saveyourassetsfirst3 |

- “The Eurozone’s Strategy is a Disaster”

- Top 12 Reasons United Rentals Must Be On Your Summer Shopping List

- Pass up company match and go with metals???

- 4 Large-Cap Stocks Retaining Strong Profits

- Gold And The 'Safe Haven' Myth

- Weekend Forex Forecast For Friday June 22, 2012

- Gerald Celente – Expect A Tidal Wave Entrance Into Gold

- What 9/11 Teaches Us About the Silver Market

- Huldra Silver Provides Progress Update on Treasure Mountain

- A Rare Occurrence in the Silver Market

- The Continuing Mystery of the U.S. Treasuries Market

- Silver For The People

- Want Gold? Marry An Indian Bride

- Russia Buys 0.5 Million Ounces and Bank of Korea “Needs To Buy More” Gold

- Real Estate Recovery Is Only a Mirage

- By the Numbers: The U.S.’s Growing For-Profit Detention Industry

- Gold Bugs: Do You Suffer from Pappagallo?

- Fed playing coy – for the moment

- OIL AND THE CRB APPROACHING A FINAL BOTTOM

- Gold still at risk of a large downward move before the rally

- Gold Hits 8-Session Low but ‘Bank Buying Supports’

- Russia Adds 500,000/oz. & S. Korea Plans Add of Gold

- T&S: Lies You Don't Want to Hear About

- Peter Grandich on The Fed & Gold

- Silver Update: Silver Bomb III – 6.20.12

- Bullion is Making a Comeback

| “The Eurozone’s Strategy is a Disaster” Posted: 21 Jun 2012 06:59 AM PDT Yves here. Mr. Market is in a tizzy today over, per Bloomberg, "concerns over the slowdown of growth". Cynics might note that journalists have to attribute motives to market moves, when their waxing and waning often defies logic. Nevertheless, we've had disappointing reports out of China, a bad Philly Fed manufacturing report, a less than stellar initial jobless claims report, and not so hot housing data this AM, and more and more signs of inability to bail out the sinking Titanic of the Eurozone (a meaningless announcement compounded by continued focus on ongoing German court challenges to more aggressive support of rescues. Even if these cases lose, any uncertainty and delay has the potential to accelerate the ongoing bank run out of periphery countries). This post from VoxEU is a good short form summary of how the Eurozone got into this fix. Its last para takes an unduly scolding tone that may turn off some readers, and does not reiterate the point made at the top, which is that the ECB needs to step up in a serious way to stem the crisis. Other remedies will take too long to implement and thus cannot change the trajectory under way. By Charles Wyplosz, Professor of International Economics at the Graduate Institute, Geneva; Director of the International Centre for Money and Banking Studies. Cross posted from VoxEU The EZ rescue strategy adopted in May 2010 failed to restore debt sustainability, avoid contagion, or reduce moral hazard. This column argues that a volte face is needed. The debt of Greece, Portugal and Italy – and perhaps Ireland, Spain and France as well – must be restructured to restore growth and end the crisis. All EZ nations should pay since their leaders' decision to violate the Maastricht Treaty's no-bail out clause is what brought us here. Chancellor Angela Merkel has sent word that Germany cannot save the euro. She is right. From the very start of the Eurozone crisis, it was clear that a domino game was under way and that a highly indebted German government should not be seen as the residual saviour. But keeping the euro will be costly and Germany will have to share the burden. The solution will have to combine debt structuring and ECB lending in last resort to banks and governments. Angela Merkel needs now to lift the German veto. All Eurozone leaders, including Mrs Merkel, are to blame for today's predicament.

The crisis has engulfed three small countries – Greece, Ireland and Portugal – and is now on its way towards Spain and Italy. France might well be next. These six countries' public debts amount to 200% of German GDP. With its own debt of 80% of GDP, Germany cannot indeed stop the rot. Moralistic rather than economic reasoning The public debate in Germany and elsewhere is often moralistic, matching the economists' concern with moral hazard.

There is no case against the view that bad policies must have consequences. In this the moralisers are right. But the issue is more complicated than meets the eye. We must ask:

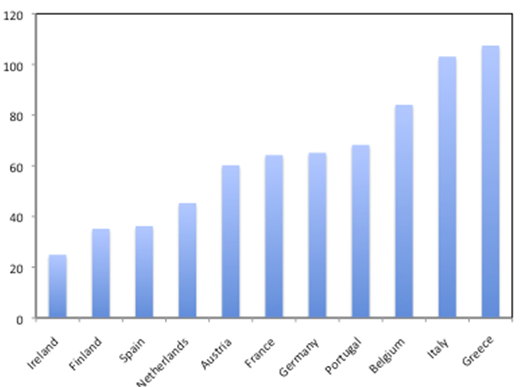

Many 'debt sinners' in 2007 Right before the financial crisis of 2007-8, few Eurozone countries could claim to have been fiscally disciplined. The figure below shows that Finland, Spain and Ireland could, but not Greece and Italy. Most other Eurozone nations – including Germany – were in the grey zone. Then the wheels of fortune that drive self-fulfilling crises started to spin, leaving us with an impression that strong moral judgments have to be terribly relative. Figure 1. Public debts in 2007 (% of GDP) Source: AMECO, European Commission Banking supervision laxity As we know, poor bank supervision is what drove Ireland and Spain into the camp of guilty countries. Here again, the story is not over and several countries may soon be found guilty of forbearance.

The debt reduction scheme applied to Greece effectively provided these banks with an exit strategy, and was delayed long enough for them to dispose of a large part of their initial holdings of Greek public debt. Even so, these same banks remain on the danger list if more defaults are needed, which is in fact the case. The list of truly innocent countries includes a small number of small countries. The consequences of bad debt and banking policy As for consequences, the issue is incredibly difficult. Austerity has been the accepted norm for punishment. But the facts have now completely undermined this view.

The Latvian public debt is still rising as a percentage of GDP and GDP is now 15% lower than in 2007 before the stabilization plan. True, this is up from a loss of 20% in 2010, but this merely illustrates how positive the multipliers are. The costs to Latvia have been massive.

Greece The Greek experience is one of never-ending economic decline, massive unemployment and intense social hardship. Sure, the Greeks are being taught a lesson, but which one?

As economists, we also need to look slightly beyond our pond. When these aspects are factored in, the consequences of the strategy adopted in 2010 are simply not justifiable, even on moral grounds. This is so especially as those who are punished most are not those that benefitted most from fiscal indiscipline in the run up to the EZ crisis. The May 2010 strategy is a disaster: Admit mistakes and move on The strategy adopted in May 2010 has not just failed to achieve its aims: restore debt sustainability, avoid contagion and reduce moral hazard. It has not produced a solution that is likely to bring the crisis to its end. A 180-degree turn is still needed.

Their governments will have to restructure their debts, totally in the case of Greece, partially – if done early enough – in the other cases.

Who will pay?

This includes the ECB, to the extent that it imposed insufficient haircuts in its various refinancing programs, and the shareholders of the EFSF and the ESM, which also happen to be the shareholders of the ECB. Waiting only raises the eventual price The more we wait, the deeper the economic deterioration – more lending to governments and more non-performing loans in banks – and the bigger the eventual costs.

The moral question reconsidered Why should German and other taxpayers, mostly from the north, pay for the others, mostly from the south? Because their governments are responsible for the disastrous situation we are in.

This was an economic policy 'crime'. It looked cheap at the time, at least under the assumption that there would be no contagion. A basic moral principle is that criminals must be held responsible for the consequences of their acts, even if those acts are unintended. Eurozone taxpayers are the victims of their elected leaders. They now face the choice between breaking up the Eurozone and paying up. Paying up still is the cheaper alternative, but not for long. |

| Top 12 Reasons United Rentals Must Be On Your Summer Shopping List Posted: 21 Jun 2012 06:30 AM PDT By Codespeed: Investors globally are looking to the governments and the central banks for more help. And every time that happens, the central bankers are responding with either Twists or assurances of stepping in when required. Then there are talks about Europe of course, and chaos in the BRIC countries, with China having their own landing as well as take off problems and India having issues with maintaining an investment grade for businesses worldwide. Amidst all this chaos, what should you look for? A company such as Cummins Inc. (CMI), which has great promise but depends largely on China, or a gold miner such as Barrick Gold Corporation (ABX) that has been pushed to the sidelines in recent rallies in spite of being a North American/Canadian play? Take a close look at United Rentals (URI). URI has had a stellar run since September 2011, jumping from the mid teens to as high Complete Story » |

| Pass up company match and go with metals??? Posted: 21 Jun 2012 05:23 AM PDT |

| 4 Large-Cap Stocks Retaining Strong Profits Posted: 21 Jun 2012 05:14 AM PDT By ZetaKap: Do you prefer investing in companies with strong track records of growth, backed by continued profitability? If so, we ran a screen you might find interesting. The Net Margin is a profitability metric that illustrates, by percentage, how much of every dollar earned gets turned into a bottom-line profit. This is just one of many profitability metrics used by investors and analysts to better understand what the company is being left with at the end of the day. Generally, a firm that can expand its net profit margins over a period of time will see its stock price rise as well due to the trend of increasing profitability. Net Margin = Net Income/Total Revenue. EPS growth (earnings per share growth) illustrates the growth of earnings per share over time. EPS growth rates help investors identify stocks that are increasing or decreasing in profitability. This profitability metric is generally a key Complete Story » |

| Gold And The 'Safe Haven' Myth Posted: 21 Jun 2012 04:22 AM PDT By Skyler Greene: Gold bugs often claim that gold is a "safe haven" asset. A quick fact check proves otherwise. According to Investopedia, the definition of a safe haven is:

For an asset to be a "safe haven," then, it must retain value. A glance at the chart of the SPDR Gold Trust (GLD) shows that anyone who Complete Story » |

| Weekend Forex Forecast For Friday June 22, 2012 Posted: 21 Jun 2012 04:14 AM PDT By Jay Norris: The Aussie Dollar responded in a whipsaw fashion that looks suspiciously like short-term distribution following Wednesday's FOMC results, where the Fed continued its current "twist" operation, albeit at a slower pace, as it starts to unwind its QE with its left hand while still flexing its right arm for the cameras. The knee-jerk reaction to the initial FOMC statement was bearish, but price quickly turned up to punch out a new high of the move just above 1.0220, a level which represents the 50% retracement of the March through May sell-off. As of this report AUDUSD has failed for the second day to close beyond 102.00, which in our estimation points to a weekend corrective sell-off. The Aussie still holds an edge for us as a trading vehicle because it is an asset class market, unlike gold, or any other currency or commodity without a yield or dividend. Because of Complete Story » |

| Gerald Celente – Expect A Tidal Wave Entrance Into Gold Posted: 21 Jun 2012 04:10 AM PDT

from kingworldnews.com: Today top trends forecaster Gerald Celente discussed gold at length, as well as other important trends with King World News. Celente is the founder of Trends Research, and the man many consider to be the top trends forecaster in the world. Celente predicted, "a tidal wave entrance into gold," because "the entire financial system is in collapse." But first, here is what Celente had to say about what is happening around the world: "The highlight for the moment is on Greece, but let's remember that Greece only counts for 2% of the eurozone GDP. It's more about publicity. How will it look if they leave? Also, everybody knew that the $125 billion (for Spain) was a drop in the bucket compared to the trillions of dollars of debt." Gerald Celente continues: Keep on reading @ kingworldnews.com |

| What 9/11 Teaches Us About the Silver Market Posted: 21 Jun 2012 03:58 AM PDT from silvervigilante.com: That nearly exact foreknowledge of the September 11 attacks on the World Trade Center and Pentagon was proceeded by financial transactions by bored money-schemers seems clear. Firms placed put options – basically, bets on a fall in price – on UNited Airlines stock. Apparently, on September 6 and 7, the Chicago Board Options Exchange harbored 4,744 put options on the aforementioned airline, but just 396 call options or bets basically on the price to rise. Those on the winning side of the bet – that is, a fall in the price of air travel in the first wake of 9/11 – stood to make $5 million. On 9/11 eve, 4,516 "puts" on American Airlines were purchased, amidst only 748 "calls." $4 million stood to be won by the puts. These are the same sort of derivative instruments that are singled-out as a key vehicle for the coordinated precious metals price drops about which much has been documented. If the cabal has used these options in order to play cataclysmic world events they themselves seem to have designed, then control of precious metals prices is certainly one arena in which they exert near total control, a la their own agenda of "full spectrum dominance." Keep on reading @ silvervigilante.com |

| Huldra Silver Provides Progress Update on Treasure Mountain Posted: 21 Jun 2012 03:54 AM PDT

from silverseek.com: VANCOUVER, BRITISH COLUMBIA–(Marketwire -06/21/12)- Huldra Silver Inc. (HDA.V) (the "Company" or "Huldra") today provides a progress update on the mining operations at its 100% owned Treasure Mountain Property and an update on the construction of its 200 tonne per day mill in Merritt, BC. The first underground stope mining commenced in November, 2011 and has been mined over a length of 75 metres and a height of 55 metres, with an average width of 1.5 metres. An additional stope at the eastern end of Level 1 of the mine, with a length of 65 metres, a height of 55 metres and an anticipated mining width of 1.5 to 1.8 metres, is fully developed and mining should begin in the next week once the ventilation system is complete. It is anticipated that it will take approximately eight weeks to mine the eastern stope. Keep on reading @ silverseek.com |

| A Rare Occurrence in the Silver Market Posted: 21 Jun 2012 03:50 AM PDT

from wealthwire.com: In New York huge lots of commodities get traded every day on the COMEX (Commodity Exchange) between market makers, speculators, producers and consumers. It can be very confusing – because we can't know why banker X, trader Y, consumer Z or producer A buys, sells or holds at any given time. There's lots of noise – and most investors simply will never buy or sell a commodity contract. It's somewhat complicated, but one easy way to get a reading on what's really going on for a specific commodity is to see how many contracts are long, and how many are short. Keep on reading @ wealthwire.com |

| The Continuing Mystery of the U.S. Treasuries Market Posted: 21 Jun 2012 03:03 AM PDT The U.S. Treasuries market is currently the dominant financial mystery of the present time. Much like the proverbial "lead zeppelin" defies the laws of physics, the current status of the U.S. Treasuries market defies all of our financial fundamentals. It is a market which cannot exist, and yet it does. Previously, my own writing has focused upon one particular aspect of this absurdity: the highest prices for U.S. Treasuries at a time of maximum supply. This in itself is an absolute financial contradiction. The highest supply in history directly implies the lowest prices in history, for every market in the world – except U.S. Treasuries. But that is merely Act One of this Theater of the Absurd. These maximum prices are occurring at the point in history where the U.S. has never been less solvent. This also directly implies that U.S. Treasuries should be fetching the lowest prices in history – as is occurring with their Deadbeat counterparts in Europe. No one has been able to explain this ultimate financial contradiction, and so I have previously done so myself. My solution for this conundrum was based upon the Holmesian Principle of logic asserted by Sir Arthur Conan Doyle: when you eliminate the impossible, whatever remains (no matter how unlikely) must be the answer. In applying this principle to the logical/financial contradiction of the U.S. Treasuries market, I was left with only possibility: that B.S. Bernanke is secretly (and illegally) counterfeiting U.S. dollars – and using those bogus dollars to prop up the U.S. Treasuries market. There is simply no other viable theory for how this "lead zeppelin" continues to (supposedly) generate the highest prices in history for this thoroughly and obviously worthless paper. Thus I originally wrote "Maximum Fraud in the U.S. Treasuries Market" back at the very beginning of this year. Since that time I have watched with interest to see if any competing theories would emerge. Obviously I haven't been watching the mainstream media. The same mindless parrots who report on this financial absurdity on a daily basis have never seen anything even slightly unusual about maximum supply and maximum prices occurring simultaneously. So I have been watching other members of the Alternative Media for such developments. To the best of my knowledge, only one such theory has emerged. This theory holds that the financial/logical contradiction of the U.S. Treasuries market is simply a product of manipulation of interest rate swaps. Sadly, this theory appears to have been accepted by many members of this Community – despite the fact it is fatally flawed. Understand that the mere (absurd) prices for U.S. Treasuries are the minor element of this mystery. The real question is and has always been: who is buying this worthless paper? As an analogy, I can advertise a used car for sale, and ask $1 million dollars for that car. People all around me may (would) scoff at the "fraudulent" price I was asking for this car, but there would be no need to punish me or even prevent me from attempting to carry out such a fraud. Why? Because merely listing a (fraudulent) asking-price for the used car in no way compels anyone to purchase that car. Here is where the explanation of interest-rate swap manipulation falls flat on its face, because it fails to explain the crucial component of this fraud: who is buying all of the most over-priced bonds in the history of the world? There is no answer for that question. We need simply delve into some additional parameters of supply and demand to illustrate this point even more vividly. Let's start with all of the currency-swaps in which (predominantly) China has been relentlessly engaging for more than two years. By my count, it has already eliminated somewhere between $1 trillion and $2 trillion in annual demand for U.S. dollars. This factor alone means there would be much less demand for U.S. Treasuries at any price – let alone the highest prices in history. Furthermore, most of the pre-Crash of '08 trade surpluses which used to be "recycled" into U.S. dollars (via U.S. Treasuries) no longer exist. Yet another major plank of demand for U.S. Treasuries has evaporated at any price. Then we have yet another absolute financial contradiction: prices for the U.S.'s fraud-bonds being at the highest prices in history, while U.S. equities simultaneously approach their own record prices. Here the alternative media has been just as comatose as the mainstream media. Where is the denouncement of yet another fraudulent set of parameters? |

| Posted: 21 Jun 2012 02:05 AM PDT |

| Want Gold? Marry An Indian Bride Posted: 21 Jun 2012 12:56 AM PDT Andy Hoffman |

| Russia Buys 0.5 Million Ounces and Bank of Korea “Needs To Buy More” Gold Posted: 21 Jun 2012 12:51 AM PDT gold.ie |

| Real Estate Recovery Is Only a Mirage Posted: 21 Jun 2012 12:34 AM PDT

from rickackerman.com: As the Great Recession drags on, albeit without official sanction, each and every silver cloud of economic news continues to harbor a dark lining. Most recently, amidst the mainstream media's hubris over a supposedly stabilizing housing market, we read yesterday in the Denver Post that the region is bracing for yet another painful round of foreclosures. "Despite reports of a thawing housing market," the paper noted in a front-page article, "yet another wave of foreclosure appears to be looming." The fact that lenders are gearing up for this is apparent in the sharp spike in deed-of-trust assignments in Colorado. Compared to 2011, they've more than doubled in the first five months of this year. Deeds of trust convey ownership rights of mortgages and the ability to foreclose on them, and they are therefore a reliable indicator of foreclosure activity to come. According to the Post, if only half of the filings become actual foreclosure cases, foreclosures could spike to 2007's crisis levels. Keep on reading @ rickackerman.com |

| By the Numbers: The U.S.’s Growing For-Profit Detention Industry Posted: 21 Jun 2012 12:29 AM PDT

from propublica.org: The growth of the private detention industry has long been a subject of scrutiny. A recent eight-part series in the New Orleans Times-Picayune chronicled how more than half of Louisiana's 40,000 inmates are housed in prisons run by sheriffs or private companies as part of a broader financial incentive scheme. The detention business goes beyond just criminal prisoners. As a Huffington Post investigation pointed out last month, nearly half of all immigrant detainees are now held in privately run detention facilities. Just this week, the New York Times delved into lax oversight at industrial-sized but privately run halfway houses in New Jersey. We've taken a look at some of the numbers associated with the billion-dollar and wide-ranging for-profit detention industry—and the two companies that dominate the market: General Statistics: 1.6 million: Total number of state and federal prisoners in the United States as of December 2010, according to the Bureau of Justice Statistics Keep on reading @ propublica.org |

| Gold Bugs: Do You Suffer from Pappagallo? Posted: 21 Jun 2012 12:23 AM PDT

from beaconequity.com: As the Greek vote Sunday came and went, the G-20 Summit, ditto, and now the announcement of the FOMC meeting in Washington comes to a close, gold bugs appear to be hanging onto every event like dogs eyeballing his master in hopes of receive a scrap from the dinner table. And for those news junkies following the European spectacle, how many times do we need to read a variation of the following quote? "This [prop up of the global financial system] is not going to work unless they let the fund gear up and draw on the full firepower of the ECB," David Owen of Jefferies Fixed Income told The Telegraph. And here comes that 'pappagallo' line that Trends Research Institute's Gerald Celente talks of—that tired, over-baked and repeated analysis coming out of every so-called financial 'expert' quoted for the past three years from so-called 'papers of record' . . . Keep on reading @ beaconequity.com |

| Fed playing coy – for the moment Posted: 21 Jun 2012 12:06 AM PDT

from goldmoney.com: Down, up, and down again – so go precious metal prices since the release yesterday of the Federal Open Market Committee's latest verdict on the near-term direction of US monetary policy. The FOMC decided to prolong "Operation Twist" – sales of short-term Treasury securities, with the cash generated used to buy long-term Treasuries – but stopped shy of announcing QE3 or any other new moves to boost bank reserves. Stocks and commodities have reacted poorly to this news, while gold, silver, platinum and palladium have also slipped lower. PIMCO's Mohamed El-Erian has a withering verdict on the Fed's latest move: "What this continued Fed activism will do is to continue altering the functioning of markets, contaminate price discovery and distort capital allocation. Already, the viability of several segments – from money markets to insurance and from pension provision to suppliers of daily market liquidity, all of whom provide financial services to companies and individuals – has been undermined. The Fed has also conditioned many market participants to believe in a policy put for both equities and bonds. And other government agencies are relieved to have the policy spotlight remain away from their damaging inactivity." Keep on reading @ goldmoney.com |

| OIL AND THE CRB APPROACHING A FINAL BOTTOM Posted: 20 Jun 2012 11:59 PM PDT June has been the month of major bottoms. Stocks and gold have already formed major yearly cycle lows. Now it's the CRB's turn to put in a major three year cycle bottom. This bottom will almost certainly form well above the 2009 low, establishing a pattern of higher lows and setting up for what I believe will be an extreme inflationary scenario over the next two years, culminating in a parabolic spike much higher than the one in 2008. Sentiment has reached levels similar to the last three year cycle low in 2009. Chart courtesy of sentimentrader.com At this point we are just waiting for the oil cycle to bottom. Today is the 51st day of oils intermediate cycle, which generally runs 50-70 days on average. I think oil is going to bottom in the next 3 to 5 days. The reason being; oil is in a waterfall decline that has just formed a midpoint consolidation. Once the midpoint consolidation gives way the final plunge usually lasts 3-5 days. This should correspond with a dead cat bounce in the dollar index before it rolls over and heads down into an intermediate bottom sometime in the next 4-8 weeks. During this final plunge it appears gold will move down into a daily cycle low. That low should hold above $1526 as I think gold has already formed its yearly cycle low back in May, slightly ahead of the stock market and the CRB. Sometime in the next few days investors will get the single best buying opportunity to position in commodity markets for the coming inflationary period. I prefer the precious metals (more specifically mining stocks) as they have already indicated they are going to lead this next leg in the commodity bull, but I think investors will generate tremendous returns in almost any area of the commodity sector. One to watch is natural gas. It might be the largest percentage gainer during the next two years as it has gotten beaten up more severely than almost any other commodity. This posting includes an audio/video/photo media file: Download Now |

| Gold still at risk of a large downward move before the rally Posted: 20 Jun 2012 11:57 PM PDT Gold has been busy consolidating in what I believe will be a 13 Fibonacci month Primary wave 4 correction. The Gold bull market I've been following since 2001 is a likely 13 year bull cycle that will end in 2013 or 2014 depending on how you count. This current correction pattern is working off a 34 Fibonacci month rally that took Gold from 681 to 1923 at its ultimate highs. Last fall I warned about the parabolic run likely ending in the 1908 ranges and for investors to position themselves accordingly. Today we have Gold trading around 1600 and our recent forecast in May was for a rally into Mid June topping around 1620-1650 ranges in US Dollars. The intermediate forecast still calls for a possible drop to 1445-1455 ranges this summer, the same figures I gave out on TheStreet.Com interview last September for a Primary wave 4 low. Only a close and a strong move over 1650 will eliminate the downside risk in my opinion. Below we can see a weekly chart showing the 34 week moving average line as well as the obvious downtrend line. The 34 week moving average line acted as support during the Primary wave 3 rally from 681-1923. It now is acting as a resistance ceiling to break through, and I don't think we will until this fall. The likely cyclical lows for this Gold correction will be in the October window and investors should make sure they are positioned long by that time. Subscribe to our regular updates to stay informed on a dialy basis on the SP 500 and GOLD in the meantime with a discount offer. Go to www.markettrendforecast.com to sign up or to ask for our free weekly reports. |

| Gold Hits 8-Session Low but ‘Bank Buying Supports’ Posted: 20 Jun 2012 11:54 PM PDT The wholesale market gold price fell further Thursday in London, falling hard to eight-session lows at $1,587 per ounce following last night's "no change" decision from the Federal Reserve on new US quantitative easing. |

| Russia Adds 500,000/oz. & S. Korea Plans Add of Gold Posted: 20 Jun 2012 11:32 PM PDT In volatile up and down trade, gold dropped for its 3rd day after Bernanke and the Fed failed to announce the latest round of QE. The sharp fall in gold and then even sharper rise and then fall again was unusual trading. |

| T&S: Lies You Don't Want to Hear About Posted: 20 Jun 2012 10:44 PM PDT With recent comments about silver, I felt it was quite important to point out how easy it has been for the public to be manipulated since the start of the Financial crisis. You may not like this video but the truth meeds to sink into each of us in order to stay prepared. from mrthriveandsurvive: ~TVR |

| Peter Grandich on The Fed & Gold Posted: 20 Jun 2012 10:43 PM PDT From GoldSeek Radio: About Gold Seek Radio: More interviews @ radio.goldseek.com |

| Silver Update: Silver Bomb III – 6.20.12 Posted: 20 Jun 2012 10:42 PM PDT brotherjohnf: Silver Update 6/20/12 The Silver Bomb 3 ~TVR |

| Posted: 20 Jun 2012 10:27 PM PDT Recent price action suggests that hard times may be over for this hardest of all assets. Despite repeated attempts, the yellow metal has failed to break down below the $1,500 support level that I have been broadcasting as the line in the sand. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment