saveyourassetsfirst3 |

- Sell Signal Flashes For Toyota, Honda And Nissan

- Gold ETFs Torch Stocks Again

- Gold Fields Management Discusses Q2 2012 Results - Earnings Call Transcript

- Gold Breaks Out

- Commodity Chart Of The Day: Silver

- Want To Make Money In Silver? 3 Companies You Should Consider Right Now

- John Paulson's Favorite Value Stocks

- Big-Name Funds Increasing Bets On Gold

- Paul Harris about gold mining in Colombia

- Gold & Silver off to the races

- Mark Ames: Tracy Lawrence: The Foreclosure Suicide America Forgot

- Gold & the History of Exchange-Rate Regimes

- Lawrence Roulston Spots Gold Juniors with Bright Futures

- Mainstream MarketWatch: "Gold technicals most bullish ever?"

- Egon von Greyerz: Gold and Silver Off to the Races

- Two King World News Blogs

- Timberline Intercepts High-Grade Gold Mineralization Down Dip of Current Resource at Lookout Mountain

- bummed,

- Precious Metals Surge As Mining Unrest Spreads

- Gold Supply-Crisis Looms?

- Does This Breakout Mean It's Time to Buy Gold?

- Beige Book Release Seems to Indicate Movement to More Easing / Implosion in Trade Figures for Japan / Spain’s IBEX Drops 2.7%

- Rule – Gold & Silver Spike & The Oil Quote May Skyrocket

- A History of Exchange-Rate Regimes

- Silver Breakout Leads to Gold Breakout

- Gold Daily and Silver Weekly Charts – Rally Intensified on Fed’s QE Statement

| Sell Signal Flashes For Toyota, Honda And Nissan Posted: 23 Aug 2012 11:24 AM PDT  By Markos Kaminis (Wall St. Greek): By Markos Kaminis (Wall St. Greek): A sell signal just flashed for the Japanese auto makers Toyota Motor (TM), Honda Motor (HMC) and Nissan Motor (NSANY.OB). Data reported Wednesday indicated Japanese exports into Europe were down dramatically, with weakness focused in autos and machinery. Though, the same report indicated stronger exports into the United States. So, after accounting for the changes and factoring in the growth of sales into other emerging markets, we are charged with understanding what the net effect will be to the bottom lines of these firms and whether their individual valuations account for it. That's not a simple task, but we'll take a shot at it. Japan reported that a collapse in exports into Europe drove its widest ever trade deficit for the month of July. Shipments into Europe dropped by a quarter compared to last year's levels. As a result, the nation's deficit was twice as wide as was expected by Complete Story » |

| Posted: 23 Aug 2012 11:07 AM PDT By Christian Magoon: Gold ETFs surged significantly on Wednesday as new Federal Reserve minutes sparked hopes of another round of liquidity. This dovish tone rocketed the largest physical gold fund in the world, the SPDR Gold Trust (GLD), close to 1.5% above its trading levels before the release. Other gold stock focused ETFs like the Market Vectors Gold Miners ETF (GDX) experienced even larger gains. It was interesting to note that both forms of gold ETF funds - physical and stock based - easily outperformed the S&P 500 for the day. Here's the annotated chart from Yahoo Finance showing Wednesday's behavior of GLD, GDX and the S&P 500 ETF (SPY). (click to enlarge) SPY finished the trading day with a slight gain while the gold ETFs were up exponentially in comparison. To view all gold ETF and ETN performance on one sortable page, check out the gold ETF list on GoldETFs.biz. U.S. Dollar WeakensComplete Story » |

| Gold Fields Management Discusses Q2 2012 Results - Earnings Call Transcript Posted: 23 Aug 2012 11:00 AM PDT Gold Fields (GFI) Q2 2012 Earnings Call August 23, 2012 10:00 am ET Executives Willie Jacobsz Nicholas John Holland - Chief Executive Officer and Executive Director Paul A. Schmidt - Chief Financial Officer, Finance Director and Executive Director Michael D. Fleischer - Executive Vice President and General Counsel Analysts David Leffel Tanya M. Jakusconek - Scotiabank Global Banking and Market, Research Division Presentation Operator Good day and welcome to the Gold Fields Second Quarter 2012 Results. [Operator Instructions] Please also note that this conference is being recorded. I would now like to hand the conference over to Willie Jacobsz. Please go ahead, sir. Willie Jacobsz Thank you very much. Good afternoon, ladies and gentlemen, and thank you very much for joining us here for the quarter 2 2012 results conference call for Gold Fields. The presentation will be done by our Chief Executive Officer, Nick Holland. He'll be making some Complete Story » |

| Posted: 23 Aug 2012 10:57 AM PDT Following a quiet summer, gold has just risen to four-month highs. BullionVault founder Paul Tustain puts the action in context… USUALLY I tend to focus on the reasons to buy gold rather than the timing. Timing is not my territory. But as we approach the anniversary of gold's all-time high, my thoughts turn to ebb and flow of the gold market. Last year, on 6th September 2011, gold hit $1920 per oz. It had shot up from about $1500 at the start of July, making new all-time highs almost daily. Three short weeks later it was back down at $1540. In sterling terms it was almost the same story, £930 at the start of July, up to £1194 and back again to £995. Since then people have left gold alone, and many have sold. But gold has not fallen away like almost everything else would have after a ten year bull run. After a rally this week, it's currently trading around $1660, or £1040. It has taken a breather. I speak to prospective gold buyers all the time – and they are worried about the situation of our currency – the Pound. Many would like to drop the pound and buy gold, yet when it was making new highs daily, like it did a year ago, they worry, understandably, that they'll pay the highest price in history. I do too. But then when it drops away we worry that it has further to fall. In volatile markets buying and selling is frightening. What volatility? Here in the gold business we have plodded along through July and August, and it's been dull. The rule of thumb in the industry is to expect July and August volumes to be 30% down on the rest of the year. Indeed not much has happened, in fact it's been quieter than usual. But in the last couple of days things have started moving. Volumes are creeping up again, and prices too. In the 7 years since we launched BullionVault, September has always been a high volume month. This week the holidays end. The money professionals get back to their desks and look into their crystal balls. What will they see, apart from this bowl shaped chart of the gold price? Nothing has improved in Europe. Nothing has improved in the UK – even if we feel temporarily lifted by the Olympics. Our government has got weaker, and borrowed more money; July was dreadful. George Osborne is now under concerted pressure to 'do something', and it's coming from his own side as well as the opposition. As we approach the latter half of a parliament we can reckon his worthy pursuit of economies will weaken. We are printing new money and adding to the stock at about £16 per working person per day – which all finds its way into the economy via the wages of a bloated public sector. It spins around for a few short weeks, generating modest economic activity, before settling on savers. For some reason, which almost defies logical analysis, they buy government bonds, thus completing the funding circle; taking cash back out of circulation and leaving just a bigger pile of government debt. Thanks to savers' appetite for gilts we have not seen the retail price inflation which money printing normally produces – but only because we are in this unusual position of printing money without increasing the quantity in circulation. There will be a flood when those bonds turn back into cash, and that looks increasingly imminent. Already there is a £1trn in outstanding debt, which is evenly spread out to about 20 years. Unfortunately every day it gets less spread out. It slowly concertinas into the short end simply through the passage of time, and as it does so it approaches the concentrated re-financing obligations which finally did for Greece. It's just a matter of time. For now we only have to finance redemptions and a budget deficit amounting to a mere £500 million a day – which is close to an indigestible quantity for the markets. Now remember, this is a government which is too fragile to impose real economies, which is already a trillion in debt, which is two years from campaigning again, and which controls the printing presses. When the market finally says 'no' to the government's need for cash, the redemption of those outstanding gilts will require printing real banknotes. You'll get your inflation then, and with £6 frozen into bond markets for every £1 in circulation savers will realize that the torrent of melt-water cannot stop for years. That's when we all abandon the currency. Any other store of value will do. I believe the Pound has a weaker future than a German dominated mini-Euro. But thanks to a year old price spike, and a dull summer, for now at least we can buy gold with Sterling at over 10% below its all-time highs. Do you really fancy buying it when it's making daily all-time highs again? I don't. I come out in a rash when I buy something at highs. It goes against my investing religion. Paul Tustain Settlement-systems specialist Paul Tustain launched BullionVault in 2005 to make the security and cost-efficiencies of the professional wholesale gold market available to private investors. Designed specifically to meet his own needs as a risk-averse investor, BullionVault now cares for 30 tonnes of client gold property, all of it privately owned in the user's choice of low-cost, market-accredited facilities in London, New York or Zurich. (c) BullionVault 2012 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. |

| Commodity Chart Of The Day: Silver Posted: 23 Aug 2012 10:43 AM PDT By Matthew Bradbard: Commodity chart of the day - Daily Silver (click to enlarge) Hi-Ho silver as the next leg higher appears to be under way. Prices of December silver futures have advanced nearly 15% in the last month. In fact prices have traded up to their 200 day MA, a level that has not been penetrated since February when prices were trading close to $35/ounce. Prices have advanced in a relatively short time frame but take a look at the big picture over the last 1 ½ - 2 years and silver is 17% off its lowest prices and 38% off its highest price. While I do not think there will be an immediate leap back near $50/ounce I do expect prices to make it to those levels again in the coming years. My favored plays are either bull call spreads into 2013 or getting long futures while simultaneously selling out of Complete Story » |

| Want To Make Money In Silver? 3 Companies You Should Consider Right Now Posted: 23 Aug 2012 10:17 AM PDT By Yesterday we had another huge gain in the precious metals and the precious metal miners. This was due primarily to the release of the July 31-August 1 FOMC minutes, where we learned that support is billowing for additional stimulus "fairly soon" unless there is evidence of a strengthening of the economic recovery. Whether a third round of quantitative easing and/or European central bank bond buying actually happens is still in question, but both are becoming ever more likely as both high unemployment in the United States and the eurozone crisis persist. Gold and silver prices are up again today and have crossed the 200 day moving average. Gold and silver are currently trading at $1671 and $30.50 an ounce, respectively. The gold ETFs (GLD) and (IAU) are now up 5.9% and 5.7% in just one month Complete Story » |

| John Paulson's Favorite Value Stocks Posted: 23 Aug 2012 10:12 AM PDT By Insider Monkey: By Matt Doiron John Paulson and Paulson & Co. haven't done well recently, but they still draw a good deal of investor and media attention for the billions Paulson has made from shorting subprime mortgages and going long gold. While Paulson tends to invest in large macro trends, we have gone through the fund's 13F for the second quarter of 2012 and looked for stocks trading at trailing P/E ratios of 15 or lower -- value stocks that tie into one of Paulson's favorite macro themes, or possibly stocks that the fund is buying on their own company-specific merits. Paulson and his team cut their stake in Delphi Automotive (DLPH), but according to the 13F, it was still their third largest holding with a position of about 32 million shares. Delphi has been hit hard by a poor auto market in the U.S. and Europe, as it sells higher-end auto Complete Story » |

| Big-Name Funds Increasing Bets On Gold Posted: 23 Aug 2012 10:05 AM PDT By Sean Weston: The Soros Fund Management, which famed billionaire investor George Soros founded in the late 60's, and fellow billionaire John Paulson's hedge fund, two of the most watched and emulated funds there are, have been sending some strong signals to the investing world about precious metals recently. Recent filings with the Securities and Exchange Commission show that the Soros fund has now doubled its gold holdings. It now holds over 800,000 shares of the SPDR Gold Trust (GLD). John Paulson raised his stake in the same SPDR Gold Trust by 26%, to bring the total amount of his hedge fund which is tied into the precious metal to an overwhelming 44%. Paulson feels that out of all the ideas he has, gold is his best long-term bet. According to him the protection it provides is against currency debasement and rising inflation, in addition to any possible breakup of the Euro. Soros, Complete Story » |

| Paul Harris about gold mining in Colombia Posted: 23 Aug 2012 10:00 AM PDT Paul Harris, publisher of the Colombia Gold Letter, talks to GoldMoney's Dominic Frisby about the state of the mining sector in Colombia. Though Colombia has been a gold producer for centuries, ... This posting includes an audio/video/photo media file: Download Now |

| Gold & Silver off to the races Posted: 23 Aug 2012 09:55 AM PDT |

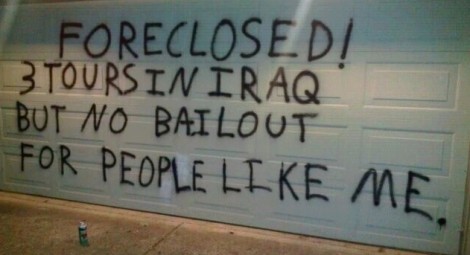

| Mark Ames: Tracy Lawrence: The Foreclosure Suicide America Forgot Posted: 23 Aug 2012 09:20 AM PDT By Mark Ames, the author of Going Postal: Rage, Murder and Rebellion from Reagan's Workplaces to Clinton's Columbine.Cross posted from The eXiled

This article was first published in the Daily Banter Every week, it seems there's another tragic story about a suicide or murder-suicides linked to foreclosure trauma. Some of the more spectacular murder-by-foreclosure stories the past few years have been collected by a blog called "Greenspan's Body Count"—others, myself included, have been writing about these terrible stories of class warfare being waged by the only side fighting it, and winning it, as Warren Buffett rightly said. Before the 2008 crisis, the media paid little attention to the death toll taken on Americans by the decades-long class warfare waged against the 99%. Now they're impossible to ignore. Stories like the US soldier in Iraq who committed suicide so that his wife could collect life insurance, and save their family home from foreclosure. Or the courtroom-suicide in Phoenix, in which a Yale-educated banker-swindler swallowed a cyanide capsule after being found guilty of setting his 10,000 sq foot McMansion on fire as a way of collecting insurance and evading mortgage payments he couldn't afford. Despite the somewhat increased media attention given to these tragic stories nowadays, there is one suicide directly tied to foreclosure fraud that has been completely ignored by the media. Her name was Tracy Lawrence, and for a brief moment last year, between the moment she turned whistleblower and her untimely and bizarre suicide, Tracy Lawrence's testimony threatened to blow the entire fraud-closure criminal enterprise wide open, with repercussions that could have easily reverberated all the way up to the major banks and GSEs complicit in one of the greatest crimes this country has ever experienced. In the months since Tracy Lawrence was found dead in her Las Vegas apartment at the age of 43, her story has only taken on more significance—even as her death has been forgotten. This is a story that demands our attention, a story we must not allow ourselves to forget. First, some background to Tracy Lawrence's suicide: On November 16, 2011, the attorney general for the state of Nevada, Catherine Cortez Masto, announced a major first-of-its-kind 606-count criminal indictment against two Orange County, California-based title officers working for Lender Processing Services, the country's largest mortgaging servicing company and the worst of the predatory "fraudclosure mills." Foreclosure fraud had been devastating America unabated for a few years, laying waste to untold hundreds of thousands of American families. The Nevada attorney general's criminal case against the two LPS title officers—Gary Trafford and Geraldine Sheppard—represented, for a brief moment, the first time in years that American justice threatened the predatory lending class.

What happened to the bombshell indictment of these LPS supervisors? Yves Smith at Naked Capitalism was among the first to report the Nevada AG's indictments, rightly pointing out the significance of going after mid-level officers in the foreclosure mill firm as a way of launching a full-scale takedown:

This marked the first time that bigtime bank fraudsters faced serious jail time—Attorney General Masto's criminal case sent shockwaves throughout the mortgage lending world. More importantly, her criminal case threatened to finally change the way America deals with the bankster class that has been plundering with impunity for years. Politically, Nevada's criminal indictment could have enormous repercussions; economically, the case could lead to invalidating tens upon tens of thousands of fraudulent foreclosures conducted in the Las Vegas area over the past few years. The next day, the Los Angeles Times reported on the scale of the fraud:

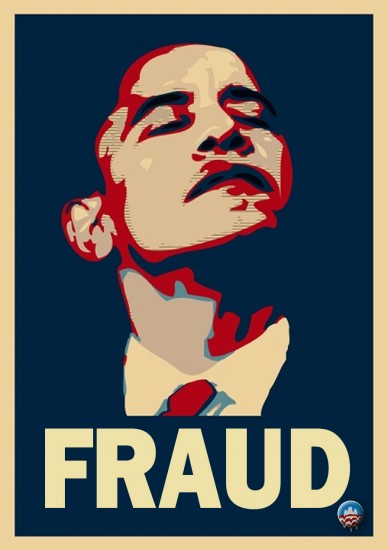

Just a few months after the Nevada AG's 606-count criminal indictment against LPS, Missouri's attorney general filed a 136-count criminal indictment against a unit of Lender Processing Services, called Docx, as the New York Times reported last February. That meant two major criminal cases. Given the sheer scale of the crime committed—a plundering so brutal and devastating you'd only expect such a thing from a conquering barbarian horde—what amazes me is how underreported this crime still is, and how few Americans in the Establishment know any of the details, beyond perhaps the word "robo-signing." One of the rare exceptions was the excellent reporting done on my friend Dylan Ratigan's Show, as well as the unforgettable 60 Minutes segment aired last year on foreclosure fraud and "robo-signing" mills. The 60 Minutes investigation focused on the fraud perpetrated by Lender Processing Services unit, Docx, which used blatantly fraudulent "robo-signing" foreclosure documents to dispossess Americans of their homes on behalf of the Wall Street banks. Like the way peasants in a banana republic are treated, hundreds of thousands—if not millions— of Americans have been illegally and fraudulently evicted from their homes. And all the while as it happened, the Obama Administration stood by and wrung its hands—and that's the kind, whitewashed way of putting it. Another way of looking at what the Obama Administration did with the mass foreclosure fraud crime—the true and honest way of putting it—is that the White House actively provided political and legal cover for one of the largest crimes perpetrated against Americans in modern history. Sorry, but that's the truth—and the sad thing is, as horrible as the Obama Administration has been on housing, a President Romney will almost certainly find a way to be even worse, even if that worseness has to be invented. That's one of the lessons we've all had to learn these past few decades.

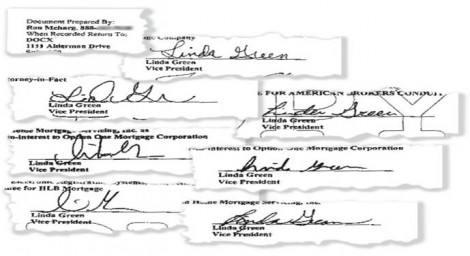

"Obama Lied, Hope Died" should be the slogan The 60 Minutes segment zeroed in on what is now the most infamous fraudulent-signature of our time: The infamous "Linda Green"—whose signature appeared on an impossibly large number of foreclosure documents. A single fake "Linda Green" was officially listed as a "vice president" at some 20 different foreclosure mills, this same "Linda Green" signing untold thousands of fraudulent documents evicting Americans from their homes. Among the worst of the foreclosure servicers abusing the fraudulent "Linda Green" signature was Docx, the unit of Lender Processing Services which has since been shuttered. 60 Minutes tracked down the real "Linda Green" whose name was fraudulently abused to destroy the lives of countless Americans, and it's worth quoting what 60 Minutes found:

So you have now a sense of just how vast the foreclosure fraud crime was, and how it involved not only the largest mortgage servicer in the nation, LPS, but also all the major banks that used LPS's services to throw Americans out of their homes illegally and take possession of them.

No fraud here folks, looks like 1 authentic "Linda Green" to us! Let's rewind again to last November 16, 2011, the day that Nevada's attorney general Masto announced her indictment against the two LPS title officers—two weeks before Tracy Lawrence took her life. Nevada's case against LPS rested primarily on the testimony of a whistleblower, Tracy Lawrence, who worked in Lender Processing Services' office in Las Vegas. Her testimony threatened to unravel tens of thousands of fraudulent foreclosures in the state of Nevada between the years 2005-2008, and the criminal activities of the entire mortgage servicing industry. Nevada has suffered the worst foreclosure problem of any state in the union. In return for turning state's witness, Tracy Lawrence plea bargained her charges down to a single misdemeanor charge of falsely notarizing a signature, which carries, in the worst case scenario, a maximum of one year in prison and a $2,000 fine. However, her testimony could put her two LPS superiors behind bars for decades—which is why many believed Nevada's goal was to turn those two LPS officers into state's witnesses against LPS's senior executives. On November 29, 2011—just two weeks after the Nevada attorney general announced the landmark criminal case—whistleblower Tracy Lawrence was supposed to appear before a judge for her sentencing. It should have been a routine appearance, but she didn't show up. Her lawyer grew anxious, called police to check on Tracy Lawrence's home, and that's when they found her dead. The timing of her death was suspicious, to say the least. Immediately, before any investigation had been conducted, Las Vegas police officially "ruled out homicide" as her cause of death. Tracy Lawrence's suicide was given scant coverage in the national media. Here is one of the few national media stories about her death, a short piece on MSNBC's website:

I recently called the Clark County coroner's office to find out if they had determined her official cause of death. A spokesperson told me that Tracy died from "intoxication" of a combination of Xanax (Alprazolam) and two antihistamines: Benadryl (Diphenhydramine) and Hydroxyzine. Officially, her death was ruled a suicide. Though there has been little public discussion about Tracy Lawrence's suicide, in private forums, her death sent a chill. Although there have been reports that Lawrence was depressed and stressed from her role as the key whistleblower, no one I know who reports on the housing disaster unquestioningly accepts the official version, that Tracy Lawrence's suicide timing just happened to come at the most convenient time imaginable.

The stakes could not have been higher: As MSNBC reported, Las Vegas police said that her testimony threatened to "throw into question the legality of most Las Vegas home foreclosures in the past few years." As one commenter darkly quipped on the site 4closurefraud.org:

One only has to remember that Las Vegas' gambling industry was created by mobsters like Meyer Lansky—who is also credited with helping invent modern offshore banking in the early 1930s in Switzerland. In this world, deaths ruled "suicides" are not unheard of. One of the most spectacular examples involved the "suicide" of Roberto Calvi, chairman of Italy's largest private bank, who in 1982 was found hanging from London's Blackfriars Bridge with bricks stuffed into his pockets along with $15,000 cash. The day before Calvi's "suicide" his secretary "jumped" out of the bank headquarter's fourth floor window and died—her death was also ruled suicide. It took over two decades for authorities to overturn the "suicide" verdict and state the obvious: In 2003, Italian authorities ruled Roberto Calvi's death a murder. In the meantime, the fallout from Tracy Lawrence's suicide has been worse than predictable: In Nevada, the case against Lender Processing Services appears to have all but fallen apart. With the Obama Administration foisting its foreclosure fraud settlement on all the states in January—a deal that left bankers happy, and everyone else screwed— and the key witness to the LPS case dead, the writing was on the wall. Masto essentially fired her deputy AG, John Kelleher, who headed up the once-aggressive Nevada mortgage Fraud Task Force. With Kelleher gone, the Task Force looks like its work is all but over, as reported in local Las Vegas Channel 8 News:

In the report, Kelleher told Channel 8: "It's my personal opinion that there was some kind of deal cut, involving signing the multi-state (agreement) for whatever reason: financial, political, you can speculate all day long and back off criminal." Along with Kelleher, several other Nevada prosecutors and investigators have since been reassigned or transferred out to pasture. In the courts, a Nevada judge all but gutted the AG's criminal case against Lender Processing Servicers. Over in Missouri, the state's criminal case was recently quietly settled for a paltry sum, and forgotten about. Meanwhile in LPS's headquarter state of Florida, the attorney general Pam Bondi has done everything to protect LPS, even firing two of her office's attorneys who made the mistake of investigating LPS fraud.

Hugh Harris, CEO of Lender Processing Services, recently named "One of the Best Places To Work In Northeast Florida" In a recent celebratory conference call that Lender Processing Servicers held with financial analysts, Hugh Harris, the CEO of Lender Processing, could barely contain himself as he gloated to analysts from Barcalys, Goldman Sachs and other financial institutions:

So Tracy Lawrence's highly suspect suicide is another major victory for the bankster class, and another giant loss for the rest of us. No matter what the circumstances of her suicide—that is, even if she was driven to kill herself in despair, after turning whistleblower and facing the pressure of confronting one of the biggest criminal fraud scams in history—that doesn't make her death any less significant, or infuriating, or disturbing. Either way, the criminal lending industry drove a lone and lonely hero to her death. All we can for now—while this country is still controlled by a rank oligarchy— is remember Tracy Lawrence's suicide, so that some day we can learn what drove this hero to her terrifying early grave. |

| Gold & the History of Exchange-Rate Regimes Posted: 23 Aug 2012 08:38 AM PDT It's almost as if currencies are designed to confuse you. In fact, sometimes they even lie to you. Take the pound sterling for example. This quirk and much more is cleared up when recounting the evolution of currency systems. |

| Lawrence Roulston Spots Gold Juniors with Bright Futures Posted: 23 Aug 2012 07:42 AM PDT |

| Mainstream MarketWatch: "Gold technicals most bullish ever?" Posted: 23 Aug 2012 07:37 AM PDT Aug. 23, 2012, 2:04 a.m. EDT Is gold heading to $4,500? Commentary: Are gold fundamentals, technicals most bullish ever? By Peter Brimelow, MarketWatch NEW YORK (MarketWatch) — Gold makes its move. The bugs are rampant. The yellow metal made life very difficult for commentators trying to keep a regular schedule on Wednesday. MarketWatch's Claudia Assis can hardly have hit the send button on her story headed "Gold ends lower as other metals gain" , which dealt with the close of floor trading — the December gold contract was down $2.40 — when the Fed minutes set the market roaring. By the stock market close, gold had risen over $17 to stand 1% above Tuesday's stock market closing level and at the highest since early May. Gold shares, too, came surging out of negative territory to finish with strong gains. The NYSE Arca Gold Bigs Index /quotes/zigman/6015494 XX:HUI +0.50% closed up 2.21%, the highest since June 19 and up 17.2% since the recent low on July 24. This late development followed a strong day on Tuesday, which saw a floor close in the CME December contract of up $19.90 (1.23%) and a 1.69% gain in the HUI. This was enough to stimulate exuberant commentary by the Aden Forecast's GCRU service, published early Wednesday morning: "AND..... THEY'RE OFF! The markets have taken off. The train has left the station, and another leg up in the bull market is getting started." BHP Billiton CEO Marius Kloppers gives his assessment of the mining sector following its full-year results. Photo: Getty Images "Whether it be gold shares on their own, compared to gold, versus bonds or versus the stock market, gold shares are rising from the dead." GCRU had a particularly kind world for silver: "Silver broke above its 75-day [moving average] for the first time in four months, showing impressive strength! Silver's rise is the strongest it's been since the rise earlier this year." GCRU's prognostication: "Silver must break above $30 to confirm strength that could push it to the February highs near $37." The silver situation is exciting particular interest. Letter editors have noted that the metal had been achieving technical objectives earlier than gold during this move. Furthermore, according to Bill Murphy at the LeMetropoleCafe website, rumors of large silver purchases in London have been followed by stories of delivery problems being experienced by London Bullion Market Association members. Stories of this type, unfounded or not, could have an explosive effect on the thin silver market. The gold action caught the attention of market veteran Richard (Dow Theory Letters) Russell. Using a point and figure chart with a 2:30 p.m. Eastern Time cut-off, he noted: "Gold may finally be on its way to higher levels. Gold has risen to fill the $1,640 box, which is constructive. The next bullish action would be a rally to the $1,650 box. This would take gold clear out and above its consolidation base, and would put it in line to try for $1,680." (By 4 p.m., gold had cleared $1,650). Russell concluded his Wednesday evening note: "If gold takes off, the gold miners will look dirt cheap." The Got Gold Report last weekend quantified an expectation about the HUI: "A print above 445 would be very convincing to skeptics and set up a test of the 40-weekly moving average currently near 474." Wednesday's close was 454.44. And further? The Golden Truth website, reportedly written by a gold-market professional, says on Wednesday after a detailed chart discussion: "From both a fundamental and technical standpoint, the indicators for gold to make a run to new highs have not been this bullish in the 11-year bull market." At JSMineset, ultra-experienced old gold hand Jim Sinclair confines himself to republishing an Aug. 1 essay from technician Alf Fields: "The bottom line is that we now have a really strong probability that the correction which started at $1,913 on Aug. 23, 2011, has been completed both in terms of Elliott waves and also in terms of time elapsed." "If this is correct, the gold price should soon be expressing itself in violent upside action as it moves into the third of third wave, which is still targeted to reach $4,500." http://www.marketwatch.com/story/is-...=home_carousel |

| Egon von Greyerz: Gold and Silver Off to the Races Posted: 23 Aug 2012 07:27 AM PDT ¤ Yesterday in Gold and SilverNote: We had some e-mail issues earlier this morning...and my daily column got lost in cyberspace for about four hours. That's why it's late today. My apologies. Ed It was a nothing sort of day in the gold market yesterday, but that all ended when the Fed minutes were released at 2:00 p.m. Eastern time. The Comex was already closed, but the gold price jumped almost twenty bucks within an hour in electronic trading. From there it traded sideways into the New York close. Gold closed at $1,654.10 spot...up $15.50 on the day. Volume was a rather large 148,000 contracts...with a large chunk of that occurring from 2:00 p.m. onwards. Here's the New York Spot Gold [Bid] chart on its own. As has been the case lately, the only action that's mattered has been in New York...and that was certainly the situation again yesterday. It was pretty much the same story in silver, so I shan't go into the details, as the charts say it all. Silver closed at $29.83 spot...up 50 cents from Tuesday. Net volume was around 30,500 contracts. Here are both the daily silver chart...and the New York Spot Silver [Bid] chart as well. The dollar index didn't do much for most of the day. It rose and fell about twenty basis points between the Far East open on Wednesday morning...and 2:00 p.m. Eastern time yesterday afternoon. As the index did a face plant off a 43 basis point cliff on the Fed news, the precious metals went in the other direction. When all was said an done, the dollar index finished down about 50 basis points...closing around 81.50. Not surprisingly, the gold stocks languished a bit on what was probably some profit taking by the day trader types. Of course that all changed at 2:00 p.m. Eastern...and by shortly after 3:00 p.m. in New York, the high was in...and the HUI finished virtually on its high tick of the day...up 2.21%. Except for one stock I own, the silver equities did very well for themselves...and Nick Laird's Silver Sentiment Index closed up 1.66%. Most of the junior producers did much better than that. (Click on image to enlarge) With the August delivery month down to its final week, there wasn't much in yesterday's Daily Delivery Report from the CME. It showed that only 22 gold contracts were posted for delivery within the Comex-approved depositories. The link to the 'action'...such as it was...is here. The GLD ETF showed that another 96,977 troy ounces of gold were added yesterday and, once again, there was no report from SLV. Considering the price action so far this week, one would think that this ETF is owed many millions of ounce of silver. There was no update to the short positions in either of these ETFs as of late last night. The U.S. Mint sold another 1,000 ounces of gold eagles yesterday. The Comex-approved depositories reported that 707,763 ounces of silver were deposited on Tuesday...and a smallish 30,157 ounces were shipped out the door. The link to that action is here. Well, as much as I...and others...were wagging our fingers and clucking our tongues at Keith Neumeyer over at First Majestic Silver Corporation for playing the silver paper game in the Comex futures market, I'm sure he's all smiles at the moment, as his positions [if he still owns them] have created another windfall profit for company shareholders. It would be peachy keen if these profits were used to buy more physical silver, rather than plow them back into general revenues. Maybe he'll be more generous than usual when Sprott does its next offering in PSLV. Here are a couple of charts that Nick Laird sent me out of the blue last night...and both are pretty much self-explanatory. But both these charts would look a lot different than this, if JPMorgan et al hadn't shown up on Sunday night, May 1, 2011. (Click on image to enlarge) (Click on image to enlarge) With some ruthless editing on my part, I have the number of stories down to a more manageable level...at least from my point of view, so I hope you have time for them all. The volume figures for both gold and silver yesterday hinted strongly that JPMorgan et al were going short these rallies. John Embry: Gold Increasingly Likely to be in Short Supply. Pimco Increases Gold Allocation From 10.5% To 11.5% In Commodity Fund. Gold to Rally as Central Banks, Investors Buy: Bloomberg. ¤ Critical ReadsSubscribeFed looks set to ease fairly soon barring swift reboundThe Federal Reserve is likely to deliver another round of monetary stimulus "fairly soon" unless the economy improves considerably, minutes from the U.S. central bank's latest meeting suggested. While the July 31-August 1 meeting occurred before some encouraging economic data, including a stronger-than-expected rise in July payrolls, policymakers were pretty categorical about their dissatisfaction with the outlook, according to the minutes released on Wednesday. "Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery," the Fed said. Casey Research's own Doug Hornig sent this Reuters story around shortly after the news broke yesterday afternoon...and the link is here.  Public pension funds lead 'London whale' class action against JPMorganPublic pension funds from Arkansas, Ohio, Oregon, and Sweden will be lead plaintiffs in a group lawsuit against JPMorgan Chase & Co. over trades made by Bruno Iksil, known as the "London Whale." U.S. District Judge George Daniels in Manhattan ruled today that lawsuits against the New York-based bank should be consolidated into a class action. The pension funds allege they lost as much as $52 million because of fraudulent activities by JPMorgan's London chief investment office. The lead plaintiffs named by Daniels are the Arkansas Teacher Retirement System, Ohio Public Employee Retirement System, School Employees Retirement System of Ohio, State Teachers Retirement System of Ohio, Oregon Public Employee Retirement Fund, and the Swedish pension fund Sjunde AP-Fonden. I found this Bloomberg story in a GATA release yesterday...and the link is here.  Matt Taibbi, Eliot Spitzer Discuss Eric Holder's FailureGot a chance to talk with Eliot Spitzer Tuesday night about Eric Holder's decision not to prosecute Goldman Sachs for the offenses laid out in the Levin report. I was trying not to be too obvious in making the point that Spitzer is an example of the kind of guy you would want looking at that Goldman case. Not only did I not want to look like a suck-up, but I wasn't sure how, "As you know, Eliot, a prosecutor is supposed to be kind of a dick!" would go over. Because I would have meant it in the most complimentary way possible. And it has nothing to do with politics. If you read James Stewart's Den of Thieves you can see that Rudy Giuliani had some of the same key qualities. A good prosecutor should look down the barrel of a bunch of millionaire lawyers at Davis Polk or White and Case and feel turned on by the challenge of combat. Making a deal with any devil should burn him at the core, keep him awake at night. This 7:34 minute video is posted over at the Rolling Stone Internet site...and it's well worth watching. His accompanying commentary contains a few "colourful metaphors" as well...and it's worth the read, too. I thank Manitoba reader Ulrike Marx for sharing it with us. The link is here.  26 Companies Pay CEO's More Money Than Federal Government In Taxes: StudyAccording to a study put out by the Institute for Policy Studies last week, 26 big companies paid more to their CEOs then they paid the federal government in taxes. The study found that the CEOs were paid on average about $20 million, while the companies surveyed paid little taxes on their profits. On average, the 26 companies generated a net income of more than $1 billion in the U.S., the study said. The study blasted tax rules allowing unlimited deductions for the CEO's "performance-based" pay, like many stock options. It said the five biggest performance payers among the 26 companies took $232 million of these deductions last year. This CBS/AP story was filed from Las Vegas on Tuesday...and is a very interesting read. I thank Michael Cheverton for bringing it to our attention...and the link is here.  NIRP: The Financial System's Death Knell? - Eric Sprott and David BakerThis month's Market at a Glance from Sprott Asset Management is a must read. The closing paragraph reads as follows... "Although it's been a quiet summer for "hard assets" like gold and silver, this low-to-no rate environment should prove to be beneficial for them over time. The tide is definitely turning in their favour. Various bond commentators have recently come out in support of hard assets, including PIMCO's Bill Gross, who opined in his August month-end letter that, "Unfair as it may be, an investor should continue to expect an attempted inflationary solution in almost all developed economies over the next few years and even decades."12 NIRP and ZIRP are critical components of that solution, and are here to stay until something unpredictable disrupts the current relationship between the banks and government bond auctions. In our view, the factors that have led to the emergence of NIRP bond auctions are the same factors that will drive demand for physical gold in the coming months: savers have nowhere to go for a "safe" return. It's only a matter of time before they realize they've overlooked a unique financial asset that would perfectly suit their needs. When they do, we would strongly advise them to take delivery." As I said, it's a must read. It's posted over at the sprott.com Internet site...and the link is here.  Germany would be 'ill advised' to let the eurozone break up, says Adam PosenHe told BBC's Hard Talk that if the eurozone collapsed: "Germany's currency would shoot through the roof, Germany's trade relations would be disrupted, and Germany's banks would then be on the bailout list instead of poor people and other countries, forever." Mr Posen said it was in "Germany's interest" - commercial, economic, and foreign policy "idealistic" interests - to restructure the debt that other countries owe them. He said it was German government decisions and German banks - as well as Dutch, Austrian and Finnish lenders - "who made the mistake" of lending to eurozone countries and companies "so they could buy German exports". "So Germany - just as sub prime lenders in the US - has been running a scheme in their own interest and so just as everywhere around the world you want to restructure the debt, you can't make it all on the borrower. There has to be some moral hazard allowance for the lender to take the hit." This story was filed from London...and posted on the telegraph.co.uk Internet site at 11:20 a.m. BST yesterday. I thank Roy Stephens for this story...and the link is here.  Break with Cronyism: Athens Shows Its Commitment to AusterityWhen Antonis Samaras travels to Berlin on Friday, his role will be clear: Greece's conservative prime minister is coming as a supplicant who is being forced to ask for more financial assistance in Germany for his hard-hit nation. Still, calls for more time to implement austerity measures in Greece have already met with resistance in a broad section of the German government. "Europe and the euro cannot be allowed to fail because people refuse to implement reforms," Economics Minister Philipp Rösler told SPIEGEL ONLINE on Sunday. And the accusation being heard in the run-up to Samaras' important meeting with German Chancellor Angela Merkel is that the Greeks are exactly these kinds of reform refuseniks. However, the reality is much different. Measured according to GDP, the Greeks are clearly making much deeper cuts than all other crisis-hit countries in the euro zone. This was recently confirmed by a study from the central bank of Ireland, which itself has a reputation as a model cost-cutter. The report finds that, since 2010, Greece has responded to pressure from the European Union and the International Monetary Fund by slashing expenditures and raising taxes worth the equivalent of 20 percent of GDP -- which represents the most brutal belt-tightening program in the history of the EU. This achievement is particularly noteworthy given the fact that it has taken place in the midst of a severe recession. I'd bet a fair chunk of money that Greece gets whatever it wants, regardless of what reforms it is, or is not, carrying out...as the consequences of not doing that would certainly result in the break-up of the E.U. We'll find out soon enough, I would think. This story was posted on the German website spiegel.de yesterday...and is Roy Stephens second offering of the day. The link is here.  |

| Posted: 23 Aug 2012 06:16 AM PDT COEUR D'ALENE, IDAHO, Aug 23, 2012 (MARKETWIRE via COMTEX) -- Timberline Resources Corporation (nyse mkt:TLR) TLR 0.00% CA:TBR +6.67% ("Timberline" or the "Company") announced today that it intercepted high-grade gold mineralization beneath the currently-defined resource at its Lookout Mountain Project near Eureka, Nevada. This significant intercept graded 0.138 opt (4.72 g/t) gold over the final 15 feet (4.6 metres) of the hole, which was terminated in mineralization due to ground conditions. The intercept establishes that high-grade mineralization occurs down dip of the presently-defined resource. This newly discovered zone is below the existing historical pit at Lookout Mountain where gold was produced in the late 1980's. The high-grade mineralization occurred in drill hole BHSE-152 whose dual purpose was to establish a water-monitoring well near the historic Lookout Mountain pit and to test the down dip feeder zone potential for higher grade gold mineralization. Drilling targeted the controlling structure of the currently reported resource where it intersects a potential cross fault. The intercept is approximately 600 feet (183 metres) down dip from the nearest previous drilling.Timberline's Chief Executive Officer, Paul Dircksen, said, "The significance of the BHSE-152 drill intercept is that it demonstrates the potential for increased tonnages of higher-grade mineralization at depth. This deeper potential has never been tested along the 4,000 feet (1.22 km) of strike length where the existing resource has been defined. These drill results validate Timberline's continued confidence in the larger potential of the greater South Eureka Property and, specifically, in the Lookout Mountain Project. It is important to note that the drill hole bottomed in the mineralized zone when we were forced to abandon the hole. With these very encouraging results, we are planning to follow up with testing the high-grade mineralization at depth with core and RC drilling later this year and in future drill programs." The current drill program at Lookout Mountain is focused on upgrading a larger portion of the current resource into the Measured and Indicated category; obtaining material for additional metallurgical studies; testing deeper zones of mineralization; and establishing a series of monitor wells to facilitate advancing the project to a near term production decision. Initial metallurgical recoveries of gold continue to indicate the potential for a low capital, low operating cost, heap-leach operation. Recent drill results from Lookout Mountain include the following intervals: ----------------------------------------------------------------------- ----- From Length Gold From Length Gold NaCN Drill Hole (feet)(feet)(1) (opt)(2)(metres)(metres)(1) (g/t)(2) Recovery(3) ---------------------------------------------------------------------------- BHSE-142 270 210 0.013 82.3 64.0 0.45 95% ---------------------------------------------------------------------------- BHSE-146 20 20 0.013 6.1 6.1 0.45 86% ---------------------------------------------------------------------------- BHSE-152 1025 15 0.138 312.4 4.6 4.73 34% ---------------------------------------------------------------------------- BHSE-126C 21 28 0.531 6.4 8.5 18.19 8% ---------------------------------------------------------------------------- BHSE-126C 81 128 0.020 24.7 39.0 0.69 86% ---------------------------------------------------------------------------- BHSE-128C 100 69 0.014 30.5 21.0 0.48 100% ---------------------------------------------------------------------------- BHSE-130C 167 89 0.012 50.9 27.1 0.41 97% ---------------------------------------------------------------------------- Notes: (1) True widths of the drill intercepts have not been determined (2) Troy ounces per ton (opt) and grams per tonne (g/t) (3) NaCN represents a Sodium Cyanide leach recovery of the gold content of the sample The South Eureka property features three extensive mineralized trends and also includes a pipeline of earlier-stage projects that feature past-producing open pits along with several areas containing historic gold resources. Timberline's current gold resource estimate at Lookout Mountain, which was prepared by Mine Development Associates ("MDA") of Reno, Nevada, consists of: -- 390,000 ounces Measured & Indicated Gold Resource(1) (20,765,000 tons at 0.019 opt gold (18,838,000 tonnes at 0.65 g/t)) -- 221,000 ounces Inferred Gold Resource(2) (18,385,000 tons at 0.012 opt gold (16,679,000 tonnes at 0.41 g/t)) The resources were calculated utilizing a cut-off grade of 0.006 ounces of gold per ton (opt) (0.21 grams per metric tonne (g/t)) for oxide material and 0.030 opt (1.03 g/t) for sulfide material. Approximately 83-percent of the resource ounces are from oxide material and 17-percent are from sulfide material. The effective date of the resource is April 17, 2012, and the complete technical report is filed on SEDAR. The full MDA Resource Estimate with various cut-off grades may be viewed at http://timberline-resources.com/main.php?page=208 . Gary Edmondo, Timberline's Great Basin District Geologist, is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this release. He has verified the drill results and other data disclosed in this news release, including sampling, analytical and test data. Field work has been conducted under his supervision. The Timberline sampling and analysis program included an industry standard QA/QC program. After logging and cutting or dividing the sample intervals in half, the samples were picked up by Inspectorate America Corporation and taken to their ISO-9001 certified assay lab in Sparks, Nevada for analysis. The samples were analyzed for gold using a standard 30g fire assay with an AA finish. Samples returning a gold value in excess of 3 ppm were re-analyzed using a 30g fire assay with a gravimetric finish. The Lookout Mountain mineral resources were modeled and estimated by MDA by evaluating the drill data statistically, utilizing geologic interpretations provided by Timberline to interpret gold mineral domains on cross sections spaced at 50- to 100-foot intervals across the extents of the Lookout Mountain mineralization, rectifying the mineral-domain interpretations on level plans spaced at 10-foot intervals, analyzing the modeled mineralization geostatistically to aid in the establishment of estimation parameters, and interpolating grades into a three-dimensional block model. Mike Gustin is a Qualified Person as defined by National Instrument 43-101 and is responsible for the resource estimate. To read the entire news release follow the link below: August 23, 2012 (Source: Market Watch) Disclosure: Timberline Resources is a Vulture Bargain Candidate of Interest (VBCI) and is our fully fledged Vulture Bargain #4. Members of the GGR team are actively accumulating shares of TLR and continue to hold a speculative long position in the company. |

| Posted: 23 Aug 2012 06:00 AM PDT can't get silver under 30 no mo' I wasn't done yet! I believe it is time for a minor correction down to $15 or so, then we can sit back and enjoy the ride........ :beer1::beer1: on another note, many of us have been chirping for awhile that the op was staring at everyone, that the seasonal was upon us, so giddy on up if you are buying, well, buying time is passing, so it is getting past time to #$@ or get off the pot |

| Precious Metals Surge As Mining Unrest Spreads Posted: 23 Aug 2012 05:59 AM PDT Bullion prices have rallied for six days, moving through the technical resistance of the 150-day and 200-day moving averages. Platinum and palladium also rallied for a fifth straight day on growing fears that violence due to labor issues will spread. |

| Posted: 23 Aug 2012 05:58 AM PDT

from bullionbullscanada.com: The World Gold Council recently released its second quarter statistics on gold "demand and supply trends". For those not familiar with the WGC, it is an "industry trade group" composed of large-cap gold miners who love bankers. How much do these mining companies love bankers? So much that they allow the bankers to keep all the records for their sector, and pretty much do all of their of their promotion to the world. It is the WGC which elevated two private "consultancies" (of bankers) – GFMS and the CPM Group – to the status of quasi-official record-keepers for the entire global gold (and silver) industry. It would be problematic at best for the gold industry to allow itself to be almost entirely represented by a "profession" now known only for its rampant fraud. However, given the known hatred of the banking community toward gold and silver, and their relentless attacks on both the bullion market and the miners themselves; it's almost beyond comprehension that the world's largest gold miners choose bankers as their spokesmen. Keep on reading @ bullionbullscanada.com |

| Does This Breakout Mean It's Time to Buy Gold? Posted: 23 Aug 2012 05:57 AM PDT After an especially quiet summer, gold has risen to four-month highs... |

| Posted: 23 Aug 2012 05:53 AM PDT

from harveyorgan.blogspot.ca: Good evening Ladies and Gentlemen: Gold closed slightly down to the tune of $2.50 to $1637.40. Silver on the other hand refused to listen to gold and advanced another 13 cents to $29.55. However after the comex close, the Fed released it's beige book and the feeling is that the Fed will have to engage in official QEIII before long. Gold and silver shot up big time as did the Euro. Here are the closing access gold and silver closings: Keep on reading @ harveyorgan.blogspot.ca |

| Rule – Gold & Silver Spike & The Oil Quote May Skyrocket Posted: 23 Aug 2012 05:50 AM PDT

from kingworldnews.com: On the heels of the release of the Fed minutes and subsequent spike in gold and silver, today King World News interviewed one of the wealthiest and most street-smart pros in the business, Rick Rule. Rule told KWN that more stimulus is on the way and the oil quote may skyrocket. Rule, who is now part of Sprott Asset Management, also discussed the release of the Fed minutes: "Additional stimulus will be needed soon according to many Federal Reserve policymakers, unless the economy shows signs of a durable pickup. I don't see any signs of a durable pickup, so I think they are signaling that there is going to be additional easing." Keep on reading @ kingworldnews.com |

| A History of Exchange-Rate Regimes Posted: 23 Aug 2012 05:42 AM PDT

from goldmoney.com: It's almost as if currencies are designed to confuse you. In fact, sometimes they even lie to you. Take the pound sterling for example; each 5, 10, 20 and 50 pound note assures you, the esteemed owner, the gracious right to redeem it for… 5, 10, 20 and 50 pounds respectively. Either there's an awkward "I-give-it-to-you-so-that-you-can-give-it-back-to-me" manoeuvre involved here or somebody's lying. Well, this quirk and much more is cleared up when recounting the evolution of currency systems over the past two centuries; and as it turns out this history is far more exciting than is usually let on (think political thriller as opposed to economic textbook!). So without further ado here we present a history of exchange-rate regimes from 1821 to the present day. Keep on reading @ goldmoney.com |

| Silver Breakout Leads to Gold Breakout Posted: 23 Aug 2012 05:41 AM PDT

from traderdannorcini.blogspot.ca: Gold put in a very strong showing in today's session the instant the FOMC press release hit the market. All that was necessary was the fact that a few words were changed from "some" to "many" and to "fairly soon". Once traders saw those words, it was off to the races and no looking back. Traders interpretted this change of wording as evidence that the committee was now largely leaning to a new round of bond buying should future economic data releases confirm the slowdown in growth. We have noted for some time that Silver would underperform gold during a time in which deflationary or slowing global growth fears are dominant. The exact converse is true when traders begin shifting towards inflationary expectations. Silver leads and then gold follows. Keep on reading @ traderdannorcini.blogspot.ca |

| Gold Daily and Silver Weekly Charts – Rally Intensified on Fed’s QE Statement Posted: 23 Aug 2012 05:38 AM PDT

from jessescrossroadscafe.blogspot.ca: Gold and silver were rallying even as stocks were declining, when the Fed released its minutes from the most recent meeting this afternoon. The Fed is concerned about the lack of growth in the economy and signalled its willingness to invoke additional quantitative easing 'fairly soon.' This intensified the rally in gold and silver and helped stocks to lose some of their early losses. Gold has stuck a close above the big resistance, and now needs to take out the trendlines around 1665 to get some legs. Stocks are running on liquidity and hot money expectations, and not much else. Keep on reading @ jessescrossroadscafe.blogspot.ca |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment