Gold World News Flash |

- 1:1 Allocated Silver Exchange to Suck Metal Away From the LBMA – Ned Naylor-Leyland

- “Render unto Caeser” and silver

- The Dollar Vigilante: Jeff Berwick speaks with Wes Messamore

- Silver Update 6/10/12 Ron Paul

- German Born Woman: “Hitler and Obama are the same” – and First-hand Perspective of Hyperinflation

- Guest Post: It Only Took A Global Depression To Reduce Gas Prices By 40 Cents

- Europe's democracies must not subcontract their destiny to the Bundebank

- Europe democracies must not subcontract their destiny to the Bundebank

- David Morgan time to Invest in Silver more than ever

- “The Euro Is Like a Knife in the Hands of a Child”

- EURUSD Jumps Driving Global Risk-On (For Now)

- Goldman Sachs? Leading Indicators Signal Steep Market Crash Ahead

- $125bn Spanish bank bailout sets gold up for $2,000 and silver $60 this autumn

- The Two Worlds of 2012

- Gold Elliott Wave Analysis

- The U.S. Dollar is Overbought

- Market Report: Elliott Wave Analysis of Gold

- Greece: Will The Real Contrarian Please Stand Up?

- Trading Gold by Timing the Fed

- Brodsky and Quaintance: Solution is asset monetization, starting with gold revaluation

- “The stock market will continue down against gold, the currencies will collapse at a faster rate against gold, and gold will continue its long-term trend (higher) that we have seen over the last 12 years.”

- Strong-Dollar Fallacy

| 1:1 Allocated Silver Exchange to Suck Metal Away From the LBMA – Ned Naylor-Leyland Posted: 10 Jun 2012 05:20 PM PDT from Silver Doctors:

Ned states that the new Asian silver exchange he is working alongside Andrew Maguire to launch (which has been kept tightly under wraps up to this point to prevent western banking interests from derailing the launch as happened with the PAGE) will trade 1:1 fully allocated silver contracts, and will suck physical metal out of the LBMA system. The new Asian silver exchange could prove to be a paradigm changer, as Ned estimates that Chinese savers took up 1 billion ounces of silver & 100 million ounces of gold via gold & silver backed savings accounts in 2011. Ned also discusses the Spanish bank bailout which he describes as the European financial community merely admitting we have contagion, as well as shocking information regarding the actual owner of the 'GLD' gold bar held up by Bob Pisani infamously, which Leyland states has been confirmed to be owned by ANOTHER ETF! |

| “Render unto Caeser” and silver Posted: 10 Jun 2012 04:43 PM PDT |

| The Dollar Vigilante: Jeff Berwick speaks with Wes Messamore Posted: 10 Jun 2012 04:34 PM PDT by Justin O'Connell, Dollar Vigilante: Topics covered: |

| Silver Update 6/10/12 Ron Paul Posted: 10 Jun 2012 03:14 PM PDT |

| Posted: 10 Jun 2012 02:31 PM PDT from webcityusa:

At the Peter Schiff seminar at the Moneyshow 2012 Las Vegas, a WW2 survivor from Germany approached Peter to say she has firsthand knowledge of the currency collapse in Germany. Today seems like a repeat of what she experienced as a German child. She makes comparison of Obama to Hitler government and says the currency collapse happened quickly., A bank run could happen again if people dont put their assets in hard currencies like gold and silver. |

| Guest Post: It Only Took A Global Depression To Reduce Gas Prices By 40 Cents Posted: 10 Jun 2012 02:27 PM PDT Submitted by Jim Quinn of The Burning Platform blog, You can't watch the mainstream media propaganda channels for more than ten minutes without a talking head breathlessly announcing that gas prices have dropped for the 24th day in a row and are now back to $3.55 a gallon. Wall Street oil analysts, who are paid hundreds of thousands of dollars per year to tell us why prices rose or fell after the fact, are paraded on CNBC to proclaim the huge consumer windfall from the drop in price. This is just another episode of a never ending reality show, designed to keep the average American sedated so they'll continue to spend money they don't have buying crap they don't need. The brainless twits that pass for journalists in the corporate mainstream media never give the viewer or reader any historical context to judge the true impact of the price increase or decrease. The government agencies promoting the storyline of those in power extrapolate the current trend and ignore the basic facts of supply, demand, price and peak oil. The EIA is now predicting further drops in prices. Two months ago they predicted steadily rising prices through the summer. What would we do without these government drones guiding us?

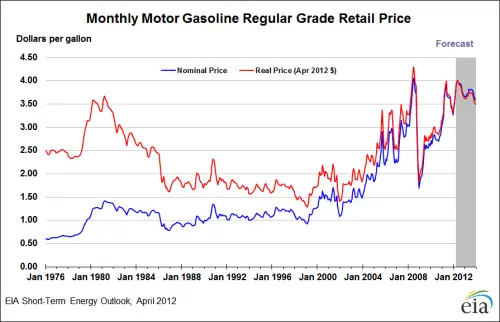

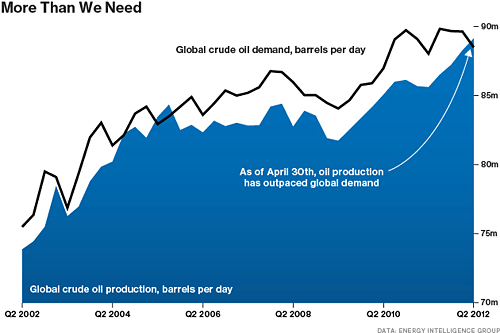

As you can see from the chart, gas prices tend to be volatile and unpredictable in the short term. You can also see that since 1998 the trend has been relentlessly higher. The average inflation adjusted price of gasoline in 1998 was $1.41 per gallon, versus $3.55 today, a 152% increase in fourteen years. Over this same time frame the BLS manipulated CPI was up only 44%. If we are swimming in oil, as the MSM pundits claim, why the tremendous surge in price? It must be those evil oil companies. It couldn't possibly be the impact of peak oil. To acknowledge the fact that worldwide oil production has reached its peak would be to concede that our suburban sprawl, just in time world is drawing to an excruciating end. So the politicians spout their assigned storylines, supported by their paid off "experts" (aka Daniel Yergin), and unquestioningly reported as fact by their designated corporate media outlet. Those of a liberal bent assail oil companies and speculators; refuse to acknowledge the law of supply and demand, while touting green energy as the solution to all our energy needs. Those of a conservative bent believe in attacking foreign countries to secure "our" oil, refuse to acknowledge the law of supply and demand, and spout "drill, drill, drill" slogans because dealing with facts is inconvenient. The willfully ignorant public believes whichever storyline matches their preconceived beliefs. All is well – no one is required to think critically. Thinking is hard. There are numerous factors that affect the price of oil on a daily basis, but at the end of the day supply and demand determine price. The chart below documents the key external events that have had a major impact on oil prices since 1970. The vital fact that you won't hear on CNBC is that every recession since 1970 has been immediately preceded by an oil price spike. Anyone living in the real world (this excludes Cramer, Liesman, Bartiromo, & Kudlow) knows we have entered part two of the Greater Depression. The surge in oil prices in the last two years has precipitated this renewed downturn.  The MSM blathering baboons of bullshit dutifully report the price of gas on a given day. People who live in the real world fill up their gas tanks every week, so the average price over a period of time is what matters. The average price of a gallon of gasoline in 2008 was $3.39. The average price in 2011 was $3.48. The average price in 2012 has been $3.62 thus far. This data paints an entirely different picture than the one painted by the politicians, experts and the clueless captured media. Gas prices are higher than they were prior to the last economic implosion. Cause and effect is a concept beyond the intellectual capabilities of MSM journalists and the millions of government educated zombies they mesmerize with misinformation. The lack of intellectual curiosity and critical thinking skills plays directly into the hands of those with a storyline to sell or truth to obscure. Swimming in OilThe recent storyline proliferated by the MSM at the behest of Washington DC politicians and the corporate interests that control them, is that the U.S. is on the verge of energy independence, with hundreds of years of plentiful oil right under our feet. The chart below made the rounds last week on Bloomberg, defender and mouthpiece of billionaires everywhere. This chart surely proves that peak oil is bullshit. Right? Besides the false representation of oil production and the misleading conclusion that we have more oil than we need, the chart and Bloomberg screed does not provide the true context of why worldwide demand is tumbling. The chart is NOT showing global crude oil production. It is showing global oil and other liquids supply, which includes crude and condensate, natural gas plant liquids, other liquids (mostly ethanol), and processing gains (increase in volume from refining heavy oil). The MSM would rather mislead the public than provide the true picture of the supposed oil production boom. The question is whether the MSM is misleading the public due to their own journalistic incompetence or are they carrying out their assigned mission on behalf of the corporate oligarchs running the kingdom. The chart below reveals a truer picture of the worldwide energy situation. Conventional oil production hit its peak/plateau around 74 million barrels per day at the end of 2004, and has barely budged from that level over the last eight years. Despite all the rhetoric about the North American oil boom, conventional oil production is at virtually the same level today as it was in 2004. The U.S.(shale oil) and Canadian (tar sands) gains in production have been matched by the collapse in Mexican production. The Middle East countries produced 23.3 million barrels in September 2004. The average price of a barrel of oil in 2004 was $38. They are now only producing 23.9 million barrels when prices are 120% higher.

Global oil demand in 2004 was around 84 million barrels per day. To increase liquid fuel supply to meet the 90 million barrels per day demand we had to turn to unconventional fuels like tar sands, tight oil, and biofuels, all of which have far higher production costs and far less energy content than sweet crude. As the easy to access, cheap to produce ($20 per barrel in Saudi Arabia), close to the surface sweet crude has been depleted, it has been replaced by heavy crude, tar sands, deep-water oil, and shale oil, with production costs in excess of $80 per barrel. Anyone anticipating a long-term decline in fuel prices must be smoking tar sands in their bong. The liquids that have "replaced" conventional crude have a few slight drawbacks. Natural gas liquids provide about 70% as much energy per barrel as crude oil, so a barrel of NGL is not equivalent to a barrel of crude. Have you filled up your SUV lately with some NGL? Ethanol provides only 60% as much energy per barrel as crude oil and its EROEI is pitifully low. The energy returned on energy invested for these non-conventional sources of energy approaches the minimum limits unless prices rise dramatically. The Obama green army does not want this chart making its way into the public discourse. Their fantasyland of renewable energy solutions is proven to be a fool's errand.

Catch-22 Energy EditionThe price of a barrel of West Texas crude is currently $86 per barrel, down from $109 per barrel in February. Obama supporters will proclaim that his threat to crack down on speculators had the desired effect. He must have scared those nasty speculators with his gravitas. The price rise surely didn't have anything to do with the U.S. led attack on Libya, the act of war economic sanctions on Iran, the beating of Israel/U.S. war drums, Japan demand due to the shutdown of their nuclear power industry, or the relentlessly higher demand from China and India. And now the MSM is trying to spin a yarn that prices have dropped by 21% because worldwide supply is surging. That is so much more palatable than telling the truth and admitting that we've entered the 2nd phase of the Greater Depression. It took $140 a barrel in oil in 2008 to tip the world into recession. Worldwide economies were much stronger then. The U.S. National Debt has risen by $6.5 trillion, or 70% since 2008. Real GDP has risen by $200 billion since 2008, or a 1.5% increase. Debt to GDP has risen from 64% to 102%. Consumer debt at $2.55 trillion is exactly the same as the 2008 level even after Wall Street banks have written off over $1 trillion, subsidized by the American taxpayer. The consumer deleveraging storyline is completely false. In 2008 there were 234 million working age Americans and 145 million of them were employed. Today there are 243 million working age Americans and 142 million of them are employed. In 2008 there were 28 million Americans in the food stamp program. Today there are 46 million Americans collecting food stamps. The economic situation in Europe has deteriorated at a far greater rate. Therefore, it is not surprising that it only took $109 a barrel oil to push the world back into recession.

The main reason prices are dropping is the collapse in demand from Europe and the United States. The bumpy plateau of peak oil is in full force. Prices rise to the point where they push economies into recession, demand crashes due to the recession, and prices decline. The double whammy of oil prices reaching $111 a barrel in 2011 and $109 a barrel in 2012 have sapped the life out of the American consumer. This is reflected in the plunge in gasoline and petroleum usage since 2008, with a temporary leveling off in 2010, followed by a further nosedive since 2011. As this recession deepens over the next six months, prices will likely fall further. But this is where the Catch-22 kicks in.

Once prices drop below $80 a barrel it sets in motion a reduction in capital investment, as new production projects are not economically feasible below $80 per barrel. Oil analyst Chris Nedler explains the Catch-22 aspect of oil prices in a recent article: Research by veteran petroleum economist Chris Skrebowski, along with analysts Steven Kopits and Robert Hirsch, details the new costs: $40 – $80 a barrel for a new barrel of production capacity in some OPEC countries; $70 – $90 a barrel for the Canadian tar sands and heavy oil from Venezuela's Orinoco belt; and $70 – $80 a barrel for deep-water oil. Various sources suggest that a price of at least $80 is needed to sustain U.S. tight oil production. Those are just the production costs, however. In order to pacify its population during the Arab Spring and pay for significant new infrastructure projects, Saudi Arabia has made enormous financial commitments in the past several years. The kingdom really needs $90 – $100 a barrel now to balance its budget. Other major exporters like Venezuela and Russia have similar budget-driven incentives to keep prices high. Globally, Skrebowski estimates that it costs $80 – $110 to bring a new barrel of production capacity online. Research from IEA and others shows that the more marginal liquids like Arctic oil, gas-to-liquids, coal-to-liquids, and biofuels are toward the top end of that range. My own research suggests that $85 is really the comfortable global minimum. That's the price now needed to break even in the Canadian tar sands, and it also seems to be roughly the level at which banks and major exploration companies are willing to commit the billions of dollars it takes to develop new projects. Oil prices may temporarily drop below $80, but prices below that level for a prolonged period will lead to supply being constricted, which will ultimately lead to higher prices. The storyline of hundreds of years of Bakken shale oil that will make the U.S. energy independent is the latest fiction to be peddled by the oligarchs as a way to sedate and confuse the masses. What the FrackU.S. oil production in 2007 averaged 8.5 million barrels per day. Today, the U.S. is producing 10.7 million barrels per day. We must have hit the jackpot. Not quite. Actual crude oil production has increased by 1 million barrels per day, a 20% increase. The other 1.2 million barrels have been from liquefied natural gas (up 34%) and government subsidized ethanol (up 100%).

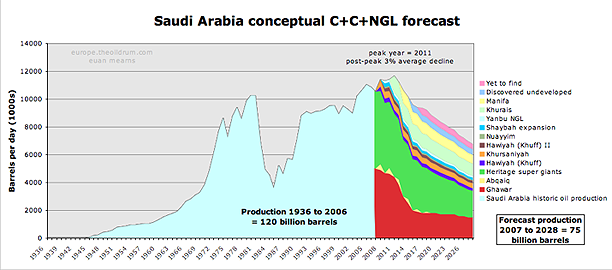

The U.S. crude oil production is at the same level it was in 1998, but somehow we are on the verge of becoming energy independent. The recent increase is solely due to the horizontal drilling and hydraulic fracturing of shale deposits in Texas and North Dakota. You don't hear much about Alaskan production declining for the ninth year in a row and California production declining to the lowest level in three decades. The paid shills predicting Bakken production of 3 million barrels per day are purposely lying or just plain delusional. North Dakota oil production has reached 550,000 barrels per day versus 187,000 barrels per day in 2009. Simpletons in the MSM will just extrapolate this growth to 3 million barrels by 2020. No need to examine the facts. Oil market expert Tom Whipple reveals the dirty secrets behind the Bakken shale oil miracle: It took the production from 6,617 wells to produce North Dakota's 546,000 b/d in January. Divide the daily production by the number of wells and you get an astoundingly low 82 b/d from each well. I say "astounding" because a good new offshore well can do 50,000 b/d. BP's Macondo well which exploded in the Gulf a couple of years ago was pumping out an estimated 53,000 b/d before it was capped. Now a North Dakota shale oil well is not in the cost class of a deep-water offshore platform which can run into the billions, but they do cost about three times as much as a classic onshore oil well as they first must be drilled down 11,000 feet and then 10,000 horizontally through the oil bearing layer before the fracturing of the rock can take place. The "fracking" involves at least 15 massive pumps that inject water and other chemicals into the well. Take a Google Earth flight over northwestern North Dakota. The fracked wells are hard to miss as there are now about 9,000 of them and they are each the size of a football field. There is still more — fracked wells don't keep producing very long. Although a few newly fracked wells may start out producing in the vicinity of 1,000 barrels a day, this rate usually falls by 65 percent the first year; 35 percent the second; and another 15 percent the third. Within a few years most wells are producing in the vicinity of 100 b/d or less which is why the state average for January is only 82 b/d despite the addition of 1300 new wells in 2011. The rapid depletion of these wells, enormous expense to drill new wells, oil prices barely above cost of production, low EROEI, swiftly falling Alaskan and shallow water production, and the snail's pace of deep water production are not a recipe for energy independence. Shale oil production will never exceed 1 million barrels per day. And if you believe Saudi Arabia's promises to fulfill any shortfalls, I've got some delightful beachfront property in Afghanistan to sell you. Saudi conventional crude oil production is at the same level it was in 2005.

The seven year Saudi plateau is just a precursor to what is going to happen over the next decade. Saudi Arabia began pumping oil in 1945. It will all be gone by 2045. You can't extract an infinite amount of oil from a finite world. Pretending this isn't true won't make it so. Oil has been the lifeblood of our nation since the late 1800s. The depletion of this essential ingredient of the modern world will not lead to a sudden death for our way of life but a slow downward spiral of waning supply, escalating prices, and economic decay.

The sustained high and rising oil prices will be economically destructive as our debt saturated, suburban sprawl, mall centric, SUV crazed, cheap oil dependent society methodically and agonizingly implodes. Chris Skrebowski describes our future succinctly: "Unless and until adaptive responses are large and fast enough to constrain the upward trend of oil prices, the primary adaptive response will be periodic economic crashes of a magnitude that depresses oil consumption and oil prices." We've entered one of these periodic economic crashes. They are coming faster and faster. So enjoy that 40 cent drop in gas prices as you drive down to sign up for food stamps. The Saudis have a saying that acknowledges their luck in being born on top of billions of barrels of oil and the inevitability of its depletion: "My father rode a camel, I drive a car, my son flies a jet plane, his son will ride a camel." Delusional Americans believe they have a right to cheap plentiful oil forever. They refuse to acknowledge that luck has played the major part in their rise to economic power. The American saying will be: My great grandfather rode a horse, my grandfather drove a Model T, my father drove a Buick, I leased a Cadillac Escalade, my son died in the Middle East fighting for my oil, his son will never be born. |

| Europe's democracies must not subcontract their destiny to the Bundebank Posted: 10 Jun 2012 01:50 PM PDT June 10, 2012 07:55 AM - Europe has lit the fuse on an economic and financial bomb. The rescue package for Spain cannot plausibly be contained to €100bn once it begins, given the subordination of private creditors and collapse of global confidence in the governing structure of monetary union. Read the full article at the Telegraph...... |

| Europe democracies must not subcontract their destiny to the Bundebank Posted: 10 Jun 2012 01:50 PM PDT June 10, 2012 07:55 AM - Europe has lit the fuse on an economic and financial bomb. The rescue package for Spain cannot plausibly be contained to €100bn once it begins, given the subordination of private creditors and collapse of global confidence in the governing structure of monetary union. Read the full article at the Telegraph...... |

| David Morgan time to Invest in Silver more than ever Posted: 10 Jun 2012 12:11 PM PDT |

| “The Euro Is Like a Knife in the Hands of a Child” Posted: 10 Jun 2012 11:22 AM PDT Wolf Richter www.testosteronepit.com While France is preoccupied with the legislative elections next weekend, Germany and Austria plunge into intense public soul searching about the euro, its meaning, its relevancy, the sheer and endlessly growing expense of maintaining it. To which are now added the $125 billion for bailing out Spain, the first in a series as Greece and others have shown: the bailout to solve the problem once and for all proves insufficient and is followed by more bailouts. Spain won’t be an exception. And then there’s Italy. And yet, the German-language media scream about the expense of abandoning the euro. They call it the crazy option of returning to the D-Mark and warn of gigantic losses. But the very fact these discussions appear on the front pages of established newspapers moves the option a step closer to reality. Because, once the debate is opened up—and it’s a big can crammed with ugly worms—it’ll be difficult for governments to sweep all these worms under the rug and to revert to the con-game. “As it’s going at the moment, the monetary union cannot function long term,” affirmed German Bundesbank President Jens Weidmann on Sunday. To avoid the worst turbulence, he called clarity: either establish a fiscal union with transfer of sovereignty to a central authority, or continue with autonomous national budget policies, in which case, “common liability must be limited.” He warned of the consequences of the break-up of the Eurozone, which would produce unpredictable and huge costs and risks. In the same breath, he cautioned that the threat of these costs and risks must not make Germany vulnerable to extortion. Germans are worried. According the ARD-Welt poll published last week, 55% believe that it would have been better to keep the D-Mark, up 9 points from November, 56% fear for their savings, 78% believe that the worst of the euro crisis is still ahead, and 83% want Greece to leave the Eurozone if it doesn’t stick to the austerity and reform measures it had agreed to. “The euro is like a knife in the hands of a child,” said Thilo Sarrazin, former member of the Executive Board of the Bundesbank and politician in the opposition SPD. As so often, “something that appears useful and sensible becomes dangerous,” he said. The advantages of the euro, including low interest rates, have led almost all participating countries astray, he said. “Now you see the consequences.” “The problem isn’t just the construction of the euro, but the bailout funds,” said Sahra Wagenknecht, deputy chairperson of the Left Party, Germany fourth largest party with 12% of the vote in 2009. “They’re not saving the euro but the financial sector! Banks, insurance companies, hedge funds, and speculators are being ransomed. Neither in Greece nor elsewhere do the people benefit.” “It was certainly a mistake to bring the euro to life without the necessary instruments to control it and secure it,” Austrian Chancellor Werner Faymann chimed in. Economically, Austria is joined at the hip to Germany. Most of its exports go to Germany, and for decades prior to the euro, the shilling had been pegged to the D-Mark. When Germany joined the euro, Austria did too. And if Germany leaves the euro, Austria will have to as well. So the Austrian Chancellor, echoing his German counterpart Angela Merkel, called for a banking union “with strict rules for banks and financial markets and a common and independent banking supervisor.” Like the Fed, perhaps: of the banks, by the banks, for the banks. The US had more debt than Europe, he added, “but as a union, they have the necessary instruments to deal with this debt.” While that type of pungent debate is missing in France, one French voice came through, in Austria: Marine Le Pen, President of the right-wing National Front and third in the French presidential election with 18% of the vote, said in an interview with the Austrian paper Kurier that she wanted to end not only the Eurozone, one of her campaign promises, but also the 27-member EU—in whose parliament she is a representative, ironically. “I want the collapse of the European Union, to make room for a Europe of Nations,” she said. Cooperating independent nations would be the principle. She cited Airbus and Ariane. A Europe “that the people agree to freely and democratically, which isn’t the case currently.” Ultimately, she said, “you have to ask the question if the system is reformable. Can you convert a Europe that is becoming a federal state into a Europe of Nations? I don’t think so. The Soviet Union wasn’t reformable either.” Not a day goes by when Germany isn’t under heavy fire from outside interests, including Barak Obama who is facing a tough reelection campaign; the last thing he wants is any crap flying across the Atlantic. They all want Germany to bail out the Eurozone. But timing couldn’t be worse. Read.... Germany on the Verge: “Dispel This Fog,” begs Mario Draghi. Yet the working-age population in Germany is set to decline, concentrating the burden of the bailouts on fewer people. Demographics are a worldwide issue that leads to investment super cycles, and to the Fed’s fear of deflation, according to economics expert and author Harry Dent who concludes in his excellent video that “Demographics is destiny.” Thought-provoking, funny at times, and laced with dark overtones.... “Understanding Demographics Is Vital to Success” (video). |

| EURUSD Jumps Driving Global Risk-On (For Now) Posted: 10 Jun 2012 10:14 AM PDT As US equity futures open up 15pts or so (stalled at post April NFP and Greek Election open levels from May 6th), it seems EURUSD's initial 130pip spike from Friday's close merely jogged it back up to Friday's late day ramp close in equities (just above Thursday's highs for the major FX cross). Of course it was a see-saw weekend for Spain - they got all the money they wanted (and probably some ponies and unicorns) but only managed a tie against Italy in Euro 2012. Given the short-interest, as we noted in our widely read analysis of #Spailout yesterday (Item 5 here), it is little surprise that we are seeing EURUSD rally. EURUSD is still around 200 pips shy of its swap-spread-implied rate (which seems to be the common level to revert to after 'stress' liquidity hits the EUR and is then 'fixed'). We won't be surprised to see other risk assets levitate on this and while some traders will resist the urge to fade, we suspect that by the time Europe opens things will look a little different as Spanish sovereigns bondholders realize what just happened. The USD is weak against all the majors except JPY as risk-on carry trades hold it practically unch against the USD. Gold has opened modestly higher (in line with USD -0.8% weakness) but Silver is its high beta self +1.9%. Treasury futures are open (cash not yet) but imply a 10-12bps jump in yields for now (which is just normalizing them to ES from Friday's close). WTI just opened 2.3% higher at $86 (so much for that tax-break?) ES opened at the May 6th swing lows - reaction post Greek election and the awful April NFP print... EURUSD and more importantly for risk, EURJPY, had pushed up to where ES closed on Friday - with maybe a 5-10pt premium for momentum, then as ES opened 15pts up EURJPY also popped - but neither seems ready to push higher or lead for now...

Each major 'event' has put downward pressure on EURUSD relative to its swap-spread-implied 'fair-value'. Think of this as a 'liquidity' premium. The lower pane shows the crisis in Q3 of last year which then reverted on global CB intervention and then the EUR's undervaluation through the entire LTRO1 and LTRO2 period (which reverted almost perfectly when LTRO 2 ended and the ECB stopped 'printing' for want of a better word). The most recent drop reflects #SPailout fears and the Greek election leaving us still 1 sigma below fair-value here - reflecting, we suspect, the fact that this doesn't change anything - both for those looking for market-based targets for their spec EUR longs, 1.2850 seems reasonable out of the gate, but we would be surprised to see it get there on anything but the squeeze of futures shorts...

Treasury Futures (prices) are dumping and imply yield 10-12bps higher than Friday's close. Which merely normalizes TSYs to where ES is trading...

So, in a nutshell, Gold 1x beta to the USD, Silver 2x, and WTI 3x, EURJPY and ES in line and stalled for now, and ES and TSYs in line (having caught up) and stalled for now.

Charts: Bloomberg |

| Goldman Sachs? Leading Indicators Signal Steep Market Crash Ahead Posted: 10 Jun 2012 09:57 AM PDT Goldman Sachs reports their Global Economic Indicators (GLI)*show the world has re-entered a contraction and…is predicting a market crash worse than that of the early 90?s recession and one slightly less than the sell-off at*the turn of the millennium. [Below are graphs to support their contentions.]*Words: 250 So says Alexander Higgins in excerpts from his original article* at [url]http://blog.alexanderhiggins.com[/url]. [INDENT]Lorimer Wilson, editor of [B][COLOR=#0000ff]www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor's Note at the bottom of the page. This, and the preceding paragraph, must be included in any article re-posting to avoid copyright infringement.[/COLOR][/B] [/INDENT]Notably, [as can be seen in the graph below] the GLI turned negative ahead of the Internet bubble bursting at the turn of the millennium and far in advance of the Financial Meltdown of 2008. The angle at which we entered this Contract... |

| $125bn Spanish bank bailout sets gold up for $2,000 and silver $60 this autumn Posted: 10 Jun 2012 09:35 AM PDT |

| Posted: 10 Jun 2012 08:43 AM PDT Providing coherent economic analysis has become a nearly impossible task. By definition, "coherent" implies something which "holds together". Conversely, this analysis is being produced in a world with a mainstream media which is (at the least) bipolar – if not simply schizophrenic. There are two dominant economic trends in the world today: exponentially increasing money-printing; and extreme, hopeless insolvency. Yet despite the fact that these two trends are extremely closely connected, we have the bipolar media reporting on them, and "analyzing" them as if these trends were occurring on separate worlds. To describe the media's reporting and analysis as merely simplistic would be inaccurate. One can be simplistic while still engaging in coherent analysis – i.e. discussing "the big picture" in superficial terms. However what the mainstream media is engaging in is much different. It is as if the media spends ½ of its time reporting while covering one eye with its hand, and the other half of its reporting is done while covering the other eye. The result is as predictable as it is inevitable: a complete and utter lack of "depth perception". Thus on the same day we have the following two articles being published in Bloomberg: "Greek Default Risk Returns As Bond Maturity Nears" [emphasis mine] "Brazil Futures Yields Rise From Record On Faster Inflation" [emphasis mine] As you read through Bloomberg's bipolar reporting on the global economy, you will note no mention (at all) of the soaring inflation gripping most of the world when you read about another, imminent Greek debt-default. Meanwhile, the inflation article on Brazil contains merely one, vague illusion to "caution" in Europe. This is despite the fact that these two trends are not only directly correlated, but causally connected. The collapse of the West's Deadbeat Debtors directly leads to an even faster acceleration in its out-of-control money-printing, and money-printing is "inflation". The very term itself was taken from the act which causes/creates it: "inflating" the money-supply. When a company prints more shares (i.e. "inflates" the supply of shares), it dilutes the value of every share, and the share price falls. When a government prints more money (i.e. inflates the money supply) it reduces the value of every unit of currency. Thus the same loaf of bread which cost $2 less than a decade ago now costs $4 today. It's the same loaf of bread, only the value of our (diluted/inflated) currency has changed. Well, that's not quite true. Actually the size of a loaf of bread has shrunk during this time as well – as the bread-makers attempt to hide even more inflation from their inflation-ravaged customers. What is also totally missed in the bipolar reporting of the Western media is that inflation worsens the insolvency of the Deadbeat Debtors. We have the tax-phobic clowns in the U.S. government absolutely refusing to restore taxation to previous levels, despite the fact that the U.S. is in the midst of the worst revenue-crisis in history – and already hopelessly insolvent. What is their justification for this dogmatic intransigence (faithfully parroted by the mainstream media)? "Taxes are a drag on the economy." The implicit premise here is that the negative impact of taxation is so severe that the U.S.'s fiscal balance would (somehow) worsen if any tax revenues were restored. We then have none other than the mainstream media's High Priest of Economics, B.S. Bernanke lecturing us on how inflation is a tax on an economy. |

| Posted: 10 Jun 2012 04:46 AM PDT With the decline seen this past week it makes the move from $1526.30 a 3 wave move, so whilst price is under $1641, the option is that prices will see under $1526 and likely to test the lower support band between $1460-80. Unless this pushes back above $1641, the bears are still in control of all the time frames except the daily picture, so the bears have a clear control point short term which is at $1641. |

| Posted: 10 Jun 2012 03:40 AM PDT |

| Market Report: Elliott Wave Analysis of Gold Posted: 10 Jun 2012 01:25 AM PDT |

| Greece: Will The Real Contrarian Please Stand Up? Posted: 09 Jun 2012 10:17 PM PDT It might sound CRAZY when I say that Greek stocks could become a good LONG TERM investment soon. However, from a real contrarian point of view, it might not be that crazy. Here's why. The Greek stock market has lost 93.3% from its top in late 2007 to its recent low. Yes that's correct: 93.3%! When we look at the Dow Jones in 1929, we can see a similar move: From the top in 1929 to the bottom in 1932, the Dow Jones lost 89.48%… So Greece has declined even more than the Dow Jones in the GREAT DEPRESSION! When we overlay both charts, we see striking similarities between the two indices: So if this pattern holds, we could expect the Greek market to drop another 30% before a MAJOR turn takes place (perhaps a "GREXIT" (referring to a Greek Exit of the Eurozone) combined with a huge devaluation of the new "Drachma"? This would boost Greek exports and could be the beginning of the end of the Greek mess… Greece's unemployment shot up to 21.9 per cent in March, rising sharply from the 15.7 per cent rate in March 2011 and up from 21.4 per cent in February. However, when we have a look at the Unemployment in the US during the Great Depression, we can – again – see striking similarities: Let's think positive: How much worse can it get than during the Great Depression?!? Greece is missing €60 Billion in taxes. Is that good news No, Maybe not the fact that it is MISSING it, but imagine if Greece could suddenly collect all (or part of) these taxes and invest it in the Economy! Now how "badly" did Greek stocks perform actually? Let's have a look at some ratios: "Greece" measured in Gold shows us that in 1999, people were willing to give 25 ounces of Gold for 1 "Greece" stock. Now they are only willing to give 0.31 ounces for that same stock. Clearly times have changed… Greece vs the SP500: only 0.37 shares of the SP500 needed to buy 1 "Greece" stock, versus an historical average of around 1.5-2 stocks… Greece vs the MSCI World index (excl. USA): showing a dramatic underperformance: Now let's have a look at Greece vs the other "PIIGS": Greece vs Spain: 0.075 "Spain" shares needed to buy 1 "Greece" stock vs an historical average of 0.3 shares… Greece vs Italy: 50% below the historical average: Now let's have a look at Greece's neighboring country Turkey: This looks like a "Pennystock" doesn't it? Speaking about neighboring countries, please have a look at this stunning chart of Spain vs Portugal: Looks like a lot of money has been made going Long Spain, Short Portugal: One thing is sure, Greece won't "disappear". There will always be people living in Greece. This means that there will always be a Greek Economy. Sure it can change dramatically, and will unlikely be the same as it was 10 years ago, but one day or another Greece will start to grow again. When that day comes, the Greek market will have rallied by several %. It's always hard to catch a falling knife as you never know where the bottom will be, but one thing is sure: compared to the rest of the world, Greece looks like a nice opportunity to me for contrarians. There's only one catch here: If you buy stocks now and Greece devaluates its currency (after exiting the Eurozone), you could lose sh*tloads of money due to the currency devaluation. I wonder if there will be other "contrarians" (the John Templeton-likes) who will follow me… ************************************************************************************' I have decided to only accept new subscribers until June 30th. From then on, my services will be open to existing subscribers ONLY. To secure your membership now, visit www.profitimes.com and subscribe now! |

| Trading Gold by Timing the Fed Posted: 09 Jun 2012 09:17 PM PDT Gold's recent sell-off seems to be a continuing pattern of major price movements and directional changes after a significant policy event or any announcement by the Federal Reserve. Federal Reserve Chairman Ben Bernanke was in front of congress again this week and provided no material news or change in policy, but he did leave the door open to more easing if needed. This was enough to cause the sell-off in gold. |

| Brodsky and Quaintance: Solution is asset monetization, starting with gold revaluation Posted: 09 Jun 2012 09:10 PM PDT In an outline posted Friday at Zero Hedge, fund managers Lee Quaintance and Paul Brodsky make the case for resolving the world debt crisis with an asset monetization and revaluation based on the upward revaluation of gold by 800 to 1,000 percent, creating lots of money with which government debt could be liquidated and bringing hopeless mortgages and the banks that issued them back to solvency... |

| Posted: 09 Jun 2012 06:41 PM PDT Greyerz – Worldwide Package Coming From Fed, ECB & IMF Egon von Greyerz: "We're seeing every week, one domino after the next that is falling. So far they are only smaller dominos such as banks, smaller countries, etc.. No (major) … Continue reading |

| Posted: 09 Jun 2012 05:30 PM PDT |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment