Gold World News Flash |

- Rick Rule: Epic Collapse in Confidence Coming ? Here?s How to Protect Yourself

- Extreme Danger Signposts

- Profitable Trade Direction Now Too Close to Call

- Gold Now Flat on a Year Ago

- Economic Countdown To The Olympics 2: Predicting Olympic Medals

- By the Numbers for the Week Ending July 13

- Gold & Stock Markets Rally, But Troubles Continue in Europe

- Guest Post: Are Treasuries The Worst Investment In The World?

- Gold in Massive Accumulation Mode Leading Up to a Massive Move to the Upside

- Gold Daily and Silver Weekly Charts – Up Again, Up Again, Jiggity Jig

- Fallacies – 1. Paper Gold is just like Paper Anything

- Gold Price Up $26.70 Today and $13.20 Higher for the Week Expect Higher Gold Prices Next Week

- Mining Equity Bargains Abound, But Buy with Care: Ivan Lo

- PM Summer Doldrums 4

- Low Volume Squeeze Takes Stocks To Green On Week

- Gold Seeker Weekly Wrap-Up: Gold and Silver End Slightly Higher on the Week

- Does Central-Bank Gold-Buying Signal the Top Is Near?

- Gold Daily and Silver Weekly Charts - Up Again, Up Again, Jiggity Jig

- Gold and Silver Disaggregated COT Report (DCOT) for July 13

- Smooth Criminals & Bad Arguments

- Too Close to Call

- COT Gold, Silver and US Dollar Index Report - July 13, 2012

- Deflation or Inflation? Answer: Yes

- Trust in gold paper will collapse and the gold rush will be on, von Greyerz says

- The Truth In Gold Is Leaking Out

- The Next Major Move in Precious Metals Is Close

- The making of a housing market – like a Hollywood set, housing inventory looks to be low only because that is what is being pres

- Betting On Mining Stocks' Higher Prices May Not Be Such A Good Idea

- Lawrence Williams: LIBOR Scandal Brings Gold Price Manipulation Once More to the Fore

- LGMR: Gold Rises But "Keeps Bearish Bias" as Beijing Investment Bucks China Slowdown

| Rick Rule: Epic Collapse in Confidence Coming ? Here?s How to Protect Yourself Posted: 14 Jul 2012 01:11 AM PDT When the public, and in particular the savings public at large, comes to understand that quantitative easing is actually counterfeiting…you will begin to see confidence cave and the collapse in confidence will be epic. That's what has me nervous. [Here is how to detect when confidence is about to cave and how to protect oneself in such an eventuality.] [To determine that such] a collapse in confidence [is upon us]: [LIST] [*]look for immediate signs of structural stress – very, very short-term credits between banks drying up….[and]*short-term or overnight lending rates going up, [*]look for peripheral assets, things like junk debt, emerging market debt, emerging market equity prices, to decline sharply as the leveraged players at big banks and brokerage firms shut down their trading books as a response to the decline in availability of short-term credits. [/LIST] The above*are certainly the signs that occurred in 2008, and I think that's the best analogue we ... |

| Posted: 14 Jul 2012 01:00 AM PDT by Jim Willie, Gold Seek:

|

| Profitable Trade Direction Now Too Close to Call Posted: 14 Jul 2012 12:17 AM PDT |

| Posted: 13 Jul 2012 11:54 PM PDT |

| Economic Countdown To The Olympics 2: Predicting Olympic Medals Posted: 13 Jul 2012 08:36 PM PDT In the second part of our five-part series on The Olympics (Part 1 here) we ponder the impossible to predict - the medal count. As Goldman notes: Economists like to think that the toolkit of their profession helps them explain many things or, as some would claim, everything that is interesting about human behavior. In the context of the forthcoming Olympic Games in London, therefore, the key question is whether economic variables can help explain and predict success at the Olympics itself. At one level, this seems like a daft question even to consider. It is hard to imagine that economic variables could even begin to capture the kind of individual skill, mental determination and hunger that drive athletes to perform feats of unimaginable virtuosity that is the stuff of Olympic legends. But at the level of a country, it may be possible to identify the ingredients that unlock success at the Games. As British Paralympian Tim Hollingsworth explains: "...when you create a world class environment you are far more likely to create world class athletes." What is a 'world class environment' and how do we measure it across countries? Luckily, we have an answer in the GS Growth Environment Scores (GES), a broad measure of growth conditions across countries - and, indeed, this is what we find: gold does go where the growth environment is superior. The forecast leaves USA, China, and Great Britain battling it out for 'Most Golds' and USA leading China overall - but remember "the most important thing in the Olympic Games is not winning but taking part." Jose Ursua and Kamakshya Trivedi, Goldman Sachs: Gold Goes Where Growth Environment Is Best—Using Our GES to Predict Olympic Medals Let's Predict Olympic Success in London 2012 One of the 'fun' parts of building econometric models is that if they are reasonably good at explaining the past, they can then be used to forecast the future. In this case, we want to predict the eventual country medals tallies at London 2012. Not all sports are created equal, and the relationship between Olympic success and the economic variables we have discussed may differ across sports for a number of reasons. It is more expensive to participate in some sports, such as Sailing or Equestrianism, and this may limit participation from low-income countries, but success may also vary on account of different traditions, culture and the demographic characteristics of the population or the geographic features of each country. The baseline model that we use to do this is a panel regression featuring as explanatory variables our headline GES, a host dummy, population and lagged medal attainment. As a starting point, note that the model does fairly well at explaining medal outcomes from previous Olympics, or that it works well in what economists call 'in sample'.

Chart 2 above shows the 'in sample' results, where we compare what the model would have predicted in the past four Olympic Games (which is as far back as our GES extend) versus what actually happened in terms of medal attainment. The 45° degree line represents a perfect forecast, and the fact that our scatter shows a high concentration of points around that line makes us quite confident that our model can satisfactorily predict Olympic success. We are now finally ready to unveil our predictions for London 2012. Table 3 (below) shows our forecasts for medals in London 2012—gold on the left-hand side, and total number of medals on the right-hand side. In each case, we also show each country's medal attainment in Beijing 2008, and the difference between the 2012 forecasts and the latter (a positive number means we expect the country to win more medals in 2012 than were attained in 2008). Our forecasts reflect two very clear patterns revealed in our analysis. First, countries with superior growth environments and higher incomes are expected to win more medals, and, second, there is also a marked host effect that will likely bump up the number of medals attained by Great Britain (11 more gold medals, and 18 more overall). The US is expected to lead the group, with something close to 36 gold medals and 110 overall. Our estimates also predict that the top 10 ranks will include five G7 countries (the US, Great Britain, France, Germany and Italy), two BRICs (China and Russia), one N11 country (South Korea), and one additional developed and emerging market (Australia and Ukraine, respectively). Based on our analysis, these 10 countries will likely capture more than half of all medals attained during the Games. The rest of the countries in the list are a diverse mix from various parts of the world, broadly led by Europeans and including Asian, Latin American and African nations. So, ultimately, it appears that gold does go where growth and the overall growth environment are best. For the next few weeks, our forecasts will be competing against other predictions for validation in the real world. Like many people around the world—economists and noneconomists alike—we will be eagerly following the medal outcomes of the long-awaited London 2012 Olympics. As Coubertin himself said, "the most important thing in the Olympic Games is not winning but taking part." We believe the same applies to our forecasts, and although we would be delighted to see them hit their targets perfectly, we will have succeeded as long as they have provided some food for thought. The die is cast—enjoy the Games! |

| By the Numbers for the Week Ending July 13 Posted: 13 Jul 2012 08:32 PM PDT |

| Gold & Stock Markets Rally, But Troubles Continue in Europe Posted: 13 Jul 2012 08:00 PM PDT from KingWorldNews:

"This was a significant announcement coming out of Spain. They also announced VAT increases, and sharply cut social security type payments. The VAT increase is over 1% of GDP. It's a rise in the VAT tax from 18% to 21%. Spain is already in a depression and this just adds to the downward bias. This takes additional growth away, it's counter-cyclical. |

| Guest Post: Are Treasuries The Worst Investment In The World? Posted: 13 Jul 2012 07:12 PM PDT Submitted by John Aziz of Azizonomics, I admit the headline is a little sensationalistic, but after Wednesday's WTF bond auction, I feel like slapping the market around the face with a rotten fish. Now certainly there are plenty of penny stocks headed to greater losses far sooner. And certainly, lots of people have made good profits on Treasuries by buying them and flipping them to a greater fool or a central bank. On the other hand, so did many during the NASDAQ bubble, or during the '00s ABS bubble. Bubbles are profitable for some, and that's why there have been so many throughout history. But once the money starts to dry up they become excruciatingly painful. Treasury yields are just going lower: After a 30-year bull market, you'd think that the financial media might have cottoned onto the idea that there is little scope left for real gains, either by holding bonds to maturity (inflation is outrunning yields) and even by flipping it off to a greater fool (or the greatest fool of all — the central bank). In theory, there are no limits to how low rates could go. In theory, nominal yields could go deeply negative, so long as there are buyers coming into the market ready to buy at a lower rate, and a push a profit to bond flippers. In reality, even Japan — a nation that has adopted desperate measures including forcing financial institutions to buy treasuries to keep rates depressed — has not managed to push nominal rates below zero. The scope for great profits from flipping bonds seems to be evaporating. And in any case, the latter case of flipping bonds to a greater fool or the central bank balance sheet is a classic characteristic of a bubble. The inherent value in a bond is its yield; everything else is speculation. In the classic bubble mentality, more and more financial media — hastened on by the prospect of deflation (something which the Fed is absolutely obsessed with preventing, and is prepared to print an unlimited amount of money to do so) — are calling Treasuries something that you can't afford to not own. The reality, though, is that even recent years treasuries have not really been a good investment. Bond prices may have gone up, but they've been eclipsed by a harder kind of asset — gold: Indeed, the real bull market in bonds ended in the '90s. It's not just that bond bulls are running out of steam; next to gold bulls they have made a relative loss. Here's what I call the gold-denominated real interest rate (or the "real real interest rate") on the 10-year treasury — rates minus the percent change in the gold price: While the bond flippers have done well (just as the NASDAQ-era bubble merchants did well flipping Pets.com to a greater fool), whoever is holding bonds to maturity is gradually pouring purchasing power down the drain. And that is the problem; the only way that the bond flippers can get their pound of flesh is for the Fed to print a whole swathe of money and buy the flippers flip-offed bonds. And however depressed the economy is, printing money to absorb treasuries is hazardous to the currency, and irritating to the largest treasury holders — who America happens to import a lot of goods and oil from — who hold treasuries to maturity instead of flipping them off. A trade war between America and her creditors seems inevitable and the bond flippers on Wall Street may end up being dragged under the bus by such an event — perhaps getting paid off in a heavily devalued dollar and losing their shirt on a bond-flipping trade where they initially only stood to make a sliver of a percent gain on their stake (made even riskier by concentrated ZIRP leverage). It is hard to really call the timing on the end of a bubble. People and events can always get more irrational. Japan has kept the Treasury ball (painfully) rolling for far longer than most of us expected (through market rigging as much as anything else). But this cannot end well. |

| Gold in Massive Accumulation Mode Leading Up to a Massive Move to the Upside Posted: 13 Jul 2012 07:04 PM PDT What we have been witnessing in gold is massive accumulation on the price chart, or what some would refer to as 'base-building.' Before any market can experience a strong, trending move to the upside, it generally has to have a period of base-building….At some point gold will have a trigger, and when it does you are going to see gold move to the upside….When gold finally breaks out to the upside from this strong, steady base, it will experience a massive move to the upside. So says Dan Norcini in edited excerpts from his most recent interview with Eric King of King World News brought to you by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds). This paragraph must be included in any article re-posting to avoid copyright infringement. [INDENT] Take Note: [LIST] [*] Go [COLOR=#ff0000]here to receive Your Daily Intelligence Report with links to the latest articles... |

| Gold Daily and Silver Weekly Charts – Up Again, Up Again, Jiggity Jig Posted: 13 Jul 2012 06:45 PM PDT from Jesse's Café Américain:

I would not mind fast forwarding a few hundred years to see what the future makes of this episode in human history. Will it be a great turning point, a high moment, as we might like to think, full of sound and fury? Or are we just a comedic footnote, an frivolous episode in life, with very little that is lasting or even new? |

| Fallacies – 1. Paper Gold is just like Paper Anything Posted: 13 Jul 2012 06:19 PM PDT |

| Gold Price Up $26.70 Today and $13.20 Higher for the Week Expect Higher Gold Prices Next Week Posted: 13 Jul 2012 04:22 PM PDT Gold Price Close Today : 1,591.60 Gold Price Close 6-Jul : 1,578.40 Change : 13.20 or 0.8% Silver Price Close Today : 2734.4 Silver Price Close 6-Jul : 2688.9 Change : 45.50 or 1.7% Gold Silver Ratio Today : 58.207 Gold Silver Ratio 6-Jul : 58.701 Change : -0.49 or -0.8% Silver Gold Ratio : 0.01718 Silver Gold Ratio 6-Jul : 0.01704 Change : 0.00014 or 0.8% Dow in Gold Dollars : $ 165.95 Dow in Gold Dollars 6-Jul : $ 166.56 Change : $ (0.61) or -0.4% Dow in Gold Ounces : 8.028 Dow in Gold Ounces 6-Jul : 8.057 Change : -0.03 or -0.4% Dow in Silver Ounces : 467.27 Dow in Silver Ounces 6-Jul : 472.97 Change : -5.69 or -1.2% Dow Industrial : 12,777.09 Dow Industrial 6-Jul : 12,717.60 Change : 59.49 or 0.5% S&P 500 : 1,356.28 S&P 500 6-Jul : 1,348.79 Change : 7.49 or 0.6% US Dollar Index : 83.384 US Dollar Index 6-Jul : 83.410 Change : -0.026 or 0.0% Platinum Price Close Today : 1,432.50 Platinum Price Close 6-Jul : 1,446.80 Change : -14.30 or -1.0% Palladium Price Close Today : 584.50 Palladium Price Close 6-Jul : 578.85 Change : 5.65 or 1.0% The GOLD PRICE followed up on silver's two non-confirming up days -- and the touch yesterday on the even-sided triangle's bottom boundary -- with a 1.7% ($26.70) rise today, closing Comex at $1,591.60. Ain't that just like summertime? For all the markets' turmoil this week, Friday landed about the same place Monday started. Oh, silver and gold did confirm the stout hardihood of their earlier lows. Today's leap took the GOLD PRICE to its 50 DMA ($1,591.21) and above its 20 DMA ($1,590.53). It will shoot quickly toward the upper boundary, today around $1,620, but without strongly piercing that line, will fall back again toward the bottom boundary. This is typical summer doldrums base building. MACD and RSI have both turned up. Expect higher gold prices next week, but be patient. Buy the declines. The SILVER PRICE, too, labors in a triangle formation, but a falling wedge. Today it hit the upper boundary of that wedge, but even if it breaks through, the upper boundary of a larger decline triangle that encloses it awaits with resistance about 2800c. SILVER gained 20.8c today to end at 2734.4c. Well I know that it runs contrary to human nature to buy when there's blood in the streets, but few nervy acts pay off so richly. Most folks, however, wait to buy until a market is making new highs. Right now, silver is still bloodied. Ned Schmidt always says that gold's best friends are central banks. This week the European Central bank is boosting gold's price with its new zero percent deposit rates, which is pushing interest rates into negative territory for all investors. For countries not yet beset by crisis, yields and repo rates are below zero, while bank to bank Euribor rates are in freefall, according to a Reuters report. Last week the ECB cut its main refinancing rate to 0.75% and its overnight deposit rate -- what it pays to banks for parking cash overnight -- to zero. Yep, zilch. Gold is as sensitive to interest rates as blonde Swedes are to sunburn. After all, holding gold means you must give up whatever interest you might otherwise earn on the funds. So ponder the cul-de-sac the poor central banking sociopaths have worked themselves into with their political economics: they stupidly maintain, maybe even believe, that forcing interest rates lower against the market's tendency will stimulate the economy. Of course, this is hilariously wrong, and only guarantees more capital will be misdirected and squandered, but let that alone for a minute. By keeping rates low, central bank felons increase the public's incentive to buy and hold gold, because they decrease the opportunity cost of holding it. Don't you feel sorry for the poor criminals, felons, and miscreants? They're like con-men defrauding a gullible old lady. Once they steal all her money, they're out of a job! Their victory guarantees their defeat. The dollar index fell from its marginal new high yesterday, tumbling 37.3 basis points (0.48%) to 83.334. Y'all stifle your jubilation there -- Dollar's trend remains skyward until/unless it closes below 81.52, the last intraday low. If the dollar can come back and beat that 83.50 high, then its upside target becomes 88.70. Hard for me to imagine the Fed felons allowing a rise that high. They want stability, and don't want to see the dollar making outsized gains against the yen or the euro. Yen is reaching for its 200 day moving average at 126.76. Closed today at 126.25 cents/100 yen (Y79.21/US$1), up 0.14%. Last time it touched the 200 DMA, it collapsed. No reason to presume it's any stronger this time. Euro managed to close higher -- 0.41% -- at $1.2249. Wow. That takes it up almost to the last low ($1.2288). Italy's debt was downgraded two steps today. Yeah, sure, everything's just hunky-dory in Euroland. Emperor's wearing a fine new birthday-suit. Stocks broke out in a regular love fest today, driven maybe by low European interest rates. Rally carried to 12,785, somewhere in the direction of Tuesday's 12,830 high. Dow revived its hopes by closing 12,777.098, up 1.62% or 203.82, above its 20 DMA (12,718). Dow has formed a bearish rising wedge, foretelling lower prices soon. S&P500 gained 1.65% (22.02) to close at 1,356.28. Upper limit of this move is 1,380. Riddlesome remains the Dow in Gold Dollars. It has formed a diamond topping pattern. A break below G$163.30 (7.900 oz) should drop like your wedding ring down the kitchen sink drain. However, diamonds are frustrating and slow to unfold. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Mining Equity Bargains Abound, But Buy with Care: Ivan Lo Posted: 13 Jul 2012 03:04 PM PDT The Gold Report: Your newsletter, The Equedia Weekly Letter, talks mainly about Canadian companies you actively own. Why did you begin writing this newsletter and how do you choose the companies you invest in? Ivan Lo: I've always been interested in the capital markets because they are the source of the world's growth. Without them there wouldn't be Google, Microsoft or Apple. My father was editor-in-chief of a prominent global newspaper, so I guess that's where I combined the two ideas. There are some extremely able men in our industry and I get to have some great discussions about investment philosophies, strategies and market outlook. We often trade ideas and go through what works and what doesn't. These brilliant men don't think like the average person; their thought processes are often beyond that of the average investor. That's how The Equedia Weekly Letter got started. I wanted to bridge that gap and turn complicated investment philosophies into something simple that everyone... |

| Posted: 13 Jul 2012 02:45 PM PDT |

| Low Volume Squeeze Takes Stocks To Green On Week Posted: 13 Jul 2012 02:26 PM PDT S&P 500 e-mini futures (ES) traded up to almost perfectly recapture their 415ET close from last Friday after a 15-point, 30-minute ramp out of the gates at the US day-session open recouped five days of losses - as once again - we go nowhere quickly. Just for clarity: China GDP disappointed and provided no signal for massive stimulus; JPM announced bigger than expected losses, cheating on CDS marks, and exposed just how large their CIO was relative to income; Consumer sentiment printed at its worst this year; and QE-crimping inflation printed hotter than expectations - and we get a more-than-30 point rally in the S&P. Whether the fuel was JPM squeeze or another big European bank biting the liquidity dust and repatriating cajillions of EUR to cover costs (or Austria needing some cash for a debt payment), what was clear was equity market's outperformance of every other asset class - with the late day surge for a green weekly close particularly noteworthy. Apart from unch on the week, ES also managed to close right at its 50DMA, revert up to credit's more sanguine behavior intra-week, and up to VIX's relative outpeformance on the week (as VIX ended the week with its steepest term-structure in over 4 months). Treasuries ended the week 6-9bps lower in yield at the long-end (2-3bps at the short end) but the USD's plunge, on the absolute rampfest in EURUSD, took it back to unch for the week. Despite the USD unch-ness, Oil and Copper surged (on the day to help the week) up 2.5-3% on the week while even Gold and Silver managed a high beta performance ending the week up around 0.5%. ES ended the day notably rich to broad risk assets - and wil need some more weakness in TSYs and carry crosses to extend this - for now, the steepness of the volatility slope, velocity of squeeze, and richness of stocks to risk makes us a little nervous carrying longs here. Credit markets have been more sanguine this week and it appears today's open was a crack wider in spreads to catch-down with stocks which then enabled the two markets to auction higher all day - with stocks (as they always tend to) over shooting at the close...

And also stocks catching up to the ever-present short-dated vol-selling rally-monkeys...

which left VIX with its steepest term-structure (short-dated vol the most complacent relative to long-dated vol) in four months... leaving equities on their own today - against HYG/VXX/TLT (credit/vol/rates) in the upper left; and broad risk assets (upper right)... FX markets were chaotic...with today's mega-gap up (down on the chart) in EURUSD extremely evident... but commodities accelerated from the middle of yesterday... and while the Dow Industrials, Dow Transports, and the S&P 500 cash indices all closed very marginally green on the week, the NASDAAPL ended down 1%... For a sense of where ES traded this week, we note that the VWAP from Sunday's open is 1337.5 (that is the volume-weighted average of every trade done this week in ES) from a Friday close at 1352.5 to today's close at 1352. The USD also closed the week unch but Treasuries rallied as did Oil, Gold, and Silver - quite a week. Charts: Bloomberg and Capital Context Bonus Chart: It would be remiss of us to not point out the biggest jump in JPM in almost 4 months on a big surge in volume - closing in on its 200DMA and longer-term resistance... and while CDS has squeezed tighter for JPM, it is still not quite as exuberant as the stock was today (suggesting the stock is around $1.50 rich at the moment)... |

| Gold Seeker Weekly Wrap-Up: Gold and Silver End Slightly Higher on the Week Posted: 13 Jul 2012 02:22 PM PDT |

| Does Central-Bank Gold-Buying Signal the Top Is Near? Posted: 13 Jul 2012 02:15 PM PDT |

| Gold Daily and Silver Weekly Charts - Up Again, Up Again, Jiggity Jig Posted: 13 Jul 2012 02:15 PM PDT |

| Gold and Silver Disaggregated COT Report (DCOT) for July 13 Posted: 13 Jul 2012 02:11 PM PDT HOUSTON -- This week's Commodity Futures Trading Commission (CFTC) disaggregated commitments of traders (DCOT) report was released at 15:30 ET Friday. Our recap of the changes in weekly positioning by the disaggregated trader classes, as compiled by the CFTC, is just below.

Continued... In the DCOT table above a net short position shows as a negative figure in red. A net long position shows in black. In the Change column, a negative number indicates either an increase to an existing net short position or a reduction of a net long position. A black figure in the Change column indicates an increase to an existing long position or a reduction of an existing net short position. The way to think of it is that black figures in the Change column are traders getting "longer" and red figures are traders getting less long or shorter. All of the trader's positions are calculated net of spreading contracts as of the Tuesday disaggregated COT report. Vultures, (Got Gold Report Subscribers) please note that updates to our linked technical charts, including our comments about the COT reports and the week's technical changes, should be completed by the usual time on Sunday (18:00 ET). That is all for now. |

| Smooth Criminals & Bad Arguments Posted: 13 Jul 2012 02:05 PM PDT Synopsis: If one New York Times writer has his way, we'll soon be using slave labor to defray the national debt. Dear Reader, While it seems churlish to complain about traveling too much – especially when those travels include so many agreeable places… Paris, Dublin, Portugal, Buenos Aires, Salta City, Cafayate, Asunción… where I have stayed over the past month – it can get pretty grueling. Especially when there is inevitably a tall pile of work waiting on return… work that has had me at the desk at ridiculous hours this week. I mention this only as something of a caveat if I seem a bit cranky as I address an issue that has caught my eye this week. As I begin, and with apologies to those of you with tamer musical tastes, I am listening to Alien Ant Farm's rendition of Smooth Criminal. For reasons you'll soon understand, it seems appropriate.

|

| Posted: 13 Jul 2012 01:42 PM PDT |

| COT Gold, Silver and US Dollar Index Report - July 13, 2012 Posted: 13 Jul 2012 01:35 PM PDT |

| Deflation or Inflation? Answer: Yes Posted: 13 Jul 2012 01:31 PM PDT By John Mauldin I am frequently asked in meetings or after a speech whether I think we will have inflation or deflation. "Yes," I readily reply, trying hard not to smirk, as the questioner tries to digest the answer. And while my answer is flippant, it's also the truth, as I do expect both outcomes. Following the obligatory chuckle from the rest of the group comes a follow-up request for a few more specifics. And they are that I expect we will first see deflation and then inflation, but the key is the timing. Recessions are by definition deflationary. Deleveraging events are also deflationary. A recession accompanied by deleveraging is deflationary in spades. That is why central banks worldwide have been able to print money in amounts that in prior periods would have sent inflation spiraling out of control. This drives gold bugs nuts, but they are not factoring in the velocity of money. If velocity were flat, inflation would be quite significant by now. But velocity has... |

| Trust in gold paper will collapse and the gold rush will be on, von Greyerz says Posted: 13 Jul 2012 01:04 PM PDT 3p ET Friday, July 13, 2012 Dear Friend of GATA and Gold: Gold fund manager Egon von Greyerz today tells King World News that much gold claimed by investment banks and central banks probably doesn't exist and that eventually trust in paper gold will collapse and the market will rush into real metal. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/7/13_Gr... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Announces Wellgreen Preliminary Economic Assessment: Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) reports the results of an independent NI 43-101-compliant preliminary economic assessment for its fully owned Wellgreen nickel-copper-platinum group metals project in the Yukon Territory. The independent assessment, prepared by Tetra Tech, evaluated a base case of an open-pit mine (with a mining rate of 111,500 tonnes per day), an on-site concentrator (with a milling rate of 32,000 tonnes per day), and an initial capital cost of $863 million. The project is expected to produce (in concentrate) 1.959 billion pounds of nickel, 2.058 billion pounds of copper, and 7.119 million ounces of platinum, palladium, and gold during a mine life of 37 years with an average strip ratio of 2.57. The financial highlights of the preliminary economic assessment, shown in U.S. dollars, are as follows: Payback period: 3.55 years Prophecy Chairman John Lee says: "We are pleased with the preliminary economic assessment results. The numbers indicate that Wellgreen is one of most exciting mineral projects in the Yukon. The company is drilling to upgrade and expand the resource base. The infrastructure is excellent as the project is only 1,400 meters in altitude and 14 kilometers from the paved Alaska Highway, which leads to the Haines deep seaport. Discussions are under way with support from local stakeholders regarding permitting and logistics." For the complete press release, please visit: http://prophecyplat.com/news_2012_june18_prophecy_platinum_announces_res... |

| The Truth In Gold Is Leaking Out Posted: 13 Jul 2012 12:58 PM PDT The London Gold Pool 2012 Posted Jul 12 2012 by Jan Skoyles The LIBOR scandal and gold. Not something many people would put together. But over the past two weeks as news broke of the LIBOR manipulation scandal some of us in the gold world thought it sounded like an all too familiar story. However the story of gold price manipulation was never juicy enough for the press, although it seems this may slowly be on its way to changing. Ned Naylor-Leyland appeared on CNBC earlier this week and mentioned his thoughts on the LIBOR saga and his belief gold has been manipulated in a similar way over a long-time frame. CNBC picked up on it and soon ran a story on his remarks. Also on Monday Mr Paul Tucker, Deputy Governor of the Bank of England, told the Treasury Select Committee that other 'self-certifying markets' may well be open to manipulation. As a result, those gold market participants are wondering if they won't be left out in the cold for much longer. The Telegraph reports: The Libor scandal could be repeated in a number of other "self-certifying" markets where prices are determined, he [Tucker] said…"Self-certification is clearly open to abuse, so this could occur elsewhere…A Financial Services Authority inquiry into Libor should be extended to other self-certifying market". The author of the article kindly points out that those self-certifying markets include gold and oil. Of course everyone acknowledges the manipulation, i.e. collusive behaviour that goes on in the oil markets. So does this mean the deputy governor is also aware of the actions being taken in the gold markets? Grant Williams' TTMYGH newsletter included a brilliant analysis of the LIBOR scandal and simply explained why it could not just be Barclay's who were involved in the rate fixing. Rather, the whole charade must have involved at least 13 of the 16 banks who submit rates. This was not just manipulation, this is a cartel and it is fraud. Seemingly, similar practices are on-going in the gold market; many banks, central and otherwise, engage in such practices to 'manage' the gold price. The idea of gold manipulation should not be all that surprising, particularly when there is such significant evidence of it in the past. When struggling to open other peoples' minds to potential gold price manipulation, I refer people to the London Gold Pool which ran from 1961 to 1968. In November of 1961 eight central banks met to agree a system by which, through cooperation, the Bretton Woods arrangement could be maintained and the gold price could be managed and suppressed at, or below, £35.20 As James Dines describes (quoted in Gold Wars), 'The Gold Pool was designed to dump gold on the gold market whenever it began to rise.' This was a blatant and open attempt to rig the gold market. Since the London Gold Pool collapsed, manipulation has become less acknowledged but still just as obvious. In more recent times we have seen repeated examples of such behaviour from central bankers, in both the US and the UK. In official remarks in 1998, Alan Greenspan, Fed chairman at the time, stated '…central banks stand ready to lease gold in increasing quantities should the price rise.' GATA explains the surreptitious ways in which countries, their central banks and investment houses conspire to rig the price of gold, 'with the so-called leasing of gold; the issuance of gold derivatives, including futures and options; and, more recently, high-frequency trading undertaken through investment houses that were happy to serve as government's intermediaries in the gold market as they could front-run government trades. When the rigging is done surreptitiously like this, much less central bank gold has to be dishoarded and the dishoarding that is done has far more suppressive influence on the price.' This type of manipulation is so easy to carry out thanks to larger size of the paper gold market compared to the physical bullion market. The ratio is believed to be about 100:1, as a result we have a fractional reserve system in the gold market. Because of the vast supply of this paper gold, the true price has not kept up to its potential, or inflation. There should almost be two prices; one for paper gold, one for allocated bullion. A slightly different way to rig the market price is one event which is close to the hearts of The Real Asset Company; the gold sales enforced by Chancellor Gordon Brown between 1997 and 1999. Yet another example of gold price manipulation it seems. The Telegraph's Thomas Pascoe reignited this debate in an interesting blog post on the broadsheet's website. In an attempt to explain the process of the gold sales Pascoe writes 'It seems almost as if the Treasury was trying to achieve the lowest price possible for the public's gold. It was.' Pascoe goes onto explain that the gold sales happened in order to enable banks to meet their borrowing obligations. Pete Hambro, chairman of Petroplavosk, is quoted 'He was facing a problem where a number of financial institutions had become voluntarily short of gold to the extent that it was threatening the stability of the financial system and it was obvious that something had to be done.' Of course, this does not just happen in the gold markets. Just this week Ned Naylor-Leyland reminded CNBC viewers that the manipulation of silver is under formal investigation. The CFTC are currently investigating JP Morgan's role in the manipulation of the sliver markets for over four years. Whilst nothing has happened just yet a huge amount of evidence has come out during the investigation. Why fiddle gold and silver prices? In regard to gold manipulation Naylor-Leyland explained "It is effectively an intervention in two ways; one would be the fact that for central banks gold and silver going up doesn't make their currency look any good and secondly a number of the big commercial banks have very large short positions which they like to manage and make easy money from". The rational for manipulating the price of gold can be easily described. Gold is simply the reciprocal of the faith in national currencies. Central banks hold far higher levels of cash than they do gold, therefore they are far more interests in maintaining government bonds and supressing interest rates. As Chris Powell, of GATA, said last month, 'as central banks are interested in supporting government bonds and the dollar in keeping interest rates low, they continue to manipulate the gold market.' What are gold investors to do? So, what does this mean for gold investors? Have we just shot ourselves in the foot by making it sound as though gold is just as manipulated as our money supply? No, not if you understand why you originally bought gold. The key to owning gold, particularly when such manipulative behaviour is yet to be investigated and chastised to the levels seen with LIBOR, is to remember the very fact that gold is the source of much secrecy and official concern shows its undeniable role in our economic system. Whilst the gold price continues to be manipulated we have benefited, and not just as individuals, those powers manipulating the markets are growing less powerful by the day as countries such as Russia and China continue to accumulate and hoard physical gold. The manipulators are running out of bullets. New buyers of physical gold now pose a significant threat to the US Dollar, one which the money men are not sure how to deal with. Since 2008, central banks have added a net 1,290 tonnes to their coffers. In Q1 of 2012 central bank gold buying accounted for 7% of total gold demand. This is despite manipulation on the part of other central banks. The way the majority of gold investors look upon this tricky situation is that it provides brilliant buying opportunities for us. Each time the gold price takes a drop other (buying) central banks are seen to come in and take advantage, something we should all take note of. Ultimately the good news about gold price manipulation is that the short-sighted fools, who are doing it, are doing a crap job. The price of gold has risen every year for 12 years, whilst the value of fiat money continues to be obliterated. But ultimately gold remains as valuable as ever and the fundamentals remain unchanged. http://therealasset.co.uk/2012-london-gold-pool/ ======================== LIBOR scandal brings gold price manipulation once more to the foreManipulation of all things financial, including gold, has been highlighted by the revelations about the fixing of the LIBOR. Governments, central banks and financial institutions all stand accused, but do they care? Author: Lawrence WilliamsPosted: Thursday , 12 Jul 2012 LONDON (Mineweb) - There has been much written about the latest financial manipulation by global bankers of LIBOR - The London InterBank Offered Rate which is the average interest rate estimated by leading banks in London that they would be charged if borrowing from other banks. It is the primary benchmark, along with EURIBOR (The European InterBank Offered Rate) for short term interest rates around the world and is calculated for ten different currencies and 15 borrowing periods ranging from overnight to one year and are published daily after 11 am (London time) by Thomson Reuters. Many financial institutions, mortgage lenders and credit card agencies set their own rates relative to it. The global significance of the rate should not be underrated with estimates suggesting that at least $350 trillion in derivatives and other financial products are tied to the LIBOR, which makes the fine imposed on Barclays for its role in manipulating the rate just a tiny slap on the wrist. A fraction of a percent on this size of figure means potential gains across the financial sector of billions of dollars - so why is anyone surprised that the mechanism might be manipulated in this way? It is certain that Barclays is not the only institution involved in this rate rigging - indeed it is already beginning to look as if governments and central banks - even the U.S. Fed - may all have colluded, or at least turned a blind eye, to these manipulations - sometimes with a view to protecting the global banking system against collapse. But how deep does this financial malpractice go? Fictional character Gordon Gekko's much misquoted financial mantra - 'Greed is good' (the actual quote is "Greed, for lack of a better word, is good. Greed is right. Greed works") - from the film Wall Street suggests Hollywood may have scratched the surface of the financial culture underlying much of the system back in 1987 - and this culture is almost certainly even more prevalent today. Indeed, there is the strong suspicion that in today's financial world everything is subject to manipulation by governments, central banks and financial institutions. For the governments and the central banks this may take the form of currency manipulation, statistical manipulation - indeed manipulation of anything to try and present the administrations in the most favourable light and keep the population on side. What is Quantitative Easing, or Operation Twist if not manipulation of markets? Pump more and more money into the markets and, hopefully, the stock market remains healthy, unemployment levels are not catastrophic and the general public kept in the dark over the true state of affairs. What of gold and silver? Two very different animals in the manipulation game, although the results may be much the same. Silver does not have the monetary attributes of gold nowadays and is a relatively small market so particularly prone to price manipulation by the investment banks and other big financial institutions working on the 'greed' principle, lining their own pockets and contributing to the mega-bonuses enjoyed by senior personnel within these organisations. It seems that anything aimed at preserving these massive pay packets for individuals is acceptable. Just don't get caught in anything which might contravene the law! Gold may be a different matter. The powers that be and their allies deny price manipulation of the yellow metal, but as it is perceived as an indicator of the value of fiat currencies worldwide, there is every reason for some governments and central banks at least to exert a degree of control over the gold price as they also openly do with currencies. Indeed the idea of gold price manipulation, once the preserve of the much derided GATA - the Gold Anti Trust Action Committee - (derision is one of the principal tools in the armoury of those wishing to diminish the views of organisations that try to expose wrongdoing) is now beginning to make an appearance in the mainstream press and among the most respected of financial commentators - take this headline from the UK's Daily Telegraph only yesterday - "The price of gold has been manipulated. This is more scandalous than LIBOR". Mark O'Byrne also writing yesterday on GoldCore had this to say: "Similarly, the gold market has the appearance of a market that is a victim of "financial repression. Given the degree of risk in the world - it is arguable that gold prices should have surged in recent months and should be at much higher levels today. The gold market has all the hallmarks of LIBOR manipulation but as usual all evidence is ignored until official sources acknowledge the truth. However, like LIBOR the gold manipulation 'conspiracy theory' is likely to soon become conspiracy fact. " He goes on to say: "It will then - belatedly - become accepted wisdom among 'experts.' Experts who had never acknowledged it, failed to research and comment on it or had simply dismissed it as a "goldbug" accusation. Financial repression means that most markets are manipulated today - especially bond and foreign exchange markets. Many astute analysts are asking today - why would the gold market be completely immune to such intervention and manipulation? The last thing insolvent banks and governments want is a surging gold price." The fact is that virtually all financial markets are subject to manipulation, or attempted manipulation, either from the 'greed' perspective or from the 'government knows best and we can bend the rules with impunity' perspective. Was it ever thus and can it ever be reined in? ======================== The price of gold has been manipulated. This is more scandalous than LiborIt does, however, reveal things that would otherwise be ignored. The issue of manipulation in the gold market which I wrote about last week is a case in point. The ball of half-truths and downright lies which have surrounded the issue for a long time is beginning to unspool in an issue internet activists kept alive long before it was acknowledged by the mainstream media. People ask why the issue is important at a time of naked market manipulation of the Libor rate. The answer is simple: the Libor manipulation scandal can be seen as the thin end of the wedge in terms of government market manipulation. Although Libor manipulation affects the interest rates we pay on all number of credit products, gold market manipulation is more serious still. The price of gold is traditionally a proxy for the value of money. A soaring bullion price is indicative of a lack of faith in fiat currency. Our financial system is predicated on the notion that money stands as a proxy for the factors of production – capital, labour, land and enterprise. In short, the abundance of money in the economy should be related to the abundance of those factors. The harder we work, for instance, the more we create. There is more labour in the economy, therefore a rise in the money supply is legitimate in order to mirror this. There is nothing wrong with printing money per se so long as the printing reflects an expansion in the real economy. Twentieth and Twenty-First century economics appears to have done away with this. Money is now created ex nihilo to feed both the top and bottom ends of society. Money printing or Quantitative Easing is mainly of benefit to two parties. Firstly, the Government, which is able to borrow more and borrow cheaper than it otherwise would have done. This is because QE money is used to buy bonds, forcing down yields. The Government uses this money to finance both existing debt and an expansive welfare state which bribes large portions of the population to accept a life of hellish boredom and dribbling docility in exchange for £70 a week in dole money. Such payments are not a genuine transfer of the fruits of existing production within an economy; they are borrowed. They help governments electorally at the cost of the vigour of society. At the top end, Quantitative Easing money goes directly to banks, who are able to sell their government bonds at a profit. In theory they may use this to even up their balance sheet. In reality they frequently use it as stake money at riskier tables. In both cases, paper money has been stripped of meaning. It is no longer a reflection of production nor any of its components. It now simply exists of its own right – but it can survive as a measure only for so long as the government keeps such printing in small enough doses that the de-leveraging does not become apparent to workers. As with everything in economics, there is a correctional market mechanism for this scenario – the flight to commodities, particularly precious metals like gold. Gold holds its value when paper money loses value, because it is beyond the gift of the government to simply will gold into being and give it to friends in high places or voters in low ones. If gold has been manipulated downwards and if that process continues, then all recourse to a store of value (other than land and property) has been taken from the individual. The value of our money is falling thanks to Quantitative Easing. Fixing in the gold market takes away one of the key hedges for those with cash assets but no property. The true fall in the value of money is probably better seen through the rise in house prices since the 1980s – a much better reflection of the market mechanism thanks to the suppliers being so large and because of the lack of a two-way interplay between house prices on the street and derivative products for traders. In any case, it would appear that the Libor scandal at Barclays has acted to draw out more market figures willing to claim openly that organised price fixing has occurred in gold. In the aftermath of the Libor scandal, the Bank of England complained that it had received no forewarning from the marketplace. Gold price manipulation may well be the next big scandal to break – if it does, this time nobody can say that they were not warned. Finally, a mea culpa – the tonnage figure quoted in the original article certainly undershot the true extent of the short position held by the US bank in question. It was very difficult to get accurate tonnage figures from anyone I spoke to for the article, and I took a pithy aside relating to a "couple of tonnes" rather too literally in a desire to include some. The true extent would have been far greater as many of you pointed out in the discussion board below the article. ======================== The Seeds For An Even Bigger Crisis Have Been SownJuly 11th, 2012 by goldswitzerlandThe Seeds For An Even Bigger Crisis Have Been Sown On occasion of the publication of his new gold report, Ronald Stoeferle talked with financial journalist Lars Schall about fundamental gold topics such as: "financial repression"; market interventions; the oil-gold ratio; the renaissance of gold in finance;"Exeter's Pyramid"; and what the true "value" of gold could actually look like. By Lars Schall Ronald Stoeferle, who is a Chartered Market Technician (CMT) and a Certified Financial Technician (CFTe), was born October 27, 1980 in Vienna, Austria. During his studies in business administration and finance at the Vienna University of Economics and the University of Illinois at Urbana-Champaign in the USA, he worked for Raiffeisen Zentralbank (RZB) in the field of Fixed Income / Credit Investments. After graduating, Stoeferle joined Vienna based Erste Group Bank (http://www.erstegroup.com), covering International Equities, especially Asia. In 2006 he began writing reports on gold. His five benchmark reports on gold such as "A Shiny Outlook" and "In Gold We Trust" drew international coverage on CNBC, Bloomberg, the Wall Street Journal and the Financial Times. Since 2009 he also writes reports on crude oil. The latest gold report by Stoeferle was published today. Lars Schall: What is "financial repression" according to Ronald Stoeferle? Ronald Stoeferle: Financial repression is a perfidious form of redistribution. It always means a combination of incentives and restrictions for banks and insurance companies, which cause the investment universe to be substantially reduced for investors. This means that capital is channelled away from the asset classes that it would flow into in a more liberal environment. I sincerely believe that financial repression will continue to crop up in many shapes and sizes over the coming years. However, the long-term costs of the lack in efforts made towards consolidating national finances are substantial. While low bond yields in the short run suggest that the saving measures are on course, one has to bear in mind that this has mainly been achieved by market interventions. Therefore, we regard the gradual transfer of assets as a disastrous strategy in the long run. What happens is that none of the previous problems of misallocation are resolved, but instead redistribution takes place (at the beginning mostly invisibly) and problems are dragged out, having to be addressed later. As the dependence on these measures rises, so does the collateral damage to be expected later, and the seeds for an even bigger crisis have been sown. L.S.: What does all that mean for gold? R.S.: Negative real interest rates are an important cornerstone of financial repression. And negative real interest rates represent the perfect environment for the gold price. During the 20 years of the gold bear market in the 1980s and 1990s, the average real interest rate level was around 4%. Real interest rates were negative in only 5.9% of all months. The situation in the 1970s, however, was completely different: real interest rates were negative in 54% of the months. Since 2000 real interest rates have been negative for 51% of the time, which constitutes an optimal environment for gold. Due to the overindebtness (that I am also discussing in my report), I believe that this trend will continue. L.S.: Are the interventions undertaken by western central banks and commercial banks in the gold and other markets more obvious than ever? R.S.: Yes, especially after the 29th of February. In general I write in my report that there is a fine line between intervention (usually a governmental / political interference) and manipulation (negative connotation in terms of "exerting influence"). There have been official and legitimised interventions by central banks in bond rates (Operation Twist, Quantitative Easing) and currencies (Swiss franc, Japanese yen). Both the quantity and the price of money are managed, i.e. controlled. The oil price is subject to interventions (OPEC cartel, release of strategic reserves), as are the food prices (subsidies). Kevin Warsh has recently confirmed this: "Now that I am out of government, I can tell you what I really believe… Central banks are now so heavily influencing asset prices that investors are unable to ascertain market values… This influence is especially evident with the Fed's purchase of government bonds, which has made it impossible for investors to use bond prices to learn anything about markets." (1) A strong gold price signals a decline in trust in the financial and monetary system, thus I believe that it would be naïve to think that gold is exempt from interventions. However, according to Dow theory, the primary trend cannot be manipulated, because the inherent market forces are simply too strong. L.S.: Could the renaissance of central bank buying be interpreted as a contrary indicator? R.S.: A legitimate question. It is no secret that central banks tend to be civil servants with an extremely pro-cyclical investment behaviour. And with good reason I have to say: since the purchase of asset classes with negative performance in the past years is difficult to justify vis-à-vis the public and also to internal committees, purchases tend to be made on a "past-performance" basis. However, I believe that the central bank purchases signal a new phase of the bull market. Since the buyers are mostly emerging countries, we regard these efforts as a logical catching up. Compared with the industrialised nations, the majority of the central banks in emerging nations remain clearly underweighted in gold. Thus the hedging of their enormous US dollar holdings is inadequate. Cynics would call the Bank of England the "ultimate contrary indicator". In the years 1999 to 2002, 395 tonnes of gold were sold at an average price of USD 275 under the then Chancellor of the Exchequer, Gordon Brown. Given that this was the absolute low of the gold price, it is also called the "Brown bottom". If the Bank of England were to announce p |

| The Next Major Move in Precious Metals Is Close Posted: 13 Jul 2012 12:47 PM PDT |

| Posted: 13 Jul 2012 12:27 PM PDT The decrease in nationwide inventory is an ongoing trend. Keeping supply constricted has clearly helped with pushing prices higher as demand is now competing for a smaller number of homes. A lower mortgage rate has also pushed the monthly payment amount lower thus allowing home buyers to purchase more home with stagnant income levels. The recent employment report should come as no surprise. The recent moves in the housing market are spurred on by record low interest rates and constrained inventory. Yet this should not be mistaken with an improving economy that is pushing prices higher which would be healthier. We have a limited horizon before the summer selling season comes to an end and the market is put to a bigger test in fall and winter. Looking at market data from a variety of perspectives shows that the market is far from being normal.

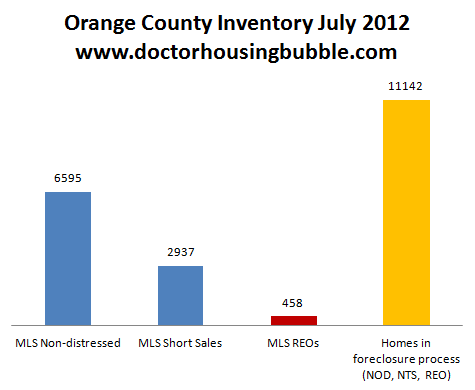

Orange Country Snapshot Orange County is seeing a solid jump in sales this year. We have seen a good amount of short sales hit the market recently. If we look at MLS inventory and last month sales we have approximately two months of inventory! This is back to the days of the mania. Yet this is only part of the story. Take a look at the total Orange County market: Short sales are a big part of the visible MLS inventory making up roughly 30 percent of all inventory. Look at how tiny the REO listings are. But take a look at the yellow foreclosure pipeline. These are homes in the foreclosure process. This figure is nearly twice the size of the non-distressed visible inventory. These are households unable (or unwilling) to pay their mortgages in an expensive county. Does that seem healthy to you? Just because banks are selectively leaking out inventory does not mean the market is healthy. It is an interesting observation on human behavior when you examine the thought process of those buying.

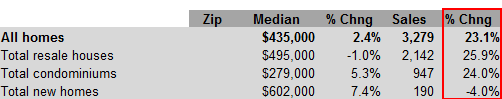

It is fascinating that many do thoroughly understand what is occurring. That is, the market is like a Hollywood set and is fake. It is a façade yet the financial system that proclaims "free market" capitalism all the way through is more than willing to let a command-control housing market take place. The irony of this all is that many of the programs holding up the market (i.e., FHA insured loans, GSEs MBS, etc) at their core are set to keep housing affordable for Americans. So what you see for example in Orange County is a surge in home sales: Price gains are seen in condos and new home sales. Prices declined a bit in resale homes. The jump in sales from last year is solid.

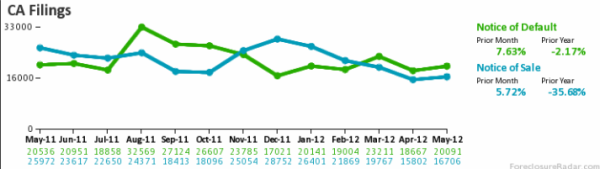

Foreclosure filings still occurring In spite of home prices moving up and visible inventory going down, foreclosure filings are still occurring at an elevated level:

These are fresh filings entering the pipeline. These are filings that will go to the yellow column above. The good news is that year-over-year the number of filings has declined substantially. This is a positive for the market. At this rate we are years away from any semblance of a normal market. What needs to be taken into context as well is the desire to modify loans and also, the jump in short sales. Banks seem to be willing to agree to short sales (if a place like Orange County has 30 percent of visible MLS inventory as short sales this is definitely a strategy that is being pursued). Short sales by definition will likely push prices lower in metrics like the Case-Shiller that look at repeat home sale.

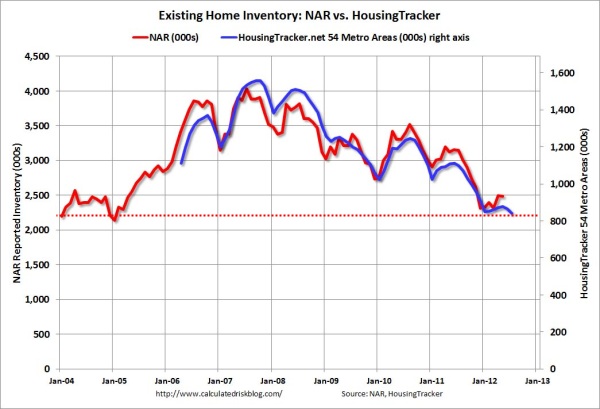

Nationwide inventory The trend of lower inventory is occurring on a nationwide basis: Inventory is back to levels last seen in 2005. The strategy of leaking out inventory in a controlled fashion while leveraging low mortgage rates seems to be the ongoing plan. If you speak with many investors in the trenches their investment strategy really is dependent on the moves the banks and government make. If you truly looked at the market as being transparent and open, you would likely jump in with both hands since visible supply is low and demand is still there. Yet you are contenting with a multitude of other factors:

Bottom line, banks are trying to maximize profits via re-writing accounting rules and using massive government bailouts to their benefit. Short sales do better than foreclosures. Constricting supply obviously will push prices higher. The Fed owns trillions of dollars in MBS and we are left with a record low mortgage rate. The market is looking for lower priced housing while the financial system is determined to do everything to keep prices inflated. Financial scandals are hitting left and right and no solid reform are ushered forward.

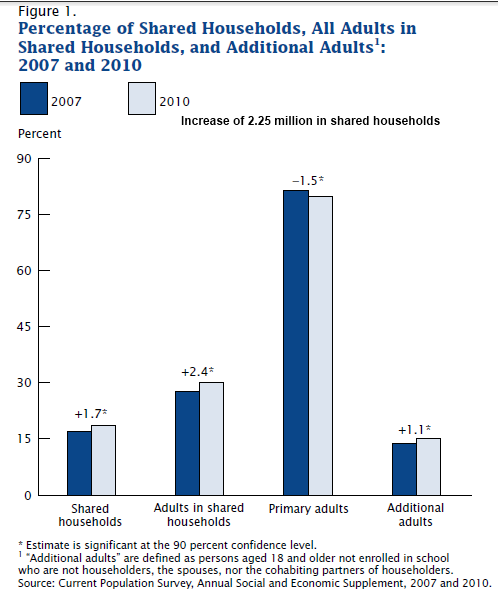

Moving in with mom and dad The increase in prices and sales is a short-term trend unless the overall economy gains traction. What will be important to see play out over the next decade is how younger Americans will perceive housing. This will be a less affluent generation. Many are already massively in debt for their pursuits of a college degree. Since the recession hit, many have moved back home with parents: 2.25 million adults have moved back home for a variety of reasons since the recession hit. You wonder if this generation is willing to dive into massive debt to purchase a home simply because a mortgage rate is low. How many will qualify if they have lower wages, a bigger student debt obligation, car loans, and other forms of debt? What is more likely is that demand for rentals in the short-term will be stronger and we are seeing this with increases in rent nationwide. You also see many of these people unable to qualify for mortgages in a tighter lending environment. The typical pattern goes:

In the past it was easier to go into the workforce as a blue collar worker and still qualify to purchase a home. Yet many Americans are now competing for lower paying service sector work so college or vocational training is the only route to a stable lifestyle and what one would consider middle class. Couple this with the massive baby boomer wave of retirements and we are certainly entering a different time.

|

| Betting On Mining Stocks' Higher Prices May Not Be Such A Good Idea Posted: 13 Jul 2012 12:15 PM PDT |

| Lawrence Williams: LIBOR Scandal Brings Gold Price Manipulation Once More to the Fore Posted: 13 Jul 2012 12:09 PM PDT |

| LGMR: Gold Rises But "Keeps Bearish Bias" as Beijing Investment Bucks China Slowdown Posted: 13 Jul 2012 11:59 AM PDT London Gold Market Report from Ben Traynor BullionVault Fri 13 July, 08:10 EST U.S. DOLLAR prices to buy gold rose to $1586 per ounce Friday morning in London, reversing losses from the previous two days but leaving gold more than 2% below its level of a month ago. "Gold has been a range trade with a bearish bias given the progressively lower highs since late February," says the latest technical analysis from bullion bank Scotia Mocatta. Prices to buy silver meantime climbed briefly above $27.50 per ounce Friday morning, as stocks, commodities and government bonds all ticked higher – with the exception of Spanish and Italian stock markets, which dipped following news of a ratings downgrade for Italy. Heading into the weekend, prices to buy gold with Dollars were more or less unchanged on the week, while silver prices were up around 25¢ from last Friday. Euro gold prices meantime looked set for a 0.7% weekly gain, with the Euro/Dollar exchange rate dipping back below $1.... |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

With gold surging $20, and stock markets rallying around the world, today King World News interviewed 25 year veteran Caesar Bryan. Gabelli & Company has over $31 billion under management and Caesar Bryan has managed the gold fund since its inception in 1994. Here is what Ceasar had to say regarding what is happening around the globe: "There are still huge challenges because there is simply too much debt, and of course the medicine that's being prescribed is to cut government spending in a very weak economic environment. The Spanish, just yesterday, an approximately $60 billion euro further budget cut over the next two years, from 2012 through 2014."

With gold surging $20, and stock markets rallying around the world, today King World News interviewed 25 year veteran Caesar Bryan. Gabelli & Company has over $31 billion under management and Caesar Bryan has managed the gold fund since its inception in 1994. Here is what Ceasar had to say regarding what is happening around the globe: "There are still huge challenges because there is simply too much debt, and of course the medicine that's being prescribed is to cut government spending in a very weak economic environment. The Spanish, just yesterday, an approximately $60 billion euro further budget cut over the next two years, from 2012 through 2014."

Gold and silver remain resilient despite the concerted campaign to push them down and dampen interest in the alternative stores of wealth.

Gold and silver remain resilient despite the concerted campaign to push them down and dampen interest in the alternative stores of wealth.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble's Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble's Blog to get updated housing commentary, analysis, and information.

No comments:

Post a Comment