saveyourassetsfirst3 |

- Gold Mining Shares - Cheap Crisis Insurance

- Markets Moving Markets

- Central Banks Are Pulling Back on Stimulus… You Know What That Means

- Dot Connecting

- Intermarket Analysis Applied to Gold, Gold Stocks and Bonds

- The Real Bombshell in the MF Global Post Mortem

- Chart of the Day: Is It Time to Get Defensive?

- Silver: A Tier 1 Asset for All

- Silver and gold to test last year’s highs as the world waits for more money printing?

- The Silver Squeeze: Bank Runs Versus EU Short Covering?

- Don’t Let It (Gold and Silver) Turn Green

- Iran Gold Imports Surge - 1.2 Billion USD Of Precious Metals From Turkey in April Alone

- EU treaty talk calms markets

- Argentine government moves against miners

- Dismal US jobs data lifts gold and silver

- Gold moved by speculators alongside the euro

- Gold not as solid as it appears

- How the Media Covers for Corrupt Elites, Catholic Church Edition

- Apple Cash or... GOLD?

- Iran’s Gold Imports from Turkey Surged in April

- Argentine : « Touche pas à mes dollars ! »

- Richard Russell: Gold & When the Bear Market in Stocks Will End

- Lights Are On, Nobody Home

- Dow Double Bottom

- Gold & Financial Preparedness

- Gold & Silver Market Morning, June 05 2012

| Gold Mining Shares - Cheap Crisis Insurance Posted: 05 Jun 2012 06:24 AM PDT By Bruce Vanderveen: All of a sudden, bad news seems everywhere. Last Friday's disastrous markets started with a weaker-than-expected Chinese manufacturing index reading. A terrible U.S. jobs report quickly followed. This all on top of the woes of the steadily worsening euro crisis. Consternation and Dread Markets are scared. Look at the news over the last few weeks. The Telegraph worries about a Greek euro exit and crumbling banks. Fitch claims European banks may need hundreds of billions in additional capital to avert bank runs. Reuters notes the rapidly slowing Chinese economy. The fear is that any one of these - or something else - will precipitate a deflationary collapse of world financial institutions. No longer are just fringe elements sounding the alarm, it's now mainstream. The Flight Out of Risk Assets Whenever fear ramps up, large investors rush into treasuries as concern shifts from return on assets to return of assets. Large Complete Story » |

| Posted: 05 Jun 2012 04:56 AM PDT

from news.goldseek.com: The questions nervously being asked during this market turmoil and onslaught of worrisome news is: 1. Are we experiencing an Intermediate-Term pullback or the beginning of a major Long Term move down? It is too soon to answer #1 until we see the "whites of the eyes" of the global central bankers and how (NOT 'IF') they will react. Whether to QE III or not to QE III? Smart investors will leave that to the central bankers and speculators and focus on questions #2 and #3. These questions we can answer! MARKETS MOVING MARKETS Several methods can be used to help determine at what level the market will stop. 1. MULTIPLE METHODS: One technique is to combine multiple tools and methodologies. When several different techniques all seem to point to a specific area, it is wise to take notice. 2. MULTIPLE MARKETS: Another method would be use #1 on multiple markets, as well as the market you are trading. When you see several markets all appearing to be due for a technical event at the same time, again it is wise to take notice. 3. KEY DRIVER$: Additionally, you can add another level of confidence by fully understanding what markets are actually directly affecting the one you are trading. This is a little more tricky and requires much more diligence. This is where the pros spend their time. Keep on reading @ news.goldseek.com |

| Central Banks Are Pulling Back on Stimulus… You Know What That Means Posted: 05 Jun 2012 04:52 AM PDT

from news.goldseek.com: Talk of QE and rumors of coming Central Bank Intervention pushed stocks and Gold higher on Monday. It's odd to hear these rumors when every major Central Bank has in fact been clearly stating NO new stimulus is coming any time soon. Indeed, as the Fed has proved now for eight consecutive FOMC meetings, it is not going to announce more QE unless another systemic Crisis erupts. Instead the Fed continues to reiterate its talk of maintaining low interest rates, which is largely a symbolic gesture as it changes nothing. To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee expects to maintain a highly accommodative stance for monetary policy. In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014. Keep on reading @ news.goldseek.com |

| Posted: 05 Jun 2012 04:25 AM PDT

from tfmetalsreport.com: Even Helen Keller, Stevie Wonder and Ray Charles could see, hear, smell and feel this one coming from a mile away. If we're going to be connecting dots, we might as well fall back upon my favorite organizational device, the dot chronology. I'm just a Turd. I don't have an MBA or a PhD. I'm not a Global Financial Strategist or a Senior Economist. I live in Flyover Country USA, not New York, London or Singapore. However, even this Turd can plainly see that the current global financial/currency system is ending. We have reached the point where debt is unsustainable and, as we know, that which is unsustainable cannot be sustained. Now, if I can see this and you can see this, is it safe to assume that the leaders of China, Russia, India, Turkey et al can see it, too? Last month, I conducted two podcasts with Jim Willie. Among the important items that Jim passed along was his information regarding "Eastern" gold purchases. Jim has an excellent and well-connected source who informed him that, since 2/28/12, over 5,000 metric tonnes of gold had purchased and removed from Gold Cartel vaults. Of course, I have no idea of whether this is accurate but the telling part of Jim's information was this: The source didn't simply inform Jim that it was "5,000 tonnes", the actual information was "as of last Friday, 5,000 tonnes". Does this exact verbiage make the information more reliable? Perhaps. In the end, the exact tonnage isn't important. I've been able to confirm through my own contacts such as "Winston" is that massive amounts of gold are being purchased every day by "Eastern" interests, namely central banks and sovereign funds. This incredible, physical demand is the primary reason paper gold bottomed at 1525 and has now reversed. Also last month, I posted a podcast with the author, John Butler, and I urged you to buy his book, "The Golden Revolution". Why? Because, in the book, John thoughtfully lays out the likely processes by which gold will be re-introduced as money and as the basis for global trade settlement. Keep on reading @ tfmetalsreport.com |

| Intermarket Analysis Applied to Gold, Gold Stocks and Bonds Posted: 05 Jun 2012 04:07 AM PDT

from news.goldseek.com: Longtime readers know that we are a huge fan of intermarket analysis which is a rather new field within technical analysis. I believe John Murphy developed this field, thanks to his book. Intermarket analysis is the analysis of the relationships between the major asset classes: stocks, bonds and commodities. Furthermore, evaluating and comparing the different sectors within those asset classes also counts as intermarket analysis. Essentially, it is comparing one market to another. Intermarket analysis is essential when analyzing the precious metals complex because it is always affected by or has some relationship to other markets. For example, strength in government bonds or strength in the US dollar is usually a headwind for gold. Likewise, strength in equities can be negative for gold as it shifts money from gold back into conventional investments. Today we are looking at US bonds and their effect on gold. Keep in mind the treasury market is the largest in the world. Upon that realization, one can easily understand why peaks and valleys in bonds have a substantial impact on precious metals. Keep on reading @ news.goldseek.com |

| The Real Bombshell in the MF Global Post Mortem Posted: 05 Jun 2012 02:05 AM PDT John Giddens, the bankruptcy trustee in MF Global, garnered headlines Monday by saying that he will decide in the next 60 days whether to filing suits against Jon Corzine and other officers for breach of fiduciary duty and negligence and against JP Morgan if he is unable to come to a settlement. JP Morgan so far has returned roughly $518 million in MF Global assets and $89 million in customer monies, a meager recovery relative to $1.6 billion in missing customer funds. The report Giddens released Monday is thorough and confirms many of the observations made in journalistic accounts of the firm's collapse, particularly regarding inadequate risk and accounting controls, JP Morgan's aggressive posture greatly increasing the liquidity squeeze. It also makes clear that this is an interim report, and unlike the trustee's report on Lehman, says that reaches no conclusion regarding legal strategies, including whether prosecutions are warranted. But a stunning revelation that comes early in the account and is central to the failure of the firm does not get the emphasis that it warrants. What is not surprising but nevertheless important is the way the document depicts MF Global as a train wreck waiting to happen. Ironically, the firm is a casualty of ZIRP. MF Global historically had gotten most of its income from low risk activities, such as interest on customer margin. Its net interest income from those sources fell by $3.5 billion from 2007 to 2011. Corzine had embarked on a strategy of turning the firm into a full service investment bank, an approach we deemed doomed to fail. To get there, Corzine took an approach that was similar to the one of Lehman and Bear, who were vastly less behind the industry leaders than MF Global was: putting lots of their chips in high risk, high profit potential activities (for Bear and Lehman, real estate; for MF Global, prop trading, specifically, Corzine's Eurobond trade) in the hope that they could grow more rapidly than the top firms and thus close the gap with them. But if you are going to increase firm-wide risk in a big way, particularly in a trading firm, it is critical to have solid risk and financial controls, and MF Global's internal audit had reported considerable shortcomings on this front in 2010 and 2011. Yet Corzine went gung ho for growth without having those in place; indeed, as was recounted in the media and in the report, the chief risk officer, Michael Roseman, was evidently forced out for dareing to tell the board he was concerned about the magnitude of the Corzine's Eurozone bets and made sure his successor was less influential. Giddens criticizes MF Global management for both increasing trading risk and entering into new lines of business without making the needed investments improving Treasury processes, trade reporting, and liquidity management. Not surprisingly, the firm was under stress considerably before the crisis hit. Even though Corzine's approach improved the firm's results, it was still losing money. And the rating agencies didn't simply want MF Global to be profitable; they required the company to earn $200 million pretax to keep an investment grade rating (being downgraded would and did produce a death spiral, since counterparties would demand higher collateral postings from an already-liquidity-strained and highly levered firm). So the firm was running out of runway and was not even close to achieving takeoff speed. The report recounts how the firm was coming apart before the denouement, which was triggered by Finra determining that the firm was capital deficient and demanding an infusion of $183 million, which the ratings agencies ignored until a Wall Street Journal story six weeks later, on October 17, forced them to take action. Employees were unclear as to whether some of the increasingly aggressive ways they were using funds in customer accounts were permissible. And the money shuffling was reaching a scale and complexity that even if it wasn't pushing the envelope, a screw-up was likely. From the report:

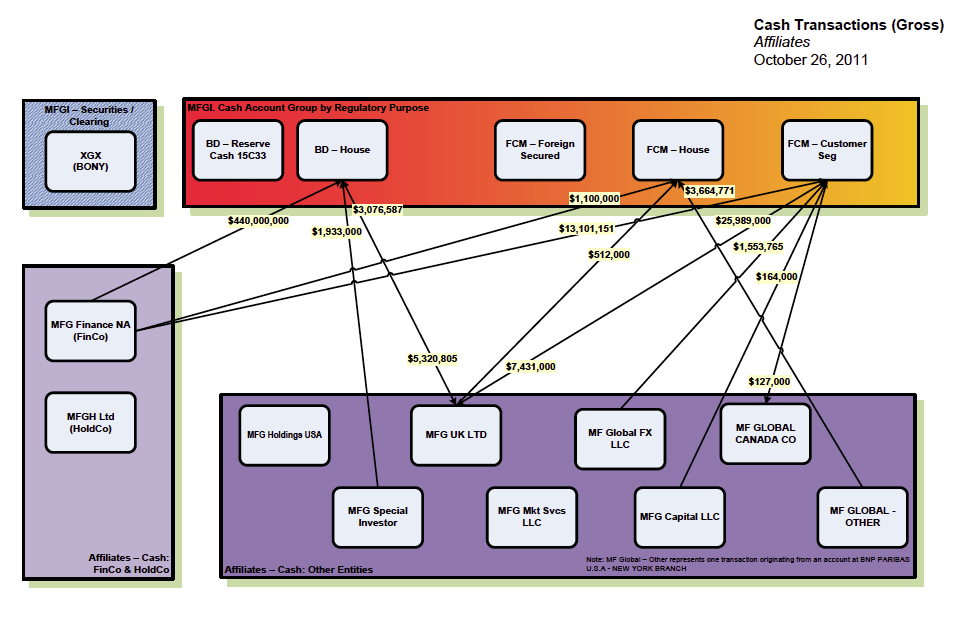

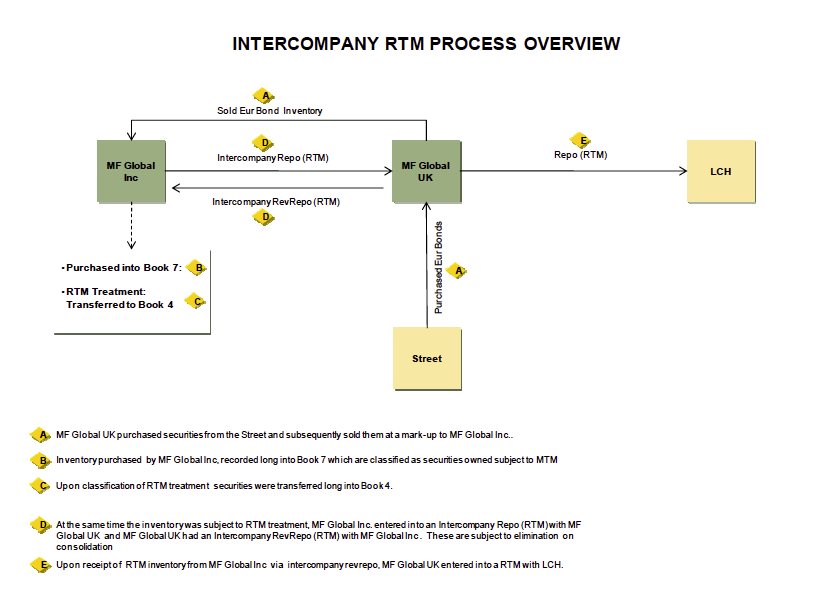

Stenkamp was the CFO. The fact that he was telling employees, and perhaps investors, that the firm was well funded when it wasn't, at best shows how poor management controls and information were. (Another issue flagged by the report is that there had been a good deal of turnover in Treasury and related functions. This made a bad situation worse, since seasoned employees were compensating for gaps in formal reports by communicating with each other via e-mails and journal entries). Note this is consistent with the argument made before on this blog, that MF Global is a prime candidate for litigation, potentially prosecution, for Sarbanes Oxley violations, namely false certifications about the adequacy of internal controls. The report includes 53 (!) pages of charts in the report which attempts to track this cash and loan shuffling in the final days: But the real stunner comes early in the report, and the media write ups thus far seem to have missed it completely. Recall that the trade that felled MF Global was one directed by Corzine, and has been depicted as a repo-to-maturity trade, in which the maturity of the repo matched that of the underlying asset exactly. That in turn allowed the trade to be treated as off balance sheet, which was helpful in presenting the firm's results to ratings agencies and analysts. The bet that commentators focused on was that the European governments would not default before the maturity of the short-term trades, and the transactions allegedly would have worked out had MF Global survived. (Note that press commentary has focused on an Italian bond). The problem has been widely described as one of short-term price moves, namely, that Corzine and other managers allegedly did not know that if the price of the maturing bonds it bought fell more than 5%, it would have to post more collateral, and that adverse price moves triggered the liquidity crisis. It turns out this description of the trade isn't accurate. It never was a real repo to maturity, as in maturity match funded externally. The funding was two days shorter than the maturity of the asset. But, no joke, MF Global dressed that up internally and somehow got accountants and regulators to buy off on this bogus characterization. And even worse, this scheme produced book profits at the expense of liquidity, the real scarce commodity at the firm:

This schematic shows how the trade worked:

Query whether this disclosure was adequate. While it does flag the exposure to default risk and adverse price movements, it does not mention the hazard that proved fatal, namely, that this trade produced accounting (and hopefully in the end actual) profits but with ongoing liquidity demands that an astute reader would not anticipate existed with a trade that was a true (as opposed to internal) repo to maturity. Top management looks even more out-to-lunch than previously thought, since MF Global had experienced large margin calls due to unfavorable price changes in the bonds used in these trades, the first time in October 2010 on some Irish sovereign debt, and an even larger haircut on Irish and Portuguese sovereign debt in September 2011. As Michael Crimmins said via e-mail:

But sadly, this scam isn't likely to get the attention it deserves, since the otherwise substantive report does not question the accounting characterization of this trade. And that means, yet again, the key enablers are likely to get off scot free. |

| Chart of the Day: Is It Time to Get Defensive? Posted: 05 Jun 2012 02:04 AM PDT Extremely low returns on perceived safe havens like US and German bonds are helping gold. It isn't hard to justify moving back to gold when bonds returns can't even beat inflation. |

| Silver: A Tier 1 Asset for All Posted: 05 Jun 2012 01:47 AM PDT

from silverseek.com: In recent years, precious metals, most notably silver and gold, have played an unusual dual role as both monetary and non-monetary commodities. That may be in the process of changing for major financial institutions to favor holding metals as collateral as the Basel Committee ponders allowing banks to use gold as a Tier 1 capital asset. Despite its well established and richly deserved safe haven status, gold is currently considered a Tier 3 asset. Ironically, this places the yellow metal lower on the asset totem pole than un-backed government bonds, which currently have low or even negative yields on an inflation-adjusted basis. Furthermore, gold is generally misunderstood and ignored, while silver is largely viewed as a commodity among investors and central bankers. In fact, Fed Chairman Ben Bernanke, in response to the question of why central banks hold gold, simply answered "Tradition". Keep on reading @ silverseek.com |

| Silver and gold to test last year’s highs as the world waits for more money printing? Posted: 05 Jun 2012 01:42 AM PDT

from silverseek.com: When will the global central banks press the button and start the electronic money printing presses rolling again? Will they first allow some hot air out of over-inflated stock markets or seize on a contracting global money supply as a reason to get on with it? Money supply data is in retreat all over the world, even in China. It is an alarm bell for recession and all the latest data on manufacturing orders points to a synchronized global slowdown already. Printing money offsets this contraction to an extent. Debt and more debt The problem is that global central banks have been printing money to deal with the financial crisis for more than three years. All they have managed to do is delay a crash, they have not induced a recovery, and at the same time they have borrowed a very great deal more money. Far more indeed than they have got back in GDP growth. If I borrow $2 from you and give you $1 to spend that is economic growth but at an uneconomic cost. For a crisis caused by too much debt in the system it was never entirely clear how borrowing even more money would solve the problem. Getting a second credit card after the first is full allows you to spend again but leaves you deeper in debt. Keep on reading @ silverseek.com |

| The Silver Squeeze: Bank Runs Versus EU Short Covering? Posted: 05 Jun 2012 01:38 AM PDT

from silverseek.com: According to Google Trends, the number of Internet searches for the phrase "bank run" has reached an all-time high, demonstrating just how concerned many intelligent people are becoming over the stability of the global banking system. Amid these troubling times for financial institutions, silver is continuing to shine as the "poor man's gold" that will provide a safe haven investment asset if paper currencies lose even more of their already tenuous credibility. Greek Bank Run Fears Grow as EU Exit Appears More Likely Reports surfaced recently that worries about an imminent Greek exit from the Eurozone have sparked the withdrawal of almost a billion Euros in cash over the past few weeks from Greek banks. Over the last couple of years, withdrawals of cash on deposit from Greek banks have averaged between 2 and 3 billion Euros per month. Nevertheless, January's withdrawals exceeded 5 billion Euros. Due to this growing loss of confidence in the banking system, Greek officials are increasingly worried about a burgeoning bank run. Reuters even reported that Greek President Papoulias warned political leaders of a "great fear that could develop into a panic" during negotiations to form a governing coalition within the fragile Greek political arena. Keep on reading @ silverseek.com |

| Don’t Let It (Gold and Silver) Turn Green Posted: 05 Jun 2012 01:32 AM PDT Andy Hoffman |

| Iran Gold Imports Surge - 1.2 Billion USD Of Precious Metals From Turkey in April Alone Posted: 05 Jun 2012 01:28 AM PDT gold.ie |

| Posted: 05 Jun 2012 12:58 AM PDT

from goldmoney.com: Precious metals had a quiet day yesterday, with gold and silver both consolidating following Friday's rally. Gold continues to face resistance at $1,625, while $28.50 remains a point of selling pressure for silver – as has been the case now for the best part of the last month. James Turk sums up Friday's gold and silver strength in a new King World News interview: "even though stock markets around the world the past few weeks have generally been in a nosedive, gold, silver and the mining shares are climbing higher. Independent strength like this is normally very bullish, and it bodes well for the precious metals and mining shares in the weeks and months ahead. It also suggests that, like last year, this summer is going to be another good one for the precious metals." Keep on reading @ goldmoney.com |

| Argentine government moves against miners Posted: 05 Jun 2012 12:52 AM PDT

from goldmoney.com: Latin America's political shift to the Left is starting to have serious consequences as far as mining companies are concerned. In April the Argentine government renationalised the oil company YPF, and early last week introduced a new law aimed at reducing mining companies' imports into Argentina. Last year foreign investment in Argentina's mining sector almost reached a new record of $3 billion, but this new law calls into question future investment. This new decree means that the government will start to control all imports by mining companies, in an effort to boost Argentina's foreign currency reserves and its trade surplus. Keep on reading @ goldmoney.com |

| Dismal US jobs data lifts gold and silver Posted: 05 Jun 2012 12:46 AM PDT

from goldmoney.com: riday's US jobs report was a game changer as far as the gold market was concerned. Jobs growth in May was just 69,000, well below economists' expectations of 150,000 gains, while April's payroll number was revised down from 115,000 to just 77,000. The unemployment rate also increased from 8.1% to 8.2% – troubling news for President Obama as the presidential election campaign shifts up a gear. Gold and silver both shot up following this news, this data providing more indicators that the Federal Reserve will resort to more quantitative easing. June Comex gold settled $57.90 higher, an impressive 3.7% intraday move, while silver for delivery in the same month gained 2.7% to close at $28.50. Platinum recorded a more modest 1.1% gain, while palladium recorded barely any gains on the day – the more industrially orientated precious metals lagging gold on account of all the bearish news swamping the global economy at the moment. Keep on reading @ goldmoney.com |

| Gold moved by speculators alongside the euro Posted: 05 Jun 2012 12:27 AM PDT

from mineweb.com: Gold Today – Gold closed in New York at $1,620.40 and in London's early morning fell to $1,615.75. There is no Fixing in London today due to the Jubilee celebrations. Ahead of New York's opening gold stood at $1,618.22 and in the euro, €1,301.55 while the euro was at €1: $1.2433. Silver Today – Silver slipped slightly in London to $28.25. Ahead of New York's opening at $28.27. Keep on reading @ mineweb.com |

| Gold not as solid as it appears Posted: 05 Jun 2012 12:23 AM PDT

from mineweb.com: Demand for gold has risen 16% in the past 12 months but investors who buy heavily into the commodity to protect capital over the short term are not playing as safe as they might think. Gold? Yellow, glittering, precious gold?… / This yellow slave / Will knit and break religions, bless th' accursed / Make the hoar leprosy adored, place thieves, / And give them title, knee and approbation / With senators on the bench. Timon of Athens, Act IV, Scene III. Shakespeare's judgement of the precious metal in Timon of Athens can hardly be called flattering. Yet even in condemning it, the bard was acknowledging the unique place gold has occupied – a physical manifestation of power, yet touching somehow on the ethereal. Keep on reading @ mineweb.com |

| How the Media Covers for Corrupt Elites, Catholic Church Edition Posted: 05 Jun 2012 12:15 AM PDT By Matt Stoller, a fellow at the Roosevelt Institute. You can follow him on twitter at http://www.twitter.com/matthewstoller Here's CBS New York, back in February.

Here's what came out today.

In the dominant cultural and media narrative, Dolan is a "rock star" for being elevated to Cardinal. He's successful and charismatic, and a possible papal successor. The bishops represent the Catholic masses, and the hierarchy of the church speak on behalf of those Catholics, attending to their spiritual and political needs. On another level, of course, these leaders are simply unaccountable corrupt corporate leaders who happen to wear robes and run a big multi-national venture known as Catholic Church, Inc, which is distinct from the religious practices of millions of Catholics. Like many corporate elites, these men, and they are men, protect their institution by covering up horrific acts of violence perpetrated on the powerless. This dual-tracking, of an overall narrative on one hand and revelations that cut entirely against that narrative, is why Obama will negotiate with bishops over contraception instead of challenging their legitimacy. It's why the Pope's attacks on nuns and suppression of all but deeply reactionary authoritarian impulses within the bureaucracy go unremarked within elite circles. Catholic elites are like bankers, who are trusted men in suits no matter what they do. Or generals, who are heros regardless of their incentive model and links to defense contractors. Etc. Obviously, not all upper level Catholic Church leaders are corrupt, and some are no doubt good faith community leaders. This is true across all authoritative classes. It's just that the structures that hold their authority, that are supposed to self-police, are no longer doing so. So corruption flourishes, as you'd expect. These institutions spiraling downward reinforce each other. That Dolan isn't prosecuted, that the Catholic Church can implement discriminatory policy against women taking leadership positions, that child sex abuse is unpunished, all of that relies on our legal and political infrastructure tolerating and encouraging the evolution of these reactionary structures. And then Church elders can provide moral cover for any number of authoritarian impulses by political factions, such as the current war on women's rights. In other words, the collapse of the rule of law in America is refracting across all elites institutions, as Chris Hayes will no doubt point out in his new book. The media plays a very specific role in this ecosystem, not to cover up the crimes so much as to paint a much more aggressive narrative that whitewashes out their very possibility. In this case, the upper level actors in the Catholic hierarchy are necessarily religious or spiritual, so no matter how many times rape and the protection of rapists is uncovered bishops and priests retain their authoritative positions in society. Ultimately, we must tear down this false authority, or it will tear us down. In modern America, Wall Street bankers aren't the only ones who go unpunished for their crimes. And that's worth noting. |

| Posted: 04 Jun 2012 11:52 PM PDT Quickly vote and make them shiver. http://finance.yahoo.com/blogs/break...120742748.html Gold has the lead as of 8:50 am. |

| Iran’s Gold Imports from Turkey Surged in April Posted: 04 Jun 2012 11:25 PM PDT Turkish exports of gold, precious metals, pearls and coins to Iran rose to $1.2 billion in April from a tiny $7,500 a year earlier, according to figures released by the state statistics institute in Ankara yesterday. |

| Argentine : « Touche pas à mes dollars ! » Posted: 04 Jun 2012 10:33 PM PDT La polémique fait rage en Argentine sur la prétention du gouvernement de maîtriser le marché parallèle du dollar. Le 30 mai, le dollar avait atteint 6,15 pesos au marché noir, un record. Il s'est ensuite stabilisé à 5,90 pesos, soit plus de 30 % au-dessus de la cotation officielle (4,47 pesos)... Lire |

| Richard Russell: Gold & When the Bear Market in Stocks Will End Posted: 04 Jun 2012 10:16 PM PDT

from kingworldnews.com: With continued volatility in global markets, the Godfather of newsletter writers, Richard Russell, warned his readers to ultimately expect a nasty decline in stocks because "bear markets operate within a background of naked fear." Russell also stated, "I no longer see a BIG correction ahead for gold." Here is what Russell had to say: "How far will the bear market carry? No one knows. Already all of 2012′s gains have been wiped out. There's a number down there to where the bear market is heading. I don't know what that number is. Dow 8,000? Dow 6,000? Dow 4,000? Dow 2,500?" Richard Russell continues: "The number could be any one of these. What I hope is that we get to that number as quickly as possible. I just hope we get the pain of the bear market over as fast as possible. One mistake is to think we know how costly the bear market is fated to be — and how far the bear market will carry. The Primary trend is a law unto itself. It will continue until it dies of exhaustion. Keep on reading @ kingworldnews.com |

| Posted: 04 Jun 2012 10:14 PM PDT

from tfmetalsreport.com: Many have said (and continue to say) this about me. In this case, however, I intend it for the silver market where seemingly no one is left. Besides, more appropriate cliches for yours truly are obviously:

Look, I know it's frustrating to wait for silver to turn and rally. It's driving me crazy, too. Even though I'm on record predicting an exciting and explosive summer for silver, it looks like we're going to have to remain patient. Why? It's all in the open interest. Keep on reading @ tfmetalsreport.com |

| Posted: 04 Jun 2012 09:51 PM PDT We see more down to flat market for June based on the charts from the close as of May 31. Dow Jones Industrial Average: Closed at 12,393.45 -26.41 on normal volume and flattening, basing momentum. At the first of May, the Dow was near 13,250 and has now fallen to base just above 12,250, producing a bull double bottom. This selling is normal for this time of year. Also normal for June, on our technical expectations, we should see a bullish move for +50% of this last price drop. This forecast should then take price back up to support and resistance at 12,750 in later June, or early July. This month end for May fell in the middle of this week producing a broken calendar pattern as opposed to closing out on a Friday. Friday is the beginning of the June month and as such we should see a market flat to down. Normal trading should resume on Monday, June 4, 2012. We forecast the Dow will rise to 12,500 resistance by the middle of June, or earlier. Greek voting occurs on June 17, and this could produce either up or down moves with power based upon expectations. Since we expect another Kick The Can postponement, the Dow should continue higher after a positive Greek voting outcome. The next time around during the fall Greek credit crisis, we forecast a larger selling event with a minimum -38% Dow sales drop. S&P 500 Index: Closed at 1310.33 -2.99 with a neutral technical closing price bar. Volume was 107% of normal and momentum stopped selling to basing flat. The 200-day moving average is 1314.42 so we can call this close on both nearby support and resistance. Price has been channeled between 1300 and 1340 for this week but look for more mild selling first, followed by new buying in mid-June. Higher resistance is 1351.56 on the 50-day moving average. Traders should expect a continued trading softness with a bias to the down side going into the month of June. After a settling and consolidation pattern, the price should regain some footing and begin to rise in the latter half of June with a calendar peak in the first ten days of July. The price of 1350 could be our peak forecast for both June and July. With this being an election year, we expect some serious pump priming by the PPT Plunge Protection Team and/or the beginnings of a very politically announced Q-3, which has already been underway in stealth fashion for the last 11 months. S&P 100 Index: Closed at 597.29 -0.88 and has stopped selling while forming a strong base. Volume was normal and momentum has based going flat. All the moving averages are crowding in around 600-615 with the 50-day average on the higher side of this trading range. The solid support and resistance for these bigger companies, match similar prices from May-July, 2012 last year. We can see a chance for a potential overshoot drop, taking the price down near 575 in June followed by more buying back up to 600 resistance in July. Nasdaq 100 Index: Closed at 2524.87 -12.53 after touching the 200-day average and bouncing back-up to touch the 50-day average at 2613.47. After that high, down she went again, but this time the price held-up nicely above 2500 major support. Volume was normal and momentum has based and flattened to go sideways. There is major price support for this market between 2400-2500. We forecast the low for June-July should be 2400 before a market rebound. Keep in mind the powers affecting these markets can push and stretch them where they want them. The set-up we are expecting is one of a lower and bottom basing summer, followed by rallies into the 4th quarter. The PPT would have to strain mightily to prop stocks unless the Federal Reserve announces stimulus to keep the game in play. We expect this but remain convinced the 4th quarter can sell hard unless artificially based to remain higher until after November 6. A decent performance to the election would set-up markets for a crushing fall after New Year's Day, 2013. 30-Year Bonds: Closed at 149.72 +0.21 after top resistance was broken through near May 15. The bonds are now in the stratosphere with a June futures price touch above 150.00 followed by new support and resistance near that number. The bonds are now rolled over to begin trading the September, 2012 contracts. With the Euro and ECB in disarray along with several of the smaller Euro-land nations, money has been flowing out of Europe into American paper and dollars. Bonds were trading for months during this year between 140.00 and 145.00. We have now entered the bond pricing twilight zone above 146.00 to 151.00. Watch for more pressure to the high side with an expected relief pullback to 148.50 support at the end of June on normal cycles. After that, more buying resumes and we have to wonder how high is high? XAU: Closed at 153.80 -1.56 on rising momentum and a metal to shares ratio that recovered and peaked and is now pausing and stalling. This index was near 200 in the first quarter but is now resisting at 160.00. The current move is a normal ABC correction after a rally. We might support and hold at 148-150 to be followed by a new rally to 160 resistance. Near the end of June, the XAU could rally from toward 175-180 with pausing resistance at 170 on the price. Silver has been so oversold and beaten down we calculate a rebound to a minimum of $38.08 by September. This would mean silver could help take the XAU up to near 180 on the 200-day moving average. Gold: Closed at 1564.40 +0.30 above our 1550 forecast floor. Momentum is flat to sideways and as we shift from the June gold futures contract into August, we expect 1550 to be the bottom and new trading to take the gold price up to 1708 just before September. Support is 1550 and resistance is 1565. Higher resistance is 1575-1585-1592.50 and then 1608. Next week gold should rise to 1575-1582 resistance. Silver: Closed at 27.79 -0.17 on flat momentum and a bottom crawling price just above 27.48. We had an old low in December, 2011 near 26.62. Our recent May drop, nearly matches this number. Also, last year we had a nice rally from the end of June to top near the end of August producing a rise of $10.00 to near $44.00. If we can post half of this gain again in a similar time frame, my technical forecast of $38+ would fit nicely. Watch for a silver breakout sometime in the third quarter of 2012 achieving that forecast number of $38.18. US Dollar: Closed at 83.06 -0.01 with new resistance on 83.00 and support at 82.50. Lower support is 81.50 but we expect the index price to next touch a newer high of 83.50 after a normal correction back to 80.50-81.50. The index price closed on a high bar today forecasting higher prices just ahead. We are still trading the June futures contract but will be shifting soon to the Septembers. After that shift, we see more buying with the price rising to 84.50 in early July. Crude Oil: Closed at 86.53 -1.02 as crude oil tumbled from $105 near the first of May down nearly -$20.00. Selling forces came from a report the reserves are now posted at a 22 month high. With a raft of recession-depression news this week, traders began to sell with some power. The moving average is now -$14.00 under the 200-day moving average. Oil could sell down to as much as 71.50 on a full retracement from 110 back in February. We expect something less dramatic with a price of $75-$78 for a major low perhaps in August. For now, oil is oversold and due for a mini-rally to $88-90. CRB: Closed at 272.97 -2.08 on falling momentum and the price gapping lower and faster with those skidding crude oil prices. Grain has been lower on reportedly good growing weather. Precious metals sold-off but the energy markets have been THE prime movers to sell the CRB. This market is oversold and should rise back to 280 support and resistance; followed by more selling to 270 support. –Traderrog This posting includes an audio/video/photo media file: Download Now |

| Gold & Financial Preparedness Posted: 04 Jun 2012 09:41 PM PDT There is no single, simple answer for protecting wealth and preserving life during an economic collapse. But an important component of any plan is to own and store physical precious metals outside of the mainstream banking system. |

| Gold & Silver Market Morning, June 05 2012 Posted: 04 Jun 2012 09:00 PM PDT |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment