saveyourassetsfirst3 |

- Russia may become No.3 gold miner by 2015 - lobby

- DRD dividend up as rand price of gold jumps

- Sibanye Gold jumps as market warms to split

- Gold, Silver fail to recover losses despite talk of currency wars, nuclear testing

- Duty hike boosts Gold smuggling in India

- The puke and whimper in gold miners

- The Silver Chart Predicting $200 Silver by 2018: Silver's Parabolic Up-trend Channel Suggests Massive Silver Move is Imminent

- Zimbabwe court orders Mugabe allies off RioZim mine

- Thunder Road Report- Silver: The Best Asset Right Now in the World

- Iran may use Revolutionary Guards to smuggle Gold

- This could be the easiest way to buy the world's most explosive silver stocks

- "Stealth" inflation could be claiming another unusual victim

- These Are The Beneficiaries From The Pipeline Revolution In North America (Part II)

- Value In Pharmaceutical Research: A Niche Software Producer

- Are gold and silver stocks ready for a rally yet?

- Cobre Panama gives big boost to Inmet reserves, resources

- Gold, silver fail to recover losses despite talk of currency wars and nuclear testing

- Gold falls to five-week low amid technical selling pressure

- High Yield Dividend Stocks: What Every Investor Should Look For

- End currency wars with gold standard?

- Devaluations. Get used to them.

- Russia may raise Gold output by 5% every year till 2020

- Russia’s external debt added record 22% in 2012

- Peru 2012 mineral exports shrink 1.7% on Gold

- Gold save the Queen

- End Currency Wars With Gold Standard? –Bloomberg Interview and FT Op-ed

- Jordan Roy-Byrne’s gold price and mining stocks outlook

- Recent optimism making Gold's safe haven properties redundant

- US private gold exports rise in December

- Middle East nations urged to increase Gold holdings

- Nepal Gold imports up nearly 15%

- LBMA trader brushes off yesterday's attack on gold

- Putin Turns Black Gold Into Bullion as Russia Out-buys the World

- New York Sun: The state of the dollar

- Russia, China and Turkey bought the most gold in 2012

- Could a new gold standard be an answer to currency instability?

- Feb 12, 1965 : De Gaulle v. the Dollar

- Technical Update on our Silver Stock Index

- Venerable Research Firm, BCA Research is Positive on Gold Stocks

- Goldman Sachs warns again on bonds so this must be about time for a rally?

| Russia may become No.3 gold miner by 2015 - lobby Posted: 12 Feb 2013 02:05 PM PST Increased output could see Russia surpass the US as the world's third largest gold miner by 2015, says the head of the Russian Gold Industrialists' Union. |

| DRD dividend up as rand price of gold jumps Posted: 12 Feb 2013 11:24 AM PST The group says if it sells its ERPM offering, a special dividend could be in the offing. |

| Sibanye Gold jumps as market warms to split Posted: 12 Feb 2013 10:45 AM PST Shares of newly-listed Sibanye Gold jumped more than 6% on Tuesday as the market warms to its potential as a stand-alone gold producer. |

| Gold, Silver fail to recover losses despite talk of currency wars, nuclear testing Posted: 12 Feb 2013 10:17 AM PST Like gold, silver also failed to make up ground lost yesterday, trading below $31 throughout this morning. |

| Duty hike boosts Gold smuggling in India Posted: 12 Feb 2013 09:36 AM PST Despite India's best efforts to curb illegal gold imports, which included a boost to the nation's customs in 2012, gold smuggling has been rather rampant. |

| The puke and whimper in gold miners Posted: 12 Feb 2013 09:15 AM PST Action in gold and the gold shares continues to be brutal. But one thing that has really piqued my interest from a trading perspective was the high volume flushout in GDX back on Jan. 25. |

| Posted: 12 Feb 2013 09:00 AM PST Today's chart of the day examines silver's 12 year logarithmic parabolic up-trend chart that began in 2001. Silver is just now approaching it's parabolic up-trend line for the first time since 2009, and only 2nd time since 2002. The last time silver touched its parabolic uptrend line the metal rose from 8 to $50 in [...] |

| Zimbabwe court orders Mugabe allies off RioZim mine Posted: 12 Feb 2013 08:57 AM PST RioZim went to court earlier this month to fight off two lawmakers, including tourism minister Walter Mzembi, who had taken control of its Renco gold mine. |

| Thunder Road Report- Silver: The Best Asset Right Now in the World Posted: 12 Feb 2013 08:30 AM PST Paul Mylchreest has released the latest MUST READ Thunder Road Report titled Silver: Right Now (probably) the Best Asset in the World. Mylchreest examines silver's cyclical trends and charts, and suggests silver is ready to place new all-time nominal highs by this August. For more than a century, the silver price has correlated most closely [...] |

| Iran may use Revolutionary Guards to smuggle Gold Posted: 12 Feb 2013 08:20 AM PST The Islamic republic began to demand gold in exchange for oil after it was ejected from the SWIFT international electronic banking system last year. |

| This could be the easiest way to buy the world's most explosive silver stocks Posted: 12 Feb 2013 08:18 AM PST From DollarCollapse.com: There are several ways to time the launch of a new exchange-traded fund (ETF). One is to strike while a sector is hot, pull in a lot of trend-following money, and accept that the fund's performance might be mediocre, since the hotter the sector, the more due it is for a correction. That's how it went for the Market Vectors Junior Gold Mine ETF (GDXJ), which nearly doubled in its first year of trading and is since down by more than half... Another approach is to launch when a sector is out of favor, accept that you'll attract very little money upfront, but hope that good future performance will draw investors later on. That's what Madison NJ Pure Funds has done with its new Junior Silver Miners ETF... More on silver: |

| "Stealth" inflation could be claiming another unusual victim Posted: 12 Feb 2013 08:18 AM PST From Liberty Blitzkrieg: They just ain't making Maker's like they used to. According to the company, an apparent bourbon shortage has besieged the company, leaving it no choice but to cut the alcohol content of their booze from 45% to 42%. I'm sorry, but this excuse reeks of marketing spin. What manufacturer decides to dilute their product when they face high demand, rather than just raise the price by 3% and keep the quality intact? In a world where horse meat is increasingly finding its way into "all beef" products, where biotech salmon is soon to hit the streets, and where Subway's foot-long sandwiches are less than 12 inches, I'd be willing to bet that this is simply just another case of good old fashioned stealth inflation... More on inflation: |

| These Are The Beneficiaries From The Pipeline Revolution In North America (Part II) Posted: 12 Feb 2013 08:17 AM PST By Introduction The first pipeline build-out in the United States came during World War II when the Government ordered a two-pipeline system, the Big Inch and Little Big Inch, to carry oil and refined products to the Northeast from the Gulf Coast. The demand for natural gas and oil drove the pipeline construction postwar and some remarkable pipeline projects from the postwar period are the pipelines connecting Gulf Coast refiners to the Northeast market and the Trans-Alaska Pipeline System. Then the pipeline construction slowed dramatically as refinery construction stopped and steady oil production necessitated only incremental improvements in the network. The natural-gas shale frenzy ignited another construction boom for new natural gas pipelines from 2006 until 2009 when the financial crisis and a collapse in prices halted investment. In the first Part of this series, I discussed the industrial companies, which have the potential to be the beneficiaries Complete Story » |

| Value In Pharmaceutical Research: A Niche Software Producer Posted: 12 Feb 2013 08:10 AM PST By An Ounce of Prevention is Worth a Pound of Cure ... A blockbuster drug has the potential to generate enormous profits for the company holding the rights to it. Despite the enormous enthusiasm surrounding new drugs, the road to regulatory approval is littered with dozens of failures for every major success. The recent collapse of Celsion Pharmaceuticals (CLSN) provides a particularly salient example of the "all or nothing" nature of many biotech companies. Though the right drug has the ability to radically alter the fortunes of a company and the health of many patients the world over, the production and research of the next panacea is always a time consuming and extremely costly endeavor. Any method to mitigate such cost, especially early in the process, is likely to be in constant demand by pharmaceutical companies as they try to maximize the benefit derived from the dollars invested in their R&D Complete Story » |

| Are gold and silver stocks ready for a rally yet? Posted: 12 Feb 2013 08:01 AM PST Precious metals mining stocks may not look too encouraging recently with mostly declines in 2013 and lack of any spectacular rally. But other influential markets suggest that the situation is likely to change in the near future. |

| Cobre Panama gives big boost to Inmet reserves, resources Posted: 12 Feb 2013 07:52 AM PST As First Quantum $5.1 billion hostile bid for Inmet is due to close on Valentine's Day, Inmet announced substantial increases in copper and gold reserves. |

| Gold, silver fail to recover losses despite talk of currency wars and nuclear testing Posted: 12 Feb 2013 07:47 AM PST Gold prices failed to recover yesterday's lost ground Tuesday morning as stocks and commodities eased higher, following news of a fresh nuclear test in North Korea and denials from policymakers that a currency war is taking place among major economies. |

| Gold falls to five-week low amid technical selling pressure Posted: 12 Feb 2013 07:42 AM PST Gold prices are trading near steady levels in the early going Tuesday, but did hit another fresh five-week low overnight. Gold has seen some intensified technical selling pressure early this week. |

| High Yield Dividend Stocks: What Every Investor Should Look For Posted: 12 Feb 2013 07:30 AM PST It can be mighty hard to earn any interest at all in today's banking environment. Many investors are looking to riskier investments to find the kind of returns they once got from an FDIC-insured CD or even a savings account. But don't despair. There are still a few decent ways to make your cash earn some income without putting it at too great a risk. My wife takes care of our filing, and during one of her filing sprees some time ago she walked into my office with the brokerage statement for her IRA and asked me why the interest was less than $1. "Interest rates have gone down that much," I said. She replied, "That's terrible," and turned around, went back into her office, and stuffed the statement into the appropriate file. Inflation was eating away at our savings, and our broker had nearly stopped paying any interest at all. When I sent him an email, he wrote back: "I am sad to say the current yield on our money market fund is 0.01%. If we travel back in time to 2007 that rate would have been around 4.00%." I was shocked! I even made him spell it out, and he confirmed that was no typo; it wasn't supposed to say 1% or 0.01%… it was actually 1/100 of 1%. In one of our recently published reports, The Cash Book, we showed retirees how to protect their cash. Safety is essential for cash, but safe places – such as checking accounts, money market funds, and even ultra-short bond funds – offer virtually no yield, while the threat of inflation is very real. Even with "official" inflation moving at a modest 3% per year, settling for a conservative money market fund's token yield of 0.05% or so means the purchasing power of your cash is leaking away. You need a yield that matches the inflation rate just to stay even. You shouldn't have to accept pathetic yields nor sacrifice safety to the whims of the stock market just to eke out enough to keep up with inflation. I'm sure I'm not the only investor who had seen his monthly interest-income cash dwindle but put off dealing with it because I had "bigger fish to fry" in the rest of my portfolio. If you're now in the same boat, it's time to fix the problem. Don't ignore those sad yields on your cash any longer. Today, minimum risk and improved yield is more important than ever. While not close to what we enjoyed just a few years ago, a 1% return instead of a 0.01% return is a hundredfold improvement. That improved yield translates into less need to take high risks elsewhere in your portfolio. When your cash is doing its job, you don't need risky bets to get your portfolio where it needs to go. Over the next few weeks we'll cover a variety of ways you can make your money work harder for you and actually minimize your risk. And given the number of questions I get about high yield dividend stocks I think it's appropriate to start with them first. Equities (stocks) can be another way to beat the yields on bonds in the US market. Of course, when you buy a stock, you don't even get a promise that your principal will be repaid. Nonetheless, with yields so low elsewhere, there are high-volume, blue-chip equities that can be good additions to your income portfolio. In the best scenario, they may give you both good yield and capital appreciation. The same can't be said of bonds, since rates are already so low. Keep in mind that dividend equities should be only a part of your yield portfolio, not all of it. And don't weigh yourself too heavily toward any one stock. Since the late 1950s, 10-year US Treasury yields have been consistently higher than the average dividend yield for the S&P 500. But now with the S&P average dividend yield at 1.98% and the 10-year Treasury yield at 1.64%, this trend has reversed, making dividend-paying stocks more attractive than almost ever before. That's just one of the reasons why we're looking for blue chips that are financially sturdy and that offer yields that more than make up for the market risk. When evaluating the stability of a high-yielding dividend paying stock, the first metric to look at is the company's fundamentals. Much of this information is freely available online on websites like Yahoo! Finance and · Do they have more current assets than current liabilities? · Do they have enough cash to cover average operating expenses? · What about debt? What percentage of operating income goes toward servicing long-term debt payments? Answering these questions should give you a good idea as to the company's financial stability. Also, stable free cash flow and operating margins greater than or equal to its competitors can help identify any potential competitive advantages. Once we have established that the company is fundamentally sound, the firm's dividend needs evaluation. Companies will sometimes publish their dividend policies on their website (often on a page titled "Investors" or wording to that effect) or annual reports, but they also frequently withhold this information. Luckily, there are a few metrics that can help assess the durability of the dividend. The most common indicator for dividend stability is the payout ratio. The payout ratio is equal to Dividends per Share/Earnings per Share, and shows you how much of the company's earnings went toward dividend payments. The lower the better and anything over 80% should be considered a red flag. As an aside, the S&P dividend payout ratio is currently at 37%, well below its long-term average of 50%. This means that the potential for dividend increases is more likely than usual. And, since companies have been hoarding cash as a result of overarching uncertainty in the economy, we could see rising dividend payouts in coming years. Next, you'll want to look at the company's dividend history. A few questions you'll want to pose: · Has the dividend been cut recently or in times of economic or market turmoil? · How many years in a row has the company raised its dividend payout? · Has the dividend payout been rising while the payout ratio and debt levels remain the same? A consistent track record of raising dividends is a good sign. Some companies that have raised their dividends 25 consecutive years fall into the elite category of Dividend Aristocrats (only 51 stocks fall into this category). However, the last metric is the most important. If a company is able to consistently raise its dividend without having to divert profit and/or take on debt, that company's dividend is safe. These metrics reflect a company's ability to meet its short-term debts and help assess the safety of the dividend. In case of rough waters, the companies with better fundamentals will be the survivors and the ones less likely to bail on dividend payouts when times get tight. With these tools in hand you should be able to start doing research on dividend stocks for your own portfolio. In our Money Forever letter we recently developed a monthly income plan using some of the safest dividend stocks on the market. The plan is easy to start and doesn't require an extensive background in investing, just a willingness to learn and a desire for monthly income. Click here to find out more. |

| End currency wars with gold standard? Posted: 12 Feb 2013 07:09 AM PST Concerns about the devaluations and the growing risk of a severe bout of inflation have led to calls for a return to fixed exchange rates and a gold standard. |

| Devaluations. Get used to them. Posted: 12 Feb 2013 06:56 AM PST Venezuelan devaluation sparks panic Venezuela devalued their currency, the Bolivar, by nearly 50% on Friday and it now looks like Egypt will be next. The story in the Financial Times is headlined "Venezuelan devaluation sparks panic." I read the article and was surprised at the content because when I read the headline I was fooled. OF COURSE the Venezuelans are in a panic, they just lost nearly 50% of their purchasing power over one evening. The "panic" that I thought would have been written about was "who's next?" This is merely a small chapter in the current global currency war. The funny thing is that these mainstream writers are gauging the "devaluation" versus the Dollar when in fact it is the U.S. who is working the hardest at devaluing. Zerohedge wrote yesterday that Russia has been exporting oil and buying Gold for years …because they know! They know that the U.S. Dollar will be devalued at some point much harder and faster than it already has been. The same goes for China who is now THE largest trading entity on the planet because they also know. Why do you think that the Chinese have structured deal after deal to purchase assets in Dollars? Why do you think that they have structured trade deals in Yuan? They want to take in less Dollars and spend as many as they can before this thing goes terminal. They are simply illustrating how to play the game of hot potato! Don't get me wrong, I know that China has blown its own bubble with debt and an exploding money supply but they are novices compared to what we've done. As my title implies, the world should get used to devaluations. They will now come more often and with deeper cuts because of what has happened and the responses by central banks over the last 5 years. The world (central banks) has collectively jumped head first into papering over the paper problems with more and more paper. What began as a solvency problem has been remedied as a liquidity problem which worsened debt ratios and watered down the currencies… until… everyone is forced to devalue versus Gold. While on the topic of "devaluation," I think I may have an idea as to why the "lock down" of the metals over the last 3 months or more. Obviously the "lid" needs to be kept on the metals as behind the scenes we know things are getting messier. I believe that the powers that be are "tapping on the brake" as opposed to the way they used to operate. They used to go for 20% or more drops to shake the weak hands out. I don't believe that is possible now. Here is why: We know that physical demand is quite strong as evidenced by the U.S. Mint figures and investors are now reacting differently to any big drops. In the past, many investors would freeze, now they are looking for entry points rather than exits. Yes I know, the sentiment is awful and everyone is moaning and groaning but a $100 or $200 drop in Gold or $3 in Silver is bringing new buyers out of the wood work. Think of it this way; by not allowing a price rise and also not pressing your hand to the downside it is not creating any emotion or urgency to buy… now. Yes it is irritating the long term holders but the lack of movement has taken gold and silver out of the spotlight. This way, anyone looking to buy on dips or "trend followers" chasing an uptrend are basically made to sit on their hands. Maybe I am wrong in this thought process but it seems to fit AND is the best strategy available in my opinion. Lock the price down, keep whacking it often and steadily to make as few emotional waves as possible. For long term holders of metal assets this is like Chinese water torture but once this changes the supply demand equation will go ballistic. As I have said all along, "Either you are in or you're out. When the music stops, you will not be able to correct or better your position." If you have not positioned yourself yet, use the current calm before the inevitable storm. You will need to be prepared to ride out whatever comes… with whatever you entered with.Similar Posts: |

| Russia may raise Gold output by 5% every year till 2020 Posted: 12 Feb 2013 06:53 AM PST According to Russian Gold Industrialists' Union, country's gold production is likely to increase by 5 percent this year from 226 tonnes in 2012. |

| Russia’s external debt added record 22% in 2012 Posted: 12 Feb 2013 06:38 AM PST It appears that Russia is good at amassing not only its gold reserves, but also debt.The country's total foreign debt reached a new height of $614 billion in 2012, or 10.5% of country's GDP, Russia's Audits Chamber's report says. This is 16.1% more than the country's gold and foreign currency reserves. Debt servicing in 2012 amounted to over $1 billion. .. Read |

| Peru 2012 mineral exports shrink 1.7% on Gold Posted: 12 Feb 2013 06:33 AM PST Peru's national statistics agency INEI said the nation saw a 1.7% fall in mining exports in 2012 due to an 11.4% decrease in gold exports. |

| Posted: 12 Feb 2013 06:15 AM PST HRH Queen Elizabeth II: "I saw all the Gold bars. Regrettably, not all of them belong to us." George Osborne, Chancellor of the Exchequer: "Some of them were sold, but we still have ... |

| End Currency Wars With Gold Standard? –Bloomberg Interview and FT Op-ed Posted: 12 Feb 2013 05:05 AM PST TCW Group, Komal Sri-Kumar, says the first step in a gold standard would be to fix the price of gold in dollar terms at near its current level of $1,675/oz. Today's AM fix was USD 1,641.75, EUR 1,225.28 and GBP 1,053.15 … Continue reading |

| Jordan Roy-Byrne’s gold price and mining stocks outlook Posted: 12 Feb 2013 05:00 AM PST Episode 99: GoldMoney's Dominic Frisby talks to Jordan Roy-Byrne, publisher and editor of TheDailyGoldPremium. They discuss the performance of gold mining stocks and his outlook for this (at the ... This posting includes an audio/video/photo media file: Download Now |

| Recent optimism making Gold's safe haven properties redundant Posted: 12 Feb 2013 04:44 AM PST Silver fell to $31.27 an ounce - its lowest level in nearly two weeks - while stocks were broadly flat and commodities edged lower as the Dollar strengthened. |

| US private gold exports rise in December Posted: 12 Feb 2013 04:38 AM PST U.S. gold exports to Hong Kong has been steadily increasing in the past several years as wealthy Asian individuals looked to diversify their portfolios into gold. |

| Middle East nations urged to increase Gold holdings Posted: 12 Feb 2013 04:28 AM PST Despite the fact that most Middle Eastern nations pegged their currencies to the dollar, they should expand their gold reserves holdings, |

| Nepal Gold imports up nearly 15% Posted: 12 Feb 2013 03:45 AM PST Nepal Gold and Silver Dealers Association said import value of gold shot up by double digit during the six-month period even though daily imports of gold through formal channel remained unchanged at 15 kg. |

| LBMA trader brushes off yesterday's attack on gold Posted: 12 Feb 2013 02:37 AM PST  Bull Market Thinking's Tekoa da Silva interviews a London gold trader about today's attack on gold and he brushes it off as exploitation of a brief interruption of physical demand. He can call it what he likes, but what it was, was a bear raid on three of the four precious metals by JPMorgan et al because China was closed for New Year celebrations. The story was posted on the bullmarketthinking.com Internet site yesterday...and I found it in a GATA release. The link is here. |

| Putin Turns Black Gold Into Bullion as Russia Out-buys the World Posted: 12 Feb 2013 02:37 AM PST ¤ Yesterday in Gold and SilverThe gold price did nothing in Far East Trading on their Monday...and volume was the lowest that I can remember for that time of day. Gold traded ruler flat until shortly after the London open...and then the selling pressure began. It came in three stages...and after each sell-off, there was a tiny rally before the selling began anew. But the moment that the Comex opened, the bid disappeared...and the gold price dropped about fourteen bucks in as many minutes. The subsequent rally wasn't allowed to get far...and the gold price chopped sideways for the rest of the day. The high tick was around $1,678 spot...and that came shortly after trading began early Monday morning in the Far East...and the low [$1,642.80 spot] came about fifteen minutes after the Comex open. Gold closed the Monday session at $1,648.30 spot...down $18.90 on the day. Volume was pretty heavy...around 200,000 contracts. The price action in silver was very similar to gold's price action, with the only significant difference being that silver's low tick [$30.74 spot] came during the New York lunch hour. The rally off that low got sold down during the electronic trading session. Silver closed at $30.95 spot...down 48 cents. Once the roll-overs out of the March contract were deducted, silver's net volume was surprisingly light...around 30,500 contracts. Here's the New York Spot Silver [Bid] chart on its own. Platinum traded ruler flat until the Comex open...as did palladium. But once trading started in New York, platinum got sold down...and platinum closed higher on the day. The dollar index opened in New York on Sunday night at 80.23...and then flopped around as the Monday trading day progressed...and closed at 80.34...up 11 basis points. The high tick was just a hair under 80.40...the first time at 9:40 a.m. Eastern...and the last time at the close of trading. Of course it nearly goes without saying that the precious metal price action had nothing to do with what was going on in the currency markets...as it was all JPMorgan et al. The gold stocks got sold down about two percent right a the open...with the lows of the day coming at gold's low...around 12:15 p.m. in New York. The subsequent rally was rather a tepid affair...and even it got sold down in the last thirty minutes of trading. The HUI finished the Monday trading session down 1.90%. Except for one stock that I track, all the silver equities got sold off pretty hard...the junior producers in particular. The seven stocks that make up Nick Laird's Intraday Silver Sentiment Index had a slightly better time of it...as the ISSI closed down only 1.84%. (Click on image to enlarge) The CME's Daily Delivery Report showed that only 91 gold and 6 silver contracts were posted for delivery on Wednesday within the Comex-approved depositories. Except for ABN Amro, it was 'all the usual suspects' in gold. The link to yesterday's Issuers and Stoppers Report is here. As of 9:36 p.m. Eastern time last night, there were no reported changes in either GLD or SLV. However, late last night the new short interest numbers for both SLV and GLD were posted on the shortsqueeeze.com Internet site...and they were amazing. In SLV, the short interest collapsed by 59.16%. Wow! The naked short position fell from 17.86 million shares/ounces, all the way down to 7.30 million shares/ounces. That leaves about 2.16% of the outstanding SLV shares held naked short. It's obvious that a large chunk of that 18.4 million ounces that was deposited back on January 16th was used to pay down that short position...and I'd be happy to bet a fair chunk of money that it was JPMorgan Chase. In GLD the short interest fell by 7.14%...from 21.58 million shares, down to 20.04 million shares. The current short position is a hair over 2 million ounces...and about 4.69% of the outstanding shares. The U.S. Mint had a sales report yesterday. They didn't sell any gold, but did report selling another 329,500 silver eagles. Over at the Comex-approved depositories on Friday, they reported receiving 198,937 troy ounces of silver...and shipped 451,777 troy ounces out the door. The link to that activity is here. Here's a chart that Washington state reader S.A. sent me yesterday...and it's self-explanatory. (Click on image to enlarge) Below is a short home video clip from Ben Bernanke's childhood...and I thank Roy Stephens for sharing it.

I have the usual number of stories for a Tuesday, which is quite a few...and I'll happily leave the final edit up to you. Well, it's a chart pattern that you've seen before...and comes as no surprise to me. U.S. gold bars and coins find new home overseas on Asian demand...especially Hong Kong. Silver Coins in Demand. Gold smuggling soars in India. Investors bankers, welcome India's new gold regulations. Bipolar Silver: How to Profit. ¤ Critical ReadsSubscribeChina Eclipses U.S. as Biggest Trading NationU.S. exports and imports of goods last year totaled $3.82 trillion, the U.S. Commerce Department said last week. China's customs administration reported last month that the country's trade in goods in 2012 amounted to $3.87 trillion. China's growing influence in global commerce threatens to disrupt regional trading blocs as it becomes the most important commercial partner for some countries. Germany may export twice as much to China by the end of the decade as it does to France, estimated Goldman Sachs Group Inc.'s Jim O'Neill. "For so many countries around the world, China is becoming rapidly the most important bilateral trade partner," O'Neill, chairman of Goldman Sachs's asset management division and the economist who bound Brazil to Russia, India and China to form the BRIC investing strategy, said in a telephone interview. "At this kind of pace by the end of the decade many European countries will be doing more individual trade with China than with bilateral partners in Europe." This article appeared on the Bloomberg website early on Sunday morning Mountain time...and the first person through the door with it was "Nick G"...and the link is here.  New York Sun: The state of the dollarAs President Obama prepares to deliver his State of the Union address tonight, the New York Sun says the state of the dollar should overwhelm all other subjects. The Sun says: "Particularly in an age of fiat money, where there is no gold or silver backing for our national currency and the only basis of it is the economic good fortune of the nation ... well, particularly in such an age, the state of the dollar can be seen as a proxy for the state of the Union itself. If so, the state of the Union is at a historic low." This short editorial was posted on the nysun.com Internet site yesterday...and I plucked it from a GATA release yesterday. It's definitely worth reading...and the link is here.  Households On Food Stamps Rise To New RecordSince Obama's inauguration, the US has generated just 841,000 jobs through November 2012, a number more than dwarfed by the 17.3 million new food stamps and disability recipients added to the rolls in the past 4 years. And since the start of the depression in December 2007, America has seen those on food stamps and disability increase by 21.8 million, while losing 3.6 million jobs. End result: total number of food stamps recipients as of November: 47.7 million, an increase of 141,000 from the prior month, and reversing the brief downturn in October, while total US households on food stamps just hit an all time record of 23,017,768, an increase of 73,952 from the prior month. The cost to the government to keep these 23 million households content and not rising up? $281.21 per month per household. This Zero Hedge piece from yesterday has three excellent charts embedded...and I thank Marshall Angeles for sending it along. The link is here.  Yellen Says Higher Rates Not Assured After Thresholds HitFederal Reserve Vice Chairman Janet Yellen said the central bank may hold the benchmark lending rate near zero even if unemployment and inflation hit its near-term policy targets. The Federal Open Market Committee said in December it will hold the main interest rate in a range of zero to 0.25 percent so long as inflation isn't forecast to rise to more than 2.5 percent in one to two years and unemployment remains above 6.5 percent. On Monday, Yellen said those objectives are "thresholds for possible action, not triggers that will necessarily prompt an immediate increase" in the FOMC's target rate. "When one of these thresholds is crossed, action is possible but not assured," she said in a speech to the AFL-CIO in Washington. Well, dear reader, that pretty much guarantees hyperinflation, as that's the only thing that will trigger a big change in consumer spending and investing habits...when the sheeple finally realize that the Fed and their own government are going to destroy the dollar. Then it will become, spend it or watch it's purchasing power disappear literally overnight. This Bloomberg story was posted on their Internet site early yesterday afternoon Mountain Time...and I thank Manitoba reader Ulrike Marx for bringing it to our attention. It's worth reading...and the link is here.  Venezuelan devaluation sparks panic buyingPanic buyers thronged Venezuelan shops over the carnival weekend after the government of Hugo Chavez announced a surprise devaluation that analysts said was overdue but would only partly right the listing economy. Domestic appliances such as fridges and cookers were in particularly high demand as Venezuelans snapped up goods imported at the now-defunct exchange rate of 4.3 bolivars per dollar. From now on they will be imported at 6.3 bolivars per dollar. Opposition politicians seized on what is Venezuela's fifth devaluation since strict currency controls were introduced in 2003, criticising the socialist government for springing an International Monetary Fund-style adjustment package on the country and quietly announcing it on Friday while people headed for the beach over the holiday. This article showed up on the Financial Times website on Sunday...and is posted in the clear in this GATA release. The link is here.  Days After Freezing Prices, Argentina Bans All AdvertisingA week after Argentina resorted to every failing authoritarian government's last ditch measure to (briefly) control inflation before runaway prices flood the nation and result in political and social upheaval, namely freezing retail prices - a decision which never has a happy ending, the country is pressing on through the rabbit hole and in the latest stunner of a government decree (which like Venezuela yesterday is merely a harbinger of what is coming everywhere else), has banned advertising in the Argentina's newspapers in an attempt to weaken what's left of a private, independent media, and to punish those who don't comply with the government's propaganda. This story was posted on the Zero Hedge website early on Saturday...and I thank Marshall Angeles for sending it. The link is here.  The Fed's Bailout of Europe Continues With Record $237 Billion Injected into Foreign Banks in Past MonthLast weekend Zero Hedge once again broke the news that just like back in June 2011, when as part of the launch of QE2 we demonstrated that all the incremental cash resulting form the $600 billion surge in the Fed's excess reserves, had gone not to domestically-chartered US banks, but to subsidiaries of foreign banks operating on US soil. in the past 4 weeks, the Fed has injected a record $237 billion of cash into foreign banks with access to the Fed's excess reserves: a number greater than both the cash influx surge seen after the Lehman collapse, and faster and more acute than the massive build up of cash during the spring and summer of 2011 when all the Fed's brand new QE2 cash was once again, solely used to overfund European bank cash. This Zero Hedge article from Saturday is an amazing read, but should come as no surprise. The Fed has been the world's lender of last resort for a long time now. I thank reader U.D. for sending me this story. The link is here.  G-7 Said to Discuss Statement to Calm Currency War ConcernThe Group of Seven nations are considering saying they won't target exchange rates when setting policy as they try to calm concern the world is on the brink of a currency war, two officials from G-7 co |

| New York Sun: The state of the dollar Posted: 12 Feb 2013 02:37 AM PST  As President Obama prepares to deliver his State of the Union address tonight, the New York Sun says the state of the dollar should overwhelm all other subjects. The Sun says: "Particularly in an age of fiat money, where there is no gold or silver backing for our national currency and the only basis of it is the economic good fortune of the nation ... well, particularly in such an age, the state of the dollar can be seen as a proxy for the state of the Union itself. If so, the state of the Union is at a historic low." |

| Russia, China and Turkey bought the most gold in 2012 Posted: 12 Feb 2013 01:30 AM PST The World Gold Council has released its latest list of the world's biggest gold buyers. So who bought the most gold in the past year? Russia, China and Turkey in that order, and India is out of the top three. Still that looks like the emerging markets hedging against a decline in the US dollar… |

| Could a new gold standard be an answer to currency instability? Posted: 12 Feb 2013 12:30 AM PST Bank of New York Mellon's Michael Woolfolk and TCW's Komal Sri-Kumar discuss the currency wars on Bloomberg Television's 'Street Smart' and the practicality of moving to some sort of new gold standard. It's amazing that this is now taken seriously as an option but says something about the dire state of global currency and bond markets and the worry about what comes next… |

| Feb 12, 1965 : De Gaulle v. the Dollar Posted: 11 Feb 2013 10:30 PM PST Time |

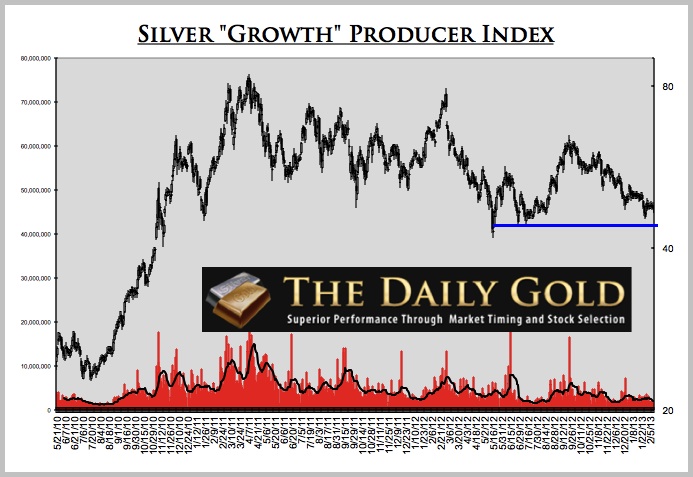

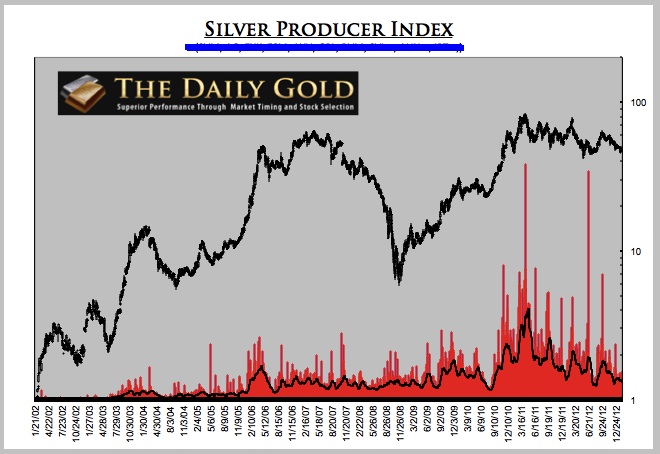

| Technical Update on our Silver Stock Index Posted: 11 Feb 2013 10:02 PM PST Our silver growth producer index contains 10 silver producers we deem as "growth-oriented" companies. As you can see the short-term price action is quite similar to GDX. The index will likely test the blue line. Will we see a major long-term double bottom? We reiterate that index has the potential for a super bullish cup and handle pattern. For that to happen we need to see the double bottom, a major recovery and eventually an explosive breakout to new all-time highs. First things first, lets see if the double bottom holds. This index is now in the 23rd month of its consolidation. |

| Venerable Research Firm, BCA Research is Positive on Gold Stocks Posted: 11 Feb 2013 09:40 PM PST BCA Research has been in business since 1949. Recently the firm commented on gold stocks vs. gold as well as gold stocks in general. You can find the full post here. Quoting part of it:

|

| Goldman Sachs warns again on bonds so this must be about time for a rally? Posted: 11 Feb 2013 09:13 PM PST Goldman Sachs President and COO Gary Cohn spoke with Bloomberg Television's Stephanie Ruhle on 'Market Makers' from Cleveland, Ohio, one of the cities where Goldman provides education and funding for small business owners. Cohn said that, 'there is really only one way that interest rates can go over some period of time which is ultimately higher. I'm concerned that the general public does not quite understand the pricing of bonds and interest rates and the inverse correlation between the two.' ArabianMoney would usually recommend doing the reverse of what Goldman says. Bonds can go higher if stocks suddenly go lower. Goldman could be talking its own book here if the stock market rally is almost done. Cohn on interest rate concerns and how Goldman Sachs is preparing: 'We have the natural concerns that everyone else has in the world. We have been in a 32-year bull market in bonds in the United States. Most of the major central banks around the world are in some type of zero interest rate policy or quantitative easing. This means to come to an end at some point. 'I am not predicting that it comes to an end anytime soon, but if you look at the normal progression of markets, there is only one way that interest rates can go over some period of time which is ultimately higher. I am concerned that the general public does not quite understand the pricing of bonds and interest rates and the inverse correlation between the two.' On the US economy: 'My views haven't changed. When you look at interest rates and when you look at fundamental monetary policy you have to take a much broader macro view. It is hard to change your views very quickly. I was in Asia last week. Asia continues to perform well. 'I was in Indonesia, Hong Kong, Singapore. All things in Asia seem to be very well. That said, you still have an interesting situation in Japan, you have an interesting situation in Europe and you have an interesting situation in the United States. Ultimately, all of these situations are going to get reflected in some type of monetary or fiscal policy.' On Goldman's 10,000 Small Businesses initiative and why he is in Cleveland: '10,000 Small Businesses is one of two cornerstone projects that we at Goldman Sachs have. The first is 10,000 Women and the second is 10,000 Small Businesses. Each of them are $500 million dollar projects. We're here in Cleveland to celebrate the first graduation of our Cleveland class. 'This is not our first graduation. Cleveland is one in nine cities where we now have 10,000 Small Businesses programs going on. It is a program where we believe we can help drive the US economy by educating small business owners around the world. On the concerns of small business owners right now: 'I think small business owners, large business owners and medium business is owners all have the same concerns. It ultimately comes down to the economy. Small-business owners are usually in the customer service business. They need customers. They need their customers to be growing. They need the economy to be expanding. 'Obviously interest rates affect larger businesses more than small businesses. Another issue is that small businesses have less access to capital. That's something that we are also dealing with in our 10,000 Small Businesses program, where our over $300 million of our $500 million contribution is access to capital for these small business owners.' On whether small business owners are going to put the capital to work: 'Unlike the big businesses, small business owners, their ability to borrow money is very difficult. For them to get access to money they need to have a very distinct need for it. When we give out capital through our CDFI programs here in Cleveland and other places, the CDFIs go through excruciating detail to make sure the small businesses need the money, but more importantly will put it to work right away and help grow jobs and help grow the economy.' |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment