Gold World News Flash |

- Goldman Sachs Ian Preston Surveys the Gold ETF vs Equity Battleground

- Senator Amy Klobuchar took Ponzi schemer’s campaign contributions, didn’t prosecute

- Silver Update 10/21/12 Silver Devils

- Change in Spread Management by Bullion Banks will Send Gold Prices to $3500 – $12,400 says Jim Sinclair

- Chinese Gold Imports Through August Surpass Total ECB Holdings, Imports From Australia Surge 900%

- How To Buy Bullion (What to Ask and What to Own)

- Notes On Governments Making Gold Illegal

- GoldSeek.com Radio: Peter Grandich & Charles Goyette, and your host Chris Waltzek

- Ambrose Evans-Pritchard: IMF's epic plan to conjure away debt and dethrone bankers

- Gold and Miners are Approaching Bottom!

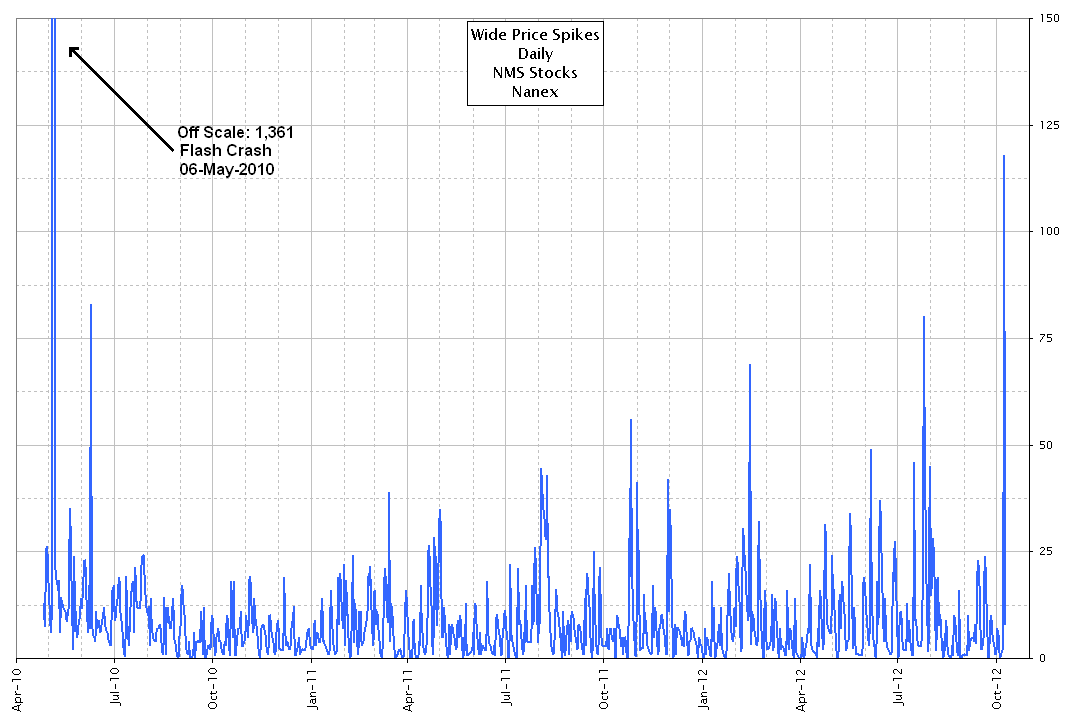

- Stock Market Fragility Fast Approaching "Flash Crash" Levels

- Is a Debt Jubilee the Next Big Meme?

- Alasdair Macleod: Gold bullion flowing from West to East

- Change In Spread Management By Bullion Banks Will Send Gold Prices To $3,500-12,400 Says Jim Sinclair

- In The News Today

- The Other Silver War Pt. 2: The Lowdown on Silver Toxicity

- In Historic First China Begins Oil Extraction In Afghanistan

- Hugh Hendry, "God is a genius because he is a sloth"

- Lessons In Fiat Reality: "Why I Learned To Trade Less And Love The Farm"

- Meet The Billionaires Behind The Best Presidents Money Can Buy

- Latest GoldMoney article: Who owns the gold?

- Examining the case for (and against) gold

- Gold bullion flowing from West to East

- The Recipe For U.S. Hyperinflation, Looming Dollar Collapse

- Gold and Mining Stocks are Approaching Bottom!

- Examining the Case For And Against Gold

- Getting Real

- Got Gold?

| Goldman Sachs Ian Preston Surveys the Gold ETF vs Equity Battleground Posted: 22 Oct 2012 12:00 AM PDT |

| Senator Amy Klobuchar took Ponzi schemer’s campaign contributions, didn’t prosecute Posted: 21 Oct 2012 11:30 PM PDT by Matthew Boyle, The Daily Caller:

That financial criminal, Tom Petters, presided over companies whose employees gave Klobuchar $8,500 for her re-election campaign, and would later contribute more than $120,000 toward her U.S. Senate run. One of those companies' vice presidents was Ted Mondale, a former state senator and son of former U.S. Vice President Walter Mondale. Before taking office as Hennepin County Attorney, Klobuchar was a partner at the Minneapolis law firm of Dorsey & Whitney, where Walter Mondale has practiced law since 1987. Perhaps because of the lure of Petters' campaign cash or his deep connection to Minnesota Democratic politics, Klobuchar used the power of her office in 1999 to ensure Petters was not charged with financial crimes. And despite significant evidence against him, she cleared the way for Petters to build his multibillion-dollar illegal empire by prosecuting only his early co-conspirators. |

| Silver Update 10/21/12 Silver Devils Posted: 21 Oct 2012 08:55 PM PDT from BrotherJohnF: |

| Posted: 21 Oct 2012 08:40 PM PDT by Peter Cooper, Arabian Money via Gold Seek:

In his latest missive, Mr. Sinclair explains: 'You must note how central banks are either buying or protecting their gold reserve positions now. This is total about face two years ago. There is another change coming which is a replacement monetary system and the need for some asset on central bank's balance sheets to have positive value, especially in the USA. Soon all that is required is a change in spread management by the gold banks and you will have whatever price the gold banks want from $3,500 to $12,400.' |

| Chinese Gold Imports Through August Surpass Total ECB Holdings, Imports From Australia Surge 900% Posted: 21 Oct 2012 08:32 PM PDT from Zero Hedge:

|

| How To Buy Bullion (What to Ask and What to Own) Posted: 21 Oct 2012 08:30 PM PDT by Graham Summers, Gains Pains & Capital:

Quite a few articles have been written about the importance of owning Gold and other precious metals as a means of maintaining one's wealth in the face of rampant money printing by the world's Central Banks. Today I'm going to share some ideas on how to actually buy bullion. As far as precious metals go, you need to: 1) Own actual Bullion 2) Store it yourself (not in a bank) I do not recommend owning a paper gold-based ETF because frankly the custodial risk is high (that is, there's no telling if the Gold is even there or who would get it if the ETF is liquidated). |

| Notes On Governments Making Gold Illegal Posted: 21 Oct 2012 07:58 PM PDT Jim, I should not have used the word "they" if the government makes gold illegal. Will they pay you full value or what is on the coin? CIGA Yor Yor, On the day of illegality, yes, compensation will be paid, market related. That is what occurred under Roosevelt. This is a key point that Continue reading Notes On Governments Making Gold Illegal |

| GoldSeek.com Radio: Peter Grandich & Charles Goyette, and your host Chris Waltzek Posted: 21 Oct 2012 07:00 PM PDT |

| Ambrose Evans-Pritchard: IMF's epic plan to conjure away debt and dethrone bankers Posted: 21 Oct 2012 06:42 PM PDT By Ambrose Evans-Pritchard http://www.telegraph.co.uk/finance/comment/9623863/IMFs-epic-plan-to-con... So there is a magic wand after all. A revolutionary paper by the International Monetary Fund claims that one could eliminate the net public debt of the United States at a stroke, and by implication do the same for Britain, Germany, Italy, or Japan. One could slash private debt by 100 percent of GDP, boost growth, stabilize prices, and dethrone bankers all at the same time. It could be done cleanly and painlessly, by legislative command, far more quickly than anybody imagined. The conjuring trick is to replace our system of private bank-created money -- roughly 97 percent of the money supply -- with state-created money. We return to the historical norm, before Charles II placed control of the money supply in private hands with the English Free Coinage Act of 1666. ... Dispatch continues below ... ADVERTISEMENT GoldMoney adds Toronto vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, and the United Kingdom, GoldMoney customers now can store their gold and silver in a high-security vault operated by Brink's in Toronto, Ontario, Canada. GoldMoney also has recently partnered with Rhenus Freight Logistics to offer another gold storage option in Switzerland. The Rhenus vault is in the secured zone of Zurich Airport and offers customers superb security as well as the ability to inspect their gold. Storage at the new vaults in Canada and Switzerland is available at GoldMoney's lowest fees. Customers can select their storage location when placing their buy order. GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata Specifically, it means an assault on "fractional reserve banking." If lenders are forced to put up 100 percent reserve backing for deposits, they lose the exorbitant privilege of creating money out of thin air. The nation regains sovereign control over the money supply. There are no more banks runs and fewer boom-bust credit cycles. Accounting legerdemain will do the rest. That at least is the argument. Some readers may already have seen the IMF study, by Jaromir Benes and Michael Kumhof, which came out in August and has begun to acquire a cult following around the world. Entitled "The Chicago Plan Revisited" -- http://www.imf.org/external/pubs/ft/wp/2012/wp12202.pdf -- it revives the scheme first put forward by professors Henry Simons and Irving Fisher in 1936 during the ferment of creative thinking in the late Depression. Irving Fisher thought credit cycles led to an unhealthy concentration of wealth. He saw it with his own eyes in the early 1930s as creditors foreclosed on destitute farmers, seizing their land or buying it for a pittance at the bottom of the cycle. The farmers found a way of defending themselves in the end. They muscled together at "one-dollar auctions," buying each other's property back for almost nothing. Any carpetbagger who tried to bid higher was beaten to a pulp. Benes and Kumhof argue that credit-cycle trauma -- caused by private money creation -- dates deep into history and lies at the root of debt jubilees in the ancient religions of Mesopotian and the Middle East. Harvest cycles led to systemic defaults thousands of years ago, with forfeiture of collateral and concentration of wealth in the hands of lenders. These episodes were not just caused by weather, as long thought. They were amplified by the effects of credit. The Athenian leader Solon implemented the first known Chicago Plan/New Deal in 599 BC to relieve farmers in hock to oligarchs enjoying private coinage. He canceled debts, restituted lands seized by creditors, set floor prices for commodities (much like Franklin Roosevelt), and consciously flooded the money supply with state-issued "debt-free" coinage. The Romans sent a delegation to study Solon's reforms 150 years later and copied the ideas, setting up their own fiat money system under Lex Aternia in 454 BC. It is a myth -- innocently propagated by the great Adam Smith -- that money developed as a commodity-based or gold-linked means of exchange. Gold was always highly valued, but that is another story. Metal lovers often conflate the two issues. Anthropological studies show that social fiat currencies began with the dawn of time. The Spartans banned gold coins, replacing them with iron disks of little intrinsic value. The early Romans used bronze tablets. Their worth was entirely determined by law -- a doctrine made explicit by Aristotle in his "Ethics" -- like the dollar, the euro, or sterling today. Some argue that Rome began to lose its solidarity spirit when it allowed an oligarchy to develop a private silver-based coinage during the Punic Wars. Money slipped control of the Senate. You could call it Rome's shadow banking system. Evidence suggests that it became a machine for elite wealth accumulation. Unchallenged sovereign or papal control over currencies persisted through the Middle Ages until England broke the mold in 1666. Benes and Kumhof say this was the start of the boom-bust era. One might equally say that this opened the way to England's agricultural revolution in the early 18th century, the industrial revolution soon after, and the greatest economic and technological leap ever seen. But let us not quibble. The original authors of the Chicago Plan were responding to the Great Depression. They believed it was possible to prevent the social havoc caused by wild swings from boom to bust, and to do so without crimping economic dynamism. The benign side-effect of their proposals would be a switch from national debt to national surplus, as if by magic. "Because under the Chicago Plan banks have to borrow reserves from the treasury to fully back liabilities, the government acquires a very large asset vis-a-vis banks. Our analysis finds that the government is left with a much lower -- in fact negative -- net debt burden." The IMF paper says total liabilities of the US financial system -- including shadow banking -- are about 200 percent of GDP. The new reserve rule would create a windfall. This would be used for a "potentially a very large buyback of private debt," perhaps 100 percent of GDP. While Washington would issue much more fiat money, this would not be redeemable. It would be an equity of the commonwealth, not debt. The key of the Chicago Plan was to separate the "monetary and credit functions" of the banking system. "The quantity of money and the quantity of credit would become completely independent of each other." Private lenders would no longer be able to create new deposits "ex nihilo." New bank credit would have to be financed by retained earnings. "The control of credit growth would become much more straightforward because banks would no longer be able, as they are today, to generate their own funding, deposits, in the act of lending, an extraordinary privilege that is not enjoyed by any other type of business," says the IMF paper. "Rather, banks would become what many erroneously believe them to be today, pure intermediaries that depend on obtaining outside funding before being able to lend." The US Federal Reserve would take real control over the money supply for the first time, making it easier to manage inflation. It was precisely for this reason that Milton Friedman called for 100 percent reserve backing in 1967. Even the great free marketeer implicitly favoured a clamp-down on private money. The switch would engender a 10 percent boost to long-arm economic output. "None of these benefits come at the expense of diminishing the core useful functions of a private financial system." Simons and Fisher were flying blind in the 1930s. They lacked the modern instruments needed to crunch the numbers, so the IMF team has now done it for them -- using the 'DSGE' stochastic model now de rigueur in high economics, loved and hated in equal measure. The finding is startling. Simons and Fisher understated their claims. It is perhaps possible to confront the banking plutocracy head without endangering the economy. Benes and Kumhof make large claims. They leave me baffled, to be honest. Readers who want the technical details can make their own judgement by studying the text. The IMF duo have supporters. Professor Richard Werner from Southampton University -- who coined the term quantitative easing (QE) in the 1990s -- testified to Britain's Vickers Commission that a switch to state money would have major welfare gains. He was backed by the campaign group Positive Money and the New Economics Foundation. The theory also has strong critics. Tim Congdon from International Monetary Research says banks are in a sense already being forced to increase reserves by EU rules, Basel III rules, and gold-plated variants in the UK. The effect has been to choke lending to the private sector. He argues that is the chief reason why the world economy remains stuck in near-slump and why central banks are having to cushion the shock with QE. "If you enacted this plan, it would devastate bank profits and cause a massive deflationary disaster. There would have to do 'QE squared' to offset it," he said. The result would be a huge shift in bank balance sheets from private lending to government securities. This happened during World War II, but that was the anomalous cost of defeating fascism. To do this on a permanent basis in peacetime would be to change in the nature of Western capitalism. "People wouldn't be able to get money from banks. There would be huge damage to the efficiency of the economy," he said. Arguably, it would smother freedom and enthrone a Leviathan state. It might be even more irksome in the long run than rule by bankers. I am a long way from reaching a conclusion in this extraordinary debate. Let it run, and let us all fight until we flush out the arguments. One thing is sure. The City of London will have great trouble earning its keep if any variant of the Chicago Plan ever gains wide support. Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Intercepts Best Pt+Pd+Au Grades Yet Company Press Release VANCOUVER, British Columbia -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) announces more results of its 2012 drill program on the company's fully-owned Wellgreen platinum group metals, nickel, and copper project in southwestern Yukon Territory, Canada. Four surface holes and four underground holes all intercepted significant mineralized widths, ranging from 28.5 meters (WS12-201) and up to 459.5 metres (WS12-193). Highlights include WU12-540, which returned 8.9 metres of 5.36 grams per tonne platinum, palladium, and gold; 1.73 percent copper; and 1.01 percent nickel within 304.5 meters of 0.66 g/t platinum-palladium-gold, 0.20 percent copper, and 0.27 percent nickel. The surface drill program started in June and has completed 16 holes (assays pending for 12 holes) with two rigs now on site. The surface program continues to progress at a steady pace. Prophecy Chairman John Lee commented: "Wellgreen is a very large nickel, copper, and platinum group metals project with near-surface high-grade zones. High-grade intercepts will be incorporated into resource modeling and mine planning in the pre-feasibility study. We expect further positive drill results from Wellgreen shortly." Wellgreen features a low 2.59-to-1 strip ratio, is situated at an altitude of 1,300 meters, and is only 15 kilometers from the two-lane paved Alaska Highway. Those factors significantly minimize the project's indirect costs. For the complete company statement with full tabulation of the drilling results, please visit: http://prophecyplat.com/news_2012_sep11_prophecy_platinum_drill_results.... |

| Gold and Miners are Approaching Bottom! Posted: 21 Oct 2012 05:48 PM PDT |

| Stock Market Fragility Fast Approaching "Flash Crash" Levels Posted: 21 Oct 2012 05:17 PM PDT This past Friday, on the 25th anniversary of Black Monday, Bill Gross warned that in the current centrally-planned market "central bank puts" are the modern day equivalent of "portfolio insurance", and he is right. By sending complacency to record levels, and essentially forcing investors to no longer worry, hedge and generally ignore tail risk, the central planners, in their futile attempts to reflate stocks at all costs, are guaranteeing that the market will experience just the type of fat tail event they promise will never occur. As for the catalyst that will make sure of it is none other than our old friend: high frequency trading. Because while central planning is the mechanism by which investing is dragged away from mean reversion, price clearing and fair value discovery, it is HFT that is Bernanke's analogue in the millisecond trading world (as all those who had stop limit orders (that did not get DKed) on May 6, 2010 very well remember). Because when the next Black ___day does happen, it will be due to central planning, but it will be enacted courtesy of HFT (which will never go away until the next and probably final market crash: too much exchange revenue depends on the perpetuation of this parasitic liquidity drain). Which is why it is only appropriate to warn readers that when it comes to system market fragility, at least according to Nanex, whose work ZH first presented nearly two years ago and has since gone mainstream now that HFT is the universal scapegoat of even such legacy media venues as CNBC (it is always better to bash the vacuum tubes than the people who profit, or those who have made a mockery of the stock market - it is not like anything will change anyway), the frequency and magnitude of "wild price spike" events (to put it simply) are now both rising at an exponential rate, and fast approaching Flash Crash levels. From Nanex:

Remember: with just two months left until the Fiscal Cliff deadline, and Congress not one picometer closer to a compromise resolution, there are just two catalysts which can get the House to cross the aisle and do what is in this nation's interest: i) a "rally behind the flag" war (which is certainly an option), or ii) a massive market crash that wakes everyone from their "the Chairman will get to work and fix everything" stupor and forces the cliff to be resolved or else everyone's political career will be cut short. So keep a close eye on the Nanex core feed and abnormal market activity. At this rate, the next wholesale stock market flash crash can not be too far away... P.S. for those curious about macroeconomic implications of systemic instability and macro stress tresholds, we urge re-reading ""Trade-Off": A Study In Global Systemic Collapse" - because in today's 'just in time' world, an "equilibrium phase shift" is always just at most minutes away, and no, you cant hedge 'after' the event. |

| Is a Debt Jubilee the Next Big Meme? Posted: 21 Oct 2012 03:48 PM PDT The idea of a "debt jubilee" — that is, a wide-spread forgiveness of debt as a way to reset the US financial system — has been bouncing around for a while. But it hasn't gained mainstream traction because it seems, at first glance, to be too simplistic to be worth serious thought. It must have a fatal flaw that would jump out as soon as one looks at it, which makes looking a waste of time. But the idea keeps bubbling up, so the other day I finally decided to try to understand it. And the story, as with most apparently simple things, is more complicated and harder to dismiss than it seems at first. According to Wikipedia, "The concept of the Jubilee is a special year of remission of sins and universal pardon. In the Biblical Book of Leviticus, a Jubilee year is mentioned to occur every fiftieth year, in which slaves and prisoners would be freed, debts would be forgiven and the mercies of God would be particularly manifest." Note the fifty-year cycle, which is not that far from the 60-year Kondratieff Wave, at the end of which debt is forcibly erased through mass default. The problem with the classical jubilee concept is spelled out by Martin Hutchinson and Robert Cyran in a 2011 New York Times article:

The fact that one person's debt is another's asset does seem to be a concept-killer. But in the ensuing year several jubilee proponents have proposed updated versions that address this flaw. Jump to minute 17 of the following interview with Australian economist Steven Keen for his proposal. In a nutshell, he thinks we've reached a debt "event horizon" where we can't grow fast enough to escape the pull of deleveraging. His solution is a kind of quantitative easing for the masses, where the Fed gives individuals newly-created dollars with the requirement that they pay off their mortgages and credit cards. And then there's the mounting federal debt held by the Fed. Consider this, from a DollarCollapse.com reader:

Now we've entered some interesting territory, and as with so many financial things, the difference between traditional and "modern" is the introduction of fiat currency. In past debt jubilees, money was real, and debt could only be forgiven if the other side of the balance sheet was likewise affected. The debtor's gain was the creditor's loss, which meant no net gain in societal wealth. But with fiat money so much of the financial system is fictitious that it opens up some new possibilities. The Fed is currently buying the majority of the debt issued by the US government, which in effect means the government is lending itself money (yes, the Fed was created as a private institution, but in recent years it has effectively merged with the Treasury and the military/industrial complex to form a single globe-spanning empire. It's all one thing now.). So what would be lost by different branches of the fiat currency monolith simply zeroing out some bookkeeping entries? Just like that, the "national debt" shrinks by a third or more. Hmmm… Same thing with the quantitative-easing-for-individuals idea, in which dollars are created out of thin air and passed to the banks, via the banks' customers. Individual debts fall, bank loans are converted to cash, and systemic net worth increases by the amount of debt that's eliminated. This probably won't happen, and would be profoundly immoral if it did. But because a modern electronic printing press makes such alchemy possible, it will be seductive to a desperate society that's been shaped by the idea of voting for free stuff. So expect to see the jubilee concept become a topic of mainstream debate we drift closer to Keen's debt event horizon. |

| Alasdair Macleod: Gold bullion flowing from West to East Posted: 21 Oct 2012 02:02 PM PDT 3:55p ET Sunday, October 21, 2012 Dear Friend of GATA and Gold: The transfer of gold from Western central banks to Eastern central banks in recent years amounts to a policy of price suppression by the former, GoldMoney research director Alasdair Macleod writes today. He says Western nations thus "are left with no 'Plan B' in the event of a monetary crisis. A global collapse of paper money, which is inevitable if current monetary policies are not reversed, will give Asians considerable wealth relative to the rest of us. History will surely judge the central bankers' promotion of ephemeral paper at the expense of gold in the harshest terms." Of course one might argue that the gold price suppression scheme of the Western central banks is their "Plan B" and that it has more or less been working, cushioning the decline of Western currencies, and that the Western central banks will need "Plan C" when the gold run out. But it's still hard to argue with Macleod's conclusion. His commentary is headlined "Gold Bullion Flowing from West to East" and it's posted at the GoldMoney Internet site here: http://www.goldmoney.com/gold-research/alasdair-macleod/gold-bullion-flo... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Platinum Intercepts Best Pt+Pd+Au Grades Yet Company Press Release VANCOUVER, British Columbia -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) announces more results of its 2012 drill program on the company's fully-owned Wellgreen platinum group metals, nickel, and copper project in southwestern Yukon Territory, Canada. Four surface holes and four underground holes all intercepted significant mineralized widths, ranging from 28.5 meters (WS12-201) and up to 459.5 metres (WS12-193). Highlights include WU12-540, which returned 8.9 metres of 5.36 grams per tonne platinum, palladium, and gold; 1.73 percent copper; and 1.01 percent nickel within 304.5 meters of 0.66 g/t platinum-palladium-gold, 0.20 percent copper, and 0.27 percent nickel. The surface drill program started in June and has completed 16 holes (assays pending for 12 holes) with two rigs now on site. The surface program continues to progress at a steady pace. Prophecy Chairman John Lee commented: "Wellgreen is a very large nickel, copper, and platinum group metals project with near-surface high-grade zones. High-grade intercepts will be incorporated into resource modeling and mine planning in the pre-feasibility study. We expect further positive drill results from Wellgreen shortly." Wellgreen features a low 2.59-to-1 strip ratio, is situated at an altitude of 1,300 meters, and is only 15 kilometers from the two-lane paved Alaska Highway. Those factors significantly minimize the project's indirect costs. For the complete company statement with full tabulation of the drilling results, please visit: http://prophecyplat.com/news_2012_sep11_prophecy_platinum_drill_results.... Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT GoldMoney adds Toronto vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, and the United Kingdom, GoldMoney customers now can store their gold and silver in a high-security vault operated by Brink's in Toronto, Ontario, Canada. GoldMoney also has recently partnered with Rhenus Freight Logistics to offer another gold storage option in Switzerland. The Rhenus vault is in the secured zone of Zurich Airport and offers customers superb security as well as the ability to inspect their gold. Storage at the new vaults in Canada and Switzerland is available at GoldMoney's lowest fees. Customers can select their storage location when placing their buy order. GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata |

| Posted: 21 Oct 2012 12:49 PM PDT Jim Sinclair's Commentary Here is the message of the article that I wrote to you on spreads. Change in spread management by bullion banks will send gold prices to $3,500-12,400 says Jim Sinclair By: Peter Cooper, Arabian Money – Posted Sunday, 21 October 2012 'Mr. Gold' of the 1970s, Jim Sinclair, the one-time Continue reading Change In Spread Management By Bullion Banks Will Send Gold Prices To $3,500-12,400 Says Jim Sinclair |

| Posted: 21 Oct 2012 12:39 PM PDT Jim Sinclair's Commentary This applies to the gold market as well as life in general. "Obstacles that come in the way are often treated with a certain amount of resentment by the pilgrims on the spiritual path. But these tests are to be treated as a means of ensuring safety. You drive a nail Continue reading In The News Today |

| The Other Silver War Pt. 2: The Lowdown on Silver Toxicity Posted: 21 Oct 2012 12:06 PM PDT Silver Chemtrails? This article is in response to comments in questions in my first article: The Other Silver War. The first article is proposed as fodder for those with an introductory knowledge of the biochemistry of silver in our bodies (as a … Continue reading |

| In Historic First China Begins Oil Extraction In Afghanistan Posted: 21 Oct 2012 11:48 AM PDT In a surprising (if not quite shocking) move, late on Friday Canada blocked Petroliam Nasional Bhd.'s C$5.2 billion takeover of Progress Energy Resources Corp. saying the bid by the Malaysian state-owned company "wasn't in Canada's national interests." As BusinessWeek explains, "in what investors say is a test case for the $15.1 billion bid by CNOOC Ltd. of China for Calgary-based Nexen Inc., the Canadian government said it "was not satisfied that the proposed investment is likely to be of net benefit to Canada," according to an Oct. 19 statement from Industry Minister Christian Paradis." While it is unclear precisely what would be of "net benefit to Canada" what is certain is that the Progress Energy move will crush investor spirits who in recent months have expected a flurry of foreign bids coming for local energy names, only to be left at the altar courtesy of government intervention. And while the outlook for foreign driven M&A in Canada has just been Ice-9'ed to a degree not seen since the BHP Billiton government-denied acquisition of Potash Corp (watch the arbs scurry out of Nexen at first trading opportunity), China is wasting no time, and is rapidly reorineting itself away from increasingly energy-protectionist governments and to "greenfield" national interest expansion opportunities. Such as Afghanistan. As Reuters reports, in a historic development, and in a key staking of regional energy claims, a Chinese oil firm, China National Petroleum Corp, has just started oil production in the country which still has thousands of US troops on the ground. Expect this issue also to suddenly be of paramount importance in next week's final presidential debate. From Reuters:

Luckily, US troops are still in Afghanistan to make sure China can extract Afghanistan resources at terms beneficial to China and Afghanistan... If not the US.

Up next for the country which is soon set to surpass the US as the largest importer of crude: more regional expansion and capture of the global markets:

And since China will indirectly be seen as a provider of jobs, guess where the local population's allegiances will increasingly lie:

They need some BLS seasonal adjustments, and an election or two: unemployment would plunge to 0.0% overnight.

Correct: in fact Exxon is increasingly looking to divest various regional interests, with just two short days ago news hitting that Exxon was "in talks to sell its stake in a contract to develop a multibillion-dollar oil project in southern Iraq." The winner, as the insolvent west increasingly seeks to abdicate regional resource control, will once again be China.

|

| Hugh Hendry, "God is a genius because he is a sloth" Posted: 21 Oct 2012 11:47 AM PDT Hendry has become known in the UK for his outspoken commentary on the financial crisis. On an episode of the BBC's Newsnight programme aired on 9 April 2010, Hendry began his response to comments by the Nobel-prize winning economist Joseph Stiglitz on the financial position of Greece by saying, "Erm, hello. Can I tell you about the real world?"On the same programme in May 2010, Hendry responded to a question from host Jeremy Paxman about the current European economic situation and the possibility of a Greek sovereign debt default with the comment, "I would recommend you panic"

Published on Jun 28, 2012 by PondWalden http://www.youtube.com/watch?v=3If06Diya_Q&feature=player_detailpage |

| Lessons In Fiat Reality: "Why I Learned To Trade Less And Love The Farm" Posted: 21 Oct 2012 11:22 AM PDT Stephen Diggle is one of the least well known (except to his clients) and yet most successful hedge fund managers over the past decade - having made around two-and-a-half billion dollars during the financial crisis - but in the last few years, he came to a dramatic (and we hope enlightening for many) perspective. This fascinating presentation, in his own words, discusses "how , having made that fortune trading, [he] came to conclude that [he] wanted to preserve the real value of that fiat money windfall, [he] had to get away from trading and buy, own, and operate real assets with real cashflows." - most specifically farms. From being ridiculed as a 'Cassandra' in the mid to late 2000s, Stephen's conviction then that the world was heading for a crisis was as high as his conviction now that in order to ride the wave of global central bank intervention and the implicit macro-economic waves that will crash on every shore in the forthcoming years, that farmland (preferably diversified) is the best risk-reward 'trade' in the coming decade. An intriguing tale of reality and un-greed and everything you need to know about agriculture (from demand to demographics and from fiat-debauchment to interventionist policies) but never knew to ask. An inspiring and insightful brief presentation that offers more depth than any Jim Rogers' mini-clip on CNBC.

Inflationary concerns...

and macro drivers...

The 'real' price of land (in USD)...

and in Oz of Gold...

Probably the most famous proponent currently of investing in farmland is Jim Rogers, who remains among the most prescient of investors; unfortunately he is offered neither the time or space to detail this view among the mainstream media. We hope Stephen's presentation provides all the color needed to comprehend this global macro view.

(h/t Grant Williams) |

| Meet The Billionaires Behind The Best Presidents Money Can Buy Posted: 21 Oct 2012 09:42 AM PDT

RESTORE OUR FUTURE Total raised as of Sept. 30: $110.5 million - supports Republican presidential candidate Mitt Romney

PRIORITIES USA ACTION Total raised as of Sept. 30: $50.1 million - supports Democratic President Barack Obama

AMERICAN CROSSROADS Total raised as of Sept. 30: $68 million - supports Republican candidates for federal offices

BARACK OBAMA (Democrat)

DEMOCRATIC NATIONAL COMMITTEE

OBAMA VICTORY FUND 2012 (The main joint Obama/DNC fund)

MITT ROMNEY (Republican)

REPUBLICAN NATIONAL COMMITTEE

ROMNEY VICTORY INC (Joint Romney/RNC fund - third quarter, July through Sept.)

Appendix: SUPER PACS: RESTORE OUR FUTURE, a Super PAC supporting Romney

PRIORITIES USA, a Super PAC supporting Obama

AMERICAN CROSSROADS, a Super PAC supporting Republicans

Source: Reuters |

| Latest GoldMoney article: Who owns the gold? Posted: 21 Oct 2012 09:12 AM PDT The following article has been posted at Goldmoney. Gold bullion flowing from West to East2012-OCT-21Earlier this month Eric Sprott circulated a paper, co-authored by him, which concluded that Western central banks have considerably less physical gold than they claim. It shows that since the year 2000 there has been a net increase in identifiable annual demand of 2,268 tonnes, and concludes that some supply, apart from mine output from the “free” world, must come from Western central banks – because there can be no other source. This supply amounts to price suppression in the name of demonetising gold. Therefore, while minimal investment interest is shown in precious metals in the West, central bank selling and net jewellery liquidation (currently running at about 1,000 tonnes annually) are effectively supplying Asia with gold at artificially low prices in what amounts to a transfer of wealth. We do not know precisely the extent to which this has happened, because available statistics only tell part of the story. The World Gold Council (WGC) has demand data going back only to 1992, and some of this is defined as actually measured (e.g. import statistics, mint and hallmarking data); otherwise it is only “indicated” on a trade-sample basis. Importantly, no statistics can capture change of ownership for vaulted gold. But we can get a feel for gold ownership shifts by recounting events since the US dollar finally dropped all links with gold in 1971. In 1971 bullion investment was still effectively banned in the US (except for foreign coins), and investment in the UK and a number of other countries was also more or less coins only. It is estimated that all existing coins today amount to about 3,500 tonnes. The oil crisis of the 1970s led to substantial bullion-buying by the enriched Middle Eastern states. This continued through the 1980s and into the 1990s. Meanwhile conservative Swiss investment managers, who collectively were the largest holders of bullion, were replaced by a new generation of managers who by 2000 had disposed of nearly all of it, as had investment managers everywhere in the West. Even today very few investment managers have bullion in their clients’ portfolios. This gold quietly disappeared into Arab and Asian hands, and into jewellery fabrication boosted by low prices. However, even in 1992 when the WGC statistics started, Asian demand ex-Japan dominated markets, absorbing 1,650 tonnes – over twice that of the developed markets. At that time private gold ownership in developed markets was predominantly in jewellery form. This accumulation is reversing as a consequence of higher prices and financial stress in some nations. Bullion investment remains unfashionable, and remarkably few people have even seen a gold coin, let alone possessed one. But the last decade has seen the growth of securitised gold in the form of exchange-traded funds and other listed vehicles, amounting to about 2,800 tonnes. While the deteriorating outlook for paper currencies has sparked a partial move into gold, much of this is in unallocated accounts with bullion banks or in synthetic derivatives. The message behind the shift of wealth from advanced nations to Asia is that we are left with no “Plan B” in the event of a monetary crisis. A global collapse of paper money, which is inevitable if current monetary policies are not reversed, will give Asians considerable wealth relative to the rest of us. History will surely judge the central banker’s promotion of ephemeral paper at the expense of gold in the harshest terms. Alasdair Macleod Head of research, GoldMoney Mob: 07790 419403 Alasdair.Macleod@GoldMoney.com Twitter @MacleodFinance |

| Examining the case for (and against) gold Posted: 21 Oct 2012 09:00 AM PDT Since being shunned by traders last year after a series of margin increases, gold has enjoyed a worthy comeback since turning around this summer. The yellow metal rallied from a yearly low of $1,540 to a recent high of nearly $1,800. All in all, not a bad performance in just over an eight week period. |

| Gold bullion flowing from West to East Posted: 21 Oct 2012 08:00 AM PDT |

| The Recipe For U.S. Hyperinflation, Looming Dollar Collapse Posted: 21 Oct 2012 04:49 AM PDT For the last year, I’ve steered clear of commenting on the US Presidential election for the simple reason that I wanted us to be closer to the actual date before I went through the process of explaining what’s to come. The reason for this is that elections by their very nature are conflicting processes. Most people vote based on emotions when we are in fact electing someone to fulfill a role that is economic in nature. |

| Gold and Mining Stocks are Approaching Bottom! Posted: 21 Oct 2012 04:36 AM PDT Large concentrated amounts of volume will appear during the intial stages of an uptrend, which is a telling sign of forthcoming strength. It is a direct result of INSTITUTIONS that accumulate massive long positions at the start of a major move. But as time 'takes a toll' on the maturation of the bullish advance, its trend grows weaker on diminishing amounts of volume even when the stock is making new price highs. The interpretation is that investors are losing interest, and a top is near. |

| Examining the Case For And Against Gold Posted: 21 Oct 2012 04:13 AM PDT Since being shunned by traders last year after a series of margin increases, gold has enjoyed a worthy comeback since turning around this summer. The yellow metal rallied from a yearly low of $1,540 to a recent high of nearly $1,800. All in all, not a bad performance in just over an eight week period. Analysts and investors are divided as to what was the impetus behind the late summer rally for gold. Was it fear of a European-led global economic recession? A slowdown in China? An anticipation of loose central bank monetary policy? The reasons behind the rally are debatable but the gains gold has made since July aren't. |

| Posted: 21 Oct 2012 12:02 AM PDT Gold only fell 1.88% for the whole week and this may anger some. If you're one of them, give your head a shake! One leading stock was off some 15% on Friday alone after a less than stellar earnings report. Now that is a scary move! If gold were to drop that much in a single day, it would be something to get nervous or even upset about, but a drop of less than 2% over the period of a whole week is no big deal at all in my view. |

| Posted: 20 Oct 2012 01:51 PM PDT |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Documents obtained by The Daily Caller show that U.S. Senator Amy Klobuchar helped keep a multibillion-dollar Ponzi schemer out of prison in the late 1990s when she was the County Attorney in Hennepin County, Minnesota.

Documents obtained by The Daily Caller show that U.S. Senator Amy Klobuchar helped keep a multibillion-dollar Ponzi schemer out of prison in the late 1990s when she was the County Attorney in Hennepin County, Minnesota. 'Mr. Gold' of the 1970s, Jim Sinclair, the one-time adviser to the Hunt Brothers who cornered the silver market then is flagging up an imminent change in the way the bullion banks manage their spreads, something he feels is inevitable from his own long experience of the business.

'Mr. Gold' of the 1970s, Jim Sinclair, the one-time adviser to the Hunt Brothers who cornered the silver market then is flagging up an imminent change in the way the bullion banks manage their spreads, something he feels is inevitable from his own long experience of the business. First it

First it

No comments:

Post a Comment