Gold World News Flash |

- Disintegration: What It Looks Like When a Nation Collapses

- Gold Working on 7th Week of Consolidation

- Embry: We’re On The Edge of Collapse, We’ve Run Out of Time

- Chinese Yuan Set to Increase Dramatically in Value ? Buy Some Now ? It?s Easy!

- Europe Heading Towards a Full-scale Disaster ? Here?s Why

- Could You Make It Up? … World's Oldest Bank Gets Modern Bailout Worth Billions

- Chile Is Latest Country To Launch Renminbi Swaps And Settlement

- Is silver finally bottoming out?

- Ray Dalio: Don't Assume That Germany Will Bail Europe Out; Consider The "Fat Tail" A Significant Possibility

- Liquidation could send Silver down to $18

- Gold Daily And Silver Weekly Charts – The Money Matrix – Sic Transit Gloria Mundi

- The Gold Price Still Must Hold $1,558 and Silver 2641c

- Guest Post: Liquidation Is Vital

- Egan Jones lowers ratings on Germany from AA minus to A plus/ Italian bonds reach 6.18%/ Spanish 10 yr bond yield 6.8%/

- An Ending Made For Gold

- A “Safe Haven” for Tough Times

- Guest Post: Who Destroyed The Middle Class - Part 3

- A “Safe Haven” for Tough Times

- Gold Daily And Silver Weekly Charts - The Money Matrix - Sic Transit Gloria Mundi

- Equities Rise On Low Volume Tide As Broad Risk Assets Tread Water

- Proposed Banking Regulations Would Drive Gold Prices Higher

- What Do Stocks and Bonds Tell Us About Gold's Future Moves?

- Platinum Outlook Remains Volatile: Erica Rannestad

- The Golden Truth About Operation Twist

- Best Can't-Lose Investment Idea You Ever Heard (BC-LIIYEH).

- The Daily Market Report

- The Black Hole of Deflation - Part 1

- Precious Metals:: Keep it Simple

- Gold & Food Lovebirds

- LGMR: "Negative Forecast" Remains for Gold, India Needs "Good Monsoon" to Boost Bullion Demand, Euro Integration Steps Outlined

| Disintegration: What It Looks Like When a Nation Collapses Posted: 26 Jun 2012 04:14 PM PDT  Whether the system is going to collapse is not the question. Whether the system is going to collapse is not the question.Most informed individuals understand that out of control spending fueled by trillions of dollars in debt, unprecedented monetary expansion and ever increasing dependence on a government social safety net overburdened by millions of people in need of essential services can not be sustained forever. For many Americans and our counterparts in Europe, the collapse is now. To suggest that we are somehow on the road to recovery is nothing but conjecture. We have no doubt that everyone is tired of bad news, but we are compelled to review the facts: Europe is currently experiencing severe bank runs, budgets in virtually every western country on the planet are out of control, the banking system is running excessive leverage and risk, the costs of servicing the ever-increasing amounts of government debt are rising rapidly, and the economies of Europe, Asia and the United States are slowing down or are in full contraction. There's no sugar coating it and we have to stop listening to politicians and central planners who continue to downplay, obfuscate and flat out lie about the current economic reality. Stop listening to them. Source: Sprott Asset Management via Zero Hedge We are, by all accounts, sliding rapidly into the abyss of an untenable economic, financial, political and social disaster. The only question now is, "how is it going to look when it happens?" A glimpse into our future can be found in the veritable canary-in-the-coalmine in Europe – Greece. Read more..... This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Working on 7th Week of Consolidation Posted: 26 Jun 2012 03:00 PM PDT courtesy of DailyFX.com June 26, 2012 01:28 PM Weekly Bars Prepared by Jamie Saettele, CMT No change…I’m looking lower. “The latest move off of the high is impulsive (5 waves) which favors lower prices from the current level to at least Friday’s low at 1553. The bearish RSI reversal signal that was in place for gold last week is now in place for USD crosses.” The mentioned 5 wave decline was succeeded by a 3 wave advance into former congestion (resistance). Look lower as long as price is below 1641. A break of the December low could result in an historic collapse. LEVELS: 1500 1522 1553 1589 1615 1641... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Embry: We’re On The Edge of Collapse, We’ve Run Out of Time Posted: 26 Jun 2012 03:00 PM PDT from KingWorldNews:

"There was this amazing back and forth today, where Merkel said, 'There would not be euro bonds as as long as she was alive.' Then, not longer after, Monti, the Prime Minister of Italy, came out and said that if there weren't euro bonds, he was going to resign. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chinese Yuan Set to Increase Dramatically in Value ? Buy Some Now ? It?s Easy! Posted: 26 Jun 2012 02:04 PM PDT If you're serious about protecting the value of your money then please, as much as I love gold, don't just buy the yellow metal — also buy some Chinese yuan! [Here's why.] Words: 400 So says Larry Edelson in edited excerpts from his original article. [INDENT]Lorimer Wilson, editor of [B]www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor's Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.[/B] [/INDENT]Edelson goes on to say, in part: China's currency is set to dramatically appreciate against the U.S. dollar in the years ahead; I estimate as much as 50% and that means the value of the U.S. dollar, conversely, is going to lose as much as 50% of its purchasing power. So it's not just gold you want to own, but some Chinese currency as well. I like the Market Vectors-Renminbi/USD ETF, symbol CNY, [to do just that]. It's an ETF that tracks the Chinese curren... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe Heading Towards a Full-scale Disaster ? Here?s Why Posted: 26 Jun 2012 02:04 PM PDT Europe is heading into a full-scale disaster [because,] you see, the debt problems in Europe are not simply related to Greece. They are SYSTEMIC. The European banking system’s leverage levels alone position Europe for a full-scale banking collapse on par with Lehman Brothers. Again, I’m talking about Europe’s ENTIRE banking system collapsing. This is not a question of “if,” it is a question of “when” and it will very likely happen before the end of 2012. Words: 750 So says Graham Summers ([url]www.gainspainscapital.com[/url]) in edited excerpts from his original article*. [INDENT]Lorimer Wilson, editor of [B][COLOR=#0000ff]www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor's Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.[/COLOR][/B] [/INDENT]Summers goes on to say, in part: The chart below*shows the official... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Could You Make It Up? … World's Oldest Bank Gets Modern Bailout Worth Billions Posted: 26 Jun 2012 12:30 PM PDT by The Daily Bell:

Dominant Social Theme: We've rescued all the rest, so why wouldn't we rescue the oldest one? Free-Market Analysis: Every day we slap our (admittedly low-slung) brows and let out whistles of amazement. The latest reason: It seems the world's oldest private bank is in need of a government loan. Once upon a time all banks were private, even the ones that belonged to the ruler. Banks were basically warehouses that collected gold and silver and issued receipts. These receipts later on turned into the monopoly fiat (unbacked) paper we use in such quantities today. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chile Is Latest Country To Launch Renminbi Swaps And Settlement Posted: 26 Jun 2012 12:25 PM PDT The dollar exclusion list is becoming bigger and bigger with every passing day as China gets ready. For simplicity's sake here is the full list of "bilateral" arranagements in the past year as presented previously: "World's Second (China) And Third Largest (Japan) Economies To Bypass Dollar, Engage In Direct Currency Trade", "China, Russia Drop Dollar In Bilateral Trade", "China And Iran To Bypass Dollar, Plan Oil Barter System", "India and Japan sign new $15bn currency swap agreement", "Iran, Russia Replace Dollar With Rial, Ruble in Trade, Fars Says", "India Joins Asian Dollar Exclusion Zone, Will Transact With Iran In Rupees", "The USD Trap Is Closing: Dollar Exclusion Zone Crosses The Pacific As Brazil Signs China Currency Swap." And now the latest: "China, Chile To Establish Strategic Partnership, Boost Trade... Launch Currency Swap and Settle In Renminbi"

Read more here. So to summarize, the list of countries that China is transacting with directly (that we know of), and bypassing the USD entirely, is as follows:

In other words, it looks like the BRICs already have their "bilateral" arranagements all sorted out, and are now quietly moving into other suppliers of key resources with swap deals, all without any mention of the word "dollar." How soon until China re-dips its toe in Europe with a modest "bailout" nobody can refuse in exchange for a simple caveat: you get paid in renminbi? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is silver finally bottoming out? Posted: 26 Jun 2012 12:10 PM PDT by Tim Staermose, Sovereign Man :

It caused quite a stir at the time. There was no shortage of people calling me delusional for suggesting the bull market in silver was overdue for a pause. Some even labeled me a "traitor," presumably to the "hard money" movement. One of the silver companies I recommended to NOT buy immediately contacted me after the article was published, insisting there was nothing to worry about, and that their stock was a great investment. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 26 Jun 2012 11:54 AM PDT

From Bridgewater's Daily Observations:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liquidation could send Silver down to $18 Posted: 26 Jun 2012 11:30 AM PDT by Ben Traynor, Bullion Street:

Wholesale market gold prices traded as low as $1560 an ounce Friday morning, before recovering some ground by lunchtime in London, while European stock markets were also down and commodities were broadly flat. Silver prices meantime sank to a 2012 low at $26.64 an ounce – a 7.2% drop on last week's close. "We believe a break of $26.00 has the ability to trigger liquidation of silver with it looking for $18.00," says the latest technical analysis note from bullion bank Scotia Mocatta. Heading into the weekend, gold prices by Friday lunchtime looked set for their biggest weekly fall since the first week of March, having fallen 3.7% since the start of Monday's trading. On the currency markets, the Euro ticked lower against the Dollar, hitting its lowest level this week. "A decline in the Euro may have contributed to a drop in gold prices," says HSBC precious metals analyst James Steel. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily And Silver Weekly Charts – The Money Matrix – Sic Transit Gloria Mundi Posted: 26 Jun 2012 11:00 AM PDT from Jesse's Café Américain:

The EU Summit meeting is on Thursday and Friday of this week, 28-29 June. Next Wednesday is the US 4th of July holiday. I would expect many punters would like to be leaving early this week if they can. This is also the last week of the second quarter. The US Supreme Court is expected to rule on Obamacare on Thursday, overturning at least a portion of it. This may provide a sellable rally. Quite often the markets search for some level, and then try and let the junior traders hold it in light volumes, unless something happens. With algos running we sometimes get some interesting intraday action but little in the way of progress. This is a week that also brings some important metals events. June 26 Comex July silver options expiry | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Still Must Hold $1,558 and Silver 2641c Posted: 26 Jun 2012 10:55 AM PDT Gold Price Close Today : 1574.00 Change : -13.50 or -0.85% Silver Price Close Today : 2703 Change : -48.2 or -1.75% Gold Silver Ratio Today : 58.214 Change : 0.529 or 0.92% Silver Gold Ratio Today : 0.01718 Change : -0.000158 or -0.91% Platinum Price Close Today : 1426.80 Change : -12.60 or -0.88% Palladium Price Close Today : 592.65 Change : -13.55 or -2.24% S&P 500 : 1,320.10 Change : 6.29 or 0.48% Dow In GOLD$ : $164.62 Change : $ 1.84 or 1.13% Dow in GOLD oz : 7.964 Change : 0.089 or 1.13% Dow in SILVER oz : 463.60 Change : 9.29 or 2.05% Dow Industrial : 12,534.90 Change : 32.24 or 0.26% US Dollar Index : 82.36 Change : -0.089 or -0.11% 'Twas a near thing for the silver and GOLD PRICE today, but it pulled out. I said yesterday gold must not close below $1,558 nor silver below 2641 cents. Lo, I watched as gold worked its way from a $1,583.55 open down to $1,667.60 just before 11:00 a.m. Gold clambered up out of that hole, and didn't sink below $1,570 again. For about 15 minutes there I couldn't keep my eyes off the screen. On Comex gold lost 13.50 and closed $1,574. This works. Day after a strong advance (+21.50 yesterday) a market often gives back quite a bit. But I am still watching that $1,558. The SILVER PRICE chart mimicked gold's, falling from the open to a 2679.8 low just after 11:00 a.m. Never dipped below 2700c after that, and closed Comex 48.2c lower at 2703.8c. Line in the sand left on today's chart -- and where the fight will take place tomorrow -- is 2720c. After that silver needs to better yesterday's close and punch through 2750c. We are now in the middle of silver and gold's seasonal low window, which can fall from mid-June to mid-August, but more narrowly in June or July. The GOLD PRICE still must hold $1,558 and the SILVER PRICE 2641. Watch 'em. Longer I hang round, the nuttier things get. Today Cyprus (a tee-tiny EU member, pop. 801,851, smaller than metro Memphis) told the EU they, too, need a bailout, and it may equal $12.5 billion, half the size of their economy. (I'm thinking about telling the EU that I need a bailout. I want $12 million, but I'll settle for $8 million. Okay, $6 in a pinch.) More than that, the EU ministers are meeting in their 19th summit in the last couple of years. I told y'all this move was coming: more centralization. This new grand plan proposes the eurozone have its own finance minister, and that the member states give control over their budgets to some central authority and share responsibility for their debt. WHOA! This is like you buying a $60 bottle of single malt Scotch, which you eke out to yourself a spoonful a week, and being ordered to share it with your brother-in-law, who drinks a quart of vodka every morning. Somebody's gonna get cheated in this deal. Mercy! Y'all think I make this stuff up, don't you? I've been telling y'all for a long time that there are no adults in the building. Been gone for years. US dollar index gave back a little today, losing 8.9 basis points (0.11%) to 82.361. It's okay, it cleared its 20 day moving average (DMA, now 82.31) yesterday, and floated above it today. Headed higher unless Big Ben the Criminal gets scared or needs to do his euro buddies a favor. Yen surprised me today by advancing a teench (0.24%) to 125.83c/Y100 (Y79.47/US$1) and the 50 DMA (125.32). Remains in a downtrend with lower highs and lower lows, so needs to close above 128.77c to reverse the downtrend. When pigs fly. Wow, here's some news: euro fell again today. Well, at least it was only 0.4% to $1.2495, but it stands below all its moving averages, RSI is headed down, MACD looks to be rolling over earthward. $1.2000, here we come! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guest Post: Liquidation Is Vital Posted: 26 Jun 2012 10:48 AM PDT Submitted by John Aziz of Azizonomics Liquidation Is Vital Many Keynesians really hate the concept of liquidationism. I'm trying to grasp why. Paul Krugman wrote:

Andrew Mellon summed up liquidationism as so:

In light of the zombification that now exists in Japan and also America (and coming soon to every single QE and bailout-heavy Western economy) — zombie companies, poorly managed, making all the same mistakes as before, rudderless, and yet still in business thanks to government intervention — it is clear that the liquidationists grasped something that Keynesians are still missing. Markets are largely no longer trading fundamentals; they are just trading state intervention and money printing. Why debate earnings when instead you can debate the prospects of QE3? Why invest in profitable companies and ventures when instead you can pay yourself a fat bonus cheque out of monetary stimulus? Why exercise caution and consideration when you can just gamble and get a bailout? Unfortunately, Mellon and his counterparts at the 30s Fed were the wrong kind of liquidationists — they could not heed their own advice and leave the market be. Ironically, the 30s Fed in raising interest rates and failing to act as lender-of-last resort drove the market into a deeper depression than was necessary (and certainly a deeper one than happened in 1907) and crushed any incipient recovery. Liquidation is not merely some abstract policy directive, or government function. It is an organic function of the market. As the stunning bounce-back from the Panic of 1907 shows — especially when contrasted against the 1930s — a market liquidation on the back of a panic avoids a depression. Prices fall as far as the market deems necessary, before market participants quickly come back in into the frame and setting the market on a new trail toward growth. For without a central bank, asset-holders who want to maintain a strong economy and growth (in 2008, that probably would have meant sovereigns like China and Arabia) have to come in and pick up falling masonry as lenders of last resort. Under a central banking regime (especially a Bernankean or Krugmanite one committed to Rooseveltian Resolve) all expectations fall onto the central bank. My own view is not just that liquidation is vital. It is that the market mechanism is vital. Without their own capital as skin in the game, central bankers are playing blind. The pace of the liquidation and the pace of the recovery should be dictated by market participants — in other words, by society at large — not by the whims of distant technocrats. Society has more skin in the game. The Great Depression was not a crisis of too little intervention — it was a crisis of too much well-intentioned intervention. As we are learning in our own zombie depression, a central bank doing the opposite of the 1930s Fed and reinflating may solve the problem of debt-deflation, but it causes many of its own problems — zombie banks, zombie corporations, zombie markets, corporate welfarism, and the destruction of the market mechanism. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 26 Jun 2012 10:43 AM PDT by Harvey Organ, HarveyOrgan.Blogspot.ca:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 26 Jun 2012 10:18 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A “Safe Haven” for Tough Times Posted: 26 Jun 2012 10:01 AM PDT The 5 min. Forecast June 26, 2012 12:50 PM Dave Gonigam – June 26, 2012 [LIST] [*]The “baby box” — an old idea that’s new again, for parents who can’t cope with the cost of a newborn [*]Barry Ritholtz with a reminder why the housing market has “stabilized” (Warning: It no longer exists) [*]Dan Amoss on why six more months of Operation Twist will accomplish little… and when you can expect QE3 [*]Kicking a can over the “fiscal cliff”… A change that could light a fire under gold on Jan. 1… A business owner’s phone-booth dilemma… and more! [/LIST] Call it a sign of the times in Europe. Medieval times, in this instance. “Boxes in which parents can leave an unwanted baby, common in medieval Europe, have been making a comeback over the last 10 years,” according to a BBC report. “Supporters say a heated box, monitored by nurses, is better for babies than abandonment on t... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

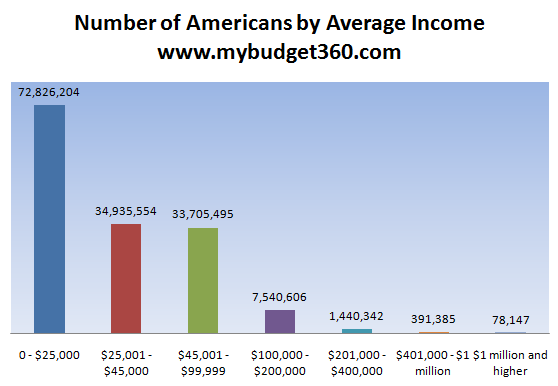

| Guest Post: Who Destroyed The Middle Class - Part 3 Posted: 26 Jun 2012 09:15 AM PDT Submitted by Jim Quinn of The Burning Platform Who Destroyed The Middle Class - Part 3 This is the 3rd and final chapter of my series about the destruction of the middle class. In Part 1 of this series I addressed where and how the net worth of the middle class was stolen. In Part 2, I focused on the culprits in this grand theft and in Part 3, I will try to figure out why they stole your net worth and what would be required to restore sanity to this world. Dude, Why Did They Steal My Net Worth? "I have no problem with people becoming billionaires—if they got there by winning a fair race, if their accomplishments merit it, if they pay their fair share of taxes, and if they don't corrupt their society. Most of them became wealthy by being well connected and crooked. And they are creating a society in which they can commit hugely damaging economic crimes with impunity, and in which only children of the wealthy have the opportunity to become successful. That's what I have a problem with. And I think most people agree with me." – Charles Ferguson – Predator Nation It is clear to me that a small cabal of politically connected ultra-wealthy psychopaths has purposefully and arrogantly stripped the middle class of their wealth and openly flaunted their complete disregard for the laws and financial regulations meant to enforce a fair playing field. Why did they gut the middle class in their rapacious appetite for riches? Why did the scorpion sting the frog while crossing the river, dooming them both? It was his nature. The same is true for the hubristic modern robber barons latched on the backs of the middle class. Their appetite for ever greater riches will never be mollified. They will always want more. They promise not to destroy the middle class, as that will surely extinguish the last hope for a true economic recovery built upon savings, investment and jobs, but it is their nature to destroy. A card carrying member of the plutocracy and renowned dog lover, Mitt Romney, revealed a truth not normally discussed by those running the show: "I'm not concerned about the very poor. We have a safety net there. I'm not concerned about the very rich, they're doing just fine." The data from the Fed report confirms Romney's assertion. The poorest 20% were the only household segment that saw an increase in their real median income between 2007 and 2010, while the richest 10% saw only a modest 5% decrease in their $200,000 plus, annual incomes. Meanwhile the middle class households experienced a brutal 8% to 9% decline in real income. Table 2 in Part 2 of this article reveals why the poorest 20% were able to increase their income. Transfer payments (unemployment, welfare, food stamps, SSDI) increased from 8.6% of their income in 2007 to 11.1% in 2010. Government transfer payments rose from $1.7 trillion in 2007 to $2.3 trillion today, a 35% increase in five years. I'm sure the bottom 20% are living high on the hog raking in that $13,400 per year. Think about these facts for just a moment. There are 23 million households in this country with a median annual household income of $13,400. That means half make less than that. There are 58 million households that have a median household income of $45,800, with half making less than that.

The reason Mitt Romney isn't concerned about the very poor is because his only interaction with them is when they cut the lawn at one of his six homes. The truth is the bottom 20% are mostly penned up in our urban ghettos located in Detroit, Chicago, Philadelphia, NYC, LA, Atlanta, Miami, and the hundreds of other decaying metropolitan meccas. They generally kill each other and only get the attention of the top 10% if they dare venture into a white upper class neighborhood. They are the revenue generators for our corporate prison industrial complex – one of our few growth industries. They provide much of the cannon fodder for our military industrial complex. They are kept ignorant and incapable of critical thought by our Department of Education controlled public school system. The welfare state is built upon the foundation of this 20%. It is certainly true that the bottom 30 million households in this country, from an income standpoint, do receive hundreds of billions in entitlement transfers, but Table 2 clearly shows that 80% of their income comes from working. The annual $72 billion cost for the 46 million people on food stamps pales in comparison to the hundreds of billions being dispensed to the Wall Street banks by Ben Bernanke and Tim Geithner, and the $1 trillion per year funneled to the corporate arm dealers in the military industrial complex. The Wall Street maggots (i.e. J.P. Morgan) crawl around the decaying welfare corpse, extracting hundreds of millions in fees from the EBT system and the SNAP program as they encourage higher levels of spending. This is all part of the diversion. Forty five years after the War on Poverty began, there are 49 million Americans living in poverty. That's a solid good return on the $16 trillion spent so far. It's on par with the 16 year zero percent real return in the stock market. We have produced a vast underclass of ignorant, uneducated, illiterate, dependent people who have become a huge voting block for the Democratic Party. Politicians, on the left, promise more entitlements to these people in order to get elected. Politicians on the right will not cut the entitlements for fear of being branded as uncaring. The Republicans agree to keep the welfare state growing and the Democrats agree to keep the warfare state growing -bipartisanship in all its glory. And the middle class has been caught in a pincer movement between the free shit entitlement army and the free shit corporate army. The oligarchs have been incredibly effective at using their control of the media, academia and ideological think tanks to keep the middle class ire focused upon the lower classes. While the middle class is fixated on people making $13,400 per year, the ultra-wealthy are bribing politicians to pass laws and create tax loopholes, netting them billions of ill-gotten loot. These specialists at Edward Bernays propaganda techniques were actually able to gain overwhelming support from the middle class for the repeal of estate taxes by rebranding them "death taxes", even though the estate tax only impacts 15,000 households out of 117 million households in the U.S. The .01% won again. It is easy to understand how the hard working middle class is so easily manipulated by the corporate fascists into believing their decades of descent to a lower and lower standard of living is the result of the lazy good for nothings at the bottom of the food chain sucking on the teat of state with their welfare entitlements. I drive through the neighborhoods of West Philadelphia every day, inhabited by the households with a net worth of $8,500 and annual income of $13,400. They inhabit crumbling hovels worth less than $25,000, along pothole dotted streets strewn with waste, debris and rubbish. More than half the people in this war zone are high school dropouts, over 30% are unemployed, and drug dealing is the primary industry. When a drug dealer becomes too successful and begins to cut into the profits of the "legitimate" oligarch sanctioned drug industry, he is thrown into one of our thriving prisons. Marriage is an unknown concept. The life expectancy of males is far less than 79 years old. But something doesn't quite make sense. Every hovel has a Direct TV satellite dish. The people shuffling around the streets all have expensive cell phones. There are newer model cars parked on the streets, including a fair number of BMWs, Mercedes, Cadillac Escalades and Volvos. How can this be when their annual income is $13,400 and they have $8,500 to their names? This is where our friendly neighborhood Wall Street oligarchs enter the picture. These downtrodden people are not bright. They are easily manipulated and scammed. They believe driving an expensive car and appearing successful is the same as being successful. Therefore, they are easily susceptible to being lured into debt. Millions of these people represented the "subprime" mortgage borrowers during the housing bubble. The tremendous auto "sales" being reported by the mainstream media in an effort to boost consumer confidence about an economic recovery, are being driven by subprime auto loans from Ally Financial (85% owned by the U.S. Treasury/you the taxpayer) and the other government back stopped Wall Street banks. This is the beauty of credit. The mega-lenders reap tremendous profits up front, the illusion of economic progress is created, poor people feel rich for a while, and when it all blows up at a future date the middle class taxpayer foots the bill. Real wages for the 99% have been falling for three decades. You make poor people feel wealthy by providing them easy access to vast quantities of cheap debt. I'm a big fan of personal responsibility, but who is the real malignant organism in this relationship? The parasite banker class, like a tick on an old sleepy hound dog, has been blood sucking the poor and middle class for decades. They have peddled the debt, kept the poor enslaved, and have used their useful idiots in the media to convince millions of victims to blame each other through their skillful use of propaganda. They maintain their control by purposely creating crisis, promoting hysteria, and engineering "solutions" that leave them with more power and wealth, while stripping the average citizen of their rights, liberty, freedom and net worth (i.e. Housing Bubble to replace Internet Bubble, Glass-Steagall repeal, Patriot Act, TARP, NDAA, SOPA). Jesse cuts to the heart of the matter, revealing the darker side of our human nature: "Sometimes when faced with problems that are confusing and troubling it is easier to think what someone tells you to think, particularly something that touches a deep and dark nerve in your nature, rather than carry the burden and ambiguity of struggling with the facts and thinking for yourself. Repeating a party line is a shorthand way of avoiding real thought. And the predators are always there to take advantage of it. They welcome trouble and often foment crisis in order to advance their agendas." "Anyone can be misled by a clever person, and no one likes to readily admit that they have been had. It is a sign of character and maturity to realize this, and admit you were deceived, and to demand change and reform. But some people cannot do this, even when the facts of the deception are revealed. It seems as though the more incorrect that the truth shows them to be, the louder and more strident they become in shouting down and denying the reality of the situation. And anyone who denies their perspective becomes 'the other,' someone to be feared and hated, shunned and eliminated, one way or the other." Until Debt Do Us PartI sense signs of desperation amongst the plutocracy. Their propaganda machine is sputtering. Their storylines are growing tired. They have fended off the fury of the Tea Party movement by successfully high jacking it and neutralizing their impact under the thumb of the Republican establishment. The oligarchs called out their armed thugs to crush the OWS rage, while using their media mouthpieces to misrepresent the true purpose of the movement – Wall Street greed and criminality with Washington DC collusion. The Savings & Loan Crisis of the late 1980s resulted in 800 bankers being thrown into prison. After the greatest banker heist in history, not one banker has been thrown in jail. Obama and Holder have been neutered by their masters. The power elite openly brandish their glee at avoiding accountability for their crimes. They are desperately attempting to re-inflate the debt bubble, as debt is the lifeblood of these vampire squids. The key piece of their current propaganda campaign is to convince the people they have effectively deleveraged and their continuing austerity efforts are actually detrimental to economic recovery. It's nothing but a confidence game to keep the Ponzi going. The Ponzi operators want to extract every last dime from the masses before the engineered collapse. The data does not confirm the deleveraging narrative. Total credit market debt in the United States is now at an all-time high and stands at 345% of GDP. In 1977 it stood at 155% of GDP and at 250% in 2000.

Total credit market debt is now $4 trillion higher than it was in 2007, prior to the financial collapse. It has gone up by $1 trillion in the last 12 months. Does this sound like deleveraging? The chart below details the truth the moneyed interests don't want you to understand. The bastions of capitalism on Wall Street have dumped $3.4 trillion of their toxic debt and $1 trillion of mortgage and credit card debt onto the backs of middle class taxpayers and future unborn generations. They did this under the auspices of saving the economic system. Their sole purpose has been to save themselves from becoming part of the middle class. The transfer of wealth from the quarry (middle class) to the predators (moneyed interests) continues unabated.

The faux journalists in the mainstream media have been pounding the consumer deleveraging mantra. They babble on about the austere masses methodically paying down their debts. It's a specious lie. The chart below shows that banks have written off $218 billion of credit card debt since 2008. It also shows outstanding revolving debt falling from $1.01 trillion to $819 billion, a $191 billion decrease. For the math challenged, like any Wall Street shill paraded on CNBC, this means consumers have added $27 billion of credit card debt since 2008. Does that sound like deleveraging? Households have also taken on $300 billion of additional student loan debt since 2008, buying into the government sponsored scam to keep the unemployment rate lower by offering the false hope of jobs with useless on-line degrees from the University of Phoenix. Does that sound like deleveraging? Consumer Credit Card Debt and Charge-off Data (in Billions):

(Source: CardHub.com, Federal Reserve) They only people with the courage to tell it like it is are skeptics and outcasts from polite society inhabited by the power elite – people like Ron Paul, Michael Burry, and deceased critical thinkers like Frank Zappa and George Carlin. In one of his final appearances, Carlin brutally lashed out with a torrent of truth, only spoken by courageous people not worried about the consequences of their blunt honesty: "Politicians are put there to give you that idea that you have freedom of choice. You don't. You have no choice. You have owners. They own you. They own everything. They own all the important land, they own and control the corporations, and they've long since bought and paid for the Senate, the Congress, the State Houses, and the City Halls. They've got the judges in their back pockets. And they own all the big media companies so they control just about all the news and information you get to hear. They've got you by the balls. They spend billions of dollars every year lobbying to get what they want. Well, we know what they want; they want more for themselves and less for everybody else. But I'll tell you what they don't want—they don't want a population of citizens capable of critical thinking. They don't want well informed, well educated people capable of critical thinking. They're not interested in that. That doesn't help them. That's against their interest. You know something, they don't want people that are smart enough to sit around their kitchen table and figure out how badly they're getting fucked by a system that threw them overboard 30 fucking years ago. They don't want that, you know what they want? They want obedient workers, obedient workers. People who are just smart enough to run the machines and do the paperwork and just dumb enough to passively accept all these increasingly shittier jobs with the lower pay, the longer hours, the reduced benefits, the end of overtime and the vanishing pension that disappears the minute you go to collect it. The table is tilted folks, the game is rigged. Nobody seems to notice, nobody seems to care. Good honest hard working people, white collar, blue collar, it doesn't matter what color shirt you have on. Because the owners of this country know the truth, it's called the American Dream, because you have to be asleep to believe it." Grotesque Casino of Corporate Fascism"The illusion of freedom will continue as long as it's profitable to continue the illusion. At the point where the illusion becomes too expensive to maintain, they will just take down the scenery, they will pull back the curtains, they will move the tables and chairs out of the way and you will see the brick wall at the back of the theater." – Frank Zappa "Specifically, over the past 15 years, the global financial system – encouraged by misguided policy and short-sighted monetary interventions – has lost its function of directing scarce capital toward projects that enhance the world's standard of living. Instead, the financial system has been transformed into a self-serving, grotesque casino that misallocates scarce savings, begs for and encourages speculative bubbles, refuses to restructure bad debt, and demands that the most reckless stewards of capital should be rewarded through bailouts that transfer bad debt from private balance sheets to the public balance sheet. What is central here is that the government policy environment has encouraged this result. This environment includes financial sector deregulation that was coupled with a government backstop, repeated monetary distortions, refusal to restructure bad debt, and a preference for policy cowardice that included bailouts and opaque accounting. Deregulation and lower taxes will not fix this problem, nor will larger stimulus packages." – John Hussman None of the solutions put forth by Obama or Romney will fix the problems facing the country today. They are two handpicked figureheads representing the same owners. Both political parties are responsible for the grotesque casino that passes for our financial system. These political hacks have been in alternating control of our government system for the last 150 years. They don't want to come up with real solutions to the problems they created. The owners want obedient slaves, distracted by technology and shallow entertainment, subjugated by debt used to buy things they want but don't need, believing waging wars in distant lands keeps us safe, and favoring the imprisonment of petty thieves and drug users while the grand thieves run the country and control our currency. Keeping the willfully ignorant masses in the dark and confused is a vital part of the plan. Debt is the ingredient that enriches the issuers and keeps the dupes in check. Wall Street bankers, Federal Reserve governors, captured financial "experts", journalists paid by corporations, economists with an ideological agenda and bought off politicians all repeating the same theme with the same unquestioning, strident conviction is a sure sign that we are being played. The never ending series of titanic bailouts of Wall Street did not avert a catastrophic economic collapse. They protected the corporate fascists from experiencing the consequences of their monstrous predatory actions over the last few decades. And it was all done for money. Simple human greed and an insane desire by a few psychotic men to control and manipulate others for their own selfish pleasure is what has turned this country into a corporate fascist state bereft of its soul and original founding principles, as stated by Ron Paul: "We're not moving toward Hitler-type fascism, but we're moving toward a softer fascism: Loss of civil liberties, corporations running the show, big government in bed with big business. So you have the military-industrial complex, you have the medical-industrial complex, you have the financial industry, you have the communications industry. They go to Washington and spend hundreds of millions of dollars. That's where the control is. I call that a soft form of fascism — something that's very dangerous." The soft form of fascism easily transforms into the hard form as those in control exhibit their supremacy with displays of military potency in our cities (Boston, St. Louis, Pittsburgh, Chicago), passage of liberty stripping legislation like the Patriot Act and NDAA, along with announcements about thousands of drones patrolling our skies over the next five years. When propaganda begins to lose its effectiveness, brute force is the next step. Whenever I write about the slow methodical disintegration of our once great republic into a dysfunctional banana republic controlled by bankers, mega-corporations and arms dealers; the apologists for the empire scoff and cynically ask for my solutions. I, along with many other rational thinking realists, have proposed solutions, but they don't have a snowballs chance in Syria of ever even being debated by the existing ruling class. The unholy alliance between bankers, corporate interests and politicians must be broken. These proposals would go a long way towards breaking that alliance: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A “Safe Haven” for Tough Times Posted: 26 Jun 2012 08:50 AM PDT Dave Gonigam – June 26, 2012

"Boxes in which parents can leave an unwanted baby, common in medieval Europe, have been making a comeback over the last 10 years," according to a BBC report. "Supporters say a heated box, monitored by nurses, is better for babies than abandonment on the street — but the U.N. says it violates the rights of the child." We won't take sides. We'll note, however, that Germany has 99 baby boxes, Poland has 45 and the Czech Republic has 44:  There are none in Greece, by the BBC's reckoning. Maybe the hospitals there are too broke to take care of unwanted babies. For sure, medicines are running out, and many health care workers volunteer to work unpaid. And in the United States? "Baby hatches as such are not known in the United States," claims Wikipedia. But all 50 states have enacted "safe haven" laws. They allow parents to give up a newborn baby at places like a hospital or fire station. Texas was the first to enact such a law in 1999. Alaska and Nebraska were the last, in 2008. Just in time for the onset of the worst financial crisis in decades…

The city council votes tonight on a budget plan that assumes its creditors won't come through with concessions to close a $26 million budget gap. "Stockton's finances collapsed along with its housing market," Reuters reports by way of background, "forcing city officials to slash $90 million in spending in recent years and a quarter of positions across agencies." Gee, guess it hasn't been enough. "Many of the houses built and bought in that boom have been abandoned, repossessed and sold at deep discount, as Stockton has been at the top or near the top of lists of housing markets suffering a glut of foreclosures in recent years."

The 20-city index registered a 1.9% year-over-year decline in April — the smallest since November 2010. Prices rose in 10 of the 20 cities, led by Phoenix. Among the cities where prices fell, Atlanta was the worst. Seems as if Georgia's a couple of years behind the proverbial "sand states."

The Fusion IQ chief and Vancouver favorite shares a chart that puts yesterday's cheery new-home sales figure in context:  "In terms of price," says Mr. Ritholtz, "we know that not having distressed assets in the mix makes it appear prices are improving; what you actually are seeing are the impacts of no foreclosures for a year." "Similarly, without as many distressed homes in the mix — they are often sold for less than replacement cost — new homes have less competition, and sales can tick up."

Alas, those shoes will remain suspended in midair till Thursday… the date of both the next EU summit and the health care ruling.

Recall that under the debt-ceiling deal the president and Congress reached last August, $1.2 trillion in spending cuts are to take place over the decade from 2013-22. Of course, in wonk-speak "spending cuts" means a cut in the rate of previously planned increases. Heh… Now congressional leaders are talking about putting off the budget-cut part of the "fiscal cliff" from January until March. At least that's according to "a House aide and industry officials who were briefed on the discussions" and spilled it to Bloomberg. Left unresolved in this are the expiring tax cuts and tax increases that kick in Jan. 1. And an increase in the debt ceiling, which will likely be hit before Jan. 1. And the U.S. credit rating isn't being downgraded today… why?

"We're well beyond the point where lower long-term interest rates can boost the economy. Those who can refinance have done so already. Low rates also keep the weaker players in many industries from restructuring, which lowers returns for every other company in that industry." "Meanwhile, retirees and pension managers are looking at low rates on fixed income for many years into the future. Fed Chairman Ben Bernanke's stated goal of pushing investors out of bonds and into stocks has not worked, and will not work until valuations are low enough to compensate investors for the risk of violent market swings." "How many retirees are willing to lock in a 2% or 3% dividend yield in stocks when days like last Thursday [when the Dow fell 250] completely offset a year's worth of dividends in a matter of hours? Not many, I suspect." "Retirees will react to this market environment by saving more, not by piling into stocks — until dividend yields are high enough (say, 5-6%) to compensate for volatility." When should you expect QE3? "Another bout of unbridled money printing would arrive," says Dan, "only after much more stress in financial markets, including lower stock prices. So by bidding up stock prices in anticipation of more quantitative easing, investors ironically lower the chances of easing. "We won't see more broad support for QE unless stocks go lower."

The Fed, the FDIC (Federal Deposit Insurance Corp.) and the Office of the Comptroller of the Currency are asking for comment on a proposal to rejigger the "risk weightings" of assorted assets — including gold. "For the first time," writes John Butler of Amphora Capital, "unencumbered gold bullion is to be classified as zero risk, in line with dollar cash, U.S. Treasuries and other explicitly government-guaranteed assets." Right now, gold has a 50% risk weighting. "If implemented, this will be an important step in the remonetization of gold and, other factors equal, should be strongly supportive of the gold price, both outright and relative to that for government bonds, the primary beneficiaries of the most-recent flight to safety." The world is slowly waking up to the words of Rep. Ron Paul in his "lost" gold bible of 30 years ago. Much of it reads as if it was written yesterday… which is why we're going out of our way to make it available to you today.

People in Spain are marching into banks and breaking out in flamenco dances… and generating a YouTube sensation:  The favorite target is Bankia, the big sickly bank that resulted from a merger of four smaller sickly banks and is now a ward of the state. "You've changed, my friend, since you came in to money. I need two jobs to pay my mortgage," says one flamenco cantaor at a Bankia branch in Seville. "You get in trouble, and I get thrown out in the street." Other protests at Spanish banks take the form of older men dressed in prison garb. Some of them, we're told, took part in protests against the Franco regime in the '60s and early '70s. They sound like the type you don't want to mess with…

"Some months ago, the oil change place I have been going to in the town of Simi Valley, Calif., for many years stopped washing the car windows as part of their service. The owner of the place just said they couldn't afford the extra permit cost. I let it go. Just today, I noticed they were again doing the windows, but only the windshield. I asked the owner about it. Here is the full story…" "The city had wanted $1,200 a year in fees if they were going to wash car windows because the window cleaner was suspected of contributing to cancer. The owner pointed out this was the same window cleaner that everyone else buys at the dollar store, and since he ran an oil change shop, that was probably the least toxic thing in the place. This logic was lost on the city employee." "He recently started using a vinegar solution instead, but kept the window work to just the windshields. (Less liability? Vinegar allergies?)" "A month ago, someone else had come by from the city to serve him notice of a fine for having additional signs out on the small lawn area in front of his business (small yard signs planted in his own lawn over the holiday weekend). The fine was $100 per day for three days over this holiday." "He went to see the mayor and then the city council to argue that he wasn't even open two of those days. Perhaps in an attempt to be visibly fair, they sent out an inspector to look at the property. The inspector pointed out that the two palm trees planted in the corners of the small lawn made him liable for any accidents, due to lack of full visibility. He offered to take out the trees (and has since done so)." "The inspector also told him to remove the pay phone at the edge of the sidewalk (they still have those?) for the same reason, and he replied that he didn't own it. I am filling in here, since I forgot to ask if he knew who owned it, so I am assuming he wasn't able to get it removed using normal channels. He had his crew remove the antiqued device with old-fashioned sledgehammers and was promptly arrested for destruction of property when he decided to take it to the scrap metal yard to cover the wages of his crew."

Should've known! Other answers proffered by readers:

"Harpo is harping as Rome burns." "Groucho is running the Middle East — fits in with their attitudinal problems." "Gummo is running the U.N. and gumming up the works." "Zeppo is not running anything; he is just about ready to use his Zippo lighter and see what happens when flame is applied to a lot of paper. Can't buy anything with it, so maybe it can keep us warm."

"Sound familiar?" The 5: Yes. And what's that about familiarity breeding contempt? Cheers, Dave Gonigam P.S. Gold mining stocks as a group are up 13% from the HUI index's bottom on May 15. If you own mining shares, you might want to consider a strategy to squeeze out even bigger gains than you can from an appreciating share price. The strategy is proven to deliver payouts as big as $2,345. Don't believe it? See for yourself here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily And Silver Weekly Charts - The Money Matrix - Sic Transit Gloria Mundi Posted: 26 Jun 2012 08:29 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equities Rise On Low Volume Tide As Broad Risk Assets Tread Water Posted: 26 Jun 2012 08:25 AM PDT Slow Day. S&P 500 e-mini futures, stumbled early on by some 'reality' from Merkel, recovered to the magical 1315 level that has seemed so important in the last few weeks. Broadly speaking risk-drivers were either weaker or went sideways in narrow ranges as Energy, Financials, and Discretionary high beta pulled stocks higher. From yesterday's equity day-session close, oil is unch, copper down modestly, Gold down more and Silver down the most as the USD limped very quietly lower on the day (interestingly divergent as AUD and GBP strength was enough to balance the EUR weakness). Treasuries went sideways to modestly higher in yields by 2-3bps. Stocks outperformed (once again) from around the European close - pulling notably away higher from CONTEXT-based broad risk perspective but, just as with the last few days, financial weakness into the close led the broad indices into a decent nose-dive back towards VWAP right into and beyond the bell (on heavy volume and larger average trade size). It's getting old. VIX fell less than 0.5 vols and surged up to nearly 20% at the close (as stocks dumped giving up almost half its day-session gains) as total day volume was weak, average trade size low, and intraday range the lowest in 2 months. HY and HYG underperformed stocks (we suspect as the LT convergence reduces the push into HYG) and we are seeing IG-HY decompression pick up a little. The early Merkel moment (red oval) was fully recovered but it seems gold and treasuries more in sync on weakness than stocks and the USD as we pushed higher... Stocks gave back some of their gains into the close but it was the major financials that appeared to be looking for the exits in a hurry (aside from JPM's outperformance)... Dispersion in FX is probably the biggest story of the week as the dispersion between GBP (+0.33% this week) for example and EUR (-0.62% this week) in this chart as JPY contonues to strengthen on carry unwinds... and Commodities generally lost ground from yesterday's day session close with Silver roundtripping on its high-beta exuberance (as Merkel spoke)... in summary, stocks outperformed in a very standalone manner relative to credit and broad risk asset classes on the day. Correlations fell as equities rallied away from risk value and VIX remains notably below its credit/equity fair-value here. The divergence between risk and stocks started (once again) just around the European close and it appears few liked the idea of holding too much overnight as we rapidly tumbled into the day-session close. Charts: Bloomberg and Capital Context

Bonus Chart: just for fun, ZNGA's momo-crushing plunge today (as the charismatic CEO shared his wisdom on value creation)...

Bonus Bonus Chart: The NYSE Composite index appears to have a big hang-up at the 7750 level - which just happens to be around the Lehman levels... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Proposed Banking Regulations Would Drive Gold Prices Higher Posted: 26 Jun 2012 08:17 AM PDT There are many, many, many, many reasons why gold prices should go higher, despite claims that gold is in a bubble … and despite the fact that gold prices may be manipulated. A giant new reason may be heading our way … Specifically, the central banks’ central bank – the Bank of International Settlements (BIS) – is considering reclassifying gold as risk-free assets as part of the Basel III framework. As BIS notes in its progress report on Basel III implementation:

(See footnote 32 on page 26). As Russ Norman – CEO of Sharps Pixley – wrote in May:

And the more favorable view of gold by banking authorities is not limited to BIS. The FDIC issued a proposed rule on June 18, 2012, stating:

John Butler – Managing Director and Head of the Index Strategies Group at Deutsche Bank in London, Managing Director and Head of European Interest Rate Strategy at Lehman Brothers in London, and now head of Amphora Commodities Alpha Fund – argues:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Do Stocks and Bonds Tell Us About Gold's Future Moves? Posted: 26 Jun 2012 08:09 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Platinum Outlook Remains Volatile: Erica Rannestad Posted: 26 Jun 2012 08:00 AM PDT The Gold Report: Erica, the June 6 issue of CPM Precious Metals Advisory reported that, "Some investors view the present easy monetary policy of the U.S. Federal Reserve as a great reason to purchase gold, seeing the current monetary policy as likely to result in higher inflation and the dollar losing value. When viewed over the longer term, much to the contrary has happened since the Fed began to ease monetary policy." It seems like the returns for quantitative easing (QE) are indeed diminishing. Tell our readers what you mean. Erica Rannestad: We ran an analysis on the impact of QE in the U.S. on gold prices in our recent report. We found that the percentage return during the periods of QE1 and QE2 were positive, but that QE2 is lower in percentage and dollar terms than the increase during QE1. The reason for that is investors were buying gold as a safe-haven asset during those periods. These quantitative easing measures have not translated to higher inflation that has trickled down... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Golden Truth About Operation Twist Posted: 26 Jun 2012 07:35 AM PDT People are always very quick at giving others advice...Mr. Obama should first of all take care of reducing the American deficit, which is higher than in the eurozone - Wolfgang Schauble, German Finance Minister LINKLast week I suggested that the Operation Twist extension by the Fed of $268 billion would be enough to fund the U.S. Government financing needs until the election in November, when the Fed can then crank up the printing press without being accused of supporting Obama's re-election efforts. At that point in time, the Fed will likely roll out an enormous stimulus/printing package to make sure the winner of the election gets off to a good start, just like occurred in 2008... I also suggested that the funding needs would be at least $400 billion between now then, of which the Fed would be able to fund at least 50% with the OT extension. Well, there's nothing like seeing proof in the numbers. Today the Treasury auctioned $35 billion in 2yr Notes, of which Wall Street banks bought $20 billion, or 57%. This week the Treasury is selling a total of $99 billion in 2,5 and 7 year paper. We'll see how the rest of the auctions play out in terms of how much Wall Street takes down, on behalf of the Fed, but so far my run-rate estimate for additional funding plus the rate of the Fed financing that funding looks pretty good. Here's a link for today's Treasury auction results: LINK Regarding the quote above, it is going to be interesting from here on out to see the degree to which finger pointing between Europe and the U.S. escalates. I can't think of anything that would irritate me more than to have that little moronic runt tax evader Tim Geithner in my face telling me how to fix my problems. It would be like a meth addict telling a heavy drinking to stop drinking. Of course, by now it's well known that both Geithner and Obama spent a considerable amount of their teenage years "up in smoke." Here is what eastern hemisphere Central Banks are doing as a mechanism to dodge the escalating fiat currency devaluation war between the U.S., Japan and Europe: Turkey raised its reported gold holdings by another 2% in the month of May. Turkey's gold holding rose by 5.7 tonnes in May to total 245 tonnes, International Monetary Fund data showed, making it the latest in a string of countries to increase gold bullion reserves this year. Russia expanded its gold reserves by 15.5 metric tons in May as Ukraine and Kazakhstan increased their holdings of the metal, International Monetary Fund data shows according to Bloomberg.Here's the LINK | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Best Can't-Lose Investment Idea You Ever Heard (BC-LIIYEH). Posted: 26 Jun 2012 07:14 AM PDT I remember that I involuntarily screamed and spasmodically clutched my chest in some kind of sudden cardiac event when I learned to my horror that the evil Federal Reserve has announced a continuation of their insane money-creation schemes for another year at least. This is supposed to keep interest rates low by flooding the bond market with oceans of new money to drive bond prices up (and hence yields down). But the low interest rates will also, theoretically, encourage the stock market to go up, which is actually the whole point of it all. This, unfortunately, was made necessary by the sheer staggering stupidity of everyone investing everything, including their entire future lives, in the stock market. Indeed, as Dave Gonigam in Agora Financial's 5- Minute Forecast said, "stock prices are what it's all about for the Fed", and then quoting Ben Bernanke saying that a rising stock market "will boost consumer wealth and help increase confidence, which can also spur spending." I am, predictably, outraged! Outraged, I tells ya! I mean, if I pay $10 to buy a share of a company which makes $1 in earnings, but I am richer if strangers in a rigged market bid the stock up to $100, to buy the same $1 of earnings? Hahahaha! I don't know why I am laughing, because on top of all my other repressed and expressed angers about all kinds of outrageous things, I am outraged anew that most of the money, created by the evil Federal Reserve out of thin air, which increases the money supply which increases prices which hurts the poor, was used to buy new government debt! Gahhhh! Monetizing the debt! To the tune of trillions of dollars! Gaaahhh! I can't believe my own eyes! My chest hurts again! My heart is painfully pounding again! Arrgghh! Monetizing the debt is the Number One Unforgivable Sin Of Economics (NOUSOE) across the entire universe. And if this kind of monumental, abject stupidity gets back to Zorggk, Supreme Commander of this whole quadrant of the galaxy, who thinks that Earthlings (which my people call "Maize people") are an irredeemably stupid species deserving of immediate extinction, we're probably toast! Part of it all, he is sure to find out, is caused by the gaping current account deficit (essentially the trade deficit), which is still falling, faster and faster, down to around $470 billion a year. This is money that is, theoretically, lost when imports exceed exports. Poof! Gone! Slipped from hands of Americans and into the hands of foreigners, but, I hasten to add, with cross-border ownerships, taxes, tariffs, fees, bribes, tax-evading shenanigans, government corruption and incessant meddling, who the hell knows what a "current-account deficit" really is anymore? Plus (and this is the biggie reason why I am so apprehensive), Zorggk himself, for amusement and with a gluttonous appetite for money and profit, is betting on a rise in gold and silver here on Earth (which my people call "Maize"), which, unfortunately, haven't done much, investment-wise, in quite a while. So he is especially peevish about not getting the expected double-digit increases from his investments in gold and silver, despite my telling him that it would be the Best Can't-Lose Investment Idea You Ever Heard (BC-LIIYEH). To be fair, this is the same thing that I told my family, any friends I once had, and the people who said they were my friends but just wanted me to give them money and/or stab me in the back the first chance they got, the bastards. "Buy gold, silver and oil!" I told them, and when they didn't listen, I told their children that their parents were stupid for not buying gold, silver and oil, and I told them all some more, and then more, and more, until they screamed "Enough about buying gold, silver and oil! We have heard it, and we have had it with hearing you say it, you creepy, horrible old man! And get out of our damned way so that we can get to the produce section and get some damned lettuce and a couple of spuds so that I can get out of this stupid grocery store and away from you!" And, since we are talking about it, I also told YOU to buy gold, silver and oil, and I also told total strangers and anyone who lets me get near enough to them, usually by sneaking up on them from the rear, to unforgettably-scream at them "We're freaking doomed, you moron! Buy gold, silver and oil against the calamitous inflation in prices, the inevitable result of an unholy, un-Constitutional treachery of a fiat currency un-tethered to gold, insane levels of fractional-reserve banking where hundreds of dollars are created out of thin air for every measly penny of new deposits, a national debt more than equal to GDP ($15 trillion), with a staggering accrued liability measured in hundreds of trillions of dollars, a huge suffocating government running amok on monstrous deficit-spending, and the foul, filthy Federal Reserve creating outrageous amounts of money to pay for it all!" To those who turned and replied, in their usual blubbering incomprehension, saying "Shut the hell up, you moron!" or "Oh, damn! Not you again!", I haughtily dismissed them with a mere wave of my insouciant hand -- away with thee, poltroon! -- as if brushing an insignificant bug from the table. On the other hand, there were those who where quizzical, along the lines of "What in the hell are you yelling about, you stupid old man who ought to be forced to take some kind of brain medicine, or locked up, or shot?" To these people I eagerly explained, as gently and kindly as I could, "Ha! That just shows how stupid you are, lard butt! Such insane levels of money inflation must always -- always, you hear me, you moron? Always! -- lead to price a destructive inflation, as evidenced by the fact that, for the last 4,500 years, inflation in the money supply has ALWAYS led to inflation in prices! What are you, some kind of drooling 'free lunch' moron or Democrat, as redundant as that is?" Usually, the conversation, as fascinating as it is, ends abruptly pretty soon after that. So I never got the chance to tell anyone that, currently, inflation is readily seen in the prices of bonds, their derivatives, the things tenuously tied to the bond market through other derivatives, and things I about which I have probably never even heard. In fact, the long inflation in the money supply has already shown up in the prices of bonds, as tons of new money allows bidding for them so frenzied that it has driven bond prices to the moon and thus caused short-term interest rates to drop to -- literally! --zero! Buying a bond that pays literally zero! Wow! And on short-term paper, yield is less than 2% on the 10-year note! And this is despite the fact that price inflation, figured the old-fashioned, pre-Clinton, pre-Greenspan, pre-Boskin deception-and-fraud kind of way, is somewhere between a horrifying 8% and a stupefying 11%! Terrifying! We're Freaking Doomed (WFD)! It seems to me that around in here, somewhere, that instead of screaming "We're freaking doomed because of the evil Federal Reserve creating so much credit/debt and money, and the despicably corrupt Congress that encouraged them to do it," I should instead make another suggestion that you, too, adopt the Best Can't-Lose Investment Idea You Ever Heard (BC-LIIYEH), which is to buy gold, silver and oil to save yourself (and theoretically prosper beyond dreams of avarice!) from the coming, inevitable, roaring inflation in prices of food and energy that you need to exist, and the devastating deflation in the prices of the things you don't need to exist. And if you do it soon enough, and the prices of gold and silver go up far enough as a result, I can thankfully, in a saving-my-own-butt kind of way, show Zorggk a smaller loss in his holdings of gold and silver, and indeed show him a very encouraging meteoric rising trend in their prices sooner rather than later! And this silly reacting-to-volatility is ignoring the dead-bang certainty of it all, which makes buying gold, silver and oil, truly, the Best Can't-Lose Investment Idea You Ever Heard (BC-LIIYEH). And did I mention it's easy, too? Certain and easy! Whee! | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 26 Jun 2012 07:02 AM PDT Gold Eases as Dollar Firms

Spanish borrowing costs rose sharply on speculation that Moody's plans to downgrade the country to junk status. Meanwhile the subordination issue related to the Spanish banking bailout continues to be debated and pressure is on Germany to forgo the senior status of any ESM loan to Spain because of the impact it would have on private bondholders and future attempts to sell bonds. In the UK, pubic sector net borrowing was much higher than expectations in May, due to a drop in income tax receipts. BoE Governor Mervyn King was quick to blame the worsening of the UK economy on the eurozone crisis. Any optimism associated with the first monthly rise in the Case-Shiller home price index in 8-months was offset by misses in the Richmond Fed index and consumer confident in June. As the US economy continues to founder, and the Obama administration continues to deflect by criticizing Europe, German Finance Minister Wolfgang Schäuble struck back saying, "Herr Obama should above all deal with the reduction of the American deficit. That is higher than that in the euro zone." Schäuble is understandably agitated by US kibitzing. While the US maintains the 'exorbitant privilege' of being able to print an endless numbers of dollars, the EMU was designed to have much tighter monetary controls. Europe can't simply print its way out of debt as the US can. • US Consumer Confidence falls to 62.0 in Jun, below market expectations of 63.2, vs negative revised 64.4 in May. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Black Hole of Deflation - Part 1 Posted: 26 Jun 2012 06:38 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Precious Metals:: Keep it Simple Posted: 26 Jun 2012 06:08 AM PDT This weekend I had a conversation with a fund manager friend who I admire. He lives in the Asia-pac region and has tremendous knowledge of and insight into markets. I asked him what his advice would be. He told me it’s simple. My advice for the next three months is patience. My advice for the next three years is precious metals. People often feel the need to complicate things by over-trading and over-thinking the situation. In this piece, we want to keep it simple for Gold and Silver and the mining shares. The first chart is the chart we published back in May when suggesting that a major bottom could be at hand. This weekly chart shows a rebound that may be fading yet the breadth indicator at the bottom (when smoothed) remains as oversold as it was in December and back in 2008. Note that in September 2008, the bullish percent index (4-week MA) was at 50%. Today it lies at 14%. The next chart from SentimenTrader.com, shows the HUI Gold Bugs Index with three diff... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 26 Jun 2012 06:06 AM PDT Stewart Thomson email: [EMAIL="stewart@gracelandupdates.com"]stewart@gracelandupdates.com[/EMAIL] email: [EMAIL="stewart@gracelandjuniors.com"]stewart@gracelandjuniors.com[/EMAIL] Jun 26, 2012 [*]Unfortunately, most precious metals investors don't take the food markets very seriously. Please click here now. That's the corn chart. [*]The major media may be playing down the skyrocketing prices of corn, wheat, and soybeans, but the price charts are telling another story. Note the vertical move by corn. It has blasted up and out of this "super-wedge" chart pattern. [*]Please click here now. That's the gold chart. Note the tremendous similarity to the corn chart. They both peaked at the end of last summer, and the price action since then is very similar. [*]A lot of investors are worried that the price zone of $1525 for gold might "break", producing a sizable decline. [*]Please note that corn broke its "$1... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 26 Jun 2012 05:54 AM PDT London Gold Market Report from Ben Traynor BullionVault Tuesday 26 June 2012, 07:45 EDT SPOT MARKET prices to buy gold traded just above $1580 an ounce throughout Tuesday morning's London session, up around 0.6% on last week's close following gains the previous day. Prices to buy silver traded in a tight range around $27.50 an ounce – 2.1% up on the week so far. "After last week's bearish price action it is hard to get excited about a sustained rally [for gold]," says the latest note from technical analysts at bullion bank Scotia Mocatta. "In our opinion," adds Commerzbank senior technical analyst Axel Rudolph, "gold has resumed its downtrend...we will retain this negative forecast while the gold price trades below the current June high at $1641." European stock markets meantime edged slightly higher by lunchtime in London – following losses the previous day – while commodities were broadly flat and US Treasury bonds fell, as markets continued to focus on upcoming pol... |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Today John Embry told King World News, when referring to what is needed to bail out Europe, "All I know is that these numbers are staggering … We are on the edge of collapse. We've run out of time." Embry, who is Chief Investment Strategist of the $10 billion strong Sprott Asset Management, also told KWN that if the euro does split apart, it "will be extraordinarily chaotic." Here is what Embry had to say about the crisis: "We've go to focus on what's coming up in the short-run with regards to the European situation. It's going to be an extremely interesting summit they are hosting this Thursday and Friday. The problems are piling up at such an enormous rate they can't be ignored anymore."

Today John Embry told King World News, when referring to what is needed to bail out Europe, "All I know is that these numbers are staggering … We are on the edge of collapse. We've run out of time." Embry, who is Chief Investment Strategist of the $10 billion strong Sprott Asset Management, also told KWN that if the euro does split apart, it "will be extraordinarily chaotic." Here is what Embry had to say about the crisis: "We've go to focus on what's coming up in the short-run with regards to the European situation. It's going to be an extremely interesting summit they are hosting this Thursday and Friday. The problems are piling up at such an enormous rate they can't be ignored anymore." Italy to put €2bn into world's oldest bank Banca Monte dei Paschi di Siena … The Italian government said Tuesday it will provide struggling Banca Monte dei Paschi di Siena, the world's oldest bank, with up to €2bn to cover a capital shortfall. – UK Telegraph

Italy to put €2bn into world's oldest bank Banca Monte dei Paschi di Siena … The Italian government said Tuesday it will provide struggling Banca Monte dei Paschi di Siena, the world's oldest bank, with up to €2bn to cover a capital shortfall. – UK Telegraph Over a year ago, I penned an article entitled "4

Over a year ago, I penned an article entitled "4  Lately, more and more professional investment "advisors" and newsletter recommendations boil down to just one catalyst: wait for either Germany, the ECB or the Fed to step in, as usual, and bail the world out, because, well, they have to, and any additional thought is rendered moot as fundamental analysis is meaningless under central planning (plus it is actually more work than just repeating the same stuff over and over while charging $29.95/month for it). Of course, when these same snakeoil salesmen are asked the simple question: what if said bailout does not happen, or if it happens late (for the purposes of this exercise let's assume one is not a central bank that can print its own money, have an infinite balance sheet, and can afford to be wrong almost into perpetuity), they give a blank stare, start mumbling something and walk away, especially if one mentions Lehman brothers and the simple detail that, oh, it failed. Which is why if Ray Dalio, head of the world's largest hedge fund, is correct, it may time to summarily fire and stop subscribing to each and every broken record Oracle whose template is "X will bailout Y" for the simple reason that it is wrong.