Gold World News Flash |

- Peter Schiff Takes On Credit Suisse Gold Bear

- Four Largest Banks Are Now Almost As Big As US GDP: Accounting Hides Risks – Taleb on Fragility

- CFTC sues Nymex over information leaks

- Gold Reverse at Bottom of Range; Upside Risk Increased

- PM Bullion Closed-End Funds: Helping or Harming?

- Andy Hoffman- Insane Gold Raid – YouTube

- Major Bottom Forming In Gold But Stocks Shaky

- Robert Kiyosaki “Don’t buy gold or silver” in 2012 – YouTube

- Gold and silver rebound/Silver OI remains stubbornly high at just under 155,000 contracts./jobless numbers increase/Philly index plummets/WalMart states that “we fell off the cliff”

- A Blueprint To Restore The Articles of Confederation

- The Global Risk Landscape For 2013

- FIGHTING THE GOOD FIGHT

- Gold Versus Gold Miners: Has The Time Come To Flip The Switch?

- WARNINGS OF DICTATORSHIP

- FBI Launches Insider Trading Investigation On Blockbuster Heinz Sale – YouTube

- Nirvana, Creditopia, And Why Central Banks Are The Devil

- The Silver and Gold Price Must Not Close Below the Last Two Days' Lows

- Peter Schiff : ‘More Reasons Than Ever’ to Buy Gold

- Scorecard: How Many Rights Have Americans REALLY Lost?

- Get Out Of DEBT! NOW!!! – YouTube

- DAVID MORGAN on SILVER, The disciplined investor is accumulating at these levels – YouTube

- The Gold Bull is Far from Dead

- Stanley Druckenmiller: "We Have An Entitlement Problem" And One Day The Fed's Hamster Wheel Will Stop

- Gold – Here Is The Good News

- Peter Schiff Takes On Credit Suisse Gold Bear – YouTube

- Gold Decline Won’t Sink Odyssey Marine – YouTube

- Wireless Technology Is Ushering In a New Era of Computing

- The Top Ten Stocks for Feb. 21 – YouTube

- Will It Be Different This Time? Will the Dow and S&P 500 Go Up, UP and Awaaay?

- Bite The Emotional Restraint Bullet

- “Just Be Your Own Central Bank”

- China Will Have World’s Largest Gold Reserves In 2 To 3 Years

- Clocks to Clean

- Gold Seeker Closing Report: Gold and Silver Gain With Dollar While Stocks and Oil Fall

- Gold Daily and Silver Weekly Charts - Bounce

- What then must we do?

| Peter Schiff Takes On Credit Suisse Gold Bear Posted: 21 Feb 2013 10:40 PM PST from SchiffReport: |

| Posted: 21 Feb 2013 10:20 PM PST from Jesse's Café Américain:

JP Morgan, Wells Fargo, Citigroup, and Bank of America, and massively interlocked derivatives positions that are 'netted out' for accounting purposes, but which collapse in chain reaction effect when they encounter counter-party failure, frame this unhappy picture. That is the heart of 'too big to fail.' And this does not include foreign based banks doing substantial business in the States, that also had to be supported by the Fed during the financial crisis. Or related firms like brokerages, faux banks like Goldman, and camp followers such as AIG and other non-bank financial sector corporations. |

| CFTC sues Nymex over information leaks Posted: 21 Feb 2013 09:41 PM PST By Kara Scannell http://www.ft.com/intl/cms/s/0/11e8490e-7c5d-11e2-91d2-00144feabdc0.html WASHINGTON -- The Commodity Futures Trading Commission is suing the New York Mercantile Exchange, a unit of CME Group, and two former employees for allegedly giving secret customer trading information to an external broker. The case is the first time the CFTC has sued Nymex since the 1980s, an official said. It reflects a growing push by regulators to hold exchange operators responsible for alleged misconduct. The CFTC alleges that from early 2008 until November 2010 William Byrnes and Christopher Curtin, the former employees on CME ClearPort Facilitation Desk, provided a broker with order flow information, including "the identities of the parties to specific trades, the brokers involved in trades, the number of contracts traded, the prices paid, the structure of particular transactions, and the trading strategies of market participants." ... Dispatch continues below ... ADVERTISEMENT How to profit in the new year with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... CME Nymex was accused of failing to fully investigate a 2009 customer complaint alleging that someone named "Billy" was divulging customer information. Mr Byrnes was identified by the exchange but was never questioned, the CFTC alleges. It was only after a second complaint, the CFTC alleges, that the CME investigated and fired Mr Byrnes. Mr Curtin is now vice-president of the control desk, a customer relations platform, for ELX Futures. A spokeswoman for ELX had no immediate comment. Mr Byrnes could not be immediately reached for comment. The CME said the lawsuit was "disappointing because it relates to incidents that CME Group has already addressed and handled appropriately, and involved no harm to any customer or the markets." It added that it had fired the relevant employees after its own review in 2010, but the CME did not address the CFTC claim that it did not act when first alerted to the possible wrongdoing a year earlier. CME said: "We simply do not believe the CFTC's claims in this case are fair to Nymex." The Nymex energy exchange hosts flagship contracts including US crude, natural gas, and heating oil futures. Its ClearPort platform processes swaps derivatives, largely in energy, for backing by the exchange clearinghouse. CME acquired Nymex in August 2008. The CME ClearPort desk is responsible for facilitating customer transactions reported for clearing. The Securities and Exchange Commission sued NYSE Euronext last year for giving customer flow information to some clients over others. NYSE paid a $5 million penalty, the first time in its history, to settle, without admitting or denying wrongdoing. In November 2012 CME sued the CFTC in a rare legal move as it sought the right to bundle trade reporting for swaps with other services, calling a pending commission rule "arbitrary and capricious." The exchange operator withdrew the suit after CFTC dropped its insistence that swaps traders be given a choice of venues to report their transactions. Join GATA here: California Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT GoldMoney adds Singapore vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, Toronto, and the United Kingdom, now with GoldMoney you can store gold and silver in Singapore in a high-security vault operated by Brink's Singapore Pte Limited. To find out more about the new vault, please visit: http://www.goldmoney.com/singapore?gmrefcode=gata GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata |

| Gold Reverse at Bottom of Range; Upside Risk Increased Posted: 21 Feb 2013 09:28 PM PST courtesy of DailyFX.com February 20, 2013 04:01 PM Daily Candles Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0 Commodity Analysis: Continue to watch the former resistance trendline (now an internal trendline), which crosses the 2011 low (1522.50) over the next few days. Much like the GBPUSD, yesterday was a large range down day which and may signal the beginning of at least near term capitulation. Today’s reversal increases the risk of at least a sharp near term advance. 1597-1619 is resistance. Commodity Trading Strategy: The reversal day after a large range day warrants a change from bearish to flat. LEVELS: 1478 1523 1548 1597 1619 1639... |

| PM Bullion Closed-End Funds: Helping or Harming? Posted: 21 Feb 2013 09:20 PM PST by Andy Hoffman, MilesFranklin.com:

Over the past decade, NO ONE has done more analysis on the closed-end funds CEF, GTU, and SVRZF (run by the Spicer family); and the more recently public Sprott funds – PHYS and PSLV. I don't hold positions in these funds today – and likely NEVER will due to the heightened risks described below – but have in prior years. Given I have written about these funds ad nauseum over the years, I will not discuss all aspects in this article. In a nutshell, all five funds are run by honorable people with their shareholders' best interests at heart. Additionally, I have ZERO doubt that every ounce of gold and silver purported to be in the funds is in fact there; safe and sound in secure vaults in Canada… |

| Andy Hoffman- Insane Gold Raid – YouTube Posted: 21 Feb 2013 09:06 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] |

| Major Bottom Forming In Gold But Stocks Shaky Posted: 21 Feb 2013 09:00 PM PST from KingWorldNews:

Eric King: "Marc, you brought up gold, and I know you recommend 25% in real estate, 25% in gold, etc. Your thoughts on the gold market? It's just been in this long consolidation for almost 2 years now." Faber: "… Following the peak, I think it was September 6, 2011, at $1,921, I maintained that the gold price is still in a correction period. After the peak in September 2011 we dropped to a low of $1,522 on December 29, 2011. Since then we traded between roughly $1,550 and $1,700." |

| Robert Kiyosaki “Don’t buy gold or silver” in 2012 – YouTube Posted: 21 Feb 2013 08:56 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] |

| Posted: 21 Feb 2013 08:04 PM PST by Harvey Organ, HarveyOrgan.Blogspot.ca:

Gold closed up 60 cents to $1578.60 gaining all the ground it lost in the access market. Silver gained 9 cents to $28.79. Today was a slow day in news. The real exciting news is the high OI in silver. The longs in silver are basically impervious to pain. They refused to buckle under the massive' not for profit' supply of non backed precious metals paper. The pound continues to buckle and remains in the 1.52 column while the Japanese yen again comes close to to 94 level to the dollar. In Europe France's manufacturing PMI continues to remain in the doldrums and this was followed by a poor service PMI. The entire Europe's PMI remains weak with Germany the only country above water. In the USA jobless claims again rise. Wal- Mart reported their quarterly report but most investors were interested in what happened in February. The company suggested that due to the increase in payroll taxes, investors just had no extra money to spend and thus sales "fell off the cliff" Bourses in Europe were deeply in the red with NY falling by 47 points. |

| A Blueprint To Restore The Articles of Confederation Posted: 21 Feb 2013 08:00 PM PST by Ron Holland, SilverBearCafe.com:

While there have been many thoughtful and needed proposals about how we need to end the Fed, return to a gold backed currency, require term limits, repeal the 16th and 17th amendments to the Constitution, require a declaration of war for military action or a balanced budget and other changes, none of these will restore limited government or our republic. I agree with these ideals and many more but all will be ineffective if we retain the federal government structure in place now. |

| The Global Risk Landscape For 2013 Posted: 21 Feb 2013 07:43 PM PST The World Economic Forum (WEF), during its Davos jaunt, created an intriguing set of 50 'global risks'. Of course these are from the perspective of the elitest of the elite but with more than 1000 respondents, the results seem all-encompassing. The global risk that respondents rated most likely to manifest over the next 10 years is severe income disparity, while the risk rated as having the highest impact if it were to manifest is major systemic financial failure. There are also two risks appearing in the top five of both impact and likelihood – chronic fiscal imbalances and water supply crisis. The report covers five key categories of 'risk' - which we will be posting on in the next few days - Economic, Environmental, Societal, Geopolitical, and Technological. In this first post we expose the 50 risks by magnitude and probability, how they have evolved over the past few years, and the importance of their inter-connectivity. Click image for very large chart. The most 'worrying' risks are up and to the right (higher probability and high impact)... Chronic Fiscal Imbalances tops the chart along with Sever Income Disparity.

The Top 5 Global Risks by Impact have evolved notably over the past few years - but it appears 'economic' remains high, though 'societal' is catching up...

The Top 5 Global 'Most Likely' Risks have also evolved but Economic remains the most dominant...

and as every good central banker (and physicist) knows, every action has consequences and so here is the WEF's view on the interconnectedness of global risks...

Three Risk Cases The report introduces three risk cases, based on an analysis of survey results, consultation with experts and further research. Each case represents an interesting constellation of global risks and explores their impact at the global and national levels. The three risk cases are: Testing Economic and Environmental Resilience Continued stress on the global economic system is positioned to absorb the attention of leaders for the foreseeable future. Meanwhile, the Earth's environmental system is simultaneously coming under increasing stress. Future simultaneous shocks to both systems could trigger the "perfect global storm", with potentially insurmountable consequences. On the economic front, global resilience is being tested by bold monetary and austere fiscal policies. On the environmental front, the Earth's resilience is being tested by rising global temperatures and extreme weather events that are likely to become more frequent and severe. A sudden and massive collapse on one front is certain to doom the other's chance of developing an effective, long-term solution. Given the likelihood of future financial crises and natural catastrophes, are there ways to build resilience in our economic and environmental systems at the same time? Digital Wildfires in a Hyperconnected World In 1938, thousands of Americans confused a radio adaptation of the H.G. Wells novel The War of the Worlds with an official news broadcast and panicked, in the belief that the United States had been invaded by Martians. Is it possible that the Internet could be the source of a comparable wave of panic, but with severe geopolitical consequences? Social media allows information to spread around the world at breakneck speed in an open system where norms and rules are starting to emerge but have not yet been defined. While the benefits of our hyperconnected communication systems are undisputed, they could potentially enable the viral spread of information that is either intentionally or unintentionally misleading or provocative. Imagine a real-world example of shouting "fire!" in a crowded theatre. In a virtual equivalent, damage can be done by rapid spread of misinformation even when correct information follows quickly. Are there ways for generators and consumers of social media to develop an ethos of responsibility and healthy scepticism to mitigate the risk of digital wildfires? The Dangers of Hubris on Human Health Health is a critical system that is constantly being challenged, be it by emerging pandemics or chronic illnesses. Scientific discoveries and emerging technologies allow us to face such challenges, but the medical successes of the past century may also be creating a false sense of security. Arguably, one of the most effective and common means to protect human life – the use of antibacterial and antimicrobial compounds (antibiotics) – may no longer be readily available in the near future. Every dose of antibiotics creates selective evolutionary pressures, as some bacteria survive to pass on the genetic mutations that enabled them to do so. Until now, new antibiotics have been developed to replace older, increasingly ineffective ones. However, human innovation may no longer be outpacing bacterial mutation. None of the new drugs currently in the development pipeline may be effective against certain new mutations of killer bacteria that could turn into a pandemic. Are there ways to stimulate the development of new antibiotics as well as align incentives to prevent their overuse, or are we in danger of returning to a pre-antibiotic era in which a scratch could be potentially fatal?

Source: WEF |

| Posted: 21 Feb 2013 07:15 PM PST What then must we do?Submitted by cpowell on Thu, 2013-02-21 21:26. Section: Daily Dispatches 1:46p PT Thursday, February 21, 2013 Dear Friend of GATA and Gold: A friend, C.S., wrote to your secretary/treasurer today asking for comment on the beating gold has taken in the last few weeks. Your secretary/treasurer is no market analyst but couldn't leave her hanging and so offered the following. * * * And the multitudes asked him, 'What then must we do?' — Luke 3:10. The smashdown of the last couple of weeks, while maybe not unprecedented since I began following the monetary metals in 1998, may be the most demoralizing. And yet the world financial system never has been more unhinged, which may explain the smashdown in large part if it represents the increasing desperation and intervention of central banks. At GATA's conference in Washington almost five years ago I said that there are no markets anymore, just interventions by central banks and governments: If that is correct, then short- and medium-term investment strategy is entirely a matter of anticipating the next intervention, and of course the Federal Reserve doesn't call or e-mail me with any notice — just the heads of the investment houses that act as agents for the U.S. government in the markets. So what is left for ordinary people to invest in if all values are manipulations, illusions, or just political calculations subject to change in an instant? What is there left to invest in if the British economist Peter Warburton was right in 2001 when he wrote that the main objective of central bank policy is to deprive the world of any standard of financial measurement?: My answer to that question would be: the monetary metals, insofar as they are real at least and have and always will have recognized value throughout the world, even if we cannot rely on the ratio of their value to the value of government currencies. But we can review history, and doing so we find that over the long term currencies have always been devalued against the monetary metals and the rigging of the monetary metals markets has always failed, if only when the metal available to the market riggers ran out. The most recent example of that is the story of the London Gold Pool, which collapsed in March 1968 because of a shortage of metal: http://en.wikipedia.org/wiki/London_Gold_Pool But Bill Buckler's Privateer newsletter has wonderfully summarized the rest of the modern war against gold and the market rigging involved: http://www.the-privateer.com/gold2.html I will bet — have bet — my life that the current war against the monetary metals will fail eventually as all the other such wars have failed and that the metals will be revalued upward as governments continue to retreat to a more defensible level for their ever-depreciating currencies. But will this happen in my lifetime? Two good friends of GATA, Ferdinand Lips and Adrian Douglas, bet their lives on the same proposition and while they saw some vindication they did not see the victory they deserved. Even if we too deserve victory, will we live to see it? If GATA obtains sufficient resources, we may be able to hasten the day considerably by bringing new freedom-of-information litigation against the U.S. Federal Reserve, the Treasury Department, and the State Department: http://www.gata.org/node/11606 In any case I think the revaluation will come in the next five years or so. If enough governments around the world want to drag the struggle out longer than that, maybe they can. But even so we may be able to depart confident that we have protected our families. And as much as we want to get rich, that is of no importance beyond ourselves. GATA is in this struggle not because of that or because we worship the golden calf or silver bull — we are not idolaters — but because we believe in limited, transparent, accountable, democratic government and free markets as the indispensable mechanisms for progress, liberty, and happiness. Sorry to get cosmic on you; for the moment it may be all we have left. But it's still enough. CHRIS POWELL, Secretary/Treasurer Gold Anti-Trust Action Committee Inc. |

| Gold Versus Gold Miners: Has The Time Come To Flip The Switch? Posted: 21 Feb 2013 07:01 PM PST Last October, among the various statements by Hugh Hendry at the annual Buttonwood gathering was this blurb by the man who is otherwise a big fan of physical gold: "I am long gold and I am short gold mining equities. There is no rationale for owning gold mining equities. It is as close as you get to insanity. The risk premium goes up when the gold price goes up. Societies are more envious of your gold at $3000 than at $300." Vivid imagery aside, he was spot on as the GDX tumbled 30% since then. Yet with the gold miners now universally abhorred and hated by virtually everyone, has the time come to take advantage of the capitulation? That is the question posed by John Goltermann of Obermeyer Asset Management, a firm better known for its deeply skeptical view toward Apple express as part of its April 2012 letter, and which also ended up being spot on. Goltermann says: "Whatever the reason, the underperformance of the mining shares in the last 18 months has been significant. At this point, because of the price divergence, the valuation disparity, and general capitulating sentiment, there doesn't seem to be a case for selling mining shares. Given the valuations, we are evaluating whether it is appropriate to add to the position. The negative sentiment towards gold could continue for a time, but as economist Herbert Stein cautions, "If something cannot go on forever, it will stop." When price divergences like this occur, they usually self-correct. In the interim, there is a strong case that gold mining stocks are cheap and that much bad news is priced in." Then again, as Hendry said, it may just as well be insanity. Curiously, in some ways Obermeyer's thesis is the opposite of Hendry's:

The flipside is that Hendry's side has been proven correct and some would say, played out. And with most things (at least in the Old Normal) mean reverting, has the time for the alternative finally come? Full letter below:

|

| Posted: 21 Feb 2013 06:53 PM PST

2 U.S. Supreme Court Justices – And Numerous Other Top Government Officials – Warn of Dictatorship Former Supreme Court Justice David Souter told University of New Hampshire School of Law that the "pervasive civic ignorance" in the U.S. could bring dictatorship: I don't worry about our losing a republican government in the United States because I'm afraid of a foreign invasion. I don't worry about it because of a coup by the military, as has happened in some other places. What I worry about is that when problems are not addressed people will not know who is responsible, and when the problems get bad enough — as they might do for example with another serious terrorist attack, as they might do with another financial meltdown — some one person will come forward and say: 'Give me total power and I will solve this problem.' That is how the Roman republic felL. Augustus became emperor not because he arrested the Roman senate. He became emperor because he promised that he would solve problems that were not being solved. Of course, they're not the only ones warning of fascism. We noted in April: Senator Frank Church – who chaired the famous "Church Committee" into the unlawful FBI Cointel program, and who chaired the Senate Foreign Relations Committee – said in 1975: "Th[e National Security Agency's] capability at any time could be turned around on the American people, and no American would have any privacy left, such is the capability to monitor everything: telephone conversations, telegrams, it doesn't matter. There would be no place to hide. [If a dictator ever took over, the N.S.A.] could enable it to impose total tyranny, and there would be no way to fight back." Now, the NSA is building a $2 billion dollar facility in Utah which will use the world's most powerful supercomputer to monitor virtually all phone calls, emails, internet usage, purchases and rentals, break all encryption, and then store everyone's data permanently. The former head of the program for the NSA recently held his thumb and forefinger close together, and said: We are, like, that far from a turnkey totalitarian state As we noted in 2008: Democratic and Republican congress members are sounding the alarm: tyranny is here. For example: Rep. Michael Burgess (R-TX) says: "I have been thrown out of more meetings in this capital in the last 24 hours than I ever thought possible, as a duly elected representative of 825,000 citizens of north Texas." Burgess asks the Speaker of the House to post the bailout bill on the internet for at least 24 hours instead of passing the largest piece of legislation in US financial history in the "dark of night." Rep. Burgess' says, "Mr. Speaker I understand we are under martial law as declared by the speaker last night." Congresswoman Kaptur (D-OH) says: "My message to the American people don't let Congress seal this deal. High financial crimes have been committed. The normal legislative process has been shelved. Only a few insiders are doing the dealing, sounds like insider trading to me. These criminals have so much political power than can shut down the normal legislative process of the highest law making body of this land." We are Constitutionally sworn to protect and defend this Republic against all enemies foreign and domestic. And my friends there are enemies." The people pushing this deal are the very ones who are responsible for the implosion on Wall Street. They were fraudulent then and they are fraudulent now." Of course, there are many other indications that tyranny has already come to Amerca, including the permanent stationing of U.S. troops inside the country to quell "civil unrest" and the probable suspension of normal constitutional government for a state of emergency "continuity of government" operation. This is not entirely new. In 2006, the Center for Budget and Policy Priorities wrote: "House leadership invokes 'martial law,' forcing members to vote on key bills without full knowledge of what they are voting on: move represents erosion of the democratic process" Indeed, many people, including high-level politicians, have been warning of tyranny in the U.S. for some time. As three of many examples: Former prominent republican congressman Bob Barr stated that the U.S. is close to becoming a totalitarian society and that the Bush administration is using fear to try to ensure that this happens Current U.S. Congressman Ron Paul stated, the government "is determined to have martial law", and that the government is hoping to get the people "fearful enough that they will accept the man on the white horse" Indeed, there is overwhelming evidence that the U.S. is quickly drifting into tyranny. For example, the following actions may get an American citizen living on U.S. soil labeled as a "suspected terrorist" today: Being young (if you live near a battle zone, you are fair game; and see this) Using social media Reporting or doing journalism Speaking out against government policies Protesting anything (such as participating in the "Occupy" movement) Questioning war (even though war reduces our national security; and see this) Criticizing the government's targeting of innocent civilians with drones (although killing innocent civilians with drones is one of the main things which increases terrorism. And see this) Asking questions about pollution (even at a public Congressional hearing?) Paying cash at an Internet cafe Asking questions about Wall Street shenanigans Holding gold Creating alternative currencies Stocking up on more than 7 days of food (even though all Mormons are taught to stockpile food, and most Hawaiians store up on extra food) Having bumper stickers saying things like "Know Your Rights Or Lose Them" Investigating factory farming Infringing a copyright Taking pictures or videos Talking to police officers Wearing a hoodie Driving a van Writing on a piece of paper (Not having a Facebook account may soon be added) And holding the following beliefs may also be considered grounds for suspected terrorism: Being frustrated with "mainstream ideologies" Valuing online privacy Supporting Ron Paul or being a libertarian Liking the Founding Fathers Being a Christian Being anti-tax, anti-regulation or for the gold standard Being "reverent of individual liberty" Being "anti-nuclear" "Believe in conspiracy theories" "A belief that one's personal and/or national "way of life" is under attack" "Impose strict religious tenets or laws on society (fundamentalists)" "Insert religion into the political sphere" "Those who seek to politicize religion" "Supported political movements for autonomy" Being "anti-abortion" Being "anti-Catholic" Being "anti-global" "Suspicious of centralized federal authority" "Fiercely nationalistic (as opposed to universal and international in orientation)" "A belief in the need to be prepared for an attack either by participating in … survivalism" Opposing genetically engineered food Opposing surveillance http://www.washingtonsblog.com/2012/09/2-u-s-supreme-court-justices-and-numerous-other-top-government-officials-warn-of-dictatorship.html |

| FBI Launches Insider Trading Investigation On Blockbuster Heinz Sale – YouTube Posted: 21 Feb 2013 06:32 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] |

| Nirvana, Creditopia, And Why Central Banks Are The Devil Posted: 21 Feb 2013 06:08 PM PST Via Hinde Capital, Central banks are the devil. They are like drug dealers except they administer regular doses of supposedly legally prescribed barbiturates to their addicts. The 'easy money' or 'credit' they create is an opiate and like all addictions there is a payback for the addicts, one exacted only in loss of health, misery and death. The economic system is an addict, but that system is comprised of banks, corporations, non-profit organisations, small businesses all of which are communities. And what comprises communities, us, human beings - individuals. We are the addicts. Popular economic academia understates human action in the economic equation of money. It is human preferences that determine our desire for goods and services and so in turn really determines the utility of money. Sadly the desire of the State to control money and administer it like a drug has left our economies unproductive and incapable of standing on their own two feet. Our reliance on 'easy money' as facilitated by credit has become terminal. Like drug users we continue to attempt to find a heightened state of Nirvana. We continue to hark for the utopian days prior to the eruption of the post 2008 crisis, even though our well-being was fallacious and based on an illusion of wealth paid for by credit - a creditopia. The abuse of credit is what defined the Great Financial crisis and one that still defines our economic system and one which will define a much worse crisis to come. Central bankers have begun a concerted effort to fight the global debt problem which has been stifling growth as tax revenues merely serve to finance debt servicing rather than addressing the repayment of principal outstanding. Omnipotent governors, Bernanke, Carney, Draghi, Svensson and Iwata or Kuroda (either are likely to replace Shirakawa) are to take a far more aggressive and activist role in pursuing a new framework for growth and inflation by seeking an alternative way to conduct monetary policy. It's called Nominal GDP Level targeting and it is in our opinion as significant a moment as Volcker's appointment to the Federal Reserve governorship in 1978. Many will recall Volcker's moment was to engineer a swift monetary contraction and deceleration of the money velocity to try and reign in excessively high inflation and stabilise growth. It worked. Today we are witnessing an 'Inverse Volcker' moment, whereby the opposite is likely true. The question remains are they all still 'inflation nutters' as Mervyn King, the BoE Governor glibly referred to those central bankers who focussed solely on inflation targets to the potential detriment of stable growth, employment and exchange rates. Are central bankers merely expanding the boundaries of monetary largesse by focusing on a broader mandate and merely evolving the singular variable approach of inflation targeting or have they finally found a solution to eradicating boom bust business cycles? This is a question we need to answer as we are currently witnessing a Central Bank Revolution which could portend severe consequences for prices in our economies - and all the attendant misery that comes with very high inflation. Nominal GDP Level targeting advocates believe they have a plausible case for a change of mandate by central banks and one which is being gradually adopted, but we believe that like central banks they have misdiagnosed the cause of the crisis by failing to examine the impact of credit creation in our global economy. Money matters less credit matters more. Global economies are still credit driven and Keynesian counterfeiting has merely arrested the collapse. The maintenance of heightened credit levels by financing of deficits with 'easy' money is beginning to see prices and output rise in the short term. In the long run only higher prices will remain whilst growth stagnates. A classic monetarist conclusion. Hinde Capital has provided a long and consistent discourse on the relationship between credit and growth. Policymakers by now may well grasp that sustainable growth is not possible as nations still have an overreliance on credit-based sectors, namely the F.I.R.E. sectors, (Finance, Insurance and Real Estate). This is an understatement as all sectors are now directly or indirectly underpinned by this false mammon called credit. Once upon a time merely altering the levels of money in the economic system could help an economy expand and contract without creating excessive levels of inflation both in asset, goods and service prices. However as this fiat currency regime has grown older so has the ability of central bank policy to contain large swings in the business cycle. ++++++ It is our contention that central banks feel they need to maintain the balance of credit in the system as it currently stands by adjusting the money supply and monetary velocity (MV) but by doing so they merely circumvent the necessary adjustment in the economic system that comes about by market failure. If they don't allow this failure then any attempt to influence MV will only lead to higher prices (P) at the expense of output (T) in the famous monetary equation MV=PT. Central Bank's Checklist Manifesto At Hinde Capital we have attempted to codify both our objective and subjective observations of asset classes over the years and have naturally migrated to a checklist routine to eliminate any behavioural biases that lead to a misdiagnosis of events before an investment decision. Full Hinde Capital Insight below...

|

| The Silver and Gold Price Must Not Close Below the Last Two Days' Lows Posted: 21 Feb 2013 06:06 PM PST Gold Price Close Today : 1578.20 Change : 0.60 or 0.04% Silver Price Close Today : 28.695 Change : 0.080 or 0.28% Gold Silver Ratio Today : 54.999 Change : -0.133 or -0.24% Silver Gold Ratio Today : 0.01818 Change : 0.000044 or 0.24% Platinum Price Close Today : 1618.90 Change : -27.10 or -1.65% Palladium Price Close Today : 733.20 Change : -2.80 or -0.38% S&P 500 : 1,502.42 Change : -9.53 or -0.63% Dow In GOLD$ : $181.81 Change : $ 7.50 or 4.30% Dow in GOLD oz : 8.795 Change : 0.363 or 4.30% Dow in SILVER oz : 483.73 Change : -2.97 or -0.61% Dow Industrial : 13,880.62 Change : -46.20 or -0.33% US Dollar Index : 81.48 Change : 0.392 or 0.48% You'd think the silver and GOLD PRICE had stayed home in bed today judging by their Comex Closes. Gold closed up sixty cents (spell it out it's so small) at $1,578.20 while silver gained eight cents to 2869.5c. However, other charts don't tell that story. Overnight the GOLD PRICE hit a lower low, about $1,558 but from midnight forward (NYC time) rallied as high as $1,584.70. This has the look of a key reversal. What's that? When a market trades into new low ground for the move, then closes the day higher, that's the first half of a key reversal. Second and necessary half is a higher close the next day, i.e., tomorrow. All this plainly shows on an EOD (End of the Day) chart. With sentiment dragging the bottom, the RSI at a 12 year low, and gold trading below its lower Bollinger Band, gold is screaming time to slam it into reverse. But screaming won't change gears. That takes market action, and I want to see some proof, like higher closes tomorrow for both silver and gold. The SILVER PRICE looks much the same as gold, but didn't quite make a lower low today. Hit 2832c at the bottom and 2884.2c at the high. However, silver's three day chart shows a double bottom yesterday and today, and a rise out of that bottom most of the day. Needs to close above 2884c tomorrow to make that look like a bottom. Be patient. Better days are coming soon, as long as silver and gold don't close below the last two days' lows. Let's watch. If the object of the FOMC manipulation was to drive down the euro against the dollar, it worked today. Euro dropped 0.75% to $1.3186, while the US dollar index (about half comprised of the euro) rose 0.5% or 39.2 basis points to 81.475. The euro gapped down and closed beneath its 62 day moving average. Euro's momentum indicators are screaming in freefall. Test will come about $1.3150. If it falls thru that, 'twill fall much more, say to the 200 DMA at $1.2827. More bad economic news out of Europe today will speed that fall. Surprise. European economy is not recovering. Euro fell 1.21% against the yen. Yen gained 0.45% today to close at 107.38 cents per 100 yen. For better than two weeks the yen has traded sideways, but now has risen high enough to approach its 20 DMA (108.04) and the first sign of a reversal. US Dollar index's close yesterday took it above the 200 DMA (80.92). Today it added to that gain 39.2 more basis points to end at 81.475. Dollar index has a minimum of 82 targeted, and perhaps higher. Of course, given the hyperactive Nice Government Men, that could change at any time. The day wasn't kind to stocks. The Dow broke 13,900 to close down 46.92 (0.34%) at 13,880.62. The day was less kind to the S&P500, which lost 9.53 or 0.63%, closing at 1,502.42. Right now 13,800 is the magic number for the Dow. It must hold that or tumble at least another 150 points. AHA! Both the Dow in Gold and the Dow in Silver gapped down today, leaving yesterday's high isolated above and looking much like an island reversal. If so, both ought to follow through with lower closes tomorrow. If confirmed, that implies stocks have peaked against silver and gold, and will cheapen against them. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Peter Schiff : ‘More Reasons Than Ever’ to Buy Gold Posted: 21 Feb 2013 05:56 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] |

| Scorecard: How Many Rights Have Americans REALLY Lost? Posted: 21 Feb 2013 05:03 PM PST

Preface: While a lot of people talk about the loss of our Constitutional liberties, people usually speak in a vague, generalized manner … or focus on only one issue and ignore the rest. This post explains the liberties guaranteed in the Bill of Rights – the first 10 amendments to the United States Constitution – and provides a scorecard on the extent of the loss of each right. First Amendment The 1st Amendment protects speech, religion, assembly and the press:

However, the government is arresting those speaking out … and violently crushing peaceful assemblies which attempt to petition the government for redress. A federal judge found that the law allowing indefinite detention of Americans without due process has a “chilling effect” on free speech. And see this and this. The threat of being labeled a terrorist for exercising our First Amendment rights certainly violates the First Amendment. The government is using laws to crush dissent, and it’s gotten so bad that even U.S. Supreme Court justices are saying that we are descending into tyranny. For example, the following actions may get an American citizen living on U.S. soil labeled as a “suspected terrorist” today:

And holding the following beliefs may also be considered grounds for suspected terrorism:

Of course, Muslims are more or less subject to a separate system of justice in America. And 1st Amendment rights are especially chilled when power has become so concentrated that the same agency which spies on all Americans also decides who should be assassinated. Second Amendment The 2nd Amendment states:

Gun control and gun rights advocates obviously have very different views about whether guns are a force for violence or for good. But even a top liberal Constitutional law expert reluctantly admits that the right to own a gun is as important a Constitutional right as freedom of speech or religion:

The gun control debate – including which weapons and magazines are banned – is still in flux … Third Amendment The 3rd Amendment prohibits the government forcing people to house soldiers:

Hey … we’re still honoring one of the Amendments! Score one for We the People! Painting by Anthony Freda: www.AnthonyFreda.com. Fourth Amendment The 4th Amendment prevents unlawful search and seizure:

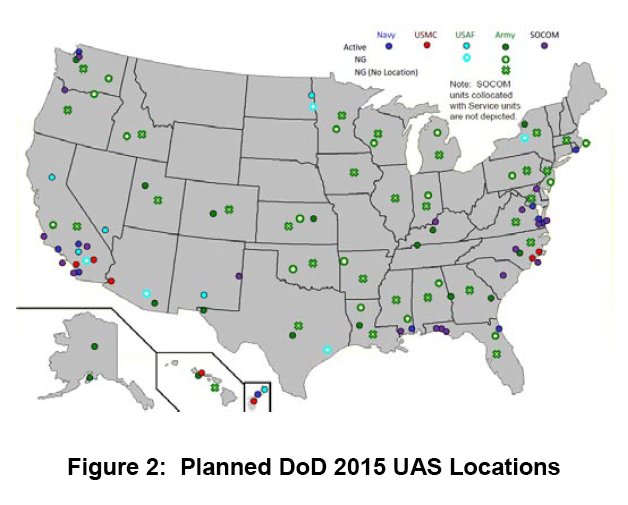

But the government is flying drones over the American homeland to spy on us. Senator Rand Paul correctly notes:

Paul introduced a bill to “protect individual privacy against unwarranted governmental intrusion through the use of unmanned aerial vehicles commonly called drones.” Emptywheel notes in a post entitled “The OTHER Assault on the Fourth Amendment in the NDAA? Drones at Your Airport?”:

Many police departments are also using drones to spy on us. As the Hill reported:

Even without drones, Americans are the Get Out Of DEBT! NOW!!! – YouTube Posted: 21 Feb 2013 04:35 PM PST |

| DAVID MORGAN on SILVER, The disciplined investor is accumulating at these levels – YouTube Posted: 21 Feb 2013 04:29 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] |

| The Gold Bull is Far from Dead Posted: 21 Feb 2013 04:15 PM PST Euro Pacific Capital |

| Posted: 21 Feb 2013 04:04 PM PST Two and a half years ago, George Soros' former partner Stanley Druckenmiller closed shop when he shut down his iconic Duquesne Management, after generating 30% average annual returns since 1986. Some time later he raised many red flags by being one of the first "establishment" types to expose the Fed's take over of the market when he said in a rare May 2011 interview that "It's not a free market. It's not a clean market.... The market isn't saying anything about the future. It's saying there's a phony buyer of $19 billion of Treasurys a week." This was in the context of the constantly declining interest rates on an ever exploding US debt load. And while back then total debt was a "manageable" $14.3 trillion, as of today it is some $2.3 trillion higher moments ago printing at a fresh record high of $16.6 trillion, not surprisingly the phony buyer is still here only now he is buying not $19 billion by over $20 billion in total debt each week. But just like it was the relentless rise in the US debt that forced him out of his privacy in the public scene back then, so it was also the US debt that was also the topic of his rare CNBC appearance today (where he fiercely poked at all those other TV chatterbox pundits when he said "money managers should manage money and not go on shows like this") in the aftermath of his recent WSJ Op-Ed. There, he once again said what everyone knows but is scared to admit: "we have an entitlement problem." Druckenmiller's definition of the problem:

A quick primer on the unsustainable Bernanke math:

A reminder on the irrationality of bond markets:

The topic of the free Fed money's diminishing returns is well-known:

His solution: means testing:

Finally, on political incentives to act, or rather not:

But of course, the merest suggestion of any of the above becoming policy and whoever is in charge screams bloody "austerity" knowing full well their political career is over the moment people's entitlements are cut. And thus: back to square one. The full clip follows below: And for those who missed it, here is the WSJ op-ed from a week ago penned by Stanley Druckenmiller and former Fed governor and current Fed critic, Kevin Warsh: Generational Theft Needs to Be Arrested A Democrat, an independent and a Republican agree: Government spending levels are unsustainable We come from different backgrounds, parties and pursuits but are bound by a common belief in the promise and purpose of America. After all, each of us has been the beneficiary of the choices made—and opportunities created—by previous generations of Americans. One of us grew up poor in the South Bronx of the 1960s and went on to lead a children's antipoverty program in Harlem. Another grew up in a small town in South Jersey, and went on to be a leading money manager. The third grew up in a small suburb in upstate New York and found his way to serve in the government amid the financial crisis. One of us is a Democrat; one, an independent; another, a Republican. Yet, together, we recognize several hard truths: Government spending levels are unsustainable. Higher taxes, however advisable or not, fail to come close to solving the problem. Discretionary spending must be reduced but without harming the safety net for our most vulnerable, or sacrificing future growth (e.g., research and education). Defense andhomeland security spending should not be immune to reductions. Most consequentially, the growth in spending on entitlement programs—Social Security, Medicaid and Medicare—must be curbed. These truths are not born of some zeal for austerity or unkindness, but of arithmetic. The growing debt burden threatens to crush the next generation of Americans. Coming out of the most recent elections, no consensus emerged either to reform the welfare state or to pay for it. And too many politicians appear unwilling to level with Americans about the challenges and choices confronting the United States. The failure to be forthright on fiscal policy is doing grievous harm to the country's long-term growth prospects. And the greatest casualties will be young Americans of all stripes who want—and need—an opportunity to succeed. Three main infirmities plague Washington and constitute a clear and present danger to the prospects for the next generation. First, the country's existing entitlement programs are not just unaffordable, they are also profoundly unfair to those who are taking their first steps in search of opportunity. Social Security is one example. According to Social Security actuaries, the generational theft runs deep. Young people now entering the workforce will actually lose 4.2% of their total lifetime wages because of their participation in Social Security. A typical third-grader will get back (in present value terms) only 75 cents for every dollar he contributes to Social Security over his lifetime. Meanwhile, many seniors with greater means nearing retirement age will pocket a handsome profit. Health-care spending through Medicare represents an even less equitable story. The government has an obligation, of course, to support needy seniors. But this pension system is ripe for common-sense reforms, including changing eligibility ages and benefit structures for those with greater means, ridding the Social Security disability program of pervasive fraud, and removing disincentives for those who would rather work in their later years. Powerful, vested interests portray reformers as avowed enemies of seniors. But, the status quo is, in fact, tantamount to saddling school-age children with more debt, weaker economic growth, and fewer opportunities for jobs and advancement. Second, while many in Washington pay lip service to the long term, few act on it. The nation's debt clock garners far less attention than the "fiscal cliff" clock. Elected officials continue to allow the immediate to trump the important. Washington appears poised to forego fundamental reform at the altar of the expedient, yet again. This could have tragic consequences. In successive administrations, the country has spent trillions in temporary tax credits and short-term "stimulus" to goose growth by the next election. What do we have to show for this spending surge? Modest growth, declining incomes and a level of national debt that undermine our long-term prospects. The Federal Reserve's policies reinforce this short-term orientation. To offset weak economic conditions, the Fed's principal policy objectives appear to be twofold: suppress interest rates and raise stock prices. As a result Congress may be missing market signals and failing to see the costs of its spending addiction in time to undertake real reforms. Ultimately, economic fundamentals—not the promises of central banks—will determine the prices of stocks and bonds. But the deeper failing is one of essential fairness. The benefits of rising stock prices accrue to those who have already amassed wealth at the expense of those who are struggling to save. And failing to deal with runaway spending will burden the country's children with higher interest rates and a debt bomb that will come due in their lifetimes. Third, too many politicians appear more eager to divide the spoils of electoral victory among their own than to increase the size of the economic pie for all. The grab-bag of special tax favors under the guise of the recent fiscal-cliff deal is only the latest example. Crony capitalism and corporate welfare aren't just expenses we cannot afford. They are an anathema to economic growth. They deny opportunities to aspiring people and companies who seek to better their lot. They ration opportunity based on things other than merit and hard work. They further ensure that poor children—who already are disadvantaged by failing schools, inadequate health care and little access to necessary resources—will never get the chance to break the cycle of generational poverty through education. Some individual Americans are surely better off than they were many years ago. The more probing question is whether America is better off. That can only be true if the hopes and aspirations of the next generation are achievable. The country must find the courage, conviction and compassion to fix what ails it. The opportunity to advance real reform is still possible. But failure to reform the entitlement culture, reaffirm long-run objectives, and re-establish a common purpose will mean a dimming of opportunities for American children today and for future generations. And a great nation will have ceded more than its greatness, but its goodness. |

| Gold – Here Is The Good News Posted: 21 Feb 2013 03:53 PM PST In the midst of extreme negative sentiment around gold and price drops that are out of proportion, some people can hardly imagine that good news does still exist. Our aim is to focus on the truth, and nothing but the truth no matter how difficult it is. The writers out there who scream that the "death cross" on gold's chart is the most bearish signal could prove to be dead wrong. First, for the non-traders and chart illiterates a short explanation on the term "death cross." The phenomenon occurs when the 20 day moving average falls below the 50 day moving average. Traders pay a lot of attention to these moving averages. The general rule of thumb is that this chart formation signals a consistent downtrend. The opposite is held true, as well. When the 20 day moving average rises above the 50 day moving average, a "golden cross" occurs which signals an uptrend. As the next chart shows, gold is hitting a "death cross," so the general wisdom says that the general trend is (much) lower. Beware the assumptions! Of all those writers who apply the general rule to the gold market, how much did check their underlying assumption? Not many. That's why it is critical to have access to the right insights and information, through correct research. Case in point: it appears that the "death cross" formation does not have predictive value in the case of gold. Ryan Detrick, senior technical strategist at Schaeffer's Investment Research analyzed the "death cross" formations in gold since 1972. The result of his research is summarized in the following table(s). Since 1972, gold passed through 22 "death cross" formations which returned between 1.29% (in the month after) and 3.17% (in the following six months). Comparing those figures with the average day since 1972 (third table), it appears there is only a slight difference. The findings go further than that. The "golden cross" formation appears to be similarly irrelevant for gold. The returns between 1 and 6 months after the formation are neutral to negative.

Since the most recent golden cross in gold in September are down 11%. To put things straight: this article does not state that prices cannot go lower. It simply says that the current "death cross" is very likely NOT one of the criteria to look at. Much more reliable data to focus on are explained in this article: how short term gold and silver prices are set. The article also incites people to put enough effort to check the underlying assumptions while not simply believing what (some) people tell / write. This information was brought to our attention thanks to Precious Metals Strategist K. Xeroudakis. |

| Peter Schiff Takes On Credit Suisse Gold Bear – YouTube Posted: 21 Feb 2013 03:47 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] |

| Gold Decline Won’t Sink Odyssey Marine – YouTube Posted: 21 Feb 2013 03:41 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] |

| Wireless Technology Is Ushering In a New Era of Computing Posted: 21 Feb 2013 03:30 PM PST Synopsis: How the latest development in cellphone technology is creating a digital gold rush for investors. By Adam J. Crawford, Junior Analyst A transformation is happening in the world of telecommunications: a technology improvement known as "LTE" now allows for the transfer of data to mobile devices at speeds equivalent to home Digital Subscriber Lines (DSL) Internet connections. This has created a transitional market in mobile phones and tablets that is projected to rapidly accelerate in the coming years. [B]What Is LTE?[/B] Originally, copper wires strung from pole to pole established the connection between telephones. Today, wireless networks usually establish that connection, using towers and antennas to relay sound and data by radio waves. Wireless networks evolved technologically over the years; each evolutionary stage has come to be identified as a "generation." The first generation (1G) – introduced in th... |

| The Top Ten Stocks for Feb. 21 – YouTube Posted: 21 Feb 2013 03:27 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] |

| Will It Be Different This Time? Will the Dow and S&P 500 Go Up, UP and Awaaay? Posted: 21 Feb 2013 03:23 PM PST "Follow the munKNEE" via twitter & Facebook or Register to receive our daily Intelligence Report (Recipients restricted to only 1000 active subscribers) Since the late 1800′s, the Dow has experienced three periods where it traded So writes Chris Kimble (http://blog.kimblechartingsolutions.com) in edited excerpts from his original post* entitled Dow and S&P 500 about to break above their 13-year sideways patterns?

CLICK ON CHART TO ENLARGE Next let's take a look at where the market P/E ratio stood when prior breakouts took place in the chart below from Doug Short reflecting the long-term P/E ratio created by Crestmont Research. CLICK ON CHART TO ENLARGE I've highlighted what the P/E ratio was at the end of the prior 13-17 year sideways markets and they ranged from 6 to 7. The current P/E ratio stands at 21….[which] is much closer to market highs than lows over the past century! [In addition, from] a Power of the Pattern perspective, notice that at the end of prior long-term sideways markets, steep bearish rising wedges weren't in place like they are today. Conclusion [While] the markets could break to the upside of the current 13-year sideways pattern [the answer to the question "Has the time now come for the Dow and S&P 500 to once again go Up, UP and Awaaay?" seems unlikely in that not too] many long-lasting bull markets have started when the P/E ratio stood at 21. Anything is possible, [however, so] investors have to remain open-minded to all possibilities! Will it be different this time? Stay tuned!!! If you would like to know how our Members are attempting to take advantage of this situation, send an email to services@kimblechartingsolutions.com or click on the box above and we will share what assets we are over and under weighting at this time.

*http://blog.kimblechartingsolutions.com/2013/02/dow-and-sp-500-about-to-break-above-their-13-year-sideways-patterns/

Related Articles: 1. The U.S. Stock Market Is Overvalued By More Than 50%! Here's Why Key stock indices are becoming significantly overpriced. The value of the U.S. stock market stands at about 133% of GDP. The average for the past 60 years has been around 82%. By this measure, the U.S. stock market is overvalued by more than 50%! Words: 398 2. Follow Bob Farrell's 10 Rules of Investing – or Suffer the Consequences Individuals are long-term investors only as long as the markets are rising. Despite endless warnings, repeated suggestions and outright recommendations – getting investors to sell, take profits and manage…[their] portfolio risks is nearly a lost cause as long as the markets are rising. Unfortunately, by the time the fear, desperation or panic stages are reached it is far too late to act and I will only be able to say that I warned you [- unless you take the time to read, and study the contents of this article]. Words: 1945; Charts: 10; Tables: 1 3. Buffett's Measure of Stock Market Health, the TMC-to-GNP Ratio, Conveys Concerns Buffett's measure – the percentage of total market cap (TMC) relative to the U.S. GNP crossed 100% last week into stretched territory for the first time since 2007 which implies a mere return of around 3.3% annualized (including dividends) over the following years. [This post presents the components of the ratio and the conclusions drawn.] 4. These 4 Indicators Say "No Stock Market Correction Coming – Yet" While I remain cautious on stocks and the risk trade, the technical picture shows that the uptrend to be intact and the bulls should still be given the benefit of the doubt for now. At this point, any call for a correction is at best conjecture [as evidenced by the following 4 indicators]. Words: 399; Charts: 4 5. Stop! Don't Forget Market Risk – Remember What Happened in 2000 & 2007/8. Investors are more bullish now than at any time since 2002 but the current rally has not been fueled by improved prospects of actual growth and wealth creation. Instead, it's mostly due to:

but nowhere do they seem to be considering market risk – the risk that your investment will lose value because it gets dragged down in a falling market. Words: 615 6. Insider Trading Suggests That a Market Crash Is Coming What you are about to read below is startling. •Every time that the market has fallen in recent years, insiders have been able to get out ahead of time… •[What] is so alarming [this time round is] that corporate insiders are selling nine times as many shares as they are buying right now. •In addition, some extraordinarily large bets have just been made that will only pay off if the financial markets in the U.S. crash by the end of April. •So what does all of this mean? [Could it be that they] have insider knowledge that a market crash is coming? Evaluate the evidence below and decide for yourself. Words: 570 At some point we are going to see another wave of panic hit the financial markets like we saw back in 2008. The false stock market bubble will burst, major banks will fail and the financial system will implode. It could unfold something like this: Words: 660 8. Bull Market in Stocks Isn't About to End Anytime Soon! Here's Why As we all know, money printing always leads to inflation. It's just a matter of figuring out which assets get inflated. This time around gold is not the only beneficiary, stocks are, too, and I'm convinced that the chart below holds the key to the end of the bull market. Words: 475; Charts: 1 9. What Recovery? Contradictions Between Reality & Political Claims Are Everywhere! There is no recovery, regardless of what the elite and their minions in the media want you to believe. The economy is sick. It was made so by the malpractice of government and will become even weaker as government continues to administer the poison that got us to this point. The political class's version of remedy is akin to the medical profession's practice of bloodletting. Neither does any good and both, carried to extreme, are fatal. [Let me explain more fully.] Words: 548 10. Ignore Wall Street Cheerleaders: Market Technicals, Fundamentals & Other Info Says Otherwise! [In spite of what] the typical Wall Street cheerleaders, I mean strategists, are predicting, we see the equity market ever more closer to its cyclical top, miners about to retest a major bottom and hard assets with a new catalyst. [This article analyzes 9 pieces of information, complete with charts, that show what is actually going on in the marketplace at this point in time and what the short-term future holds.] Words: 930; Charts: 8 The Swimsuit Issue Indicator says that U.S. equity markets perform better in years when an American appears on the cover of Sports Illustrated's annual issue as opposed to years when a non-American appears on the cover. [What is the nationality of this year's cover model? Can we expect returns above the norm or will we see a year of underperformance for the S&P 500 this year? Read on.] Words: 323 ; Table: 1 12. QE Could Drive S&P 500 UP 25% in 2013 & UP Another 28% in 2014 – Here's Why Ever since the Dow broke the 14,000 mark and the S&P broke the 1,500 mark, even in the face of a shrinking GDP print, a lot of investors and commentators have been anxious. Some are proclaiming a rocket ride to the moon as bond money now rotates into stocks….[while] others are ringing the warning bell that this may be the beginning of the end, and a correction is likely coming. I find it a bit surprising, however, that no one is talking of the single largest driver for stocks in the past 4 years – massive monetary base expansion by the Fed. (This article does just that and concludes that the S&P 500 could well see a year end number of 1872 (+25%) and, realistically, another 28% increase in 2014 to 2387 which would represent a 60% increase from today's level.) Words: 600; Charts: 3 13. Investors, Get Fully Invested! S&P 500 On Verge of Entering Euphoria Stage of Cyclical Bull Market [In spite of all that is seemingly wrong with the U.S. economy] I think we are on the verge of entering the euphoria stage of this cyclical bull market where traders become convinced that QE3 is a magic elexir with no unintended consequesnces. [As such,] I see a strong acceleration and a significant and sustained breakout above the S&P 500 September high of 1475. (Words: 264 + 3 charts) 14. 5 Sound Reasons Investors Would Be Better Off On the Sidelines Than In the Market New year festivities have continued on the stock market even as the Christmas trees have been put away. The "death of the fiscal cliff," not horrible job numbers and supportive comments from Mario Draghi on the other side of the pond have led to bold and bullish behaviors over the last three weeks. While no one can predict the exact peak, here are five reasons you're better off on the sidelines than in the market. 15. These Charts Suggest a Possible +/-60% Decline in the S&P 500 by 2014 J.P. Morgan Asset Management has developed a chart showing the past two cycles in the S&P 500 highlighting peak and trough valuations. At face value it is very alarming as it suggests a potential decline of somewhere in the vicinity of 60% over the next year or two and concurs with previous innovative trend analyses included in this article. Charts: 4 16. 3 Reasons the Stock Market Could Rally & 3 Reasons to Be Cautious Near Term The U.S. stock market rally that kicked off the New Year continued last week, and after only two weeks, US stocks are up around 3% for the year. European stocks have posted similar gains and equities in Japan have advanced even further. What's behind this rally – and more importantly, can it continue? In my view, the rally can be attributed to three factors. Words: 615 17. Start Investing In Equities – Your Future Self May Thank You. Here's Why As Winston Churchill once said: "A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty" and in that vain I challenge all readers to fight off the negativity, see long-term opportunity in global equity markets and, most importantly, remain invested. Your future self may thank you. Words: 732; Charts: 6 18. Don't Ignore This Fact: "Greedometer Gauge" Signals S&P 500 Drop to the 500s by July-August, 2013! 19. Bite The Emotional Restraint Bullet Posted: 21 Feb 2013 03:21 PM PST *Originally posted February 7, 2013* My Dear Friends, The pressure on gold is not permanent in any sense. This decline is, as I have told you, similar to the series of declines just before gold took off in the 70s from $400 to $887.50. Those declines then were for the purpose of the last Continue reading Bite The Emotional Restraint Bullet |

| “Just Be Your Own Central Bank” Posted: 21 Feb 2013 03:20 PM PST The past year has tested the worldview, and sometimes the sanity, of precious metals investors. But it has also given us another chance to load up at what might turn out to be dirt-cheap prices, says Carsten Ringler, managing director of German financial firm TASS Wertpapierhandelsbank GmbH. Here's an excerpt from a long conversation we had this week, in which he laid out the reasons for optimism about precious metals in general and the junior silver miners in particular. DollarCollapse: Good afternoon Carsten, it's great to finally speak with you. Let's begin with your general take on the major asset classes. Carsten Ringler: It is nonsense to be in long-term government bonds at the moment. A 1% – 2% rise in interest rates would kill you in 10-year Treasuries. Gold and silver on the other hand are money, and as long as the [paper] money supply is increasing at today's rate, precious metals are the place to be. There might be another leg down, but it will be short and mild. I am confident that within in the next 2-3 years we'll see a breakout in precious meals that leads to a mania similar to the past few bubbles. One way to understand how cheap precious metals are in paper money terms is to go to the Minneapolis Fed's website and use their inflation basket calculator. You can put in the price of a good on a date in the past, and the machine calculates the inflation-adjusted price from then to now. For gold, starting in 1980 when it was $850, today's inflation-adjusted price is $2,400. So when anyone says gold is too expensive because it has risen the past ten years, you can respond that according to the Minneapolis Fed $2,413 is where it would be if it had just kept up with inflation. For silver, start with the 1980 $49.45 high and you get an inflation-adjusted price of $139. I also calculate ratios for more than 40 different interest rates, equity indices, real estate prices and other commodities. And those results are just as encouraging. For example, in 1980 you could buy the Dow Jones Industrial Average for 17.5 ounces of silver. Today you need 451 ounces. If the Dow remains stable at 14,000 and the Dow/Silver ratio returns to its all-time low of 17.5 ounces, silver would be $802. One ounce of gold would have bought the Dow back then and today you need more than eight. So either the Dow is overvalued to silver and gold, or silver and gold are undervalued compared to the Dow. There are 1,226 billionaires in the world. If just a few of them shifted a few percent of their assets into gold and silver it would cause a massive run on those metals. This will be a shift that will be written about in history books. They'll ask how we could have been so stupid to trust fiat currencies. Gold and silver are not going up in value, currencies are losing purchasing power against them. Therefore holding precious metals will help to store wealth and give protection against rising inflation in the future. Based on all of the above, my minimum price targets are $150 for silver and $4,000 for gold within the next five years. DC: You recently launched a fund that invests in junior miners and strategic metals. Why this combination, and why now? CR: The second biggest part of the fund's capital is allocated in mining companies with a focus on strategic metals like tungsten, cobalt and graphite that are used in a variety of electronic devices. Most of these metals aren't traded on futures markets and so aren't easy to manipulate. China is one of biggest suppliers, so I like companies with deposits in North America, especially in Canada where the product fabricators need new supply. The other 60% of the fund is in precious metals miners, mostly silver, with 60% producers and 40% advanced developers. Right now the mining industry is weak for a variety of reasons. Production costs are rising faster than metal prices, and there are growing issues with nationalization risk, capex overruns and construction problems. The gold mining stock indexes, as a result, are falling like stones. If someone asks me whether they should buy bullion or stocks, I'm definitely a strong believer in bullion as the core of one's holdings. But if you pick ten interesting companies with nice production numbers and growth prospects and reasonable costs, there's also a good possibility that going forward they will outperform just about everything else. There are many bargains for counter-cyclical investors in these days. DC: What are your favorite companies? CR: Aurcana (AUN.V), our biggest position, offers extremely nice leverage to the silver price. They operate a mine in Mexico that produced 2.5 million silver equivalent ounces last year. They began commercial production at a mine in Texas in December, and when its mill is running at full capacity we'll see another 3.8 million ounces of silver each year. This could be a 6 million ounce producer in 2014 and with a small investment to optimize two mills it could easily be a 9-10 million ounce producer in 2015. It's fully funded and has a small $380 million market cap. Compared to other producers of similar scale like Endeavour Silver (EDR.T), it's really undervalued. It could be the next First Majestic (AG), getting organic growth from one mine while expanding others. My second and third biggest positions are in Santa Cruz Silver (SCZ.V) and Avino Silver and Gold (ASM.V). Both have extremely good management. Santa Cruz is constructing its first of three mines in Mexico. They plan to be in commercial production in Q1 2013. Everything is commissioned and ready to go. It could be a 5 million ounce producer in 2016 if everything goes according to plan. I was one of the first institutional investors in this stock last summer when it was $0.86 a share. Since then it has risen as high as $2.50, but is still extremely cheap compared to better-established juniors like Fortuna Silver (FVI.T). Avino is already producing between 50,000 and 60,000 ounces of silver equivalent per month, with nice grades and recoveries, and they're expanding their mill from 250 tpd to 1,250 tpd. It could be a 2 million ounce producer in 2014 and its market cap is only $44 million. In this market even quality juniors are undervalued based on ounces in the ground. I hope to locate them before they're found by the rest of the investment community. There are no guarantees, but if you're a big believer in silver now is a great time to accumulate these stocks. But we have to be patient. We have to accumulate precious metals over time. I tell clients who buy physical precious metals through our company to be cautious with paper money receivables like life insurance. Just be your own central bank by owning gold and silver. In this kind of environment nothing is certain so you have to diversify in real assets. An abrupt loss of confidence in global currencies could come anytime in the next few years. |

| China Will Have World’s Largest Gold Reserves In 2 To 3 Years Posted: 21 Feb 2013 03:18 PM PST 21-Feb (King World News) — Today acclaimed money manager Stephen Leeb told King World News that "… within the next 2 or 3 years China is going to be the largest gold holder in the world." Here is what Leeb had to say: "Obviously the markets are to say the least a little bit jittery. The key here is not so much what the Fed said yesterday when they again discussed that they may consider cutting back on quantitative easing, but it's really the context in which that was said." …I believe the Chinese will step in to the gold market and support at these levels because they have a populace which owns a lot of it, and they certainly have the wherewithal to fight any selling, especially if that selling is short selling. So I'm bullish. I'm flat out bullish on gold. Any selling that's going on here is just selling to the Chinese. The gold that is reported to be flowing to the Chinese through Hong Kong is only part of the story. The Chinese are importing gold from other sources. Certainly within the next 2 or 3 years China is going to be the largest gold holder in the world. Again, I think that gold will continue to act as a barometer, and as gold continues in its bull market by heading thousands of dollars higher, the gold barometer is signaling the East triumphing over the West. Unfortunately, unless we begin to take this situation seriously in the West, that's just how this is going to continue to unfold, and gold is going to reflect it. The bottom line is you are going to see dramatically and I mean dramatically higher prices. There is nothing that's changed my mind about that at all." [source] |

| Posted: 21 Feb 2013 03:13 PM PST On the [COLOR=#e06666]Time Frame Clock, Gold, Silver and the XAU continue their bear market in all TDItime frames. This includes any other standard metric or traditional moving average you choose which also clearly demonstrates a bear trend.[/COLOR] To expand on the dynamics outlinedin the "Trend Power Synchronized" below, nothing will change unless: [LIST] [*]The money flows described improve. [*]The waterfall exhaustioneffect completes and no sellers are left. [*]All the stocks, referred tobelow, are in agreement. So far, only 2 of 3 have met that requirement. [*]The [COLOR=#e06666]USD index completes its strong daily and weekly uptrend.[/COLOR] [*]Short sellers, who havesignificant profits, become fearful and begin to cover. [*]A high volume selling climaxis noted with a strong intraday reversal. [/LIST] In addition, as suggested in"[COLOR=#e06666]PatternAnalysis", no trend change will occur until all the cheer leaders of moon shots,imminent turnarounds and assorted... |