saveyourassetsfirst3 |

- Strike Debt’s Rolling Jubilee Puts Borrowers at Risk

- Silver Dealers and Mass Hypnosis

- The Old Spanish Gold Mine in the Sierra Estralla Mountains

- Eric Sprott: We Will Go Public If They Don’t Send Us Our Silver

- Eric Sprott: Gold To Rise 500% From Current Levels

- The coming silver price eruption

- Central Banks are NOT ordinary Gold Investors

- The Big Picture For The Week Of December 2, 2012

- 5 Big Buys By David Einhorn

- Diamond ETF GEMS Hits The Market

- Coming Week: 9 Reasons The 1% Are Bearish

- Eric Sprott - Gold Could Move Up 500% From Current Levels

- J. D. Alt: 2020

- Gold Market Lending

- CEF Weekly Review: Cohen & Steers Preferred

- Civil Disobediance **Video**

- The Gold Standard: A History and Debate 2012

- Bron Suchecki - ETF PRICE SUPPRESSION MECHANICS

- Silver and Gold Technicals

- TPTB in India are getting very nervous!

- Jim Sinclair: Use Logic, Not Your Emotions

- Commodities: Gold, Silver Due For A Correction

- Iran importing gold to evade economic sanctions, Turkish official says

- Gold – Solution to the Banking Crisis: Eric Sprott & David Baker

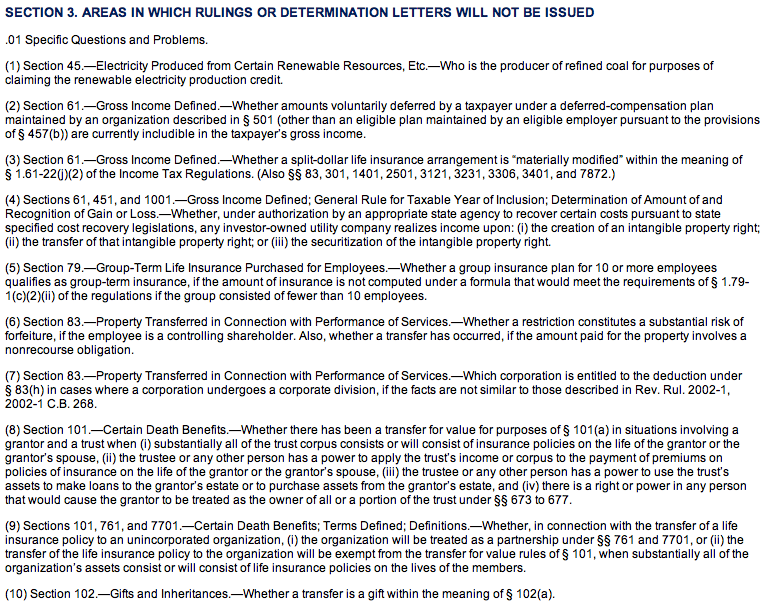

| Strike Debt’s Rolling Jubilee Puts Borrowers at Risk Posted: 02 Dec 2012 11:48 AM PST Last month, I criticized the well meaning but naive strategy of the Occupy Wall Street group Strike Debt for dealing with consumer debt, which is to buy severely discounted debt from debt collectors and forgive it. My main complaint was that there were more productive approaches, such as wider publicity and distribution of the Debt Resistors' Operations Manual, providing more counseling and legal support to borrowers, and using debt purchases to develop cases against the debt sellers. By contrast, the Rolling Jubilee increases the profitability of bad system by providing more revenues to the incumbents, while the debt purchases are unlikely to do more than help a few random people. It might make for feel-good PR, but it won't make a dent in the problem. Perversely the post got pushback on the last (and by implication, the least important) issue raised, namely, that of possible tax problems with the scheme. I wanted to revisit this issue and demonstrate why the responses of allies and members of Strike Debt have failed to put the issue to rest, and more important, why this matters. The short version is that Strike Debt maintains that there is no risk here, when as we will demonstrate, the outcome is not knowable at this juncture (yes, that is unsatisfying, but welcome to the world of tax). It's possible that things will work out just fine for the Rolling Jubilee. But if not, the ramifications to Strike Debt and the borrowers whose debt was cancelled would be significant. Thus, to dismiss this very real possibility is irresponsible. Tax issues are nerdy. You need to be prepared to read this entire post, carefully. Go get some coffee or a cola. I'm planning to box readers about the ears if they raise issues that were addressed in the post. To review: normally, the cancellation of indebtedness is treated as income unless the party is in bankruptcy or can establish that they are insolvent. Strike Debt claims they do not need to issue 1099-Cs, the usually-required notification to the IRS that debt has been forgiven. They further claim that they have "double checked" with the IRS on this matter. In addition, Strike Debt is conducting its activities through a 501 (c)(4), which is a form of tax exempt organization (a "Civic League and Social Welfare Organization"). As we will also discuss, its debt forgiveness plan also appears to run afoul of the IRS's published requirements for a 501 (c)(4). Why the Tax Risk is Real, and Strike Debt's Due Diligence is Inadequate While the Rolling Jubilee site currently does not discuss the tax implications for borrowers whose debt has been forgiven, the Strike Debt scheme rests fundamentally on the idea that their cancellation of debt can be construed as a gift. (note that the site previously stated, "a project like this …will almost certainly have no effect on anyone's taxes."). Otherwise, borrowers will have to report the cancelled debt as income, which in many cases would require them to pay more in taxes. And this issue is binary: a transfer is either a gift or it is income. It is important to understand that issue separate from whether Rolling Jubilee has an obligation to report to the IRS on debt cancellations (as in the borrower liability for taxes is independent of whether the income is reported). It is also important to understand that this is a novel tax argument. Allies of Strike Debt claim the movement has "double checked" with IRS on the impact of their plan on debtors, but this statement is a sign of inadequate tax knowledge. The only type of reading from the IRS that can be relied upon is a written opinion, known as a ruling. Yet the IRS has always included the question of whether a transfer is a gift (and a cancellation of debt is a transfer) on their annual published list of questions on which it will not issue a ruling. Moreover, even if Rolling Jubilee had been able to get a ruling, a ruling is valid ONLY for the party requesting it. Thus Rolling Jubilee could not obtain a ruling as to the tax implications for borrowers; it can get rulings only regarding its own tax matters. Thus whatever view Strike Debt got from the IRS on the gift question (I'd hazard from a phone rep) is irrelevant. The agents that answer the call center lines are not lawyers, have only 20 hours of training, and their job is to answer routine questions, like whether points on your mortgage are tax deductible, not novel and complex tax issues. Even so, they have been found to give incorrect answers 20% to 30% of the time on everyday tax matters (see here, here and here). Relying on bad tax advice from IRS does not relieve the taxpayer of the consequences, such as filing late, owing penalties or more tax. Below is the 2012 IRS "no ruling" list, see item 10: We need to underscore the basic problem: Strike Debt issue is an extraordinary question involving a rare intersection of incompatible rules. No one gives phone answers to complex questions like that, not just in the IRS but in general. Sophisticated taxpayers get tax opinions from law firms with recognized expertise in tax matters, or ask for rulings from IRS (a non-starter here), or document their positions with heavily researched memos. Rolling Jubilee should get one of its sympathetic celebrites to write a check to a serious tax lawyer to take a proper look. Now it may be that Strike Debt has confused the issue of whether it needs to file 1099-Cs with the question of borrower tax liability. Rolling Jubilee has this cheery language in its FAQ:

As one tax attorney wrote:

And the IRS does audit about 1% of the people making under $200,000 a year. (Their position on not being required to issue 1099-Cs is also debatable*, but that's not germane to the thrust of this post). There are at least two reasons why the transfer might be deemed to be income rather than a gift. The first is that Rolling Jubilee, by buying debt, is participating in a commercial activity. The second is that the IRS has very stringent notions of who proper recipients of gifts are. Middle class individuals are not seen by the IRS as proper recipients of charity. We discussed the "commercial activity" issue in our earlier post:

Moreover, middle class borrowers are not considered a proper charitable class under the tax law. For instance, see this language from a summary of a 2011 IRS private letter ruling. Notice the use of the word "exclusively":

Readers may contend that the people being pursued by debt collectors are ones that were unable to pay off their creditors, ergo they must be poor or under financial stress. That isn't necessarily so. Chase employee Linda Almonte was fired for objecting to the sale of 23,000 loans in which there was a major error in 60%, either in the amount owed or whether a judge had ruled in favor of the bank. Banks are known to sell disputed debt, debt discharged in bankruptcy, debt close to or past the statute of limitations, or where they can't successfully find borrower wages or bank accounts to garnish. Given that the debt in many cases is old (it has often been traded several times), a borrower could have gone through a rough patch, stared a creditor down, and now is in better financial shape. The real issue here is that Strike Debt will be buying the debt blind. It would be an operational nightmare to try to track down borrowers to ascertain their current financial status, and even if Strike Debt found them, there's no assurance they'd cooperate in answering intrusive questions about their financial condition. And Rolling Jubilee has never conceptualized this program as being about helping poor people but helping the indebted. Its site proclaims: "Think of it as a bailout of the 99% by the 99%." This may be admirable, but the 99% is a much bigger cohort than low income individuals. "Oh, the IRS Won't Go After This" Some supporters of Rolling Jubilee have argued that either the IRS won't find out about the debt forgiveness or won't intervene because it would look silly and OWS would ridicule them in public. I have to tell you, these are remarkably naive viewpoints. The IRS reads the newspapers. The Treasury Department separately maintains a news clipping service. The IRS also pays whistleblower bounties and performs audits. Rolling Jubilee has hardly been secretive about its plans. The IRS could ask Rolling Jubilee whose debt was forgiven. And even if the IRS does not act immediately, that is no assurance that Strike Debt is in the clear. Gretchen Morgenson's column two weeks ago dealt with a case where the IRS weighed in on an issue years after it was raised in the media. The statute of limitations on individual Federal income tax returns is three year after the filing date, so any debts forgiven in 2013 are exposed to the IRS questioning treatment of the cancellation of debt through 2017. As for the "oh, they wouldn't dare," are you kidding? Being in the tax collection business means doing things that are not popular every day of the week. The IRS routinely goes after people who win cars on game shows, with the typical result that the taxpayer has to sell the car to pay the taxes owed. Similarly, the IRS recently denied tax exempt status to an organization formed to give debt counseling to troubled homeowners. Being involved in a worthy cause does not mean you can flout the rules. The Use of a 501 (c)(4) is Also Problematic Rolling Jubilee is using a 501 (c)(4), which is a form of tax exempt organization used for "social welfare" purposes, which can include lobbying and political activities as long as they are primarily for the promotion of social welfare. However, the debt buying scheme appears to run afoul of the "private benefit" rule. From the IRS discussion of 501 (c)(4)s:

Forgiving someone's debt could be a violation of the private benefit rule. Middle class debtors are not a charitable class. Generally, individuals must be poor or distressed to constitute a charitable class. This discussion underscores the idea that only minor exceptions are permitted:

Nor would winning on the gift question save it from running afoul of the private benefit question. A transfer without consideration to a private individual who is not poor or distressed is a private benefit. The IRS recently revoked the exemption of an organization that provided down payment assistance because it did not restrict those gifts to lower-income buyers. If it were to lose its 501 (c)(4) status, Rolling Jubilee would owe additional taxes and penalties. What Would the Consequences Be if Rolling Jubilee Loses Its Tax Argument? If Rolling Jubilee's tax position is incorrect, the consequences would be ugly. In many cases, the people it claimed it was helping would be worse off than if it had done nothing. The forgiven debt would be treated as taxable income. If the individual is a non-taxpayer (as in has too little income) the debt forgiveness could push them into owning taxes, and for anyone who was a taxpayer in the year the debt was forgiven, would result in additional taxes owed. The worst of this is that in many cases, the debt forgiven by OWS would be invalid debt: past the statute of limitations, discharged in bankruptcy, disputed, paid off but for some reason not removed from a bank's systems. In these cases, if Rolling Jubilee's tax view turns out to be incorrect, the borrower will be considerably worse off, since he could have disputed the invalid debt (and debt collectors tend to roll easily) but will now have to disprove the validity of the debt to the IRS. The result is that this shifts the burden of proof: in debt collection matters, the burden of proof is on the plaintiff, the debt collector, to demonstrate the validity of the debt and the amount owed. In disputes with the IRS, the burden of proof is with the taxpayer. In addition, even if Strike Debt is correct in its gift argument, it would in some cases owe gift taxes. It does not appear prepared for this eventuality. Nor would winning on the gift question save it from running afoul of the private benefit question. Even a gift to an individual is a private benefit. If it were to lose its 501 (c)(4) status, Rolling Jubilee would owe additional taxes and penalties. * * *

What has been most disturbing about bring up these issues is the defensive, even angry, reactions to raising legitimate questions about the tax issues. What Strike Debt is doing is analogous to someone who has found a chemical that kills cancer cells in a petri dish. Rather than do animal studies, or even do a lit search on whether this compound is toxic, they've proposed to go directly to putting it in the water of individuals who have neither been informed of nor given their consent to this procedure. The previous post was analogous to saying there don't seem to be any human studies on this particular compound, but similar compounds have caused adverse reactions. Rather than do further research or get patient/borrower consent, or hold a reserve for tax litigation and paying the taxes of adversely affected borrowers, Strike Debt's allies instead are shooting the messengers. This attitude is shocking. This OWS scheme has the potential to make the people it says it wants to help worse off than if it had done nothing. As discussed longer form in the earlier post, it has other courses of action open to it that would help them combat predatory debt collectors with no downside risk. Nor does it appear to be doing any contingency planning for possible adverse outcomes. But rather than do the responsible thing, undertake a proper investigation, and make course corrections if needed, Strike Debt appears more concerned about preserving its image with its celebrity backers than the welfare of debtors it says it wants to help. –––– * The language in the FAQ suggests that Strike Debt is taking the position it will earn no income from its debt purchases. As remarkable as it may sound, the question of whether uncollectible interest is income is not a settled tax question. The IRS does provide for a safe harbor from providing 1099-Cs:

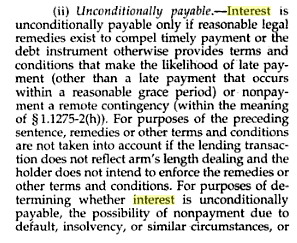

But "Gross income from lending of money" in (d) includes:

And the latest definition of "qualified stated interest" I could unearth quickly (2007 regs), this section emphasizes that it hinges on the contractual right to receive interest, and to ignore the possibility of non-payment: While this discussion of case law does indicate this issue is not straightforward, the part that raises a hurdle Strike Debt is that mere non payment of interest or distressed market value is not proof of noncollectibility. And remember, if the debt in question does not meet the IRS standard of noncollectibility, interest accrues, which means Strike Debt may have interest income:

Let's do a little math. The Rolling Jubilee site shows that they assume they will be buying debt at 5 cents on the dollar (see their front page, the ratio of the debt forgiven to the amount they have raised so far). And let's assume that the average interest rate on the debt is 15%. That's conservative: it will probably be higher. You can hardly get a rate below 12% even if you are current and have decent on unsecured consumer borrowing, ex a short term teaser offer. At $500,000 of donations (I'm assuming that counts as income) they can buy $10 million of debt. That $500,000 has to be at least 85% of total income per the test of this section. So the most they can have in qualified stated interest is $88,235. That's 5.88% of the assumed level of qualified interest $88,235/1,500,000). They have to extinguish the debt in 21 days or they might have a problem. And this, sport fans, is why they should have a heavyweight tax professional look at these issues. Even if there is a problem here, it appears it could be addressed simply by making sure that when Strike Debt acquires debt, they go through whatever steps they need to take to forgive the debt promptly. As a volunteer organization, they might not take simple steps to eliminate possible risk, which in this case might be to process debt cancellations expeditiously, if they don't realize there is reason to. |

| Silver Dealers and Mass Hypnosis Posted: 02 Dec 2012 11:04 AM PST Silver Futurist presents his experience "under" hypnosis and and its relation to those who worship at the alter of the bullion pundit. from silverfuturist: ~TVR |

| The Old Spanish Gold Mine in the Sierra Estralla Mountains Posted: 02 Dec 2012 10:28 AM PST BrazilBrazil |

| Eric Sprott: We Will Go Public If They Don’t Send Us Our Silver Posted: 02 Dec 2012 08:44 AM PST

Eric Sprott: We Will Go Public If They Don't Send Us Our Silver Today billionaire Eric Sprott spoke with King World News about his latest silver offering and how much physical silver it will vacuum out of the market. He also issued further warnings on the crumbling financial system. …I don't think we're going to have delivery problems. As you know, I've always hoped we can't get that last bar (of silver) because we'll publicize it. Keep on reading @ kingworldnews.com ~DF |

| Eric Sprott: Gold To Rise 500% From Current Levels Posted: 02 Dec 2012 08:07 AM PST

Eric Sprott: Gold To Rise 500% From Current Levels Today billionaire Eric Sprott warned King World News, "There is no doubt that central planners are trying to avoid a financial collapse here." This is the first in a series of interviews with Sprott that will be released today which reveals what is going on behind the scenes with the increasingly desperate Western central planners and their gold and silver price suppression scheme. Keep on reading @ kingworldnews.com ~DF |

| The coming silver price eruption Posted: 02 Dec 2012 06:00 AM PST There was a degree of predictability about the knockdown in gold and silver at the US futures market (Comex) last Wednesday. The reason is that the Commercials (together the producers, processers, ... |

| Central Banks are NOT ordinary Gold Investors Posted: 02 Dec 2012 05:59 AM PST Central Banks are NOT ordinary Gold Investors by Adrian Douglas - Market Force Analysis From the Archives Originally published August 19th, 2009 Financial market letter writer Adam Hamilton's essay, "Central Bank Gold Agreement," is a fairy tale. Hamilton writes that central banks are just investors in gold like everyone else. What Hamilton and most people overlook in analyzing central bank gold sales is that they are a farce that beats the best Monty Python sketches. The central banks have printing presses and now computers that can generate loads of fiat money. It is beyond side-splittingly funny that we should take central banks seriously that they need to sell gold in exchange for the stuff they manufacture for free. Can you imagine the Saudis selling oil in exchange for sand, or Eskimos selling fish in exchange for ice, or Paul McCartney selling an apartment in London in exchange for a Beatles poster autographed by himself? Yes, you think those examples are funny, don't you? So why not have a big fat laugh at a central bank selling its gold for the funny paper it produces in infinite quantities? Central banks run the world's biggest Ponzi scheme, issuing bits of paper that people will accept in return for real goods and services. If you enjoyed this privilege to the tune of a few trillion dollars that finance an empire, expending a few tonnes of gold to keep it going would be a no-brainer. Central banks do not sell gold to get a few billion of their own fiat money in return, money they probably would throw on top of the stack of half a trillion freshly printed notes that rolled off their presses just that morning. No, central banks sell gold to make it appear that the paper stuff is more desirable than its true supply and demand fundamentals would allow. And when the game looks like it's coming to an end, the central banks can always buy back the gold. It is not a problem to buy back the gold at even $50,000 per ounce when any amount of paper currency can be printed. What is a big problem is if the currency loses its value so fast that no one will sell the central banks any gold for any amount of paper. (Try buying gold with Zimbabwean dollars.) If that happens, the central banks lose and the people win, because when the music stops the people have the gold and the central banks are stuck with the depreciating paper. Central banks have to use their gold to support their Ponzi paper creation, but they have to control the destruction of their currency's purchasing power so they can still buy their gold back with their own paper before the game ends and they have to start a new one. When the paper currency has little purchasing power left but the central banks have bought back their gold, they can introduce a new currency and start the cycle all over again. In this way they leverage their gold instead of having something honest like one-for-one backing in a classical gold standard. They have even found ways of having more leverage by selling paper promises for gold to make it look as if they have 10 or 20 times as much gold as they really have. There is another problem. What if someone else with a large amount of worthless paper currency gets the idea to buy back your gold before you do? Do you ever wonder why China kept so quiet about the 450-tonne increase in its gold reserve over the last five years? Clearly China would not want to tip off the Western central banks that it was going to beat them at their own game. If China has admitted to acquiring 450 tonnes of gold, it probably has a lot more than that. This is all about world dominance. Whoever has the most gold is king. Adrian Douglas Marketforceanalys.com http://www.24hgold.com/english/news-...Adrian+Douglas |

| The Big Picture For The Week Of December 2, 2012 Posted: 02 Dec 2012 04:54 AM PST  By Roger Nusbaum: By Roger Nusbaum: A pseudonymous tweeter named Art Vandelay posted a link to Hugh Hendry's latest fund report. Hendry tends to be very opinionated and seems glad to share his opinions. I find him to be an interesting manager to keep tabs on. The linked report included the fund's top ten positioning as of September 30, both in terms of percentage weightings but also value at risk weightings. NAV top ten: Australian Ten Year Bond Futures VaR top ten: Source Physical Gold ETC Complete Story » |

| Posted: 02 Dec 2012 02:13 AM PST By Osman Gulseven: By Aubrey Tabuga Greenlight Capital is an American hedge fund manager founded by David Einhorn in 1996. With a starting amount of $900,000, Einhorn was able to turn it into a $6 billion hedge fund company in a matter of 12 years. Einhorn has made a huge business out of strategic shorting when the market is struggling. He became famous for short-selling the Lehman stock prior to the 2008 collapse. In the latest quarter, the fund had about $6 billion worth of assets under management. Because of Greenlight's popularity in yielding robust profits, it is worth to check on its latest picks. The big buys for the third quarter are General Motors Company (GM), Computer Sciences Corporation (CSC), Yahoo! Inc. (YHOO), Marvell Technology Group Ltd. (MRVL), and Aetna Inc. (AET). Investors who are closely watching the moves of the popular fund Complete Story » |

| Diamond ETF GEMS Hits The Market Posted: 02 Dec 2012 12:56 AM PST By CommodityHQ: By Jared Cummans FactorShares, an ETF provider that was recently acquired by GenCap Ventures, has debuted the first ever ETF to focus on diamonds and gemstones. The PureFunds ISE Diamond/Gemstone ETF (GEMS) invests in a handful of firms that produce and sell diamonds/gemstones, making this fund one of a kind. The GEMS fund has been in the works for some time now, as several issuers were jockeying to release the first Diamond fund, but FactorShares beat everyone to the punch. Next comes the question of whether or not to invest. For the average retail investor, the cost will certainly be an enticing factor. Normally, diamonds come with at a hefty expense, allowing for only those with large capital bases to make a significant investment. But just as GLD broke down the barrier to entry in the gold market, so too may GEMS for diamonds. The only issue that Complete Story » |

| Coming Week: 9 Reasons The 1% Are Bearish Posted: 02 Dec 2012 12:42 AM PST By Cliff Wachtel: The following is Part 2 of our weekly review and preview strategy guide for traders and investors of all major asset classes and global markets - see Part 1 for prior week market review 1. Fiscal Cliff: Weekly Bias - Neutral To NegativeFiscal cliff news remains the most likely market driver this week, assuming no major surprises related to the EU debt crisis. That's because the fiscal cliff is 'only' a recession threat. The EU crisis is an economic and market collapse threat. Given that there is still time before year end, the likelihood is for more of the same brinksmanship and haggling that has characterized past deficit and budget negotiations, just like last week. Last week's tight trading ranges and low volatility suggest that markets anticipate a deal that does not radically deviate from the current situation; most of the pain is expected to be Complete Story » |

| Eric Sprott - Gold Could Move Up 500% From Current Levels Posted: 01 Dec 2012 11:26 PM PST By Patrick MontesDeOca: "The fundamentals for gold are unassailable, the long technical picture is excellent and gold remains very inexpensive when compared to almost every other alternative (most particularly, bonds, treasury bills and bank deposits). With currency debasement assured and some form of hyperinflation probable, gold should trade at several multiples of the current price before this bull market reaches its end." By John Embry As the end of 2012 approaches, I took a look back at an interview I published in Seeking Alpha with billionaire Eric Sprott from Sprott Asset Management on November 13, 2011. Eric Sprott is recognized as one of the world's premier gold and silver investors, and as an expert in the precious metals industry. He is Chairman of Sprott Money Ltd., and CEO, CIO and Senior Portfolio Manager of Sprott Asset Management LP, and Chairman of Sprott Inc. Eric has been stunningly accurate in his predictions about Complete Story » |

| Posted: 01 Dec 2012 11:15 PM PST By J. D. Alt, author of The Architect Who Couldn't Sing, available at Amazon.com or iBooks. Originally posted at New Economic Perspectives. Lambert here. I find this fable interesting for two reasons: First, it's a powerful narrative exposition of what MMT would look like in the real world when put to use for public purpose; more like this please! Second, the cellphone-enabled "digital lira" of 2020 is screaming out to be simulated by an app — and a suitable back end — in 2012. Perhaps the UMKC buckaroo needs to go digital? * * * It was in the year 2020 that a majority of people first began to "see" what money is. For a few months—after the "realization" started hitting the pages, airwaves, blogs, tweets and twits of mainstream media—it became a silly joke: "2020 perfect vision, at last! How could things have been so blurry for so long?" For thousands of years, in fact. Most agree the vision-shift began with the final collapse of the Eurozone in 2019, an event which had been forecast for some time. The surprise was that the unraveling had begun with Italy, instead of Greece as everyone had expected. It turned out to be the hot Italian blood that first reached a boiling point over the crippling cruelty of the long imposed austerity: the island of Sicily threatened secession and deadly street riots broke out in Rome, Naples and Milan—and then everywhere else. The government capitulated on September 12, 2018, declaring not only that pensions would be reinstated—with payments made in "the Italian national currency"—but also would be increased by 10%. It further declared a twelve month federal tax holiday: income and value-added taxes were put on hold for what was called the "National Transition." The dire predictions of hyper-inflation never materialized. Instead, people went back to work picking up the garbage and debris that had piled up for months, working for Lira, rebuilding burned out buildings and repairing roads and utilities that hadn't been maintained for over a year. What caught everyone by surprise, however, was a decision by the Italian Ministry of Finance about how to affect the transition from Euro to Lira: Why go to the expense and trouble of printing Liras again? they reasoned. Cell phones for some time had been capable of making credit and debit card transactions. Why not, the Ministry decided, dispense with cash Lira entirely, and issue to every Italian citizen a "Digital Lira Card" (DLC) which could be loaded with Lira at any ATM machine, and then debited by any vendor with a cell phone. Why not indeed? Within hours of the government's Declaration of Transition, workers in the "Emergency Reconstruction Brigade" (created to remove the garbage and debris left by the riots) were pulling their "paychecks" by inserting bright red Digital Lira Cards into the slots of ATM machines—the Lira "in" the ATM machines having been "placed" there by computer keystrokes at the Ministry of Finance. Soon, DLCs were buying wine and bread, pasta, olives and biscotti in the markets of Napoli and Rome. The street cafes reopened and even the Teatro dell'Opera, which had cancelled its 2017 season, was back in business, swiping DLCs as patrons entered the theater. Most of all, everyone was happy the long, bitter political argument was over. Italy really wasn't broke after all. It had only run out of Euros—and good riddance to boot! What really got everyone's attention, though, were the DLCs. There was something about using digital money that began to change the way people thought about money itself. It wasn't as though it was something new—most financial transactions, in fact, had been occurring for decades with digital keystrokes. What made the difference, it seems, was the complete absence of cash money. The new Lira only existed in digital form: numbers on a screen. You could not hold them in your hand and count them out one at a time. You could not fold them into bundles and put them in your pocket or purse, or lock them safely in a strong-box. They could not fall out of your pocket and be lost either. The idea began to lose its grip of money being a physical thing which, like other physical things, was somehow associated with a finite quantity. Even stranger, everyone began to clearly understand where the digital Lira (dLs) were coming from—how they were created. They were created by computer keystrokes at the Ministry of Finance. It wasn't as if they were coming out of a pot that had to somehow be replenished. In fact, the Ministry of Finance was producing Lira exactly like an electric generator pumps electrons into the electric grid where they run motors and illuminate lighting fixtures and television screens. ERB workers could "see" this happen when they slid their DLCs into an ATM and watched the numbers tally up on the little screen. Banks continued to make loans as before, but there was a surprise here as well: The cellphone-app made available for everyone to manage their DLC accounts clearly revealed—in a visual format—that when a bank loan was made, the bank was NOT increasing the nation's money supply (as had been previously believed for hundreds of years.) When a pasta-maker borrowed 100 dLs to purchase flour, the right hand column of his DLC-app magically increased by 100 "new" dLs; but the left had column simultaneously showed -100 dLs—the amount he had to repay the bank. His net dLs (the bottom line on his DLC-app) remained unchanged: the bank, in fact, had not "created" any money at all! This reinforced the profound perception that the only new digital Lira being created were the ones keystroked by the Ministry of Finance. There was no other way they could get created. And, as this fact became clear, another began to percolate into people's everyday awareness: The only way the Ministry of Finance could keystroke the digital Liras into existence was by "spending" them on something. And spend they did. To everyone's astonishment, during that year of "National Transition," September 12, 2018 to September 12, 2019, the federal government solicited proposals from private business and contractors for over sixty billion dLs in reconstruction and repair projects. The public education system was expanded, new schools and trade colleges were planned for every community, and teacher training was made a national priority. The "Emergency Reconstruction Brigade" was quickly expanded to entirely replace unemployment benefits, providing useful work for any unemployed Italian citizen over the age of sixteen who wanted to work for a paycheck. After the general clean-up was completed, the ERB undertook whatever services local mayors determined could be usefully provided without competing with local businesses. Proof-of-Concept grant programs—modeled on the Gates Foundation efforts to eradicate tropical diseases—were established to provide seed money for small-scale innovators on any topic, with the grants awarded through an internet-based peer review and voting process. Coastal cities began the long and arduous process of raising their historic, stone-laid sea-walls against the dire predictions of rising oceans. The national unemployment rate, which had been nearing 40% before the riots, dropped to less than 10% in twelve months. With unemployment plummeting, the biggest debate within the Ministry of Finance during that year of "National Transition" was whether, or for how long, to extend the federal tax holiday, and what kind of tax structure to impose when it ended. What enlivened the debate in an unexpected way was the realization—suddenly clear as day—that the reason they would be reinstating federal taxes was NOT because they needed to collect digital Lira to pay for federal spending. It had become perfectly clear that the Ministry of Finance could spend as many dLs as needed simply by keystroking them into existence. It was not necessary first to collect them as taxes. No, the reason the Ministry would be re-imposing a federal tax would be to drain dLs out of circulation—and the reason they would do that would be to control inflation. While inflationary pressure on the dL had not yet appeared, it seemed inevitable that it would as unemployment dropped closer and closer to a theoretical full employment. This, the Ministry of Finance realized, was what the federal taxes would effectively be doing: taking back out some portion of the dLs they'd previously spent in, to keep the total number of Lira in circulation from ballooning out of control. Once this realization became a consensus, the debate shifted to what kind of federal tax should be imposed. If it was not being collected to cover federal spending, shouldn't it then achieve some other purpose? Why not an Income Tax for wealth redistribution? But if you had just agreed that taxes would not be used for federal spending (there being no difference between a tax-collected dL and a keystroked dL) then how would an Income Tax redistribute wealth? Taxing income, it was evident, no longer accomplished anything at all! In the same way, what was accomplished by taxing consumption with a Value Added Tax? You wanted consumers, after all, to consume, so why "penalize" them for it? What was eventually agreed upon was a Carbon Tax. This had the merit, first of all, of achieving the goal (which they all knew would soon become critical) of draining dLs out of the economy to control inflation. But second, it achieved the goal of incentivizing both businesses and consumers to burn less carbon in both manufacturing and consumption. The seawalls being raised by the Emergency Reconstruction Brigade might not have to be built so high as they otherwise would. There was one group who was particularly unhappy about all of this: The Mafioso had begun scrambling to convert their businesses to any currency other than the Italian Lira because they discovered it was suddenly impossible to fill suitcases with laundered cash for their felonious transactions. The godfathers were steaming with fury—but, of course, it was awkward to make their objections known. In a related discovery, the federal government found that a simple computer program virtually eliminated the corruption typically endemic in government contracts. Every dL issued, it turned out, could be tracked endlessly, and accurately, through the economy. The program, known as L-Track, could do searches with variable filters which generated an instant report of where the digital Lira were at any given moment. It was impossible to hide them, and difficult to skim them without being seen. The world was watching all this of course. With great interest. Mainstream economists were busy explaining the "Italian Spring" and scrambling to explain why it appeared that the federal "deficit" the Italian government was "tallying up" didn't appear to be "debt" that it was ever, at any point, going to have to be "repay" to anyone at all. This final bit of confusion came to a head—and the "great realization" started to unfold, the blinders torn off, the window shades yanked up, the curtains thrown open to a new understanding of money itself—when those villainous financiers who had held the Eurozone hostage through all the years of the debt-crisis, bidding up the interest rates they demanded to buy the Greek, Italian and Spanish bonds, refusing to take even the smallest "hair-cut" when those nations struggled to make their interest payments—when those self-righteous bond-buyers came to the Italian Ministry of Finance and announced they would now like to buy Italy's bonds again! And the Ministry of Finance replied: "Bonds? We have no bonds for sale. Why would we want to sell you bonds? We have no need to borrow your money!" And the bond-buyers responded: "But we want to buy your bonds! We need a place to park all this cash that we can't think of anything good to do with—a place to park it that will earn us interest. We need you to issue bonds so we can buy them!" And the Ministry of Finance replied: "If you want to spend your money in Italy, come and build a factory or start a business, or invent a new way to convert sunlight to electricity using Nano-particles, or commission a new opera or some other great work of art…. But don't come here wanting to buy our bonds. We're no longer in the business of parking your money for you—and paying for the privilege." That was in the year 2020, and the world sat up and took notice. |

| Posted: 01 Dec 2012 10:50 PM PST Blanchard |

| CEF Weekly Review: Cohen & Steers Preferred Posted: 01 Dec 2012 09:44 PM PST By Joe Eqcome: Actionable Items: Highest Positive Spread: Cornerstone Strategic Value Fund (CLM) Focus Stock: Cohen & Steers Select Preferred Income (PSF) Last Week's Focus Stock: New Germany Fund (GF) Week of 11/30/12: The equity index was a positive (1.1%) and the bond prices were again on the rise (0.3%). The industrial commodities were (1.5%). The US Dollar was off by -0.1%. The entire "index" (without the VIX) was up by 0.4%. The market's volume was up 26% this week after the average holiday week. Spending Losses and Tax Cuts: Mitch McConnell (Senate Minority Leader) outlined his wish lists for changes in Medicare and Social Security spending (fair enough). While he supports income on the richest, he tax not give away the prevailing system. Most of Mr. McConnell's wish list for income taxes will be "smashed". The republicans did understand the way the majority was voting. Complete Story » |

| Posted: 01 Dec 2012 08:50 PM PST Looks like some of the sleepwalkers are waking up. |

| The Gold Standard: A History and Debate 2012 Posted: 01 Dec 2012 08:14 PM PST Chair: Gary Wolfram – Hillsdale College DF Note – this is my summary of the presentation George Selgin – University of Georgia Brian Domitrovic – Sam Houston State University, Author, "Econoclasts" Lawrence H. White – George Mason University from hillsdalecollege: ~DF |

| Bron Suchecki - ETF PRICE SUPPRESSION MECHANICS Posted: 01 Dec 2012 06:11 PM PST We have found the writings and opinions of the Perth Mint's Bron Suchecki worthy of our time. The article below is no exception. The article speaks for itself. Bron begins:

There are some mistakes in the article that need to be addressed lest they become more virally accepted "truths" in the precious metal blogosphere. Andrew also uses some terminology/jargon that readers may not be familiar with. I'll cover both of these in the first section titled "Getting the facts straight". With the facts established I'll then seek to hopefully explain some of Andrew's "mechanics" a bit more clearly. I think it is a combination of jargon, poor wording and the fact that Andrew talks about different transaction mechanics that results in this sort of comment from Ed Steer: "I haven't a clue as to what he's talking about" and Ed's a smart guy who can follow an argument. This will be in the second section titled "Transaction mechanics". Finally, I'll discuss how significant the ETFs and the transaction mechanisms around them are to the market. ..."

Source: Bron Suchecki, Perth Mint Comment: Our own, long held contention is that gold and silver ETFs would be a terribly inefficient vehicle to attempt to alter the supply/demand/liquidity equilibrium, when there are much better, less transparent ways available. (Such as the OTC and COMEX markets. Mostly the former.) |

| Posted: 01 Dec 2012 05:49 PM PST |

| TPTB in India are getting very nervous! Posted: 01 Dec 2012 05:45 PM PST 'Being tough on gold imports won't work' ENS Economic Bureau : Mumbai, Sun Dec 02 2012, 00:49 hrs  Two former Reserve Bank of India governors on Saturday warned against taking tough measures to rein in gold imports — a major reason for the persistently high current account deficit (CAD). The Prime Minister's Economic Advisory Council (PMEAC) chairman C Rangarajan said steps like banning gold imports would only push up its smuggling. Rangarajan, who served as RBI governor, said there are already indications that illegal shipments of the precious metal have gone up in the last three months after the hike in the excise duty. "That is an indication of how much gold is being smuggled in. I would say to some extent we should dissuade people from holding an asset which does not give a rate of return. However, you can't go beyond a particular point," Rangarajan said here at a function organised by the Indira Gandhi Institute of Development Research (IGIDR), an institution set up by RBI. Former governor YV Reddy said, "If Mercedes Benz and aftershave lotion can be imported, why not gold? It is both an investment and consumption good. Many people seem to mistake that it is only hedge against inflation. There is a demand for it. It is being imported. If you can, try to stop it." The RBI Governor D Subbarao said the central bank is "concerned about gold as means of saving because it blocks off savings". "We are concerned about gold… lending against gold by non-bank finance companies (NBFCs) because of financial stability concerns. We have been concerned about gold from an external management perspective because of the pressure it puts on current account or capital account depending on your account for it," Subbarao said. On growth and inflation, Bimal Jalan, Rangarajan's successor and Reddy's predecessor said, "There are periods when growth is more important and you take policy measures to boost it. There are periods when you have to control inflation because that is the dominant public issue. So, there will be periods when you take measures, however, harsh they are to control inflation." Reddy added household savings which was an achievement till recently is now the most critical challenge for a future. "The behaviour of household savings indicates that they do not have faith in financial markets except banks. It is a bad sign." Rangarajan said, "If what has happened in the three-year period of decline is reversed either because of a fiscal consolidation programme or because of the inflation coming down lower, it is possible to get back… if not the 9 per cent but the 8 per cent rate of growth." http://www.indianexpress.com/news/-b...ork-/1039101/0 |

| Jim Sinclair: Use Logic, Not Your Emotions Posted: 01 Dec 2012 04:00 PM PST

from jsmineset.com: Dear CIGAs, If you believe that fiat paper will survive this you are so wrong. Gold is the only asset that will survive the constant manufacturing of paper money and the dynamic expansion of debt. Pension funds, if they had to mark their assets to market, would be as broke as the Student Loan Program is. If student loans get forgiven it is a direct payment, in a sense, to each loan holder for their loyalty. How can ANYONE even think about such a thing as the country approaches the popular new MSM boogey man, the Fiscal Cliff? So many of you are being fooled by the gold and silver manipulators. Gold is no different today than it was at $248. We were being hit then on every move up. It was 10 steps forward and 9 steps back. The only thing is that gold then had little volatility, and today it is getting wild. If manipulation was to forbid higher prices, how come it got from $248 to here with as much or more manipulation then, than now? The swings are just that more visible due to increased volatility. Please wake up! Just like in 1978- 1980 the manipulators will be on the long side as soon as you all finish throwing in the towel like last week. One CIGA sold $3,000,000 of gold Thursday. He had purchase this gold at somewhere around $300 to buy investment diamonds. If he is not a gemoligist he is going to be skinned. J.S. Keep on reading @ jsmineset.com |

| Commodities: Gold, Silver Due For A Correction Posted: 01 Dec 2012 02:50 PM PST By Matthew Bradbard: Editor's Note: This article was written on November 30, 2012, and includes prices and statistics relevant and valid as of that date. Energy: Crude oil closed higher by nearly 1%, finishing just under its 50 day MA. We finished the week near the upper end of the recent trading range, so I do not expect much more… maybe a grind to $90.50-$91/barrel in January. I'm only long futures if they are hedged with options for clients. Heating oil finished just under its 50 day MA after trading above that pivot point in the last two sessions. I see solid support at the 18 day MA, but I would not expect much in the way of appreciation. After three positive weeks, RBOB finished in the red this week, but well off its lows after a mid-week reversal. January ended nearly a dime off its lows. Natural gas Complete Story » |

| Iran importing gold to evade economic sanctions, Turkish official says Posted: 01 Dec 2012 02:37 PM PST Over the last six months, Iran has evaded U.S. sanctions by importing Turkish gold to pay for billions of dollars worth of energy sales to Turkey. Turkey's deputy prime minister has described what amounts to a gold-for-oil barter system... Read |

| Gold – Solution to the Banking Crisis: Eric Sprott & David Baker Posted: 01 Dec 2012 12:37 PM PST Gold – Solution to the Banking Crisis By: Eric Sprott & David Baker Gold – Solution to the Banking Crisis The Basel Committee on Banking Supervision is an exclusive and somewhat mysterious entity that issues banking guidelines for the world's largest financial institutions. It is part of the Bank of International Settlements (BIS) and is often referred to as the Central Banks' central bank. Ever since the financial meltdown four years ago, the Basel Committee has been hard at work devising new international regulatory rules designed to minimize the potential for another large-scale financial meltdown. The Committee's latest 'framework', as they call it, is referred to as "Basel III", and involves tougher capital rules that will force all banks to more than triple the amount of core capital they hold from 2% to 7% in order to avoid future taxpayer bailouts. …If the Basel Committee decides to grant gold a favourable liquidity profile under its proposed Basel III framework, it will open the door for gold to compete with cash and government bonds on bank balance sheets – and provide banks with an asset that actually has the chance to appreciate. Given that US Treasury bonds pay little to no yield today, if offered the choice between the "liquidity trifecta" of cash, government bonds or gold to meet Basel III liquidity requirements, why wouldn't a bank choose gold? From a purely 'opportunity cost' perspective, it makes much more sense for a bank to improve its balance sheet liquidity profile through the addition of gold than it does by holding more cash or government bonds – if the banks are given the freedom to choose. Keep on reading @ ericsprott.blogspot.com ~DF |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment