saveyourassetsfirst3 |

- December Trade Update: Short The Brazilian Real

- Commodity Chart Of The Day: Gold

- Fiscal Cliff Hang Gliding

- Argonaut Gold Rated New Outperform at RBC with $14 Target

- Corvus Gold expands North Bullfrog property by 52%

- The Facebook Bait And Switch

- Fear Index November 2012: The Faustian Bargain

- Silver: Are You All In?

- James Turk: Gold Supply Aboveground is Overstated

- Buffett’s Gen Re Sees “Tendency To Higher Gold Prices”

- Metals are down!!!

- Motions of No Confidence in Precious Metals

- Buffett’s Gen Re Sees 'Tendency To Higher Gold Prices'

- China, Investors & Central Banks 'Buy on Dips'

- Aboveground gold stock likely smaller than commonly thought

- Gold Smacked – Classic Dead Cat Bounce

- Silver Smoke Signals: Ned Naylor-Leyland

- Silver Update: San Burning Down

- Precious Metals – As the Smart Money Exits Too Soon

- Links 12/4/12

- Getting Tough on Gold Imports Won't Work, Two Former Indian Central Bankers Say

- Washington Proposes $1 Trillion Bailout for Delinquent Student Loans

- Gold and Silver Market morning, December 04, 2012

- Gold Buying Hits 6-Month High on "2013 Insurance" Demand

- CASH IS STILL KING: Why Preppers Need to Stop Worrying about Gold and Start Keeping Cash

- Abigail Field: HousingWire Propaganda Not to Be Believed, Part I – Reanalyzing the Data

| December Trade Update: Short The Brazilian Real Posted: 04 Dec 2012 10:31 AM PST By Emerging Money: Back on Nov. 14 we suggested shorting the Brazilian real against the U.S. dollar, and again reiterated our position on Nov. 23 with great success. Be aware of what effect Complete Story » |

| Commodity Chart Of The Day: Gold Posted: 04 Dec 2012 10:30 AM PST By Matthew Bradbard: Commodity Chart Of The Day Daily Gold (click image to enlarge) I had previously predicted the gold market to correct, and to date the market is cooperating, trading lower by approximately $55/ounce in the last two weeks. Perhaps a bigger development is a trade under that psychological $1700 level, and as one can see on the chart above, we are probing the 100 day MA -- identified by the red line. Also, February futures may be breaching a trend line that has held since mid-summer. There is plenty of Central Bank activity, as the RBA cut rates to 3.0% today while the BOC left rates alone at 1.0%. Still on the docket this week, we have an ECB meeting and the BOE, not to mention a jobs number to round out the week. I bring this up because any surprise could cause increased volatility. My stance remains the same Complete Story » |

| Posted: 04 Dec 2012 10:26 AM PST By Wall Street Strategies: By David Silver The big news yesterday, besides the subpar economic data, was Speaker of the House John Boehner's counter proposal to avoid the fiscal cliff. While I don't think the plan would actually fix many of the problems that we are facing as a nation, it is a great starting point -- much better than the kitchen sink offer from President Obama. On "Closing Bell" yesterday on CNBC, Bill Griffeth made a great point about why the government is letting the fiscal cliff go to the last minute. He said (and I am paraphrasing), you don't study for a final a year and a half in advance. I thought it was a great point, but at the same time, why does it take a day for each side to bring something to the negotiating table? I have said it before, but I really don't want to know what Complete Story » |

| Argonaut Gold Rated New Outperform at RBC with $14 Target Posted: 04 Dec 2012 10:25 AM PST Argonaut Gold Inc (AR CN) was rated new "Outperform" at RBC Capital Markets by equity analyst Sam Crittenden. The 12-month target price is C$14.00 per share. |

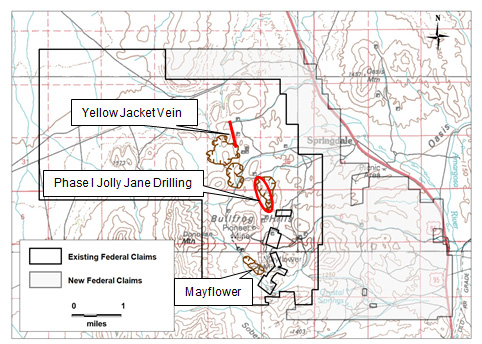

| Corvus Gold expands North Bullfrog property by 52% Posted: 04 Dec 2012 10:20 AM PST Vancouver, B.C……..Corvus Gold Inc. ("Corvus" or the "Company") – (TSX: KOR, OTCQX: CORVF) announces the expansion of its North Bullfrog land package in Nevada by approximately 23.5 square kilometres or 52% (Figure 1). The land acquisition involved staking an additional 297 federal mining claims to cover expanded exploration and development potential (NR May 23, 2012, July 24, 2012 & November 28, 2012). The North Bullfrog property package now covers approximately 68 square kilometres, representing one of the larger new gold-silver projects in Nevada. Corvus commenced phase I resource conversion and expansion drilling at the Jolly Jane deposit in the North Bullfrog area (Figure 1). The phase I program is focused on resource conversion on private lands in the Jolly Jane deposit which the Company anticipates including in its phase I mine development plan. The drill program is expected to be completed by yearend and results available for inclusion into the Company's ongoing phase I feasibility study scheduled for completion in the first quarter of next year. Jeff Pontius, Corvus CEO, stated "Our recent land acquisition is in response to the new high-grade vein potential we see in our North District and to the east. These newly discovered high-grade systems have little surface expression and we feel the potential for new discoveries in this area is very high. We are excited to not only follow-up and expand the Yellow Jacket discovery but to begin exploring new targets generated from our new structural and geophysical data."

About the North Bullfrog Project, Nevada Corvus controls 100% of its North Bullfrog Project, which covers approximately 68 km² in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick Gold Corp. The property package is made up of a number of leased patented federal mining claims and 758 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor. The Company and its independent consultants completed a robust positive Preliminary Economic Assessment on the existing resource in February 2012. The project currently includes numerous prospective gold targets with four (Mayflower, Sierra Blanca, Jolly Jane and Connection) containing an estimated Indicated Resource of 15 Mt at an average grade of 0.37 g/t gold for 182,577 ounces of gold and an Inferred Resource of 156 Mt at 0.28 g/t gold for 1,410,096 ounces of gold (both at a 0.2 g/t cutoff), with appreciable silver credits. Mineralization occurs in two primary forms: (1) broad stratabound bulk-tonnage gold zones such as the Sierra Blanca and Jolly Jane systems; and (2) moderately thick zones of high-grade gold and silver mineralization hosted in structural feeder zones with breccias and quartz-sulphide vein stockworks such as the Mayflower and Yellowjacket targets. The Company is actively pursuing both types of mineralization. A video of the North Bullfrog project showing location, infrastructure access and 2010 winter drilling is available on the Company's website at http://www.corvusgold.com/investors/video/. Qualified Person and Quality Control/Quality Assurance Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information (other than the resource estimate) that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options. Mr. Gary Giroux, M.Sc., P. Eng (B.C.), a consulting geological engineer employed by Giroux Consultants Ltd., has acted as the Qualified Person, as defined in NI 43-101, for the Giroux Consultants Ltd. mineral resource estimate. He has over 30 years of experience in all stages of mineral exploration, development and production. Mr. Giroux specializes in computer applications in ore reserve estimation, and has consulted both nationally and internationally in this field. He has authored many papers on geostatistics and ore reserve estimation and has practiced as a Geological Engineer since 1970 and provided geostatistical services to the industry since 1976. Both Mr. Giroux and Giroux Consultants Ltd. are independent of the Company under NI 43-101. The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control.

About Corvus Gold Inc. Corvus Gold Inc. is a resource exploration company, focused in Nevada, Alaska and Quebec, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% owned Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production. On behalf of (signed) Jeffrey A. Pontius Contact Information: |

| Posted: 04 Dec 2012 09:57 AM PST By Peter Pham: A few weeks ago, Facebook (FB) changed its privacy settings that will allow the company to gather user data from its own and external services such as Instagram but it had bigger implications when the company announced that it is working on an external ad network. The move will be welcomed by its investors as Facebook could potentially double its earnings within a short span of time. It will also be welcomed by users who won't have silly ads inserted into their streams. The company also announced ending its silly policy of needing 30% of users to vote for a specific change. =30% of Facebook users means 300 million people, 2.5 times more than those who voted for the U.S. President. While people's Facebook feeds are likely more important to them than whom the president is, it is still no way to run a multi-billion dollar company. Since Complete Story » |

| Fear Index November 2012: The Faustian Bargain Posted: 04 Dec 2012 08:26 AM PST US M3 grew by another $46 billion in October, reaching an estimated $14.8 trillion. At the same time the gold price weakened, taking a small break after the substantial run-up in September. As a result the Fear Index remains above the significant 3% level. |

| Posted: 04 Dec 2012 07:32 AM PST The Doc sat down with Chris Duane Monday to discuss the recent explosion in gold purchases, his outlook on silver, and the launch of the 2nd coin in the Silver Bullet Silver Shield series, the Trivium Medallion. from silverdoctors: Duane states that while the big money appears to be finally waking up to the incoming tsunami of fiat devaluation, the smart money is going to silver. Duane expects silver to massively outperform gold throughout the duration of the bull market, easily surpass the current in ground ratio 9-1, and potentially reach 1:1 parity with gold prior to the end of the secular bull. ~TVR |

| James Turk: Gold Supply Aboveground is Overstated Posted: 04 Dec 2012 07:30 AM PST Andy Duncan interviews James Turk, Chairman of GoldMoney and co-author of The Collapse of the Dollar, about his study of the aboveground global gold stock, gold's role as money, and the coming fiat currency collapse. from goldmoneynews: They discuss the discrepancies between official gold stock figures and the study's carefully calculated figures, going all the way back to Roman times and using the year 1492 as a pivotal calculation point — which was when the Spanish Empire began its imports of gold deposits discovered in the Americas. In contrast to the widely referenced number of 171,000 tonnes of aboveground gold, James's study suggests that it is actually closer to 155,000 and therefore overstated by about 10%. James explains that gold is not an investment, but money. He talks about the difference between money and currency, and emphasises the ability of gold to preserve purchasing power over long periods of time (as opposed to fiat currency). Given the lack of discipline exhibited by central banks and politicians, James's outlook for paper currencies is gloomy. He predicts one or more fiat currency collapses to take place sometime between 2013 and 2015. This podcast was recorded on 3 December 2012. ~TVR |

| Buffett’s Gen Re Sees “Tendency To Higher Gold Prices” Posted: 04 Dec 2012 07:24 AM PST gold.ie |

| Posted: 04 Dec 2012 05:56 AM PST |

| Motions of No Confidence in Precious Metals Posted: 04 Dec 2012 05:43 AM PST Gold prices broke to under the pivotal $1,700 mark overnight, and did so despite a slightly weaker US dollar, despite a firmer euro, but alongside almost 1% weaker crude oil values. The decline was partially attributed to an overall slide in commodities. |

| Buffett’s Gen Re Sees 'Tendency To Higher Gold Prices' Posted: 04 Dec 2012 05:32 AM PST Gold fell to its lowest point in a month on Tuesday, briefly touching $1,700/oz after a drop below $1,710/oz triggered some technical selling. Investors with a longer time horizon continue to accumulate on the dip. |

| China, Investors & Central Banks 'Buy on Dips' Posted: 04 Dec 2012 05:08 AM PST Spot market prices to buy gold rose back above $1,705 an ounce during Tuesday morning's London session, though it remained below where it started the week following falls overnight, while stock markets also edged higher along with the euro. |

| Aboveground gold stock likely smaller than commonly thought Posted: 04 Dec 2012 05:00 AM PST Episode 78: GoldMoney's Andy Duncan interviews James Turk, Chairman of GoldMoney and co-author of The Collapse of the Dollar, about his study of the aboveground global gold stock, gold's role as ... This posting includes an audio/video/photo media file: Download Now |

| Gold Smacked – Classic Dead Cat Bounce Posted: 04 Dec 2012 04:50 AM PST Gold received another body blow in mid-Asian trading hours which saw spot prices dip briefly below $1,700 before finding support at the technically important $1,705 level – the low seen on Nov. 15; a failure of this level after the US opening exposes $1,672. |

| Silver Smoke Signals: Ned Naylor-Leyland Posted: 04 Dec 2012 04:23 AM PST In this episode, Max Keiser and Stacy Herbert investigate the black hole of debt sucking in our economies, jobs and wealth like strings of spaghetti past the economic event horizon. from russiatoday: In the second half, Max Keiser talks to Ned Naylor-Leyland of Cheviot Asset Management about the fishy smoke signals blowing at the LBMA regarding silver contracts and about the debate between inflation, deflation, hyperinflation actually being a debate about the final denouement of paper currencies. Ned also reveals that BBC's flagship programme, Panorama, had interviewed him and Andrew Maguire about silver manipulation and yet have never aired the episode. ~TVR |

| Silver Update: San Burning Down Posted: 04 Dec 2012 04:22 AM PST BJF on Ag technicals, Ag questions, and a "quick and dirty" on San Bernardino and possible implications for the U.S. at large. from brotherjohnf: ~TVR |

| Precious Metals – As the Smart Money Exits Too Soon Posted: 04 Dec 2012 04:04 AM PST "Too little, too late" could well describe the current plight of the "smart money" silver investor, since many seem to be arriving late to the party when the market has not even yet entered the final phase for investment demand in either silver or gold. |

| Posted: 04 Dec 2012 03:55 AM PST Cave Fish, Draconectes Narinosus, Discovered On Vietnamese Island Huffington Post (Carol B) How tall can a Lego tower get? BBC (Richard Smith) Price gouging: It costs more to send a text message on Earth than from Mars ExtremeTech (Carol B) Woman With Runny Nose Turns Out to Be Woman With Leaking Brain Fluid Gawker. !!!!! Teens Dying From Sunbed Tanning Curb $5 Billion Industry Bloomberg Loss of income caused by banks as bad as a 'world war', says BoE's Andrew Haldane Telegraph. Haldane is not toning it down even though incoming boss Mark Carney has said he thinks nothing is wrong with having big banks, a clear disagreement with Haldane's views. We'll see if Haldane is simply making good use of his remaining time under Mervyn King and becomes more circumspect, or whether he keeps it up. I suspect the latter, and would further bet that Carney would not take it lying down. Currency War Coming to Europe? Bruce Krasting Europe's temporary reprieve MacroBusiness French economy buckles as car sales collapse Telegraph Prosthetic Legs Placed Outside Of Greek Parliament Clusterstock Morsi has left Egypt on the brink Mohamed ElBaradei, Financial Times Iran claims capture of US drone Guardian Top NSA Spying Chief: "If You Ever Get On Their Enemies List, Like Petraeus Did, Then You Can Be Drawn Into That Surveillance" George Washington Progressive media claims they'll be 'tougher' on Obama now Glenn Greenwald. "Tougher" = wet noodle lashing. Catfood watch:

Buddhist Scholar Says Norquist Pledge Is Treason, Goes Viral Addicting Info (furzy mouse) How the Coastline Became a Place to Put the Poor New York Times JOURNALISM AS CRIMINAL VAGRANCY: CITY OF LA FINALLY CHARGES ME FOR REPORTING ON LAPD'S OCCUPY LA RAID Yasha Levine, NSFW No Foreclosure for the Holidays? Adam Levitin, Credit Slips. I like Levitin, but he has a Scrooge attack. Deflationary Trends in Consumer Credit Michael Shedlock An instant banking classic, from Treasury Select Committee hearing on HBOS (Richard Smith): https://twitter.com/creditplumber/status/275673495713751040: "It would appear the ability to see risk is inversely proportional to the time spent trying to model it." Antidote du jour (furzy mouse): |

| Getting Tough on Gold Imports Won't Work, Two Former Indian Central Bankers Say Posted: 04 Dec 2012 03:24 AM PST ¤ Yesterday in Gold and SilverJust eye-balling the Kitco gold chart below, it's obvious to me that the gold price, despite several serious attempts to do so, wasn't going to be allowed to break above the $1,720 spot mark anywhere on Planet Earth yesterday and, with the exception of the high tick of the day [$1,724.10 spot] at the London p.m. gold fix, it didn't. The gold price finished the day at $1,716.00 spot...up a whole 80 cents from Friday's New York close. Net volume was very light at only around 108,000 contracts. Here's the New York Spot Gold [Bid] chart on its own...and three of four of gold's attempts to climb above the above mentioned price got turned back...and the glaring one is at the 3:00 p.m. GMT London gold fix...10:00 a.m. Eastern. Silver rallied right from the New York open on Sunday night...and its Far East high came around 10:00 a.m. Hong Kong time. It was all down hill from there until the noon silver fix in London. That proved to be the low of the day. The subsequent rally ran into the usual not-for-profit seller at the afternoon London gold fix...and that was it. Silver closed at $33.66 spot...up 22 cents on the day. Net volume was a rather unexciting 30,500 contracts...give or take. The dollar index, which closed on Friday at 80.24, was under pressure right from the get-go in Far East trading on their Monday morning...which most likely explains the initial rally in gold and silver. The index sank under the 80.00 mark around 3:00 p.m. in Hong Kong...about an hour before London opened. From there it kept declining in fits and starts...closing around the 79.89 mark...down about 35 basis points on the day. It was obvious that both gold and silver wanted to rally at midday in London...and at the Comex open...but it's equally obvious that there were forces standing by to make sure that it didn't happen. The US dollar index packed up on the ino.com Internet site around 9:00 a.m. yesterday morning...and as you can see, I stole the chart below from one of Peter Spina's websites...goldseek.com...and I'm sure he won't mind.

As you are more than aware, the shares did very poorly yesterday...and the HUI finished down 2.33%. The HUI from that yahoo.com website has been M.I.A. for many days now...and here's one that Scott Pluschau offered up in its stead. (Click on image to enlarge) The silver shares fared little better...and despite the metal itself finishing well in the black, the shares got sold down pretty hard as well. Nick Laird's Silver Sentiment Index closed down 1.68%. (Click on image to enlarge) The CME's Daily Delivery Report for 'Day 3' in the December delivery month showed that 1,906 gold and 712 silver contracts were posted for delivery on Wednesday within the Comex-approved depositories. In gold, the big short/issuer was Deutsche Bank with 1,741 contracts posted for delivery...and in very distant second place came the Bank of Nova Scotia with 162 contracts. The big long/stopper in gold was JPMorgan Chase with 1,565 contracts...275 in its client account and 1,290 in its proprietary [in house] trading account. There were about a dozen other small stoppers accounting for the rest. In silver, the big short/issuer was Deutsche Bank as well with 579 contracts...and JPMorgan, in its proprietary account, was in second with 106 contracts. The biggest long/stopper was JPMorgan in its client account with 341 contracts. Second was Barclays with 225 contracts...and third was Credit Suisse First Boston with 98. The Issuers and Stoppers Report is well worth a few minutes of your time...and the link is here. Note the delivery info in palladium as well...Deutsche Bank, JPMorgan and Barclays. If you haven't figured it out already, it should be patently obvious that JPMorgan is at the center of the precious metals universe. There were no reported changes in either GLD or SLV yesterday...and no sales report from the U.S. Mint, either. Over at the Comex-approved depositories on Friday, they reported receiving no silver at all...but shipped 458,050 troy ounces out the door. The link to that activity is here. Washington reader S.A. had no charts for me today...but he more than made up for it by sending me a photo of the latest addition to the Oregon Zoo. Being a Tuesday column, I have a few more stories than usual for you today...and I'll leave the final edit up to you. I wasn't amused that the precious metals shares got sold off as heavily as they did... Casey Research: Gold Supply Crunch Coming? The growing clamor about monetary metal that may not be where it's supposed to be. The Chart That Keeps Ben Bernanke Up at Night. Multi-million gold heist from boat in Caribbean. ¤ Critical ReadsSubscribeISM: US Manufacturing Sector Contracts, Plunges to Three-Year LowManufacturing unexpectedly contracted in November to its lowest level in more than three years, as companies worried about whether lawmakers in Washington could reach a budget deal in time avert a crisis that many fear could lead to a recession. This story was posted on the moneynews.com Internet site yesterday morning...and I thank West Virginia reader Elliot Simon for providing the first story of the day. The link is here.  Strikers Shut Down the ports of Los Angeles and Long BeachStrikes in the ports of Los Angeles and Long Beach that began last Tuesday are delivering a blow to the U.S. economy. Clerical workers from the International Longshore and Warehouse Union (ILWU) Local 63 have been without a contract for 2.5 years, and negotiations between them and the ports broke down last Monday. The ILWU has accused management of trying to outsource clerical jobs to overseas workers that are paid far less and receive fewer benefits. This story from the businessinsider.com was posted on their Internet site early yesterday afternoon Eastern time...and I thank Roy Stephens for this first offering of the day. The link is here.  Treasury Scarcity to Grow as Fed Buys 90% of New BondsEven as U.S. government debt swells to more than $16 trillion, Treasuries and other dollar fixed- income securities will be in short supply next year as the Federal Reserve soaks up almost all the net new bonds. The government will reduce net sales by $250 billion from the $1.2 trillion of bills, notes and bonds issued in fiscal 2012 ended Sept. 30, a survey of 18 primary dealers found. At the same time, the Fed, in its efforts to boost growth, will add about $45 billion of Treasuries a month to the $40 billion in mortgage debt it's purchasing, effectively absorbing about 90 percent of net new dollar-denominated fixed-income assets, according to JPMorgan Chase & Co. "The shrinking amount of bonds in the market is lowering rates and not just benefiting the Treasury, but providing lower rates for private-sector decision-makers as well," Zach Pandl, a senior interest-rate strategist in Minneapolis at Columbia Management Investment Advisers LLC, which oversees $340 billion, said in a Nov. 30 telephone interview. "The Fed is not creating this scarcity to help out the Treasury, it's primarily to get the economy going." More paper games. This Bloomberg story showed up on their website yesterday morning Mountain Standard Time...and it's Elliot Simon's second offering of the day. It's certainly worth skimming...and the link is here.  Fair Game: In an F.H.A. Checkup, a Startling NumberDO we have another Fannie or Freddie on our hands — another mortgage giant headed for a rescue? Like Fannie Mae and Freddie Mac before it, the Federal Housing Administration is suffering in a mortgage hell of its own making. F.H.A. officials say they won't need taxpayers' help, but we've heard that kind of line before. The F.H.A. backs $1.1 trillion of American mortgages and, by the look of things, it's in deep trouble. Last year, its mortgage insurance fund was valued at $1.2 billion. Today that fund is valued at negative $13.48 billion. Gretchen Morgenson tees up the F.H.A. in her Saturday column in The New York Times. I thank Phil Barlett for bringing this story to our attention...and the link is here.  Washington Proposes $1 Trillion Bailout for Delinquent Student LoansAmerica's now-nationalized student loan industry just reached a value of $1 trillion, according to Citigroup, growing at a 20 percent-per-year pace. Since President Obama nationalized the industry (a tacked-on provision of the Obamacare bill), tuition has gone up 25 percent and the three-year default rate is at a record 13.4 percent. With many young people unable to pay their loans (average graduating debt is about $29,000), Citigroup and others are speculating that this industry might be ripe for a bailout. To pay off all the current defaults, Citigroup says it would cost taxpayers $74 billion. However, this number doesn't include those who will default in the coming years, and, when the government rewards the defaulters, it will encourage more borrowers not to pay their debts. And liberals in Congress have proposed forgiving all student loans via "The Student Loan Forgiveness Act 2012," costing taxpayers $1 trillion. This story was posted on the breitbart.com Internet site last Thursday...and I thank 'David in California' for bringing this story to our attention. The link is here.  American Households Hit 43-Year Low In Net Worth: StudyThe median net worth of American households has dropped to a 43-year low as the lower and middle classes appear poorer and less stable than they have been since 1969. According to a recent study by New York University economics professor Edward N. Wolff, median net worth is at the decades-low figure of $57,000 (in 2010 dollars). And as the numbers in his study reflect, the situation only appears worse when all the statistics are taken as a whole. According to Wolff, between 1983 and 2010, the percentage of households with less than $10,000 in assets (using constant 1995 dollars) rose from 29.7 percent to 37.1 percent. The "less than $10,000″ figure includes the numerous households that have no assets at all, or "negative assets," which is otherwise known as "debt." This CBS article from Washington, D.C. was posted on their Internet site early Friday afternoon...and it's a story that I found buried in yesterday's edition of the King Report. The link is here.  SEC Says Big Four Audit China-Affiliates Blocked ProbeU.S. regulators probing potential fraud by China-based companies increased pressure on their auditors by formally accusing affiliates of Big Four firms of withholding documents from investigators. Deloitte Touche Tohmatsu CPA Ltd., Ernst & Young Hua Ming LLP, KPMG Huazhen and PricewaterhouseCoopers Zhong Tian CPAs Limited have refused to cooperate with accounting fraud investigations into nine companies whose securities are publicly traded in the U.S., the Securities and Exchange Commission said in an administrative order yesterday. BDO China Dahua Co. Ltd. was also named by the SEC in the action. China-based companies listed on U.S. exchanges have faced increased scrutiny over the past two years after regulators became concerned that some firms may not be providing accurate financial statements to investors. Investigators have struggled to obtain documents central to the probes because auditors, citing China's laws, have declined to cooperate. This Bloomberg story was posted on their website early yesterday evening...and I thank Elliot Simon once again for sending it our way. The link is here.  China surpasses U.S. as top global traderShin Cheol-soo no longer sees his future in the United States. The South Korean businessman supplied components to American automakers for a decade. But this year, he uprooted his family from Detroit and moved home to focus on selling to the new economic superpower: China. In just five years, China has surpassed the United States as a trading partner for much of the world, including U.S. allies such as South Korea and Australia, according to an Associated Press analysis of trade data. As recently as 2006, the U.S. was the larger trading partner for 127 countries, versus just 70 for China. By last year the two had clearly traded places: 124 countries for China, 76 for the U.S. This AP article, filed from Seoul, was posted on the finance.yahoo.com Internet site Sunday evening Eastern...and I thank Matthew Nel for sending it. The link is here. |

| Washington Proposes $1 Trillion Bailout for Delinquent Student Loans Posted: 04 Dec 2012 03:24 AM PST  America's now-nationalized student loan industry just reached a value of $1 trillion, according to Citigroup, growing at a 20 percent-per-year pace. Since President Obama nationalized the industry (a tacked-on provision of the Obamacare bill), tuition has gone up 25 percent and the three-year default rate is at a record 13.4 percent. With many young people unable to pay their loans (average graduating debt is about $29,000), Citigroup and others are speculating that this industry might be ripe for a bailout. |

| Gold and Silver Market morning, December 04, 2012 Posted: 04 Dec 2012 03:00 AM PST |

| Gold Buying Hits 6-Month High on "2013 Insurance" Demand Posted: 04 Dec 2012 01:16 AM PST Drop in price sees BullionVault users adding half-a-tonne of gold... This posting includes an audio/video/photo media file: Download Now |

| CASH IS STILL KING: Why Preppers Need to Stop Worrying about Gold and Start Keeping Cash Posted: 04 Dec 2012 01:00 AM PST |

| Abigail Field: HousingWire Propaganda Not to Be Believed, Part I – Reanalyzing the Data Posted: 04 Dec 2012 12:47 AM PST By Abigail Field, an attorney and writer. Cross posted from Reality Check Friday HousingWire ran a six-and-a-half page big bank/mortgage servicer propaganda piece called "Living Large", by Tom Showalter. The article, subtitled "A person's lifestyle plays into whether they will pay their mortgage after a loan modification", purports to explain why people default on loan modifications. Instead, it spins a bank-exonerating morality play not justified by the data supposedly being interpreted. I'll get to the morality play and the "irresponsible borrower" propaganda it represents in my next post to keep this one to readable length. First, to clearly show the wrongness of the bank-serving mythology being sold as its interpretation, I'm going recap the data the 'article' presents to answer the questions the underlying study apparently aimed at: why did so many people with mortgage mods made in 2009 default on those mods by 2011? And what needs to be done to make mods more successful going forward? Note: I can't assess the data quality because I don't have access to the underlying tables and sourcing info; I am working off HousingWire's/Showalter's analysis of it. I just take his numbers at face value, though as I discuss below, however, something is screwy either in the some of the data or Showalter's reporting of it. Regardless, after looking at the data as presented by Showalter, the answer's clear: People defaulted because the loan mods weren't steep enough to make them solvent. To get successful mods in the future, payment reduction needs to be enough for borrowers to be solvent again. That's all. Importantly, a post-mod solvent borrower is what would've happened if the loan restructuring were allowed to happen in bankruptcy; we've long understood what dealing with debt crises takes. The Data: Tremendous Financial Stress, Inadequate Modification So let's look at the data as described by Showalter. Here's the setup: A control group of a random sample of 1 million people with mortgages in 2009, skewed to be a little more than 50% subprime, Alt-A and jumbo prime, was compared to a random sample of 55,000 loans modified in 2009 and tracked through 2011. (Showalter does not say if the modified loan sample is a subset of the control group or not.) The debt loads, bill paying performance and other characteristics of the people in both groups, and of people within the modified group, were compared. In fact, the people in the modified group were broken out into seven different groups, A through G. So what do we learn about these various groups? The metric most discussed is who was seriously delinquent–60-days or more past due–on credit lines from 2007-2009. This data point is fixated on because, according to the analysis, it is the overwhelmingly strongest predictor of defaulting on a 2009 modification by 2011. Turns out the baseline borrower–the average borrower in the million person sample of people with mortgages in 2009–was seriously delinquent with 16% (1 in 6) of their "active credit lines" sometime in 2007-09. Think about that: the average borrower with a mortgage in 2009 became seriously delinquent on one or more accounts in 2007-09. That is quite a backdrop of financial stress. So how do the people who qualified for a mortgage modification compare? Unsurprisingly, mod recipients were even more debt stressed: 30% of their accounts had been seriously delinquent during 2007-09. Mind you, they're not deadbeats; they were keeping 70% of their accounts current. Still, they were struggling much more than the average mortgage holder. What about the people who defaulted on their loan mod by 2011? Turns out they were even worse off, having been on average behind on half (51%) of their credit lines during 2007-2009. No surprise there–people with the most debt stress at the start continued to have the most trouble paying their bills. Still, that's not the whole story. See, the data show that the tipping point at which "loan modification redefault performance erodes substantially" is serious delinquency on 25% of accounts in 2007-09. But wait–the average for all modified borrowers is 30%! There's only conclusion possible: the mods were systematically inadequate, unable to address the financial crisis faced by the average person they purported to help. Redefaulting Data Screwy as Reported How likely to redefault? Depends on the subtype. At best one in ten redefaulted (11%, subtype F, representing 2% of the sample), and then one in four (26%, subtype G, 3% of the sample). That leaves 95% of the modified borrowers redefaulting at a higher rate, and also signals that the data are screwy, at least as presented by Showalter. See, he says the average redefault rate was 30%. Group A, which came in at 30% redefault rate, represents 22% of the sample. If 5% of the sample is below the average, and 73% of the sample above, shouldn't the average be higher? It's not like the other rates were very close to the average. Subtype C comes in at 34%, D at 37%, and E and B, which combined account for 56% of the loan mods, redefaulted at 41% and 51% respectively. No way that average is 30%; either Showalter or the data are just wrong. UPDATE: The sentence Showalter writes is "These borrowers…redefaulted at below average rates (average redefault rate <30%)." I read that as meaning the average redefault rate is 30%. Otherwise the 30% is a meaningless, arbitrary number. But considering that a 30% average doesn't make sense, per the above, and given how incoherent the data presentation was generally, maybe Showalter doesn't mean the average is 30%. Maybe he picked 30% just because it was the first round number above 26% and 11%, the redefault rates of the groups in question, and the average is in fact higher. Doesn't really matter. The Mods Were Inadequate It's not just the pre-mod financial stress data that shows mods simply weren't substantial enough to work. It's the other data Showalter fixates on, namely what people did with the cash freed up by the mod. Given the "Living Large" headline, I expected to read that redefaulting, 'bad' borrowers blew their mod-freed up cash on shopping sprees, decking out their lives with flat screen tv's, jewelry and vacations. Living Large is about self-indulgent pleasure chasing, isn't it? But here's the "lifestyle" choice that Showalter says make some borrowers good, and some bad: whether the borrowers decided to use the cash to pay Peter (the mortgage bill) or Paul (the revolving debt/credit card bill.) Seriously. Showalter writes:

Since when is someone "Living Large" by paying down some bills while falling behind again on their mortgage? Snark aside, here's the key point: both groups–the high redefaulters and low redefaulters–are still insolvent after mortgage modification. They still can't pay all their bills even though they are trying to. Showalter talks about high redefaulters paying down distressed revolving debt. He doesn't claim the high redefaulters rang up large new debts with the cash, just that they chose to pay existing creditors other than the mortgagee. Mods Should Make Borrowers Solvent Let's remember the context for these mods: our nation faced, and faces, a housing and foreclosure crisis triggered by the collapse of a lender-inflated, fraud filled housing and housing-related securities bubble. The crisis has been exacerbated by the unemployment crisis of the Great Recession. Our government stepped in to help, and responded quickly to save the bankers and Wall Street. The big help for Main Street was supposed to be loan modifications/refinancings. Seen through the lens of public policy aimed at avoiding foreclosure, the inadequacy of the mods is even more obvious. Why did the government let the banks do mods that left people still insolvent? But wait, banks might say: it's not fair to put the homeowner debt reduction burden solely on the mortgage; why should our payment be cut so much that the borrower can service all their debts post-mod? Why not force the other debt lines to take a hit too? A variation on this whine is: but wait, by reducing the mortgage payment so much, you're hurting pension funds and other investors, folk we don't want to hurt. Here are my responses: Dear Bankers: If you hadn't falsely inflated principal balances by suborning appraisal fraud and adding fake demand to the marketplace by abandoning underwriting, thus directly and fraudulently increasing the homebuyer's debt load; If you hadn't engaged in widespread predatory lending including steering people into more expensive mortgages when they qualified for cheaper ones, thus directly and fraudulently increasing the homebuyer's debt load; If you hadn't engaged in predatory servicing, misapplying payments, forcing borrowers to purchase grotesquely priced insurance policies (even when they were maintaining insurance of their own), and charging rolling late and other junk fees, thus directly and fraudulently increasing the homebuyer's debt load; If you hadn't worked so hard to kill mortgage-loan restructuring in bankruptcy, which would have led more people into bankruptcy and thus forced other creditors to take a hit too; If you hadn't defrauded homebuyers-as-taxpayers by making false mortgage insurance claims; If you hadn't defrauded homebuyers-as-pension-fund-participants by lying about mortgage-backed securities to the investing pension funds; If you hadn't criminally manufactured documents to foreclose on people's homes; It would have been enough to justify you lowering the mortgage payment to make borrowers solvent that you were bailed out with tax dollars and not held accountable for any of your crisis-causing misdeeds. Dear Investor Protectors: The issue isn't whether the mortgage payment should be modified sufficiently to allow borrowers to become solvent. It's who should pay for that modification. I agree with you: the banks should pay. There's nothing about modifying the amount of the payment due you that comes out of the borrower's pocket that requires investors to take the hit for the difference, except investor passivity and comparatively (to the banks) weak political power. The Bottom Line Insolvent people will default on debts owed, making the choice that seems most rational to them about whether to pay Peter or Paul. Public policy aimed at keeping people in their homes based on loan mods is a total failure if the loan mods leave borrowers insolvent. And apparently the 2009 loan mods did just that. And that failure is unconscionable against the backdrop of banker wrongdoing and government solicitousness of bankers. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment