Gold World News Flash |

- What Is A Gold Space Helmet?

- Gold: Volatile Within A Bull Market

- Preparing for a Lengthy and Unpredictable US Dollar Crisis

- Just In: Coalition requests UN intervention to stabilize Spent Fuel Pool No. 4 at Fukushima — Endorsed by nuclear experts

- 22 Facts That Doom Is Coming in 2012 For Global Financial Markets

- Gold Short Term Bullish Base?

- 95 Percent Of The Jobs Lost During The Recession Were Middle Class Jobs

- “Massacre” Anniversary

- Barron’s Releases Massive Silver Propaganda Hit Piece

- The Value of Worthless Money

- Silver Scrap Supply Sees Further Growth

- Yamashita's Gold: Two sides of the Coin

- Is Central Planning About To Cost The Jobs Of Your Favorite CNBC Anchors?

- Austerity Fires Voter Vengeance Against Euro

- Peter Schiff : Gold Is A Reserve, Gold Is An Asset

- May day holiday so very little action/gold and silver hold

- This Is the First Time In History that All Central Banks Have Printed Money at the Same Time … And They’re Failing Miserably

- The Silver and Gold Price Continue to Confuse Both Must Climb from here to Make Good Their Escape

- Exclusive – Gary Savage: “We've Built up a Wall of Worry in Mining Shares That Can Drive A 300% Move Similar to 2008″

- "Calculating The Power Of Your Hard-Earned Yuan"

- QE: To Infinity And Beyond

- Marin Katusa vs. Porter Stansberry

- Embry tells KWN what he's doing with his own money

- Occupy May Day!

- Embry - This is What I’m Doing with My Own Money Right Now

- Gold Seeker Closing Report: Gold and Silver End Slightly Lower

- Gold Daily and Silver Weekly Charts - Stormy Blues - Down Don't Worry Me

- Exclusive Interview – Peter Grandich: “I've Now Committed 75-80% of My Investment Dollars to The Junior Resource Sector”

- Time to Accumulate Gold and Silver

| Posted: 01 May 2012 06:06 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold: Volatile Within A Bull Market Posted: 01 May 2012 06:01 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preparing for a Lengthy and Unpredictable US Dollar Crisis Posted: 01 May 2012 04:58 PM PDT by Eric Fry, DailyReckoning.com:

"During normal times," we continued, "investors can focus only on buying quality stocks one by one from the bottom up, without also trying to envision what tragedies might befall them from the top down… But it may be time to begin imagining the unimaginable. "It may be time, in other words, to begin considering that the next phase of the global monetary system might not include the US dollar as its reserve currency…or that the next two decades of life in America might not look anything like the last two decades." | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 May 2012 04:41 PM PDT from ENEnews.com: To: UN Secretary General Ban Ki-moon An Urgent Request on UN Intervention to Stabilize the Fukushima Unit 4 Spent Nuclear Fuel Recently, former diplomats and experts both in Japan and abroad stressed the extremely risky condition of the Fukushima Daiichi Unit 4 spent nuclear fuel pool and this is being widely reported by world media. Robert Alvarez, Senior Scholar at the Institute for Policy Studies (IPS), who is one of the best-known experts on spent nuclear fuel, stated that in Unit 4 there is spent nuclear fuel which contains Cesium-137 (Cs-137) that is equivalent to 10 times the amount that was released at the time of the Chernobyl nuclear accident. Thus, if an earthquake or other event were to cause this pool to drain, this could result in a catastrophic radiological fire involving nearly 10 times the amount of Cs-137 released by the Chernobyl accident.

Nuclear experts from the US and Japan such as Arnie Gundersen, Robert Alvarez, Hiroaki Koide, Masashi Goto, and Mitsuhei Murata, a former Japanese ambassador to Switzerland, and, Akio Matsumura, a former UN diplomat, have continually warned against the high risk of the Fukushima Unit 4 spent nuclear fuel pool. US Senator Roy Wyden, after his visit to the Fukushima Daiichi nuclear power plant on 6 April, 2012, issued a press release on 16 April, pointing out the catastrophic risk of Fukushima Daiichi Unit 4, calling for urgent US government intervention. Senator Wyden also sent a letter to Ichiro Fujisaki, Japan's Ambassador to the United States, requesting Japan to accept international assistance to tackle the crisis. We Japanese civil organizations express our deepest concern that our government does not inform its citizens about the extent of risk of the Fukushima Daiichi Unit 4 spent nuclear fuel pool. Given the fact that collapse of this pool could potentially lead to catastrophic consequences with worldwide implications, what the Japanese government should be doing as a responsible member of the international community is to avoid any further disaster by mobilizing all the wisdom and the means available in order to stabilize this spent nuclear fuel. It is clearly evident that Fukushima Daiichi Unit 4 spent nuclear fuel pool is no longer a Japanese issue but an international issue with potentially serious consequences. Therefore, it is imperative for the Japanese government and the international community to work together on this crisis before it becomes too late. We are appealing to the United Nations to help Japan and the planet in order to prevent the irreversible consequences of a catastrophe that could affect generations to come. We herewith make our urgent request to you as follows: 1. The United Nations should organize a Nuclear Security Summit to take up the crucial problem of the Fukushima Daiichi Unit 4 spent nuclear fuel pool. 2. The United Nations should establish an independent assessment team on Fukushima Daiichi Unit 4 and coordinate international assistance in order to stabilize the unit's spent nuclear fuel and prevent radiological consequences with potentially catastrophic consequences. 30 April 2012 Endorsed by: Signing organizations: 72 Japanese organizations have signed this petition (as of 30 April 2012) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 22 Facts That Doom Is Coming in 2012 For Global Financial Markets Posted: 01 May 2012 03:57 PM PDT  The clock is ticking, and time is running out. The clock is ticking, and time is running out.If you haven't prepared, or wanna wait until you watch CNN that a collapse happened, IT'S TOO LATE! If you enjoy watching financial doom, then you are quite likely to really enjoy the rest of 2012. Right now, red flags are popping up all over the place. Corporate insiders are selling off stock like there is no tomorrow, major economies all over Europe continue to implode, the IMF is warning that the eurozone could actually break up and there are signs of trouble at major banks all over the planet. Unfortunately, it looks like the period of relative stability that global financial markets have been enjoying is about to come to an end. A whole host of problems that have been festering just below the surface are starting to manifest, and we are beginning to see the ingredients for a "perfect storm" start to come together. The greatest global debt bubble in human history is showing signs that it is getting ready to burst, and when that happens the consequences are going to be absolutely horrific. Hopefully we still have at least a little bit more time before the global financial system implodes, but at this point it doesn't look like anything is going to be able to stop the chaos that is on the horizon. The following are 22 red flags that indicate that very serious doom is coming for global financial markets…. #1 According to CNN, the level of selling by insiders at corporations listed on the S&P 500 is the highest that it has been in almost a decade. Do those insiders know something that the rest of us do not? Read more......... This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 May 2012 03:41 PM PDT courtesy of DailyFX.com May 01, 2012 02:38 PM Daily Bars Prepared by Jamie Saettele, CMT Last week’s hold above the 4/4 low suggests that gold has been forming a bullish base since mid-March. Exceeding the April high would put bulls in control towards the trendline above 1700 (that line extends off of the September 2011 and February 2012 highs). Bottom Line (next 5 days) – higher?... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 95 Percent Of The Jobs Lost During The Recession Were Middle Class Jobs Posted: 01 May 2012 03:35 PM PDT from The Economic Collapse Blog:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 May 2012 03:26 PM PDT by Andy Hoffman, Miles Franklin:

The Chinese market was closed for a holiday, with not a cloud was in the sky regarding supply or demand. In fact, nearly all bullion dealers were SOLD OUT of silver rounds and bars, as I wrote in several RANTS at the time… Ranting Andy: Alert! Alert! APMEX (and Likely Nearly All Mints) Out of Silver | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Barron’s Releases Massive Silver Propaganda Hit Piece Posted: 01 May 2012 02:31 PM PDT from Silver Doctors:

The piece contains phrases such as 'silver bites people, it's nasty', 'don't be seduced into thinking that silver is about to shine again anytime soon', 'Silver's charms are fading–and so are chances of a quick silver comeback', and comes with a headline intended to keep the Average Joe away: 'Beware: Silver Can Bite!' Lest investors remain unsure of Barron's bias, they are informed that 'signs abound that silver's best days are behind it', and then fed a bevy of misleading data intending to steer investors clear of silver. Frankly, this is a bullish sign, as it reeks of desperation among the banksters and elite. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 May 2012 02:23 PM PDT from TheDailyBeast:

That's one of the takeaways from Signs of Inflation, a new exhibition at the Federal Reserve Bank of New York. The show, presented by the American Numismatic Society, looks at the history of inflation through the 7th century B.C. to present day. (Yes, even Ancient Rome experienced inflation—it needed to finance those wars.) Signs of Inflation includes almost 200 monetary objects, ranging from engraved gold coins and cowrie shells to twisted iron rods and handwritten IOUs. But it also demonstrates the myriad, complex ways a bank note—or coin, shell, or what have you—reveals a society's political and economic health. And it does so through treating money as partly an objet d'art. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Scrap Supply Sees Further Growth Posted: 01 May 2012 01:55 PM PDT by Michelle Smith, Silver Investing News:

Part of the increase in scrap silver can be attributed to individuals. Philip Klapwijk, Head of Global Analytics at GFMS, noted an increase in buy silver campaigns analogous to the buy gold campaigns that encouraged the public to cash in on items such as old jewelry and silverware. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yamashita's Gold: Two sides of the Coin Posted: 01 May 2012 01:54 PM PDT - Here's a Question, an Answer & a Rebuttal over the mystery of the "Yamashita's Gold". If you've not researched the issue, this discourse might be a good place to start. Question: "Yamashita's Gold", What do you think? "I know your are one of the world's most studied experts on this subject, way ahead of me in [...] This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is Central Planning About To Cost The Jobs Of Your Favorite CNBC Anchors? Posted: 01 May 2012 01:40 PM PDT Something funny happened when last August CNBC hired access journalist extraordinaire Andrew Sorkin to spiff up its 6-9 am block also known as Squawk Box: nothing. At least, nothing from a secular viewership basis, because while the block saw a brief pick up in viewership driven by the concurrent (first of many) US debt ceiling crisis and rating downgrade, it has been a downhill slide ever since. In fact, as the chart below shows, the Nielsen rating for the show's core 25-54 demo just slid to multi-year lows. And as NY Daily News, the seemingly ceaseless slide has forced CNBC to start panicking: "CNBC insiders tell us executives at the cable business channel are "freaking out" because viewership levels are down essentially across-the-board, particularly with its marquee shows, "Squawk Box" and "Closing Bell." "Their biggest attractions have become their biggest losers," says one TV industry insider familiar with the cable channel's numbers. According to Nielsen ratings obtained by Gatecrasher, from April 2011 to April 2012, "Squawk Box" is down 16 percent in total viewers and 29 percent in the important 25-54 demographic bracket that advertisers buy." Yet is it really fair to blame the slide of the morning block's show on just one man? As a reminder, Sorkin was never the type of personality that CNBC needed: his background was one always best suited to a print medium, where he would be (ab)used by bigger financial interests (at a far slower paced news cycle) who would leak information to him when the time was right. No understanding of the big, or little, picture was required (and none was ever imputed): merely continued "access" (think Wall Street and Blue Horseshoe) which could be gained in exchange for promises of amicable 'profiles' in the occasional infinitely biased non-fiction book. As such, anyone who truly penned their hopes of a rating reincarnation on an access journalist likely needs to be fired. He was not the flamboyant, blonde, mini skirt-clad, eye candy that the bulk of traders who watch the morning block, most of them on mute, are looking for. Yet the collapse in CNBC ratings goes to a deeper issue. Because while the cyclical shifts in CNBC viewership are macro event driven, the unmistakable secular decline indicates that just like loss of faith in capital markets by retail investors (last week the ICI reported the biggest weekly outflow from US equity markets in 2012), manifesting itself in a crippling collapse in trading volumes, which in turn is forcing banks to fire traders and salespeople left and right, secondary derivatives of this phenomenon are impacting the financial media, just like CNBC. But the biggest irony is that it is precisely the same central planning cheerleading that one hears on CNBC day in and day out (look no further than Bob Pisani and Steve Liesman) which is the silver bullet that has been fired right at the head of the Comcast/GE-owned financial station. Because as Artemis Capital showed previously, equity vol collapses whenever the Fed is busy intervening and manipulating the capital markets. This in turn kills the speculative mania that drives an interest toward stocks, and the only entities that can trade in this type of vol vacuum are the appropriately named vacuum tubes: as Zero Hedge first showed three weeks ago, the percentage of electronic trading in markets is now nearly 90%. But this, and everything else, is merely a symptom of one underlying cause: endless central planning intervention by central bankers who now have sole control over the stock market. Who in their right mind would want to participate? And yet this new normal "vol to zero" regime is precisely what CNBC is cheering day in and day out. One wonders: does CNBC grasp that it is cheering for its own demise? We doubt they are that stupid: they must. So then the real question is: whereas Zero Hedge at least is openly against central planning and is demanding a return to normalcy, yet we realize that this will not happen until after a systemic crash so vast that the status quo is wiped out and a fresh start is mandated, is CNBC not the ultimate agent provocateur: on one hand egging on the failed status quo regime (we all know who their main sponsors and advertisers are), and on the other praying and hoping quietly each and every day for a market collapse which will at least return some of their viewers? Because just like markets are worthless without participants, so CNBC without viewers is a whole lot of ads with nobody caring about opening a Lind Waldock account (sorry, too soon?). And a victory for the bulls is no victory if no bulls are watching. Yet just like with dying capital markets whose symptom is being misdiagnosed by regulators day after day, so CNBC will likely blame the collapse of its Squawk Box ratings on the wrong guy, until finally Sorkin is fired. But sadly, for all the wrong reasons. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Austerity Fires Voter Vengeance Against Euro Posted: 01 May 2012 01:35 PM PDT From John Browne, Euro Pacific Capital:

It is one of those issues that now appears lost to history, but the Germans were not wildly enthusiastic about the euro in the years before the common currency. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peter Schiff : Gold Is A Reserve, Gold Is An Asset Posted: 01 May 2012 12:24 PM PDT Peter Schiff : I don`t think gold is a reserve... [[ This is a content summary only. Visit my website http://goldbasics.blogspot.com for full Content ]] This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| May day holiday so very little action/gold and silver hold Posted: 01 May 2012 11:21 AM PDT by Harvey Organ, HarveyOrgan.Blogspot.ca:

Gold closed down today to $1661.70 a fall of $1.70. The price of silver lowered by 9 cents to $30.89. Let us head over to the comex and assess trading today. The total gold comex OI fell by 3411 contracts yesterday as no doubt JPMorgan tripped up many of newbie longs who simply do not under the criminal psyche of our arch enemy. The total OI rests tonight at 408,005 down from 411,418 yesterday. The May delivery of gold (non official delivery month) saw its OI fall from 386 to 88 for a loss of 298 contracts. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 May 2012 10:44 AM PDT Simultaneous Global Printing Is Failing MiserablyMainstream Keynesian economists argue that the failure of the European austerity measures to pull Europe out of the doldrums proves that more stimulus is needed, and that austerity is poison at this stage. Indeed, most mainstream economists pretend that debt doesn’t exist … or believe that debt for its own sake is good and necessary. But Martin Weiss noted last month:

Indeed, China and India have been printing as well, as shown by the last 2 of these 2011 charts:

Pimco CEO El-Erian warned last month that central banks might fail in their giant experiment to cure the world’s economic ills with paper money. See this and this. Conservative economists argue that if war spending could get us out of our slump, it would have done so by now. They also point out that “more empires have fallen because of reckless finances than invasion”. They also point out that the government has spent more in the last decade than in all of American history before that … to no avail:

“Deficit hawks” like top economic historian Niall Ferguson says that America’s debt will drive it into a debt crisis, and that any more quantitative easing will lead our creditors to pull the plug. See this, this and this. Indeed, PhD economist Michael Hudson says (starting around 4:00 into video):

Yet the U.S. hasn’t reined in its profligate spending. While modern economic theory shows that debts do matter (and see this), the U.S. is spending on guns and butter, and American debt has risen to more than 100% of GDP. As PhD economist Dean Baker points out, the IMF is cracking down on the once-proud America like a naughty third world developing country. (As I’ve repeatedly noted, the IMF performed a complete audit of the whole US financial system during Bush’s last term in office – something which they have only previously done to broke third world nations.) Indeed, economics professor and former Senior Economist for the President’s Council of Economic Advisers Laurence Kotlikoff wrote in 2010:

Indeed, despite all of the global money printing, we’re still in a Depression. And see see this. False Debate: More Stimulus Or More AusterityIn fact, the whole stimulus-versus-austerity debate is a false one (as we noted last year). Let’s examine an analogy to get beyond the rhetoric and see what’s really going on … The blood pressure of the patient in the emergency room drops precipitously. The ER docs have already given 15 pints of blood over the course of many hours. But the patient is still on the verge of dying. Medical rules and regulations say that more than 15 pints of blood should never be given, as too much transfusion can cause other fatal problems. The “liberal” doctors want to give the patient more blood. After all, this is a life-or-death emergency … and if they can just buy more time, they might be able to figure out a way to save the patient. The “conservative” doctors want to stop with the transfusions. After all, giving too much blood could kill the patient … and maybe he’ll be able to pull out of it on his own. Who is right? Well, the “liberal” and “conservative” doctors are so busy arguing their point of view that they haven’t noticed that one of the patient’s legs has been half chewed off. He’s bleeding out through the huge open wound. Unless the doctors suture up the wound, the patient will bleed out no matter how much blood they give him. The government isn’t even stimulating in an effective way …. it isn’t spending money on the types of stimulus that will have the most bang for the buck. And giving money to the little guy helps stimulate the economy much more than giving it to the big financial players. But while D.C. has thrown a couple billion dollars at jobs and the states – it is a tiny drop in the bucket compared to the many tens of trillions of dollars in handouts to the giant banks. Whether or not Keynesian stimulus could help in our climate of all-pervading debt, Washington has already shot America’s wad in propping up the big banks and other oligarchs. More important still, Keynes implemented his New Deal stimulus at the same time that Glass-Steagall and many other measures were implemented to plug the holes in a corrupt financial system. The gaming of the financial system was decreased somewhat, the amount of funny business which the powers-that-be could engage in was reined in to some extent. As such, the economy had a chance to recover (even with the massive stimulus of World War II, unless some basic level of trust had been restored in the economy, the economy would not have recovered). Today, however, politicians haven’t fixed any of the major structural defects in the economy ( and see this). So even if Keynesianism were the answer, it cannot work without the implementation of structural reforms to the financial system. A little extra water in the plumbing can’t fix pipes that have been corroded and are thoroughly rotten. The government hasn’t even tried to replace the leaking sections of pipe in our economy. Bailouts, money-printing and lose monetary policy can’t patch a financial system with giant holes in it. What are the giant holes? Some of the biggest are:

Of course, the loss of America’s manufacturing base, encouraging jobs to be shipped abroad, out of control derivatives and other shenanigans are giant holes as well. And the government has been throwing money at the big banks instead of the little guy, which – as Steve Keen as demonstrated – is not an effective way to stimulate the economy. Another useful analogy is that of parasite and host. As we wrote in 2009:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Silver and Gold Price Continue to Confuse Both Must Climb from here to Make Good Their Escape Posted: 01 May 2012 10:37 AM PDT Gold Price Close Today : 1661.70 Change : (1.70) or -0.10% Silver Price Close Today : 3087.70 Change : 8.2 cents or -0.26% Gold Silver Ratio Today : 53.817 Change : 0.088 or 0.16% Silver Gold Ratio Today : 0.01858 Change : -0.000030 or -0.16% Platinum Price Close Today : 1570.90 Change : 6.60 or 0.42% Palladium Price Close Today : 679.65 Change : -2.05 or -0.30% S&P 500 : 1,405.82 Change : 7.91 or 0.57% Dow In GOLD$ : $165.20 Change : $ 1.00 or 0.61% Dow in GOLD oz : 7.991 Change : 0.048 or 0.61% Dow in SILVER oz : 430.07 Change : 3.26 or 0.76% Dow Industrial : 13,279.32 Change : 65.69 or 0.50% US Dollar Index : 78.84 Change : 0.034 or 0.04% The SILVER and GOLD PRICE continue to confuse and bewilder their supporters. Gold did challenge $1,670 today -- on a spike -- but fell back just as quickly to bump along $1,660 support. Closed Comex at $1,661.70, down $1.70. It's stalling, and in this world you either go forward or backward, but you can't stall. Move that thing! The SILVER PRICE lost a tiny 8.2c to close at 3087.7. Chart looks like an EKG, just moving right across the paper. Silver is range bound by 3060c beneath and 3140c above. Nothing happens till it breaks one of those lines. As to those falling wedges the silver and GOLD PRICE have traced out, there's no change. Gold remains above the upper boundary line of its wedge, as does silver, but both must climb from here to make good their escape. The market was kind to stock investors today. The Dow made a 4 year intraday high, 13,338.66, but backed off that to close 13,279 (up 65.69 or 0.5%). That barely bested, but bested still, the previous high at 13,264.49 on 2 April 2012. (Odd, just exactly a month later?) S&P500 did not make a new high, offering a mild divergence. S&P 500 rose 7.91 (0.57%) to 1,405.82. Assuming that the Dow can advance tomorrow, that will prove the head and shoulders we have been watching is a consolidation pattern and not a topping formation. As long as this continues and doesn't fizzle in the next few days, that sets the Dow on track to challenge the October (14,164.53). No, I still would not buy stocks, but today does illustrate a well known principle of human behavior: people buy a rising market. I suppose that's one strong driver of bull markets, that so few people are willing to buy when the price is flat, and after a long decline. Then as the market begins gaining, only a few more will hop on. Ahh, but when the big rises come, you have to beat the buyers away with a stick. That's how you know a top is near. And of course frenzied stocks and plentiful headlines suck investor dollars away from silver and gold. Therefore it will do little good if any for me to point out to y'all that stocks are at the end of a long rise and face every fundamental economic headwind, while silver and gold have spent 12 and 7 months respectively correcting. People like the pizzazz and razzle-dazzle of rising markets, and never mind the fundamentals. That's what drives bubbles. Ask any former real estate agents. CURRENCIES did very little today. Appears on the 5 day chart that the US Dollar Index double bottomed yesterday and today, then bounced up off that bottom for a 78.97 high. At the end of the day, though, it's all smoke and dust, 'cause the dollar gained only 3.4 basis points to wind up at 78.835. Euro played the mirror image of the dollar, breaking at mid-day from a high, closing up 0.02% to $1.3243. These moves are becoming too small to measure. Yen backed off 0.49% today to 124.73c (Y80.17/US$1), but is in a roaring uptrend. I received two good questions from a reader: "At what point do you think the declining silver American Eagle sales will affect the price of silver? Doesn't that along with the climbing silver stocks in Comex depositories show a bearish sign?" No, declining silver AE sales is an EFFECT, not a cause. Sales are declining because silver has been correcting, and therefore losing investor attention, since April 2011. Just as the US Mint minting silver Eagles does not CAUSE the public to buy them, so declining sales does not cause silver to drop. I pay no attention whatever to silver stocks or to physical supply/demand (commodity) analysis for silver, because all that is immaterial to this bull market and does not drive it. Monetary demand alone is driving this bull market. Warehouse stocks and increased scrap reclamation don't change that at all. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 May 2012 10:31 AM PDT

Gary announced major news today regarding a breakdown in the U.S. dollar, a resumption of the inflation trade, as well as the potential for a 300% move in the mining shares starting right at about these levels. During the interview I asked Gary to explain the significance of this change in the dollar trend, and he replied by saying, "In my opinion we are at a very important juncture—yesterday the dollar penetrated below 78.65. The reason that's important is that was the level of the last daily cycle low. So what happened yesterday was we made a marginally lower low, so the dollar has reversed the pattern of higher Commenting further on the implications of a failed dollar rally here, Gary said, "If we start to get intermediate highs and lows that reverse so that the intermediate cycle starts to stair step down, that's a pretty strong signal that the three year cycle may have already topped…What that would indicate if that does turn out to be the case, would be that at the next three year cycle low, due probably around the fall of 2014, there's a very good chance we could be embroiled in a severe currency crisis in the U.S. dollar—which could very possibly drive the bubble phase of the gold bull market."

Concluding on the mining shares Gary This was another outstanding interview with one of the world's most successful gold traders, and is required listening for investors looking to profitably trade the gold bull market. To listen to the interview, click the following link and/or save to to your desktop: Interview also posted on our YouTube Channel To learn more about Gary and The Smart Money Tracker visit: Smart Money Tracker Enjoy the interview? Please support the site by joining our Free Mailing List and sharing this URL page link with friends, family, and your favorite chat forum. Thanks, This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

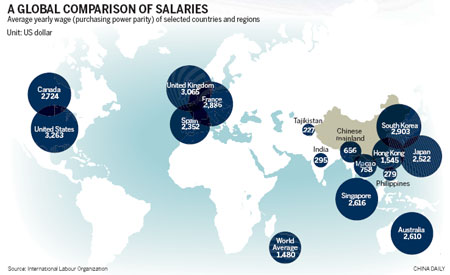

| "Calculating The Power Of Your Hard-Earned Yuan" Posted: 01 May 2012 10:03 AM PDT There is so much #win (not to be confused with #yuan) in the following article from today's edition of China Daily, that we just felt compelled to post it in its entirety for three reasons: i) an article like this will never appear in the US press - here the best one could get is the calculation of the lack of power of one's easily borrowed Charmin'; ii) it contains the phrase: "There are no lies, just statistics" when discussing data released by the China's National Bureau of Statistics, iii) being on the front page of the paper, and addressing a topic near and dear to everyone: namely how much pay Chinese workers are receiving in absolute and relative terms, in an attempt to spin the data, it confirms what everyone knows - that more and more Chinese workers are getting antsy about the only number that matters: the bottom one. So without further ado, here is China Daily and "Calculating the power of your hard-earned yuan." Calculating the power of your hard-earned yuan Recent figures differ over average incomes of Chinese workers, and there's no easy answer to which is nearest the truth, Chen Xin reports. What's the average wage in China and how does it compare with that in other countries? It seems a straightforward question, and the answer is always officially presented as such. But the answers will vary depending on the source and factors used in calculating the figures. There are no lies, just statistics. China's National Bureau of Statistics will tell you that the average monthly income in the country last year was about 2,000 yuan. That is for urban residents only. At the current exchange rate, that would be $317. According to the International Labour Organization - a United Nations body set up to "promote rights at work" and "encourage decent employment opportunities" a worker in China earns around 4,100 yuan a month on average. Converted to US dollars, that is around $656, more than twice what the Chinese bureau of statistics calculated for the nation's main wage earners. Does this mean Chinese workers are better off than they think they are? Yes and no. First, the ILO estimates the average monthly wage throughout the entire working world is $1,480. China's doesn't look too good set against that. But more important, all amounts are calculated on the basis of purchasing power parity. PPP is the "currency conversion" device used by the ILO, and other bodies when comparing international incomes, rather than market exchange rates. Currency rates fluctuate and can be misleading when reflecting the standard of living in poorer countries. In other words, the equivalent of 5 yuan won't buy you much in Western nations, but you can get a large bottle of good beer or a decent snack with it in China. PPP, the purchasing power rate, is determined by how much money is needed to buy the same goods and services in different countries. If the same basket of goods is bought for $100 in the US and 400 yuan in China, then the parity of the dollar to yuan is 1 to 4, as opposed to the current market exchange rate of 1 to 6.3. Officially, according to Patrick Belser, a Geneva-based ILO economist, the Chinese worker who earns 1,500 yuan per month can be said to have a purchasing power of 2,520 yuan, or the equivalent of $400 if he spent it in the US. Unfortunately, the reality is the worker will not be spending it outside China, and the PPP does not take into account price rises within the country. So how do workers regard the level of their income and its purchasing power, and what do economists and experts in labor studies think? Although they have seen a steady increase in their wages in recent years, there has also been an accompanying rise in the cost of goods, with the consumer price index showing a year-on-year rise of 5.4 percent last year. More significantly, the cost of food rose by 11.8 percent in 2011. "The price of everything is going up. Seven or eight years ago, 10 yuan could buy 5 kg of rice. Two years ago, the same amount of money could buy 2.5 kg. Now, it can only buy a few scallions," said Li Yinping, a Beijing resident. Wu Xin, who works at an insurance company in Chongqing in Southwest China, and earns a little more than 3,000 yuan a month, also didn't think his purchasing power was as high as the ILO figures suggest. "I have to buy cheaper clothes and cheaper versions of other necessary items in order to make ends meet," said the 26-year-old. Zhang Yi, an expert in labor economics at the Chinese Academy of Social Sciences, says that the incomes of 60 to 70 percent of workers fall below the national average, because that average wage figure, whether calculated by the ILO or NBS, will be boosted by the much higher incomes of individuals who run their own businesses, and of company management. "And low-wage earners would spend most of their money on food and medicine, which means the less they earn, the lower their purchasing power would be," he said. Zhang said people felt that the 11.8 percent rise in food prices limited their purchasing power, and noted that PPP conversion does not take fluctuation of consumer prices into account. This is reflected in the actual sales figures. The total retail sales of consumer goods grew by 11.6 percent in 2011, but this was the lowest rate of growth in the past six years, and a drop of 3.2 percent on 2010, according to the National Commercial Information Center. The People's Daily reported that in 2011, retail sales of consumer goods amounted to 13,400 yuan per person, one-seventh the amount spent per capita in the US. What's more, the goods and services purchased by households in China, calculated as part of GDP, had declined from 48.8 percent in 1978 to 35.3 percent by 2008, with the world average at about 60 percent. Experts blame this partly on the massive increase in house prices. Household spending Despite China maintaining two-digit economic growth, the proportion of household income in GDP also declined in recent years. The ratio dropped from 53 percent in 1995 to 40 percent in 2007, according to Bai Chongen, associate dean of Tsinghua University's school of economics and management. "Workers' pay is the most important source of residents' disposable income and the declining ratio of household income in GDP would affect spending," he told a recent forum. Perhaps more significantly, the widening income gap between different groups of wage earners has also curbed overall spending. The average income in the sectors with the highest-paid workers is about seven times higher than that of those with the least paid, said Yang Yiyong, director of the social development research institute under the National Development and Reform Commission. In addition, official statistics show that in 2010, the average annual salary of a public sector worker was more than 37,000 yuan, while a worker in the private sector earned only 20,700 yuan. And although the government has been increasing the minimum wage, an ILO report in 2009 found that more than 20 percent of local workers and about 40 percent of migrant workers in China were still underpaid. Liu Junsheng, a researcher with the labor and wage institute under the Ministry of Human Resources and Social Security, said that official statistics of workers' average wages were only calculated from earnings in State-owned, overseas-funded and large private enterprises, while the income of workers in small and medium-sized enterprises (SMEs), which employ almost 70 percent of the total labor force, were not included. The ILO recognizes these disparities, and it may be another reason why its figure for the average monthly wage differs so much from that of China's National Bureau of Statistics. "The official figures do not reflect real wages of the majority of workers because they are not covered by the calculation, and that's why many people would feel that both their wages and purchasing power have been overestimated," Liu said. Insecure living Wu Fei works at a perfume design company in Beijing and earns more than 5,000 yuan a month an above-average income by either calculation. Wu said he spends 1,100 yuan a month on renting an apartment, which he shares with two other people, about 1,500 yuan on food, and another 500 yuan on telephone, transport, and water and electricity bills. "I can live on that income, but the disposable part, what's left to spend, is less than 2,000 yuan. I don't feel very secure with that because I wouldn't know how to deal with a sudden sickness or other emergencies with such a small sum of money," he said. Wu said he is considering finding part-time jobs to make more money. But how much would be enough to feel secure? An online forum has attracted calculations and suggestions recently from around the country. The site posted a list of baseline wages that would satisfy people in 2012 in different cities. In Beijing, the bottom line would be 8,550 yuan a month while in Shanghai they're looking to earn at least 9,250 yuan. According to the statistics authorities in these cities, the average monthly salary of workers in Beijing in 2011 was 4,672 yuan and in Shanghai, 4,331 yuan. Closing the gap Liu Junsheng suggests several ways in which the gap between the low and high income groups can be reduced and the income of low earners raised to a more secure level. "Workers in monopoly industries should have their wages raised at a much slower rate," he said. "And the monopoly in some of those industries should be broken to get rid of the conditions and environment that encourage big wage increases for high-ranking employees." Liu added that the government's fiscal policies should favor SMEs more to help them increase profits, so they can afford to raise their workers' salaries. The transfer of labor-intensive industries from coastal regions to western areas and the further development of industries in advanced areas should be carried out promptly, as this would help increase workers' pay, he said. Experts also highlight the importance of collective negotiations between employers and workers to achieve steadier and fairer wage increases. A recent industrial collective contract will give more than 100,000 software workers in Dalian, Liaoning province, a pay rise of at least 6 percent this year. Another contract will mean an 18 percent increase this year for 11,600 working for sports appliance manufacturers in Yangzhou, Jiangsu province. For its part, the central government has pledged in its 12th Five-Year Plan (2011-15) that incomes will "keep pace with economic growth" and wages will "increase in line with improvements of productivity". Delivering the government work report in March, Premier Wen Jiabao said the government is to set up a mechanism for scheduling income increases and to raise the minimum wage by at least 13 percent a year, in order to curb the widening income gap. Wen also promised more effective adjustments to taxation to balance the incomes of different social strata. He said the government will strictly regulate the income of senior managerial staff at State-owned enterprises and financial institutions, and raise the income of low earners.

If successful, the plan will create a much larger middle-income group and narrow the gap in wealth generally. It will also be interesting to see if the ILO rates the purchasing power of their hard-earned yuan stronger or weaker than it is today. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 May 2012 10:01 AM PDT This Friday, May 4, 2012 the US Government Bureau Of Labor Statistics [BLS] will release the April 2012 Non-Farm Payrolls report, better known as an "obfuscation of economic Truth". Because America can't handle the Truth! The April 2012 Non-Farm Payrolls should, for lack of a better word, "suck". The headline unemployment number "should" rise as the number of "jobs created" comes in "less than expected". Unfortunately, the BLS data is far from accurate, or representative of the truth, so we best resign ourselves to a fabricated number to make our Crybaby President look like his economic policies are genius. Still, a lie, is a lie, is a lie. The data we have been spoon fed by the mainstream financial media courtesy of the government data magicians hardly adds up when looked at closely: When Data Is Spun, What Data Can We Trust? (April 30, 2012) oftwominds / Charles Hugh Smith "Headline" government data is massaged, falsified or spun for the purpose of perception management: believe the headlines at your own risk. Modern investing offers the promise that investors who "do their homework" and use data more intelligently than the herd can gain a valuable edge. But what if the underlying data available to the investing public is fundamentally flawed? The federal government agencies that issue headline data and the mainstream media that reprints the data without skeptical analysis would have us believe that these indicators -- the unemployment rate and the consumer price index (CPI), for example -- accurately reflect economic realities. The other indicator that is implicitly or explicitly assumed to reflect the economy's health is, of course, the stock market, generally represented by the S&P 500 index. That the government indicators and the stock market are both suspect is now a given. The chart below, one of many possible examples, proves this suspicion is well-founded. This is a chart of a broad measure of employment in the U.S. published by the U.S. Department of Labor, Bureau of Labor Statistics (BLS). As we can see, when 140 million people had jobs in 2009, the official unemployment rate was 7.3%. Yet when 140 million people had jobs in early 2012, the unemployment rate was 8.3%. How can the rate change when the number of jobs remain constant? The reason is that the unemployment rate is based not just on the number of jobs but on the number of people who are ready, willing and able to work—the labor force. The unemployment rate is based on the labor force minus the number of employed equals the number of people counted as unemployed. The government games the unemployment rate by keeping the labor force number artificially low. Despite the working-age population rising by 9.4 million people since 2008, the official labor force has been 154 million since 2008. Where did the government put all those millions new workers? In the "not in the labor force" category, which rose by roughly 8 million since early 2009. In other words, dropping millions of people from the labor force artificially lowers the unemployment rate. It doesn't take any fancy analysis to conclude that if the true labor force were counted, then the unemployment rate would be much higher -- and that is, of course, politically unacceptable.  So the numbers are gamed, massaged, adjusted... However you choose to describe it, the "headline number" of unemployment reflects political expediency, not reality. The same can be said of the CPI and a slew of other headline data points issued by the government and blithely accepted by a corporate mainstream media committed to presenting the "recovery" as real. If We Can't Trust Headline Indicators, What Can We Trust? If these headline indicators are not a reliable reflection of economic reality, what is? To the degree that any government statistic can be massaged, seasonally adjusted, or simply rejiggered behind the curtain, we must always be alert to the possibility that numbers have been gamed for political expediency. But the farther we move away from headline numbers, the farther we also get from the political pressure to make the numbers either positive or benign. For example, relatively few people are going to study chart PRS85006173, showing labor's share of the non-farm business sector (i.e., the vast majority of the economy).  This charts reveals that labor's share of the economy has been falling sharply since the dot-com top in 2000, and has been in a downtrend of lower highs and lower lows since 1982. This suggests that the number of counted jobs (which includes part-time, temporary, and self-reported self-employed) may be less valuable as a metric of economic recovery than income and labor's share of the economy. READ MORE _________________ Biderman On The Fed: "They Control The Market, We Play With Their Money" From Zerohedge The pastel-wearing President of TrimTabs proffers an entirely non-perfunctory prose explaining why he believes we are now due for a stock market decline. Echoing our thoughts, Charles notes that "It's the Federal Reserve that controls the market, it's their money, they're the boss, we play with their money that they print or stop printing". Sadly true (especially for all the highly-paid economists and strategists out there), the pre-2009 drivers of equity performance (specifically new or excess savings) are no longer so; since the initial QE1 this has not been the case and providing us with a thoughtful history of equity market valuations relative to the various QE-efforts over the past few years - especially when compared to income growth and/or macro-economic data - provides just the color required to comprehend this essentially a obvious thread of reality that merely four years ago would have been denigrated to the tin-foil-hat-wearers of the world. Real-time data says that wages and salaries are barely growing above inflation, Europe is a disaster, and the emerging nations are seeing slowing growth; without the Fed's new money where will cash come from to drive stock prices higher? _________________ Silver – I'm Buying The Inverse Head & Shoulders – Mike Maloney (Delayed Public Release) Published on May 1, 2012 by whygoldandsilver http://www.goldsilver.com This is an 'Insiders' report that was sent out to our customers a few weeks ago, advising of the impending inverse head and shoulders pattern forming on the gold and silver charts. Usually these videos are for our Insiders only, but every now and then we release one to the public so that folks can see one of the main benefits of being a GoldSilver.com Insider: we let our customers know how we are investing as this bull market unfolds, sharing our research and analysis. In this case, Mike and many of the team here at GoldSilver.com had made large purchases of US Silver Eagles, warranting this update video. We have had many questions of late as to what the Insiders program entails, so we have made a short info clip on it at the end of this video. If you have any questions, please check our website or call 1-888-319-8166 Mike also points out in this update that the European crisis is worsening, and there are now even more nails in the dollar's coffin than before. Human nature is playing its role in the market, as people become accustomed to the bad news (and a relatively flat silver price)…BRICS, PIIGS, just more reasons why many of our team have ramped up their accumulation program and changed their gold/silver purchase allocation ratios. Don't forget to get our free report on the 6 precious metals scams to avoid, like Mike says, 'Get educated!'. Thanks for watching, may all your investments have a silver lining. The team at GoldSilver.com _________________ Mike is absolutely right. You cannot wait for the coming US Dollar collapse to protect your wealth...you must be preparing NOW. NOW, at these relativelylow Precious Metals prices, you should be accumulating "physical" bullion to insure and protect you wealth. Once the US Dollar collapses, it will be far to late to buy the protection offered by the ownership of physical Gold and Silver. When these precious metals go "no offer", you will not be able to find any to purchase...you will financially naked. _________________ Trend Channel Firming. New Key Level 31.5by brotherjohnf on Tuesday, May 1st, 2012 http://www.brotherjohnf.com/wp-content/uploads/2012/05/SILVER5112.jpg http://www.brotherjohnf.com/wp-content/uploads/2012/05/SILVER5112.jpg_________________ GATA's Bill Murphy exposes how the Gold Cartel is Bombing the Market for Precious Metals Published on Apr 30, 2012 by CapitalAccount Welcome to Capital Account. In one of his writings, a leading English art critic of the Victorian era, John Ruskin, told the story of a man who boarded a ship carrying his entire wealth in a large bag of gold coins. When a storm hit a few days into the voyage and the decision was made to abandon ship, the man strapped the bag around his waist, jumped overboard, and sank straight to the bottom of the sea. The man's body was found with the wreck of the ship many years later. Reflecting on this, Ruskin asked "Now, as he was sinking, had he the gold? Or had the gold him?" We tell you this story to impress upon you the enduring value that gold has held in the minds of people through the centuries. It has represented not only a store of value, but a means to an end…any end, including one that concludes at thebottom of the sea. For muchof Western history, gold has been synonymous with money. It was not so long ago that the United States and Europe fixed their currencies to gold, and despite the free floating currency regime that we have had since the end of Bretton Woods in the early 1970s, one could argue that we are still on a defacto gold standard. After all, gold has been rising steadily, and at times rather frenetically, since 2001, when it was trading at below 300 dollars per ounce, to levels nearing 2000 dollars in the past year. There are those, like Nouriel Roubini, who have been calling it a bubble since at least 2009. One of the good things about markets is that they tend to have a mind of their own, and don't care all too much what academics or policy makers think. But evenif markets don't need policymakers, policymakers still need markets, and the gold market in particular is one that central bankers keep a close eye on. Gold, as our guest James Turk said in a recent interview with us, is the messenger, and what it has been telling us is that people don't trust governments and they definitley don't trust central banks. But how far are governments, central banks and their too-big-to-fail handlers willing to go in order to silence the messenger? Is market manipulation by governments real, and if so, how is it being done and where? Joining us to discuss this, and other golden news is Bill Murphy, Chairman of the Gold Anti-Trust Action Committee and veteran of the precious metals space. Bill Murphy has been raising the alarm of manipulation in the precious metals market since at least 1999, and has been a prominent voice among defenders of free markets and sound currency. _________________ As if we need any more proof that the Gold Cartel is beating down the prices of Gold and Silver in the "paper" CRIMEX market to "protect themselves" from annihilation for failure to make delivery on their massive unback short positions in both metals, Monday the whole global trading community got to witness first hand these desperados criminal hijinx in broad daylight: Manipulative Gold 'Fat Finger' Or Algo Trade Worth $1.24 Billion GoldCore The gold market was briefly shaken by an unusually large early morning sell order, which triggered a brief trading halt in gold futures and left traders questioning whether the transaction was a mistake and the motivation of the seller.  Gold 3 Day Chart – (Bloomberg) Gold 3 Day Chart – (Bloomberg)Gold fell $14 in one minute despite no breaking financial and economic news and despite no movement in the dollar, oil, equity or bond markets. There was only the insignificant personal income and spending numbers – which came in slightly better than expected and could not justify such quick falls. CME Group Inc's Comex division recorded an unusually large transaction of 7,500 gold futures during just one minute of trading. The sale took out blocks of bids as large as 84 contracts in one fell swoop and cut prices down $15 to $1,648.80 a troy ounce. The sharp losses triggered a 10-second trading halt in June-delivery gold futures, CME told Dow Jones Newswires Tatyana Shumsky. "The market was given a short period to recalibrate and ... it was for 10 seconds," a CME spokesman said. "It only happened in gold futures, in the June gold contract." Gold traders buzzed with speculation that the transaction was an input error - a so-called "fat finger" trade. "Or a Gold Finger as it might be known in the bullion market," traders at Citi joked in a note to clients. The massive size of the transaction - 750,000 troy ounces worth more than $1.24 billion – led to speculation that it was either a mistake by a trader or that an entity wished to manipulate the market lower. Such large trades have frequently been seen at month and quarter beginning and ends. Yesterday was the last trading day of the month. They have also been seen when Ben Bernanke has been making important statements regarding the dollar and the outlook for the US economy. The nature of the massive sell order, one of many seen in recent months, suggested that the seller was not motivated by profit and may have had other motives. Such large trades are rarely conducted amid very thin trading volumes. Trading yesterday was expected to be quiet as market participants in China and Japan were out on holiday and many European traders were preparing for May Day holidays today. "No one who has the account size and the money to trade thousands of gold contracts would do it in one transaction; that's just stupid," said one trader.  Silver 3 Day Chart – (Bloomberg) Silver 3 Day Chart – (Bloomberg)It seems likely that the seller was either a large hedge fund or institution as the collateral required to purchase 7,500 contracts is high. The seller would have had to have deposited $ 75.9 million in cash with a broker. There was a suggestion in the Reuters Global Gold Forum that the selling may have been due to algorithm trading or computer driven. The trade could be as a result of the shift to electronic trading. Computer trading systems are vulnerable to input errors, as they do not 'question' the order before executing the transaction. By contrast, when most order flow would pass through the Comex floor where human traders processed the deals, potential errors stand higher chances of being intercepted and there is a higher level of transparency. "You would definitely [verify a trade this big] before you executed it," said one Comex floor broker. However, the trade is unlikely to have been a keystroke error as silver also saw substantial selling at the same time and similar price falls. This suggests that the seller wished to see gold and silver prices lower. Some traders suggest that there may be High Frequency Trading (HFT) programmes that can see where stop loss orders are placed and sell in order to force stop loss selling – then buying back and thus making a quick profit. It will further fuel allegations that certain Wall Street banks, either alone or in conjunction with the Federal Reserve and US Treasury, are intervening in and manipulating prices in the precious metal markets. The Gold Anti Trust Action Committee (GATA) and other knowledgeable market participants have alleged that this is continuing to be done in order to maintain faith in the US dollar and the US capital markets. FAT FINGER IN SILVER TOO? Trader Dan's Market Views Traders continue to chatter about the so-called "FAT FINGER" trade in gold that occurred early this morning, a trade which dropped the gold price $15 in minutes and consisted of an order of 7,500 contracts. Many seem to agree that it was a trade placed in error. The problem is that we also witnessed a similar surge in the volume done in the nearby silver pit at the exact same moment. Note the time right after the 5:00 AM hour (Pacific time) on the following 5 minute chart and see how large the volume was compared to that for the remainder of the session. No matter who did the trade, ( I remain of the opinion that this was a raid designed to knock the metal lower in hopes of creating a cascading running of downside sell stops), the fact is that it failed miserably. Besides, if it was a "FAT FINGER" ( a trade placed in error) how did the same fat finger knock silver down so sharply? Was that too a simple "error". Note how both metals recovered the losses and added some additional gains even with the mining shares weaker and the broader equity markets lower. Even copper was lower today for a while before it too moved higher. I still believe that traders are becoming more convinced that another round of QE is coming sooner rather than later. At least that is what is being reflected in the price action.  Finally, WSJ Reports of Suspicious Activity in Gold Market Posted by Dominique de Kevelioc de Bailleul on May 01, 2012 Better late then never for a mainstream financial publication to notice what seasoned professionals of the gold market have known for decades—the gold market trades in mysterious ways. "The CME Group Inc.'s Comex division recorded an unusually large transaction of 7,500 goldfutures during one minute of trading at 8:31 a.m. EDT," Wall Street Journal's Tatyana Shumsky penned in an Apr. 30 article, titled, Gold market shakes off $1.24 billion 'fat finger'. "The sale took out blocks of bids as large as 84 contracts in one fell swoop and cut prices down to $1,648.80 a troy ounce. The overall transaction was worth more than $1.24 billion." Shumsky then writes that there is speculation among traders of a 'fat finger' in the market place that day—maybe a mistake, she reckons, maybe an "input error." Instead of calling up Bill Murphy or Chris Powell at Gold Anti-Trust Action Committee (GATA) for their take on such a peculiar trade, the gumshoe hound reported comments made by Citi traders, instead. A 'fat finger', "or a Gold Finger as it might be known in the bullion market," she quoted Citi traders in their note to clients regarding the incident. To her credit, however, the determination of Shumsky to get to the bottom of this mystery didn't lead her to solicit a comment from JP Morgan's Blythe Masters. There, Masters most likely would have replied that she was shocked, shocked at such shenanigans would ever take place at the CME establishment. "One indicator that the transaction was a mistake was its size," Shumsky brilliantly surmised. "At 750,000 troy ounces, such large trades are rarely conducted amid very thin trading volumes. Monday trading was expected to be quiet as market participants in China and Japan are out on holiday and many European traders are preparing for a holidays there." Like a city beat reporter who daringly suggests that men showing up at a bank on a holiday to make a deposit through the back door at 3 a.m. was apparently fishy, Shumsky captured the event eloquently so that the reader could make up his own mind of the event. "No one who has the account size and the money to trade thousands of gold contracts would do it in one transaction, that's just stupid," WSJ's Barney Fife quoted a trader. "The collateral required to purchase 7,500 contracts is about $75.9 million in cash that the trader would have deposited with his broker." In her dogged determination to collect varying opinions of what happened, Shumsky met up with a seasoned Wall Street pro, where she then finds the plot thickening. "Still, not everyone agreed Monday's slip in gold was caused by a keystroke error," she stated. "Chuck Retzky, director of futures sales for Mizuho Securities USA, said that silver prices suffered a similar leg down at the same time as gold, tumbling 35 cents to $30.805 a troy ounce, but other markets like Treasurys, currencies and stocks were unperturbed." Now that uncovered anomaly is something Jack Anderson would have offered effusive kudos to the meticulous WSJ reporter—a budding Junior Mogambo Ranger, of whom most certainly Richard Daughty would be proud. ________________ Is the mainstream financial press FINALLY catching on to and REPORTING the TRUTH on the Gold Cartel manipulations of the Gold and Silver markets. Any market manipulation concerns from the Crybaby President? _________________ Time to Accumulate Gold and Silver By Jeff Clark 05/01/12 Do you own enough gold and silver for what lies ahead? If 10% of your total investable assets (i.e., excluding equity in your primary residence) aren't held in various forms of gold and silver, we at Casey Research think your portfolio is at risk. After speaking at the Cambridge House conference last month and talking with many attendees, I came away convinced that most investors fall into one of two categories: those who hold an abundance of gold and silver (which tends to be physical forms only), and those with little or none. While both groups need to diversify, I'm a little more concerned about the second group. Here's why. Regardless of what you think will happen over the remainder of this decade, one thing seems virtually certain: the value of paper money will be affected, perhaps dramatically. Even if the economy slipped into deflation, the deflation wouldn't last long. A panicked Fed would print to the max and set off a wild rise in prices. This is why we're convinced currency dilution will not only continue but accelerate. Let's take a look at what's happened so far with the value of our currenc | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marin Katusa vs. Porter Stansberry Posted: 01 May 2012 09:17 AM PDT Synopsis: A friendly wager about where oil prices are headed reveals valuable insights for energy investors. At the latest Casey Research conference, respected investment analyst Porter Stansberry stood at the podium and predicted that the price of oil will fall below US$40 per barrel within the next 12 months. Part of his reasoning revolves around the impact that the shale gas revolution has had in the United States – he believes a similar thing will happen with oil. Porter is a friend of mine and a very smart, successful individual… but I think not. From my perspective, the pressures at play in the oil market are all pushing prices in the opposite direction: up. Global supplies are tightening, costs are rising, and demand is not falling. Prices are going to remain high, and then go higher. And there will not be a shale oil revolution anytime soon. I'm the kind of guy who puts his money where his mouth is, so I challenge Porter to a bet. I bet Mr. Stansberry that the price of oil will stay above $40 a barrel over the next 12 months. The wager? 100 ounces of silver. Porter has made a lot of good calls in his career. I highly recommend watching his video The End of America, an interesting and entertaining look at his prediction that the US will soon drown in its debts and cease to be a global economic powerhouse, a transition that will lead to riots across the country. Porter and I agree on a lot of things, but on this one he's wrong. Below are my top ten reasons that high oil prices are here to stay. (Editor's Note: Porter Stansberry was one of 31 financial experts who provided valuable investor insights at the just-concluded Casey Research Recovery Reality Check Summit. He gave a surprisingly optimistic presentation on his vision for America that caught everyone off guard. You can hear it and all the other Summit presentations in their entirety with the Recovery Reality Check Audio Collection.) Reason 1: "The Big Pinch" Oil production levels, as well as exports, have been falling in most of the world's top ten supplier nations: