Gold World News Flash |

- How High Will Silver Go? – Office Series 17

- Vietnam central bank to inject more Gold into market

- Top 14 Reasons To Buy Silver – Full Version

- The Fraud of Negative Gold/Silver Lease Rates

- Silver To Surge 433% From Current Levels

- 9/11: The Mysterious Collapse of WTC Building 7 was Not An Inside Job

- Guest Post: Janet Tavakoli: Understanding Derivatives and Their Risks

- Who says silver is second best? Price streaks ahead 572% in the past decade – beating even gold as the top-performing commodity

- How Investors Can Protect Themselves in a Politicized Economy

- The Next Recession Will Be Triggered by Oil

- John Hathaway - $2,000 Gold Will Happen Very Quickly

- Silver Liberation Army Readies Major Assault with New ‘Ethical Silver Keisers'

- This Past Week in Gold

- Dramatic pre-election action from an activist Fed

- All Signs Pointing to Gold

- QE3 Removes Price Ceiling for Gold and Silver

- QE3 will drive up gold price but won't solve economic problems

- Retirement Accounts: Problems Above And Beyond Sentinel Ruling and Custodian Integrity

- Transforming Collateral is the Newest Ponzi

- Why Did Ben Bernanke Cross the Road?

| How High Will Silver Go? – Office Series 17 Posted: 15 Sep 2012 09:34 PM PDT |

| Vietnam central bank to inject more Gold into market Posted: 15 Sep 2012 08:30 PM PDT from Bullion Street:

The State Bank of Vietnam said the Saigon Jewelry Company began to recast deformed gold bars on August 25 and plans to issue a total of 48,000 taels (1.8 tons) of gold onto the market by early next month. Last week, the central bank officially made Saigon Jewelry Company (whose SJC-branded bullion already accounted for 90 percent of the local market) Vietnam's sole bullion producer. The long-anticipated move came after the central bank said it would take over gold production to tighten control over the market. From now on, Saigon Jewelry will only produce bullion based on orders from the central bank, according to a statement from the government. |

| Top 14 Reasons To Buy Silver – Full Version Posted: 15 Sep 2012 07:49 PM PDT [Ed. Note: You absoultely must re-watch the clip from 13:05 - 18:15. As I have told Chris Duane, if people truly understood how absolutely incredibly difficult physical silver is to find, mine, refine & get to market, APMEX, Gainsville, LibertyCPM, Tulving & Provident would be sold out by morning.] from TruthNeverTold : |

| The Fraud of Negative Gold/Silver Lease Rates Posted: 15 Sep 2012 07:30 PM PDT by Jeff Nielson, Bullion Bulls Canada:

In general, any time we contemplate a situation where lenders are paying borrowers to borrow, the word "dump" immediately comes to mind. This is because we begin the scenario with a lender choosing to enter into a transaction with the deliberate outcome of losing money. Because the world of commerce is entirely devoted to earning profits rather than creating losses, this automatically also implies market-manipulation – and thus fraud. It is with this general context that we can now look at the particular subject of the gold and silver markets, where lease-rates are now usually negative (and are negative again currently). With negative lease rates creating a prima facie presumption of manipulation and fraud, the issue then becomes whether the particular fundamentals of the gold and silver markets either support or refute that presumption of fraud. The easiest way to approach this issue is by asking ourselves a question: are there conditions where it might make some crude "business sense" to enter into a transaction with the deliberate intent of losing money? This is ultimately a fairly simple question to answer since when we examine any market, we quickly discover that it is very difficult to construct even hypothetical circumstances where it would make sense to lease that asset at negative prices (other than illegal/nefarious purposes). |

| Silver To Surge 433% From Current Levels Posted: 15 Sep 2012 06:30 PM PDT from KingWorldNews:

Today Egon von Greyerz told King World News that silver is going to surge a remarkable 433% from current levels. Greyerz, who is founder and managing partner at Matterhorn Asset Management out of Switzerland, also said the move in silver could take place, "… in the next twelve months." Here is what Greyerz had to say: "Gold is now up 13% this year after having been up 19% compound annual growth in the last ten years. Gold is going up every year, paper money has been going down, and that will continue because of the amount of money printed." |

| 9/11: The Mysterious Collapse of WTC Building 7 was Not An Inside Job Posted: 15 Sep 2012 05:54 PM PDT Preface: If you believe that the government always tells the truth, you have gotten lost in a bad neighborhood, and you should turn around and get back on the freeway as quickly as possible. If you believe that politics, war and terrorism do not greatly affect your lifestyle, your investment portfolio and the economy, you are sadly mistaken. See this, this, this, this and this. If, on the other hand, you believe that 9/11 was an inside job, then please point out any inaccuracies, shortcoming or erroneous conclusions contained within the post. Please don’t just label it as being a “limited hang-out” propaganda sell-out hit piece … instead, if you believe it is wrong, please link to actual evidence which disproves what I am saying, or which adds pieces of information which you think are missing. Maybe I’ll agree with you, maybe I won’t. But I will consider every comment. People who state that 9/11 was an inside job are claiming that it is a false flag operation which killed people, was used to justify wars in Iraq and elsewhere and a power grab in the U.S. But World Trade Center building 7 – the third building to collapse on September 11th – has nothing to do with any inside job:

As such, the collapse of the building – also known as the “Solomon Brothers Building” – was not an inside job. Of course, the building might have been demolished to save lives. For example, Paul K. Trousdale – a structural engineer with decades of experience – says:

(some point to the World Trade Center owner's statement about the decision to "pull" the building as confirming Trousdale's theory). So why am I wasting your valuable time in discussing this? Because the government – as part of its political cover-up of negligence before and on 9/11 – pretended that the building collapsed due to “natural causes”. This should not be entirely surprising … we know that government personnel sometimes misspeak about things like the economy or Iraq and weapons of mass destruction, and they may also have made some minor errors peripherally related to 9/11:

Again, this post has nothing to do with “9/11 inside job”: no one died when building 7 collapsed. What Do the Experts Say?What does the evidence show about the Solomon Brothers Building in Manhattan? Numerous structural engineers – the people who know the most about office building vulnerabilities and accidents – say that the official explanation of why building 7 at the World Trade Center collapsed on 9/11 is “impossible”, “defies common logic” and “violates the law of physics”:

The above is just a sample. Many other structural engineers have questioned the collapse of Building 7, as have numerous top experts in other relevant disciplines, including:

Watch this short video on Building 7 by Architects and Engineers (ignore any reference to the Twin Towers, deaths on 9/11, or any other topics other than WTC7): Fish In a Barrel Poking holes in the government’s spin on Building 7 is so easy that it is like shooting fish in a barrel. As just one example, the spokesman for the government agency which says that the bui |

| Guest Post: Janet Tavakoli: Understanding Derivatives and Their Risks Posted: 15 Sep 2012 05:31 PM PDT Submitted by Adam Taggart of Peak Prosperity, Global financial markets are awash in hundreds of trillions of dollars worth of derivatives. By some estimates, the total amount exceeds one quadrillion. Derivatives played a central role in the 2008 credit crisis, as they had a brutal multiplying effect on the magnitude of the carnage. As a bad asset was written down, oftentimes there were derivative contracts written against it that resulted in total losses 10x greater than the initial write-down. But what exactly are derivatives? How do they work? And have we learned to treat these "weapons of mass financial destruction" (as Warren Buffet colorfully coined them) any more carefully in the aftermath of the global financial crisis? Not really, claims Janet Tavakoli, derivatives expert and president of Tavakoli Structure Finance. But the danger behind derivatives doesn't lie in their existence, she stresses. They play and important and constructive role in a healthy financial system when used responsibly. But when abused, derivatives can create massive damages. So at the root of the "derivatives problem", Tavakoli stresses, is control fraud - the rampant unchecked criminal action by influential players on Wall Street. (This is the same method of fraud we've explored in past interviews with Bill Black [13] and Gretchen Morgenson [14]). Derivatives contracts are too often constructed in favor of these parties, who if they end up on the losing side of the trade, are able to socialize their losses. Until we address this root problem of corruption, says Tavakoli, derivatives (as well as other securities: stocks, bonds, etc) will continue to subject investors and our makets, overall, to unacceptable risk. On The Nature of Derivatives

On Control Fraud

On Deriviative Risk in a Market Downturn

On Gold and Countyparty Risk

Click the play button below to listen to Chris Martenson's interview with Janet Tavakoli (54m:27s):

Click here to read the full transcript |

| Posted: 15 Sep 2012 05:30 PM PDT by Tanya Jeffries, Mail Online:

Gold, which saw a 428% price jump, was the second-best performer in a league table compiled by Lloyds TSB Private Banking. The top duo were followed by tin (414%), copper (406%) and lead (344%). But there is a sting in the tail, because commodity prices have suffered an overall decline of 13 per cent in the past year due to fears of a global economic slump – and precious and base metals have fared worst with falls of 19 per cent in both sectors. Some 15 of the 20 commodities tracked by Lloyds TSB have at least doubled in value since 2002, according to Lloyds TSB. Silver proved the winner over 10 years because it is seen as a safe haven investment and is in high demand for industrial uses, it explained. |

| How Investors Can Protect Themselves in a Politicized Economy Posted: 15 Sep 2012 03:31 PM PDT Right on the heels of the Republican and Democratic National Conventions, the recent Casey Research Summit in Carlsbad, California—cosponsored by SprottGlobal—focused on a timely theme: "Navigating the Politicized Economy." The somber revelations of the summit contrasted with the buzz of the party conventions. The Gold Report sat down with Louis James, Casey Research's chief metals and mining investment strategist, Rick Rule, founder of Global Resource Investments, and Marin Katusa, Casey Research's chief energy investment strategist, to discuss how investors can position themselves in a politically driven economy. |

| The Next Recession Will Be Triggered by Oil Posted: 15 Sep 2012 01:27 PM PDT |

| John Hathaway - $2,000 Gold Will Happen Very Quickly Posted: 15 Sep 2012 12:41 PM PDT  Today John Hathaway told King World News that "$2,000 gold will happen quickly." The four decade veteran and prolific manager of the Tocqueville Gold Fund also believes gold will continue to surge, "I just don't think $2,000 is a convenient stopping point." Today John Hathaway told King World News that "$2,000 gold will happen quickly." The four decade veteran and prolific manager of the Tocqueville Gold Fund also believes gold will continue to surge, "I just don't think $2,000 is a convenient stopping point." Hathaway went on to cover silver, but first, here is what he had to say about what is taking place in the gold market: "We've had a very strong move off the lows in gold. Bernanke has been saying all year long, 'No more QE.' What do we have? More QE, with no end in sight. I'm amazed that people are surprised by all of this. That's the way the shares and the metals have been acting." This posting includes an audio/video/photo media file: Download Now |

| Silver Liberation Army Readies Major Assault with New ‘Ethical Silver Keisers' Posted: 15 Sep 2012 11:13 AM PDT I just got some of these first-run 'Ethical Silver Keisers' this morning. The rounds are being minted at The Birmingham Mint here in the UK. These rounds will be produced using recycled silver and silver sourced from ESG compliant supplies … Continue reading |

| Posted: 15 Sep 2012 10:08 AM PDT |

| Dramatic pre-election action from an activist Fed Posted: 15 Sep 2012 08:43 AM PDT Steven Beckner with Futures writes: The Federal Reserve is looking increasingly desperate as it layers one monetary stimulus program on top of another, but no one can fault Chairman Ben Bernanke and company for being timid. Going into its Sept. 12-13 meeting, the Fed's policymaking Federal Open Market Committee (FOMC) already had renewed its Maturity Extension Program or "Operation Twist," and the New York Federal Reserve Bank was in the process of buying $267 billion in longer-term Treasury securities through year's end. Now, the FOMC announced Thursday, the Fed also will buy $40 billion per month of agency mortgage-backed securities (MBS) in a third round of quantitative easing (QE3) — until further notice. Unlike Operation Twist, whose bond purchases are financed by sales of shorter-term securities in the Fed's portfolio, this third round of large-scaled asset purchases will create new reserves and further expand the Fed's already bloated $2.8 trillion balance sheet. And that's not all. The two-fisted FOMC also is having another go at verbal easing. The FOMC further delayed the expected date of initial short-term rate hikes until at least mid-2015. Since January it had been saying it expected the Federal Funds rate to stay near zero "at least through late-2014." Prior to that, dating back to August 2011, the FOMC was putting the funds rate "lift-off" date at "at least through mid-2013." Just as important as the actions themselves are the FOMC's new strategy and new way of communicating. There were two important new approaches. First l, the FOMC made QE3 open-ended. In contrast to QE1 and QE2, in which large amounts of total intended bond purchases were preannounced over a predetermined time period, QE3 has no fixed amount or end date.The Fed will continue to buy $40 billion of MBS per month indefinitely. "If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability," the FOMC statement said. This will give the Fed additional flexibility. As Bernanke said in his post-FOMC news conference, how much bond buying the Fed does will be "a function of how the economy evolves," he said. "If the economy is weaker, we'll do more. And in those cases probably rates would be pretty low in any case because the economy is looking weak." He also made clear that the FOMC could adjust the composition, not just the size of its asset purchases from meeting to meeting. The FOMC also augmented its "forward guidance" on the path of the funds rate in important ways, presumably to meet objections that its conditional pledge to hold rates low was not sufficiently credible. Beyond merely extending the anticipated zero rate period from "late-2014" to "mid-2015," the FOMC removed the conditionality it had been attaching to the calendar date. Gone was the old caveat that "economic conditions — including low rates of resource utilization and a subdued outlook for inflation over the medium run — are likely to warrant exceptionally low levels for the federal funds rate...." Now the FOMC is stating bluntly that it expects to keep the funds rate near zero "at least through mid-2015." What's more, the FOMC said it "expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens." In case there were any doubts about the Fed's intentions, Bernanke told reporters the FOMC has an "obligation" to continue using its various policy tools until it sees "substantial" labor market improvement. "We will be looking for the sort of broad based growth in jobs and economic activity to signal sustained improvement in labor market conditions and sustaining employment," he said, maintaining that low inflation allows the Fed to do that. Even if inflation rises above the 2% target, the FOMC will not necessarily desist, he implied. In that event, the FOMC will "take a balanced approach," he said. "We bring inflation back to the target over time, but we do it in the way that takes into account the deviations from both of their targets." Why did the FOMC take these dramatic steps? Well, the FOMC explained its action by saying it was "concerned that, without further policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions." Many will point to the dismal August employment report, with its meager 96,000 non-farm payroll rise; 41,000 downward revision to prior months and 368,000 plunge in labor force participation, or to Bernanke's Aug. 31 speech in Jackson Hole, where he expressed "grave concern" about "the stagnation of the labor market" and vowed to "provide additional policy accommodation as needed." But the Sept. 13 decision was not a result of one month's jobs data, ugly as they were. Nor did it happen because Bernanke had a sudden epiphany in the shadows of the Grand Tetons. It was the culmination of a series of disappointments going back months. Remember that, as the year started, the labor market seemed to be on the mend. From December through February, payrolls rose an average 245,000 per month. But Bernanke was skeptical, warning in March that "further significant improvements ... will likely require a more-rapid expansion of production and demand..." His Okun's Law-based fears that the economy wasn't growing fast enough to reduce unemployment soon were realized. In March, payroll gains dipped to 143,000 and then decelerated even more sharply — to 68,000 in April, 87,000 in May and 45,000 in June. The July employment report, released a couple of days after the FOMC decided on Aug. 1 to stay on hold and take "more time" to assess the impact of the renewed "Operation Twist" bond-buying program, was seen as encouraging by officials who were uncertain about whether more easing was needed when it showed non-farm payrolls rebounding by 163,000. But less than a week before the FOMC convened in September, that number was revised down to 141,000, and the 96,000 August rise suggested a return to the dreary pre-July pattern. And the FOMC was convinced that the outlook wouldn't be much better unless it did more to cushion the economy against downside risks from the fiscal cliff and Europe. As they performed their quarterly ritual of revising their three-year economic projections and federal funds rate forecasts, Federal Reserve Bank Presidents and Fed governors did not see much improvement on the horizon. Still, why did the FOMC go ahead with new easing measures at this politically sensitive time?Why — when a vocal cadre of officials have been warning that the Fed has done all it can effectively do in the face of non-monetary impediments and that the cost of further easing would exceed the benefits? Why do QE3 when the Fed already had one stimulus program — Operation Twist — running? Why delay rate hikes when officials and academics alike have questioned the credibility and efficacy of such pledges? There are two basic answers: 1. The FOMC majority believes that its statutory dual mandate commands the Fed to use the tools at its disposal even though internal and external factors may limit their impact. If there are forces such as mortgage lending constraints and business and household uncertainty about taxes, regulation and health care costs that are gumming up the "monetary transmission mechanism," well then, the Fed just needs to push all the harder on its policy levers. An ancillary point is that the FOMC majority believes the economy's woes are primarily "cyclical," which is to say because of a shortfall of aggregate demand, and thus amenable to monetary policy. 2. If the normal interest rate channel through which lower rates are supposed to work is clogged, that doesn't render monetary policy impotent in the eyes of the FOMC majority. There are other channels through which unconventional easing measures can work that policymakers would rather not talk about publicly — namely the exchange rate channel. Lower rates and rate expectations should, in theory lower the value of the dollar, making U.S. goods more competitive in global markets and boost net exports. The Fed also hopes that by holding rates very low, investors will put their money into riskier assets such as stocks, yielding a positive "wealth effect" on the economy. Well, what's next? The Fed, in its limited experience with QE has never done an "open-ended" asset purchase program. QE1 and QE2 involved pre-announced and well-defined large amounts of bond buying with a fixed end date. QE3, as designed, seems like a sensible departure and likely garnered support it might not otherwise have had because of its flexibility. For one thing, it parallels more conventional monetary policymaking in which, in normal times, the FOMC decides meeting by meeting how much to adjust the federal funds rate. It will enable the FOMC to honestly say it is not wedded to a predetermined amount of easing and can terminate the bond buying, or extent and enlarge it, depending on the circumstances. How much or how little the FOMC ultimately will decide to do is anyone's guess. It will depend, among other things, on the election's outcome, the steepness of the fiscal cliff, the success of the European Central Bank's latest bond-buying adventure and the magnitude of the Chinese slowdown. One thing is for sure, until such time as the composition and/or leadership of the FOMC changes significantly and so long as it has tools left to use, the Fed will keep plugging away at stimulating the economy. September 14, 2012 (Source: Futures) |

| Posted: 15 Sep 2012 08:35 AM PDT Frank Holmes, U. S. Global Investors writes: With another syringe of quantitative easing being injected into the U.S. economy's bloodstream, Ben Bernanke is giving the markets their liquidity fix. The Federal Reserve's action reaffirmed my stance I've reiterated on several occasions that the governments across developed markets have no fiscal discipline, opting for ultra-easy monetary policies to stimulate growth instead. The government's liquidity shot promptly boosted gold and gold stocks, as investors sought the protection of the precious metal as a real store of value. You can see below the strong correlation between the rising U.S. monetary base and growing gold value. Since the beginning of 1984, as money supply has risen, so has the price of gold.

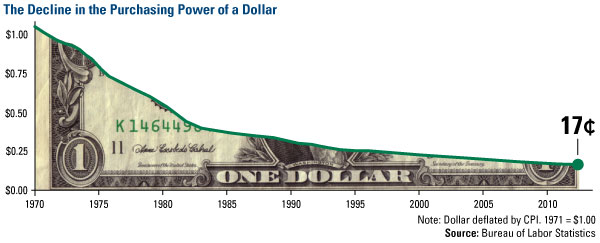

The dollar declined due to the Fed's easing, which isn't surprising, given the fact that gold and the greenback are often inversely correlated, and increasing money supply generally causes the currency to fall in value. What's interesting is that currency decline was what Richard Nixon sought to avoid when he ended the gold standard in 1971 and announced that the country would no longer redeem its currency in gold. During his televised speech to the American public, Nixon translated in simple terms the "bugaboo" of devaluation, saying, "if you are among the overwhelming majority of Americans who buy American-made products in America, your dollar will be worth just as much tomorrow as it is today." As you can see below, more than 40 years later, a dollar is worth only 17 cents. This significant decline in purchasing power only strengthens the case of gold as a store of value, likely prompting Global Portfolio Strategist Don Coxe to propose making Nixon the "patron saint of gold investors," during this year's Denver Gold Forum.

As Milton Friedman once said, "Only government can take perfectly good paper, cover it with perfectly good ink and make the combination worthless." In its long-term asset return research charting economic history in comparison to current markets, Deutsche Bank illustrates multiple ways how "the world dramatically changed post-1971 relative to prior history." While the research firm makes it clear that returning to the gold standard would be "disastrous," DB finds that the "lethal cocktail of unparalleled levels of global debt and unparalleled global money printing" are relatively new governmental developments. Prior to the last four decades, deficits only occurred in extreme situations of war or severe economic setbacks, such as the Great Depression. Balanced budgets were a "routine peace time phenomena in sound economies." Since 1971, surpluses have been rare. The U.K. has had an annual budget deficit 51 out of the past 60 years and Spain has had 45 years of deficit spending over the past 49 years, according to DB.

Countless discussions over fiscal and monetary policies will carry on, but time will tell. Ian McAvity, editor of Deliberations on World Markets, says, "Excessive debt creates deflationary drag that they repeatedly fight by throwing fresh 'liquidity' or 'stimulus' at, to debauch the currency of that debt … For private investors, gold is the best medium for self-protection and preservation of purchasing power in my view." I agree. Rising money supply, declining purchasing power and annual deficits are giving the all-clear to include gold in your portfolio. Many others appear to agree with us, as sentiment has shifted in favor of the metal in recent days: According to Morgan Stanley's survey of 140 institutional investors in the U.S., gold sentiment was at its highest bullish reading since July 2011 and the largest month-over-month increase during the survey's three-year history! So, gold investors, if you haven't put in your orders, consider getting them in quickly, because the bulls are buying. Credit Suisse saw "massive inflows" into gold exchange-traded products in August after experiencing significant outflows compared to crude oil and the broader market in March, April, May and July. August shows a clear preference toward gold.

We generated lots of interest when we showed our standard deviation chart a few weeks ago, so I updated it through September 13. Although gold has been on a tear recently, breaking through the stumbling block of $1,600 and climbing to $1,770 by the end of the week, bullion still looks attractive, with a low sigma reading of -1.7

A look at a histogram shows how many times gold bullion historically fell in this sigma range. Today's sigma of -1.7 has occurred only about 2 percent of the time. Bernanke and Draghi only made the decision more obvious for gold and gold stock buyers.

The Fed and ECB also make my job presenting at the Hard Assets conference in Chicago very exciting. Don't miss my presentation on September 21. I invite you to be there in person if you live in close proximity to Chicago, or you can download a pdf at www.usfunds.com following the meeting. You might also learn something you didn't know with our newest interactive slideshow, the 10 Surprising Uses of Commodities. Check it out and share with a friend. September 14, 2012 (Source: U S Global Investors) http://www.usfunds.com/investor-resources/investor-alert/

|

| QE3 Removes Price Ceiling for Gold and Silver Posted: 15 Sep 2012 07:18 AM PDT Peter Schiff, chief executive officer of Euro Pacific Capital, recently gave an interview discussing the prospects of gold. When asked how high the price of gold may reach, he responded that there is no ceiling for the precious metal, because there is no limit on how much money will be printed. The Federal Reserve’s latest announcement confirms this theory, and paves the way for much higher gold and silver prices. |

| QE3 will drive up gold price but won't solve economic problems Posted: 15 Sep 2012 06:34 AM PDT Paul Brent writes: Gold's sharp price increase in response to yesterday's QE3 announcement compared to a smaller increase in equity prices indicates the futility of more fiat currency expansion, according to Bullion Management Group Inc.'s CEO Nick Barisheff. It confirms what he sees as gold priced at $10,000 an ounce.After yesterday's announcement of QE3, something dramatic occurred in the price of all precious metals. Gold futures shot 2.2% higher yesterday while the S&P was up 1.6%. Platinum, another precious metal, also rose more than 2% and silver jumped almost 4%. |

| Retirement Accounts: Problems Above And Beyond Sentinel Ruling and Custodian Integrity Posted: 15 Sep 2012 05:10 AM PDT Jim Sinclair's Mineset My Dear Extended Family, There is one more serious problem with all retirement accounts above and beyond the Sentinel Ruling and the integrity of the custodian. If a systemic failure and lower dollar causes an unwanted increase in interest rates in light of the Fed as the major consumer of treasury paper in the last 18 months, how would the US government fund itself? You can be certain that China and the Middle East are not coming to the rescue. One way would be to liquidate retirement accounts ($2 trillion USD) and put treasury paper into them to save the poor worker and coming retirees from loss as MSM and MOPE would say. Look around the world at governments either eyeing retirement programs or invading them. You will find it is already happening. Please, at a minimum, stop creating and funding them. Regards, Jim... |

| Transforming Collateral is the Newest Ponzi Posted: 15 Sep 2012 02:00 AM PDT Wall Street changes the rules any time it is threatened, rule changes claim to prevent a meltdown, collateral transformation, Congress demands to see more details in derivatives trades, limited amount of T-bills available to soak up demand, collateral that is rented. The risk is only going to be shuffled around. |

| Why Did Ben Bernanke Cross the Road? Posted: 15 Sep 2012 01:10 AM PDT |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Reiterating it's commitment to ensure enough gold supply in the market, Vietnam's central bank.

Reiterating it's commitment to ensure enough gold supply in the market, Vietnam's central bank. Experienced precious metals investors are familiar with the topic of "negative lease rates" for gold and silver bullion. However, even novice investors can infer what is being discussed: paying someone to "borrow" gold/silver bullion.

Experienced precious metals investors are familiar with the topic of "negative lease rates" for gold and silver bullion. However, even novice investors can infer what is being discussed: paying someone to "borrow" gold/silver bullion.

Silver has zoomed up in value by 572 per cent over the past decade – outstripping the performance of all other top commodities, including gold.

Silver has zoomed up in value by 572 per cent over the past decade – outstripping the performance of all other top commodities, including gold.

No comments:

Post a Comment