Gold World News Flash |

- James Turk: $2,000 Ounce Gold by End of 2012

- Overnight Market: Futures Breaking Below Draghi-Believe Lows

- Silver Update 10/25/12 Sham Silver Stockpiles

- First Government Demand For Physical Gold

- Why The Chinese May Buy Undervalued Junior Miners

- Guest Post: The Dark Age Of Money

- Commodity Technical Analysis: Gold Trades Higher after 1700 Test

- Book Review: Free Market Revolution: How Ayn Rand's Ideas Can End Big Government

- Fukushima Fish Still Glowing As Brightly In The Dark One Year Later

- David Einhorn Explains How Ben Bernanke Is Destroying America

- TURD ON GOLD

- Has the Gold Price Correction Ended? Gold Clawed Back $11.50 Closing at $1,712

- Gentlemen, Start Your Deloreans

- A Valuable, Valuable Clue As To What To Do

- Welcome to the Currency War, Part 4: Corporate Revenues Plunge

- Gold Daily and Silver Weekly Charts

- German gold has been gone since 2001, Turk tells King World News

- Jesse: Gold and silver are the strategic high ground in the currency war

- James Turk - The Entire German Gold Hoard Is Gone

- IT'S JUST MATH

- Why This New Uranium Mine Is Critical For European Nuclear Power

- A Review of Gary North's "What is Money?"

- James Bond, Buffett's Martian, and Europe's New Gold Standard

- The Telegraph Notes Mystery German Gold Withdrawal and GATA's Clamor About It

- Manufactured Market Drama

- LGMR: UK Economy News Dents Gold in Pounds, Diwali "Could See Last Minute Rush" for Gold

- National Economic Suicide

- Welcome To The 10th Annual Silver Summit In Spokane Washington 25.Oct.12

- The Road To Bullion Default: Part II

- QE3 – Pay Attention If You Are in the Real Estate Market

| James Turk: $2,000 Ounce Gold by End of 2012 Posted: 26 Oct 2012 12:00 AM PDT from radio.goldseek.com:

CLICK HERE FOR AUDIO INTERVIEW This posting includes an audio/video/photo media file: Download Now |

| Overnight Market: Futures Breaking Below Draghi-Believe Lows Posted: 25 Oct 2012 11:06 PM PDT S&P futures are being crushed overnight. Currently trading below the levels of September 5th Draghi comments (back under 1400) and -11pts from the close. AUD is weak, Treasuries are modestly bid (as is the USD) and commodities are rolling over. The catalyst? We see four things: 1) Delayed reaction to global supply chain implications of an AAPL outlook cut (and/or overseas holders hedging) as well as some missed earnings in China; 2) Major Aussie quasi-bank Banksia (yes, its really called that!) hitting the skids (a la Northern Rock) bringing fear that Australia is entering 2008-mode USA; 3) a NYT article which could be inferred as a direct attack on the Chinese political faction (exposing Wen Jiabao's hidden billions); and/or 4) a realization that at 14-plus x P/E multiples, the US equity markets are not pricing in anything the kind of possible pain a fiscal cliff scenario (or Romney-ite in the Fed) might bring. Of course, the need for a narrative is irrelevant, the most net long position since 2008 is unwinding (for now) but by the time we wake for New York's morning, things could have reversed once again.

S&P 500 futures are down over 11pts at 1396.50 - 100DMA is 1388.75, 200DMA is 1364.5

AUDJPY is 1 big figure down from yesterday's highs. TSY ylds are 6bps down from yestereday's highs. WTI is at the lows of the week - around $85. Gold and Silver are sliding - down 1% on the week at $1703 and $31.79 respectively. The NKY, Tpoix, and Hang Seng are down around the same 1% or so as US equity futures but the Shanghai Composite is down 1.7%. |

| Silver Update 10/25/12 Sham Silver Stockpiles Posted: 25 Oct 2012 10:54 PM PDT from BrotherJohnF: |

| First Government Demand For Physical Gold Posted: 25 Oct 2012 10:50 PM PDT Jim Sinclair's Mineset My Dear Extended Family, Whatever real gold there is will supply this. This is the first demand for the real thing by a government while some governments are on the ropes. Now someone should take delivery from the Crimex. The old German story is interesting but what has occurred today is the real thing. You should be interested in who is a part of the German organization significantly responsible for this. Respectfully yours, Jim The Germans Are Coming for Their Gold Published: Wednesday, 24 Oct 2012 | 5:10 PM ET John Carney Senior Editor, CNBC.com A German federal court has said that country's central bank should conduct annual audits and physically inspect its gold reserves worldwide, including gold in the custody of the Federal Reserve Bank of New York. In addition to the FRBNY, Bundesbank gold is stored in London, Paris and Frankfurt. For decades, the Bundesbank has relied on written confirmation of its g... |

| Why The Chinese May Buy Undervalued Junior Miners Posted: 25 Oct 2012 09:42 PM PDT

|

| Guest Post: The Dark Age Of Money Posted: 25 Oct 2012 09:13 PM PDT Authored by James C. Kennedy, originally posted at CounterPunch, [It's Thursday; The World Series is on - so is Football; Grab a drink, we know it's long - and read this - at least skim the bolded segments and the last section - will open your mind a little] If you often wonder why ‘free market capitalism’ feels like it is failing despite universal assurances from economists and political pundits that it is working as intended, your intuition is correct. Free market capitalism has become a thing of the past. In truth free market capitalism has been replaced by something that is truly anti-free market and anti-capitalistic. The diversion operates in plain sight. Beginning sometime around 1970 the U.S. and most of the ‘free world’ have diverged from traditional “free market capitalism” to something different. Today the U.S. and much of the world’s economies are operating under what I call Monetary Fascism: a system where financial interests control the State for the advancement of the financial class. This is markedly different from traditional Fascism: a system where State and industry work together for the advancement of the State. Monetary Fascism was created and propagated through the Chicago School of Economics. Milton Friedman’s collective works constitute the foundation of Monetary Fascism. Knowing that the term ’Fascism’ was universally unpopular; Friedman and the Chicago School of Economics masquerade these works as ‘Capitalism’ and ’Free Market’ economics. The foundation of Friedman’s corrupting principle is that the investor (money to be more precise) has no duty, obligation or covenant to anyone or anything. Friedman’s ‘Market’ is not subject to ‘any’ human standard of morality, political limitations or national interests. Money is free to act without bounds or conventions. Nothing is prohibited as long as the market can provide a “clearing price”. The fundamental difference between Adam Smith’s free market capitalism and Friedman’s ‘free market capitalism’ is that Friedman’s is a hyper extractive model, the kind that creates and maintains Third-World-Countries and Banana-Republics, without geo-political borders. If you say that this is nothing new, you miss the point. Friedman does not differentiate between some third world country and his own. The ultimate difference is that Friedman has created a model that sanctions and promotes the exploitation of his own country, in fact every country, for the benefit of the investor, money the uber-wealthy. He dressed up this noxious ideology as ‘free market capitalism’ and then convinced most of the world to embrace it as their economic salvation. As improbable as it sounds, this ideology has the near-universal support of most economists, the media, universities, the Federal Reserve, the U.S. Treasury, nearly every member of The U.S. Congress and most everyone you know. Today Friedman’s ideology is accepted, to some degree, by nearly every country in the world. But ultimately this exploitive model is not sustainable at any level, or for anyone or any nation. The ultimate difference between Friedman’s ideology and Smith is simply this: Smith was in fact a Mercantilist. True, he opposed the custom of hording gold and other Mercantilist practices, but ultimately he was a Mercantilist. Smith promoted “free trade” with the goal of improving the English merchant’s advantage, and thus the State’s. Nothing expresses this more clearly that the title of his book An Inquiry into the Nature and Causes of the Wealth of Nations. Mercantilism is based on the relative wealth of one Nation State over the other, not the plunder of the State and it’s peoples for the benefit of the individual. Smith believed in the power of the State and recognized that it was only by the power of the State that free enterprise could succeed and thrive. In a world without the State, he sided with Lock, “life was brutish and short”. Consequently one had obligations to the State and the people who make up the state: the working man. According to Smith every butcher, baker, craftsman and merchant would seek out his own self-interest and that economic advantage would ultimately benefit his fellow Englishman and the Crown. Smith’s arguments against some precepts of Mercantilism were intended to give the English tradesman a greater advantage, nothing more. The intended effect was to enrich one’s State above all others as an alternative to the primitive act of war, the traditional means to National enrichment. Smith viewed things as a zero sum game. And as England was the undisputed master of global exploitation at this time, exploitation of other Nations was fair game. However, according to Economist David Ricardo trade between nations of relative economic parity result in what he termed “Comparative Advantage”. Comparative Advantage is based on specialization: Germany builds machine equipment, Italy does leather goods, France produces cheese, wine and literature. When these nations trade with each other all parties enjoyed a net gain as a result of specialization and non-duplication of resources. Of course this does not work when first world nations off-shore factories and jobs into subsistence-based economies (the term “comparative” is no longer germane). Off-shoring into non-comparative economies is purely extractive because all of the gains are ‘privatized and are no longer correlated to national interests. Non-Comparative off-shoring undermines both the host and source/flagship nation. The financial entity is able to extract environmental, capital, tax and infrastructure concessions from the host nation. If the host nation ever seeks to renegotiate its position with the financial entity the entity can enlist the powers of its flagship nation (i.e. State Department). This type of intervention can be very costly to the flagship nation and end very tragically for the host nation. Under Monetary Fascism the financial entity maintains out-sized rents from the host nation by utilizing the state as its enforcement agent, while maximizing tax avoidance via off-shore corporations (and other gimmicks). Free market capitalism, as conceived by Smith, was Nationalistic in nature and as the Nation State became wealthier, so did its people and industry. This relationship required shared obligations and shared rewards between the State and its people. Traditional Fascism, as conceived by Mussolini or Hitler, had an aggressive Nationalistic disposition where the State promoted Industry above all others in order to strengthen the State relative to its perceived rivals. Hitler and Mussolini believed that as the State lifted industry, industry lifted the people – dignity and pride in one’s nation were foundational principles. Monetary Fascism, as conceived by Friedman, uses the powers of the state to put the interest of money and the financial class above and beyond all other forms of industry (and other stake holders) and the state itself. In democracies and first world nations this is achieved through lobbying, campaign donations, financial incentives, revolving door regulators and through other means. As such, the state is coopted into altering regulations / legislation, diverting investigations / prosecutions or creating tax loopholes for the benefit of the financial class/ industry. Ultimately these actions undermine states sovereignty. For the rest of the world state interests and sovereignty are undermined through the IMF, The World Bank and other global monetary agencies. Monetary Fascism has a strong preference for political rather than capital investments. These investments are designed to sustain and support the preferences and activities of the financial class as it manipulates and create ever larger out-sized rent opportunities or constructs risk-diverting transactions that aggregate a ‘risk-arbitrage premium’ to one side of a transaction and transfers all future losses to the other. On a global basis Friedman’s ideas heavily influence international treaties on taxation and capital flows with the single minded goal of freeing capital from any obligation to the host or origin country. These agreements have essentially created a virtual nation, or non-nation, of money that is ultimately beyond the reach of the conventional Nation State. Friedman’s ‘invisible hand’ is free to extract the wealth of any corporation or Nation without any reciprocal obligations. The Serene Insurrection of Money All economic theories are devised to fill a need; to justify public and / or private actions. With the rapidly growing profits to the financial class during the divestment era, beginning in the early 1970s and continuing today, they needed some ideological justification for what they were doing (selling out America’s future and destroying corporations and jobs for quick profits) so they found and embraced Monetary Fascism. In fact, they found each other: Friedman was just ‘fulfilling a need in the market place’. Friedman simply created a new ideology that justified what the financial class was doing. Rationalizing the divestment of an entire economy is morally deplorable, but it also offered “out-sized” profit opportunities on a massive scale. Seeking relevance in this sweeping tide of economic-cannibalism other academics rushed into the water. None bothered to consider the long term consequences that would result from the wholesale dismemberment of our industrial economy. Instead academics suddenly ‘discovered’ an implausible utopian future that would be sustained by the creative powers of finance and trading our industrial heritage for a service economy. Shocking? – no, the academic promotion of concepts, theories, historical narratives and the state of ‘fact’ and ‘science’ are increasingly available to the highest bidder. Custom realities are also made-to-order ad nausea from within our Nation’s many tax exempt ‘think tanks’ that attempt to define public debate and guide public policy for the benefit of their patrons. Milton Friedman and the Chicago School of economics claimed to have refined and developed modern, scientific tools of ‘free market capitalism’, capable of unlocking ever greater rewards from Adam Smith’s simple, primitive concept of free markets. Monetary Fascism was rapidly adopted because western culture recognizes the tremendous historical contributions of traditional free market capitalism and wanted to participate in the promise of these enhanced rewards. In truth, it was nothing more than a cloak of deception – providing cover for the unscrupulous behavior of investment bankers, corporate raiders, speculators, off-shore corporation, debt mongers and bubble pushers (typically one and the same). The enhanced rewards came from the pilfering of capital investments and technology from generations past, the liquidation of employees and off-shoring of production, the pilfering of pension accounts and the termination or spin-out of R&D departments and option packages to executives and directors that focused on short term stock price targets. Bell Labs, once part of AT&T, laid the foundation for all modern telecommunication and electronics technology today was morphed into Lucent Technology. Lucent quickly looted the legacy portfolio of Bell Laboratories to enrich themselves and shareholders, leaving a worthless shell that was eventually merged with Alcatel. Wall Street Investment Bankers, leveraged buyout firms and hedge funds became the Paladin Knights of the ’free market’ whose allegiance was to the ‘noble shareholder’, markets and liquidity. In truth the shareholder was/is nothing more than a nameless, faceless transient in an endless pursuit of ever larger ‘outsized returns’. Traditional capital formation was replaced with financial schemes designed to acquire existing asset for liquidation, management and directors traded long term management discipline for short term performance and accounting gimmicks tied to stock and option pricing. With most of the IPO capital used to pay for the exit of early investors, the stock market has become nothing more than a series of game theory type exit strategies. The equity markets are a failed forum for the creation of productive or capital intensive projects. However, the larger system failure at the nation and global level stems from the perversion of the public and private debt market. This was made possible through massive decade’s long deregulation and the post 2008 financial crisis. The entire 2008 financial crisis lies at the feet of The U.S. Congress. When The U.S. Congress repealed the Glass Steagall Act, passed in response to the Great Depression, they eliminated any meaningful financial oversight within the Banking and Investment Banking industry. Why did the U.S. Congress change the law that protects our economy from a second 1930s type depression? Simple, it was campaign contributions (shit-loads of cash, considered bribes or worse in the private sector), filling the top post in the Fed, Treasury and the Administration with top level executives from Goldman and the like and the prospects of private sector jobs in the financial industry for pliable regulators, retired Members of The U.S. Congress and former Presidents. It was from the decades-long cash infused orgy of conflicted interest that Congress finally entrusted the financial industry with “self-regulation.” If you believe the rhetorical record, deregulation was intended to unleash the ‘wealth creating powers’ of these new financial instruments created through the pure genius of the investment bankers. Alan Greenspan and others saw no limits to the potential economic contributions of the financial markets – if they could only be freed of unnecessary and burdensome regulations. This wanton deregulation allowed the financial industry to create trillions of dollars in unregulated CMOs and CDSs (CMO: Collateralized Mortgage Obligations – packages of high risk mortgages that were rated AAA & CDS: Credit Default Swaps – bogus insurance on junk paper like CMOs) and other complex derivatives, hypothecated derivatives, synthetic derivatives, even hypothecated synthetic derivatives and the ‘black pools’ of unregulated capital that created and priced these complex financial instruments. This resulted in the unprecedented and unsustainable accumulation of debt and related derivative instruments, literally in the hundreds of trillions of dollars, dwarfing global GDP by a number of factors, controlled by unregulated and uninhibited bankers. Ultimately it has cost most nations their sovereignty. Monetary Sovereignty and the Death of Nations Friedman’s model of wealth extraction has been in conflict with the traditional Nation State and the concept of State sovereignty from inception. Great, you say! The state is evil and must be replaced with something new. Beware of this thinking. The evils of the state are nothing when compared to the money-counter. The State must answer to the public, or at least the mob. The money-counter only answers to his insatiable desire for more and more money. Friedman’s ideology undermines State sovereignty by initially delinking the aggregation of wealth from the interest of the state. As wealth accumulates it is then used to alter political outcomes, tax avoidance and financial regulations for the benefit of the wealthy. Throughout history the State has always jealously protected its sovereignty. So how did this ideology survive and eventually overtake the State. Easy, they co-opt everyone. First the academics and think tanks then one political party after the other. The media was consumed and consolidated by large corporate conglomerates who quickly enforced their own interest’s at the editor and programmer’s desk. Then they locked in the entire public through 401(k)s and savings plans. Even the unemployed and the unemployable qualified for credit cards, new cars and even homes. At the national and global level they expanded public and private debt everywhere. They made everyone feel richer for a short time. At the same time the financial industry off-shored, liquidated, crowded out and displaced the traditional industry of our economy. With the introduction of Monetary Fascism financial activities as a percentage of GDP grew from less than 5% in 1969 to more than 22% of GDP by 2008. Over the same period U.S. manufacturing as a percentage of GDP declined from more than 26% to just 12%. Using historical measures 2008 GDP for the manufacturing sector would be considerably less than 10%. Only the federal government was consuming a larger portion of GDP at 35%. Taking the number one spot in the U.S. economy, the finance industry has become the most influential player in government. But the real power behind the finance industry is much deeper than just the political access that campaign donations buy, the financial industry has wide and deep influence throughout government policy via the Federal Reserve, Treasury, Fannie May, Freddie Mac, the FDIC, key advisory rolls in the Administration, Members of Congress, political appointments within the SEC, CFTC, and membership on The Council on Foreign Relations and participation in global organizations like the G8, G20, Basil Accords, IMF and World Bank. Through their unparalleled influence over the Administration, Congressional Finance Committees and the Federal Reserve they gained full control over the regulators. In fact, it was the Allen Greenspan, Tim Geithner (Federal Reserve) Robert Rubin, and Larry Summers (the Administration) and others who silence ‘Rouge Regulators’ who attempted to alert The U.S. Congress to the potential risks of deregulation, dark pools and derivatives. Greenspan, Summers, Rubin and others essentially staged a soviet era show trial against Brooksley Born and others, designed to send the message to any would-be-regulators that the rules no longer apply to the financial class. It worked. Once they controlled the regulators and the key members of the Congressional Finance Committee they were free to alter accounting standards, create complex financial vehicles, and leverage risk in derivatives while real losses accumulated to staggering and globally disruptive levels. They hypothecated CMOs and even synthetic CMOs to unsupportable levels, papering over any potentially observable warning signs with zero-collateral CDSs. The real risks to global finance were hidden in the derivative instruments related to the massive debt portfolios controlled by the “Too Big To Fail” banks with unprecedented political power. These banks were not subject to any measurable regulatory restriction. Point of fact, Goldman Sachs and others were able to morph into traditional Prime-Banks overnight, with the blessing of their regulators, instantaneously gaining unlimited access to the Discount Window. The act is so egregious that the public is incapable of cognition, while the media, academics and think tanks collectively remain silent. Unlimited access to the Discount Window was not enough. Investment Banks and the overall financial industry enjoy unlimited government largess in the form of Quantitative Easing, immunity from prosecution, as it relates to fraudulent financial instruments such as CMOs, CDSs & assorted derivatives, front running client accounts, pilfering of client accounts, wholesale asset sweeps from failed banks to failing banks and even the wholesale world-wide manipulation of LIBOR. The final act of treachery was delivered by the U.S. Supreme Court who imbued ‘money’ with a voice and electoral powers. This decision treated each and every single dollar in circulation as a prospective voter. In the hands of an ordinary citizen the dollar’s ultimate voice is limited to $2,500 per person per candidate. But in the hands of a corporate controlled Super-PAC the dollar’s voice is virtually unlimited. The Financial Sector invested more than $5 billion in campaign contributions and lobbyists from 1998 to 2008. As if $5 billion was not sufficient, the new Supreme Court Ruling and the creation of Super PACs will create a financial Tsunami Effect on politics. Super PACs may raise and spend unlimited sums of money from individuals, corporations, associations, and other interest groups to “overtly” advocate for political candidates. A recent example of how disruptive this is demonstrated by Sheldon Adelson and his wife’s $10 million contribution to Newt Gingrich. The Aelson’s ‘legal’ Super PAC contributions were able to keep ‘their candidate’ in the Republican Primary single handedly. Gingrich had no meaningful support beyond this single patron. Democracy? Representative government? This decision effectively abolished our representative form of government. Again, this act of treachery did not spark any meaningful discussions from academics, constitutional scholars, think tanks, civil rights groups or the media. Why? They have all been co-opted. Today the power of the State blindly serves the interest of these banks at the expense of all others. I am not claiming that this needs to be a preconceived conspiracy. To the contrary, the outcome was inevitable. Without any restraints most growth oriented systems, such as a virus, tend towards uninhibited growth. With no means of restraint, equilibrium becomes impossible. The single-minded focus on the growth of money compromises all other systems in the economy. Any U.S. political leader who puts forward a Nationalist agenda is pillared as an opponent of ‘free trade’ and a danger to ‘free markets’. A perfect example is the U.S. Congressional and Administrative reaction to traditional Industrial Policy initiatives. The universal reaction is to characterize any U.S. Industrial Policy initiatives as “anti-free trade” and un-American. This is wrong on both counts: Adam Smith’s entire argument about free trade was intended to enhance England’s Industrial Policy. It is also a fact that the U.S.’s industrial greatness was rooted in 200 years of government directed, supported or sponsored Industrial Policy. The press and pundits also contribute to this reversal of reality when they recently questioned Obama’ |

| Commodity Technical Analysis: Gold Trades Higher after 1700 Test Posted: 25 Oct 2012 07:54 PM PDT courtesy of DailyFX.com October 25, 2012 03:25 PM Daily Bars Chart Prepared by Jamie Saettele, CMT Commodity Observations: “Gold is nearing potentially strong support from the 38.2 retracement of the rally from 1522.50 at 1691.40 and 9/7 low at 1689.05. The decline from the top would consist of 2 equal legs at 1685.63 (also the 9/3 low).” Commodity Trading Strategy Implications: 1685-1691 is a level to consider longs LEVELS: 1646 1677 1685/91 1714 1730 1753... |

| Book Review: Free Market Revolution: How Ayn Rand's Ideas Can End Big Government Posted: 25 Oct 2012 07:40 PM PDT |

| Fukushima Fish Still Glowing As Brightly In The Dark One Year Later Posted: 25 Oct 2012 07:33 PM PDT In the immortal words of Bruce-the-shark from Finding Nemo: "Fish are friends, not food"; but in Fukushima, they are neither! As Bloomberg reports, radiation levels of fish caught off the coast of Northern Japan are as high as they were a year ago with contamination levels particularly high among bottom-dwellers. There remains a fishing ban on these bottom-dwelling fish as 40% are still above the limit for human consumption. As one scientist noted, "This means that even if these sources were to be shut off completely, the sediments would remain contaminated for decades to come." So, today's lesson is, Fukushima fish are neither friends nor food, but more like lava lamps we suspect.

Via Bloomberg:

|

| David Einhorn Explains How Ben Bernanke Is Destroying America Posted: 25 Oct 2012 06:50 PM PDT David Einhorn knocks it out of the park with his very first statement during today's Buttonwood Gathering, in a segment dedicated to one thing only: explaining how the Fed's policies are not only not helping the economy, they are now actively destroying this country.

And that, in a nutshell is it: everything else follows. Because in addition to explaining the same fundamental error in the Fed's logic (from an economic standpoint; we already showed what the "market" error is, namely that instead of forcing investors to buy risk assets as Bernanke's wealth effect prerogative demands, these same investors are merely frontrunning the Fed's purchases of bonds and MBS, in what is truly a risk free, if lower-returning trade, and is key reason why ever fewer equity market participants are left, leading to lower bank revenues, bank employee terminations, lower Federal and State tax refunds, and so on, in a closed loop) it also points out the social aspect. At one point in the interview, Einhorn observes that traders and economists now have diametrically opposing views on the effectiveness of QE (no need to explain whose view is what). The reason for this dichotomy is simple, if crucial: we are now at a point where the entire practice of new-classical economics - the bedrock thinking of all modern soecity - is at risk of being exposed for a sham "science" which is and has always been absolutely flawed. Because when one day the Fed fails to prop up the Fed, and fail it will, all the economists that encouraged the Fed to do what it does, without grasping the true implications of 'diminishing returns', will be forced to fall on their swords (hopefully metaphorically but who knows). And with that the end of the shaman cult that shaped the modern world will finally end. But not before every single "economist" keen on perpetuating their job, their tenure, and their paycheck for as long as possible, backs the Chairman fully and unconditionally: anything less, any outright dissent within the economic cabal, would lead to a far faster unwind of the Fed's policy artifice even faster than it otherwise will fail. Recall that this was precisely the dilemma before the Bundesbank as we explained yesterday, when it did what it had full right to do openly, yet did secretly, when it pulled its gold inventory from London: it implicitly confirmed it was no longer a willing participant of the NWO, and no longer is willing to sacrifice its sovereign independence at the altar of Keynesianism, and monetary theory. But back to Einhorn, who presents one of the most coherent explanations why QE, contrary to the Chairman's "best intentions" does nothing to stimulate the economy at the consumer level, and why it effectively serves as a hindrance to future growth:

As a reminder, in America consumption, not the government (which despite incorrect claims to the contrary has never created even one penny of wealth), is responsible for 70% of annual GDP. Is it any wonder that the Fed's own policies, done solely to protect the financial system, and to enrich those whose wealth is already primarily in the stock market (the infamous "1%"), are the cause of the ongoing catastrophe that is the destruction of America's middle class, which day after day sinks lower and lower? Also, in direct debunking of all those Magic Money Tree (aka MMT) "economists" who say that government deficits are a great thing because the lead to higher savings, while maybe true on paper, Einhorn shows that the "expectations" component of behavior here is far more critical than what simplistic Econ 101 textbooks claim, especially the ones that were written long before anyone thought that the US would have a Zero Interest Rate Policy for at least 7 years (and likely more until the runaway inflation finally hits):

Finally, and touching on the previous point of why theoretical economists' views differ so much from those who practically make a living by being right for a change, Einhorn is laconic: "It's very hard for economists with models, with very limited sample sets and empirical data to understand [that we've gone beyond the point of monetary policy diminishing returns.] I think you wind up with a different view from people like me in the real world who aren't just trying to figure out what do the models say, but how do people actually behave.... We've opened up enormous tail risks of what happens if the Fed loses control, what happens if the Treasury loses control and these scare people and drive up risk premiums, and drive down P/E multiples and make companies defer long-term investments in the country because they are worried about significant tail risks these very aggressive policies are creating." And there you have it - someone please advise Paul Krugman and his cotterie of useless voodoo shamans whose only recommendation has always been more of the same. Pardon: much, much more. None of the what Einhorn said in today's Buttonwood gathering of course is news, as he simply reiterated everything he said in his letter to investors from Tuesday, which is just as effective at explaining how the Fed's solipsistic illogical methods are bankrupting America. The key section in that letter is the following excerpt:

And so on. If by now it is unclear to anyone that Bernanke is not only not doing anything to help America, or the world, but is merely accelerating this country's destruction, and perpetuating the same practices that result in breakouts of food price shocks leading to isolated genocide in those parts of the world without a safety net, then we congratulate you on your imminent receipt of a Nobel prize in Economics. Finally, for those asking "what should be done", Einhorn's suggestion is identical to the one Zero Hedge has preached to its readers since day 1, nearly 4 years ago. And we don't even charge 2 and 20...

So who should listen to: a failed historian-economist who has never worked in the real world, who has no idea how human behavior plays out in reality, who has lived in an ivory tower all his life, and who has never had to put his money where his mouth is, or a self-made billionaire? For us the choice is clear. * * * The Einhorn segment in the Economist clip below starts 56 minutes in. Watch live streaming video from theeconomist at livestream.com And for more context, here is what Einhorn said about the Fed in his latest letter to clients:

One observation: it is not $40 billion. It is $85 billion as we said the day QE3 was announced:

Because remember: exchanging Long-Term debt which has massive 10 year equivalent duration, with risk free paper, aka Operation Twist and of which $45 billion takes place each month (i.e., the direct monetization of all gross Treasury issuance with a maturity more than 10 Years) is merely another "Flow" type operation. Einhorn continues:

|

| Posted: 25 Oct 2012 06:28 PM PDT |

| Has the Gold Price Correction Ended? Gold Clawed Back $11.50 Closing at $1,712 Posted: 25 Oct 2012 05:33 PM PDT Gold Price Close Today : 1712.00 Change : 11.50 or 0.68% Silver Price Close Today : 32.049 Change : 0.454 or 1.44% Gold Silver Ratio Today : 53.418 Change : -0.404 or -0.75% Silver Gold Ratio Today : 0.01872 Change : 0.000140 or 0.76% Platinum Price Close Today : 1567.10 Change : 6.90 or 0.44% Palladium Price Close Today : 604.80 Change : 11.75 or 1.98% S&P 500 : 1,412.97 Change : 4.22 or 0.30% Dow In GOLD$ : $158.22 Change : $ (0.73) or -0.46% Dow in GOLD oz : 7.654 Change : -0.035 or -0.46% Dow in SILVER oz : 408.86 Change : -5.04 or -1.22% Dow Industrial : 13,103.68 Change : 26.34 or 0.20% US Dollar Index : 80.03 Change : 0.075 or 0.09% The GOLD PRICE clawed back $11.50 to close $1,712. Toughest job in the world is calling thing by their real name -- admitting what your eyes see and your ears hear. The SILVER PRICE today regained 45.4 cents to close above 3200 at 3204.9c. I know this soundeth sanguine, but 'tain't. They have only risen to the ruling downtrend line, and until they close ABOVE that downtrend line and confirm intentions by doing it twice, they are still obeying that downtrend line, no matter what I would like em to do. I remind y'all, the SILVER and GOLD PRICE remain in a primary Uptrend, a BULL market. You are watching a mere normal correction in that bull market. Keep watching for that place to buy. Today was Dead Cat Thursday, when most markets bounced no matter how moribund they might be. All but the US dollar index, which rose a determined 7.5 basis points to elbow its way through that 80.00 resistance and close at 80.034. US dollar is still nursing a rally, and fended off an attack today that drove it down to 79.70. It wheeled and closed above 80. Now it's time to spit or chew: dollar index has posted two tops about the same place yesterday and today. Tomorrow it must advance. Currencies: US$1.00 = Y80.30 = E0.7732 Whoa! Just when I thought the yen had finished falling, it found a manhole cover, dragged it off, and jumped down the hole. Lost 0.64% today, gapped down, and closed at 124.54 cents. If it doesn't stop at the June low (124.12), it could plunge to 119. Euro looked only slightly better. Range widened out and it lost 0.28% to close at $1.2934, now below the $1.2970 twenty day moving average. It's only hovering above its 200 DMA ($1.2826). One piece of really bad news would send the euro tailspinning toward $1.2600. Stocks wound up with tiny gains after a very raggedy day. Dow gained 0.2% or 26.34 points to 13,103.68. S&P50 gained 4.22 to 1,412.97. Not a step of this bodes well for stocks. They have broken down through the neckline of that head and shoulders that they painted earlier in the year, formed a fatal rising wedge, fell down out of that, and confirmed their love of gravity by closing below the 20 and 50 day moving averages, and if the 200 DMA was a pretty girl, the Dow'd be close enough to steal a kiss (12,972.57). Stocks need some magic to pull out of this nosedive, and I think Swami Ben is all out of tricks. But what good is the opinion of a natural born fool from Tennessee? Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Gentlemen, Start Your Deloreans Posted: 25 Oct 2012 04:48 PM PDT Submitted by Lee Quaintance & Paul Brodsky of QBAMCO, "If my calculations are correct, when this baby hits 88 miles per hour... you're gonna see some serious _ _ _ _." It seems engines are revving and it may be time to go forward to the past. Earlier this month, a large and well respected asset manager that has begun taking positions in gold expressions issued a report in which it began to justify gold's relative value. One metric it used was comparing the quantity of currency in the world to the quantity of gold. The report concluded that using this metric, the relative value of gold would be about $2,500/ounce, a significant premium to its current spot price. The analysis posited gold's value upon a return to the gold standard, posing the question: "what if the entire world's gold were used to back the global supply of fiat currency?" It then explained that there are approximately $12.5 trillion of physical and electronic global currency reserves and in excess of 155,000 metric tons (tonnes) of above-ground gold (which would imply a price of approximately $2,500/ounce if current global bank reserves were to be backed by gold). As you know, we agree fully with the concept of finding one's value bearings on gold by pricing its quantity vis-à-vis the quantity of reserves (as per our Shadow Gold Price); however, we thought it important to explain the flaws in the method used above, and to augment it in a way we feel better portrays gold's present value. First, we do not think $12.5 trillion in global base money is the relevant figure to use as the numerator. The only reason there would be a conversion from a fiat monetary system to a gold standard would be continuing financial pressures, specifically pressure from the commercial marketplace to deflate the value of systemic credit. This credit-deflation dynamic began in 2008, and has been forcing global central banks to print more base money (bank reserves) with which to service and repay that credit. In a global monetary system in which the future purchasing power of currencies is respected and the system is generally perceived as solvent, there would be no need for a conversion to a fixed exchange rate (a gold standard). So, any discussion of conversion must presume further stress weighing on the marketplace; the ongoing perception of endless money creation that threatens further purchasing power loss. A gold standard would be demanded by global commercial counterparties and savers. Central banks and their treasury ministries would ultimately be forced to cap such fears by "fixing" the exchange value of their currencies to gold. So the numerator in the calculation should not be the current level of base money, but the amount of unreserved credit in the system (i.e. global bank assets). (Fiat currencies are largely credit currencies, created primarily in the banking system as unreserved loans that create offsetting deposits in kind.) Thus, we think the most appropriate benchmark to use as the numerator in the calculation would be global bank assets – about $100 trillion – not $12.5 trillion in global base money. Second, for gold to be money in a gold standard overseen by governments, the denominator used must be official gold holdings – not total above-ground gold in the world. Otherwise, the mechanism of a gold standard – the ability to exchange a government-sponsored currency for gold interchangeably at a fixed rate – would not work. As per the World Gold Council, about 31,000 tonnes of gold is held in official hands (only about 20% of total above-ground reserves). Central banks have no legally or ethically enforceable claim on the balance of the 155,000 tonnes, which is held in private hands. This implies that the denominator in the calculation would have to be much closer to 31,000 tonnes than 155,000 tonnes. So, we agree with the logic of dividing base money by gold holdings to find gold's "intrinsic value" (as per Bretton Woods and our Shadow Gold Price), but we believe the reasonable value upon conversion to a gold standard would be many multiples higher than $2,500/ounce. We are heartened that some of the world's largest and most sophisticated financial asset investors are beginning to consider money and gold stocks into their present value analyses for currencies, and in turn into their portfolio allocations. We believe allocations to gold will increase substantially as investors previously dedicated to stocks and bonds progress in their analysis. Speaking of Transmissions… Herewith a reiteration of our proposal of a transmission mechanism to a fully-reserved banking system, gold standard and fully-funded federal debt in the US:

Theoretically, the notional size of the existing money stock would remain stable so there would be no diminution of purchasing power by existing currency holders. The wealth redistribution that would occur at revaluation would be from current non-gold asset holders to gold holders, which is a byproduct of bank system deleveraging regardless of whether it is market-driven or policy administered. While some continue to argue that the US can only get its fiscal house in order by running trade and/or budget surpluses, it would seem the US's official gold stock could be revalued to the extent that no trade or budget surplus is necessary as any sort of precondition. Going forward, of course, if the US were to allow trade and budget deficits to persist, it would lose its gold in the process and the credibility of the dollar would decline in sympathy. Practicalities The Fed would pay for Treasury's gold at a price high enough to provide the proceeds to Treasury to pre-refund ALL of its debt. At the current U.S. bank asset to base money ratio, that number would be about 5 to 6 times the current spot price. In the aftermath of the dollar's devaluation against gold, it clearly would behoove the Fed to support gold as its own reserve base going forward. In aggregate, bank assets are marked at a premium to market value so banks would gladly dump their assets as marked. Banks would then have incentive to offer rates of return and maturity terms to depositors that are commensurate with the banks' lending opportunities (as things should be). Fears of US Treasury paper free-falling into a bottomless pit in response to the dollar devaluation are unfounded as these liabilities immediately become fully-funded by Treasury's gold sale to the Fed. There would be no domestic or foreign public/private bids required. In theory, the bank assets/loans the Fed would purchase could be marked down 90% if need be and still not impact the solvency of the Fed. The Fed could simply bid gold up X times to maintain its capital cushion. (After all, the Fed is the monopoly supplier of base money.) Some have argued that such a policy maneuver would put incremental pressure on non-US entities that have borrowed in USD terms. We disagree as the USD money stock that supported that debt originally would be unchanged in terms of its quantity. Only the mix between base and credit/deposit money has changed. Some have also argued that US Treasury paper would be susceptible to ratings agency downgrades as a result of these actions. Hogwash. Nothing would have occurred except an exchange of base money from the Fed to Treasury and gold from Treasury to the Fed. Thus, if anything, Treasury paper would be upgraded immediately as Treasury payments would be immediately defeased by the newly acquired base money proceeds from the gold sale to the Fed. As Marty McFly said; "I guess you guys aren't ready for that yet. But your kids are gonna love it." |

| A Valuable, Valuable Clue As To What To Do Posted: 25 Oct 2012 04:17 PM PDT October 25, 2012 Mogambo Guru Now, I gotta tell ya, I can remember a lot of things, mostly as a result of living a lot of years and thus spending a lot of years finding out about a lot of stuff, but 1910 was not one of them. Accordingly, on the Mogambo Hierarchy Of Interest (MHOI), it always rated a big, fat zero since I have never heard anything about 1910 that I could use. For instance, maybe in 1910 there was some wonderful hair tonic to grow my hair back, only fuller and more luxuriant, or some glorious elixir to give me a powerful, studly physique with bulging biceps and washboard abs, but without exercising, preferably in an inexpensive pill, that works overnight, while I sleep, so that I wake up refreshed, strong as an ox and looking like a million Hollywood bucks. Now THAT'S as a 1910 I could use! So, perennially scoring the proverbial "none of the above", I thought I would be immediately bored to death with some doofus email about 1910. It turns out I was wrong! It was more interesting than that, from an economics standpoint, by which I mean from an inflation standpoint, by which I mean prices going up, by which I mean the inevitable result of creating too much money and credit, by which I mean that the evil Federal Reserve is creating massively too much money and credit so that the horrid Obama administration can deficit-spend roughly $1.5 trillion a year, by which I mean we're talking about annually adding national debt equal to ten percent of GDP, by which I mean This Is Too Freaking Insane For Words (TITFIFW). For instance, from the email we learn that in 1910, "The average US wage in 1910 was 22 cents per hour." We later learn that "The average US worker made between $200 and $400 per year." Well, I immediately sense that this is the perfect opportunity to show off my skills in using a calculator, and so I start to look for mine, and I couldn't find it, eventually gave up after a fruitless twenty seconds or so, and reluctantly did the long-division by hand, over and over, seemingly getting a different result every damned time, until my hand got a cramp and I was really grumpy. In doing so, I found out two interesting things. 1) Doing long-division with paper and pencil is more confusing than I remember, and 2) The average US worker (working 52 weeks a year) worked somewhere between 909 hours per year (a lousy 17.5 hours per week) and 1,818 hours per year (a more respectable 35 hours per week). Immediately, the nimble Analytical Mind Of The Mogambo (AMMTM) concluded "Seventeen hours a week working? What a bunch of lazy bastards they were!" Of course, I am not going to call them "lazy bastards" out loud since that would cause, as it always does, those people who are merely standing nearby to perk up, happily start talking trash about me, and how I am the King of Lazy Bastards, and that I am, by consensus, the laziest bastard in town, no matter what town I am in, and definitely the laziest man any of THEM ever met. Ever! And it's not like I don't patiently and clearly explain to them that "I am not here to do any work, you lowlife morons! I am only here to (insert variously 'Get a paycheck,' 'Sit on my fat ass,' or 'Eat like a pig')!" Yet, unbelievably, they look at me like I am the crazy one! Me! I mean, why ELSE would I even BE here, ya morons? For my health? "So," I can hear you asking yourself, "what does any of this have to do with anything? Is there a point? Will he ever get to the point? Why am I wasting my pathetic life reading such Stupid Mogambo Crap (SMC), anyway? What in the hell is WRONG with me?" Well, since you are so impatient, I'll tell you the point: It has to do with inflation in prices, and how intelligent people fear inflation, especially the kind where people cannot afford to buy food, which is the big killer of economies and countries, and then there is usually a war with somebody, and the whole thing is a Big Freaking Bankrupted Mess (BFBM). More to the point, in 1910 "Sugar cost four cents a pound." Eggs were fourteen cents a dozen. Crappy coffee was fifteen cents a pound. That got me started thinking about how the prices we pay for these things are relatively low, according to the inflation calculator at the Bureau of Labor Statistics, as they calculate that it now takes $23.37 to buy what one dollar bought in 1913 (the farthest back the program can calculate). And even though 1913 is three full years after 1910, that's still a whopping 2,337% inflation! And that staggering loss of buying power of the dollar comes from just 3.14 % inflation per year, compounding! So anybody -- and I mean anybody! -- telling you that 5% inflation is a worthy goal, "to prevent deflation" in the prices of stocks, houses and overvalued things in general, is a complete and irredeemable moron, which I deftly prove by noting that this outrageous idiocy is the actual opinion of the horrible Ben Bernanke, lowlife loser chairman of the catastrophic failure known as the Federal Reserve, and whom I nominate as King of the Keynesian Econometric Nitwits. Now, after that unsavory-yet-satisfying bit of completely gratuitous rudeness and scornful disrespect, I will now, at last, add that spicy, piquant bit of extra horror that is so traditional during the Halloween season. In this case, the terror of John Williams of shadowstats.com still calculating inflation the correct, old-fashioned way, and finding the chilling, terrifying result that inflation in prices is now over 9% per year, compounding! And by "compounding" we mean, of course, "growing exponentially", which is the problem with debt growing at an exponential rate: After all these years and decades of creating massive amounts of debt (and therefore new money) to both spend and to pay the interest due on an even more unbelievably colossal amount of existing debt, the upward-sloping curve of debt ("curve of death!") is getting pretty steep, the required amount of new money necessary to "keep on keeping on" becomes truly unbelievable, and soon, after that, things will really start getting completely irrational. What to do? Beyond screaming in outrage and vowing to use the upcoming elections to wreak righteous revenge on the elected scumbags who caused all this mess, you mean? What to do? That's a good question! Hundreds of millions of people in the last 4,500 years of world history, in millions of other countries and governments, have faced this Exact Same Question (ESQ) because their rulers were this same kind of Stupid Corrupt Scumbags (SCS). So, pray tell, what did those hundreds of millions of people do? What Did they do? What did THEY do? What did they DO? I mean, if we knew what they all did, and how it worked out for them, it could provide a valuable, valuable clue as to what to do! Hmmmm! "A valuable, valuable clue as to what to do"! Catchy! Anyway, my fabulous bon mot aside, what history boils down to is that when the value of the currencies kept going down and down because the governments acted like they always do, the people who owned gold and silver (and got the hell out of town with it) did very well. Those who owned all other things did, unfortunately, not. So, I ask incredulously, how can this "investing thing" get easier when it is so glaringly, grotesquely obvious that the corrupt Federal Reserve is now, year after year, creating enough money equal to a tenth of GDP? Causing massive price inflation? So that the insane federal government can borrow and deficit-spend that selfsame tenth of GDP? All because the US economy is now disgustingly distorted, monstrously malignant, twisted and totally, totally dependent upon massive, gagging amounts of government spending? If you suddenly feel sick to your stomach, like me whenever I think of it, cheer up! I have good news at last! What to do? It's not for nothing that Junior Mogambo Rangers (JMRs) around the world eagerly accumulate gold and silver bullion, and who say to themselves as they do, "Whee! This investing stuff is easy!" And with 4,500 years of history backing their play, how can they lose? Easy and guaranteed! Whee! |

| Welcome to the Currency War, Part 4: Corporate Revenues Plunge Posted: 25 Oct 2012 03:20 PM PDT |

| Gold Daily and Silver Weekly Charts Posted: 25 Oct 2012 02:20 PM PDT |

| German gold has been gone since 2001, Turk tells King World News Posted: 25 Oct 2012 02:09 PM PDT 2:52p CT Thursday, October 25, 2012 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk, whose 2001 commentary first posted at his Free Gold Money Report Internet site, "Behind Closed Doors" -- http://www.fgmr.com/behind-closed-doors.html -- and republished at GATA's Internet site -- -- martialed the evidence that the United States had swapped gold with the German Bundesbank for market-rigging purposes, today tells King World News that all the German gold vaulted abroad has been gone, leased into the market, for 11 years. Excerpts from the interview and Turk's 2001 commentary are posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/10/25_J... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Opinion Around the World Is Changing When Deutschebank calls gold "good money" and paper "bad money". ... http://www.gata.org/node/11765 When the president of the German central bank, the Bundesbank, pays tribute to gold as "a timeless classic". ... http://www.forbes.com/sites/ralphbenko/2012/09/24/signs-of-the-gold-stan... When a leading member of the policy committee of the People's Bank of China calls the gold standard "an excellent monetary system". ... http://www.forbes.com/sites/ralphbenko/2012/10/01/signs-of-the-gold-stan... When a CNN reporter writes in The China Post that the "gold commission" plank in the 2012 Republican platform will "reverberate around the world". ... http://www.thegoldstandardnow.org/key-blogs/1563-china-post-the-gop-gold... When the Subcommittee on Domestic Monetary Policy of the U.S. House of Representatives twice called on economist, historian, and gold standard advocate Lewis E. Lehrman to testify. ... World opinion is changing in favor of gold. How can you learn why and what it will mean to you? Read the newly updated and expanded edition of Lehrman's book, "The True Gold Standard." Financial journalist James Grant says of "The True Gold Standard": "If you have ever wondered how the world can get from here to there -- from the chaos of depreciating paper to a convertible currency worthy of our children and our grandchildren -- wonder no more. The answer, brilliantly expounded, is between these covers. America has long needed a modern Alexander Hamilton. In Lewis E. Lehrman she has finally found him." To buy a copy of "The True Gold Standard," please visit: http://www.thegoldstandardnow.com/publications/the-true-gold-standard Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Fred Goldstein and Tim Murphy open All Pro Gold Longtime GATA supporters Fred Goldstein and Tim Murphy have brought their many years of experience in the precious metals and numismatic coins to All Pro Gold as metals brokers who specialize in the delivery of gold and silver bullion bars and coins as well as numismatic gold and silver coins. Fred and Tim follow these markets closely and are assisted by a team of consultants in monitoring market trends. All Pro Gold offers GATA supporters competitive pricing on all bullion products and welcomes inquiries. Tim can be reached at 602-299-2585 and Tim@allprogold.com, Fred at 602-799-8378 and Fred@allprogold.com. Ask about their ratio strategy and the relationship of generic $20 dollar gold pieces to 1-ounce gold bullion coins. Visit their Internet site at http://www.allprogold.com/. |

| Jesse: Gold and silver are the strategic high ground in the currency war Posted: 25 Oct 2012 01:41 PM PDT 2:35p CT Thursday, October 25, 2012 Dear Friend of GATA and Gold: Jesse's Cafe Americain has some insightful commentary this week about the international currency war and gives GATA credit for perceiving the war's gold and silver details. Jesse writes: "Gold and silver are intimately involved in the unfolding currency war, because they take no sides and have no counterparty risk. No one can print them. And this is why I think GATA is right -- not because of the evidence they have, which is more substantial than one might suspect given obsessive secrecy and the disinformation campaigns -- but because it is exactly what one would do if there was to be a currency war, and such things as gold and silver existed. It is basic strategy of war: Seek to control the high ground. And along with oil, gold and silver are strategic high ground in a currency war. And the first victim in a war is the truth." Jesse's commentary is posted here: http://jessescrossroadscafe.blogspot.com/search?updated-max=2012-10-23T1... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Platinum Intercepts Best Pt+Pd+Au Grades Yet Company Press Release VANCOUVER, British Columbia -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) announces more results of its 2012 drill program on the company's fully-owned Wellgreen platinum group metals, nickel, and copper project in southwestern Yukon Territory, Canada. Four surface holes and four underground holes all intercepted significant mineralized widths, ranging from 28.5 meters (WS12-201) and up to 459.5 metres (WS12-193). Highlights include WU12-540, which returned 8.9 metres of 5.36 grams per tonne platinum, palladium, and gold; 1.73 percent copper; and 1.01 percent nickel within 304.5 meters of 0.66 g/t platinum-palladium-gold, 0.20 percent copper, and 0.27 percent nickel. The surface drill program started in June and has completed 16 holes (assays pending for 12 holes) with two rigs now on site. The surface program continues to progress at a steady pace. Prophecy Chairman John Lee commented: "Wellgreen is a very large nickel, copper, and platinum group metals project with near-surface high-grade zones. High-grade intercepts will be incorporated into resource modeling and mine planning in the pre-feasibility study. We expect further positive drill results from Wellgreen shortly." Wellgreen features a low 2.59-to-1 strip ratio, is situated at an altitude of 1,300 meters, and is only 15 kilometers from the two-lane paved Alaska Highway. Those factors significantly minimize the project's indirect costs. For the complete company statement with full tabulation of the drilling results, please visit: http://prophecyplat.com/news_2012_sep11_prophecy_platinum_drill_results.... Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT GoldMoney adds Toronto vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, and the United Kingdom, GoldMoney customers now can store their gold and silver in a high-security vault operated by Brink's in Toronto, Ontario, Canada. GoldMoney also has recently partnered with Rhenus Freight Logistics to offer another gold storage option in Switzerland. The Rhenus vault is in the secured zone of Zurich Airport and offers customers superb security as well as the ability to inspect their gold. Storage at the new vaults in Canada and Switzerland is available at GoldMoney's lowest fees. Customers can select their storage location when placing their buy order. GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata |

| James Turk - The Entire German Gold Hoard Is Gone Posted: 25 Oct 2012 12:58 PM PDT  Today James Turk shocked King World News when he stated, "The entire German gold hoard was gone because it had been leased into the marketplace. Meaning, the vaults holding German gold were emptied by 2001 because of the Bundesbank leasing activities." Today James Turk shocked King World News when he stated, "The entire German gold hoard was gone because it had been leased into the marketplace. Meaning, the vaults holding German gold were emptied by 2001 because of the Bundesbank leasing activities." This posting includes an audio/video/photo media file: Download Now |

| Posted: 25 Oct 2012 12:53 PM PDT Charles Hugh Smith with some basic facts that cannot be denied. More than 4 million old Boomers per year will start collecting Social Security and destroying the Medicare System for the next 13 years. If you think the economy is shitty now, wait until this sucking sound really gets going. There is nothing that can change these facts. NOTHING. It's just math. The Fiscal Cliff and Demographic Drag October 25, 2012 Federal spending is heading for a fiscal cliff while millions of retirees are starting to draw Federal benefits. We know two things about the future: 1. Borrowing 35% of Federal expenditures every year is unsustainable. (2012 Federal budget = $3.8 trillion, Federal deficit = $1.3 trillion, 34.2% of every Federal dollar spent is borrowed) 2. The Baby Boom generation of 75+ millionmay be working longer, but they are also retiring en masse, joining the ranks of Social Security and Medicare beneficiaries at the rate of 10,000 per day, a flood that will not ebb until the late 2020s. (The Baby Boom is generally defines as those born between 1946 and 1964, though many quibble with the 1964 date. The choice of parameter doesn't change anything about the consequences.) The first Boomers qualified for early Social Security retirement (age 62) in 2008 and for Medicare (age 65) in 2011. The biggest cohort years (almost 4 million a year) will start reaching early retirement (62) in 2014 and Medicare (65) in 2017. The number of people entering these programs will rise every year from 2014 to 2020, and then remain constant at 4+ million a year until 2025. Here are three views of the Baby Boom for context:

Frequent contributor B.C. calls this enormous transfer of people from wage earners to retirees drawing government benefits the demographic drag, as it will reduce consumer spending, wages and taxes while dramatically increasing Federal spending. Here is a chart courtesy of B.C. that overlays year-over-year changes in private-sector wages+Federal expenditures, Treasury bond yields and the consumer price index (CPI).Note the downtrend in wages+Federal spending and Treasury yields, and the range-bound CPI.

Here is B.C.'s commentary:

B.C. also submitted this year-over-year chart of Federal expenditures.Despite the unprecedented size of Federal deficits, both in dollars and as a percentage of peacetime budgets, the recent spurt of spending growth was lower than previous spikes.

To reduce the deficit–i.e. address the "fiscal cliff"–Federal spending will have to decline for many years. Such an extended period of declining Federal spending would be unprecedented. This raises the obvious question: if Federal spending must decline, then where is the money going to come from to fund 75 million retirees? Calling the Central Bank of Mars: Greetings, Martian friends. Please send us 10 trillion quatloos every year from now until 2029. We promise to pay you in 2030 (heh). |

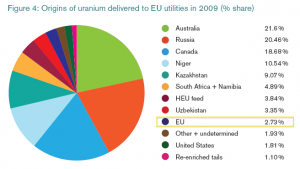

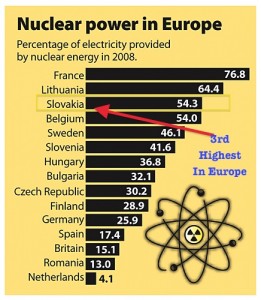

| Why This New Uranium Mine Is Critical For European Nuclear Power Posted: 25 Oct 2012 12:42 PM PDT

|

| A Review of Gary North's "What is Money?" Posted: 25 Oct 2012 12:13 PM PDT The inaugural installment of this collection of essays first appeared on LewRockwell.com on September 29, 2009 - fittingly, Ludwig von Mises' birthday. Dr. North is one of the foremost Austrian economists and economic historians working today, and has gained a wide following with his writing and lectures. These essays are virtually impossible to overrate; they clear up so much of what is misunderstood about money and banking. Our civilization depends on sound money and honest banking. As North makes emphatically clear, we have neither. A few excerpts should get my point across: "The heart of the modern monetary system is fractional reserve banking. This system is based on fraud. At the very heart of the modern economy is fraud -- fraud on a gigantic scale. What is the nature of this fraud? Counterfeiting. Banks are government-licensed institutions that issue bogus IOUs. Because these IOUs function as money, they are counterfeit money. This is the heart, mind, and soul of all modern banking." "Counterfeiting is universally condemned by civil governments. Wherever we go, a national civil government has passed a law imposing serious sanctions against anybody who would counterfeit the national monetary unit. Why do governments do this? Because they are all counterfeiters, and they deeply resent an invasion of their turf. Laws against counterfeiting in today's world are a form of gang warfare." "To reform central banking is to perpetuate it. To perpetuate it is to accept the fundamental premise of modern economics: money is different. Money is not governed by the same laws of supply and demand that govern the rest of the economy. Money requires experts to administer it. Private contracts are not sufficient." "Someday, perhaps, central banks will stop subsidizing their respective Treasury Departments. On that glorious day, governments will move rapidly toward bankruptcy, interest rates on government debt will rise, the markets will begin to crash, consumer prices will begin to fall, and the mother of all bank runs will begin. Get there early." "The powers that be will cease to be powers if money dies. They have based their political control and their wealth on their control of digital money. This is the line to which the hook of state power is attached. To destroy the currency is to break this line. Better a new Great Depression than hyperinflation, if you are a central banker. "If money dies, a lot more than money will die. This includes Bernanke's pension. He knows this." I suppose one could be critical of the author for writing so informally about a subject that many would say cannot be translated into everyday language; that any attempt to translate it corrupts it and renders it misleading or just plain wrong. But one of the hallmarks of Austrian School economics is the clarity of its expositors, a trait that seems to annoy the Keynesians who understand money only in the context of aggregates, equations, and central planning. But if thought is to be a guide to individual action, then clarity of thought is indispensable, and North, in these essays, offers the reader a remarkable degree of lucidity. There are other popular essays that delve into the nature of money. Bastiat's What is Money? is instructive and entertaining, and Thomas Paine's attack on paper money lays bare what we've forgotten. Having no real value in itself it depends for support upon accident, caprice, and party; and as it is the interest of some to depreciate and of others to raise its value, there is a continual invention going on that destroys the morals of the country.Also highly recommended is Ron Paul's three-part lecture series, What is Money? The sophisticated elites who run the monetary system proudly admit they don't know what money is, though they do concede that being unable to define money makes it difficult to manage. In a sense I can empathize with them. Money - the commodity - was removed from the economy completely in 1971. It is indeed hard to manage something that no longer exists, and if it did exist, would not require managing. As Milton Friedman once wrote, If a domestic money consists of a commodity, a pure gold standard or cowrie bead standard, the principles of monetary policy are very simple. There aren't any. The commodity money takes care of itself. [p. 356]North, borrowing from Mises, tells us what money is in six words, then proceeds to build on it. Not very sophisticated, but infinitely usable. |

| James Bond, Buffett's Martian, and Europe's New Gold Standard Posted: 25 Oct 2012 11:57 AM PDT by Adrian Ash BullionVault Wednesday, 24 October 2012 Europe's huge gold reserves are currently more useless than Bond-villain Auric Goldfinger could wish... LET'S SAY you owe the world €2 trillion, but you also hold the world's 4th largest hoard of physical gold. Sounds like a no-brainer, right? Use Italy's gold to pay Italy's debt. Trouble is, Rome's gold would be worth only a drop in the bucket – a mere 10% of its outstanding debt. The gold isn't Rome's to sell either. It belongs to the central bank, the Banca d'Italia. And under the terms of the Eurozone treaty, as well as domestic law, that puts it beyond the reach of grabbing politicians, as Silvio Berlusconi learnt in 2009. Two solutions are being bounced around regardless. First, says the Council of Economic Experts in Germany, every Eurozone country with public debt of more than 60% of its annual GDP should put up assets – like gold – to join a big "redemption fund". That fund would be secured by those assets, w... |

| The Telegraph Notes Mystery German Gold Withdrawal and GATA's Clamor About It Posted: 25 Oct 2012 11:50 AM PDT |

| Posted: 25 Oct 2012 11:48 AM PDT Jim Sinclair's Mineset My Dear Extended Family, 1. The entire reason that I launched into the explanation of spread trading was to demonstrate how it is used to manipulate markets. 2. Recognizing the multiple blocks at $1775 and $1800, it was obvious a line was being drawn in the sand. 3. In that market situation a reaction was reasonable to anticipate. 4. I wanted to drive home to you the fact that all the market drama as seen today is manufactured by the gold banks. 5. QE cannot stop or the economic implosion would blow up your computer screen. 6. If some nitwit Chairman tried to stop QE you would have a few days of dollar strength followed by a collapse of the currency based on the economic implications. 7. Then gold's highest possible estimates would come into focus as the downward spiral already in place in the Western world did in fact present itself as a black hole. 8. The event horizon to a total collapse is QE to infinity, as was anticipated. 9.... |

| LGMR: UK Economy News Dents Gold in Pounds, Diwali "Could See Last Minute Rush" for Gold Posted: 25 Oct 2012 11:48 AM PDT London Gold Market Report from Ben Traynor BullionVault Thursday 25 October 2012, 08:15 EDT WHOLESALE gold bullion prices rallied to $1718 an ounce Thursday morning in London, less than 24 hours after dipping below the $1700 mark for the first time since the US Federal Reserve announced a third round of quantitative easing last month. Gold in Sterling however ended the morning lower at £1068 per ounce, close to yesterday's seven-week low, as the Pound rallied after the release of better-than-expected UK economic growth data. Silver bullion meantime hovered around $32.20 an ounce, roughly in line with where it started the week, with other commodities also broadly flat. "Lower prices now seem to be attracting new buyers [for gold]," says today's Commodities Daily note from Commerzbank. "India should come back to the market because Diwali is coming," added a dealer of physical gold bullion in Singapore this morning, speaking to newswire Reuters. "We should be expecting a b... |

| Posted: 25 Oct 2012 11:47 AM PDT October 25, 2012 [LIST] [*]If the politicos won't act, the Fed will: Byron King on Bernanke & Co.'s latest moves [*]A "major shift" in the metals markets: The chart that confirms investors are moving from "paper gold" to the real thing [*]From Uncle Sam's cross hairs into the arms of Russia and China: new developments in the saga of the rating agency that dared to downgrade the U.S. first [*]Finding holes in an impenetrable substance: New uses for the wonder substance graphene [*]Reporter takes on TSA, TSA takes off the gloves: When life becomes a Family Guy episode... Plus: A reader's encounter with the no-fly list -- and he wasn't even boarding a plane! [/LIST] "From the outside looking in," opines our resource maven Byron King, "it appears that the Fed has all but given up on the American political class." Let's back up a moment: The Fed wrapped up one of its periodic two-day meetings yesterday. After launching QE-to-the-moon six weeks a... |

| Welcome To The 10th Annual Silver Summit In Spokane Washington 25.Oct.12 Posted: 25 Oct 2012 11:45 AM PDT www.FinancialSurvivalNetwork.com presents We spend literally all of yesterday travelling to the Silver Summit in beautiful wet and cold Spokane Washington. The flights were horrible. Cramped seating, delays, police intervention, you name it. We landed in Denver and it was pouring. Then we witnessed an older man get arrested by the police for punching a flight attendant. The rain quickly turned to snow, in October no less! The airport was completely unprepared and had no de0icing equipment working. From there things got worse quickly and we were stuck for 3.5 hours. Luckily they let us off the plane. Finally we got de-iced, it took an hour. We landed in Spokane at midnight-3am New York time. Got to the hotel, popped an ambien and slept like a dead person till the morning. Go to www.FinancialSurvivalNetwork.com for the latest info on the economy and precious metals markets This posting includes an audio/video/photo media file: Download Now |