saveyourassetsfirst3 |

- Gold: The Ultimate Secular Stock Market Hedge

- More Insider Buying for Northern Tiger Resources (NTR.V)

- Poor Economic Numbers Cause U.S. Dollar To Stumble

- Jim Sinclair Has Something To Say

- Gold’s Long-term Picture Remains Bullish

- World Silver Survey 2012 Confirms Bullish Picture

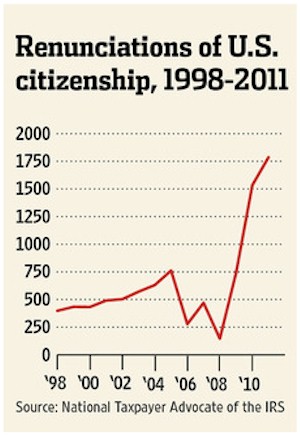

- Getting Out, Part One: Americans Renouncing Citizenship

- Butler: Return to the Gold Standard Inevitable

- The Silver Megathrust

- Paper Money: The Barbarous Relic

- Gold “Buying Opportunity” - Gold Analysts More Bullish On Central Bank Demand

- Large Cap Miners Underperforming the Juniors and Silver Stocks

- Silver Market Update

- Good News -- the Impending Gold & Silver Launch

- Long Interview with Jim Sinclair

- Shanghais futures exchange will offer contracts for silver

- Will a gold bar buy a case of beer?

- Gold Traders are Getting More Bullish as Central Banks Hoard More: Commodities

- Gold Daily and Silver Weekly Charts - Gold to $10,000 oz. - Walkin On the Sun

- Gold Traders Get More Bullish as Central Banks Hoard More

- Jim Grant – The People have had Enough, The Fed’s Atlas Complex

- Gold market takes big cues from the Fed

- Gold-starved Indians lap up gold ETFs

- Morning Outlook from the Trade Desk 04/27/12

- Dollar Slides, Metals Edge Higher on US GDP Tallies

- Paper gold market will disappear, von Greyerz tells King World News

- Bullion ‘Buying Opportunity’ – Analysts More Bullish

- IAMGOLD expands gold production pipeline in Canada with acquisition of Trelawney

- Commodities Look to US GDP to Offset Euro Jitters

- Central Bankers Leading the Way on Gold

| Gold: The Ultimate Secular Stock Market Hedge Posted: 27 Apr 2012 05:56 AM PDT By Eric Parnell: It is tough for gold to get respect. Many often conclude that only those investors filled with mistrust and paranoia about the current financial system hold gold. But here is the thing. If you took the name tag off of the asset class and examined it over history, many would likely conclude that gold is a category that demands close attention and deserves more esteem. First, any historical examination of gold as an investment must begin in 1971 when the direct convertibility of gold into U.S. dollars was officially eliminated and the gold price was free to fluctuate. Since that time, gold has generated an annualized return of just under +10% versus stocks as measured by the S&P 500 at just over +10%. Thus the rate of return is comparable. Moreover, the risk characteristics are also in the same ballpark, as gold has annualized return standard deviation of 23% versus Complete Story » |

| More Insider Buying for Northern Tiger Resources (NTR.V) Posted: 27 Apr 2012 05:34 AM PDT HOUSTON – The market for junior miners and explorers in general has been uncommonly harsh since early 2011 and it has been especially so for exploration companies focused in the Yukon Territory of Canada. Just below is a simple chart of the Canadian Venture Exchange Index or CDNX to show the nasty action. Looking down through our list of possible exploration discovery plays, the issuers who seem to have taken it on the chin (and to the gut, and to the shin, knee, neck and nose et al) … the ones who have been sucker punched the most are the companies we follow operating in really very, very promising areas in the highly prospective, but underexplored wilds of the Yukon.Even the companies that have already made a high-grade, interesting discovery have not been spared, such as the company we mention below. Fair warning and full disclosure, the company is a Vulture Bargain Company (VB; which means we own some shares and track it on charts shared with our subscribers here at Got Gold Report). We are anything but unbiased when it comes to our VB issuers. Northern Tiger Resources (TSX:NTR.V or NTGSF) has been trounced by a scared and fickle market; pummeled by persistent negative liquidity endemic to the entire small explorer sub-sector, which has been compounded by an off-season dearth of any news (since January). However, Northern Tiger is gearing up for its 2012 exploration season, armed with the knowledge and data they gathered in 2011 and the CEO of NTR, Greg Hayes, has been buying shares of his own company in the open market by the boxcar full near or above current pricing. Mr. Hayes is demonstrating his own confidence in NTR's "chances" in the most visible way possible. He's bought close to two million shares of NTR just since December. For those who have yet to look into the company, a good place to begin is NTR's corporate presentation, just updated for April, 2012 at this link. Pay particular attention to NTR's flagship prospect, the road accessible (that's pretty important) 3-Ace Project in the SE Yukon, where NTR has already drilled up to 30.3 meters of 4.3 grams per tonne (gpt) gold, including 1.05 meters of 145.2 gpt. (About 4.67 ounces per tonne.) While there savor the samples shown with visible gold galore. We have been interested in the 3-Ace project since the late David Coffin (HRA Advisors) mentioned to us his impressions of 3-Ace and another of NTR's highly prospective zones called "Sleeping Giant" which lies east of the 3-Ace Main Zone. As we understood him, David stood upon the ridge there at Sleeping Giant and said he could "see" the potential of a very large, possibly quite deep mineralized system there. We'll have more about that story for subscribers in the near future. David's brother, Eric Coffin, continues to cover Northern Tiger and keeps his HRA subscribers up with the latest intel from his well-placed offices in Vancouver. There are few wealth building services we recommend publically, but HRA is one of them. No one does a better job of discovering the early stage exploration companies than HRA in our own opinion. That's not the reason for this brief, though. The reason we are mentioning NTR today is because it is very close to its 3-year lows in price and has traveled deep into our "Vulture Road Kill Bargain" opportunity box, as shown in the chart just below. No wonder Mr. Hayes has been buying up so much of his own stock, eh? The stock has only been at these prices less than 1% of the time in the past three years. Having already bought close to two million shares from December to March, we couldn't help but notice that Mr. Hayes is not done buying yet, as shown in the table below courtesy of Ink Research. Last week Mr. Hayes added yet another 40,000 shares of NTR to his own holdings, at prices between $0.125 and $0.135. As we send this off to be posted, shares are changing hands in Toronto at C $0.11, but volume is exceedingly light. We wouldn't be at all surprised to learn that Mr. Hayes is actually on the bid here too, as they gear up for the Yukon exploration season just ahead. Catch the latest from Northern Tiger at the company website, here: http://www.northern-tiger.com/s/Home.asp Disclosure: Northern Tiger Resources is a Vulture Bargain Candidate of Interest (VBCI) and is our fully fledged Vulture Bargain #7. Members of the GGR team are actively accumulating and hold long positions in NTR.V or NTGSF. |

| Poor Economic Numbers Cause U.S. Dollar To Stumble Posted: 27 Apr 2012 05:15 AM PDT By Ralph Shell: After last weekend's election in France, where the incumbent Sarkozy finished poorly, many were expecting the euro to weaken versus the US dollar. Such was not the case, and to the chagrin of a market loaded with shorts, the euro worked higher. Uncertainty, something markets loathe, remains, as we work our way to the final May 6th date for the run-off election between Sarkozy, and the socialist Hollande. Experts agree the coming election will be close, and most of the polls project Hollande to be the winner. A differing view was offered by veteran journalist Arnaud de Borchgrave, who said: " French President Nicolas Sarkozy will "squeak through" his upcoming election and remain in office, but a Sarkozy loss would lead to a decline of the European Union that could render it "irrelevant." De Borchgrave also says a major issue in the French election is the war in Afghanistan, which Complete Story » |

| Jim Sinclair Has Something To Say Posted: 27 Apr 2012 05:06 AM PDT

from futuresmag.com: Jim Sinclair is not simply a gold bug; he successfully has called every major move in the precious metal — both up and down — over a generation. But he is not merely a market guru either. Sinclair has had a love affair with markets for 50 years. He has owned brokerages, clearing firms, mining companies and a precious metals dealer. His Sinclair Group of Companies, founded in 1977, offered brokerage services in stocks, bonds and commodities operating in New York, Kansas City, Toronto, Chicago, London and Geneva until he sold them in 1983. At one time he was considered the largest gold trader in the world, but today he is running his African-based Tanzanian Royalty Exploration Company and the MineSet web site that provides unique macroeconomic information to his loyal followers. Sinclair is a good person to listen to. Futures Magazine: You have been right on gold for years. How? Jim Sinclair: Gold has been a primary focus of mine for 50 years; I'm 71, if you put enough time into a subject you probably ought to get to know it. It became obvious to me that gold had performed extraordinarily well as a currency vs. the dollar; it performed very well in the 1980s and it performed very well on the downside. It was obvious to me that a turn was coming in 2001 and we reached a high in the U.S. currency and accordingly I felt we reached a low in gold. FM: As opposed to some gold analysts, you have not been a perma-bull. JS: There was an article in The Wall Street Journal in the 1980s that said "Bull takes off his horns," which dealt with my feeling that the gold market had maximized its price and for at least 15 years it would not be central to investor interest. I put an ad in Barron's in 1974, which they had a hard time with but finally accepted that [stated] "Gold at $900." My call over the past 10 years or so has been $1,650. It has gone beyond that; I put it as a minimum it would trade at in 2011. My calls in gold have had reasons and so far have been accurate. Keep on reading @ futuresmag.com |

| Gold’s Long-term Picture Remains Bullish Posted: 27 Apr 2012 05:01 AM PDT

from news.goldseek.com: Lately, gold has been a disappointment to many investors while it has been mostly treading water. Gold has traded well beneath its all-time high of $1,924 an ounce on September 6th and well above its subsequent low near $1,520 which took place in late December. Many anticipated higher prices this year, but the year isn't over yet, and neither is gold's long-term spectacular, secular bull market. We are now in one of those periods of consolidation that tries the souls of gold investors, tests their resolve and challenges their staying power. This is when the market takes a breather and adjusts to prepare for the next major move. If you need some encouraging news, according to the latest IMF statistics, at least 12 countries are known to have increased their gold reserves in March continuing a trend that goes back more than two years. Overall Central Banks appear to have purchased about 58 tons in the month, which suggests acceleration in their gold accumulation. The significant purchases were by Mexico, which increased its holdings by 16.81 tons; Russia with purchases of 16.55 tons and Turkey with 11.48 tons. The statistics only show the figures for those nations which are transparent in their reporting. In the past there have been some sharp 'upwards adjustments,' to gold reserves notably from China, which seems to like to accumulate its gold on the quiet. Last year Central Banks that do report their statistics bought 439.7 tons of gold and many gold analysts are predicting similar levels of purchases in 2012. And to think that years ago investors feared that the bull market will end a long time ago because of massive sales of gold by governments and monetary authorities over the world… Keep on reading @ news.goldseek.com |

| World Silver Survey 2012 Confirms Bullish Picture Posted: 27 Apr 2012 04:49 AM PDT

from goldmoney.com: The Silver Institute's "World Silver Survey 2012″ report hasn't surprised investors and market participants. Silver mining output hit record highs last year, while silver demand from end users and investors remained robust – despite silver's correction phase which started close to a year ago. The Silver Institute is one of the most important organisations in the silver sector, comprising producers, dealers and numerous companies that use silver. Thus, this study is of significance. Although global investment demand dropped slightly to 282.2 million ounces (8,766 tonnes) this marginal decline isn't too consequential, since in 2011 silver registered a higher average price than in the previous year. As a consequence, the financial value of global silver demand reached a new record high of almost $10 billion – a 73% increase on the previous year. Demand for silver coins and medals climbed by 129% to a new record high of 118.2 million ounces (3,677 tonnes). In comparison with 2010 demand for silver bars increased 67% to 95.7 million ounces (2,975 tonnes). Currently the silver price is moving in a fairly narrow trading range, oscillating around the $31.50 per ounce mark, which is an important resistance level. As the study shows, high investment demand last year was largely triggered by investors' increasing fears of a continuing devaluation of the US dollar and the euro. Many investors are keeping a close eye on the central banks and their moves – especially the US Federal Reserve (Fed) and the European Central Bank (ECB). Fears of continuous global debt monetisation are driving more and more investors to buy gold and silver Keep on reading @ goldmoney.com |

| Getting Out, Part One: Americans Renouncing Citizenship Posted: 27 Apr 2012 04:37 AM PDT Capital, like information, wants to be free. The idea that it should be limited to one country has always struck rich people as silly, which is why Swiss bank accounts, offshore trusts and Caribbean beachfront condos have been perennial big-sellers. But lately, the legitimate reasons for investing overseas have been joined by a couple of new ones: disgust with a ridiculously intrusive US tax system and worry that the country is becoming something different and less predictable. As the Wall Street Journal's William McGurn reports below, a small but growing number of Americans aren't just moving money offshore, but are renouncing citizenship altogether:

But the other motivation for getting out — fear that if we and our money stick around we'll be trapped by capital controls and then impoverished by inflation and confiscation — will be the driver going forward. The list of "creeping fascist" laws that have been proposed and/or passed lately reads like something out of a bad dystopian novel. Combine this evolving police state with never-ending wars and ever-rising debt and you have the recipe for a financial collapse/state of emergency in which no one's capital is safe. So the escape strategy is evolving to fit the new reality. Where in the past it seemed reasonable to stick around but move a bit of money offshore, now the goal is "internationalization," in which not just one's assets but one's identity is geographically diversified. That means a second passport to go with foreign real estate and bank accounts, to make a complete break possible should it be necessary. |

| Butler: Return to the Gold Standard Inevitable Posted: 27 Apr 2012 04:36 AM PDT A return to the gold standard is inevitable, perhaps as earlier as early next year. And gold prices could hit $10,000 per ounce so says a new book by Amphora CIO John Butler. from educationmonkey123: ~TVR |

| Posted: 27 Apr 2012 04:28 AM PDT if I wanted to sell silver today at the same price level as in January 1980 considering today's purchasing power of the dollar, silver would need to trade at around $500 today. |

| Paper Money: The Barbarous Relic Posted: 27 Apr 2012 04:02 AM PDT Gold is a barbarous relic. Even most ordinary people who rarely pay any attention to topics in the realm of economics will be familiar with this expression. Like most of the Big Lies from the media propaganda machine, our governments have made sure that most of us have heard this one enough times to have it burned into our psyches. As with most of these Big Lies, this too is a blatant perversion of the truth. It will come as no surprise to gold-bugs and that dwindling minority who advocate sound monetary policies that the reference to gold as a "barbarous relic" was made by the one-and-only John Maynard Keynes. It was from Monetary Reform, a book Keynes published in 1924 – and it was a reference not to gold itself – but to the gold standard: In truth, the gold standard is already a barbarous relic… Thus the original reference was made by the most infamous paper-printer in all of history, desperately searching for some insult he could hurl at the gold standard in order to attempt to make his monetary nonsense sound appealing to the Sheep – i.e. the global economics community. For those not familiar with the mechanics of national economies, the gold standard has often been referred to over history as "the Golden Handcuffs". How did it acquire this intimidating nickname? Because it absolutely limits our governments from any extreme/insane fiscal or monetary policies without the consequences of those policies being immediately known to the general public. A government trying to run huge deficits (like the U.S. government was doing during the Vietnam War), would quickly see its "bank account" (i.e. the national gold reserves) quickly evaporate as paying for those deficits emptied the government's Treasury. Thus ultimately the primary reason that a gold standard is despised (or rather feared) by all the charlatan money-printers like Keynes and the deadbeat governments of modern Western economies is that a gold standard forces governments to pay their bills. However, the fear/hatred of the Money-Printers and Deadbeats toward the gold standard doesn't end there, it only begins. By definition, a gold standard bases all new currency creation on one's national gold reserves. Thus these Handcuffs also prevent Keynes and all his central-banking ilk from allowing the printing presses to run wild with new money-printing – quickly destroying the value of any currency with dilution. So in addition to forcing governments to pay their bills it also forcibly prevents them from excessive money-printing. Two strikes against the gold standard. There is yet a third category of social miscreants who fear/despise a gold standard even more than the charlatan economists and deadbeat politicians – the thieving bankers. The bankers use excessive money-printing as their primary means of stealing all of the wealth of an entire society. Three strikes against the gold standard! The mechanics are simple arithmetic and thus totally incontrovertible. When you recklessly dilute the nation's currency at a rate of more than 10% per year (i.e. the 10+% "inflation rate" for the U.S. as calculated by John Williams of Shadowstats.com), but you only pay people near-zero interest rates on their savings then these people are effectively becoming 10% poorer each year with respect to those savings. Into whose pocket does all that money disappear? The pockets of the Thieving Bankers, who are legally allowed to print-up all this "money" for themselves absolutely for free. This act of theft; the largest, most blatant, and most pervasive form of theft in the history of the human race has been given an innocuous euphemism by the bankers, and their minions in the media propaganda machine: "fractional-reserve banking". |

| Gold “Buying Opportunity” - Gold Analysts More Bullish On Central Bank Demand Posted: 27 Apr 2012 03:07 AM PDT gold.ie |

| Large Cap Miners Underperforming the Juniors and Silver Stocks Posted: 27 Apr 2012 03:02 AM PDT |

| Posted: 27 Apr 2012 02:54 AM PDT |

| Good News -- the Impending Gold & Silver Launch Posted: 27 Apr 2012 02:49 AM PDT "The Fed is transferring immense wealth from the middle class to the most affluent, from the least privileged to the most privileged." Mark Spitznagel, Universa Investments L.P., 4/19/12 Since late February, 2012, The Cartel* has ground Gold and Silver Bullion and the Mining Shares Prices Down. This is especially frustrating for those invested in Mining Shares, because they have been Technically "Due" for a Powerful Breakout for weeks. (As "Paper" Securities, Mining Shares are especially susceptible to Cartel Price Suppression.) But the Fundamentals for Bullion and Mining Shares are ragingly Bullish. With Central Banks having added Trillions in various forms of QE (i.e., Money Printing) in the last three years, the Purchasing Power of the Fiat Currencies increasingly continues to erode. This is what happens to all Fiat Currencies when the Nominal Value of the Money Printed exceeds the Real Value of Increases in Goods and Services produced. So it is not surprising that The Cartel continues to relentlessly attack Precious Metals and Tangibles Prices. The Cartel wants to have investors continue to be wedded to its Paper Fiat Currencies and Treasury Securities because they are the source of its Power and Wealth. In sum, by its ongoing Precious Metals Price Suppression operations, the Cartel is conducting an intensifying War against Positive P.M. Sentiment. But Price Suppression of Gold and Silver Shares and Bullion cannot last. Jim Sinclair explains why "The European Stabilization Mechanism Treaty due to pass in July this year will take care of whatever money is required by Spain or any other Euroland nations for effective bailout. It starts with $700 billion in capitalization and has an open call for additional capital infusion with no limit placed on these calls and no further agreements required. "New additional capitalization called on by this treaty is mandatory, not elective and therefore will go to infinity. "The member nations have 7 days to pay up when ordered to by the management of the EMS who are protected against any form of attack or litigation to legislation. It will be backed by the US Fed via swaps while the US publicly denies it is adding any capital to the IMF or this new entity, ESM. "It is the mechanism for QE to infinity in Europe. "QE to infinity, properly understood, is debt monetization on steroids. Denials will be legion, but this debt monetization on steroids will not and cannot be avoided. "The advent of the ESM Treaty establishing the European Stabilization Mechanism is economically Earth shaking and recognized by almost no one out there. It cannot be otherwise, it cannot be avoided. It can be denied but it will occur."(emphasis added, ed.) "ESM Will Supply Whatever Money Is Needed In Euroland" Jim Sinclair, JSMineSet.com, 4/24/12 "QE to Infinity" (i.e., Money Printing to Infinity) entails continuing Diminishment of the Purchasing Power of Currencies printed. Think Weimar Republic, and , more recently, Argentina and Zimbabwe. (One is reminded of the "No Zim Dollars in the Loo, Please!" sign.) "Debt Monetization on Steroids" does not provide Solutions, it just buys time, while it worsens The Problem. Unfortunately, Money Printing to Infinity also necessarily entails eventual Price Hyperinflation. Indeed, Price Inflation is already occurring; it is just concealed by Bogus Official Figures. The U.S., for example, is already at Threshold Hyperinflation with Real Inflation of 10.28%.* Thus, The Purchasing Power of Money Vanishes. "Issuing debt and printing money do not create wealth. All they can create is a temporary illusion of wealth. "I could have written "if all the money vanishes," but that would be misleading, for all unbacked money will most certainly vanish into thin air. The only question is when, not if. Frequent contributor Harun I. explains why: Those who fail to understand that the Status Quo is impossible to maintain will be shocked when the disintegration is undeniable. …Words like capitalism and meritocracy are thrown around to make people feel good when, in reality, we have never owned anything, not even ourselves. How can we own ourselves when the very thing we use for subsistence can be cheapened or reduced to nearly nothing, not by market forces, but by central banks acting at the behest of governments? When a person does not control his labor, what is he? I wait patiently for people to come to the understanding that the only way for everyone to get their money would be to destroy its value completely… As the exponential debt curve moves closer to the pure vertical, the rate at which debts come due will approach infinity. How many more food items be made smaller and sold at the same price? In effect this is a slow starvation of those at the margin. The 46 million American souls on food stamps will soon find their food stamps to be worthless. Those who assert that a credit system cannot go hyper-inflationary may not have thought through the exponential effects on the relationship of the debt and productivity curves within the context of all money is debt and the only way to create money is for debt to be created. Eventually the debt curve accelerates away from the productivity curve, then the productivity curve collapses all together. Sovereign debt crises caused by governments stepping in to keep the debt system going is the last stage. Then comes the debt/currency collapse. "Thank you, Harun. Many observers have addressed the key concept here, which boils down to this: paper money is an abstract representation of the real world. "Here is the primary point: issuing debt and printing money do not create wealth. All they can create is a temporary illusion of wealth. "Creating debt and paper money does not create real goods and services or real wealth. "Just as on the desert island, the growth of actual goods (and services –Ed.) in the real world lags the growth of money, i.e. abstract representations of real goods. "The U.S. Central State (Federal government) has borrowed and squandered $6 trillion over the past four years, and the actual production of goods and services has not risen at all when adjusted for inflation. The central bank (the Federal Reserve) has expanded its balance sheet by $2 trillion, and yet all the assets it have tried to force higher are actually lower when measured in real goods such as gold, oil, wheat, etc. "It's easy to expand the money supply and difficult to expand the actual production of real goods in the real world. "This is why Greek towns are reportedly reverting to barter, the exchange of real goods for other real goods. We can anticipate that silver and gold will soon enter the barter as means of exchange that can't be counterfeited or printed by wise-guys (central bankers). "What Happens When All The Money Vanishes Into Thin Air?" Charles Hugh Smith, OfTwoMinds.com, 4/24/12 Indeed, the Key Reason Gold and Silver (and essential Tangibles like Oil and Wheat) will launch up is that Gold, Silver, Crude Oil and Wheat (e.g.) are Tangible Stores and Measures of Value. As the Central Bank-created Hot Fiat Money Winds its way into Prices (as it is already doing with Crude), the Price of these in Fiat terms will (and is already in some Sectors, if one considers mid and long term trends) soar (Deepcaster forecasts Timing and identifies P.M. Assets with especially Excellent Potential in his recent Alerts.) Specifically regarding Gold, that is because "…Gold is not just another market. It is the currency of last resort with no liabilities attached to it and certainly no connection to the Western Powers which are presiding over their own financial downfall by their insistence on papering over their structural problems. "The gold shares, as exemplified by the HUI continue getting more and more undervalued in relation to gold itself. At some point, these shares are going to be the trade of the decade. You now have to move as far back as early 2002, a FULL DECADE AGO, to find the shares at this level of valuation against an ounce of gold. Heaven help the shorts in these shares when the tide reverses - there will be no one left to sell to as they try to cover." "Gold Chart and Some Comments," Dan Norcini, 4/24/12 Short-term other Assets (such as High-Yielding Securities) can be (and should be) profitably held (See Note 2) as Profitable Antidotes to Real Inflation. But for the Mid and Long Term, Gold and Silver and mining shares and selected Tangibles are Essential Core Holdings to Garner both Gain and Protection. Best regards, Deepcaster April 26, 2012 Note 1: We encourage those who doubt the scope and power of Overt and Covert Interventions by a Fed-led Cartel of Key Central Bankers and Favored Financial Institutions to read Deepcaster's December, 2009, Special Alert containing a summary overview of Intervention entitled "Forecasts and December, 2009 Special Alert: Profiting From The Cartel's Dark Interventions - III" and Deepcaster's July, 2010 Letter entitled "Profit from a Weakening Cartel; Buy Reco; Forecasts: Gold, Silver, Equities, Crude Oil, U.S. Dollar & U.S. T-Notes & T-Bonds" in the 'Alerts Cache' and 'Latest Letter' Cache at www.deepcaster.com. Also consider the substantial evidence collected by the Gold AntiTrust Action Committee at www.gata.org, including testimony before the CFTC, for information on precious metals price manipulation. Virtually all of the evidence for Intervention has been gleaned from publicly available records. Deepcaster's profitable recommendations displayed at www.deepcaster.com have been facilitated by attention to these "Interventionals." Attention to The Interventionals facilitated Deepcaster's recommending five short positions prior to the Fall, 2008 Market Crash all of which were subsequently liquidated profitably. Note 2: There are Magnificent Opportunities in the Ongoing Crises of Debt Saturation, Rising Unemployment, negative Real GDP growth, nearly 11% Real U.S. Inflation (per Shadowstats.com) and prospective Sovereign and other Defaults. One Sector full of Opportunities is the High-Yield Sector. Deepcaster's High Yield Portfolio is aimed at generating Total Return (Gain + Yield) well in excess of Real Consumer Price Inflation (10.28% per year in the U.S. per Shadowstats.com). To consider our High-Yield Stocks Portfolio with Recent Yields of 18.5%, 8.6%, 10.6%, 26%, 6.7%, 8%, 10.6%, 14.9%, 10% and 15.6% when added to the portfolio; go to www.deepcaster.com and click on 'High Yield Portfolio'. |

| Long Interview with Jim Sinclair Posted: 27 Apr 2012 01:44 AM PDT |

| Shanghais futures exchange will offer contracts for silver Posted: 27 Apr 2012 01:29 AM PDT China Daily |

| Will a gold bar buy a case of beer? Posted: 27 Apr 2012 01:24 AM PDT |

| Gold Traders are Getting More Bullish as Central Banks Hoard More: Commodities Posted: 27 Apr 2012 01:22 AM PDT |

| Gold Daily and Silver Weekly Charts - Gold to $10,000 oz. - Walkin On the Sun Posted: 27 Apr 2012 01:11 AM PDT |

| Gold Traders Get More Bullish as Central Banks Hoard More Posted: 27 Apr 2012 01:02 AM PDT ...The Bernanke...." we own/buy gold because it's ...aah...tradition..yeah...thats it!" [paraphrased sarcasticly] Gold traders are more bullish after central banks expanded their bullion reserves and hedge funds increased bets on a rally for the first time in three weeks. Fourteen of 28 analysts surveyed by Bloomberg expect prices to gain next week and nine were neutral, the highest proportion in two weeks. Mexico, Russia and Turkey added about 44.8 metric tons valued at $2.39 billion to reserves in March, International Monetary Fund data show. Fund managers raised their so-called net-long positions by 2.5 percent in the week ended April 17, according to the Commodity Futures Trading Commission. Federal Reserve Chairman Ben S. Bernanke said April 25 that he's prepared to "do more" if needed to spur the economy, and the Bank of Japan (8301) today expanded its bond-purchase plan by 10 trillion yen ($124 billion). Gold rose about 70 percent as the Fed bought $2.3 trillion of debt in two rounds of quantitative easing ending in June 2011. The U.K. fell into its first double- dip recession since the 1970s, data showed April 25, while the IMF predicts the 17-nation euro region will contract. "Ultra-loose monetary policies of recent years don't look like they're going to end any time soon," said Mark O'Byrne, the executive director of Dublin-based GoldCore Ltd., a brokerage that sells and stores everything from quarter-ounce British Sovereigns to 400-ounce bars. "The problems in the euro zone don't look like they're going to end any time soon. We've had a dip, and our advice to clients is always to buy the dip." Gold Gains Gold rose 5.7 percent to $1,656.10 an ounce this year on the Comex in New York, and is now 7.6 percent below this year's peak. The Standard & Poor's GSCI gauge of 24 raw materials climbed 5.8 percent as the MSCI All-Country World Index (MXWD) of equities added 9.5 percent. Treasuries gained less than 0.1 percent, a Bank of America Corp. index shows. Options traders are also bullish, with the most widely held contract on futures traded on the Comex conferring the right to buy at $2,200 by July, 33 percent above prices now. The seven most popular options give owners the right to buy at prices ranging from $1,800 to $2,300, bourse data show. Central banks are joining investors in buying gold, adding 439.7 tons in 2011, the most in almost five decades, the London- based World Gold Council estimates. They may buy a similar amount this year, it predicts. Mexico bought 16.8 tons last month as Russia added 16.5 tons and Turkey's holdings expanded by 11.5 tons. Kazakhstan, Ukraine, Tajikistan and Belarus also raised reserves, according to the IMF. Hedge Funds Speculators increased wagers on price gains to 112,275 futures and options, from a three-year low the previous week, CFTC data show. The net-long position is still 56 percent below the peak reached in August. That provides "ample room" for new long positions, Edel Tully, an analyst at UBS AG in London, wrote yesterday in a report. Investors own 2,389.6 tons in bullion-backed exchange- traded products, within 0.9 percent of the record reached on March 13, data compiled by Bloomberg show. Demand for bullion coins is weakening, with the U.S. Mint selling 17,000 ounces so far this month, compared with an average 75,917 ounces in the previous 12 months, data on its website show. The Fed said two days ago that growth will "pick up gradually" as the labor and housing markets show signs of improvement. About $4.99 trillion was added to the value of global equities this year on optimism the world will skirt another recession. The IMF raised its global growth outlook to 3.5 percent from 3.3 percent on April 17, while forecasting a 0.3 percent contraction in the euro area. U.S. Recovery "If people really believe that the U.S. recovery is coming through, I think they will buy equities," said Carole Ferguson, an analyst at Fairfax IS in London. "Gold is more likely to go sideways." Other investors may also be shunning gold. Open interest, or contracts outstanding, in U.S. futures declined to 395,389 on April 24, the lowest level since September 2009, bourse data show. That contrasts with combined open interest across the 24 commodities in the S&P GSCI, which rose 18 percent this year. Bullion slid from a record $1,923.70 in September, taking it below the 200-day moving average, a sign of more declines to some investors. That may present a "buying opportunity," GoldCore's O'Byrne said. Prices held above the measure from the beginning of 2009 through the end of last year. The metal will trade at $1,940 in 12 months, Goldman Sachs Group Inc. said in an April 24 report. The bank maintained a neutral outlook on raw materials in the near term, partly because of European debt concerns. Benchmark Contract In other commodities, 12 of 28 traders and analysts surveyed by Bloomberg expect copper to climb next week and eight were neutral. The metal for delivery in three months, the London Metal Exchange's benchmark contract, rose 10 percent to $8,378.25 a ton this year. Six of 13 people surveyed said raw sugar will decline next week and three were neutral. The commodity dropped 8.9 percent this year to 21.23 cents a pound on ICE Futures U.S. in New York. Eighteen of 29 people surveyed anticipate higher corn prices next week, while 16 of 30 said soybeans will advance. Corn slipped 5.2 percent to $6.1275 a bushel this year as soybeans climbed 24 percent to $14.9175 a bushel. "It should be the macro factors and political uncertainties that influence the markets most, and less the fundamental factors," said Daniel Briesemann, an analyst at Commerzbank AG in Frankfurt. "The sovereign debt crisis should stay in focus. I think it's premature to say that we have seen the worst." Gold survey results: Bullish: 14 Bearish: 5 Hold: 9 Copper survey results: Bullish: 12 Bearish: 8 Hold: 8 Corn survey results: Bullish: 18 Bearish: 5 Hold: 6 Soybean survey results: Bullish: 16 Bearish: 6 Hold: 8 Raw sugar survey results: Bullish: 4 Bearish: 6 Hold: 3 White sugar survey results: Bullish: 4 Bearish: 7 Hold: 2 White sugar premium results: Widen: 5 Narrow: 2 Neutral: 6 To contact the reporter on this story: Nicholas Larkin in London at nlarkin1@bloomberg.net To contact the editor responsible for this story: John Deane at jdeane3@bloomberg.net |

| Jim Grant – The People have had Enough, The Fed’s Atlas Complex Posted: 27 Apr 2012 12:55 AM PDT Jim Grant repeats his message regarding the strange, manipulated markets we live in today thanks to the constant barrage of incorrect price signals an overly managed, heavily distorted, zero interest rate manipulated economy sends. Grant says the Federal Reserve suffers from an "Atlas Complex." The idea that the world would come to an end without them. In this Capital Account video interview Grant posits that if the Supreme Court strikes down Obamacare and Republicans win a majority in congress, both events could be positive for the financial markets. In response to the question of whether the global financial system might actually migrate to some kind of gold standard, Grant replies:"I think it is entirely possible. I think the people have just about had enough of our overfed needy and only cyclically solvent financiers. And the collective voice of these financiers in the councils of state, I think, is properly being marginalized. I'm not sure if the people are going to rise up in the next election. I'm not sure what the voice of the people in this respect is going to exactly sound like, or when they will be heard. But I have to believe people have had enough of zero percent interest rates for the savers – for artificially supported prosperity for the undeserving financiers. I can see every political piece of dry tinder in place ready for the match. (But) I'm not sure when the match will be dropped." The brilliant Dr. Grant has a much simpler and less burdensome answer to the problem of banks taking risk but not bearing risk than the idiotic 2,500 pages of Dodd-Frank (Ed. which never should have passed should be repealed ASAP). Grant calls it the "Isaac Claw-back Plan." It is as strongly and certainly powerful as it is elegantly simple to understand. See if you agree in the 28-minute video below.

Source: YouTube -- With a nod to Lauren at Capital Account for the interview (nicely done) and Zerohedge for the link. http://www.youtube.com/watch?v=ZxiwmzeCbhw&feature=player_embedded |

| Gold market takes big cues from the Fed Posted: 27 Apr 2012 12:47 AM PDT

from marketwatch.com: fter an impressive run to a record high near $1,900 an ounce in August of last year, gold hasn't been quite as exciting, but that may be changing with the market lately hanging on every whim or comment from the U.S. Federal Reserve. The gold market has been "seemingly boring, but rife with more upside potential and downside risk than most investors may realize," said Brien Lundin, editor of Gold Newsletter. From the start of this year, the chart of gold futures looked like a roller-coaster ride, beginning around $1,600 an ounce, gaining another $200 by the end of February and then trading in a tight range roughly between $1,600 and $1,700 for the last two months. On Wednesday, the Federal Open Market Committee policy statement and Chairman Ben Bernanke's news conference "provided little fodder for gold bulls or bears," said Lundin. Wednesday's post-Fed futures settlement showed only a $1.50 decline from a day earlier, but prices had fallen nearly $19 at one point to touch a low of $1,625. On Thursday, prices rallied over $18. "After initially dropping upon the release of the statement, gold quickly rebounded," Lundin said. "Obviously, quick-acting traders had […] searched the FOMC statement for any mention of quantitative easing and, having found none, sold gold. But a closer read, and Bernanke's comments, reveal that the Fed, if anything, is more open to monetary stimulus now than at the last meeting." Keep on reading @ marketwatch.com |

| Gold-starved Indians lap up gold ETFs Posted: 27 Apr 2012 12:44 AM PDT

from mineweb.com: ndia's penchant for the yellow metal continues to grow. Even as the price of physical gold hovers near a two month high, savvy retail investors have opted for gold exchange traded funds (ETFs), with the number of folios in this segment growing by 61% to 460,000 over a one year period ending March 2012, and by 11% in the past six months, according to available data. Keep on reading @ mineweb.com |

| Morning Outlook from the Trade Desk 04/27/12 Posted: 27 Apr 2012 12:33 AM PDT S&P downgrades Spain two notches, but the equity markets and surprisingly the Euro are relatively strong. Metals unchanged after yesterdays pop, but very susceptible to a headline story. Short term trend will be focused on the US$/Euro pricing. |

| Dollar Slides, Metals Edge Higher on US GDP Tallies Posted: 27 Apr 2012 12:32 AM PDT The US dollar and stock index futures frowned upon the GDP estimate and headed lower. The development may give gold players another chance at trying to go for the assault on the $1,660-$1,675 resistance area. |

| Paper gold market will disappear, von Greyerz tells King World News Posted: 27 Apr 2012 12:17 AM PDT |

| Bullion ‘Buying Opportunity’ – Analysts More Bullish Posted: 26 Apr 2012 11:49 PM PDT Gold is some 1% higher on the week in USD and EUR and the higher weekly close would aid the poor short term technical picture. Gold consolidated on the gains seen yesterday as the downgrading of Spain's credit rating added fuel. |

| IAMGOLD expands gold production pipeline in Canada with acquisition of Trelawney Posted: 26 Apr 2012 11:20 PM PDT TORONTO, April 27, 2012 /CNW/ - IAMGOLD Corporation (TSX: IMG) (NYSE: IAG) ("IAMGOLD" or "the Company") andTrelawney Mining and Exploration Inc. (TSX Venture:TRR)("Trelawney") today announced that they have entered into a definitive agreement (the "Agreement") whereby IAMGOLD will acquire, through a plan of arrangement, all of the issued and outstanding common shares of Trelawney. Trelawney is a Canadian junior mining and exploration company, focused on the development of the Côté Lake Deposit located adjacent to the Swayze Greenstone Belt in northern Ontario.Under the terms of the Agreement, each Trelawney shareholder will receive $3.30 in cash for each Trelawney share held. The transaction price represents a 36.6% premium based on Trelawney's 20-day volume weighted average price ("VWAP") for the period ending April 26, 2012. "The acquisition of Trelawney creates a larger and more geographically balanced portfolio of long-life gold assets forIAMGOLD. This transaction provides an accretive return on invested capital as we are effectively redeploying the cash proceeds from the sale of non-core assets last year into a Canadian gold project that significantly strengthens our future gold production profile. This is consistent with our strategy to invest in development projects that we own and operate so we can derive maximum benefit from leveraging our operational and development expertise. Trelawney is an excellent strategic fit with our existing Canadian portfolio and we look forward to advancing this promising property," stated Stephen Letwin, President and Chief Executive Officer of IAMGOLD. Trelawney's President and Chief Executive Officer Greg Gibson said, "Over the past three years, the Trelawney team has done a tremendous job in advancing the Côté Lake Project to its current status. I want to take this opportunity to thank all Trelawney employees for their contributions to the discovery and advancement of Côté Lake into a world class gold deposit. I am very proud of our success and the exceptional value that it has created for our shareholders. This acquisition will reward our shareholders with a significant premium that reflects this success." Transaction Highlights

Trelawney's main asset is the advanced exploration Côté Lake Project, located in Ontario, Canada. On February 24, 2012, Trelawney announced an updated mineral resource estimate for Côté Lake, comprising 35 million tonnes at 0.82 g/t gold for 0.93 million ounces of indicated resources and 204 million tonnes at 0.91 g/t gold for 5.94 million ounces of inferred resources. Mineralization at Côté Lake has been intersected over a strike length of 1,200 metres, a horizontal width of 100 - 300 metres and a depth extent of more than 500 metres1. Gordon Stothart, Executive Vice President and Chief Operating Officer of IAMGOLD stated, "This project has the potential to become a large bulk tonnage operation, with significant economies of scale at competitive cash costs. I'm excited to have this asset as part of our portfolio. We believe the project has the potential and scale to significantly contribute to our future production and growth profile." Terms of the Transaction

To read the entire press release follow the link below: April 27, 2012 (Source: IAMGOLD Corp)

|

| Commodities Look to US GDP to Offset Euro Jitters Posted: 26 Apr 2012 11:18 PM PDT Commodity prices are down in early European trade as risk aversion grips financial markets following a S&'s downgrade of Spanish credit. Sentiment-linked crude oil and silver prices are following shares lower while gold and silver face de-facto selling pressure. |

| Central Bankers Leading the Way on Gold Posted: 26 Apr 2012 11:07 PM PDT While the Fed is watching for any signs of US unemployment or European debt crisis to deteriorate before launching QE3, gold is likely forming a bottom. With the speculative net longs about 56% below that of August's peak, gold has room to rally. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment