saveyourassetsfirst3 |

- “Pressure Mounting” on Gold, But Central banks Still Adding to Reserves

- Embry: We’re On The Edge of Collapse, We’ve Run Out of Time

- Don Coxe – Get Ready, Banks to Collapse In Europe

- What Do Stocks and Bonds Tell Us About Gold’s Future Moves?

- ECB: decrease of oz793.09 in gold and gold receivables

- Gold Bides Time As ‘Risk Free’ German Debt Downgraded On “Exposure to Eurozone”

- Could You Make It Up? … World's Oldest Bank Gets Modern Bailout Worth Billions

- Liquidation is Vital

- Daily Pfennig: A Plan To Have A Plan?

- Homeless charity ‘swamped' by eurozone migrants

- Sabina A Possible 10-Bagger Within 2-3 Years

- ‘Pressure Mounting’ on Bullion, But Central Banks Buying

- Pondering Gold's Last 11.5 Years of Performance

- SilverFuturist: The “silver gone wild” scenario

- John Williams: “The System Will Fail”

- Fabian: War on The American People (Part I)

- Canada’s Pink Gold Rush Attracts the World

- Why Don’t Americans Take More Vacations? Blame It on Independence Day

- Further decline in Australian gold production during Q1

- Links 6/27/12

- Michael Hudson/Jeffrey Sommers: Latvia, the Austerians’ Potemkin Village

- China & Russia Buy Bullion as Protection

- Big Anything

- Is the Silver Price Finally Bottoming Out?

- The European Summit is a Write Off

- Income Inequality: The Silent Killer

| “Pressure Mounting” on Gold, But Central banks Still Adding to Reserves Posted: 27 Jun 2012 02:42 AM PDT from news.goldseek.com: U.S. DOLLAR gold prices dropped as low as $1565 an ounce during Wednesday morning's London trade – 1.4% down on this week's high – before recovering some ground by lunchtime, while stock markets posted slight gains ahead of tomorrow's European Union summit. Silver prices traded below $27 an ounce for most of this morning, while other industrial commodities were broadly flat on the day by lunchtime. On the currency markets meantime, the Euro was broadly flat against the Dollar, trading just below $1.25 for most of the morning. "We're in a bit of a period over the summer when we are going to see very little meaningful action by policymakers in three key regions – Europe, the US and China," reckons Daniel Brebner, head of metals research at Deutsche Bank. "Pressures in the gold market will continue to mount…I don't think there's any kind of catalyst near term for a significant rebound in gold prices." Keep on reading @ news.goldseek.com |

| Embry: We’re On The Edge of Collapse, We’ve Run Out of Time Posted: 27 Jun 2012 02:30 AM PDT

from kingworldnews.com: Today John Embry told King World News, when referring to what is needed to bail out Europe, "All I know is that these numbers are staggering … We are on the edge of collapse. We've run out of time." Embry, who is Chief Investment Strategist of the $10 billion strong Sprott Asset Management, also told KWN that if the euro does split apart, it "will be extraordinarily chaotic." Here is what Embry had to say about the crisis: "We've got to focus on what's coming up in the short-run with regards to the European situation. It's going to be an extremely interesting summit they are hosting this Thursday and Friday. The problems are piling up at such an enormous rate they can't be ignored anymore." John Embry continues: "There was this amazing back and forth today, where Merkel said, 'There would not be euro bonds as as long as she was alive.' Then, not longer after, Monti, the Prime Minister of Italy, came out and said that if there weren't euro bonds, he was going to resign. Keep on reading @ kingworldnews.com |

| Don Coxe – Get Ready, Banks to Collapse In Europe Posted: 27 Jun 2012 02:25 AM PDT

from kingworldnews.com: Today 40 year veteran, Don Coxe, told King World News "…the amounts involved are at mind-boggling levels," in terms of what is needed for Europe's governments and banks. Coxe, who is Global Strategy Advisor to BMO ($538 billion in assets), also said that European banks, "…have borrowed huge amounts of money, in dollars, under currency swap arrangements," and "if banks start to go down, we know from 2008, when banks start to crumble, then the whole system falls." Here is what Coxe had to say about the ongoing crisis: "Well, first of all we've got to stop using 'billions' because if there is going to be a fund that works, it's going to have a 'T' (for trillions) on it. We are dealing with some very big numbers in the sense that Italy, although it's not that big of an economy, it's got the third largest amount of bond debt outstanding." Don Coxe continues: "So Italy's situation is truly serious because they also have a short duration on their debt. If you were holding a three-year Italian bond, but it's only got three months to maturity, you are probably not going to sell it now because you want to get your money out. But you are not likely to roll it over, unless you are an Italian bank. Keep on reading @ kingworldnews.com |

| What Do Stocks and Bonds Tell Us About Gold’s Future Moves? Posted: 27 Jun 2012 02:19 AM PDT

from news.goldseek.com: Gold prices fell last Tuesday for the first time in eight days and Wednesday gold fell below $1,600 an ounce as buyers stayed on the sidelines ahead of the meeting of the U.S. Federal Reserve whichannounced Wednesday a modest increase in its efforts to reduce borrowing costs for businesses and consumers. The Fed voted to extend its existing "Operation Twist" asset-purchase program through the end of the year. In plain English, the Fed will keep selling short-term bonds, and using that money to buy long-term bonds.It gets its name not from the Chubby Checker song but from the Fed trying to twist the yield curve. The Fed has decided to play a game of wait-and-see. Recent U.S. economic data has been as soft as the belly of the Pillsbury Doughboy and the Fed's decision reflects that. There is growing concern that the economy is once again faltering into the summer months after the false start of a relatively strong winter. The Fed's policy-making committee said in a statement that it expected the economy would continue to grow at a "moderate pace," but it noted that "growth in employment has slowed in recent months," even as inflation has declined. Keep on reading @ news.goldseek.com |

| ECB: decrease of oz793.09 in gold and gold receivables Posted: 27 Jun 2012 02:04 AM PDT |

| Gold Bides Time As ‘Risk Free’ German Debt Downgraded On “Exposure to Eurozone” Posted: 27 Jun 2012 01:22 AM PDT |

| Could You Make It Up? … World's Oldest Bank Gets Modern Bailout Worth Billions Posted: 27 Jun 2012 12:56 AM PDT

from thedailybell.com: Italy to put €2bn into world's oldest bank Banca Monte dei Paschi di Siena … The Italian government said Tuesday it will provide struggling Banca Monte dei Paschi di Siena, the world's oldest bank, with up to €2bn to cover a capital shortfall. – UK Telegraph Dominant Social Theme: We've rescued all the rest, so why wouldn't we rescue the oldest one? Free-Market Analysis: Every day we slap our (admittedly low-slung) brows and let out whistles of amazement. The latest reason: It seems the world's oldest private bank is in need of a government loan. Once upon a time all banks were private, even the ones that belonged to the ruler. Banks were basically warehouses that collected gold and silver and issued receipts. These receipts later on turned into the monopoly fiat (unbacked) paper we use in such quantities today. In this little squib of a news article (excerpted above) we do not see any sense of amazement being expressed that a bank that has survived independently for some 600 years suddenly needs a huge injection of "capital." You would think that sort of thing might raise the proverbial red flag. We are obviously past that sort of questioning. It is apparently taken as a matter of course that if a bank is in jeopardy of bankruptcy it must not be allowed to fail. Of course, we are treated in the article to the usual reasons for such a bailout – most predictably it is because the Italian government is struggling to stave off "debt contagion." Here's some more: Keep on reading @ thedailybell.com |

| Posted: 27 Jun 2012 12:47 AM PDT

from azizonomics.com: Many Keynesians really hate the concept of liquidationism. I'm trying to grasp why. Paul Krugman wrote: One discouraging feature of the current economic crisis is the way many economists and economic commentators — apparently ignorant of what went on over the last 75 years or so of macroeconomic debate — have been reinventing old fallacies, imagining that they were coming up with profound insights. The Bank for International Settlements has decided to throw everything we've learned from 80 years of hard thought about macroeconomics out the window, and to embrace full-frontal liquidationism. The BIS is now advocating a position indistinguishable from that of Schumpeter in the 1930s, opposing any monetary expansion because that would leave "the work of depressions undone". Andrew Mellon summed up liquidationism as so: The government must keep its hands off and let the slump liquidate itself. Liquidate labor, liquidate stocks, liquidate the farmes, liquidate real estate. When the people get an inflation brainstorm, the only way to get it out of their blood is to let it collapse. A panic is not altogether a bad thing. It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people. Keep on reading @ azizonomics.com |

| Daily Pfennig: A Plan To Have A Plan? Posted: 27 Jun 2012 12:36 AM PDT

from caseyresearch.com: In This Issue… * Very tight range for currencies… And, Now, Today's Pfennig For Your Thoughts! A Plan To Have A Plan? Good day… And a Wonderful Wednesday to you! I'm at a loss this morning… Usually, I have done some reading the previous night, and come to work loaded for bear… But that didn't happen last night, as Alex and his band mates had "band practice" in my man cave / basement… While I love listening to Alex play his guitar, the beating of the drums gets to me after about, oh, 5- minutes! So, I went upstairs, to watch the baseball game… and since my computer is downstairs… no reading! Which means this could be short-n-sweet today… and then again, you never know with me, once I begin to bang on the keyboard with my fat fingers! And never knowing what's going to happen next is the trading pattern we've been thrust into these past months, but even more so now, as the Central Bankers around the world, begin to figure out, what they could have learned years ago, by reading the Pfennig, and that is… they can't control the economy like they think they can! And with every Central Bank meeting between the U.S. and Eurozone, the lead up to the meeting is full of anticipation, and then are left with disappointment… Keep on reading @ caseyresearch.com |

| Homeless charity ‘swamped' by eurozone migrants Posted: 27 Jun 2012 12:29 AM PDT

from telegraph.co.uk: A homelessness charity has called on the Government to restrict immigration, saying it is being "swamped" with destitute people fleeing the eurozone's troubled economies. Keep on reading @ telegraph.co.uk |

| Sabina A Possible 10-Bagger Within 2-3 Years Posted: 27 Jun 2012 12:17 AM PDT

from dollarvigilante.com: Investors looking for an emerging producer with the capability to put a medium sized gold deposit into production in a relatively politically stable jurisdiction, where costs are reasonable, and without having to dilute shareholders with a gazillion share issue, or bootstrap itself with a project financing, look no further. The timing is probably good too. Sabina Gold & Silver published a preliminary economic assessment completed by SRK on the Back River project recently. The news release stated the following: "PEA contemplates a scenario with concurrent open-pit and underground mining operations delivering mineralized material from the Llama, Umwelt, Goose and George deposits to a centralized 5,000 tonne per day ("tpd") processing facility located near the Umwelt deposit. Gold production is projected to average ~300,000 oz/year over 12.3 years for total production of 3,677,000 oz Au, beginning in late 2016 or early 2017." Keep on reading @ dollarvigilante.com |

| ‘Pressure Mounting’ on Bullion, But Central Banks Buying Posted: 26 Jun 2012 11:51 PM PDT US dollar gold prices dropped as low as $1,565 an ounce during Wednesday morning's London trade – 1.4% down on this week's high – before recovering some ground by lunchtime, while stock markets posted slight gains. |

| Pondering Gold's Last 11.5 Years of Performance Posted: 26 Jun 2012 11:24 PM PDT Gold price has been hampered recently by deflationary, or more accurately, dis-inflationary forces, and the US dollar strength. However, despite the economic headwinds, the European credit crisis, and the stock markets' volatility, gold futures are still up 0.5% for this year. |

| SilverFuturist: The “silver gone wild” scenario Posted: 26 Jun 2012 11:22 PM PDT Prediction: from silverfuturist: ~TVR |

| John Williams: “The System Will Fail” Posted: 26 Jun 2012 11:17 PM PDT Anyone who thinks the U.S. is in recovery should stop listening to the mainstream media and listen to John Williams. He heads up Shadowstats.com, and is one of the few economists who crunches the numbers to give unvarnished true statistics. from usawatchdog: Adjusted for real inflation of about 7%, Williams says, "GDP has plunged, and we have been bottom bouncing" ever since the financial crisis started. Williams says, "The next crash will be a lot worse (than 2008) because it will push us into the early stages of hyperinflation." He predicts this will happen "by the end of 2014″ at the latest. Long before 2014, Shadowstats.com thinks there is a good chance of "panic selling of the U.S. dollar," if the Federal Reserve starts another round of money printing (QE3) to save the system and the big banks. No matter what Williams predicts, "There will eventually be a crisis to bring the system down as we know it. . . . We're on the brink." According to Williams, "at some point, you will see a new currency in the U.S." The founder of Shadowstats.com sat down for a one on one interview with Greg Hunter to talk about the mathematical certainty of a systemic collapse in the not-so-distant future. ~TVR |

| Fabian: War on The American People (Part I) Posted: 26 Jun 2012 11:07 PM PDT Tanks rolling down the street in St. Louis is the latest example of urban warfare drills breaking out across America. In San Diego the Pentagon as built a mock American City made up of 1,560 buildings for troops and special forces to train. Why is the system doing this? And what if anything does this have to do with the ecumenic collapse? from fabian4liberty: ~TVR |

| Canada’s Pink Gold Rush Attracts the World Posted: 26 Jun 2012 10:18 PM PDT China and India have high-priority national mandates to get a piece of the potash action in what is now being dubbed as Saskatchewan's Pink Gold Rush. Both emerging superpowers are anxious to lock-in long-term supplies by partnering-up with smaller players. |

| Why Don’t Americans Take More Vacations? Blame It on Independence Day Posted: 26 Jun 2012 09:55 PM PDT An article in the Boston Review by professor of sociology Claude Fischer falls prey to a pattern that is all too common: attributing social/political outcomes to American attitudes without bothering to examine why those attitudes came to be. Let me give you a bit of useful background before I turn to the Fischer article as an illustration of a lack of curiosity, or worse, among soi disant intellectuals in America, and how it keeps Americans ignorant as to how many of our supposed cultural values have been cultivated to inhibit disruptive thought and action. Since I have managed to come in on the last act of Gotterdammerung and am still trying to find the libretto, I've been in what little spare time I have reading history, particularly on propaganda. One must read book is by Alex Carey, Taking the Risk Out of Democracy. Carey taught psychology in Australia, and he depicts the US as the breeding ground for the modern art of what is sometimes more politely called the engineering of consent. The first large scale campaigns took place before World War I, when the National Association of Manufacturers began its decades-long campaign against organized labor. Carey stresses that propaganda depends on cultivating Manichean perspectives, the sacred versus the Satanic, and identifying the cause to be promoted with symbols that have emotional power. For many people, Americans in particular, patriotism is a rallying point. Carey demonstrates how, again and again, big business has managed to wrap itself in the flag, and inculcate hostility to unions. One of the early struggles was over immigrants. A wave of migration from 1890 to 1910 left many citizens concerned that they were a threat to the American way of life. Needless to say, corporations were opposed to restrictions on immigration, since these migrants were willing to accept pretty much any work. Thus the initial alignment of interests was that whole swathes of American society were allied with the nascent labor movement in opposing immigration. And this occurred when even conservatives saw concentrated corporate power as a threat to American values (witness the trust busting movement, the success of the Progressives). Big business split these fair weather friends by promoting an Americanization movement. These foreigners simply needed to be socialized: taught to speak English, inculcated in American values. In addition, the radical Industrial Workers of the World had become a force to be reckoned with, culminating in its success in the Lawrence textile mill strike in 1912. So even though labor unions were particularly hostile to immigrants, the IWW's leadership role made it possible to cast unions as subversive, a symbol of foreign influence. The counterweight, the Americanization movement, was born in 1907 with the establishment of the North American Civic League for Immigrants, headed by conservative businessmen. Aligned groups. such as the New England Industrial Committee, were created as NACLI promoted its program. The success of the Lawrence strike, which garnered national outrage due to police beatings of women who had volunteered to transport and harbor children of strikers, increased the urgency of countering the union threat. The message was that chambers of commerce, as "conservators of the 'best interests' of their communities" needed to educate (as in domesticate) adult alien workers. This Americanization movement had business backers in every sizable city with an immigrant population doing outreach to business organizations, church leaders, and other community groups. In 1914, NACLI decided to extend its program nation-wide, and changed its name to the Committee for Citizens in America. The CIA paid and provided staff to the Department of Education [correction: Federal Bureau of Education] to sponsor Americanization programs (private interests' ability operate directly through the Federal government ended in 1919). The outbreak of World War I was a Godsend to the Americanization movement. The war stoked nationalist sentiment and with it, suspicion of obvious aliens as at best "un American" and at worst, subversive. President Wilson spoke at a highly staged "patriotic" event for 5000 recently naturalized citizens in spring 1915. This event was so successful that the movement leaders succeeded in forming local Americanization committees all over the US. Quoting Carey:

Carey describes and quotes a pamphlet promoting the event written by one of the executive committee members:

This hidden history of our national celebration is only a small portion of Carey's account of the extent and reach of the Americanization campaign. It shows how big business has led a long standing, persistent, and well financed campaign to turn the public against fighting for one's rights if those rights are workplace rights. Now let's look at the Fischer article in light of this. He does, usefully, describe how Americans toil far more than their advanced economy peers:

This sets up the key question:

Fischer's teasing out of the first "answer" (he offers only two options and later points out that they are not mutually exclusive) is an embarrassment. He claims Americans have little "class consciousness" and in passing contends well financed propaganda efforts have no effect:

Anyone who has studied the history of public relations in the US will not only tell you it works, and will be able to provide numerous examples, starting with the Creel Committee in World War I, which turned a pacifist US into rabid German-haters in a mere 18 months. But Fischer would rather appeal to Americans' vanity and exceptionalism. Carey, by contrast, documents the intensity of messaging efforts, the channels used, and tracks how polls and headlines changed. And contra Fischer, he finds Americans to be particularly susceptible to propaganda (by contrast, Australians' native skepticism of authority, keen sense of irony, and strong community orientation gives them a wee bit of resistance, although Carey described how they were being worn down too). Mark Ames wrote on the same topic in 2006, and his article is more on point:

Now in fairness to those office slaves, while Americans buy into the "always on duty" attitude (I noticed how little smart phones and IPads were visibly in use, even in the toniest parts of London, compared to New York City), some of it is rational. Even before the bust, it was hard for anyone over 35 who loses a job to land another, much the less at the same level of pay, job tenures are short, and companies keep squeezing workers. Everyone I know who is still on the corporate meal ticket is doing what would have been one and one half or two jobs ten years ago. So while there is no easy way to turn to regain control of a cultural commons so throughly under the sway of well heeled corporate interests, perhaps we can start to engage in small acts of reprogramming. While I am not telling you to skip Fourth of July fireworks, it might be time to recognize key events that help us look at our history with fresh eyes. Perhaps we should quietly celebrate what we still have of the America our founders envisaged, say on the anniversary of the signing of the articles of Confederation (a protracted affair, with the last signature affixed on March 1, 1781) or their replacement with the Constitution on March 4, 1789. But regardless of how individuals go about it, the more we recognize how cultural memes are created and propagated, the more hope we have of freeing ourselves from them. |

| Further decline in Australian gold production during Q1 Posted: 26 Jun 2012 09:02 PM PDT |

| Posted: 26 Jun 2012 07:12 PM PDT Dear readers, our Matt Stoller is a writing for and performing in (as a straight man, natch) a new comedy show on FX starring Russell Brand. It's called Brand X and starts June 28th at 11 PM Eastern. Although I'm not privy to details, I believe it will push the bounds of discourse beyond the acceptable (as in barely left) margin defined by Paul Krugman and Jon Stewart. Be sure to catch it! Condors threatened by 'epidemic' lead poisoning from hunters' bullets Christian Science Monitor South Korea to ban catching of dolphins for shows PhysOrg The amazing iguana which can stay underwater for half an hour – to feed from the bottom of the ocean Daily Mail (May S) Google team: Self-teaching computers recognize cats PhysOrg (Robert M) Roman coin hoard found BBC (John M) Healing Spirits Lapham's Quarterly (Aquifer) Drug War is Fueling the Global HIV Pandemic Alternet (furzy mouse) 5 Ways Email Can Completely Ruin Your Life Alternet Facebook changed your e-mail address, here's how you can change it back CNET (furzy mouse). Haha, no Facebook here! Manic Nation: Why Americans Are Anxious, Stressed, Depressed and Fat (And What We Can Do About It) Alternet (Aquifer) Chart: What Killed Us, Then and Now Atlantic (Carol B) Death by suburban sprawl: better urban planning will combat sedentary lifestyles The Conversation (May S) As Congress looks away, U.S. tiptoes toward exporting a gas bounty Reuters 'Supreme leader' is fascist Tehelka (May S). And in case you think the headline is over the top: Hindu Nationalist's Historical Links to Nazism and Fascism International Business Times China's, ahem, "stabilising trade" MacroBusiness Tax scandal reaches No.10 as it's revealed Cameron's spin doctor helped run 'avoidance' scheme for BBC presenter wife Daily Mail (May S). Fact set is so bad DM can get away with a straightforward and relatively short headline. Will European Peripheral Sovereigns be Monetized? Russ Winter Monti lashes out at Germany ahead of summit Financial Times Robert Mundell, evil genius of the euro Greg Palast, Guardian (Aquifer) Look beyond summits for euro salvation Martin Wolf, Financial Times Spanish Officials Hailed Banks as Crisis Built New York Times US home prices rise for third month Financial Times versus Home Prices In U.S. Cities Fall At Slowest Pace Since '10 Bloomberg The Mixed Economy Manifesto: Part 1 New Economic Perspectives. Not a bad program, but the tone is defensive, which is understandable given how neoclassical economics dominates academia and the MSM. IMHO, the opponents need a more direct line of attack. Maybe the simplest is that neoclassical economics assumes no actor has any power (they acknowledge but then largely ignore monopolists and oligopolists). Since both buyers and sellers have varying degrees of power, this means neoclassical economics is flat out irrelevant. Breaking Up Big Banks Hard To Do As Market Forces Fail Bloomberg. This is not hard to understand. Bank CEO pay is highly correlated with size of balance sheet. Yes, there is an alternative to capitalism: Mondragon shows the way Guardian (Aquifer) Pro-business and pro-markets are different MacroBusiness * * * Lambert here: D – 74 and counting* "You're gonna have to learn your clichés. You're gonna have to study them, you're gonna have to know them. They're your friends. Write this down: 'We gotta play it one day at a time.'" –"Crash" Davis, Bull Durham Occupy. Long form post partum on Occupy Toronto: "'Okay,' says Marechal. He turns back to speak with Inspector Neadles. 'This protester's demand is that he be arrested,' Marechal says. 'And, seeing as you brought so many of your fine officers with you today, I was wondering if you could help facilitate this process.'" Post partum on OWS: "When OWS began erecting tents to provide shelter from the elements, public space began vanishing from Zuccotti. Paths through the park narrowed and vanished. Flower-beds were camped on and destroyed. By early November, the public meeting space at the eastern edge of the park, where the General Assembly was held, had all but vanished. Vicious turf-wars occurred over sleeping space. Various ideas of private property were invoked and denied. In the privacy of individual tents, crime flourished." But aren't hard problems the ones worth solving? Montreal. Printemps Érable post partum: "The first word means "spring"; the second means "maple." … [T]he École de la Montagne Rouge artist collective … pronounced it for me — twice: one way of stressing the "é" means "maple"; the other means "Arab." [Not quite. Arabe: pun, not homonym.] [The phrase] acknowledges instead our sense of deliciously sweet interconnectedness, mutual inspiration, and the shared project — notwithstanding all the very real contextual differences that make each uprising translatable and yet not translatable — of not only desiring but self-organizing toward new forms and contents of freedom. It's like hanging around the sugar shack, after the sap has run and been collected in buckets, after it's been boiled down into a thick maple syrup, when people gather together to hold maple festivals and share treats like "sugar on snow" or maple candy. They get this collective high — the fruits of their labor suddenly tasting extra poignant." CO. David Sirota: "Mark my words: the moment Fox News or MSNBC or NBC/ABC finally says the fires are 'news' we will see Obama and Romney in Colorado." (DCB) GA. Mass incarceration: "Since June 10 … an undetermined number of prisoners at Georgia's massive Diagnostic and Classification Prison near Jackson have been on a hunger strike. … [P]rison officials simply told [Miguel] Jackson 'You're going to die,' and left it at that." NOTE: Readers will remember that is the second example of non-violent tactic #159 in the news lately. IA. Voting: "[Gov] Branstad's new process [for felons to regain their voting rights] requires applicants to submit a credit report." Nice precedent! LA. Corruption: "Covington businessman Frank Fradella has been charged [with one count of securities fraud and one count of conspiring to bribe a public official ] in a new bill of information that appears to implicate former Mayor Ray Nagin." Tasers: "A Metairie mother has sued the Jefferson Parish Sheriff's Office, claiming deputies tortured her with a Taser and a stun gun during an incident near Gretna last year." MI. Occupy Detroit: "So far we have been successful in keeping people in their homes (and in one case, in his business) by forcing banks to renegotiate the mortgages." MT. Voting, money: "[T]he R Party of Sanders County, MT, filed a federal lawsuit, to overturn the Montana law that makes it a criminal offense for a political party to endorse a candidate for state court judge." NC. DNCon: "Organizers announced Monday night they are moving the much-touted Labor Day festival from Charlotte Motor Speedway to uptown Charlotte." DNCon: "McCaskill joins a growing list of D senators and representatives who face tough re-elections who have said they will not attend the convention in Charlotte." "Senators Jon Tester of MT and Joe Manchin of WV are the other senators who find themselves too busy to make the trip." NY. Corruption: "The former head of a Bronx gay and lesbian center was busted for allegedly scamming $338,000 from the non-profit outfit to pay for vacations and a dog walker." (AH) Corruption: "A Troy-based company that serves youths throughout the Capital Region has been flagged … for [$831,244 in "disallowed" charges between 2008 and 2010], including what auditors say amounted to a no-show job for one of its directors." A snob grows in Brooklyn Heights: "I have worked very hard to be able to afford to live on Montague Terrace and i do not need a hot dog vendor out side my window so he can make a few bucks." OH. Fracking, tinpot tyrants: "A 'fracking' protester [and local landowner] who had secured herself to two concrete barrels at an oil and gas waste-water injection well in Alexander Township was separated from the barrels and hauled away by a sheriff's cruiser. [She] explained that she had volunteered to be the person who committed civil disobedience to help draw attention to the issue of waste-water injection wells in Athens County. [L]aw enforcement soon blocked the [accompanying protesters' view] with vehicles, and then ordered the protesters to move about 150 yards down the road to a nearby intersection. They also ordered the news media away…. [More help was] called in, including the Ohio State Highway Patrol, the federal Department of Homeland Security and an unidentified fire department, apparently to help with the chains." What law were these guys enforcing, actually? And wasn't a multijurisdictional police response excessive — and expensive? And since when does the DHS need to get involved? Corruption: "[A] branch of the OH Chamber of Commerce received a huge grant from Michelle Rhee's StudentsFirst just as they started ramping up lobbying efforts to promote anti-teacher legislation in Ohio. StudentsFirst is reportedly on track to raise hundreds of millions of dollar over the next year from anti-public school advocates and billionaire hedge fund managers. And they plan to put that money into state-based efforts like the one in Ohio." Awwww! "Dad saves kittens before fire destroys mobile home." TN. Privatization #FAIL: "DCS can save several million dollars if it does its own training. That does require adding roughly 30 permanent positions. She expects many will be filled by longtime social-workers looking to advance their careers with the state. Other state departments are also moving functions in-house to save money. TDOT Commissioner John Schroer says some of the design work for roads and bridges is returning to state employees, who can sometimes do it for half the cost." We have a word for privatization. But we don't have a word for… publification? Publifying? What does that say? Your tax dollars at play: "$266,000 given by the state to Volkswagen to put a sign atop its Chattanooga plant that is visible only from the air… [O]nly about 500 people per day fly in or out of the airport." But the only people who matter fly executive jets, so that's OK. VA. #UVA Hoo d'Etat: Board of Visitors reinstates President Sullivan, unanimously. BoV meeting, Fralin leads off: "It is my opinion that everyone agrees that the process was flawed. It can never be repeated when important decisions are being made by this Board." In a moment of high academic comedy proposes a committee: "I encourage the members to consider establishing a strategic planning committee consisting of Board ofVisitor members, staff members, and faculty members with advice from outstanding consultants with higher education backgrounds to develop a strategic vision and direction for this great University." Next, Rector Dragas: " … mindful of the constraints of the confidentiality of personnel matters and the non-disparagement agreements in the President's contract (!) …. I want to say once again to the University, and directly to my fellow Visitors: I sincerely apologize for the way this was presented, and you deserved better." Finally Sullivan to crowd outside the Rotunda: "I have been especially proud these past three weeks to hear the careful crafting of reasoned arguments from alumni and students. These arguments have shown that the University is still providing to the world the educated citizenry that Mr. Jefferson wanted to safeguard the new Republic." Genuinely classy. World, watching: "The #UVa stream of BOV meeting topped out at 13,300 viewers; #uvafinals2012 [final exercises] topped out at 600." Twitter: "#UVA experience makes me especially grateful for quality local media. Thx @HenryGraff @readthehook @cavalierdaily @cvillenews!" I agree, adding twitter itself: Here's a nifty visualization of #UVA. Reaction, Siva Vaidhyanathan: "It's clear that we all have to do twice as much work over the next few years to get beyond this moment, but everybody in the UVa community is totally signed up [for what? Bad, cynical lambert!] and committed and we're ready to work twice as hard." Blogger: "Right now, Ms. Teresa , and one of the most powerful in the country.Sullivan is likely the most powerful University President in Virginia's history She is supported by an unprecedented, in my memory, campus and alumni coalition, at a very critical time in higher education." Twitter: "#UVA's reinstatement of Sullivan is something that's literally never happened before at a major research university." Lambert here. What have we got that's good? Secrecy remains. Only insiders know the whole story. Larry Sabato: "Friends, enough second-guessing the #UVA matter. I'm not answering questions about what really happened, who did what to whom, etc." ("I know it was you, Fredo.") The timeline: "1. Dragas decides President Sullivan is not doing something enough. (What, exactly that is, is still unclear.) 2. Dragas then does not tell Sullivan that she is not doing something enough. Repeatedly…." WaPo reporter to Fralin: "So what exactly just happened? How did all of the board members come to an unanimous vote without a lengthy public discussion?" Fralin stonewalls. the excellent Cavalier Daily: "The process that led to Sullivan's reinstatement was just as shrouded in secrecy as the process that led to her resignation. The Board voted 12-1 to appoint an interim president on June 19, and all 12 of those members supported Sullivan today. Apart from the resignation of Vice Rector Mark Kington and the publication of emails between Dragas and Kington discussing changes in the field of higher education, the public has little insight into what [or who] forced the Board to rescind its earlier decision." Governance issues remain. Compares this chart of governance structures at UVA and UBC, where UBC is in the top 50 and UVA is in the top 200 world rankings. "It is simply foolhardy to assume governance systems can and should exclude those being governed." (You mean like our electoral system?) (See also this good tabulation of various university governance structures.) Privatization and MOOC issues remain unclear — and they apparently sparked the firing! "In the aftermath of #UVA, it might be worth detailing why digital humanities scholars [e.g., Siva Vaidhyanathan!] are some of the most vociferous opponents of MOOCs." Corrupt and Orwellian language remains. "Insta-Strategic Mercurialism!" And debt remains, just as in Montreal. "As resources dwindle [translation: As public space is starved and looted], universities are left with little choice but to put more of the financial burden on students who are already taking on record levels of debt." Feature, not bug (cf). All that said, I think the outcome is big net positive, in that the university community asserted its agency, individually and collectively. The events at #UVA were, all in all, an uprising, although a very genteel one. "At a university that takes special pride in its rigorous codes of honor, the process by which Ms. Sullivan was pressured to resign sparked some of the greatest outrage." As it should have. The source of that outrage leads me to what I think is the moral of the story: "It was the pace of change that apparently motivated the Board to try to oust Sullivan. In this act, they were guided by many management consultants. But not, apparently, by Peter Drucker, who famously observed, 'Culture eats strategy for breakfast.'" The left, which does a lot of work on strategy, would do well to consider this. WI. Zombie iron mine rises: "The Wisconsin Mining Association has hired Behre Dolbear Group Inc. to analyze Wisconsin's mining laws. The collapse of mining legislation prompted Gogebic Taconite … to abandon plans to construct a massive open pit [iron] mine spanning Ashland and Iron counties. The chairman of the mining association … was appointed by Walker in February as a special assistant for business and workforce development." Referenda: "A D lawmaker plans to introduce a bill [modeled on an Ohio law] next session that would allow the public to force a referendum to repeal individual laws." Lesson learned from SB5! Privatization #FAIL: "Lassa cites a 2009 Legislative Audit Bureau report which found that nearly 60 percent of the work done by outside consultants on highway projects could have done less expensively using state employees. Walker's proposed 2011-13 budget called for axing this annual report." Outside Baseball. Prediction is hard: "In some ways, in fact, poor forecasts seem to be a part of the human condition." Media critique. The discourse: "It was these explicative and clarifying statements on the economy ['doing fine'] that bloated the Obama campaign's neutral messaging. Over 50% of statements from the Obama campaign from June 7 – 19 were about the economy, and 37% of these were neutral." Keen chart, showing you can't clean up your gaffe and go on the attack at the same time. Cable weasels: "After several months of bad ratings news for CNN, official quarterly numbers confirm that the cable news network has hit 21-year lows in both viewers and adults 25-to-54." Digital sharecropping at Patch. Policy. Climate: "A federal appeals court on Tuesday upheld the first-ever regulations aimed at reducing the gases blamed for global warming." Mass incarceration: "As I've pointed out multiple times, the United States is the world's largest police state, with more people in prison both in absolute numbers and as a percentage of population than Stalin at his worst. So what is the end game of police states?" HCR. Will the Court punt? "The most deflating option, for all of those anxiously awaiting a definitive decision, would be for the Court to issue a simple order setting the case for re-argument at the next Term, starting October 1." October surprise?! What happens next? "More than three-fourths of Americans want their political leaders to undertake a new effort, rather than leave the health care system alone if the court rules against the law, according to the poll. … A new health care bill doesn't seem to be in either party's plans." Grand Bargain™-brand cat food watch. Shock, or not? "Republican and Democratic congressional leaders are weighing whether to delay automatic federal spending cuts until March 2013." So, "automatic" except manual? Atrios: "Amazingly Congress discovers that they can change laws. They voted for these cuts, and now they're changing their minds! Next thing you'll be telling me is that if they pass tax increases and budget cuts, they could go back and rescind the tax cuts! I just won't believe it." Economalism: "The OECD economic survey does contain some qualified backing for the Affordable Care Act – aka Obamacare – for its help in containing government healthcare spending. It suggests upping the Medicare entitlement age upwards." Old people are expensive so let's kill them! ("Upping…. upwards?") Elizabeth Warren. 2016 warm-up: "[WARREN:] No, Mitt, corporations are not people. Peopl |

| Michael Hudson/Jeffrey Sommers: Latvia, the Austerians’ Potemkin Village Posted: 26 Jun 2012 06:03 PM PDT Yves here. I'm dwelling on the spectacular failure of Latvia in part because readers like the writings of Michael Hudson, but more important, because a major push is on to reimage the implosion of that economy as some sort of success, not unlike the claims the Chicago Boys made for their efforts in Chile. It also doesn't hurt that this account, which is a considerably expanded version of a recent Financial Times op-ed, is vivid and pointed. By Michael Hudson and Jeffery Sommers, a distinguished professor at the University of Missouri-Kansas City and associate professor at the University of Wisconsin-Milwaukee respectively, who have both advised members of Latvia's government on alternatives to austerity. They are also contributors to the forthcoming book by Routledge Press: The Contradictions of Austerity: The Socio-Economic Costs of the Neoliberal Baltic Model. Cross posted from Counterpunch by permission of the authors Austerity's advocates are declaring victory with Latvia's battle against the European economic crisis and advocating it as the model for Greece & Spain to emulate. Curiously, Latvians have been declaring this "win" by exiting their country. The "austerians" are celebrating Latvia as the plucky country that through hard work and discipline showed the way out of the financial crisis plaguing so many countries. For austerians, Latvia represents a veritable Protestant morality play demonstrating that austerity works. Indeed, they hope the Latvian example will retread Margaret Thatcher's "there is no alternative" tire for a European-wide scale austerity tour. Few writing on the subject unfortunately have the time on the ground to evaluate the economic and social costs of the Latvian model. While the Latvian government chose austerity, most of its people have not. Feeling there is no acceptable political alternative available, many elect to emigrate. The European Commission and the IMF declared this victory with a public event in Riga on June 5th celebrating the Latvian model. The IMF head, Christine Lagarde, proclaimed Latvia "could serve as an inspiration for European leaders grappling with the euro crisis." The IMF's chief economist, Olivier Blanchard, followed with a mea culpa admitting initially he thought the Latvian peg and internal devaluation program a "disaster," but now sees success. To better appreciate Blanchard's remarks one must bear in mind Latvia is one of the few countries following the 2008 crisis that actually attacked the IMF from the right on economic and social policy. In effect, Blanchard and the IMF are declaring, "our policies were too cautious on austerity, long live austerity!" For the IMF it reprises a familiar chorus harkening back to their greatest hits of the 1980's and 1990's glory days of structural adjustment. A seat at the table of power routinely flatters pundits invited to these affairs. They dutifully report, rather than investigate, what they are told. On Latvia, The Economist, to paraphrase Paul Krugman's characterization of US Congressman Paul Ryan, increasingly "looks like stupid person's idea of what a smart magazine looks In short, Latvia is not a model for austerity in Greece or anywhere else. The impression that neoliberal policy has been a success is debatable, and the claim that Latvians have voted to support it, false. Latvia's solid economic growth since its economy plunged by 25 per cent in 2008-10 is billed as a success. Its unemployment during the crisis soared above 20 per cent as the shutdown of foreign capital inflows (mainly Swedish mortgage loans to inflate its real estate bubble) left Latvia with deep current-account deficits. It had to choose between devaluation and maintaining the euro peg. There are inherent problems with either choice, but the theological manner in which the choices have been made has been disturbing. Latvia's government chose internal devaluation in order to proceed towards euro accession; and indeed this goal is more popular with Latvians given the people have lost their savings multiple times to devaluations and banking crises since the collapse of the USSR. To meet the eurozone criteria on inflation and deficits it cut public sector wages by 30 per cent, driving down consumption to match its low labor productivity. What enabled Latvia to survive the crisis were EU and IMF bailouts (a "credit card" which for whom the Latvians did not utilize the full credit line extended) – whose payments will soon fall due. Relatively low public sector debt (9 per cent of gross domestic product at the start of the crisis) also provided some protection from bond traders. Latvia's problem was mostly private sector debt; especially mortgage debt, which is often secured not only by property but also by the personal liability of entire families as joint signatories. The banks insisted on this measure as it saw unaffordable housing prices being inflated by reckless bank lending. For this, the Swedes, have thanked Latvia for taking on a Stockholm Syndrome view of the crisis, thus having Latvia fall on the sword of austerity to protect Swedish Banks and the Swedish economy. To be fair, the Latvians expect this gratitude to be returned by both euro accession in 2014 and continued Swedish liquidity supplied to the Latvian economy. Whether either of these is good for Latvia is contestable. Yet, what of the contention that Latvia's people supported austerity as distasteful, yet necessary? Latvia's parliament often polls approval ratings in the single and low double-digits. Yet the government has survived two elections. How is one to read this? Chiefly by ethnic politics. Harmony Center was the biggest party opposing the austerity model—albeit often without consistently voicing any program. Moreover, the party (as with most in Latvia) contains its quota of grabbers and neoliberals as most of Latvia's parties do. They largely represent ethnic Russians and had no chance of winning given its focus on rights for Russian speakers. Other previously powerful parties were run by post-Soviet oligarchs. They were rightly seen as being in league with Russian interests and are widely resented for fiscal imprudence during the boom years, when they were part of the governing coalition. So the only political force left was the austerians. While most voters dislike their economic policy, a majority is convinced that they are best able to resist Russia's embrace. All other issues come a distant second for Latvian voters. That said, Latvians strongly protested austerity. On January 13, 2009, in the dead of winter, 10,000 in Riga protested against austerity and corruption. Teachers, nurses and farmers held demonstrations in the months following. The national police were called to suppress protests over the closure of a hospital in Bauska; fearing local police might not do what was "required." Police detained one economist for two days for his remarks on the economy, meanwhile there is evidence a foreign economist in Riga critical of Latvian economic policy had his phone tapped. Latvia is by no means a police state, but neither is it innocent in matters of controlling public opinion either. Latvia's policymakers in the main are neither saints nor sadists. Indeed, some genuinely care about the country's future. Their Prime Minister leading the austerity charge is by all accounts a paragon of integrity. Unfortunately, he has come under the policy counsel of Anders Aslund, now seeking to salvage his place in history given he was one of the chief proponents of the failed shock therapy in 1990's Russia. Too many in Latvia, however, take a view of the poor and of the country's speculators that would comfortably fit in the pages of Ayn Rand's Atlas Shrugged. This is especially true of Central Bank, which has dominated economic policy since Latvia's independence in 1991. For Latvia's elite, the internal devaluation and austerity program have become something of a vanity project. Coming of age during the 1980s when the USSR was crumbling and the US neoliberal model ascendant, they fully internalized market fundamentalism as a rigid dogma to advance liberation from the Soviet occupation. The chief criterion for its selection seems to be it was the model that looked most different from Soviet policy. To see their austerity model heralded by the IMF and ECB today is seen as vindication of their worldview, and repudiation of the putdowns heaped on them by chauvinistic occupiers in the past. Elites aside, many emigrated. After these protests subsided, Latvians resigned themselves to the situation and left. Demographers estimate that 200,000 have departed the past decade – roughly 10 per cent of the population – at an accelerating rate that reflects the austerity being inflicted. Latvian demographers estimate that at least 200,000 have left Latvia the past decade, Moreover, birth rates declined from already low numbers. If a similar percent left the US, some 30 million would exit. Where would they go? Mexico? Surely, this model cannot be reproduced in any sizeable country. Why have so many left Latvia if it is such an economic success as the advocates claim? Latvia experienced the full effects of austerity and neoliberalism. Birth rates fell during the crisis – as is the case almost everywhere austerity programs are imposed. It continues having among Europe's highest rates of suicide and of road deaths caused by drunk driving. Violent crime is high, arguably, because of prolonged unemployment and police budget cuts. Moreover, a soaring brain drain moves in tandem with blue-collar emigration. The moral for Europeans is that a Latvian economic and political model can work only temporarily, and only in a country with a population small enough (a few million) for other nations to absorb émigrés seeking employment abroad. Such a country should be willing to have its population decline, especially its prime working-age cohort. In Greece, this could only worsen an already serious demographic challenge. Politically, it helps to be a post-Soviet economy with a fully flexible, poorly unionized labor force. Above all, its cultural and policy elite needs to put an almost blind faith in "free market" central planners. Ethnic divisions can distract voters from complaints against austerity. Only under these political conditions can austerity be considered a "success." On balance, the Latvian model has done much harm. Demographically, in terms of its future, one can even argue that the country is being euthanized. The fact that the point is even debatable hints at the huge costs and risks the country has undertaken with its neoliberal program since 1991 and austerity following 2008. To be fair, one must also give the Latvian government their due. After the calamitous crash following 2008, their economy is now growing again. While much Latvian growth is linked to unsustainable clear-cutting of timber to satisfy West European demand (though Latvia has plenty of forest for managed logging), other sectors are growing too, such as food exports, along with some rebound of its small manufacturing sector. Transit and the emergence of a new Silk Road is yet another growth area. One must also note that Latvia's options are circumscribed by the limitations imposed by Article 123 of the EU treaty. This removes currency autonomy and domestic credit creation for national development. The treaty locks countries like Latvia into an embrace of private credit markets that forces governments to pay rents to bankers rather than financing their own development where possible. What additionally holds production back more than anything are regressive tax policies that place Latvia's tax burden on labor. Thus, this makes labor expensive, preventing advantages that could accrue from lower labor costs. Meanwhile, speculators get a free ride on taxes. Latvia's growth, however, is tenuous. It is exceptionally dependent on a rogue financial offshore industry that destroys wealth in other countries. Production is also disproportionately geared to exports, even for a small country. Yet, even if growth continues it will be years before they reach pre-crisis level of GDP. Thus, victory laps on recovery, let alone advocacy for others to follow the Latvian path, is premature at best, and reckless at worst. Latvia has many strengths: an impressive reservoir of human talent; a highly developed aesthetic and design sense rivaling the Scandinavians; an embrace of innovation and approach to tasks with a perfectionist sensibility; and geography facilitating trade. Yet, its government's advocacy of austerity is decidedly not among those assets. While the Latvian model is not exportable, might it deliver economic recovery in the highly specific conditions of that country? Too early to tell. What is possible, however, is that even if it does, the price paid for it might be too few people to sustain the country into the future. Europeans should reject Latvia as a model to emulate. Instead, they should engage a wholesale reorganization of European Union rules facilitating national development to liberate its member states from usurious ties to European banks currently delivering its people into penury. |

| China & Russia Buy Bullion as Protection Posted: 26 Jun 2012 05:54 PM PDT Russia is clearly buying gold to protect the ruble from devaluations and Russia from an international monetary crisis. China is doing the same both by official gold purchases and by encouraging individuals to buy precious metals. |

| Posted: 26 Jun 2012 05:51 PM PDT If you value free speech and worry about legislated censorship, you owe it to yourself to have a look at Ray Finklestein's inquiry into the media and media regulation. The report contains some explicit recommendations on how and why Australia's media should be regulated. There are also some nauseating submissions by academics and rent seekers you have to read to believe (if you can stand reading them). Before you get tucked in, you should know we read most of the report in March, a few weeks after it was released. We made some notes at the time, chortled over a few paragraphs, and guffawed in outrage over some of the claims. But since this is a daily letter about finance and not media, we didn't go out of our way to publish any analysis of the report's recommendations. But with Gina Rinehart's move to gain board seats at Fairfax, some of her critics are drawing on the Finklestein report to suggest new regulations of the media. They are claiming to act in the 'public interest'. This claim needs to be examined. Even though the Daily Reckoning is not a news gathering organisation (it can hardly be said to be an organisation at all), we believe the recommendations in the report would affect our ability to write to you in the way we do. More than that, the report itself is being used as an excuse to a: subsidise losing business models, and b: threaten publishers with fines and penalties when they run afoul of government appointed media boards. That's worth more examination. Some people are worried that big corporations have too much influence over media and government. Some people are worried that big government has too much influence over media and private life. The common ground for these concerns is that 'big' anything tends to act in its own interest, to the detriment of anything that gets in its way. We won't prattle on about it now. But we have penned some thoughts we'll publish in the weekend edition of the Daily Reckoning. That way, if such matters interest you, you can read them at your leisure without interrupting your dose of daily financial contrariness. Until then! Regards, Dan Denning From the Archives... The US Deficit of Deceit How Nice to Have Friends At the Fed Deep in the Stock Market Trenches In Praise of the Eureka Rebellion What Could Possibly Go Wrong With Infrastructure Investment Bonds?

This posting includes an audio/video/photo media file: Download Now |

| Is the Silver Price Finally Bottoming Out? Posted: 26 Jun 2012 05:49 PM PDT Over a year ago, I penned an article entitled "4 Silver Investments to Avoid." About two weeks later, on April 26th, I wrote another article: "Should I Sell My Silver?" saying that I expected an imminent correction in the silver price, after it had gone "parabolic." It caused quite a stir at the time. There was no shortage of people calling me delusional for suggesting the bull market in silver was overdue for a pause. Some even labeled me a "traitor," presumably to the "hard money" movement. One of the silver companies I recommended to NOT buy immediately contacted me after the article was published, insisting there was nothing to worry about, and that their stock was a great investment. For the record, since then, the price of silver is down 35.2% (based on the London PM fix). And of the four silver investments I said to avoid: 1. The iShares Silver Trust (SLV) is down 33.3%. Not pretty. One of the biggest headwinds for the gold and silver markets right now is the weakness in India's economy and currency. For a long time, India has been the world's biggest market for physical precious metals. Though it was recently eclipsed by China as the world's single biggest market for physical gold, India remains in the top 3 for both silver and gold. As the Indian economy slowed rapidly over the past 12 months, the Indian Rupee swan-dived. Today it takes more than 57 rupees to buy one US dollar, up from 46 a year ago. That makes the price of silver (and gold), which is priced in US dollars on world markets, much higher for Indian buyers. Demand has dropped accordingly - silver bullion sales volumes in India are off between 30% and 40% versus a year ago. Nonetheless, the weakness in India's currency, which has also been undermined by political uncertainly, is a perfect illustration of why it pays to hold silver and gold in the first place. Indian savers who entrusted their savings to banks and kept their money in rupees have been at the mercy of the sliding currency. Those who bought and held precious metals, on the other hand, have seen their purchasing power hold steady, even as the rupee tanked. While the US dollar may again be enjoying a period of relative strength, this is almost certain to prove temporary. And just like Indian savers who kept their money in rupees, trusting your money to the government will be a losing proposition in the long term. Holding your money in US dollars, particularly in some insolvent, illiquid bank earning one-half of one percent interest, will result in the destruction of your purchasing power. If you agree with that thesis, the question still remains, what's a good price to exchange your dollars for physical silver at? To be fair, nobody can accurately divine the short-term movements in precious metals prices. But from a purely technical standpoint, silver is starting to look very interesting.  The gold/silver ratio has been clobbered over the past year in an almost uninterrupted pattern except for a brief respite in early 2012. At the peak of the last precious metals boom, it took fewer than 20 ounces of silver to buy one ounce of gold. Over the past few years, the ratio has dipped as low as 32. But today the number has blown out 57. If the thesis holds that we are in another precious metals boom, it certainly stands to reason that the gold/silver ratio ought to correct and become much lower once again. More importantly, however, every single indication out there suggests that central bankers will continue doing... the only thing they know how to do: PRINT. Despite some short-term corrections (as we saw in 2008), this is no doubt bullish for precious metals... and especially silver. Given silver's already steep decline from its highs last year, a price in the mid-$20s range is beginning to look very compelling. Regards, Tim Staermose Ed Note: This article originally appeared in Sovereign Man: Notes From the Field From the Archives... The US Deficit of Deceit How Nice to Have Friends At the Fed Deep in the Stock Market Trenches In Praise of the Eureka Rebellion What Could Possibly Go Wrong With Infrastructure Investment Bonds?

|

| The European Summit is a Write Off Posted: 26 Jun 2012 05:42 PM PDT By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness. Spain took a beating overnight after Moody's downgraded the long term debt and deposit ratings of 28 Spanish banks on the back of the sovereign downgrade earlier in the month. Yields on short term debt spiked at auction:

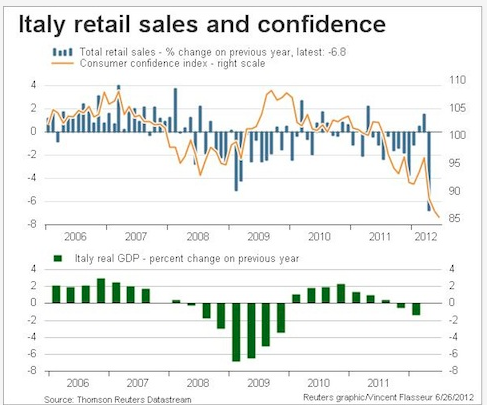

Longer term yields were also up with 10 years heading back towards 7%. Spain, however, was not the only bearer of dour news. Data from Italy continues to disappoint, this time it was retail sales:

Not to be left out there was also Cyprus:

That's somewhere around 50% of GDP by the way, however Cypriot officials later claimed that the final figure hasn't been determined yet. And, to the resolution… Overnight the Europe's fabulous 4 (European Commission President Jose Manuel Barroso, European Central Bank President Mario Draghi, Eurogroup Chairman Jean-Claude Juncker and European Council President Herman Van Rompuy) released an already shortened draft paper for the up-coming EU summit. The draft (available below) is jam packed with all of the plans I have been discussing over the last few weeks including banking unions, shared issuances and the move of fiscal sovereignty to Brussels which includes the right of veto over national budgets. As I discussed yesterday this is the grand vision for Europe but there are 4 major issues with the document. Firstly, there really isn't much in the seven pages that I consider new which, given the expectations of the summit, is already a problem. Secondly, the new draft is absent of any short term resolutions. Thirdly, as I hinted at yesterday, there is this line from the document:

A decade ? Cyprus has become the 5th bailout nation, Greece is on the verge of collapse, Portugal is struggling to meet targets, Spain is crumbling and Italy is now in serious trouble. Can anyone honestly think Europe has another 10 years to build a sustainable economic architecture? And lastly, there is this:

Yesterday José Manuel Barroso gave a speech (transcript here) at the European policy centre explaining much of the document below where he also touched on a number of other topics including periphery banking Zombification. From his opening statements it would appear that he is well aware of what is at stake at this week's summit yet also recognises that his sense of urgency is not be shared across Europe:

I'm not sure what else to say, it's bloody depressing stuff. Although I agree with many of the long term architectural goals, the likely practical short term outcomes of this week's summit appear to be increasingly disconnected from economic reality. The crisis is once again ahead of the policy response which means European leaders are patching up holes and fighting fires instead of delivering realisable and credible plans. The basic chicken and egg problem of debt sharing and national sovereignty appears completely unresolved and unfortunately I see very little to suggest the Eurocrats are about to leap ahead of their problems. I am therefore becoming increasingly concerned that this week's summit will be a massive disappointment which is likely to create a huge problems for the rest of the world. I genuinely hope I am wrong on this and I welcome any comments to convince me that I am. I need a coffee. |

| Income Inequality: The Silent Killer Posted: 26 Jun 2012 05:25 PM PDT Reckoning today from Paris, France... We're sitting in our favorite café in Paris. On the corner are two security guards trying to look inconspicuous. One speaks into an ear-mounted telephone. The other stares straight ahead. What are they looking for? Who are they meant to guard? "They're still guarding Carla," [Sarkozy's wife...who lives in the area...] said a bar patron. Maybe. But we're always surprised by how much people think they know that ain't so... Our friend Dylan Grice told us about a study where people were asked a simple question and then asked how sure they were about their answer. Those who were 100% sure were only right 70% of the time. After a few minutes the undercover cops disappear... Dear Readers looking for investment advice should know better by now. If you think we know something about investing you've mixed us up with someone else. Besides, when it comes to the markets nobody knows anything. We don't even believe in investing...not the way most people think of it. What we do know is that you can't expect to get something for nothing...not in the world of finance and investment. So you can't expect to earn a lot from your investments...unless you are lucky, or smart, or the feds rig the system in your favor. Which, of course, is what they've done for the last 40 years! No kidding. In the early '70s, the feds created a new kind of money. Dollars...with nothing behind them other than the feds themselves. If they wanted, they could destroy the dollar. Or keep it solid. It was entirely up to them. In the event, they destroyed it slowly. In the early '70s, we recall buying gasoline for 25 cents a gallon. Now, it was over $3 when we left the US a week ago. It's lost more than 90% of its value! But this destruction had consequences that were different for the "rich" than they were for the working classes. Financial assets rose with the inflation of the money supply. The price of labor did not. Stocks went up 13 times. Consumer prices (excluding gasoline) went up about half as much. No wonder the rich got richer! And now the same dumbbell economists who encouraged the feds to mess up the monetary system are whining about 'inequality.' Here's Brian Fung kvetching in The Atlantic. He says income equality is not just an economic problem; it's a matter of life or death. No kidding:

Growing income inequality in the United States has Americans talking about justice and economic fairness, but a new study suggests the burgeoning wealth gap is threatening more than just our pocketbooks. It might be raising our risk for an early death. Does income inequality itself cause you to die young? If some guy in your town gets filthy rich, will your life expectancy go down? What if some guy gets extremely poor...like Mike Tyson, said to be the poorest man in the world, because he has such a huge debt to the IRS? Will that take years off the lives of the rich? We don't know exactly what insight Mr. Fung is discovering. But we are pretty sure that he doesn't either. Income inequality in itself is not going to shorten anyone's life...unless he gets depressed about it and blows his brains out. Even then, we'll never really know why he did it. Nobody knows anything. Especially economists. Regards, Bill Bonner From the Archives... The US Deficit of Deceit How Nice to Have Friends At the Fed Deep in the Stock Market Trenches In Praise of the Eureka Rebellion What Could Possibly Go Wrong With Infrastructure Investment Bonds?

|

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment