saveyourassetsfirst3 |

- The Fraud of Negative Gold/Silver Lease Rates

- THE NEXT RECESSION WILL BE TRIGGERED BY OIL

- Emperor Bernanke, 3 Castles, And An Inevitable Unwind

- Dramatic pre-election action from an activist Fed

- All Signs Pointing to Gold

- Top 7 Insider Sells Filed On September 14

- Indian Gold Demand Jumps as Jewellers Buy at Record Price

- Hyperinflation is Virtually Assured – John Williams

- BofA Sees Fed Assets Surpassing $5 Trillion By End Of 2014...Leading To $3,350 Gold And $190 Crude

- CME Group: Gold Trading Halted Twice on Thursday to Prevent Volatility

- Three King World News Blogs/Audio Interviews

- Market Thermometer Points To Further Gains

- Links 9/15/12

- Nokia's Genius Move: Was It Wrongly Viewed As A Catastrophic Mistake?

- The craigslist silver bull index

- Miners Catching Up To Metals - Huge Run Coming?

- Links for 2012-09-14 [del.icio.us]

- The costs of a Gold Standard

- By the Numbers for the Week Ending September 14

- EM: Silver, Gold, QE3, SVM

- Davincij: Silver Short Squeeze

- Peter Schiff: Operation Screw

- By Design: The Fed's Engineered Collapse

- Zombies and Fireworks Aren’t Real

- The Myth Behind Central Bank Money Printing

- Dollar Unnecessary in Iran Stealth Oil Trades

| The Fraud of Negative Gold/Silver Lease Rates Posted: 15 Sep 2012 10:35 AM PDT Experienced precious metals investors are familiar with the topic of "negative lease rates" for gold and silver bullion. However, even novice investors can infer what is being discussed: paying someone to "borrow" gold/silver bullion. In general, any time we contemplate a situation where lenders are paying borrowers to borrow, the word "dump" immediately comes to mind. This is because we begin the scenario with a lender choosing to enter into a transaction with the deliberate outcome of losing money. Because the world of commerce is entirely devoted to earning profits rather than creating losses, this automatically also implies market-manipulation – and thus fraud. It is with this general context that we can now look at the particular subject of the gold and silver markets, where lease-rates are now usually negative (and are negative again currently). With negative lease rates creating a prima facie presumption of manipulation and fraud, the issue then becomes whether the particular fundamentals of the gold and silver markets either support or refute that presumption of fraud. The easiest way to approach this issue is by asking ourselves a question: are there conditions where it might make some crude "business sense" to enter into a transaction with the deliberate intent of losing money? This is ultimately a fairly simple question to answer since when we examine any market, we quickly discover that it is very difficult to construct even hypothetical circumstances where it would make sense to lease that asset at negative prices (other than illegal/nefarious purposes). The immediate proposition we must confront is that the moment we separate ownership of an asset from possession of that asset that we impair our ability to sell the asset; we are intentionally "encumbering" that asset by lending it to a 3rd party. This is problematic with respect to any-and-all price behavior in a market. If prices are rising, we don't want to encumber our asset; since it impairs our ability to take profits (through a sale) – and incurs further losses at the same time through losing money on the lease transaction. The situation is even more adverse with respect to a falling market, since prudent asset-holders would want to retain maximum liquidity with that asset should the need to sell the asset (to cut losses) arise. Even in a flat market it makes no sense to engage in losing transactions via negative lease rates. By definition, a flat market implies "dead money": an asset generating no profits (nor even deductible losses). Should a party be forced to hold a "dead" asset like this (for instance the gold reserves of central banks), while it would make sense to lend-out their gold for very minimal profits (i.e. slightly "positive" lease rates); it would never make sense for these asset-holders to lend-out their bullion at a loss. With there never being price conditions under which it makes sense to lease bullion at negative rates, this leaves us only one more variable to consider: inventories. If the (changing) value of an asset is never a valid basis for choosing to lose money by lending gold/silver at negative rates, then maybe the quantity of an asset being held would be a valid determinant? |

| THE NEXT RECESSION WILL BE TRIGGERED BY OIL Posted: 15 Sep 2012 09:57 AM PDT I was confident that the Fed had already begun printing. That seemed pretty evident by the overall action in the commodity markets, the dollar, and the fact that stocks were unable to correct in the normal timing band for a daily cycle low. However, I didn't really expect Ben would come out and publicly admit it. That one took me by surprise Thursday. I guess Bernanke wants to get full value for his attack on the dollar and make sure that markets are rising into the election. At this point all the pieces are in place for the inflationary spike and currency crisis I've been predicting for 2014. We now have open ended QE that is tied to economic output and unemployment. But since debasing currencies has historically never been the cure for the bursting of a credit bubble, all the Fed is going to produce is spiraling inflation. So as this progresses we are going to see the Fed printing faster and faster as the result they are looking for never materializes. This is what will ultimately drive the currency crisis at the dollar's next three year cycle low in 2014. At this point watch the price of oil if you want to know when the next recession is going to begin. As I've pointed out many times in the past, recessions, well at least since World War II, have all been preceded by a sharp spike in the price of energy. Any move of 100% or more in a year or less, has historically been the straw that breaks the camels back. Modern economies can not survive that kind of shock. It invariably triggers the collapse of consumer discretionary spending and economic activity comes to a grinding halt. In 2007 oil surged out of the 3 year cycle low into a parabolic advance as Bernanke trashed the dollar in the vain attempt to halt the sub prime collapse. That 200% spike in oil is what tipped the economy over into recession, which was then magnified in the fall of 08 as the financial bubble and debt markets imploded. Despite the complete inability of QE to heal the economy or job market, and since he really has no other tool, Bernanke just keeps doing the same thing over and over expecting a different result, but never getting it. Commodities are the check that prevent Keynesian economic policies from healing the global economy. Keynesian academics either don't understand this, or refuse to acknowledge it. Until they do, or we install Austrian economic advisers in the government, we are destined to continue making the same mistakes over and over. So we will watch the price of oil as it rises out of it's three year cycle low. If it hits $160 by next summer that will probably be enough to start the economy on the next downward spiral. If politicians get involved (and I'm sure they will) and try to impose price controls, they will multiply the damage, and probably guarantee that the next economic downturn escalates into a truly catastrophic depression. Until we see the spike in oil and the corresponding damage to the economy, no one has any business try to short anything, well maybe bonds, but even that will be risky because the Fed is going to be actively trying to prop the bond market up and keep interest rates artificially low. All in all there is going to be so much money to be made on the long side, especially in precious metals, that no one needs to fool around with puny little gains on the short side, especially in a market that is going to be hell to trade from the short side. The time to sell short will be in 2014 after the dollar's next three year cycle low. The dollar's rally out of that bottom will correspond with the next global economic collapse, ultimately caused by the decisions made by the ECB and the Fed this past week. I dare say if they could see the damage their decisions are going to inflict upon the world and the dire unintended consequences, maybe they would finally stop kicking the can down the road, and let the economy heal naturally. Of course that would entail several years of severe pain, and politicians as we all know, are extremely allergic to that. 2014-2015 is when we are going to see the stock market drop 60-75% and the next great leg down in this secular bear market. But until then there's probably a pretty good chance we are going to see the S&P at new all time highs in the next 6 months – 12 months. The rest of the weekend report is available to SMT subscribers. $10 one week trial. |

| Emperor Bernanke, 3 Castles, And An Inevitable Unwind Posted: 15 Sep 2012 08:53 AM PDT By Colin Lokey: I have talked quite a bit lately about how investors' hunger for more stimulus has created a perverse marketplace where bad news is good in terms of economic indicators. The key point is that when the market wishes for bad economic data, it is

With the announcement of an open-ended asset purchase program wherein additional purchases beyond year-end will be contingent upon - to use the Fed's own words - "the outlook for the labor market", the Fed has implicitly encouraged this behavior. Indeed, after December (the central bank will be buying until then regardless) there will be an explicit, quantifiable link between bad economic data and more asset purchases: Complete Story » |

| Dramatic pre-election action from an activist Fed Posted: 15 Sep 2012 07:43 AM PDT Steven Beckner with Futures writes: The Federal Reserve is looking increasingly desperate as it layers one monetary stimulus program on top of another, but no one can fault Chairman Ben Bernanke and company for being timid. Going into its Sept. 12-13 meeting, the Fed's policymaking Federal Open Market Committee (FOMC) already had renewed its Maturity Extension Program or "Operation Twist," and the New York Federal Reserve Bank was in the process of buying $267 billion in longer-term Treasury securities through year's end. Now, the FOMC announced Thursday, the Fed also will buy $40 billion per month of agency mortgage-backed securities (MBS) in a third round of quantitative easing (QE3) — until further notice. Unlike Operation Twist, whose bond purchases are financed by sales of shorter-term securities in the Fed's portfolio, this third round of large-scaled asset purchases will create new reserves and further expand the Fed's already bloated $2.8 trillion balance sheet. And that's not all. The two-fisted FOMC also is having another go at verbal easing. The FOMC further delayed the expected date of initial short-term rate hikes until at least mid-2015. Since January it had been saying it expected the Federal Funds rate to stay near zero "at least through late-2014." Prior to that, dating back to August 2011, the FOMC was putting the funds rate "lift-off" date at "at least through mid-2013." Just as important as the actions themselves are the FOMC's new strategy and new way of communicating. There were two important new approaches. First l, the FOMC made QE3 open-ended. In contrast to QE1 and QE2, in which large amounts of total intended bond purchases were preannounced over a predetermined time period, QE3 has no fixed amount or end date.The Fed will continue to buy $40 billion of MBS per month indefinitely. "If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability," the FOMC statement said. This will give the Fed additional flexibility. As Bernanke said in his post-FOMC news conference, how much bond buying the Fed does will be "a function of how the economy evolves," he said. "If the economy is weaker, we'll do more. And in those cases probably rates would be pretty low in any case because the economy is looking weak." He also made clear that the FOMC could adjust the composition, not just the size of its asset purchases from meeting to meeting. The FOMC also augmented its "forward guidance" on the path of the funds rate in important ways, presumably to meet objections that its conditional pledge to hold rates low was not sufficiently credible. Beyond merely extending the anticipated zero rate period from "late-2014" to "mid-2015," the FOMC removed the conditionality it had been attaching to the calendar date. Gone was the old caveat that "economic conditions — including low rates of resource utilization and a subdued outlook for inflation over the medium run — are likely to warrant exceptionally low levels for the federal funds rate...." Now the FOMC is stating bluntly that it expects to keep the funds rate near zero "at least through mid-2015." What's more, the FOMC said it "expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens." In case there were any doubts about the Fed's intentions, Bernanke told reporters the FOMC has an "obligation" to continue using its various policy tools until it sees "substantial" labor market improvement. "We will be looking for the sort of broad based growth in jobs and economic activity to signal sustained improvement in labor market conditions and sustaining employment," he said, maintaining that low inflation allows the Fed to do that. Even if inflation rises above the 2% target, the FOMC will not necessarily desist, he implied. In that event, the FOMC will "take a balanced approach," he said. "We bring inflation back to the target over time, but we do it in the way that takes into account the deviations from both of their targets." Why did the FOMC take these dramatic steps? Well, the FOMC explained its action by saying it was "concerned that, without further policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions." Many will point to the dismal August employment report, with its meager 96,000 non-farm payroll rise; 41,000 downward revision to prior months and 368,000 plunge in labor force participation, or to Bernanke's Aug. 31 speech in Jackson Hole, where he expressed "grave concern" about "the stagnation of the labor market" and vowed to "provide additional policy accommodation as needed." But the Sept. 13 decision was not a result of one month's jobs data, ugly as they were. Nor did it happen because Bernanke had a sudden epiphany in the shadows of the Grand Tetons. It was the culmination of a series of disappointments going back months. Remember that, as the year started, the labor market seemed to be on the mend. From December through February, payrolls rose an average 245,000 per month. But Bernanke was skeptical, warning in March that "further significant improvements ... will likely require a more-rapid expansion of production and demand..." His Okun's Law-based fears that the economy wasn't growing fast enough to reduce unemployment soon were realized. In March, payroll gains dipped to 143,000 and then decelerated even more sharply — to 68,000 in April, 87,000 in May and 45,000 in June. The July employment report, released a couple of days after the FOMC decided on Aug. 1 to stay on hold and take "more time" to assess the impact of the renewed "Operation Twist" bond-buying program, was seen as encouraging by officials who were uncertain about whether more easing was needed when it showed non-farm payrolls rebounding by 163,000. But less than a week before the FOMC convened in September, that number was revised down to 141,000, and the 96,000 August rise suggested a return to the dreary pre-July pattern. And the FOMC was convinced that the outlook wouldn't be much better unless it did more to cushion the economy against downside risks from the fiscal cliff and Europe. As they performed their quarterly ritual of revising their three-year economic projections and federal funds rate forecasts, Federal Reserve Bank Presidents and Fed governors did not see much improvement on the horizon. Still, why did the FOMC go ahead with new easing measures at this politically sensitive time?Why — when a vocal cadre of officials have been warning that the Fed has done all it can effectively do in the face of non-monetary impediments and that the cost of further easing would exceed the benefits? Why do QE3 when the Fed already had one stimulus program — Operation Twist — running? Why delay rate hikes when officials and academics alike have questioned the credibility and efficacy of such pledges? There are two basic answers: 1. The FOMC majority believes that its statutory dual mandate commands the Fed to use the tools at its disposal even though internal and external factors may limit their impact. If there are forces such as mortgage lending constraints and business and household uncertainty about taxes, regulation and health care costs that are gumming up the "monetary transmission mechanism," well then, the Fed just needs to push all the harder on its policy levers. An ancillary point is that the FOMC majority believes the economy's woes are primarily "cyclical," which is to say because of a shortfall of aggregate demand, and thus amenable to monetary policy. 2. If the normal interest rate channel through which lower rates are supposed to work is clogged, that doesn't render monetary policy impotent in the eyes of the FOMC majority. There are other channels through which unconventional easing measures can work that policymakers would rather not talk about publicly — namely the exchange rate channel. Lower rates and rate expectations should, in theory lower the value of the dollar, making U.S. goods more competitive in global markets and boost net exports. The Fed also hopes that by holding rates very low, investors will put their money into riskier assets such as stocks, yielding a positive "wealth effect" on the economy. Well, what's next? The Fed, in its limited experience with QE has never done an "open-ended" asset purchase program. QE1 and QE2 involved pre-announced and well-defined large amounts of bond buying with a fixed end date. QE3, as designed, seems like a sensible departure and likely garnered support it might not otherwise have had because of its flexibility. For one thing, it parallels more conventional monetary policymaking in which, in normal times, the FOMC decides meeting by meeting how much to adjust the federal funds rate. It will enable the FOMC to honestly say it is not wedded to a predetermined amount of easing and can terminate the bond buying, or extent and enlarge it, depending on the circumstances. How much or how little the FOMC ultimately will decide to do is anyone's guess. It will depend, among other things, on the election's outcome, the steepness of the fiscal cliff, the success of the European Central Bank's latest bond-buying adventure and the magnitude of the Chinese slowdown. One thing is for sure, until such time as the composition and/or leadership of the FOMC changes significantly and so long as it has tools left to use, the Fed will keep plugging away at stimulating the economy. September 14, 2012 (Source: Futures) |

| Posted: 15 Sep 2012 07:35 AM PDT Frank Holmes, U. S. Global Investors writes: With another syringe of quantitative easing being injected into the U.S. economy's bloodstream, Ben Bernanke is giving the markets their liquidity fix. The Federal Reserve's action reaffirmed my stance I've reiterated on several occasions that the governments across developed markets have no fiscal discipline, opting for ultra-easy monetary policies to stimulate growth instead. The government's liquidity shot promptly boosted gold and gold stocks, as investors sought the protection of the precious metal as a real store of value. You can see below the strong correlation between the rising U.S. monetary base and growing gold value. Since the beginning of 1984, as money supply has risen, so has the price of gold.

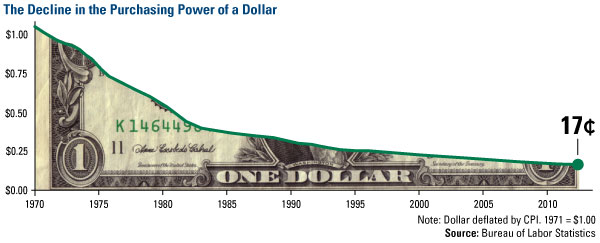

The dollar declined due to the Fed's easing, which isn't surprising, given the fact that gold and the greenback are often inversely correlated, and increasing money supply generally causes the currency to fall in value. What's interesting is that currency decline was what Richard Nixon sought to avoid when he ended the gold standard in 1971 and announced that the country would no longer redeem its currency in gold. During his televised speech to the American public, Nixon translated in simple terms the "bugaboo" of devaluation, saying, "if you are among the overwhelming majority of Americans who buy American-made products in America, your dollar will be worth just as much tomorrow as it is today." As you can see below, more than 40 years later, a dollar is worth only 17 cents. This significant decline in purchasing power only strengthens the case of gold as a store of value, likely prompting Global Portfolio Strategist Don Coxe to propose making Nixon the "patron saint of gold investors," during this year's Denver Gold Forum.

As Milton Friedman once said, "Only government can take perfectly good paper, cover it with perfectly good ink and make the combination worthless." In its long-term asset return research charting economic history in comparison to current markets, Deutsche Bank illustrates multiple ways how "the world dramatically changed post-1971 relative to prior history." While the research firm makes it clear that returning to the gold standard would be "disastrous," DB finds that the "lethal cocktail of unparalleled levels of global debt and unparalleled global money printing" are relatively new governmental developments. Prior to the last four decades, deficits only occurred in extreme situations of war or severe economic setbacks, such as the Great Depression. Balanced budgets were a "routine peace time phenomena in sound economies." Since 1971, surpluses have been rare. The U.K. has had an annual budget deficit 51 out of the past 60 years and Spain has had 45 years of deficit spending over the past 49 years, according to DB.

Countless discussions over fiscal and monetary policies will carry on, but time will tell. Ian McAvity, editor of Deliberations on World Markets, says, "Excessive debt creates deflationary drag that they repeatedly fight by throwing fresh 'liquidity' or 'stimulus' at, to debauch the currency of that debt … For private investors, gold is the best medium for self-protection and preservation of purchasing power in my view." I agree. Rising money supply, declining purchasing power and annual deficits are giving the all-clear to include gold in your portfolio. Many others appear to agree with us, as sentiment has shifted in favor of the metal in recent days: According to Morgan Stanley's survey of 140 institutional investors in the U.S., gold sentiment was at its highest bullish reading since July 2011 and the largest month-over-month increase during the survey's three-year history! So, gold investors, if you haven't put in your orders, consider getting them in quickly, because the bulls are buying. Credit Suisse saw "massive inflows" into gold exchange-traded products in August after experiencing significant outflows compared to crude oil and the broader market in March, April, May and July. August shows a clear preference toward gold.

We generated lots of interest when we showed our standard deviation chart a few weeks ago, so I updated it through September 13. Although gold has been on a tear recently, breaking through the stumbling block of $1,600 and climbing to $1,770 by the end of the week, bullion still looks attractive, with a low sigma reading of -1.7

A look at a histogram shows how many times gold bullion historically fell in this sigma range. Today's sigma of -1.7 has occurred only about 2 percent of the time. Bernanke and Draghi only made the decision more obvious for gold and gold stock buyers.

The Fed and ECB also make my job presenting at the Hard Assets conference in Chicago very exciting. Don't miss my presentation on September 21. I invite you to be there in person if you live in close proximity to Chicago, or you can download a pdf at www.usfunds.com following the meeting. You might also learn something you didn't know with our newest interactive slideshow, the 10 Surprising Uses of Commodities. Check it out and share with a friend. September 14, 2012 (Source: U S Global Investors) http://www.usfunds.com/investor-resources/investor-alert/

|

| Top 7 Insider Sells Filed On September 14 Posted: 15 Sep 2012 06:20 AM PDT By Markus Aarnio: A study titled "Predictive and Statistical Properties of Insider Trading" by James H. Lorie and Victor Niederhoffer reached the following conclusion:

Based on the findings of this encouraging insider trading study, I screened for companies where at least one insider made a sell transaction filed on September 14. I chose the top seven companies with insider selling in dollar terms. Here is a look at the seven stocks: 1. Kinder Morgan (KMI) is the largest midstream and the fourth largest energy company Complete Story » |

| Indian Gold Demand Jumps as Jewellers Buy at Record Price Posted: 15 Sep 2012 05:24 AM PDT ¤ Yesterday in Gold and SilverThe gold price didn't do a thing yesterday...and chopped around between $1,770 and $1,780 spot for most of Friday. Gold closed in New York at $1,770.50 spot...up $3.30 on the day. Despite the lack of price action, the volume was an immense 204,000 contracts...down about a third from Thursday's volume. It was pretty much the same story in silver. A price spike at 10:00 a.m. Hong Kong time got hammered flat in short order...and the silver price didn't do much after that. It finished the day at $34.68 spot...the same price as it closed on Thursday. Volume was a very chunky 55,000 contracts...down substantially from the 94,000 contracts traded on Thursday. The dollar index opened at 79.27 on Friday morning in the Far East...and it was all down hill from there. The low of the day [$78.62] came at 10:00 a.m. Eastern time right on the button...and the index recovered a bit from there, closing the week at 78.85...down 42 basis points from Thursday's close. That's about the same amount the index fell on Thursday but, as you can see, this dollar index decline had no affect on the precious metal prices at all...or wasn't allowed to. The gold stocks gapped up once again at the opening of trading yesterday morning...and reached their zenith just minutes after 10:00 a.m. Eastern time. From there the stocks chopped sideways...and the HUI closed the trading day up 2.83%. For the most part, the silver stocks had a pretty decent time of it as well...and Nick Laird's Silver Sentiment Index closed up another 3.71%. (Click on image to enlarge) The CME's Daily Delivery Report showed that only 5 gold contracts were posted for delivery within the Comex-approved depositories on Tuesday. Nothing to see here. The GLD ETF took in more gold yesterday, as an authorized participant deposited 290,865 troy ounces of the stuff...and it came as no surprise to me that there was no silver deposited in SLV. It boggles the mind as to how much silver must be owed to this particular ETF. The U.S. Mint had a decent sales report yesterday. They sold 9,500 ounces of gold eagles...1,000 one-ounce 24K gold buffaloes...and 100,000 silver eagles. Month-to-date the mint has sold 29,500 ounces of gold eagles...4,000 one-ounce 24K gold buffaloes...and 1,139,000 silver eagles. Based on this sales data, silver is outselling gold by a factor of 34 to 1...and I sure do hope that you're getting your share, dear reader. The Comex-approved depositories reported receiving 617,909 troy ounces of silver on Thursday...and shipped a smallish 34,493 ounces of the stuff out the door. The link to that activity is here. Yesterday's Commitment of Traders Report, for positions held at the 1:30 p.m. close of Comex trading in New York on Tuesday afternoon, was not happy reading this week, either. In silver, the Commercial net short position increased by another 2,352 contracts, or 11.8 million ounces. The Commercial net short position now stands at 236.4 million ounces of silver. Ted Butler informed me that the '5 through 8' traders went short an additional 700 contracts, the raptors sold another 200 long contracts at a profit...and the 'Big 4' went short an additional 1,400 contracts...of which, Ted says, about 1,000 were JPMorgan. According to Ted, that puts JPM short about 27,000 Comex silver contracts...or 135 million ounces. A back-of-the-envelope calculation shows that JPMorgan is short [on a net basis] a bit over 27% of the entire Comex futures market in silver all by itself. As of the cut-off on Tuesday, the 'Big 4' are short 217.9 million ounces...and don't forget that approximately 135 million of that is held by JPM. The '5 through 8' traders are short an additional 44.2 million ounces. In total, the 'Big 8' are short 262.1 million ounces of paper silver. As a percentage of the entire Comex futures market in silver on a 'net' basis...the 'Big 4' are short 44.1%...and the '5 through 8' traders add another 8.9 percentage points to that. In total, the 'Big 8' short holders are short 53.0% of the entire Comex silver market. JPMorgan holds half of that position. Is that outrageous, or what??? In gold, the Commercial net short position increased by another chunky amount. This time it was 1.77 million ounces, or 17,705 contracts. The total Commercial net short position is currently 23.71 million ounces. Ted said that the '5 through 8' traders went short another 1,000 contracts...and the raptors increased their net short position to a new all-time record high by going short another 4,000 odd contracts during this reporting week. Reader E.W.F...who provides me with a complete set of COT charts based on the Disaggregated COT report, had this to say..."Butler's Gold Raptors are net short 55,181 contracts, their largest net short position in the data going back to January 15, 1986." But it was the 'Big 4' that were the big movers in gold, as they went short another 12,000 contracts. In percentage terms on a 'net' basis, the 'Big 4' are short 29.4% of the entire Comex futures market in gold...and the '5 through 8' traders are short an additional 12.7 percentage points. Adding it up shows that the 'Big 8' are short 42.1% of the entire Comex futures market in gold on a 'net' basis. That's not as grotesque as the 53.0% short position that these same eight traders hold in silver...but it's an eye-watering number nonetheless. This is Price Management 101...and it's amazing the number of people that can't see it...and if they do, won't acknowledge it...even with the chart posted below staring them in the face. Here are all the gory details as portrayed by Nick Laird's "Concentration of Traders in the CFTC COTs" chart of all the physical commodities traded on the Comex. Silver is the standout...and it has always been the standout. It has occupied the position on the far right-hand side of this chart for as long as this chart has been around...and that's more than ten years. (Click on image to enlarge) Without question the Commitment of Traders Report for next week will show even more deterioration, as the open interest and volume numbers from the CME on Friday morning showed that there was little, if any, short covering on the Thursday rally...unless it was well hidden by spread trades, which is a possibility. There's also an outside chance that JPMorgan et al were going long themselves. There are several ways that 'da boyz' can cover what they're doing...and those are two of them. Whatever the scenario was, we won't find out about it until next Friday...and as I said in this space yesterday, that's a lifetime away in a market such as this. One can only fantasize what the prices of the precious metals would be if JPMorgan et al weren't standing in as short sellers of last resort. I got an interesting e-mail from reader "Jan in Denmark" yesterday. Here's a lightly edited version of what he had to say..."The attached report [in Danish, of course! Ed] come from one of the major Danish banks, Jyske Bank. They recommend gold, expect it to test USD$1,800 and if broken, then USD$1,900. But also, they anticipate a bumpy ride ahead. This is the first time I have seen a recommendation on gold from a Danish bank." ...or any bank for that matter, Jan! Here's an updated "Transparent PM Holdings" chart courtesy of Nick Laird. It's a new all-time high in ounces...and nearly there in dollar terms as well. (Click on image to enlarge) Since this is my weekend column, I have quite a few stories for you today, as I've been saving some all week for today's missive...plus there's lots happening in this world of ours. I hope you can find the time to read the ones that interest you. Well, it's a sure bet that the safety catch is now off the world's economic, financial and monetary system. Frank Holmes: All Signs Pointing to Gold. Peter Schiff: QE3 Removes Price Ceiling for Gold and Silver. Illegal gatherings won't be tolerated - South African government. Bring it on, Lonmin miners tell Radebe. ¤ Critical ReadsSubscribeEgan Jones Downgrades US From AA To AA-Well, they did it again. These guys must have gonads the size of church bells to tweak Uncle Sam's nose once again. Of course, if it had been me, all U.S. paper would be downgraded to it's intrinsic value, which is junk. I thank Marshall Angeles for today's first story, which was posted on the zerohedge.com Internet site late yesterday afternoon...and the link is here.  U.S. Consumer Price Index Increases by Most Since 2009The cost of living in the U.S. climbed in August by the most in more than three years, reflecting a surge in fuel costs. The 0.6 increase in the consumer-price index was the biggest since June 2009 and followed no change in the previous month, the Labor Department reported today in Washington. The median forecast of 85 economists surveyed by Bloomberg News called for an advance of 0.6 percent. The core index, which excludes volatile food and fuel costs, climbed a less-than- projected 0.1 percent for a second month. "I think inflation will remain benign for some time," Ryan Sweet, a senior economist at Moody's Analytics Inc. in West Chester, Pennsylvania, said before the report. "The consumer's still very, very price-sensitive, and rightfully so because the unemployment rate's high, wage growth is barely keeping up with inflation." This Bloomberg story showed up on their website early yesterday morning...and I thank West Virginia reader Elliot Simon for sending it. The link is here.  Hyperinflation is Virtually Assured – John WilliamsNot surprisingly, John Williams over at shadowstats.com has a few things to say about QE3. The Federal Reserve is talking about "unlimited QE," or money printing, to boost employment. Economist John Williams says, "That's absolutely nonsense...as the Fed is just propping up the banks." Williams says, "You're likely going to see a dollar sell-off...and that should evolve into hyperinflation." Williams, "Doesn't see the current system holding together without hyperinflation beyond 2014." He contends the real annual deficit is "$5 trillion per year" and says, "That's beyond containment." Williams predicts, "Hyperinflation is virtually assured because the Fed doesn't have any options left." Williams says people should get prepared because we are facing a "man-made disaster." The interview with Greg Hunter over at USAWatchdog.com was posted over at the jsmineset.com Internet site on Thursday...and I thank London, U.K. reader Iain Doherty for sharing it with us. The interview runs for 17 minutes...and the link is here.  Marc Faber: If I Were Bernanke, I Would ResignCentral bankers are "counterfeit money printers" and Federal Reserve Chairman Ben Bernanke should resign for messing up the U.S. economy so badly, Marc Faber, author of the Gloom, Doom and Boom, told CNBC on Friday. He said Bernanke was one of the main proponents of an ultra-expansionist economic monetary policy that was to blame for the latest financial crisis. "If I had messed up as badly as Bernanke I would for sure resign. The mandate of the Fed to boost asset prices and thereby create wealth is ludicrous — it doesn't work that way. It's a temporary boost followed by a crash," Faber said. This CNBC story, with the 4-minute video interview with Dr. Faber, was filed on their Internet site early yesterday morning. I thank Nitin Agrawal for sending it along. It's worth the read...and the clip is definitely worth watching. The link is here.  Doug Noland: QE ForeverI'll state what others hesitate to admit: this week our central bank took a giant leap from radical to virtual rogue central banking. If Bernanke's plan was to leapfrog the audacious Draghi ECB, our sinking currency – even against the euro – is confirmation of his success. If his goal was to provide markets a Benjamin Strong-like "coup de whiskey" – he should instead fear the dangerous instability central bankers have wrought on global markets and economies. And I am all too familiar to the adversities of being a naysayer in the midst of Bubble mania. I've read about it, I've lived it and I'm ok with it – and actually am motivated by it. I highlighted last week the ominous divergence between world fundamentals and the markets. And this week, well, global markets enjoyed just a spectacular time of it. Away from the Bloomberg screen, it sure seemed like a less than comforting week for the world at large. As an analyst of Bubbles, I often quip that they tend to "go to incredible extremes - and then double." Timing the bursting of a Bubble is a very challenging – if not nearly impossible – proposition. Yet this in no way should cloud the harsh reality that the longer a Bubble is accommodated, the more devastating the unavoidable consequences. It is, as well, the nature of speculative manias for things to turn crazy in the destabilizing terminal-phase. The past few weeks – with more than ample Bubble accommodation and craziness - really make me fear that eventual day of reckoning. I was waiting for Doug's Credit Bubble Bulletin with eager anticipation yesterday evening...and he certainly didn't disappoint. This is a must read for sure...and it's posted over at the prudentbear.com Internet site. The link is here.  NYSE paying $5M fine to settle charges of giving some clients unfair advantage in market dataThe New York Stock Exchange is paying $5 million to settle federal civil charges that it gave some customers an unfair head start by providing them with trading data ahead of the wider public. It marked the first time the Securities and Exchange Commission ever imposed a fine on an exchange. The NYSE and its parent NYSE Euronext also agreed in the settlement to hire an independent consultant to review their systems for delivering market data. They neither admitted nor denied the SEC's allegations. As is the case with all 'fine'...they are just licensing fees...and this incident with the NYSE is probably no exception. As soon as everyone's head has turned away, they'll most likely be back at it...just like the big banks. This story was filed on The Washington Post Internet site mid-morning yesterday...and I thank Donald Sinclair for sending it. The link is here.  |

| BofA Sees Fed Assets Surpassing $5 Trillion By End Of 2014...Leading To $3,350 Gold And $190 Crude Posted: 15 Sep 2012 05:24 AM PDT  Yesterday, when we first presented our calculation of what the Fed's balance sheet would look like through the end of 2013, some were confused why we assumed that the Fed would continue monetizing the long-end beyond the end of 2012. Simple: in its statement, the FOMC said that "If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability." |

| CME Group: Gold Trading Halted Twice on Thursday to Prevent Volatility Posted: 15 Sep 2012 05:24 AM PDT  Stop Logic, a type of circuit breaker that pauses trading for between five and 20 seconds, was triggered at 12:14:47 EDT and at 12:31:20 EDT Thursday. "Stop Logic offers market participants the opportunity to provide additional liquidity and permits the market to regain its equilibrium," the spokesman said in the email. That's just about all there was to this foxbusiness.com story that Washington state reader S.A. sent me on Thursday night...and the link to the hard copy is here. |

| Three King World News Blogs/Audio Interviews Posted: 15 Sep 2012 05:24 AM PDT  The first is with John Embry...and it's headlined "We Are Seeing Mounting Shortages Of Gold & Silver". The second blog is with Egon von Greyerz. It's entitled "Silver To Surge 433% From Current Levels". The audio interview is with Felix Zulauf. |

| Market Thermometer Points To Further Gains Posted: 15 Sep 2012 04:08 AM PDT By Macro Economist: My deepest apologies for not being more diligent with my updates. Our focus has been on making money for our clients and ourselves, and there has been plenty of money to be made. Furthermore, given no change in outlook, I really didn't feel the need to spoil a good thing. As we witnessed this summer, in addition to herding, the other fatal mistake investors make is taking profits too early. I assure you, many times it's best to stick with your view and just take a vacation. After identifying a bearish inflection in Ominous Signs, I became bullish in late July and outlined my thesis in Bulls Will Win The Battle, Bears Will Win The War. Since my buy signal, in a little over six weeks, we have witnessed an 8% rally in the SPY. Certain cyclicals that I identified, such as the Market Vectors Gold Miners ETF (GDX) and Complete Story » |

| Posted: 15 Sep 2012 03:55 AM PDT Pregnant males and pseudopenises: complex sex in the animal kingdom ars technica Crows Hold Grudges in Humanlike Fashion LiveScience The Salton Sea: Death and Politics in the Great American Water Wars Wired (Lambert). A must read. The Next Industrial Revolution Starts in this 20-foot Shipping Container Gizmodo My Life as a TaskRabbit BusinessWeek Japan aims to abandon nuclear power by 2030s Reuters Greeks work the longest hours in the EU; and other facts about the Greek labor markets Sober Look. This can't be said often enough. Protests target U.S. symbols across Muslim world AFP A Map of Muslim Protests Around the World Atlantic (Lambert) THE WAR NERD: OBAMA'S WARS >> Good Fighter, Can't Cheerlead Worth A Damn // Gary Brecher, NSFW Mitt Romney says 'middle income' is $250,000 Telegraph Battle of the sexes Economist Why are the Chicago public school teachers on strike? mathbabe County Judge Strikes Down Some Restrictions on Public Unions in Wisconsin Law New York Times Fed risks political fallout from QE3 Financial Times How Much Does the Fed's Plan Really Help Main Street? New York Times. Important. And notice the failure of the Fed to jawbone the banks on their margins. Looks like yet another stealth bailout. QE Won't Work Because There's No Demand For Credit Clusterstock Investor euphoria as Federal Reserve launches QE3 risks turning sour Nouriel Roubini, Project Syndicate CFPB Issues Second Semi-Annual Report; Nearly Mum on Enforcement Consumer Law and Policy Blog (Deontos) Over 1 Million Homeowners Bounced From HAMP Since Program Began David Dayen, Firedoglake State court ruling deals blow to U.S. bank mortgage system Reuters Treasury Lowballs Settlement Against Standard Chartered, Despite Large Award to New York Regulator Dave Dayen, Firedoglake Professor Adam Levitin Appointed to Consumer Financial Protection Bureau's New Consumer Advisory Board Georgetown Law. Yah! * * * lambert here: Mission elapsed time: T + 8 and counting* "Mean people suck." –Neal Stephenson, Cryptonomicon Chicago Teachers Strike. Deal? Friday morning: "Chicago Teachers Union delegates are expected to vote Sunday on whether to end Chicago's first teacher strike in 25 years, but first, they want to see any deal in writing." … Deal? Friday evening: "'I'm pleased to report that the talks today were very productive,' Chicago Teachers Union attorney Robert Bloch told reporters. 'We are still continuing to work out the details of the contract, but we are hopeful that we will have a complete agreement to present to the union's House of Delegates by Sunday.'" So, it's not yet in writing? … Deal? "Both of the sides were careful not to describe the deal as a final agreement and declined to release the terms." … Teacher evaluation: "It turns out that when you chart the achievement growth of students (plants in our analogy) and try to take into account the socioeconomic factors (soil conditions) that affect educational attainment, there still are too many variables to yield a reliable, consistent measurement of the quality of teachers (the fertilizers)." … From the ground: "An observation that I find difficult to report as a communist is the role of the police: I have to say that the police were some of our biggest supporters. The police approached us to make sure that they didn't give any of us tickets for being parked in restricted areas around the school. The beat cops wanted to talk about how they were next and that public servants are taking the brunt of the economic crisis. It really makes me think about how sophisticated we need to be in recognizing how at different times the rulers lose the allegiance of those they rely on to enforce their rule." Montreal. Neologism watch: "Wangst." … A la prochaine fois Anarchopanda: "The panda outings were above all an intervention tactic against police brutality, and the context of these interventions, despite the welcome return of cooler weather, are becoming very limited following the end of the strike. It is time for Anarchopanda to tell you, without much hope, 'Until next time.'" CA. Monsanto: "Nine anti-GMO protesters were arrested for blocking the gates [by chaining] themselves to vehicles they parked at the entrances to Oxnard's Seminis Vegetable Seeds. The blockade prevented trucks from entering or leaving the facility for nearly six hours." … CO. Fracking: "During a radio interview, [Gov. Hickenlooper] said he would like to come to Longmont and listen to people's concerns; "Our Longmont" offered its invitation Aug. 31. Gov. Hickenlooper on Thursday turned down an offer to appear at an 'Our Health, Our Future, Our Longmont' rally to ban fracking in Longmont." FL. Charters: "Brevard Public Schools will be verifying with parents that teachers of online classes run by for-profit company K12 are the same instructors the company claims are teaching." … Voting: "[O]f [the] 247,300 new voters registered between December 2011 and July 2012 52% — or 129,456 — are NPA [No Party Affiliation]. Another 16% are D and 35% are R." GA. Transparency: "SoS Kemp announced the archives starting Nov. 1 will accept only limited public appointments to see GA's important and historical records. The move, in response to Gov. Deal's request to again trim spending, could make GA the only state in the nation without full-time, centrally located public access to historical government and state records." MA. FTW: "I think both sides should bask in the warm glow of closure." ME. East-West Corridor: "Earlier this month, the Piscataquis County town of Monson became the first Maine municipality to impose a six-month moratorium on privately owned highways and utility corridors. The vote to that end was unanimous — 47 to 0." NJ. Tinpot tyrants: "The parents of a 5-year-old autistic boy say his New Jersey elementary school refused to serve him a $2.30 lunch because they were a few days late paying the [$8.00] bill for his meal plan." TN. Loaded: "[State Rep. Curry Todd R] was arrested after failing a roadside sobriety test. A loaded .38-caliber gun was found stuffed between the driver's seat and center console. Todd was a main sponsor of a state law allowing handgun carry permit holders to bring firearms into bars and restaurants that serve alcohol." Hubris, nemesis. TX. Corruption: "State Rep. Harvey Hilderbran, the Kerrville R who heads the tax-writing House Ways & Means Committee, blanketed the state Capitol this week with flyers advertising his real estate business." A D would have used a straw. … Mass incarceration: "The most significant causes of reduced jail populations in Harris County stem from changes in policies at the DA's office: The cessation of charging people caught with drug paraphernalia with felonies based on trace amounts, and the creation of the DIVERT program for DWI defendants." VA. Uranium: "Hagerman, a supervisor in Pittsylvania County which is at the center of a battle over proposed uranium mining, says that State Sen. Stanley told him that Gov. McDonnell asked Stanley to lobby the county Board of Supervisors to shelve a resolution regarding uranium at its Sept. 4 meeting. Hagerman says he has a taped telephone call from Stanley to prove it." … The Handmaid's Tale: "The state Board of Health this afternoon voted 13-2 to adopt regulations requiring existing abortion clinics in VA to comply with building regulations for new hospital construction." WA. Police state: "A judge this afternoon ruled that King County deliberately withheld information on a sheriff's deputy's troubling past behavior from the attorneys of a man who was left permanently brain-damaged when he was tackled by the deputy in 2009." WI. Act 10: "The decision could still be overturned on appeal – the Supreme Court has already restored the law once in June 2011 after it was blocked by a different Dane County judge in a different case earlier that year." WY. Safety: "The safe environment that people tout brims with all kinds of dangers–more dangers, I submit, than we ever encounter in the wild. Routinely, we pile our children into cars and drive around at lethal speeds. We litter our homes with toxic substances, spray our yards with pesticides, keep firearms, eat food full of chemicals, breathe polluted air, let our kids drive and put them in social contexts where bad things happen all the time." Outside baseball. Psychopaths: "And if the narrative being flogged here is the frightening prospect of having a bunch of psychos inflicting noxious social and economic policies on the rest of us, isn't the collusion of countless "sane" accomplices far more chilling?" … Strikes: "A good moral person will take whatever he or she can get even if it means working two or three crappy, low-paying jobs with no benefits. That's what we're supposed to do. Our reward is our pride and our dignity. I'll tell what would give me pride and dignity. Participating in a general strike that shut down a city." OK, and then? Grand Bargain™-brand cat food watch. Second term: "The working assumption is that Obama will face a divided government and want badly to get something done, even if it means cutting far-from-ideal deals with an R House." The economy. Best excuse yet: "Bill Clinton argued strenuously that the economic mess Mr Obama inherited was so severe that no president could fix it in just four years. Apparently, this is a message that resonates with many voters." The trail. Registration: "[Teams of young canvassers] spent eight weeks knocking on 120,882 doors across 208 of Milwaukee's 317 wards. The voter file said they were all home to a registered voter flagged as likely to be African-American. Canvassers were able to find and interact with only 31 percent of their targets. Twice that number were confirmed to no longer live at the address on file — either because a structure was abandoned or condemned, or if a current resident reported that the targeted voter no longer lived there" (Stoller). … Undecideds: "These folks look like DISAFFECTED voters [no sh*t, Sherlock], they seem disengaged from the campaign, and they don't call themselves enthusiastic about the election. They are probably NOT voters." Or voters for emergent parties. … Registration: "[M]any registration drives necessarily rely on one-to-one, in-person contacts, the process of converting potential registrants into actual registrants is highly labor-intensive. And voter registration organizations get nowhere close to the funding they require to fundamentally alter the size of the unregistered population." Use a Jobs Guarantee to rebuild the franchise! … Polls, Nate Silver: "But we've suddenly gone from having perhaps two state polls released every day to more like a dozen. (There has also been an increase in the number of national surveys.) When this happens, there can be the tendency for the news media to focus on those polls that confirm its current narrative about the race, while ignoring those that might tell a different story." … Unemployment: ""Using county-level data on unemployment and election returns for 175 midterm gubernatorial elections and 4 presidential elections from 1994 to 2010, the analysis finds [o]ther things being equal, higher unemployment increases the vote shares of Democratic candidates." Now, if I were really cynical… The Romney. Interview: "[ROMNEY: [W]hat Bernanke's doing is saying that what the president's saying is wrong. The president's saying the economy's making progress, coming back. Bernanke's saying, "No, it's not. I've got to print more money." … Class warfare: "[A]s distanced from the real economy as campaign reporters may be, Mitt and his team are even further divorced from the real world. So they don't even realize that two different sets of people are turning away from their campaign: the reporters, based on campaign fuck-ups, and real people, based on a solid sense of what could turn around their lived economic struggles." … Money: "Romney campaign aides said Thursday they were unsure whether former president Bush would appear at the lunchtime event at his home." His own home?! … Too much information: "[ANN ROMNEY:] And Anita and I were like we wonder what's behind this door? It was George [and not Neil] Bush having a massage." … Toast: "Personally, I suspect that Romney knows that he can't win the election and is, at this point, trying to protect himself from personal blame for losing an easy election." Ouch. The Obama. Poll: "Who would win in a fistfight? Obama: 58%; Romney: 22%." … Have a beer with: "'It's the likability factor,' said [Stuart] Spencer, a Romney supporter. ]Many people think that Obama hasn't delivered, but they still like him. I'd rather have a beer with him than Romney. Wouldn't you?'" "Have a beer with" — They actually say it! Would have to be an O'Dools with Romney, of course. … Pulling ahead? "But what we may ultimately remember of this period is that it was the time the Romney campaign's tight focus on the economy and jobs was loosened. Chasing headlines makes it hard to catch up, particularly if the campaign's original assumptions were correct." … New Obama comic impersonator: "Comic Jay Pharoah will play the commander in chief when the new [Saturday Night Live] season begins this weekend. 'I just thought it might be time to shake it up,' [Lorne] Michaels said" (cf. essential Stoller post). … Multilevel marketing: "Voters trust the traditional media less than ever. They do not believe politicians and their surrogates either. So the aim is to get friends to persuade their friends, using material supplied by the campaign." What a bunch of users. * slogan of the day: Warmly celebrate the 4th anniversary of the election of The Obama! * * * Antidote du jour: Also, the documentary "We're Not Broke" on corporate tax evasion and the Uncut movement, is playing in select locations. See the website for details. |

| Nokia's Genius Move: Was It Wrongly Viewed As A Catastrophic Mistake? Posted: 15 Sep 2012 03:47 AM PDT By Sacha May: Everyone was looking forward to Nokia's (NOK) September 5th event, drooling over the possibilities of innovative Windows Phone 8 devices. The buzz built up leading to the event, and Nokia, on the most part, didn't disappoint. It's hard for anyone to say that the Lumia 820 and the Lumia 920 are not high quality, innovative devices. In fact, many analysts and tech experts believe that Nokia's phones are the most innovative of the plethora of smartphones released recently. I'm not going to spend time describing the devices; I'll leave that to the experts, check out these links: Lumia 820, Lumia 920. Let's move on to the meat of this article. Introduction The purpose of this article is to address Nokia's seemingly biggest mistake: the late release of its Windows 8 devices. Many criticize this as being the last nail in Nokia's coffin, even though it had a gold mine ready Complete Story » |

| The craigslist silver bull index Posted: 15 Sep 2012 12:10 AM PDT This is my own little discovery, and I sense an extremely bullish sentiment for silver to me. Normally there are only a few silver/gold buyers on craigslist in my area, and they are lowballing widdow robbers offering like 17-20 bucks per dollar for 90% and such, but tonight I checked craigslist and there were over 25 buyers of silver posting and they were paying near spot. I shall call this the craigslist silver index. Anyone else notice the same in their area? |

| Miners Catching Up To Metals - Huge Run Coming? Posted: 15 Sep 2012 12:08 AM PDT Dollar Collapse |

| Links for 2012-09-14 [del.icio.us] Posted: 15 Sep 2012 12:00 AM PDT

|

| Posted: 14 Sep 2012 11:00 PM PDT Mises.org |

| By the Numbers for the Week Ending September 14 Posted: 14 Sep 2012 09:48 PM PDT |

| Posted: 14 Sep 2012 05:57 PM PDT |

| Davincij: Silver Short Squeeze Posted: 14 Sep 2012 05:56 PM PDT |

| Posted: 14 Sep 2012 05:51 PM PDT The geniuses at the Federal Reserve have concocted a bold new plan to revive the U.S. economy — print a bunch of money, loan it to Americans at super low interest rates so they can speculate on rising real estate prices, extract the appreciated equity and spend it on consumer goods. In other words, build an economy of real estate, by real estate, and for real estate. from schiffreport: The only problem is we've been there and done that. The last time it almost destroyed the U.S.economy. I guess almost isn't quite good enough for the Fed, so now it's determined to finish the job. These actions will destroy Americans' savings and hurt people on fixed incomes. To protect yourself, I recommend a strategy of foreign equities, commodities, and gold and silver. To buy gold and silver, contact my company Euro Pacific Precious Metals at 888-GOLD-160, or visit http://www.europacmetals.com. For your stock portfolio, contact my brokerage firm Euro Pacific Capital at 888-727-7922, or visit http://www.europac.net. ~TVR |

| By Design: The Fed's Engineered Collapse Posted: 14 Sep 2012 05:10 PM PDT The premise of this book is simple: Very smart and powerful people are robbing you of your wealth, freedom and future. The system they've created to accomplish this is both ingenious and 100% legal. The average citizen, unaware of how the system works, cannot effectively fight it. from thealexjoneschannel: If the premise of this book is simples, then its purpose is even simpler: Help the average citizen learn "the system" so they can protect their wealth, freedom and future. Stop the thieves before they steal everything. By the end of this short book, the average citizen will be familiar with these terms, will know "who benefits" and (more importantly) will know who pays… ~TVR |

| Zombies and Fireworks Aren’t Real Posted: 14 Sep 2012 04:10 PM PDT There's a movie about a zombie apocalypse where fireworks are used to distract the zombies. While their yellow eyes are peeled to the sky, scroungers go looking for food outside the safety of the walls. The violent zombies are so absorbed by the fireworks they let people walk right past them. Think of it as stimulus. The last two weeks have seen the pyrotechnicians busy goosing the zombie economy. While they were doing so, their mates got away with the goods. In Germany, the European Central Bank set off fireworks by agreeing to bail out countries that ask for their help. Where does the money for the bailouts come from? A bookkeeping entry. Thin air. A few taps on the keyboard. In other words, the central bank just creates it. Then, just up the Autobahn from the ECB, the Bundesverfassungsgericht ruled the bailout mechanism of Europe's governments to be just fine. Over-indebted governments can now bail out even more indebted governments. The zombies loved it. Not to be out done, Federal Reserve Chairman Ben Bernanke sent the zombies scrambling to see his $40 billion a month fireworks show. He announced he 'will buy $40 billion of mortgage-backed debt per month until the outlook for jobs improves substantially as long as inflation remains contained.' That left Sydney's New Year celebrations for dead. If you're wondering why on earth a central bank would buy mortgage debt, you're caught up in the fireworks. You need to snap out of the zombie mentality and realise what's really going on. But before we get to that, here's another story right out of the zombie movie itself. For some of the zombies, the fireworks don't have much of an effect anymore. They don't own American shares, they don't pay German taxes, and they don't live in Greece or Spain. So the distraction had to be a little more creative:

'A group of suspected bank robbers threw cash out of the windows of their getaway car as they led police on a wild chase through the streets of Los Angeles. Crowds of people reportedly flocked onto the streets in search of the cash as the chase was televised live from news choppers in the US. Bernanke is famous for declaring that the central bank he runs could drop money from a helicopter if economic times got desperate. Apparently economic times are so desperate, he had to swap his helicopter for a black van. Hey, if the banks refuse to lend all the money being pumped into them by central banks, why not get things moving in a different way? Given the stimulus, money printing and bailouts so far, what exactly is any additional manipulation supposed to achieve? It's not like we've had a half decent economic recovery anywhere. At least, not one that looks sustainable. If you think the last two weeks of shenanigans are anything other than a distraction, you've been zombified. Here's a hint as to what's really going on. Just up the highway from the bank robbery, people have been living it up on other people's money:

'In Santa Clara County, the center of the global tech industry and one of the wealthiest places in the United States, most home buyers get help from the government, an analysis of government lending data shows. The same is true in other wealthy enclaves such as Nassau County, outside New York, and Arlington County, outside Washington, the analysis of more than 50 million loans finds.' That's right, while the poor fight over cash lying in the street, and the middle class fight over goosed stock markets and welfare cheques, the rich are getting help with their mortgages. How quaint. What keeps this system of looting alive is the distractions the zombies are fed. Without the pyrotechnics at the Fed, ECB and government, the zombies would quickly be up over the walls. Some zombies are catching on and staging a non-violent protest:

'"There are so many people like me who aren't paying their mortgage so they can buy groceries and gas," said Harris, who was rejected for loan modification programs. "It's creating this whole false economy".' Just imagine if the false economy were exposed with realistic interest rates, honest mortgage repayments, or failed government budgets. In other words, imagine if the zombies were reincarnated. Reality, at this point, is quite terrifying. Don't worry though. Bernanke, Draghi and their minions will blow up the whole world with their gunpowder before letting the zombies figure things out. That leaves you in an awkward position. How should you deal with a zombified investment market? First up, make sure you don't get caught up in the fireworks. And, depending on your ethical disposition to such things, make sure you get your unfair share of the government's loot. For example, invest in small cap shares, which have a habit of soaring under money printing conditions. You might also want to protect yourself with assets that are too boring to attract the attention of zombies. Assets that are real and unalterable by laws and showmanship. Assets like gold and silver. But most important of all, don't get caught relying on the false global economy. Bailouts, money printing and stimulus fail eventually. Economic law holds. It just happens to be irritatingly patient. Until then, Nickolai Hubble. About the author: having recently escaped from academia, Nick decided to drop his tights (the required attire of a trapeze artist) and joined Port Phillip Publishing. Instead of telling everyone about the Daily Reckoning, he now spends his time writing for the weekend edition. From the Archives... The ECB's Outright Monetary Madness Who Knows What's Going on in China's Centrally Planned Economy? The Australian Dollar is Not the Euro Australia's Unbalanced Boom Why a Monarchy Beats Modern Democracy

|

| The Myth Behind Central Bank Money Printing Posted: 14 Sep 2012 04:00 PM PDT One of the longest-running myths in financial markets is going to damage a lot of portfolios: the myth that central bank money printing - in the context of a modern banking system - hikes the value of stocks. Many academics still think printing lots of money - which is thought to permanently increase stock prices - will lead to some sort of trickle-down economy phenomenon. Ben Bernanke said as much in his famous November 2010 Op-Ed in The Washington Post: "Higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion." Since then, the S&P 500 has rallied from 1,200 to 1,430, mostly on the belief that stocks are a good substitute for bonds. Printing from the Fed and other central banks has front-loaded returns. Front-loading returns means the potential market gains will be depressed. In other words, the Fed's actions have temporarily pushed stock prices above intrinsic value, and when the Fed stops money printing, stocks could quickly fall back to intrinsic value. Yale professor Robert Shiller created the "Shiller P/E ratio," which is the most-robust measure of the intrinsic value of the broad [US] stock market. The Shiller P/E ratio is calculated as follows: Divide today's S&P 500 index by the average inflation-adjusted earnings from the previous 10 years. I look at 10 years of earnings and cash flow data in researching stocks to get a feel for how earning might look in the future. Most investors remain too focused on the quarter-to-quarter minutiae, which often leads to surprises at turning points in the earnings cycle. The Shiller P/E of the S&P 500 is currently 23 - 50% higher than its long-term average. The average Shiller P/E ratio since 1880 is about 15. A move back to the average would take the S&P 500 back to 930. A move to bear market low valuations would take the S&P 500 back to roughly 400. Right now, it's 1,432. The Fed can't grow the intrinsic value of stocks. Companies can do that only by earning returns above their cost of capital. In the coming quarters, many companies that had been earning returns above their cost of capital will be earning lower returns. Free cash flow will follow returns lower. Look at Intel's latest revenue warning; look at FedEx's earnings warning. Profit margins have peaked in many industries. Manufacturing companies exporting to Europe and China will continue to suffer. Apple can hold neither the stock market nor the economy up. Meanwhile, household budgets out in the real world are straining to the breaking point. This morning's data showed the US labor force participation rate at a terrible 63.5% - the lowest in 31 years. So Ben Bernanke is responding to this silent crisis the only way he knows how...by pushing repeatedly on the "print money" button at the Federal Reserve. He calls is "quantitative easing," or QE. And it's my bet that QE3 is coming soon to a nation near you. With each successive round of quantitative easing, demand for gold and other stores of value will rise and demand for stocks will weaken. As I observed in this column, "Fed officials have been all over the media for weeks, laying the groundwork for a third round of quantitative easing. By preparing markets for QE3, the Fed refuses to let real-world evidence get in the way of its beloved theories... Perhaps once the global paper money system is restructured, involving some sort of gold standard, sanity will return to the Fed and other central banks. Until we see more signs of sanity, hold a core position in gold, silver, and precious metal mining stocks. These asset classes will be the prime beneficiaries of future printing." Regards, Dan Amoss From the Archives... The ECB's Outright Monetary Madness Who Knows What's Going on in China's Centrally Planned Economy? The Australian Dollar is Not the Euro Australia's Unbalanced Boom Why a Monarchy Beats Modern Democracy

|

| Dollar Unnecessary in Iran Stealth Oil Trades Posted: 14 Sep 2012 03:57 PM PDT In Southeast Asia, nestled in the South China Sea, lies Malaysia. Just slightly larger than New Mexico and established in 1963, Malaysia is not typically the first location that comes to mind when thinking of international intrigue. Nevertheless, that is exactly where this Ian Fleming style story of international finance takes place—a story that at its heart is another piece of the tale of the death of the U.S. dollar. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment