This is really the perfect situation. TGR: How does silver fit into what's happening with gold? Brien Lundin: Silver is leveraged to gold. It follows the moves of gold, but it exaggerates those moves both upward and downward. With gold rising, silver is outperforming gold – a sign of a healthy bull market. In turn, silver equities are a way for investors to leverage the moves in silver. Investors get a double-play action by investing in silver equities. TGR: What is the importance of safe jurisdictions? Brien Lundin: Safer jurisdiction is an important point. In this market, there are so many undervalued companies out there that there is no reason to take on sovereign risk if you don't have to. As we start this rebound, it's important to look for undervalued juniors that have proven resources or are in production. You can get them at bargain level prices, and they will be the first to respond. TGR: What about Mexico? Brien Lundin: Mexico is a great mining region. Geophysical anomalies mark every big discovery along the Guerrero Gold Belt. A number of multimillion-ounce discoveries line up along that belt like pearls on a string. TGR: Tell us what people can expect at the New Orleans Investment Conference this November. Brien Lundin: We have a tremendous lineup, highlighted by Dr. Ron Paul, the iconic leader of the libertarian movement in the US. Charles Krauthammer, one of the smartest guys in geopolitical analysis out there today, and Peter Schiff, one of the smartest guys in the investment business, will be there. Other big names include Dr. Marc Faber and Dr. Benjamin Carson. Dennis Gartman, who has made some very accurate calls on the commodities markets, and Dr. Martin Weiss, a leading authority on the bond market and rating financial institutions, are scheduled. And, of course, we have dozens of today's top experts in every investment area. TGR: Do you have any parting thoughts on the gold and equities space? Brien Lundin: Over the past 12 or 13 years we've seen a shift to a secular megatrend in the metals and commodities markets. There have been some tremendous profit opportunities along the way, including periods when junior resource stocks multiplied in value very rapidly. We've also seen some severe setbacks. Right now, we're seeing an analogue to previous periods where, with courage and cash, investors could reap tremendous gains as the metals rebound. All the evidence is pointing toward a new rally in the metals. It's time finally for investors to get back into the market. TGR: Brien, it's always a pleasure to talk with you. |

| Posted: 10 Sep 2013 12:25 PM PDT What this meeting of supply & demand mean for gold prices long term... CEO of Jefferson Financial, Brien Lundin is publisher of the highly regarded Gold Newsletter, and host of the annual New Orleans Investment Conference, the oldest and most respected event of its kind. Now, with the global rally for gold prices underway since late June, Brien Lundin speaks here with The Gold Report about hunting out undervalued mining companies in safe North American jurisdictions... The Gold Report: Brien, judging from the tone of the September 2013 issue of Gold Newsletter, you have renewed excitement for precious metals equities. Why? Brien Lundin: You're absolutely right, and it's all based on the metals markets. In a typical year, the precious metals markets bottom out at the end of July to early August, when physical demand from Asia abates, before kicking back up in late August and September. This year, gold bottomed out in a final downward thrust at the end of June and then started building back up. At the same time, a lot of anecdotal evidence began to reveal an extremely tight supply situation in the global gold market. Taking all of that together, I was fairly confident in calling a bottom for gold prices. Then, the equities started to respond. However, the situation in Syria prompted some safe-haven demand in the last few days and the mining equities stepped back; with safe-haven demand, investors want the metal, not the paper. But that was just a brief blip. I see an open road ahead for gold metal and gold equities. TGR: Gold is moving higher, but without much of an explanation. What is your take on the situation? Brien Lundin: The market has had some strong performance, jumping $15, $25, even $35 in a day. I think those spikes are a result of the extremely tight demand situation in the gold market. In the spring, Western speculators and some of the big holders of SPDR Gold Trust (GLD), the gold exchange-traded fund (ETF), abandoned the market in anticipation of the imminent end of quantitative easing (QE). We also had some manipulation, notably on April 12 and April 15, in a blatant attempt to force the market through sell stops, thus benefiting from short positions. As a result of these speculative selloffs, the market was dramatically oversold. But this rapid price decline sparked tremendous bargain hunting in Asia. Asian demand more than overcame the selling by Western speculators. The supplies of gold in the Comex warehouses dropped to record low levels. We saw gold being transferred from vaults in the West to the East, causing the rare occurrence of a negative Gold Forward Offered (GOFO) rate – the interest rate difference between gold holdings and LIBOR. That has happened only twice in this bull market, at the beginning of the major bull trend around 2000, and in 2008. Both times it marked a major turnaround in the metal. There is a lot of evidence that this unprecedented supply situation was behind the sharp, brief upward spikes in the gold price. As you add up these sharp spikes, gold was gradually and then more rapidly coming off that bottom in late June. There are number of players in the East who want gold and are willing to pay higher prices. There also is a shortage of gold in the West. From a fundamental supply-demand standpoint, we still have some room to go in this oversold rebound. TGR: Could you expand on why you believe China will soon be "driving the bus" for the global gold market? Brien Lundin: The Shanghai Gold Exchange (SGE), putatively a futures exchange, is actually a physical delivery mechanism for the Chinese market. Most of the gold traded on the SGE is actually delivered to end-users. As of the end of June, SGE reported nearly 1,100 tons of gold have been traded so far this year. That equates to all of the metal that had been traded on the SGE in 2012, which itself was a record year. Put another way, at this rate of consumption, demand on the SGE this year will equal the entire newly mined global output projected for 2013. In effect, all of the new gold supply in the world is being consumed by a single exchange in a single nation. China will soon exceed India as the largest source of gold demand in the world. There are demographic factors behind this: a deep cultural affinity for gold, a growing population and a rapidly growing middle class. The per-capita use for gold in China is still relatively low but has a lot of upside. As incomes grow in China, gold demand will grow on a per-capita basis even as the population grows. The potential for growth in the demand for gold is almost exponential. TGR: Who in China is buying gold? Brien Lundin: The assumption is that the People's Bank of China is buying gold to build up the nation's gold reserves. China also has become the world's largest gold producer, yet none of the gold it produces ever gets exported. There is tremendous upside potential in central bank buying of gold in China, in that China holds a huge amount of US Dollars in its foreign currency reserves. If it were to increase its gold reserves to the average level of most developed nations, it would quickly absorb all of the available metal in the global gold market. TGR: Would the gold price be on an even stronger upward trajectory if India hadn't taken measures to curb gold buying? Brien Lundin: Yes, Indian demand would have been much stronger if its central bank hadn't increased the tariff in phases to 10%. Just as importantly, it imposed an 80/20 rule, which requires that 20% of all of the gold imported into India must be subsequently exported as finished goods. Those rules, imposed without explanation of how to follow them, effectively shut down Indian gold imports from the end of July through the end of August. TGR: You recently wrote "Gold has bottomed. The market is set up for a large sharp rally when and if a short covering stampede is sparked." What could those sparks be? Brien Lundin: One appears to be the situation in Syria, although we don't know how that will develop. A more important and fundamental driver for a short-covering rally would be the flow of economic data in the US, where economic growth had been showing signs recently of slowing. That slowdown, if it were confirmed, would eliminate any justification for tapering off the Federal Reserve's QE program. A growing consensus that QE will be here for a while will be the driver that gets the shorts to abandon their bearish gold positions. TGR: How does all this translate to gold equities? Brien Lundin: The majors had a fairly good rebound and were outperforming gold until the Syria situation erupted. That touched off broader equity market selloffs, and the gold stocks were victimized. Interest is just starting to filter down to the junior resource stocks. I'm not as negative on that subsector as some of my compatriots. Greed is the most powerful motivator in the investment markets, and greed will draw investors to the juniors like iron filings to a magnet if we see a sustained upward trend in gold and silver. TGR: What do patterns in the market trends tell you? Brien Lundin: This year the gold market has experienced a number of head fakes, where we thought we had a bottom, then it dropped to a lower plateau, then dropped again. I think the June 28 bottom will hold. The fundamental evidence argues for an extremely tight situation in the gold market, which will keep the prices from dropping to an even lower plateau. A lot of evidence, from stochastics to moving averages, is delivering very strong buy signals. There is anecdotal technical evidence like the negative GOFO rate and backwardation in the near-term futures. All this added together points to higher gold prices and a more sustained rally. Yet, in the broader market, sentiment is still not very positive for gold. We're still climbing a wall of worry in regard to sentiment, yet, for those willing to look, an increasing amount of evidence is pointing toward higher prices. This is really the perfect situation. TGR: How does silver fit into what's happening with gold? Brien Lundin: Silver is leveraged to gold. It follows the moves of gold, but it exaggerates those moves both upward and downward. With gold rising, silver is outperforming gold – a sign of a healthy bull market. In turn, silver equities are a way for investors to leverage the moves in silver. Investors get a double-play action by investing in silver equities. TGR: What is the importance of safe jurisdictions? Brien Lundin: Safer jurisdiction is an important point. In this market, there are so many undervalued companies out there that there is no reason to take on sovereign risk if you don't have to. As we start this rebound, it's important to look for undervalued juniors that have proven resources or are in production. You can get them at bargain level prices, and they will be the first to respond. TGR: What about Mexico? Brien Lundin: Mexico is a great mining region. Geophysical anomalies mark every big discovery along the Guerrero Gold Belt. A number of multimillion-ounce discoveries line up along that belt like pearls on a string. TGR: Tell us what people can expect at the New Orleans Investment Conference this November. Brien Lundin: We have a tremendous lineup, highlighted by Dr. Ron Paul, the iconic leader of the libertarian movement in the US. Charles Krauthammer, one of the smartest guys in geopolitical analysis out there today, and Peter Schiff, one of the smartest guys in the investment business, will be there. Other big names include Dr. Marc Faber and Dr. Benjamin Carson. Dennis Gartman, who has made some very accurate calls on the commodities markets, and Dr. Martin Weiss, a leading authority on the bond market and rating financial institutions, are scheduled. And, of course, we have dozens of today's top experts in every investment area. TGR: Do you have any parting thoughts on the gold and equities space? Brien Lundin: Over the past 12 or 13 years we've seen a shift to a secular megatrend in the metals and commodities markets. There have been some tremendous profit opportunities along the way, including periods when junior resource stocks multiplied in value very rapidly. We've also seen some severe setbacks. Right now, we're seeing an analogue to previous periods where, with courage and cash, investors could reap tremendous gains as the metals rebound. All the evidence is pointing toward a new rally in the metals. It's time finally for investors to get back into the market. TGR: Brien, it's always a pleasure to talk with you. |

| Gold Elliott Wave Technical Analysis Posted: 10 Sep 2013 12:05 PM PDT Last analysis expected upwards movement, which would have been confirmed with a trend channel breach on the hourly chart. Price has moved sideways, and remains firmly within the channel. Read More... |

| Negative Sentiment Fuels Gold Bull Posted: 10 Sep 2013 12:01 PM PDT Graceland Update |

| West wages 'psychological war' on gold, Embry tells King World News Posted: 10 Sep 2013 11:24 AM PDT 2:20p ET Tuesday, September 10, 2013 Dear Friend of GATA and Gold: Sprott Asset Management's John Embry today tells King World News about the "psychological warfare" being waged by Western governments and central banks against monetary metals prices. He makes a point he and other GATA supporters have often made: that war and the threat of war, like the threat of war in Syria now, actually send the gold price down because they prompt even more intervention by central banks. Indeed, if the Northern Hemisphere was destroyed in a nuclear war, the U.S. Exchange Stabilization Fund would sell enough futures contracts in Johannesburg, Sydney, and Rio de Janeiro to knock the gold price down by 25 percent; CPM Group's Jeff Christian would attribute the crash to new hedging by mining companies expecting further declines in price, even though the war had brought mine production to an end in the Northern Hemisphere; and what remained of the mainstream financial news media would quote Christian without putting a critical question to him or to any central bank. (Actual journalism is never attempted in regard to gold.) Embry notes that these central bank manipulations will fail eventually. The question is whether they will fail in the lifetimes of market analysts who purport to enjoy price suppression so they can acquire more discounted metal or in the lifetimes of their children, grandchildren, or greatgrandchildren. Of course GATA is doing what it can to hasten the day and thereby achieve free and transparent markets and limited and accountable government. That may take a while longer, so in the meantime an excerpt from Embry's interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/9/10_We... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Posted: 10 Sep 2013 11:21 AM PDT September 10, 2013

S&P Dow Jones Indexes are shaking up the composition of the Dow Jones Industrial Average. As of Monday, Sept. 23, Alcoa, Bank of America and Hewlett-Packard will be gone. Taking their places will be Goldman Sachs, Visa and Nike. “Who needs aluminum or electronics (or on a good day, merchant banking) in a modern economy, right?” Byron laments. “Especially when you have manufacturing powerhouses like Goldman and Visa, which print fake paper by the truckload. And of course, Nike, with its fancy basketball shoes.”

Come Sept. 23, seven of the Dow’s 30 components will be new arrivals within the last six years. Two of those slots have turned over twice during that span. This time, however, is the first three-for-three swap to take place in one fell swoop since April 8, 2004. The new arrivals then were Verizon, Pfizer and… AIG. Ruh-roh…