saveyourassetsfirst3 |

- Philip Morris Earnings Review

- Metals, Grains & Crude. Oh, My!

- Freeport, Vale, Barrick All Undervalued 'Buys'

- QE “Uncertainty” Sees Gold Prices Drift Lower, US “Needs to Deal with Fiscal Issues” Bernanke Tells Congress

- The Remonetization of Gold?

- The Inverse Relation Between Bitcoin & Silver, Gold Persists

- Gold & Silver: Daily Outlook For July 19

- Dear gold, thanks for the diversification

- Biderman – Fed Rigging of Stock Market Won’t Work Much Longer

- Peter Schiff – This Is My Single Greatest Fear

- NIRP vs GOLD

- WHY GOLD WILL ERUPT

- Spain 10 yr bond yields approach 7%. Problems continue in Sicily

- Brodsky On Gold, ‘Credit Money', And Real Return Investing

- Eveillard – We Are Near The End Of This Correction In Gold

- Faith in gold as the ultimate money – Jay Taylor

- $38m silver hoard removed from World War II shipwreck off the coast of Ireland

- Poor Monsoon and “Summer Doldrums” Hit Demand to Buy Gold, But “Bearish Trend Only Weak”

- MineWeb's Lawrence Williams: It would be surprising if gold market wasn't manipulated

- More Earthquakes In The Silver Market

- SS Gairsoppa Shipwreck Nets $38 Million In Silver

- Precious Metals vs. Commodities

- $38m Silver Hoard Removed From WWII Shipwreck

- Is 30.2.Au flying in Ben’s face? Not yet

- Corvus Gold Reports Positive Metallurgical Results, Mayflower Deposit, North Bullfrog Project, Nevada

- Gold Producers in the Catbird Seat: Jay Taylor

| Posted: 19 Jul 2012 11:03 AM PDT By David Silver: Before the opening bell today, Philip Morris International (PM) released operational results for its second quarter of fiscal year 2012. The former international arm of Altria (MO), reported that revenue fell to $8.12 billion from $8.27 billion year over year, as declining volumes offset higher prices. The Street was expecting revenue of $8.0 billion, while my forecasts called for revenue of $7.97 billion. On the bottom line, PM reported that earnings fell slightly to $2.31 billion from $2.40 billion year over year. However, due to the nearly $6 billion of share repurchases made over the past year, earnings per share improved to $1.36 per share from $1.35 per share. Both the Street and I expected earnings of $1.35 per share. Volumes were down in four of the five segments in which the Company operates, however, it did see pricing gains across the board. The weakness continues in Western Europe, with Complete Story » | ||||||||||||||||||

| Metals, Grains & Crude. Oh, My! Posted: 19 Jul 2012 10:45 AM PDT

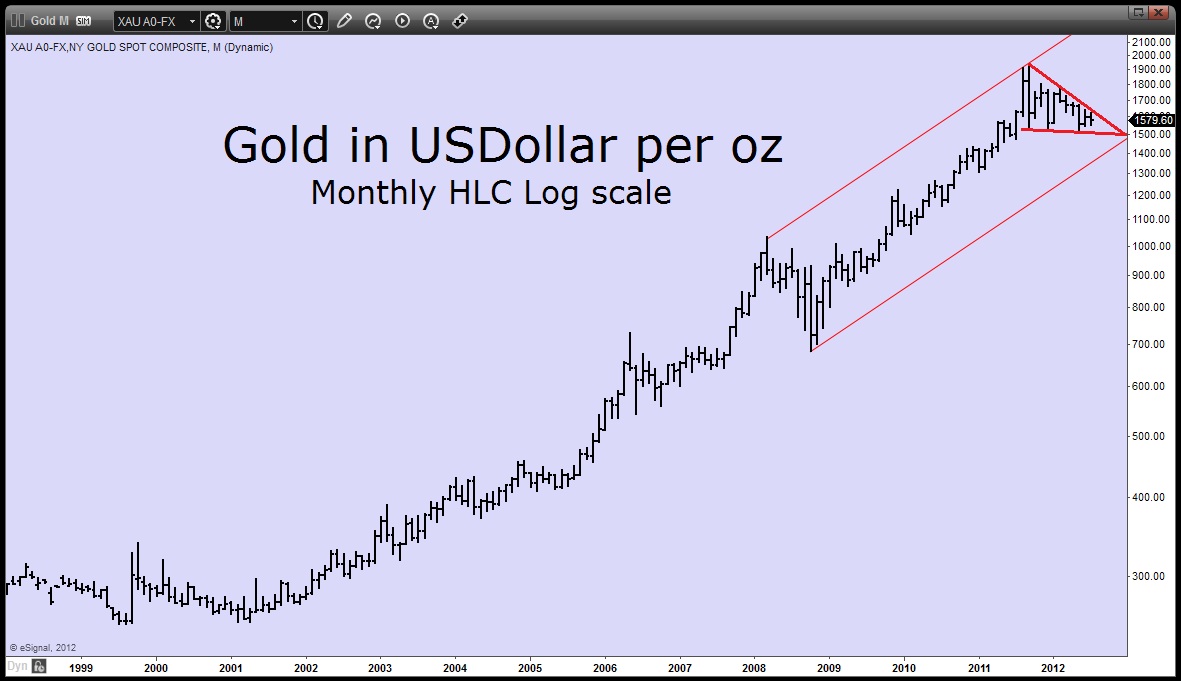

from tfmetalsreport.com: A very interesting day in all three. What will Wednesday bring? First, the metals. As has been the case for all of 2012, The Bernank spoke today and down went gold and silver. After nearly reaching $1600 in early London trading, gold was pummeled well in advance of The Bernank and fell to as low as $1572 shortly after The Great Douchebag spoke. However, contrary to pattern from earlier this year, the metals subsequently reversed and traded higher, reaching $1592 just two hours later. Both metals have since been beaten back but the action today was encouraging, nonetheless. As you can plainly see on the charts below, both metals are rapidly moving toward a conclusion of their multi-month corrections. When they break…which will be soon…they will both break sharply and decisively higher. Crude is getting very interesting as the situation in the MENA is becoming quite tense. Here's a story from the LATimes which confirms much of what Debka told us earlier today. Now above $88, the next objective is $90. IF it can get a toe-hold there and maintain it for a day or two, it will be set up for a run back toward $100. Not only could options players profit from this but holders of UCO would make a few bucks, too. Keep on reading @ tfmetalsreport.com | ||||||||||||||||||

| Freeport, Vale, Barrick All Undervalued 'Buys' Posted: 19 Jul 2012 10:42 AM PDT By Takeover Analyst: As the Fed commits America to low interest rates for at least the near-term, basic materials will continue to hedge against greater economic uncertainty. Within the basic materials sector, investors can back a variety of different industries: copper, gold, molybdenum, silver, potash, iron ore, steel, and phosphate, among others. Where diversification is advised, investors are encouraged to "keep it simple" - many stocks, like Freeport (FCX) already offer diversification across a variety of precious metals. Gold has been one of the main ways to protect investments from economic "tail risks", or unlikely, but devastating, potential macro events. In my view, investors should consider backing some producers because they are undervalued in the sense that future growth has not been factored into the stock price. Put differently, I recommend betting on volume increases, not metal price changes--the latter of which is inherently challenging to forecast. Three basic materials that I recommend Complete Story » | ||||||||||||||||||

| Posted: 19 Jul 2012 10:40 AM PDT

from goldnews.bullionvault.com: Gold Prices drifted lower during Wednesday morning's trading, dropping below $1580 per ounce, while stocks and commodities were broadly flat on the day and US Treasuries gained, as markets continued to digest yesterday's testimony to Congress by Federal Reserve chairman Ben Bernanke. Like gold, Silver Prices also eased, falling as low as $27.04 per ounce in Wednesday morning's London trading. A day earlier, Gold Prices fell 1% in an hour on Tuesday after Bernanke began his testimony. Although the Fed chairman said monetary policy is "still on a loosening cycle", there was no clear mention of a third round of asset purchases, known as quantitative easing. "The bull camp in gold wanted to see more quantitative easing," says a note from CME Group. "[But] seeing the US economy hold together might keep broad based risk-off deflationary selling interest from resurfacing in the near term." "We suspect that the short-term outlook for the precious group will be somewhat lower from here," adds INTL FCStone analyst Ed Meir. "While easing may be expected, investors are still saddled with the uncertainty of not knowing exactly when such an order will be given." "Monetary policy is kind of at its end right now," Bernanke told US lawmakers yesterday. "What will be needed to make it more effective is that fiscal issues need to be dealt with." The Fed chairman said that the so-called "fiscal cliff" – the combination of tax hikes and spending cuts currently due to come into effect at the start of 2013 – risks "negative effects likely to result from public uncertainty about how these matters will be resolved". "The recent downshift in economic data," says a note from Swiss refiner MKS, "may suggest that there will be steady pressure on the Fed to provide additional monetary accommodation." Bernanke also said that in 2008 the New York Fed "informed all the relevant authorities" in the US and UK about suspicions it had that the interbank interest rate Libor was being manipulated. Bank of England governor Mervyn King however told UK lawmakers Tuesday that he first heard about alleged wrongdoing two weeks ago. Bernanke is due to give further testimony to Congress today when he appears before the House Financial Services Committee. This will be the last chance Ron Paul has to quiz the Fed chairman, with the Texas Congressman due to retire from Congress in December. Here in London, the Bank of England's Monetary Policy Committee voted seven-to-two in favor of the decision to increase quantitative easing by £50 billion to £375 billion, minutes from this month's MPC meeting published Wednesday show. Keep on reading @ goldnews.bullionvault.com | ||||||||||||||||||

| Posted: 19 Jul 2012 10:35 AM PDT

from financialsense.com: Two forces collided head-on. Hundreds of people spent more than 30 years looking for the answer. The Higgs boson discovery? No, gold. After experimenting with fiat currencies, this flawed premise has collided with an equally bigger truth: Gold is finite, paper isn't. Bankers now lie, even governments lie, and politicians always lie. Gold tells the truth. Gold is on the first step towards remonetization. Gold is money, it is a currency. Without gold to bind the system together we believe, like the Higgs boson, the financial universe will fall apart. With the highest deficits since World War II, Mr. Obama and the Federal Reserve proved particularly adept at printing, borrowing and spending money creating one of the biggest financial bubbles ever. And the implications of the Fed's promise to keep interest rates ultra-low by extending "Operation Twist" (QEII ½) is a tidal wave of liquidity with money created out of thin air. Since 2008, the Fed expanded its balance sheet by 250 percent with nearly $2 trillion worth of toxic securities. After two rounds of quantitative easing, debt to GDP stands at 100 percent and deficits run at 9 percent GDP. And as in late 2008, the Fed's decision to keep Maison interest rates artificially low has caused short term stock market volatility, runs on sovereign debts, bank bailouts and a dash for cash. Risk is back on again. In the eighties, government yields of 5 percent were considered low because they exceed both the inflation rate and equity returns. Today, the safe haven economies' yields are negative and returns are less than equity. Investors were prepared to lock up their cash for the next decade at a record low yield of 1.459 percent for 10 year US treasury notes, less than the S&P's 2.3 percent yield. As a consequence we believe that the forty year bond bubble peaked as investors in their quest for safety, flee crumbling Europe for government bonds backed by sovereign entities whose finances are similarly insolvent. Interest rates must eventually reflect this underlying fiscal insolvency and the quest for scarce capital will be accompanied this time by depreciating currencies, higher inflation and of course a collapse in overvalued bond prices. US bonds seem to be a good place to park funds for 30 days, not 30 years. Meanwhile, at a time when markets and politicians are calling for the equality of tax rates, politicians naively ignore the role of capital in the production of wealth and of course jobs. A side effect is that investors have ignored risk as they seek safety of capital instead of the meager returns offered by central banks that collude to keep interest rates low. Higher returns are needed to assume risk today. Of course, one of the reasons that taxes are being raised is that cash strapped governments everywhere are desperate for new sources of revenues to close the financing gap. Some, like Australia, are soaking rich miners, and others their rich citizens. Even if America's top 1 percent paid more taxes it would not be enough to get America going. Higher tax rates also increases costs and in turn reduces the availability of investment capital. In Ontario, a surtax will see capital move towards lesser taxed provinces. In France, Mr. Hollande who just assumed office has already raised taxes on wealth and capital, increased the size of the public sector and lowered the retirement age pushing the debt to GDP ratio close to 90 percent. France's deficit will exceed 5 percent of gross domestic product and quickly assumes the have-not status of Spain or Greece leaving only Germany to shoulder the eurozone's burden. Keep on reading @ financialsense.com | ||||||||||||||||||

| The Inverse Relation Between Bitcoin & Silver, Gold Persists Posted: 19 Jul 2012 10:30 AM PDT

from silvervigilante.com: Today the inverse relationship between gold and silver and bitcoin persists, as silver continues its doldrums flirting with the $26 handle and gold stands around $1578.00, whilst bitcoin continues its stealth 2012 rally. The Mt. Gox Bitcoin index has the digital currency up above ฿9 after last week reaching the high ฿7 handle. The Bitcoin-silver ratio sits today at ฿3 per ounce of silver. The gold-bitcoin ratio sits at ฿175 per ounce of gold. Currently, it seems changing bitcoin into silver or gold bullion is a good trade, although patience is a must considering the pressure gold and silver have been under by the powers-that-be. Bitcoins seems to be poised for a break in their run-up. The silver chart, on the other hand, is all fucked up, but thanks to its overwhelming price appreciation over the last ten years, a trendline can still be established. Silver will escape these doldrums, but it will take serious dislocations in the geo-economic sphere and brave, massive silver buying from large investors to break this range and get up past $36 USD. Keep on reading @ silvervigilante.com | ||||||||||||||||||

| Gold & Silver: Daily Outlook For July 19 Posted: 19 Jul 2012 10:25 AM PDT By Lior Cohen: Gold and silver declined for the third consecutive day. The testimony of Bernanke didn't reveal the next move of the FOMC. The U.S housing starts report came out yesterday: housing starts rose by 6.9% during June (M-o-M). This report may have contributed to the decline in bullion. On today's agenda: U.S. Jobless Claims Weekly Report, Philly Fed Manufacturing Index, and U.S. Existing Home Sales. Gold price decreased again on Wednesday by 1.18% to $1,570.8; Silver also fell by 0.81% to $27.1. During July, gold declined by 2.08% and silver by 1.87%. Furthermore, during yesterday the SPDR Gold Shares (GLD) also declined by $0.42 and reached by July 18th 153.47. Currently, GLD is trading up. The chart bellow presents the normalized rates of these precious metals during the month (normalized to 100 as of June 29th). (click to enlarge) On Today's Agenda Philly Fed Manufacturing Index: In the previous June survey, Complete Story » | ||||||||||||||||||

| Dear gold, thanks for the diversification Posted: 19 Jul 2012 10:25 AM PDT

from therealasset.co.uk: In these pages we regularly mention the unique attributes of gold bullion investment, and how gold is able to diversify a portfolio like nothing else. We've cited a gold investment's role in Harry Browne's legendary Permanent Portfolio, the role gold has played in Jim Rogers' stellar investment record, and why Swiss bankers and traditional money managers always steered clients to put >10% into gold bullion. Research just out from the World Gold Council (WGC), titled 'Gold as a Strategic Asset for UK Investors', adds to the evidence that gold investing adds diversification to a portfolio like nothing else. This research argues that gold is the ultimate diversifier, and more relevant to investors today than ever. For more detailed analysis, read the WGC's full report. The WGC's new research finds that across a wide range of investment strategies, from conservative, moderate, to aggressive, gold 'is a significant contributor to portfolio efficiency by reducing risk-adjusted returns and reducing expected losses'. Essentially gold can help balance many types of portfolios, and crucially help protect against losses. The WGC argue that holding between 2.6% and 9.5% own ones wealth in gold can help achieve this diversification. Within the wider research piece the WGC also find, as others have before, that over a 25 year sample period gold has strong 'risk-hedging credentials'. To cut through the jargon again, this means that gold is indeed good at protecting your portfolio when bad things happen. Keep on reading @ therealasset.co.uk | ||||||||||||||||||

| Biderman – Fed Rigging of Stock Market Won’t Work Much Longer Posted: 19 Jul 2012 10:18 AM PDT Trim Tabs CEO Charles Biderman on the divergence between stock market and housing market valuations and why stocks have so strongly outperformed housing since the 2008 crash. He cites primarily the Fed's rigging of the stock market and investor's reliance on "The Bernanke Put" as the main reasons and posits the official interference in the market won't work much longer.

| ||||||||||||||||||

| Peter Schiff – This Is My Single Greatest Fear Posted: 19 Jul 2012 10:10 AM PDT

from kingworldnews.com: Today Peter Schiff stunned King World News by speaking about his single greatest fear. Schiff, who is CEO of Europacific Capital, gave an extraordinarily candid interview. Here is what Schiff had to say: "My biggest worry is that capitalism and the free markets will get the blame when it really hits the fan. When we get the real crash and everything implodes, and it's really an Armageddon style collapse, my fear (again) is that capitalism and free markets take the blame for problems that were created by government." Peter Schiff continues: "Then we just finish our journey on the road to serfdom. We totally become a totalitarian, centrally planned, police-type state, where Constitutional rights go out the window. And really the only thing you can do as an American is leave. Keep on reading @ kingworldnews.com | ||||||||||||||||||

| Posted: 19 Jul 2012 10:05 AM PDT

from blog.milesfranklin.com: Today's RANT was inspired by the below commentary in Jim Willie's new July newsletter: France has joined Germany, Switzerland, and the U.S. in selling bonds with negative short-term yield. Thus, the sub-zero club admits a new, ashamed member. The Central banks are aiding and abetting nations in removing capital from productive sources, as government bonds soak up capital in true parasitic manner. When Japan carried negative yields, they were criticized as running a carnival sideshow in the credit markets. Nowadays, not only is the Japanese style ZIRP adopted, but negative bond yields are spreading like weeds in the West. Critics claiming gold pays no yield should pay close attention to the bond perversions. However, the idea has been percolating for some time, forced back into my frontal lobe by last week's shocking announcement that the Bank of Denmark has become the first-ever Central bank to set OFFICIAL interest rates below zero… Central Banks Helpless As Denmark Goes NIRP, Cuts Deposit Rate To NEGATIVE 0.2% Interest rates have been negative before, such as U.S. T-bills during last year's Global Meltdown III. However, for the first time EVER, this terminal monetary disease has infected one- and two-year bonds, and spread to multiple countries, from perceived "safe havens" such as Switzerland… Swiss 2Y Rates Plunge To -43bps As All Trust Is Lost …and Germany… Finland Enters The NIRP Club As Germany Sells 2 Year Subzero Debt For The First Time …to lesser credits, simply because they are "big"… Dutch, French & Germans sell Treasury Notes at NEGATIVE interest rates I mean, WHAT PLANET ARE WE ON, when one of the worst financial messes on Earth… Keep on reading @ blog.milesfranklin.com | ||||||||||||||||||

| Posted: 19 Jul 2012 09:54 AM PDT

from goldswitzerland.com: Intervention, manipulation and suppression We have gold intervention, manipulation and suppression by governments, banks and hedge funds. We have a paper market in gold which is around 100 bigger than the physical market, facilitating this market intervention. Governments dislike gold since it reveals their deceitful actions in destroying the value of paper money by printing unlimited amounts of it. The media don't understand gold. Financial TV ridicules gold and even the most respected newspapers, like the FT, don't appreciate that gold is money. But in spite of all the adversity that gold has encountered in the last 12 years, the yellow metal has still appreciated over 6 times since 1999. And even with the major investment demand that we have seen in the last few years, only 1% of world financial assets are in gold. So why is gold likely to erupt in the next few weeks? After a strong move into late August 2011 we have had a correction/consolidation for almost 11 months. During this time, every single fundamental factor in the world economy has deteriorated. The Eurozone countries are in a complete mess and can never recover. The UK economy is in a terrible state but they are just lucky that they can print money which Eurozone countries can't do. The same is the case with the US. Debts are increasing at an exponential rate and there is no attempt by government to stop the spending of money the country doesn't have. Total debts and exposure in the US is approaching $500 trillion. This includes unfunded liabilities and derivatives. The latter are likely to become worthless when counterparty fails, something which is very likely to be the case. Most economic figures are deteriorating in the US. The US has had the fortune of all the focus being on Europe but that will soon change. Japan has massive debts and the economy is extremely weak. And China with its major credit explosion will also suffer badly when the whole world stops buying their goods. Sadly as I have been writing, only Deus ex Machina (EvG article Dec 2011) can save the world and this is an unlikely event. Governments will continue to apply the only method they know (with the blessing of economists like Paul Krugman and Martin Wolf) which is issuing unlimited amounts of worthless paper that they call money. This is of course no solution and only adding insult to injury. But this is the only way that governments believe they can appease their voters. But in spite of the handouts in most European countries, governments are thrown out at every election by their people which is used to the its leaders taking care of them from cradle to grave. The free market economy exists no more but has turned into a socialist monstrosity based on paper. We are on the way to "The Dark Years Are Here" as I wrote in 2009. A concerted (ECB, FED, IMF etc) money printing bonanza is likely to start in 2012. This will lead to all currencies collapsing in real terms. Collapsing currencies will lead to a hyperinflationary depression. But many assets will deflate in real terms, especially the ones that were inflated by the credit bubble. This includes stocks, property and bonds as well as debt which have all been in a massive bubble for at least four decades. Gold will be a major beneficiary. Keep on reading @ goldswitzerland.com | ||||||||||||||||||

| Spain 10 yr bond yields approach 7%. Problems continue in Sicily Posted: 19 Jul 2012 09:48 AM PDT

from harveyorgan.blogspot.com: The price of gold fell $2.10 to $1589.10. Silver fell by one cent to $27.29. Today we witnessed the Spanish bonds creep ever so close to 7%. The Italian bonds also finished the day at 6.07%. Spain saw further deterioration in its finances as bank withdrawals continue unabated. Bad bank loans continue to play havoc in Spain as well as house prices continue to fall for the 14th consecutive month. In Italy, Mario Monti has asked for the resignation of Lombardo the governor of Sicily as this autonomous region is set to default on its bonds. Sicily represents 5.5% of Italy's GDP and has over 19.5% unemployment. The Euro/USA cross finished the day at 1.228 The city of Compton California is now contemplating defaulting on its muni bonds. This would be the first major California city to enter the morgue. The Bank of America reported its earnings today and over 1/2 came from reserves for loan losses. The total gold OI lowered by 1,049 contracts from 434,366 to 431,317. Gold recovered from the early raid so maybe a few more bankers lightened up on their shorts. The July delivery month for gold saw its OI lower by one contract from 25 to 24 despite 8 delivery notices yesterday. We thus gained 7 gold contracts or 700 oz of additional gold ounces standing. The next big delivery month is August which is less than 2 weeks away. Here the OI fell by 5466 contracts from 178,036 to 172,570. Most rolled their contracts into either October or December. The estimated volume at the gold comex today was extremely light at 136,549 contracts. The confirmed volume yesterday was also on the light side at 155,522. Many investors are abandoning the comex knowing full well that it is rigged. Keep on reading @ harveyorgan.blogspot.com | ||||||||||||||||||

| Brodsky On Gold, ‘Credit Money', And Real Return Investing Posted: 19 Jul 2012 09:42 AM PDT

from zerohedge.com: Macroeconomic issues currently playing out in Europe, Asia, and the United States may be linked by the same dynamic: over-leveraged banking systems concerned about repayment from public- and private-sector borrowers, and the implication that curtailment or non-payment would have on their balance sheets. Global banks are linked or segregated by the currencies in which they lend. Given the currencies in which their loan assets are denominated, market handicapping of the timing of relative bank vulnerability is directly impacting the relative value of currencies in the foreign exchange market, which makes it appear that the US dollar (and economy?) is, as Pimco notes, "the cleanest dirty shirt". Is there a clean shirt anywhere – creased, pressed and folded? QBAMCO's Paul Brodsky (in a deep dramatic voice-over) sets the scene: In a world where time series stand still… and real purchasing power value has no meaning… a few monetary bodies stand between economic death and destruction… between commercial hope and financial despair… between risk-free returns and return-free risk. Amid this set of conditions it seems entirely prudent to position purchasing power in vehicles that would benefit as the nominal stock of base money grows at a rate far in excess of the gold stock growth rate. Keep on reading @ zerohedge.com | ||||||||||||||||||

| Eveillard – We Are Near The End Of This Correction In Gold Posted: 19 Jul 2012 09:36 AM PDT

from kingworldnews.com: Today legendary value investor Jean-Marie Eveillard told KWN, "If you look at China's view of the West, they think we are decadent. They think we are Rome, towards the end." Eveillard, who oversees $50 billion at First Eagle Funds, also said, "At the same time, they are beginning to worry about China itself." He also discussed the gold market, but first, here is what Eveillard had to say about Europe and the US: "One can have confidence that if the economy does not start doing somewhat better, at some point Bernanke will use some tools to try to stimulate things. I think he's mistaken. The fact that the short-term interest rates have been taken to zero over the past several years, and kept there, I mean money is not supposed to be free." Keep on reading @ kingworldnews.com | ||||||||||||||||||

| Faith in gold as the ultimate money – Jay Taylor Posted: 19 Jul 2012 09:30 AM PDT

from mineweb.com: The Gold Report: Jay, in the June 20 issue of your newsletter, you made the case that gold has broken away from the downtrend that started in late 2011. Why is gold a better investment now? Jay Taylor: At the time, I was convinced we were looking at a breakthrough in the junior gold index on the Toronto Stock Exchange (TSX). Now, it seems it may have been a false breakthrough. The S&P/TSX Global Gold Index was as high as 450 back in September/October 2011, dropping to 270 by May 2012. Today, it is around 282. I see the junior gold index as a barometer of the industry as a whole. Although I was getting optimistic, I remain concerned about the possibilities of much lower levels in gold shares as a whole. The companies that have to raise capital and put money in the ground are my greatest concern. I am less concerned about companies that are in production and generating cash flow from operations, many of which are doing extremely well. TGR: In that newsletter, you wrote that the value of gold, "vis-à-vis. . .the Rogers Raw Materials Fund. . .had a rocket ship trajectory following the credit deflationary Lehman Brothers event and has remained on a gradual uptrend." JT: I was referring to the real price of gold, not its nominal price. I am absolutely bullish on gold's real price. There is a distinct uptrend since Lehman Brothers in terms of what an ounce of gold will buy. That, not the dollar price, is what matters. The recent record highs in the real gold price reflected the anxieties caused by the European crisis. To give you an idea, in July 2008 an ounce of gold would have purchased only 17% of the Rogers Raw Materials Fund. By March 2009, it had skyrocketed to 44%. After quantitative easing 1 and 2, commodities, stocks and gold all rose. Then gold fell back to 30% of the Rogers Raw Materials Fund until the first Greek crisis. It rose again to 44%, and then got worse as Europe seemed to be falling apart. Recently, it has come back a bit. The anxiety about the world monetary system is driving gold prices. Forget about jewelry or about gold as a commodity. Gold is money, and that is driving its real purchasing power higher and higher. I am much less confident in the dollar as gold continues to rise. Gold could actually break below the $1,550/ounce (oz) support level. TGR: Will it drop beneath the 52-week low of $1,480/oz set roughly a year ago? JT: It could in nominal terms versus the dollar. If that happens, I would expect oil, copper and other commodities to fall even more. I think the dollar could be surprisingly strong for a number of years, which would make gold weaker relative to the dollar, but not relative to other commodities. Keep on reading @ mineweb.com | ||||||||||||||||||

| $38m silver hoard removed from World War II shipwreck off the coast of Ireland Posted: 19 Jul 2012 09:24 AM PDT

from arabianmoney.net: Still shining after 71 years some five kilometres under the Atlantic Ocean off the coast of Ireland, this hoard of 1.4 million ounces of silver was recovered by the SS Gairsoppa owned by Odyssey Marine Exploration, its heaviest and deepest underwater mission to date. The silver has kept its value of around $38 million but it is still very undervalued in comparison to gold. A comparable cargo of 1,203 gold bars would be worth $2.2 billion at today's prices. Government property The silver still belongs to the UK Government that has paid $500,000 to the owners of the cargo, according to The Daily Telegraph today. The ship was sunk by a German torpedo in February 1941 and the silver being transported was part of the British Government's War Risk Insurance programme. The loss of such principal must have been a blow to government finances at a time when the very future of the United Kingdom was under severe threat before Pearl Harbor brought the US into the war and made the final victory inevitable. Perhaps the silver will now go back to vaults of the Royal Mint in Wales so recently emptied by the bargain sale of UK gold by the former Prime Minister Gordon Brown when he was finance minister. It's a testament to the indestructable qualities of precious metals that it looks hardly tarnished by so long under the sea, although Odyssey's research indicated that there was five times as much silver on board. Keep on reading @ arabianmoney.net | ||||||||||||||||||

| Posted: 19 Jul 2012 09:18 AM PDT from goldnews.bullionvault.com: U.S. DOLLAR prices to Buy Gold rose 1.3% from yesterday's 1-week low Thursday morning in London, recovering $1590 per ounce as world stock markets also rallied. Silver Prices outpaced gold, adding 2.2% to $27.55 per ounce, but the Euro failed to rise above $1.23 for the fourth time in a week. Spain had to pay 5.2% per year to raise new loans due to mature in 2014 – up from 4.3% at June's auction of 2-year bonds. German Bunds meantime continued to offer investors less-than-zero as prices rose further, squashing the yield on Berlin's 2-year debt to minus 0.05%. German inflation was last seen at 1.7% per year. Brent crude oil today rose to a 7-week high above $107 per barrel – the highest level since May when priced in the Euro. Lawmakers in Berlin were due Thursday to vote on the Eurozone's €100 billion credit line to Madrid, with German tax payers set to underwrite 30% of the package. "The range in [Dollar prices to Buy Gold ] is converging," says Russell Browne in his technical analysis for bullion bank Scotia Mocatta, "and is currently defined by $1554 support and $1613 resistance. "While a bearish trend has been in force since late February, trend momentum is weak." "Gold on the weekly chart is heading back down towards the 2008-12 uptrend line at 1559," reckons Axel Rudolph, technical analyst at Commerzbank, drawing his 4-year uptrend from the base of Oct. 2008 straight to May 2012, rather than joining the nine rising lows in between. Over in Asia today, "People are buying and selling when prices move ten or twenty dollars," Reuters quotes a Singapore dealer. Such tight trading means "We remain range-bound," he says, forecasting that "People are not going to be very hungry for physical materials" until the return of festive demand from India later in the year. Although the India Meteorological Department says that the current monsoon should improve as August begins – boosting potential incomes for rural consumers to Buy Gold – "Looking at the current scenario of monsoon, I don't expect much pick-up from here," one Kolkata gold wholesale, Harshad Ajmera of JJ Gold House, is quoted today by the Business Standard. Keep on reading @ goldnews.bullionvault.com | ||||||||||||||||||

| MineWeb's Lawrence Williams: It would be surprising if gold market wasn't manipulated Posted: 19 Jul 2012 09:12 AM PDT

from gata.org: Reflecting on the latest report on the gold market by Erste Bank analyst Ronald Stoeferle (http://www.gata.org/node/11564), MineWeb's Lawrence Williams inclines even more toward the likelihood that the gold and silver markets are manipulated. Williams writes: "There are so many hugely interested parties in precious metals price movements — from both financial and political ends — that it would actually be remarkable if there was no manipulation or intervention in the gold and silver markets in particular. Indeed, many of the manipulators, or interventionists, would just not see it as such but as a normal part of their day-to-day business. "The world is at last becoming aware that everything is almost certainly manipulated in some way or another — particularly by governments and the major financial institutions, which have the political and financial clout to carry this out, to meet their own agendas. But what is acceptable manipulation and what is not?" Williams' question has an answer. First, market manipulation by private entities is, in most modern economies, against the law, like anti-trust law, though the law may not be much enforced anymore as the West sinks haplessly into corruption and demoralization. Second, market manipulation by governments is at least morally wrong if it is undertaken in secret to deceive market participants, and in some circumstances freedom-of-information law may be brought to bear against it, as GATA has done: http://www.gata.org/node/9917 Keep on reading @ gata.org | ||||||||||||||||||

| More Earthquakes In The Silver Market Posted: 19 Jul 2012 09:05 AM PDT from edegrootinsights.blogspot.com: I know neither Rule or Sprott, and realize they have a vested interest in talking their book, but their assertion that substantial upside for silver exists once a technical trigger is generated is supported not only by their observations in the physical but also by statistical concentrations in the paper market. The invisible hand is furiously covering its shorts into (D-wave) weakness while the silver bugs liquidate their positions in disgust. The hand's net long position as a percentage of open interest has increased to -8.38% (chart 1). The highest level since 2001 demands some viral recognition followed by a string of WTF suffixes. The commercial traders are loading up the boat and forcing the shallow pocketed and highly emotional retail trader to walk the plank with impunity. This setup is illustrated by clear, diametrically-opposed statistical concentrations of commercial and retail traders highlighted in the green boxes. Keep on reading @ edegrootinsights.blogspot.com | ||||||||||||||||||

| SS Gairsoppa Shipwreck Nets $38 Million In Silver Posted: 19 Jul 2012 08:58 AM PDT While the SS Gairsoppa may not be worth its weight in gold, the 412-foot British shipwreck is worth a whole lot in silver -- approximately $38 million of it.

| ||||||||||||||||||

| Precious Metals vs. Commodities Posted: 19 Jul 2012 08:55 AM PDT I had the opportunity to listen to an inteview with noted commodities-guru Jim Rogers, which is never a bad investment of one's time. Rogers is both very astute, and a straight-talker; two "commodities" which I'm sure that he would purchase if he could – since both are clearly in short supply in the 21st century. The central topic on the mind of Rogers' interviewer was Ben Bernanke's farcical testimony before the U.S. Congress. That love-fest had all the interrogative value of spending the day watching Sesame Street. Rogers was also totally unimpressed: …Mr. Bernanke is going to print more money…I wouldn't pay much attention to the man…He only knows one thing – and that's what he's going to do… The interview then proceeded to Rogers' specialty: the world of commodities. He remains totally committed to commodities over the long term, rightfully pointing out that as the global economy continues to be drowned in mountains of the bankers' paper currencies, that these hard assets must soar in price – as all that paper collapses in value. When asked to compare the different commodity sectors, Rogers was also unequivocal. He was most bullish with respect to "soft" commodities and industrial commodities, while less bullish on the monetary commodities: gold and silver (at the present time). It's here that I'm going to dare to differ with Rogers to a degree. I wouldn't presume to contradict his long-term prognosis on the future of commodities, in a commodity-starved world. In fact I completely agree with him. However, it is over the short/medium term where I believe I detect a small inconsistency in his analysis of these markets. The inconsistency lies in the fact that Rogers fervently believes (as do I) that we are on the verge of a Flight out of Paper. He ranked the various forms of these fraud-currencies, and said he expected the holders of this paper to soon begin an exodus out of the most-worthless of them – specifically noting the U.S. dollar. He also observes that once this exodus starts that there will not be enough stable currency remaining in the world for all of the U.S.-dollar refugees (and other paper-holders) to find a home. This leads to the obvious question: where will all those other $trillions go? Rogers' implicit answer is that this paper will flow into his favored soft and industrial commodities. However this ignores a large and obvious practical issue: the absolute need for functional currency. Once we ditch the last of our banker-paper in favor of holding our wealth in some instrument which actually has value, we cannot simply all load up on commodities. People are not going to go to their local shopping mall lugging bushels of wheat, barrels of oil, or truckloads of lumber in order to do their daily shopping. However, they will be quite happy to conduct their commerce using silver and/or gold coins, since as a species we have collectively had thousands of years of practice in using this only form of "good money". What we have here is the world's foremost expert on commodities warning us that we are about to experience a shortage in a "commodity" with which our modern economies cannot function: usable currency. Then there is silver and gold. These precious metals have a 5,000-year track-record of being the world's ultimate "safe havens", because they are the only perfect form of money we have ever been able to devise. | ||||||||||||||||||

| $38m Silver Hoard Removed From WWII Shipwreck Posted: 19 Jul 2012 08:51 AM PDT Still shining after 71 years some five kilometers under the Atlantic Ocean off the coast of Ireland, this hoard of 1.4 million ounces of silver was recovered by the SS Gairsoppa owned by Odyssey Marine Exploration, its heaviest and deepest underwater mission to date. | ||||||||||||||||||

| Is 30.2.Au flying in Ben’s face? Not yet Posted: 19 Jul 2012 08:36 AM PDT The FOMC announced that Operation Twist would continue through year end. This is where the Fed tries to re-inflate the housing bubble (and related areas) by buying long term T bonds to artificially hold down long term interest rates while sopping up any inflationary implications to the money supply by selling short term T bonds. Throw in a side of ZIRP, and you've got a lot of free money flying around out there with very subdued inflation effects. Gold is in an orderly corrective consolidation. Silver has been hanging around at support and is sponsored by a bullish CoT structure. Commodities, even backing out the wildcards in agriculture, are in nice short-term bottoming patterns (copper is rounding upward and crude oil is breaking up from a small Inverted H&S with a target around 98) and just waiting for the Fed to lose control of the nice macro painting it has been working on since Op/Twist #1, back in September of 2011. Since the FOMC's most recent announcement, the 30.2 yield spread (30 year/2 year ratio) has gone upward right along with commodities. Now, does this imply that the Fed has lost control and we are finally going to see some inflationary expectations anxiety? Unfortunately, no. 30.2 has simply reacted with the relief in commodities. Maybe the Fed is just letting it breathe in a natural way before taking manipulative action once again. Gold certainly does not seem to think a release of inflationary endorphins is directly forthcoming. When might this condition change? Well, let's see 30.2 get through the resistance area noted on the above daily chart before even thinking of a lasting trend change. A weekly version of the chart shows the 30.2 and gold firmly locked in downtrends. As long as the Federal Reserve is able to conduct yield curve operations to its liking, there will be no apparent inflationary implication to casual (read: most) observers. But the facts are…

'Yes, we know that Gary'. Well I know you know. But as market participants we have got to factor the above because it is only critical to just about everything. Buy or sell stock markets, commodities, gold, silver, T bonds? Factor in the powerful force at work in the bond market. Factor in its agenda, its supply of ammo (short term T bonds for sale). I will not pretend that this operation has not messed with the tools with which I go about managing markets. It has. It is hard to know what to believe and what to discount. Speaking for one asset – the monetary stress barometer, gold – we note that its chart structure is a consolidation, not a blow off top. In other words, it looks like something that is in waiting. Meanwhile, the chief operator at the most powerful manipulative agency in the world is sitting pretty: "that'll be the last time you people publicly lynch me with your helicopter jokes and inflation hysteria; how you like me now suckas?" As we work through the process of sorting out the timing in which the market's more natural forces come back into play, you are invited to check out the free – and spam free - eLetter and of course, this blog. http://www.biiwii.blogspot.com | ||||||||||||||||||

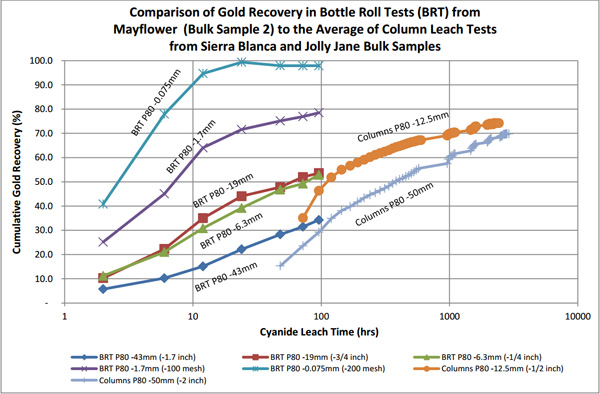

| Posted: 19 Jul 2012 08:30 AM PDT Vancouver, B.C……..Corvus Gold Inc. ("Corvus" or the "Company") – (TSX: KOR, OTCQX: CORVF) is pleased to announce a series of bottle roll tests performed over 96 hours on bulk sample materials collected from historical mine waste dumps at the Mayflower deposit (see Figure 1). Test results confirm potential for low cost heap leach recovery operation. Samples returned approximately 98% of gold recovered for particles ≤ 200 mesh size (-0.075mm). The initial Mayflower results (Table 1) have returned similar or better leach curves to other oxide ores in the district. The Company is conducting similar leach tests on samples from the large diameter core drilling program that was completed in June to assess the long term recovery rates of different size fraction at Mayflower. Based on this initial data the Company expects the long-term Mayflower gold recovery rates to compare very favourably to those observed in the column tests run between 100 to 120 days from bulk samples at Sierra Blanca and Jolly Jane (Chart 1) as reported in the Preliminary Economic Assessment of North Bullfrog (Technical Report and Preliminary Economic Assessment for the North Bullfrog Project, Bullfrog Mining District, Nye County, Nevada, February 28, 2012). Chart 1: Chart comparison of gold recoveries from bulk samples using bottle roll tests at Mayflower and the average of column tests at Sierra Blanca & Jolly Jane Carl Brechtel, COO of Corvus, stated: "These initial metallurgical test results are confirming the potential for a low unit cost, heap leach recovery operation at Mayflower. It is encouraging to see recoveries over 50% in just 96 hours for particles less than 3/4 inch when we consider the normal production leach cycle will be in excess of 100 days. The near total gold recovery in the -200 mesh material indicates that essentially all of the gold in the rock is recoverable which is a very positive indication for heap leaching. The Mayflower project (see Figure 1) is progressing rapidly with encouraging technical results, paving the way to developing Nevada's next gold mine." Table 1

Metallurgical composites have been prepared from the PQ core drilled in Phase 1 of the 2012 program (NR12-16, June 12, 2012). A total of 6 composite samples have been created for the Mayflower deposit, with sufficient material for 12 individual column leach tests at a P80 size of -3/4 inch (-19 mm). The column leach results will be supplemented by bottle roll tests on each composite at nominal P80 sizes of -200 mesh (-0.075 mm), -100 mesh (-1.7 mm), -1/4 inch (-6.3 mm) and -3/4 inch (-19 mm). A similar group of columns and bottle roll tests have been prepared from composites of PQ core material from Sierra Blanca. Leaching of the columns has begun at McClelland Laboratories, with final results planned to be available in December 2012.

Figure 1: Corvus land position at North Bullfrog showing the Mayflower Resource Area, and the Other Resource Areas. Drill collar locations are shown for reference. About the North Bullfrog Project, Nevada Corvus controls 100% of its North Bullfrog Project, which covers approximately 24 square kilometres in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick. The property package is made up of a number of private mineral leases of patented federal mining claims and 161 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor. The project currently includes numerous prospective gold targets with four (Mayflower, Sierra Blanca, Jolly Jane and Connection) containing an NI 43-101 compliant estimated Indicated Resource of 15 Mt at an average grade of 0.37 g/t gold for 182,000 ounces of gold and an Inferred Resource of 156 Mt at 0.28 g/t gold for 1,410,000 ounces of gold (both at a 0.2 g/t cutoff), with appreciable silver credits. Mineralization occurs in two primary forms: (1) broad stratabound bulk-tonnage gold zones such as the Sierra Blanca and Jolly Jane systems; and (2) moderately thick zones of high-grade gold and silver mineralization hosted by structural zones with breccias and quartz-sulphide vein stockworks such as the Mayflower and Yellowjacket targets. The Company is actively pursuing both types of mineralization. A video of the North Bullfrog project showing location, infrastructure access, and 2010 winter drilling is available on the Company's website at Qualified Person and Quality Control/Quality Assurance Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information (other than the resource estimate) that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options. Carl E. Brechtel, PE, a qualified person as defined by National Instrument 43-101, is responsible for planning and execution of the technical and engineering studies at North Bullfrog, and has prepared this news release. He approves the disclosure herein. He has over 30 years of experience in the mining industry, is a registered professional engineer in the States of Colorado and Nevada, and is a Registered Member of SME. Mr. Brechtel is not independent of Corvus, as he is the COO and holds common shares and incentive stock options. Mr. Gary Giroux, M.Sc., P. Eng (B.C.), a consulting geological engineer employed by Giroux Consultants Ltd., has acted as the Qualified Person, as defined in NI 43-101, for the Giroux Consultants Ltd. mineral resource estimate. He has over 30 years of experience in all stages of mineral exploration, development and production. Mr. Giroux specializes in computer applications in ore reserve estimation, and has consulted both nationally and internationally in this field. He has authored many papers on geostatistics and ore reserve estimation and has practiced as a Geological Engineer since 1970 and provided geostatistical services to the industry since 1976. Both Mr. Giroux and Giroux Consultants Ltd. are independent of the Company under NI 43-101. Mr. William J. Pennstrom, Jr., a consulting process engineer and President of Pennstrom Consulting Inc. has acted as the Qualified Person, as defined by NI 43-101, for evaluation of the metallurgical testing data. He has over 30 years of experience in mineral process design and operation, and has been an independent process and metallurgical consultant for the mining industry for the last nine (10) years. He is a Registered Member of the Society of Mining, Metallurgy and Exploration (SME Member No. 2503900). Mr. Pennstrom and Pennstrom Consulting Inc. are both independent of the Company under NI 43-101 definitions. The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, a Qualified Person defined by NI 43-101, by and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control. McClelland Laboratories Inc. prepared composites from duplicated RC sample splits collected during drilling. Bulk samples were sealed on site and delivered to McClelland Laboratories Inc. by ALS Chemex or Corvus personnel. All metallurgical testing reported here was conducted or managed by McClelland Laboratories Inc.

About Corvus Gold Inc. Corvus Gold Inc. is a resource exploration company, focused in Nevada, Alaska and Quebec, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% owned Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production. On behalf of (signed) Jeffrey A. Pontius Contact Information: Ryan Ko | ||||||||||||||||||

| Gold Producers in the Catbird Seat: Jay Taylor Posted: 19 Jul 2012 08:17 AM PDT |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment