Gold World News Flash |

- LaRouche Verbally Annihilates Volcker, “This Damned Fool” Sabotaged the Restoration of Glass-Steagall

- WHO DESTROYED THE MIDDLE CLASS – PART 1

- Silver Update 6/19/12 Jason vs Martin

- A Dollar's Worth in 1913 Costs $23.52 Today. Thank the Federal Reserve Banksters!

- Volcker Confesses to $2 Trillion Swindle Against the American People

- Gold Marks Time Near Upper End of Range

- Guest Post: Who Destroyed The Middle Class? (Part 1)

- The Gold Price has Remained Above it's 20 and 50 Day Moving Average Could Skid Either Way

- Very bad exchanges

- Dr. Nu Yu?s Trend Analyses: U.S. Stock Markets Looks Strong, Precious Metals, Bonds

- Gerald Celente: Entire Financial House of Cards About to Collapse ? Got Gold?

- François Hollande on Collision Course with ... France

- In Case Of NEW QE, Gold To $1,900-$8,500 Says SocGen

- Hera Research Report: Fortuna Silver Mines

- Hera Research Report: New Gold Inc.

- By Frontrunning QE, Did The Market Make QE Impossible?

- The Twisted “Logic” of the Street

- Truth In Reporting

- India's Government Seeks to Dissuade People From Investing in Gold

- LGMR: FOMC "Influencing Gold More Than Eurozone", Extending Operation Twist "May Not Be Sufficient", Spanish Borrowing Costs Soar

- Gold Seeker Closing Report: Gold and Silver End Slightly Lower

- Gold Daily and Silver Weekly Charts - Pre-FOMC Action

- An Icy Saga Is Emblematic of Oil Price's Inevitable Climb

- The Daily Market Report

- Risk Rallies on G-20 Rumors

- Grandich Client Spanish Mountain Gold

- Commodities Rev Their Engines

- Fed Wrestles With How Best to Bridge U.S. Credit Divide

| Posted: 19 Jun 2012 05:45 PM PDT from laroucheyouth: In a discussion with associates on June 19th, Lyndon LaRouche laid out the fraud of Paul Volcker and Volcker's deliberate sabotage of the momentum around the restoration of Franklin Roosevelt's Glass-Steagall Act in the midst of a world economic collapse. Also see the LaRouchePAC statement "Volcker Confesses to $2 Trillion Swindle Against the American People" |

| WHO DESTROYED THE MIDDLE CLASS – PART 1 Posted: 19 Jun 2012 05:15 PM PDT from The Burning Platform:

The Federal Reserve released its Survey of Consumer Finances last week. It's a fact filled 80 page report they issue every three years to provide a financial snapshot of American households. As you can see from the chart above, the impact of the worldwide financial collapse has been catastrophic to most of the households in the U.S. A 39% decline in median net worth over a three year time frame is almost incomprehensible. Even worse, the decline has surely continued for the average American household through 2012 as home prices have continued to fall. Median family income plunged by 7.7% over a three year time frame and has not recovered since the collection of this data 18 months ago. Even more shocking is the fact that median household income was $48,900 in 2001. |

| Silver Update 6/19/12 Jason vs Martin Posted: 19 Jun 2012 04:29 PM PDT |

| A Dollar's Worth in 1913 Costs $23.52 Today. Thank the Federal Reserve Banksters! Posted: 19 Jun 2012 04:19 PM PDT

Thanks to Eric G. for this one. According to the Federal Reserve's own Minneapolis Ninth District website, the U.S. Dollar has been devalued by 2,352% since the Federal Reserve came into existence in 1913. If you feel poorer, it's because you are. What a Dollar bought then, takes $23.52 – or more than 3 hours of labor at minimum wage – to buy today. You can thank the Banksters.

|

| Volcker Confesses to $2 Trillion Swindle Against the American People Posted: 19 Jun 2012 03:52 PM PDT [Ed. Note: So much for the "Volcker is a good guy" theory.] from LaRouche Pac:

The LaRouche Political Action Committee has learned that former Federal Reserve Board Chairman Paul Volcker is conducting a call-up campaign against the reinstatement of Glass Steagall, arguing that the so-called Volcker Rules are sufficient because they do not "punish" bankers by demanding that they take responsibility for the more than $2 trillion in still-outstanding gambling losses. Under a full return to the FDR Glass Steagall Act, taxpayers would be freed from responsibility for covering the gambling debts of Wall Street, which amount to trillions of dollars that Volcker wants the American people to cover. Lyndon LaRouche, who has led the campaign to reinstate Glass Steagall ever since the collapse of the trans-Atlantic financial and monetary system beginning in the summer of 2007, sharply denounced the "Volcker attempt to swindle the American people out of $2 trillion plus," recalling that as Chairman of the Fed in the late 1970s and 80s, Volcker presided over the takedown of the real U.S. economy by driving interest rates up over 20 percent, bankrupting countless farms and businesses. Volcker's efforts to kill Glass Steagall, which has been reintroduced into the House of Representatives by Rep. Marcy Kaptur (D-Oh.) as H.R. 1489, with over 65 co-sponsors, were first made public by Rep. Michael Burgess (R-Tex.), during a recent district town hall meeting, at which he told constituents that he would not support Glass Steagall and H.R. 1489 because he had spoken with Volcker and had been told that it was unnecessary because the Volcker Rule was sufficient. It has been further confirmed by top Democratic Party sources that the Volcker calls to pro-Glass Steagall economists and politicians is part of a larger push by the Obama White House to push back against Glass Steagall. |

| Gold Marks Time Near Upper End of Range Posted: 19 Jun 2012 03:00 PM PDT courtesy of DailyFX.com June 19, 2012 03:25 PM Weekly Bars Prepared by Jamie Saettele, CMT “The latest move off of the high is impulsive (5 waves) which favors lower prices from the current level to at least Friday’s low at 1553. The bearish RSI reversal signal that was in place for gold last week is now in place for USD crosses.” The mentioned 5 wave decline was succeeded by a 3 wave advance into former congestion (resistance). Look lower as long as price is below 1641. Exceeding that level would shift focus to the May high at 1672. LEVELS: 1527 1553 1584 1641 1672 1697... |

| Guest Post: Who Destroyed The Middle Class? (Part 1) Posted: 19 Jun 2012 02:50 PM PDT Submitted by Jim Quinn of The Burning Platform blog, "Over the last thirty years, the United States has been taken over by an amoral financial oligarchy, and the American dream of opportunity, education, and upward mobility is now largely confined to the top few percent of the population. Federal policy is increasingly dictated by the wealthy, by the financial sector, and by powerful (though sometimes badly mismanaged) industries such as telecommunications, health care, automobiles, and energy. These policies are implemented and praised by these groups' willing servants, namely the increasingly bought-and-paid-for leadership of America's political parties, academia, and lobbying industry." – Charles Ferguson – Predator Nation

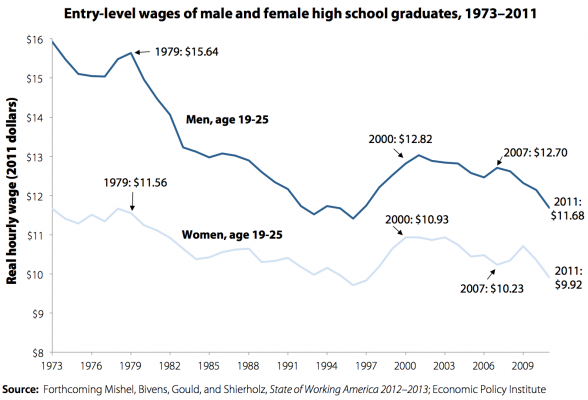

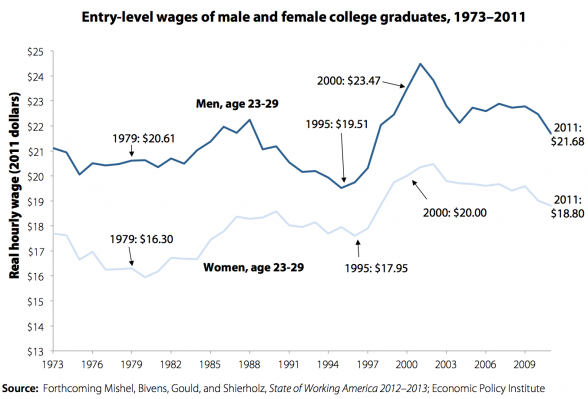

The Federal Reserve released its Survey of Consumer Finances last week. It's a fact filled 80 page report they issue every three years to provide a financial snapshot of American households. As you can see from the chart above, the impact of the worldwide financial collapse has been catastrophic to most of the households in the U.S. A 39% decline in median net worth over a three year time frame is almost incomprehensible. Even worse, the decline has surely continued for the average American household through 2012 as home prices have continued to fall. Median family income plunged by 7.7% over a three year time frame and has not recovered since the collection of this data 18 months ago. Even more shocking is the fact that median household income was $48,900 in 2001. Families are making 6.3% less today than they were a decade ago. These figures are adjusted for inflation using the BLS massaged CPI figures. Anyone not under the influence of psychotic drugs or engaged as a paid shill for the financial oligarchy knows that inflation is purposely under reported in order to keep the masses sedated and pacified. The real decline in median household income is in excess of 20% since 2001. The destruction of the blue collar jobs has been underway since the early 1970s. And the relentless decline in real blue collar wages has followed a bumpy downward path for decades. Sadly, the average person doesn't understand the insidious destruction caused to their lives by the Federal Reserve generated inflation, as they actually believe their wages today are higher than they were in 1973. The reality is the oligarchy has used foreign wage differentials and the perceived benefits of globalization to ship manufacturing and now service jobs to Asia while using their captured mainstream media to convince the average American that this has been beneficial to their lives. Using one of their 15 credit cards to buy cheap foreign goods made by people who took their jobs was never so easy. I wonder if the benefits of being able to buy cheap Chinese electronics, toxic dog food, and slave labor produced igadgets outweighed the $2.3 trillion increase in consumer debt, 27% decline in real wages, 7 million manufacturing jobs lost since the mid-1970s, 46 million people on food stamps, $15 trillion increase in the National Debt since 1978, and a gutted decaying industrial base.

Not only have the oligarchs gutted our industrial base, resulting in enormous job losses among middle aged industrial workers, but they are now in the process of impoverishing the youth of this country by sucking them into crushing college debt with the false promise of decent paying jobs when they graduate with a degree in feminist studies from the University of Phoenix. The fabricated mantra that a college education guarantees a good paying job and a better future is not borne out by the facts. There are over 4,800 institutions of higher learning in this country, with only about 50 considered elite. There are another few hundred top notch institutions, with a few thousand mediocre schools and hundreds of for profit on-line diploma mills exploiting the easy Federal government debt to lure millions into their profit scheme of bilking unemployed naïve middle aged dupes and eventually the American taxpayer. The average student loan debt per student is $29,000. Student loan debt outstanding has risen from $200 billion in 2000 to over $1 trillion today. The Federal Government is blowing another bubble. They are the issuer, regulator and guarantor of these loans. They are making the loans with teaser rates to the ultimate in subprime borrowers – students without jobs going for worthless degrees at mediocre schools. The taxpayer is on the hook for the billions in loses that will surely follow. The payoff for this quadrupling of debt has been an 8% real decline in wages for college graduates since 2000. The monetary policies of the Federal Reserve and bipartisan fiscal policies of our government have led to this dreadful job market for the middle class.

The mainstream media dutifully reported a few key highlights from the Federal Reserve report and moved onto more important issues like Snooki's pregnancy and the octomom's new porno gig. We certainly couldn't expect business journalists at Bloomberg, CNBC, NYT, or CNN to actually analyze the data, produce an intelligent dialogue of the causes, and reach a conclusion that the affluent and influential on Wall Street and in Washington DC caused the average family in this country to endure tremendous hardship while the oligarchy plundered and pillaged the countryside, stuffing their pockets with ill-gotten gains. Each of the ideological camps within the oligarchy trot out the usual suspects to blame the other ideological camp, while doing nothing to change the existing paradigm. Krugman and Carville are assigned the task of blaming Republican policies and dogma for the demise of the middle class. Obama and his minions already had their press release prepared, blaming George Bush and claiming the median family has made tremendous strides since he assumed command in2009. Mitt Romney (worth $250 million), whose pocket change exceeds the annual median household income of $45,800, feels the pain of the average American family and proposes a tax decrease for billionaires and less overbearing regulation on the honorable Wall Street banks in order to help the average family. It's nothing but Kabuki Theater as the characters play their assigned parts in this elaborate display. Gary Wills cuts right to the chase: "Yet while the rest of the populace was suffering, the rich just got richer. In 2009 and 2010, years in which millions were unable to find work, the top one percent reaped 93% of the 'recovery' income, and corporations are making more than they ever did. And the Republicans can still propose even further cuts in the taxes of 'job creators' whose only job creation has been for their own lawyers and lobbyists." What you will not receive from the corporate mouthpieces in the mainstream media is an explanation of where the money went, who stole it and why it happened. The theme from the media is the loss in net worth and decade long decline in household income was unavoidable and due to circumstances beyond anyone's control. This is a false storyline perpetrated by those who have stolen your money. It's been a bipartisan screw job and it was initiated by Clinton, Rubin, Gramm and Leach, who deregulated the banking system in 1999 by repealing the Glass-Steagall Act, but made it clear the Greenspan Put would always be in place to protect the banks from their own recklessness, greed and hubris. As a result, Wall Street could go ahead and take irresponsible financial system destroying risks in pursuit of vast riches, knowing they could count on the unlimited checkbook of Uncle Sam if things went south, and that's exactly what happened. Heads they won, tails you lost. It's good to own the politicians, regulators, and media. Dude, Where's My Net Worth?"Sometime around the year 2010, Xers will hit a hangover mood like that of the Lost in the early 1930s and the Liberty in the late 1760s: a feeling of personal exhaustion mixed with a new public seriousness. The members of this forty- and fiftyish generation will fan out across an unusually wide distribution of personal outcomes, reminiscent of a night at the bingo table. A few will be wildly successful, others totally ruined, and the largest number will have lost a little ground since the days of Boomer midlife." – Strauss & Howe – Generations – 1991 Neil Howe and Bill Strauss wrote their first generational theory book six years prior to their epic Fourth Turning prophecy. It appears they nailed it. Generation X households saw their net worth crushed, with a 54% loss in three years. The Baby Boomer households also took a beating in this banker engineered financial collapse. The Silent generation has survived this downturn relatively unscathed. Most of the Silents traded down from their primary residence at or near the top of the housing boom. As Neil Howe points out: "Most sold or annuitized their financial assets at a much better moment in the history of the Dow. Even if they didn't, they are more likely than Boomers or Xers to be getting retirement checks from defined-benefit corporate or government plans that are unaffected by the market." The Millenials and late Xers did not lose much because they didn't have much to lose. Most did not own a house or stocks. As the economy continues to deteriorate the generational tension builds. The Silents and Boomers, who vote in large numbers, have not and will not vote for anyone who attempts to reform our entitlement system and make it economically viable over the long-term for young people just entering the job market.

The false storyline about the 2007 through 2010 being an aberration in the long term path to prosperity for the average American family is refuted by the following chart.

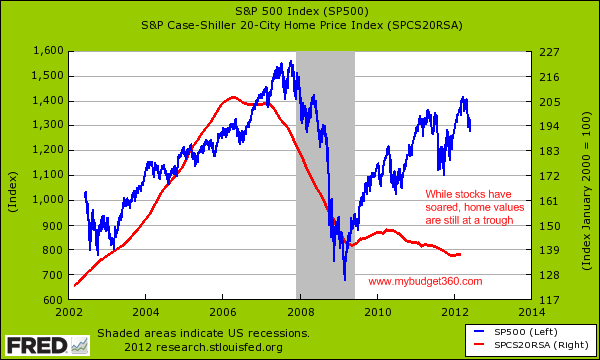

This chart paints a long-term picture of generational inequality that has been going on over the last three decades. Over three decades the Silent generation has seen their median real net worth increase by 133%, while GenX has seen their median real net worth decrease by 55% compared to the same age cohort in 1983. Only those 55 and over have seen a real improvement in their net worth over the last 27 years. Considering this period encompassed a seventeen year bull market and the GDP grew from $3.5 trillion to $15.7 trillion, a 450% increase, a few bucks should have trickled down to the average household. Even on an inflation adjusted basis, GDP has risen 125% since 1983. Evidently the economic policies supported by both parties across decades have not floated all boats – just the yachts. Age is only part of the equation. Class is the other piece. There is a class war being waged and the Buffett, Dimon, Blankfein, Romney, Clinton, Koch and the rest of the ultra-wealthy oligarchs are winning. We are now in the midst of a Fourth Turning and the corrupt, dysfunctional, amoral social order will be swept away before the climax of this Crisis. "Through the Third Turning and into the initial stages of the Fourth, the Silent will prosper, Boomers will cope with declining expectations, and Gen-Xers will get hammered. Throughout history, we have argued, inequality both by class and by age reaches its apogee entering the Crisis era. Indeed, part of the historical purpose of the Crisis is to tear down dysfunctional institutions, vacate positions of entitlement and privilege, rectify the inequality, and create a tabula rasa on which the rising generation can build something new." – Neil Howe The reason for the epic collapse of middle class net worth is quite simple when viewed from a 10,000 foot elevation. The great descent in net worth was primarily due to the bursting of the Federal Reserve created real estate bubble. The Case Shiller Home Price Index plunged 28% between 2007 and 2010. The wealth destruction was concentrated among the working middle class because their homes accounted for the vast majority of their household net worth. For the wealthy, housing is a fraction of their vast net worth, while for the lowly poor; homeownership is now only a dream. Of course, between 2000 and 2007 anyone that could fog a mirror was encouraged by George Bush, Barney Frank, the National Association of Realtors, Alan Greenspan, and Wall Street shills to "own" a home. With home prices having fallen an additional 7% since 2010, the middle class has seen a further decline in their net worth. Meanwhile, Ben Bernanke's ZIRP, QE1, QE2, Operation Twist, and the upcoming "Operation Screw the Middle Class Again" have succeeded in expanding the net worth of millionaires, billionaires and the bonuses of Wall Street bankers, while destroying the fragile finances of little old ladies and middle class risk adverse savers.

Once you dig into the details beneath the thin veneer of Bernaysian obfuscation, you realize the corporate mainstream media storyline of middle class decline has a veiled storyline of a powerful, connected 1%, enriched at the expense of the middle class. In Part 2 of this three part series I will examine who stole your net worth and in Part 3 why they stole your net worth. Part 4 will require pitchforks, torches and a guillotine. |

| The Gold Price has Remained Above it's 20 and 50 Day Moving Average Could Skid Either Way Posted: 19 Jun 2012 12:31 PM PDT Gold Price Close Today : 1622.20 Change : -3.50 or -0.22% Silver Price Close Today : 2836.20 Change : -30.3 or -1.06% Gold Silver Ratio Today : 57.196 Change : 0.482 or 0.85% Silver Gold Ratio Today : 0.01748 Change : -0.000149 or -0.84% Platinum Price Close Today : 1479.00 Change : -3.60 or -0.24% Palladium Price Close Today : 628.25 Change : -3.60 or -0.57% S&P 500 : 1,357.98 Change : 13.20 or 0.98% Dow In GOLD$ : $163.59 Change : $ 1.58 or 0.98% Dow in GOLD oz : 7.914 Change : 0.077 or 0.98% Dow in SILVER oz : 452.62 Change : 8.12 or 1.83% Dow Industrial : 12,837.33 Change : 95.51 or 0.75% US Dollar Index : 81.39 Change : -0.458 or -0.56% I'm antsy and uncomfortable that the silver and GOLD PRICE have floated in the same range for so long. Gold today lost $3.50 to close Comex at $1,622.20. For five days the GOLD PRICE has remained between $1,608 and $1,635.40. Optimistically gold remains above its 20 (1596.86) and 50 (1614.90) day moving averages. Why do I care? Markets do not like stasis, that steady state where nothing is changing. Static markets are easily to manipulate because they are delicately balanced, OR, they are a stand-off between evenly matched buyers and sellers, waiting for an explosion when one side or the other weakens. This doesn't feel like that fight of opposing forces -- too slow, too dull. So watch out. Gold is banging away at $1,633 resistance, but supported at $1,615 - $1,608. Breaching either boundary will send gold skidding a long way, fast. I'm not changing my opinion that gold's correction from last September has bottomed. However, you might see a short, sharp move here either way. For the last seven days the SILVER PRICE has been bound between 2820 and 2900. Today it ranged 63 cents between 3893c and 2830c. Today silver lost 30.3c to close at 2836.2c -- yawn. It fell barely below its 20 DMA (2841c). Boundaries for silver are 2800c and 2900c. Up above the 50 DMA awaits at 2953c, the 200 at 3215c. Face it: this is the seasonal doldrums for the SILVER and GOLD PRICE. Usually they remain quiet across June and July, and only begin lacing up their running shoes in August for the September races. All eyes are on the Fed Open Market Committee meeting tomorrow, when the committee will explain in un-parsable bureaucratese how they plan to jimmy the economy next. This spectacle is too painful, too repulsive for a fastidious and rational mind, the triumph of pygmies over giants, of envy and stupidity over honest and integrity. Ain't central banking great? Clearly the hopeless optimists in the stock markets expect great news -- by that they mean "more inflation" -- out of the FOMC, as stocks are blowin' and goin'. Dow levitated 95.51 (0.75%) today to perch on a cloud at 12,837.33. S&P500 floated up 13.2 (1.8%) to 1,357.98. Looking at the more active and minutely more believable S&P500 (no stock index can be believed since the creation of the Plunge Protection Team in 1987 -- government manipulates every market) we find that the recent foray BELOW the neckline of the Head and Shoulders top formed February - May in fact traced out an upside down head and shoulders that targets a rally to 1,405. Interesting (to some people) is the shape of the S&P500's decline from its April high, plainly an impulsive five wave decline. That implies that the market's natural direction is down. You! There! Put down that telephone! Resist at all costs the temptation to call your stockbroker, unless you are calling to SELL all your stocks and shift the proceeds into silver and gold. That US dollar Index today lost more than it had gained yesterday. Vomited back 45.8 basis points (0.59%) to 81.386. Today's low market a double bottom with the weekend low, so the dollar index might stop there (81.20). Should it break that 81.20 support, then brace for a quick plunge to 80.74. Euro profited from the dollar's fainting spell today. Rose 0.87% to $1.2687. Why do I care? I don't know. Dealing with fiat currencies to me is like having to sort dung beetles. No, that's not quite accurate. Dung beetles are actually a noble and worthy cog in nature's recycling machinery, while fiat currencies are in need of recycling themselves. Anyway, the Euro today managed to break through resistance left from the January low at 1.2624. Also, it has remained above its 20 day moving average (first sign of turning up) for five whole days. Euro might reach 1.2800 before its needle hits "Empty." Yen rose 0.23%, but isn't really going anywhere. Touched its 200 dma (127.14) two days ago, and fell back chastened. No opinion here. Closed today at 126.70c/Y100 (Y78.93/US$1). Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Posted: 19 Jun 2012 11:30 AM PDT An election in today's welfare-fiat world is somewhat like gangs of people pushing on a big sow in different directions, trying to get it to move their way. So who won the pushing contest Sunday in Greece? The media tells us it's the conservatives, who will stay the course and keep the sow on an austerity diet once they form a new government. But the losers are not without influence, and they don't like this frugality business, so maybe the new government will only mostly stay the course. They will negotiate with creditors. They will attempt to exchange their present deal for something more pleasing to the also-rans. In the perpetual crisis of modern banking and sovereign states it may seem that economics is an arcane art beyond man's comprehension. Yet, its mystery is purely man-made. In its broadest sense, economics can be thought of as the study of exchanges. This is how it is defined by Robert Murphy, author of an unusual textbook called Lessons for the Young Economist. It's unusual in that it's methodical without being tedious. In fact, it's downright fascinating. The economists who were blindsided by the 2008 crisis were neck-deep in charts, aggregates, and bad theory they believe in to this day. They tell us no one saw the train coming, so if everyone was blind, no one was blind. The train wreck was just an unfortunate reminder that economics is hard stuff. Better to leave it to the experts at the Fed and other places where high IQs run rampant. Problem is, economists of the Austrian school, such as Murphy, saw the train coming as soon as it left the station. Every train that leaves the interventionist station has its fate written in economic law, as expounded in the works of Mises, Hayek, Rothbard, and others, including Ron Paul. Everything that has happened in the past decade, and longer, has had all the suspense of a bad novel - for Austrians. Did the Fed inflate pre-crisis? Like mad. Perhaps at Paul Krugman's suggestion, Alan Greenspan created a monster housing bubble to replace the dot-com bubble. Did it inflate in response to the bust? Bernanke spiked the monetary base. Are investors calling for even more monetary pumping? The ones calling for QE3 are. And there are countless nervous others hovering around the panic button ready to join them. Will this pattern ever end? Yes - and there's an unspoken terror behind that thought. Murphy's book, though geared to bright middle schoolers, provides the tools for understanding what the interventionist crowd seems unable to grasp, which is this: Unhampered markets have built-in regulatory mechanisms that keep the train on the tracks. And the issue at stake could not be more critical. As we read on page 9: Unlike other scientific disciplines, the basic truths of economics must be taught to enough people in order to preserve society itself. It really doesn't matter if the man on the street thinks quantum mechanics is a hoax; the physicists can go on with their research without the approval of the average Joe. But if most people believe that minimum wage laws help the poor, or that low interest rates cure a recession, then the trained economists are helpless to avert the damage that these policies will inflict on society.The world's policymakers as well as the people who suffer under them could benefit enormously from committing that passage to memory. We have, in essence, exchanged sound economic principles for very bad ones - ancient fallacies framed in modern jargon - and are now wondering why the economic outlook is so threatening. The idea of "exchange," though, is not limited to the trading activities of individuals in which goods and services are traded for money or for other goods and services. In every aspect of our lives we're confronted with the possibility of exchanging the status quo for something else. The exchange can be performed by an individual in isolation, such as the shipwrecked fictional character Robinson Crusoe who must build a one-man economy, or the change can be brought about by people acting together . . . as Greek voters did recently. Exchanging education for state indoctrination In the early 19th century educational reformers began "exchanging" the Jeffersonian system of voluntary parental education for a more collectivist approach inspired by the despotic Prussian system. Jefferson was a strong advocate of public schools for the poor, but an equally staunch opponent of compulsion in education. Yet, by the end of the 19th century almost every state had compulsory public schools in which the "virtues" of obedience, equality, and uniformity were inculcated, sometimes violently, while independent thinking was discouraged or punished. Given the educational system, should we be surprised that government inroads into the economy and our private lives take place without much resistance? In 1913, we exchanged a high tariff for the income tax. Then got the high tariff again later. In 1917, we exchanged peace for war. Then peace for war again a generation later. And finally peace for perpetual war. In 1933, we exchanged economic liberty for economic fascism. It still bears the name of "free market capitalism," though, which is useful for confusing people when the fascists in power screw things up. After 2001, we exchanged freedom for security and are getting less of both. But the biggest disaster has been the exchange of market money for political money, initiated in 1933 and completed in 1971. Every American and dollar holder is now at the mercy of bureaucrats instead of Mother Nature. In economics, all voluntary exchanges are win-win agreements at the time of the transaction. Both sides to the trade believe they're improving their lot, otherwise they wouldn't agree to make it. When politicians take to making exchanges for our benefit, however, we're almost always on the losing side. Someone must be winning, but in the end it's not clear who. |

| Dr. Nu Yu?s Trend Analyses: U.S. Stock Markets Looks Strong, Precious Metals, Bonds Posted: 19 Jun 2012 11:13 AM PDT The broad stock market should continue its recovery while Treasury bonds and the U.S. dollar take a pause. The weakening Chinese stock market and the coming FOMC meeting may add pressure on gold, silver and mining stocks. Below are 13 graphs and 3 tables to give you an indepth view of developing trends.*Words: 1446 So says Dr. Nu Yu (http://marketweeklyupdate.com/) in edited excerpts from his original article*. [INDENT]Lorimer Wilson, editor of [B][COLOR=#0000ff]www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor's Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.[/COLOR][/B] [/INDENT]Yu goes on to say: 1. The Broad Stock Market Trend is Bullish a) The Leading Wave Indicator (LWX) is Bullish The LWX (see below) shows that the broad market is still in a short-term bullish window which I project to last until 6/21/2012. b) The Broad Market Ins... |

| Gerald Celente: Entire Financial House of Cards About to Collapse ? Got Gold? Posted: 19 Jun 2012 11:13 AM PDT The entire financial system is in collapse. It's not about the Greeks, Spanish, Italians, English, Americans, the Chinese, it's about everybody. That's what we're looking at, and…I believe a tidal wave entrance into gold will happen when there's a real collapse and catastrophe that they can't paper over anymore. When does the crash point happen? No one can tell, but all of the cards are in place for the house of cards to collapse. So says Gerald Celente*in edited excerpts from his interview with Eric King of King World News as brought to you by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!). This article must be included in any article reposting to avoid copyright infringement. Celente*goes on to say, in part: Here is my take on gold, the next big breakout point is $1,655. After that it's $1,675, and then $1,700. For me to see gold strong again, it has to break the $1,850 mark. In the full interview Celente gives a sneak peak at what he is predicting i... |

| François Hollande on Collision Course with ... France Posted: 19 Jun 2012 10:58 AM PDT Wolf Richter www.testosteronepit.com During the French presidential election, it became clear that François Hollande, if he were to win the presidency, would try to align other Eurozone countries, particularly Italy and Spain, into a southern front against German Chancellor Angela Merkel and her government—to fix the problems of the Eurozone à la française. Among his ideas: pushing the ECB to buy government bonds of troubled debt-sinner countries and instituting eurobonds—or euro-bills, as he now calls them—that would give any member access once again to cheap unlimited loans. Everyone would benefit, except the German taxpayer, who’d have to foot the bill. Both policies are despised in Germany where budgetary discipline is seen as the solution to the debt crisis—rather than even more debt and monetizing of that debt. Now that he has won the election, he has set out on his pre-charted collision course with Germany. The war of words has already started. For the first time that I can remember, a French government is lobbing unvarnished and relentless verbal attacks across the Rhine. They had their differences before, but they always put makeup on them and dress them up nicely to come across as the harmonious if not always smiling Franco-German couple. But now, the center of Europe, the two architects of Europe and the Eurozone have chosen the path of confrontation—and if any single thing can break up the Eurozone, or cause Germany to bail out—that will be it. But Hollande isn’t just on collision course with Germany. “We have the feeling that we live a grave historical moment, a moment of truth,” said Laurence Parisot, President of the MEDEF, the largest employer union and lobbying group in France, representing 700,000 companies. During a press conference on Monday, “the boss of the bosses” delivered her solemn words without a trace of a smile. The situation for French companies, she said, was already tough: collapsing margins, falling orders, extreme cash flow tensions, frozen hiring projects, and “uncertainties of such magnitude that all large investment projects are put on standby” (video). And she plowed into Hollande’s program item by item:

“These increases will not remain endurable for long,” she said, before “they hit small and medium-size enterprises very hard.” They were already in distress, and with these policies, France would “run the risk that private investors will invest less, or elsewhere.” And bringing taxation of capital in line with taxation of work would “dry up” the economy. The new programs are “disconnected from the reality companies have to face, from what a company can endure.” Based on these new costs, taxes, and limits, she said, “We fear a programmed strangling.” Adding to the uncertainties about Europe is the feeling among foreign countries, she said, that the old continent is no longer a market of the future. She called for a unified European voice in foreign policy, defense, economic strategy, and finance that would allow it to “counterbalance the colossal powers in other parts of the world”—particularly China and the US. Thus, without saying it, she implored Hollande to make peace with Germany. And she warned him “not to transform our country into a hyper-rigid enclave that would be totally disconnected from the functions of a market economy. And so the euro crisis moved on in its inexorable manner. The G-20 summit last November in Cannes, France, was all about bailing out Greece, and it turned into a fiasco. Now at the G-20 summit in Los Cabos, Mexico, tiny Greece is still front and center, but the summit has been escalated to bailing out the entire Eurozone. President Obama took it even further: he wanted everybody else to do “what’s necessary to stabilize the world financial system.” Read.... The G-20 Farce: Saving The Eurozone From Collapse. And here is an excellent, hard-hitting article by Rex van Schalkwyk, former justice of the South African Supreme Court. In politics, he writes, it is the idea that counts. And between idea and reality, there lies that vast uncharted terrain of promises unfulfilled, of lies and deceit and of naked hypocrisy—a self-inflicted deception that accounts for the failure of society, particularly relevant, given the Eurozone fiasco. Read.... Compassion – Killer of Society? |

| In Case Of NEW QE, Gold To $1,900-$8,500 Says SocGen Posted: 19 Jun 2012 10:30 AM PDT In a previous post we showed how, despite Goldman's best wishes, the market may have just priced itself out of a treat from the Fed tomorrow, and right into a trick. That said, in case the Fed has in fact succumbed to the pleadings of its superiors (read Primary Dealers) and does proceed with some seriously unsterilized dollar mauling, the next question is what is the best hedge. SocGen asked the same, and provided several strategies to take advantage of central planners exhibiting a rare case of Einstein's definition on insanity... over and over. Their "Strategy #1: Bolster Positions In Gold Ahead of QE3." Why? Because once the next round of the gold juggernaut is unleashed, gold may go to anywhere between $1900, just shy of the all time nominal high, and $8500... just a tad higher than the nominal high. From SocGen:

The latter scenario is the price only catching up with where it should be. Add another $700 billion - $1 trillion for a potential NEW QE, and you get a 5 digit (and increasingly more meaningless) number. |

| Hera Research Report: Fortuna Silver Mines Posted: 19 Jun 2012 09:42 AM PDT Full report: Fortuna Silver Mines, Inc. (TSX: FVI / NYSE: FSM) Overview Established in 2005, Fortuna Silver Mines is a growing, low-cost silver producer with two operating mines in Peru and Mexico. The company is focused on organic growth in production and resources, as well as on exploration and acquisition of economic silver mineral assets in Latin America. Fortuna expects to increase production from an estimated 3.7M oz of silver and 17,400 oz of gold in 2012 (4.6M silver equivalent oz) to an estimated 5M oz of silver and 26,000 oz of gold, not including significant lead and zinc by-products, by 2014. In 2014, the company projects total production of 6.4M silver equivalent oz, a 39% increase. In 2011, the company’s net realized price per ounce of silver sold was over $30 USD.... |

| Hera Research Report: New Gold Inc. Posted: 19 Jun 2012 09:39 AM PDT Full report: New Gold Inc. (TSX: NGD / NYSE: NGD) Overview With three producing gold mines and three development-stage projects, New Gold Inc. (TSX:NGD / NYSE:NGD) is a growing midtier gold producer. The company’s currently producing assets, located in the United States, Mexico and Australia, together with its New Afton mine, located in British Columbia, Canada, are expected to produce more than 400,000 ounces of gold in 2012. The New Afton mine will begin production in mid-2012 and in 2013 the company expects to produce between 450,000 and 500,000 ounces of gold. As of the first quarter of 2012, the company’s average cash cost per ounce of gold produced was $543, yielding an average cash margin of $1,032 per ounce. Net of byproduct credits, the company expects its cash costs to fall to between $150 and $200 per ounce of gold produced in 2013, assuming a $30 per ounce price for silver and a $3.50 per pound price for copper. The company’s 100% owned, d... |

| By Frontrunning QE, Did The Market Make QE Impossible? Posted: 19 Jun 2012 09:09 AM PDT Ever since the beginning of the year we have been saying that in order for the Fed to unleash QE, stocks have to drop by 20-30% to give political cover to the Fed (and/or ECB) to engage in another round of wanton currency destruction. Because while on one hand the temptation to boost stocks is so very high in an election year, the threat to one's presidential re-election chances that soaring gas prices late into the summer does, is simply far too big to be ignored. Yet here we are: stocks are just 4% off their 2012 highs, even as bonds are near all time low yields, and mortgages are at their all time lows. As such, even with the latest batch of economic data coming in simply atrocious, the Fed finds itself in a Catch 22 - it wants to help the stock market hoping that in itself will boost the "economy", yet it knows what more QE here will do to the priced of gold and inflation expectations: something which as Hilsenrath himself said yesterday does not compute, as it runs against everything "Economic textbooks" teach. What is more important, is that the market, like a true addict, is oblivious to any of these considerations, and has priced in a massive bout of Quantitative Easing to be announced tomorrow at 2:15 pm. There is one problem though: has the market, by pricing in QE on every down day - the only buying catalyst in the past month have been hopes of more QE - made QE impossible? Observe the following chart from SocGen which shows 6 month forward equity vol. What is obvious is that due to precisely being priced in, QE is now virtually unfeasible, irrelevant of what Goldman and its "FLOW QE" model tell us. As SocGen simply states: "More stress is needed to trigger ample policy response." Naturally, SocGen is not the first to get this. Recall that this is precisely the logical espoused by both Citi a month ago which warned of XO crossing above 1000 bps first, and then Deutsche Bank this weekend saying a crash may well be needed to jar Europe out of inactivity like last fall. Not to Goldman though. Goldman is confident that the 4% drop in the S&P from its highs is enough to unleash an epic episode of monetization. Well, the chart below begs to differ. Of course, if Goldman is right, and the Fed does indeed go ahead and launch some version of a Flow-based easing program, with a $50-$75 billion monthly monetization total, then kiss it all goodbye, as going forward the market will consider even a one tick drop in the ES a sufficient reason to kill the USD, and buy every ounce of physical gold available. In the process, of course, the Weimar wheels will start turning. Furthermore, while stocks are always in their little world, and always, absolutely always wrong in the long-run, recall that the fixed income markets are saying something totally different: no bombastic LSAP program, but a very timid Op Twist expansion, where the 3 year selling threshold is extended by one year to include 4 year bond sales. An outcome such as this will send stocks plunging as it is merely more sterilized easing - the kind of intervention that has had no real impact on risk at all as all risk gains in the past 9 months have came solely from Europe's $1.3 trillion LTRO-based balance sheet expansion. So what will it be? More QE, whereby the Fed admits defeat and hands over the monetary apparatus to an increasingly more petulant market, or no QE, and a wholesale risk crash in one day. Tune in tomorrow at 2:15 pm to find out. |

| The Twisted “Logic” of the Street Posted: 19 Jun 2012 08:55 AM PDT Dave Gonigam – June 19, 2012

This insight — one of the more famous take-aways from Dubner and Steven Levitt's book Freakonomics — comes to mind anew with the passing of Rodney King. While the rest of the world reflects on how King's story altered U.S. race relations, we're struck more this morning by Nassim Nicholas Taleb's Fooled by Randomness thesis. "Here's a guy," muses Addison via IM, "beaten senseless by the cops, later on crashes his car into a brick wall, later still is shot in the face… and what does him in? A swimming pool." Random events, however, have an unfortunate way of spurring the world-improvers into action. "What might the government response be?" suggests Addison. "A ban on swimming pools?" Exactly. And when it comes before Congress or the California legislature, they'll call it "Rodney's Law." Ugh…

At 12,850, the Dow is at a six-week high. This, according to financial media forever in search of "reasons" the market moves one way or another, is driven by a Spanish debt auction that went all right… and a respectable number from the housing sector.

The month-over-month increase was 7.9%. Meanwhile, new construction was down… but the previous months' figures were revised up. All in all, not great, but not bad. This is the final economic number to come in before the poobahs at the Federal Reserve begin their two-day meeting today. Given the recent logic of the Street, stocks should be tanking: A semi-decent housing number, in theory, makes another round of easy money less likely. But who said anything approaching "logic" was at work here? Heh… Anyway, traders hope that tomorrow at 12:15 p.m. EDT white smoke will emerge from atop the Marriner Eccles building — confirming a new round of quantitative easing, or something approximating it.

Remember, stock prices are what it's all about for the Fed: "Higher stock prices," wrote Ben Bernanke in The Washington Post heralding the launch of QE2, "will boost consumer wealth and help increase confidence, which can also spur spending." In 2010, the S&P dropped 15.5% peak to trough… spurring QE2. In 2011, the drop was a slightly sharper 17.8%… spurring "Operation Twist."  This year? The S&P's peak came on April 2, at 1,419. The trough came two months later on June 1, at 1,278. That's a drop of 9.9% — not even enough to reach the conventional definition of a "correction." And the index has recovered more than half of that loss since. Never mind that Operation Twist isn't even over yet — that comes at the end of the month.

This is the Fed's "five-year forward break-even inflation rate." Fed statisticians run a formula involving the rate on Treasury Inflation-Protected Securities (TIPS)… and then try to guess where investors believe inflation will be five years down the road. As Jonas Elmerraji pointed out in our virtual pages last month, every major easing move the Fed has made since 2008 has coincided with this indicator falling to 2.2%. The current reading? Nearly 2.5%. Understand we don't pretend to read the minds of Fed governors. Jan Hatzius, the chief economist at Goldman Sachs, predicts they will announce something tomorrow. Seeing as his predecessor was current New York Fed chief William Dudley, he might be on to something. Too, the makeup of the Federal Open Market Committee is more "dovish" this year than in 2010-11. But… if the Fed doesn't deliver whatever the hopium crowd is looking for… and the S&P is knocked down 20 handles in an afternoon… you shouldn't be surprised.

Silver's off a bit, to $28.52.

"Could silver prices fall further? Yes, everything can go down. But despite the overall market sell-off, and despite an utter wipeout in some parts of the resource sector, silver has been holding its own." Byron bailed out of a couple of silver plays a year ago for gains of 43% and 100%. Both subsequently tanked as silver retreated from a dizzying $48 an ounce. Now it's time, he says, to get back in. "Looking at the problems that plague the world's monetary systems, I believe it's time to refocus on silver." He recently recommended a play that has a hand in no less than 20 silver mines to readers of Outstanding Investments. [Ed. Note: Byron is less than one week away from convening a conference call covering three revolutionary "technology metals" that The Guardian says will "revolutionize everything from nanosurgery to homebuilding." "I believe," says Byron, "we're on the verge of a wealth-building opportunity that will make the energy boom seem like child's play." The call takes place next Monday, June 25. To make sure you have access, follow this link.]

"I've met with three of the four largest banks, the largest beverage company, the largest cement company, the largest broker, three different real estate companies, a really hairy coal company, several investors and even a former member of parliament." Under the circumstances, it's no surprise Chris spent most of his time in the capital Ulaanbaatar. But he also ventured with a couple of other investors into the countryside. "I have lots of pictures, but none seems to really do it justice." "There are stunning rock formations, expansive grasslands, picturesque streams, gentle hills and forests of larch and pine — all under a big blue sky full of white fluffy clouds. We also ran into grazing herds of yak and horses."  "Of course," he goes on, "the source of all the new wealth in Mongolia comes not from what's in UB, but what lies under the ground in Mongolia's open spaces. Mining is the big engine driving the economy today." "But the country also has a rich supply of livestock. There are some 32 million livestock animals in Mongolia; about half of them are goats for making cashmere wool." Indeed, Mongolia supplies more than a quarter of the world's cashmere. Chris is still poring over the extensive notes he took from his trip, highlights from his visit to the stock exchange later in the week.

Russian blogger and activist Alexei Navalny is one of the most visible opponents of President Vladimir Putin's United Russia. He's one of Time magazine's "100 Most Influential People" of 2012. While he's made a name for himself using the Internet, his newest expression of dissent is a decidedly old-school rubber stamp.  It says simply "United Russia: Party of Crooks and Thieves". Navalny figures the average bank note changes hands up to three times a day during a useful life of at least seven months. So a slogan on a single note could reach up to 700 people. We like Navalny's way of thinking… not least because his slogan laughs at the powers that be. Here in the States, it appears the best we can get is Ben Cohen of Ben & Jerry's ice cream fame encouraging people to stamp dollar bills with "Money is not speech"… to spread the word about that most useless of do-gooder causes, campaign finance reform. Good lord… You can do better than that, right? If you had a pithy rubber-stamp protest to slap on a dollar bill, what would it be? Suggestions here.

"It is a cartel," he goes on, "made up of the largest private banking entities in the United States. They can, and do, manipulate the currency and interest rates!" The 5: Easy there, partner. Governments don't have a monopoly on bureaucracy — as any number of charities and universities can attest. Elsewhere in these virtual pages, we've labeled central banking a "peculiar public-private mongrel" — a view backed up by Rep. Ron Paul in his book End the Fed. "The Fed is a public-private partnership," he wrote, "a coalition of large banks that are the owners working with the blessing of the government, which appoints its managers. In some way, it is the worst of both the corporate and the government worlds." Amen. There's an earlier volume of Dr. Paul's, by the way, that we heartily recommend. It was written 30 years ago, but its warnings are equally prescient today. Around here we've taken to calling it his "lost" gold bible.  We like it so much we're making it ridiculously easy to get a copy of your own.

"When we unpacked at home, we found my wife's golf bag to be upside down inside the carrying case; golf shoes were out of place and have permanent creases in them." "I was, obviously, upset, but the real tragedy here is not the material damage but that I actually fear escalating the issue to anyone — fear that if I complained, I would be on some sort of permanent 'screw' list in future travels." "Boy, have we come a long way where an honest citizen has to fear Big Government! That used to be the trademark of dictatorial or communist countries. But no longer."

"I have at least four offices," the Pentagon employee says, "and six different people in the chain for acquisition of my travel itinerary. Not to mention they screwed up my flight because the last step (authorization, aka to click submit) is done by one guy who dropped the ball on my original flight, so I couldn't board, because there's no assistance on the weekend)." "I could eliminate six jobs by going back to the old system where I look up my own flights, submit my government travel card and purchase a rate that's regulated by a simple policy determining the max amount of cost authorized. If the traveler screws it up and overpays, they pay the balance." "I could simply go work at GSA and spend hundreds of thousands of dollars on Vegas conventions and I wouldn't have travel problems…."

"The little stunt they are about to pull (again) with Sunday liquor sales is nothing new! Flashback to April 1994… Mecklenburg County (read: Charlotte), April… NCAA Final Four… alcohol sales permitted that Sunday only… HMMMM!" "Thought all that hypocrisy would have died with that crazy old curmudgeon Jesse Helms, but……." "Love my 5!" The 5: Is it hypocrisy… or is it more like a full-employment act for lawmakers? If they didn't have to pass these one-day exceptions all the time, they'd have nothing to do! Cheers, Dave Gonigam P.S. It's enough to make you wonder if rubber-stamped dollar bills will soon be the only available means of protest: "Google reports it has seen an 'alarming' incidence in government requests to censor Internet content in the past six months," according to CNET. During that time, Google says it got more than 1,000 such requests from governments around the world. "It's alarming," says the company's senior policy analyst Dorothy Chou, "not only because free expression is at risk, but because some of these requests come from countries you might not suspect — Western democracies not typically associated with censorship." "U.S. agencies," according to CNN, "asked Google to remove 6,192 individual pieces of content from its search results, blog posts or archives of online videos, according to the report. That's up 718% compared with the 757 such items that U.S. agencies asked Google to remove in the six months prior." There's one haven for dissent that's never received a "take-down" notice. It's accepting new members right now. P.P.S. Addison will be the guest of money manager and radio host Gabe Wisdom tonight at 7:30 p.m. EDT on the Business Talk Radio Network. The network's homepage is here and there's a "listen live" link right beneath the masthead. |

| Posted: 19 Jun 2012 08:42 AM PDT Before I correct a comment from another daily metals report, I wanted to mention the housing starts number. Housing starts for May were reported today to be down 4.8% from April: LINK Don't be fooled by the headline "spin" about housing permit applications spiking higher. A certificate to build does not mean that a home will be sold, as evidenced by downward trend in mortgage purchase applications. As I have mentioned in previous posts, I'm not sure how trustworthy the housing start numbers reported by the Government are, and certainly the trend reported by the Government recently of rising starts is quite inconsistent with the persisten decline in mortgage purchase applications tracked by the Mortgage Bankers Association. Furthermore, May is part of what should be a seasonal peak in the entire housing industry. But despite the Government/Fed's best attempts to heavily subsidize mortgages, the housing market is turning back down. Given that personal income after netting out Government entitlement/transfer payements is declining, I'm not really sure who is buying the new homes being built other than the people who now qualify for the new FHA no down payment, taxpayer subsidized interest rate programs. One last point about the housing market, which I contend continues to bounce around a "bottom" that has been temporarily put in place by the Government, Fannie Mae is out with a report that suggests the housing market will now bottom in 2013: LINK Fannie Mae has been remarkably unreliable in its housing market forecasts over the past several years. And for as egregious as Fannie Mae's soothsayers have been, Wall Street and the National Association Of Realtors' Einstein economists have been downright dismal. For anyone looking to buy a house thinking that an elusive bottom is somewhere nearby, all I can say is "caveat emptor" - buyer beware... Regarding my other issue, Ed Steer's Daily Gold and Silver - which is always worth at least skimming - cited commentary by Ted Butler in which Ted - who has been a staunch defender of the legitimacy of SLV and GLD - references a website that now posts a frequently updated list of the silver bars in, added to and removed from the SLV Trust: LINK Ed comments that this website, by virtue of its existence, proves that SLV is completely legitimate. Hmmm...I guess because JP Morgan files its quarterly financial reports with the SEC, according to SEC and FASB GAAP accounting standards, that JP Morgan's financial reporting is therefore legitimate. Anyone buy into that? If not, then why would anyone buy into the legitimacy of a website that purports to accurately report the silver bars sitting in SLV's Trust. Let me preface my comments by saying that I have utmost respect for the work Ted Butler does on the COT report and Comex silver market. But he completely misses the boat - either because of blind naivete or tragic stubborn optimism - with regard to the CFTC and the legitimacy of GLD/SLV. To begin with, I can't find any information about the "about.ag" website. Who owns it, controls it, publishes the information, etc. I see they have a lot of ads on their site so they clearly have some kind of profit-motive. But you'll note at the bottom that the data compiled by about.ag actually comes from SLV. If you don't trust SLV, why would you trust the data provided by SLV on the about.ag website? If you want to know why I don't trust SLV, please read this report on GLD I wrote in 2009: LINK Just by virtue of the fact that about.ag makes money from publishing the SLV-provided data calls into question a conflict of interest as to about.ag's independence from SLV. In other words, about.ag has no motivation to ensure that data provided by SLV is bona fide. Regarding the bar list website for SLV: Just because SLV lists the bars it has taken into custody does not mean that the bars are not leased out or hypothecated/rehypothecated. In a lease transaction, the lessor does not move the bars unless the lessee is called on to deliver the silver the lessee has sold in the marketplace. It's typically just a paper transfer of ownership. And most of the time the bars remain in the vault of the lessor but are theoretically moved into a "segregated account" area of the vault. Whether or not this movement actually occurs is open to debate, since an independent audit is not offered. As for hypothecation of assets, see MF Global. Coincidentally, or not coincidentally, JP Morgan is the silver bar custodian for SLV. Recall that JP Morgan is at the center of the MF Global customer hypothecation fraud. When an asset custodian hypothecates an asset, the asset is still reported in the account of the rightful owner, in this case the SLV Trust. So just because SLV has an inventory list that it sends to about.ag, that does not prove that SLV has not hypothecated or leased out the silver bars. Please refer to my GLD report linked above to see how these ETF prospectuses are structured to enable leasing and fraudulent reporting. And all of this does not relieve SLV of the short interest issue. For those unaware, the short interest in SLV stock certs typically runs around 10%. When SLV certs are borrowed (hypothecated) and short-sold, the Trust does not take in money from this transaction in order buy silver to back those shares with silver. This means that 10% of the SLV shares sitting in owner accounts are not backed by any silver. Ed Steer mentioned that he was not aware of a similar website for GLD's gold. He said this in a manner in which he implied about.ag lends further credibility to SLV. If this is so, then I guess Jerry Sandusky's self-witness testimony lends credibility to his defense. Again, I need to correct misinformation here. First, the about.ag website gets its data from SLV. It does not audit the SLV Trust nor will it ever be allowed to audit the Trust. GLD publishes a list of its gold bars on its website. So why would GLD need to give that information to someone else to make money off of? Furthermore, GLD supposedly has it's bars randomly audited by some shady outfit in London. You can find the link on GLD's website. I shredded that audit report a few years ago on my blog. The Bob Pisani/CNBC incident in the GLD vault confirmed my thesis presented back then. Butler has been wrong about the CFTC eventually cracking down on Comex manipulation since at least 2001, that I know of, and he's wrong about SLV and GLD being legitimate. It took him at least 10 years to admit he was wrong about the CFTC - how long will it take him to admit he's wrong about SLV and GLD? I guess if Butler wants to believe that the same JP Morgan that is the primary illegal manipulator of the silver market, is at the center of the MF GLobal fraud, among many other frauds being committed by JP Morgan, and yet is a fully accountable, legitimate custodian of SLV silver trust, that's his business. But on that basis, I would love invite Butler to big poker game at my house. |

| India's Government Seeks to Dissuade People From Investing in Gold Posted: 19 Jun 2012 08:28 AM PDT "Well, here we sit once again. Everything is just as bad, if not worse than it was on Friday." [COLOR=#7f4028] Yesterday in Gold and Silver Gold ticked higher right at the 6:00 p.m. Sunday night open...but that lasted less than a minute before the high-frequency traders showed up...and had gold down about a percent in less than an hour. The price recovered strongly from there, but remained below Friday's closing price for the balance of Far East and early London trading. The New York low came at the London p.m. fix at 10:00 a.m. in New York...and the subsequent rally got stepped on at 11:30 a.m. Eastern right on the button...and the gold price more or less traded sideways from there. The 11:30 a.m. New York high was $1,631.20 spot...and the low at the fix was $1,612.90 spot. Of course the intraday trading range was slightly bigger than that. Gold closed the Monday trading session at $1,628.70 spot...up $2.00 on the day. Net volume was reasonably... |

| Posted: 19 Jun 2012 08:22 AM PDT London Gold Market Report from Ben Traynor BullionVault Tuesday 19 June 2012, 08:30 EDT THE U.S. DOLLAR gold price hovered around $1630 an ounce during Tuesday morning's trading in London – in line with where it ended last week – while stocks and commodities were also broadly flat ahead of the latest Federal Reserve policy meeting. The silver price traded in a tight range just below $29 an ounce – 1.7% up on Monday's low. Over in India, traditionally the world's biggest gold buying nation, local press report that the Rupee gold price set a fresh record in Delhi Tuesday, as the Rupee fell against the Dollar on international currency markets. "There has been very light buying from India, but it's really quiet there," says one Singapore-based dealer, adding that there has been a pickup in scrap gold bullion sales from Thailand. "I guess there's a kind of wait-and-see attitude because there's a lot of uncertainty in the market." "For the moment," adds Lynette Tan, investment... |

| Gold Seeker Closing Report: Gold and Silver End Slightly Lower Posted: 19 Jun 2012 08:18 AM PDT Gold rose $5.90 to $1633.30 in Asia before it fell back to $1617.40 in early afternoon New York trade, but it then bounced back higher into the close and ended with a loss of just 0.48%. Silver climbed to $28.938 before it slipped back to $28.33, but it then also rallied back higher late trade and ended with a loss of just 1.08%. |

| Gold Daily and Silver Weekly Charts - Pre-FOMC Action Posted: 19 Jun 2012 08:10 AM PDT |

| An Icy Saga Is Emblematic of Oil Price's Inevitable Climb Posted: 19 Jun 2012 06:48 AM PDT Synopsis: Royal Dutch Shell has spent $4 billion over several decades for the opportunity to test-drill for Arctic oil, but now faces an unexpected obstacle that no amount of money can overcome. By Marin Katusa, Chief Energy Investment Strategist If anyone needs more proof that diminishing supplies of easy oil are forcing the world's oil majors to venture into ever-riskier, more complicated, and more expensive areas in their search for new reserves, look no further than Royal Dutch Shell's (NYSE:RDS.A) pending voyage into the Arctic. Shell is about to set sail on a mission that has been eight years and more than $4 billion in the making… and all that is before first well is even spudded. Environmental wrangling, legal battles, regulatory changes, and technological developments have all played a role in the saga to date. But persistence pays: Shell now has two drilling rigs ready to go and is just waiting for the receding ice to expose its targets. When Shell's drills penetrate those targets, they might tap into a vast wealth of oil. Alaska's outer continental shelf is thought to host billions of barrels of recoverable oil and trillions of cubic feet of natural gas. Those hydrocarbons, however, will not be easy to access. The challenge is not water depth – Shell's Arctic targets sit beneath just 150 feet of water, which is nothing compared to the 5,000 feet of water that covers many drill targets in the Gulf of Mexico. But those 150 feet of water bring with them crushing ice floes, frigid temperatures, Arctic storms, and total darkness for 70 days a year. And those are just the technical challenges. On the regulatory side, Shell has had to contend with environmentalists and native groups vehemently opposed to Arctic offshore drilling, a complete overhaul of the US offshore drilling regulatory system that generated new spill preparedness requirements, and the reality that their rigs will be working in a delicate ecosystem alongside key migration routes for bowhead whales and walruses. It's about as challenging as oil exploration can be. And yet there the company goes, setting off on an adventure that – if the company is lucky and all goes according to plan – will enable to Shell to start producing Arctic oil in another eight or nine years, and after a total investment of roughly $7 billion. Shell is going to these incredible lengths to find oil because the company feels it has to. The world's oil giants are in a constant battle to find significant new oil reserves that they think can become tomorrow's producing fields. Since a century of oil production has depleted most of the world's easy oil deposits, the Shells of the world have no choice but to explore in increasingly challenging conditions to find those significant new reserves. Just ten years ago it would have been inconceivable to spend $4.5 billion getting ready to test an oil target. But ten years ago oil was only worth about $25 a barrel. Today prices have almost quadrupled, reflecting rising global demand juxtaposed against sliding export volumes from many of the world's major suppliers. With Big Oil increasingly forced to search for oil in the frigid Arctic, in the ultradeep waters of the Gulf, in the shifting salt formations off Brazil, or in any number of unstable countries where politicians and terrorists pose almost equal threats, production costs are inexorably rising. The result: oil prices cannot help but climb in the coming years. For a perfect example of why costs are climbing, read on. Shell's Arctic DreamShell has been trying to spud these Arctic wells for almost a decade. In 2002 the federal government began selling offshore leases in Alaska; Shell purchased its first blocks in 2005 and has picked up additional acreage since. In late 2006 the company submitted a plan to explore its Beaufort Sea blocks; the Mineral Management Service (MMS) – the umbrella organization that has since been broken apart into the Bureau of Ocean Energy Management (BOEM), the Bureau of Safety and Environmental Enforcement (BSEE), and the Bureau of Ocean Energy Management, Regulation, and Enforcement (BOEMRE) – approved the proposal a few months later. That first approval sparked the first court challenge, a pattern Shell would see repeated time and again in subsequent years. The Ninth Circuit Court of Appeals denied MMS's approval, claiming the offshore regulator had not required Shell to complete a sufficiently detailed analysis of potential environmental impacts. This derailed exploration for two years, eventually forcing Shell to submit a new exploration plan in 2009. The MMS approved the new plan, and this time the Ninth Circuit upheld the decision. Things were starting to roll in the right direction for Shell, until the company's Arctic plans ran up against an unforeseen obstacle: the Deepwater Horizon disaster in the Gulf of Mexico. That fatal explosion and five-million-barrel oil spill led to a moratorium on offshore Arctic drilling that lasted through the summer of 2010 and resulted in a raft of regulatory changes. Shell had to start over again. The company submitted its third Arctic exploration plan in May 2011. The BOEM and BSEE both eventually approved the plan. A coalition of environmental and indigenous groups again found reason to sue, but the court sided with the new offshore regulatory bureaus and upheld the permits. The ducks are now all in a row and Shell is ready to go, but the company isn't taking any chances. In an attempt to head off yet another last-minute postponement, Shell has even filed a pre-emptive lawsuit against environmental groups that might file a legal challenge to Shell's oil spill response plan. By doing so, the company is forcing the courts to go through and essentially approve Shell's plans before anyone has a chance to challenge them. It's a lesson learned in time. Big Gamble, Massive PotentialBefore sinking a single well, Shell will have already invested eight years and $4.5 billion in its Alaskan project – $2.3 billion on equipment and personnel plus $2.2 billion for the leases – and yet the company is still years and billions of dollars away from a potential payday. The wells Shell will begin drilling in July are only to probe for hydrocarbons; they are not designed for production. If those drills do find oil, it would take another seven to ten years to drill production wells, install production platforms, and build the on- and offshore pipelines needed to move this Arctic oil to customers. By then, Shell's upfront investment could well top $7 billion. Why is the company dedicating so much time and money to this project? For two reasons. First, the easy oil is gone, which means majors simply have to contend with risks and challenges of this nature if they want to replenish their reserve books. Second, if estimates are even close to correct, there is a heck of a lot of oil and gas in the Arctic. The USGS estimates that the Beaufort Sea holds 2-7 billion barrels of economically recoverable oil and 3 -20 trillion cubic feet of economically recoverable natural gas. The Chukchi Sea could hold as much as 12 billion barrels of oil and 54 trillion cubic feet of natural gas. Alaska's outer-continental shelf as a whole is thought to hold 27 billion barrels of recoverable oil and 130 trillion cubic feet of natural gas.