saveyourassetsfirst3 |

- Why supply is going to be the next big mining issue

- ECB: increase of oz853,78 in gold and gold receivables

- Gold and Silver: The Government's Metal

- Silver likely to outperform Gold, Copper in Q4 2012: TD Securities

- The Rig Is Up

- Gold Seen At USD 3,500, 6,000 and 10,000 Per Ounce

- Citi’s Fitzpatrick – 2 Key Markets: The Euro vs Dollar & Stocks

- Continuing gold and silver volatility

- John Embry – Fixes From The 70s Won’t Stop This Disaster

- Rule – We Are Seeing Dislocations In Many Financial Markets

- A Dow/Gold Ratio for Independence Day

- Monetary stimulus chatter helps gold

- Macleod - Gold Reentering Monetary System

- Gold “Helped by Short Covering”, ECB Considers Rate Cut, Monetary Policy “Will Push Gold Higher Next Year”

- “QE3 Probability” Could Boost Gold, No Need for Gold Standard “Until Money Collapses Completely”

- Why This Is The Only Long-Term Safe Haven For Me

- The Christmas Gift Portfolio - Core Holdings On Sale Now

- John Embry: Fixes From the 1970s Won't Stop This Disaster

- Why mine production has little influence on the gold price

- Turd: LIBOR is Manipulated, and Silver Isn't?

- Gerald Celente talks with Greg Hunter

- Gold and Silver Crossword Puzzle

- New Swiss storage option for GoldMoney customers

- Links for 2012-07-03 [del.icio.us]

- The Question China Has To Answer Fast to Save it’s Economy

- CRB Index Spike Lifts Gold

| Why supply is going to be the next big mining issue Posted: 04 Jul 2012 11:40 AM PDT Why supply is going to be the next big mining issue Standard Chartered's Jeremy Gray looks at how the commodities sector is currently placed and why future supply is going to become a big issue. Download podcast here: http://www.mineweb.com/mineweb/view/...tail&id=92730 |

| ECB: increase of oz853,78 in gold and gold receivables Posted: 04 Jul 2012 10:10 AM PDT |

| Gold and Silver: The Government's Metal Posted: 04 Jul 2012 10:07 AM PDT

from silver-coin-investor.com: I think the gov wants to control the price if silver so it can control the economy better. If the price of pms were actually left free to run were it may. The stock market would be S&P 500 at 28 and the DOW at 1550. Oh yes, and gold $12500 an silver $1400. It would be the biggest bubble of all in history. But this isnt even close to a true market. It use to be a long time ago the one with the most gold an silver rules the world and is king. These days its even better. Its the one that rules the price of gold an silver rules the world. Keep on reading @ silver-coin-investor.com |

| Silver likely to outperform Gold, Copper in Q4 2012: TD Securities Posted: 04 Jul 2012 09:59 AM PDT

from commodityonline.com: NEW YORK (Commodity Online): Silver likely to outperform gold, copper, crude oil and platinum in fourth quarter (Q4) this year, said TD Securities (TDS) in a commodities briefing. TDS is the global wholesale banking arm of Toronto-Dominion Bank Financial Group. Silver to eventually get a boost from an increasing probability of more aggressive Federal Reserve monetary policy, although the metal could run into more tough sledding in the meantime should there be renewed eurozone debt worries and disappointments about U.S. quantitative easing, TDS added. According to BNP Paribas, "An improving macroeconomic outlook and high risk appetite should see silver outperform gold for most of H2'12 and 2013 although silver, like gold, remains vulnerable to waves of liquidation. As a result, the gold/silver ratio should decline to the low 40s by H2'13." TDS also noted that, silver has been held back by gold's sideways action lately and an economic slowdown that has hurt expectations for industrial demand. Meanwhile, mine supply keeps rising. Keep on reading @ commodityonline.com |

| Posted: 04 Jul 2012 09:55 AM PDT

from jsmineset.com: Gold will go to and above $3500. This is the most important message I have sent you since 2001. There are very few of us dynamic thinkers that see everything as a trend constantly in motion. Anyone can be a static thinker, quoting recent economic figures or news headline (MSM), and coming up with a usually wrong opinion. The change today is that the "Rig Is Up." The Bank of England turning their backs on Barclays, the company who did their bidding, will be the event in time marking the trend change. Many of us in our areas of activity will successfully fight the Riggers. The many complaints that so many of you kindly sent in to fight manipulation released the Kraken in me. The Kraken is back in its cage where it belongs. The paper trail is there. The worm has turned. Even more importantly is that this fight in the $1540 gold price area was not for regaining the old high in gold. The six attempts to kill gold, supported by some gold writers looking for favors from the riggers was a now failed attempt to keep gold from trading above $3500. The battle to stop gold has been lost. The start, like all starts towards the old high and well above, should be slow with more unfolding drama. It will build on itself but gold will trade at and above $3500. I am now as certain of this as I was over ten years ago when I told you gold was headed for $1650. I knew that as fact and to me from $248 gold was trading at $1650. Keep on reading @ jsmineset.com |

| Gold Seen At USD 3,500, 6,000 and 10,000 Per Ounce Posted: 04 Jul 2012 09:52 AM PDT

from goldcore.com: Today's AM fix was USD 1617.00, EUR 1285.37 and GBP 1032.90 per ounce. Gold rose by $24.40 in New York yesterday and closed up 1.5% at $1,622.80/oz. Silver surged to as high as $28.45 and ended with a gain of nearly 3%. Gold has traded erratically overnight and this morning in Europe but is slightly lower than yesterday's close in New York. Further impetus to higher prices may come from the ECB who are expected to cut interest rates to a record low tomorrow – continuing ultra loose monetary policy which should further weaken the euro. Negative interest rates continue to penalise pensioners and savers in European countries and this will lead to further diversification into gold. Financial markets are already starting to wonder about the solidity of last week's summit measures to tackle the euro zone crisis and soon they may question whether even looser monetary policies will help prevent recessions and sovereign defaults. Keep on reading @ goldcore.com |

| Citi’s Fitzpatrick – 2 Key Markets: The Euro vs Dollar & Stocks Posted: 04 Jul 2012 09:46 AM PDT

from kingworldnews.com: Today King World News wanted to share with its global readers a portion of top Citibank analyst, Tom Fitzpatrick's latest report. Fitzpatrick, a 28 year veteran and top analyst at Citibank, which has $1.3 trillion in assets, covered the two key markets, the euro vs the dollar and stocks. Below were his comments with two important charts: Tom Fitzpatrick latest report: "EUR/USD is still trading in the recent range. The low last week was a marginal undershoot of the 76.4% Fibonacci retracement against the June 1st lows. However we have not as yet seen a break to the upside. The key level to watch is 1.2748.A close above there, if achieved, would suggest a stretch higher to the channel top and lows from Feb-April this year at 1.2975-1.30. At this stage that is NOT the bias unless and until we breach 1.2748 on a close basis. Keep on reading @ kingworldnews.com |

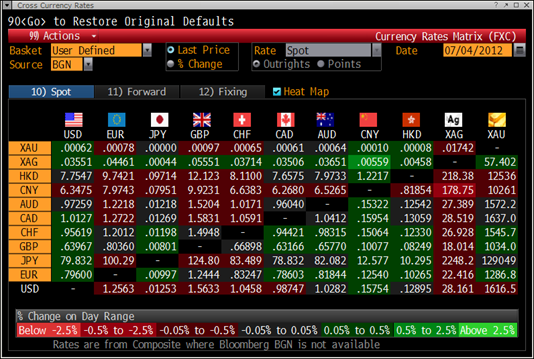

| Continuing gold and silver volatility Posted: 04 Jul 2012 09:45 AM PDT The last couple of months have been characterised by volatility in gold and silver. Below is an overview of all daily increases of more than 4% in the gold price since 2001, both in dollar and euro ... |

| John Embry – Fixes From The 70s Won’t Stop This Disaster Posted: 04 Jul 2012 09:43 AM PDT

from kingworldnews.com: Today John Embry gave King World News an extraordinary interview. Embry, who is Chief Investment Strategist of the $10 billion strong Sprott Asset Management, discussed market manipulation, the crisis today vs the 70s, inflation and where we are headed. Here is what Embry had to say: "I'm fascinated by this whole Barclays situation, in the sense that they have been accused, and have admitted as such, that they have been manipulating Libor. This actually affects about $360 trillion worth of the world's financial transactions." John Embry continues: "It's actually a shocking thing when you think about it, but I like to relate it to the gold and silver markets. These people messed around with Libor, and there's some suggestion that the Bank of England might have thought this was a good idea when things were looking particularly dark in late 2008. Keep on reading @ kingworldnews.com |

| Rule – We Are Seeing Dislocations In Many Financial Markets Posted: 04 Jul 2012 09:40 AM PDT

from kingworldnews.com: With gold up about $25 and oil trading almost $4 higher, today King World News interviewed one of the wealthiest and most street-smart pros in the business, Rick Rule. He warned that we are seeing dislocations in many financial markets. Rule, who is now part of Sprott Asset Management, also had this to say when asked about what is happening in Iran and how it is impacting markets: "I think that may be driving the gold price as well. You have a situation where the United Nations approves stronger sanctions against Iran, and apparently the sanctions that were already in place were already starting to bite." Rick Rule continues: "The Iranians have responded by announcing they had tested a surface missile which was capable of hitting Israel, and they regarded new sanctions against Iran as a security threat. There was also legislation moved in the Iranian Parliament that would call on the Iranian Navy to respond to sanctions by closing the Straits of Hormuz. Keep on reading @ kingworldnews.com |

| A Dow/Gold Ratio for Independence Day Posted: 04 Jul 2012 09:29 AM PDT Dividing the Dow Jones index of stocks by the Gold Price 80 years after its low... |

| Monetary stimulus chatter helps gold Posted: 04 Jul 2012 09:15 AM PDT US markets are of course closed today for the 4th of July, but elsewhere in the world traders are still going about their merry business. Gold and silver posted strong performances yesterday on the ... |

| Macleod - Gold Reentering Monetary System Posted: 04 Jul 2012 08:48 AM PDT Alasdair Macleod, writing for GoldMoney Foundation writes: Early in 2011, the London Bullion Market Association began to push for gold to be recognised by the Basel Committee on Banking Supervision as the ultimate high-quality liquid asset. It has been a planned approach involving the wider financial community, with the European Parliament voting unanimously to recommend that central counterparties (basically regulated settlement intermediaries for securities markets) accept gold as collateral under the European Market Infrastructure Regulation (EMIR). Lobbying by the LBMA certainly contributed to this favourable outcome. A growing acceptance of gold as collateral in regulated markets is forcing the Basel Committee to reconsider the position of gold as a banking asset, which currently has a 50% valuation haircut. It is now a racing certainty the haircut will be revised to zero, the same status as secure cash. This is an important development for the physical gold market, and early warning of the change was signalled by a consultation document issued by the Fed and banking regulators in the light of forthcoming Basel 3 regulations1. It must have stuck in the Fed's craw to have to circulate a proposal that "A bank holding company or savings and loan holding company may assign a risk-weighted asset amount of zero to cash owned and held in all offices of subsidiary depository institutions or in transit; and for gold bullion held in a subsidiary depository institution's own vaults, or held in another depository institution's vaults on an allocated basis, to the extent the gold bullion assets are offset by gold bullion liabilities."(Page 291 and elsewhere). There can be little doubt if history is any guide that the US Treasury and the Fed would rather not give gold a status that rivals the dollar, but they cannot boss the Basel Committee around. Ever since President Nixon took the dollar off the gold standard, the official mantra has been that gold no longer has any monetary role. To do an about-turn and accord it the same rank as dollar-cash is therefore extremely significant. Furthermore, there is an unarguable logic in favour of not penalising banks who wish to diversify their balance sheets and collateral away from fiat currencies, some of which are becoming increasingly risky in these times of systemic stress. The proposal is only at the stage where comments are invited, but it is unlikely that the banks will turn this proposal down, since it represents a secure lending opportunity and the opportunity to diversify a bank's own assets without facing a risk-weighting penalty. The proposal when implemented is certain to encourage banks to buy gold, and the bullion banks in London will hedge uncovered unallocated customer liabilities. And what is sauce for the commercial goose is also sauce for the central-bank gander: it makes no sense for the central banks to continue to marginalise gold on their own balance sheets. Instead, central banks should abandon the myth of valuing gold on their books at $42.22 and treat it as a proper monetary asset. What this proposal amounts to is no less than the official remonetisation of gold. And as the implications dawn upon the wider banking community we shall see increasing numbers of banks seeking gold-related lending opportunities and more and more bankers seeking to acquire it as a core balance sheet asset. 1Very few commentators fully appreciate its importance, a notable exception being the current issue of John Butler's Amphora Report, which is recommended reading. July 1, 2012 (Source: GoldMoney) Comment: For those with the time, the links in the story above are important reading. Thanks to James Turk for the link. (GA)

|

| Posted: 04 Jul 2012 08:48 AM PDT

Gold "Helped by Short Covering", ECB Considers Rate Cut, Monetary Policy "Will Push Gold Higher Next Year" WHOLESALE MARKET gold prices held steady around $1615 an ounce during Wednesday morning's London trading – 1.1% up on last week's close – while stocks edged lower and the Dollar gained, amid reports that the European Central Bank is expected to cut interest rates tomorrow. A day earlier, gold prices rallied as high as $1624 an ounce during Tuesday's US trading, the last trading day before today's Independence Day holiday. "Short covering and bargain hunting helped support the rally," says a note from Commerzbank, referring to the practice of traders who have bet on gold going lower closing their position by buying gold futures or options. Spot silver prices meantime climbed as high as $28.41 an ounce this morning – 3.2% up on the week so far – as other industrial commodities edged lower. On the currency markets, the Euro fell below $1.26. "The main focus of the week is Thursday's ECB meeting, where a rate by of 25 basis points [one quarter of a percentage point] by the ECB is expected," says a note from Swiss bullion refiner MKS. The ECB's main policy rate currently stands at a record low of 1% – though it remains higher than those of the Bank of England and the Federal Reserve. "The economic case for a 50 basis-point rate cut is pretty watertight," says Ken Wattret, chief Euro-area economist at BNP Paribas. "But for now it's easier to just cut by 25 basis points…that is enough to show you are standing ready to do something," he adds, noting that a cut in rates would benefit banks that borrowed over €1 trillion at the ECB's three-year longer term refinancing operations (LTROs) in February and December. Cutting interest rates would be "a bold move and will lead the ECB into uncharted territory" says Julian Callow, chief European economist at Barclays Capital in London. "With soaring unemployment and few signs of the economy recovering, some strong monetary medicine is needed. But let's be honest, a rate cut by itself will not end the recession, we need much more for that." The services sector of the Eurozone economy continued to contract last month, although at a slowly rate than in May, according to purchasing managers index data published Wednesday. The June Eurozone Services PMI was 47.1 – up from 46.7 in May (a figure below 50 indicates sector contraction). Germany's Services PMI meantime fell by more than expected, from 51.8 in May to 49.9 last month. Here in London, the Bank of England is also due to announce its latest policy decision on Thursday, when it is widely expected to announce at least a further £50 billion in quantitative easing asset purchases. "As everybody now expects QE the announcement effect has already happened so there will be very little negative impact [on Sterling], if any at all," reckons Adam Cole global head of FX strategy at investment bank RBC Capital Markets. Last month's UK Services PMI showed a bigger sector slowdown than most analysts were expecting, coming in at 51.3 – down from 53.3 in May. The front pages of British newspapers are dominated today by the appearance before the Treasury Committee of former Barclays chief executive Bob Diamond (available to watch live at 2pm UK time), after written evidence from Barclays included reference to a conversation between Diamond and the Bank of England's Paul Tucker. Tucker, the Bank's deputy governor for financial stability and a possible replacement for Mervyn King as governor, was one of two Bank staff members cited by the Telegraph this week as having benefited from pension pot gains in excess of £1 million over the last year, "due mainly to a fall in gilt yields". The US economy meantime will grow at 2% this year, according to revised International Monetary Fund forecasts. The IMF also cut its 2013 growth forecast yesterday, from 2.4% to 2.25%, citing the risks posed by the so-called "fiscal cliff" – the combination of spending cuts and tax rises due to come in next January unless lawmakers agree alternative policies. "It is critical to remove the uncertainty created by the 'fiscal cliff'," the IMF's report says, "as well as promptly raise the debt ceiling, pursuing a pace of deficit reduction that does not sap the economic recovery." "No country can go on with heavy and growing debt," added IMF managing director Christine Lagarde. "In order to bring the debt under control, action needs to be taken over a period of time…it needs to be gradual, not so contractionary that the economy stalls." "Americas debt/GDP [ratio] at close to 100% is not near-term threatening," says Bill Gross, founder of world's largest bond fund Pimco, in his monthly Investment Outlook. "But if continued upward on trend could be absolutely debilitating….an authentic debt crisis – which the world is now experiencing – can only be ultimately cured in two ways: 1) default on it, or 2) print more money in order to inflate it away. Both 1 and 2 are poison for bond and stock holders." Back in Europe, Deutsche Bank has cuts its gold forecast for 2012 to an average gold price of $1726 per ounce – down from the previous forecast of $1800 – with analysts citing the "holding pattern" they say has been adopted by central banks. Next year, however, Deutsche Bank forecasts gold will average $2050 per ounce – more than 25% higher than its current level. "While we question the effectiveness of [monetary policy] in sustainably supporting growth in the western world," a note from Deutsche says, "we do believe that it will have the effect of pushing up gold prices as the metal responds to the implied erosion in value of money in Dollar terms." Ben Traynor Gold value calculator | Buy gold online at live prices Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK's longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. (c) BullionVault 2011 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. |

| “QE3 Probability” Could Boost Gold, No Need for Gold Standard “Until Money Collapses Completely” Posted: 04 Jul 2012 08:43 AM PDT

SPOT MARKET gold prices traded close to $1610 an ounce for most of Tuesday morning in London, after breaking through the $1600 mark during the earlier Asian session. Silver prices touched $28 an ounce for the first time in nearly two weeks, while stocks and commodities also gained after disappointing US manufacturing data led to renewed speculation that the Federal Reserve might launch a third round of quantitative easing, known as QE3. US manufacturing activity fell last month, according to the June ISM purchasing managers index published Monday. The ISM PMI was 49.7 – down from 53.5 in May and below analysts' consensus forecast, which was around 52. A PMI score of less than 50 indicates contraction. "The dimmed economic outlook leads to expectations of more stimulus, which will weaken the Dollar and help metals," says one trader in Shanghai, adding that "silver will be relatively weaker than gold due to its industrial nature." "Over the last few weeks US numbers have worsened a lot," says Eugen Weinberg, head of commodity research at Commerzbank. "This has brought about the probability of QE3 – which is probably the most important reason for the market to believe in gold." The Federal Reserve last month chose not to launch an additional round of QE, instead extending its bond maturity extension program Operation Twist, which aims to lower longer term interest rates by selling shorter=dated securities and buying longer-dated ones. "We are unlikely to see a big add-on after Operation Twist was extended," reckons Dominic Schnider at UBS Wealth Management. "Unless things fell off the cliff. And remember, when things did fall off the cliff in 2008, gold fell as well." Sales of gold coins by the US Mint were down 40% in the first half of the year, compared to the same period last year, although June sales beat May's for the first time in three years. Over in Europe, goods prices received by producers fell 0.5% in May, according to official Eurozone producer price index data published Tuesday. "Businessmen don't like prices going down," says Lord Robert Skidelsky, professor of political economy at Warwick University, speaking on BBC Radio 4 Monday on a program looking at whether a gold standard would make the financial system more stable. "It means they produce at one price and then may have to sell at a lower price…they prefer prices to be going up [because] they reckon their profits as a markup of their costs." Skidelsky adds that "although [western economies have] been printing money, it hasn't been too much money". The time to worry, says Skidelsky, is when prices "accelerate and the value of money collapses completely…then of course you go back to gold". Here in London, Bob Diamond has resigned as Barclays chief executive. Diamond has been under pressure since Barclays was fined a record £290 million last week, after the bank admitted some of its staff had sought to manipulate Libor, the London interbank offered rate used as a worldwide benchmark. Marcus Agius, who resigned as Barclays chairman on Sunday, will now return to lead the hunt for Diamond's successor. Over in Asia, traders report that the rise in gold prices since the weekend has led to a fall in demand for physical bullion. "Customers went in to pick up gold below $1560 last week, but now the market is quiet again," one dealer in Singapore told newswire Reuters Tuesday. Ben Traynor Gold value calculator | Buy gold online at live prices Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK's longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. (c) BullionVault 2011 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. |

| Why This Is The Only Long-Term Safe Haven For Me Posted: 04 Jul 2012 08:11 AM PDT By Shaun Connell: Here in America, it's Independence Day, so it's only fitting that I write about the one type of money and asset that is truly independent of governments. Gold has value, and it doesn't need the government to "incorporate" or "guarantee" it. Gold has value because of its own free market properties, not because of artificial demand cooked up by the government. But on to the point of this article. A couple of days ago, I responded to an article by fellow SAer Skyler Greene. In the article, he basically missed the point of gold completely, suggesting that it was a bad inflation hedge -- or the "worst ever". This was fascinatingly wrong on such a fundamental level, I simply had to respond by explaining why gold's attackers were wrong. Then, Skyler wrote up another article essentially "refuting" my argument. In his article, he, unfortunately, ignored almost everything I said about Complete Story » |

| The Christmas Gift Portfolio - Core Holdings On Sale Now Posted: 04 Jul 2012 07:36 AM PDT By Skyler Greene: The second quarter ended with a quite nice day for the market, and we're now into the last two quarters of 2012. Will it all collapse on our heads as the Mayan predicted, or is this the time to load up for a year-end rally? The great Joe Springer and I decided to have a friendly little paper portfolio competition through the end of the year. The premise, as explained by Joe:

Complete Story » |

| John Embry: Fixes From the 1970s Won't Stop This Disaster Posted: 04 Jul 2012 05:25 AM PDT ¤ Yesterday in Gold and SilverThe low price for gold [around $1,595 spot] during the Tuesday trading session came around 9:00 a.m Hong Kong time...and from there the price never looked back. It traded pretty flat during the first four hours of the London market, but shortly after 12 o'clock noon BST, gold began to rally anew...with the high tick of the day [$1,623.10 spot] coming about 11:45 a.m. in New York. From there it got sold off for the rest of the day...and closed at $1,616.70 spot...up $19.80. Net volume was pretty light at around 97,000 contracts...as I'm sure traders were heading out the door early. Silver's price path was very similar to gold's...with the low price and the high tick of the day [$28.51 spot] coming the same time as gold's as well. From that high, silver got sold off 22 cents going into the close of electronic trading, ending the Tuesday session at $28.29 spot...up 77 cents on the day. Net volume was decent at around 30,000 contracts. The dollar index didn't do much in Far East trading...but put on a bit of a rally starting early in London...and reaching its zenith [82.02] by 8:30 a.m. in New York. From there it sold of to its low of the day, which was around 81.71...just before noon Eastern time. From there it rose a hair and then traded sideways for the rest of Tuesday...closing around 81.80...down less than 10 basis points from its Monday close. The low tick for the dollar index matched the high tick in the gold and silver price almost precisely...but the currency price movements certainly don't explain the fact that gold was in rally mode while the dollar index did very little during Far East and early London trading. The gold stocks gapped up a bit over two percent at the open...and then tacked on another percent and change in pretty short order. With New York closing early, the HUI closed on its high tick of the day...up 3.61%. Except for Pan American Silver once again, it was all green arrows in the silver equities yesterday, with a couple of junior producers up double digits. Nick Laird's Silver Sentiment Index closed up 4.10%...but a lot of the silver stocks did much better than that. (Click on image to enlarge) The CME's Daily Delivery Report showed that 12 gold and 301 silver contracts were posted for delivery on Friday. In silver, the big short/issuer was Jefferies with 300 contracts...and the two biggest long/stoppers were JPMorgan with 195 contracts...and the Bank of Nova Scotia with 103 contracts. As of the CME's preliminary report early this morning, there are still 2,277 silver contracts still open for July...minus the 301 that will be delivered on Friday. There were no reported changes in either GLD or SLV...and no sales report from the U.S. Mint, either. We finally have another report from the gold and silver ETFs over at Switzerland's Zürcher Kantonalbank. Between June 21st and July 2nd, they reported that 80,595 troy ounces of gold and 88,093 troy ounces of silver were added. The Comex-approved depositories reported receiving 597,282 troy ounces of silver on Monday...and shipped a smallish 26,586 ounces of the stuff out the door. The link to that action is here. John Paulson on Gold: "We view gold as a currency, not a commodity," Paulson says. "Its importance as a currency will continue to increase as the major central banks around the world continue to print money." He added that as the market keeps shuddering, demand for gold will stay high, and soon enough all of his depressed gold holdings should shoot up. He also thinks that "anyone in Greece, Italy, and France should pull all their money out of the banking system and purchase gold bars before the Continent collapses." … John Paulson, the founder of Paulson & Co., one of the world's largest hedge funds, in Business Week on June 28, 2012 [Courtesy of reader U.D.] Reader Scott Pluschau has posted a blog on his website about gold. This one is headlined "Gold once again approaching a major multipoint trend line". The link is here. With the fourth of July holiday upon us, there wasn't much in the way of news stories to report yesterday, so I hope you can find the time to at least skim the cut and paste portions of the ones I've selected. It's impossible to tell whether the quiet advances by all four precious metals on Tuesday was short covering, or new speculative longs being placed. James Turk: Why mine production has little influence on the gold price. Rick Rule: We are seeing dislocations in many financial markets. John Paulson: "We view gold as a currency, not a commodity." ¤ Critical ReadsSubscribeJPMorgan Probed Over Potential Power-Market ManipulationJPMorgan Chase & Co. is being investigated over potential power-market manipulation that inflated payments for electricity, according to the U.S. Federal Energy Regulatory Commission. The FERC, which has pledged to combat manipulation of prices, began its probe after reports last year of bidding practices by JPMorgan that the California and Midwest grid operators deemed to be abusive, according to documents provided by the Washington-based agency. "Three of the bidding techniques had together resulted in at least $73 million in improper payments," the agency said in documents filed yesterday, citing estimates by the two system operators. So, what else is new? This Bloomberg story was sent to me by Scott Pluschau who discovered it shortly after it was posted on their website late yesterday morning Eastern time. The link is here.  Government Motors: As GM shares near record low, taxpayer loss on bailout rises to $35 billionTo quote Lando Calrissian..."this deal is getting worse all the time." General Motors shares fell to a fresh 2012 closing low of 19.57 on Monday. The stock hit 19 in mid-December, the lowest since the auto giant came public at $33 in November 2010 following its June 2009 bankruptcy. This investors.com story from yesterday is Scott Pluschau's second contribution in a row to today's column...and the link is here.  Barclays Nukes The Bank of England, and Basically Accuses it of Being Behind Their Interest Rate Manipulation[Yesterday] morning, British investment bank Barclays announced that its CEO Bob Diamond would immediately resign in the wake of a massive fine over manipulating interest rates a few years ago. Specifically, Barclays has been accused of submitting false numbers about the rate at which it was borrowing money, skewing LIBOR (which is an index measuring the rate at which banks borrow money). Diamond will be at a government hearing tomorrow, and in preparation for that, Barclays has submitted a stunning letter to the government, basically accusing the Bank of England of being the real conspirator behind the interest rate manipulation scheme. This businessinsider.com story was posted on their website midmorning Eastern time yesterday...and I thank Roy Stephens for his first offering of the day. The link is here.  The Bank of England told us to do it, claims BarclaysA memo published by Barclays suggested that Paul Tucker gave a hint to Bob Diamond, the bank's chief executive, in 2008 that the rate it was claiming to be paying to borrow money from other banks could be lowered. His suggestion followed questions from "senior figures within Whitehall" about why Barclays was having to pay so much interest on its borrowings, the memo states. Barclays and other banks have been accused of artificially manipulating the Libor rate, which is used to set the borrowing costs for millions of consumers, businesses and investors, by falsely stating how much they were paying to borrow money. The bank claimed yesterday that one of its most senior executives cut the Libor rate only at the height of the credit crisis after intervention from the Bank of England. This story showed up on the telegraph.co.uk Internet site last night...and is Roy's second offering in today's column. The link is here.  Why is Nobody Freaking Out About the LIBOR Banking Scandal? - Matt TaibbiThe LIBOR manipulation story has exploded into a major scandal overseas. The CEO of Barclays, Bob Diamond, has resigned in disgrace; his was the first of what will undoubtedly be many major banks to walk the regulatory plank for fixing the interbank exchange rate. The Labor party is demanding a sweeping criminal investigation. Mervyn King, Governor of the Bank of England, responded the way a real public official should (i.e. not like Ben Bernanke), blasting the banks: It's time to do something about the banking system…Many people in the banking industry are hardworking and feel badly let down by some of their colleagues and leaders. It goes to the culture and the structure of banks: the excessive compensation, the shoddy treatment of customers, the deceitful manipulation of a key interest rate, and today, news of yet another mis-selling scandal. The furor is over revelations that Barclays, the Royal Bank of Scotland, and other banks were monkeying with at least $10 trillion in loans (The Wall Street Journal is calculating that LIBOR affects $800 trillion worth of contracts). Matt Taibbi, in his usual pithy prose, tees this story up and drives it down the fairway. It's a fairly longish blog, but well worth your time if you have it. It is, of course, posted on the Rolling Stone website...and I thank Roy Stephens once again for sending it along. The link is here.  Better Off Outside? Euro Crisis Fuels Debate on British EU ReferendumThe British seem to have a taste for referendums at the moment. Next year, the inhabitants of the Falkland Islands will vote on their status as a British overseas territory. Then, in 2014, the Scottish government will hold a referendum on independence from the United Kingdom. Now it looks like there could be another nationwide referendum after that -- on Britain's membership of the European Union. The pressure from euroskeptics puts Cameron, who does not want to be rushed into holding a vote, in a tricky situation. In a speech to parliament on Monday on the outcome of last week's EU summit, the prime minister said that although he is not in favor of an immediate referendum on EU membership, he does not want to rule one out for the future. He insisted that the "status quo" was unacceptable in any case. If the euro zone grows ever closer together into a political union, it will change Britain's relationship with the EU, Cameron said. This Roy Stephens offering was posted on the German website spiegel.de yesterday...and the link is here.  Row Over Euro Policy: German Party Leader Threatens To Axe CoalitionBavarian governor Horst Seehofer, the leader of the conservative Christian Social Union party (CSU) which is part of Chancellor Angela Merkel's center-right federal government coalition, has criticized the outcome of last week's European Union summit and threatened to let the government collapse if Berlin makes any further financial concessions to ailing euro member states. "The time will come when the Bavarian government and the CSU can no longer say yes. And I wouldn't then be able to support that personally either," Seehofer said in an interview with Stern magazine released on Tuesday. "And the coalition has no majority without the CSU's seats." The CSU is the Bavarian sister party to Merkel's Christian Democratic Union. This is the second story in a row from the German website spiegel.de...and I thank reader Marshall Angeles for sending it. The link is here.  |

| Why mine production has little influence on the gold price Posted: 04 Jul 2012 05:25 AM PDT  GoldMoney founder and GATA consultant James Turk interviewed financial writer Robert Blumen about a crucial difference gold has from commodities -- that it is produced for hoarding as money and is not consumed...and that nearly all gold ever produced remains available to the market. As a result annual gold production from mines has relatively little influence on the metal's price. The interview is 20 minutes long and it's posted in audio format at the GoldMoney.com Internet site...and the link is here. |

| Turd: LIBOR is Manipulated, and Silver Isn't? Posted: 04 Jul 2012 05:14 AM PDT The Doc sat down with Turd Ferguson of TFMetalsReport Monday for an exclusive interview regarding gold & silver and the massive exodus of physical metal from the system. from silverdoctors: Part One Part Two In this explosive interview focusing on the metals, The Doc & TF discussed the massive reduction in the cartel's net short position in silver, the LIBOR manipulation scandal, the new downturn in the US, the manipulation of ALL markets, and physical supply issues with gold and silver. ~TVR |

| Gerald Celente talks with Greg Hunter Posted: 04 Jul 2012 05:13 AM PDT Gerald Celente is the publisher of the Trends Journal. He is a renowned forecaster. from usawatchdog: He has a history of spotting trends and predicting future events such as the fall of the Berlin Wall and the financial meltdown of 2008 long before they occurred. Celente is spotting new trends, and things do not look good. Gerald Celente thinks, "The banks are taking over the world." That's what is really happening in Europe with the sovereign debt crisis. Celente says, "America has already turned into pre-World War II Germany," and "A war with Iran will be the beginning of World War III." Celente lost money in the MF Global bankruptcy and says the lesson learned is "You don't own your money unless you have it in your possession." Greg Hunter of USAWatchdog.com goes "One-on-One with Gerald Celente." ~TVR |

| Gold and Silver Crossword Puzzle Posted: 04 Jul 2012 04:55 AM PDT I tried, but it won't copy due to scripts etc. Go to the source page Gold and Silver Crossword Gold has proven to be the right investment for the times. But, how much do you know about gold and silver? Test your knowledge of gold and the gold market with this crossword puzzle. http://lewrockwell.com/rep3/crossword2.1.1.html |

| New Swiss storage option for GoldMoney customers Posted: 04 Jul 2012 01:00 AM PDT New Swiss storage option for GoldMoney customers London, 4 July 2012 - GoldMoney, the world's leading provider of gold, silver, platinum and palladium for retail and corporate investors, ... |

| Links for 2012-07-03 [del.icio.us] Posted: 04 Jul 2012 12:00 AM PDT

|

| The Question China Has To Answer Fast to Save it’s Economy Posted: 03 Jul 2012 11:06 PM PDT Dan Denning wrote on Monday in his article on the Australian share market that there is a brutal one-two punch combo coming towards the average portfolio this year. The first swing is the European credit crisis affecting the Australian banks. The second bit of biffo is the Australian resources sector falling because of China's economy. We'll take it for granted you've had your fill of the European debacle. It's been a constant story for weeks. So today we'd like to follow up on the idea of a China punch coming our way. To do that, we're going to call upon your regular Daily Reckoning editor Greg Canavan. But first! It might sound strange to even question the Chinese growth story at all. Although a recent Chinese manufacturing survey revealed a decline for the eighth month in a row, HSBC chief economist Hongbin Qu said positively (as probably only an economist can):

That's economist-speak to say the economy isn't going so flash, but the government will pump some more money in to ramp it back up again, so it's all good. Underlying this is the idea that the government can manipulate the whole shebang. But there doesn't seem to be much evidence that the last massive economic stimulus produced any benefit. In fact, it's probably completely the opposite. As the Financial Times reported a few days ago:

So, it appears that China's economy has dug a hole for itself. The question is, can it get out? To try to answer that question, we sat down with Sound Money. Sound Investments' editor Greg Canavan. He has been researching the Chinese economy deeply over the last year. In October 2011, he warned his subscribers about the coming China slowdown, and recommended avoiding the resource sector. Q: In your last report on China, back in March, you mentioned how the Chinese Communist Party puts 'people before profits'. What did you mean by this? China's economic growth is politically motivated. The Communist Party's mantra is social stability. It's this stability that allows them to retain their grip on power. It's what allows them to live a very privileged existence. To maintain stability, 'The Party' must provide jobs. An employed and well-fed populace won't take to the streets demanding change. So employment is the main focus for China's leadership…even if employment comes at the expense of profits. And this is exactly what is happening in China's economy now. They're pumping billions of dollars into uneconomic projects purely to maintain short term stability, but it's causing major long term distortions. Much of China's growth is fake. They're practising a retarded form of capitalism. Putting people before profits only works in the short run. In the long run, it catches up with you. The long run has arrived in China. Q: Economists and Western media expect China to increase their stimulus efforts…and that this will avoid a hard landing. Do you think this is possible? China's trying to rebalance its economy from investment to consumption. More stimulus will not help with this transition. It will only exacerbate the imbalances. So lower interest rates or reserve requirements or whatever might help in the short term, but they won't help China to make the transition that China desperately wants to make. They know ever greater imbalances will only foment social instability down the track…which is a threat to their grip on power. They know the old growth model is dead. They're just not sure how to make the transition. And if you look at the long term performance of the Shanghai Stock Exchange, you'll see that investors are not holding out too much hope for stimulus to be very effective. The index is in an obvious downtrend. This chart goes a long way toward explaining why the Aussie market has performed so poorly in recent years.

|

| Posted: 03 Jul 2012 11:06 PM PDT |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment