saveyourassetsfirst3 |

- China Gold Imports Surging

- What Jim Chanos Is Missing On Coinstar

- Golden Eye of Hurricane

- John Embry talks with Chris Waltzek

- Endeavour Silver Corporation: Q1 Silver Production Up 19%

- Endless Mountain: Gold Silver Ratio

- Matt Stoller: Some Observations on the Second Lien Problem

- Possible Capitulation for The Little Guys?

- Nevsun’s Bisha Mine at the Golden Apex

- Gold Loves It: More QE Rumors

- Will Spain Send Gold to $2,000?

- The War at the End of the Dollar

- Gold Investment in 2012: The Bullish and Bearish Signals

- George Soros: Eurozone Crisis Has Entered “A Less Volatile but Potentially More Lethal Phase”

- Gold Equities Gaining Credibility: Doug Groh

- IMF: Gold Is Scarce “Safe Asset” And “Growing Shortage of Safe Assets”

- Getting Your Gold Out Of Dodge

- Longer-Term Investment ‘Driven by Low Rates & Inflation Fears’

- IMF: Bullion is a Scarce ‘Safe Asset’

- How Serious are China & India About Their Gold?

- Risk off? Having Sold Most of its Own, IMF Now Lauds Gold as 'Safe Asset'

- Richard Russell: Crime, Chaos, Collapse & Skyrocketing Gold

- Rick Rule Market Commentary

- Gold & Silver Market Morning, April 12 2012

- China's gold demand boosts prices

- Charles Biderman: Go Long Gold

- Silver Update: “Wallstreet Looters”

- JP Morgan Silver Manipulation

- Gold Rules In Vietnam

- Historicals silver production statistics in the United States

| Posted: 12 Apr 2012 06:25 AM PDT By Katchum: In December of last year there was a big concern that China would stop importing gold (GLD, PHYS) due to lack of demand. This was derived from the fact that gold imports from Hong Kong to China dropped 62% in December 2011. As a consequence, the gold price plunged from $1,700/ounce to under $1,600/ounce. Lately though, the gold imports from Hong Kong to China have stabilized around 40 tonnes/month (Chart 1). This drop of 62% seems to be huge, but when we look at the long term chart, the overall picture is entirely different.

On Chart 2 we see the long term chart for China gold imports. China's hunger for gold exploded just after the financial crisis of 2008. In 2011 China noted a 4 fold increase in imports.

Complete Story » | ||

| What Jim Chanos Is Missing On Coinstar Posted: 12 Apr 2012 06:17 AM PDT By Bill Wolf: Jim Chanos mentioned on CNBC on the morning of 4/12/12 that he is short Coinstar (CSTR). The rather obvious thesis was that streaming would someday supplant DVD rentals. He put Coinstar in the bucket of companies threatened by technological obsolescence. Fair enough, someday in the future it is likely that streaming overcomes physical distribution of media for movie rentals. But, that day is very far into the future. There are a few things that Mr. Chanos is missing in his analysis. Given the seeming similarities, Mr. Chanos is likely using the MP3 vs. CD analogy as justification for his belief. I believe that the fundamentals of the movie and music businesses are drastically different, thus altering the pace of obsolescence of physical media for the DVD rental market. Let's look at the simple fact that movies are often rented. Were CDs rented? No. Why would billion dollar businesses be built Complete Story » | ||

| Posted: 12 Apr 2012 05:32 AM PDT

What an incredibly complex confusing and treacherous month. It can be safely said that 80% of the activity is almost totally kept from the public. The financial system is breaking in an accelerated fashion. Compare to some grisly horror movie where a man is strapped in a chair. The more he moves, the tighter the bindings pull on his gasping throat and pressed nether stones. The most significant two factors at work are the Iran sanctions and their powerful backfire, and the futile efforts in Europe to stem the banking center collapse. The anti-USDollar federation that spans widely across the globe is gathering strong momentum. Financial aggression is being met by financial alternative development. As Greece moved off the daily news fabrication factory, the reality of a collapse in Spain and Italy has moved to the front center of observations. Meanwhile, the American nitwits continue to argue over Quantitative Easing when it never stopped, and in fact, went global under their noses. The US news machine, dominated by the syndicate, churns out absurdities after more nonsensical bites on an economic recovery. The subprime loan machinery has ramped up. The retail factor does not tell of strength, but of weakness. Spending on consumption does not indicate strength, but a path to ruin still not well recognized. The gap between reality and reports is diverging.

Back at the gold desk, another cartel member kill is in progress. A string of UBS-type gold arena deaths is the biggest untold story of the new decade. The UBS rogue trader story was a total fabrication, written and staged to conceal the removal of all UBS gold from their reserves inventory. They are a dead gold player. The gold community, even LeMetropole Cafe and GATA, appears to be missing the coalition kills taken place in sequence with each paper gold ambush. If the cartel wishes to drive down the paper gold price, then they must deal with the consequences of having one more cartel member bank offered on the physical altar in a death sacrifice. They are vulnerable from sovereign bond positions and weak currency positions. In the margin call vise, they must forfeit their gold, but in a long slow process as truly enormous physical gold orders are being filled over a pyramid of prices lower than the cartel bank wishes. Details are scanty, but the trail can be followed to some extent by false stories to cover the damaging tracks. The press did a wretched job in checking the facts on the UBS rogue story. The loss was over $6 billion. The trades were all approved at VP level. The trap was laid and UBS entered with both feet, the consequence for which was being expelled from the gold arena, probably forever, in a total loss of its gold bullion. No wonder the press did not report the actual story. It would have been a monster bull story for gold. If Barclays or Royal Bank of Scotland or Bank of America were having their golden blood removed on a table, with straps in place for directors of their gold desks, and hot pokers applied by coalition forces to extract their gold, the outcome dictated by incredibly insolvency and margin call vulnerability, the effect on the gold market would be magnificent. Such events are in progress in my opinion, based on some juicy information feeds. Rather than divulge the entire details of the cartel kill, the coalition prefers to move to the next victim in the Wall Street & London cesspool of finance.

What follows will not be presented in great detail. That is saved for the Hat Trick Letter reports, where research has come across magnificent events in progress. As the calm spreads like a fog over the financial sphere, the level of risk rises. As the phony recovery stories propagate like a disease from the host, the level of risk rises. As the US political race takes center stage and the stakes increase, the level of risk rises. Events are catapulting in a loose coordination that is very difficult to observe, except for the quicksand in Spain.

POWERFUL FALSE CALM EVENTS The subprime cancer has returned. The struggle to revive the credit engines has drawn the weaker elements into the room. Banks wish to lend more. While few players qualify for loan approval and partnership grants, the banks themselves have never been more insolvent. Without the FASB accounting largesse and generosity, all large US banks would be declared insolvent and prepared for liquidation proceedings. The junk bond warning lights are flashing. The movement to even remain standing still has come with greater risk assumed and embraced.

The anti-USDollar forces gather strength. The emerging nations had been making numerous significant bilateral agreements a month ago. The Iran oil deals had dictated some degree of innovation in payment systems in response. The sanctions forced their hands. Additional sanctions like usage of SWIFT bank systems as a weapon, threatening usage in Europe, resulted in a flash point. The BRICS nations, led by China, appear to be on the verge of launching a rival SWIFT bank procedure that might be critical in trade settlement. It is likely to be outside the US$ setting.

Prepare for the possibly sudden cardiac arrest event to the Petro-Dollar. In April 2010, a major conference took place in Abu Dhabi among Arab royals. They arrived in unmarked jets, over 200 strong in number. They struck important accords, including the reliance upon Russia and China in the security role for the protectorate. In essence, the Saudis worked to replace the United States in the protection racket that has endured since the 1973 embargo, manifested in trade surplus recycling, even as the Germans worked to establish the Eastern Alliance. If a new SWIFT system comes, then the foundation will be set to walk away slowly from the Petro-Dollar. Few see the pieces coming together. The impact on the USEconomy would be something between a wrecking ball and catastrophic.

China prepares to wrest control of the USDollar, for the stacks of reserves held outside the US boundaries. This is history in the making. If a Chinese USDollar is launched, and trades independently of the domestic USDollar, then it is Third World curtain time for the United States. The practical effect would be rampant price inflation from a devalued domestic Dollar. It would be rampant shortages, since the restated Dollar would not be a favored piece of paper, not with tremendous economic weakness, absent industry, insolvent banks, ruined states, bond fraud charges in every nook & cranny, war cost impact, and the big storm cloud of the runaway USGovt deficits which could tack on another $200 billion in March. The path is clear, which begins with over 50% in external held debt, then lost sovereignty, then foreign voices influencing key decisions, then wearing down the muscle mass of tools like the IMF and World Bank, and finally lost control of the global reserve currency. Never in history has a nation had control of its currency wrested by another nation. The reaction process by foreign entities to the USFed and USDept Treasury abuses to the USDollar in hyper monetary inflation have wrought vengeance at worst and survival tactics at best.

Germany has made preparations to leave the Euro currency union. The more accurate statement should be that Germany is preparing to take the Euro ball out of the park, to improve it, to sign new free agency team members, and to leave the Southern European nations to fend for themselves in a sandlot. The Latin remnant will be essentially bagholders left with the gristle, fat, and toxic matter of the Euro currency itself. What they hold onto will be devalued in a fast moving storm. The risk to Germany will be the opposite. They must sign up enough new trade partners so that whatever new currency (Nordic Euro, New Marc, Euro Mark) is not a victim of its own success. A fast rising new currency would inflict damage on the German export trade. Numerous financial safety nets have been created and loaded, designed to aid large German banks. Some might fail.

Spain is on the verge of rejecting the austerity measures and maybe the Euro currency. Refusal to swallow the poison pill might have some benefits, like not pulling the rug from under the economy in vast spending cuts. But the reality bites hard, as the Spanish Govt Bond yield will revisit its old high levels. Funding problems will become acute. Think NO WAY OUT. The 23% jobless rate in Spain is written like an unusual figure in the West, but it equals the United States. The US simply has better liars in the economic trenches and more thorough press control. The strain in Spain will likely rain chaos on the bond plains, sufficient to cause their leaders to show disdain for remaining within the strained Euro domain.

The USFed and Euro Central Bank are guilty of $5 trillion in paper binges in the last several months alone. The US Federal Reserve and the European Central Banks are operating like desperate siamese twins in the frantic rescue attempt to prevent a Western banking system collapse. ECB head Draghi might have expressed reluctance to trade in bad PIGS debt paper, but he has been the champion in EUR 3.1 trillion in window activity over just the last six months. Notice nothing is fixed despite the massive effort that has been no more than glorified paper mache application. It is a futile battle akin to the task of Sisyphus, who was forced to push a stone uphill, but every time he rested, it rolled back down the hill. Since the central bank paper merchants can only apply paper bandages to the paper wounds, the rotten limbs and appendages cannot distinguish between the old rot and the new fester that begins immediately upon treatment. Nothing is fixed, no remedy in place, none even attempted, nor is recognition of the problem part of the debate.

The US financial markets have become an abandoned playground left to the High Frequency Trading freaks and their cadre of corrupt video game ilk. Volume is way down on the NYSE. Fund outflows are magnificent for stocks, as the public aint so dumb after all. ETF-type congames are losing their appeal. As the LTRO effect wanes from central bank paper shell games played at windows, the financial markets are experiencing a vast low pressure zone. The windows will eventually all be shattered.

The US housing market is permanently destroyed. The Jackass has played word games since 2007 calling for a two-year decline. But my call has been repeated every year. Let the forecast be made in more plain terms. The US housing market will never come back. Its decline will go hand in hand with the deterioration of the USEconomy and lead the nation on the path to a USGovt debt default, accompanied by over 25 individual State defaults (called another name in legal parlance). The foreclosure parade is unending. The delinquencies mount unabated. The decline in home prices puts new household ranks into negative equity territory, exactly as Greenspan warned a year ago. What irony that the chief architect also acted as the Cassandra in warning. The banks refuse to liquidate, since doing so would expose their insolvent ruin and inflict even more deadly downdrafts in home prices, as well as expose the vast corruption among bonds, from false property titles to duplicate title usage to outright bond counterfeit, even to raids by past presidents.

The hidden factor in the systemic ruin was the China card played in the last decade. The decision to send US factories to Asia, starting in the 1980 decade with Intel to the PacRim, followed by a climax to China in the 2010 decade, will serve as the basis of a chapter in history that led to the US systemic ruin. The gold card was played within the Most Favored Nation status deal granted in 1999, since the Rubin team ran out of US gold, ran out of European gold, and needed fresh gold meat. The Chinese committed their gold hoard and promised to recycle trade surplus, just like the Saudis did with oil money. The Gold Carry Trade began but did not end with Fort Knox raids. The carry trade is the singlemost financial factor that pushed the nation to ruin. Nothing backs the USGovt debts, not with an empty Fort Knox, never to be audited, the home of nerve gas storage if truth be told. The deep storage gold on the USGovt balance sheets does not fool many people anymore, the subject of ridicule. The US is insolvent without collateral, facing a margin call, soon to lose control over its own currency. American life savings are at risk, while pensions have been gutted, but the sirens are silenced.

GOLD CONSOLIDATES IN REVOLVING DOOR Since October, the pressure has been squarely on the US and EU central bankers to print money, to direct it to insolvent giant banks, and to prevent a collapse. They reacted to sovereign bond pressures. But at the same time they had to exert extreme force on the gold market, so it did not reflect the extreme debasement of money itself. Thus the huge naked short ambushes of gold. But during these past six months, a new coalition has emerged to exact a heavy cost on the gold cartel. They will lose one additional cartel member to the gold war battlefield with each and every illicit paper ambush. A big order is being filled in the last two weeks, a very big order, at a low price, by brute force. The result will be another dead cartel member. Its completion will be followed by another nice price rise. Whether the cartel is willing to lose another member bank afterwards as the cost of yet another paper ambush, hard to know. But the unshakable fact is that the global monetary system is being ruined. The confidence in sovereign bonds is at rock bottom. In Europe it is more clearly in the open, but in the US it is more hidden, as the safe haven ruse plays on. Somehow a $200 billion single month deficit for the USGovt credit card line does not juxtapose well with any claim of being a safe haven, no more than a metal flagpole is during a lightning storm. The biggest buyers of the USTreasury Bonds are the USFed and its handy printing press, used and abused frantically and at high volume speeds. Distrust of the monetary system will bring about the rise of a new system, backed by gold. However, the old system cannot be permitted to fall unless and until the new system is ready, in place, and fully wired. That day is coming soon. The signposts are in place, the painted messages legible. home: Golden Jackass website Use the above link to subscribe to the paid research reports, which include coverage of critically important factors at work during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS. From subscribers and readers: At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

"Your monthly reports are at the top of my list for importance, nothing else coming close. You are the one resource I can NOT do without! You have helped me and countless others to successfully navigate the most treacherous times one can possibly imagine. Making life altering decisions during tough times means you must have all the information available with direct bearing on the decision. Jim Willie gives you ALL the needed information, a highly critical difference. You cant afford to be wrong in today's world." (BrentT in North Carolina) "You have warned over and over since Fall of 2009 that Europe would come apart and it sure looks like exactly that is happening. You have warned continually about the COMEX and now the entire CME seems to be unraveling. You must receive a lot of criticism regarding your analysis, trashing the man, without debate. Your work is appreciated. I do not care how politically incorrect or how impolite your style is. What is happening to our economy and financial system is neither politically correct or polite." (DanC in Washington) "The best money I spend. Your service is the biggest bang for the buck." (DaveJ in Michigan) "As the nation screams down the mountain out of control into the abyss, it is good to have a guide. Jim Willie helps to understand what is happening and more important, why. With that information, you can make the right decisions to protect yourself from the current apocalyptic catastrophe. Forget the MSM propaganda. Here is offered good in-depth actionable reports that are the most insightful and valuable." (AlanS in New Mexico)

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com. For personal questions about subscriptions, contact him at JimWillieCB@aol.com | ||

| John Embry talks with Chris Waltzek Posted: 12 Apr 2012 05:30 AM PDT

About GoldSeek Radio: More interviews @ radio.goldseek.com | ||

| Endeavour Silver Corporation: Q1 Silver Production Up 19% Posted: 12 Apr 2012 05:28 AM PDT In our mail box this morning we have this news release from Endeavour Silver Corporation (EXK) which reported Record Production in First Quarter, 2012; producing 1,072,491 oz Silver, Up 19% and 6,321 oz Gold Up 26%, both of which are new production records. Revenues were up 39% to US$49.0 million thanks to both the higher metal production and higher realized gold prices. Now, before we look at the highlights we would like to draw the readers attention to the fact that Endeavour Silver is now one of few silver producers who are using part of their production as a mechanism for saving. Instead of having all of their profits in dollars, they now take a view of the market and decide just how much of their production will be sold in order to cover their needs and withhold the rest. In our view the management ought to be commended for Complete Story » | ||

| Endless Mountain: Gold Silver Ratio Posted: 12 Apr 2012 04:08 AM PDT | ||

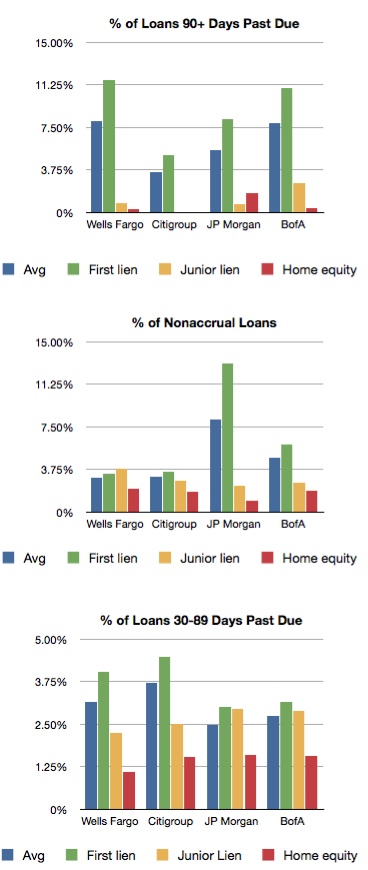

| Matt Stoller: Some Observations on the Second Lien Problem Posted: 12 Apr 2012 04:00 AM PDT Matt Stoller is a fellow at the Roosevelt Institute. You can follow him on twitter at http://www.twitter.com/matthewstoller Over the past three years, the big four servicers have been keeping hundreds of billions of dollars of second mortgages on their books (mostly in the form of Home Equity Lines of Credit, or HELOCs). Many of these mortgages would seem effectively worthless, because a home equity line of credit or second mortgage on top of an already deeply underwater first mortgage has no value. You can't use it to foreclose, because you'd get nothing out of the foreclosure – all of that would go to the first mortgage holder (usually some investor in a pension fund somewhere). It has only "hostage value", or the ability to stop a modification or write-down from happening. The best way to clean up this situation is to have the regulators (FDIC, OCC, Federal Reserve) simply tell the banks that they must write down their second mortgages on collateral that has been impaired. That way, the incentive problem goes away. By forcing the bank to recognize the loss now, the bank will no longer stop a modification on a first mortgage. And in fact, the regulators pretty much agreed that this is what their examiners should do, when they issued new rules earlier this year on accounting for second liens. Only, the regulators haven't done it, because the banks claim their seconds are performing. Bank of America says that these loans are worth 93 cents on the dollar. Several of the other banks don't break out their loss reserves for seconds, so it's hard to tell, but I think it's clear they aren't reserving enough. We can tell that because the Federal Reserve itself is dramatically overvaluing these seconds. In a stress test, the Fed said in its worst case scenario that the banks would lose only "$56 billion". These are low numbers. According to their most recent investor report, Wells Fargo alone has $35 billion of second liens behind first mortgages that are underwater. I did an analysis of some of these numbers, downloading FDIC data on the bank holding company level. I'm not a bank accountant, so I ran these numbers by a few people who know what they are doing, and they were not surprised by what I found. Here' the percentage of loans at various stages of impairment, by loan type. You can see that junior liens and HELOCs do far better than first mortgages, which is puzzling considering that delinquency rates are still at crisis-era levels. Something interesting happens at 90+ days, where essentially no seconds get put into that category. In fact, Citi has zero seconds in the 90+ days past due category, which a Citi rep told me was because they place their 90+ day plus loans in the non-accrual category. And the Citi rep. wouldn't tell me how much the bank is reserving for these seconds, nor would he tell me how many of these loans are amortizing, or being paid off (more on that later). Citi's actually in the best shape of any of the banks regarding these seconds, with a book about a third the size of Bank of America, Wells, and JPM Chase. These second liens are doing really, really well. Oddly well. So how valuable are these seconds? I took a look at the expansion of the second lien book for the top four servicers (you can see my spreadsheet here). Basically there was a massive expansion of these second liens from 2007-2008, and then a very slow reduction of the books from 2009 onward. The banks extended a lot of credit in 2008, and have been withdrawing it ever since. But it's not as if their loan books are entirely going down because the loans are being paid back. They are going down because some of it is being paid back, and some is being charged off. There's a mix of healthy payoffs and unhealthy charge-offs. That means we can sort of assess how healthy these loans are overall by looking at the mix. And indeed, for the top four banks, the trend is positive. From 2009 to 2010, for instance, Wells reduced its second lien exposure by $4B. But it wrote off $5B of second liens! That means it was actually extending more loans than it was paid back, even as its loan book shrank. Very bad. JP Morgan, Bank of America, and Citi weren't quite as bad, but their experience with second liens from 2009-2010 wasn't good. This improved the next year. The latest data we have is that from the end of 2010 to the end of 2011, Wells reduced its HELOC book by $7B, with $3B or 45% of that being charge-offs. Citi's percentage was roughly 40% ($2B reduction, $900M in charge-offs), JPM's percentage was roughly 20% ($7B in reductions, $1.9B in charge-offs), and Bank of America was roughly 40% ($9B in reduction, $3.6B in charge-offs). There are other reasons to think these liens aren't worth 93 cents on the dollar and should be written down. For instance, Ed DeMarco recently discussed second liens behind Fannie/Freddie loans. Here's what he said.

That's a lot to write off. And I've seen a securitization of quality Countrywide second mortgages that were actually securitized, and so do not face the same accounting fraud and conflict of interest problems. On that trust, losses were upwards of 30%, so far. The real question here is data. We don't know a lot about this market, and the banks like it that way. They don't have to write down their seconds, they don't have to take a big capital hit, and the OCC gets to continue its love affair with the banks. But I suspect, based on what I've seen here, that examiners should begin to demand more information from their banks on whether these second liens are really worth what they say they are worth. Otherwise, the foreclosure crisis will continue, investors and homeowners will continue to bear losses, and blight will spread as vacant homes continue to have their copper wiring stripped out. I welcome your thoughts and comments, as this is somewhat new territory for me and I would like corrections on where I've gone wrong. | ||

| Possible Capitulation for The Little Guys? Posted: 12 Apr 2012 03:39 AM PDT Houston -- From the Chart Book. As Vultures (Got Gold Report Subscribers) already know, because they have 24/7 access to all of our forty-something technical charts for gold, silver, mining shares big and small, our Vulture Bargain small resource related companies, etc., we reentered the Market Vectors Junior Gold Miners Index ETF (GDXJ) from the long side on April 10. Just below is just one of the factors that led to our decision to attempt a reentry then.

Naturally, as is our habit with all of our short-term trading positions, we have put in an appropriate new-trade trading stop, which we disclose and update in a dialog box in the GDXJ trading chart, which is also available to Vultures on the GGR Subscriber pages.

Volume Candle Charts are very useful and are a worthy addition to a trader's arsenal of trading tools, provided one spends enough time with them to gain an understanding of the Volume Candle Chart personality in general and its relationship to the issue being traded in particular. For context, below is a simple GDXJ chart showing another of the reasons we have attempted a reentry now. Simply put, GDXJ had reached an area where the chart "said buy." (A retest of the falling wedge into known support.) We plan to update our trading stop and trade changes often, directly in the Subscriber Charts looking ahead. As always the first place to look for new commentary is directly in the GGR charts of interest to Subscribers. Just below is a vastly reduced image of one of two actual GDXJ tracking charts. Subscribers see the full-sized, crystal clear, completely legible version, which fills a normal computer screen and then some. Right, wrong, win, lose or draw, we have chosen to reenter perhaps the best index ETF that tracks a basket of small and mid-cap junior and mid-tier miners and explorers as of April 10. But we only did so with what most might consider a razor-thin trading stop, as disclosed, and only after a number of the indicators we track continuously all "said" the time had come to attempt a Buy! Vultures might want to log in and note new commentary on several of the VBCI issues over the past two days. We've been busy! | ||

| Nevsun’s Bisha Mine at the Golden Apex Posted: 12 Apr 2012 03:11 AM PDT With cash costs between $264 and $314 per ounce during 2011, Bisha is one of the lowest cost gold mines in the world making Nevsun one of the most profitable resource companies around these days. | ||

| Posted: 12 Apr 2012 03:10 AM PDT

from ZeroHedge.com: We guessed it wouldn't be too long before the next rumor was dropped and Gold is surging – now over $1670 – on this latest chatter… Don't tell Gartman, but gold is now of 5% higher in math terms from the minute the "world renowned" gold swing trader sold everything 7 days ago. Keep on reading @ ZeroHedge.com | ||

| Will Spain Send Gold to $2,000? Posted: 12 Apr 2012 03:05 AM PDT

from wealthwire.com: We recently reported that gold was likely to surpass all previous price records by the end of 2012. As each day passes, more experts are coming forward with predictions that gold will eventually soar to $2,000 and beyond. Keep on reading @ wealthwire.com | ||

| The War at the End of the Dollar Posted: 12 Apr 2012 03:03 AM PDT

from news.goldseek.com: The history of the U.S. dollar is closely linked to U.S. involvement in a series of wars. The Bretton Woods Accord and the resulting world reserve currency status of the U.S. dollar were both byproducts of World War II (1939-1945). The Korean War (1950-1953) was followed six years later by the Vietnam War (1959-1975) which led to the end of the Bretton Woods system. Unfettered by the constraint of gold backing after 1971, the U.S. dollar became a weapon in the Cold War (1945–1991) between the U.S. and the former Union of Soviet Socialist Republics (U.S.S.R.). Each war corresponded with an increase in the U.S. money supply. The Gulf War (1990-1991) was followed by wars in Afghanistan, beginning in 2001, and in Iraq, beginning in 2003, and, simultaneously, by the U.S.-led War on Terror that began in 2001. Like the wars that came before them, the recent staccato of U.S. wars is correlated with increases in the U.S. money supply. The Iraq war, for example, is estimated to have cost as much as $4 trillion. The loss of value in the U.S. dollar caused by excessive expansion of the money supply, together with rising demand for raw materials from emerging economies, has led to permanently higher global commodity prices. Higher crude oil prices, in particular, have put pressure on the U.S. economy, which is putatively in a gradual recovery from the recession that began in 2007. At the same time, international trade has begun to move away from the U.S. dollar, threatening its world reserve currency status. Given the history of the U.S. dollar, it seems likely that an eventual end of the U.S. dollar's reign as the world reserve currency will be marked by war. Keep on reading @ news.goldseek.com | ||

| Gold Investment in 2012: The Bullish and Bearish Signals Posted: 12 Apr 2012 02:29 AM PDT Key factors from this week's GFMS 'Gold Survey 2012'... | ||

| George Soros: Eurozone Crisis Has Entered “A Less Volatile but Potentially More Lethal Phase” Posted: 12 Apr 2012 02:00 AM PDT Matt Stoller is a fellow at the Roosevelt Institute. You can follow him on twitter at http://www.twitter.com/matthewstoller As the next INET conference begins in Germany, one topic of conversation is sure to be George Soros's piece discussing the Eurozone crisis. He points out that the Eurozone has been quietly restructuring its financial arrangements along national lines, ending an era of co-mingled assets and liabilities across national borders. This is something I hadn't realized, but it presents, as he shows, other dangers.

The big problem, Soros says, is Germany. The Bundesbank doesn't want to be left with credit losses or the remote possibility of inflation, so it is seeking to reduce aggregate demand in Germany.

Soros offers a complex plan which would start with fiscal probity, at least nominally. He proposes auctioning off the ECB's "seignorage rights", ie. the profit that the ECB makes by creating Euros. This large pot of money would be used to incentive member states to bring down debt. Soros also distinguishes between debt that will lead to investment returns versus debt that will not. He proposes making the latter the basis for fiscal tightness.

This sounds like a clever way to allow the European elites to pretend like they are engaged in austerity and avoiding money printing, as the European elites engage in fiscal expansion and money printing. the holdup is Germany. As with the ECB printing huge sums of money to buy Eurozone debt through its LTRO program while masking those purchases, it's about ultimately doing the stability enhancing political embarrassing step while not wounding anyone's pride. | ||

| Gold Equities Gaining Credibility: Doug Groh Posted: 12 Apr 2012 02:00 AM PDT | ||

| IMF: Gold Is Scarce “Safe Asset” And “Growing Shortage of Safe Assets” Posted: 12 Apr 2012 01:47 AM PDT gold.ie | ||

| Getting Your Gold Out Of Dodge Posted: 12 Apr 2012 01:13 AM PDT

from dollarvigilante.com: If there has been a more dangerous time for your wealth in human history we are unaware of it. There have been individual or even entire nations of people who have been wiped out in the past but never before has there been such risk to assets across the entire globe. In the past, a few savvy Zimbabweans have converted their Zimbabwe dollars into US dollars to sidestep the complete annihilation of their currency and savings. Or residents of the Weimar Republic were able to salvage their wealth and savings by stepping across the border and converting their marks into francs. But what happens when the US dollar, the world's reserve currency, and with it all fiat currencies collapse? It's not an if, it's a when. Anyone who has done even a modicum of research into the financial state of affairs of the western nation states knows that it is not only inevitable but imminent. And those who have studied the history of currencies, specifically fiat currencies, knows that they all eventually reach their intrinsic value and rarely ever last more than forty years – an anniversary that passed on August 15, 2011 which marked forty years since the Nixon shock when the US Government was bankrupted by the Vietnam war and the gold backing was taken away from the dollar. Keep on reading @ dollarvigilante.com | ||

| Longer-Term Investment ‘Driven by Low Rates & Inflation Fears’ Posted: 12 Apr 2012 12:08 AM PDT Prices quoted for buying gold fell together with the US dollar on Thursday morning in London, dropping away from $1,660 per ounce and falling harder in other currencies as commodities also edged lower. Silver prices slipped back to $31.50 per ounce. | ||

| IMF: Bullion is a Scarce ‘Safe Asset’ Posted: 11 Apr 2012 11:13 PM PDT Gold has been trading sideways in Asian trading and remains in a tight range in Europe this morning near $1,656.07/oz. Gold remains supported this morning as the ECB signaled that it would intervene in the debt markets on worries about Spain. | ||

| How Serious are China & India About Their Gold? Posted: 11 Apr 2012 09:56 PM PDT Despite the Dow Jones Industrial Average and the S&P 500 suffering their worst day of the year on Tuesday, precious metals were able to decouple and climb higher. Gold futures for June delivery increased almost $17 to settle at $1,660, while silver gained 16 cents to close at $31.68. | ||

| Risk off? Having Sold Most of its Own, IMF Now Lauds Gold as 'Safe Asset' Posted: 11 Apr 2012 09:29 PM PDT ¤ Yesterday in Gold and SilverWell, if you slept the day away yesterday, you didn't miss much...as gold traded within about a five dollar price range for the entire 24-hour time period. The gold price closed at $1,659.70 spot...down 90 cents. Net volume was a very quiet 86,000 contracts. The silver price traded within about a 40 cent price range...twenty cents either side of $31.60 spot all day long on Wednesday. However, if you look closely enough, the silver price pattern during Comex trading had some structure to it. The high of the day [$31.95 spot] came at 9:40 a.m. Eastern...and the low price tick [$31.31 spot] came shortly before noon in New York. From that low, silver recovered about 30 cents going into the close. Silver closed at $31.16 spot...down 23 cents. Net volume was an anemic 24,000 contracts. Here's the New York Spot Silver [Bid] chart on its own. The price pattern is far more obvious, when you view this 8-hour market segment on its own...and the Comex trading session is the most important part of the day when it comes to pricing. I would guess that a not-for-profit seller showed up before the silver price was allowed to blast through the $32 price mark...and if you look at the first three days of this week on the Kitco silver chart above, you'll note that this price level appears to be well defended. The dollar index edged slightly lower during the Wednesday trading day...but only closed down about 10 basis points from Tuesday. It will be interesting to see which way the dollar index breaks from here. The gold stocks peaked in positive territory at 9:40 a.m. Eastern time...and pretty much hit their low of the day a few minutes before noon. From there they basically traded sideways for the rest of the day. The HUI finished down 1.25%. The silver stocks also finished in negative territory...and Nick Laird's Silver Sentiment Index closed down 0.88%. (Click on image to enlarge) The CME's Daily Delivery Report showed that 95 gold contracts were posted for delivery on Friday. Merrill was the short/issuer on all 95 contracts...and JPMorgan stopped 87 of them. The link to that action, such as it was, is here. There were no reported changes in either GLD or SLV. I wasn't impressed with the new short position in SLV that was posted over at the shortsqueeze.com website last night. It showed that the short interest in SLV increased by 29.92%...from 9.07 million shares/ounces, up to 11.78 million shares/ounces. The short interest in GLD also rose...by 8.98%. Short interest increased from 1.01 million ounces to 1.10 million ounces. The U.S. Mint had a sales report worthy of the name yesterday. They sold 6,000 ounces of gold eagles...3,000 one-ounce 24K gold buffaloes...and 177,000 silver eagles. The Comex-approved depositories reported receiving 627,679 troy ounces of silver on Tuesday...and shipped 556,470 ounces out the door. The link to this action is here. Silver analyst Ted Butler posted his mid-week commentary on his website yesterday...and here are three questions that he's still look for answers for...questions that can't be answered without concluding that the price of silver [and gold] has been manipulated. "The first question is one I asked back in August 2008 when the unusual concentration on the short side of COMEX silver by one or two US banks first came to my attention. Looking back at the available data, at that time JPMorgan was short more than 30% of the entire COMEX net open interest and 25% of world annual production. I asked how such levels of concentration could not be manipulative to the price. The CFTC couldn't answer and instead began a new investigation in silver, even though they ended their second major silver investigation in four years just months earlier. That investigation, now the longest running in US Government history, continues because the question can't be answered without concluding manipulation. This is a conclusion that the CFTC is, obviously, unwilling to reach. So the question and the investigation remain open." "The second question is how a world commodity can plunge 35% within days with no noticeable change in real supply and demand in a free market? Silver did this not once, but twice in 2011 and the obvious cause was unusual trading in COMEX futures trading. This means the COMEX set the price with the obvious conclusion that this represents manipulation. What make this question disturbing is that such a decline would never be allowed in any other commodity and if it did occur would be publicly addressed with much fan fare. Not so in silver. Worse, is that the two 35% price smashes occurred while an active silver investigation was ongoing. The Keystone Kops couldn't perform more ineptly than has the CFTC in this instance. I think, sooner rather than later, this question must be addressed, although I have yet to run across any free-market explanation." "The last question is how is it possible that the COMEX commercials in gold and silver futures are always the big net buyers on every big sell-off and that not be evidence of collusion and market control? I've been studying the Commitment of Trader Reports (COT) for more than 30 years and I can't come up with an alternative and plausible free market explanation, other than this is clear evidence of a continuing manipulation. Not once have the commercials sold on a net basis in any big price decline; never panicked as a group, never guessed wrong on a sell-off. How is that possible in free market terms? I think if anyone could respond to this question they would have done so by now, but I'm still eager for an answer." I note that Endeavour Silver reported that it was temporarily taking silver off the market once again. They stated that "Metal held in inventory at quarter-end included 925,100 oz silver and 3,927 oz. of gold." They also had this to say... "In January and February, 2012, gold and silver prices enjoyed a significant rebound from their lows in December 2011. Endeavour therefore elected to sell most of the precious metal inventory it accumulated in Q4 2011 in order to capture the higher gold and silver prices. However, gold and silver prices corrected sharply once again in March 2012 so Endeavour management once again chose to accumulate its precious metal production in Q1, 2012 rather than sell at depressed prices. Management plans to monitor precious metal prices closely and sell some (or all) of the silver and gold inventory at appropriately higher metal prices, or if the need arises for more cash." This is all well and good for the bottom line and company shareholders...and they should be applauded for this. But it does nothing to permanently remove physical silver production from the market. Here's an excellent chart that reader "EWF" sent me in the wee hours of this morning. The Gold/XAU Ratio is now above 10 for the first time since the crisis of 2008. (Click on image to enlarge) I have the usual number of stories for you today...and I hope you have the time to at least skim what I've cut and paste from each one. Then the world's central banks will really be up against it...and the run to hard assets will begin anew, but this time with a real vengeance. Don't Give Up on Gold: Christopher Barker. Gold 'to hit $2,000' on Spain fears: GFMS. Gold may fall below $1,550 in coming months: GFMS. Doug Casey on Tax Day. ¤ Critical ReadsSubscribeLenders Again Dealing Credit to Risky ClientsAnnette Alejandro just emerged from bankruptcy and doesn't have a job, and her car was repossessed last year. Still, after spending her days job hunting, she returns to her apartment in Brooklyn where, in disbelief, she sorts through the piles of credit card and auto loan offers that have come in the mail. "Even I wouldn't make a loan to me at this point," Ms. Alejandro said. But as financial institutions recover from the losses on loans made to troubled borrowers, some of the largest lenders to the less than creditworthy, including Capital One and GM Financial, are trying to woo them back, while HSBC and JPMorgan Chase are among those tiptoeing again into subprime lending. This story was posted in The New York Times yesterday...and I thank Phil Barlett for sending it along. The link is here.  Doug Casey on Tax DayLouis: Doug, the Taxman cometh, at least for most US citizens who file their annual tax papers on April 15. We get a lot of letters from readers who know about your international lifestyle and wonder about the tax advantages they assume it confers. Is this something you care to talk about? Doug: Yes; something wicked this way comes, indeed. But first, I have to say that as much as I can understand the guy who flew his airplane into an IRS building, as we once discussed, I do not encourage anyone to break the law. That's not for ethical reasons - far from it - but strictly on practical grounds. The Taxman can and will come for you, no matter how great or small the amount of tax he expects to extract from you. The IRS can impound your assets, take your computers, freeze your accounts, and make life just about impossible for you, while you struggle to defend yourself against their claims and keep the rest of your life going. The number of IRS horror stories is beyond counting. As the state goes deeper into insolvency, its enforcement of tax laws will necessarily become more draconian. So you absolutely don't want to become a target. Louis: So... just bow down and lick the boots of our masters? Doug: Of course not. People can and should do everything they can to pay as little in taxes as possible. This is an ethical imperative; we must starve the beast. It could even be seen as a patriotic duty - if one believes in such things - to deny revenue to the state any way possible, short of endangering yourself. These are the opening Q & A in yesterday's edition of Conversations with Casey. Louis James, the editor of the International Speculator, as usual, does the honours. It's worth the read...and the link is here.  Pension risks threaten UK finances, IMF warnsBritain is at risk of pensions time bomb that could cost the state as much as £750bn, the International Monetary Fund (IMF) has warned. In an analysis of the financial impact of longevity risk, the Bretton Woods institution said the public finances of countries across the western world would become unsustainable if the average lifespan of their citizens rose by just three years more than expected. For the UK, the fund calculated that on the "not unreasonable" assumption that the entire cost were to fall on taxpayers the country's public debt would rise from 76pc of gross domestic product to as much as 135pc. In today's money, that would be about £750bn. This is just another sign that the welfare state [any welfare state] cannot keep up with the promises that they made to their citizens over the last fifty years. The bills are now coming due...and there are insufficient funds available now, or in the future. This story was posted in The Telegraph yesterday...and is Roy Stephens first offering of the day. The link is here.  Spanish epiphany as depression deepens? - Ambrose Evans-PritchardSpain's industrial output is sliding at an accelerating rate, as is entirely predictable if you enforce draconian fiscal tightening on an economy in deep recession with no offsetting monetary stimulus or exchange rate devaluation. The latest data show that output fell 5.1% (y/y) in February, after 4.3% in January and 3.5% in December. Durable goods fell 14.8pc, the sixth successive monthly fall. Capital goods output fell 10.6pc, according to Raj Badiani from IHS Global Insight. This is politically untenable. Unemployment is already 23.6pc on the Eurostat measure. David Owen from Jefferies Fixed Income expects this to reach 27.5pc by the end of the year (which is roughly 32pc using the old measure from the 1990s, based on a Bank of Spain study). This story from yesterday's edition of The Telegraph...and is Roy Stephens second offering of the day. This story is worth skimming...and the link is here.  ECB may buy Spanish bonds over debt fearsThe European Central Bank could again intervene in bond markets to try to rectify "unjustified" concern over Spain's fiscal position, according to a senior official. The suggestion by Benoît Coeuré, an ECB executive board member, of possible market intervention, helped to ease tension over Spain's debt yesterday and pushed down the country's implied cost of borrowing. However the comments could spark renewed disagreement within the central bank over one of its most controversial crisis-fighting tools. In the past two years the ECB has bought bonds issued by euro zone governments to try to support demand for the debt and drive down yields, which move in the opposite direction to bond prices. This story, which is worth reading, was posted in the Irish Times earlier this morning...and I thank Roy Stephens for sending it along. The link is here.  Europe's banks beached as ECB stimulus runs dry: Ambrose Evans-PritchardCredit experts say the Spanish and Italian banks are trapped with large losses on sovereign bonds bought with ECB funds under the three-year lending programme, or Long-Term Refinancing Operation (LTRO). Andrew Roberts, credit chief at RBS, said Spanish banks used ECB funds to purchase five-year Spanish bonds at yields near 3.5pc in February and 4.5pc in December. The same bonds were trading at 4.77pc on Wednesday, implying a large loss on the capital value of the bonds. It is much the same story for Italian banks pressured into buying Italian debt by their own government. Any further dent to confidence in Italy and Spain over coming weeks – either over fiscal slippage or the depth of economic contraction – could push losses to levels that trigger margin calls on collateral. "The banks are deeply underwater. This is turning into a disaster for the eurozone periphery now that the liquidity tap has been turned off," said Mr Roberts. "But given the opposition in Germany, the ECB can't easily do another LTRO until there is a major crisis." This must read story was posted on The Telegraph's website late last night...and the link is here.  | ||

| Richard Russell: Crime, Chaos, Collapse & Skyrocketing Gold Posted: 11 Apr 2012 09:29 PM PDT  This Richard Russell blog was posted over at the King World News website late last evening...and the link is here. | ||

| Posted: 11 Apr 2012 09:29 PM PDT  After a reasonably long period of sustained and occasionally dramatic escalations, commodity markets in general, and precious metals markets in particular have declined. This is normal and healthy behavior, even if it is uncomfortable for some market participants. Readers with a long memory will remember the 1970's gold bull market, where the gold price advanced from $35 per ounce to $850 per ounce, and investors with a good memory may remember 1975, in the middle of that epic bull market, when the gold price DECLINED by 50%! | ||

| Gold & Silver Market Morning, April 12 2012 Posted: 11 Apr 2012 09:00 PM PDT | ||

| China's gold demand boosts prices Posted: 11 Apr 2012 07:51 PM PDT GOLD prices will reach US$2,000 an ounce before the year is out as China's sparkling demand for jewelry helps to send the cost of the precious metal ever higher, a new report suggests... Read | ||

| Charles Biderman: Go Long Gold Posted: 11 Apr 2012 07:16 PM PDT TrimTabs President & CEO Charles Biderman explains why currency printing and a weakening European economy have reaffirmed his investment strategy. from trimtabs: ~TVR | ||

| Silver Update: “Wallstreet Looters” Posted: 11 Apr 2012 07:15 PM PDT BJF on Ag, Apple, criminality and more in the 4.11.12 Silver from brotherjohnf: Got Physical? ~TVR

| ||

| Posted: 11 Apr 2012 07:08 PM PDT

from silverstockreport.com: Allow me to bring you up to date on what you need to know about JP Morgan's manipulation of the silver market. It is being exposed, and JP Morgan is failing, and losing money on their scheme. On April 5th, we were given the gift of JP Morgan's Blythe Masters giving a TV interview on CNBC where she was trying to claim that JP Morgan does not hold any position in the silver market, but rather, is hedging client long positions in silver. Blythe says, "We store significant amounts of commodities, for instance silver, on behalf of customers. We operate vaults in New York City, in Singapore and in London. Often when customers have that metal stored in our facilities they hedge it on a forward basis through JPMorgan, which in turn hedges in the commodities market," she said. "If you see only the hedges and our activity in the futures market but you aren't aware of the underlying client position that we're hedging, then it would suggest inaccurately that we're running a large directional position," she added. "In fact that's not the case at all. We have offsetting positions. We have no stake in whether prices rise or decline." Keep on reading @ silverstockreport.com | ||

| Posted: 11 Apr 2012 06:57 PM PDT

by Simon Black Here's something you don't see every day: Banks in Vietnam will actually pay YOU to store your gold in one of their safe deposit boxes. I was pretty surprised to find this out for myself; neither Simon nor I have seen it anywhere else in the world except here. This is actually how banking used to be. The original bankers were goldsmiths– big burly guys who worked with gold on a daily basis. They had the security systems already established, and, for a fee, they were willing to let you park your gold in their safes. Eventually, goldsmiths got into the moneylending business; instead of charging a security fee, they would pay depositors a rate of interest for the right to loan out the gold at a higher rate of interest. Goldsmiths' reputations lived and died based on the quality of their loan portfolios, and their consistency of paying back depositor savings. Today that's all but a footnote in history. Except in Vietnam. Vietnam's economy enjoyed a strong boom in the mid-2000s thanks to economic liberalization and foreign capital inflows. Within a few years, the economy overheated and inflation became rampant. Then came the global financial crisis. Keep on reading @ zerohedge.com | ||

| Historicals silver production statistics in the United States Posted: 11 Apr 2012 06:30 PM PDT USGS |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment