Gold World News Flash |

- The Trial of the Pyx

- Gold, Bonds and the Dollar – Short- and Long-Term Implications

- These Economic Videos Have Been Viewed 8,880,000 Times – Take a Look At Some You Might Have Missed

- Bulloney: Peak Silver Land Grab Gun Control

- GLD Cannibalizing the HUI?

- By the Numbers for the Week Ending February 8

- Real Estate Investor’s Club Feb. 2013 – YouTube

- WHERE NOT TO LIVE

- DAVID FRANKLIN on GoldSeek Radio – Feb 7, 2013 – YouTube

- Earnings Season Is Over With Slow Economic Growth Ahead in 2013 – YouTube

- Venezuela Launches First Nuke In Currency Wars, Devalues Currency By 46%

- Currency Wars Often Lead to Trade Wars ... Which In Turn Can Devolve Into Hot Wars

- Crude Going Much Higher, Dollar Free-Fall, 2008 Crash. By Gregory Mannarino – YouTube

- The Gold Price Traded Sideways and a Little Lower for the Week Sell Stocks Buy Gold

- Venezuela devalues currency by 32%

- Jim's Mailbox

- Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week

- Gold Daily and Silver Weekly Charts - Risk On

- USD Surges By Most In 7 Months As Stocks Stumble And Bonds Bid

- How to Survive the Illusion of Recovery

- The Truth on Gold Stocks vs. Gold

- 'Money Stimulus Marathon' Good for Gold Price: Eric Winmill

- Equities Should Outperform Gold in the First Half of 2013- Here?s Why

- Gold and Silver Disaggregated COT Report (DCOT) for February 8

- Equities Should Outperform Gold in the First Half of 2013- Here's Why

- COT Gold, Silver and US Dollar Index Report - February 8, 2013

- Paper (money) Is Poverty

- Gold, Bonds and the Dollar - Short- and Long-Term Implications

- A Quick Way To Buy The SilverJuniors

- Inflation Expectations Influencing Path of Stock Prices Differently These Days

- State Of Collapse

- Russian policy study group notes GATA's exposure of gold price suppression

- Bank Run!

- Russian policy study group notes GATA's exposure of gold price suppression

- Nothing At All, Then All at Once

- Is Gold GLD ETF Cannibalizing the HUI Stocks Index?

| Posted: 09 Feb 2013 12:00 AM PST Jan Skoyles looks at an age-old trial which worked to assess the value of the money supply. She suggests that in times of such blatant monetary debasement, the scope of the trial should be expanded so as to make the stewards of the monetary system less susceptible to the temptations of easy monetary policy. by Jan Skoyles, TheRealAsset.co.uk

Since 1282, the Trial of the Pyx, which is a full judicial trial, has taken place every year in order to check the integrity of new coins produced by the Royal Mint. Taking place at the Goldsmith's Hall in the City of London, the trial is done in three-stages and involves a jury of goldsmiths counting and weighing the new coins which are transported in the Pyx, Latin for 'chest'. The trial has legal implications for the Royal Mint who is on trial. The jury is made up of Goldsmith's members who are summoned to the Goldsmith's Hall by the Queen's Rememberancer, a senior judge in the Courts of Justice. |

| Gold, Bonds and the Dollar – Short- and Long-Term Implications Posted: 08 Feb 2013 11:30 PM PST by Przemyslaw Radomski, Gold Seek:

A trend is a trend until it stops. Could this be the case for bonds? Is the bond bubble about to burst? And if so, what are the implications for precious metals? Anyone following the financial press can see that analysts are rumbling that bond prices will fall when interest rates rise and that it will happen sooner than later. And we generally agree – you can't lower interest rates below zero (who knows, maybe the Fed will surprise us calling that an unconventional but necessary move?) and since they are practically there, the ceiling is very close to the current bond valuations. |

| Posted: 08 Feb 2013 11:11 PM PST "Follow the munKNEE" via twitter & Facebook or Register to receive our daily Intelligence Report Below are introductory paragraphs and links to 21 videos, ranging in The first 17 documentaries were sourced* from the economicreason.com site and the 4 related videos from articles posted on www.munKNEE.com (Your Key to Making Money!) and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds). Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. 1. Overdose: The Next Financial Crisis – Directed by Martin Borgs This documentary depicts When the world's financial bubble blew, the solution was to lower interest rates and pump trillions of dollars into the sick banking system. The solution is the problem, that's why we had a problem in the first place. Featured guests; Peter Schiff, Gerald Celente, Dennis Hannon. ~46 min. 984,201 views 2. 97% Owned – Directed by Peter Joseph 97% owned presents serious research and verifiable evidence on the troubling issues facing our economic and financial system. This documentary provides a UK-perspective, however, its inner workings of Central Banks and the Money creation process are virtually the same concept all around the world. ~2:10 hr. 240,401 views 3. Money as Debt 1 – Directed by Paul Grignon Todays money is a new form of slavery, and distinguishable from the old simply by the fact that it is impersonal, there is no human relation between master and slave. Debt- government, corporate and household has reached astronomical proportions. Where does all this money come from? How could there BE that much money to lend? The answer is…there isn't. Today, MONEY IS DEBT. If there were NO DEBT there would be NO MONEY. ~ 47 min. 18,373 views 4. Money As Debt 2, Directed by Paul Grignon Bailouts, stimulus packages, debt piled upon debt…Where will it all end? How did we get into a situation where there has never been more material wealth & productivity and yet everyone is in debt to bankers. ~1:16 hr. 187,579 views 5. Money As Debt 3 – Directed by Paul Grignon This third and final movie in the Money as Debt trilogy presents a comprehensive picture of how "money" could work in the future. It is a blueprint full of surprising specifics for creating a whole new system applied with technologies that exist right now. Money as Debt. ~1:02 hr. 204,835 views 6. The Ascent of Money: A Financial History of The World - By Niall Ferguson This documentary provides a financial History of the World by a Harvard professor, Niall Ferguson. It examines the long history of money, credit, and banking. ~4:30 hr. 481,213 views 7. Fiat Empire – Why the Federal Reserve Violates the U.S. Constitution – Directed by Matrixx Entertainment Corporation A good documentary about the federal reserve in the United States. Most people believe that this bank is government owned but it is not. ~58 min. 28,152 views 8. Money, Banking, and The Federal Reserve System – Produced by Ludwig von Mises Institute Thomas Jefferson and Andrew Jackson understood The Monster but to most Americans today, Federal Reserve is just a name on the dollar bill. They have no idea of what the central bank does to the economy, or to their own economic lives; of how and why it was founded and operates; or of the sound money and banking that could end the statism, inflation, and business cycles that the Fed generates. ~ 42 min. 859,559 views 9. The Crash Of 1929 – Produced by Ellen Hovde and Muffie Meyer By 1929, Charles Mitchell, President of the National City Bank (which would become Citibank), had popularized the idea of selling stock and high yield bonds directly to smaller investors. Mitchell and a very small group of bankers, brokers, and speculators manipulated the stock market, grew wealthy and helped create the economic boom of that fabulous decade. ~1 hr. 131,606 views 10. MeltDown – The Secret History of the Global Financial Collapse – by Doc Zone Doc Zone has traveled the world – from Wall Street to Dubai to China – to investigate The Secret History of the Global Financial Collapse. Meltdown is the story of the bankers who crashed the world, the leaders who struggled to save it and the ordinary families who got crushed. ~44 min. 3,887 views 11. The Take – by Avi Lewis We heard rumors of a new kind of economy emerging in Argentina. With hundreds of factories closing, waves of workers were locking themselves inside and running the workplaces on their own, with no bosses. ~ 1:20 min. 124,472 views 12. The Money Masters – Directed Bill Still The Money Masters is a 3 1/2 hour non-fiction, historical documentary that traces the origins of the political power structure that rules our nation and the world today. ~ 3:30 hr. 111,160 views 13. I.O.U.S.A – Directed by Patrick Creadon The film focuses on the shape and impact of the United States national debt. The film features Robert Bixby, director of the Concord Coalition, and David Walker, the former U.S. Comptroller-General, as they travel around the United States on a tour to let communities know of the potential dangers of the national debt. The tour was carried out through the Concord Coalition, and was known as the "Fiscal Wake-Up Tour." From Wikipedia. ~ 45min. 46,323 views 14. The Last Days Of Lehman Brothers Drama inspired by the real events that took place on the weekend of 12 September 2008 – when the Lehman Brothers went to the wall. ~59 min. 85,068 views 15. The Crash Course – by Chris Martenson In this powerpoint presentation, Chris Marentson presents an indepth consideration of the economy, energy and the environment. He explains the fundamentals for an economic collapse and ways on how you can prepare by being more resilant. This is chapter one only, to see all videos concerning this crash course see here ~ 2:30 hr. 96,450 views 16. Debt Collapse – by Mike Maloney This presentation by Mike Maloney of Gold and Silver shows how Gold and Silver are only just starting their upward move to higher prices. ~1:30 hr. 869,501 views 17. The Secret of Oz – by Bill Still Ben Still shows the world economy is doomed to spiral downwards until we do 2 things: outlaw government borrowing and outlaw fractional reserve lending. A documentary worth watching. ~1:56 hr. 456,400 views

Other Documentary Videos: 1. These 25 Videos Warn of Impending Economic Collapse & Chaos The internet is awash (drowning?) in hundreds of doom and gloom videos providing dire warnings of coming world depression, food shortages, rioting in the streets, rampant (hyper) inflation, deepening banking crisis, economic apocalypse, financial Armageddon, the demise of America – well, you get the idea. Below is a small sample of such videos with a hyperlink to each. 2. Economic Collapse of U.S. Is Inevitable This short video – on the unsustainability of government spending – should be watched by everyone, including those not yet old enough to vote. It should be shown in every high school and college classroom. Anyone that cannot understand this presentation should not be allowed out without a guardian. ~ 5:37 3,677,479 views 3. A Must Watch Video On Why America Is In A "Death Spiral"

4. Video: What Could Happen in the First 12 Hours of a US Dollar Collapse This is the scenario nobody thinks is possible but really at the end of the day, it's not like the US can print money and live on debt forever right so when something cannot go on forever what happens when it stops? 7:08 371,235 views

|

| Bulloney: Peak Silver Land Grab Gun Control Posted: 08 Feb 2013 10:15 PM PST from Ag47Liberty: Peak Silver is just a cover story for the truth behind the lie of scarcity in silver and how it helps the government grab land and force gun control upon the people of the US. |

| Posted: 08 Feb 2013 08:56 PM PST Zealllc |

| By the Numbers for the Week Ending February 8 Posted: 08 Feb 2013 07:57 PM PST This week's closing table is just below. Vultures, (Got Gold Report Subscribers) please note that updates to our linked technical charts, including our comments about the COT reports and the week's technical changes, should be completed by the usual time on Sunday (by 18:00 ET). To subscribe to Got Gold Report please click on the "Subscribe to GGR" button at top right. Join us today. |

| Real Estate Investor’s Club Feb. 2013 – YouTube Posted: 08 Feb 2013 07:55 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] |

| Posted: 08 Feb 2013 05:12 PM PST fleeing (Verb) Run away from a place or situation of danger: "a man was shot twice as he fled from five masked youths".

The States People Are Fleeing In 2013 No. 1: New Jersey

No. 2: Illinois (aka the Socialist State of Illinois)

No. 3: West Virginia No. 4: New York No. 5: New Mexico

Long-term shifts in the U.S. economy coupled with the recent recession means Americans are more likely to pack up and move for employment-related reasons. Although the total number of residential moves is down, new data shows a clear pattern of the states that people are fleeing the fastest. Moving company United Van Lines released its 36th annual study of customer migration patterns, analyzing a total of 125,000 moves across the 48 continental states in 2012. The study provides an up-to-date, representative snapshot of overarching moving patterns in the U.S., and reveals a mass exodus from the Northeast. At No. 1, New Jersey has the highest ratio of people moving out compared to those moving in. Of the 6,300 total moves tracked in the state last year, 62% were outbound. "New Jersey has been suffering from deindustrialization for some time now, as manufacturing moved from the Northeast to the South and West," says economist Michael Stoll, professor and chair of the Department of Public Policy at the University of California, Los Angeles. "And because it's tied to New York, the high housing costs may also be pushing people out." In fact, most of the top-10 states people are leaving are located in the Northeast and Great Lakes regions, including Illinois (60%), New York (58%), Michigan (58%), Maine (56%), Connecticut (56%) and Wisconsin (55%). According to Stoll, this reflects a consistent trend of migration from the Frost Belt to the Sun Belt states based on a combination of causes. The economy has been a major push factor for residents in the Frost Belt, particularly those in hard-hit areas like Michigan. "They had a terrific excess of people as a result of the collapse of the economy," says Stoll. Detroit, the state's largest city, has the highest metropolitan unemployment rate in the U.S. At 20%, it more than doubles the national average. At the same time, Stoll says local employment trends combined with high costs of living causes many displaced workers to look for greener pastures. New York City, for example, consistently ranks as one of the most expensive cities in the nation. If you've lost your job, shelling out the median $4,000 monthly rent for a two-bedroom apartment in Manhattan is likely no longer feasible or attractive. The Northeast and Midwest also feature a comparatively high concentration of residents over 65, says Stoll, who tend to retire to states that are warmer and less expensive. That's why southern and western states are some of the most popular places to move to. According to the study, North Carolina, South Carolina, Florida and Arizona feature some of the highest ratios of people moving in. Meanwhile, the most popular state for relocation is Washington, D.C. "It's a high-cost area," says Stoll, "but it features good economic opportunities. It has a maturing high-tech sector and many Federal government jobs, which are more stable in recessions." Furthermore, D.C. attracts highly educated professionals, and Stoll says college-educated young people between the ages of 18 to 35 are the most likely to move. One big surprise from the study is Oregon, which is the second most popular state with 61% inbound migration. Although it's not the typical temperate climate of a retirement spot, Stoll believes hipster city Portland may be attracting both older individuals and young people with its mix of economic growth, cutting edge urban planning and scenic landscape. |

| DAVID FRANKLIN on GoldSeek Radio – Feb 7, 2013 – YouTube Posted: 08 Feb 2013 04:49 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] |

| Earnings Season Is Over With Slow Economic Growth Ahead in 2013 – YouTube Posted: 08 Feb 2013 04:23 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] |

| Venezuela Launches First Nuke In Currency Wars, Devalues Currency By 46% Posted: 08 Feb 2013 04:03 PM PST While the rest of the developed world is scrambling here and there, politely prodding its central bankers to destroy their relative currencies, all the while naming said devaluation assorted names, "quantitative easing" being the most popular, here comes Venezuela and shows the banana republics of the developed world what lobbing a nuclear bomb into a currency war knife fight looks like:

And that, ladies and gents of Caracas, is how you just lost 46% of your purchasing power, unless of course your fiat was in gold and silver, which just jumped by about 46%. And, in case there is confusion, this is in process, and coming soon to every "developed world" banana republic near you.

and just as we (and Kyle Bass) have warned - this is what happens to the nominal price of a stock market as currency wars escalate... how do those US investors who flooded Venezuela with cash feel now? bringing back those VEF gains is going to hurt... The chart above is a free lesson in nominal vs real: the hardest lesson for some 99.9% of the world's population to grasp. One person who certainly knows how to devalue a currency in real terms FDR, whose 70% devaluation of the USD courtesy of executive order 6102, is merely an appetizer of what is about to be unleashed upon the US. From Bloomberg:

|

| Currency Wars Often Lead to Trade Wars ... Which In Turn Can Devolve Into Hot Wars Posted: 08 Feb 2013 03:27 PM PST |

| Crude Going Much Higher, Dollar Free-Fall, 2008 Crash. By Gregory Mannarino – YouTube Posted: 08 Feb 2013 03:16 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] |

| The Gold Price Traded Sideways and a Little Lower for the Week Sell Stocks Buy Gold Posted: 08 Feb 2013 02:53 PM PST Gold Price Close Today : 1,666.00 Gold Price Close 1-Feb-13 : 1,669.40 Change : -3.40 or -0.2% Silver Price Close Today : 31.425 Silver Price Close 1-Feb-13 : 31.942 Change : -51.70 or -1.6% Gold Silver Ratio Today : 53.015 Gold Silver Ratio 1-Feb-13 : 52.263 Change : 0.75 or 1.4% Silver Gold Ratio : 0.01886 Silver Gold Ratio 1-Feb-13 : 0.01913 Change : -0.00027 or -1.4% Dow in Gold Dollars : $ 173.63 Dow in Gold Dollars 1-Feb-13 : $ 173.48 Change : $0.15 or 0.1% Dow in Gold Ounces : 8.399 Dow in Gold Ounces 1-Feb-13 : 8.392 Change : 0.01 or 0.1% Dow in Silver Ounces : 445.28 Dow in Silver Ounces 1-Feb-13 : 438.60 Change : 6.68 or 1.5% Dow Industrial : 13,992.97 Dow Industrial 1-Feb-13 : 14,009.79 Change : -16.82 or -0.1% S&P 500 : 1,517.93 S&P 500 1-Feb-13 : 1,513.17 Change : 4.76 or 0.3% US Dollar Index : 80.263 US Dollar Index 1-Feb-13 : 79.088 Change : 1.175 or 1.5% Platinum Price Close Today : 1,713.50 Platinum Price Close 1-Feb-13 : 1,686.20 Change : 27.30 or 1.6% Palladium Price Close Today : 751.10 Palladium Price Close 1-Feb-13 : 756.00 Change : -4.90 or -0.6% The silver and GOLD PRICE are wallowing along sideways and lower, platinum is climbing even against the wind, the dollar surprised everyone by moving higher, while the mania in stocks continues feverish. Silver and gold were arguing with each other again today. Silver gained 3.8 cents (0.12%) to 3142.5c while the GOLD PRICE lost $4.40 (0.26%) to end at $1,666.00. For the week silver lost 1.6% and gold lost 0.2%. Look at the chart: both metals are forming even-sided triangles. What's happening? They're being batted from one side of the triangle to the other. Nothing much to say until they escape their imprisonment up or down. Y'all can examine the SILVER PRICE chart or GOLD PRICE. Nobody likes this stalling, but look further on those charts and you'll see that silver and gold alike remain above their uptrend lines from the June 2012 lows. There's nothing wrong here, but the mania in stocks is pulling attention and bucks away from silver and gold. This is the time to ask yourself whether you believe the mania in stocks or not. If not, it's time while stocks are high for you to sell them and put the proceeds into silver and gold. Or you could wait until the crash a few weeks hence. The US dollar index rose 3.2 basis points today to 80.236, trying to digest its 46.2 basis point jump yesterday. This slams it up against an internal resistance line and the downtrend line prevailing since November. Last Friday the Euro punched to a spike top at $1.3711 (intraday). Yesterday it tumbled 0.92% (large move for currencies), wrecking its uptrend by plunging through the uptrend line and settling below the 20 day moving average ($1.3430). Today it confirmed its lower intentions by both opening and closing lower. Whoops -- did I mention that it closed below the last intraday peak ($1.3394), too? A break below the last cluster of peaks around $1.3150 will add to the conviction that the euro's rally has ended. Meanwhile the yen, having made new low after unbelievable new low, rallied today, up 0.97% to 107.78c/Y100. First confirmation of a trend change, a rise through the 20 day moving average, won't come until 110.10c. Those Japanese aren't playing fair with their currency war, and the other Nice Government Men won't like it. Pretty soon they'll wax angry. Stocks rose today: Dow 48.92 (0.35%) to 13,992.97 and S&P500 8.54 (0.57%) to 1,517.93. Dow could not today hold on at the high, 14,022, but before this mania ends most likely will, and exceed the last peak. Generally when people get drunk, they will keep on drinking till they pass out. This ends in multiple woes, both digestive and cranial, but past some point they just can't stop. Manias work the same way. The charts of the Dow in Gold and the Dow in Silver tell me more than the raw Dow chart. Today the raw Dow poked its head through the top of what might be a diamond top, but we can't be certain what that means yet. Dow in Gold and Dow in Silver both rose to the top of formations that could be topping or continuation formations. Monday will tell us a lot. Question here is, can stocks gain more on silver and gold before they turn down? A question of how much, not if. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Venezuela devalues currency by 32% Posted: 08 Feb 2013 02:43 PM PST By Eyanir Chinea http://www.reuters.com/article/2013/02/08/venezuela-currency-devaluation... CARACAS -- Venezuela devalued its bolivar currency to 6.3 per dollar from 4.3 per dollar, the finance minister said today, in a widely expected move to shore up government finances after blowout government spending last year. The measure will help ease a shortage of dollars that has crimped imports and left many supermarkets barren of staples such as flour or sugar. It is also seen pushing up consumer prices in the import-dependent OPEC nation that already has one of Latin America's highest inflation rates. Venezuela has maintained exchange controls on the bolivar for a decade under which importers and travelers must seek dollars through a state currency board, or buy them on an illegal black market where greenbacks fetch nearly four times the official rate. ... Dispatch continues below ... ADVERTISEMENT Fred Goldstein and Tim Murphy open All Pro Gold All-Pro Gold, run by long-time GATA supporters Fred Goldstein and Tim Murphy, offers its services to GATA supporters and anyone else interested in precious metals. The company brokers a full line of precious metals and numismatic coins. It aims to inform prospective clients about the importance of the monetary metals as part of a diversified financial portfolio and to keep prospective clients current with market trends. All-Pro Gold has competitive pricing and ships promptly to clients so they may have physical possession. Learn more by e-mailing Fred@allprogold.com or Tim@allprogold.com or telephone 1-855-377-4653 or visit www.allprogold.com. Central Bank President Nelson Merentes said on Friday the government was also eliminating a currency exchange system known as SITME, which functioned via bond swaps in parallel with the state currency control board. The currency adjustment follows two months of silence from socialist President Hugo Chavez, who is in Havana and has not been seen in two months since a complex cancer surgery. The inflationary impact over the coming months could dent Chavez's popularity at a time of ongoing uncertainty over whether his cancer will prevent him completing a third term in office. The central bank said on Friday that consumer prices rose 3.3 percent in January, the country's second-highest rate since 2010, while product shortages reached their highest in close to five years. Join GATA here: California Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Opinion Around the World Is Changing When Deutschebank calls gold "good money" and paper "bad money". ... http://www.gata.org/node/11765 When the president of the German central bank, the Bundesbank, pays tribute to gold as "a timeless classic". ... http://www.forbes.com/sites/ralphbenko/2012/09/24/signs-of-the-gold-stan... When a leading member of the policy committee of the People's Bank of China calls the gold standard "an excellent monetary system". ... http://www.forbes.com/sites/ralphbenko/2012/10/01/signs-of-the-gold-stan... When a CNN reporter writes in The China Post that the "gold commission" plank in the 2012 Republican platform will "reverberate around the world". ... http://www.thegoldstandardnow.org/key-blogs/1563-china-post-the-gop-gold... When the Subcommittee on Domestic Monetary Policy of the U.S. House of Representatives twice called on economist, historian, and gold standard advocate Lewis E. Lehrman to testify. ... World opinion is changing in favor of gold. How can you learn why and what it will mean to you? Read the newly updated and expanded edition of Lehrman's book, "The True Gold Standard." Financial journalist James Grant says of "The True Gold Standard": "If you have ever wondered how the world can get from here to there -- from the chaos of depreciating paper to a convertible currency worthy of our children and our grandchildren -- wonder no more. The answer, brilliantly expounded, is between these covers. America has long needed a modern Alexander Hamilton. In Lewis E. Lehrman she has finally found him." To buy a copy of "The True Gold Standard," please visit: http://www.thegoldstandardnow.com/publications/the-true-gold-standard |

| Posted: 08 Feb 2013 02:23 PM PST Dear Mr. Sinclair, I was curious if you would consider posting this link below in regards to the US gold audit petition on the White House's website. Hopefully if enough CIGAs sign the petition then we will get the required 25,000 signatures. Click here to view and sign the petition… Thanks for everything you Continue reading Jim's Mailbox |

| Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week Posted: 08 Feb 2013 02:21 PM PST Gold edged up to $1673.53 in Asia before it fell back to as low as $1665.14 in early New York trade, but it then bounced back higher at times and ended with a loss of just 0.19%. Silver slipped to $31.314 in early New York trade, but it then rose to as high as $31.68 at about 10:40AM EST and ended unchanged on the day. |

| Gold Daily and Silver Weekly Charts - Risk On Posted: 08 Feb 2013 02:08 PM PST This posting includes an audio/video/photo media file: Download Now |

| USD Surges By Most In 7 Months As Stocks Stumble And Bonds Bid Posted: 08 Feb 2013 02:07 PM PST Keep Calm and Keep Buying. We are sure this will be the message as for the first time this year, the Dow closed the week in the red. First time in 42 years that the S&P 500 started the year up six weeks in a row... as the S&P and Nasdaq managed modest gains (thanks to AAPL's help) - making new multi-year highs as yet another high stop-run was sent out early. After testing back under 13%, VIX popped back higher in the afternoon to close the week slightly higher. However, while stocks stumbled along sideways not really doing anything - every other asset class saw significant risk-off related moves. The USD saw its biggest weekly rise in 7 months! Treasury yields dropped 6-8bps - the biggest rally in bonds in 5 weeks. High-yield credit has suffered its biggest 2-week plunge in 9 months. WTI Crude saw its biggest weekly drop in 2 months. Given the USD strength, gold performed very well (ending the week unch). Stocks remain significantly dislocated from credit, rates, and FX markets in the medium-term (all of which closed the week with a risk-off shift). Volume, amid the blizzard, was dismal today.

Been a divergent week in risk assets...

as stocks just storm away from their risk-related brother in credit...

The USD surged by its most in seven months this week!

as the EUR lost 2% against the USD this week (and JPY is unch)...

HY Credit has seen the biggest 2-week drop in nine months!

Stocks ended the week notably out of line (short-term) from risk-assets - but all of the stock buying was early as the rest of the day saw risk in general being sold (as rates and the USD rallied and credit sold off). VIX and Stocks clung close together once again but VIX term structure steepened to its highest in a month...

While tracking the optical difference between credit and equity markets is useful...

...the relationship is notably non-linear. However, Capital Context provides a more useful tactical model to ascertain the separation between stocks and credit - for now, as the charts below show - stocks are 2.5 to 3% over-valued relative to credit (but bear in mind that as and when stocks correct, credit will also be offered and the mispricing can exacerbate). For now, the S&P 500 and Russell remain notably rich... suggesting market neutral positioning for any long book.

and of course, fundamentally, things do not look too supported here...

The major indices saw some heavy blocks go through into the last few seconds and AAPL was fading off its intrday highs - but today's volume was 20% below average.

In case you were wondering what was catching stocks each time they dropped - it appears (for now) that convergence trades with the old favorite 2s10s30s Treasury butterfly have been doing well...

Charts: Bloomberg and Capital Context

Bonus Chart: It seems once again that what European banks lose, Apple gains as the two fulcrum securities of the world look to be converging once again... |

| How to Survive the Illusion of Recovery Posted: 08 Feb 2013 02:05 PM PST There is no economic recovery, and there are no signs that a recovery is coming, says Shadowstats.com author John Williams. In this Gold Report interview, he blames mal-adjusted inflation statistics for creating an alternate reality that overestimates economic activity in a way that is unsustainable. Williams warns that eventually the painful truth will be so difficult that even government manipulation won't be able to deny it and that is when hyperinflation will take its toll on those who have not taken his advice for preserving purchasing power and securing wealth. |

| The Truth on Gold Stocks vs. Gold Posted: 08 Feb 2013 02:04 PM PST The gold and silver stocks as a group have certainly been a disaster over the past two years. Both GDX and GDXJ are down with GDXJ leading the spiral. Yet, the metals are actually higher. Gold is up quite a bit while Silver is up ... |

| 'Money Stimulus Marathon' Good for Gold Price: Eric Winmill Posted: 08 Feb 2013 01:40 PM PST The Gold Report: Eric, most of the companies you cover are small-cap names operating one or two mines in the Americas. Is that where investors will make money in 2013? Eric Winmill: We are seeing a lot of money flowing back into the Americas, along with a lot of merger and acquisition (M&A) activity in the gold space. This is happening for all the reasons you might expect: access to skilled workers, a highly productive workforce, security of mineral rights, great infrastructure and, of course, great geology. These small- to mid-cap producers with one or two assets are typically ramping up. We focus on finding great teams and great assets as we believe these will deliver the best potential for returns this year and in subsequent years. TGR: What valuation metric do you use or trust most? EW: We tend to use price-to-net-asset-value (NAV) multiples. That captures most of the growth in the companies and the projects going forward and allows us to run sensitivities on gold prices... |

| Equities Should Outperform Gold in the First Half of 2013- Here?s Why Posted: 08 Feb 2013 01:40 PM PST "Follow the munKNEE" via twitter & Facebook or Register to receive our daily Intelligence Report I expect gold to move sideways or trend down in the first half of 2013 [and, as such,] I would consider this as a good opportunity to buy gold as there is still no long-term fix in place for the economic and financial problems [that the U.S., and indeed the world, face. Here's why]. Words: 665; Charts: 5 So writes the Economics Fanatic ([url]http://www.economicsfanatic.com/[/url]) in edited excerpts from his original post**on Seeking Alpha entitled*Gold Down 30% In Dow Terms: More Correction Likely. [INDENT]This article is presented compliments of [B]www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and [COLOR=#ff0000]www.munKNEE.com [/COLOR](Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note... |

| Gold and Silver Disaggregated COT Report (DCOT) for February 8 Posted: 08 Feb 2013 01:39 PM PST HOUSTON -- This week's Commodity Futures Trading Commission (CFTC) disaggregated commitments of traders (DCOT) report was released at 15:30 ET Friday. Our recap of the changes in weekly positioning by the disaggregated trader classes, as compiled by the CFTC, is just below. (DCOT Table for February 8, 2013, for data as of the close on Tuesday, February 5. Source CFTC for COT data, Cash Market for gold and silver.) More... In the DCOT table above a net short position shows as a negative figure in red. A net long position shows in black. In the Change column, a negative number indicates either an increase to an existing net short position or a reduction of a net long position. A black figure in the Change column indicates an increase to an existing long position or a reduction of an existing net short position. The way to think of it is that black figures in the Change column are traders getting "longer" and red figures are traders getting less long or shorter. All of the trader's positions are calculated net of spreading contracts as of the Tuesday disaggregated COT report. |

| Equities Should Outperform Gold in the First Half of 2013- Here's Why Posted: 08 Feb 2013 01:38 PM PST "Follow the munKNEE" via twitter & Facebook or Register to receive our daily Intelligence Report I expect gold to move sideways or trend down in the first half of 2013 So writes the Economics Fanatic (http://www.economicsfanatic.com/) in edited excerpts from his original post* on Seeking Alpha entitled Gold Down 30% In Dow Terms: More Correction Likely.

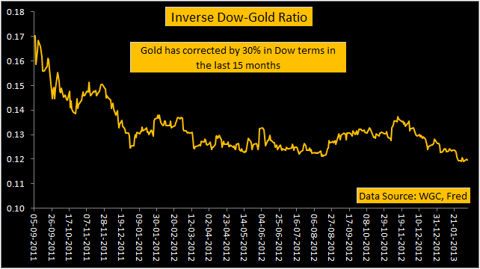

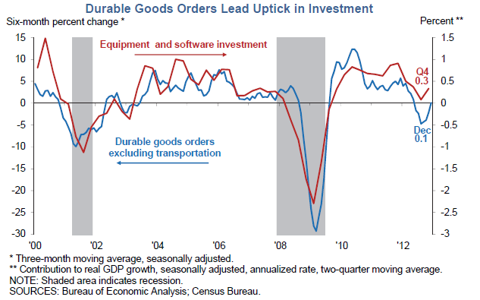

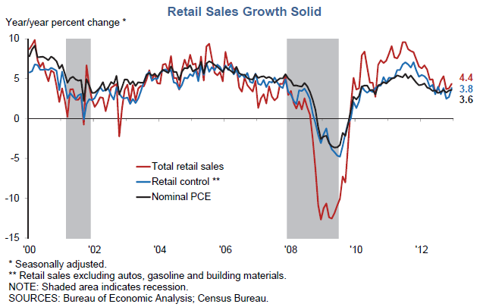

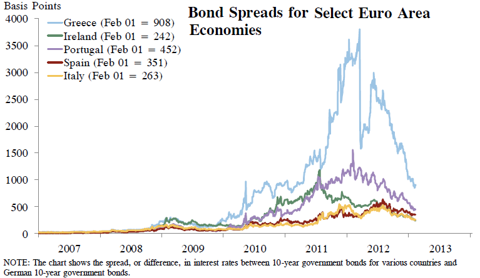

The Economics Fanatic goes on to say in further edited excerpts: …Equities have outperformed gold in the last 15 months. On converting this observation into numerical terms, [the inverse Dow-Gold]…ratio from September 2011 to February 2013 [is as follows]: As mentioned earlier, the primary objective of this discussion is to underscore the importance of portfolio diversification. [While] I am bullish on gold long-term…if [I had]… 100% [of my portfolio in] gold,…[it] would be down by 30% at a time when a diversified portfolio might [likely] be performing well or [even]outperforming. Investors, therefore, need to create a portfolio having a mixed asset class exposure such as gold, equities, industrial commodities, agricultural commodities, real estate and corporate bonds among others. Given the current expansionary policy environment, I would suggest 20% exposure to gold and precious metals, a 20% exposure to domestic equities, 20% exposure to emerging market equities, 20% exposure to industrial and agricultural commodities and 20% exposure to cash and investment grade corporate bonds. The portfolio diversification might differ depending on age and other factors. Coming [back] to the expected trend in gold and equities, I expect [a] further decline in gold in Dow terms and, as such, investors [would be well advised to] be overweight in equities and underweight in gold and precious metals for the first half of 2013. One of the primary reasons for being bullish on equities is related to the global economic performance. An improving or stable global economy will result in more liquidity flowing into equities. As the chart below shows, there has been a meaningful improvement in the global purchasing manager index in the recent past. With this improving trend likely to continue, equity market sentiment will remain bullish. In the U.S., an increase in durable goods orders has resulted in an uptick in investments, which is positive for the economy. At the same time, retail sales growth has been robust and ensures that the first quarter will be decent in terms of economic growth. I am not suggesting that economic activity is the only factor that can lead to upside in equities. However, given the current bullish sentiment and liquidity scenario, equities can witness further upside. In terms of economic activity and financial market risk, an improvement in the Euro zone PMI gives yet another reason to believe that equities can sustain at current levels or trend higher. Higher bond spreads for the PIIGS did result in declining equity markets in the past. Currently, the bond spreads for PIIGS is on a decline and should decline further if economic activity improves in the Euro zone. Besides the economic fundamental factors, I personally don't see any irrational exuberance in equity markets at this point of time. Investors can expect…a robust rally before any healthy and meaningful correction. Conclusion Given the above factors, I expect gold to move sideways or trend down in the first half of 2013 [and, as such,] I would consider this as a good opportunity to buy gold as there is still no long-term fix in place for the economic and financial problems [that the U.S., and indeed the world, face].

*http://seekingalpha.com/article/1163591-gold-down-30-in-dow-terms-more-correction-likely

Related Articles: 1. Bull Market in Stocks Isn't About to End Anytime Soon! Here's Why As we all know, money printing always leads to inflation. It's just a matter of figuring out which assets get inflated. This time around gold is not the only beneficiary, stocks are, too, and I'm convinced that the chart below holds the key to the end of the bull market. Words: 475; Charts: 1 2. 5 Compelling Reasons Why It's Now Time to Sell Gold I recently explained my thesis for why gold's 12-year winning streak will come to an end in 2013…[and] nearly a month into 2013, the case for selling gold is gaining strength. [This article puts forth 5 compelling reasons why it is now time to sell gold.] Words: 690 ; Charts: 2 3. Gold On Verge of Another MAJOR Down Leg – Here's What to Do Now I would love nothing more than to tell you that gold has finally embarked on its next leg up to $5,000+ but the fact of the matter is that there is no evidence that it has. Period. In fact, gold is telling you exactly the opposite. Gold is now nearly $257 below its all-time record high. It can barely rally and very time it does, the rally fades away and now the price of gold is dangerously near an important weekly sell signal on my systems, which stands at $1,657. Words: 780; Charts: 1 4. 5 Reasons to Short Gold In 2013 There are significant challenges to gold prices increasing in 2013. In fact, I believe that gold prices should move down in 2013 because of five strong headwinds, elaborated in this article. Words: 464 5. Gold Is Looking Increasingly Vulnerable – Here's Why The threats of global recession, insurmountable debt, terrible government policy, central bank support, and many other very persuasive arguments present gold as a very appealing investment or safe haven but all of this is an illusion. Gold was a sensible investment in the early part of the bull market (1999-07), but has now become a false sense of security for many investors who will soon learn the hard way. Not only are the fundamentals already priced in, the technicals severely weakened, and the extremes in gold optimism easily apparent, but the bad news for gold could soon get much worse. The next weeks or few months will hopefully give us a lot more clarity. Words: 1170 6. Is Gold's 13 Year Run Almost Over?

7. It's Time to Seriously Consider SHORTING Gold – Here's Why

8. 7 Indications That Gold & Silver Bearishness Most Likely Will Continue

9. Rising Deflation Concerns Could Cause Gold to Plummet Dramatically – Here's Why

10. My Case Against the Case Against The Case Against Gold

11. QE Could Drive S&P 500 UP 25% in 2013 & UP Another 28% in 2014 – Here's Why Ever since the Dow broke the 14,000 mark and the S&P broke the 1,500 mark, even in the face of a shrinking GDP print, a lot of investors and commentators have been anxious. Some are proclaiming a rocket ride to the moon as bond money now rotates into stocks….[while] others are ringing the warning bell that this may be the beginning of the end, and a correction is likely coming. I find it a bit surprising, however, that no one is talking of the single largest driver for stocks in the past 4 years – massive monetary base expansion by the Fed. (This article does just that and concludes that the S&P 500 could well see a year end number of 1872 (+25%) and, realistically, another 28% increase in 2014 to 2387 which would represent a 60% increase from today's level.) Words: 600; Charts: 3 12. 5 Reasons To Be Positive On Equities For the month of January, U.S. stocks experienced the best month in more than two decades [and the Dow hit 14,009 on Feb. 1st for the first time since 2007]. Per the Stock Traders' Almanac market indicator, the "January Barometer," the performance of the S&P 500 Index in the first month of the year dictates where stock prices will head for the year. Let's hope so…. [This article identifies f more solid reasons why equities should do well in 2013.] Words: 453 13. World Economy & Market Forecast: More Sunshine & Less Stormy Weather Ahead It seems clear that there are a number of investors who have gained confidence in the global economy and are seeking to capture the growth opportunities taking place around the world. With the European crisis comfortably in the rear view mirror and global central banks taking the position that they will continue their easing policies, investors have taken their foot off the brake and have begun to accelerate….We see more sunshine and less stormy weather ahead [and explain why that is the case in this article]. Words: 695; Charts: 3 14. Start Investing In Equities – Your Future Self May Thank You. Here's Why As Winston Churchill once said: "A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty" and in that vain I challenge all readers to fight off the negativity, see long-term opportunity in global equity markets and, most importantly, remain invested. Your future self may thank you. Words: 732; Charts: 6

|

| COT Gold, Silver and US Dollar Index Report - February 8, 2013 Posted: 08 Feb 2013 01:33 PM PST COT Gold, Silver and US Dollar Index Report - February 8, 2013 |

| Posted: 08 Feb 2013 01:26 PM PST Great short video on what REAL money is. The most interesting part to me is the concept that you are trading equal value for equal value when you use gold or silver to purchase something. |

| Gold, Bonds and the Dollar - Short- and Long-Term Implications Posted: 08 Feb 2013 01:21 PM PST In our previous essay we stepped back from the day-to-day price analysis in order to focus on the major event that happened recently on the silver market (the silver - JP Morgan manipulation lawsuit was dismissed) and today we would ... |

| A Quick Way To Buy The SilverJuniors Posted: 08 Feb 2013 12:36 PM PST There are several ways to time the launch of a new exchange traded fund (ETF). One is to strike while a sector is hot, pull in a lot of trend-following money and accept that the fund's performance might be mediocre, since the hotter the sector the more due it is for a correction. That's how it went for the Market Vectors Junior Gold Mine ETF (GDXJ), which nearly doubled in its first year of trading and is since down by more than half. (Full, painful disclosure: I've ridden that train from beginning to end.) Another approach is to launch when a sector is out of favor, accept that you'll attract very little money up front but hope that good future performance will draw investors later on. That's what Madison NJ Pure Funds has done with its new Junior Silver Miners ETF (SILJ). As a group these miners have truly sucked (both operationally and as investments) in the past couple of years, underperforming both silver itself and the overall stock market. This has scared away the momentum players, while intriguing contrarians and non-gold-bug value investors. As with most small cap sectors, someone approaching silver juniors faces a lack of good information and massive company-specific risk that cries out for either months of in-depth research or immediate diversification. Which is where ETFs come in. By offering instant exposure to 20 or 30 names, they allow someone new to a sector to play while learning. From this point of view SILJ has launched at just the right time. Its top ten holdings are a mix of familiar and unfamiliar names, almost all of which are closer to their 12-month lows than highs: One of the downsides of introducing an ETF in an out-of-favor sector is that it won't have much initial trading volume. As this is written on the morning of February 8, SILJ literally hasn't seen a single trade. So this is not something you buy "at the market," since "the market" might be 30% higher than the next trade. Instead, choose a reasonable price and put in a good-until-cancelled bid — and then watch it to make sure nothing crazy happens in the meantime. And of course don't expect results right away. Trends have a habit of continuing, so the silver miners could easily have another crappy year. But at some point both silver and its derivatives (including mining shares) will start moving in the right direction. Listen to this interview with Sprott Asset Management's Rick Rule for inspiration. |

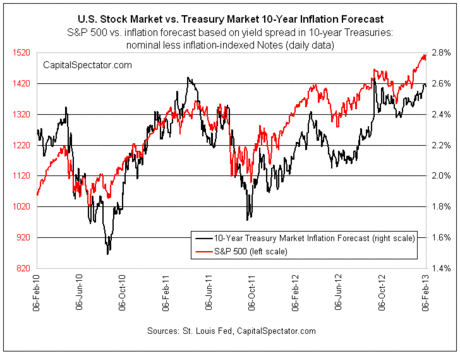

| Inflation Expectations Influencing Path of Stock Prices Differently These Days Posted: 08 Feb 2013 12:33 PM PST "Follow the munKNEE" via twitter & Facebook or Register to receive our daily Intelligence Report Higher (lower) inflation expectations have remained closely bound So writes James Picerno (www.capitalspectator.com) in edited excerpts from his original article* entitled Mr. Market's Abnormal Relations – An Update.

Picerno goes on to say in further edited excerpts: The new abnormal is the positive connection between the stock market and the implied inflation forecast via the yield spread between the 10-year Treasury note and its inflation-indexed counterpart. As the chart below shows, the S&P 500 has been rising so far in 2013, echoing a similar advance in inflation expectations. What's behind this connection? The short answer: fear of disinflation/deflation. David Glasner lays out a broader, deeper economic explanation in a 2011 paper titled "The Fisher Effect Under Deflationary Expectations." The main takeaway for investors: Mr. Market likes higher inflation these days, but he becomes anxious when the outlook for inflation falls. That's a sign that the state of macro is, shall we say, off its game. Until that changes, it's best to go with the flow. As such, keep your eye on the market's estimate of future inflation for a clue about the future path of stock prices. In particular, a change in the trend for inflation expectations is likely to bring a similar reversal in equity prices. On that note, expected inflation is now roughly at levels that prevailed before the financial crisis struck in September 2008 — around 2.6%. Inflation has come full circle since the global economy had a near-death experience. The questions before the house: Can inflation expectations break through this ceiling to higher ground? If so, will the stock market continue to view higher inflation as a positive?

*http://www.capitalspectator.com/archives/2013/02/mr_markets_abno.html#more

Related Articles: 1. Inflation: What Do the Non-CPI Inflation Gauges Say It Is? Whenever the BLS posts their monthly CPI there's always the same response from critics that the index is flawed. That's fine. I think a healthy dose of skepticism regarding government data is perfectly good. So let's take a look at some independent gauges to see where prices are. 2. The Big Mac Index Reveals the REAL Facts On U.S. Inflation! A look at the trend in prices of the Big Mac clearly shows that investors are being penalized with higher inflation, lower income from bonds and certificates of deposit and being led to believe that the economy is growing better than it really is. [Let me explain.] Words: 1012; Charts: 2 3. These 6 Charts Illustrate That Hyperinflationary Pressure in America Is Growing The six charts I provide in this article illustrate why the hyperinflationary pressure in America is growing. This is not necessarily a forecast for hyperinflation – this is simply a demonstration that some of the precursors to a hyperinflationary cliff are building. (Words: 1001; Charts: 7) 4. Bull Market in Stocks Isn't About to End Anytime Soon! Here's Why As we all know, money printing always leads to inflation. It's just a matter of figuring out which assets get inflated. This time around gold is not the only beneficiary, stocks are, too, and I'm convinced that the chart below holds the key to the end of the bull market. Words: 475; Charts: 1 5. QE Could Drive S&P 500 UP 25% in 2013 & UP Another 28% in 2014 – Here's Why Ever since the Dow broke the 14,000 mark and the S&P broke the 1,500 mark, even in the face of a shrinking GDP print, a lot of investors and commentators have been anxious. Some are proclaiming a rocket ride to the moon as bond money now rotates into stocks….[while] others are ringing the warning bell that this may be the beginning of the end, and a correction is likely coming. I find it a bit surprising, however, that no one is talking of the single largest driver for stocks in the past 4 years – massive monetary base expansion by the Fed. (This article does just that and concludes that the S&P 500 could well see a year end number of 1872 (+25%) and, realistically, another 28% increase in 2014 to 2387 which would represent a 60% increase from today's level.) Words: 600; Charts: 3

|

| Posted: 08 Feb 2013 12:26 PM PST Leadership is a historical relic - a museum piece. Money leads all. A conversation with a good colleague of mine triggered my rant. He had commented that our country is lacking in leadership. In reference to Obama's appointments of Chuck Hagel and John Brennan - "I just don't see much in the way of top leadership..." Here's my response: "Leadership? What leadership? They're just figureheads. Look at the money behind them? It's just incredible to me that most people look at these politicians and they think that they're the people creating and implementing policy. They definitively are not. They are bought and paid for many times over by big corporate interests and wealthy individuals. The rest is nothing but a dog and pony show. The human version of the Westminster Dog Show. Take a look at the people Obama has appointed for Secretary of Treasury and the SEC. You think for one second that if most of the people in this country bothered to look into their backgrounds and Wall Street track records and current Wall Street ties that they would vote for those two people if we could vote on appointments? No way in hell. Both Jacob Jack Lew and Mary Jo White are completely conflicted and heavily under the influence of Wall Street. Look at our "wonderful" President. Go re-listen to his 2008 campaign speeches. He promised to clean up DC and Wall Street. Not only has he NOT cleaned those sewage pits up, he's enabled them to take even more control of lives and our wealth. How about the first thing he did after he got elected: he appointed someone as Treasury Secretary who was a pure lap dog for the big banks AND who was caught cheating on his taxes three god damn years in a row. Are you kidding me? The guy in charge of tax revenues is a tax cheat and Obama insisted on putting him in office. So much for cleaning up the system. Our system is so completely sold down the river that watching Fox News or CNN is an absolute complete waste of time. Pure mental masturbation. Nothing but American Idol for the class of people who think they have higher IQ's than the masses. But they don't. They the same creature as the zombies that slavishly watch Jerry Springer, The View and Dr. Phil. The Government is irrelevant except to the extent that it's used as a vehicle with which the truly inside elite are raping everyone else. That and to continue funneling printed money to more than 50% of the population in the form of outrageous entitlements as a means of keeping the masses sedated. Just read through this thorough analysis of RomneyObamaCare: Must Read Link The biggest problem with our country is We The People. We stand idly by while the politicians and business leaders confiscate our wealth. We watch with disdain, yet with full acceptance, as more and more Americans pile onto the "entitlement" payroll: 8,830,026: Americans on Disability Hits New Record for 192nd Straight Month: LINK Now, whether or not you think people are entitled to a lot of Government support, someone has to pay for it. Right now this massive, all-engulfing entitlement spending requires 100% of our taxpayer revenue PLUS additional Treasury borrowing. That's right, even if we could cut defense spending to zero, this country would still run a big deficit. Will someone please tell me how we will ultimately pay for this? Before you answer that question, read this real life accounting of someone who definitively does not need Government support and yet is sucking the system for everything she can. This account is from a good friend of mine who hangs out at night at a busy Denver Starbucks and has gotten to know a group of people, one of whom is this woman: Here is that woman I told you about. Middle age woman, with husband and two kidsNow, does anyone really think this woman is entitled to disability? Really? Does anyone think she's entitled to use student loans to buy her son a bike and finance weekend getaway trips? This is not an atypical story. This is what We The People are paying for and eventually will be on the hook for. This is not going to end well for our country. The end of Saturday mail delivery is just another smoke signal indicating that the system is collapsing - a slow motion train wreck. I don't know when, but at some point the train will hit the gas tanker stuck trying to cross the tracks. If you want to see how this story ends, read or re-read "Atlas Shrugged." |

| Russian policy study group notes GATA's exposure of gold price suppression Posted: 08 Feb 2013 12:23 PM PST GATA's work has come to the attention of a public policy study organization in Russia, the Strategic Culture Foundation, whose researcher, Valentin Katasonov, notes particularly GATA's publication of secret records from the International Monetary Fund confirming gold price suppression by Western central banks. |

| Posted: 08 Feb 2013 12:20 PM PST February 8, 2013

According to our archives, five years ago today, Citibank announced a limit on cash withdrawals from its ATMs in New York City. "There could be a perfectly reasonable explanation for all of this," suggested Dan Denning from his post in Australia. "But the simplest explanation is almost always the best. Citibank is in desperate need of its capital. The best way to keep your customers' money is to prevent them from taking it out of the bank. It's a kind of low-level, mild-mannered capital control."

Heh… As noted here a month ago, BAC has hemorrhaged $44 billion to date for lawyers, payouts and reserves stemming from rotten mortgage securities, robosigned foreclosures and the like. With more to come. But all's well, apparently… Oh, and if you're wondering what "Nemo" is all about… God help us, The Weather Channel's practice of naming winter storms like hurricanes appears to be spreading.

With the debt ceiling now suspended until mid-May, the Treasury has racked up $47.2 billion in new debt going back to Jan. 1. Meanwhile, the Fed's balance sheet has grown $51.1 billion over the same period.

Just a guess here: When the January numbers come out next month, they'll show a pop in revolving credit too. It wouldn't surprise us a bit if the purchasing power drained by the payroll tax increase is being put on plastic. We'll know whether we're onto something when the January retail sales figures come out next week…

Precious metals are sliding a bit — gold to $1,663, silver to $31.59.

Or at least that's the takeaway from a poll conducted by Fairleigh Dickinson University. It found 75% of those surveyed approve of the military using drones "to carry out attacks abroad on people and other targets deemed a threat to the U.S." On the other hand, when asked, "To the best of your knowledge, can the U.S. target U.S. citizens living in other countries with drones, or is that illegal?" Only 24% approve. Drones and the killing of U.S citizens with drones were the big topic yesterday during the Senate confirmation hearings for John Brennan, the president's pick to run the CIA. It was much sound and fury, signifying nothing. "There's bipartisan consensus to whistle awkwardly and let the system continue," writes Slate's David Weigel.

Earlier this week, House Intelligence Committee Chairman Mike Rogers put out a statement calling the targeted killing of U.S. citizens a "lawful act of national self-defense." "In general," Weigel writes, "Republicans agreed with the legal theories behind all this when George W. Bush was president. They agree with the theories now." [Ed Note. "Hoppe shows that a monopoly of violence would never be approved by the population if the people understood it," reads the executive summary of an all too timely book released by the Laissez Faire Club this morning. Hans-Hermann Hoppe's A Theory of Socialism and Capitalism argues instead "the state seeks out tactics to convince people that it is doing good through redistribution that hurts some and helps others. "Most importantly, it seeks to control education (to instill civic pride), communication (to control access to information), money (to raise funding for the state without taxation) and the apparatus of security (to convince people that they are being kept safe and being offered justice services)." If you'd like to take a look... you can do so here.]

"We will continue to make our gold exports this year to whoever seeks them," Turkish Economy Minister Zafer Caglayan said yesterday. "We have no restrictions and are not bound by restrictions imposed by others." Meanwhile, "The sanctions," according to a New York Times dispatch from Tehran, "while the source of constant complaint and morbid jokes, have not set off price riots or serious opposition to the Iranian government." In other news, the Castro family is still in power after 52 years of U.S. sanctions on Cuba…

"Up to now, the energy industry had an acceptable working presence across the Middle East and North Africa (MENA). Shiny, energy-producing technology existed side by side with the ancient caravan routes. Westerners did their work and kept a low profile. There wasn't too much trouble — occasional, but manageable. "Now? The terrorists have determined that Westerners and energy interests are fair game. The global energy industry — Western players, but national oil companies, as well — must deal with the new reality of development amidst a vast battle space of irregular warfare. It'll make everything more difficult, time-consuming, costly, riskier." The investing takeaway? "Looking ahead, I see better days — better years, actually — for offshore players. Offshore is where there's lots of oil. Also, offshore, there are far fewer Islamist terrorists." And there's another plus…

With recent news of faulty bolts used in subsea drilling connectors, investors got a blunt reminder of the offshore rig fleet's age. These connectors attach blowout preventers to drilling risers and the subsea wellheads. In other words: We're talking about critical equipment that must remain in top shape to avoid costly disasters. In a Jan. 29 alert, the U.S. Bureau of Safety and Environmental Enforcement ordered faulty bolts manufactured by GE Oil & Gas must be retrieved and replaced. This may involve costly delays for drillers operating with GE's equipment. In today's 5 PRO, we feature a GE competitor. Dan Amoss says it's making a fortune finding solutions to the industry's equipment aging challenges. (If you're not yet a PRO-level subscriber, watch for a special offer soon.)

Straight from the "strangest one yet" file, Jim Tour, a researcher at Rice University in Houston has discovered a few economical sources of the "miracle material": Girl Scout cookies, chocolate, Dachshund feces and… a cockroach leg. We assure you, we didn't see this one coming either. In an interview with NPR, Marc Abrahams, editor and co-founder of The Annals of Improbable Research magazine ,explains the evolution of the graphene-production process: "Until now, most of the ways of making it started with this first step: Get some really pure, really expensive chemicals that you're going to mix in and do the next stuff. Huge expense." But the researchers in Houston have discovered a different approach. They converted the aforementioned objects into, says host Ira Flatow, "the super-strong wonder material that can be worth over 2 million times the price of gold." What's unique about this motley assortment of materials? Not much. The oddness stems from the researcher's preferences. Anything with carbon will work, leaving a wide array of more… aesthetic… objects to choose from.

Unfortunately, this method produces such small quantities of graphene that hoarding Girl Scout cookies and dog poo is hardly worth it. Nevertheless, progress is progress.

"The number of examples is flabbergasting," he goes on, "Ten thousand [research] papers were published last year on graphene." Although "small niche products," like Australian champion tennis player Novak Djokovic's racket, made of graphene, are flooding the market, rest assured: Graphene is still in its infancy. "Normally," professor Geim concludes, "it takes 40 years for a new material to move from academia to consumer products, so graphene is just a bambina." [Ed. Note: Again, this "graphene limbo" situation makes for perfect timing to learn everything you can about, and invest in, our resource maven Byron King's leader of the "super carbon" pack, here.]

It's part of a series in which he takes to the streets of California and offers to give a 1-ounce Canadian Maple Leaf — free– to anyone who can guess its current market value. He'll even spot you a 25% margin of error. Or if he's feeling generous, even 50%. It's almost as funny as it is sad. One poor girl guesses $3…

"Many people there are concerned that they may have already seen their salad days of go-go growth behind them. There are unbelievable amounts of personal wealth looking for preservation. Gold and real estate are two traditional approaches. "Like any intelligent person wanting to keep what they have, they would prefer that their government not know about it, hence they seek ways off the radar. Cash in the bank gets reported, but physical gold in a safe, often offshore location and overseas property do not. "Check out the drive to sell depressed U. S. property to Asians. I attended such a presentation recently. The agent was a London-based company selling residential property in the Detroit suburbs to the Chinese. The selling points included the fact that potential tenants will receive what amounts to 'rent stamps' from Uncle Sam. I asked what would happen if (when) the government stopped the program and the response was, 'They can't do that because it would cause the economy to collapse.' "The person being a Brit cannot conceive of a situation over which the government is not in control, in spite of their delusions to the contrary. "Love The 5. Spot-on stuff."

"Or, if Virginia goes back to a precious metals-based currency, perhaps one could use a nickel made of… uh… nickel, or a penny made out of real copper? As a matter of fact, if you do the conversion, a gallon of gasoline is still what it was 40 years ago — if you pay in silver. "I clearly recall my parents paying around 32 cents a gallon for gas around 1970. Today, a silver quarter is around $5 (there are online calculators to get today's value). Or just under a gallon of gas. Same as it was 40 years ago. Where do people who say these things actually come from?"

"Ninety-nine percent of the persons who use firearms illegally and incur civil liability would not have a liability insurance policy in the first place. And even if they did, which is purely hypothetical, the policy would be void upon the policyholder's illegal use of the firearm — like shooting someone. "What a dumb idea, reader!" The 5: Gee, and we thought he was being facetious… Have a good weekend, Dave Gonigam The 5 Min. Forecast P.S. "The world of ideas has become stale and in desperate need for innovation," our friend Doug Casey writes, with a surprising recommendation to join one of our latest projects, "even upheaval. That's why I'm excited about the Laissez Faire Club. It is infusing a great body of radical ideas with the energy of a commercial service. The model is new, creative and astonishingly productive. I'm a member of the Club, and I encourage our readers to join as well. It's the place to find the future of serious ideas in the grand liberal tradition. Everyone should join it — now, before they forget." We couldn't agree more. In fact, we're adding a new benefit to Silver membership as we speak: executive summaries of the most important ideas found in the over 40 titles we've already delivered in e-book format to new members. If you haven't had a chance to review our two-year project yet, please take the time this weekend to do so, here. |

| Russian policy study group notes GATA's exposure of gold price suppression Posted: 08 Feb 2013 12:16 PM PST 2:17p ET Friday, February 8, 2013 Dear Friend of GATA and Gold: GATA's work has come to the attention of a public policy study organization in Russia, the Strategic Culture Foundation, whose researcher, Valentin Katasonov, notes particularly GATA's publication of secret records from the International Monetary Fund confirming gold price suppression by Western central banks: http://www.gata.org/node/12016 http://www.gata.org/node/12009 Katasonov's analysis, published yesterday, is headlined "IMF Information Leaks: Central Banks' Gold Manipulations" and it's posted in English at the Strategic Culture Foundation's Internet site here: http://www.strategic-culture.org/pview/2013/02/07/imf-information-leaks-... And in Russian at the foundation's Internet site here: http://www.fondsk.ru/news/2013/02/06/utechka-informacii-iz-mvf-zolotoe-m... Russian officials have been watching GATA's work for a long time, at least since 2004, when the deputy chairman of the Bank of Russia, Oleg Mozhaiskov, with whom GATA had not previously had any contact, spoke approvingly of GATA in his address to a meeting in Moscow of the London Bullion Market Association: Mozhaiskov seems to have been warning the Western bullion bankers that Russia was now on to them. Amid the depression and despair in the monetary metals industry in the West, it must be remembered that the East -- not just Russia but China too -- http://www.gata.org/node/10380 http://www.gata.org/node/10416 -- knows exactly how the gold market has been rigged and presumably is positioning itself to profit from the scheme's undoing. Martin Luther King Jr. said no lie can live forever -- http://www.youtube.com/watch?v=IIT0ra9-mTc -- and the lie against gold is being found out. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Opinion Around the World Is Changing When Deutschebank calls gold "good money" and paper "bad money". ... http://www.gata.org/node/11765 When the president of the German central bank, the Bundesbank, pays tribute to gold as "a timeless classic". ... http://www.forbes.com/sites/ralphbenko/2012/09/24/signs-of-the-gold-stan... When a leading member of the policy committee of the People's Bank of China calls the gold standard "an excellent monetary system". ... http://www.forbes.com/sites/ralphbenko/2012/10/01/signs-of-the-gold-stan... When a CNN reporter writes in The China Post that the "gold commission" plank in the 2012 Republican platform will "reverberate around the world". ... http://www.thegoldstandardnow.org/key-blogs/1563-china-post-the-gop-gold... When the Subcommittee on Domestic Monetary Policy of the U.S. House of Representatives twice called on economist, historian, and gold standard advocate Lewis E. Lehrman to testify. ... World opinion is changing in favor of gold. How can you learn why and what it will mean to you? Read the newly updated and expanded edition of Lehrman's book, "The True Gold Standard." Financial journalist James Grant says of "The True Gold Standard": "If you have ever wondered how the world can get from here to there -- from the chaos of depreciating paper to a convertible currency worthy of our children and our grandchildren -- wonder no more. The answer, brilliantly expounded, is between these covers. America has long needed a modern Alexander Hamilton. In Lewis E. Lehrman she has finally found him." To buy a copy of "The True Gold Standard," please visit: http://www.thegoldstandardnow.com/publications/the-true-gold-standard Join GATA here: California Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Get the real story about the precious metals Now you don't have to travel to attend a financial conference to hear Sprott Asset Management's precious metals experts -- Eric Sprott, Rick Rule, and John Embry. They'll be holding a round-table discussion via the Internet at 2 p.m. ET Tuesday, February 12, and you can be part of it. Among their topics: -- Why are precious metals such a compelling investment opportunity? -- Why are non-G7 central banks buying gold? Do Western central banks have any left? -- Why are investors buying as much silver as gold in dollar terms? What does this mean for the price of silver? -- Is the growing supply deficit of platinum and palladium going to push their prices higher? To register for this Internet conference and participate from the comfort of your own home or office, please visit: http://w.on24.com/r.htm?e=579230&s=1&k=70B829852A33CD255CC2A43ED63D18D0 |

| Nothing At All, Then All at Once Posted: 08 Feb 2013 12:07 PM PST Where money was tight, suddenly it's all arrived at once. Just like trouble does... |

| Is Gold GLD ETF Cannibalizing the HUI Stocks Index? Posted: 08 Feb 2013 11:49 AM PST With gold stocks languishing near lows in a desolate sentiment wasteland, investors are wondering why this sector has fallen so deeply out of favor. One theory is capital that would have traditionally flowed into major gold producers has been diverted into the GLD gold ETF instead. Taken to extremes, this logically leads to the conclusion gold stocks will never thrive as long as GLD exists. Is it cannibalizing the miners? Undoubtedly it is, so the real question is to what degree. Since GLD’s birth in November 2004, it has grown into a wildly successful behemoth holding a staggering $71.5b worth of physical gold bullion in trust for its shareholders. I suspect the majority of GLD purchases have been for diversifying large portfolios, for obtaining that necessary fractional exposure to the gold price. GLD is fantastic for that. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The Trial of the Pyx, perhaps one of the oldest legal events in Great Britain, took place earlier this week.

The Trial of the Pyx, perhaps one of the oldest legal events in Great Britain, took place earlier this week. In our previous essay we stepped back from the day-to-day price analysis in order to focus on the major event that happened recently on the silver market (the silver – JP Morgan manipulation lawsuit was dismissed) and today we would like to get back to the recent price moves, however, first, let's discuss the current situation on the bond market.

In our previous essay we stepped back from the day-to-day price analysis in order to focus on the major event that happened recently on the silver market (the silver – JP Morgan manipulation lawsuit was dismissed) and today we would like to get back to the recent price moves, however, first, let's discuss the current situation on the bond market.

Gee, the major banks must all be well-capitalized again after the Panic of '08.

Gee, the major banks must all be well-capitalized again after the Panic of '08.

My, what a big drone you have…

My, what a big drone you have…

"Super carbon" just got a whole lot weirder…

"Super carbon" just got a whole lot weirder…