saveyourassetsfirst3 |

- Growth of Income Inequality Is Worse Under Obama than Bush

- 7 Dividend Stocks For An Inflation-Adjusted Income Stream

- The Challenge Of Sterling

- Fed Intervention And The Market: New Update

- Market Events A Cover For Silver Manipulation?

- Gold Reality Check

- Gold Action Is Unlike The Fall Of 2008

- Europe Will Collapse in May-June

- Bernanke on the Gold Standard

- Silver To Fall Short Term

- Vaulted Gold – Facts & Figures

- Something To Watch For In Gold

- Vietnam increases gold market controls

- Comex Registered Silver Inventory Falls Below 30 Million Ounces Again

- Chinese Gold Imports From Hong Kong Rise Nearly 13 Fold – PBOC Likely Buying Dip Again

- Is India Dodging a Silver Bullet?

- Despite the Common Gloom, Gold is Still Shining

- Davincij15: Silver Blite From the Masters

- Morning Outlook from the Trade Desk 04/11/12

- Chinese Gold Imports from HK Up Nearly 13 Fold

- GFMS Issues Caution on Short-Term Gold Prices

- Pain in Spain rattles investors

- Gold & Silver Market Morning, April 11 2012

- JPM's TV Appearance Hints of Major Change in Silver Market: Ted Butler

- Ease Up on stocks, gradually accumulate gold: Marc Faber

- Ted Butler: JPM's TV appearance hints of major change in silver market

- Mike Kosares: Surging central bank gold demand will guide bull market

- Three King World News Blogs

- Russia Today's 'Capital Account' examines gold and silver manipulation

- Stock and bond markets rocked by fears of Italian and Spanish debt spirals

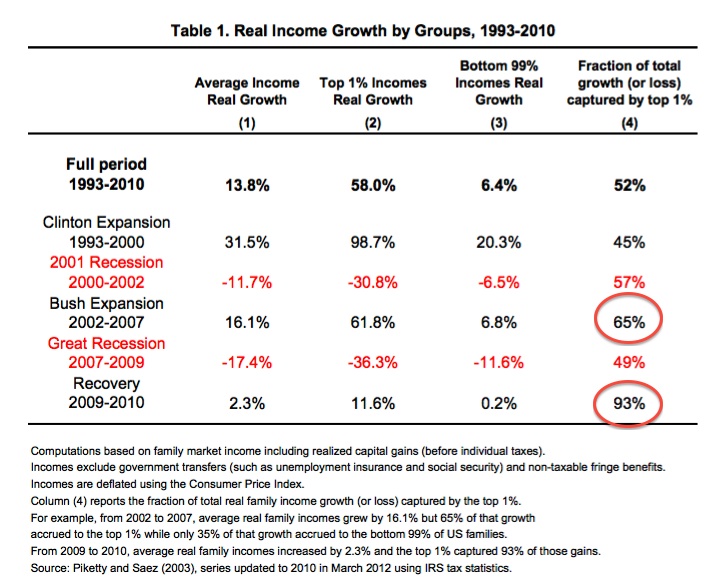

| Growth of Income Inequality Is Worse Under Obama than Bush Posted: 11 Apr 2012 04:41 AM PDT Matt Stoller is a fellow at the Roosevelt Institute. You can follow him on twitter at http://www.twitter.com/matthewstoller Yesterday, the President gave a speech in which he demanded that Congress raise taxes on millionaires, as a way to somewhat recalibrate the nation's wealth distribution. His advisors, like Gene Sperling, are giving speeches talking about the need for manufacturing. A common question in DC is whether this populist pose will help him win the election. Perhaps it will. Perhaps not. Romney is a weak candidate, cartoonishly wealthy and from what I've seen, pretty inept. But on policy, there's a more interesting question. A better puzzle to wrestle with is why President Obama is able to continue to speak as if his administration has not presided over a significant expansion of income redistribution upward. The data on inequality shows that his policies are not incrementally better than those of his predecessor, or that we're making progress too slowly, as liberal Democrats like to argue. It doesn't even show that the outcome is the same as Bush's. No, look at this table, from Emmanuel Saez (h/t Ian Welsh). Check out those two red circles I added. Yup, under Bush, the 1% captured a disproportionate share of the income gains from the Bush boom of 2002-2007. They got 65 cents of every dollar created in that boom, up 20 cents from when Clinton was President. Under Obama, the 1% got 93 cents of every dollar created in that boom. That's not only more than under Bush, up 28 cents. In the transition from Bush to Obama, inequality got worse, faster, than under the transition from Clinton to Bush. Obama accelerated the growth of inequality. The data set is excellent, it's from the IRS and it's extremely detailed. This yawing gap of inequality isn't an accident, and it's not just because of Republicans. It's a set of policy choices, as Saez makes clear in his paper.

Income concentrations are relatively rare, but when they happen, sharp policy moves can retain a strong measure of equality. It's well-known at this point that President Obama did not want to make such moves. TARP, cramdown, and the foreclosure fraud settlement suggest that his interests lie in preserving the capital structure of the large banks. What about other policy priorities? Despite his recent speech, President Obama knows that his income tax proposal is going nowhere. So let's look at three recent policy choices that are going somewhere. 1) President Obama is on the verge of approving a Free Trade deal with Colombia, despite the murder of union organizers in that country. Not content with establishing similar deals with Panama (which has to do with enlarging tax havens) and South Korea, the administration is now embarking on a much vaster Trans-Pacific Partnership deal with countries all over Asia. And it's being negotiated entirely in secret, with corporate and government officials the only ones allow to be in the room. Trade is a significant driver of lower wages. 2) President Obama just pushed for and signed the JOBS Act, which is a substantial relaxation of regulations and accounting requirements on corporations seeking to go public. Bill Black has many four letter words to describe this bill, but it's basically a license for Wall Street to commit fraud in the equity markets. The SEC is beginning to promulgate instructions on how this will work. 3) President Obama just refused to issue an executive order forcing campaign spending disclosure by government contractors. President Obama actually criticized the Supreme Court's decision in Citizens United at a State of the Union address, but as with yesterday's speech on raising taxes on millionaires, there was actually no there there. There are many other policy fights, and the President has engaged constructively in some areas and negatively in others. He has been undermined as well as aided by his staff. And he's just one man, heading up a franchise of thousands of other political actors. It's been clear, though, since before he took office, that his is a consistent policy architecture on the core questions of power and wealth. In the orbit of this President, power and wealth flow upward. It's important not to overstate the conclusion. It's not obvious that Obama's policy framework is worse than Bush's, only that the outcome is. After all, the losses suffered by the wealthy during 2007-2009 recession were less severe than those it suffered in the 2000-2002 recession, and most of the Great Recession happened under Bush (with a Democratic Congress). It's possible that the Obama policy framework is a bit less bad, but he has been more successful at implementation because unlike Bush, he han't face any pressure from Democrats. In other words, perhaps Obama's policy thrust has just been implemented more fully, because the traditional opposition to plutocratic rule, the left, has been silenced. Perhaps it's a competence issue. Or maybe you can chalk it all up to structural factors, though I suspect the JOBS Act and trade deals imply otherwise. Maybe he really is as conservative as these policy choices suggest. It's hard to say. Mitt Romney might be easy to jeer at for his wealth and arrogance, but Saez's data suggests that Barack Obama is just as much the candidate of inequality. |

| 7 Dividend Stocks For An Inflation-Adjusted Income Stream Posted: 11 Apr 2012 04:19 AM PDT By Dividend Growth Investor: One of the biggest challenges that retirees face is inflation. Inflation decreases the purchasing power of the dollar every year. Over the past decade, inflation has averaged 2.40% per year, which has been slightly below the long-term average of 3% annually. Even if inflation were to continue to remain around 3% for the next few decades, this would affect the standard of living of retired investors over time. At a 3% annual inflation rate, the purchasing power of your income would be decreased by half in 24 years. As a result, investors relying on fixed income such as US Treasury bonds, would be faced with an income source which purchases less each year. In addition, given the low current yields on US Treasuries, investors these days have few options to invest for income besides dividend Complete Story » |

| Posted: 11 Apr 2012 04:16 AM PDT By Marc Chandler: Many participants can single out a currency that is particularly vexing for them. Some say that the yen is the graveyard of all good (and poor) traders. Yet for many currency pairs there are some factors that seem to be more influential than others, even if over time, there is significant variability. For example, the two-year interest rate differential between the US and Japan on one hand and the dollar-yen on the other. In this sense, sterling is especially challenging. It relationship to equity markets and interest rate differentials tends not to be very strong. It is difficult to know what to look at for clues into sterling's direction. Around the same time the euro's correlation (60-day percentage change) with the S&P 500 put in what appears to be a record high in early December near 0.85, sterling's correlation set its record high near 0.72. The correlation now stands near Complete Story » |

| Fed Intervention And The Market: New Update Posted: 11 Apr 2012 04:06 AM PDT By Doug Short: Note from dshort: I've updated the charts below to include today's decline in both equity prices and Treasury yields. We're well into our sixth month since the latest Federal Reserve intervention, Operation Twist, was officially announced on September 21. We've now seen several bouts of aggressive Fed attempts to manage the economy following the collapse of the two Bear Stearns hedge funds in mid-2007 about three month before the all-time high in the S&P 500. Initially the Fed Funds Rate (FFR) underwent a series of cuts, and with the bankruptcy of Bear Stearns, the Fed launched a veritable alphabet soup of tactical strategies intended to stave off economic disaster: PDCF, TALF, TARP, etc. But shortly after the bankruptcy filing, the Fed really swung into high gear. The FFR fell off a cliff and soon bounced in the lower half of the 0 to 0.25% ZIRP (Zero Interest Rate Policy). The Complete Story » |

| Market Events A Cover For Silver Manipulation? Posted: 11 Apr 2012 03:31 AM PDT

from SilverInvestingNews.com: The sharp declines of precious metals on February 29 was largely associated with the Federal Reserve's failure to give indication of another round of quantitative easing. However, an alleged employee of JP Morgan Chase reportedly offered the Commodities Futures Trading Commission (CFTC) an alternate explanation. The individual claims his employer was involved in orchestrating the price declines, which raises the question of whether events are such Fed speeches and jobs reports serve as masks for silver manipulation. Keep on reading @ SilverInvestingNews.com |

| Posted: 11 Apr 2012 03:18 AM PDT

from gold-eagle.com: For well over a decade GATA has been "ranting" about the evils of the Fed and how the world economy is going to collapse in a heap. "Oh but it will, it will, trust us, it will." All this negative energy – to what end? If it does collapse in a heap – and GATA turns out to be right – then what? If economic activity implodes no one will escape – not the gold holders and not the paper holders. Surely, therefore, if one has a brain with finite capacity then it would be far more constructive to apply that capacity to working out ways to solve the problems. It is an unarguable fact that no economy can operate effectively without focussed participation – AT ALL LEVELS – of those who add value. The Federal Reserve will achieve nothing by marginalising those at the bottom of the totem pole who previously added their particular value. Financial enslavement has its flip side: dishonesty and crime which, by definition, cannot be centrally controlled if it turns out to be the rule as opposed to the exception. By definition, anarchy is uncontrollable. Keep on reading @ gold-eagle.com |

| Gold Action Is Unlike The Fall Of 2008 Posted: 11 Apr 2012 03:16 AM PDT

from news.goldseek.com: old prices have actually risen quite sharply and silver has held its ground as global stock markets took a dive this week. So far there has been none of the price crushing rush to sell off gold and silver to meet stock market margin calls that we saw in late 2008. That could still come of course. Oil, on the other hand, has already hit an eight-week low. But as an article on this website pointed out recently not all recessions are bad for the price of precious metals (click here). It could be different this time with oil down and gold up. Demand for precious metal is coming from multiple sources now. The same guys that are printing the money and causing global inflation to tick up, the central banks, have also emerged as big buyers of gold. Less wealthy investors have been buying silver in larger and larger numbers. To be fair most of the new buying by central banks is coming from the emerging markets and not the old money printers: China, Russia, Saudi Arabia, India, Mexico and Brazil. They all want to build up their gold reserves as a hedge against a collapse in the value of the dollar after this November's US presidential election and to strengthen the independence of their own currencies. Keep on reading @ news.goldseek.com |

| Europe Will Collapse in May-June Posted: 11 Apr 2012 03:14 AM PDT

from gainspainscapital.com: The following is an excerpt from a recent issue of Private Wealth Advisory. In it, I explain why exactly Europe will Collapse completely in the May-June period. The confluence of negative factors is unlike anything I've ever seen before. To find out more about Private Wealth Advisory and how I'm preparing clients to profit from this mess (we've already locked in 9 winners based on Europe's woes in the last two weeks alone)… Click Here Now!!! Starting back in August, I began suggesting that we were approaching a Systemic Crisis/ Crash scenario in the markets. The technical and fundamentals both supported this forecast, but I completely underestimated the degree to which the Central Banks and EU would attempt to prop up the market. At that time, I thought it likely we'd see a Crash, which would then be met with another round of stimulus, which would push the economy temporarily into the green. It seemed the most logical outcome given that we were heading into an election year with a President whose ratings were at record lows. Instead, the Federal Reserve, particularly those Fed Presidents from Financial Centers (Charles Evans of Chicago and Bill Dudley of New York) began a coordinated campaign of verbal intervention, hinting that more easing or QE was just around the corner. Keep on reading @ gainspainscapital.com |

| Posted: 11 Apr 2012 03:13 AM PDT

from mises.org: In his lecture at George Washington University on March 20, 2012, Federal Reserve chairman Ben Bernanke said that under a gold standard the authorities' ability to address economic conditions is significantly curtailed. The Fed chairman holds that the gold standard prevents the central bank from engaging in policies aimed at stabilizing the economy after sudden shocks. This in turn, holds the Fed chairman, could lead to severe economic upheavals. According to Bernanke, Since the gold standard determines the money supply, there's not much scope for the central bank to use monetary policy to stabilize the economy.… Because you had a gold standard which tied the money supply to gold, there was no flexibility for the central bank to lower interest rates in recession or raise interest rates in an inflation. Keep on reading @ mises.org |

| Posted: 11 Apr 2012 03:11 AM PDT

from mineweb.com: After a fairly strong start to 2012, it seems much of exuberance with which silver started the year has dissipated. Keep on reading @ mineweb.com |

| Vaulted Gold – Facts & Figures Posted: 11 Apr 2012 03:06 AM PDT An explanation, in infographic form, of what vaulted gold is and visualization of key facts relating to investments in gold which is stored on behalf of investors in high-security vaults. |

| Something To Watch For In Gold Posted: 11 Apr 2012 02:45 AM PDT |

| Vietnam increases gold market controls Posted: 11 Apr 2012 02:32 AM PDT Goldmoney |

| Comex Registered Silver Inventory Falls Below 30 Million Ounces Again Posted: 11 Apr 2012 02:29 AM PDT |

| Chinese Gold Imports From Hong Kong Rise Nearly 13 Fold – PBOC Likely Buying Dip Again Posted: 11 Apr 2012 01:43 AM PDT gold.ie |

| Is India Dodging a Silver Bullet? Posted: 11 Apr 2012 01:19 AM PDT The midweek trading session in precious metals opened to the downside in New York this morning despite a 0.31% drop in the US dollar on the trade-weighted index and a 0.30% gain in crude oil values. |

| Despite the Common Gloom, Gold is Still Shining Posted: 11 Apr 2012 01:00 AM PDT SunshineProfits |

| Davincij15: Silver Blite From the Masters Posted: 11 Apr 2012 12:33 AM PDT Is the inventor of the death star called credit default swap derivatives. She also works at JPM to manage the price of silver for her clients who are the Federal Reserve and the United States Government. from davincij15:

~TVR |

| Morning Outlook from the Trade Desk 04/11/12 Posted: 10 Apr 2012 11:54 PM PDT Global equities got hammered yesterday as Spain and Portugals debt pricing rose. Leading some to opine that the European situation is worsening. The talking heads believe its nothing more than a correction in the equity markets and in the short term I tend to agree. None the less, fund managers bought the metals as a fear hedge, which bounced gold $30 off the lows. All eyes on the earthquake this morning and the possibility of another Tsunami. Metals appear supportive but the market is again a headline market, which opens the door to more volatility. |

| Chinese Gold Imports from HK Up Nearly 13 Fold Posted: 10 Apr 2012 11:10 PM PDT Gold climbed $17.70 or 1.2% in New York yesterday and closed at $1,659.00/oz. Gold gradually ticked lower in Asian trading prior to tentative gains in Europe and is now trading around $1,655/oz. Gold's 1.2% gain yesterday was the largest since March 26. |

| GFMS Issues Caution on Short-Term Gold Prices Posted: 10 Apr 2012 10:00 PM PDT Gold prices could fall close to $1,500 in the next few weeks but should rise towards $2,000 before the end of the year, analysts from Thomas Reuters GFMS said Wednesday in issuing the 2012 edition of the company's Gold Survey. |

| Pain in Spain rattles investors Posted: 10 Apr 2012 09:15 PM PDT The gold price staged a decent rally late yesterday, heading from an intraday low around $1,630 at 11EDT to over $1,660 over the next hour and a half. There was no obvious news catalyst for this ... |

| Gold & Silver Market Morning, April 11 2012 Posted: 10 Apr 2012 09:00 PM PDT |

| JPM's TV Appearance Hints of Major Change in Silver Market: Ted Butler Posted: 10 Apr 2012 08:53 PM PDT ¤ Yesterday in Gold and SilverAs I pointed out in my closing comments in 'The Wrap' in yesterday's column...gold added about fifteen dollars in early Far East trading in their Tuesday morning...but shortly after lunch Hong Kong time, the gold price topped out...and it was sold down right up until noon in London before it caught another bid. That tiny rally ended about twenty minutes after the Comex opened...and then gold sold off to its low of the day...$1,630.80 spot...which came at the precise close of trading in London, which was 11:00 a.m. in New York. From that low, the gold price worked it's way about eight bucks higher by 12:20 p.m. Eastern. Then, in the space of less that fifteen minutes, the gold price tacked on about twenty bucks...and about half an hour after that, jumped to its high of the day [$1,664.90 spot] five minutes before the close of Comex trading, which is 1:30 p.m. in New York. From that high, gold dropped back about five bucks...and spent the rest of the day hugging the $1,660 spot mark. Gold closed at $1,660.60 spot...up $19.30 on the day. Net volume was pretty high at 147,000 contracts. From the London open on Tuesday, the silver price followed Monday's price action very closely...almost too close to be a coincidence. The London low came mid-morning...and then rallied a bit into the Comex open in New York. At that point it blasted higher, just like Monday...got sold off at the same times in New York...8:40 and 9:40 a.m. Eastern...just like Monday...and hit its low around 11:30 a.m. Eastern...just like Monday. The subsequent rally got capped at about the same time in the New York lunch hour as well. The silver price gained a bit more in electronic trading after the Comex close...and instead of closing up a nickel like it did on Monday, it closed up eight cents at $31.84 spot. Net volume was substantially higher than Monday...around 35,000 contracts. The dollar index poked through the 80.00 price level briefly again yesterday...but spent the rest of the day dancing around just under that mark, pretty much like it has been doing since last Thursday afternoon. The gold stocks opened basically unchanged...and began to slide into negative territory as the gold price did the same. The gold price blast off is the most obvious feature on the graph below...and the HUI finished up 1.20% on the day. Considering how poorly silver did during the Comex trading session, the stocks themselves finished in positive territory...and Nick Laird's Silver Sentiment Index closed up 0.54%. A lot of the other silver stocks actually did considerably better than that. (Click on image to enlarge) The CME Daily Delivery Report showed that one lonely gold contract was posted for delivery tomorrow. The GLD ETF had a tiny withdrawal of 14,582 ounces yesterday. But there was a more substantial withdrawal of 1,262,261 troy ounces out of SLV. There was no sales report from the U.S. Mint. Over at the Comex-approved depositories on Monday, only 977 ounces [1 good delivery bar] was reported received...and 449,480 troy ounce of silver were shipped out the door. The link to that activity is here. I have a lot less stories for your reading 'pleasure' today...and I'm always happy to leave the final edit up to you. I'm not sure what to make of what happened yesterday, although I was sort of hoping that yesterday's spike in gold may have been short covering. Russia Today's 'Capital Account' examines gold and silver manipulation. Gold Shorts in Retreat, Currency Destruction Guaranteed: James Turk. Chinese Imports of Gold are Massive. ¤ Critical ReadsSubscribeEase Up on stocks, gradually accumulate gold: Marc FaberThe story, along with the 4:41 minute video clip with the good doctor was posted over at the finance.yahoo.com website yesterday...and I thank reader Randal Reinwasser for sending it along. The link is here.  Analysis - Short on tools, central banks left with wordsSome of the world's most prominent central bankers may have to hope the pen is as mighty as the sword. With the Federal Reserve, the European Central Bank and other authorities in industrialized countries already stretching the limits of monetary policy, pressure has risen for them not go any further, and even to begin pulling back. Top officials have had to rely increasingly on speeches - not always successfully - to convey to financial markets how they intend to manage their economies. "A new policy regime characterized by jawboning is now here," said Eric Green, economist at TD Securities. "Policy is more constrained and more accommodation increasingly problematic in scope and complexity." This short Reuters piece was posted on their website on Sunday...and I borrowed it from yesterday's King Report. It's worth the read...and the link is here.  Brazil president Dilma Rousseff blasts Western QE as 'monetary tsunami'In her first visit to the White House since her election more than a year ago, Ms Rousseff voiced concern over an "expansionist" monetary policy that has caused a "depreciation in the value of currencies of developed countries, thus impairing growth" in other nations. The Brazilian government has taken aggressive steps to try to tame the strength of its currency and protect exports, with the country's central bank intervening in the currency markets in recent weeks. "Brazil will continue to take whatever actions required to offset the detrimental effects of QE policies," Ms. Rousseff said. This story was posted in The Telegraph late yesterday afternoon in London...and is Roy Stephens first offering of the day. The link is here.  Stock and bond markets rocked by fears of Italian and Spanish debt spiralsItaly's leading MIB index plunged 5pc and Spain's Ibex fell 3pc amid fears that the eurozone's third and fourth biggest economies were in the grip of a deadly and uncontrollable spiral of debt and recession. The borrowing costs of both "sinner states" soared. The yield on Italy's benchmark 10-year bonds jumped to 5.7pc, heading into the danger zone that is considered unsustainably high. The equivalent Spanish debt climbed to 6pc. Meanwhile, the yield on safe-haven German bunds was pushed to an almost record low of 1.6pc. UK gilts benefited, too, dropping to 2pc. The yields reflected a level of fear on the bond markets not seen since the fraught period before Christmas when traders bet that the eurozone could collapse. France's CAC index fell 3.1pc, Germany's DAX dropped 2.5pc and in London more than £33bn was wiped off the value of Britain's biggest companies as the FTSE 100 fell 2.2pc. In the US, the Dow fell 1.7pc - its worst day so far this year. This must read story appeared in The Telegraph shortly before midnight British Summer Time yesterday...and is Roy's second offering of the day. The link is here.  Cop shop: Crisis-hit Greece rents police for €30 per hourGreece is offering a 'cop-for-hire' service, renting out policemen for €30 per hour, plus €10 if you want a police car too. It triggered fears that security of people who cannot afford a policeman for hire may be affected in favor of those who can. This new way for the cash-strapped Greek state to raise money will "pay for the cost of using police materials and infrastructure, and allow to modernize them", the Ministry of Citizen Protection said in a statement. The Police services on offer were previously used in "exceptional cases" – escorting the transportation of dangerous material or art works and were free of charge. Now, Police services have a price-tag. If you need something special the hourly fee for patrol boats is €200, and €1500 for helicopters, according to the Proto Thema newspaper. This Russia Today story was posted on their website yesterday...and is another Roy Stephens offering. The link is here.  Surrender now or we'll bomb you laterSurrender now or we'll bomb you laterUS President Barack Obama has issued an ultimatum to the leadership in Tehran before ... setting optimal conditions for an "all options on the table" exercise. As I said yesterday, it's basically the 2012 version of "the Hull note" delivered to the Japanese shortly before hostilities began on December 7, 1941. This rather short piece was posted over at the Asia Times website yesterday...and is another Roy Stephens offering. I consider it a must read...and the link is here.  Russia Today's 'Capital Account' examines gold and silver manipulationLast Friday the "Capital Account" program of the Russia Today television network, hosted by Lauren Lyster, focused on gold and silver market manipulation, interviewing Mike Maloney of GoldSilver.com and citing GATA, silver market analyst Ted Butler...and last week's comments on silver market manipulation by JPMorganChase's Blythe Masters. This GATA release from yesterday contains the link to the above RT interview...and a few other things as well. It's well worth your time...and the link is here.  Three King World News BlogsThe first is fund manager Egon von Greyerz...and his blog is headlined "Chinese Imports of Gold are Massive Right Now". The second is with James Turk...and it's entitled "Gold Shorts in Retreat, Currency Destruction Guaranteed". And lastly is a Dan Norcini blog. It's headlined "Take That Gold Shorts, as Massive Bids Shock Market."  Mike Kosares: Surging central bank gold demand will guide bull marketCentennial Precious Metals proprietor Michael Kosares writes that gold's future is likely to be secured most by the change in central bank attitudes toward the monetary metal. While they were recently big sellers, Kosares notes, central banks are now net buyers, with China likely taking the lead. I found this story in a GATA release yesterday...and both the headline and the introduction are courtesy of Chris Powell. Kosares' commentary is headlined "Surging Central Bank Gold Demand Adds New Dimension to Bull Market" and it's posted at Centennial's Internet site, USAGold.com. The link is here.  |

| Ease Up on stocks, gradually accumulate gold: Marc Faber Posted: 10 Apr 2012 08:53 PM PDT  The story, along with the 4:41 minute video clip with the good doctor was posted over at the finance.yahoo.com website yesterday...and I thank reader Randal Reinwasser for sending it along. The link is here. |

| Ted Butler: JPM's TV appearance hints of major change in silver market Posted: 10 Apr 2012 08:53 PM PDT  Silver market analyst Ted Butler writes that JPMorgan Chase's carefully scripted televised acknowledgment of complaints of silver market manipulation is a hint of a major change in the market. Butler also rebuts the investment house's claims of innocence. Well, it didn't take long for Ted to post this in the public domain. I included three paragraphs of it in this column yesterday...and here's the rest of it. It's a must read for sure...and it's posted over at the silverseek.com website. The link is here. |

| Mike Kosares: Surging central bank gold demand will guide bull market Posted: 10 Apr 2012 08:53 PM PDT  Centennial Precious Metals proprietor Michael Kosares writes that gold's future is likely to be secured most by the change in central bank attitudes toward the monetary metal. While they were recently big sellers, Kosares notes, central banks are now net buyers, with China likely taking the lead. I found this story in a GATA release yesterday...and both the headline and the introduction are courtesy of Chris Powell. Kosares' commentary is headlined "Surging Central Bank Gold Demand Adds New Dimension to Bull Market" and it's posted at Centennial's Internet site, USAGold.com. The link is here. |

| Posted: 10 Apr 2012 08:53 PM PDT  The first is fund manager Egon von Greyerz...and his blog is headlined "Chinese Imports of Gold are Massive Right Now". The second is with James Turk...and it's entitled "Gold Shorts in Retreat, Currency Destruction Guaranteed". And lastly is a Dan Norcini blog. It's headlined "read more |

| Russia Today's 'Capital Account' examines gold and silver manipulation Posted: 10 Apr 2012 08:53 PM PDT  Last Friday the "Capital Account" program of the Russia Today television network, hosted by Lauren Lyster, focused on gold and silver market manipulation, interviewing Mike Maloney of GoldSilver.com and citing GATA, silver market analyst Ted Butler...and last week's comments on silver market manipulation by JPMorganChase's Blythe Masters. This GATA release from yesterday contains the link to the above RT interview...and a few other things as well. It's well worth your time...and the link is here. |

| Stock and bond markets rocked by fears of Italian and Spanish debt spirals Posted: 10 Apr 2012 08:53 PM PDT  Italy's leading MIB index plunged 5pc and Spain's Ibex fell 3pc amid fears that the eurozone's third and fourth biggest economies were in the grip of a deadly and uncontrollable spiral of debt and recession. The borrowing costs of both "sinner states" soared. The yield on Italy's benchmark 10-year bonds jumped to 5.7pc, heading into the danger zone that is considered unsustainably high. The equivalent Spanish debt climbed to 6pc. Meanwhile, the yield on safe-haven German bunds was pushed to an almost record low of 1.6pc. UK gilts benefited, too, dropping to 2pc. The yields reflected a level of fear on the bond markets not seen since the fraught period before Christmas when traders bet that the eurozone could collapse. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment