saveyourassetsfirst3 |

- The Link Between Gold And Equities

- Commodity Chart Of The Day: Yen

- Hope, Change & Gold

- Now We Can Stop Paying Attention

- Report Questions Central Bank Gold Holdings

- ECB : increase of oz932,62 in gold and gold receivables

- Obama Wins; Gold And Silver Jump 2 and 3 Percent

- Escobar: Billion-dollar, one-party machine behind Obama victory

- Jim Willie: US recovery is a fairy tale – Part 1

- Greyerz – The Gold Train Is Picking Up A Head Of Steam

- Massive Short Covering & Buy Stops Triggered In Gold & Silver

- Richard Russell – I See Catastrophic Insane Bubbles Everywhere

- Selling Dental Gold

- Post-Election Trading Made Simple

- Indian Gold Demand 'Abysmal' Ahead of Festivals

- Obama Wins – Gold & Silver Jump 2% & 3%

- Bullion Price Surges on President Obama's Re-election

- India Could Import Around 800 Tonnes This Year: World Gold Council

- 'The big move' in gold is under way, von Greyerz tells King World News

- Four King World News Blogs/Audio Interviews

- Million-Dollar Traders Keep Getting Replaced By Machines

- Washington's European Cliff

- Quelle Surprise! QE Zombifies Economies

- Countdowns for the Economy

- Perched on the Knife's Edge with Jay Taylor

- Be Prepared for Precious Metals Rally after Election

| The Link Between Gold And Equities Posted: 07 Nov 2012 10:58 AM PST By Matthew Claassen: In recent commentary we discussed the fact that the bull cycle from the 2009 low has not experienced normal sector rotation. This would seem logical because sector rotation models are based on economic behavior as a typical four year cycle ages. The current cycle has not been a normal cycle by any measure. In addition, consistent sector leadership based on an economic driver, a theme, is missing. The most recent commentary mentioned gold and that investor enthusiasm for precious metals may be based on fearing the consequences of monetary policy (an economically unhealthy state of mind), not some new innovations in technology that have resulted in a greater demand for gold, which would be part of a healthy expansion of demand. Because there has been no theme based on a top-down economic influence, it would seem logical to examine the potential for a bottoms-up theme, similar to the "Nifty-Fifty" theme, Complete Story » |

| Commodity Chart Of The Day: Yen Posted: 07 Nov 2012 10:56 AM PST By Matthew Bradbard: Commodity Chart Of The Day Daily Japanese Yen (click image to enlarge) Risk off is very evident, with stocks and commodities getting hit hard in today's session. Where the money is flowing as of this post is into the U.S. dollar and Treasuries. A bullish engulfing candle in the greenback, and if this rally can hold at two month highs, we should grind higher. Similar performance in both 30-year bonds and 10-year notes, with bullish engulfing candles lifting prices to their highest in weeks as well. 134'00 should be challenged in 10-year notes, while a trade above 151'00 is expected in 30-year bonds. I'd be interested in establishing bearish plays from higher levels. Back to the JY…I expect an inverse relationship to risk assets to play out. By no stretch of the imagination am I anticipating a 2008-like meltdown, but we could see pressure short term. To have some skin Complete Story » |

| Posted: 07 Nov 2012 10:51 AM PST |

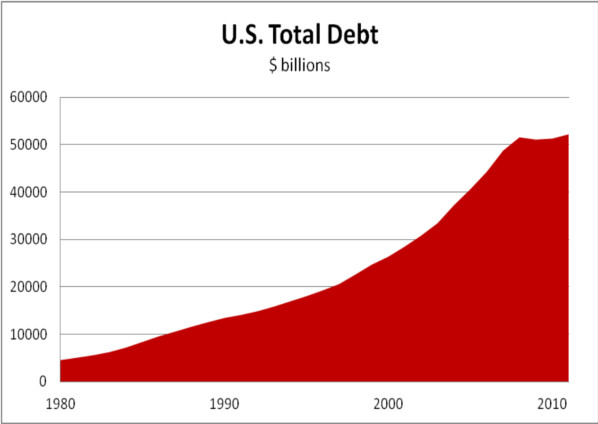

| Now We Can Stop Paying Attention Posted: 07 Nov 2012 10:12 AM PST Two years, billions of dollars worth of political ads, and a nearly infinite number of platitudes and lies later, the election is finally over and we're…back where we started, with a divided government run by the same people, likely to pursue the same policies and spend a similar amount of time in gridlock. Not all that surprising when you think about it, since the country is evenly split between two outmoded but antithetical worldviews. What is surprising is that anyone thought the outcome of this election mattered in the first place. The sad reality is that the institutions that dominate the system no longer care who is "in charge." And all it takes to illustrate this point is a quick glance at the following chart of America's total debt, which is the sum of federal, state, and local borrowing, home mortgages, credit cards, student loans, business loans, etc. Note that between 1980 and 2008 it rose steadily under both republicans and democrats. Even during the supposedly fiscally responsible Clinton years (1990 – 1998), while government debt fell a bit, total debt soared. Why? Because there are two ways for a government to fund its overspending: The first is to borrow, as happened in the 1980s under Ronald Reagan. The second is to convince individuals and businesses to do the borrowing and to buy stuff with the proceeds, thus producing taxable income that helps balance the government's books. Either way, systemic debt goes up. In the 1990s the Clinton administration chose the second strategy, using easy money to fuel a housing boom and tech stock bubble. The result was a torrent of borrowing, spending, and IPOs, which boosted federal tax revenue and produced a few years of balanced budgets. The government – for those who were focused only on the public debt – looked well-run. But to the tiny handful of Austrian economists out there, the fact that total debt was soaring, and that the average loan was becoming more and more speculative, led to the conclusion that we were creating a debt bubble that could only end with an historic bust. That bust came in 2000, and George W. Bush was forced by its magnitude to leverage both the public and private sectors, producing a housing bubble combined with record government deficits. That bubble burst in 2008, leaving incoming president Obama with a traumatized private sector incapable of leveraging itself further. He saw no option but to run deficits that a generation ago would have seemed physically impossible. The system, in short, demands ever-increasing amounts of debt and couldn't care less whether republicans or democrats provide it. Someday the markets will put a stop to the borrowing, but until then it really doesn't matter who we elect or what they promise. Debt, after it reaches a certain level, is all that matters – not immigration policy or health care or marginal tax rates or short term interest rates or gay marriage. All are irrelevant compared to the institutional momentum of increasing leverage. Total debt is now about $175,000 per citizen, or $700,000 per family of four. The average family's income is something like $50,000, so it's clear that we've long since passed the point where a return to a 1980s version of placid normality is a viable possibility for the country, any more than it would be for a typical family that woke up to find itself $700,000 in debt. Going forward the choice is to inflate or die. So Why Bother Watching? The solution? Accept that time spent obsessing over a process with a predictable result but unpredictable schedule is time wasted. So just stop watching. Make the right – and by now obvious – financial and lifestyle choices and then tune out. Turn off the TV and stop reading the business and political sections of the paper. Use the resulting time to develop yourself and cultivate your community. You know what's going to happen, more or less: A decade hence your gold will be worth a lot more and everything else quite a bit less. And you know your friends will suffer and need your help. So prepare for the things that you can predict. Once the markets stop providing unlimited leverage and the system crashes for good, then tune back in and add your voice and your capital to the debate over what to build in its place.

|

| Report Questions Central Bank Gold Holdings Posted: 07 Nov 2012 09:35 AM PST Expect general interest in gold as a store of value to increase while confidence in fiat currencies declines. If this trend is energized by increasing uneasiness over the safety, security, and ownership of the gold held by the world's central banks, volatility could result. |

| ECB : increase of oz932,62 in gold and gold receivables Posted: 07 Nov 2012 09:02 AM PST |

| Obama Wins; Gold And Silver Jump 2 and 3 Percent Posted: 07 Nov 2012 07:27 AM PST gold.ie |

| Escobar: Billion-dollar, one-party machine behind Obama victory Posted: 07 Nov 2012 07:24 AM PST Barack Obama has vowed to move America forward in a victory speech to cheering supporters, after winning the U.S. election to stay in office for a second term. RT talks to Asia Times correspondent Pepe Escobar on what Obama's re-election means for the country and who secured the victory. from russiatoday: ~TVR |

| Jim Willie: US recovery is a fairy tale – Part 1 Posted: 07 Nov 2012 07:11 AM PST Episode 64: Jim Willie, statistical analyst and newsletter writer at GoldenJackass.com, talks to GoldMoney's Alasdair Macleod about the economy, the impact of a zero interest rate policy, and flaws in economic statistics. Willie states that the Federal Reserve's ongoing efforts to debase the US dollar are contributing to a relentless deterioration of the US economy. The Fed is committed to keeping interest rates at zero, and therefore has to continue to intervene in the bond market. As opposed to mainstream economic thought, Willie argues that the extraordinary low interest rates are not stimulating the economy, but rather destroying capital and hindering genuine growth. When money has a negative real cost, market participants are forced to hedge — for instance, by buying commodities. At the same time the housing market is stuck in decline even though official statistics will have you believe otherwise. Bank inventory of foreclosure homes is not clearing and still sitting at 9-11 million homes. Willie emphasises that economic statistics in the US are distorted and that the US has actually been in recession for the last four years — government unemployment statistics are in his view flawed. He expects the recession to accelerate over the coming months. This podcast was recorded on 3 November 2012. from goldmoneynews: ~TVR |

| Greyerz – The Gold Train Is Picking Up A Head Of Steam Posted: 07 Nov 2012 07:10 AM PST

from kingworldnews.com: With gold, silver, and the entire commodity complex on fire today, Egon von Greyerz told King World News, "… the physical buyers are continuing their aggressive purchases." Here is what Greyerz had this to say: "Eric, this is just the action that I've been predicting for a while. I expected the pressure to last until the election. It's clear that November will be a strong month. This is the start of the big move. This is the start of the move that will last until at least next summer before a major correction." Egon von Greyerz continues: "The potential exists here for a major upside move. Just look at the major charts you published today. These are charts that show gold will move up exponentially once the key levels on those charts are taken out to the upside. I am absolutely convinced there will be unlimited money printing worldwide, and the gold market is reflecting that. Keep on reading @ kingworldnews.com |

| Massive Short Covering & Buy Stops Triggered In Gold & Silver Posted: 07 Nov 2012 07:08 AM PST

from kingworldnews.com: On the heels of some wild trading in many key global markets, today acclaimed trader Dan Norcini told King World News, "Once gold took out $1,700, they set off the buy stops and generated more algorithm buying. All of the hedge funds that were selling gold and silver on Friday are now buying those contracts back." Dan Norcini continues: "It would not surprise me to see a melt-up as the day progresses after-hours or overnight if gold clears $1,720 and does not fall back. Gold could head quite rapidly to $1,740. The strange thing about this is the dollar has barely budged in all of this, so we have to keep an eye on the integrity of this move. Keep on reading @ kingworldnews.com |

| Richard Russell – I See Catastrophic Insane Bubbles Everywhere Posted: 07 Nov 2012 07:06 AM PST

from kingworldnews.com: Today the Godfather of newsletter writers, Richard Russell, has written a very serious piece discussing the fact that we are seeing insane bubbles in many different areas. But Russell also covers the state of the gold market and what investors should be doing with their gold. Here are Russell's thoughts in his latest note to subscribers: "What's Bernanke doing for the dollar – or to the dollar? By creating multi-millions of additional dollars, the Bernanke Fed has knocked the dollar down. But due to weakness in other major currencies, the dollar (which is now oversold) has rallied over the last day or so." Keep on reading @ kingworldnews.com |

| Posted: 07 Nov 2012 06:46 AM PST Hey everyone. I have some old dental gold that I am looking to sell but cannot seem to find any information about what dental gold is worth. If anyone can point me in the right direction as to where to sell my dental restorations or where I could find out if they are worth anything or not. Thanks |

| Post-Election Trading Made Simple Posted: 07 Nov 2012 06:30 AM PST Over the past two months shares of gold (NYSE:GLD) and Apple (NASD:AAPL) have had a sizable bite taken out of their share price. Active traders along with the longer term investors have had a wild ride this fall watching these investments slide to multi month lows. The big question is when will gold and apple shares bounce? Here we are again with another election behind us and Barack Obama in the White House again. Many think this means four years of the same thing… Printing, Inflation and higher stock prices. Is this good or bad for Americans or the world for that matter? I doubt it, but who really knows and who cares because there is nothing anyone can do about it now. So buckle up your seat belt and focus on trading and investing with major trend both within the United States and abroad using exchange traded funds. Currently the broad stock market and commodities are in a full blown bull market so the focus should be to buy the dips until proven wrong. Below are some charts showing the important breakout levels for Apple, metals, oil and key indexes like the Russell 2000. Be aware that during pullbacks which last more than a month which is the market has done, some of the biggest drops in price happen just before prices bottom… Scaling into positions is the key to minimal draw downs.

Apple Inc. – AAPL Stock Chart:Shares of Apple clearly show the down channel which must be broken before investors start buying again. This stock seems to have big potential for $650 to be reached quickly. If Apple shares rise so will the overall stock market… Follow my live charts free here: http://stockcharts.com/public/1992897

Gold Spot – GLD Exchange Traded Fund:During August and September investors flooded the gold market in anticipation of QE3. Since then gold has been drifting lower with profit taking and because of some slowly strengthening economic numbers in the USA. Gold looks ready for a run to the $1800 but may stabilize here for a few weeks first.

Silver Spot – SLV Exchange Traded Fund:The price of silver moves similar to that of its big yellow sister (Gold). While the charts look the same silver is highly volatile and can super charge your portfolio when metals rally.

Crude Oil Spot – USO Fund:Crude oil has been correcting for a couple months also and still has a lot of work to do before a new uptrend to be triggered. Currently oil is trading in the middle of is trading range but once the price breaks above $93 per barrel a good investment fund would be USO.

Russell 2000 Small Cap Index – IWMSmall cap stocks typically lead the broad market in both directions. They are the first to rally and the first to rollover and sell off. The major indexes like the DOW, SP500 and NYSE have not formed clean chart patterns which is why my focus is on the Russell 2000. Small cap stocks are now showing a rising relative strength compared to the SP500 large cap stocks and this is very bullish for stocks in general. The best way to trade this index is through the exchange traded funds IWM and TNA.

Post-Election Trading Breakout Summary:In short, history shows that equities tend to rally after an election. For a detailed outlook of how to trade stocks and indexes during the election cycles be sure to read my report "The Election Cycle – What to Expect in Stocks & Bond Prices" Chris Vermeulen |

| Indian Gold Demand 'Abysmal' Ahead of Festivals Posted: 07 Nov 2012 05:41 AM PST Spot prices for buying gold fell back to $1,720 an ounce Wednesday morning in London, after hitting two-week highs following news of the re-election of Barack Obama as US president. |

| Obama Wins – Gold & Silver Jump 2% & 3% Posted: 07 Nov 2012 05:09 AM PST Gold fell slightly in Asia prior to eking out further gains and rising above $1,730/oz in early European trading after President Obama was confirmed as the next president of the United States. |

| Bullion Price Surges on President Obama's Re-election Posted: 07 Nov 2012 04:52 AM PST In the early afternoon of Asian trading, gold futures rose to $1,724.30, prompted by the re-election of the US President Barack Obama. The Dollar Index traded weaker during the Wednesday morning in Asia at around 80.3. |

| India Could Import Around 800 Tonnes This Year: World Gold Council Posted: 07 Nov 2012 03:05 AM PST ¤ Yesterday in Gold and SilverThe gold price didn't do much of anything until shortly after London began to trade at 3:00 a.m. Eastern time...and even then, the tiny rally that began at that point had only tacked five bucks onto the price by the 3:00 p.m. GMT London gold fix...10 a.m. in New York. But from that point, the rally became much more pronounced...and at 12:00 noon in New York, a sharp rally began that lasted less than a hour...before the buyer disappeared, or the price got capped. It had all the hallmarks of a short covering rally, but it's hard to know for sure if that's what it was or not. The $1,722.10 spot high tick came at 12:50 p.m...and then got sold off about six bucks going into the 1:30 p.m. Comex close, before trading sideways into the 5:15 p.m. electronic close. The gold price closed the Tuesday trading session at $1,716.90 spot...up $31.90. Volume was decent...around 160,000 contracts. It was pretty much the same story in silver...except silver's high in London came around the 12 o'clock noon silver fix...and from there it declined into the London p.m. gold fix at 3:00 p.m. GMT...10 a.m. in New York. From there, silver followed the same price path as gold. It finished the day at $32.02 spot...up 84 cents from Monday's close. Considering the price action, the net volume wasn't overly heavy...around 41,000 contracts. It's entirely possible that the big silver price rally that began around 11:30 a.m. in New York was short covering as well but, like gold's rally during the same time frame, it's not something you would want to bet the ranch on...and I'll have more on this in 'The Wrap'. Here are the charts for platinum and palladium as well. There are similarities between them and gold and silver...but their are important differences as well. The dollar index opened at 80.71 on Tuesday morning in the Far East...and didn't do a lot until mid-morning in London...and from there drifted quietly lower, hitting its nadir shortly after 2:00 p.m. in New York. From there it rallied a hair, closing at 80.63. Nothing to see here...and it's patently obvious that the precious metal prices were driven by other factors yesterday. The gold stocks didn't trade with much enthusiasm at the open of the New York equity markets yesterday...with the low tick coming at the point where gold began its big rally at 11:30 a.m. Eastern during the Comex trading session. The stocks shot up into positive territory from there...and then traded more or less sideways into the close. The HUI finished up only 1.16% on the day. The HUI would have closed much higher if it hadn't been for CDE and HL...as their Q3 earnings were pretty ugly...and they got sold off hard, especially Coeur d'Alene. This is a "blood-running-in-the-streets" scenario if there every was one...and you know, dear reader, what most investment advisors say you should do when presented with such a situation. The silver stocks did OK...with some doing much better than others. You would have thought [with the exception of CDE and HL, of course] that they would have all been up big...but that was not case. Nick Laird's Silver Sentiment Index was down 2.95%...as the above two mentioned companies are heavily weighted in this 7-company index. (Click on image to enlarge) The CME's Daily Delivery Report showed that 25 gold and 3 silver contracts were posted for delivery within the Comex-approved depositories on Thursday. Considering the engineered price decline that occurred on Friday, I was rather surprised to see that authorized participants added to both GLD and SLV yesterday. There were 67,829 troy ounces of gold added to GLD...and 387,282 troy ounces of silver were added to SLV. Over at Switzerland's Zürcher Kantonalbank, they updated their gold and silver ETFs as of the close of business on Monday, November 5th. They added a tiny 4,410 troy ounces of gold...but a whopping 2,473,260 troy ounces of silver was reported withdrawn since the previous report on October 30th. There was no sales report from the U.S. Mint. The Comex-approved depositories reported receiving 600,227 troy ounces of silver on Monday...and shipped 751,055 troy ounces out the door. The link to that action is here. Here are a couple of graphs courtesy of Nick Laird. They are the intraday average price movements for gold and silver for the month of October. Note that the vast majority of the price pressure in both metal occurred between the London p.m. gold fix at 10:00 a.m. in New York...and 3:00 p.m. Eastern time, in both metals. These are the footprints of the New York bullion banks...JPMorgan Chase et al. But you should also note the London low in silver at the noon GMT silver fix. (Click on image to enlarge) (Click on image to enlarge) I have the usual number of stories for a mid-week column...and only the first one is about yesterday's U.S. election. India Could Import Around 800 Tonnes This Year: World Gold Council Royal Canadian Mint Purchases 3 Million Ounces of Silver. Gold rush: China jewelers go west for growth. 'The big move' in gold is under way, von Greyerz tells King World News. GLD and SLV both took in metal on Tuesday. ¤ Critical ReadsSubscribeElection Day Is Finally Here: Tonight Is Going to Suck No Matter WhatWarning: Matt Taibbi's "Pity Prose" warning is in effect from the get go... So it's finally here – the big day. After eighteen months of relentless, ear-splitting propaganda, with thousands, if not tens of thousands, of reporters humping the horse-race (jumping on every single poll like heavily-panting boy-dogs with their little red wieners showing) and day after day swinging the heavy horseshit-hammer of Thor, braining us with one meaningless, made-up non-controversy after another – after all that angst and stress and directionless aggression, it's finally going to end. That it's all going to be over finally, thank God for that. But today will still go down as a truly sad day, no matter who wins. Years from now, when we look back at these last days and weeks before this 2012 election, what we're going to remember is how intensely millions of Americans hated during this time, how many shameless and dishonorable lies were told as the race tightened (we scratched and clawed at each other like sewer rats over every absurd factual dispute, finding ways to shriek at each other even over things that by definition are nobody's fault, even over acts of God like Hurricane Sandy) and how reflexively people on opposite sides of the race disbelieved each other and laid blame at each others' feet over just about every issue, important or (more often) not. Matt's blog was posted on the Rolling Stone magazine website early yesterday morning...and I thank Roy Stephens for today's first offering. The link is here.  Fed's Williams Says Bond Buying May Exceed $600 BillionFederal Reserve Bank of San Francisco President John Williams said the central bank may buy more than $600 billion in bonds by extending its third round of quantitative easing well into next year. The Federal Open Market Committee last month affirmed its decision in September to buy $40 billion of mortgage-backed securities each month without specifying the total size or duration of the purchases. Williams, who holds a vote on policy this year, was among the first Fed officials to advocate open- ended bond buying. "It should be at least that big but I would think it would probably be bigger given my view on how slow the economy is going," Williams said yesterday, referring to his Aug. 31 comment that the Fed should purchase $600 billion in bonds in a third round of asset purchases. This Bloomberg story was posted on their website late on Monday evening Mountain Time...and I thank West Virginia reader Elliot Simon for sending it along. The link is here.  Million-Dollar Traders Keep Getting Replaced By MachinesWall Street's credit-derivatives traders, who before the financial crisis commanded $2 million of annual pay, are being replaced by machines as banks cut costs and heed new regulations. UBS AG, Switzerland's biggest bank, fired its head of credit-default swaps index trading, David Gallers, last week, with no plan to fill the position, according to two people familiar with the matter. Instead, the bank replaced Gallers with computer algorithms that trade using mathematical models, said the people, who asked not to be identified because moves are private. UBS joins Barclays Plc, Credit Suisse Group AG and Goldman Sachs Group Inc. in using computer programs to trade financial instruments that once generated some of their biggest fees. With regulators preparing rules under the 2010 Dodd-Frank financial reform that will push swaps toward exchange-like systems to improve transparency, credit dealers are going digital as automated trading makes humans too expensive. This story was posted on the businessinsider.com Internet site early yesterday morning as well...and is Roy's second offering a row. The link is here.  Banks struggle to adapt or survive in commoditiesStick, twist or fold? Like card players, the top five banks in global commodities trade have reached the point where they must decide to hold strategy, adapt, or give up and get out. The boom in resource markets that started 10 years ago attracted many big banks to trade oil, metals and agriculture, but the 2008 financial crisis forced a painful retreat and tighter regulation now means some banks may throw in the towel. Decisions rest on whether the banks believe their business models can be changed to keep them sufficiently profitable under the rising oversight of regulators, after four years when their revenue from commodities was halved. "The total wallet back at the peak was about $14 billion for the banking sector in commodities trading. I'd imagine this year it'll be about $7 billion. There were 10-14 banks when it was at $14 billion, now there are really five relevant ones," said David Silbert, who leads commodities trading at Deutsche Bank. This Reuters story was filed from London early Monday morning Eastern time...and I thank reader Andrew Holland for bringing it to our attention. It's certainly worth reading if you have the time...and the link is here.  François Hollande lurches Right in historic U-Turn to save French economyCompany taxes will fall by €20bn a year equal to 1pc of GDP, to be phased in gradually by 2015 under a convoluted system of rebates. Premier Jean-Marc Ayrault said it amounted to a 6pc cut in unit labour costs, enough to close the gap with eurozone rivals. "France is not condemned to a spiral of decline, but we need a national jolt to regain control of our destiny," he said. The mid-rate of VAT for restaurants and services will jump from 7pc to 10pc. The top rate will rise slightly to 20pc. Spending cuts will plug the revenue gap in order to meet the EU's 3pc deficit target. Critics call it the most humiliating U-turn in French politics since François Mitterrand abandoned his disastrous experiment of "Socialism in one country" under a D-Mark currency peg in 1983. Hollande finally blinked...and Ambrose Evans-Pritchard has a field day with this story that was posted on the telegraph.co.uk Internet site early yesterday evening GMT. It's the first of four in a row from Roy Stephens...and the link is here.  Spain 'faces slower growth and bigger deficit'This year's public deficit - the shortfall between government spending and revenues - will come in at 8.0pc of Gross Domestic Product, well above the target of 6.3pc agreed with Brussels when Spain was given an extra year to put its strained finances in order. The deficit next year will be 6pc, compared with Madrid's estimate of 4.5pc, a European source told AFP a day before the European Commission unveils its official forecasts for the bloc. In 2014, when the deficit was supposed to come in at 2.8pc - under the EU ceiling of 3pc - it will be still at 5.8pc, the source said, leaving Spain in dangerous waters. "This means that Spain finds itself with a real problem - it either gets another extension [to the timetable] agreed in June" or it will have to take additional austerity measures, the source said. This is the classic debt trap that Greece has already fallen into...and that Portugal, Italy...and someday, France will follow as well. This story from The Telegraph late yesterday afternoon GMT is Roy's second of four in a row...and the link is here.  Eve of Austerity Strikes Consume Greece Ahead of New CutsHundreds of thousands of Greeks began a 48-hour nationwide strike on Tuesday, shutting down schools, banks, local government offices and ports to protest the government's latest round of austerity measures. Transportation in Athens became difficult as subway and taxi services were halted and flights in and out of the country were stopped for three hours early in the day. State hospitals were running on emergency staff. About 16,000 people gathered at a union-organized protest outside parliament in Athens, where lawmakers on Wednesday will vote on the law, chanting slogans like, "People, don't bow your heads!" and "This strike is only the beginning!" Several thousand more marched in a separate demonstration in Athens, and about 20,000 protested in Greece's second-largest city, Thessaloniki. This is the now-unstoppable road that Spain will now travel. Roy's third offering in a row comes from the German website spiegel.de yesterday...and the link is he |

| 'The big move' in gold is under way, von Greyerz tells King World News Posted: 07 Nov 2012 03:05 AM PST  This GATA release contains the KWN blog with Egon that is posted above...but also links to a few other things of great importance...such as Kitco's Jon Nadler posting a recommendation to sell gold just before it blasted $30+ higher yesterday. This is worth skimming...and the link is here. |

| Four King World News Blogs/Audio Interviews Posted: 07 Nov 2012 03:05 AM PST  The first blog is with Dan Norcini...and it's headlined "Massive Short Covering & Buy Stops Triggered in Gold & Silver". Next is Egon von Greyerz...and his blog is entitled "The Gold Train is Picking Up a Head of Steam". The last blog is with Richard Russell...and it bears the title "read more |

| Million-Dollar Traders Keep Getting Replaced By Machines Posted: 07 Nov 2012 03:05 AM PST  Wall Street's credit-derivatives traders, who before the financial crisis commanded $2 million of annual pay, are being replaced by machines as banks cut costs and heed new regulations. UBS AG, Switzerland's biggest bank, fired its head of credit-default swaps index trading, David Gallers, last week, with no plan to fill the position, according to two people familiar with the matter. Instead, the bank replaced Gallers with computer algorithms that trade using mathematical models, said the people, who asked not to be identified because moves are private. |

| Posted: 07 Nov 2012 02:37 AM PST Although the euro zone crisis did not make it into the US presidential debate on foreign policy in October, Treasury Secretary Timothy Geithner did remark earlier in the month: "We are very worried about the risk of collapse in Europe." |

| Quelle Surprise! QE Zombifies Economies Posted: 07 Nov 2012 01:20 AM PST Nobody has wanted to heed the lesson of post bubble Japan until way too late. Early in the crisis, the Japanese took the uncharacteristic step of telling American policy makers loudly that Japan had made a big mistake in how they handled theirs. They stressed that the most important step was cleaning up the banks. Then the IMF had the bad fortune to release a study of 124 banking crises on the heel of the Lehman and AIG meltdowns, which meant its findings were ignored, since the finance officialdom was too busy trying to deal with the wreckage to process new information. But it too came squarely down on the side of making banks take their medicine:

This section of the IMF report is particularly germane to austerity-mad Europe:

Now in Europe, the salvaging of otherwise insolvent French and German banks isn't being done via anything as straightforward as "blanket guarantees" but the result coming to look a lot like that, despite all the smoke and mirrors involved. One of the major features of the current programs, which also emulate Japan but was not analyzed in IMF paper, which focused on fiscal operations, has been the use of extraordinary monetary measures, at first to stabilize asset values and then to encourage new borrowing by putting money on sale. That hasn't worked at all in Japan, where overly cheap loans have not done much to spur new investment but have served to prop up inefficient borrowers who remain on life support. This was a concern early in the crisis: Japan's super competitive exporters stood in sharp contrast with a very inefficient retail sector, and in some industries, mom and pop suppliers too. Japan prioritizes stability of employment over profit, so initially, this seemed like a sensible move at first. But the super-cheap funding has become permanent as the economy has never attained liftoff and the cost of incurring a lot of pain is still perceived to be too high. Now John Plender of the Financial Times, citing some new research from JP Morgan, argues that zombification is an inevitable result of distorting the price of capital. Note that we've been on the path of distorting capital markets prices for a very long time. The Greenspan, later Bernanke put, has been perceived (correctly so far) of reducing the downside risk of speculation and the degree of support has grown over the last 25 years as the amount of intervention it takes to staunch crises has only kept growing. From the Financial Times (hat tip Joe Costello):

If you know anything about Japan, the idea that the Japanese banks have managed to get worse at judging credit risk is truly scary. The part of the Japanese financial debacle that isn't discussed widely enough is that Japan had a highly regulated banking system through the mid 1980s, when the US pressed it hard to liberalize its market. Being a military protectorate of the US, it wasn't exactly in a position to say no, with a result that it deregulated rapidly. The result was not, contrary to US fond hopes, that American banks were able to get a strong foothold and make oodles of money. Japanese strongly prefer doing business with established Japanese firms, except for clearly foreign business (and even then, a lot of medium and large corporations would prefer a Japanese firm) and foreign banks also found it hard to attract top Japanese graduates (Western firms didn't offer lifetime employment, nor were they as prestigious). But what did happen was Japanese banks raced out to do all sorts of things they had been formerly prohibited from doing, and started doing it badly. When I had Sumitomo Bank as a client (and it was seen as one of the best run, most innovative banks in Japan) I was horrified to see how far behind US banks it was on pretty much every front, except being a super low cost operation. A couple of simple indicators: branches (and its New York operation was a branch) had six month revenue targets. No notion of risk weighting or funding costs. So my revenues in no-risk M&A were treated the same as up front fees on $500 million of lending to Campeau (a famous turkey LBO that the bank did indeed lend to, along with a host of other terrible deals). Plender points out that the bad behavior of the bubble years continues in reduced form, and (similar to Michael Pettis) he suggests China is following the same failed playbook:

This means, sport fans, that a slowdown in Japan and China could produce much worse outcomes than conventional thinking believes is possible. It might be time to prepare for a rough ride. |

| Posted: 07 Nov 2012 12:02 AM PST Thanks to a surging gold price that rally appears to have arrived. It's not a broad rally yet. Traders are looking for companies with discoveries and management that knows how to add shareholder value. |

| Perched on the Knife's Edge with Jay Taylor Posted: 07 Nov 2012 12:00 AM PST |

| Be Prepared for Precious Metals Rally after Election Posted: 06 Nov 2012 09:54 PM PST Bull trends in gold and silver rise on walls of worry. Healthy pullbacks afford secondary opportunities. We may be basing and bottoming right now. A powerful reversal could occur after the election. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment