Gold World News Flash |

- Gold/Silver Ratio Signals Much Higher Silver Prices

- Brent to Hike

- Without Fraud and Accounting Gimmicks, Earnings Are Falling...

- Gold: ‘It’s like summer never happened’

- Bloomberg: Smashing The Big Banks — For Profit

- Write-Downs: Death Sentence or Opportunity?

- The Daily Market Report

- Gold and Crude Oil Ready For A Pull-back

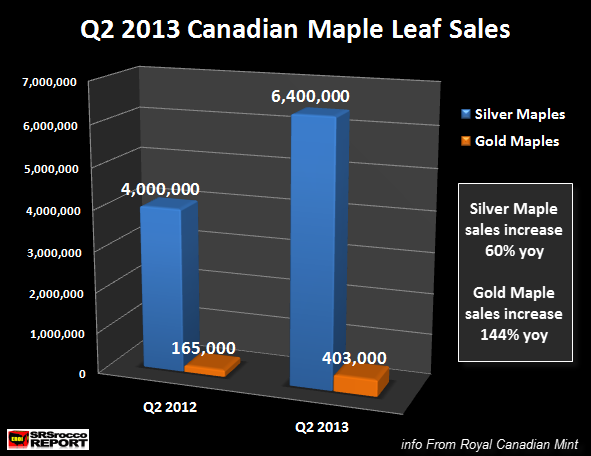

- Canadian Maple Leaf Sales Beat All Records

- Amgen Onyx Deal, The Fastest Route To Biotech Profit Now

- THIS IS WHY YOU OWN PHYSICAL GOLD

- If Gold Shorts Miscalculate “There Is Going To Be Hell To Pay”

- "Flight to safety" seen driving gold prices

- Middle East tension buying boosts gold price

- NUM to give SA gold producers strike notice on Friday – source

- US bear raid on gold and its journey East

- Dozer remote control helps speed up Bingham Canyon pit slope collapse remediation

- SA gold producers make final wage offer

- Dollar's and Mining Stocks' Implications for Gold

- Taper Or No Taper - Either Decision Is Bullish For Gold

- Taper Or No Taper - Either Decision Is Bullish For Gold

- Pretivm Announces Non-Brokered Private Placement

- Pretivm Announces Non-Brokered Private Placement

- Gold, Silver and the Status Quo

- Bitcoin Is the New Napster… and That’s a Good Thing

- India rupee closes in on 69 per dollar in biggest day fall for 18 years

- Turbulence in a Changing World as Gold-Loving Asia Rises

- Gold Nears Bull-Market Territory as Syrian Tensions Spur Demand

- Egypt Crumbling: “The Most Important Event so Far of the 21st Century”

- Gold keeps momentum after run into bull market

- Syria Sparks "Flight to Safety" in Gold Investment Analysts Reckon, as US Crude Oil Hits 2-Year High

- Market Monitor – August 28th

- Gold higher at 1427.60 (+9.30). Silver 24.90 (+0.35). Dollar higher. Euro lower. Stocks called better. US 10yr yield 2.74% (+3 bps).

- Bloomberg News: Currency spikes at 4 p.m. in London provide rigging clues

- Gold Soars to 3-Month High on Syria Conflict Fears

- Polymetal posts interim loss after writedown

- Gold and Silver Ratio Signals Much Higher Silver Prices

- Follow the Beta Plays with Junior Silver Miners: PureFunds' Andrew Chanin

- Follow the Beta Plays with Junior Silver Miners: PureFunds' Andrew Chanin

- Follow the Beta Plays with Junior Silver Miners: PureFunds' Andrew Chanin

- Turbulence in a Changing World as Gold-loving Asia Rises

| Gold/Silver Ratio Signals Much Higher Silver Prices Posted: 28 Aug 2013 11:40 AM PDT by Hubert Moolman, Silver Seek:

The top chart is gold (inflation-adjusted) from 1966 to1981, and the bottom is gold (inflation adjusted) from 1999 to 2013. It is evident that both gold bull markets, started sometime after a major peak in the Dow/Gold ratio. They both had an important peak about nine years after the Dow/Gold ratio peak, which was followed by a significant correction. |

| Posted: 28 Aug 2013 11:32 AM PDT Follow ZeroHedge in Real-Time on FinancialJuice If Syria is invaded by the West, then we should be getting ready for a hike in the price of Brent that some say may reach a much as $150 since it will escalate into a regional problem and affect supplies coming out of Iraq. Société Générale warns that there will be a "significant supply disruption in Iraq or elsewhere". That will mean that there will be a knock-on effect that will disrupt from anywhere between 500, 000 and 2 million barrels per day. Brent is expected to increase by as much as $5 to $10 in the coming days as the West ponders over whether they should intervene in Syria and go over the United Nations Security Council's authority. It could go as high as $125 very quickly and already today Brent crude oil has increased by $2 and was trading at a high of $117.34. That's a high that hasn't been seen since the start of this year. When the chemical attack was reported, Brent increased and hit a five-month high on Monday this week at $111.68 as the US government suggested that they would respond with military intervention of President Obama's 'red line' had been crossed, changing the game entirely. As the possibility of stepping in regarding the internal conflict in Syria approaches faster and faster, there is a proportional escalation of the price of Brent. BrentIt is difficult to know just how high the prices might go but the latest analysis by the French bank Société Générale seems to suggest that we are in for a hike. Secretary of State John Kerry's comments on Bachar al-Assad and the use of chemical weapons which were described as 'moral obscenity' had the immediate effect of making a strike imminent. It is thought that there would first be a strike from the Mediterranean Sea using cruise missiles. The other factor that will necessarily push oil prices higher is the increased need for oil in the US due to the hurricane season. Both the geopolitical strife and the pressure on supply that the US is currently applying mean that prices will rise beyond levels seen before. A rise in Brent crude oil prices would be bad for everyone. Prices have risen by about 15% since the lows that were experienced in April this year. The already hard hit economies of emerging nations that are suffering from the cash being withdrawn from them after the tapering threats that have been bandied about by the Federal Reserve will come in for a second hammering with the hike in Brent. The West will also suffer the immediate consequences of any strike that results and inflict a damping down of the slight upturn in the economic situation we are being told is taking place. India would be particularly hit as it is very much exposed to the brunt of oil price fluctuations. That would be catastrophic for the country in particular today given the trouble the Rupee is experiencing. Inflation will worsen and so will the fiscal deficit of India. The Rupee has already lost 44% of its value in the last two years and the country fears having a sovereign downgrade slapped on it in the coming weeks as the country has difficulty repaying $20 billion in debt. The economy only grew by 5% (year ending March 31st 2013) and it will suffer the consequences even more due to Brent shooting through the roof. 7 CountriesHowever, that is the immediate effect. The US will, in the long-term, (if it does manage to oust Bachar al-Assad, which will be no mean feat) benefit from the assurance of the stable dollarification of yet another oil nation in the world. Thus, the future of the Dollar as the world's major currency for trade will once again be the promise of a healthy economy. As General Wesley Clark (Retired 4-star U.S. Army General, Supreme Allied Commander of NATO during the 1999 War on Yugoslavia) stated in 2007 that a memo from Secretary of Defense Donald Rumsfeld (2001-2006) outlined a plan: "we're going to take out seven countries in five years, starting with Iraq, and then Syria, Lebanon, Libya, Somalia, Sudan and, finishing off, Iran". Those seven countries were problems for the US because they undermined the strength of the Dollar in the world. Libya needed to be knocked on the head since Colonel Gaddafi had started selling his oil in the Gold Dinar. He was cutting the ground from under the very feet of the hegemonic rule of the US Dollar and doing it right in front of the Americans. The idea was that African and Middle Eastern countries would join forces and use the Libyan Gold Dinar together to purchase and sell oil. The plan had been hatched decades before and President Reagan declared the Libyan leader an 'international pariah' in 1981, with the obvious undertones of the botched June 27th 1980 assassination attempt on the belligerent Libyan leader (amongst many others). But Libya is now safely back in the hands of the Dollar and the hegemony assured to some extent. The decision to enter the Middle East and to gain control of those countries that might have turned elsewhere to trade in another currency than the US Reserve needed to be done before China took over. PetroyuanBut, China is already trading Brent in the Yuan today. There are not just a few that are moving over to the Yuan either. There are 20 countries including Japan and Australia that are side-stepping the US Dollar, using the Yuan. The Petroyuan has been born and it's time for another war to gain control of the oil in Syria today. Syria currently produces over 400, 000 barrels a day. China has every possibility of transforming itself into the petrol currency of the world by the mere fact that it is estimated that it will become the world's largest importer of Brent sometime in 2014 (OPEC). This is also due to the fact that the US is concentrating on its own domestic supplies. Has the US realized that it is fighting a losing battle over this?

Reuters has provided reports that China is now using the Yuan to trade with oil suppliers. It has been calculated that with just Russia, Iran, Angola, Sudan and Venezuela there will be 5 million barrels per day that are traded in Yuan, to the detriment of the Dollar. The war is even more needed today in the eyes of the American administration to ensure that the Dollar doesn't quite lose its magic touch and control on the world. But, just how long that will last is another matter. Controlling the central banks to all intents and purposes of the Middle Eastern producers of oil means that Brent will be traded still for a while in the US Dollar. But, what the US is banking on is the winning of any war with Syria. That is another matter and the past record is not looking good.Assad: Failure Awaits the USA | US Bankrupt! | Septaper Will Open Floodgates | How Sinister is the State? | Food: Walking the Breadline | Obama NOT Worst President in reply to Obama: Worst President in US History? New Revelations: NSA and XKeyscore Program | Obama's Corporate Grand Bargain Death of the Dollar | Joseph Stiglitz was Right: Suicide | China Injects Cash in Bid to Improve Liquidity Technical Analysis: Bear Expanding Triangle | Bull Expanding Triangle | Bull Falling Wedge | Bear Rising Wedge | High & Tight Flag |

| Without Fraud and Accounting Gimmicks, Earnings Are Falling... Posted: 28 Aug 2013 11:30 AM PDT

Based simply on CAPE (cyclical adjusted price to earnings) the market is significantly overvalued with a reading of 23.

However, even this measurement understates the true nature of the bubble because one of the biggest drivers of corporate earnings in the post-2009 era is financials (they account for 16.8% of the S&P 500, second only to IT). And financials’ earnings are a complete fantasy derived via accounting gimmicks.

I’ll give you an example. One of the classic accounting gimmicks is to write off loan loss reserves.

Banks and other financial institutions are required by law to maintain a certain amount of capital to make up for loans that borrowers default on. No matter how hard a bank works to only lend to those who won’t default, inevitably a certain number of loans go bad.

Loan loss reserves are expensed against earnings. So when you raise loan loss reserves, your profits fall (profits= sales-expenses). And in contrast, when loan loss reserves fall earnings are higher even though the bank hasn’t technically made more money.

JP Morgan used this tactic to juice its first quarter earnings for 2013 by a whopping $1.2 billion. Without this gimmick, earnings were only 8% higher than those of first quarter 2012, not the incredible 33% JP Morgan claimed by lowering loan loss reserves.

This is just one of a numerous accounting gimmicks financial companies use to juice earnings higher. But it’s a very safe assumption to state that financials’ earnings are imaginary in nature.

So, let’s take financials out of the mix. Unfortunately for the bulls, financials are the largest contributors to earnings growth for the S&P 500 in 2Q13. If you remove this sector, then earnings for the S&P 500 in the second quarter so far are DOWN 2.9%

This is the most critical issue for the US stock market, not who will be the next Fed Chairman. Earnings are the primary drivers of markets.

If you have not taken steps to prepare for a market collapse, we have a FREE Special Report that outlines how to prepare your portfolio. To pick up a copy, swing by:

http://gainspainscapital.com/protect-your-portfolio/

Best Regards Graham Summers

|

| Gold: ‘It’s like summer never happened’ Posted: 28 Aug 2013 10:57 AM PDT 28-Aug (CNBC) — Gold has rallied steadily for over a week, as investors bid for safe haven assets, due to fears about the possibility of Western military involvement in Syria. As global stock markets flounder, analysts told CNBC that investors appeared to have dismissed the bullion rout that happened just a few months ago. The price of gold has shot up over 4 percent in the last week, climbing to $1,427, its highest price since May 15. The precious metal is now up more than 20 percent from the low of $1,180 it hit in late June. “It’s like summer 2013 never happened for gold and silver,” said Adrian Ash, head of research at BullionVault. [source] PG View: All of the June price slump has been retraced, and then some. Time to start working on those April losses now… |

| Bloomberg: Smashing The Big Banks — For Profit Posted: 28 Aug 2013 10:45 AM PDT …JPMorgan Chase and Co. (JPM), the biggest U.S. bank by assets, would be worth 30 percent more if broken into its four business segments. – Bloomberg by Jeff Nielson, Bullion Bulls Canada:

Incidentally, these arguments have observed that (contrary to Corporate Media mythology) these gigantic financial institutions are not even efficient. They have long since passed any economies-of-scale where "bigger is better." Instead, these Big Banks now exhibit all of the characteristics of clumsiness, inertia, and general inefficiency which all of the Small Government zealots point to – in insisting that "Big Government" needs to be shrunk. |

| Write-Downs: Death Sentence or Opportunity? Posted: 28 Aug 2013 10:17 AM PDT For many primary gold producers, Q213 was a breathtakingly bad quarter. It wasn't so much the massive drop in earnings many reported-those had been, for the most part, expected-but the so-called "impairment charges" announced. Read More... |

| Posted: 28 Aug 2013 10:13 AM PDT Gold Hits New 15-Week Highs

Gold remains driven in the short-term by heightened geopolitical tensions in the middle east, with many believing the U.S. and perhaps some of its allies are about to launch retaliatory strikes against Syria. The rebound from the June low has exceeded 20%, signalling a return to bull market footing. Silver continues to lead the way, probing back above $25 for the first time since the market plunged through this area back in April. Silver is now about 37% off the June low at 18.18. It’s been an impressive rebound to be sure, and the gold/silver ratio touched a five-month low of 57.02 today. As I said, everyone seems to be focused on Syria right now, but while pushed into the background for the time being, the rest of the fundamentals remains generally positive for gold as well. Physical demand from individual investors and central banks remains robust, although the buying by individuals has tapered in recent weeks as the market gained upside momentum. Basically, the physical buyers took advantage of the lower prices earlier in the summer and are now enjoying a nice lead. Now, prices are being driven by the paper investors coming back to the market. Broad investment demand for gold has risen as the Treasury and stock markets have come under pressure with rising Fed taper expectations. It’s been refreshing to see the yellow metal track higher, regardless of the ebb and flow of those taper expectations. As we hurdle toward a military action against Syria, as well as a monstrous internal political battle over spending and debt, it seems there are plenty of reasons to buy gold at this point. In India, the story for gold is particularly compelling, even as the government tries to stanch the import of gold into the country. The rupee is essentially in free-fall at this point. With inflation already running close to 10%, and likely to rise further, demand for gold is likely to remain strong. The destruction of the currency may well make consumers more inclined to pay the 8% import duty, or take the risk of smuggling. |

| Gold and Crude Oil Ready For A Pull-back Posted: 28 Aug 2013 10:00 AM PDT We know that after every five wave move correction follow in three waves. And that’s exactly what is happening on OIL; we see a completed five wave move from 105.50 to 112.20 so market is now forming a pull-back; an a)-b)-c) move back to former wave four zone placed at 108.57. |

| Canadian Maple Leaf Sales Beat All Records Posted: 28 Aug 2013 10:00 AM PDT by Steven St. Angelo, SRS Rocco:

The Royal Canadian Mint just published its Q2 2013 Fiscal Report showing that it sold 403,000 oz of Gold Maples in the 13 week period ending on June 29th, 2013 compared to 165,000 during the same period last year. Furthermore, Silver Maple Leaf sales increased to 6.4 million Q2 2013 compared to 4 million in Q2 2012. |

| Amgen Onyx Deal, The Fastest Route To Biotech Profit Now Posted: 28 Aug 2013 09:53 AM PDT Tara Clarke writes: On Sunday, the world's largest independent biotechnology company, Amgen Inc. (Nasdaq: AMGN), bought Onyx Pharmaceuticals Inc. (Nasdaq: ONXX) in a $10.4 billion dollar deal - making it the fifth-largest biotech deal in history according to Standard & Poor's Capital IQ. |

| THIS IS WHY YOU OWN PHYSICAL GOLD Posted: 28 Aug 2013 09:46 AM PDT I love listening to the anti-gold nitwits who call it a barbaric relic. They put their faith in pieces of paper produced by central bankers and politicians. Do you need any more proof than what is happening to the people of India? Their politicians have been running large deficits over the last few years. They […] |

| If Gold Shorts Miscalculate “There Is Going To Be Hell To Pay” Posted: 28 Aug 2013 09:36 AM PDT  Today one of the most highly respected fund managers in Singapore told King World News that the that the gold bears are in serious trouble at this point in the gold market. Grant Williams, who is portfolio manager of the Vulpes Precious Metals Fund, also warned that if the shorts miscalculate, "there is going to be hell to pay." Below is what Williams had to say this powerful interview. Today one of the most highly respected fund managers in Singapore told King World News that the that the gold bears are in serious trouble at this point in the gold market. Grant Williams, who is portfolio manager of the Vulpes Precious Metals Fund, also warned that if the shorts miscalculate, "there is going to be hell to pay." Below is what Williams had to say this powerful interview.This posting includes an audio/video/photo media file: Download Now |

| "Flight to safety" seen driving gold prices Posted: 28 Aug 2013 09:14 AM PDT The possibility of US military action against Syria is driving demand for safe-haven assets including gold,” reckons a fund manager at DoubleLine. |

| Middle East tension buying boosts gold price Posted: 28 Aug 2013 09:14 AM PDT Gold demand by investors concerned about growing tensions within the Middle East is coming on top of expected seasonal growth in demand from Asia. |

| NUM to give SA gold producers strike notice on Friday – source Posted: 28 Aug 2013 09:14 AM PDT A source with knowledge of the matter says the union will give gold producers on Friday 48-hour notice of its intention to strike over deadlocked wage talks. |

| US bear raid on gold and its journey East Posted: 28 Aug 2013 09:14 AM PDT Demand from Asia received a boost when the gold price was around $1,200 but it also jumped in the developed world, including Europe and the US, writes Julian Phillips. |

| Dozer remote control helps speed up Bingham Canyon pit slope collapse remediation Posted: 28 Aug 2013 09:14 AM PDT Western Australian company Remote Control Technologies has pulled out all the stops to help Rio Tinto's Kennecott Utah Copper recover from its recent massive pit slope failure at its Bingham Canyon mine. |

| SA gold producers make final wage offer Posted: 28 Aug 2013 09:14 AM PDT South Africa’s gold producers have laid their final wage offer on the table, but it remains rather far away from union demands. |

| Dollar's and Mining Stocks' Implications for Gold Posted: 28 Aug 2013 09:14 AM PDT It seems that everybody is talking about the yellow metal and wondering where will the next local top form. When we take a look at the charts, we see that the price of gold has risen nearly 8% in August, as expectations receded that the ... Read More... |

| Taper Or No Taper - Either Decision Is Bullish For Gold Posted: 28 Aug 2013 08:07 AM PDT A taper now would be the same mistake the Fed made back in 1929. Please recall that it was this mistake by the 1929 Fed that Bernanke pointed to and claimed he knew exactly what to do to in order to avoid a depression and deflation. It seems unlikely that Bernanke wants to go down as the Fed Chairman who triggered the next big economic recession. To Taper Or Not To Taper - That Is The QuestionIn what has become one of the most absurd rituals on Wall Street - and is really a sign of just how broken our system is - the entire financial media and all the Wall Street "Einsteins" are debating whether or not the Fed will begin to slow down its money printing when it announces its latest fatuously palaverous policy statement in September. The golden truth is that gold doesn't care. In fact, not only does gold not care, but either decision will be bullish for the world's oldest currency. As it turns out, I've written thoughts on this matter, explaining why I've reached that conclusion and you can read my analysis here: LINK If the Fed were to announce a small "taper," it is likely that the metals will get hit hard, initially. It is this smack-down that you need to buy with both hands, as the market will soon realize that the Fed is going to have to reverse itself and increase QE in subsequent months. My personal feeling is that the Fed will hold off on any decision and, ultimately, be forced to increase QE at some point. In fact, in line with what I was thinking about Syria situation, others have come to the same conclusion as me: Syria Is The Fed's "Out" on the Taper Also, please note - and although I think it's a ridiculous report - the National Association of Realtors' Pending Homes Sales report for July showed a decline in "pending" home sales from June to July. Given that the index is "seasonally adjusted," it should be registering a nice gain from June to July, unless contracts on new homes are seriously slowing down. They are and the housing market is back in its bear tracks. |

| Taper Or No Taper - Either Decision Is Bullish For Gold Posted: 28 Aug 2013 08:07 AM PDT A taper now would be the same mistake the Fed made back in 1929. Please recall that it was this mistake by the 1929 Fed that Bernanke pointed to and claimed he knew exactly what to do to in order to avoid a depression and deflation. It seems unlikely that Bernanke wants to go down as the Fed Chairman who triggered the next big economic recession. To Taper Or Not To Taper - That Is The QuestionIn what has become one of the most absurd rituals on Wall Street - and is really a sign of just how broken our system is - the entire financial media and all the Wall Street "Einsteins" are debating whether or not the Fed will begin to slow down its money printing when it announces its latest fatuously palaverous policy statement in September. The golden truth is that gold doesn't care. In fact, not only does gold not care, but either decision will be bullish for the world's oldest currency. As it turns out, I've written thoughts on this matter, explaining why I've reached that conclusion and you can read my analysis here: LINK If the Fed were to announce a small "taper," it is likely that the metals will get hit hard, initially. It is this smack-down that you need to buy with both hands, as the market will soon realize that the Fed is going to have to reverse itself and increase QE in subsequent months. My personal feeling is that the Fed will hold off on any decision and, ultimately, be forced to increase QE at some point. In fact, in line with what I was thinking about Syria situation, others have come to the same conclusion as me: Syria Is The Fed's "Out" on the Taper Also, please note - and although I think it's a ridiculous report - the National Association of Realtors' Pending Homes Sales report for July showed a decline in "pending" home sales from June to July. Given that the index is "seasonally adjusted," it should be registering a nice gain from June to July, unless contracts on new homes are seriously slowing down. They are and the housing market is back in its bear tracks. |

| Pretivm Announces Non-Brokered Private Placement Posted: 28 Aug 2013 07:50 AM PDT Pretium Resources Inc. (TSX:PVG)(NYSE:PVG) ("Pretivm") is pleased to announce that it has entered into a subscription agreement with Liberty Metals & Mining Holdings, LLC ("LMM"), a subsidiary of Boston-based Liberty Mutual Insurance, to issue to LMM by way of a private placement 1,069,518 common shares of Pretivm (the "Purchased Shares") at a price per share of C$9.35 for gross proceeds of approximately C$10 million (the "Offering"). The Offering is scheduled to close on or about September 12, 2013, subject to the receipt of all necessary regulatory approvals including the approval of the Toronto Stock Exchange. Pretivm intends to use the proceeds of the Offering to advance the Brucejack Project, including ongoing permitting and engineering activities. LMM is not permitted to trade the Purchased Shares for a period of four months plus one day from the closing of the Offering. The Purchased Shares described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended, and may not be offered or sold within the United States absent registration or an applicable exemption from the registration requirements of such Act. About Pretivm Pretivm is creating value through gold at its high-grade gold Brucejack Project, located in northern British Columbia. Brucejack hosts a major undeveloped high-grade gold resource, with Probable Mineral Reserves in the Valley of the Kings totalling 6.6 million ounces of gold (15.1 million tonnes grading 13.6 grams of gold per tonne). Brucejack is being advanced as a high-grade underground mine with an average of 425,700 ounces of gold produced annually for the first 10 years and an average of 321,500 ounces of gold produced annually over the Project's 22-year mine life. Commercial production is targeted to commence in 2016. Pretium Resources Inc. (SEDAR filings: Pretium Resources Inc.) Forward Looking Statements This News Release contains "forward-looking information" and "forward looking statements" within the meaning of applicable Canadian and United States securities legislation. Forward-looking information may include, but is not limited to, risks related to satisfying conditions of the Offering, our planned exploration and development activities, the adequacy of Pretivm's financial resources, the estimation of mineral reserves and resources, realization of mineral reserve and resource estimates, timing of development of Pretivm's Brucejack Project, costs and timing of future exploration, results of future exploration and drilling, production and processing estimates, capital and operating cost estimates, timelines and similar statements relating to the economic viability of the Brucejack Project, timing and receipt of approvals, consents and permits under applicable legislation, Pretivm's executive compensation approach and practice, and adequacy of financial resources. Wherever possible, words such as "plans", "expects", "projects", "assumes", "budget", "strategy", "scheduled", "estimates", "forecasts", "anticipates", "believes", "intends" and similar expressions or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative forms of any of these terms and similar expressions, have been used to identify forward-looking statements and information. Statements concerning mineral reserve and resource estimates may also be deemed to constitute forward-looking information to the extent that they involve estimates of the mineralization that will be encountered if the property is developed. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be forward-looking information. Forward-looking information is subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied by the forward-looking information, including, without limitation, those risks identified in Pretivm's prospectus supplement to the short form base shelf prospectus dated March 19, 2012 filed on SEDAR at www.sedar.com and in the United States through EDGAR at the SEC's website at www.sec.gov. Forward-looking information is based on the expectations and opinions of Pretivm's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise. We do not assume any obligation to update forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable law. For the reasons set forth above, prospective investors should not place undue reliance on forward-looking information. The TSX has neither approved nor disapproved of the information contained herein. Source: Pretivm Resources via Marketwired http://www.marketwire.com/press-release/pretivm-announces-non-brokered-private-placement-tsx-pvg-1825222.htm PVG is a Vulture Bargain Candidate of Interest (VBCI). |

| Pretivm Announces Non-Brokered Private Placement Posted: 28 Aug 2013 07:50 AM PDT Pretium Resources Inc. (TSX:PVG)(NYSE:PVG) ("Pretivm") is pleased to announce that it has entered into a subscription agreement with Liberty Metals & Mining Holdings, LLC ("LMM"), a subsidiary of Boston-based Liberty Mutual Insurance, to issue to LMM by way of a private placement 1,069,518 common shares of Pretivm (the "Purchased Shares") at a price per share of C$9.35 for gross proceeds of approximately C$10 million (the "Offering"). The Offering is scheduled to close on or about September 12, 2013, subject to the receipt of all necessary regulatory approvals including the approval of the Toronto Stock Exchange. Pretivm intends to use the proceeds of the Offering to advance the Brucejack Project, including ongoing permitting and engineering activities. LMM is not permitted to trade the Purchased Shares for a period of four months plus one day from the closing of the Offering. The Purchased Shares described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended, and may not be offered or sold within the United States absent registration or an applicable exemption from the registration requirements of such Act. About Pretivm Pretivm is creating value through gold at its high-grade gold Brucejack Project, located in northern British Columbia. Brucejack hosts a major undeveloped high-grade gold resource, with Probable Mineral Reserves in the Valley of the Kings totalling 6.6 million ounces of gold (15.1 million tonnes grading 13.6 grams of gold per tonne). Brucejack is being advanced as a high-grade underground mine with an average of 425,700 ounces of gold produced annually for the first 10 years and an average of 321,500 ounces of gold produced annually over the Project's 22-year mine life. Commercial production is targeted to commence in 2016. Pretium Resources Inc. (SEDAR filings: Pretium Resources Inc.) Forward Looking Statements This News Release contains "forward-looking information" and "forward looking statements" within the meaning of applicable Canadian and United States securities legislation. Forward-looking information may include, but is not limited to, risks related to satisfying conditions of the Offering, our planned exploration and development activities, the adequacy of Pretivm's financial resources, the estimation of mineral reserves and resources, realization of mineral reserve and resource estimates, timing of development of Pretivm's Brucejack Project, costs and timing of future exploration, results of future exploration and drilling, production and processing estimates, capital and operating cost estimates, timelines and similar statements relating to the economic viability of the Brucejack Project, timing and receipt of approvals, consents and permits under applicable legislation, Pretivm's executive compensation approach and practice, and adequacy of financial resources. Wherever possible, words such as "plans", "expects", "projects", "assumes", "budget", "strategy", "scheduled", "estimates", "forecasts", "anticipates", "believes", "intends" and similar expressions or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative forms of any of these terms and similar expressions, have been used to identify forward-looking statements and information. Statements concerning mineral reserve and resource estimates may also be deemed to constitute forward-looking information to the extent that they involve estimates of the mineralization that will be encountered if the property is developed. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be forward-looking information. Forward-looking information is subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied by the forward-looking information, including, without limitation, those risks identified in Pretivm's prospectus supplement to the short form base shelf prospectus dated March 19, 2012 filed on SEDAR at www.sedar.com and in the United States through EDGAR at the SEC's website at www.sec.gov. Forward-looking information is based on the expectations and opinions of Pretivm's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise. We do not assume any obligation to update forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable law. For the reasons set forth above, prospective investors should not place undue reliance on forward-looking information. The TSX has neither approved nor disapproved of the information contained herein. Source: Pretivm Resources via Marketwired http://www.marketwire.com/press-release/pretivm-announces-non-brokered-private-placement-tsx-pvg-1825222.htm PVG is a Vulture Bargain Candidate of Interest (VBCI). |

| Gold, Silver and the Status Quo Posted: 28 Aug 2013 07:36 AM PDT Gold and Silver will survive as a store of value and wealth. Paper money, the economic status quo, unfunded liabilities, pension plans, exponentially increasing debt, massive budget deficits, "to-big-to-fail" banks, and so much ... Read More... |

| Bitcoin Is the New Napster… and That’s a Good Thing Posted: 28 Aug 2013 07:28 AM PDT The US government's bid to Like Bitcoin, Napster was a revolutionary success. As the first person-to-person (P2P) file-sharing program to gain widespread acceptance, it transformed the music industry forever. By allowing people to share music directly with each other, it eliminated the need for the record industry as a middleman. Also like Bitcoin, Napster infuriated some powerful people. Upon realizing that the unauthorized downloading of music would cripple its business model, the Recording Industry Association of America (RIAA) unleashed an army of lawyers to sue Napster. The RIAA won, forcing Napster into bankruptcy. But as it turned out, slaying Napster was about as effective as Hercules slicing off one of the Hydra's heads. A bevy of new P2P software purveyors soon sprouted to fill the void left by Napster. Ever hear of LimeWire? Or Kazaa? Or Morpheus? Or the Pirate Bay? Or BearShare? Or BitTorrent? What the RIAA failed to understand was that Napster was only the beginning. Napster tapped in to an idea that was too powerful to be stopped: the idea that people should be able to get music quickly, easily, and—if they're comfortable skirting copyright laws—for free. Similarly, Bitcoin is only the beginning of the crypto-currency industry. It has flaws, to be sure. And predicting Bitcoin's specific destiny is impossible. It's a distinct possibility that the US government will regulate Bitcoin to the point that it's no longer useful to Americans. But the beauty is that it really doesn't matter what Bitcoin's fate turns out to be. Just like Napster, Bitcoin unleashed an unstoppable idea—that people should be able to send money anywhere in the world, to pay for anything, completely anonymously. That's simply too powerful a proposition for the government to quietly discard down the memory hole. The US government should take a lesson from the RIAA and learn to coexist with crypto-currencies. After all, capital goes where it's treated best—so any government that fights this burgeoning trend is only depriving its economy of much-needed capital, as this week's guest author, Jeffrey Tucker, will explain. Jeffrey Tucker is an expert on crypto-currencies and much more. He's currently executive director of the Laissez Faire Club, but you may know him best as former editorial vice president of the Ludwig von Mises Institute, where he helped build the website that houses the most impressive collection of economic and libertarian literature anywhere. He's also a prolific author, having written four books on economics, politics, and culture. I've personally read two of them—Bourbon for Breakfast and It's a Jetsons World—and they're fantastic. Read on for Jeffrey's take on which regimes are embracing crypto-currencies, which are fighting them, and the economic consequences citizens of those countries should expect. Enjoy, and see you next week. Dan Steinhart |

| India rupee closes in on 69 per dollar in biggest day fall for 18 years Posted: 28 Aug 2013 06:49 AM PDT 28-Aug (Reuters) — The Indian rupee slumped to a record low near 69 to the dollar on Wednesday on growing worries that foreign investors will continue to sell out of a country facing stiff economic challenges and volatile global markets. The pummeling in markets sent the rupee reeling 3.7 percent to an all-time low of 68.85 with the unit closing just a touch off that, at 68.80/81 per dollar, its biggest single-day fall since October 1995. It closed on Tuesday at 66.24/25. In absolute terms too, the 256-basis-point fall in the rupee was the biggest ever. [source] PG View: Today’s drop in the rupee alone would have offset nearly half of the 8% import duty currently being charged on gold in an effort to stanch demand. Maybe India should focus on halting the free-fall in the ruppee, rather than wasting so much time trying to change hearts and minds regarding gold. |

| Turbulence in a Changing World as Gold-Loving Asia Rises Posted: 28 Aug 2013 06:38 AM PDT In 2013 we have seen, so far a massive bear raid on the gold market in the U.S. led by the big banks, JP Morgan Chase and Goldman Sachs, who along with their clients engineered the price of gold down, first with massive short positions on COMEX ... Read More... |

| Gold Nears Bull-Market Territory as Syrian Tensions Spur Demand Posted: 28 Aug 2013 06:32 AM PDT 28-Aug (Bloomberg) — Gold climbed to a three-month high in New York, approaching a bull market, as speculation about an attack against Syria within days spurred demand for precious metals as a haven. Silver rose to four-month high. Any armed response would be focused on Syria's weapons capabilities and wouldn't be aimed at deposing President Bashar al-Assad, U.S. and U.K. officials said. U.K. Prime Minister David Cameron said in London that while no decision has been made on a course of action, it would be legal and proportionate. …"We are seeing safe haven buying across the board," said Bernard Sin, head of currency and metal trading at bullion refiner MKS (Switzerland) SA in Geneva. "Geopolitical uncertainty triggered this buying interest." [source] PG View: The spot market cleared the 20% rebound threshold yesterday at 1415.80, signalling a return to bull market footing. The futures market cleared the corresponding level today. |

| Egypt Crumbling: “The Most Important Event so Far of the 21st Century” Posted: 28 Aug 2013 06:04 AM PDT “What is happening now in the Middle East,” said British Foreign Secretary William Hague this week, referring to Egypt, “is the most important event so far of the 21st century, even compared to the financial crisis we have been through and its impact on world affairs. I think it will take years, maybe decades, to play out.” Stop the presses! According to the British foreign secretary, turmoil in Egypt is more important than the market crash of 2008. You haven’t heard American politicians say that, have you? What does the British foreign secretary know? Something big is going on. But if you consume only U.S. mainstream media, you’re not getting the story. It’s more important for the mainstreamers to discuss President Obama’s new dog, I suppose. In a moment, I’ll have more on Egypt and Secretary Hague’s comments. First, let’s attend to business close to home. Ongoing Opportunities in Energy and Resources Despite all the lamentations about the “end of the resource super-cycle” in the Financial Times, we’re far from playing taps over the energy and natural resource boom of recent years. There’s money yet to be made in the right kind of ideas. Yes, parts of the resource sector have been in the doghouse over the past year. First and foremost, a decade-long uptrend in precious metals flattened out and pulled back last year. Then again, we may already be in the early innings of a new revival for gold and silver. Good things don’t stay down for long. As we know well, here, miners suffered due to the pullback in metal prices. Some energy guys are down, too. “Diggers and drillers” (as Australians call resource plays) look shabby, compared with the highflying Dow Jones and its big banks and crisp blue chips. Then again, the wheel will eventually turn. Meanwhile, low share prices for great resource assets make for long-term bargains. For another comparison, look at the small-cap resource space that I cover in Energy & Scarcity Investor. Much of the “junior” sector has been savaged during the recent down market. There’s an ongoing washout within the Toronto Venture Exchange. Hundreds of small companies — too small for their own good — are delisting and going to “company heaven.” Drums, bagpipes and weeping violins for them, I suppose. As I see it, low current prices for metals and energy plays are not predictive of the future. We live in a world of rising human desire for “real stuff.” Plus, we live in a world of geopolitical turmoil, as a glance at the headlines from Egypt will drive home. And that gets us back to the comment by British Foreign Secretary Hague. Turmoil alters political alliances, not to mention markets. That can be bad. And it can be good, if you do the right things that are in your best long-term interest. The Red Nile of Egypt Still, why is Secretary Hague worried? There’s political upheaval and bloodshed in Egypt, of course. But in the big scheme of things, is the Egypt story more significant than, say, what happened with recent conflicts elsewhere in the Middle East, in places like Syria, Libya, Yemen, Mali and other locales? Let’s stick with resource investing, which is our focus. Paid-up readers may recall that I bailed out of Egypt exposure about two years ago — even issuing a sell recommendation on Apache Oil, which is a great company other than its Egypt oil plays. On the Apache call, I was ahead of the game. Last week brought sell recommendations from a variety of brokers on Apache, citing its Egypt exposure. Why walk away from investing in Egypt? Because the Arab world’s most populous nation — the nation that controls the Suez Canal, too — is essentially in a civil war. Invest there at your peril (although there are high-risk opportunities for the truly bold). Egypt’s civil war is not like the American Civil War of 150 years ago. It’s not regional. It’s not as if half the country seceded and the North is going to invade the South or such. But in its own way, Egypt is a nation at war with itself. There are profound philosophical divisions rooted in the very meaning of Islam. Also, Egypt highlights the collision between East and West. Alliances are about to alter in a big way — a grand, strategic sort of way. Turmoil in Egypt is NOT good for the Middle East in general or the stability of one-third of the world’s oil production, in particular. This is part and parcel of that “Oil Wars” scenario we’ve worked on for several years here. Welcome to the 21st Century Indeed, turmoil in Egypt is a big part of why oil prices have moved up by $10 per barrel over the past two months. That’s part of Secretary Hague’s concern, but just the beginning. Over and above oil politics, Egypt is now a case in point of how the “great power” relationships of the past three generations are clearly breaking down. What’s going on in Egypt stands for the ongoing rearrangement of the chessboard of the post-Cold War world. This is where Secretary Hague is going with his comments. The most worrisome thing for people in the U.S. and “West” is that the U.S. is losing face and influence in the Middle East faster than Lake Nasser would drain out if the Aswan Dam burst. The failure of U.S. Middle East policy is clear in Egypt. It’s a total wreck. The political powers in Washington have made a mess of it. In Egypt right now, it’s fair to say that pretty much everybody mistrusts the U.S. government, and certainly hates current U.S. Egypt policy. The U.S. supported former strongman Hosni Mubarak until suddenly he got inconvenient and went over the side. Then the U.S. supported hard-line Muslim Brotherhood Islamist guys who wrecked the economy and initiated the process of tearing civil society to shreds. Now the U.S. can’t seem to make up its mind about the Egyptian army, which took over — despite the fact that we’ve been arming and training the colonels and generals for 35 years. Confused? Well, so are the Egyptians. So are nations and leaders across the Middle East. Thus is U.S. credibility in Egypt, and across the Arab/Muslim world, shattered. They are walking away from us, fast! The Next Alliances Meanwhile, we see a new alliance of Saudi Arabia, Russia and China. They’re teaming up to aid Egypt. The aid ranges from the macro level to the grass roots. For example, Saudi Arabia has opened its checkbook to the tune of $11 billion in just the past month, along with sending tankers full of fuel. Saudi aid dwarfs the piddling amounts of depreciating dollars that the U.S. sends to Egypt — much of that “aid” being military equipment, which is, at root, just money to large defense contractors like Lockheed. Meanwhile, Russia and China are sending ships full of food aid. This is for distribution to people in Egypt who truly know hunger in the broken economy left behind by the maladministration of the Muslim Brotherhood. The critical thing to understand is that the Saudi-Russia-China alliance is designed to break the Egypt-U.S. relationship. The new alliance reflects how U.S. influence is waning in the Middle East. After many decades of driving events in the Middle East — and spending incalculable national treasure — the U.S. is about to lose big. New alliances in Egypt reflect Saudi-Russian-Chinese efforts to help keep hard-line Islam under control. The Saudis fear Brotherhood-style religious fervor. Russia wants to control the spread of hard-line Islam in its southern regions — Chechnya comes to mind — while China has issues with hard-line Islam in its western regions. And the U.S.? There’s no sense of consistency coming from Washington, nor of long-term policy goals. There’s no sense of pursuing long-term American national interests. U.S. credibility is evaporating. What’s the investment angle? Certainly expect problems with Middle East oil. Expect hard-line Islamism to strike out at targets of opportunity. Expect energy and “real” assets to hold value and offer gains over time. I could go on. But that’s all for now. There’s plenty more to discuss in future notes. Best wishes… Byron W. King |

| Gold keeps momentum after run into bull market Posted: 28 Aug 2013 06:02 AM PDT 28-Aug (MarketWatch) — Gold prices recovered from a brief decline to continue pushing higher early Wednesday, after the safe-haven asset surged into a bull market on concerns about military action against Syria. …The contract on Tuesday surged $27.10, or 2%, to $1,420.20 an ounce on the Comex division of the New York Mercantile Exchange. That was the highest settlement since mid-May, according to FactSet data, based on the most-active contracts. The rise put gold at least 20% above intraday lows hit by Comex gold futures of around $1,180 on June 28. Technically, a bull market is a rise in value of any market security by at least 20%. [source] |

| Syria Sparks "Flight to Safety" in Gold Investment Analysts Reckon, as US Crude Oil Hits 2-Year High Posted: 28 Aug 2013 05:49 AM PDT GOLD INVESTMENT prices touched their highest level since mid-May in London on Wednesday morning, trading briefly at $1433 per ounce before edging $10 lower as European stock markets extended yesterday's losses. Silver prices touched their best level since this April's gold crash while US crude oil added another 1.2% to hit 2-year highs above $110 per barrel. US Treasury bonds fell, nudging interest rates higher, even German and UK debt prices rose. "The possibility of US military action against Syria is driving demand for safe-haven assets including gold," reckons commodities fund manager Jeffrey Sherman at Los Angeles-based $56 billion DoubleLine. UK prime minister David Cameron said Wednesday he's pushing for a UN resolution "authorising necessary measures to protect [Syrian] civilians" following this month's chemical weapons attack. "This is a classic case of a flight to safety," agrees Mike Meyer, assistant vice president at EverBank World Markets, talking about gold investment to CNN. "The tension in Syria, as well as Egypt a few weeks ago, have set the wheels in motion for gold to rise." But "Helped by a thin trading environment, gold was immediately treated as safe haven" after last Friday's poor US home sales data, says the latest weekly report from German investment-bar and refining group Heraeus. "With the summer coming to an end, general demand is picking up again and we see in the current environment sufficient support for gold to stay around the current level." Starting in early August, says Credit Suisse's Tom Kendall, speaking to Reuters, "you've had something of the order of 6 million ounces of short-covering going through on the Comex futures and options market." That turnaround in short-term gold investment sentiment "has been playing into it as well," says Kendall. On a technical basis. "Gold has been rising within an up sloping channel since July and within a steeper one since early August," write chart analysts at French investment bank Societe Generale today. Investment gold is now "nearing the channel upper limits," the SocGen analysts believe, "with hourly indicators...suggesting $1437/41 to be a key graphic level." "We will retain our longer term bearish forecast," says Axel Rudolph at Germany's Commerzbank, "while the gold price remains below the $1424.05 June high on a daily chart closing basis. "The current corrective rally higher should be followed by another decline back to the $1300/1250 region." Rising 20% from their near 3-year low in Dollar terms at end-June, prices for wholesale gold bars also broke new multi-week highs today against all other currencies. Investment gold priced in Australian Dollars today leapt above A$1600 per ounce, the highest level since February 12. Gold prices in Indian Rupees touched fresh record highs as the #1 gold consumers' currency sank to fresh lows on the FX market. |

| Posted: 28 Aug 2013 05:38 AM PDT Top Market Stories For August 28th, 2013: One of the Most Important Gold Charts That You Should Remember - Jesse's Cafe From two-tier gold backwardation to goldscam! - Fekete - Mineweb 140 Years Of Monetary History In 10 Minutes - GoldSilver.com |

| Posted: 28 Aug 2013 05:30 AM PDT |

| Bloomberg News: Currency spikes at 4 p.m. in London provide rigging clues Posted: 28 Aug 2013 05:30 AM PDT 8:25a ET Wednesday, August 28, 2013 Dear Friend of GATA and Gold: Recurring spikes in currency market pairs over the last two years look like attempts by big currency dealers to rig financial benchmarks much as the LIBOR interest rate benchmark has been manipulated, Bloomberg News reports. Maybe Bloomberg will get around to the gold market in another decade or so. Plenty of documentation of gold market rigging, underwritten by Western central banks, long has been delivered to Bloomberg by GATA. The Bloomberg report on currency market rigging is posted here: http://www.bloomberg.com/news/2013-08-27/currency-spikes-at-4-p-m-in-lon... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Is your gold safe, secure, and guaranteed? Canada is one of the safest places to store bullion because of its prosperity and economic and political stability. By vaulting your bullion with Sprott Money's Canadian storage program, you guarantee that your metals are stored securely and privately with little risk. -- We store with Brink's, a private and non-bank storage facility renowned for its integrity, security, and efficiency. -- Your precious metals will be safe under the protection of Brink's world-class technology and infrastructure. -- Your precious metals will be fully insured by Brink's and Sprott Money. In the unlikely event of loss, theft, or physical damage to your metal, you will be fully compensated. Sprott Money is a recognized and trusted name in the precious metals industry. For more information, please visit: http://www.sprottmoney.com/store-with-us In June, America's Internal Revenue Service (IRS) said it was examining the use of virtual currencies such as bitcoins amid fears that Americans are using them to evade taxes. In the future, taxpayers could be forced to disclose to the IRS whether they are using PayPal accounts for the virtual transfer of money, according to Victor Lessoff, director of the IRS. Last month Thailand became the first country to ban bitcoins after the central bank ruled it is not a currency. The ruling means it is illegal to buy and sell bitcoins, buy or sell any goods or services in exchange for bitcoins, send any bitcoins to anyone outside of Thailand, or receive bitcoins from anyone outside the country. Launched in 2009 in the wake of the global financial crisis, bitcoins are "mined" using complex computer source code. The virtual currency started as a relatively niche method of payment, devised by an anonymous programmer, but can now be used for anything from online gambling to pizza delivery. Join GATA here: Gold Investment Symposium 2013 New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold Soars to 3-Month High on Syria Conflict Fears Posted: 28 Aug 2013 05:15 AM PDT courtesy of DailyFX.com August 28, 2013 04:06 AM Gold soared to the highest level in three months while crude oil touched a two-year high amid worries about an expanding conflict in Syria. Gold soared to the highest level in three months while crude oil touched a two-year high amid worries about an expanding conflict in Syria. Talking Points [LIST] [*]Gold Advances to Three-Month High as Syria Drives Market Turmoil Fears [*]Crude Oil Spikes to Highest in Over Two Years on Supply Disruption Jitters [/LIST] To receive Ilya's analysis directly via email, please SIGN UP HERE Gold prices soared to a three-month high while crude oil spiked its most expensive level in over two years amid continuing worries about an expanding conflict in Syria. Fears of regional spillover and a possible disruption in oil deliveries that hurts global economic growth emerged early in the week after US Secretary of State John Kerry said the Syrian government will be held accountable for its use of ch... |

| Polymetal posts interim loss after writedown Posted: 28 Aug 2013 01:45 AM PDT Russian precious metals producer Polymetal swung to an interim loss in the first half, hit by a plunge in the gold price and a $273m (£176m) writedown on the value of its mines. This posting includes an audio/video/photo media file: Download Now |

| Gold and Silver Ratio Signals Much Higher Silver Prices Posted: 28 Aug 2013 01:26 AM PDT It is natural to compare the current precious metals' bull market with that of the 70s, since there are many similarities between the two. Below is a comparison which illustrates some of the similarities between the two bull markets: |

| Follow the Beta Plays with Junior Silver Miners: PureFunds' Andrew Chanin Posted: 28 Aug 2013 01:00 AM PDT PureFunds has a simple strategy: Be first in the market with innovative exchange-traded funds. Andrew Chanin, PureFunds' co-founder and COO, describes the firm's ISE Junior Silver ETF and the factors that make a "leveraged play to the actual spot price of the metal." In this interview with The Gold Report, Chanin goes on to list some of the names included in the fund and explains how they contribute to its success. |

| Follow the Beta Plays with Junior Silver Miners: PureFunds' Andrew Chanin Posted: 28 Aug 2013 01:00 AM PDT PureFunds has a simple strategy: Be first in the market with innovative exchange-traded funds. Andrew Chanin, PureFunds' co-founder and COO, describes the firm's ISE Junior Silver ETF and the factors that make a "leveraged play to the actual spot price of the metal." In this interview with The Gold Report, Chanin goes on to list some of the names included in the fund and explains how they contribute to its success. |

| Follow the Beta Plays with Junior Silver Miners: PureFunds' Andrew Chanin Posted: 28 Aug 2013 01:00 AM PDT |

| Turbulence in a Changing World as Gold-loving Asia Rises Posted: 27 Aug 2013 05:00 PM PDT In 2013 we have seen, so far a massive bear raid on the gold market in the U.S. led by the big banks, JP Morgan Chase and Goldman Sachs, who along with their clients engineered the price of gold down, first with massive short positions on COMEX added to by selling over 200 tonnes of the physical stock of gold they held. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

It is natural to compare the current precious metals' bull market with that of the 70s, since there are many similarities between the two. Below is a comparison which illustrates some of the similarities between the two bull markets:

It is natural to compare the current precious metals' bull market with that of the 70s, since there are many similarities between the two. Below is a comparison which illustrates some of the similarities between the two bull markets:

Four hundred years of economic theory (and economic History) tell us that oligopolies (in any form) are totally parasitic behemoths, which should never be allowed to exist in any

Four hundred years of economic theory (and economic History) tell us that oligopolies (in any form) are totally parasitic behemoths, which should never be allowed to exist in any

According to the information just released by the Royal Canadian Mint, sales of Gold & Silver Maples are beating all records. Not only are Canadian Maple sales surpassing its own previous records, Gold Maple Leaf sales actually out performed U.S. Gold Eagles during the second quarter of 2013.

According to the information just released by the Royal Canadian Mint, sales of Gold & Silver Maples are beating all records. Not only are Canadian Maple sales surpassing its own previous records, Gold Maple Leaf sales actually out performed U.S. Gold Eagles during the second quarter of 2013..jpg)

No comments:

Post a Comment