saveyourassetsfirst3 |

- Gold to rise sharply in second half of 2012: Commerzbank

- Gold As Tier 1 Asset = More Elitist Loans Aimed at the Meddlesome Middle Class

- Vegas: The Collapse Is Getting Close

- Where was the gold?

- Government’s Multitude of New Offices

- The Biggest Fraud in Economics

- Financial markets facing a perfect storm as in 2008?

- T&S: Face the Inevitable and Buy Gold Now

- Stop Being So Nervous About Where Gold Is Headed

- Just Like 1965: These are Golden Years

- California state budget may ban suction gold mining forever, mining hobbyists fear

- One King World News Blog

- There's no plan and everything is a lie, Sprott tells King World News

- Links 6/30/12

- Gold jumps over 3 percent on EU deal, logs monthly gain

- Art Cashin – Shorts Squeezed in Dear God Get Me Out Moment

- Europeans Storing Gold in Switzerland On Concerns About Inflation and Systemic Risk

- The Black Hole of Deflation & Gold and Silver - Part 2

- World Navigating Troubled Waters: Gold and Silver Will Move Higher As Safe Haven

- Welcome to the Currency War, Part 2: Massive Euro Devaluation

- The Five Myths about the Gold Standard

- Currency Ideals

- By the Numbers for the Week Ending June 29

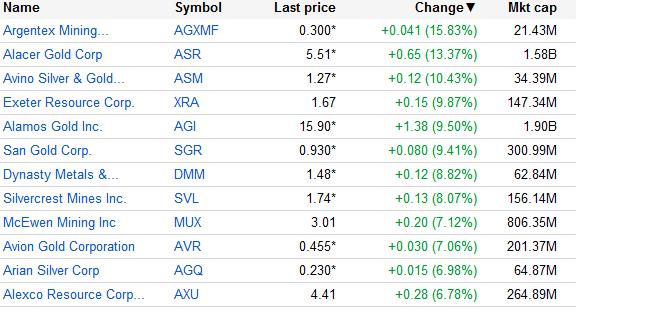

- Today’s Winners and Losers

- Stocks Dump Gold 2 Weeks Into Beach Season

- EU Master Plan: Lurching Toward Oblivion

| Gold to rise sharply in second half of 2012: Commerzbank Posted: 30 Jun 2012 03:05 AM PDT

from commodityonline.com: NEW YORK (Commodity Online): Gold to rise sharply in the second half of this year and platinum group metals also looks positive, said Commerzbank, the second-largest bank in Germany, after Deutsche Bank. The bullion is still down more than 6 percent in the second quarter, its steepest quarterly loss since 2004. Gold has fallen more than 12 percent from the 2012 peak of around $1,790, and 18 percent from an all-time high above $1,920 reached in September 2011. According to the German bank, all metals are rallying sharply from Thursday's sell-off as the dollar weakens after some progress was reported at the European Union summit. The previous slide in gold as puzzling, since the high risk aversion among market participants during the European debt crisis should be supporting rising gold prices, they added. Keep on reading @ commodityonline.com |

| Gold As Tier 1 Asset = More Elitist Loans Aimed at the Meddlesome Middle Class Posted: 30 Jun 2012 03:00 AM PDT

from silvervigilante.com: Much has been reported regarding the US Treasury, Federal Reserve and FDIC seeking comment on the altering of capital adequacy rules pertaining to gold held as reserves at a bank. Currently, when gold is held as an asset, it is "risk weight" is 15%, which means a 15% discount on its current value for capital adequacy. So, when a bank holds gold, one must take 15% taken off of the spot price so as to arrive at the amount off of which a bank can make loans. What's being proposed is that gold not be discounted in the slightest, thus placing gold on the same plain as cash. As the document states: 217.131 Mechanics for Calculating Total Wholesale and Retail Risk-Weighted Assets. (i) A bank holding company or savings and loan holding company may assign a riskweighted asset amount of zero to cash owned and held in all offices of subsidiary depository institutions or in transit; and for gold bullion held in a subsidiary depository institution's own vaults, or held in another depository institution's vaults on an allocated basis, to the extent the gold bullion assets are offset by gold bullion liabilities. Keep on reading @ silvervigilante.com |

| Vegas: The Collapse Is Getting Close Posted: 30 Jun 2012 02:31 AM PDT In this video I discuss how the pan-global collapse is moving closer. from gregvegas5909: Link to my website: http://www.lulu.com/spotlight/thegameisrigged ~TVR |

| Posted: 30 Jun 2012 01:00 AM PDT I am an avid reader of monetary history. Of late I have been focusing on the monetary events of the 1920s and 1930s. By learning from the maelstrom that riled the global financial scene during those ... |

| Government’s Multitude of New Offices Posted: 30 Jun 2012 12:02 AM PDT

from mogamboguru.com: Alone in the Mogambo Bunker Of Solitude (MBOS), I crouch like a cornered rat in, as expected, the corner of the darkened room, hunched over a pizza-stained keyboard nestled behind crates of ammo, where I peck out my usual Hysterical Mogambo Tirade (HMT), which I have to do because when I confront people face-to-face at the stupid mall or at the stupid grocery store — to give them the exact same information! — they get all huffy! Cops are suddenly everywhere! Guns! Tazers! Pepper spray! Lawyers! Keep on reading @ mogamboguru.com |

| The Biggest Fraud in Economics Posted: 29 Jun 2012 11:50 PM PDT

from dailyreckoning.com.au: Forget 'peak oil.' Or so they say. It has fracked its way to energy self-sufficiency. Porter Stansberry: … there are roughly 20 major shale oil plays in the US. The largest five of these new reservoirs have more than 20 billion barrels of recoverable oil… meaning that each of these new fields is not only the largest in US history (by a wide margin), but that each of them, individually, would more than double the proven reserves of domestic oil… The Wall Street Journal tells us that the US will not import a single barrel of oil from the Middle East by 2035. Hey, wait a minute. Wasn't that supposed to be why we're spending trillions on wars in Middle East…to keep vital supplies of black goo headed our way? Keep on reading @ dailyreckoning.com.au |

| Financial markets facing a perfect storm as in 2008? Posted: 29 Jun 2012 11:43 PM PDT

from news.goldseek.com: The parallel most analysts draw with this summer is the summer of 2008. Nobody then could fully appreciate the carnage to come in financial markets but there were plenty of warning signs. It was trouble in the banking sector that gave us the biggest warning then, namely subprime lending and the first bank run in the UK for more than a century at Northern Rock. JP Morgan This time we have the eurozone sovereign debt crisis, and headlines like JP Morgan's $9 billion loss on its 'London Whale' trading book and a half-billion dollar fine for Barclays Bank over interest rate fixing. The economic backdrop is also equally fragile if not considerably worse because global central banks have orchestrated so much in terms of massively expensive bailouts in the interim. Their efforts are ever bigger and each shot of heroin for the global economy delivers a shorter and shorter period of calm. Keep on reading @ news.goldseek.com |

| T&S: Face the Inevitable and Buy Gold Now Posted: 29 Jun 2012 11:40 PM PDT We need to recognize we are ending a cycle as all things do. It's obvious that our politicians are only interested in re-election and NOT doing what is needed to be done. Otherwise, we wold have re-set the system to functionality with much less pain in 2008-2009. The loss of confidence in currency will come suddenly and without warning. You won't be able to get gold at ANY price when that occurs. from mrthriveandsurvive: ~TVR |

| Stop Being So Nervous About Where Gold Is Headed Posted: 29 Jun 2012 11:31 PM PDT

from blog.milesfranklin.com: Today I received three phone calls from friends who have each purchased over $100,000 worth of gold from Miles Franklin. All three have been in the market for years and are well versed on why it is important to own gold and they all know only too well my bullish feelings on where gold is headed. All three started the conversation with a reference to a CNBC story that gold was headed to $700 an ounce – and asked me what I had to say about that. Two of them asked me directly, should I sell my gold? We must be damn close to a bottom, because even those who should know better are starting to panic. All of my hand-holding and bullish information is falling on deaf ears. I recall some time back Jim Sinclair stating that the banks that are "short" gold now will be "long" when the market takes off. Their strategy must be to scare the weak hands out of their positions, which are happening, and also to create a wall of worry and doubt to keep them from buying at these low prices so they can pick it up on the cheap. Believe me, that is exactly what is happening. If you want my advice, laugh at these ridiculous "analysts" who are giving you terrible advice with their "the sky is falling" gold and silver predictions. The bull market IS ALIVE AND WELL. This is the summer, and typically gold is weak over the summer. I am looking for gold to move up, strongly, in September when the Fed will bring out QE3. They have no other rational choice. Keep on reading @ blog.milesfranklin.com |

| Just Like 1965: These are Golden Years Posted: 29 Jun 2012 11:16 PM PDT ¤ Yesterday in Gold and SilverAs I mentioned in 'The Wrap' in Friday's column, the initial news out of Brussels early on Friday morning their time, caused a waterfall decline in the dollar...along with a bit of a melt-up in gold and silver prices...and as lunchtime approached in London, gold was up about eighteen bucks. Then just before 12:00 o'clock noon, another rally began. This lasted until about 12:30 p.m. BST...and then sold off a bit going into the New York open fifty minutes later. Once Comex trading began, away went the price to the upside...but ran into a not-for-profit seller at the $1,600 spot price level at precisely 9:00 a.m. Eastern...and from there it traded sideways until shortly before 1:00 p.m. Eastern time. Then gold rallied anew...and made it to its high tick of the day [$1,608.60 spot] about five minutes before the Comex close. From there it was sold off gently...and the price was carefully closed below the $1,600 price market at $1,599.10...up $47.10 on the day. Without doubt, left to its own devices, the gold price would have closed up significantly more than that. Not surprisingly, net volume was very high at around 172,000 contracts. Here's the New York Gold [Bid] chart for yesterday. I just wanted you to see the precise 9:00 a.m. intervention in the gold price with your own eyes. Nothing free-market about that. Silver rallied on the news out of Brussels as well...and by 11:45 a.m. BST, silver was up about fifty cents. Then silver blasted higher at what might have been an early London silver fix. Silver, like gold, also got sold off a hair at 12:30 p.m. in London, but that only lasted thirty minutes...and away it went to the upside again...and the rally accelerated at the Comex open. Within fifteen minutes silver had gained about 80 cents in what had obviously become a 'no ask' market. The silver price was going vertical. But the moment that it broke through the $28 spot price level, a not-for-profit seller showed up...and that, as they say, was that. It took 'da boyz' just over an hour to beat the silver price back to the Comex opening price. The high tick was $28.05 spot. The silver price wasn't even allowed a sniff of that price level again, although it made every attempt to do so as, like gold, it rallied strongly into the Comex close. Then it got sold down over a percent going into the close of electronic trading Silver finished the Friday trading day at $27.49 spot, up $1.17. Net volume was pretty heavy at around 53,000 contracts. The dollar index was quite a sight yesterday. To be sure, some of the rallies in the precious metals corresponded roughly to what was going on in the currency markets, but it certainly doesn't explain the big rallies in gold and silver that began at 11:45 a.m. in London...6:45 a.m. Eastern time...as the dollar was trading sideways at that point. The dollar index closed down 107 basis points at 81.63...but was down about 120 basis points at its New York low. Here's the 3-day dollar index that shows the entire move on Friday. The gold stocks gapped up about four percent at the open...but then [mysteriously?] got sold off until just before noon in New York before rallying once again to a secondary peak which came about fifteen minutes before the gold price rally ended at the Comex close. From there the stocks more or less traded sideways into the close. The HUI finished up 3.19%. Considering the size of the price move in gold, I was expecting better than this. I spoke with John Embry yesterday...and he was expecting better as well, as one junior gold producer that we both follow, actually finished unchanged on the day! The silver stocks did better, but even then, there were some that didn't do particularly well. Nick Laird's Silver Sentiment Index closed up only 3.55%. The CME's Daily Delivery Report showed that 15 gold and 235 silver contracts were posted for delivery on Tuesday. In silver, the only short/issuer was Jefferies, with all 235 contracts...and the two biggest long/stoppers were JPMorgan with 159...and the Bank of Nova Scotia with 72. The link to the Issuers and Stoppers Report is here. There were reductions in both GLD and SLV yesterday...as authorized participants withdrew 67,924 troy ounces of gold and 1,745,755 ounces of silver. The U.S. Mint had no sales report again on Friday, so they finished the month with sales of 54,500 ounces of gold eagles...10,000 one-ounce 24K gold buffaloes...and 2,593,000 silver eagles. Despite the lousy price action in the month just past, June gold and silver eagle sales were the third highest of the year. My coin guy had his best sales day in June yesterday, as these higher prices brought out the procrastinators in droves. On Thursday, the Comex-approved depositories reported receiving 609,909 troy ounces of silver...and shipped 473,360 troy ounces out the door. The link to that action is here. Well, the Commitment of Traders Report in silver was a sight to see. The Commercial net short position declined by 4,943 contracts...and is now down to 12,011 contracts, or 60.0 million ounces. According to reader E.F...this is the smallest Commercial net short position since September 10, 2001...almost eleven years ago! We also have a 9-year low in the Non-Commercial net long position...and almost a 5-year high in the raptor [small Commercial traders other than the 'big 8'] net long position. All that is just dandy, but here's the ugly news. The four largest Commercial traders are short 151.4 million ounces of silver...and the '5 through 8' largest traders are short an additional 44.8 million ounces. On a net basis the four largest traders are short 30.7% of the entire Comex futures market in silver, once all the Non-Commercial market-neutral spread trades are subtracted out. And once you remove the spread trades that only show up in the Disaggregated COT report, these four traders are short much more of the Comex silver market than that. Most of that is held by JPMorgan. In gold, the Commercial net short position declined by 19,531 contracts...and now stands at 144,160 contracts, or 14.4 million ounces. The four largest Commercial traders are short 10.0 million ounces...and the '5 through 8' traders are short an additional 4.9 million ounces. On a net basis the four largest Commercial short holders in gold are short 26.1% of the entire Comex gold market. In gold, the eight largest traders are short 103.5% of the Commercial net short position. But in silver, the eight largest traders are short 327% of the Commercial net short position. Now that's concentration! Here's Nick Laird's Total PMs Pool chart for the third time this week. (Click on image to enlarge) I have quite a few stories for your reading pleasure this weekend...and the final edit is up to you. And as many commentators have already said in today's column, the world's financial goose is pretty much cooked. There's no plan and everything is a lie, Sprott tells King World News. Adrian Douglas: A good time to buy gold. Gold Traders Extend Bullish Call on European Debt Crisis. ¤ Critical ReadsSubscribeAnother Domino Falls in the LIBOR Banking Scam: Royal Bank of ScotlandAnother one bites the dust. The Royal Bank of Scotland is about to be fined $233 million (£150 million pounds) for its role in the Libor-rigging scandal. It joins Barclays as the first banks to walk the plank in what should be, but so far is not, the most sensational financial corruption story since the crash of 2008. Many of the banks implicated in the Libor mess have also been targeted in the various municipal bond bid-rigging investigations, and RBS is no different – its subsidiary Natwest is also a defendant in the major civil lawsuit in the bid-rigging case. The cases aren't related, except in the sense that they both involve manipulation and anticompetitive cooperation. It's going to be harder and harder to make the case that the major banks do not routinely cooperate at the expense of the public when it serves their purposes to do so. This very short Matt Taibbi blog was posted over at Rolling Stone magazine yesterday...and it's well worth your time. I thank Roy Stephens for his first offering in today's column...and the link is here.  Mervyn King tells banks: you can't go on like thisSir Mervyn King, the governor of the Bank of England, piled the pressure on the City on Friday when he said something had gone "very wrong" with Britain's banks that needed to be put right. As Barclays and other high street banks became embroiled in a new mis-selling scandal, King launched his most scathing attack yet on the culture of banking in the five-year-long financial crisis. King refused to say Bob Diamond was a "fit and proper" person to run Barclays as the reputational damage from an interest rate-fixing fine led to another fall in the bank's shares. More than £4bn has been wiped off the value of the bank since the rate-fixing scandal emerged. "It is time to do something about the banking system," King said. As he warned that the outlook for financial stability had deteriorated as a result of the eurozone crisis, he dismissed mounting calls for a Leveson-style investigation into banks, saying that enough was already known to implement root and branch reform of the City. This longish article appeared in The Guardian on Friday...and is Roy's second offering in a row. The link is here.  The $289 Trillion Dollar Problem: David ChapmanTwo hundred and eighty-nine trillion dollars. An unimaginable amount. That is the total of derivatives outstanding at the top five US bank holding companies as of March 31, 2012, according to the Office of the Comptroller of the Currency (OCC). The five holding companies are JP Morgan Chase, Bank of America, Citigroup, Morgan Stanley and Goldman Sachs. They hold roughly 45% of all over-the-counter derivatives outstanding in the world, based on the $648 trillion total estimated by the Bank for International Settlements. Others estimate that the total global derivatives outstanding could be as large as $1.2 quadrillion, or $1,200 trillion. The five banking behemoths are so large in the global derivatives market that they would appear to be the market. According to the OCC, their outstanding holdings constitute some 95% of the US market total of approximately $302 trillion. Over the past decade the amount of outstanding derivatives has exploded. Since the end of 2002 the outstandings of the bank holding companies have grown from $58.2 trillion to $302 trillion an increase of 419%. This is a fairly long read, but gives you some idea as to just how gargantuan the derivatives market has become. I had something about it in my column earlier this week. This report is rather technical...and my best advice is for you to read until your eyes start to glaze over. It was posted over at the goldseek.com website on Thursday...and I thank reader U.D. for bringing it to my attention. The link is here.  Deal on funding banks a 'breakthrough', EU chief saysAfter tough all-night bargaining, European leaders appeared to salvage what had seemed to be a summit teetering toward failure by agreeing early Friday to funnel money directly to struggling banks, and in the longer term to form a tighter union. The agreements at a European Union summit in Brussels suggested Germany had yielded a bit on its insistence on forcing tough reforms in exchange for rescue money. That was a victory for Italy and Spain, who have argued they have done a lot to clean up their economies yet are facing rising borrowing costs. The bank decision in Brussels was aimed at helping Spain, which sought a €100 billion rescue to help its troubled banks. This AP story appeared on the france24.com website yesterday...and is another offering from Roy Stephens. The link is here.  Debt crisis: Ireland hails euro 'game changer'The deal, sealed by leaders in the early hours of Friday morning in Brussels, will allow stricken banks to directly access the region's rescue fund. The hope is it will enable Ireland to return to international bond markets. Eamon Gilmore, Ireland's deputy prime minister, said: "This is a massive breakthrough for Ireland and it changes the game in terms of our bank debt. This deal will allow the country to recover much faster." Under previous rules, rescue funds first had to be handed to governments before being passed on to troubled banks. That way countries like Spain ,which has been forced to intervene to help its banks, had to take on additional debt, pushing up borrowing costs. This is another story courtesy of Roy Stephens. This one is out of The Telegraph yesterday afternoon...and the link is here.  Irritation in Berlin over Euro Summit Compromise Politicians Demand Delay in German Bailout VotePoliticians from both inside and outside Chancellor Angela Merkel's government are calling for the vote on the euro bailout fund scheduled for Friday evening to be pushed back. Too much has changed since the marathon summit in Brussels, they say, and they need time to sort things out. Jürgen Koppelin, a member of the Free Democratic Party, called for a delay in Friday evening's planned vote to okay funds to shore up the ailing euro, saying his party did not want to see the watering down of the criteria Merkel agreed to Friday morning in Brussels. "The position of the FDP up until now has been that the criteria cannot be eased," he said. "Talks within the coalition are necessary." "My immediate advice is to postpone the vote until next week and not to hold it now," he said. This story was posted on the German website spiegel.de yesterday...and I thank Roy Stephens for sending it. The link is here.  Merkel has plenty of room to maneuver despite Euro Summit ConcessionsGerman Chancellor Angela Merkel rarely sees these kinds of negative headlines when returning from European Union summits. During her over six years as the head of Germany's government, she has usually been able to put a positive spin on even unpopular compromises. California state budget may ban suction gold mining forever, mining hobbyists fear Posted: 29 Jun 2012 11:16 PM PDT California Gov. Jerry Brown has approved the state's newly adopted $92 billion state budget which contains a rider which continues the state's moratorium on suction dredge mining until the state adopts new rules which "fully mitigate all identified significant environmental impacts." The rider also directs California's Department of Fish and Game, which regulates suction dredge mining, to work with public health, water and tribal authorities in a review of the practice. Opponents contend the new rider essentially bans the practice in California waters forever. |

| Posted: 29 Jun 2012 11:16 PM PDT  With global stock markets on the move, while gold and oil exploded to the upside, today Art Cashin told King World News that for the shorts, "It is a kind of 'Dear God get me out of here and I promise not to do this again.' So a general panic along those lines." Cashin, who is Director of Floor Operations for UBS, which has $612 billion under management, also commented on the spectacular rally in gold and oil. Here is what Art Cashin had to say: "Expectations for this summit were so low that if they came out of it without a fist-fight, we probably would have had a rally. The idea that they may have gotten something moving caused a spectacular short-covering rally in the euro and put pressure on the dollar. You can see oil is |

| There's no plan and everything is a lie, Sprott tells King World News Posted: 29 Jun 2012 11:16 PM PDT  Sprott Asset Management CEO Eric Sprott tells King World News today there's no plan to fix the European financial system, that everything from government officials is a lie, and that there's nothing to do but wait for governments to get out of the business of gold price suppression. I borrowed the headline and the introductory paragraph from a GATA release yesterday. This KWN blog is a must read for sure...and the link is here. |

| Posted: 29 Jun 2012 09:55 PM PDT Calling time on the pint in the pub Guardian (John L). I frequented a pub in Potts Point. It was one of the best parts of being in Sydney. It was displaced by a Woolworths (food chain) and we regulars couldn't find another watering hole to colonize. 'Paint-on' batteries demonstrated BBC City populations boom as young people opt against settling down in the suburbs Daily Mail. May S points out this was not unexpected, see this 2005 article: Suburban Decline: The Next Urban Crisis Cost of Prince Charles rises to £2.2m Guardian (John L). Time to outsource him. Revealed: the scale of sexual abuse by police officers Guardian Predictable Punishment: Clandestine U.S. Attacks On Pakistan Bilmon Fairfax Media, Rinehart board stoush gets personal The Age (Harry Shearer) China responds to Fukushima Bulletin of the Atomic Scientists June 2012 EU Summit Verdict: A good decision that will, probably, go to waste Yanis Varoufakis The Global Slowdown Will Accelerate Credit Writedown 'Health law upheld, but health needs still unmet': national doctors group PHNP (Aquifer) Quelle surprise! Medicaid Expansion Rejection Would Particularly Impact People of Color David Dayen, Firedoglake Was the Obamacare Dissent Originally the Majority Opinion? Mother Jones (Aquifer) Did John Roberts Give Mitt Romney A Gift? Marcai Angell, Huffington Post. The third paragraph is terse and devastating. Here's Where Ivy League Students Go When They Graduate Clusterstock Consumer Spending In U.S. Stalls As Hiring Weakens: Economy Bloomberg Things Nobody Warned Me About Atrios Debating the Debt! letsgetitdone, Corrente Wal-Mart Suspends Supplier After Terrifying Working Conditions Revealed Huffington Post First American Financial v. Edwards: Surprising end to a potentially important case SCOTUSblog (Abigail Field) JPMorgan's Other Big Gamble Pam Martens Managing Discovery of Electronic Information: A Pocket Guide for Judges Cryptome SUNTRUST BANK – You'd evict a 76 year-old woman who lived in home for 44 years over $41? Martin Andelman Who Owns Your Neighborhood? The Role of Investors in Post-Foreclosure Oakland Info Alameda County and Report: Investors buy nearly half of Oakland's foreclosed homes Bay Citizen BofA's $40 Billion Blunder Wall Street Journal Banker to the Bankers Knows the Numbers Are Lying Jonathan Weil, Bloomberg "Science" without falsification is no science Noahopinon What utter self-serving drivel, Brad Delong! Steve Keen. The underlying post really is pretty appalling… * * * Lambert here: D – 71 and counting* The art of losing isn't hard to master; Readers, again a little narrower than usual as I recover from National Federation of Independent Business v. Sebelius. CA. "The Committee to Recall Mayor Jean Quan Now has a Monday deadline to submit petitions carrying 19,800 valid signatures. [C]ommittee member said they had only collected about 17,000 signatures and had all but given up." CO. Colorado Springs Mayor Steve Bach: "I really appreciate the president coming here … if nothing more than just to reassure us that this has a focus at a national level, that there are people all over this country who are concerned for our citizens and those who have lost their homes," Bach said, according to CNN. "And I do plan to ask for cash." "Small government," liberatarian paradise! GA. Bellwether counties: "[L]ook to Lowndes County. In the last three presidential elections, Lowndes voters have given each major-party candidate within 2 percentage points of their statewide share of the vote." HCR: "[GOV. NATHAN DEAL R:] We are probably just going to be in a holding pattern until such time as we see what the events of November bring us." IA. Corruption: "A court is upholding a $1.2 million state fine for labor violations committed by a TX labor broker [Henry's Turkey Service] who underpaid dozens of mentally disabled workers at an Iowa turkey processing plant." No criminal charges, so cost of doing business. (TH) "Senate President Jack Kibbie, D [requested] a formal opinion from IA AG Tom Miller's office regarding an announced a policy change by the state Department of Public Safety to end its role of conducting electrical inspections at farm facilities effective next week unless the inspection is voluntarily requested by the property owner or designee." (TH) ID. Mass incarceration: "After high-profile news stories about the Corrections Corporation of America-run prison at Boise described it as a 'gladiator school' and worse after violence and injuries, the ACLU filed suit in March 2010 'that alleged deliberate indifference by CCA officials, inadequate staffing and supervision, and a failure to investigate acts of violence.' …. Since then, Idaho's prison population — the state has one of the highest rates in the nation — has continued to grow… So how is it resolving the difficulty? By entering into a new contract with CC[A]." IL. Legalization: "The Chicago City Council voted overwhelmingly Wednesday to decriminalize marijuana possession, joining a wave of states and big cities that have opted for fines instead of arrests for small amounts of the drug." LA. Corruption: "Derrick Shepherd [D], the former state senator from Marrero whose meteoric rise in politics crashed with his federal conviction of conspiracy to commit money laundering, will never practice law in Louisiana again. " Tinpot tyrants: "The controversial [school reform] consultant pushing to overhaul the Algiers Charter Schools Association raised the idea of prominently displaying the state-assigned letter grade of D at Eisenhower Academy of Global Studies, printing it on shirts worn by employees, memos and signs." Why not use a branding iron? MI. Electoral chicanery: "The State Board of Canvassers, which has two R and two D members, did not certify the [Emergency Manager referendum] petition after members deadlocked 2-2 on whether it was valid." (Because the 5th member, an R, unexpectedly resigned and has not been replaced. NC. Ballot access: "In Pisano v Bartlett, the lawsuit challenging the May petition deadline for petitions for newly-qualifying parties, [the North Carolina State Board of Election's brief] argues that because the two plaintiff parties, the Constitution Party and the Green Party, have made only feeble attempts to qualify for the ballot this year, the case should be dismissed. The brief ignores all the reported court decisions that have held that unqualified parties, and independent candidates, have standing to challenge early petition deadlines, whether those parties and candidates have tried to get on the ballot or not." NY. Corruption: "AG Eric Schneiderman's office is suing Kelli Conlin, the former President of NARAL Pro-Choice New York, for 'abusing her position and using more than $250,000 in charitable funds for her own personal benefit.'" Corruption, petty: "The letter is on its way to the Town Clerk. A freshman town councilor [in Geddes is] asking for the ethics committee to convene to review problems he says exist in adherence to the town procurement policy by the town's Highway Department." PA. Fracking, water: "[T]he Susquehanna River Basin Commission (SRBC; www.srbc.net) today announced that 37 separate water withdrawals approved by SRBC are suspended due to localized streamflow levels dropping throughout the Susquehanna basin." TN: "[The UT Knoxville] tuition increase to be paid in the fall will average about $289 while [President Jimmy] Cheek's raise is $22,356." VA. UVA: Governor Bob McDonnell reappoints Rector Helen Dragas. "[BoV] Newcomers include Linwood Rose, former president of James Madison University; Edward Miller, dean of the School of Medicine at Johns Hopkins University; and Victoria Harper, CFO of Gannett Company." "[Dragas is] the public face of the recent, failed attempt to oust President Teresa A. Sullivan." And we never did learn the private faces, did we? [hums "kumbaya"] "Siva Vaidhyanathan, chairman of the media studies department and one of the most-heard faculty voices on the controversy around Sullivan's forced resignation and return, said he wasn't surprised by Dragas' reappointment. He put it down as a necessary price for getting Sullivan back, saying he suspected it was part of the deal-cutting that brought Sullivan back." [hums "kumbaya"] Vivian Page: "I'm convinced more than ever that the business takeover of higher ed will continue to occur. And UVA remains a target. Next time, it's not going to be bungled like it was this time. And I'm betting it happens within the remaining 3 years of Sullivan's contract." WI. Fracking: "[T]he hills of northwestern WI and bordering eastern MN, areas now serving as the epicenter of the frac-sand mining world" (an excellent primer on the place of sand in the fracking supply chain). HCR. The market state: Politico: "Obama wants to move swiftly beyond the court decision, to cherry-pick the most attractive parts of his reform effort — prohibitions on discrimination based on pre-existing conditions, free checkups for women, extension of parental coverage to kids up to the age of 26 — and present them to the public as a menu of enticing new benefits and consumer protections." Consumers. Not citizens. Lynn Sweet: "The Obama team has a particular expertise in collecting the stories of people. … People who are getting treatments and coverage they otherwise would not have — and that includes peace of mind — have stories to tell that transcend partisan politics. Each of these stories — whether by paid media, word-of-mouth or social networking — is an ad for Obama." Just like conversion narratives in 2008. Atrios: "My basic take on the ACA is that it's good because it makes improvements to our current system, but bad in that it enshrines our current sh*tty system forever." Anarchist thumbsucker: "Obamacare is in fact a direct continuation of the bipartisan neoliberal consensus of the past thirty years. The guiding principle of this consensus is the use of state power to protect corporate profits — which consist mostly of rents on artificial scarcity — from the radical deflationary effects of technologies of abundance. Mandate coverage: "A recent study by the Urban Institute, a nonpartisan research center that focuses on economic and social policy, found that if the law had been fully implemented last year, 93 percent of the population under age 65 wouldn't have faced a penalty or had to buy insurance under the mandate." The taxing power: "A few minutes later, pressed by Justice Roberts, he reiterated the point. '[I]t is in the Internal Revenue Code,' [Solictor General Donald] Verrilli said. 'It is collected by the IRS on April 15th.' The floor sponsor, Senator Baucus, defended it as an exercise of the taxing power." Politics and optics: First Read: "[T]he ruling is no political booster rocket. He simply doesn't have a new drag." Mischiefs of Faction: "Sentiments about health reform are already baked into people's assessments of the candidates." Politico: "The victory was dropped into the pre-July 4th valley of summertime news coverage rather than as a welcome fall bombshell dropped when voters will be most tuned into the race." The normally astute Charles Pierce pins the bogometer: "[T]he act itself is chock-full of innovative ideas and pilot programs and all sorts of other experimental goodness directed toward making easier the lives of people dealing with serious health problems. What a crock. We've already done the experimenting we need, and the results are in. Here's the chart. Conservative fever swamp: "And, may godly courageous leaders rise up in His wisdom and power to lead us in displacing the criminal invaders from their seats and restore our constitutional republic." Well, I agree with the criminal invaders part. (But Jeebus, the Tea Party uses Ning?) Stay classy: "In response to the Supreme Court's ruling in favor of health care reform, the Drudge Report is smearing Chief Justice John Roberts over the possibility that he might use epilepsy medication and suggesting that it affected his judgment." Nooners: "[Obama's statement] was a targeted base-greaser. [Not so, not so! Visionary minimalism!] … In any case, brace yourself for the admiring profiles of Chief Justice John Roberts. Last week's wisdom: right-wing nut in black robe. This week's wisdom: rigorous mind, independent nature, unswayed by partisan considerations, he's grown in the role since being appointed by George W. Bush." Ha ha ha. Nooners totally nails it. "Rep. Gary Ackerman D, who was holding a sign that read, "Obama-Roberts 2012″ as he left a Democratic Caucus meeting, said Roberts has 'rebranded himself' with Thursday's healthcare ruling." Change in the constitutional order: Neal K. Katyal, former acting Solicitor General: "This was the first significant loss for the federal government's spending power in decades." James B. Stewart, Times business columnist: "'The commerce clause is not a general license to regulate an individual from cradle to grave,' Chief Justice Roberts wrote. Libertarians and conservatives have been seeking such a declaration since the New Deal." Policy. Money: "When they were in power, House Democrats passed the DISCLOSE Act, which would have improved the now-limited disclosure of political donors, only to see it fail to garner the 60 votes necessary to achieve cloture and avoid a filibuster in the Senate" (ES). But if the Ds really cared about policies like this, they would have abolished the filibuster in 2009 with the nuclear option. King Corn: "IA ranks second in the nation in terms of farm subsidies, with 8.7 percent of the total in 2011. TX leads all states at $1.4 billion in subsidies, or 9.5 percent of the overall amount." Voting: "In a final vote of no confidence, Ireland's ill-fated e-voting machines are finally headed to the scrap heap. Plans to roll out the machines on a national basis in 2004 local … were abandoned … after a report from an independent commission raised issues about their reliability." Security: "The legislation, a massive bill that overhauls highway and transit programs, bars the use of federal money to purchase red-light cameras or other automated traffic enforcement cameras." Prediction is hard. Nate Silver: "Since the stock market is one of the economic variables the model considers, Mr. Obama's probability of winning the Electoral College rose with the European news, to 67.8 percent." Good thing Mr. Market is never manipulated. Oh, wait… The trail. Razor edge: "We find little evidence of a 'wave' election developing, and that means Democrats would have to cherry-pick themselves to a gain of 25 seats, an almost impossible challenge." Razor edge: "The three NBC/Marist Institute swing state polls released Thursday reconfirm the picture painted by the Quinnipiac University polls unveiled Wednesday in three other swing states: the presidential race stands on a knife's edge, with both President Obama and Mitt Romney facing substantial vulnerabilities with undecided voters. Fast & Furious: "Darrell Issa (R-Calif.) quietly dropped a bombshell letter into the Congressional Record. The May 24 letter to Rep. Elijah Cummings (D-Md.), ranking member on the panel, quotes from and describes in detail a secret wiretap application… [R]eleasing such information to the public would ordinarily be illegal. But Issa appears to be protected by the Speech or Debate Clause in the Constitution." So the nutso R, Issa, does something that sane, polite Ds could also do on torture, assassinations, warrantless surveillance, and a host of other issues they claim are important to them … But never do. So who's nutso, really? "[DEPUTY AG JAMES COLE:] We will not prosecute an executive branch official under the contempt of Congress statute for withholding subpoenaed documents pursuant to a presidential assertion of executive privilege.' [T]he department relied in large part on a Justice Department legal opinion crafted during Republican Ronald Reagan's presidency." Elizabeth Warren: "Of course Menino will endorse and help out Warren. But he's got a reasonably good relationship with Scotto, plus he doesn't want to unnecessarily tick off the many Brown-voting conservative-Catholic-Democrats in the city, plus he probably wants Warren to make clear that she understands how important he and his machine are. So he can wait a good while." Robama vs. Obomney watch. Romney supported the mandate in 2006 when he adopted RomneyCare. When Obama passed RomneyCare, Romney flipped and opposed the mandate. Obama opposed the mandate in 2008. Then Obama passed RomneyCare in the form of ObamaCare, flipped, and supports the mandate. Both sides: "ZOMG!!!! He's a FLIP-FLOPPER!!!!" And of course, both sides are right. One good thing: Now that the Obama Fans are swooning over John Roberts, we aren't hearing any more of the "ZOMG!!!! Teh Supreme Court!!! foo fra." Romney. "Romney increases criticism of Obama (with handy chart). Teebee: "The 30-second ad, titled "Shame on You," shows footage of Clinton, Obama's rival for the Democratic nomination in 2008, accusing Obama of spending "millions of dollars perpetuating falsehoods" in the hotly contested nominatiVon battle. "Shame on you, Barack Obama," Clinton, now Obama's secretary of state, says in the footage." Cheeky! Obama. Plouffe: "The White House is encouraging congressional Democrats to go on the offensive after the Supreme Court upheld the president's signature healthcare legislation Thursday, urging members on the campaign trail to 'illustrate how the President and Democrats in Congress are standing up for the middle class.'" Shorter Plouffe: Let's you and him fight. * 71 days 'til the Democratic National Convention ends with peeled grapes on the floor of the Bank of America Stadium, Charlotte, NC. Nora Ephron was 71. * * * Gold jumps over 3 percent on EU deal, logs monthly gain Posted: 29 Jun 2012 06:47 PM PDT from reuters.com: (Reuters) – Gold surged 3 percent to above $1,600 an ounce on Friday, ending June with its first monthly gain in five months, as a European deal to shore up banks and cut borrowing costs lifted bullion's investment appeal. Silver and platinum group metals also soared after EU leaders agreed to let their rescue fund inject aid directly into stricken banks from next year and intervene on bond markets to support troubled member states. Monetary stimulus by central banks and governments is bullish for gold, which has been a favorite among hedge fund managers and institutional investors to hedge against the loss of purchasing power due to currency depreciation and inflation. The metal, which has for the most part of this year moved in tandem with riskier assets, received a boost from heavy short-covering after losses earlier this week sent the metal close to being oversold. Keep on reading @ reuters.com |

| Art Cashin – Shorts Squeezed in Dear God Get Me Out Moment Posted: 29 Jun 2012 06:37 PM PDT

from kingworldnews.com: With global stock markets on the move, while gold and oil exploded to the upside, today Art Cashin told King World News that for the shorts, "It is a kind of 'Dear God get me out of here and I promise not to do this again.' So a general panic along those lines." Cashin, who is Director of Floor Operations for UBS, which has $612 billion under management, also commented on the spectacular rally in gold and oil. Here is what Art Cashin had to say: "Expectations for this summit were so low that if they came out of it without a fist-fight, we probably would have had a rally. The idea that they may have gotten something moving caused a spectacular short-covering rally in the euro and put pressure on the dollar. You can see oil is up 8%." Art Cashin continues: "Some of these things are phenomenal, but that's what happens when you get a huge short-covering rally. Gold is up $50, it's bizarre. It's not necessarily a reasonable progression. It is a kind of 'Dear God get me out of here and I promise not to do this again.' So a general panic along those lines. Keep on reading @ kingworldnews.com |

| Europeans Storing Gold in Switzerland On Concerns About Inflation and Systemic Risk Posted: 29 Jun 2012 05:29 PM PDT gold.ie |

| The Black Hole of Deflation & Gold and Silver - Part 2 Posted: 29 Jun 2012 05:26 PM PDT Gold Forecaster |

| World Navigating Troubled Waters: Gold and Silver Will Move Higher As Safe Haven Posted: 29 Jun 2012 05:14 PM PDT |

| Welcome to the Currency War, Part 2: Massive Euro Devaluation Posted: 29 Jun 2012 05:03 PM PDT Dollar Collapse |

| The Five Myths about the Gold Standard Posted: 29 Jun 2012 04:00 PM PDT |

| Posted: 29 Jun 2012 03:50 PM PDT By Sell on News, a global macro equities analyst. Cross-posted from Macrobusiness. The slow motion train wreck that is the Euro is grinding relentlessly on. Commentators are smugly, if not gleefully, announcing the currency's imminent demise, enjoying their triumphant occupancy of the moral high ground. The European elites are just as determinedly asserting that the currency will survive, looking for some sand to stick their heads in. The financial markets are looking to exploit the situation to best advantage, gloriously mixing self righteousness with hyper venality. It is quite a soap opera, a sort of financial Groundhog Day. The noise is obscuring the real questions. The most obvious of these is: "What will the currency markets look like when the situation is resolved?" It is worth recalling why the Euro was created. It was established to establish a bulwark against the financial markets, which were wreaking havoc with Europe's Exchange Rate Mechanism. Sovereign governments in Europe were trying to protect themselves against financial markets, specifically hedge funds and the likes of George Soros, in order to protect their control of money. There were also ancillary ambitions to have a reserve currency like the greenback, but that was always on the margin, for reasons I will explain later. It might be added that the greatest absurdity of the current situation is Soros pontificating about European policy and fretting about the power of the financial markets. A tour de force in hypocrisy to accompany his many achievements in making money, I suppose. A bit like an assassin complaining about rising crime rates. In terms of structure, there seem to be three possibilities. First scenario is that the Euro survives and the world moves into a three part currency world: the American dollar, China's yuan and the Euro, with the yen, Swiss franc and Australian dollar on the sidelines. This would have an effect on the power of the greenback as the world's reserve currency because there would be significant euro-yuan trade, partially sidelining the $US for the first time since the 1950s. (That is why the Euro is not a reserve currency, by the way, because 80% of its trades have the $USD on the other side). It would create three currency regions: Europe, Asia and America. A bit reminiscent of the three super states in 1984 it will just have arrived about 40 years late. Second scenario is that the Euro breaks up, with the world being dominated by the greenback and the yuan. This would leave the $USD with its hegemony, allowing America a degree of financial freedom on its economic policy that no other country enjoys. Third scenario is that the Euro collapses and the world starts to revert to a more nationalist currency regime, as it had twenty years ago. Once again, this would leave the $USD supreme. For what it's worth, I consider the first scenario the most likely, the second fairly likely, and the third unlikely. In terms of their sound function as money, the question is which system creates the most redundancy, that is, extra capacity to absorb shocks when things go wrong? This is crucial in a system that only relates to itself. I suspect scenario one is probably the most stable, although scenario three may also have capacity to absorb shocks. Scenario two, which would be similar to the current Euro-$USD axis, is unstable, as we are seeing. In a self referring system dyadic structures (i.e, binary) tend to magnify problems, because they keep bouncing off each other, they have nowhere to go to release the pressure. In terms of their character, the currency markets are likely to become increasingly post-modern. They have no objective standard; it is an exercise in total relativism. That is why gold bugs look so longingly at the yellow metal, they are pining for an absolute. Thus, when it is said that a currency weakens, it only weakens in relation to other currencies. There is no absolute measure of value. This does not seem to be well absorbed by financial market commentators and politicians. For instance, at the moment, much is being made by traders about the Euro falling to about, 1.1 against the $US, as if that is some harbinger of doom. Yet the Euro has been a lot lower against the greenback, at the moment it is in the mid range: What one notices when looking at this graph is the volatility. These major currencies have swung in a 100% range since the establishment in 1999. Such extremes can hardly be explained by differentials between their respective economies, or trade, current and capital account flows. They are a measure of sentiment amongst traders. In a world where there is no absolute, perception rules. It is a kind a idealism in which the idea comes first before reality:

Such idealism pretends to be realistic, based on objective truth, however. The currency markets are nothing if not riddled with contradictions. What it means in practice, was nicely described by an anthropologist friend of mine commenting on my piece last week about Peirce and pragmaticism:

The currency markets are not concerned with truth, they are concerned with meaning. What is yet to emerge is how that meaning will play out in terms of the market structure. What we do know is that it will be extremely volatile, and fast moving. Crises are becoming the norm, which is to say they are no longer crises. That means countries can recover as quickly as they can get into trouble. |

| By the Numbers for the Week Ending June 29 Posted: 29 Jun 2012 02:43 PM PDT |

| Posted: 29 Jun 2012 12:44 PM PDT |

| Stocks Dump Gold 2 Weeks Into Beach Season Posted: 29 Jun 2012 10:53 AM PDT By Jay Norris: Relationships change, behavior does not. Last year's best girl becomes this summer's "ex," and countless parents will comfort innumerable teenagers through umpteen break-ups. It's just the nature of relationships -- they change. As any real player will tell you, he/she who loves less wins. In the case of gold, her suitors have always been too enamored with her. Over the past several years, I've seen perfectly rational men alter their entire career paths after being seduced by her. They'll argue that she's going to take them to $3,000, or $5,000, even $10,000…and that you're a fool to not see gold is the only true asset class market. C'mon, even a first year econ student knows it isn't (gold does not produce a yield or a dividend, and it has a carry cost, not a carry yield). Love is blind, but the analysts aren't. Any fool can see, the relationship between Complete Story » |

| EU Master Plan: Lurching Toward Oblivion Posted: 29 Jun 2012 10:41 AM PDT The grownups of the European Union all got together for a nice dinner in Brussels last night, but the "peripheral nation" children refused to eat their vegetables unless they were first promised dessert. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment