saveyourassetsfirst3 |

- SA gold companies plan to lock out employees - Solidarity

- US Mint begins 2013 P Fort McHenry Five Ounce Silver Uncirculated coin sale

- Taper Or No Taper – Either Decision Is Bullish For Gold

- Gold Price in India: Gold Erased Its 9-month Losses. What’s Next?

- Top market tracker Hulbert: What to expect from stocks this September

- Legendary investor Jim Rogers: Gold and commodities are about to soar

- "Dr. Doom" Marc Faber: The gold crash is over

- Gold price Syria factor already waning

- Gold market in for a wonderful Fall – Embry

- Endeavour Silver: Investors Need To See Better Cost Controls To Support The Company Valuation

- Is Silver Overbought?

- All-Time High for Rupee-Priced Gold

- Gold & Silver Drop as "Syrian Strike Delayed", Indian Sales Flood Jewelers

- The Implosion Has Begun, But Not Yet!

- Paul Mylchreest: Gold Collateral: Could the Post-Lehman Reflation be Reaching its Limits?

- Petropavlovsk takes $600m of impairment charges

- Tanzania pledges to end child labour in gold mines

- Silver Price Forecast: Massive Debt Levels Will Push Silver To $150 And Beyond

- The Chinese and Russians Know Exactly What We’re Doing!

- First Signs of Hyperinflation Have Arrived!

- Gold Erased Its 9-month Losses. What’s Next?

- Caption Contest Thursday!

- Smuggling continues to rise on hike in Gold import duty in India

- The Primary Trend For Gold And Silver Is UP!

- Follow the beta plays with junior silver miners

- Precious metals & miners flash short-sell signal

- 72 Types Of Americans That Are Considered “Potential Terrorists” In Official Government Documents

- Gold & silver drop as Syrian strike delayed, Indian sales flood jewelers

- Carney inspires gold investment

- All-Time High for Rupee-Priced Gold

- Precious Metals & Miners Flash Short-Sell Signal

- Another Chance Coming to Buy Mining Stocks

- Citigroup sees gold at $3,500/oz; silver jumping to $100/oz

- Another Chance Coming to Buy Gold and Silver Stocks

- Citigroup Sees Gold at $3,500/oz; Silver Jumping to $100/oz

- The “Squeeze” Is Coming

- Gold consolidates as Syria military strike weighed

- Citigroup Sees Gold at $3,500/oz; Silver Jumping to $100/oz

- Citigroup Sees Gold at $3,500/oz; Silver Jumping to $100/oz

- Keiser Report: Sinkhole of Stupid

- End Of Summer Blowout Sale!! Industry Low Prices On Silver Eagles, Maples, Philharmonics, and Buffalos!!

- Cartel Attacks Mining Shares Again to Contain Gold & Silver Ahead of Likely Imminent Assault on Syria

- Indians saving in Rupees lose nearly 30% in 2013 – Indians saving in gold are UP 7% in 2013

- India Gold Price at An All-Time High

- Currency Spikes at 4 p.m. in London Provide Rigging Clues

- Financial Times: "World Is Doomed To An Endless Cycle Of Bubble, Financial Crisis And Currency Collapse"

- Three King World News Blogs

- Jim Rogers Warns Syria War And "Market Panic" To Send Gold "Much, Much Higher"

- Gold Nears Bull-Market Territory as Syrian Tensions Spur Demand

- South Africa's mining firms make final wage offer to gold workers

| SA gold companies plan to lock out employees - Solidarity Posted: 29 Aug 2013 03:23 PM PDT Companies plan to lock out employees after labour groups refused to accept a revised pay offer, says Solidarity union. |

| US Mint begins 2013 P Fort McHenry Five Ounce Silver Uncirculated coin sale Posted: 29 Aug 2013 03:05 PM PDT The US Mint has already released the bullion version of the coin, which does not have a mint mark and features a brilliant finish. Sales for the bullion version have reached 10,200 units so far. |

| Taper Or No Taper – Either Decision Is Bullish For Gold Posted: 29 Aug 2013 01:15 PM PDT In what has become one of the most absurd rituals on Wall Street – and is really a sign of just how broken our system is – the entire financial media and all the Wall Street “Einsteins” are debating whether or not the Fed will begin to slow down its money printing when it announces [...] The post Taper Or No Taper – Either Decision Is Bullish For Gold appeared first on Silver Doctors. |

| Gold Price in India: Gold Erased Its 9-month Losses. What’s Next? Posted: 29 Aug 2013 01:09 PM PDT SunshineProfits |

| Top market tracker Hulbert: What to expect from stocks this September Posted: 29 Aug 2013 01:02 PM PDT From The Reformed Broker: Mark Hulbert makes a nuanced point in his MarketWatch column about the historical behavior of stocks during the month of September. On the one hand, he finds that this is really and truly the cruelest month... Let me first review the impressive statistics behind September's terrible reputation.

Since the Dow was created in 1896, it has lost an average of 1.09% during September. The average return during all other months, in contrast, has been a gain of 0.75% — a spread of 1.84 percentage points between September and all other months' average. That's huge, from a statistical point of view.

Not only that, September's dismal performance has been remarkably consistent.

Consider what I found when I focused on all decades since the late 1800s... More on the market: |

| Legendary investor Jim Rogers: Gold and commodities are about to soar Posted: 29 Aug 2013 01:02 PM PDT From Zero Hedge: Astute investor Jim Rogers has warned overnight in an interview with Tara Joseph of Reuters, that oil and gold will go "much, much higher" due to "market panic" regarding Syria and the coming "end of free money": Jim Rogers: Well, Tara, I own oil, I own gold, I own things like that and if there is going to be a war, and it sounds like America is desperate to have a war, they're gonna go much, much higher.

Stocks are gonna go down, some of the markets that I'm sure are already going down, commodities are gonna go up. I mean, yeah, some of the things I own all make a lot of money.

It's, I'm not particularly keen on war, I assure you, but it sounds like they want it.

Tara Joseph: Is your main concern about supply chain disruptions for oil? Is that where we'll see the biggest moves?

Jim Rogers: Well, that's where we'll see huge moves but the problem with war, Tara, is... More from Jim Rogers: |

| "Dr. Doom" Marc Faber: The gold crash is over Posted: 29 Aug 2013 01:02 PM PDT From Hard Assets Investor: Swiss-born and educated Marc Faber's distinct voice is a common sound on CNBC and Bloomberg TV when it comes to big-picture forecasting in investments. Publisher of the “Gloom, Boom & Doom Report,” Faber's views on the markets are highly regarded. HAI Managing Editor Sumit Roy caught up with Faber at his Hong Kong residence and spoke to him about debt, gold and stocks. HardAssetsInvestor: What are your views on the stock market? Marc Faber: Following the huge increase in stock prices we had since March 2009, when the S&P was at 666, a 20 percent correction would not surprise me at all. I don't look at the 20 percent correction as a huge decline in stock prices. In Asia, we've had corrections in the order of 20 percent in many markets. We had a huge decline in bond prices in the U.S. In July 2012, yields on the 10-year bond were at 1.43 percent; we're now close to 2.9 percent. Yields have doubled. The longs have been hit quite hard... More from Marc Faber: |

| Gold price Syria factor already waning Posted: 29 Aug 2013 12:40 PM PDT "You will note that the fall of the gold price today was greater in the dollar than in the euro," says Julian Phillips. |

| Gold market in for a wonderful Fall – Embry Posted: 29 Aug 2013 12:33 PM PDT After a quiet summer for the gold market, prices are in for a much better run of things in Autumn, says John Embry. |

| Endeavour Silver: Investors Need To See Better Cost Controls To Support The Company Valuation Posted: 29 Aug 2013 11:44 AM PDT Executive Summary Endeavour Silver's (EXK) Q2FY13 quarter left a lot to be desired from investors from a true all-in costs basis, with their costs rising from previous quarters even after the major decline in precious metals prices. Liquidity remains sufficient and production numbers were pretty good, but investors should expect much more from management in terms of lowering costs of production. Management does forecast production cost decreases in H2 and that is what investors will need to see in Q3FY13. Unfortunately, precious metals mining companies have a bad track record at significantly cutting costs and that is what EXK will have to do in Q3 to justify the current share price at the current silver price. We think there is a lot of risk built into EXK shares and believe investors should look to other silver miners (or silver ETF's) until management can prove to investors that they can lower |

| Posted: 29 Aug 2013 11:39 AM PDT Silver prices ran into resistance levels, and prices will be tested after the US released stronger than expected economic data. Prices of the precious metal have climbed nearly 24% in August, as weaker economic data and fear over a military strike in Syria have boosted the demand for silver. Hedge funds have decreased short positions according to the most recent report released by the CFTC. Better than expected economic data released on Thursday created a mixed picture for precious metals traders as yield moved higher making the dollar more attractive. A stronger dollar is generally a negative for silver prices, as the metal is viewed by many as a currency against the greenback. According to the US Commerce Department Gross domestic product increased at a 2.5 percent annualized rate, compared to an initial estimate of 1.7 percent. Economists had forecast a 2.2 percent gain in GDP. The gain came in corporate profits as well as exports. The GDP price deflator remained relatively tame reflecting a modest inflation environment. In employment news, which is the gauge that is used by the Fed to determine interest rates, Jobless claims declined by 6K in the week ended Aug. 24 to 331,000 from a revised 337,000 according to the Labor Department. Analysts' had predicted a decline to 332,000. Next week investors will need to absorb the BLS's non-farm payroll report which is scheduled to release on Friday September 6, 2013. According to the latest commitment of traders report, released for the week ending August 20, 2013 hedge fund traders reduced short positions by nearly 5,600 contracts.

Silver prices are now at an inflection point that could be critical to the future direction of the precious metal. Prices ran into resistance near the 24.80 region which coincides with the highs seen in April of 2013. Support on silver is seen near the 10-day moving average near 23.65. A close below the 10-day moving average would likely lead to a test of the mid-August lows near 22.50. If prices are able to recapture the 25 per ounce level, the next likely test of resistance would be 28 per ounce. Momentum on silver prices remains strong, with the moving average convergence divergence index (MACD) printing in positive territory with an upward trajectory. This means that the differential between the 12-day moving average and the 26-day moving average is accelerating away from the 9-day moving average of the differential (as the chart from Alpari.com shows). As silver prices ran into resistance, the RSI (relative strength index) printed above the 70 overbought trigger level. The RSI also ran into resistance and has created a double top while continuing to print in overbought territory. This should be a warning signal to traders, and although prices can print in overbought territory for a while, the yellow light is flashing. This is a guest post by Marcus Hollander. |

| All-Time High for Rupee-Priced Gold Posted: 29 Aug 2013 11:37 AM PDT Miles Franklin |

| Gold & Silver Drop as "Syrian Strike Delayed", Indian Sales Flood Jewelers Posted: 29 Aug 2013 11:37 AM PDT Bullion Vault |

| The Implosion Has Begun, But Not Yet! Posted: 29 Aug 2013 11:35 AM PDT World War 3 does not kick off tomorrow… but by October all bets are off! From V, SteveQuayle.com: One of the cardinal rules of banking states that during a currency crisis good money leaves and there is a rush for specie or hard assets. I will tell you right now that the first victim of [...] The post The Implosion Has Begun, But Not Yet! appeared first on Silver Doctors. |

| Paul Mylchreest: Gold Collateral: Could the Post-Lehman Reflation be Reaching its Limits? Posted: 29 Aug 2013 11:30 AM PDT The greatly under-reported repo market sits at the centre of the banking system and the securities markets. It is a primary source of leverage and, therefore, risk. Time after time, the risks remain hidden until events cascade beyond the point of no return. Stability in the repo market depends on confidence in repo-counterparties (which can [...] The post Paul Mylchreest: Gold Collateral: Could the Post-Lehman Reflation be Reaching its Limits? appeared first on Silver Doctors. |

| Petropavlovsk takes $600m of impairment charges Posted: 29 Aug 2013 11:20 AM PDT The company is the hardest-hit by write-offs among Russian gold producers after its rival Polymetal took an impairment of $305 million. |

| Tanzania pledges to end child labour in gold mines Posted: 29 Aug 2013 11:06 AM PDT Human Rights Watch says children as young as 8 years old are working in small-scale gold mines in Tanzania. |

| Silver Price Forecast: Massive Debt Levels Will Push Silver To $150 And Beyond Posted: 29 Aug 2013 09:52 AM PDT Silver Price Forecast: The massive debt bubble created by our monetary system is about to burst. The demonetization of gold and silver, has over the years diverted value from these metals, to all paper assets (such as bonds) linked to the debt-based monetary system. The process of the devaluation of gold and silver, started by […] |

| The Chinese and Russians Know Exactly What We’re Doing! Posted: 29 Aug 2013 09:15 AM PDT In the Miles Franklin Newsletter's new format, my focus is on "big picture" commentary on the economic world; and specifically, the factors driving what are still the EARLY STAGES of an historical Precious Metal bull market. I promise I'll drive this piece home with a poignant "punch line," albeit through a circuitous route featuring the "nuts and bolts" analysis I have become associated with. After all, I cut my "blogosphere teeth" for more than five years on GATA's Le Metropole Café; in the process, en route to becoming a global expert on government-orchestrated Precious Metals manipulation. In fact, I was already set to discuss the "big picture" issue serving as this article's namesake when we were treated to today's "Cartel special," as described. Anyone watching PMs as long as I know the Cartel's top "KEY ATTACK EVENTS" are unquestionably geopolitical crises – as we are witnessing in Syria today. In other words, such events are deemed not allowed to catalyze safe haven PM buying – lest TPTB's "reality mask" be exposed for what it is. Never mind what I wrote yesterday; i.e., there are MANY other factors contributing to the PM rally – as the fact remains that MSM commentary will focus solely on Syria to "justify" the recent gold and silver surges. Fortunately, the MSM's grip on PROPAGANDA is rapidly loosening – per this morning's news that CNBC's ratings have fallen to 20-year lows, to levels last seen just before it went on air. However, the fact remains that the clueless, dumbed-down masses still look to such drivel for the "reasons" PMs are moving higher; particularly given the enigmatic trading patterns the Cartel has created over a decade of 24/7 manipulation. For the past two days, we have seen violations of what I long ago deemed "Cartel Rule #1"; i.e., thou shalt not allow PMs to surge whilst the Dow plunges. Moreover, yesterday was a COMEX options expiration day; and rarely in my eleven years of PM watching have prices risen into such events. Remember, the more contracts that expire in the money, the more likely buyers are to take delivery of the scant, plunging PHYSICAL inventories; per this shocking chart of "registered" COMEX gold inventory, depicting what is setting up for an imminent DEFAULT…

FYI, it is not the actual Expiration day that matters so much (yesterday), but the First Delivery day three days later (i.e., Friday). Often, the Cartel loses the "battle for expiration day" (in which only a handful of measly PAPER profits are at stake); but presses harder later in the week before in-the-money option holders pull the trigger on delivery requests; as essentially, they have this entire three-day period to decide. This is why the Cartel desperately capped gold at the ROUND NUMBER of $1,420/oz. yesterday – not to mention, shellacking the HUI by 5% to signal "raptor" traders of an impending PM attack today. However, the Cartel's best laid plans went awry last night; as following yesterday's MASSIVE 3% gain, oil prices exploded higher last night; whilst the Rupee plunged an astonishing 3.5%, the Middle Eastern war drums beat louder, and expectations of Fed "tapering" rapidly shifted towards the "winds of more QE." Thus, just ten minutes before today's NYSE open – when prospects for a RECORD third straight violation of "Cartel Rule #1" were highest; the Cartel attacked PAPER gold and silver with such a blatant act of manipulation, even "Tyler Durden" wrote of it. Off topic, does anyone recall me attacking Zero Hedge mercilessly a year or two back for ignoring gold manipulation; which amazingly, they have not only done a 180-degree turn on; but in some ways, are starting to sound like "Andy Hoffman" himself…

Actually, Zero Hedge missed an even more momentous piece of news that emerged as the COMEX PAPER slam was occurring; as it appears the ill-fated South African gold mining union negotiations are on the verge of collapse. Given how far apart the two sides are, we may well see a major, long-term strike in one of the world's largest gold-producing regions. You know the type of news that causes one to rapidly sell PHYSICAL metal (facetious)…

…like the $10/oz. collapse in PAPER gold in just two minutes time…

…or better yet, the whopping $0.70/oz., or 3%, silver WATERFALL DECLINE that occurred at – what do you know – EXACTLY the VERY, VERY KEY ROUND NUMBER of $25/oz. And oh yeah, notice what happened when silver first breached $25/oz. in the night's wee hours; yep, you guessed it – a visit from its old nemesis, "THE 2:15 AM"…

Finally, to the point of this diatribe, as gold continues to fight today's "war for $1,420/oz."; i.e., the ENTIRE WORLD now understands what the Cartel – that is, the U.S. government – is doing! Russian President Putin's top economic advisor, Andrey Bykov, practically said so following GATA's 2005 Yukon Conference. Lo and behold, he participated in GATA's 2011 London Conference as well; and since then, the Russians have been MASSIVE gold buyers. Aside from the Russians, only the Chinese are bigger gold importers; at least officially, as most of the gold entering India today is smuggled. The Chinese have been manically acquiring gold for the past five years; but particularly since the summer of 2011 – i.e., when the expanding U.S. debt crisis came into full view. Since then, the U.S. national debt has risen by nearly $3 TRILLION (no, that is not a typo); with the official "debt ceiling" about to be raised to INFINITY, prompting interest rates to rise amidst historically weak economic activity. Not un-coincidentally, Chinese gold imports have gone parabolic…

We "shadow worlders" have long assumed the Chinese are aware of Western gold price suppression (how could they not be?); but now we finally have PROOF – via the below interview with a Chinese government official, in which he spells out the multi-decade, Federal Reserve and Bundesbank led schemes to mask the dollar's and Euro's "shortcomings" with secretive PAPER ploys like gold leasing. Forgive the poor English translation, and simply focus on key phrases like "In the 1990s, we saw the introduction of the gold leasing business, to effectively combat the price of gold"; as TRUST ME, he is describing the whole, sordid affair no differently than I, Bill Murphy, or "ADMIRAL SPROTT"… Chinese State Press on how the Fed has been Manipulating the Price of Gold for Decades My point is simply thus. If the world's largest gold buyers are aware of what I have been writing of for years, you can be sure they know every trick in the Cartel's book. Such "subsidy" of their PHYSICAL purchases is the reason the East is rapidly overtaking the West in terms of economic and political power; and why, when the END GAME of dollar, Euro, pound, and Yen collapse commences, the East that will wind up owning the gold; and thus, dominating a new monetary order featuring gold-backed Yuan and Rubles. Thus, not only will the West suffer the HYPERINFLATION that accompanies currency collapse, but play serf to the Eastern feudal lords. It is your choice if you want to be enslaved by the East – or West; and by continuing to hold dying "scrip" like dollars and Euros, you are GUARANTEEING such an outcome. Thus, I plead that you exchange them for REAL MONEY while you still can; as one day soon, the shrinking "window of opportunity" to purchase PHYSICAL gold and silver – to boot, at heavily subsidized prices – will PERMANENTLY close.Similar Posts: |

| First Signs of Hyperinflation Have Arrived! Posted: 29 Aug 2013 09:10 AM PDT The first signs of hyperinflation have arrived. There was one hugely notable development in the gold and silver markets last week. Normally anytime, Ben Bernanke whispered even a hint or suggestion of QE tapering, the gold and silver markets would crash on such an announcement. However, this time, gold price behavior reacted intelligently to the [...] The post First Signs of Hyperinflation Have Arrived! appeared first on Silver Doctors. |

| Gold Erased Its 9-month Losses. What’s Next? Posted: 29 Aug 2013 09:02 AM PDT SunshineProfits |

| Posted: 29 Aug 2013 09:00 AM PDT The post Caption Contest Thursday! appeared first on Silver Doctors. |

| Smuggling continues to rise on hike in Gold import duty in India Posted: 29 Aug 2013 08:34 AM PDT Imports have come to a standstill following hike in import duty while festival and wedding season demand is likely to push up demand for imported gold in the coming few months, analysts said. |

| The Primary Trend For Gold And Silver Is UP! Posted: 29 Aug 2013 08:30 AM PDT Let's talk about the realities of the precious metals market. Are they controlled by the Fed and the Bullion Bank Cartel? Before I get into today's topic, I want to call your attention to a phone solicitation Susan received from a representative of "The Children's Cancer Fund." With a name like that, who wouldn't be tempted to write a check? But as always the case, Susan asked the telemarketer, "How much of my $50 donation goes to the cancer fund?" The lady answered, "five dollars." Susan asked her, "Aren't you embarrassed?" The lady said thank you and hung up. This is not uncommon. Everywhere we turn, someone is out to scam the public. The moral fiber of our country has disappeared. Bankers steal. Charities are a fraud. Politicians lie and cheat. The Church is reeling from child molestation scandals. Welfare fraud is rampant. Professional athletes look for an edge with banned substances. And who can forget Jerry Sandusky at Ohio State? In the scheme of things, the lying cheating manipulating bullion banks are acting no different than the overall environment that we are a part of. Getting back to the Children's Cancer Fund solicitation, I would hope that all of you ask the same question that Susan asked the next time you get a call like this. And one of the best of the scams is the calls from your local police department or highway patrol. Like the rest, usually no more than 5% or 10% actually goes to the stated charity or organization. When you get one of these calls, tell them to shove it! Lest you think I am being overly moral here, Susan spent six months working many hours a day for the Breast Cancer Fund, in our complex in Aventura. She raised many tens of thousands of dollars – and every single nickel went to the charity! Today I read an article that asked the question, "What kind of Commander-in-Chief publicly announces in advance details and targets of his proposed strike?" Furthermore, the potential for "unintended consequences" is huge. Frankly, we do not belong there! If our Administration is so concerned with human rights violations, why not focus on Africa? Because relatively speaking, there is no oil there. Yesterday, Zero Hedge posted an article titled 7 Countries In 5 Years below: General Wesley Clark: Wars Were Planned – Seven Countries In Five Years Below is another excellent article on a US strike against Syria, from Zero Hedge:

Based on the pullback in gold and silver, and the rise in the dollar and the drop in oil on Wednesday evening, the markets are betting that the US will not attack Syria – at least not now. So much for Obama's Red Line! It used to be that I voted for the lesser of two evils. But what happens when either choice isn't worth a darn? For the last 12 years, we have been ensnared in one unnecessary war after another. Who benefits? The oil industry. The military industrial complex. The banks that lend money to fight the wars. The politicians, either party, that gain votes by fighting for the American Way. But the rest of us; well we get nothing but body bags and more debt. We are hated throughout the Middle East. Is it any wonder why? The truth is that we don't even have a choice. If we did, there would be very few incumbents left in office and a third party President would be in the White House. But even then, I wonder if things would be better? Let's talk about the realities of the precious metals market. Are they controlled by the Fed and the Bullion Bank Cartel or are they just a reflection of trading for a profit by the hedge funds? The answer is YES, they are – both of them! There is absolutely no reasonable doubt that the Fed and their cronies at the bullion banks, led by JPMorgan, hold down the price of gold and silver. They do it to support the dollar and hide the inevitable inflation that is always the result of rampant money creation (QE). As for the hedge funds, and the trading departments of the bullion banks, they make a lot of money trading gold and silver. They don't differentiate gold and silver from any other commodity. They are just "things" to trade for a profit. As long as the CFTC sits on the sidelines, they have a free reign to do as they please. All one has to do is look at JPMorgan's huge 25%+ position in gold and silver. In any other commodity (copper, oil, etc.) a 5% concentration would be deemed illegal. In order to maximize profits, the hedge funds and bullion banks need volatility, and that is exactly what we are getting now in gold and silver. Have you noticed that the moves down are usually much larger than the moves up? It is as if the bullion banks pull the bids on the way down. They love to see the prices fall, so they can come back in and buy all over again at a lower price. The Chinese, Indians and Russians sit on the sidelines and say thank you for being able to buy the physical metals at the lower price. The way back up is slower; but always remember – no one, not the Fed, not the hedge funds and not the bullion banks, no one can divert the primary trend. The primary trend for gold and silver is UP! Prices can be managed for a while, but sooner or later, the primary trend will take over. The manipulation to the downside is strictly in paper and it takes place on the Comex. But the lower the prices go, the greater the demand for physical gold and silver becomes, so they have to pull back and let prices rise all over again. Expect more volatility and an uptrend in gold and silver from now on. Let's examine a few charts that look encouraging for gold and silver and give you a peek at where the trend is headed. Here are the 6-month charts for silver and gold. Both metals are a bit "overbought," but I like the look of the trends. Whatever happens in the short to medium term is not overly relevant, as the long-term trend is up, way up.

Here is another chart, a point and figure chart from Richard Russell. Again, the primary trend now is UP. Russell said:

Similar Posts: |

| Follow the beta plays with junior silver miners Posted: 29 Aug 2013 08:16 AM PDT PureFunds has a simple strategy: Be first in the market with innovative exchange-traded funds. Andrew Chanin, PureFunds' co-founder and COO, describes the firm's ISE Junior Silver ETF and the factors that make a "leveraged play to the actual spot price of the metal." |

| Precious metals & miners flash short-sell signal Posted: 29 Aug 2013 08:07 AM PDT It has been a bumpy ride for precious metal investors over the past couple of years and unfortunately I do not think it's over. The good news is that the bottom has likely been put in for gold, silver and gold miners BUT the recent rally in these metals and... |

| 72 Types Of Americans That Are Considered “Potential Terrorists” In Official Government Documents Posted: 29 Aug 2013 08:00 AM PDT We are moving into a very dangerous time in American history. You can now be considered a "potential terrorist" just because of your religious or political beliefs. Free speech is becoming a thing of the past, and we are rapidly becoming an Orwellian society that is the exact opposite of what our founding fathers intended. [...] The post 72 Types Of Americans That Are Considered "Potential Terrorists" In Official Government Documents appeared first on Silver Doctors. |

| Gold & silver drop as Syrian strike delayed, Indian sales flood jewelers Posted: 29 Aug 2013 07:44 AM PDT For Indian households outside the major bullion centers, the gold price has now fallen below main-market prices, reports the Times of India, lagging Mumbai's futures contracts by as much as 1,000 Rupees per 10 grams – more than 3%. |

| Carney inspires gold investment Posted: 29 Aug 2013 07:38 AM PDT In the last month or so I have noticed a pick-up in the amount of Canadians signing up to buy gold bullion or invest in physical silver. It makes you wonder what kind of state Mark Carney has left the economy in, especially as he's now over here charming the... |

| All-Time High for Rupee-Priced Gold Posted: 29 Aug 2013 07:30 AM PDT Bill Holter wrote today of the upcoming squeeze; not in the PHYSICAL PM markets – although that's coming, too, as sure as night follows day – but worldwide consumers, care of the recent surge in oil prices and interest rates. We're all aware that the impact of higher oil prices is GLOBAL in nature, but so are U.S. Treasury yields; by far, the most important rate-setting instruments on the planet. Yesterday was the year's lowest volume day in the U.S. equity markets; as Syria or not, we are amidst the most popular holiday week on the American calendar. This is why the PPT was successful in pushing the Dow up while oil continued its moonshot and interest rates rocketed higher – with the all-important ten-year yield surging back to 2.79%. Think about it; the year's lowest equity volume day, a terrible "pending home sales" number, surging oil prices and inevitable Middle Eastern WAR – and still the Fed was soundly beaten in its "QE" efforts. Just wait until the WORLD returns from vacation next week; not to mention, the September 5th G-20 meeting – when the fate of the dollar itself will likely be discussed. Back to Syria, I'm reminded of what I wrote last March in "AN ODE TO W." I was on my feet screaming at the television – ask my wife – when Bush II announced the Iraqi invasion; as I didn't just think, but knew it would turn out to be a seminal, nation-killing event in American history. However, those were the "good old days" compared to what I foresee of the upcoming Syrian invasion; as I truly believe it may catalyze a 21st century version of World War II. Not just Russia, but China itself and even Iran are vowing to back Syria; whilst traditional U.S. lackeys England and France are towing Obama's coattails, as Israel lurks in the shadows – looking for any excuse to enter the conflict. NATO says last week's alleged "chemical attack" needs to be investigated before actions can be taken, but last night Obama claimed he was "convinced" Assad is responsible; and thus, MUST be punished. How sad that people "hoped" for "change" when he burst onto the national scene in 2007; you know when he made this quote at a campaign interview…

And finally, my Indian friend informed me this morning that gold is trading at the equivalent of $1,650/oz. (35,000 Rs/10 grams) – following last night's Reserve Bank of India intervention in the Rupee/dollar market. Essentially, this is an ALL-TIME HIGH for Rupee-priced gold, as citizens panic to get whatever they can find – in most cases via illegal smuggling. And yet, in perhaps the dumbest MSM article of all-time, Forbes.com claims "Gold hits all-time high against Rupee, curbing demand, say analysts." It's times like this when I simply throw my hands up in the air screaming, 'how stupid is the human race?'Similar Posts: |

| Precious Metals & Miners Flash Short-Sell Signal Posted: 29 Aug 2013 07:16 AM PDT It has been a bumpy ride for precious metal investors over the past couple of years and it unfortunately I do not think its over just yet. The good news is that the bottom has likely been put in for gold, silver and gold miners BUT the recent rally in these metals and miner looks to be coming to an end. While we could see another pop in price over the next week or so the price, volume and momentum see to be stalling out. What does this mean? It means we should expect short term weakness and lower prices over the next month or two. Below are three charts I posted several months ago on my free stockcharts list. These forecast were based off simple technical analysis using cycles, Fibonacci and price patterns. As you can see we are not trading at my key pivot level which I expect selling pressure to start to increase and eventually overpower the buyers sending the prices lower.

Gold Trading Weekly Chart:Here you can see that gold is technically in a bear market when viewing it on the weekly chart. If you were to pull up a daily chart you would likely notice how the price of gold is trading at a key resistance level on the chart and has reached its full flag measured move. What does this mean? It means the odds are pointing to lower prices for gold in the next few weeks. Keep in mind though I do feel as though a major bottom has been put in place for the precious metals sector. So buyers are likely to step back in around the $1300 area.

Silver Trading Weekly Chart:Silver has a little bit different looking chart but the same analysis applies here as it did in gold.

Gold Miners Trading Monthly Chart:Gold miners may have bottomed on this monthly investing timeframe chart but the daily chart which you will see next clearly shows short term weakness has started.

Gold Miners Trading Daily Chart:This daily chart really shows my thinking for miners and the overall precious metals sector as a whole. The recent weakness in gold miners to the down side point to distribution of shares. This is very negative for the price of physical gold and silver as gold mining stocks tend to lead physical metals. The yellow box shows a possible major stage 1 basing pattern forming. If this is the case, then we will have a great opportunity in the coming months when the precious metals down trend completes a reversal and start heading higher.

How to Trade Precious Metals & Gold Miners Conclusion:In short, I think that staying in cash or shorting metals is the play for the next couple weeks. After that anything can happen and until price breaks down or finally completes the basing pattern and confirms a market bottom I would be very cautious trading here. In the last week members of my trading newsletter took profits on our short SP500 trade and we closed a long trade in natural gas for a quick 6.5% gain. Join our community of traders and have your money on the right side of the market! Chris Vermeulen |

| Another Chance Coming to Buy Mining Stocks Posted: 29 Aug 2013 07:14 AM PDT Last week we wrote: "Technically, the gold stocks continue to follow a typical post-bottom rebound path and look very strong. The daily RSI of GDX is at a 10-month high as GDX consolidates around $30. We'd love to see GDX consolidate for a few weeks but it may break above $31 within days." On Monday and Tuesday GDX traded up to $31 but failed to close above it. Tuesday we saw a nasty bearish reversal which confirms that GDX over the very short-term will correct and consolidate its gains. This is good news as it will alleviate the overbought condition and put the market in position to launch a sustainable breakout around the end of September. In the chart below we plot GDX (large miners), ZJG (Canadian mid-tiers) and SIL (silver stocks). In previous writings we've noted the importance of the 50-day moving average in the formation of bottoms. We've said that the test of a rising 50-day moving average confirms the bottom and provides a buying opportunity. As of a few days ago, precious metals shares were trading well above their 50-dma's. Many stocks were up 50% from the August low in only ten trading days. Thus, it only makes sense that these markets digest those gains and test support.

GDX closed Wednesday at $28.30 while its 50-dma is at $26.19 and rising. ZJG closed at $9.09. Support is at $8.50 and ZJG's 50-dma is at $7.91 and rising sharply. ZIL closed at $15.46 and has support at $14. Its 50-dma is at $13.19 and rising sharply. The HUI (essentially a GDX with less holdings) remains well in-line with our projected recovery. The projection is the amalgamation of four recoveries (1970, 1976, 2000, 2008) starting from the current bottom. The HUI is in blue while the projection is in red.

Below is a chart of the four recoveries (1970, 1976, 2000, 2008) along with the current recovery (in black). Again, the current rebound is well in-line with history.

The bottom line is the current correction or consolidation is quite healthy for the sector. Many stocks have made huge runs in a very short period of time and are set to digest those gains and correct short-term overbought conditions. Be patient over the coming days and weeks and use the 50-dma as a guide for support and potential lows. Further weakness in the coming days and weeks could be the last chance to get in at low prices before this sector moves quite a bit higher. Our work leads us to believe there is a high probability of big gains in the fall. If you'd be interested in our analysis on the companies poised to lead this new bull market, we invite you to learn more about our service. Good Luck!

Jordan Roy-Byrne, CMT |

| Citigroup sees gold at $3,500/oz; silver jumping to $100/oz Posted: 29 Aug 2013 07:12 AM PDT Gold and silver should surge in the coming years as the precious metals continue to benefit from the easy monetary policies adopted by central banks. |

| Another Chance Coming to Buy Gold and Silver Stocks Posted: 29 Aug 2013 07:05 AM PDT The Daily Gold |

| Citigroup Sees Gold at $3,500/oz; Silver Jumping to $100/oz Posted: 29 Aug 2013 07:02 AM PDT gold.ie |

| Posted: 29 Aug 2013 06:30 AM PDT The world is about to if not already feeling a “squeeze.” I bet by reading the title you thought this would be about gold and silver squeezing the shorts? This is certainly happening now with the good part yet to come when it turns out that the metal does not even exist to be delivered but…No, the “squeeze” that I am talking about is just everyday life and what is already happening now and what will happen if Syria goes live and the U.S. faces off with Russia and China. For better than 2 months now interest rates have been moving higher…very quickly. This is not just a U.S. phenomenon, on balance. Interest rates have gone up everywhere. We also watched the price of oil break through $100 to the upside amidst decent supply and demand that was surely not even close to off the charts. Now it has breached $110 on the upside based on the fears of a Syrian conflict. Both of these, higher interest rates and higher oil prices will hit the common man harder than anything except maybe food prices. Going one step further, we also have watched for the last 60 days as gold went higher versus all of the major currencies …even as the major currencies trounced the emerging currencies. The Brazilian Real, Indian Rupee, South African Rand, Indonesian Rupiah and others have outright cratered in purchasing power over (and from before) this last 60 days. (As a side note, in terms of the emerging currencies, gold and silver have had rallies of up to and over 30% in just the last 90 days, will this maybe add more to their physical demand?). So the “squeeze” is already on and has been in the emerging economies, now as interest rates and oil go higher, the squeeze will intensify…and spread to those of us in the “leading economies.” …Then you have to wonder what a Syrian conflict would mean. Will it push prices higher? I have heard forecasts of $125 per barrel spoken of…even $150 per barrel. What if these numbers are wrong? Let’s look at a couple of scenarios. Let’s assume that that interest rates and oil stay right where they are now, how “good” was the global economy 3 months ago with $90 oil and 10 yr. Treasuries at 1.6%? Should the economy be getting better or worse with the current and higher interest rates and oil price? What if interest rates and oil went even higher from here? …To say, 4% and $125-$150 per barrel? I will tell you that the “growth numbers” we were fed up until 2 months ago were bogus in the first place because inflation was certainly higher than what the “official” numbers were. Using correct inflation numbers to lower the “nominal” growth rates to the “real” growth rate would have turned real growth negative. In other words, we were ALREADY in a global recession. Higher interest rates and higher oil from here will only deepen the recession and turn it into a full blown DEPRESSION! I mentioned the other day that if the Syrian conflict is not just a 3 day fly by where we drop some bombs and go home, rather a conflict with Russia …that China could control our fate without sending one soldier nor 1 piece of hardware. I received quite a bit of feedback on this that overwhelmingly said “China would never dump Treasuries because it would not be in their self-interests.” Really? Why do you think rates have already spiked? Because Mom and Pop sold their bonds? Or Hedge funds? No, sovereigns far and wide sold…are including China. China has the ability with the stroke of a pen or push of a button to outright destroy our Treasury market. But…but…but the Federal Reserve would buy all of these bonds and hold interest rates down. Um, maybe, maybe not but if this were the case then how many dollars would it take to purchase a pound of coffee, barrel of oil or…an ounce of gold. The dollar would outright crash as hard as or harder than the emerging currencies are right now. Of course China will act in their best interests and of course they don’t want to shoot themselves in the foot…but. Would they maybe show their displeasure with us by selling “just a little” as a shot across the bow? Or, they may even think “he who sells first, sells best” in the case of a bankruptcy which the United States most assuredly is. Another wild card (and another discussion) which we will get to see very quickly is whether or not a decision has already been made by the G-20 with regards to abandoning the dollar for settlement of trade. If this decision has been made, China as will everyone else become and even bigger seller of Treasuries which will put more pressure on either interest rates, the value of the dollar or both. Higher interest rates, higher inflation and higher oil…which one of these won’t affect you negatively? In any case, Syrian conflict or no, interest rates and oil have already risen here in the U.S. $5+ per gallon of gasoline and 5% mortgage rates will bite into our standard of living hard no matter how sugar coated or outright lied about the “official” economic numbers are that are reported. If you think that the last 5 years have felt like a “squeeze,” get ready to tighten your belts some more because even without a disastrous World War our standard of living is about shrink!Similar Posts: |

| Gold consolidates as Syria military strike weighed Posted: 29 Aug 2013 06:20 AM PDT Gold futures prices consolidated mid-week, after testing resistance on Monday and Tuesday. Fears associated with tensions in Syria have pushed the yellow metal back above the $1,400 level for the first time in nearly three-months. |

| Citigroup Sees Gold at $3,500/oz; Silver Jumping to $100/oz Posted: 29 Aug 2013 06:09 AM PDT Respected Citigroup strategist Tom Fitzpatrick said in a telephone interview from New York with Bloomberg that gold and silver should surge in the coming years as the precious metals continue to benefit from the easy monetary policies adopted by central banks. Fitzpatrick, who has a good track record, said that gold has put in a [...] The post Citigroup Sees Gold at $3,500/oz; Silver Jumping to $100/oz appeared first on Silver Doctors. |

| Citigroup Sees Gold at $3,500/oz; Silver Jumping to $100/oz Posted: 29 Aug 2013 06:07 AM PDT "… gold is the hard currency of choice, and we expect for this trend to accelerate going forward. We still believe that in the next couple of years we will be looking at a gold price of around $US3,500. As the gold/silver ratio plummets near 30, this would also suggest a silver price above $US100." Citigroup playing catch up with Max’s prudent advice to own silver.

Today's AM fix was USD 1,406.25, EUR 1,059.96 and GBP 906.79 per ounce. Gold rose $0.20 or 0.014% yesterday, closing at $1,415.70/oz. Silver ceded some its previous gains and closed down $0.17 or 0.7%, closing at $24.29. Platinum gained $9.45/oz to $1,531.20.

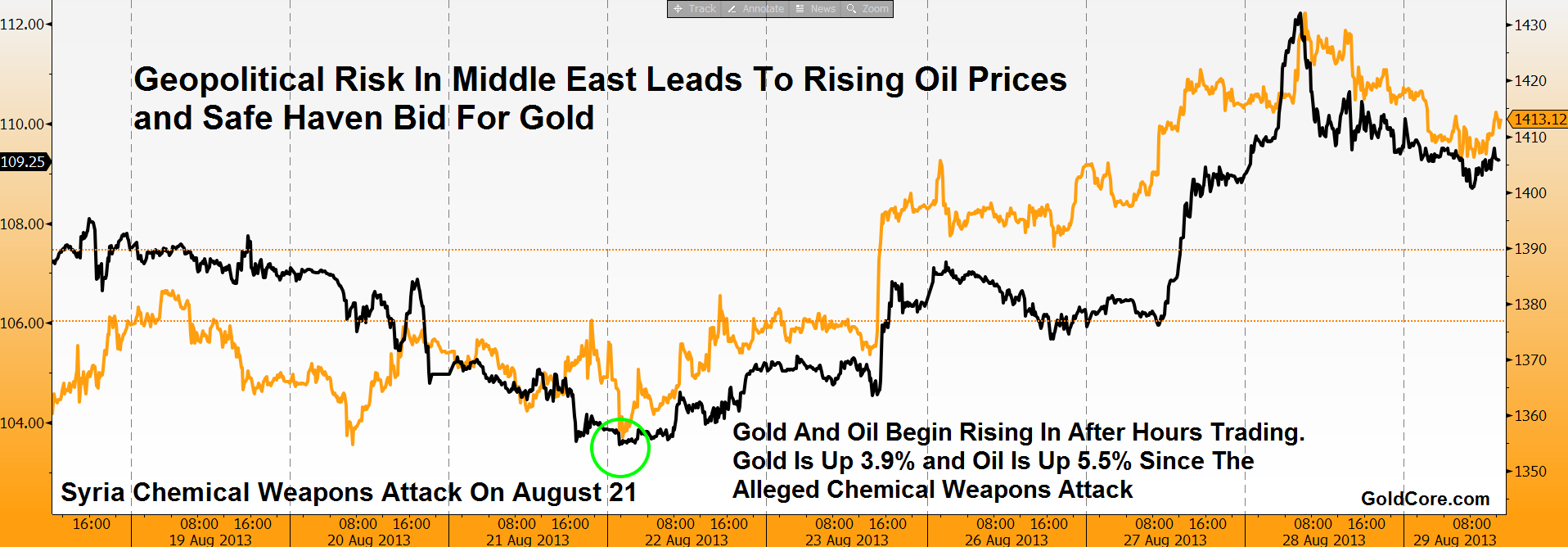

Gold fell from a three month high, its first fall in six days on profit taking after the likelihood of U.S. military strikes on Syria, at least in the short term, diminished. Prices rallied to $1,433.83 yesterday, the highest since May 14, partly due to concern about military action and the risk that it may lead to a deeper, more protracted Middle Eastern war. Geopolitical risk, emanating from the Middle East in particular, has been underestimated for some time. Since the alleged chemical weapons attack on August 21, oil has risen sharply and gold has received a safe haven bid. Gold and oil began rising in after-hours trading on the day of the incident and since then gold is up 3.9% and oil is up 5.5% (see chart). From $103.52 per barrel to $109.25 per barrel (NYMEX crude) and from $1,355/oz to $1,408/oz today. Gold and oil are often correlated particularly when there are sharp movements up in oil prices as was seen in the 1970s and in the period from January 2002 to July 2008 when NYMEX crude oil prices rose from less than $20 a barrel to over $140 a barrel. An escalation of the crisis in the Middle East and the real possibility that Iran and Israel could become embroiled in the conflict means that there is again the possibility of oil rising to new record highs, with an attendant rise in gold prices.

There are also growing concerns that the recent poor U.S. economic data and geopolitical uncertainty will lead to the Federal Reserve not slowing stimulus or 'tapering.' A continuation of cheap money policies will be bullish for gold. Another positive factor for the gold market is the very delicate situation regarding peak gold and supply from South Africa. In what could be described as a provocative move, gold mining companies in South Africa are considering locking out workers. The aggressive move is being considered if labour unions fail to accept a revised pay offer. The four unions in the gold industry have until 12 p.m. local time today to accept an offer from the chamber, which represents gold mining companies, to increase the wages of some categories of workers by 6.5%. Workers in the automotive, construction and aviation industries are already on strike to demand pay increases in excess of the considerable inflation rate of 6.3% in July. The chance of a South African gold strike is 'highly likely' said Solidarity Union General Secretary Gideon du Plessis, in a speech in Johannesburg. Citigroup Sees Gold at $3,500/oz; Silver Jumping to $100/oz Fitzpatrick, who has a good track record, said that gold has put in a low for the year and will rise to about $1,500-$1,525/oz this year. A gain of over 6.3% from today's prices. He said that silver is in a strong uptrend and will likely outperform gold as the gold silver ratio will drop from its current level at 58.1. Separately, in an interview with King World News' Eric King, Fitzpatrick elaborated on why he believes gold could reach $US3,500: "So we believe we are back into that track where gold is the hard currency of choice, and we expect for this trend to accelerate going forward. We still believe that in the next couple of years we will be looking at a gold price of around $US3,500." "As the gold/silver ratio plummets near 30, this would also suggest a silver price above $US100."

Despite the recent gains, gold remains down 16% this year and this is leading to contrarian buyers buying gold at what they still see as discount prices. Gold appears to have bottomed in June and is rising due primarily to strong physical demand for jewelry, coins and bars globally. Gold is heading for a second monthly gain which is very important technically and from a momentum perspective. For breaking news and commentary on financial markets and gold, follow us on Twitter. |

| Keiser Report: Sinkhole of Stupid Posted: 29 Aug 2013 06:05 AM PDT We discuss the sinkholes of stupid causing collapse wherever they occur and, how in Texas, they are totally fracked as the sinkhole of stupid has caused water shortagesl. In the second half, Max talks to Chris Martenson of PeakProsperity.com about the four signs of dangerous bubble territory, the markets oblivious to the costs of Fukushima meltdown and the bad economics of fracking. |

| Posted: 29 Aug 2013 05:10 AM PDT Doc’s End of Summer Blowout Sale!! 2013 Silver Eagles As Low As $2.49 Over Spot!! 2013 Silver Maples As Low As $1.99 Over Spot!! 2013 Silver Philharmonics As Low As $1.89 Over Spot!! 1oz Silver Buffalo Rounds As Low As 99 Cents Over Spot!! Shop Online or Call 614.300.1094 Now!! Sale [...] The post End Of Summer Blowout Sale!! Industry Low Prices On Silver Eagles, Maples, Philharmonics, and Buffalos!! appeared first on Silver Doctors. |

| Posted: 29 Aug 2013 05:05 AM PDT War mongers in the West want to further destabilize Syria and by all accounts from mainstream media mouthpieces, an attack is imminent. History shows that when crisis is on the near-term horizon, so-called policy makers in the economic establishment attempt to keep gold (and now silver) under wraps. But the physical markets are too tight [...] The post Cartel Attacks Mining Shares Again to Contain Gold & Silver Ahead of Likely Imminent Assault on Syria appeared first on Silver Doctors. |

| Indians saving in Rupees lose nearly 30% in 2013 – Indians saving in gold are UP 7% in 2013 Posted: 29 Aug 2013 05:01 AM PDT |

| India Gold Price at An All-Time High Posted: 29 Aug 2013 02:26 AM PDT "These last two trading days in August might prove interesting." ¤ Yesterday In Gold & SilverThe gold price didn't do a thing in Far East trading until about half-past lunchtime in Hong Kong on their Wednesday. Then, starting at that time, and by around 2:15 p.m. local time, gold had rallied about twenty bucks [the high of the day] before a seller of last resort put in an appearance, and the price began to slide lower from there. There was a small rally attempt that began very shortly before the 8:20 a.m. EDT Comex open, but that got capped immediately, before getting sold down about fifteen bucks starting around 9:15 a.m. in New York, and after that the gold price didn't do much. It was another day where the gold price really wanted to fly, but wasn't allowed to. It closed the Wednesday session at $1,417.80 spot, up $1.80 from Tuesday's close. Volume, net of August, September and October, was around 145,000 contracts. Not overly heavy, but not light volume, either. It was exactly the same chart pattern in silver, except the Far East rally had more legs, and the high of the day came shortly after 2 p.m. Hong Kong time as well. The rally just before the Comex open also got capped, but the 9:15 a.m. EDT sell-off took the silver price down almost 80 cents in about forty-five minutes. Nothing free market about that. It should be obvious to anyone that's not willfully blind, that silver would have closed substantially higher if not-for-profit sellers hadn't been lurking at the ready to stop any breakout in its tracks. Then, like gold, the silver price didn't do much after that take-down, closing the Wednesday trading day at $24.39 spot, down 13 cents from Tuesday. Roll-over volume was very heavy, but net volume was only 18,000 contracts. Here's the New York Spot Silver [Bid] chart on its own, so you can see the pertinent Comex action in more detail. The platinum and palladium charts were somewhat similar, with their respective highs coming at 2 p.m. in Hong Kong trading. Then they traded slowly lower before getting sold off at 9:15 a.m. EDT as well. Both metals recovered all their loses and closed in positive territory. Here are the charts. The dollar index closed in New York late on Tuesday afternoon at 81.17 and then traded flat until around 10:20 a.m. in Hong Kong on their Wednesday morning. Then away it went to the upside, with the high tick of the day [81.57] coming a few minutes before 10 a.m. in New York. From there it got sold down into the 5:15 p.m. EDT close, finishing the trading day at 81.44, up 27 basis points. The 27 basis point "rally" in the dollar index between 9 and 9:45 a.m. EDT was the fig leaf that the sell-off in all four precious metals was hidden behind, and it's a rather tiny fig leaf for the corresponding moves in all four precious metals, particularly silver. Not surprisingly, the gold stocks opened in positive territory for the second day in a row and for the very same reason, and that was because both gold and silver were in positive territory. But, like Tuesday, a not-for-profit seller put in an appearance around 2:30 p.m. in New York yesterday, and the rest as they say, is history. The HUI finished down another 2.93%. With the odd exception, every silver company was down on the day, and that included all the shares that make up Nick Laird's Intraday Silver Sentiment Index, as it closed down 2.74% yesterday. (Click on image to enlarge) The HUI has declined over 7 percent in the last two trading days, and Nick's Silver Sentiment Index is down exactly 7 percent in the same time period, despite the fact that gold and silver have traded flat to up. There is no chance that free-market forces are behind these moves, plus the other counterintuitive declines we've seen over the last two weeks. Someone is deliberately selling shares during the last hour or so of trading to prevent the HUI and SSI from breaking out. I have much more on this in The Wrap. The CME's Daily Delivery Report for Wednesday showed that 164 gold and zero silver contracts were posted for delivery within the Comex-approved depositories on Friday. The three short/issuers were HSBC USA with 49 contracts, JPMorgan with 45 contracts out of its client account, and Barclays with 68 contracts out of its client account as well. Waiting to scoop up 154 of those contracts was JPMorgan Chase out of its in-house [proprietary] trading account. The link to yesterday's Issuers and Stoppers Report is here. That should just about do it for the August delivery month, but we won't know for sure until tomorrow's report. There were no reported changes in either GLD or SLV yesterday, and no sales report from the U.S. Mint, either. The activity in gold on Tuesday within the Comex-approved depositories is hardly worth mentioning, as only 610 troy ounces were withdrawn from Brink's, Inc. It was much busier in silver, as 964,373 troy ounces were reported deposited, and 438,474 ounces were withdrawn. JPMorgan was not involved in any of yesterday's silver movement, and the link to that activity is here. Here's the list of reading material for you today, and I'm happy to say that it's not an overly long list. ¤ Critical ReadsU.S. Bank Legal Bills Exceed $100 BillionThe six biggest U.S. banks, led by JPMorgan Chase & Co. and Bank of America Corp., have piled up $103 billion in legal costs since the financial crisis, more than all dividends paid to shareholders in the past five years. That’s the amount allotted to lawyers and litigation, as well as for settling claims about shoddy mortgages and foreclosures, according to data compiled by Bloomberg. The sum, equivalent to spending $51 million a day, is enough to erase everything the banks earned for 2012. The mounting bills have vexed bankers who are counting on expense cuts to make up for slow revenue growth and make room for higher payouts. About 40 percent of the legal and litigation outlays arose since January 2012, and banks are warning the tally may surge as regulators, prosecutors and investors press new claims. The prospect is clouding outlooks for stock prices, and by some estimates the damage could last another decade. No surprises here. This particular cost of doing business is pretty steep when you're a crook, but it's just another business expense. This Bloomberg news item was posted on their Internet site around 10 a.m. MDT...and I thank reader Ken Hurt for today's first story. It's worth reading. JP Morgan "London Whale" fines may hit $600 millionThe Justice Department, Securities and Exchange Commission, the CFTC, the Office of the Comptroller of the Currency and the UK’s Financial Conduct Authority are still conducting investigations into JP Morgan’s handling of the episode. Discussions between the bank and various agencies involve collective penalties of roughly $500 million to $600 million as part of a “global” settlement, although the total could change slightly, these people said. Not all agencies have agreed to their final numbers, one of these people added. U.S. and U.K. officials for months have been considering the possibility of a global settlement that would resolve all the probes at once, said another person familiar with the matter. Exact terms aren't known and no final decisions have been reached. Government officials believe the wide-ranging pact could be agreed to as soon as the fall, this person said. This news item was posted on the efinancial.com Internet site yesterday...and it's courtesy of reader M.A. Currency Spikes at 4 p.m. in London Provide Rigging Clues Recurring spikes in currency market pairs over the last two years look like attempts by big currency dealers to rig financial benchmarks much as the LIBOR interest rate benchmark has been manipulated, Bloomberg News reports. Russian rocket engine export ban could halt U.S. space programRussia’s Security Council is reportedly considering a ban on supplying the US with powerful RD-180 rocket engines for military communications satellites as Russia focuses on building its own new space launch center, Vostochny, in the Far East. A ban on the rockets supply to the US heavy booster, Atlas V, which delivers weighty military communications satellites and deep space exploration vehicles into orbit, could impact NASA’s space programs – not just military satellite launches. Say what? The Russians provide the rocket motors for some U.S. military space flights? You couldn't make this stuff up. This Russian Today story was posted on their website late Tuesday afternoon Moscow time...and I thank reader Bob Visser for bringing it to our attention. Angela Merkel: Greece should never have been allowed in the euroThe German leader’s outburst came as she attempted to prove to voters she maintains a tough stance on struggling euro countries, just a month before facing key elections. “Greece shouldn’t have been allowed into the euro,” Ms Merkel told around 1,000 supporters of her Christian Democratic Union in Rendsburg on Tuesday. “Chancellor Schroeder accepted Greece in [in 2001] and weakened the Stability Pact, and both decisions were fundamentally wrong, and one of the starting points for our current troubles.” This article was posted on the telegraph.co.uk Internet site late on Tuesday evening BST...and it's Roy Stephens first offering in today's column. The erosion of southern EuropeIn the past year or so, the backlash against austerity in Southern Europe has resulted in policy shifts, which, in turn, have supported greater stability, less severe contractions and an improved sentiment across the region. None of these gains indicate a major turnaround, but alleviation of single-minded austerity measures that have added to European challenges. Despite the shift from the conservative Sarkozy to the socialist François Hollande, the competitiveness of France continues to erode. While Paris is slowly moving toward reforms, it is lingering in contraction and can hope for weak growth in 2014, at best. Italy has been ridden by contraction for nine consecutive quarters. Enrico Letta’s government has been strong enough to stay in power, but too weak to achieve major changes. The more flexible approach to austerity across the Eurozone has benefited Italy and may allow Rome’s exit from the excessive deficit procedure (EDP) in 2014. But Italy suffers from structural challenges, which translate to continued decline of industrial production and the end of the Letta government by 2014. And the list goes on. This op-ed piece, filed from Brussels, was posted on the euobserver.com Internet site early yesterday morning Europe time...and it's worth reading. It's the second contribution in a row from Roy Stephens. Financial Times: "World Is Doomed To An Endless Cycle Of Bubble, Financial Crisis And Currency Collapse"Nearly five years ago, when we first started, and said that the world is doomed to an endless cycle of bubble, financial crisis and currency collapse as long as the Fed is around, most people laughed: after all they had very serious reputations aligned with a broken and terminally disintegrating economic lie. With time. some came to agree with our viewpoint, but most of the very serious people continued to laugh. Fast forward to last night when we read, in that very bastion of very serious opinions, the Financial Times, the following sentence: "The world is doomed to an endless cycle of bubble, financial crisis and currency collapse." By the way, the last phrase can be written in a simpler way: hyperinflation. So OK then: we are happy to take that as an indirect, partial apology by some very serious people. Partial, because the piece's author, Robin Harding, doesn't explicitly come out and state that this cycle of boom and bust is a direct function of ever encroaching central-planning being handed over to a few economists with zero real world experience, whose actions result in ever more devastating blow ups once the boom cycle shifts to bust. Instead, it is their admission that this is what the world has come to. But, being economists, they naturally fail to see that it is all due to them. Instead, just like pervasive market halt, flash crashes, and everything else that now dominates a broken New Normal, this cycle which eventually culminates with currency collapse, or said otherwise, hyperinflation. And finally, on that other topic, gold and systemic stability, here is what the FT has to say: A stable international financial system has eluded the world since the end of the gold standard. This Financial Times commentary is posted mostly in the clear in this Zero Hedge piece from yesterday...and it's worth your time. I thank Manitoba reader Ulrike Marx for sharing it with us. Emerging market rout is too big for the Fed to ignoreThe U.S. Federal Reserve has told Asia, Latin America, Africa and Eastern Europe to drop dead. This has the makings of a grave policy error: a repeat of the dramatic events in the autumn of 1998 at best; a full-blown debacle and a slide into a second leg of the Long Slump at worst. Emerging markets are now big enough to drag down the global economy. As Indonesia, India, Ukraine, Brazil, Turkey, Venezuela, South Africa, Russia, Thailand and Kazakhstan try to shore up their currencies, the effect is ricocheting back into the advanced world in higher borrowing costs. Even China felt compelled to sell $20bn of US Treasuries in July. "They are running down reserves by selling US and European bonds, leading to a self-reinforcing feedback loop," said Simon Derrick from BNY Mellon. Ambrose Evans-Pritchard chimes in on the currency problems of the world's emerging markets. This territory has already been covered by others, including Jim Rickards...but Ambrose puts his spin on things in this story posted on The Telegraph's website yesterday evening. I thank Ulrike Marx for her second contribution in a row to today's column...and it's worth the read. William Hague plays down imminence of Syria attack as the U.N. seeks more timeSpeaking after a meeting of Britain's National Security Council, the British foreign secretary said the UN security council should "shoulder its responsibility" over Syria; if it failed to do so, however, Britain and and its allies would act on their own. "This is the first use of chemical warfare in the 21st century," he said. "It has to be unacceptable. We have to confront something that is a war crime, something that is a crime against humanity." Britain and the other four permanent members of the security council have begun talks in New York on a resolution proposed by Britain that would authorise the use of military force in Syria as a response to its use of chemical weapons last week. Russia and China are firmly opposed to a security council resolution allowing force, and British government officials admit their initiative is likely to fail. But Labour said on Wednesday it would not support the government in Thursday's Commons vote unless ministers had tried to win security council agreement. This news item was posted on the guardian.co.uk Internet site very early yesterday evening BST...and it's another offering from Roy Stephens. Egyptian and Arab democracy üeber alles?Insanity has been described as constantly repeating the same mistake and expecting a different outcome. That characterization sadly applies to U.S. attitudes and policies toward much of what is happening in Egypt and the Arab and Islamic worlds. The Americans have been there before, often supporting what is mistakenly regarded as the triumph of some sort of democratic movement over |

| Currency Spikes at 4 p.m. in London Provide Rigging Clues Posted: 29 Aug 2013 02:26 AM PDT Recurring spikes in currency market pairs over the last two years look like attempts by big currency dealers to rig financial benchmarks much as the LIBOR interest rate benchmark has been manipulated, Bloomberg News reports. |

| Posted: 29 Aug 2013 02:26 AM PDT Nearly five years ago, when we first started, and said that the world is doomed to an endless cycle of bubble, financial crisis and currency collapse as long as the Fed is around, most people laughed: after all they had very serious reputations aligned with a broken and terminally disintegrating economic lie. With time. some came to agree with our viewpoint, but most of the very serious people continued to laugh. Fast forward to last night when we read, in that very bastion of very serious opinions, the Financial Times, the following sentence: "The world is doomed to an endless cycle of bubble, financial crisis and currency collapse." By the way, the last phrase can be written in a simpler way: hyperinflation. So OK then: we are happy to take that as an indirect, partial apology by some very serious people. Partial, because the piece's author, Robin Harding, doesn't explicitly come out and state that this cycle of boom and bust is a direct function of ever encroaching central-planning being handed over to a few economists with zero real world experience, whose actions result in ever more devastating blow ups once the boom cycle shifts to bust. Instead, it is their admission that this is what the world has come to. But, being economists, they naturally fail to see that it is all due to them. Instead, just like pervasive market halt, flash crashes, and everything else that now dominates a broken New Normal, this cycle which eventually culminates with currency collapse, or said otherwise, hyperinflation. And finally, on that other topic, gold and systemic stability, here is what the FT has to say: A stable international financial system has eluded the world since the end of the gold standard. This Financial Times commentary is posted mostly in the clear in this Zero Hedge piece from yesterday...and it's worth your time. I thank Manitoba reader Ulrike Marx for sharing it with us. |

| Posted: 29 Aug 2013 02:26 AM PDT 1. Grant Williams: "If Gold Shorts Miscalculate "There is Going to Be Hell to Pay". 2. James Turk: "What We Are Witnessing in the Gold Market is Truly Historic". 3. Keith Barron: "Massive Flight of Physical Gold and Silver Out of the West Continues". |

| Jim Rogers Warns Syria War And "Market Panic" To Send Gold "Much, Much Higher" Posted: 29 Aug 2013 02:26 AM PDT Astute investor, Jim Rogers has warned overnight in an interview with Tara Joseph of Reuters that oil and gold will go much, much higher” due to “market panic” regarding Syria and the coming “end of free money”: Jim Rogers: Well, Tara, I own oil, I own gold, I own things like that and if there is going to be a war, and it sounds like America is desperate to have a war, they're gonna go much, much higher. Stocks are gonna go down, some of the markets that I'm sure are already going down, commodities are gonna go up. I mean, yeah, some of the things I own all make a lot of money. It's, I'm not particularly keen on war, I assure you, but it sounds like they want it. Tara Joseph: Is your main concern about supply chain disruptions for oil? Is that where we'll see the biggest moves? Jim Rogers: Well, that's where we'll see huge moves but the problem with war, Tara, is -- and I'm not the first to know this -- no matter how well the plans are made, strange things happen in war and who knows what unintended consequences will come. But I do know that throughout history whenever you had war, things like food prices have gone up a lot, energy prices have gone up a lot, copper price, lead prices: you know, all of these things go up a lot whenever there's been a war in the past. This article was posted on the Zero Hedge website yesterday morning EDT...and it's worth skimming. I thank West Virginia reader Elliot Simon for finding it for us. |

| Gold Nears Bull-Market Territory as Syrian Tensions Spur Demand Posted: 29 Aug 2013 02:26 AM PDT Gold climbed to a three-month high in London, heading for a bull market, as speculation about an attack against Syria within days spurred demand for precious metals as a haven. Silver rose to four-month high. Surging demand for jewelry, coins and bars in Asia helped prices rally 19 percent since the end of June. “We are seeing safe haven buying across the board,” said Bernard Sin, head of currency and metal trading at bullion refiner MKS (Switzerland) SA in Geneva. “Geopolitical uncertainty triggered this buying interest.” This article was posted on the moneynews.com Internet site early yesterday morning EDT...and it's another contribution from Elliot Simon. |

| South Africa's mining firms make final wage offer to gold workers Posted: 29 Aug 2013 02:26 AM PDT South Africa's mining industry chamber said on Tuesday it had made a final wage increase offer to unions representing workers in the gold sector. The Chamber of Mines said gold mining companies have offered to increase basic wages by between 6 and 6.5 percent, depending on activity category. The above two paragraphs is all there is to this Reuters piece, filed from Johannesburg, that found a home on the mineweb.com Internet site yesterday. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment