saveyourassetsfirst3 |

- An Attempt to sell fake antique gold coins foiled

- PMEX announces listing of 10-oz Gold Futures Contract

- Current Gold Demand Completely Unsustainable Without Sharply Higher Prices: Eric Sprott and David Franklin

- Using U.S. Dollars, Zimbabwe Finds a Problem: No Change

- We May Have Just Found The Bottom In Gold Stocks

- Getting Out, Part One: Americans Renouncing Citizenship

- A Basket of Goodies to Suggest Gold is Set to Break New Highs

- Another “Collapse” Prediction

- By the Numbers for the Week Ending April 27

- Silver coins, profit vs preps vs art

- SilverFuturist: There is enough gold/silver in the world

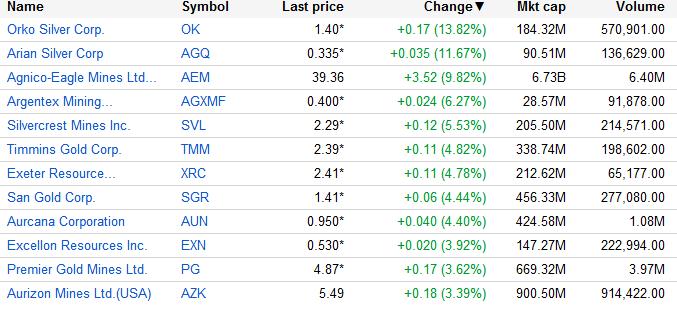

- Today’s Winners And Losers

- BigDad: Taxation and Confiscation

- Ben Bernanke’s Paper Dollar Embodies Systemic Risk

- Global Gold Supply 3

- Good News - the Impending Gold & Silver Launch

- Gold and Silver Disaggregated COT Report (DCOT) for April 27

- Sinclair: Most Important Development Since MOPE Began

- Paper Money: The Barbarous Relic

- Silver Acts Industrial in an Uncertain Market

- Goldman & CITI Love Gold

- Good News: The Impending Gold & Silver Launch

- Futures exchange to offer contracts for Silver

- Gold Traders Get More Bullish as Central Banks Hoard More

- Central Bankers Lead The Way on Gold

- Spain's Collapse is No Little Thing

- USAWatchdog: Weekly Wrap

- The Silver Megathrust

- Vision Victory: Raw Silver Analysis

- Gold’s Long-term Picture Remains Bullish

| An Attempt to sell fake antique gold coins foiled Posted: 28 Apr 2012 02:31 AM PDT |

| PMEX announces listing of 10-oz Gold Futures Contract Posted: 28 Apr 2012 02:25 AM PDT |

| Posted: 28 Apr 2012 01:46 AM PDT ¤ Yesterday in Gold and SilverIt was a very quiet day both price and volume wise in gold on Planet Earth yesterday. The gold price didn't do much through all of Far East and London trading...and the tiny rally that gold had, didn't begin until 8:30 a.m. in Comex trading in New York. Over the next hour, the gold price ran up about ten bucks...and expect for the momentary high tick of the day at $1,669.00 spot around 10:40 a.m. Eastern...the gold price developed a slight downward bias for the remainder of the New York trading session. Gold closed at $1,662.80 spot...up $5.70 on the day. Net volume was a very light 88,000 contracts. The silver price action was more or less a variation of the gold price action...with the high of the day coming at 9:40 a.m. in New York...the same moment that gold's rally ran out of gas. The high tick at that point was $31.55 spot...and from that high, silver sold off about two bits going into the close of Friday trading. Silver closed at $31.27 spot...up 18 whole cents. As has been the case all week, gross volume in silver was immense, but net volume was tiny...around 17,000 contracts. Except for deliveries, May is now off the board...and the new front month for silver is July. The dollar index rallied a bit during Far East trading. That rally, such as it was, ended at the London open at 8:00 a.m BST...and it was all down hill from there...with the bottom coming a few minutes before 9:00 a.m. in New York. From that point, the index bounced off the 78.70 level a few times...and closed the day virtually on that low...down about 41 basis points on the day. The gold stocks hit their zenith at 9:40 a.m...the top of the rally in the gold price...and like Thursday, the shares got sold down a bit over a percent. Then, also like Thursday, they spent the rest of the day drifting higher, as the gold price drifted slowly lower. Despite the rather lackluster gold price action, the HUI finished up 1.46% on the day. Most of the silver equities finished in the plus column yesterday, but not by a lot. That was reflected in Nick Laird's Silver Sentiment Index, which was up only 0.43%. (Click on image to enlarge) Well, the CME Daily Delivery Report showed that last delivery for gold in April was 49 contracts...and that's to be delivered on Monday the 30th. First Day Notice numbers for delivery into the May contract in gold was 296 contracts. The big short/issuer was JPMorgan in its client account with 295 of those contracts...and the big long/stopper was the Bank of Nova Scotia with 255 contracts to be received on May 1st. In silver, there were 957 silver contracts posted for delivery on Tuesday. The big short/issuer was JPMorgan in its house account with 653 contracts. In distant second place were the Bank of Nova Scotia and Jefferies, with 157 and 142 contracts respectively. The big long/stoppers were Deutsche Bank [314 contracts for its in-house trading account]...JPMorgan [280 contracts in its client account]...and Goldman Sachs with 218 contracts in its in-house account. The link to all the action, which is worth a minute of your time, is here. The GLD ETF showed that an authorized participant added 77,682 troy ounces of gold...and there were no reported changes in SLV. The U.S. Mint had a sales report of sorts. They sold 3,000 ounces of gold eagles and 40,000 silver eagles. Month-to-date the mint has sold 20,000 ounces of gold eagles...9,000 one-ounce 24K gold buffaloes...and 1,320,000 silver eagles. The Comex-approved depositories took in another big chunk of silver on Thursday. This time it was 1,221,282 troy ounces of the stuff...and didn't ship out a single ounce. The other happening of note was the transfer of 4,991,883 troy ounces of silver out of the Eligible category into the Registered category over at the JPMorgan warehouse. Time will tell if that means anything or not. The link to Thursday's action is here. I was more than happy with yesterday's Commitment of Traders Report [for positions held at the close of Comex trading on Tuesday]. The Commercial net short position in silver declined by a chunky 4,144 contracts...and is now down to 111.8 million ounces. The '1-4' largest traders in the Comex silver market are short 163.3 million ounces of the stuff...33.8% of the entire Comex futures market in silver on a net basis. The '5-8' big short holders are short an additional 40.4 million ounces of silver, which represents 8.4% of the net short position. So, the '1 through 8' largest traders on the short side, are short 42.2% of the entire Comex futures market in silver, once the market-neutral spread trades are removed from the Non-Commercial category. This is called a short-side corner on the silver market. In gold, the Commercial net short position declined another goodly chunk. This week it was 8,854 contracts, or 885,400 troy ounces. The Commercial net short position is now down to 16.7 million ounces. The '1-4' largest short holders in gold are short 10.7 million ounces of the stuff...and the '5-8' largest short holders are short an additional 5.0 million ounces. The '1 through 8' largest short holders in gold are short 15.7 million ounces. This amount represents 94.0% of the Commercial net short position in gold. In silver, the '1 through 8' largest short holders are short 182% of the Commercial net short position. Yes, the gold market is managed, but it pales in comparison to the internal structure of the Comex futures market in silver. As I mentioned in Friday's column, the engineered price decline in the silver market on Wednesday was not going to be in yesterday's COT report. Ted Butler and I pretty much agree that if what happened on Wednesday was factored into Friday's COT, it's clear that we would be back at the low COT levels of late December. Here's Ted's "Day of World Production to Cover Short Positions" that Nick Laird maintains on a weekly basis. In all four precious metals you can see that the 'big 4' traders hold the lion's share of the short positions compared to the '5 through 8' traders. (Click on image to enlarge) Here's a chart that Nick Laird sent me in the wee hours of Saturday morning...and it requires no further embellishment from me. (Click on image to enlarge) Saturday is the day I get to empty my in-box...and I intend to do precisely that, so I hope you enjoy what I've been saving. The "Where do we go from here?" is 100 percent up to JPMorgan et al...as it always is. Gold posts biggest weekly rise since late February. The Shocking 15-Year Bear Market for Gold Stocks. Currencies will be devalued, metals will break through paper, Sprott says. ¤ Critical ReadsSubscribeJohn Williams: Recovery faked by phony government numbersWriting at King World News, ShadowStats editor John Williams argues that evidence of economic recovery in the United States turns bogus when government-doctored inflation data is discarded and real inflation data is used. Williams predicts that more debt monetization will be employed to prop up banks while being portrayed as economic stimulus. I borrowed this introduction from the GATA press release. This blog is posted over at KWN website...and the link is here.  Terrorizing, Smuggling, And Assault: All In A Week's Work At The TSAThe TSA's had a banner week. It began with former Head Cheese, Kip Hawley – the guy who foisted the liquids-in-baggies nonsense on us – bleating that the agency is "broken" and it's no wonder Americans hate it. As if to prove him right, screeners beat up on little girls – twice. And it was only Monday. By Wednesday, cops had arrested four screeners at Los Angeles International who took a break from pawing passengers to smuggle illicit drugs through checkpoints. Meanwhile, a Congressman alleged assault after a "very aggressive … pat-down." Hmmm. Seems there are several clues here that perhaps we might want to, oh, I don't know, abolish this vile agency. This story was posted over at the forbes.com website yesterday...and I thank 'Jan from Denmark' for sharing it with us. The link is here.  Ron Paul on CNBCTexas congressman Ron Paul spent about 45 minutes on CNBC on Monday...and although I haven't had time to listen to the whole thing, what I have heard is worth your time. I thank West Virginia reader Elliot Simon for sending it to me earlier this week...and the link to the youtube.com video is here.  Robert Wenzel's 'David' Speech Crushes Federal Reserve's 'Goliath' DreamIn perhaps the most courageous (and likely must-read for future economists) speech ever given inside the New York Fed's "My views, I suspect, differ from beginning to end... I stand here confused as to how you see the world so differently than I do. I simply do not understand most of the thinking that goes on here at the Fed and I do not understand how this thinking can go on when in my view it smacks up against reality." But his closing was tremendous: "Let's have one good meal here. Let's make it a feast. Then I ask you, I plead with you, I beg you all, walk out of here with me, never to come back. It's the moral and ethical thing to do. Nothing good goes on in this place. Let's lock the doors and leave the building to the spiders, moths and four-legged rats." [Rather than the 2-legged variety. - Ed] No shades of grey here. The entire speech is posted over at zerohedge.com...and I thank Elliot Simon for his second offering in a row in today's column. The link is here.  Finance Now Exists For Its Own Exclusive BenefitThe financial system is simply unable to make enough money off the real economy in order to even survive its past episodic spasm of over-speculation, describing the scale of dysfunction as something far greater than anyone perhaps realizes. In many ways the system is at a terminal crossroads, as it cannot function without the synthesization of so much credit, but the real economy may not be able to survive the resource drain and monetary inefficiency that this much synthesization requires. Intermediation was supposed to be a tool for the real economy. Now the real economy is nothing more than a support system for the global investment banking regime. In bailing out the banking system, central banks have put their money on the wrong horse since banks are almost completely disconnected from their true role as a tool of the real economy. The labyrinth of complexity and intentional opacity is designed to hide this fact. Real credit is shrinking throughout the system, but synthetic credit is alive, well and flourishing. The financial system now exists to its own exclusive benefit. This eye-opening essay was posted last December over at the realclearmarkets.com website. I came close to zapping this without reading it, but persevered...and was glad I did. It's a rather longish read, but very much a must read in my opinion. I thank reader Julius Adams for sending it...and the link is here.  Using U.S. Dollars, Zimbabwe Finds a Problem: No ChangeFor years, Zimbabwe was infamous for the opposite problem: mind-boggling inflation. Trips to the supermarket required ridiculous box loads of cash. By January 2009, the country was churning out bills worth 100 trillion Zimbabwean dollars, which were soon so worthless they would not buy a loaf of bread (the notes now circulate on eBay, as gag gifts). But since Zimbabwe started using the United States dollar as its currency in 2009, it has run into a surprising quandary. Once worth too little, money in Zimbabwe is now worth too much. "For your average Zimbabwean, a dollar is a lot of money," said Tony Hawkins, an economist at the University of Zimbabwe. Zimbabweans call it "the coin problem." Simply put, the country hardly has any. Coins are heavy, making them expensive to ship here. But in a nation where millions of people live on a dollar or two a day, trying to get every transaction to add up to a whole dollar has proved a national headache. This story was posted in The New York Times earlier this week...and is another Elliot Simon offering. It's an interesting read...and the link is here.  16 Reasons To Move To Iceland Right NowWay back in heady days of 2009, we gave you 6 reasons to move to Iceland. Well, we actually spent some time there last month — and guess what! You should still move. In fact, there's even more reasons now. This 18-slide businessinsider.com story was posted on their website on Wednesday...and I thank Roy Stephens for sending it along. The link to Reason #1 is here.  |

| Using U.S. Dollars, Zimbabwe Finds a Problem: No Change Posted: 28 Apr 2012 01:46 AM PDT  For years, Zimbabwe was infamous for the opposite problem: mind-boggling inflation. Trips to the supermarket required ridiculous box loads of cash. By January 2009, the country was churning out bills worth 100 trillion Zimbabwean dollars, which were soon so worthless they would not buy a loaf of bread (the notes now circulate on eBay, as gag gifts). But since Zimbabwe started using the United States dollar as its currency in 2009, it has run into a surprising quandary. Once worth too little, money in Zimbabwe is now worth too much. "For your average Zimbabwean, a dollar is a lot of money," said Tony Hawkins, an economist at the University of Zimbabwe. |

| We May Have Just Found The Bottom In Gold Stocks Posted: 28 Apr 2012 01:31 AM PDT By Paul Nathan: In my book, The New Gold Standard, I suggest that the best way to get back to a gold standard is forward, through the use of new technologies. I also submit that the move back to gold will evolve naturally through the market process, as more and more individuals, institutions and governments demand it. But Missouri isn't waiting for the market to pronounce gold the winner. Representative Paul Curtman (R-Pacific) says the new bill he's sponsoring "…allows you to liquidate gold and spend it in real-time. We're not monetizing gold and silver in the sense that you're going to walk into stores and use gold and silver, but if you have gold and silver and you put it in a depository, for lack of a better word, they might in exchange give you a debit card. So, you can go out and use your debit card and as you spend Complete Story » |

| Getting Out, Part One: Americans Renouncing Citizenship Posted: 27 Apr 2012 05:23 PM PDT Dollar Collapse |

| A Basket of Goodies to Suggest Gold is Set to Break New Highs Posted: 27 Apr 2012 05:18 PM PDT |

| Another “Collapse” Prediction Posted: 27 Apr 2012 04:14 PM PDT Regular readers of this blog know how I feel about an economic recovery. Mac Slavo agrees: With the Presidential election cycle in full swing our incumbent administration, the media, and their financial pundits continue to maintain that the US economy's green shoots have blossomed into fields of golden sunflowers. Despite what we're being told, however, |

| By the Numbers for the Week Ending April 27 Posted: 27 Apr 2012 02:49 PM PDT |

| Silver coins, profit vs preps vs art Posted: 27 Apr 2012 12:23 PM PDT |

| SilverFuturist: There is enough gold/silver in the world Posted: 27 Apr 2012 11:29 AM PDT I foresee gold being used as settlement between trades. However… I can also see the people still using fiat. Maybe the people won't even know this settlement is taking place! from silverfuturist: ~TVR |

| Posted: 27 Apr 2012 11:25 AM PDT |

| BigDad: Taxation and Confiscation Posted: 27 Apr 2012 11:25 AM PDT Jim Sinclair says gold could gap up to $3,000 an oz. as the gold shorts are trapped and the link is here http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/4/24_Sinclai…$3,000.html . Paper money is a barbarous relic and the link is here http://www.bullionbullscanada.com/gold-commentary/25378-paper-money-the-barba… . The gold standard is inevitable and the link is here http://sgtreport.com/2012/04/gold-standard-inevitable/ . It's all rigged, and the link is here http://www.youtube.com/watch?v=NqVxl7u30c4&feature=g-user-c . Thanks for watching! from bigdad06: ~TVR |

| Ben Bernanke’s Paper Dollar Embodies Systemic Risk Posted: 27 Apr 2012 10:02 AM PDT The paper dollar is now the single most important source of systemic risk to the financial system, the world economy, and the security of the American people. That is the lesson of the past 100 years that Federal Reserve Chairman Ben Bernanke did not teach during his four lectures at George Washington University's Graduate School of Business. Instead, he celebrated the importance of the extraordinary powers he and his fellow governors have to manipulate interest rates and the value of the dollar in the name of economic growth and stability. In so doing, he ignored completely that the ever-growing need for heroic interventions by the Fed is itself being created by the paper dollar system he celebrates. This failure is all the more telling because Mr. Bernanke states up front that central banks perform two critical functions: The first is to "achieve macroeconomic stability." By that, he generally means "stable growth in the economy, avoiding big swings, recessions and the like, and keeping inflation low and stable." The second is to provide "financial stability" by either trying to prevent or mitigate financial panics or financial crises. On both counts, the paper dollar system in effect since the final link between the dollar and gold was broken in 1971 has failed and failed miserably when compared to the results produced under the gold standard. Let's begin by stipulating that we agree with Chairman Bernanke's point that the gold standard is not a perfect monetary system. What is? The more important question is which system, the gold standard or the paper dollar, provides more macroeconomic stability and fewer financial crises. To answer this question, let's examine the historic record beginning with the most difficult example, the Great Depression, which supporters of the paper dollar invoke to discredit the gold standard and thereby avoid defending the abysmal record of the paper dollar. As Professor Brian Domitrovic pointed out in his recent Forbes.com column, the officials running the Federal Reserve in the critical period between 1928 and 1933 chose to ignore the rules of the gold standard, which would have forced them to increase the money supply in response to inflows of gold. Instead, the Fed exercised discretion and tightened, thereby making the deflation of the early 1930s worse than it otherwise would have been. Explains Domitrovic:

"Rather, as (Richard H.) Timberlake has shown, we know what guided Fed thinking in this period, and this was the doctrine that the Fed would refrain from issuing money unless it clearly would go to financing end-point economic transactions, as opposed to things like stock-market speculation and even investment. Whatever you want to say about this doctrine, it has zip to do with the gold standard. And it was at the root of the Fed's weird decision-making 1928-33 where it presided over a radical narrowing of the money supply." What about the claim that, while the gold standard maintains a stable price level over longer periods of time, in the words of Chairman Bernanke: "over shorter periods, maybe 5 or 10 years, you can actually have a lot of inflation, rising prices, or deflation, falling prices." After the largest gold discovery of modern times set off the 1849 California gold rush the price level in the US rose 12.4% over the next 8 years. Under the paper dollar, that 8 year cumulative increase was exceeded in 1974, 1979 and 1980 alone. Moreover, an 8 year increase of 12.4% is equivalent to an average increase of 1.5% a year. By contrast, current Fed policy calls for inflation to average 2% a year which equates to a 17% increase in the price level over the next 8 years. Since abandoning the last vestiges of the gold standard in 1971, inflation has averaged 4.4% a year. Nevertheless, various sectors of the economy have suffered Great Depression like deflations. For example, between 1980 and 1986, the price of oil fell 60%, and the price of agricultural commodities and farm land fell by double digits. Those deflations led to the major bank failures of the mid and late 1980s. And, of course, the most recent financial crisis was triggered by a 30% decline in home prices, a disaster for American families, banks and investors alike that ranks right up there with the hardships experienced during the Great Depression. The net result is that without the guidance of the gold standard, the Fed and the paper dollar have become the leading sources of economic and financial instability. Since 1971, when President Nixon freed the Federal Reserve from the strictures of the gold standard, recessions have become more frequent, longer and deeper. From 1971 through 2010 (under the paper standard) unemployment averaged 6.3%, much worse than the 1947-67 (gold standard) average of 4.7%. We have since experienced the three worst recessions since the end of World War II, with the unemployment rate averaging 8.5% in 1975, 9.7% in 1982, and now above 8% for three years and counting. Under the post-World War II gold standard, there were no financial crises that presented a systemic risk to the US economy. Since 1971, we have experienced the:

In addition, the massive increase in the Fed's and other major central bank balance sheets since the first quantitative easing in 2009 has coincided with the slowest recovery ever - even worse than the recoveries experienced during the 1930s - and the fear of yet another break out in inflation. Under Chairman Bernanke's leadership, the extraordinary steps taken to contain the financial panic in late 2008 and early 2009 by fulfilling its "lender of last resort" role to banks and, under emergency powers granted to it by the Federal Reserve Act, to non-bank institutions, may well have avoided a complete collapse of the world's financial system. But to use that success as justification for a discretionary monetary policy and a defence of the Fed's ability to manipulate interest rates and the value of the dollar is to miss the greater point. The growing instability of the macro economy and the financial system is itself a product of the paper dollar system. The most important thing the Fed could do now to fulfil its two fundamental roles of providing for a stable economy and preventing financial crises would be to begin an orderly transition back to a dollar whose value was once again defined by a unit weight of gold - that is to make the dollar once again as good as gold. To do otherwise is to leave in place the fundamental source of systemic risk that no amount of increased regulation or oversight can correct - the inherent instability of today's monetary system based on a paper dollar whose future value is unknown and unknowable. Regards, Charles Kadlec Ed. Note: Mr. Kadlec is a member of the Economic Advisory Board of the American Principles Project, an author and founder of the Community of Liberty. From the Archives... A Sub-prime Crisis State of Mind How The Belief in Australian Property Will Go With the Generational Wind Chinese Communism and the Human Cost of the Cultural Revolution Lifting the Curtain on the Chinese Communist Party How Empires Really Work

|

| Posted: 27 Apr 2012 08:12 AM PDT Zealllc |

| Good News - the Impending Gold & Silver Launch Posted: 27 Apr 2012 08:10 AM PDT |

| Gold and Silver Disaggregated COT Report (DCOT) for April 27 Posted: 27 Apr 2012 07:52 AM PDT • Also this week, Legacy Combined Commercial COT (LCNS) HOUSTON -- This week's Commodity Futures Trading Commission (CFTC) disaggregated commitments of traders (DCOT) report was released at 15:30 ET Friday. Our recap of the changes in weekly positioning by the disaggregated trader classes, as compiled by the CFTC, is just below. This week we also include the graphs and changes for the combined commercial net short positioning or LCNS, the "Legacy COT" report. In the DCOT table below a net short position shows as a negative figure in red. A net long position shows in black. In the Change column, a negative number indicates either an increase to an existing net short position or a reduction of a net long position. A black figure in the Change column indicates an increase to an existing long position or a reduction of an existing net short position. The way to think of it is that black figures in the Change column are traders getting "longer" and red figures are traders getting less long or shorter. All of the trader's positions are calculated net of spreading contracts as of the Tuesday disaggregated COT report.

Continued… Vultures, (Got Gold Report Subscribers) please note that updates to our linked technical charts, including our comments about the COT reports and the week's technical changes, should be completed by the usual time on Sunday evening (around 18:00 ET). As a reminder, the linked charts for gold, silver, mining shares indexes and important ratios are located in the subscriber pages. In addition Vultures have access anytime to all 30-something Vulture Bargain (VB) and Vulture Bargain Candidates of Interest (VBCI) tracking charts – the small resource-related companies that we attempt to game here at Got Gold Report. Continue to look for new commentary directly in the charts often. Combined (legacy, not disaggregated) Commercial Net Short Position for Silver, then Gold below. Source CFTC for COT, Cash market for gold and silver. Combined Commercial Net Short positioning (LCNS) for silver futures (including Swap Dealers) fell a quite large 4,144 lots to a very low 22,353 contracts net short (111.8 million ounces), a reduction of 15.6% w/w, as silver declined 86-cents or 2.3% from $31.67 to $30.81 Tuesday to Tuesday.

The LCNS as a percentage of all silver contracts open (LCNS.TO) fell to an extremely low and potentially contrary bullish 18.27% - the lowest since January 3 (14.9% then).

Note that the combined commercials (the entities whose job it is to hedge metal inventory on hand or managed for others, metal sold/bought forward, metal for delivery, metal in shipment/transit, metal anticipated to be needed and metal backing a myriad of financial derivatives), are very near their lower limits of net short positioning relative to the past three years of previous trade. To us that suggests that the Big Hedgers are not, repeat not, positioning as though they expect gold and silver to move materially lower. To the contrary, if the Big Hedgers thought that gold and silver were heading much lower we would expect them to be positioning for it with higher, not extremely low net short positions. (Edit at 19:40 CT.) Speaking of the open interest for gold futures we find it remarkable and very interesting that the COMEX open interest for gold futures has declined for eight consecutive weeks, reflecting an apparent spec migration from gold futures elsewhere. From February 28 to April 24 the gold open interest fell 83,655 lots from 479,044 to 395,389 contracts open, a reduction of 17.5%.

Gold closed February 28 at $1,783.83 and fell $109.85 or 6.2% the following week to $1,673.98. The open interest plunged 35,795 contracts that week also, and has continued to decline another 47,860 lots in the seven weeks since. But instead of breaking down with the evaporating open interest in gold futures, gold has found willing bidders (likely including some central banks) above the $1,600 level. Indeed, as measured on COT reporting Tuesdays, gold has remained in a $1,640 to $1,680 trading range since March 6 as the open interest fell. We believe that is an indication there have been and likely still are substantial and determined bidders for gold on most any significant dip. That is all, carry on. Gene Arensberg for Got Gold Report ***

|

| Sinclair: Most Important Development Since MOPE Began Posted: 27 Apr 2012 06:54 AM PDT The Most Important Development Since The MSM/MOPE Assault On Euroland Began from jsmineset.com: My Dear Extended Family, Do not discount this. It has the potential of being the most important positive development in the euro since the beginning of the USA and GB's MSM/MOPE assault on Euroland's problems. This I am told is the reason behind the Euro holding above $1.30 no matter how much the US and GB MSM/MOPE is thrown at it. This is another economic war taking place under the radar of the sheeple between the USA and GB on one side and Euroland on the other. Russia and China might make the euro their reserve currency of selection if Hollande can pull off this plan. I might go to France to vote for him twice. He knows what the euro's real problem is and will work to cure it. This is extremely important in the dollar equation. It may be the most important swing factor in the political scene of gold and the US dollar. Hollande could be the political figure of this century for the upcoming euro block. It is possible. Do not discount this. Respectfully, French Front-Runner Says He'd Seek to Renegotiate Fiscal Treaty if Elected PARIS — The front-runner for the French presidency, the Socialist candidate François Hollande, said on Wednesday that if elected he would ask other European leaders to renegotiate a fiscal treaty in order to promote growth. Mr. Hollande also praised the position taken in Brussels on Wednesday by the head of the European Central Bank, Mario Draghi, who said he favored "a growth compact" of structural reforms in parallel with the fiscal treaty limiting budget deficits and national debt. But there was little indication that Germany, the driving force behind the austerity-driven fiscal treaty agreed to last month, was warming to his ideas. Keep on reading @ jsmineset.com |

| Paper Money: The Barbarous Relic Posted: 27 Apr 2012 06:52 AM PDT

from bullionbullscanada.com: ven most ordinary people who rarely pay any attention to topics in the realm of economics will be familiar with this expression. Like most of the Big Lies from the media propaganda machine, our governments have made sure that most of us have heard this one enough times to have it burned into our psyches. As with most of these Big Lies, this too is a blatant perversion of the truth. It will come as no surprise to gold-bugs and that dwindling minority who advocate sound monetary policies that the reference to gold as a "barbarous relic" was made by the one-and-only John Maynard Keynes. It was from Monetary Reform, a book Keynes published in 1924 – and it was a reference not to gold itself – but to the gold standard: In truth, the gold standard is already a barbarous relic… Thus the original reference was made by the most infamous paper-printer in all of history, desperately searching for some insult he could hurl at the gold standard in order to attempt to make his monetary nonsense sound appealing to the Sheep – i.e. the global economics community. For those not familiar with the mechanics of national economies, the gold standard has often been referred to over history as "the Golden Handcuffs". How did it acquire this intimidating nickname? Because it absolutely limits our governments from any extreme/insane fiscal or monetary policies without the consequences of those policies being immediately known to the general public. A government trying to run huge deficits (like the U.S. government was doing during the Vietnam War), would quickly see its "bank account" (i.e. the national gold reserves) quickly evaporate as paying for those deficits emptied the government's Treasury. Thus ultimately the primary reason that a gold standard is despised (or rather feared) by all the charlatan money-printers like Keynes and the deadbeat governments of modern Western economies is that a gold standard forces governments to pay their bills. Keep on reading @ bullionbullscanada.com |

| Silver Acts Industrial in an Uncertain Market Posted: 27 Apr 2012 06:50 AM PDT

from silverinvestingnews.com: The Shanghai Gold exchange increased margin requirements, but as with COMEX silver margin decreases, the changes appear to have had little immediate effect. Silver seems to be nestling further into its physical commodity personality lately and is showing it by reacting to news that has implications for its industrial demand. And given the economic environment, there is a growing camp that believes the bears could be set to gain ground. Keep on reading @ silverinvestingnews.com |

| Posted: 27 Apr 2012 06:48 AM PDT Goldman Sachs and CITI both very positive on gold price. from mineweb.com: In its latest Commodity Watch, Goldman Sachs' commodities analysis team in New York, London and Shanghai remains cautious on the commodity complex as a whole but does admit to liking the prospects for gold. However it does emphasize that its views are based "not on improving fundamentals, but rather on relative value" as the bank sees the U.S. economy slowing again this quarter and expects gold to converge to real interest rates. Keep on reading @ mineweb.com |

| Good News: The Impending Gold & Silver Launch Posted: 27 Apr 2012 06:46 AM PDT

from news.goldseek.com: Since late February, 2012, The Cartel* has ground Gold and Silver Bullion and the Mining Shares Prices Down. This is especially frustrating for those invested in Mining Shares, because they have been Technically "Due" for a Powerful Breakout for weeks. (As "Paper" Securities, Mining Shares are especially susceptible to Cartel Price Suppression.) But the Fundamentals for Bullion and Mining Shares are ragingly Bullish. With Central Banks having added Trillions in various forms of QE (i.e., Money Printing) in the last three years, the Purchasing Power of the Fiat Currencies increasingly continues to erode. This is what happens to all Fiat Currencies when the Nominal Value of the Money Printed exceeds the Real Value of Increases in Goods and Services produced. So it is not surprising that The Cartel continues to relentlessly attack Precious Metals and Tangibles Prices. The Cartel wants to have investors continue to be wedded to its Paper Fiat Currencies and Treasury Securities because they are the source of its Power and Wealth. In sum, by its ongoing Precious Metals Price Suppression operations, the Cartel is conducting an intensifying War against Positive P.M. Sentiment. But Price Suppression of Gold and Silver Shares and Bullion can not last. Keep on reading @ news.goldseek.com |

| Futures exchange to offer contracts for Silver Posted: 27 Apr 2012 06:45 AM PDT

from chinadaily.com.cn: The Shanghai Futures Exchange received regulatory approval on Wednesday to start trading in silver contracts, giving Chinese investors a new way to bet on the precious metal. Keep on reading @ chinadaily.com.cn |

| Gold Traders Get More Bullish as Central Banks Hoard More Posted: 27 Apr 2012 06:43 AM PDT

from businessweek.com: Gold traders are more bullish after central banks expanded their bullion reserves and hedge funds increased bets on a rally for the first time in three weeks. Fourteen of 28 analysts surveyed by Bloomberg expect prices to gain next week and nine were neutral, the highest proportion in two weeks. Mexico, Russia and Turkey added about 44.8 metric tons valued at $2.4 billion to reserves in March, International Monetary Fund data show. Fund managers raised their so-called net-long positions by 2.5 percent in the week ended April 17, according to the Commodity Futures Trading Commission. Federal Reserve Chairman Ben S. Bernanke said April 25 that he's prepared to "do more" if needed to spur the economy, and the Bank of Japan (8301) today expanded its bond-purchase plan by 10 trillion yen ($124 billion). Gold rose about 70 percent as the Fed bought $2.3 trillion of debt in two rounds of quantitative easing ending in June 2011. The U.K. fell into its first double- dip recession since the 1970s, data showed April 25, while the IMF predicts the 17-nation euro region will contract. "Ultra-loose monetary policies of recent years don't look like they're going to end any time soon," said Mark O'Byrne, the executive director of Dublin-based GoldCore Ltd., a brokerage that sells and stores everything from quarter-ounce British Sovereigns to 400-ounce bars. "The problems in the euro zone don't look like they're going to end any time soon. We've had a dip, and our advice to clients is always to buy the dip." Keep on reading @ businessweek.com |

| Central Bankers Lead The Way on Gold Posted: 27 Apr 2012 06:42 AM PDT

from sharpspixley.com: After the widely anticipated FOMC meeting on Wednesday, gold futures ended up down only $1.5 or -0.09 percent. Intra-day gold fell $15 to $1,625 after the FOMC policy statement was out, and then swiftly rebounded to $1,650 and settled at $1,642.3. Gold futures rose $18 to 1,660.5 on Thursday but fell to $1,656 on Friday Asian morning after S&P cut Spain's credit rating to BBB+ because of Spain's worsening fiscal trajectory. S&P rose 1.7% and the Stoxx was up 3.4% in the past 2 days. There is still no imminent QE3. However gold did not plunge but actually went up this time. What has seemingly cheered the gold market? In sum, Bernanke is still cautious as the statement says interest rate will be kept low at least until late 2014. While the Fed upgraded the US economic growth and unemployment outlook for this year, they lowered economic growth in 2013 and also viewed that the unemployment rate was not declining fast enough to the long-run rate of 5.2 to 6 percent. With the economy moderately improving, the Fed is not willing to do more policy easing now but is prepared to do more to meet growth and inflation target and leave bond purchasing option on the table. Why, this is because U.S. fiscal tightening towards year-end and the sovereign crisis in Europe will dampen the US economic growth outlook. In Japan, the BOJ Governor increased monetary stimulus on Friday by stepping up bond purchases and extending maturities as economy is not doing so well. Dovish central bankers are good for gold. Gold traders are getting more bullish and expect price to rally next week, according to Bloomberg, as the IMF data showed at least twelve central banks bought an estimate of 58 tonnes of gold in March. Central bankers see gold as a safer alternative to fiat currency. Keep on reading @ sharpspixley.com |

| Spain's Collapse is No Little Thing Posted: 27 Apr 2012 06:34 AM PDT

from thedailybell.com: S&P cuts Spain's credit rating by two notches to BBB+ … Standard & Poor's cut Spain's sovereign debt rating Thursday by two notches, warning that the government's budget situation is worsening and that is likely to have to prop up its banks. S&P cut the country's rating to BBB-plus and added a negative outlook, saying it expected the Spanish economy to shrink both this year and next, raising more challenges for the government. Esther Barranco, a spokeswoman for the Economy Ministry, told Reuters: "They haven't taken into consideration the reforms put forward by the Spanish government, which will have a strong impact on Spain's economic situation." S&P also said that eurozone-wide polices were failing to boost confidence and stabilize capital flows, and that the region needed to find ways to directly support banks so that governments were not forced to take on those burdens themselves." – UK Telegraph Dominant Social Theme: It's just a downgrade. Spain will bounce back. Free-Market Analysis: Is Spain beginning to collapse and, perhaps, the EU with it? For well over a thousand years, Spain has been at the epicenter of Europe and its fate has provided a bellwether for Europe's larger situation. And whither Europe goes, so goes the West. The S&P downgrade on its face is just further confirmation of what is taking place in Spain. Of itself, it has little impact on the larger picture except to make borrowing a bit harder. Keep on reading @ thedailybell.com |

| Posted: 27 Apr 2012 06:28 AM PDT The so-called "recovery" story is alive and well in the mainstream media despite fact there is little evidence there is a real recovery. On Wednesday, Federal Reserve Chief Ben Bernanke raised his forecast for growth and said the economy was improving. Really? from usawatchdog: Bernanke reaffirmed near zero percent interest rates through 2014 and said, this week, that more bond buying or money printing "remain very much on the table." Is that the sign of a good economy? How about the record number of Americans that are on food stamps? How about the latest Case-Shiller report that showed housing prices downâ€"again? How about the recent unemployment report that was not so hot? If unemployment was measured the way it was by Bureau of Labor Statistics in 1994 and earlier, it would be north of 22%. That's right where it's been for months, and we still have a "recovery"? Russian Special Forces are training with U.S. forces in Colorado next month. The reason: to counter terrorists here in the U.S. That's a little frightening when you consider so many experts say the U.S. is on shaky ground financially. What are they preparing for–a financial collapse? A new Pew poll says only 33% of Americans think the federal government is doing a good job. Big surprise. North Korea made an unusually specific threat, this week, when it said it would reduce South Korea "to ashes in less than 4 minutes." Tensions are rising on the Korean peninsula since the failed North Korean missile test a few weeks ago. Newt Gingrich is out of the GOP presidential race, and that leaves just Romney and Paul. Paul vowed to stay in it until the convention, and he has the backing and money to do it. Speaking of Ron Paul, he is currently fighting against the Cyber Intelligence Sharing and Protection Act or CISPA. Dr. Paul says it is an assault on the 4th Amendment (illegal search and seizure). If the bill is signed into law, it could allow Google and Facebook to report to the National Security Agency about Americans' private lives. Greg Hunter brings you all these stories and more from the USAWatchdog.com Weekly News Wrap-Up. ~TVR |

| Posted: 27 Apr 2012 06:26 AM PDT

from silverseek.com: „History does not repeat itself, but it sure does rhyme." (Mark Twain) Between 1970 and 1979, the silver price was increasing steadily from $1.50 to $6, before taking off in September 1979 from $10 to $50 within 5 months. During that bull cycle, demand for silver did not increase but actually declined (sharply in 1979). It was as late as 1983 when demand increased confidently from 12,000 to 27,000 tons per year until 2000 – yet the silver price was in a 20 year bear market during that time. In 2003, when silver started its new bull market, the demand actually dropped to 23,000 tons until 2005 – during which 2 years silver almost doubled from $4.50 to $8. Since 2005, demand is rising stronger than ever, having reached 33,000 tons in 2010, whereas the silver price is rising strongly as well. The initial comparisons indicate one important phenomenon in the silver market, namely that (industrial) silver demand is "price inelastic": that is, changes in price have a relatively small effect on the quantity demanded. The demand for other commodities is known to be "price elastic": that is, changes in price have a relatively large effect on the quantity demanded (if tomato prices blow up, go bananas). This basically translates into: no matter if the silver price crashes or explodes, demand – unimpressed – will keep its own dynamic pace, because demand does not respond to price changes. Firstly, silver is the most broadly used metal, because of its unique characteristics, such as highest thermal and electrical conductivity of all metals. In most of its few thousand application fields, silver is considered a non-substitutable product. In contrast for example, when the platinum price increases too strongly, automotive demand traditionally substitutes for cheaper palladium thus potentially driving down the platinum price. Secondly, silver typically makes up only a relatively small component in the total of the product and the total of its costs. Both these demand characteristics/inelasticities (not substitutable and small cost component) are crucial to understand the silver price, because they remind that no matter if price explodes or crashes, (industrial) demand virtually does not care, but keeps on consuming as per its own factors/fundamentals. Notwithstanding, an increased demand principally has a positive effect on the price, of course (GFMS expects fabrication demand in 2012 to rise by approx. 3-5% to around 29,000 tons silver, whereas fabrication demand accounts for more than 80% of total demand; fabrication demand includes industrial applications, photography, jewelry, coins and silverware). Keep on reading @ silverseek.com |

| Vision Victory: Raw Silver Analysis Posted: 27 Apr 2012 06:21 AM PDT |

| Gold’s Long-term Picture Remains Bullish Posted: 27 Apr 2012 05:53 AM PDT

Lately, gold has been a disappointment to many investors while it has been mostly treading water. Gold has traded well beneath its all-time high of $1,924 an ounce on September 6th and well above its subsequent low near $1,520 which took place in late December. Many anticipated higher prices this year, but the year isn't over yet, and neither is gold's long-term spectacular, secular bull market. We are now in one of those periods of consolidation that tries the souls of gold investors, tests their resolve and challenges their staying power. This is when the market takes a breather and adjusts to prepare for the next major move. If you need some encouraging news, according to the latest IMF statistics, at least 12 countries are known to have increased their gold reserves in March continuing a trend that goes back more than two years. Overall Central Banks appear to have purchased about 58 tons in the month, which suggests acceleration in their gold accumulation. The significant purchases were by Mexico, which increased its holdings by 16.81 tons; Russia with purchases of 16.55 tons and Turkey with 11.48 tons. The statistics only show the figures for those nations which are transparent in their reporting. In the past there have been some sharp 'upwards adjustments,' to gold reserves notably from China, which seems to like to accumulate its gold on the quiet. Last year Central Banks that do report their statistics bought 439.7 tons of gold and many gold analysts are predicting similar levels of purchases in 2012. And to think that years ago investors feared that the bull market will end a long time ago because of massive sales of gold by governments and monetary authorities over the world… Analyzing the fundamental situation and news is important, but the analysis would be incomplete without referring to charts. In today's essay, we will focus on the long-term charts of USD Index and S&P 500 and then briefly discuss the impact that they can have on the gold market. Let's begin with the analysis of the US Dollar Index (charts courtesy by http://stockcharts.com.) On the above chart we see that the sideways trading patterns continue between the two levels which are quite important from a technical perspective. These are the declining long-term support line and the horizontal support line based on the early 2011 high. At this point, the very-long term chart remains mixed with a bearish bias (after all, the prevailing trend is down). To illustrate how small the trading range has been for the USD Index recently, the past six Premium Updates have found the change from the previous week to be as follows: down .41, down .61, up .95, down .79, up .25, and down .39. So nearly every week saw a change of less than 1% for the index value of a week earlier, and with the good mix of ups and downs, this is a prime example of true sideways trading. Still, with the main trend being down, the odds are that the next significant move will take the USD Index lower, not higher. Having said that, let's take a look at the general stock market. From the long-term perspective, the bottom in the S&P 500 Index appears to be in. The support line based on previous highs has been reached and crossed but the breakdown failed. Prices bounced higher soon after reaching this line (based on 2011 high), and the long-term picture is bullish based on this development. The Correlation Matrix is a tool, which we have developed to analyze the impact of the currency markets and the general stock market upon the precious metals sector. Let's see how the above can translate into future price moves of gold. Since we are discussing the long-term impact, please focus on the 1500-trading-day column. The values of correlation coefficients are negative in terms of the relationship between precious metals (gold, silver, mining stocks) and the USD Index and they are mixed as far as metals-stocks link is concerned. Consequently, the rather negative long-term situation in the USD Index is what we should focus on and since its relationship is inverse, we can infer that the long-term picture for gold is indeed bullish. Summing up, both: fundamental and (indirect) technical factors provides with a bullish long-term outlook for the gold market. As far as short-term is concerned and whether the consolidation is over or not is a different matter and other factors (not mentioned above) must be taken into account. To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Gold & Silver Investors should definitely join us today and additionally get free, 7-day access to the Premium Sections on our website, including valuable tools and unique charts. It's free and you may unsubscribe at any time. Thank you for reading. Have a great and profitable week! P. Radomski * * * * *

Sunshine Profits provides professional support for Gold & Silver Investors and Traders.

All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Radomski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment