| What Does The U.S. Trade Deficit Have To Do With Chinese Education? Posted: 20 Sep 2012 10:56 AM PDT By Alberto Savrieno:Let me begin with a chart. That's the U.S. trade deficit. Nobody likes to look at it. In fact, most people like to ignore it, because the implications of it are quite bad. The deficit can only get worse. To understand why, take a look at an eerily similar chart: (Courtesy TDAmeritrade) That's the dollar index. The reason for the trade deficit is simple, really. As the dollar weakens faster than other currencies, it becomes cheaper to import and more expensive to export. The conventional thinking is the reverse, but the reality is that when the domestic currency weakens, raw materials become so expensive that exports are nearly impossible to manufacture at competitive prices, so they fall. Prices in other countries are lower, so imports rise. So the weaker the dollar, the more dollars we give for imports, and the less we get for exports. Hence the deficit. Since the Complete Story » |

| Is This The World's Most Important Debate? Posted: 20 Sep 2012 10:51 AM PDT By Will Bancroft:Last week, the Bernanke Fed recommenced its interventionist tendencies and announced QE3. The world's most important central bank will be able to buy its previously targeted range of securities to the tune of $40bn a month. The Fed probably felt newly empowered by the ECB's recent promises to action, and the deliberately awe inspiring words of "Super" Mario Draghi. The world's most systemically important central banks are building their balance sheets and with it an even bigger hand in the world's most important financial game of poker. The financial system gets more "managed" every day, as the stewards at the helm implement their policies and ideologies. What the debate is all about There has been hot debate since the unfolding of the Financial Crisis in 2008 about the actual causes, the symptoms and necessary prescriptions. The Neoclassical economists, who maintain numerical ascendancy in educational and research posts, central bank committees Complete Story » |

| Chart of the Week: CDNX/Gold Ratio Posted: 20 Sep 2012 10:33 AM PDT SafeHaven |

| Which Of These Heavyweight Gold Diggers Represents The Better Buy At Current Levels? Posted: 20 Sep 2012 10:31 AM PDT ByChristopher F. Davis:What a fantastic two months for gold and gold stocks! Since I began pounding the table two months ago to pick up some exposure to the sector, the SPDR gold trust ETF (GLD) is up 12.2% while the gold miners ETF (GDX) and junior gold miners ETF (GDXJ) are up 33.2% and 35.8% respectively. In August I featured the five largest gold mining stocks in a battle royal style matchup, ultimately declaring Barrick Gold (ABX) as my favorite of the five. The other contenders considered for the heavyweight gold digger title were Goldcorp (GG), Yamana gold (AUY), AngloGold Ashanti (AU) and Newmont Mining (NEM). Since that time all five stocks have performed admirably along with the sector as worldwide central bank easing has spurred gold buying. First we had the European Central Bank's announcement of an unlimited bond-buying program. Then Ben Bernanke and the U.S. Federal Reserve announced a massive Complete Story » |

| John Mauldin's Prescription For Avoiding Economic Catastrophe Posted: 20 Sep 2012 10:08 AM PDT By The Gold Report:Best-selling author John Mauldin of Mauldin Economics says the EU is only left with choices that range from bad to disastrous. Republicans and Democrats will have to hold hands and walk off the cliff together to solve U.S. economic problems. In this exclusive Gold Report interview, Mauldin expands on his comments at the Casey Conference, "Navigating the Politicized Economy." Read more about the consequences of those choices and necessary compromises-and how he would reform the U.S. tax code. The Gold Report: Back in January you said the European Union [EU] would have to make serious political decisions with "major economic consequences" in 2012. Is the EU making those decisions and what is your prognosis? John Mauldin: It is doing its best to avoid making decisions, but is being forced to make them, ad hoc. The EU allowed the European Central Bank [ECB Complete Story » |

| Top 5 Stocks With Insider Buys Filed On September 19 To Consider Posted: 20 Sep 2012 09:56 AM PDT By Markus Aarnio:I screened with Open Insider for insider buy transactions filed on September 19. I then checked with Stock Charts if the stocks had bullish Point and Figure counts. From this list I chose the top 5 stocks with insider buying in dollar terms. Here is a look at the top 5 stocks: 1. Cracker Barrel Old Country Store (CBRL) was established in 1969 in Lebanon, Tenn. and operates 615 company-owned locations in 42 states. Cracker Barrel Old Country Store provides a friendly home-away-from-home in its old country stores and restaurants. Guests are cared for like family while relaxing and enjoying real home-style food and shopping that's surprisingly unique, genuinely fun and reminiscent of America's country heritage … all at a fair price. The restaurant serves up delicious, home-style country food such as meatloaf and homemade chicken n' dumplings as well as its made from scratch biscuits using an old family Complete Story » |

| If You Had Any Doubts About Gold … Posted: 20 Sep 2012 09:51 AM PDT Since Ben Bernanke's announcement of QE3 last week, new forecasts for gold have been popping up like acne at a high school prom. They range from the conservative to the absurd, from $1,900 to $55,000. But they all have one thing in common: higher.  |

| Fake Bars Found in NYC Posted: 20 Sep 2012 08:55 AM PDT |

| Can Dividends Cure Gold Equity Hangovers?: David Christensen Posted: 20 Sep 2012 07:47 AM PDT |

| Golden Cross For Gold and Silver Signals Further Gains Posted: 20 Sep 2012 07:40 AM PDT gold.ie |

| The Most Dangerous Word I Know: Risk Posted: 20 Sep 2012 07:34 AM PDT Timber is a far more lucrative inflation hedge than gold. The shiny metal has its place (in the form of a nugget or two in your bedroom safe), but when it comes to outpacing the ever-decreasing value of an American greenback, timber's the best of the breed.  |

| Jim Cramer & Deutsche Bank Agree: Gold Is Money Posted: 20 Sep 2012 07:29 AM PDT |

| 10 Quotes From Financial Experts About The Effect That QE3 Will Have On Gold And Silver Posted: 20 Sep 2012 07:14 AM PDT

from endoftheamericandream.com: Do you want to know what QE3 is going to do to the price of gold and the price of silver? Well, you can read what the financial experts are saying below, but it doesn't take a genius to figure out what is likely to happen. During QE3, the Federal Reserve will be introducing 40 billion new dollars that have been created out of nothing into the financial system each month. So there will be more dollars chasing roughly the same number of goods and services, and that means that more inflation is on the way. In an inflationary environment, investors tend to flock to hard assets such as gold and silver. And it is important to remember that a lot of the money from QE1 and QE2 ended up pumping up the prices of various financial assets. This included commodities such as gold and silver. The same thing is likely to happen again with QE3. In addition, investors now have an expectation that the Fed will continue printing money for the foreseeable future and that the U.S. dollar is going to steadily decline, and that expectation will also likely give further momentum to the upward movement of gold and silver. Of course when it comes to investing, there is never a "sure thing" and as the global financial system falls apart in the coming years we are likely to see wild swings in the financial markets. So there is definitely an opportunity when it comes to gold and silver, but anyone that wants to invest in gold and silver needs to be ready for a wild ride. Keep on reading @ endoftheamericandream.com |

| Gold Daily and Silver Weekly Charts – Romulus and Remus Posted: 20 Sep 2012 07:12 AM PDT

from jessescrossroadscafe.blogspot.ca: It looks like there will be an attempt to cap gold and silver until the election or Kingdom come, whichever comes first. Some days it is hard to tell. The elites of the world seems quite determined to have another go at provoking destruction on a massive scale to escape the ennui of another Great Depression, successfully achieved once again. I should like to think that the key resistance on the charts is rather obvious, for both gold and silver. Even a dreary fellow like Bernanke can see it, although it appears invisible to certain precious metals analysts, who have a less expansive repertoire of forecasts than the Magic 8 ball. All they can say is 'lower.' A coin flip has a better track record that those knuckleheads. And that in itself should tell you something about their true function in serving their employers. If the financial cartel does lose control of it here, they will back up to the next higher level and try to hold it even more firmly there. Again the lines of resistance are fairly well established. Keep on reading @ jessescrossroadscafe.blogspot.ca |

| QE3 – Pay Attention If You Are in the Real Estate Market Posted: 20 Sep 2012 07:09 AM PDT

from thedailybell.com: I used to have a deputy who said that the FHA mortgage insurance funds were where mortgages went to die. That was, however, before the creation of MERS, derivatives and the explosion of mortgage fraud during the 1990′s which in combination with the "strong dollar policy" engineered what I have referred to as a financial coup d'etat. The challenge for Ben Bernanke and the Fed governors since the 2008 bailouts has been how to deal with the backlog of fraud – not just fraudulent mortgages and fraudulent mortgage securities but the derivatives piled on top and the politics of who owns them, such as sovereign nations with nuclear arsenals, and how they feel about taking massive losses on AAA paper purchased in good faith. On one hand, you could let them all default. The problem is the criminal liabilities would drive the global and national leadership into factionalism that could turn violent, not to mention what such defaults would do to liquidity in the financial system. Then there is the fact that a great deal of the fraudulent paper has been purchased by pension funds. So the mark down would hit the retirement savings of the people who have now also lost their homes or equity in their homes. The politics of this in an election year are terrifying for the Administration to contemplate. Keep on reading @ thedailybell.com |

| ‘Golden Cross’ For Gold and Silver Signals Further Gains Posted: 20 Sep 2012 06:56 AM PDT

from goldcore.com: Today's AM fix was USD 1,760.00, EUR 1,360.33 and GBP 1,088.03 per ounce. Yesterday's AM fix was USD 1,774.50, EUR 1,361.44 and GBP 1,092.54 per ounce. Silver is trading at $34.31/oz, €26.61/oz and £21.28/oz. Platinum is trading at $1,619.50/oz, palladium at $663.50/oz and rhodium at $1,225/oz. Gold fell $0.10 or 0.01% in New York yesterday and closed at $1,770.50. Silver hit $34.958 in Asia and fell to $34.27 in early New York trade and it then bounced back higher, but finished with a loss of 0.49%. Keep on reading @ goldcore.com |

| Bron Suchecki: How Much Gold Does China Have? Posted: 20 Sep 2012 06:51 AM PDT

from caseyresearch.com: Yesterday in Gold and Silver It was an uneventful day in the gold market on Wednesday. The price dipped a bit in the early going in Far East trading…and the high of the day [such as it was] came just a few minutes before the London open. From there it got sold back to unchanged by the New York open…and traded sideways into the close from there. Gold closed the day at $1,769.70 spot…down $1.40 from Tuesday. Volume was an immense 171, 000 contracts…mostly of the high-frequency trading variety one would think. Keep on reading @ caseyresearch.com |

| Gray Swans and Fat Tails Posted: 20 Sep 2012 06:41 AM PDT  The term "Black Swan" became extremely popular after Nassim Taleb introduced it in his book and the 2008 meltdown graphically illustrated the concept. The term "Black Swan" became extremely popular after Nassim Taleb introduced it in his book and the 2008 meltdown graphically illustrated the concept.

As it became part of the Wall Street lexicon, the term was abused to the point where all sorts of low probability scenarios were referred to as "Black Swans." This irritated Taleb to no end as it missed his main point – the Black Swan as he described it is unpredictable, the Rumsfeldian "unknown unknown" that you don't see coming. The idea of the Gray Swan – a riff on the Black Swan – is a potential catastrophe that is not only foreseeable, but likely to occur at some point given a confluence of drivers. The challenge with a Gray Swan is that you don't know the actual timing. There is just a strong sense it could happen sooner or later. Many potential macro-level crises fit the Gray Swan profile, since it is so hard to know when a bubble is going to burst, a credit cycle is going to break down, or inflation / deflation hits a tipping point etcetera.  Related to the Gray Swan is the "fat tail," which refers to a higher than expected chance of an extreme outcome. In a "normal" distribution the outliers, or "tails" – the lines tapering off to the left and right of the bell curve – are thin, meaning that the probability of outlier events is low. When the tails get "fat" it means the chance of something crazy happening is higher than one might expect. Related to the Gray Swan is the "fat tail," which refers to a higher than expected chance of an extreme outcome. In a "normal" distribution the outliers, or "tails" – the lines tapering off to the left and right of the bell curve – are thin, meaning that the probability of outlier events is low. When the tails get "fat" it means the chance of something crazy happening is higher than one might expect.

Right now we see a lot of tail risk in concert with gray swans coming home to roost. Take the ongoing hard landing in China, for example, which bears with it (no pun intended) all kinds of knock-on effects. Or consider that Europe's problems are not solved, and may be about to worsen as the impact of China slowdown hits Germany (the world's third largest exporter)… and then of course there is the Senkaku Islands stuff and a weakening Japan… You can see how many fat tails and gray swans there are in play just by glancing over some recent headlines: In addition to the above, you have Western central banks (the ECB and the Fed) that have essentially fired their big cannons (in psychology terms) and are thus not well positioned to support overbought, overextended markets. Is it possible that markets grind higher from here? Yes. Is it possible that the major US indices (Dow, S&P 500, Nasdaq, Russell) correct sideways, through time, rather than downward, through price? Certainly it is. But it is also possible that the primary driver for higher equity prices the past few months – stimulus anticipation – has now been removed, creating potential for sharp downdraft… A key point here is that the probability of a move should also be considered in the context of magnitude. Strong likelihood of a small, modest move is not as interesting as lower likelihood of a large, powerful move. To wit, an eighty percent chance of winning one dollar is not as interesting (or profitable) as a twenty percent chance to win ten dollars. Odds and probability must become the trader's trusted companions. When you seek big waves instead of little wavelets you spend more time searching and trying, but you also get much longer and bigger rides on the big waves you do successfully catch. We remain skeptical that QE will do much at all for the US economy, and even more skeptical that various major currencies will maintain their strength against the dollar. Fat tail risks are building now, and they work in favor of a larger than expected "risk off" market correction as Western markets are so priced for complacency. Our highest conviction trade, and this should be no surprise as it hasn't changed much, remains short the Aussie…

The Australian dollar is tanking today on the ugly data from Asia and Europe. Once the trend really gets underway, we hope to find a good pyramid spot or two (or three) on the trip below par and possibly all the way back to 90 cents (or even lower)… In addition to AUDUSD we have an assortment of attractive short positions on and seek to add more incrementally. The ECB's OMT and the Fed's infinite QE may prove to have been twin peak points of a sort with sentiment and irrational exuberance heading into decline after their climactic introduction. Per the usual, all real money, real time positions documented and time stamped in the Mercenary Live Feed… JS (jack@mercenarytrader.com)   p.s. Like this article? For more, visit our Knowledge Center! p.p.s. Break the Institutional Barrier - and Substantially Increase Assets Under Management! Access our FREE report to find out how... p.p.s. follow us on Stocktwits & Twitter! @MercenaryJack and @MercenaryMike  |

| Bitcoin, gold and competitive currencies Posted: 20 Sep 2012 06:30 AM PDT GoldMoney's James Turk interviews Félix Moreno de la Cova, who is a studied economist, trader and GoldMoney contributor. They discuss the idea of currency competition and talk about the pros ...  |

| Riverstone Announces Liguidi RAB Drilling Results - Confirmation of 13 km Long Gold Soil Anomaly Posted: 20 Sep 2012 06:05 AM PDT Riverstone Resources Inc. (TSX-V; RVS) (" Riverstone" or the " Company") is pleased to report results from a Rotary Air Blast (" RAB") drilling program completed on the Liguidi Exploration Permit (" Liguidi"). The RAB drilling confirms a gold soil anomaly in excess of 13 kms long and also confirms the results of a quartz boulder sampling program previously undertaken over a broad area known as the Quartz Float Zone. ( see map on Company's website illustrating the RAB intercepts). The RAB drilling totaled 13,002 m in 876 holes, along lines spaced at 200 m intervals, with holes every 50 m along the lines. Most holes were vertical but a small number were angled where structure was evident. Significant intercepts include: - 1.43 g/t gold over 24 m, including 2.78 g/t gold over 12 m in LMG-RAB-523

- 1.69 g/t gold over 11 m in LMG-RAB-436

- 1.46 g/t gold over 12 m in LMG-RAB-538

- 1.24 g/t gold over 15.5 m, including 5.07 g/t gold over 3 m in LMG-RAB-042

- 1.28 g/t gold over 12 m in LMG-RAB-869

- 1.02 g/t gold over 18 m in LMG-RAB-499

- 4.14 g/t gold over 3 m in LMG-RAB-590

- 2.80 g/t gold over 3 m in LMG-RAB-613

- 1.98 g/t gold over 6 m in LMG-RAB-864

- 1.00 g/t gold over 11 m, including 3.27 g/t gold over 3 m in LMG-RAB-232

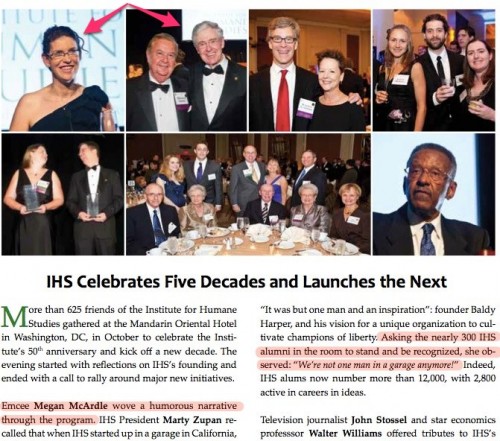

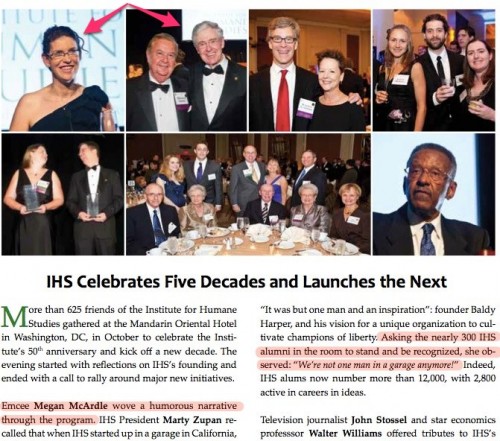

"Riverstone is very pleased with the results of the RAB drilling as the drilling confirms the longest gold soil anomaly in Burkina Faso", commented Dwayne L. Melrose, President and CEO of Riverstone. "Riverstone has always considered the Liguidi property to be very prospective for hosting a gold deposit". The Liguidi property is situated along the Markoye Structural Trend, which currently has numerous gold deposits which combined contain reported resources in excess of 15 million ounces. The RAB drilling targeted the most prospective areas of the Liguidi property, which included the Quartz Float Zone, Three Hills, Lagare's Zone and Dassoui. The gold soil anomaly represents one of the largest and strongest reported continuously mineralized gold anomalies in Burkina Faso, and which is characterized by highly anomalous gold values in excess of 100 ppb gold. The gold soil anomaly remains open to the southwest. Lagare's Zone is defined by mapping along the southern portion of the 13 km long gold soil anomaly. The RAB drilling concentrated on a 6 km strike length of the 8 km long zone. Lagare's Zone is characterized by a linear series of historic artisanal workings, along a shear zone that exposes interbanded volcanic and sedimentary rocks, felsic dykes and quartz veins. The Dassoui is a parallel trend to the south of Lagare, contains at least four anomalous zones from 200 to 800 m long. The Quartz Float Zone is located in the north-central part of the Liguidi property where grid based rock sampling over the gold soil anomaly defined four large anomalies grading greater than 1.0 g/t, with the largest measuring 1,000 m by 150 m. Over 20% of the samples collected ranged in grade between 1.01 and 6.88 g/t gold, with values as high as 15.81 g/t gold. The RAB drilling program confirmed the size and extent of the anomalies of the Quartz Float Zone. Work previously completed on the Wayalguin and the Three Hills areas located in the far northern portion of the gold soil anomaly zone returned trench results of 0.63 g/t gold over 111 m, including 18 m of 1.45 g/t gold and 18 m of 1.53 g/t gold. Follow up RC drill results of 16.5 m of 1.25 g/t gold, including 9 m of 1.88 g/t gold, were obtained at Wayalguin and Three Hills. A more complete summary of significant results in these RAB drill holes is presented in the following table: | Hole | From | To | Interval | Au | | Number | (m) | (m) | (m) | (ppb) | | | | | | | | | | | | | | LMG-RAB-008 | 3 | 6 | 3 | 745 | | | | | | | | LMG-RAB-016 | 12 | 15 | 3 | 733 | | | | | | | | LMG-RAB-024 | 6 | 12 | 6 | 591 | | and | 9 | 12 | 3 | 713 | | | | | | | | LMG-RAB-037 | 9 | 17 | 8 | 1175 | | | | | | | | LMG-RAB-042 | 0 | 15.5 | 15.5 | 1242 | | including | 3 | 6 | 3 | 759 | | and | 6 | 9 | 3 | 5071 | | | | | | | | LMG-RAB-066 | 3 | 9 | 6 | 615 | | | | | | | | LMG-RAB-070 | 0 | 3 | 3 | 740 | | | | | | | | LMG-RAB-090 | 0 | 3 | 3 | 892 | | | | | | | | LMG-RAB-094 | 0 | 3 | 3 | 714 | | | | | | | | LMG-RAB-095 | 3 | 4 | 1 | 2347 | | | | | | | | LMG-RAB-113 | 0 | 13 | 13 | 612 | | including | 0 | 6 | 6 | 1282 | | | | | | | | LMG-RAB-124 | 3 | 6 | 3 | 683 | | | | | | | | LMG-RAB-125 | 9 | 15 | 6 | 548 | | | | | | | | LMG-RAB-133 | 3 | 9 | 6 | 1694 | | including | 3 | 6 | 3 | 2580 | | | | | | | | LMG-RAB-180 | 3 | 6 | 3 | 760 | | | | | | | | LMG-RAB-185 | 0 | 8 | 8 | 781 | | including | 6 | 8 | 2 | 2885 | | | | | | | | LMG-RAB-188 | 0 | 7.5 | 7.5 | 723 | | including | 0 | 3 | 3 | 1644 | | | | | | | | LMG-RAB-232 | 0 | 11 | 11 | 1002 | | including | 6 | 9 | 3 | 3269 | | | | | | | | LMG-RAB-256 | 0 | 3 | 3 | 1063 | | | | | | | | LMG-RAB-382 | 0 | 9 | 9 | 554 | | | | | | | | LMG-RAB-394 | 0 | 4 | 4 | 679 | | | | | | | | LMG-RAB-430 | 0 | 3 | 3 | 960 | | | | | | | | LMG-RAB-436 | 0 | 26 | 26 | 757 | | including | 15 | 26 | 11 | 1690 | | | | | | | | LMG-RAB-437 | 12 | 15 | 3 | 606 | | | | | | | | LMG-RAB-497 | 12 | 18 | 6 | 602 | | | | | | | | LMG-RAB-499 | 0 | 23 | 23 | 819 | | including | 0 | 18 | 18 | 1023 | | | | | | | | LMG-RAB-515 | 27 | 30 | 3 | 1435 | | | | | | | | LMG-RAB-523 | 0 | 24 | 24 | 1425 | | including | 12 | 24 | 12 | 2784 | | | | | | | | LMG-RAB-527 | 0 | 27 | 27 | 431 | | including | 15 | 24 | 9 | 798 | | | | | | | | LMG-RAB-538 | 0 | 23 | 23 | 882 | | including | 3 | 15 | 12 | 1461 | | | | | | | | LMG-RAB-585 | 9 | 27 | 18 | 729 | | | | | | | | LMG-RAB-590 | 42 | 45 | 3 | 4143 | | | | | | | | LMG-RAB-613 | 3 | 6 | 3 | 2796 | | | | | | | | LMG-RAB-630 | 3 | 9 | 6 | 846 | | | | | | | | LMG-RAB-702 | 27 | 30 | 3 | 1001 | | | | | | | | LMG-RAB-703 | 15 | 21 | 6 | 992 | | | | Jim Cramer & Deutsche Bank Agree: 'Gold Is Money' Posted: 20 Sep 2012 05:17 AM PDT Wholesale prices to buy gold using US dollars or British pounds fell Thursday morning to trade just 1% below their seven-month highs of the last week. Commodity prices dropped once again with Asian and European equities.  | | 'Golden Cross' For Gold & Silver Signals Further Gains Posted: 20 Sep 2012 04:49 AM PDT Gold edged down today due to dollar strength and profit taking as speculators and some investors booked profits on 16% price gains from this year's low. Gold continues to see smart money diversification.  | | Project S.H.A.M.E.: Megan McArdle, a Covert Republican Party Activist Trained by the Billionaire Koch Brothers Posted: 20 Sep 2012 03:40 AM PDT We are delighted to post the latest offering of Project S.H.A.M.E., a media transparency initiative led by Yasha Levine and Mark Ames. Megan McArdle Special correspondent on economics, business and public policy; Newsweek/The Daily Beast

Megan McArdle is a Koch-trained conservative activist working as a business journalist and pundit. She earned her MBA from the University of Chicago, received journalism training at the Kochs' flagship libertarian think-tank, the Institute for Humane Studies, and has used her position at The Atlantic and, most recently, Newsweek/The Daily Beast, to run cover for and promote Koch interests and the Republican Party agenda. In early 2009, a GOP outfit backed by the Kochs hailed McArdle for her "leadership role in … re-branding the Republican party." McArdle continues to conceal the extent of her deeply conflicted relationships with the Koch influence-peddling machine. The recovered history of Megan McArdle

- Megan McArdle built her career on bashing public servants and government, but her father's taxpayer-subsidized work in government and as a government lobbyist funded her upbringing as a "child of privilege" as she described herself. McArdle's father, Francis McArdle, was a career public servant in the New York City administration who took the revolving door to the private sector as chief lobbyist for the General Contractor's Association of New York, where her father represented private contractors "primarily engaged in construction of public buildings and plants." In 1987, the head of the New York state Organized Crime Task Force accused Francis McArdle's clients of pervasive corruption, bribery, racketeering and union-busting. Thanks to New York's lucrative public construction projects, Megan was able to attend Riverdale Country School, the most expensive prep school in America, according to Time magazine. Today, annual tuition at Riverdale runs over $40,000.

- In the early-mid 1990s, McArdle attended the University of Pennsylvania. She converted from "ultraliberal to libertarian" in her junior year, after working as a canvasser and field manager for Ralph Nader's Public Interest Research Groups, which she called "the most deceptive, evil place I've ever worked." [ ]

- In 2001, after her job offer in management consulting was "rescinded", McArdle was given a day job in the construction industry, which her father was lobbying for at the time, and started blogging free-market Republican propaganda under the Ayn Rand-inspired pseudonym "Jane Galt." McArdle claimed she did not use her real name for fear of being persecuted for her libertarian views: "I lived in the Upper West Side so I couldn't discuss these things with anyone. I would just stew." Her first blog post to go viral in the conservative blog network argued for scrapping corporate taxes. [ ]

- In 2002, McArdle applied for a job in the Foreign Service but was rejected, which she blamed on asthma. "Apparently, they don't want a foreign service full of people who are, like, 'Well, I can only go to Paris,'" she told the Koch-funded AFF newsletter, Doublethink.

- In 2003, The Economist hired McArdle as a blogger. On the eve of the Iraq invasion, McArdle gleefully advocated the use of violence to suppress antiwar demonstrations, writing: "I'm too busy laughing. And I think some in New York are going to laugh even harder when they try to unleash some civil disobedience, Lenin style, and some New Yorker who understands the horrors of war all too well picks up a two-by-four and teaches them how very effective violence can be when it's applied in a firm, pre-emptive manner."

- McArdle received journalism training from the right-wing Institute for Humane Studies, headed by Charles Koch since the 1960s. According to the IHS, its journalism program "places talented writers and communicators—who support individual liberty, free markets, and peace—at media companies and non-profit newsrooms" and offers "mentoring and job placement assistance." The program currently includes a $3,200 stipend, as well as travel allowance.

- In 2011, McArdle returned to her Koch alma mater as a guest lecturer and instructor at the Institute for Humane Studies' "Journalism & the Free Society" summer internship program. The program tackled such topics as "Is an 'objective' press possible — or even desirable?" Other faculty members joining McArdle that year included Radley Balko, then-editor at the Kochs' Reason magazine

- In a sign of just how close and trusted McArdle is to the Kochs, in October 2011, she was chosen to emcee Charles Koch's 50th Anniversary gala celebration of his flagship libertarian think-tank, the Institute for Humane Studies, featuring Charles Koch as the keynote speaker and guest of honor. McArdle and Koch were joined by hundreds of leading GOP donors and activists. An IHS newsletter wrote of her performance: "Emcee Megan McArdle wove a humorous narrative through the program." The IHS attempted to hide McArdle's involvement, scrubbing her name from the dinner announcement page. (See side bar for more info on the gala event.)

- In 2006, McArdle published an article in Reason, a magazine controlled by the Kochs since the 1970′s, headlined, "The Virtue of Riches: How Wealth Makes Us More Moral". McArdle's article argued that wealth makes people "more tolerant of minorities, more welcoming to immigrants, more solicitous of their fellow citizens, more supportive of democratic institutions, and just plain better specimens of humanity." In fact, studies show that the wealthiest Americans are more likely to lie and steal, while the poor donate proportionally much more of their incomes to charity.

- In August 2007, The Atlantic hired McArdle as a business and economics blogger. Her first post, titled "Dont panic!" [sic], wrongly predicted that the liquidity shock that hit the financial system earlier that month was nothing to worry about: "Having a nasty market contraction does not mean that your economy automatically goes down the tubes."

- In September 2008, as the financial markets collapsed, McArdle gave a talk at an anti-regulation event hosted by the Koch-funded Mercatus Center at George Mason University focusing on how "government regulation actually contributed" to the financial meltdown. [ ]

- That same month, in September 2008, McArdle transformed her blog at the The Atlantic into a feverish Wall Street crisis-management propaganda outlet. She argued that bankers were largely innocent, blamed government regulators and homeowners for tanking the economy, and mocked news of a criminal investigation into Wall Street crimes, writing, "For what, I have no idea." McArdle also bizarrely claimed that bankers were victims of the real estate bubble, while blaming borrowers for being greedy profiteers: "You know who made most of the money on the subprime bubble? Anyone who bought a house in the last ten years. Yes, that's right, you, with your low fixed interest rate on a reasonably sized house. You're the profiteer who laughed all the way to the bank." The truth is that rampant fraud and predatory lending had decimated homeowner net-worth, leaving people substantially poorer and more in debt than they had been in decades.

- McArdle's position on financial regulations was in perfect sync with Koch Industries. The company is a major player in financial markets and emerged as one of the most powerful forces lobbying against financial reform following the crash, according to Bloomberg. Just in the last four months of 2008, Koch Industries spent over $7 million on lobbying efforts, much of that directed at fighting various financial regulation bills. Despite blatantly promoting the Kochs' political and business agenda, McArdle failed to disclose her numerous Koch conflicts of interests.

- In 2008, McArdle argued that the recession had a silver lining for liberals and the 99%, claiming the economic downturn would reduce wealth inequality because it hurt the rich more than middle- and lower-income Americans: "Recessions are bad for everyone, but they're worse for the wealthy." In fact, wealth inequality has substantially worsened since then.

- McArdle proposed permanently ending inheritance taxes on the super-wealthy, citing her own experience as a "child of privilege" which gave her insight into how the super-rich never paid their taxes anyway, so why waste money forcing them to offshore their earnings. She also claimed that "estate tax may actually cost the treasury money."

- In January 2009, McArdle was singled out for her "leadership role" by the Koch-connected America's Future Foundation and took part in a panel of GOP strategists and top conservative activists pushing for "re-branding the Republican party." McArdle's strategy speech argued that so long as unemployment remained high and housing prices remained low in 2010, the Republicans would win the mid-term elections, and it would be easier to shift blame for the 2008 economic collapse onto Democrats and Big Government.

- McArdle spent the next two years criticizing proposals that threatened to improve voters' lives before the 2010 elections. She pushed hard against health care reform, mortgage relief, financial consumer protection and unions.

- In February 2009, McArdle led a propaganda campaign in her Atlantic blog to discredit investigative journalism exposing the first Tea Party protest in February 2009 as an Astroturf campaign backed by the Koch brothers and FreedomWorks. McArdle wrote of the Kochs: "from what I know of them, astroturfing doesn't really seem like their style. I've seen Koch in action at private events, and though I'll respect the privacy, I'll say that even in the company of other like-minded rich people, he displayed rather a mania for honest dealing." The Tea Party was launched in February 2009 to oppose a White House bill providing mortgage relief to struggling homeowners, and thereby stabilize housing prices. In the "Republican rebranding" campaign, it was important to present the Tea Party as completely autonomous and grass-roots, rather than backed by the Kochs and FreedomWorks. Thanks in large part to McArdle's efforts discrediting the exposé, the media spent the next year-and-a-half misrepresenting the Tea Party as an authentic grassroots uprising rather than a Koch-sponsored Astroturf campaign. [ ] [ ]

- A year before the Tea Party, in 2008, McArdle's fiancé Peter Suderman worked on an identical Astroturf campaign for FreedomWorks called "AngryRenter.com", a fake grassroots movement launched by FreedomWorks' wealthy Republican donors designed to kill proposed legislation to provide mortgage relief to homeowners, which then-President Bush opposed. In May 2008, the Wall Street Journal exposed AngryRenter.com as a fake campaign funded by Republican donors and lobbyists: "Though it purports to be a spontaneous uprising, AngryRenter.com is actually a product of an inside-the-Beltway conservative advocacy organization led by Dick Armey, the former House majority leader, and publishing magnate Steve Forbes, a fellow Republican. It's a fake grass-roots effort — what politicos call an AstroTurf campaign." McArdle did not disclose that her fiancé worked on FreedomWorks' AngryRenter.com Astroturf campaign when she attacked the 2009 exposé on the Tea Party as a FreedomWorks/Koch project.

- In May 2009, McArdle led a smear campaign against New York Times reporter Ed Andrews who published a book about how he went broke under the weight of mortgage and credit card debt. To "prove" that Andrews' bankruptcy story was really his own fault, McArdle obtained his wife's records showing she had declared bankruptcy in the past, and used that to paint the author as untrustworthy and profligate. In fact, his wife was forced to file for bankruptcy before she met Andrews, when she had been a single mother with an ex-husband who refused to pay court-ordered child support. However, the damage was done; numerous publications attacked Andrews' credibility, effectively blunting the effect his book might have had on the public discourse on debt and bankruptcy.

- In June 2010, McArdle married fellow Koch activist Peter Suderman. Suderman spent much of his adult career on the Koch payroll, rotating through positions at America's Future Foundation, Competitive Enterprise Institute, FreedomWorks, as well as the Moonie-owned The Washington Times. Suderman is currently a senior editor at Reason magazine.

- In 2010, McArdle wrote about how she bought a house in a low-income black neighborhood in Washington DC that was in the process of being gentrified, and claimed she'd met an anonymous black man on a bus who told McArdle he (and presumably many more) blacks fully approved of their neighborhoods being gentrified and pushed out by wealthier whites. McArdle quoted the anonymous pro-gentrification black man telling her: "'You know, you may have heard us talking about you people, how we don't want you here. A lot of people are saying you all are taking the city from us. Way I feel is, you don't own a city.' He paused and looked around the admittedly somewhat seedy street corner. 'Besides, look what we did with it. We had it for forty years, and look what we did with it!'"

- In December 2010, McArdle attacked a New York Times investigation into the dangerous effects of formaldehyde, which causes cancer in humans. McArdle mocked those dangers: "It's a chemical! Indeed it is. You're surrounded by chemicals. Your couch is made of chemicals. So is the table. So is the hand-carded wool sweater you bought from the woman who raises her own sheep on organic feed. Distilled water is a chemical. Fine wine is full of them." Once again, McArdle ran cover for Koch Industries' business interests: According to an investigation into the Koch family by New Yorker reporter Jane Meyer, "Koch Industries has been lobbying to prevent the E.P.A. from classifying formaldehyde, which the company produces in great quantities, as a 'known carcinogen' in humans." [ ]

Wall of S.H.A.M.E. "I don't see any evidence offered that Koch money funds FreedomWorks, or any astroturfing organization . . . " "…from what I know of [the Kochs], astroturfing doesn't really seem like their style."

—From McArdle's attack on an investigative article exposing the first Tea Party protest as a Koch/FreedomWorks Astroturf campaign; February 2009 "I've seen Koch [sic] in action at private events, and though I'll respect the privacy [sic], I'll say that even in the company of other like-minded rich people, [Charles Koch] displayed rather a mania for honest dealing."

—McArdle on the Kochs' moral character; February 2009 "My husband once had a fellowship with the Charles G. Koch Foundation, and works for Reason Magazine, which has been a recipient of funds from Koch charitable organizations."

—McArdle issues a partial disclosure about her husband's Koch ties; February 2012 "I also disagree with the notion that the concentration of wealth is a large political problem. … while the wealthy certainly have the ear of politicians, and also give a lot of money to those politicians, it's not clear to me how tightly these things are linked on matters of broad national policy."

—McArdle isn't bothered by economic inequality and concentration of wealth; February 2008 "consumption inequality, not income inequality, is what matters. If the rich have access to broad classes of goods that the poor can't have, I find this worrying. On the other hand, if the problem is that Bill Gates has a really awesome 80 inch flat panel television, while the poor have to be content with a 32 inch CRT, well, I can't say my heartstrings are plucked very tight by this injustice."

—On why she doesn't believe in income inequality; July 2009 "Borrowers were not brought down by predatory lending. . . . Borrowers were brought down by a willingness to gamble on rising home prices–exactly the same thing that knocked out Lehman Brothers. At least Lehman Brothers had the excuse that ten years of rising prices had completely screwed up their default models."

—McArdle on why homeowners were more to blame than bankers for tanking the economy; September 2008 To me, the unsung villain of the mortgage crisis is the 30-year fixed rate self-amortizing mortgage with no prepayment penalty…The 30 year fixed rate mortgage was ultimately at the heart of the Savings and Loan crisis. —McArdle discovers another red herring to blame; July 2010 Am I suggesting that the Iraqis should pay for occupation expenses? Nope. We can afford it, and there's something repellent about making impoverished Iraqis pay for a war foisted on them by an evil dictator. But most of that $2t, if it is any sort of a real number, will be stuff for Iraqis: roads, schools, hospitals, government buildings, power plants and sewers and all the good stuff that lets us live like citizens of the 21st century. That stuff should come out of Iraqi oil revenues.

—McArdle belittling Iraq war critics Eric Alterman as "nuts" and economist James Galbraith as "paranoiac" for (correctly) predicting the war would cost trillions; March 2003 "I love Cato. I love school choice. I read their stuff all the time, and I think a lot of it is great. I cite it and use it."

—McArdle on the quality of Cato Institute's scholarship; May 2008 "For some reason, marriage always and everywhere, in every culture we know about, is between a man and a woman; this seems to be an important feature of the institution. We should not go mucking around and changing this extremely important institution, because if we make a bad change, the institution will fall apart.

—McArdle argues against rushing to legalize gay marriage, which she described as "a bedrock of our society" and compared gay marriage rights to a government welfare program; April 2005 "One of the dividing lines between me and a lot of the commentators on the Wall Street crisis is that I am not outraged by their pay."

—McArdle explains her position on exorbitant Wall Street bonuses; April 2009 McArdle on Science "Here's the thing: humans aren't like bonobos. And do you know how I know that we are not like bonobos? Because we're not like bonobos."

—McArdle explains why she's not convinced by evolutionary biology; August 2010 "I've basically outsourced my opinion on the science to people like Jonathan Adler, Ron Bailey, and Pat Michaels of Cato . . ."

—McArdle on where she gets her climate change information; February 2012. (Pat Michaels admitted on CNN he gets 40% of his funding from the petroleum industry.) Undisclosed Koch Work

Gold and Silver Market morning, September 20 2012 Posted: 20 Sep 2012 03:00 AM PDT

| | When Will Gold Hit $3,500 per Ounce? Posted: 20 Sep 2012 02:57 AM PDT Shouldn't stocks be flying? Shouldn't gold be closing over $1,800 per ounce... and on its way to the moon? The Fed last week announced what could turn out to be the biggest program of money-printing ever undertaken by a central bank in history.  | | Reserve Bank of India Mulling Financial Products to Check Gold Imports Posted: 20 Sep 2012 02:28 AM PDT Concerned over rising gold imports, the Reserve Bank of India on Wednesday said it is planning to come out with financial products on the lines of gold ETFs to give options to investors to take advantage of price movement in the precious metal. "...We can provide people with financial attraction of gold without them having physically own it. That would in a sense reduce the pressure on imports. So ETFs are one such," RBI Deputy Governor Subir Gokarn told reporters on the sidelines of a PHD Chamber event in New Delhi. read more |

|

No comments:

Post a Comment