Gold World News Flash |

- GoldSeek.com Radio Gold Nugget: Peter Grandich & Chris Waltzek

- Chronically low gold price forecasts

- The Gold Sandwich. Chew Carefully.

- The Coming Derivatives Panic That Will Destroy Global Financial Markets

- 20 Shocking Examples Of How Sadistic And Cruel People Have Become

- This Is Going To Require 30% - 50% Of Global Silver Production

- Gold Seeker Closing Report: Gold and Silver Fall About 1% and 2%

- Ned Naylor-Leyland: Silver Smoke Signals at the LBMA

- 2012: A Trader's Odyssey

- US households already went off their fiscal cliff and breached their debt ceiling

- Commodity Technical Analysis: Gold Drop Beginning of December Break?

- Washington’s Biggest Lie (and Why it Continues to be Told)

- The Gold Price May Fall to it's 150 Day Moving Average but Remains in it's Primary Uptrend

- Hugo Salinas-Price: The Price of the Dollar

- The Answers To Today's Most Common Questions

- Gold slumps to one-month low below $1,700

- Gold Seen to Triple on World Economic Deterioration

- PIMCO's Gross Again Recommends Gold

- Central Banks Hedge Their Bets

- TRUE YOUTH UNEMPLOYMENT

- The Gold Sandwich. Chew Carefully

- Gold Daily and Silver Weekly Charts - Bear Raid of a Sort

- A Christmas Offer.

- THE RUSSIAN LIMBAUGH

- Yamarone - The Collapse Is Getting Even Worse

- Three Feet to the Bottom

- Gold Bulls Attempting to Hold the Line at the 100 Day Moving Average

- Turk, Embry, Sinclair comment on gold and silver action

- BIS gold report hints at repatriation by central banks

- Gordon T. Long–Reservations About The Dollar’s Reserve Status 04.Dec.12

| GoldSeek.com Radio Gold Nugget: Peter Grandich & Chris Waltzek Posted: 05 Dec 2012 08:29 AM PST GoldSeek.com Radio Gold Nugget: Peter Grandich & Chris Waltzek | |

| Chronically low gold price forecasts Posted: 05 Dec 2012 08:17 AM PST The main reason to be bullish on the US$ gold price is that the ignoramuses at the upper echelons of the Fed truly believe that they can help the US economy by conjuring money out of nothing. The weaker the economy becomes the more money they will create, and the more money they create the weaker the economy will become. | |

| The Gold Sandwich. Chew Carefully. Posted: 04 Dec 2012 11:43 PM PST Graceland Update | |

| The Coming Derivatives Panic That Will Destroy Global Financial Markets Posted: 04 Dec 2012 11:30 PM PST from The Economic Collapse Blog:

| |

| 20 Shocking Examples Of How Sadistic And Cruel People Have Become Posted: 04 Dec 2012 11:10 PM PST from End of the American Dream:

| |

| This Is Going To Require 30% - 50% Of Global Silver Production Posted: 04 Dec 2012 10:01 PM PST  Today acclaimed money manager Stephen Leeb spoke with King World News about gold and why silver is going to soar beyond a level investors can even imagine. But first, here is what Leeb had to say about some of the recent suspect trading in the gold market: "Somebody wants to see gold down. There's no doubt about that. Gold, all of the sudden, had fallen $14. If you look at a chart, it's a straight line. Now anyone that is selling into an illiquid market, which you obviously have during overnight trading, is nuts." Today acclaimed money manager Stephen Leeb spoke with King World News about gold and why silver is going to soar beyond a level investors can even imagine. But first, here is what Leeb had to say about some of the recent suspect trading in the gold market: "Somebody wants to see gold down. There's no doubt about that. Gold, all of the sudden, had fallen $14. If you look at a chart, it's a straight line. Now anyone that is selling into an illiquid market, which you obviously have during overnight trading, is nuts."This posting includes an audio/video/photo media file: Download Now | |

| Gold Seeker Closing Report: Gold and Silver Fall About 1% and 2% Posted: 04 Dec 2012 10:00 PM PST Gold fell to as low as $1691.20 in early New York trade before it bounced back higher at times, but it still ended with a loss of 1.08%. Silver slipped to as low as $32.66 and ended with a loss of 1.88%. | |

| Ned Naylor-Leyland: Silver Smoke Signals at the LBMA Posted: 04 Dec 2012 08:49 PM PST This posting includes an audio/video/photo media file: Download Now | |

| Posted: 04 Dec 2012 08:17 PM PST Submitted by institutional trader Paulo Pereira, currently on sabbatical Global market Musings: Volatility And The "Backstop" I recently received the following question from a friend of mine and wanted to share my thoughts with my market pals, and throw this out for feedback. I would be particularly interested in hearing from my derivatives friends who are much more technically informed than I am on the subject.

From my viewpoint this has been a key debate/driver in the equity derivatives world for a good while now (I started having this discussion in early 2011 with some market pals and the situation has only grown more extreme since then). One excellent resource on the subject I would encourage everyone to follow is the work done by Artemis Capital, a volatility fund run by a fellow named Chris Cole. His letters are heavily technical but he does a great job of discussing the volatility landscape and market topology. I know it's a bit of heavy reading, but if you really want to get to the bottom of this, here is his website link: http://www.artemiscm.com/category/research/ ... Just scroll down the page for the summary of each letter. Specifically, I would encourage you to read the paper Volatility at World's End from April 2012 (see the chart on page 6 discussing the VIX curve) and the letter Fighting Greek Fire with Fire from Sept 2011 on volatility and correlation. I particularly like this quote:

But back to the question – how am I interpreting this? In my own modest, undereducated opinion, I think the volatility curve reflects two simultaneous dynamics. The first dynamic is in the long end, in the variance/swap market for longer dated volatility (>1yr) which remains stubbornly elevated in the upper 20s or higher, even though realized vol is nowhere close to this... why? Yes there are plenty of folks who believe the Great Depression 2 has arrived, but even during the early 1930s, volatility did not realize 30+ except in very short stretches during the decline. Nobody I know is seriously buying longer dated implied vol in size at such levels, so what gives? I think the problem is not with demand for long-term protection but with supply, i.e. who would the natural seller of long-dated 30+ vol be. Buffett? Insurance companies? Yale/Harvard? The reality is nobody in the financial has long-term balance sheet visibility AND security of funding, and I think this is a symptom of how the Fed and govt intervention has farked up everything by preventing the market from clearing through actual price discovery over the past five years. Few investors fully trust a non-government counterparty to be there to pay out a few years down the road, and private entities struggle to retain the balance sheet funding to commit as a seller of vol and "ride out" the immense carry available (the Harvard endowments should be ALL OVER THIS imho, as you could easily extract double digit returns riding down the vol curve assuming you have the balance sheet to take a MTM hit when "shtuff happens"). Come to think of it, if major technology megacaps can place long term debt at extremely low rates, why not go into the long-term carry finance business by issuing a 10-year 2% coupon and use the proceeds to continuously sell 1-year variance for a low-double digit unlevered return? I would prefer this to a dilutive acquisition, but I doubt any investors would be pleased! With capex, staff, and economic outlook being what they are -- what else you gonna do with the money? Somebody should call Breitburn (Apple's cash manager in Nevada). The other dynamic is in the short-to-mid market for vol, which remains in severe contango (the premium of VIX futures over spot my friend described). I chalk this up to the unrelenting efforts over the past three years by policymakers whose third mandate appears to be to stick-save stocks no matter what and "kick the grenade down the road." I fear this has conditioned long-biased cash investors that stocks always come back (I have written about the dangers of this psychology in Global Market Musings earlier this year). But this psychology of "the Big One may come… just not yet" is faced off against the ever present "event risk" – the gap risk that keeps premiums elevated a few months out. The "system would blow big ...if it does blow...which could be in a few months, but not this week" sort of thinking perhaps? This has led to an unbelievably profitable "carry" (short gamma) business for derivative dealing desks on the Street these past two years – in fact, of all my market pals, the only ones I know who are having a great time on the sellside are those whose job it is to trade equity derivatives. They are killing it because ultimately their job comes down to collecting steeply overpriced insurance products…in the short run. Sure, some buyers of that insurance suffer from what I call the "Paulson factor" (wanting to be the short hero when everyone is long). Chris Cole's quote earlier about the jackpot being a lot smaller when everyone has a winning lotto ticket is very apropos. But it also reminds me of a quote I read many years ago: "The moral is clear. When Wall Street appears in genius mode, raking in huge profits on mysterious products and complex trades, the secret isn't genius at all. It is that hubris is running wild, and so is risk. And whether it's tomorrow or five years hence, risk will jump from the shadows, knife in hand, to cut genius down to size." (Fortune Magazine, 26 November 2007) Ultimately what I'm saying here boils down to this: unceasing market intervention has crushed the forward-looking expected returns for pretty much every asset class out there: rates, credit, HY, equities, equity with overlay/protection strategies (calls too cheap), long/short, macro, relative value, you name it. The Feds have done much more than just peg rates to zero and sit on the yield curve – they have quite literally stripped the investment management industry of most (but not all) alternatives for generating a decent return in the future by convincing the trapezing investment community that there is a safety net. This belief heuristic pulled investment returns into the present by rallying EVERYTHING. This is simple math, but hard to stomach for the investor who's career is on the line if he's not "chasing" or "in the game." While I remain sympathetic to the left tail of deflation as the probable outcome (the risk is real, but yes the risk has been overpriced by protection buyers for some time now, as Chris Cole points out), I have been thinking a lot lately about something else that's bugging me about the right tail. I recently went back to my notes from late 2007 and found an old rant that I wrote at Citi where I discussed Bill Ackman's Pershing Square presentation on shorting MBIA and Ambac. Those were his high conviction shorts on account of their overwhelming exposure to junk mortgages – and as it turns out they were some of the "AAA backstop" to the whole shadow banking system when it came to shoddy mortgage securitizations. Ackman's view was, even if subprime is only a $100bln problem that is 'contained,' the claims that MBIA and AMBAC might have to pay out were so huge relative to capital cushions that they would quickly overwhelm the balance sheet and send these stocks from $80 to zero, quite literally on a razor's edge (did I mention these were AAA rated!!). In recalling this recently, it suddenly occurred to me that we are into something comparable but possibly far more serious today. The idea of how pressure in complex systems builds up over time... that complexity and connectivity magnifies contagion mechanisms both seen and unseen... and yet asset prices no longer reflect much worry for future risks ... why exactly? Because the Federal Reserve has become the ultimate backstop, just as the fixed income derivatives guys on the trading floor upstairs thought they could rely on Ambac and MBIA. I hate that this seems to head down the goldbug rabbit hole, but where else does this go? The real convexity... the real non-linearity payout today... it's in betting on the failure of the optical backstop just like it was back then – the thinly capitalized, AAA-rated guys who are purportedly smarter than everyone and happily set up a business where they guarantee immense risks and collect what they think is a sufficient premium that turns out to be laughably insignificant. Today MBIA and AMBAC are no longer in business – by this I mean their "guarantee" is not worth much for any future underwriting. So who took their place, figuratively speaking? Whose balance sheet is the ultimate backstop to reckless financial speculation? Who created Too Big To Fail? Who says "Hey, I have the ultimate liability here, but don't sweat it cuz the worst case scenario is simply impossible"... do you see where I'm going with this? Now to be clear, I have owned boatloads of silver for years on a thesis that has nothing to do with currency failure or printing money or all that "goldbug stuff"... but I am starting to grow sympathetic to their arguments. After all, what would you own when the market decides to test the backstop on an immense amount of risk, and the backstop turns out to be a guarantee from a thinly capitalized entity that loses its sanctified status in the eyes of the market at the worst possible time? What's the hedge to that? I can only think of real assets like gold, farmland, etc. Frankly, for all this talk about owning equities as a defense to a currency or sovereign debt crisis, I'm not entirely sure that owning fractional shares of American businesses is a suitable form of protection in a chaotic environment where interest rates, foreign exchange, and global capital are flying around like "a loose cannon on the deck of the world, amid a tempest-tossed era" (President Herbert Hoover from his memoirs in 1931, as quoted in Charles Kindleberger's The World In Depression 1929-1939, p. 148). After all, equities are as dependent on an internal rate of return in determining their value as bonds are – so how are equities a hedge in all this exactly? People in equities tell me all the time "don't fight central banks" – but isn't that like saying Ambac's insurance is "money good"? The Fed may be the biggest bank in the world, but they're still just a bank making a promise. So back to the short-term vol contango issue... are the derivative dealing desks conducting similar MBIA-style activity in the equity markets? Selling overpriced insurance for a few months' duration has been a great profit center for them and if current conditions persist, good times will abound. But if the ultimate outcome is one where we wake up one morning and S&P futures are locked limit down with one contract traded at the limit, then yes, derivative dealing desks might just be the new Ambac sellers of protection for equities, figuratively speaking. Are the Feds going to take on these liabilities as well? Is that what "Too Big To Fail" has come to? I am not saying this is going to happen. But this is why I presented the possibility back in April that at some point in the future we may see equity markets trade like grain futures, gapping around at the limit while attempting to clear. Yes, yes, I know the Feds would "never allow this." But frankly this scenario doesn't even worry me so much anymore from a systemic point of view, because how often and to what size do stocks turn up as collateral in another obligation? The Rate & FX derivatives market is measured in hundreds of trillions, whereas the equity derivatives market is measured in trillions. Maybe equity protection buyers are operating in the wrong market – maybe the convexity and non-linearity of the payout is in the rate and FX market, not the equity market. Maybe the goldbugs are on the right track. But my gut tells me the big Paulson trade is not betting on a stock market crash – because even if stocks were to crash, the protection is so expensive that to bank a 25:1 return means 1987 on steroids in terms of outcome. The asymmetry is to be found in the markets with the "ultimate backstop"…the Federal Reserve. Somewhere in there is an Ambac trade. Of course I have to caveat all this by saying if there is one lesson I can take home from the past two years, it's that the inevitable and the imminent are quite different things. As always, I would love to hear your thoughts. With kind regards, | |

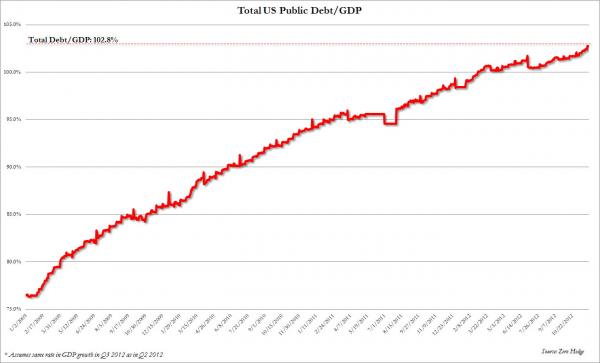

| US households already went off their fiscal cliff and breached their debt ceiling Posted: 04 Dec 2012 08:00 PM PST US quickly approaching another debt ceiling limit aligning with the fiscal cliff from MyBudget360.com:

| |

| Commodity Technical Analysis: Gold Drop Beginning of December Break? Posted: 04 Dec 2012 07:22 PM PST courtesy of DailyFX.com December 04, 2012 06:13 PM Daily Bars Chart Prepared by Jamie Saettele, CMT Commodity Analysis: “Viewed in light of the 3 wave advance from 1672.50, the trend is lower.” Rallies should be sold and estimated resistance now comes in at 1709. The most bearish count, in which the 11/30 high completes a small 2nd wave, is valid as long as price is below 1731.52. 1685 may provide interim support. Commodity Trading Strategy: Look to short strength near 1709 with a 1732 stop. 1630/45 (measured level and 8/31 low) is the target area. LEVELS: 1646 1673 1685 1709 1723 1735... | |

| Washington’s Biggest Lie (and Why it Continues to be Told) Posted: 04 Dec 2012 06:30 PM PST Washington's Biggest Lie (and Why it Continues to be Told)From The latest Market Shadows newsletter: A Failure to Communicate: Numbers, Rates & Lies

Normal people have no trouble defining how they measure inflation in their own lives. They compare what the same exact purchases of goods and services cost them today versus one-year earlier. It would include everything they spend money on. Big ticket items like gasoline, insurance (health, life, auto and property/casualty), food and utility bills have the greatest impact. Increases in other major expense categories such as college tuition, property taxes, FICA, Federal, state and local income taxes can also add tremendously to the year-over-year true cost of living. Those of us old enough to have lived through the 1970s remember the bad old days when prices were escalating at a sickening pace. An item that cost $1 on Jan. 1, 1969, cost $1.31 five years later. At the end of the ten year period, the cost had shot up to $1.92! The officially reported 1980 CPI increase of 13.91% was the 'straw that broke the camel's back' in terms of what our leaders were willing to admit to. They decided to change the way CPI was calculated to avoid making people even more upset. Intentionally understating CPI also served to diminish COLA (cost of living adjustments) in government salaries, pensions and social security obligations. It also kept the rates paid on government borrowing somewhat below what would otherwise have been demanded by bond vigilantes. Those nasty lenders insisted on being compensated for the fast-diminishing value of their dollars. Unions across America used the high CPI rates to justify huge increases in pay and benefits. While inflation calmed down from the roaring period described below the BLS again adjusted their calculation of CPI in 1990 to further understate the truth as most of us see it. Today's headline core CPI excludes food and energy completely. That's impossible for us to do that in our real lives. Remember the old sub-$2 per gallon gasoline prices? How about the health insurance premiums, grocery expenses and electric bills you're paying today versus four or five years ago?

(Chart above is looking at the compounding inflation starting on Jan. 1 , 1969 - so baseline starting point is on Jan. 1, 1969.)

CPI Year-to-Year Growth The CPI-U (consumer price index) is the broadest measure of consumer price inflation for goods and services published by the U.S. Government's Bureau of Labor Statistics (BLS). While the headline number usually is the seasonally-adjusted month-to-month change, the formal CPI is reported on a not-seasonally-adjusted basis, with annual inflation measured in terms of year-to-year percent change in the price index. The chart below shows the Shadow Government Stats -Alternate CPI estimate. It figures inflation based on our own government's official methodology for computing the CPI-U in the years through 1980. Under the old rules US inflation has been in the double-digits for much of the preceding five years. The 'new' BLS numbers want you to believe price increases since 2008 have been quite mild. The Bureau of Labor Statistics also uses a technique called 'substitution' to hold down their reported inflation figures. If an item in their index goes up in price they can assume consumer would simply trade down to something cheaper instead. If your favorite rib-eye steak went from $7.99 to $12.99 per pound you'd simply eat hamburger instead. Have those organic bananas gotten too expensive. Try prunes. Need a replacement for your Lexus? Buy a Kia instead. Presto, there's no inflation evident in any of those situations according to the BLS. All these changes in the way CPI is calculated have been duly disclosed to the public. That doesn't make them any less dishonest when viewed the way most people gauge changes in their real cost of living.

Chart courtesy of Shadow Statistics. The chart above compares the official CPI-U to the pre-1980 methodology for computing the CPI-U. It shows that without the government's manipulation of the methodology for computing the CPI, current inflation would be nearly 10%.

Fed Chairman Ben Bernanke has put Bond Vigilantes on the endangered species list with his multiple, and now eternal QE programs. Interest rates are no longer useful as measures of present or future inflation. Bond Vigilantes are people/institutions that insist on coupon rates (i.e. interest rates paid on bonds) being high enough to offset inflation. The Fed's almost unlimited bond buying (money printing) took away the ability of 'the free market' to set interest rates. This rendered useless the 'diagnostic' value of treasury bond rates as a measure of true inflation. Currently, the interest rates on bonds are much lower than actual inflation, making real interest rates essentially negative. That is why I would avoid bonds like the plague. If truth in advertising were being strictly enforced the BLS might be renamed just the BS. Please post comments to this article letting others know which view matches your personal, real-life experience. ****

From The latest Market Shadows newsletter: A Failure to Communicate: Numbers, Rates & Lies

Individual articles featured in the Market Shadows newsletter become available over the weekend, here on the website. Special Offer from Phil's Stock World: Click on this link to try PSW Free! | |

| The Gold Price May Fall to it's 150 Day Moving Average but Remains in it's Primary Uptrend Posted: 04 Dec 2012 06:22 PM PST Gold Price Close Today : 1694.40 Change : -25.20 or -1.47% Silver Price Close Today : 32.734 Change : -0.947 or -2.81% Gold Silver Ratio Today : 51.763 Change : 0.707 or 1.39% Silver Gold Ratio Today : 0.01932 Change : -0.000268 or -1.37% Platinum Price Close Today : 1581.40 Change : -30.90 or -1.92% Palladium Price Close Today : 681.10 Change : -8.35 or -1.21% S&P 500 : 1,407.05 Change : -2.41 or -0.17% Dow In GOLD$ : $158.01 Change : $ 2.17 or 1.39% Dow in GOLD oz : 7.644 Change : 0.105 or 1.39% Dow in SILVER oz : 395.67 Change : 10.71 or 2.78% Dow Industrial : 12,951.78 Change : -13.82 or -0.11% US Dollar Index : 79.67 Change : -0.322 or -0.40% Woe, Woe, smarting day for the silver and GOLD PRICE. Not much else prospered, either. Today the GOLD PRICE tumbled $25.20 (1.5%) to $1,694.40 at the Comex close. Silver lost 94.7 cents (2.81%) to end Comex at 3273.4c. Here's how gold's day played out. Overnight it dropped to $1,700 but climbed back above $1,705. Come New York open and the selling began, driving gold down to $1,693 by 9:30. It gapped up, failed to breach $1,700, then traded mostly sideways until about 5:30 Eastern time when for about 30 minutes it traded back and forth between $1,688 and $1,698. Now it has levelled off to about $1,698. It's conceivable gold might stop here, but since it broke that neckline support, not likely. Momentum points down, as gold is floating below its 50 day moving average ($1,736.41) and its 20 DMA (1,725.68). Logical stopping points are the clustered 200 (at $1,665.40) and 150 ($1,661.78) DMAs, just a bit below the last low at $1,672.50. Below those is the uptrend line from the June low today about $1,640. Other half of my mind is screaming, "Whipsaw!" Just about the time you switch position, market turns on a dime and runs the other way. Here's another eyecatcher: draw a line under the end- September low at $1,674.10, November low at $1,672.50, and it strikes today's market about $1,680. Naaa, unlikely. If this is the last leg down, most likely is that it exceeds the November low and touches that 150 DMA. Of course, it could whipsaw back the other way, but would have to rise above $1,725 resistance (also the 20 DMA) to evidence that. Nothing to do but stand aside and wait. However, I would buy some at $1,662 and more at $1,640. The SILVER PRICE punctured 3320c about 1 a.m. Eastern time, but traded up over 3340c, vacillating between there and 3320c until about 7:30. Selling began then that took silver below 3320c to 3280c by 8:30. By 9:30 silver had found its nerve again and bounced up to 3310. Failing to hold on, it hit its 3267c low about 1:30, then climbed above 3280c to trade between there and 3300c the rest of the day. Odd, how silver's low and gold's both came in about Comex closing time. Looks like a little Sherwin- Williams to spruce up that old tape. Silver has divers safety nets below. There's that old neckline support at 3200c, then the 300 DMA at 3129c, just above the 200 DMA at 3098c. If all those give way, the uptrend line from June comes in about 3000 - 3050c. So where are gold and silver? UNLESS they catch in the next couple of days and reverse upward, I misjudged the end of the correction and called it too soon. However, this doesn't change my interpretation of events since August. The August rally took both metals through their downtrend lines from the 2011 highs, effectively ending the corrections following those highs. We saw the first little upleg-let of that rally that topped in September. Now it appears this last leg down of that post September correction must travel a bit further down to find its feet. Mean time, we watch, Oh, and buy a little more silver at 3200c and 3150c, and 3050c. Don't ever let these short-term flip-flops blind you to the big picture: silver and gold remain in a PRIMARY UPTREND, a 15 - 20 year trip that has another 5 - 10 years to run. Best strategy is never to trade in and out, whipsawing yourself and emptying your own pockets, but to climb aboard that bull and ride, and never let him shake you off. US DOLLAR INDEX, having signalled its mind to move lower yesterday, consummated that threat by losing 32.2 basis points (0.41%) slicing clean through an old support line. Next support lies about 78.80, but when the dollar slices that, blood will gush the sharks will gather, and the mayhem will become general. Better shuck those dollars for something with more staying power -- and I DON'T mean Yen or Euros, or stocks. Euro is waving a flag, blue I reckon, poking through that short term downtrend line. All set up to run higher, and could reach 134.50 before the next inevitable crisis sucks the wind out of its sails. Rose 0.29% today to $1.3093. Yen jumped 0.34% to 122.03c/Y100. It's gappy up and down, a wretched chart. However, while candidate Abe is talking it down, the US dollar is lifting it up. No good thing awaiteth the yen. US$1=Y81.95=E0.7638=0.030 549 oz Ag = 0.000 590 oz Au. Since Thursday last stocks have been unable to climb, blocked about 13,050. Dow held the loss to 13.82 (0.11%) today, closing at 12,951.78. Dow lost 2.41 (0.17%) to 1,407.05. I reckon stocks are hard pressed to make any headway against the storm of selling that Obama's threatened tax increase has sparked, like hitting a mule with a cattle prod. Everybody wants to take profits this year before they have to pay twice as much tax next year. My, my! This soak the rich scheme, it is sure enough one brilliant program, ain't it? If I hear the inanity "fiscal cliff" one more time, I am going to tap the speaker between the eyes with a ball peen hammer. I've seen soap operas that made more sense and were more believable. These people aren't responsible enough to make decent snake-oil salesmen. Listen! It would take a statesman of the stature of Washington or Jackson or Jefferson Davis to solve the mess in Washington, and today in America men like that are rarer than passenger pigeons. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. | |

| Hugo Salinas-Price: The Price of the Dollar Posted: 04 Dec 2012 04:26 PM PST This posting includes an audio/video/photo media file: Download Now | |

| The Answers To Today's Most Common Questions Posted: 04 Dec 2012 03:31 PM PST Jim Sinclair's Mineset My Dear Extended Family, This should serve as an answer to more than 300 emails: 1. There is no top in place for the gold price. Absolutely none. 2. This reaction is an operation using the MSM multitude of reports on the Fiscal Cliff sure to occur in order to scream unopposed deflation (wrong). 3. The US Dollar and Gold are under pressure by the operators screaming Fiscal cliff, deep depression, no additional stimulation will be provided. 4. As usual since $248 Gold, they are dead wrong as to the result. 5. The fact that the Fed is the primary buyer of US Treasuries is the common denominator of all the reasons why gold is going to $3500 and above. This common denominator is simply not going to change for years. 6. The Administration proposes as part of a Fiscal Cliff compromise that the debt Ceiling be permanently removed. That means debt to infinity. 7. This is nothing more than noise. It has finally happened. I ... | |

| Gold slumps to one-month low below $1,700 Posted: 04 Dec 2012 03:22 PM PST

"The typical investor makes portfolio decisions at month's beginning and month's end, and so sometimes we see greater-than-average market moves during these time windows," said Vedant Mimani, lead portfolio manager of the Atyant Capital Global Opportunities Fund. … And with many traders still seeing gold as a commodity, the drop makes sense in light of the stalled fiscal cliff/debt ceiling talks, according to Peter Grant, chief market analyst at USAGOLD, a firm which offers gold research and analysis and also sells gold coins and bullion. Even so, "whether a deal can be struck and the can is kicked, or whether we topple over the cliff" of spending cuts and tax hikes, "the underlying fiscal situation is clearly unsustainable," he said. The Federal Reserve will likely expand its third round of quantitative easing and "that will continue to underpin the gold market," he noted. [source] | |

| Gold Seen to Triple on World Economic Deterioration Posted: 04 Dec 2012 03:12 PM PST 04-Dec (Bloomberg) — Rob McEwen, chief executive officer of McEwen Mining Inc. and founder of Goldcorp Inc., talks about gold production and prices. He speaks with Guy Johnson on Bloomberg Television's "City Central." [video] PG View: McEwen advises having some "insurance" in the form of gold, as debt continues to accumulate to levels that exceed the ability of the economy to finance it. McEwen also says that he prefers physical gold to paper representations. | |

| PIMCO's Gross Again Recommends Gold Posted: 04 Dec 2012 02:42 PM PST 04-Dec (SeekingAlpha) — Billionaire Bill Gross, the managing director of Pimco, one of the largest fixed-income investment companies in the world, and the man charged with stewarding the world's biggest bond fund in the Pimco Total Return Fund (PTTRX) during these dangerous times has once again recommended that investors buy gold. Bill is turning into something of a real gold bug; that is, after hinting around about "real assets" for some time now and avoiding actually writing the "G-word" in his weekly commentary, something that he now does on a fairly regular basis. In his December Investment Outlook, Gross adds to the growing collection of recent commentaries that have popularized the practice of questioning rosy assumptions about economic growth. In the case of the U.S., more and more wise men are now thinking that sustained growth rates of 3% or 4% are a thing of the past. According to Gross and others, this development has important implications for investors. As an aside, anyone looking for the real tragedy in the ongoing fiscal cliff debate in Washington should peruse the heady assumptions for economic growth that both sides are using when figuring how much they might be able to shrink the budget deficit. As per the current Congressional Budget Office baseline forecast, it averages a farcical 4% per year from 2014 to 2017. [source] | |

| Central Banks Hedge Their Bets Posted: 04 Dec 2012 02:40 PM PST By: John Browne Tuesday, December 4, 2012 Gold appears to be headed for an impressive price appreciation for the second half of 2012. Since the beginning of July, gold is up almost 10 over the same time frame. What is noteworthy here is that in recent months, fears of a worldwide recession have increased markedly. It used to be considered axiomatic that recession created adverse conditions for commodities (a reality that has helped push down the price of crude oil thus far in 2012). How then can we understand the movement in gold? Reports have recently been released that throw particular light on the degree to which central banks around the world are accumulating gold. These activities must be playing a significant role in keeping the heat turned up when it may be otherwise cooling down. Given the extraordinary degree of insight that central bankers are expected to have, what do they see tha... | |

| Posted: 04 Dec 2012 02:27 PM PST We have seen the charts on Zero Hedge showing youth unemployment of 50% in Greece and Spain and we shake our heads and say I'm sure glad were not Europe. I think Europe needs to hire the drones from the BLS to massage their numbers for them. The BLS reports our youth unemployment as follows: 16 to 19 year olds – 23.5% 20 to 24 year olds – 12.7% Isn't that precious? It's also complete and utter bullshit. Here are the facts:

Edward Bernays would be so proud of the BLS drones. I don't buy the bullshit about these people being in school, therefore they aren't in the workforce. I got a job at the age of 16 and have worked every year since. In college I worked two jobs for a year. Where I come from you got a job at 16 years old to pay for your car, clothes, concerts and sports. Everyone I knew was working from the age of 16. No matter how the BLS spins the data, the truth is that the youth unemployment rate in the United States of America is 54%. http://www.bls.gov/web/empsit/cpseea13.htm

Worst Since World War II: 50% Unemployment: Over Six Million Teens and Young Adults Are Out of Work and Not In SchoolAmid a worsening fiscal crisis, a crumbling economy, and the destruction of over 40% of America's wealth in just the last few years, it should be quite clear that this is no ordinary recession. In fact, with progressively dwindling job opportunities, a long-term downward trend in real estate prices, and the near doubling of participation in emergency benefits programs like food stamps and disability, one could make the argument that the United States is smack-dab in the middle of the next Great Depression. The notion that we are potentially facing a decades-long paradigm shift which threatens to alter the very fabric of American life is becoming a stark reality for many, especially America's younger generations who, according to a new report from the Annie E. Casey Foundation, are experiencing the highest jobless rates since at least World War II:

The prospects for the Millennial Generation, who once enjoyed the seemingly never ending prosperity of McMansions, high-end technology and brand name apparel provided by their debt-laden parents, are rapidly disappearing. The most challenging jobs market since the last Great Depression, coupled with an inability to acquire an education and trade skills due to tightened student loan requirements, yields an untenable situation for America's youth. Combine this with the fact that most of these kids have or will soon be having kids, and you have tens of millions more Americans added to already overburdened government safety nets. Reality television shows and government education convinced many teens and young adults that they would enjoy a carefree life of riches and luxury. Never would they have even entertained the idea they would instead be plagued with a lifetime of misery, poverty and government dependence. It's a hard-knocks life, and it's about to get a whole heck of a lot worse for a lot of people. | |

| The Gold Sandwich. Chew Carefully Posted: 04 Dec 2012 02:17 PM PST When everything around you becomes more complex, you can try to employ more complexity yourself, to compete, or step back from it. High-frequency trading (HFT) is a very complex approach to markets. Read More... | |

| Gold Daily and Silver Weekly Charts - Bear Raid of a Sort Posted: 04 Dec 2012 02:07 PM PST This posting includes an audio/video/photo media file: Download Now | |

| Posted: 04 Dec 2012 02:06 PM PST I'd like to make an offer to the shit throwing denizens of TBP. I typically send a bit of fiat admins way on an irregular basis. My hope is that the money gets spent to offset TBP expenses that admin incurs, however, I give it freely he can spend it however he wishes even if that includes romancing his lovely wife Avalon at the nearest dive bar. (I hear that they are fond of those places.) Ever since discovering TBP, the place has felt like home and I truly appreciate all the effort admin puts into running it. So, in that spirit I am going to send admin my usual, paltry fiat donation AND I am also going to do something I've never, ever done before. I'm going donate an actual ounce of .999 silver in the form of one Silver Bullet Silver Shield round (pictured below) along with a coin holder signed by the designer, Chris Duane himself. The current average selling price of this round on eBay is over $70! Admin can do whatever he wants with it. Sell it. Donate it. Keep it or even wear it on a chain around his neck as he navigates the 30 blocks of squalor!

In addition to that, I will donate one dollar for every individual shit throwing monkey that makes a donation to admin, up to $20. Since I'm a bit late getting this out, lets make the deadline January 5th, 2013. So, if twenty different people step up and make a donation of any size by 1-5-2013, I will add $20 to my paltry fiat donation. If only fifteen people donate, I'll add $15. I'll trust admin to tell me how many monkeys make a donation. He seems like an honorable guy. Hopefully admin can keep this post bumped to the top of the list until 1-5-2013 since shit throwing monkeys are easily distracted. | |

| Posted: 04 Dec 2012 02:03 PM PST An interesting interview, by "the Russian Limbaugh". A different viewpoint and take on American politics by someone very familiar with socialism. The Russian Limbaugh Interview with Victor Topaller, the prominent Russian-American journalist, radio and television host. "We are not better than native born Americans, and of course not smarter. We've just been to the last stop of this bus." – Sergei Dovlatov A: Well, probably because we both adhere to very conservative views. Q: Victor, we both went through the Soviet education system and memorized Karl Marx' Communist Manifesto and Lenin's works by heart. If we didn't we would not have gotten our diplomas. I personally think that the ideological heads of the Democratic Party and liberal labor unions simply copied their programs and slogans from there. What's your opinion on this? A: There are no opinions here, only facts, and the facts are that Lenin's "Global Socialist Revolution" is becoming a reality. Speaking of which, the "Leader of the Proletariat" was far from naive; he predicted that the global revolution will be carried out mainly by what he referred to as the "useful idiots from the West" – all that far-left-liberal riffraff… which is exactly what's happened. And as for unions, I'd rather not comment. After all, who wants to mess with them? Note that Lenin called labor unions "The Schools of Communism" – what else can one say?

Q: Your previous article "The House is Lost" went viral with the Russian speakers in America, Israel, and even in Russia itself. I personally received it over 40 times from my friends all over the world. Please, explain to our American friends what is the meaning of the title "The House is Lost"? A: The title quotes the protagonist of Mikhail Bulgakov's "Heart of a Dog", Philip Philippovich Preobrazhensky. This professor of medicine, who despises Socialism and the Soviet regime with every fiber of his being, speaks of his beloved apartment building, which the Communists wrecked beyond recognition, leaving one no choice but to flee. It's clear that it's not so much about the house, but rather the country as a whole: "'What, again?' exclaimed Philip Philipovich mournfully. 'Well, this is the end of this house. I'll have to go away – but where to? I can see exactly what'll happen. First of all there'll be community singing in the evening, then the pipes will freeze in the lavatories, then the central heating boiler will blow up and so on. The House is Lost.' 'Philip Philipovich worries himself to death,' said Zina with a smile as she cleared away a pile of plates. 'How can I help it?' exploded Philip Philipovich. 'Don't you know what this house used to be like?'" This quote is the source of the title of my article on Obama's reelection. You know, I had once the audacity to notice that if at least a fraction of the not-yet-terminally-insane U.S. politicians were familiar with Russian Literature beyond Tolstoy, Dostoevsky and Chekov: with the likes of Bulgakov, Platonov,Zoshchenko orNagibin; this country wouldn't be in such a shameful condition. Incidentally, I think we can claim to understand American Literature better than Americans understand Russian Literature – we grew up reading Jack London, O.Henry, Mark Twain, James Fenimore Cooper, Mayne Reid, while authors like Salinger, Vonnegut, Irving, Edgar Allan Poe, Dreiser, Hemingway, Steinbeck, Capote, Bradbury (one can keep on going) were revered as favorites. And of playwrights, it's enough to mention Albee, Williams, Miller… Q: What do you think about political correctness in America? A: Any noble undertaking, taken to absurd extremes, becomes a terrible evil. This is exactly what happened in America. Do you already call your "Christmas Tree" a "Holiday Tree"? Congratulations! I heard that soon the word "Woman" will be banned for sexual discrimination, and replaced by "Vaginamerican". God – how many idiots are there in this world? To me, political correctness is a serious evil. Taken to its absurd extreme, it becomes an ethical injury to this country, as it teaches apathy, falsehood and vileness. My friend, the famous writer, Mikhail Veller got it right when he said: "We all know that this is a cat, but we can't call it a 'cat' because it may get offended, so we call it 'a tailed quadrupedal'. We all know that the cat likes gobbling raw fish, but saying that would also be offensive, so we say that it 'enjoys fresh sea food'. In the meantime, the cat shits scot-free wherever it likes, leaving the lobby smelling so awful that none would enter the building." I think that's a very accurate analogy of political correctness and the crap-hole it dug us into. Political correctness is the duplicity and insincerity between what one says, and what one truly means, which was very common in the Soviet Union, but is far more dangerous here in America, given that it's a free, democratic society. Q: Israel, what can be done? A: Nothing has to be done. The right question is what should no longer be done. We have to stop deceiving, playing dumb, and pretending that the issue at hand is merely two sides in conflict, rather than the heroic struggle of the only civilized nation in a region otherwise inhabited by brazen bandits. Murderers and criminals should be called murderers and criminals. We need to realize that negotiating with terrorists is a dead end, a catastrophe; that back in the day pirates went extinct only when they were declared outlaws and cracked down upon by military forces. We must realize that Israel is our only ally in the region; and that what's good for Israel is good for America, and vice versa. By the way, Hamas is on the FBI's and Department of State's list of terrorist organizations. If I'm not mistaken, the famous Soviet nuclear physicist and dissident Andrei Sakharov once said, that ultimately, honesty in politics brings success, while lies and hypocrisy that seem so "profitable and visionary" result in a total collapse. | |

| Yamarone - The Collapse Is Getting Even Worse Posted: 04 Dec 2012 01:00 PM PST  King World News released an incredibly sobering interview over the weekend with Egon von Greyerz, which detailed the reality of what is really happening around the globe in terms of the economy. KWN has received tremendous interest in this piece and wanted to follow it up today with a warning from one of the top economists in the world. King World News released an incredibly sobering interview over the weekend with Egon von Greyerz, which detailed the reality of what is really happening around the globe in terms of the economy. KWN has received tremendous interest in this piece and wanted to follow it up today with a warning from one of the top economists in the world. This posting includes an audio/video/photo media file: Download Now | |

| Posted: 04 Dec 2012 12:41 PM PST December 4, 2012

So quipped The Daily Reckoning's Joel Bowman yesterday during a flurry of intercontinental emails. Surely, it's more entertaining than this: "Stocks and commodities," reports the Financial Times this morning, "are struggling for traction as investors express renewed concern about the prospects for the U.S. economy amid continual bickering in Washington over the fiscal cliff."

The big "news" yesterday was that the House Republicans came forward with a budget proposal to counter the one the White House offered on Friday.

While you ingest, keep in mind, in the logic of Washington…

First, the White House…

(Pardon us while we stifle a yawn.)

A deficit of $600 billion would have set a record in any year before 2009. "That 'cliff,'" a reader quips, "is about three feet to the bottom! Let's just go off it and, hopefully, get a sample of the self-discipline we really need to get our financial house in order."

A survey of the Fed's 18 "primary dealers" — the banks required to bid every time the Treasury auctions its paper — found that Uncle Sam will reduce net sales of its debt from $1.2 trillion to $950 billion during fiscal 2013. That's because they expect Operation Twist to turn into QE4 at the end of the year, with the Fed buying $45 billion in Treasuries every month. Result: The Fed would be "effectively absorbing about 90% of net new dollar-denominated fixed-income assets," according to a Bloomberg summary of remarks from primary dealer J.P. Morgan Chase. "I guess the bond vigilantes are nowhere to be found, eh?" remarks EverBank's Chuck Butler in today's Daily Pfennig. "Back 'in the day,' they would take a country's bonds to the woodshed if the central bank of that country were going to absorb 90% of the bonds. I shake my head in disgust, folks."

Gold has sunk below $1,700 for the first time in a month, at $1,698. Silver's down to $33.10. Can't chalk up the move to dollar strength — the dollar index is down to a six-week low, at 79.9.

"Taxpayers," explains the Citi report, "already (or will) indirectly subsidize both the housing and health care sectors by covering [Fannie and Freddie] losses and paying for a health care system that pays out more than it receives in revenues. If the continued misalignment of educational resources ultimately leads to government 'forgiveness' of student loan debt, it will simply be one more example of fiscal subsidies for a narrow demographic." Expect the fallout, says Dan, next summer — exactly four years after the volume of federally funded student loans surged… and payments come due for the first wave of graduates.

The Associated Press has crunched trade numbers from the International Monetary Fund and concluded that as of last year, China is the No. 1 trading partner for 127 countries, compared with 76 for the United States. That's almost a mirror image of the figures from 2006: Then, the U.S. was No. 1 for 124 countries, China 70. No wonder Asian and Pacific countries are turning up their nose at the Trans-Pacific Partnership (TPP) — a secret treaty spearheaded by the U.S. and excluding China. As we noted a week ago today, original TPP signatories New Zealand and Australia are hedging their bets and joining talks aimed at a similar treaty — spearheaded by China and excluding the U.S. The announcement came during a TPP summit in Cambodia, with none other than President Obama in attendance.

"It is symptomatic of the national condition of the United States," Goldman wrote last week at Asia Times, "that the worst humiliation ever suffered by it as a nation, and by a U.S. president personally, passed almost without comment… "What does the United States have to offer Asians?" Goldman asks rhetorically… offering the following answers:

"As 3 billion Asians become prosperous," says Goldman, "interest fades in the prospective contribution of 300 million Americans… America's relative importance is fading."

"It's no wonder that office rents are up over 50% on the year and vacancy rates are practically nil."

"Uber is everyone's private driver," says a description at Apple's App Store. "Using the app, you can make an on-demand request for a private driver. Leave the cash at home, because we'll automatically charge your credit card on file and email you a receipt. Request a ride in one of our many cities, and get a classy, convenient, and reliable experience anytime." In other words, Uber is shaking up a highly regulated and coddled taxi and limo industry. (We've described New York's nonsensical taxi medallions here.) "Transportation regulators and car service operators from cities in the United States and Europe," reads a New York Times account from a recent conference in Washington, "proposed guidelines that would effectively force Uber, a San Francisco startup, to cease operations in the United States… "The startup, which has raised $50 million since 2010, generally does not consult transportation regulators before it starts rolling in each city. Because it is not an actual provider of rides, it says that it is not subject to such regulation." "If you put yourself in the position to ask for something that is already legal," says Uber founder Travis Kalanick, "you'll find you'll never be able to roll out. The corruption of the taxi industries will make it so you will never get to market."

"They're clearly designed to shut down Uber," Kalanick says. "How are you supposed to tell somebody in a city that if they want a town car, they can't get one in less than 30 minutes, and that's illegal and it's bad for them to do that?" How, indeed…

"Unless these folks all inherited their wealth — highly unlikely — they created it somewhere, and they likely created some jobs along the way. Last time I looked for a job, the poor and downtrodden were not hiring, nor were they good prospects for me when I started up my business and was looking for clients. "As always, thanks for The 5."

"Wake up, people. Government is all of our problems, rich or poor, Republican or Democrat. I think the government has succeeded with this 1% crap. Now that we are all fighting with each other about who has this much and who should pay for this or that, what are we not seeing??? "We are going to miss something and get blindsided with something really bad for everyone. Just stop!!" The 5: It's much easier for politicians to squabble about who pays for government functions than to confront the question of what functions government ought to perform, no? Cheers,

Addison Wiggin The 5 Min. Forecast P.S. If you're still in the midst of holiday shopping, Laissez Faire Books is offering 50% off any book on the site from now until year-end. We'll give you a moment to let that sink in: Half off. Any title. Back up the truck! But act soon to assure timely holiday delivery.

Now with the start of the Sessions less than 48 hours away (you can still secure your best available price on the recordings at this link), we've dispatched Chris for Roving Reporter duties. From what follows, we'd venture to say he's already getting into the spirit… "Uh… el bano?" I asked the employee of the small grocery store, officially marking my first foreign words in a foreign country. After a series of trains, planes and automobiles, and jumping through more hoops than a dachshund in a dog show to get a passport, I'm now sauntering in paradise, munching on fruit — surfing pelicans at my front, trees filled with monkeys and geckos at my back… The things we do for work.

You see, I'm not the biggest fan of hurling through the sky in a metal pod with wings, but nevertheless, I'm obliged to agree with world traveler Paul Theroux when he writes, "You define a good flight by negatives: You didn't get hijacked, you didn't crash, you didn't throw up, you weren't late, you weren't nauseated by the food. So you are grateful." Grateful I am. And conversely, if you define the destination by positives, the beautiful Rancho Santana is encyclopedic. Hello, dear reader, my name is Chris Campbell, and over the next few days I'm going to serve as your Roving Reporter for our second Rancho Santana Session of the year. Soon, we will be meeting up with the familiar favorites Chris Mayer, Eric Fry and Joel Bowman to hammer out the details of the week. And later, we'll convene with the rest of the no-less exciting roster: Vancouver vet Brad Farquhar of Nomad Capital, tax specialist John Towers and founder of Compound Capital Management Joe Altman. I'll be keeping you updated on the happenings, adventures, inevitable misadventures and, of course, all the global investment advice, insights and observations my mind and your portfolio can handle. Brace yourself… you're in for a treat. For now, though, the waves are calling. And as your Roving Reporter, it is my duty to investigate thoroughly. Stay tuned… | |

| Gold Bulls Attempting to Hold the Line at the 100 Day Moving Average Posted: 04 Dec 2012 12:30 PM PST [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] Today's breach of both psychological as well as technical chart support centered near the $1700 level has set the bulls on their heels while raising the spirits of the gold bears. The market has not been able to get its feet solidly underneath it since that beating it took last Wednesday. When the overnight seller/sellers of large size managed to shove it down below the low of that last Wednesday, they found the stops that they were hoping to find and then some. The market is now moving purely on technical momentum as there is really not a lot in the way of fundamental developments. The Dollar is actually lower today while at the same time reports indicate strong buying of gold in Asian markets. Don't forget also the surge in gold bullion coins as the public begins to finally show some signs of nervousness/unease with the general state of the US financial picture. A large portion of this move... | |

| Turk, Embry, Sinclair comment on gold and silver action Posted: 04 Dec 2012 12:23 PM PST 2:16p ET Tuesday, December 42012 Dear Friend of GATA and Gold: Interviewed today by King World News, GoldMoney founder and GATA consultant James Turk gives a rationale for governments and their agents to be pounding the monetary metals today. Turk says: "The reason they are attempting to make gold and silver look weak here is because these monetary metals will provide the foundation when the monetary system is eventually re-constructed, and the price of gold and silver will be far higher than the numbers they are painting the tape with today. But before that day comes, they need to shake as many people out of these markets as possible so they are victims of the greatest wealth transfer in history, not beneficiaries." An excerpt from Turk's interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/12/4_Tu... Also interviewed by King World News today, Sprott Asset Management's John Embry has similar observations: "How many times in the last 15 years have I seen the type of action we witnessed last week? You can set your watch by this type of action. We had big open interest and then they attack it. So down gold and silver go as they clean out the weak hands. The metals will rebuild themselves, and one of these times it won't happen that way. The physical market will overpower these paper players. It didn't happen this time, but at some point it will." Embry's interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/12/3_He... And Jim Sinclair brushes off today's market action as a lot of propaganda: http://www.jsmineset.com/2012/12/04/the-answers-to-todays-most-common-qu... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Fred Goldstein and Tim Murphy open All Pro Gold Longtime GATA supporters Fred Goldstein and Tim Murphy have brought their many years of experience in the precious metals and numismatic coins to All Pro Gold as metals brokers who specialize in the delivery of gold and silver bullion bars and coins as well as numismatic gold and silver coins. Fred and Tim follow these markets closely and are assisted by a team of consultants in monitoring market trends. All Pro Gold offers GATA supporters competitive pricing on all bullion products and welcomes inquiries. Tim can be reached at 602-299-2585 and Tim@allprogold.com, Fred at 602-799-8378 and Fred@allprogold.com. Ask about their ratio strategy and the relationship of generic $20 dollar gold pieces to 1-ounce gold bullion coins. Visit their Internet site at http://www.allprogold.com/. Join GATA here: Vancouver Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Opinion Around the World Is Changing When Deutschebank calls gold "good money" and paper "bad money". ... http://www.gata.org/node/11765 When the president of the German central bank, the Bundesbank, pays tribute to gold as "a timeless classic". ... http://www.forbes.com/sites/ralphbenko/2012/09/24/signs-of-the-gold-stan... When a leading member of the policy committee of the People's Bank of China calls the gold standard "an excellent monetary system". ... http://www.forbes.com/sites/ralphbenko/2012/10/01/signs-of-the-gold-stan... When a CNN reporter writes in The China Post that the "gold commission" plank in the 2012 Republican platform will "reverberate around the world". ... http://www.thegoldstandardnow.org/key-blogs/1563-china-post-the-gop-gold... When the Subcommittee on Domestic Monetary Policy of the U.S. House of Representatives twice called on economist, historian, and gold standard advocate Lewis E. Lehrman to testify. ... World opinion is changing in favor of gold. How can you learn why and what it will mean to you? Read the newly updated and expanded edition of Lehrman's book, "The True Gold Standard." Financial journalist James Grant says of "The True Gold Standard": "If you have ever wondered how the world can get from here to there -- from the chaos of depreciating paper to a convertible currency worthy of our children and our grandchildren -- wonder no more. The answer, brilliantly expounded, is between these covers. America has long needed a modern Alexander Hamilton. In Lewis E. Lehrman she has finally found him." To buy a copy of "The True Gold Standard," please visit: http://www.thegoldstandardnow.com/publications/the-true-gold-standard | |

| BIS gold report hints at repatriation by central banks Posted: 04 Dec 2012 12:13 PM PST I have been checking on the changes that have taken place to the gold banking business carried out by the Bank for International Settlements since March 2009 and the bank's use of gold derivatives (essentially all are gold swaps), which have grown from zero as of March 31, 2009. All the data in the table below is sourced from BIS annual reports and from the bank's 2012 interim report published in early November. | |

| Gordon T. Long–Reservations About The Dollar’s Reserve Status 04.Dec.12 Posted: 04 Dec 2012 12:12 PM PST www.FinancialSurvivalNetwork.com presents Gordon T. Long is an Austrian Economist who is greatly alarmed at the impending demise of the dollar as the world's reserve currency. He quotes Ludwig von Mises extensively when discussing sound money. Mises believed that sound money was one of the pillars of a free society. He believed that sound money ranked up with the Constitution and the Bill of Rights in protecting freedom. Now we've reached a point where there's no longer any limitations upon government power and everyone's liberty is at risk. Go to www.FinancialSurvivalNetwork.com for the latest info on the economy and precious metals markets This posting includes an audio/video/photo media file: Download Now |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

When financial markets in the United States crash, so does the U.S. economy. Just remember what happened back in 2008. The financial markets crashed, the credit markets froze up, and suddenly the economy went into cardiac arrest. Well, there are very few things that could cause the financial markets to crash harder or farther than a derivatives panic. Sadly, most Americans don't even understand what derivatives are. Unlike stocks and bonds, a derivative is not an investment in anything real. Rather, a derivative is a legal bet on the future value or performance of something else. Just like you can go to Las Vegas and bet on who will win the football games this weekend, bankers on Wall Street make trillions of dollars of bets about how interest rates will perform in the future and about what credit instruments are likely to default. Wall Street has been transformed into a gigantic casino where people are betting on just about anything that you can imagine. This works fine as long as there are not any wild swings in the economy and risk is managed with strict discipline, but as we have seen, there have been times when derivatives have caused massive problems in recent years. For example, do you know why the largest insurance company in the world, AIG, crashed back in 2008 and required a government bailout? It was because of derivatives. Bad derivatives trades also caused the failure of

When financial markets in the United States crash, so does the U.S. economy. Just remember what happened back in 2008. The financial markets crashed, the credit markets froze up, and suddenly the economy went into cardiac arrest. Well, there are very few things that could cause the financial markets to crash harder or farther than a derivatives panic. Sadly, most Americans don't even understand what derivatives are. Unlike stocks and bonds, a derivative is not an investment in anything real. Rather, a derivative is a legal bet on the future value or performance of something else. Just like you can go to Las Vegas and bet on who will win the football games this weekend, bankers on Wall Street make trillions of dollars of bets about how interest rates will perform in the future and about what credit instruments are likely to default. Wall Street has been transformed into a gigantic casino where people are betting on just about anything that you can imagine. This works fine as long as there are not any wild swings in the economy and risk is managed with strict discipline, but as we have seen, there have been times when derivatives have caused massive problems in recent years. For example, do you know why the largest insurance company in the world, AIG, crashed back in 2008 and required a government bailout? It was because of derivatives. Bad derivatives trades also caused the failure of  How much sicker can people get? It seems like our world is becoming more sadistic and more cruel with each passing day. If you doubt this, just keep reading. Sadly, I could have easily included hundreds more examples just like these. Changes are happening to our society at a very deep and very fundamental level. Everywhere you look, hearts are growing colder and it seems like we are completely surrounded by

How much sicker can people get? It seems like our world is becoming more sadistic and more cruel with each passing day. If you doubt this, just keep reading. Sadly, I could have easily included hundreds more examples just like these. Changes are happening to our society at a very deep and very fundamental level. Everywhere you look, hearts are growing colder and it seems like we are completely surrounded by  Few people realize that the debt ceiling is aligning right on track with the

Few people realize that the debt ceiling is aligning right on track with the

"Equating tax hikes and spending cuts in the U.S. with a 'fiscal cliff' is like calling a spot of exercise and a balanced diet 'Caloric Armageddon' for the morbidly obese."

"Equating tax hikes and spending cuts in the U.S. with a 'fiscal cliff' is like calling a spot of exercise and a balanced diet 'Caloric Armageddon' for the morbidly obese."

Now, the Republicans…

Now, the Republicans… Divide these numbers by 10 to get a true idea of the impact. We're talking about a difference between $180 billion versus $220 billion in "savings." Or in the context of a $1.2 trillion deficit, the big standoff in Washington is about whether the deficit will be trimmed by 15%… or 18%.

Divide these numbers by 10 to get a true idea of the impact. We're talking about a difference between $180 billion versus $220 billion in "savings." Or in the context of a $1.2 trillion deficit, the big standoff in Washington is about whether the deficit will be trimmed by 15%… or 18%.

More than half a trillion in the coming year alone. But even then, assuming a $1.2 trillion deficit, we're talking only about cutting the deficit in half.

More than half a trillion in the coming year alone. But even then, assuming a $1.2 trillion deficit, we're talking only about cutting the deficit in half.

"No matter what I looked at," he writes in the current issue of M-ZINE+, the country's business weekly, "I found a market that was tiny relative to its neighbors and to its own history. Consider office space. Hanoi, a city with half the population of Yangon, has nearly 17 times as much office space. There is one building in Bangkok that has more space than all of Yangon.

"No matter what I looked at," he writes in the current issue of M-ZINE+, the country's business weekly, "I found a market that was tiny relative to its neighbors and to its own history. Consider office space. Hanoi, a city with half the population of Yangon, has nearly 17 times as much office space. There is one building in Bangkok that has more space than all of Yangon.

Competition: It's a good thing… unless you're an entrenched,

Competition: It's a good thing… unless you're an entrenched,

As noted above, some of our crew is convening in Nicaragua for a new round of

As noted above, some of our crew is convening in Nicaragua for a new round of

No comments:

Post a Comment