saveyourassetsfirst3 |

- Talk of gold upturn premature as bears taste blood?

- PanAust seeks joint copper/gold projects with Codelco

- Unusual charts show a major gold bottom could be forming now

- This retirement fact could shock you

- Controversial analysis suggests gold and silver prices are being manipulated

- A surprising post every gold-stock investor should see

- CNBC Gold Bull vs Bear Debate

- Polyus Gold stake sale approval seen imminent

- SPDR gold fund sees biggest 1-day outflow since Aug 2011

- Gold up after Fed knocks prices to 7-month lows

- India bans gold jewellery from Thailand

- Hey Gold Bugs! The Dollar Still Matters!

- Where to buy gold in difficult times - Jay Taylor

- A pivotal point for gold and silver explained

- Silver price remains above its 16 month long-term support

- Fear In Gold Market As Hedge Funds And Retail Sell – HNW And Smart Money Accumulate Aga

- Gold Bounces Off 7-month Low as US Fed Minutes See T-Bonds Rise, Equities Join Commodity

- Where to buy gold in difficult times: Jay Taylor

- A Golden Opportunity With Miners, Part I

- Is This the Bottom? Hope So.

- Gold and silver nearing major long-term support

- Gold falls as technical selling pressure mounts

- Gold bounces off 7-month low as U.S. Fed minutes see T-bonds rise

- THE FORCES THAT WILL PUSH SILVER OVER $100

- Bill Murphy- Manipulation Will End, $100/oz Silver Coming Soon

- Gold price bounces off 14 month support level

- Send Them a Link!

- Ben Davies: Stagflation Dead Ahead!

- Fear in gold market as hedge funds and retail sell

- Gold and Silver Nearing MAJOR Long Term Support

- The Petrodollar System’s End Will Propel Gold Higher

- Fear In Gold Market As Hedge Funds And Retail Sell – HNW And Smart Money Accumulate Again

- Dr. Marc Faber: Bottom Forming in Gold

- Three King World News Blogs

- Corvus Gold is Positioned to Ride Out the Gold Volatility

- Eric Sprott: The Cartel Will be Taken to Their Knees!

- Panic-Driven Austerity in the Eurozone and its Implications

- The Beast Is On The Prowl

| Talk of gold upturn premature as bears taste blood? Posted: 21 Feb 2013 06:05 PM PST An optimistic tone for the gold price we remarked on a week or so ago has been overtaken by a sharp downturn in the markets. |

| PanAust seeks joint copper/gold projects with Codelco Posted: 21 Feb 2013 02:14 PM PST PanAust wants to form mine ventures with Codelco to add to its Inca de Oro copper/gold project in Chile. |

| Unusual charts show a major gold bottom could be forming now Posted: 21 Feb 2013 12:58 PM PST From Gold Scents: For months and months now, I've been warning traders that QE 3 & 4 were going to have a major effect on stocks... I was confident the latest counterfeiting operation by the Fed would push stocks to at least test the 2007 highs, and I really expect we will see a marginal break above that level sometime this year. Probably by the end of the month... Make no mistake, though. We are still in a secular bear market. Stocks are testing their all-time highs at the same time earnings are in decline, GDP has turned negative, and unemployment is starting to tick up. It has been my expectation that the stock market would put in a final top sometime this year. I also expect this will be a very extended and difficult topping process lasting months, if not a year, or more. During this topping process, I expect to see an inflationary surge very similar to what happened in the oil markets during the 2007 top. Notice the breakdown in early 2007 that convinced everyone that the bull market in oil was finished. This set up a massive parabolic move into the 2008 blowoff top. This time, however, I don't think it's going to be oil leading the inflationary charge. In order to generate that kind of move, we need something that has formed a long consolidation similar to what happened in oil, and preferably an asset that has declined long enough and far enough to push sentiment to negative extremes capable of convincing everyone that the bull market is over... More on gold: |

| This retirement fact could shock you Posted: 21 Feb 2013 12:58 PM PST From Dennis Miller of Casey Research: Who fares better in retirement, pensioners or folks who saved up their own respective nest eggs? If you look at the numbers, you might be surprised to learn who's really "living large" after retirement. Regardless of how you made your money, what determines if you're rich when you retire? Frankly, it isn't how much money you made, but how much you accumulated that counts. So who are the real rich people? Retirees generally fall into one of four groups: folks who retired from the private sector with a 401(k), IRA, or a lump sum payout in lieu of a private pension; those with a government pension; self-employed folks who saved their own respective nest eggs; and finally, those scraping by on Social Security alone. The U.S. Census Bureau reports that in 2010 the top 10% had a median net worth of $1,864,000. If you're worth that much or more, 95% of the population thinks you're rich. But are you? When my wife and I were first married, we had a negative net worth. No silver spoons for us! By our late 50s, we were successfully self-employed and in the top income tax bracket. And yet, once we paid federal and state income taxes, plus Social Security and Medicare, about 50% of our gross income went to taxes. We raised a family with what was left. Once the children left the nest, we were in the race to the retirement finish line. For us, like most folks, that's when we really began to accumulate wealth for retirement. Here was our challenge... More on retirement: |

| Controversial analysis suggests gold and silver prices are being manipulated Posted: 21 Feb 2013 12:58 PM PST From PeakProsperity.com: Not everyone is a morning person. And few people like Mondays. But if you're a precious metals investor, mornings – especially Mondays – are brutal. The Evidence The precious metals are routinely sold off at or soon after the 8:20am EST morning open of the New York NYMEX exchange. Below are the daily gold price charts (source: Kitco) for each Monday (or Tuesday, if Monday was a holiday) since early this year. The current day's gold price is noted by the bright green line. The morning takedown is highlighted by the orange oval... More on precious metals: |

| A surprising post every gold-stock investor should see Posted: 21 Feb 2013 12:58 PM PST From The TSI Trader: Watching the HUI Gold Bugs Index of late brings to mind the saying, "If it wasn't so funny, I'd cry" or perhaps the opposite is better, "If it wasn't so sad, I'd laugh." Either saying [would be] correct, as what we are witnessing right now is extremely emotional and irrational price behavior... All along, I have resolved, without wavering, to hold my underwater mining positions for however long is required to sell each and every one at a profit. A nice, generous profit is what I have in mind. But at a time such as now, I suppose that sounds pretty naive, right? I mean, everyone knows the sky is falling, so what is my problem? ... I'd like to show you the earnings of the individual mining companies that make up the HUI Gold Bugs Index. And to put it in perspective, I worked hard to get the annual earnings for all 16 companies from 2004 right on up to the estimated earnings for each company in 2013. What I think you will quickly see is that this take down of the HUI Gold Bugs Index is emotional nonsense... More on gold stocks: |

| Posted: 21 Feb 2013 12:23 PM PST It has been a veritable gold bear parade on CNBC. As traders are bombarded with notes and warnings from large banks (who also happen to run hedge funds that trade futures), that the gold market is about to crack (talking their very short term book), the weakness in gold is giving gold bears a reason to be confident and to hammer the beaten up gold bulls into the ground. Gold bears have been ubiquitous on CNBC and other financial media in recent days. The hedge funds very large short gold position, as we reported earlier this week, is apparently based on the notion that investors "feel better" about the U.S. and European economies. That presupposes that it is the perception of investors about the economy that is the most important driver of the price of gold – something that may or may not actually inversely correlate, as Peter Schiff notes in his comments. It doesn't mean they are right, just convinced they are right. |

| Polyus Gold stake sale approval seen imminent Posted: 21 Feb 2013 12:05 PM PST Sources close to the matter say a decision by the U.K. Takeover Panel to approve the sale by Mikhail Prokhorov of his 38% stake in Polyus is imminent. |

| SPDR gold fund sees biggest 1-day outflow since Aug 2011 Posted: 21 Feb 2013 12:00 PM PST SPDR Gold Trust, the world's largest gold-backed ETF, said its bullion holdings dropped by 20.77 tonnes on Wednesday, its largest one-day outflow in 18 months. |

| Gold up after Fed knocks prices to 7-month lows Posted: 21 Feb 2013 11:52 AM PST The gold price recovered slightly on Thursday after plunging 2.6% in the previous session, as lower prices tempted some buyers back to the market. |

| India bans gold jewellery from Thailand Posted: 21 Feb 2013 11:40 AM PST In its ever growing bid to cut down on gold imports, the Indian government's attention has now turned to Thailand from where it has just suspended gold jewellery imports. |

| Hey Gold Bugs! The Dollar Still Matters! Posted: 21 Feb 2013 11:27 AM PST By Doug Eberhardt: The price of gold has moved higher 12 straight years. Even if gold were to finish lower in 2013, 12 out of 13 years of the price of gold going higher is a very good trend. Heck, even the S&P got 8 good years out of the last 12, and people still invest in stocks. Over the last few years, we keep hearing gold bugs talking about the weaker dollar. But ironically, the price of gold started its current trend down within days of the strong move up in the dollar, as seen in the Dollar Index chart below. (click to enlarge) Complete Story » |

| Where to buy gold in difficult times - Jay Taylor Posted: 21 Feb 2013 10:56 AM PST Jay Taylor, host of the radio show "Turning Hard Times into Good Times", points to some spots where selective investors can find value and growth potential. |

| A pivotal point for gold and silver explained Posted: 21 Feb 2013 10:56 AM PST "I feel that we are seeing what is called a "weak hands clean out" of small investors in the gold and slilver markets, and that gold will continue its twelve year record of gains in 2013." |

| Silver price remains above its 16 month long-term support Posted: 21 Feb 2013 10:54 AM PST |

| Fear In Gold Market As Hedge Funds And Retail Sell – HNW And Smart Money Accumulate Aga Posted: 21 Feb 2013 10:32 AM PST gold.ie |

| Gold Bounces Off 7-month Low as US Fed Minutes See T-Bonds Rise, Equities Join Commodity Posted: 21 Feb 2013 10:28 AM PST Bullion Vault |

| Where to buy gold in difficult times: Jay Taylor Posted: 21 Feb 2013 10:23 AM PST According to the calendar, it is still winter and gold markets still face some tough sledding, says Jay Taylor, host of the radio show "Turning Hard Times into Good Times." Big investors are leaving the market and small investors hesitate to reenter. |

| A Golden Opportunity With Miners, Part I Posted: 21 Feb 2013 10:06 AM PST This commentary is not for all investors. Sadly, many if not most investors will never know the intellectual (and financial) satisfaction of truly "buying low and selling high". When some company (or even an entire sector) is falling in price toward some long-term bottom, most investors will be fleeing in panic – rather than edging closer, sensing opportunity. The popular (but apparently mistaken) belief in the West is that the Mandarin characters which represent the Chinese word for "danger" also can be used to represent the word "opportunity". The fact that this botched-translation has achieved cliché status here in the West is, in fact, because it articulates one of the most time-tested principles of Contrarian logic. There is no better context in which to demonstrate this principle than in markets. The vast majority of investors are bandwagon-jumpers. This is in no way intended as an insult. It is a simple statement of empirical evidence and human nature. What should any smart investor invest in: "winners" or "losers"? Most smart investors don't even have to think about that one – naturally, you invest in the "winners" and shun the "losers". By definition, a "winner" (in market terms) is something which has already risen in value, substantially. One is jumping on the bandwagon. Conversely, by definition a "loser" is something which has fallen in value, substantially. To truly "buy low" requires buying losers – i.e. being a Contrarian. Thus while all the talking-heads in the financial management industry parrot the words "buy low, sell high"; the only people in our markets who actually walk the walk are the Contrarians. If Contrarians are (literally) the only investors in our markets who actually practice the money-making principle of buy low/sell high; then why aren't all Contrarians fabulously wealthy, and (ironically) thus viewed as Market Gurus? Because sometimes when "losers" go down they never come back up again. Anyone bought any "Kodak film" lately? One must be a Contrarian if one wishes to even attempt to "buy low and sell high". However, one must be an intelligent Contrarian (or at least a competent one) to do so successfully. We can summarize the challenge which faces investors with a simple metaphor. Being a successful Contrarian means being able to discern between a "low tide" (which precedes a high tide), and a ship which has absolutely (and permanently) "run aground." This brings us to the Mother of All Low Tides: the precious metals sector. Envision two sectors. One sector has been rising for twelve consecutive years, during which time it has outperformed all others (and produced stellar returns for investors). The other sector has been shunned by mainstream investors to the point where the majority of market participants have invested only roughly 1% as much capital in this sector as the historical average, throughout the entire history of our markets. It is continuously described by the mainstream media as "about to collapse", and avoided by most "respectable" financial management professionals because it is "too risky." Now try to wrap your head around the notion that these "two sectors" are the same sector: precious metals. How is it possible that the best-performing asset class over the past twelve has been (and remains) more under-owned than at any time in the entire history of our markets? |

| Posted: 21 Feb 2013 09:45 AM PST This is my last day with my son Andy, his wife and two daughters. They go back to Minneapolis early Thursday morning. We are spending all our time with the family and I will not be offering any personal insight today – other than to say I believe we are very near the bottom. I asked my friend Trader David R "Will the market hold $1550?" He replied, "No, the market is too long still." Gold does have strong support above $1525. Check out the following chart.

I hope to add to my gold and silver positions before the week is over. You can be sure the Asians are thrilled with these prices. Idiots sell off their Comex contracts and the Asians and Russians buy physicals. Similar Posts: |

| Gold and silver nearing major long-term support Posted: 21 Feb 2013 09:31 AM PST Gold and silver along with their related miners have been under a lot of selling pressure the last few months. Prices have fallen far enough to make most traders and investors start to panic and close out their long term positions, which is a bullish signal in my opinion. |

| Gold falls as technical selling pressure mounts Posted: 21 Feb 2013 09:24 AM PST Gold futures prices are lower and hit a fresh 8.5-month low in early U.S. trading Thursday. Follow-through technical selling pressure and more weak-long liquidation are featured. |

| Gold bounces off 7-month low as U.S. Fed minutes see T-bonds rise Posted: 21 Feb 2013 09:17 AM PST The price of gold bounced off a fresh seven-month dollar low on Thursday morning in London, rising after their worst one-week drop since May 2012 amid what one analyst called "a proper sell-off on the precious metal markets." |

| THE FORCES THAT WILL PUSH SILVER OVER $100 Posted: 21 Feb 2013 09:00 AM PST *Editor note: With sentiment near all-time lows for the entire bull market, we thought it apropos to bring back SRSrocco's viral, comprehensive FUNDAMENTAL ANALYSIS on the forces that will push silver over $100/oz. PLEASE CHECK YOUR EMOTIONS AT THE DOOR AND REVIEW THE FUNDAMENTALS! By SRSrocco There are tremendous forces at work that will push [...] |

| Bill Murphy- Manipulation Will End, $100/oz Silver Coming Soon Posted: 21 Feb 2013 08:00 AM PST In the face of this week's relentless paper attacks on the gold and silver markets, GATA's Bill Murphy provides some clarity and perspective on the long term fundamentals for silver. In his latest interview with our friends at AltInvestors, Murphy states that $100 silver is coming soon. Full MUST LISTEN interview is below: SDBullion's new [...] |

| Gold price bounces off 14 month support level Posted: 21 Feb 2013 07:47 AM PST |

| Posted: 21 Feb 2013 07:12 AM PST Many of you have been reading Miles Franklin's dailies for a while. David writes from the heart and hits straight to the point yet as the owner of a precious metals dealer he is no carnival barker. I bet you could go back 5 years and read one of his missives and see that he was pretty close to correct. I write like I speak and tell it the way I see it and (R)Andy, well, he gives you more information in one space than is humanly possible. So where am I going with this? If you like what you have been reading and think that we make sense, tell the truth and you've learned anything from us then please send it along to 10 or even just 5 of your friends, relatives or people that you care about. I have found over the years that "Gold people" are some of the most "real" people on the planet. They inherently are "searchers" for the truth. Generally they are people that would prefer a world where business is done on a handshake and goes off without a hitch. "We" are the minority in a world where even written contracts are ignored on a regular basis. If you are reading this "they" are probably like you. But there is a "rest of the world" who either don't think or analyze, are too busy to bother, don't care or something else. These are our friends, relatives and others that we wouldn't want to see get run over by the obvious oncoming fiat steam roller. That said, I ask that for the next week you send them a link to our writings. You can talk to many of these people until you are blue in the face and they will either think you are nuts, eccentric or just plain wrong. You are not and you know this. The metals have been "sold" down on the paper markets at the same time that physical demand has increased, somewhat reminiscent of late 2008 when prices crashed but… it was hard to find any real silver to purchase at any price near the paper price. Right now is an excellent time to forward our writings and get those that you care about to think about entering the metal arena. You can do this with confidence because anyone who does buy now should be very happy in a relatively short period of time as this "paper operation" ends, which it surely must and will. By making this push now you will be doing a service and with very little chance of being told "what a bad investment you suggested." I know that it is difficult (and scary) to recommend anything to those close to you. I know this personally as the scariest thing in my 23 year Wall St. career was making a recommendation to my Mom or Dad. If you pass our information along, it is not you making the recommendation, it is us. If you believe (as you rightly should) that the only true insurance from the coming financial calamity is gold and silver then please take this seriously and forward the link to 10 people each day for the next week. We are not barking "buy from us," though we would appreciate the opportunity to compete price wise for any trade you might contemplate. I have received numerous e-mails over the last 8 or 9 months thanking me for my writings. Try to help those that you care about, forward our "stuff" for a week or so and consider us even. It is our pleasure to tell the truth as even that is becoming scarce and more valuable. Thanks. DisclaimerSimilar Posts: |

| Ben Davies: Stagflation Dead Ahead! Posted: 21 Feb 2013 07:05 AM PST GoldMoney's Alasdair Macleod has released an interview with Ben Davies of Hinde Capital. They discuss the idea of nominal GDP targeting as a monetary policy strategy for central banks. Nominal GDP growth is the sum of real GDP growth plus the inflation rate. Davies says that proponents of a nominal GDP targeting — so-called market [...] |

| Fear in gold market as hedge funds and retail sell Posted: 21 Feb 2013 07:02 AM PST Gold has come under pressure from heavy liquidation by hedge funds and banks on the Comex this week. The unusual and often 'not for profit' nature of the selling, at the same time every day this week, has again led to suspicions of market manipulation. |

| Gold and Silver Nearing MAJOR Long Term Support Posted: 21 Feb 2013 06:55 AM PST Gold and silver along with their related miners have been under a lot of selling pressure the last few months. Prices have fallen far enough to make most traders and investors start to panic and close out their long term positions which is a bullish signal in my opinion. My trading tactic for both swing trading and day trading thrive on entering and exiting positions when panic trading hits an investment. General rule of thumb is to buy when others are extremely fearful and cannot hold on to a losing position any longer. When they are selling I am usually slowly accumulating a long position. Looking at the charts below of gold and silver you can see the strong selling over the past two weeks. When you get drops this sharp investors tend to focus on their account statements watching the value drop at an accelerated rate to the point where they ignore the charts and just liquidate everything they have to preserve their capital. A few weeks ago I posted my outlook on precious metals which seems to be unfolding as expected: http://www.thegoldandoilguy.com/articles/precious-metals-miners-making-waves-and-new-trends/ Gold Bullion Weekly Chart: The price and outlook of gold has not really changed much in the past year. It remains in a major bull market and has been taking a breather, nothing more. Stepping back and reviewing the weekly chart it's clear that gold is nearing long term support. With panic selling hitting the gold market and long term support only $20 – $30 dollars away this investment starts to look really tasty. But if price breaks below the $1540 level and closed down there on a weekly basis then all bets are off as this would trigger a wave of selling that would make the recent selling look insignificant. And the uptrend in gold would now be over.

Silver Bullion Weekly Chart: Silver price is in the same boat as its big sister (Yellow Gold). Only difference is that silver has larger price swings of 2-3x more than gold. This is what attracts more traders and investors but unfortunately the masses do not know how to manage leveraged investments like this and end up losing their shirts. A breakdown below the $26.11 price would likely trigger a sharp drop back down to the $17.50 level so be careful…

Gold Mining Stocks – Monthly Chart: If you wanna see a scary chart then look at what could happen or is happening to gold miner stocks. This very could be happening as we speak and why I have been pounding the table for months no to get long gold, silver or miners until we see complete panic selling or a bullish basing pattern form on the charts. We have not seen either of these things take place although panic selling is slowly ramping up this week. There will be some very frustrated gold bugs if they take another 33% hair cut in value… You can view some of my trading charts, setups and analysis free at my stockcharts.com list. Be sure to vote for me chartlist each day so I know its of value: https://stockcharts.com/public/1992897

Precious Metals Trend and Trading Conclusion: In short, the precious metal sector remains in a cyclical bull market. That being said and looking at the daily charts the prices have been consolidating and are in a down trend currently. Until we see some type of bottoming pattern or price action form it is best to sit on the side lines and watch the emotional traders get caught up and do the wrong thing. The next two weeks will be crucial for gold, silver and miner stocks. If metals cannot find support and close below the key support levels things could get really ugly fast. If you would like to receive my daily analysis and know what I am trading then check out my newsletter at:www.TheGoldAndOilGuy.com Chris Vermeulen |

| The Petrodollar System’s End Will Propel Gold Higher Posted: 21 Feb 2013 06:48 AM PST Despite so many negative predictions, the dollar is still resisting as the World's reserve currency in 2013. Experts say its days are numbered, it's just a matter of time until the dollar collapses. But what is still keeping the dollar in power? According to PrimeValues.org, the dollar's strength is partly due the petrodollar system. This is what's ensuring the US currency its reserve currency status and its strength in terms of value on the forex markets as well. Shortly: the petrodollar system means buying petrol for US dollars. Countries which want to buy oil must buy US dollars first in order to pay for it. Saudi Arabia is part of the petrodollar system. It's the second largest oil producer in the World. But there were times when the arab country was the top oil producer. When Saudi Arabia is selling oil to, for example – Italy, then the Italians must buy dollars in order to pay for the oil. There are several countries in the World that are part of the petrodollar system, but more and more countries are ditching it. The US dollar's reputation is "at the edge of the cliff" mainly due to intense money printing by the fed and the immense debt accumulated. For decades (especially in the second part of the 20th century), the US dollar has enjoyed the strong status due to the petrodollar trading system. Across the World, buyers of oil resorted to the dollar as a means to pay for the "black gold". The US dollar has gained tremendous strength on the back of this system. But due to the economic crisis and political interests, many countries are ditching the dollar and actually selling their petrol for "almost anything else valuable": either other currencies or gold or they're bartering. Venezuela, Iran are major oil producers that have ditched the dollar. As the dollar is more and more avoided in bilateral trade between countries (and, it's not just the case of petrol trade), the petrodollar's significance in the global economy is diminishing. Eventually, the crash of the petrodollar system will crash the dollar as well. Either because of avoidance of the US currency, either because of depletion of the World's oil reserves It's a mix of factors that PrimeValues.org considers will put an end to the petrodollar system and the above-mentioned two are the main ones. The US dollar may not resist until "domestic issues" will put crash it. The problems might come from outside.

|

| Fear In Gold Market As Hedge Funds And Retail Sell – HNW And Smart Money Accumulate Again Posted: 21 Feb 2013 06:19 AM PST More speculative gold buyers appear to have been spooked by the FOMC minutes from the Fed's January 30th meeting which "said the central bank should be ready to vary the pace of their $85 billion in monthly bond purchases amid a debate over the risks and benefits of further quantitative easing." Gold has come under [...] |

| Dr. Marc Faber: Bottom Forming in Gold Posted: 21 Feb 2013 03:11 AM PST ¤ Yesterday in Gold and SilverAll was quiet in Far East trading right up until 3:00 p.m. in Hong Kong. At that point, the gold price developed a slight negative bias...and shortly after the London morning gold fix was in, the high-frequency traders went to work. The rest, as they say, is history. Then right at 2:00 p.m. in New York...probably on the Fed news...the bid disappeared and the gold price plunged another $20 in electronic trading. Gold's low price tick [$1,558.00 spot] came minutes before 3:00 p.m. in New York...and after that it traded sideways until the 5:15 p.m. Eastern time close. When the smoke cleared, gold finished the Wednesday trading session at $1,564.30 spot...down $40.30 on the day. Volume was immense...around 276,000 contracts. Silver followed a similar path, but the price was basically unchanged through all of Far East trading...and right up until shortly before 11:00 a.m. in London, the same time as the high-frequency traders showed up in gold. Silver's low [$29.21 spot] came at the same moment as gold's...but recovered 35 cents going into the close of electronic trading. For the second day in a row, silver had an intraday price decline of over a dollar. Yesterday, it was $1.23. Silver finished the Wednesday trading day at $28.56 spot...down 88 cents. Net volume was very healthy at 58,500 contracts. Gross volume was north of 138,000 contracts. And, for the second day running, both platinum and palladium traded in a far different price pattern than did gold and silver...but both got smoked to the downside as well. As I pointed out a couple of weeks back when the monthly Bank Participation Report came out...two or three U.S. bullion banks had been going short against all comers during the platinum and palladium rallies that had begun several months prior...and yesterday was the first day that they did the real dirty in those two precious metals...and rang the cash register on them as well. The dollar index opened at 80.51 on Wednesday morning in the Far East...and faded down to 80.28 around 3:00 p.m. in Hong Kong...and less than an hour before the London open. From there, the dollar began to rally...and by 2:00 p.m. in New York it had made it up to about 80.81...and then jumped up to 81.10 following the Fed news. From there it traded sideways into the close, finishing the Wednesday trading session at 81.05...up 54 basis points from Tuesday's close. The dollar index rally was well under way before the high-frequency traders showed up in London just after the morning gold fix, so to hang yesterday's precious metals price action entirely on the currencies, is a stretch...and that's being kind. It's my opinion that this was a manufactured rally so 'da boyz' could hide behind this fig leaf as they did the dirty in the precious metals...and that's certainly not the first time the've used this technique. The gold stocks got crushed...and the HUI closed on its absolute low of the day...down 4.97%. Except for a couple of silver stocks...mostly notably First Majestic Silver...Nick Laird's Intraday Silver Sentiment Index got hammered to the tune of 5.13%. (Click on image to enlarge) The CME's Daily Delivery Report showed that 22 gold and 8 silver contracts were posted for delivery on Friday within the Comex-approved depositories. It was mostly the 'usual suspects' as issuers and stoppers...and the link to that activity, such as it was, is here. The GLD ETF showed a huge decline yesterday, as at least one authorized participant withdrew a total of 667,796 troy ounces of gold. I was expecting the worst when I clicked on the link to SLV, but was amazed to discover that an authorized participant added 580,078 troy ounces of silver! Is someone covering a short position? Since the big engineered price decline began on Monday, February 10th, SLV has had 1.45 million ounces added to it...and GLD has had 890,000 ounces withdrawn. After I hit the 'send' button on today's column, the good folks over at Switzerland's Zürcher Kantonalbank sent out their latest update early this morning. As of the close of business on February 19th, they reported that their gold ETF declined by 47,805 troy ounces during the reporting period that began on February 12th...and there was virtually no change in their silver ETF. The U.S. Mint had a sales report of sorts yesterday. They didn't sell any gold eagles or buffaloes...but did report selling another 424,500 silver eagles. Over at the Comex-approved depositories on Tuesday, they reported receiving 352,093 troy ounces of silver...and shipped 845,166 troy ounces out the door. The link to that activity is here.

I'm back to the usual number of stories for a mid-week column, so I hope you can find the time to read the articles that interest you the most. In Thursday's Far East trading, new low price prices for this move down were set in all four precious metals Adam Taggart: Gold's regular morning mugging. Ted Butler: A Manipulation Timeline. SLV adds another 580,000 troy ounces of silver. Despite the Smash, Big Picture for Gold Points to New Highs. ¤ Critical ReadsSubscribeFed, uneasy over 'QE'...plans bond-buy debateMinutes of the Federal Reserve's January meeting released Wednesday reveal that many Fed officials are worried about the costs and risks arising from the $85 billion–per–month asset-purchase program. And they all seem to have their own ideas on how to proceed. Several Fed officials said the central bank should be prepared to vary the pace of the asset-purchase plan depending on the outlook or how the program was working. One wanted to vary it on a meeting-by-meeting basis. One new idea backed by a "number" of Fed officials would have the central bank promising markets that it will not sell its massive holdings of Treasuries and mortgage-backed securities as quickly as the market now expects. This could be a substitute for asset purchases, they argued. Say what? You can't make this stuff up. Today's first story was posted on the marketwatch.com Internet site shortly after the markets closed in New York yesterday afternoon...and I thank Casey Research's own Dennis Miller for sending it our way. The link is here.  U.S. Banks Bigger Than GDP as Accounting Rift Masks RiskWarning: Banks in the U.S. are bigger than they appear. That label, like a similar one on automobile side-view mirrors, might be required of the four largest U.S. lenders if Thomas Hoenig, vice chairman of the Federal Deposit Insurance Corp., has his way. Applying stricter accounting standards for derivatives and off-balance-sheet assets would make the banks twice as big as they say they are -- or about the size of the U.S. economy -- according to data compiled by Bloomberg. "Derivatives, like loans, carry risk," Hoenig said in an interview. "To recognize those bets on the balance sheet would give a better picture of the risk exposures that are there." This Bloomberg article appeared on their website late Tuesday afternoon..and I thank Manitoba reader Ulrike Marx for bringing it to our attention...and the link is here.  Matt Taibbi: Justice Department's New Get-Tough Policy Is, Well, NotI don't want to sound like a broken record, but . . . the latest ploy by the government to insist it is "getting tough" on Wall Street is beyond laughable. The tough new-and-improved regime, as described by the curiously credulous Dealbook, is a policy of extracting criminal guilty pleas from foreign subsidiaries, as opposed to the "usual fines and reforms." This was the path chosen in the recent UBS deal (in which a Japanese subsidiary was charged while the parent company was given a complete walk, a non-prosecution settlement) and in the more recent deal with the Royal Bank of Scotland. Both of those banks were implicated in the LIBOR rate-fixing case, which is only maybe the most egregious and far-reaching financial scandal of our generation. You know what an effective deterrent to crime is? Jail! And do you know what kind of criminal penalty actually makes people think twice about committing crimes the next time? The kind that actually comes out of some individual's pocket, not fines that come out of the corporate kitty. Matt goes supernova on this one. His blog is not overly long...and definitely worth reading if you have the time. It was posted on the rollingstone.com Internet site yesterday...and I thank Roy Stephens for his first of many contributions to today's column. The link is here.  Global banks shun U.K. Gilts on 'stagflation' riskA clutch of global banks and funds have warned clients to steer clear of UK Gilts, fearing that the Bank of England has opened the door to "stagflation" and risks losing credibility. "Systematically forecasting a disinflation that never materialises has exposed the bank to ridicule," said Nomura, Japan's biggest lender and a conduit for Asian investors. Nomura said the Bank's refusal to check inflation running at 2.7pc validates suspicions that it is "actively seeking to inflate away debts. It seems the Bank of England may be taking the dubious path of ignoring stated targets when they prove problematic. Markets are becoming less forgiving," it said. I do believe that this is an example of the pot calling the kettle, black. This Ambrose Evans Pritchard offering was posted on The Telegraph's website early yesterday evening GMT...and I thank Ulrike Marx for her second offering in today's column. The link is here.  Spain's 'head is out of the water' as deficit drops below 7pcMariano Rajoy has declared that "Spain's head is out of the water" as he revealed that austerity efforts have pulled the budget deficit for 2012 below 7pc of GDP. The Spanish prime minister, who was delivering his State of the Nation address to the parliament in Madrid, said it was a "readjustment without precedent". In 2011, the Spanish deficit was 9.4pc of GDP. He said the results would end speculation about Spain crashing out of the eurozone. "A year ago, nobody looking at Spain from outside would bet on it," Mr Rajoy said. "Today, no one would say we could leave the euro." However gloom was cast over Spain's break-through by the Euroframe Group that warned that eurozone GDP is likely to fall by 0.3pc this year. One data point does not a recovery make. This is whistling past the graveyard, Spanish style. The story was posted on the telegraph.co.uk Internet site late yesterday afternoon GMT...and it's courtesy of Roy Stephens. The link is here.  Spain and Italy: The Euro Crisis Gnaws at Europe's UnderbellyThe euro crisis may have dropped out of the headlines recently, but Spain and Italy would seem to be doing their best to bring it back. Real estate giant Reyal Urbis' bankruptcy has raised fresh concerns about Spanish banks and many fear that a Berlusconi election victory could drive Rome to seek emergency aid. It had become a trend among top European politicians to forecast that the worst of the euro crisis had passed. A pledge by the European Central Bank to buy up unlimited quantities of sovereign bonds as needed, promising numbers from Greece indicating that the country was finally getting its budget deficit under control and a reform-minded government in Rome -- 2012 seemed set to go down in history as the year the crisis lost its bite. This week, the outlook is looking less rosy. And much of the pessimism is focused on the two countries long seen as potentially the most dangerous should the euro crisis grow: Spain and Italy. In light of what's in this article, it's hard to take the prior story about Spain's 'success' seriously. This was posted on the German website spiegel.de yesterday...and is another Roy Stephens offering. The link is here.  Berlusconi's Faithful: 'Only Silvio Can Save Italy'Comparisons to Jesus, professions of love: Supporters of Silvio Berlusconi are rabidly faithful. As the campaign winds down ahead of elections in Italy, the rhetoric has heated up. For those who deify "Il Cavaliere," the Germans are to blame for their country's woes. The savior is making the crowd wait and Giovanni Ferrante briefly lost his faith. "Where the devil is Berlusconi hiding," he says. He's been waiting for more than an hour in a stuffy crowded hall, with narrow seats. Just then the party anthem starts playing and the star marches into the theater in Palermo, shaking hands, winking and grinning. Even those in the highest seats can see the gleam reflecting off of his unnaturally white teeth. Ferrante waves back. Il Cavaliere has finally arrived. Silvio Berlusconi, Italy's scandal-plagued former prime minister, is back. Just days before Italians are set to go to the polls on Sunday and Monday, he and his party are narrowing the once sizeable lead enjoyed by center-left candidate Pier Luigi Bersani. Just how narrow that lead now is cannot be known for sure; no new survey numbers can be published in the two weeks before Italian elections. At least they're not screaming "Il Duce"...not yet, anyway. This is another story from the spiegel.de Internet site yesterday afternoon Europe time...and the articles from Roy just keep on coming. The link is here. |

| Posted: 21 Feb 2013 03:11 AM PST  The first blog is with Kevin Wides...and it's entitled "Despite the Smash, Big Picture for Gold Points to New Highs". Next is this interview with Ron Rosen. |

| Corvus Gold is Positioned to Ride Out the Gold Volatility Posted: 21 Feb 2013 02:17 AM PST Jeff Pontius, founder and CEO of Corvus Gold discusses the company's recent news, why it's positioned well for the future and what investors should be looking for in mining companies.

Corvus Gold is a paid sponsor of our website and free newsletter. |

| Eric Sprott: The Cartel Will be Taken to Their Knees! Posted: 21 Feb 2013 02:00 AM PST The Doc sat down with gold and silver expert and billionaire fund manager Eric Sprott Wednesday for the first of a series of interviews regarding the markets. Eric warned The Doc prior to the interview that the KWN and USAWatchdog sites were maliciously attacked the day they published interviews with Sprott. There appear to be [...] |

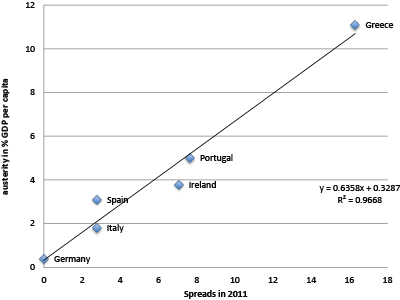

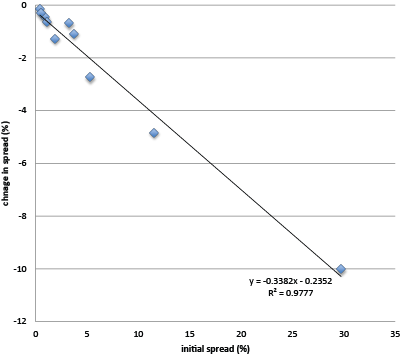

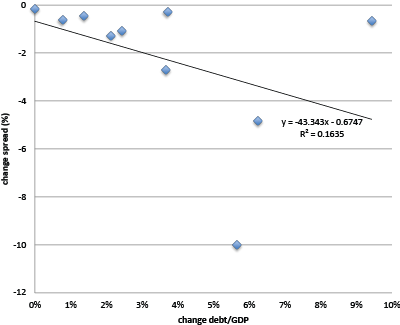

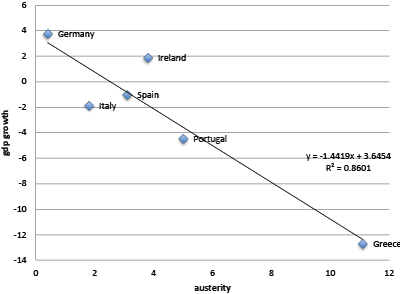

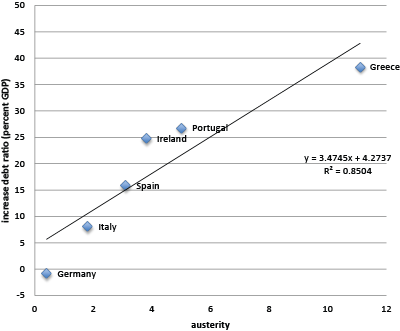

| Panic-Driven Austerity in the Eurozone and its Implications Posted: 21 Feb 2013 01:00 AM PST By Paul De Grauwe, Professor of international economics, London School of Economics, and former member of the Belgian parliament, and Yuemei Ji, Economist, LICOS, University of Leuven. Cross posted from VoxEU Eurozone policy seems driven by market sentiment. This column argues that fear and panic led to excessive, and possibly self-defeating, austerity in the south while failing to induce offsetting stimulus in the north. The resulting deflation bias produced the double-dip recession and perhaps more dire consequences. As it becomes obvious that austerity produces unnecessary suffering, millions may seek liberation from 'euro shackles'. Southern Eurozone countries have been forced to introduce severe austerity programs since 2011. Where did the forces that led these countries into austerity come from? Are these forces the result of deteriorating economic fundamentals that made austerity inevitable? Or could it be that the austerity dynamics were forced by fear and panic that erupted in the financial markets and then gripped policymakers. Furthermore, what are the implications of these severe austerity programs for the countries involved? The Facts: Austerity and Spreads There is a strong perception that countries that introduced austerity programs in the Eurozone were somehow forced to do so by the financial markets. Is this perception based on a reality? Figure 1 shows the average interest rate spreads in 2011 on the horizontal axis and the intensity of austerity measures introduced during 2011 as measured by the Financial Times on the vertical axis. It is striking to find a very strong positive correlation. The higher the spreads1 in 2011 the more intense were the austerity measures. The intensity of the spreads can be explained almost uniquely by the size of the spreads (the R-squared is 0.97). Note the two extremes. Greece was confronted with extremely high spreads in 2011 and applied the most severe austerity measures amounting to more than 10% of GDP per capita. Germany did not face any pressure from spreads and did not do any austerity. Figure 1. Austerity measures and spreads in 2011 Source: Financial Times and Datastream. There can be little doubt. Financial markets exerted different degrees of pressure on countries. By raising the spreads they forced some countries to engage in severe austerity programs. Other countries did not experience increases in spreads and as a result did not feel much urge to apply the austerity medicine. Two Theories About Spreads The next question that arises is whether the judgement of the market (measured by the spreads) about how much austerity each country should apply was the correct one. There are essentially two theories that can be invoked to answer this question. According to the first theory, the surging spreads observed from 2010 to the middle of 2012 were the result of deteriorating fundamentals (e.g. domestic government debt, external debt, competitiveness, etc.). Thus, the market was just a messenger of bad news. Its judgement should then be respected. The implication of that theory is that the only way these spreads can go down is by improving the fundamentals, mainly by austerity programs aimed at reducing government budget deficits and debts. Another theory, while accepting that fundamentals matter, recognises that collective movements of fear and panic can have dramatic effects on spreads. These movements can drive the spreads away from underlying fundamentals, very much like in the stock markets prices can be gripped by a bubble pushing them far away from underlying fundamentals. The implication of that theory is that while fundamentals cannot be ignored, there is a special role for the central bank that has to provide liquidity in times of market panic (De Grauwe 2011). The decision by the ECB in 2012 to commit itself to unlimited support of the government bond markets was a game changer in the Eurozone. It had dramatic effects. By taking away the intense existential fears that the collapse of the Eurozone was imminent the ECB's lender of last resort commitment pacified government bond markets and led to a strong decline in the spreads of the Eurozone countries. This decision of the ECB provides us with an interesting experiment to test these two theories about how spreads are formed. Figure 2 provides the evidence. On the vertical axis we show the change in the spreads in the Eurozone from the middle of 2012 (when the ECB announced its program) to the beginning of 2013. On the horizontal axis we present the initial spread, i.e. the one prevailing in the middle of 2012. We find a surprising phenomenon. The initial spread (i.e. in 2012Q2) explains almost all the subsequent variation in the spreads. Thus the country with the largest initial spread (Greece) experienced the largest subsequent decline; the country with the second largest initial spread (Portugal) experienced the second largest subsequent decline, etc. In fact the points lie almost exactly on a straight line going through the origin. The regression equation indicates that 97% of the variation in the spreads is accounted for by the initial spread. Thus it appears that the only variable that matters to explain the size of the decline in the spreads since the ECB announced its determination to be the lender of last resort is the initial level of the spread. Countries whose spread had climbed the most prior to the ECB announcement experienced the strongest decline in their spreads – a remarkable feature. Figure 2. Change in spreads vs. initial spreads Source: Datastream (Oxford Economics). In previous research (De Grauwe and Ji 2012) we provided evidence that prior to the regime shift made possible by the ECB a large part of the surges in the spreads were the results of market sentiments of fear and panic that had driven the spreads away from their underlying fundamentals. Figure 2 tends to confirm this. By taking away the fear factor the ECB allowed the spreads to decline. We find that the decline in the spreads was the strongest in the countries where the fear factor had been the strongest. What about the role of fundamentals in explaining the decline in the spreads observed since the middle of 2012? Figure 3 provides the evidence. We selected the change in the government debt-to-GDP ratio as the fundamental variable as suggested by many studies (Aizenman and Hutchinson 2012, Attinasi, et al., 2009, Beirne and Fratscher 2012, De Grauwe and Ji 2012). We observe two interesting phenomena in Figure 3. First, while the spreads declined, the debt-to-GDP ratio continued to increase in all countries after the ECB announcement. Second, the change in the debt-to-GDP ratio is a poor predictor of the declines in the spreads. Thus the decline in the spreads observed since the ECB announcement appears to be unrelated to the changes of the debt-to-GDP ratios. If anything, the fundamentalist school of thinking would have predicted that as the debt-to-GDP ratios increased in all countries, spreads should have increased rather than decline. Figure 3. Change in debt-to-GDP ratio vs. spreads since 2012Q2 Source: Datastream (Oxford Economics). From the previous discussion one can conclude that a large component of the movements of the spreads since 2010 was driven by market sentiments. These market sentiments of fear and panic first drove the spreads away from their fundamentals. Later as the market sentiments improved thanks to the announcement of the ECB, these spreads declined spectacularly. This was predicted in De Grauwe (2011), Wolf (2011) and Wyplosz (2011). We can now give the following interpretation of how the spreads exerted their influence on policymakers and led them to apply severe austerity measures. As the spreads increased due to market panic, these increases also gripped policymakers. Panic in the financial markets led to panic in the world of policymakers in Europe. As a result of this panic, rapid and intense austerity measures were imposed on countries experiencing these increases in spreads. The imposition of dramatic austerity measures was also forced by the fact that countries with high spreads were pushed into a liquidity crisis by the same market forces that produced the high spreads (De Grauwe 2011). This forced these countries to beg 'cap in hand' for funding from the creditor countries. The Effects of Panic-Driven Austerity How well did this panic-induced austerity work? We provide some answers in Figures 4 and 5. Figure 4 shows the relation between the austerity measures introduced in 2011 and the growth of GDP over 2011-12. We find a strong negative correlation. Countries that imposed the strongest austerity measures also experienced the strongest declines in their GDP. This result is in line with the IMF's recent analysis (IMF 2012). Figure 4. Austerity and GDP growth 2011-2012 Source: Financial Times and Datastream. Some will say that this is the price that has to be paid for restoring budgetary orthodoxy. But is this so? Figure 5 may lead us to doubt this. It shows the austerity measures and the subsequent change in the debt-to-GDP ratios. It is striking to find a strong positive correlation. The more intense the austerity, the larger is the subsequent increase in the debt-to-GDP ratios. This is not really surprising, as we have learned from the previous figure, that those countries that applied the strongest austerity also saw their GDP (the denominator in the debt ratio) decline most forcefully. Thus, it can be concluded that the sharp austerity measures that were imposed by market and policymakers' panic not only produced deep recessions in the countries that were exposed to the medicine, but also that up to now this medicine did not work. In fact it led to even higher debt-to-GDP ratios, and undermined the capacity of these countries to continue to service the debt. Thus the liquidity crisis that started all this, risks degenerating into a solvency crisis. Figure 5. Austerity and increases in debt-to-GDP ratios Source: Financial Times and Datastream. Note: The Greek debt ratio excludes the debt restructuring of end 2011 that amounted to about 30% of GDP. Conclusion Three conclusions can be drawn from the previous analysis.

They also gave these wrong signals to the European authorities, in particular the European Commission that went on a crusade trying to enforce more austerity. Thus financial markets acquired great power in that they spread panic into the world of the European authorities that translated the market panic into enforcing excessive austerity. While the ECB finally acted in September 2012, it can also be argued that had it acted earlier much of the panic in the markets may not have occurred and the excessive austerity programs may have been avoided.

These sentiments have forced southern EZ countries into quick and intense austerity that not only led to deep recessions, but also up to now, did not help to restore sustainability of public finances. On the contrary, the same austerity measures led to dramatic increases of the debt-to-GDP ratios in southern countries, thereby weakening their capacity to service their debts. In order to avoid misunderstanding, we are not saying that southern European countries will not have to go through austerity so as to return to sustainable government finances. They will have to do so. What we are claiming is that the timing and the intensity of the austerity programs have been dictated too much by market sentiments of fear and panic instead of being the outcome of rational decision-making processes.

The desirable budgetary stance for the Eurozone as whole consists in the south pursuing austerity, albeit spread over a longer period of time, while the north engages in some fiscal stimulus so as to counter the deflationary forces originating from the south. The northern countries have the capacity to do so. Most of them have now stabilised their debt-to-GDP ratios. As a result, they can allow a budget deficit and still keep their ratio constant. Germany in particular could have a budget deficit of close to 3%, which would keep its debt-to-GDP ratio constant. Given the size of Germany, this would allow for a significant stimulus for the Eurozone as a whole. The intense austerity programs that have been dictated by financial markets create new risks for the Eurozone. While the ECB 2012 decision to be a lender of last resort in the government bond markets eliminated the existential fears about the future of the Eurozone, the new risks for the future of the Eurozone now have shifted into the social and political sphere. As it becomes obvious that the austerity programs produce unnecessary sufferings especially for the millions of people who have been thrown into unemployment and poverty, resistance against these programs is likely to increase. A resistance that may lead millions of people to wish to be liberated from what they perceive to be shackles imposed by the euro. ____ For references, see original article at VoxEU |

| Posted: 20 Feb 2013 11:09 PM PST As the economic collapse approaches, be aware that government will become more desperate and resort to measure(s) that will enable it to survive. The myth of government as a good, necessary and positive force in society is coming unraveled. To understand how we got to this point, it is useful to review some economic history.. The |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment