Gold World News Flash |

- GoldSeek.com Radio Gold Nugget: Nick Barisheff & Chris Waltzek

- Asian Metals Market Update

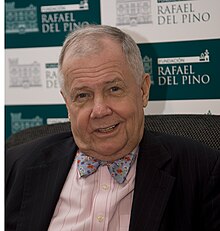

- Jim Rogers: Obama Re-election Will Spark SOARING INFLATION

- A World of Undisclosed, Unallocated Accounts

- U.S. Dollar, Gold Implications of Election

- Best time to buy gold during election periods

- Hope, Change & Gold

- This Is How Gold & Silver Will Fare If Stocks Are Crushed

- Gold Seeker Closing Report: Gold and Silver End Mixed and Near Unchanged

- Despite Rising Prices, Gold Holds the Glitter in India

- How And Why To Buy Bullion...Plus Where To Store It

- Silver Update 11/7/12 Power Of Markets

- What You Need To Know About The Coming Gold & Silver Move

- Commodity Technical Analysis: Gold Support Expected Near 1700

- On Long-Term Fiscal Probity? Or Another 'Quick Fix'...

- The Inexplicable American Consumer Revolts Against Prescription Drugs

- The Gold Price Reached a New High Stop Waiting and Buy

- Marc Faber's Asset Protection Plan: "Buy A Machine Gun", No Really, "You're Right, Buy A Tank"

- The False Ego & The Silver Market

- Gold slips; market mulls dollar, debt woes, Obama

- Gold Daily and Silver Weekly Charts - Good To Be Back Again

- Proponent of Gold & Silver? Then Consider Cheering for the Obama Victory

- Full Steam Ahead

- Hope, Change and Gold

- Perched on the Knife's Edge with Jay Taylor

- Scary Halloween Time

- The Daily Market Report

- Tocqueville's Hathaway expects powerful and dramatic rise for gold

- Bayman Beachfront Blues

- India Could Import Around 800 Tonnes This Year: World Gold Council

| GoldSeek.com Radio Gold Nugget: Nick Barisheff & Chris Waltzek Posted: 08 Nov 2012 08:04 AM PST |

| Posted: 08 Nov 2012 12:05 AM PST We need to be careful with the way we trade. Days like yesterday can result in huge losses for everyone. After the news of Barack Obama getting reelected as the US president everyone went long in gold and commodities only to get a shock and stop losses getting triggered as gold prices fell like a pack of cards. They recovered later but buy stop losses were triggered and losses incurred. Patience is the need of the hour for jobbers. Moves will come, we just need to find the right trend. |

| Jim Rogers: Obama Re-election Will Spark SOARING INFLATION Posted: 08 Nov 2012 12:00 AM PST by Forrest Jones, Money News:

Under Obama's first term in office, the Federal Reserve slashed interest rates to near zero and pumped the economy with trillions of dollars in fresh liquidity via a monetary policy tool known as quantitative easing, under which the U.S. central bank buys bonds from banks and floods the economy with excess money supply to encourage investing and hiring … "It's going to be more inflation, more money printing, more debt, more spending," Rogers told CNBC just prior to Obama's re-election. Investors should avoid U.S. government debt and the dollar and stock up on gold. "It's not going to be good for you me or anybody else," Rogers said. |

| A World of Undisclosed, Unallocated Accounts Posted: 07 Nov 2012 11:15 PM PST from Silver Vigilante:

The undisclosed, unallocated account really sums up the way of the world. Essentially all funds deposited into Keystone banks are seen by those banks as not deposits of the customer, but rather property of the bank, with which they can gamble away, doing as they please. Government does the same thing with taxpayer money. |

| U.S. Dollar, Gold Implications of Election Posted: 07 Nov 2012 11:00 PM PST by Axel G. Merk, Gold Seek:

Alia iacta est! As networks projected an Obama victory, there was a sea of red: the dollar is down versus currencies and gold. As pundits will shift the focus on the fiscal cliff, the market appears firmly focused on what may be more relevant: an Obama win favors a continuation of the current easy money policy. Had Romney won, Fed Chair Bernanke would have become a lame duck, undermining the credibility of the Fed's commitment to keep interest rates low way beyond the end of Bernanke's term in early 2014. With this uncertainty removed, the Fed's increased emphasis on employment is here to stay. The market rewards this certainty by bidding up gold, selling off the dollar versus all major currencies. |

| Best time to buy gold during election periods Posted: 07 Nov 2012 10:52 PM PST |

| Posted: 07 Nov 2012 10:27 PM PST |

| This Is How Gold & Silver Will Fare If Stocks Are Crushed Posted: 07 Nov 2012 10:01 PM PST  Today Tom Fitzpatrick spoke with King World News about what to expect going forward from gold, silver, the US dollar, the euro, bonds and stocks. Fitzpatrick has been astonishingly accurate in forecasting the movements of both gold and silver. Now Fitzpzatrick lets KWN readers know what to expect from stocks, bonds and the currencies, as well as the metals. Today Tom Fitzpatrick spoke with King World News about what to expect going forward from gold, silver, the US dollar, the euro, bonds and stocks. Fitzpatrick has been astonishingly accurate in forecasting the movements of both gold and silver. Now Fitzpzatrick lets KWN readers know what to expect from stocks, bonds and the currencies, as well as the metals. This posting includes an audio/video/photo media file: Download Now |

| Gold Seeker Closing Report: Gold and Silver End Mixed and Near Unchanged Posted: 07 Nov 2012 10:00 PM PST Gold climbed $15.40 to $1731.60 at about 5:30AM EST before it fell back to as low as $1703.11 in late morning New York trade, but it then rallied back higher in afternoon trade and ended with a gain of 0.12%. Silver slid to as low as $31.209 before it also rallied back higher in late trade, but it still ended with a loss of 0.56%. |

| Despite Rising Prices, Gold Holds the Glitter in India Posted: 07 Nov 2012 09:55 PM PST by Aesha Datta, The Hindu Business Line :

The nearly 30 per cent rise in price of the precious metal over the last year has not kept customers away, according to metal major MMTC Ltd. The company expects its annual exhibition-cum-sale, Festival of Gold, which was inaugurated on November 2, to notch up sales of Rs 50 crore by the close of the event on November 11 – equal to last year. "Already in three days sales have touched Rs 15 crore," Rajender Prasad, General Manager of MMTC, said, while adding, "We are getting very good response right through the year." However, sales peak during the auspicious Akshaya Tritiya and Diwali, he claimed. |

| How And Why To Buy Bullion...Plus Where To Store It Posted: 07 Nov 2012 09:03 PM PST |

| Silver Update 11/7/12 Power Of Markets Posted: 07 Nov 2012 08:54 PM PST from BrotherJohnF: |

| What You Need To Know About The Coming Gold & Silver Move Posted: 07 Nov 2012 08:50 PM PST from KingWorldNews:

Today acclaimed money manager Stephen Leeb told King World News, "Usually I'm not surprised by anything I see in these markets, but yesterday when gold was up over $30, I was a bit surprised. Even with the market action today, it's very clear that the market realizes that money is going to remain very easy. My advice is if we get a dip in gold, I would buy that dip. Gold has a lot of support. I think long-term and that's a bet that I'm always willing to make. I haven't sold a single ounce of gold or a single share of a gold stock. That is because I am positioning and I am thinking about the long-term." |

| Commodity Technical Analysis: Gold Support Expected Near 1700 Posted: 07 Nov 2012 08:44 PM PST courtesy of DailyFX.com November 07, 2012 05:09 PM Daily Bars Chart Prepared by Jamie Saettele, CMT Commodity Observations: Gold extended gains initially before failing just above the 11/1 and 10/23 highs. The rally from the 11/5 low is impulsive. “The sharp advance following a sharp decline does suggest that weakness was exhaustive and that a base is forming from which price can work higher.” Commodity Trading Strategy Implications: Expect a dip into 1695-1702 before another rally. LEVELS: 1685 1695 1702 1727 1749 1775... |

| On Long-Term Fiscal Probity? Or Another 'Quick Fix'... Posted: 07 Nov 2012 06:53 PM PST Against the backdrop of a tepid US recovery, Eurozone recession and stuttering growth across the emerging economy complex, investors are beginning to focus on how that 'status quo' outcome impacts the odds of success, which after all, if there is one thing economists agree on, it is that a US and global recession will ensue if the legislated tax increases and spending cuts worth roughly 3.5% of US GDP take effect next year. UBS believes that if the US economy dips into recession next year, operating earnings—which are near peak levels—could easily plunge by a fifth. Risk premiums would almost certainly climb, particularly because the US and the world would have run out of policies that could lift their economies out of recession. Those factors point to significant downside risk (at least 30%) for global equity markets if the US falls off the 'cliff'. Yet the S&P500 remains within a few percentage points of its cyclical highs. Accordingly, as we have previously concluded investors assign a very low probability to the 'cliff' and a 2013 US recession, which UBS finds 'darn surprising' that this much faith in common sense prevailing in Washington amidst such divisive politics.

Via UBS Investment Research Quick fix or long-term solution? ...Curiously, investors appear to have a great deal of faith that... common sense will prevail in Washington and the 'cliff' will be averted. Consider that if the US economy dips into recession next year, operating earnings—which are near peak levels—could easily plunge by a fifth. Risk premiums would almost certainly climb, particularly because the US and the world would have run out of policies that could lift their economies out of recession. Those factors point to significant downside risk (at least 30%) for global equity markets if the US falls off the 'cliff'. Yet the S&P500 remains within a few percentage points of its cyclical highs. Accordingly, we can only conclude that investors assign a very low probability to the 'cliff' and a 2013 US recession. That's darn surprising against the backdrop of divisive US politics in recent years, including the political brinksmanship during the debt-ceiling negotiations in the summer of 2011 that nearly resulted in a US default. So it is difficult to understand the confidence that investors have in the ability of US politicians to accomplish in the next few months what they haven't been able to do in the past two years. Basing investment decisions on the idea that the unthinkable is impossible is a curious trait after the unthinkable things that have occurred in recent years. But for all the attention the 'cliff' deserves, the fundamental challenge for the US (and many other countries) is to address fiscal stability as a long-term necessity, not a short-term fix. Yet if fixing the 'cliff' is going to be, well, a cliff-hanger, is there any hope Washington can restore to health the country's long-term fiscal position? The answer may be surprising. Getting it right in the long run is do-able and there is precedent. But it will take political resolve and good growth. Even more, it will take significant re-balancing in the US and world economies. And that's where the grounds for skepticism are greatest. But let's first review the historical precedent—the large US fiscal adjustment during the 1990s—and see what it tells us about the chances for the same in the decade ahead. From 1992-2000 the US general government balance improved by 7.5 percentage points of GDP (Chart 1). As a consequence, relatively large US budget deficits declined and eventually became surpluses. And as a further consequence, over the decade of the 1990s the US gross government debt-to-GDP ratio fell from 61.2% in 1990 to 54.5% in 2000 (OECD basis).

Oh, and by the way, for virtually the entire decade the US was led by divided government, with plenty of hard-nosed partisan politics. So, could it happen again? The answer depends on the factors that permitted the US to consolidate its public finances in the 1990s. Briefly put, the salient features of the US fiscal adjustment in the 1990s included the following:

So, could it happen again? Overall, the challenge today looks daunting. In at least four important respects, the experience of the 1990s is not particularly relevant to the present:

In short, faced with a big fiscal adjustment and without the ability to count on lower interest rates or big cuts in defense spending, the restoration of long-term US fiscal stability hinges on a combination of good public policy and good growth. Neither can be assumed, but nor can either be categorically ruled out. As regards good public policy, a number of factors must come together to produce the right result, but as the 1990s experience suggests two ingredients are probably crucial:

Today, after nearly two decades of already high productivity growth, another productivity-led growth spurt seems improbable to many observers. Yet reasons for optimism exist. The US economy may be on the verge of revival, centered on energy, technology, and manufacturing, underpinned by a more competitive economy courtesy of a low real exchange rate. Faster US trend growth is not impossible to imagine. But the big difference between growth in the 1990s and the prospects ahead resides in financial balances. Improving the fiscal imbalance will require an offsetting deterioration in the household or business sector balance, and/or a significant improvement in the external balance. If not, deficit reduction will sap aggregate demand, leading to below-trend growth (if not recession) and rising unemployment, an unsustainable state of affairs. Put differently, either US consumers or US businesses must borrow and spend more, or the US must generate a swing from net importer to net exporter, if deficit reduction is to be accompanied by the restoration and maintenance of full employment. Yet re-balancing—domestically and globally—appears improbable in the years ahead. Significant re-leveraging of the US private sector is unlikely, not least because of a post-crisis regulatory environment inimical to debt. And hoping that the rest of the world, burdened by its own adjustments and blinkered by mercantilist thinking, will absorb US external surpluses seems even more farfetched. So, the bottom line is that we'd better hope for a short-term fix to the 'fiscal cliff'. At least that way we can avoid recession next year. That achievement, as difficult as it may be, looks comparatively easy next to the challenge of restoring long-term US fiscal probity.

Source: UBS |

| The Inexplicable American Consumer Revolts Against Prescription Drugs Posted: 07 Nov 2012 05:51 PM PST Wolf Richter www.testosteronepit.com www.amazon.com/author/wolfrichter Anecdotal evidence has been coagulating into numbers, and these numbers are now beginning to weigh down corporate earnings calls. It appears the toughest creature out there, the one that no one has been able to subdue yet, the ever wily and inexplicable American consumer, is having second thoughts about prescription drugs. And is fighting back. A paradigm shift. We’ve already heard from some companies, such as drug maker Pfizer, whose revenues in the US plunged 18%, largely due to the collapse of its flagship drug Lipitor that is losing its battle with much cheaper generics. But the direst indications came from Express Scripts, the largest pharmacy benefit manager in the US—and perhaps one of the best gauges of spending patterns for prescription drugs. During the earnings call, CEO George Paz, who ominously was “not prepared to provide 2013 guidance,” embarked on a dark speech. The company’s clients had “unprecedented concerns about our country’s economic outlook,” he said. Unprecedented concerns! So even worse than 2008-2009. He went on:

He lamented “the current weak business climate and the unemployment outlook” and was worried about the “challenging macroeconomic environment.” Shorts must have felt a certain frisson. Remains to be seen whether the dive that Express Scripts shares performed is a buying opportunity that will add to a cushy retirement or one that will slice off your fingers. But beyond the company’s fate, he’d pointed at what ails the US economy, including a shift to part-time workers and contractors often without healthcare benefits, and smaller employers who, in their struggle to survive, are cutting back on healthcare benefits. As these workers—the inexplicable American consumers—are left to their own devices, they have to make their own decisions about what prescription drugs, if any, to blow their scarce money on. Express Scripts has seen this trend in another area. Its Drug Trend Report, which dissected prescription drugs sold to its members in 2010 and 2011, sketched the beginnings of the paradigm shift: in 2011, specialty drugs sales increased 17.1%, down from a 19.6% increase in 2010; traditional drugs only eked out a gain of 0.1%, the lowest increase since it began tracking the data; and spending on all prescription drugs combined rose only 2.7%, also a record low. That was for 2011. But the report didn’t include insights into the buying behavior of the 48.6 million uninsured Americans who’re even more reluctant to spend money they don’t have on prescription drugs they can live without. And it didn’t include the trends of 2012, which as Paz phrased it, are cause for “unprecedented concerns.” Whatever the reasons, whether prescribing behavior by doctors or buying behavior by consumers, lack of insurance or lack of money, or the growing prevalence of generic alternatives: spending on prescription drugs, long considered recession-proof, seems to have bumped into a wall for the first time ever. Healthcare costs in the US, around $2.6 trillion a year, or 17.9% of GDP, may be reaching a level beyond which the various players in the economy cannot go, or refuse to go, a market-based barrier of sorts. And the inexplicable American consumer may be on the forefront—not only those who don’t have insurance, but also those who have high-deductible plans. In 2012, plans with deductibles of $1,000 or more made up 19% of employee-sponsored health plans. Families covered by such plans, for better or worse, are cutting back medical spending ... by 14%, according to a study last year. They’re making medical decisions where at least one part of the equation is their own money. And they’re accomplishing what no one has been able to accomplish so far, namely taming the untamable healthcare expense monster. That the US has too much debt is no longer a controversial statement. Some may believe other problems are more urgent, or that we need to grow our way out rather than slash spending. But the debt-to-GDP ratio must decrease if we are to have a stable, prosperous economy. Read... One Chart Explains Why Government Debt Is Dragging on the Economy. |

| The Gold Price Reached a New High Stop Waiting and Buy Posted: 07 Nov 2012 05:36 PM PST Gold Price Close Today : 1713.20 Change : -0.90 or -0.05% Silver Price Close Today : 31.651 Change : -0.368 or -1.15% Gold Silver Ratio Today : 54.128 Change : 0.594 or 1.11% Silver Gold Ratio Today : 0.01847 Change : -0.000205 or -1.10% Platinum Price Close Today : 1535.50 Change : -18.80 or -1.21% Palladium Price Close Today : 509.55 Change : -9.80 or -1.89% S&P 500 : 1,394.53 Change : -33.86 or -2.37% Dow In GOLD$ : $156.05 Change : $ -3.68 or -2.30% Dow in GOLD oz : 7.549 Change : -0.178 or -2.30% Dow in SILVER oz : 408.60 Change : -5.08 or -1.23% Dow Industrial : 12,932.73 Change : -312.95 or -2.36% US Dollar Index : 80.74 Change : 0.116 or 0.14% The silver and GOLD PRICE both kissed their old support good-bye, both reached new highs. Yes, both closed lower, too, but all lower closes are not equal. The SILVER PRICE lost 36.8 cents to end at 3165.1. Low came at 3135, which, not coincidentally was it had been stymied climbing up from below, and where it broke out and gapped up on Tuesday. Same holdeth true for gold, but the bottom was our well-known old friend, $1,706.60. Likely silver and gold have one more leg down in this correction, but that may be truncated. They cannot close below $1,700 and 3135, without demolishing my interpretation. Both silver and gold pierced their 20 day moving averages (3229c and $1,722.24), so they are trying to break that tripwire for a higher move. Both have successfully pierced and remained above their downtrend lines. Unless the silver and GOLD PRICE gainsay all these up-pointing signs by closing lower, we have a sinewy, scrappy, leather-tough rally in our future. Stop mooning about not buying Tuesday or Monday at the lows and BUY. Sooner or later you have to take a risk, and the odds just don't get no better than this. Colorado and Washington voted to legalize marijuana. I find that enlightening. Neither these states nor any others will challenge the federal tyranny on the police state or unconstitutional money or foreign wars or interference in the economy or the liberties of the citizen, or assassinations or torturing prisoners, but that smoking dope, now that's another matter. We'll fight the feds down to our last roach, Buddy! We believe in freedom, after all. Got to get that head right! Wonder what they do when the feds flex their muscles and withhold their highway funds and other subsidies? That'll be fascinating. I don't think this can be fixed. An email arrived in my box early today with the single word "Election" in the subject line. I opened it to read, "Hold on to your seat, Dorothy, because Kansas is going by-by." To such prophetic genius, what could I possibly add? Markets are not, contrary to what some economists contend, rational, any more than the people who make them up are rational. Today, for instance, the US dollar index rose and stocks fell on the news that Bernard O'Bama had been re-elected. If people had any foresight, they'd see that O'Bama's policies will gut the dollar, and they'd sell that dog. On the other hand, to the extent that stocks represent underlying real assets, the dollar depreciation will send their price up. Those gains will be illusory, due only to inflation, but they'll probably gain, unless, of course the prospect of another four years of government regulation, ethanol schemes, green pipe dreams, and stimulus packages to nowhere drives stocks down to the earth's core. I look at the Dow chart and am impelled to burst out the same thing my mother blurted out the first time she visited our log house here, before we renovated it and doubled the size: "I don't think this can be fixed!" Turned out she was wrong, but I believe I am right. Dow chart is green and puking sick. Dow today dropped 312.95 (2.38%, huge!) to 12,932.73. It sliced through the 200 DMA (12,991.63) like the guillotine through Marie Antoinette's ivory neck. Its jaws of death are eating jaws of death: it has formed a broadening top formation within a broadening top, offering a two-fold witness of its intent. S&P500 sank 33.85 (2.37%) to 1,394.53. It looks no better than the Dow. And measured in Gold, stocks broke down emphatically. The Dow in gold formed a long-lived diamond, broke down out of it in August, fell like your glasses out of your shirt pocket down a well, caught, rallied a little, then today collapsed through the uptrend line of that little rally, AND traded below the last low. I don't think this can be fixed. US dollar index jumped up again today, as high as 80.924, nearly that 81 I've been looking for, and is trading now at 80.742, up 11.6 basis points (0.15%). That boosts the buck slightly above its 200 DMA (80.64). Either it will stall here, or clear 81 and head for 82, maybe 81.50. Momentum indicators are headed up, but technical indicators are chancy, chancy when a market is manipulated by central banks. The euro saw no joy in Comrade Obama's election, socialist as it is. Euro sank through the crucial 62 DMA (127.87) and ended at 127.79, down 0.27%. I don't think this can be fixed, either. Yen gained 0.53% to 125.09 cents per 100 yen, and appears to have turned up. Oh, not for any big rally, just turned up instead of sinking like an anvil in quicksand. I don't think the yen can be fixed, either. Watching markets, sometimes things are really hazy. You can peer and peer and simply can't make out any form. The last year or so has been that way. Other times, all the klaxons blow and the bells ring and you'd have to be blind and deaf to miss what's going on. Today was one of those latter days. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Posted: 07 Nov 2012 04:00 PM PST Trish Regan and Adam Johnson do their best to hold themselves together in this sublime rant by 'Gloom, Boom & Doom's Marc Faber on Bloomberg TV as he sees Obama's re-election as "very negative for the economy". From his view that the market should be down at least 20% - and maybe 50%, to the implied ignorance of both of the candidates, he believes fervently that the "standards of living of people in the western hemisphere will continue to decline." Faber views Obama's re-election as one of many unintended consequences of market manipulation (since Democrat attacks on the wealthy were 'enabled' by their profiteering from Bernanke's money printing) and sees the need to protect one's assets "with a gun, a machine gun... or perhaps a tank." He concludes with a stunner as he exclaims his view doubting Obama will make it through the whole four-year term because "there will be so many scandals" since "there is so much smoke, there must be some fire!"

The pre-amble is useful and well worth listening to as Faber describes exactly what is occurring in the world... The good stuff begins around 7:30 as Faber goes Baumgartner... and gives the Bloomberg hosts a taste of reality we suspect they have not heard from their run-of-the-mill portfolio manager sheep guests...

Faber on President Obama's reelection:

Onwhere he sees the equity markets given Obama's reelection:

On how investors should protect their assets:

On why he believes Obama won't make it another four years as president:

On Speaker Boehner's comments to Congress today on the fiscal cliff:

On whether he sees the U.S. in recession in 2013:

On his dollar and euro positions:

|

| The False Ego & The Silver Market Posted: 07 Nov 2012 03:54 PM PST There is MUCH MORE to Silver than GETTING RICH To buy silver for the self is to buy silver to undermine the oppression machine which interferes with our own personal availability to our natural environment. It's to rid the world … Continue reading |

| Gold slips; market mulls dollar, debt woes, Obama Posted: 07 Nov 2012 02:25 PM PST

Gold for December delivery fell $1, or less than 0.1%, to settle at $1,714 an ounce on the Comex division of the New York Mercantile Exchange. Read: What the election means for stocks, bonds, gold. There has been "lots of 'noise' … surrounding the election and the situation in Europe," said Peter Grant, chief market analyst at USAGOLD, but the underlying fundamentals for gold remain "constructive." "Tune out the noise and focus on things like the debt and debt ceiling, fiscal cliff, the mess in Europe, central bank demand and there are plenty of reasons to buy gold," he said. "This all outweighs near-term dollar strength, which is really more euro weakness than true dollar strength." [source] |

| Gold Daily and Silver Weekly Charts - Good To Be Back Again Posted: 07 Nov 2012 02:17 PM PST |

| Proponent of Gold & Silver? Then Consider Cheering for the Obama Victory Posted: 07 Nov 2012 01:25 PM PST Many folks in the gold and silver community write to me, voicing their distaste in the economic and monetary policies of the Obama administration, and in particular, the "monetary easing" conducted by the US Federal Reserve. At surface, I understand—printing money (much like the printing of shares) is like watering down your milk in order to make a cup for fat Albert, who sits at home all day and watches tv. However, when you're a beneficiary of this paper asset dilution process–why spend all your time anguishing over it? Inflation and monetary expansion isn't just a fiscal disciplinary problem—it's a human problem. Wherever there are humans, there will be inflation. Period. The inflation may occur within a paper money system, or the inflation will occur in the production of fake coconut-shell currency units, or gold-dipped tungsten bars. The act of becoming emotionally bothered by a human phenomenon such as inflation, is my opinion, is to be ignorant of history. It happens all the time, and it's completely normal—get used to it. The idea in protecting yourself, is to own physical assets which offer a multitude of advantages. A producing farm for example, may offer you income, and the agricultural products will rise in value at the rate of (and sometimes much higher than) the rate of inflation. Additionally, you can eat your farm production, which offers you security, saves you time, money, and tax dollars. Lastly—you can have fun in your farm. You can learn to milk cows, slaughter chickens, ride horses, and even roll around in the hay if you wish. Owning a producing gold mine or oil well offers similar advantages (minus the "rolling around-in" option of course), in that you will have ownership of physical assets, and an income which rises with inflation. Owning assets in the ground held within an exploration company may also offer highly leveraged upside against inflation if the company is managed properly, however, there are a myriad of risks when considering publicly traded companies. If you're a fiscal conservative, gritting your teeth at another "4 more years"—I suggest relaxing the tension in your body, taking in a deep breathe, and allowing a pleasant smile to grace your face. Know that by building a fortress of hard assets, the Obama/Bernanke duo represent "good time Charlie's"—with their hands deep in the cherry jar. They're tossing out cherries one by one, and your job is to catch as many as you can during this time. Consider this reelection as a victory for your "hard asset team", and make plans to become sharper, wealthier, more skilled, and more adaptive than ever before. Cheers to four more years.

Photo source. |

| Posted: 07 Nov 2012 01:21 PM PST Don't look now, Fellow Reckoner. It's the market's turn to vote! Stocks fell this morning. Hard. Last we checked, the Dow was down by more than 300 points. Gold dipped too, shaving $20 off the previous session's $45 per ounce gain. And energy prices were down across the board, with a barrel of oil trading just a touch above $85. What's happening, Johns and Janes want to know? What's going on in the vast, gaping, chasm separating the realm of lofty electioneering pomp and the honest, workaday reality in which the rest of us reside? Nobody knows for certain. We can only guess… Maybe investors thought Mitt was their man, that he would carry forward real change…the kind Obama promised but never delivered. Maybe they thought the spending would stop under a Republican president, that finally some semblance of sanity would return to the budget numbers. Perhaps they envisioned another "Morning in America" moment, where the country would, united once again, march boldly, bravely and stupidly into the future. Mitt certainly talked the talk. In fact, he talked whatever talk was required of him. A man of thoroughly independent non-thinking, he seemed to be both for and against whatever it was his audience told him they wanted on the day, as if he would be able to deliver all their wants and needs. Hey, what's not to like? In the battle of ideas, Obama clearly came with all the wrong ones. Mitt, however, arrived empty handed, but ready to accept donations. Maybe investors saw this as a good thing, something about which to get excited? If so, it could be that these folk are a tad sore today. Could be that they're selling their stocks and cashing out of the American Dream. Maybe they'll take their money elsewhere, to other, more promising markets around the world. That's one possible explanation for today's market selloff. One version. You can construct whatever narrative you so wish. It's all guesswork in the end. More than that, it's storytelling. We take moments in time, moments we believe to be pivotal — elections, declarations of war, signs from the gods — and arrange them to suite our own version of events. Humans are, after all, pattern-seeking creatures. We enjoy a good yarn, something to help us make sense of the terminal mystery that surrounds us. Then we wrap ourselves in our little story and, comforted by its supposed truth, its claim on impossible knowledge, we get on with our lives. Today, America embarks on the next Olympiad in her journey. We have no clue where these four years will take her, over rough seas or calm. But we're fairly certain last night's victor — regardless of who had won — will be of any real consequence to the voyage. In the end, all ships must sink. And for every Titanic, there's a sea of deep, blue icebergs. It's not that we're fatalists, mind you. Ahead of any nation there lies virtually infinite possibilities, including, but not limited to, outright extinction. Who in China's Qing Dynasty, which lasted until 1911, could have known the Middle Kingdom would later that same century run crimson with the blood of a Cultural Revolution or a Great Leap Forward? Which Prussian peasant, upon hearing the news, in 1871, of the creation of a new, invincible German Empire, could have foreseen anything like the madness of The Final Solution? And which common blacksmith, when hearing the words of the Founding Father's noble experiment, might have ventured a guess that the United States would one day wage undeclared wars on a dozen foreign borders while standing as the world's largest debtor? Just as no one person can really know the future of complex societies, neither can any one, single person direct it. To suppose as much is to imagine the cart pushing the horse, or the bobbing life raft guiding carefully the course of the great ship in front of it. Still, every good story needs a protagonist…and an antagonist. Some people will blame today's market selloff — and whatever comes afterward — on the result of the presidential election. Others will imagine alternative scenarios, the "what ifs" of a Romney victory. But it matters not. The needle of time is pointed at "Full Steam Ahead"…wherever that may take us. Joel Bowman Full Steam Ahead appeared in the Daily Reckoning. Subscribe to The Daily Reckoning by visiting signup for an Agora Financial newsletter. |

| Posted: 07 Nov 2012 12:43 PM PST |

| Perched on the Knife's Edge with Jay Taylor Posted: 07 Nov 2012 12:40 PM PST The Gold Report: Jay, what investment themes are you focusing on in your newsletter? Jay Taylor: I focus a lot on the huge credit deflation that the markets are demanding. Debt has become so large that it cannot be serviced with the amount of income available. The so-called solution requires the creation of more debt money. In a fiat currency system, money is debt. At some point, total debt levels have to be wound down to levels akin to the normal levels of the past when total debt to GDP in the U.S. ranged between 175% and 225%. Following Lehman Brothers it grew to over 360%! These debt levels simply cannot be repaid from current income steams even with zero interest rates. Those debt levels are leading to tension in the banking system that bodes very well for gold because people are starting to lose confidence in the banking system and in the fiat monetary system itself. As long as credit deflation remains intact, it will be a very bullish environment for gold and gold mining sto... |

| Posted: 07 Nov 2012 12:35 PM PST Mogambo Guru Scary Halloween Time The horror of our economic situation is, for some weird reason, made even more terrifying on Halloween, when the little darlings from the neighborhood come to the door with their annual "Trick or Treat" tomfoolery, knowing that it is going to cost me money. I find that I can no longer frighten them away by popping up with the usual scary masks, fangs, fake blood, or even screaming at them at the top of my lungs, my face bent down to theirs, nose to nose, "You're going to die! Die! You and your parents will die horrible, painful, lingering deaths because the evil Federal Reserve is creating so much money that it will cause so much inflation in prices that you will all starve to death! Have some candy! Happy Halloween!" This year, I decided that I was becoming stale. That is why, this year, I greeted them by saying "Happy Halloween! Have some candy! Eat up! Enjoy it while you can, kids, and eat all this yummy candy to make yourself fat and sweet because your parents will soon have to kill you, probably while you are sleeping, and then use big, sharp knives to cut out your bones and organs to sell on the black market, and then cut up what's left of you into little pieces before they cook you. And then they will eat you, maybe topped with some tangy barbeque sauce made out of your congealed blood sautéed in butter with some minced onion, brown sugar, maybe a little mustard, salt and freshly-ground pepper to taste, topped with a festive sprig of fresh parsley, all because the prices of food, and the prices of everything else, are so high that they cannot afford to buy regular food! Fatten up, kids!" As I am dishing out handfuls Halloween candy to each of the kids, I continued in Fine Mogambo Style (FMS), loudly yelling at the kids anew, asking "And you want to know why? Huh? You want to know why you are going to be killed and made into hamburgers? It's because the evil Federal Reserve is creating so terrifyingly much money, and thus creating horrifying, murderous inflation in prices. And they are doing it to -- incredibly! -- allow the corrupt, insane federal government to give money to literally half the population by irresponsibly deficit-spending the equivalent of a full 10% of the Whole Freaking Economy (WFE), and, in the process, racking up insane, suffocating amounts of painful, bankrupting debt that cannot possibly be repaid!" By this time, out of the corner of my eye, I can see the concerned parents are no longer patiently waiting in the street, but are coming up to see why I am yelling at their kids and the other trick-or-treaters, making them scream and cry, but still wanting for me to give them more candy, the greedy little beggars. The parents call out anxiously "Angela! Are you okay? Why are you crying?", and "Jimmy, get away from the creepy, horrible man!" Immediately sensing that they are nervous and distressed, I soothingly tell the concerned parents "Of course they are okay, you lowlife morons! They are crying in fear because they have seen the ugly future, a destroyed, nasty, barbaric world after an insane Federal Reserve has created untold more trillions and trillions of dollars in new money and debt, until the buying power of the massively over-produced dollars falls to zero. And it scares them, as it should!" Keeping the kids carefully herded into a tight group standing between me and their strangely-and-suddenly angry parents descending upon me, I quickly explained "I was just trying to help your children learn to buy gold, silver and oil to capitalize on the inflationary horror destined to devour them, since you seem to be too stupid to understand any of it!" Then, surprisingly, one of them yells out "If you are so smart, how come the velocity of money is going down?" Well, I gotta tell ya, I was pretty astonished at this odd turn of events! And so was everyone else, apparently, as suddenly everything got very quiet, and everyone was looking right at me. Well, of course, the reason is that the velocity of money is merely a plug figure, equal to GDP divided by the money supply. This comes from the famous Fisher equation where the Price of things sold, times Quantity of things sold, equals Money supply times the Velocity of money (turnover in financing transactions), or, more familiarly, PQ = MV. Since PQ is essentially the Gross Domestic Product (GDP), the idle calculation of velocity of money is made simplistically easy by simply dividing the money supply into GDP, which are two readily-available figures, thus perhaps explaining its popularity. In general, when the denominator (Money supply) goes up faster than the numerator (Price times Quantity sold, or GDP), the calculation of Velocity will, by simple arithmetic, go down, and when things are vice-versa, vice-versa. In this case, though, the question seemed apt, though the Halloween setting seemed odd, as the Money supply is undeniably rising rapidly, making Velocity go down, but Prices are obviously rising, making Velocity go up, and Quantity sold is disastrously going down, making Velocity go down. But remember: Velocity is the result of three variables, and velocity could be rising (a supposedly good sign) although Prices were exploding upward (a bad economic sign) and the Money supply was rising (another bad economic sign) if Quantity sold was actually falling (a very bad economic sign). With all due respect to the singer Meatloaf and his immortal song, maybe two out of three ain't bad, but not so when zero out of three is, without a doubt, bad. So I answered, in that strangely cryptic, monotonic, robotic way that visitors from other planets have when addressing Earthling carbon-units, "Velocity has fallen because the ratio of the numerator to the denominator went down. Surrender, Earthlings. Resistance is futile." I expected, if not a suddenly-enlightened crowd cheering and shouting my praises for my illuminating insight in interpreting PQ=MV, at least a brief smattering of polite applause for my pithy profundity. Well, there MAY have been some of that, but it was drowned out by shouts of "You're crazy!" and "Quit trying to look up my wife's skirt!" and "Burn him and take all his candy!" At least, I THINK that is what they were saying, because by that time I have scurried off, safe and sound inside the Fabulous, Fully-Fortified Mogambo Bunker (FFFMB), and all I hear is muffled voices through the thick walls. In the sudden silent solitude, I realized that the kids got the candy treat, referred to in "Trick or Treat,", but their moron parents got the trick, in that I did not get a chance to tell them to frantically buy gold, silver and oil to prevent their looming and dooming calamity. But, then again, they would not have listened. They never do. That's the way it is with most Earthlings. Happy Halloween, doomed carbon units. |

| Posted: 07 Nov 2012 12:03 PM PST Gold Regains $1700 on Election Day and is Holding Those Gains

However, as Mike Kosares wrote before the election, "the history of post-election years since 1971 suggests that the gold market is decidedly indifferent, or apolitical, if you will, about the outcome of presidential elections." Since Richard Nixon ended convertibility between the dollar and gold in August of 1971, there have been eleven Presidential elections. Here is how gold performed in the years immediately following those elections: 1973 after Republican victory: +73%. 1977 after Democrat victory: +21%. 1981 after Republican victory: -32%. 1985 after Republican victory: +7%. 1989 after Republican victory: -3%. 1993 after Democrat victory: +20%. 1997 after Democrat victory: -21%. 2001 after Republican victory: 0%. 2005 after Republican victory: +20%. 2009 after Democrat victory: +24%. 2013 after Democrat victory: ?? To summarize: The six "up" years, were evenly split; three when Republicans won the White House and three when the Democrats triumphed. Of the three "down" years, two occurred following a Republican victory and one when the Democrats won. There was one year the price of gold was essentially unchanged after a Republican victory and then of course it remains to be seen what the price of gold will do in 2013, now that Barack Obama has been re-elected. Now the market's attention turns to weighty matters such as the 'fiscal cliff' and an impending battle over yet another debt ceiling hike. The Fed will maintain their super-easy policy stance, and may still heap additional accommodations on top of the already unprecedented measures, as the U.S. economy continues to sputter. The eurozone remains a mess with the Greeks voting on further austerity measures later this evening. Central bank gold demand, mainly for the purposes of reserve diversification is expected to remain robust, even amid rising supply concerns. Gold extended gains in overseas trading today, establishing a new three-week high at 1731.38. Despite a subsequent intraday pullback, the yellow metal is maintaining gains above $1700, even though the dollar index snapped back to set new nine-week highs. The rise in the dollar is more a function of renewed euro weakness, yet traders continue to pay attention to the recent inverse correlation between the dollar and gold. Our clients however are not traders. They buy gold as wealth preservation, portfolio diversification and for hedging purposes. They don't make their buying decisions based on who sits in the oval office, but rather based on the aforementioned reasons, like the 'fiscal cliff' and the ever-rising debt ceiling. |

| Tocqueville's Hathaway expects powerful and dramatic rise for gold Posted: 07 Nov 2012 11:58 AM PST 1:55p ET Wednesday, November 7, 2012 Dear Friend of GATA and Gold: Tocqueville gold fund manager John Hathaway today gives King World News a pep talk about the monetary metal's prospects, predicting that resumption of gold's rise will be powerful and dramatic. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/11/7_Ha... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Opinion Around the World Is Changing When Deutschebank calls gold "good money" and paper "bad money". ... http://www.gata.org/node/11765 When the president of the German central bank, the Bundesbank, pays tribute to gold as "a timeless classic". ... http://www.forbes.com/sites/ralphbenko/2012/09/24/signs-of-the-gold-stan... When a leading member of the policy committee of the People's Bank of China calls the gold standard "an excellent monetary system". ... http://www.forbes.com/sites/ralphbenko/2012/10/01/signs-of-the-gold-stan... When a CNN reporter writes in The China Post that the "gold commission" plank in the 2012 Republican platform will "reverberate around the world". ... http://www.thegoldstandardnow.org/key-blogs/1563-china-post-the-gop-gold... When the Subcommittee on Domestic Monetary Policy of the U.S. House of Representatives twice called on economist, historian, and gold standard advocate Lewis E. Lehrman to testify. ... World opinion is changing in favor of gold. How can you learn why and what it will mean to you? Read the newly updated and expanded edition of Lehrman's book, "The True Gold Standard." Financial journalist James Grant says of "The True Gold Standard": "If you have ever wondered how the world can get from here to there -- from the chaos of depreciating paper to a convertible currency worthy of our children and our grandchildren -- wonder no more. The answer, brilliantly expounded, is between these covers. America has long needed a modern Alexander Hamilton. In Lewis E. Lehrman she has finally found him." To buy a copy of "The True Gold Standard," please visit: http://www.thegoldstandardnow.com/publications/the-true-gold-standard Join GATA here: Vancouver Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Fred Goldstein and Tim Murphy open All Pro Gold Longtime GATA supporters Fred Goldstein and Tim Murphy have brought their many years of experience in the precious metals and numismatic coins to All Pro Gold as metals brokers who specialize in the delivery of gold and silver bullion bars and coins as well as numismatic gold and silver coins. Fred and Tim follow these markets closely and are assisted by a team of consultants in monitoring market trends. All Pro Gold offers GATA supporters competitive pricing on all bullion products and welcomes inquiries. Tim can be reached at 602-299-2585 and Tim@allprogold.com, Fred at 602-799-8378 and Fred@allprogold.com. Ask about their ratio strategy and the relationship of generic $20 dollar gold pieces to 1-ounce gold bullion coins. Visit their Internet site at http://www.allprogold.com/. |

| Posted: 07 Nov 2012 11:54 AM PST Off the keyboard of RE Discuss this article at the Frankenstorm Table inside the Diner

As most people are aware by now, most of the damage caused by Sandy came along the shoreline due to an impressive Storm Surge over a very long stretch of coast, one of the most densely populated coastlines on any continent.

Numerous iconographic Beachfronts were hit, the Boardwalk in Atlantic City basically destroyed and I suspect the newly renovated Coney Island Amusement Park did not fare much better. The beach in the Rockaways where I made Sand Castles as a kid was hit hard, and many homes and biznesses in this aging beachfront community were simply washed out to sea.

Sandy didn't just hit the poor and the middle class though, she was equally destructive of the multi-million dollar Mansions in the Hamptons where the Masters of the Universe go to play each weekend, sutffing themselves with Canapes and 500 year old bottles of Pinot Noir while they stuff the noses of Ford Models with coke prior to doing Channel Stuffing they practice on the Stock Market during the week.

Although there is no Beach on the Southern Tip of Manhattan Island, it's not much more above sea level than the typical Beach is and also went under water for several hours, long enough to fill some Subway Stations and Tunnels with seawater, along with the basement Safes of some Securities firms holding $trillions$ in Stock Certificates in them, with some estimates putting the value of this Toilet Paper in the $36T range.

Hindsight is always 20-20 Vision of course, and after the fact here all the talk is about how to Build it Bigger and Better for Next Time, robust enough to fend off the worst that Mother Nature can throw out. In terms of Large Public Works Projects, some impressive ones are being bandied about. One is to build a huge underwater Seawall around lower Manhattan and the Port of NY/NJ that would deflect most of the energy of a storm surge. Said Seawall would have some breaks in it that Tanker Ships could pass through. This of course is similar to the Dykes built around the Netherlands holding back the Sea there, and overall on the engineering level this is some pretty impressive stuff for sure. In the Dutch case though, the Dykes were built up over many Centuries of time and the marshy areas which were reclaimed were not very deep. Although I am sure with modern heavy equipment, lots of Fuel and GOBS of Money the Army Corps of Bozos probably could build something like this it sure would not happen overnight, even if they do Print new Debt Money to do it. The estimate on cost I read for this brainstorm is around $6B, but I am sure that estimate is made with the assumption Oil stays at $100/barrel for the decade it would take to complete it.

Thing is here, while this might prevent the worst Storm Surge from overrunning Wall Street, the deflected water is going to go somewhere, likely the Jersey shore to the left and the Brooklyn shore to the right. So they will end up WORSE off after it gets built. Another somewhat more reasonable Infrastructure Improvement I read about was to put Storm Doors on all the vulnerable Subway entrances and Air Vents and create "plugs" or "corks" to stuff in the ends of tunnels which exit into low lying areas. Apparently Bangkok has such a system in place which allowed their subway system to keep running even during the regular and heavy flooding events they have been subject to the last few years. Again though, nobody really explains where all the MONEY is going to come from to make all these improvements or how it would ever be paid off if you issue Debt to do it. In the case of the Subway improvements, how high do you have to hike the Fare the Straphangers pay to actually pay this stuff off and then maintain it? The subway system is ALREADY subsidized heavily, by you guessed it BROKE Goobermint. The reason the system never gets Upgrades is BECAUSE it doesn't pay for itself already. Although little Newz is trickling out from the devastated Beachfront communities along the Jersey Shore and Long island, the pictures alone tell you that the rebuild costs are Unimaginable, and Goobernator Chris Christie has already said it will be "a long time" before these communities get their lights back on. He should have added, "if ever".

So, SHOULD people actually be LIVING so close to the shore in such vulnerable spots to the destructive Power of Mother Nature? On the surface Common Sense says no, but there are many reasons why MOST of the population of Homo Sapiens does in fact live close to the shore. First off, going right back to Ancient Civilizations which first used Boats for fishing and then trade, a large portion of the population has always made its living from the Sea. So you naturally get towns and cities forming up at locations where boats can port up in relative safety, and in fact the Port of NY/NJ is one of the best protected harbors in the whole world on a geographic level. That is WHY the Dutch dropped the settlement in New Amsterdam at the bottom of Manhattan Island. Prior to the Railroads, once you got interior to a land mass to any great degree, any trade goods from other places became quite scarce and expensive. Evne once you HAVE Railroads though, you need to have substantial numbers of people at the terminal end near the Seaport. Still, you probably could organize it so only a Skeleton Crew of people are at the shoreline, and most of the people are far enough inland that they won't get nailed with a Storm Surge.

The problem here is that people LIKE the Ocean. they like swimming in it, surfing on it, tanning on the beach and Ogling the Girls in their Bikinis also. Recreation is BIG BIZNESS, and there are Seaside Resorts in just about every Country and Island in the WORLD, and Seaside Communities that grow up around them to service the Tourist trade. For some places like Hawaii, this Recreational tourist Trade is pretty much the only real economic driver they have, you just don't earn all that much FOREX growing Pineapples and Macadamia Nuts. Even for pitiful and aging Seaside Communities like Atlantic City, the Boardwalk and the Beaches are what set it apart from the Indian Reservation Casinos and Las Vegas. In terms of Tax Revenue, it was a main source for New Jersey and that revenue is not coming back anytime too soon, and not until NJ spends a small fortune to do a rebuild. Can they ever recoup what the spend in Taxation of a refurbished Atlantic City? Highly unlikely of course. Probably the most important econonomic driver for our Industrial Societies centered along the coastlines are all the Refineries and offload points for Tankers carrying the Crude from underneath the Desert Sands of Saudi Arabia and off the shore of Brazil and Venezuela. The VLCC Super Tankers require specialized deepwater ports like the LOOP to function, and moving heavy unrefined crude through pipelines from them is costly on EROEI. The closer you can make the Refinery to the offload point for the crude, the more profitable it is. So you have many FSofA refineries near the shores of Lousiana and Texas, and on the Jersey shore also. You need workers for those refineries who live nearby them, and again communities sprout up in vulnerable locations. Trying to move all this infrastructure away from the shorelines is an impossibility as long as you want to maintain this sort of Industrialized culture, and overall most people who live inside such societies want them to continue onward as they have known them. They want Lights On in their McMansions, they want Running Water in their Toilets. They want the I-pads, Plasma TVs and SUVs too, but they at LEAST EXPECT that they can live in a heated home with running water. While it does appear that the NY Shity Subway System has been brought back online for the most part, underplayed in NEWz Reports to date is just how much OTHER infrastructure has not been brought back yet. As the Major Financial Hub of the Empire, Wall Street is the first one to consider on the Economic Loss level here. Even though CONedison has brought Power back to Lower Manhattan, MANY Coomercial and Residential Skyscrapers can't accept that power. Why? Because their basements were not hardenned against such a massive Flooding even tlike the Subways are, and most of their Electrics and Heating mechanisms are housed in their BASEMENTS, which in many if not most cases WERE Flooded Floor to Ceiling. These include buildings like 125 Maiden Land & 55 Water Street, which houses offices for companies like S&P and services like UNICEF and Planned Parenthood:

These towers are not all strictly Bizness either, some are residential, often housing Eledrly people:

A rapid Cleanup for many of these buildings is unlikely, because besides the damage to the electrical and heating systems, they also have been contaminated with Oil and Gas Seepage from Sunken Carz:

Precisely where the Management Companies for these buildings is getting the MONEY to do this Cleanup remains unclear. Also unclear is whether Commercial or Residential Tenants inthese buildings will continue to pay Rent/Mortgages on spaces they can't Work or Live in. Larger companies in NY Shity have Multiple Office Spaces distributed through many Towers, so these companies are no doubt shuffling people around to some other spaces they have "doubling up". For the smaller companies though, they have to quickly find alternate locations to workout of, or else go Outta Biz. So beginning with Wall Street on the Economic Level, you have huge hits here in 3 areas, Clean Up cost, Insurance Liability and Payout and Lost Tax Revenue. Those spaces don;t come cheap, and there are a lot of them "underwater" here now, around 400 large buildings in this Nabe "Yellow Tagged" by the Department of Buildings as Unsafe. While Individually not as costly, the AGGREGATE cost of all the Residential and Comercial Real Estate that went Underwater on Long Island and the Jersey Shore, along with the Brooklyn, Queens and Staten Island Real Estate is likely much GREATER than even the cost of Out-of-Service Wall Street buildings. An important factor to consider is how many people will continue to Pay Mortgages on housing and commercial structures which either no longer EXIST, or have been declared so Unsafe as to be Uninhabitable now. Would YOU keep paying your mortgage on a McMansion so damaged you cannot live in it anymore? Many if not most of these folks will eventually here walk away from these Properties. Calculating the precise total here of lost revenue, lost taxes and cleanup costs is basically impossible at this point, and true Numbers as they come in will certainly never be reported. The $50B "estimate" for damage here is a crock of shit, it is WAY higher than that, even NOT taking into account the possibility of $Trillions$ in Securities being "lost" in some Basement Safes. One thing you can be certain of as the Money to Rebuild is distributed out, it will NOT be distributed out to the Individual Homeowners and Small Bizmen who lost their homes and livelihoods here. The Money will be distributed out to Well Connected Corporations, Big Bizmen & Contractors with good Political Connections who get Cleanup work. A bit of this will Trickle Down to J6P Construciton Worker who has been UE for a while and now will have Cleanup work for a few months, but once done those jobs will disappear as fast as they appeared here. Those New Jobs are more than balanced out by the many people who LOSE their jobs here because their workplaces no longer EXIST at all, or the companies they work for are not on the Gravy Train to get the Big Loans to "rebuild". What many people on the Jersey Shore and Long Island just found out is that you CAN'T expect that Electric Power and Heat for your Biz or Domicile will remain in place, just as a whole bunch of people found that out when NOLA got hit by Katrina. If you are not Well Connected enough to get the Big Money Handouts from Da Federal Goobermint to "rebuild" you are basically SOL here. I am quite SURE S&P will be floated a $100M or $1B Loan from Helicopter Ben to repair THEIR Building, I seriously DOUBT Emilio or Mohammed gets a $100K loan to repair his Bodega. So across the board here, we at the very LEAST are looking at a version of Jimmy Kunstler's Long Emergency, and incremental Spin Down of the quality of life for MANY formerly Middle Class people in the NY Shity Nabe. Staten Island is QUINTESSENTIAL "Middle Class" Working Man territory in NY Shity, probably half the NYPD, Sanitation Department and NYs Bravest Firefighters live on Staten Island. These are not "Welfare Leechfucks", they were hard working people who bought into the Amerikan Dream, now turned Amerikan Nightmare. Now they ALSO are the Underclass, and will be left Hung Out to Dry as the Big Money is passed out to Big Corporations in the Capitalist system to "rebuild".So it has always been here in the FSofA, since Alexander Hamilton openned the First Bank of the FSofA, since Andrew Jackson tried to "Kill" the Second Bank of the FSofA and since Paul Warburg and Nelson Aldrich SUCCEEDED in resurrecting said Banking System for the Illumati on Christmas Eve of 1913 with the passing of the Federal Reserve Act after Secret Meetings on Jekyll Island. Anyone who believes that "Freedom" & "Dmocracy" have EVER existed inside the borders of the FSofA is seriously deluded, victim of 300 years of solid and continuos BRAIN WASHING. The thing is, once the Coastal Shities fail, the Interior Shitieshere in the FSoA will also FAIL, though not necessarily from the direct attacks of Mother Nature from Hurricanes and rising Sea levels with bigger Storm surges. They will fail as the energy supplies they need to operate fail to reach them from the coastline. They will fail as the huge ports which service the Container Ships are damaged and destroyed by Mother Nature.

Here in Alaska the Port of Anchorage is aging and decaying, it hasn't been rebuilt or even maintained all that well since the Big Quake in '64. Next decent quake we get there, it's all rubble and I seriously doubt will be rebuilt. The small Fishing Boats and Kayaks will last a while longer though, and people will still live and work near the Sea, from which ALL LIFE comes, until the Sea itself has life no more. A dangerous place to be for sure as Mother Earth becomes more Geologically and Atmospherically unstable, you never know if you picked the WRONG day to go out Dip Netting the Kings when the run and a Tsunami comes your way here on the Ring of Fire. If you do see the tide run out real fast though, drop the dip net, drop the fish and RUN LIKE HELL for the High Ground. At least it slopes up pretty quick here in most places and you can get up 30 meters pretty quick. Not so true on Long Island, where you gotta get inside a good mile from the shoreline to be up more than a few feet above Sea Level.

Anyhow, you can second guess all you like all the people who lived once on the Jersey Shore and in Coney Island and Rockaway Beach and on Fire Island too, but who will live there no more even if they did escape with their lives this time. While you are at it, you might also second guess all the folks who live in Tornado Alley on the Texahoma border. Not to mention all the folks who live in the Flood Plain of the Mighty Mississippi. Not to mention all those folks living on top of the San Andreas Fault or in range of Sparks from tinder dry Forests in New Mexico and Colorado. Wherever you are, eventually the Odds catch up with you, and you never know the day the Big Show will Come to a Theatre Near You. The odds don't appear to be improving here either, apparently 500 year floods now arrive 2 or 3 times a decade, and we get a new "Freak" event all the time like "Derechos", "Haboobs" and "Frankenstorms". Perhaps the most IMPORTANT Second Guessing to be done here is WRT the Nuke Plants distributed out worldwide in ALL of these vulnerable locations. Nuke Plants need a HUGE amount of Water for cooling, so they are always nearby major rivers or near the coast. The cities and Ag Land these Nuke Plants provide energy for quite often are over geological fault lines and/or subject to drought or flooding. There is nowhere "safe" to put something that has toxins that will last for Millenia, on a Millenial Timescale just about EVERY neighborhood gets hit with some kind of major disaster.

All Nuke Plants need to be Decommissioned, and all the spent fuel collected and sequestered off where it can do the least damage, perhaps in Antarctica or perhaps by sinking it into a subduction zone around the Marianas Trench, but it MUST be moved BEFORE, not AFTER the disaster strikes. Will we have to sacrifice the Lights and the Flush toilets? Most probably so, but at least perhaps then we will survive as a species and eventually come up with some better ways to manage the resources of the Planet we live on, and which gives us ALL life. Its the only one we got, and we ain't making out to any Exoplanets anytime too soon either. RE

|

| India Could Import Around 800 Tonnes This Year: World Gold Council Posted: 07 Nov 2012 11:42 AM PST |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

A newly re-elected President Barack Obama will continue encouraging loose monetary policies that will fuel inflation rates down the road, and investors need to get ready now, said famed commodities investor Jim Rogers.

A newly re-elected President Barack Obama will continue encouraging loose monetary policies that will fuel inflation rates down the road, and investors need to get ready now, said famed commodities investor Jim Rogers. In our complex and diverse marketplace, it is not always the most convenient option to go through through "Better Business Bureau," 100% customer recommended establishments. After all, these businesses tend to be larger than some of the other options in a marketplace. So, for instance, while it is tempting to store with a company like Garda or Brinks, since they come recommended from all the self-directed IRA companies and are well-established companies, there is nothing like being able to talk face-to-face with a local business owner who is willing to make safes available to you. You can feel more comfortable, and even more control. But, there is often more than meets the eye, and that is why you must be wary of the precious metals investors' biggest foe: The undisclosed, unallocated account.

In our complex and diverse marketplace, it is not always the most convenient option to go through through "Better Business Bureau," 100% customer recommended establishments. After all, these businesses tend to be larger than some of the other options in a marketplace. So, for instance, while it is tempting to store with a company like Garda or Brinks, since they come recommended from all the self-directed IRA companies and are well-established companies, there is nothing like being able to talk face-to-face with a local business owner who is willing to make safes available to you. You can feel more comfortable, and even more control. But, there is often more than meets the eye, and that is why you must be wary of the precious metals investors' biggest foe: The undisclosed, unallocated account.

Gold prices may fluctuate, but the country's love for the yellow metal does not seem to diminish.

Gold prices may fluctuate, but the country's love for the yellow metal does not seem to diminish.

No comments:

Post a Comment