saveyourassetsfirst3 |

- John Butler: Gold to $10,000

- Analyzing Noteworthy Insider Trades On Tuesday

- Bullion Prices: How to Climb the ‘Golden Staircase'

- About That 3-Month Drop in Gold Prices

- A Weak Economy Remains Gold’s Best Friend

- Gold Down in Dollars, Up in Euros, “Anemic” US Economy Misses Bernanke Jobs Target

- McAlvany: Discretion – Rules = Uncertainty

- The Inflation Trade is On: Bernanke Has Broken the Dollar Rally

- ECB: decrease of oz796,04 in gold and gold receivables

- Americas "Safest Long Term Investment" Is Gold - Gallup

- Internal Sunshine of the Fed’s Mind

- Morning Outlook from the Trade Desk 05/02/12

- America's ‘Safest Long Term Investment’: Gallup

- David McWilliams Video Series

- Metals Prices May Diverge on ADP Employment Data

- Two Different Gold Price Directions

- Inflation Trade is On: Bernanke Breaks Dollar Rally

- John Embry: This is What I'm Doing With My Own Money Right Now

- The Moneychanger interviews GATA secretary about gold and silver suppression

- King World News Interviews Jean-Marie Eveillard

- Gold & Silver Market Morning, May 02 2012

- 2012 Gold and Silver Price Forecasts Too Pessimistic

- Silver Scrap Supply Sees Further Growth

- Jeff Clark: Time to Accumulate Gold and Silver

- Has Australia’s Rate Cut Put the Carry Trade at Risk?

- Catalytic Events Moving Gold Stocks: Jocelyn August

- Caribbean Island Gold: Scott Jobin-Bevans

- Is Wells Fargo a Lehman in the Making?

- Philip Pilkington: Bankers Shoot Selves in Foot – “Reduce Our Profits by Cutting Deficits, Please!”

- A Tale of Two Gold Miners

| Posted: 02 May 2012 06:07 AM PDT With "The Golden Revolution", author John Butler provides us with an indelibly strong case for a return to the gold standard. What's more is that Butler takes it a step further, and provides us with a plausible and realistic way of actually doing so. Joining us to discuss this further and expand on the implications of such move is the author himself, John Butler. For Kitco News, Daniela Cambone reports. May 2, 2012. from kitconews: ~TVR |

| Analyzing Noteworthy Insider Trades On Tuesday Posted: 02 May 2012 05:36 AM PDT By Ganaxi Small Cap Movers: We present here three noteworthy insider buys and nine noteworthy insider sells (ex-basic materials, energy, healthcare, and technology sectors that are covered in a prior article) from Tuesday's (May 1st, 2012) over 320 separate SEC Form 4 (insider trading) filings, as part of our daily and weekly coverage of insider trades. The filings are noteworthy based on the dollar amount sold, the number of insiders buying or selling, and based on whether the overall buying or selling represents a strong pick-up based on historical buying and selling in the stock. Rock-Tenn Co. (RKT): RKT is a leading manufacturers of containerboard, recycled paperboard, bleached paperboard, packaging products, and merchandising displays in the U.S., Canada, Mexico, Chile, Argentina, Puerto Rico, and China. On Tuesday, CFO Steven Voorhees filed SEC Form 4 indicating that he exercised options and sold the resulting 40,000 shares for $2.5 million, ending with 0.18 million shares after the Complete Story » |

| Bullion Prices: How to Climb the ‘Golden Staircase' Posted: 02 May 2012 05:21 AM PDT It typically takes 12 to 18 months for gold to establish a new price high once it retreats from a strong run-up. Eight months have already passed since gold reached $1,900. The "Golden Staircase" theory tells us that it will take between four and 10 months to see new highs. |

| About That 3-Month Drop in Gold Prices Posted: 02 May 2012 04:12 AM PDT Gold Prices just fell for 3 months running. Which is rare... |

| A Weak Economy Remains Gold’s Best Friend Posted: 02 May 2012 04:03 AM PDT It was Bob Prechter of Elliott Wave fame, likely among others who noted that correlations between all asset classes are quite strong during a Depression. This is true in a cyclical sense but not in a structural sense. Stocks tumbled in the 1929-1941 period while commodities, led by Gold and gold producers, increased in value. We've experienced similar phenomena in the past 12 years. Cyclically, there has been a correlation between these asset classes. Structurally, stocks have been in a bear market and resource sector has been in a bull market. The driving force has been a weak economy and bear market which usually leads to more inflationary policy, which in turn benefits the resource sector. Are we soon to see a replay of this scenario? Despite unprecedented monetary inflation, stimulus and bailouts, the economy has barely recovered. The chart below (from Doug Short) displays post-war real gdp growth. The black line shows the 10-year average which has been in a steep decline since 2006. At the time, the Bush II recovery was the weakest on record. It has been surpassed by a pathetically weak recovery (statistically) under Obama. The growth rate in each of the past seven quarters has been below the the 10-year moving average. Meanwhile, economic data as a whole is okay but is currently failing to meet expectations. The Citigroup Economic Surprise Index, (economic data relative to expectations) has gone negative for the US, and the rest of the world is not far behind. Clearly, continued disappointing economic data combined with any weakness in equities would prompt more Fed action. Judging from what happened in 2010 and 2011, it is a near certainty. It is important to note the current position of the markets in contrast to a year ago. Currently, precious metals are bottoming while equities are nearing multi-year resistance. This decoupling, shown in the chart below, began in the aftermath of the mini-Euro crisis.

Other than 2001-2002, we haven't seen an extended period of decoupling between precious metals and equities. However, that doesn't preclude the possibility in the coming years. In fact, there are two cases of a decoupling during the 1970s. In the chart below we graph the S&P 500 (blue) and the Barron's Gold Mining Index (red, and scale numbers adjusted).

The period from 1971-1972 bears quite a bit of resemblance to 2011-2012. The S&P 500 (blue) continued to make new highs while the gold stocks (red) remained in a long-term consolidation that included two corrections. However, decoupling would soon benefit the gold stocks as they rose more than 4-fold in less than 18 months. Oh and during that period, the S&P entered one of its worst bear markets on record. Finally, note that the next major bottom in the gold stocks in 1976, coincided with a top in the S&P 500. The current decoupling of precious metals and equities combined with an unsustainable recovery provides insight into the future. With equities nearing major resistance and precious metals emerging from an important low, it is obvious which asset class is in position to benefit from disappointing economic data and which asset class could enter a mild cyclical bear market. Equities have already experienced two nasty bear markets and two recessions. Though still in a secular bear, the likely outcome of the next few years is far more likely to be something on the order of the late 1970s and not the mid 1970s. The combination of the failure of equities to make new highs and continued Good Luck! Jordan Roy-Byrne, CMT |

| Gold Down in Dollars, Up in Euros, “Anemic” US Economy Misses Bernanke Jobs Target Posted: 02 May 2012 03:54 AM PDT

THE SPOT MARKET gold price rallied to $1658 an ounce ahead of Wednesday's US trading, following the release of disappointing US jobs data – though gold in Dollars remained down on the week so far. The ADP National Employment Report shows the US economy added 119,000 nonagricultural private sector jobs in April – less than many analysts had forecast. The ADP report is closely watched as a precursor to the official nonfarm payrolls report, which is out this Friday. Federal Reserve chairman Ben Bernanke said last week that the US needs to add between 150,000 and 200,000 jobs each month to meet Fed projections. Earlier in the day, gold dipped back below $1650 per ounce during Wednesday morning's London trading – 1.23% down on yesterday's high – while European stock markets were mixed and the Euro fell following the release of disappointing economic data. London's FTSE lost 0.6% by lunchtime, while French and German stock markets were up following yesterday's May 1 absence. Commodity prices ticked lower, with copper down nearly 1.3% on the day. The silver price meantime fell to $30.59 per ounce – 2.2% down on the week so far. "[Silver's] inability to bounce above $31.50 remains a concern for longer term bulls," says technical strategist Russell Browne at bullion bank Scotia Mocatta. On the currency markets, the Dollar this morning extended the rally that it began on Tuesday shortly after the publication of better-than-expected manufacturing data. "Growth is more anemic than any of us would want," said Federal Reserve Bank of Dallas president Richard Fisher last night. "But it's positive." Fisher added that he would not support further monetary stimulus such as quantitative easing "unless truly horrific data were to come forward", although the Dallas Fed president is not due to become a voting member of the Federal Open Market Committee until 2014. Fisher added that Congress now has "to do their part; we've done ours". "[The] central scenario is now for further Fed monetary accommodation to be implemented only in the fourth quarter instead of June," said a note from French bank BNP Paribas this morning. BNP has cut its average gold price forecast for 2012 from $1855 per ounce to $1715, and its silver price forecast from $37.50 to $33.10. Fisher's comments meantime echo those of European Central Bank Executive Board member Joerg Asmussen, who said last month that "Europe has done its part" in fighting the sovereign debt crisis, and that the onus was now on the International Monetary Fund. ECB president Mario Draghi meantime called for a "growth compact" last week when he appeared at a European Parliament hearing, though he added that fiscal austerity measures are "unavoidable". "The only answer to this," said Draghi, "is to persevere and for the ECB to create an environment that is as favorable for this as possible." Eurozone manufacturing activity continued to fall last month – and at a faster rate – according to official purchasing managers' index data published this morning. The Eurozone-wide manufacturing PMI fell from 46.0 in March to 45.9 for April. The Eurozone's unemployment rate meantime hit its highest level in nearly 15 years in March – rising to 10.9% – according to data published Wednesday by Eurostat, the European Union's official statistics agency. German manufacturing activity also contracted last month, with April's PMI falling to 46.2, down from 48.4 in March. German unemployment meantime grew by 19,000 last month to hit 6.8%, in line with March's figure, which was adjusted higher from 6.7%. The Euro dropped sharply against the Dollar this morning, and by Wednesday lunchtime was down 1.2% on yesterday's high. Against the Pound, the Euro fell to its lowest level since June 2010. The Euro gold price meantime hit a two-week high, breaking through €40,500 per kilo (€1260 per ounce). The ECB should lend money to the European Stability Mechanism, the permanent bailout fund that Here in the UK, Bank of England figures released Wednesday show M4 money supply grew by £8.2 billion in March, excluding money held by institutions the Bank classifies as 'intermediate other financial corporations' i.e. companies that facilitate transactions between banks such as clearing counterparties. Of this, the 'household sector' portion of M4 rose by £2.8 billion, while 'private non-financial corporations' saw a decline in money holdings of £1.4 billion. The bulk of M4 growth was accounted for by 'non-intermediate other financial corporations' – which include insurance companies and pension funds. These saw their M4 holdings grow by £6.8 billion in March. M4 excluding intermediate OFCs saw year-on-year growth of 6.4% in the first quarter of the year, although M4 lending fell by 0.3%. "Severe credit tightening would drag the economy back into a deep recession," say economists at Moody's Analytics. "Further quantitative easing by the Bank of England is unlikely to be announced at the May monetary policy meeting, but future action will not be ruled out." Ben Traynor Gold value calculator | Buy gold online at live prices Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK's longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. (c) BullionVault 2011 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. |

| McAlvany: Discretion – Rules = Uncertainty Posted: 02 May 2012 02:17 AM PDT

from mcalvanyweeklycommentary.com:

much more @ mcalvanyweeklycommentary.com |

| The Inflation Trade is On: Bernanke Has Broken the Dollar Rally Posted: 02 May 2012 02:01 AM PDT |

| ECB: decrease of oz796,04 in gold and gold receivables Posted: 02 May 2012 01:49 AM PDT |

| Americas "Safest Long Term Investment" Is Gold - Gallup Posted: 02 May 2012 01:46 AM PDT gold.ie |

| Internal Sunshine of the Fed’s Mind Posted: 02 May 2012 01:21 AM PDT Gold spot prices opened with losses on the order of about $10 and near the support level that the $1,650 area is thought to be able to now offer. Silver dropped nearly 50 cents and started the midweek session out under the $30.50 mark per ounce. |

| Morning Outlook from the Trade Desk 05/02/12 Posted: 02 May 2012 12:20 AM PDT Gold hit the top end of the range yesterday and then reversed on better than expected economic numbers. Remember, good numbers would lead to a tighter Fed bias, aka good for the dollar and bad for metals. This morning flirting at support around $1,650. US dollar up this morning accounts for metal weakness. Would still like to see a wash out to levels mentioned last week but my medium term 6 months and further out remains bullish. The more depressed the dealers become the more bullish becomes my sentiment. They are actually amazed that they have to work for profits. Whats this all about. |

| America's ‘Safest Long Term Investment’: Gallup Posted: 01 May 2012 11:16 PM PDT Gold gradually fell during trading in Asia and this weakness has continued in European trading where gold looks set to test the $1,650/oz. level or $1,646/oz., the price low after the $1.24 billion sell trade on Monday. |

| Posted: 01 May 2012 11:12 PM PDT Below is a very worthwhile video series by Irish economist David McWilliams. We'll let it speak for itself, but we reckon it is this kind of communication that captures and enlightens the youth today – and the youthful at heart. When serious subjects are fun to watch, more people are likely to watch them. Part 1: http://www.youtube.com/watch?v=oAR0VRLRGHE&feature=player_embedded

Part 2: http://www.youtube.com/watch?feature=player_embedded&v=V5z0rQRdsiE

Part 3: http://www.youtube.com/watch?feature=player_embedded&v=wDFgtb0by4E

|

| Metals Prices May Diverge on ADP Employment Data Posted: 01 May 2012 10:52 PM PDT Commodity prices are pushing lower in European trade as dismal economic data weighs on demand expectations for growth-sensitive crude oil and copper while risk aversion encourages safe-haven flows into the US dollar and downward pressure on gold and silver. |

| Two Different Gold Price Directions Posted: 01 May 2012 10:24 PM PDT After rising almost 11% in January, gold Comex futures have declined three months in a row, ending April at $1,664.2. While spot gold in US dollars has not recovered from its early September peak, gold bar per 10 grams in India has reached an all-time high. |

| Inflation Trade is On: Bernanke Breaks Dollar Rally Posted: 01 May 2012 09:31 PM PDT It may not seem like much happened Monday, but a very important event occurred. Monday the dollar index breached 78.65. A penetration of that level indicates that the current daily cycle has now topped in a left translated manner. |

| John Embry: This is What I'm Doing With My Own Money Right Now Posted: 01 May 2012 09:06 PM PDT ¤ Yesterday in Gold and SilverThe gold price didn't do much up until about lunchtime in Hong Kong. From that point the price developed a negative bias, with the London low coming about 11:30 a.m. BST. The subsequent rally really gathered some steam late during the lunch hour in Britain, but at 9:40 a.m. in New York, twenty minutes after the Comex open, a not-for-profit seller showed up...and that was it for the day...and once the London p.m. fix was in at 10:00 a.m. Eastern time, the price got taken down below Monday's close. From there it more or less traded sideways into the electronic close at 5:15 p.m. in New York. The high tick of the day was $1,672.80 spot. Gold closed at $1,662.20 spot...down $2.10 from Monday. Net volume was around 84,000 contracts, which is a very low number. The silver price more or less followed the same price path as the gold price. The high of the day in silver, which was $31.45 spot, came at the London p.m. gold fix at 3:00 p.m. British Summer Time...10:00 a.m. in New York. Silver closed at $30.97 spot...down 4 whole cents on the day. Net volume was vanishingly small at 22,000 contracts. The dollar index declined slowly all night long...and hit its low minutes before 10:00 a.m. in New York. Then in less than twenty minutes, the dollar index was at its high of the day...and up about 33 basis points from its low. From there the dollar index drifted lower...and finished the Tuesday trading day basically unchanged from Monday. I guess the skeptics could say that both gold and silver sold off at the London p.m. fix because the dollar gained a third of a cent at precisely that point. OK, if that's the case, maybe they can explain why both metals ran into a brick wall at 8:40 a.m. in New York...and what caused the rally before that? The gold stocks opened mixed...and then ran up strongly after the low following the London p.m. gold fix. But once gold began to trade sideways to lower after that, the day traders took away most of the gains...but the HUI finished up 0.46% nonetheless. It looked like someone was bottom-fishing in the gold shares today. The silver stocks finished mixed to down but, despite that, Nick Laird's Silver Sentiment Index finished up 0.69%. (Click on image to enlarge) Day three of the May delivery month showed that 4 gold and 315 silver contracts were posted for delivery on Thursday. The big short/issuer in silver was JPMorgan out of it's in-house trading account with 290 contracts. The largest long/stoppers were Deutsche Bank in its in-house trading account...and then way behind them was Goldman Sachs in its in-house account and JPMorgan in its client account. The contracts involved were 122, 83 and 82 respectively. The link to the Issuers and Stoppers Report is here. For the third day in a row there was a withdrawal from the GLD ETF. This time it was 135,938 troy ounces. There were no reported changes in SLV...and there hasn't been any change since April 20th. Surprisingly, the U.S. Mint had a sales report on the first day of May. They sold 10,000 ounces of gold eagles and, as Ted Butler pointed out, that was equal to 50 percent of all the gold eagles sold during the entire month of April. The mint didn't report selling anything else. It was a very busy day at the Comex-approved depository on Monday. They reported receiving 1,914,905 troy ounces of silver...and shipped 1,352,770 ounces of the stuff out the door. Most of the action was at Brink's, Inc...and the link to everything is here. It was a very quiet news day yesterday...and, thankfully, I don't have a lot for you today. It's so quiet that I'm even including a couple of stories that I was saving for this Saturday. I hope you have the time to peruse them all. With vanishingly small volumes in both silver and gold yesterday, I wouldn't read too much into Tuesday's price action. Bolivian President Evo Morales seizes assets from Spanish energy company Red Electrica. The Moneychanger interviews GATA secretary about gold and silver suppression. ¤ Critical ReadsSubscribeTotal US Debt Soars To 101.5% Of GDPThere is nothing quite like a $70 billion debt auction settlement at the last day of a month to bring total US debt to a record $15.692 trillion, which happens to be just $600 billion shy of the $16.394 trillion debt ceiling. Now that the end of month auction has settled, one can easily see why the Treasury forecast of debt issuance through the end of September will only be correct if somehow the Treasury finds a way to print its own money without reliance on the Fed, or else every US taxpayer somehow hikes their tax payments by 15% voluntarily. Good luck on both counts. This zerohedge.com story from yesterday was sent to me by Phil Barlett...and the link is here.  US Economy Faces Risk of 'Fiscal Cliff': Fed OfficialsTwo Federal Reserve officials warned Tuesday that the U.S. could be heading for a "fiscal cliff" at year's end if mandated tax increases and spending cuts are implemented. Charles Evans of the Chicago Fed called the cliff a "big uncertainty" while Atlanta Fed President Dennis Lockhart said there could be a "financial shock" if markets begin to anticipate that Congress and the White House do little to address this situation. The expected tax increases and spending cuts were triggered when a congressional "super committee" failed to come up with a way of closing the federal budget deficit. This cnbc.com story was sent to me by West Virginia reader Elliot Simon...and the link is here.  CFTC Considers Proposal on Mandatory Swap Clearing, Barnett SaysThe Commodity Futures Trading Commission, the main U.S. derivatives regulator, may propose within months which swaps must be guaranteed by central clearinghouses, said Gary Barnett, the agency's director of swap dealer and intermediary oversight. The CFTC may seek comment about which types of swaps will face the 2010 Dodd-Frank Act's clearing mandate that is designed to reduce risk in the $708 trillion global market, Barnett said at the International Swaps and Derivatives Association Inc.'s annual meeting in Chicago. "We hope that in the next couple of months we will move in that direction," Barnett said. Clearinghouses seek to reduce risk in swaps by accepting margin, or collateral, from trading parties in the transactions. Dodd-Frank was enacted after largely unregulated swaps helped fuel the 2008 credit crisis. This 4-paragraph story was posted over at the Bloomberg website yesterday afternoon...and you just read them all. It's another contribution from Elliot Simon...and the link to the hard copy is here.  Top ICE figure pleads guilty in brazen, $600G scamIn a brazen criminal scheme to defraud taxpayers, one of the highest-ranking officials in the U.S. Immigration and Customs Enforcement agency pleaded guilty Tuesday in federal court to helping embezzle $600,000 from the federal government. Over three years, James Woosley and at least five other ICE employees scammed the agency by fabricating expenses for trips that were never taken and for hotel, rental car and restaurant expenses that did not exist, according to court records. His son and Woosley's live-in girlfriend, Lateisha Rollerson -- both ICE employees -- allegedly ran the scam out of the elder Woosley's two Virginia homes. You can't make this stuff up...and I thank Washington state reader S.A. for bringing it to my attention. It's posted over at the foxnews.com Internet site...and the link is here.  Economy Face Off: Ron Paul vs. Paul KrugmanCongressman Paul just makes so much sense, it's impossible to believe that anyone would take that little weasel Krugman seriously. This Bloomberg video from Monday runs just under 21 minutes...and I thank reader Federico Schiavio for sending it along. The link is here.  Euro Stress Crosses Border Into the NetherlandsOf all the people rocked by the debt and austerity tumult rattling Europe, the famously prudent but prosperous Dutch were seldom on anybody's watch list. Until now. This bastion of probity became a flash point of euro zone turmoil last week, when the government fell in a showdown over how to cut the budget to keep the nation from getting caught in Europe's long-running debt crisis. The action focused fears in other European capitals that austerity, rather than helping to put countries back on their feet, will impede growth and make it harder for them to recover. It is the Netherlands' toughest test of economic resolve since the nation became a founding member of the euro currency union in 1999. Last week, facing a crisis that could have tarnished the country's sparkling credit rating, a caretaker government maneuvered to pass a 14 billion euro ($18.5 billion) plan for spending cuts and tax increases. Political leaders acknowledge that the belt-tightening will further retard an economy already in recession. This 2-page story was posted in The New York Times yesterday...and I thank Phil Barlett for sending it our way. The link is here.  In Southern Italy, Fake Euros That Even the Police AdmireWhile Europe's financial overlords debate the wisdom of spurring growth by letting the European Central Bank print more money, some enterprising sorts in this semi-urban sprawl northwest of Naples are taking matters into their own hands and printing reams of counterfeit euros. The Campania region of southern Italy is known for its sunny skies, fresh mozzarella and organized crime, but it has a different kind of cottage industry that accounts for more than half of the 550,000 to 800,000 fake euro notes pulled from circulation annually by European central banks. "In Italy, there's a great, ancient and august tradition: Here, they make fake money, done well," said Col. Alessandro Gentili, the head of the Italian Carabinieri's Currency Anti-counterfeiting Unit in Rome. "Giugliano is still the capital. It has the best professionals." Well, dear reader, I wonder they don't throw the banksters in jail for conjuring money up out of thin air as well, as it's nothing more than legalized counterfeiting. This second 2-page New York Times offering in a row was also sent to me by reader Phil Barlett...and the link is here.  A Tiny Island Is Where Iran Makes a StandFor Iranians, whose country's borders have shrunk in the past 200 years after wars and unfavorable deals by corrupt shahs, territorial issues are a delicate matter. So a renewed claim by the United Arab Emirates to the tiny island of Abu Musa in the Persian Gulf has touched a raw nerve. But many here say that may just be the point. President Mahmoud Ahmadinejad and his reactionary agenda tend to be unpopular among the urban middle classes, but he is enjoying a rare surge of support even in those inhospitable quarters in the growing dispute with Iran's Persian Gulf neighbors — one that he touched off by making a surprise visit to the island last month, a first by an Iranian president. This interesting piece of Persian Gulf trivia was posted in The New York Times this morning...and I thank Roy Stephens for sending it. The link is here.  Three stories from the Tehran TimesThe first one is headlined "Iran signs €16 billion oil deal with Spanish firm". The second item is entitled "IMF snubs pressures to suspend Iran". And lastly is this article headlined "Iran seeks 200,000 tonnes of barley, offers payment via India". All stories are courtesy of Roy Stephens.  The Moneychanger interviews GATA secretary about gold and silver suppression Posted: 01 May 2012 09:06 PM PDT  This longish 4-page interview is posted in the clear at the gata.org website...and I'll leave the introduction and the rest of the preamble up to Chris. The link to this must read interview is here. |

| King World News Interviews Jean-Marie Eveillard Posted: 01 May 2012 09:06 PM PDT  Jean Marie Eveillard oversees $50 billion at First Eagle Funds. Eveillard told KWN that the authorities should not be in the business of manipulating equity prices because it is extremely dangerous. He also discussed the gold market. The link to this KWN blog is here. |

| Gold & Silver Market Morning, May 02 2012 Posted: 01 May 2012 09:00 PM PDT |

| 2012 Gold and Silver Price Forecasts Too Pessimistic Posted: 01 May 2012 08:58 PM PDT

from pricelessgoldandsilver.com: If anything gold and silver forecasters are probably too cautious about the outlook for 2012. This is not surprising after the volatility of 2011 which saw record highs for both metals but a collapse later in the year that left gold up 10 per cent and silver down around the same amount for the year. The worry for precious metal investors is that deflation and recession will overcome the inflationary forces of money printing in 2012 and limit the upside for prices. Correction done? But while it is certainly possible to see a 2008-style drop in commodity prices in another global financial crisis, most likely with the eurozone at its epicentre this time, the correction that we have already seen in precious metals probably shields them from a copycat correction. In short the correction is largely behind us, whereas in late 2008 it was well overdue. Then again in 2009 it took a few months for the bailouts to kick into action while they are ongoing in 2012. We even have the IMF now doubling its funds to $1 trillion by means of borrowing and leveraging debt from its heavily indebted members, or at least proposing such a preposterous move. QE3 is also there waiting in the wings for a suitable crisis for the Fed to push the button. At the same time the biggest investment bubble in the world, US treasuries continues to inflate. Investors around the world know that this is unsafe and that the only real protection from a bond market crash is to hold real assets and among currencies that is gold and silver. 'The Chinese are converting their money to gold and silver', said the Sharjah trader interviewed by ArabianMoney last week (click here). It is a gross over simplification but not an inaccurate one. Keep on reading @ pricelessgoldandsilver.com |

| Silver Scrap Supply Sees Further Growth Posted: 01 May 2012 08:52 PM PDT

from silverinvestingnews.com: High metal prices have not only encouraged an increase in silver mining, but have also prompted growth in silver recycling. Supply from scrap rose for the second consecutive year in 2011, according to data from the Thomson Reuters GFMS World Silver Survey 2012. With silver from scrap rising some 20 million ounces, this source of supply accounted for nearly 25 percent of total production last year. Keep on reading @ silverinvestingnews.com |

| Jeff Clark: Time to Accumulate Gold and Silver Posted: 01 May 2012 08:47 PM PDT

Do you own enough gold and silver for what lies ahead? If 10% of your total investable assets (i.e., excluding equity in your primary residence) aren't held in various forms of gold and silver, we at Casey Research think your portfolio is at risk. After speaking at the Cambridge House conference last month and talking with many attendees, I came away convinced that most investors fall into one of two categories: those who hold an abundance of gold and silver (which tends to be physical forms only), and those with little or none. While both groups need to diversify, I'm a little more concerned about the second group. Here's why. Regardless of what you think will happen over the remainder of this decade, one thing seems virtually certain: the value of paper money will be affected, perhaps dramatically. Even if the economy slipped into deflation, the deflation wouldn't last long. A panicked Fed would print to the max and set off a wild rise in prices. This is why we're convinced currency dilution will not only continue but accelerate. Let's take a look at what's happened so far with the value of our currency vs. gold, after accounting for the loss in purchasing power.

Both the US and Canadian dollar, after adjusting for their respective CPIs, have lost about a quarter of their purchasing power just since 2000. Concurrently, gold has increased dramatically in buying power, far outpacing the effects of inflation. This is the core reason why I'm convinced we should hold our savings in gold and silver instead of dollars. Mayan prophecies aside, many of our panelists last month, including most of the senior Casey staff, believe economic, monetary, and fiscal pressures could come to a head this year. The massive build-up of global debt, continued reckless deficit spending, and the lack of sound political leadership to reverse either trend point to a potentially ugly tipping point. What happens to our investments if we enter another recession or — gulp — a depression? Here's an updated snapshot of the gold price during each recession since 1955.

Clearly, one should not assume that gold will perform poorly during a recession. Even in the crash of 2008, gold still ended the year with a 5% gain. And with the amount of currency dilution we've undergone since that time, it seems more likely gold will rise in any economic contraction than fall. Indeed, if the response of government to a recession is more money printing, precious metals will be a critical asset to have in your possession. Even if the gold price ends up flat or down this year, the CPI won't. Gold's enduring purchasing power is why we hold the metal. How about gold stocks?

In spite of the debilitating 1970s that suffered from stagflation, price controls, three recessions, and the Vietnam war, gold producers rose over 600% while the S&P was basically flat. And that includes a roughly 65% fire-sale correction, much like we saw in 2008. To be clear, gold and silver stocks won't be immune to selloffs if a recession or worse temporarily clobbers our industry. But in the end, we're convinced they will prevail. Don't lose patience with, or confidence in, your gold holdings. What happens to the price over any short period of time is only one chapter in the book of this bull market, and we think you'll be happy by the time that last chapter is written. Regards, |

| Has Australia’s Rate Cut Put the Carry Trade at Risk? Posted: 01 May 2012 08:25 PM PDT The Australian dollar carry trade, popular among investors to cash in on the interest rate differential between countries, is under threat following the Reserve Bank of Australia's (RBA) interest rate cut, say forex strategists, who expect further policy easing by the central bank this year... Read |

| Catalytic Events Moving Gold Stocks: Jocelyn August Posted: 01 May 2012 07:00 PM PDT |

| Caribbean Island Gold: Scott Jobin-Bevans Posted: 01 May 2012 07:00 PM PDT |

| Is Wells Fargo a Lehman in the Making? Posted: 01 May 2012 06:24 PM PDT Banking maven Chris Whalen has a must-read piece on the reckless real estate risk taking underway at Wells Fargo, the sanctimonious #4 bank. While I sometimes take issue with Chris on his readings on capital markets related businesses, he is solid on his knowledge of traditional banking and also has access to very good intelligence in that arena. Thanks to the crisis just past, we tend to think of banks as creating danger to bystanders via their over-the-counter trading operations: securitizations, CDOs, derivatives, all that stuff that is now loosely termed as "shadow banking." But the US crisis prior to that was the S&L and the less widely recognized LBO debt meltdown of the early 1990s, both traditional bank lending. Even though economists airily wave it away as damaging but not catastrophic, it didn't look that way at the time. Citibank nearly failed and the entire banking sector was really wobbly. Greenspan engineered an extremely steep yield curve to help banks earn their way out of the hole faster. Wells is in the awkward position of being a monster traditional bank, when its big retail bank competitors, Citi, Bank of America, JP Morgan Chase, also have substantial capital markets businesses. Citi has long had a leading foreign exchange and money markets business, and has a corporate cash management operation which in and of itself makes it too complicated to fail. Bank of America absorbed Merrill. JP Morgan, in addition to having a large investment banking business, also has a huge derivatives/tri party repo clearing business. That means they have more diversified sources of earnings. Whalen points out how real estate dependent Wells is. In this way, it is not unlike Lehman and Bear, subscale players in investment banking who put their chips on real estate as a way to (hopefully) grow faster and catch up with the big boys. The difference between the now-dead investment banks is that they were at a competitive disadvantage by being smaller (in a crude simplification, you have to have pretty close to 100% of the infrastructure of the leaders, and since there are real returns to scale, for instance, big network effects in trading, the further you are away from 100% of their trading volume, the worse your economics are. That means competitors can poach not just individuals but entire teams, since they will produce more on a platform with bigger activity). Wells isn't so much at a competitive disadvantage via not being as big, but is instead a prisoner of having been overweight real estate historically. As Whalen makes clear, Wells is engaging in accounting games to make it look better than it is. The San Francisco bank is hardly alone it that, but Whalen depicts it as worse in this regard than its peers. It is only taking losses on its least bad real estate loans, and using those to value the rest of its portfolio. On top of that, as we pointed out, Wells has been releasing loss reserves aggressively since early 2009, something which we suspect will prove to have been ill advised (oh, except for the senior executives who collected bonuses between then and now). And lacking other high margin businesses to earn its way out of its hole, Wells is doubling down in real estate lending, and on top of that, engaging in yet more dodgy accounting. Per Whalen:

Whalen argues that Wells will take a hit when Basel III is implemented because banks will no longer be able to afford to retain mortgage servicing rights. This is his only worry that I discount, because Basel II was never adopted in the US and there are reasons to think Basel III will not be either. The picture is just as troubling on the commercial real estate side:

Note that you can lose more than 100% of your money on development lending. You foreclose, losing the value of your loan, and you have to raze the partly completed project. Back to Whalen:

This has the smell of something that will end badly, but it may take a couple of years to play out. As Whalen said, stay tuned. |

| Philip Pilkington: Bankers Shoot Selves in Foot – “Reduce Our Profits by Cutting Deficits, Please!” Posted: 01 May 2012 06:20 PM PDT By Philip Pilkington, a writer and journalist based in Dublin, Ireland. You can follow him on Twitter at @pilkingtonphil Are governments really engaging in 'financial repression'? That's what Neil Collins over at FT Alphaville, drawing on the work of Stephen King (HSBC analyst, not the writer), implies. This meme has been around for quite some time. As far as I can tell it was brought into being by Austrian School types, but then went on to be taken up by more mainstream commentators like Gillian Tett and now FT Alphaville. The idea is that the government is forcing investors into buying pricey government debt by 'repressing' yields through their quantitative easing programs. (There are also some tactics that the government supposedly use to force debt down investors' throats but I won't mention them here because, frankly, they are a stretch). Collins summarises:

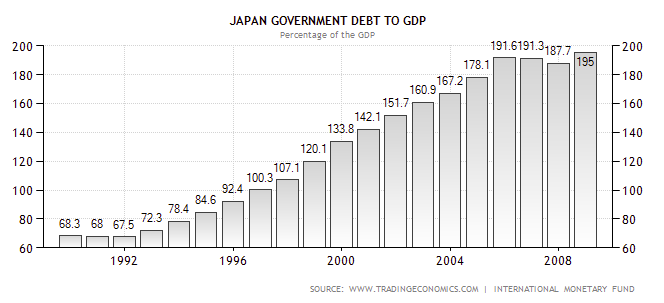

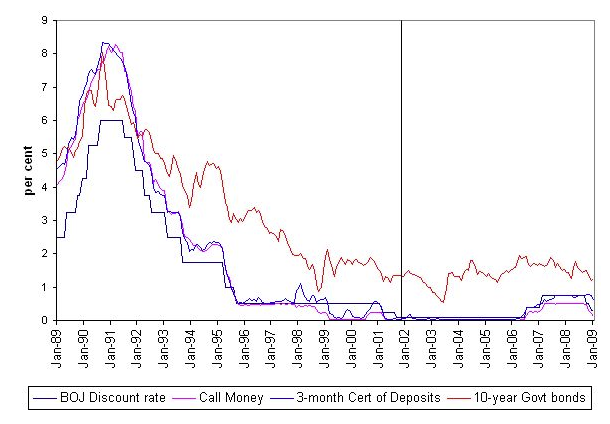

We will leave aside Collins' view that the UK's fiscal policy is "out of control" for the moment and focus instead on the argument that, if it were not for the QE programs, the market would soon 'discipline' the government by raising yields on government debt. Actually we have a perfect experiment in this regard. During the 1990s Japan was running exceptionally large fiscal deficits after their housing and stock market bubbles blew — and what's more, they did this without any QE program in place. Japan initiated their very first QE program in mid-2001, ten years after their financial crisis. As can be seen in the following chart between 1994 and 1996 Japan had amassed similar amounts of government debt-to-GDP that the UK and US governments now hold: And yet, for all that interest rates remained extremely low: Clearly then, investors were buying up Japanese government debt even though there was no QE in place. Indeed, the yields on 10-year government bonds changed little after around 1999, with the effects of the 2001 QE program on yields being pretty minimal. So, the evidence simply does not show what Collins and King — together with many other normally astute commentators — are trying to prove. In the bad times people buy government bonds at low yields regardless of if the central banks are engaging in so-called 'financial repression' or not. There is little to no alternative. Indeed, despite what Collins and King imply, this debt — provided that it is issued by a government that issues its own currency — provides the investment community with a perfectly safe asset in order to weather the tough economic times and ensure that their balance sheets remain in relatively good order. The problem seems to be that financial and economic commentators are suffering from what appears to be almost perpetual anxiety. They're disoriented and confused right now and they're jumping at the sight of every shadow they encounter; including their own. The truth of the matter, as other Financial Times writers like Martin Wolf know well, is that the current high levels of government debt are necessary in order for the private sector to deleverage. Without the government taking on debt the UK economy would collapse and the investment community would see their profits margins (which aren't doing too badly despite their moaning — indeed, King's own HSBC has seen a remarkable comeback post 2008) collapse. The fact is that the current government deficits in the UK and elsewhere are the new norm. Investors should come to realise that it is upon these deficits that their profits rely, so they should stop their fear-mongering and get with the program. Western economies have some very real problems right now — like high unemployment and a sustained lack of aggregate demand — but government deficits are the cure, not the poison. |

| Posted: 01 May 2012 05:21 PM PDT Dollar Collapse |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment