saveyourassetsfirst3 |

- 3 Trends To Watch For Global Investors

- Juniper Stock May Collapse More Than 25%; Buy Competitors

- Monday Options Recap

- Making Money On Citigroup With April's Earnings

- Gold Miners: The New Dividend Growth Machines?

- Silver, Gold & Miner Stocks on the Rise?

- U.S. Standard of Living Has Fallen More Than 50%

- ECB: gold and gold receivables remain unchanged

- Gold is Still Getting Fixed

- Precious Metals - Silver, Gold, Gold Miner Stocks On The Rise?

- We Owe How Much??

- Fed’s Richard Fisher – ‘I think we have done enough.’

- EndlessMountain: Silver Update 4.2.12

- Gold Blossoming in Colombia: Paul Harris

- Gold is Manipulated… and It’s Not Okay

- BRICs Bank To Rival World Bank and IMF and Challenge Dollar Dominance

- Factoring in China's Factories

- Stella: Buying Silver

- Die Zukunft der USA /2012-2016 (2. Teil) - Die wirtschaftliche Todesspirale: Rezession/Depression/Inflation

- The future of the USA - 2012-2016 (Part 2) - The unstoppable US economic spiral: Recession/depression/inflation

- Avenir des USA / 2012-2016 (2° partie) - La spirale économique infernale US: récession/dépression/inflation

- Brics Bank to Rival World Bank, IMF & Dollar

- View From the Turret: The Beat Goes On…

- April 2, 1792 : The US Coinage Act

- Gold is Manipulated (But That's Okay)

- Jim Grant: ‘gold price is the reciprocal of faith in central banks’

- GOLD: 2012 Will Be The Year Of Delivery

- Gold Rush: What Happened To Bling?

- Eric Sprott talks with Ellis Martin

- Bidding for the Stars

| 3 Trends To Watch For Global Investors Posted: 02 Apr 2012 07:23 AM PDT By Frank Holmes: Bloomberg announced over the weekend that China's manufacturing grew at the fastest pace in a year. We follow the government's Purchasing Managers' Index (PMI) closely, as we believe it is a better indicator of China's domestic demand than the HSBC PMI. Whereas HSBC PMI surveys 400 small and mid-sized companies, which are typically export-oriented, the government's PMI surveys 820 mostly large, state-owned enterprises across 20 industries. Though manufacturing activity exceeded analysts' estimates, some China bears focused on the fact that the March 2012 number is lower than the average during the third month from 2005 through 2011. What's important for investors to consider is that the trend is your friend: It is the fourth month in a row where the PMI landed above the three-month PMI, and shows the economy is on the right path. Below are three additional constructive trends we see in China. 1. China Returns Poised to Complete Story » |

| Juniper Stock May Collapse More Than 25%; Buy Competitors Posted: 02 Apr 2012 07:19 AM PDT By Takeover Analyst: The communications equipment industry contains some of the riskiest investments. They tend to be at least 50% more volatile than broader indexes and thus have a wide variance between upside and downside. As an investor relations consultant, I believe that bull cases overwhelming characterize smaller under-followed companies, like Augme Technologies (AUGT.OB) and MediaG3 (MDGC.PK). As press coverage improves for these firms (and I plan on writing focus pieces), they are bound to go skyward. In the meanwhile, a disproportionate amount of attention will be placed on larger firms like Juniper (JNPR). In this article, I will run you through my DCF analysis on Juniper and then triangulate the result with an exit multiple calculation and a review of the fundamentals compared with Alcatel-Lucent (ALU) and Cisco (CSCO). I find that Juniper is significantly overvalued. First, let's begin with an assumption about revenue. Juniper finished FY2011 with $4.4B in revenue, which Complete Story » |

| Posted: 02 Apr 2012 06:48 AM PDT By Frederic Ruffy: SentimentStocks are broadly higher, but volumes are light and it's been a slow news day so far. Trading was cautious early Monday, but then stock market averages strengthened in morning trading after ISM said its gauge of manufacturing activity improved to 53.4 in March. Economists were looking for an increase to 53 from 52.4. Construction Spending was down 1.1 percent in February and much worse than the .5 percent increase that had been anticipated. The construction numbers didn't seem to hold much sway, as both the Dow and NASDAQ had forged gains through midday. Crude oil is also up and added $2.19 to $105.21 per barrel. Gold gained $9.7 to $1679 an ounce. The Dow Jones Industrial Average added 80 points and the tech-heavy NASDAQ gained 31. CBOE Volatility Index (.VIX) is starting the second quarter with a .16 point loss and is at 15.34. With forty minutes left Complete Story » |

| Making Money On Citigroup With April's Earnings Posted: 02 Apr 2012 06:45 AM PDT By John Mylant: Last article we wrote on Citigroup (C), we were bullish on the stock for two reasons. First we felt that management was addressing the debt situation well and secondly, we were following the hedge fund money. At the writing of our first article, the stock was trading at $33.69 and presently it is at $36.55- so it has grown almost 8% and the trade we recommended has already passed on through. Steven Englander heads 10 currency strategy groups in New York for Citigroup. He stated recently that he believes Europe is getting a good handle on the debt issue and in the next couple months the euro should strengthen against the dollar. He said:

This is more good news for Citigroup, Complete Story » |

| Gold Miners: The New Dividend Growth Machines? Posted: 02 Apr 2012 06:20 AM PDT By Bayesian Investing: As an avowed dividend growth investor, I regularly scan the declared dividends of stocks to see which companies are serious about raising their payouts. I couldn't help but notice that one sector has been increasing their dividends like crazy the last couple of years: precious metal miners. Not exactly a sector known for dividends, I know. Dividend investors may be cautious of the highly cyclical nature of miners or simply distrust the sector's commitment to dividends: after all, it has taken a decade long bull market to get these stingy companies to open up their wallets. Still, in a world where it is easy for the average investor to access gold directly through ETFs, the miners are desperate to attract investors to their stocks and have suddenly got religious about dividends. I ask you all to have an open mind and let's take a look at the numbers behind a Complete Story » |

| Silver, Gold & Miner Stocks on the Rise? Posted: 02 Apr 2012 05:40 AM PDT Looking forward two to three weeks precious metals seem to be setting up for higher prices as we go into earnings season and May. Overall the market is close to a top so it could be a bumpy ride as the market works on forming a top in April. |

| U.S. Standard of Living Has Fallen More Than 50% Posted: 02 Apr 2012 05:00 AM PDT In writing about the relentless collapse of Western economies, I frequently point to "forty years of plummeting wages" for Western workers, in real dollars. However, where I have been remiss is in quantifying the magnitude of this collapse in Western wages. On several occasions I have glibly referred to how it now takes two spouses working to equal the wages of a one-income family of forty years ago. Unfortunately that is now an understatement. In fact, Western wages have plummeted so low that a two-income family is now (on average) 15% poorer than a one-income family of 40 years ago. Regular readers will recognize the chart below on U.S. average wages:

[courtesy of http://nowandfutures.com/index.html] Using the year 2000 as the numerical base from which to "zero" all of the numbers, real wages peaked in 1970 at around $20/hour. Today the average worker makes $8.50 hour – more than 57% less than in 1970. And since the average wage directly determines the standard of living of our society, we can see that the average standard of living in the U.S. has plummeted by over 57% over a span of 40 years. There are no "tricks" here. Indeed, all of the tricks are used by our governments. The green line shows average wages, discounted by inflation calculated with the same methodology for all 40 years. Obviously that is the only way in which we can compare any data over time: through applying identical parameters to it each year. Then we have the blue line: showing wage data discounted with our "official" inflation rate. The problem? The methodology used by our governments to calculate inflation in 1975 was different from the method they used in 1985, which was different than the method they used in 1995, which was different than the method they used in 2005. Two obvious points flow from this observation. First, it is tautological that the only way in which data can be compared meaningfully is to use a consistent methodology. If the government thinks it has improved upon its inflation methodology, then all it had to do was take all of its old data and re-calculate it with their "improved" methodology. Since 1970 there is this invention called "computers" which makes such calculations rather simple. This brings us to the second point: the refusal of our governments to adopt a consistent methodology in reporting inflation statistics can only imply a deliberate attempt to deceive, since it is 100% logically/statistically invalid to simply string together disconnected series of data – and present it as if it represents a consistent picture. More specifically, we can see precisely what lie our government was attempting to get us to believe. |

| ECB: gold and gold receivables remain unchanged Posted: 02 Apr 2012 04:39 AM PDT |

| Posted: 02 Apr 2012 04:24 AM PDT |

| Precious Metals - Silver, Gold, Gold Miner Stocks On The Rise? Posted: 02 Apr 2012 04:23 AM PDT |

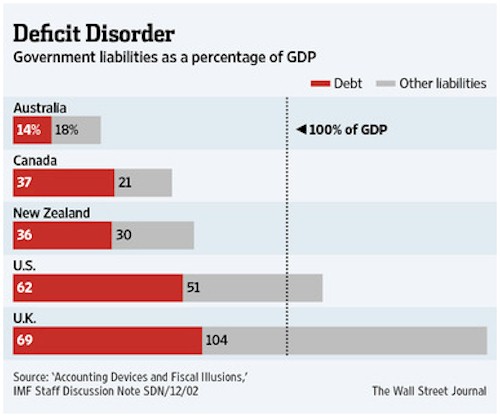

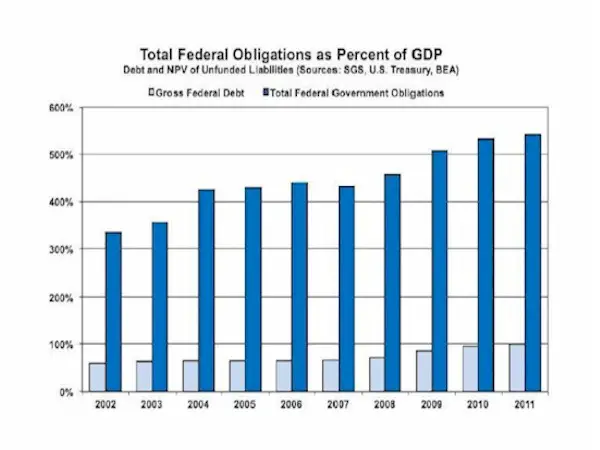

| Posted: 02 Apr 2012 04:19 AM PDT One of the problems with the debate over the "national debt" is that there's no generally agreed upon definition of that term. Is it what the federal government owes, or what it owes foreigners, or what the whole country, private and public sector together, owes? Does it include off-balance-sheet items and contingent liabilities? There's a hundred-trillion dollar gap between lowest and highest on this spectrum, which allows each commentator to confuse the rest of us by picking the measure that best suits their point of view. New York Times columnist Paul Krugman, for instance, uses "net debt" — the amount that the US owes foreigners — to argue that since this number is relatively small and slow-growing, we're actually fine. Analysts using broader definitions of debt come to the opposite, more apocalyptic conclusion. Consider this from today's Wall Street Journal, on the impact of off-balance-sheet obligations:

Then there are the "unfunded liabilities" of entitlements like Social Security and Medicare, which dwarf the official national debt. From a recent Zero Hedge article:

Here's a chart illustrating the impact of adding unfunded liabilities to the national debt (can't recall where I got it; my apologies to its creators for the lack of citation): There are two reasons that debt and unfunded liabilities are treated as separate things: 1) The practice allows government to hide its true obligations in the same way that Enron did — right up to the day it evaporated. In other words, it's is a legally sanctioned lie. 2) Debt and unfunded liabilities are, at first glance, different in some ways. Debt is a legal obligation that gives the lender recourse, i.e. some way of getting back some of their money. In the private sector a lender who's not getting paid can seize the borrower's assets or force the latter into bankruptcy court where a judge decides who gets what. With sovereign debt, the creditor (who lent money by buying bonds) can sell those bonds and use the proceeds to buy up the borrower's assets. Unfunded liabilities, in contrast, are simply promises that don't carry a legal obligation. In theory, Medicare could be cancelled tomorrow by Congress. Just like that, the program and its associated unfunded liabilities would disappear. So the question becomes, how real — and therefore how dangerous — are US unfunded liabilities? The answer is that because they represent a promise to tens of millions of retired baby boomers who expect to get free money and health care for the last 30 or so years of life, they're effectively more real an obligation than a Treasury bond. A politician who messes with the Most Selfish Generation's free health care will find himself back in the harsh private sector world of actual expected results before the polls close in the next election. Compare this with the probable repercussions of stiffing China or Saudi Arabia on bond interest — some contentious headlines and a bit of turmoil in the foreign exchange markets that most voters would hardly notice — and it's clear that unfunded liabilities have, if anything, a more solid claim on future economic activity in the US than does interest on Treasury bonds. So our true national debt is government debt plus private sector debt plus off-balance-sheet obligations plus unfunded liabilities, which comes to somewhere around half a million dollars per man, woman and child, or two million per family of four. We can't pay this of course, so the story of the next few years will be the search for the least painful way of breaking our promises. And history is pretty clear on this: a country with a printing press will always use it before exploring the harder options of actual default, whether through non-payment of interest or cancellation of benefits. |

| Fed’s Richard Fisher – ‘I think we have done enough.’ Posted: 02 Apr 2012 04:13 AM PDT In response to a question by CNBC's Steve Liesman of what the Fed should do in the coming months with regard to additional stimulus, the Dallas Fed chief said, "I think we've done enough. I don't think there's a need to add. There's so much liquidity, Steve, in the system. Why would we add more unless we have a crisis on our hands or something that was happening and we're seeing significant slippage in the economy?" "I think we ought to sit, wait, watch and in fact be looking if the economy continues to improve as to how we're going to exit from the position we're currently in. Not willing to tighten, but not willing to support further accommodation either through greater QE," Fisher added. Fisher pans the idea of a "Bernanke Put" under the market. Listen closely to how he cleverly addresses that subject with Becky Quick. It is as deft a case of "responsibility transference" as we have seen from a Fed official, and we have seen some good ones. He says the time for riding the "jet stream" of Fed liquidity is "over." Source: CNBC http://video.cnbc.com/gallery/?video=3000081820 Fed's Richard Fisher – 'I think we have done enough.' In response to a question by CNBC's Steve Liesman of what the Fed should do in the coming months with regard to additional stimulus, the Dallas Fed chief said, "I think we've done enough. I don't think there's a need to add. There's so much liquidity, Steve, in the system. Why would we add more unless we have a crisis on our hands or something that was happening and we're seeing significant slippage in the economy?" "I think we ought to sit, wait, watch and in fact be looking if the economy continues to improve as to how we're going to exit from the position we're currently in. Not willing to tighten, but not willing to support further accommodation either through greater QE," Fisher added. Fisher pans the idea of a "Bernanke Put" under the market. Listen closely to how he cleverly addresses that subject with Becky Quick. It is as deft a case of "responsibility transference" as we have seen from a Fed official, and we have seen some good ones. He says the time for riding the "jet stream" of Fed liquidity is "over." Source: CNBC http://video.cnbc.com/gallery/?video=3000081820

|

| EndlessMountain: Silver Update 4.2.12 Posted: 02 Apr 2012 03:29 AM PDT from endlessmountain: ~TVR |

| Gold Blossoming in Colombia: Paul Harris Posted: 02 Apr 2012 01:37 AM PDT |

| Gold is Manipulated… and It’s Not Okay Posted: 02 Apr 2012 01:36 AM PDT Andy Hoffman |

| BRICs Bank To Rival World Bank and IMF and Challenge Dollar Dominance Posted: 02 Apr 2012 01:32 AM PDT gold.ie |

| Factoring in China's Factories Posted: 02 Apr 2012 01:19 AM PDT The first session of the new quarter commenced on an upbeat note for all of the precious metals, save gold, this morning. The yellow metal opened on the weak side, showing a bid-side quote at $1,665 as against a marginally higher US dollar. |

| Posted: 02 Apr 2012 01:17 AM PDT |

| Posted: 02 Apr 2012 01:02 AM PDT - Auszug GEAB N°60 (17. Dezember 2011) -  Die USA beenden das Jahr 2011 in einem Zustand der Schwäche wie nie seit dem Bürgerkrieg. Auf der internationalen Bühne habe sie ihre Führungsrolle eingebüßt. Die Spannungen zwischen den Blöcken nehmen zu und die USA sind an fast allen Streitigkeiten beteiligt: China, Russland, Brasilien (eigentlich mit allen Ländern Süd-Amerikas) und nunmehr auch Euroland (1). Gleichzeitig verbessert sich die Lage auf dem US-Arbeitsmarkt, auf dem die reelle Arbeitslosigkeit bei 20% liegt, kaum, obwohl die Zahl der aktiven Personen in der Bevölkerung stetig und wie noch nie zuvor zurückgeht; sie ist nunmehr auf den Stand von 2001 gefallen (2). Die Preise für Immobilien, die zusammen mit Aktienbesitz den Hauptteil des Reichtums der US-Privathaushalte bilden, gehen trotz der verzweifelten Versuche der Fed (3), mit zinslosen Krediten die Wirtschaft anzukurbeln, Jahr für Jahr weiter zurück. In den Bilanzen der amerikanischen Banken stehen weitaus mehr zweifelhafte Finanzderivate als in denen der europäischen (4). Es besteht die konkrete Gefahr, dass einige von ihnen bald zahlungsunfähig werden; der Bankrott von MF Global ist insofern ein Vorzeichen für das, was kommen könnte, und hat wieder einmal gezeigt, dass drei Jahre nach dem Beinahe-Absturz der Wall Street Finanzaufsicht dort ein rein theoretisches Konzept bleibt (5). Mit jedem Tag nimmt die Armut in den USA zu. Inzwischen ist jeder sechste Amerikaner auf den Bezug von Lebensmittelkarten (6) angewiesen und jedes fünfte Kind war schon einmal Opfer von Obdachlosigkeit (7). Die öffentliche Daseinsvorsorge (Bildung, Soziales, Polizei, Straßen) wurde quer durch das Land eingeschränkt, da die Staaten, Kreise und Gemeinden sie nicht mehr bezahlen können. Die Unterstützung, die die die Proteste der Mittelklasse und der Jungen, also TP und OWS, laut Meinungsumfragen bei vielen Amerikanern gefunden haben, ist die unmittelbare Folge der Tatsache, dass die überwiegende Mehrheit der Amerikaner in ihrem täglichen Leben mit den realen Protestgründen konfrontiert werden. Diese Trends werden sich in den kommenden Jahren verstärken. Der Schwächezustand der US-Wirtschaft und – Gesellschaft ist paradoxerweise das Ergebnis der 2009/2010 durchgeführten Rettungsversuche (Konjunkturprogramme, QE) sowie der Verschärfung einer allgemeinen Lage, die schon vor dem Ausbruch der Krise alles andere als rosig war. 2012 wird das erste Jahr sein, in der die Situation sich von einem bereits sehr schlechten Niveau aus noch einmal verschlechtern wird (8). Die kleinen und mittleren Unternehmen, die Kreise, Städte und Gemeinden (9), die öffentlichen Unternehmen der Daseinsvorsorge usw. verfügen über keine Finanzreserven mehr, die sie durch die neue Rezessionsphase bringen könnten (10). Wir hatten vorhergesagt, dass 2012 der Wert des Dollars im Vergleich zu den anderen großen Weltwährungen um 30% fallen werde. Da die USA fast alle Konsumgüter einführen, bedeutet dies einen unmittelbaren Kaufkraftverfall in der gleichen Größenordnung. Gleichzeitig wird die Kaufkraft durch eine Inflation im zweistelligen Bereich weiter geschwächt. TP und OWS haben also ihre besten Tage noch vor sich. Denn die Wut des Jahres 2011 wird sich 2012/2013 in rasenden Zorn wandeln. Und wir gehen davon aus, dass niemand so sehr geeignet sein wird, diesen Zorn in geordnete Bahnen zu lenken, wie ein General in Uniform. 2012 wird die große Herausforderung für die US- Finanzinstitutionen darin bestehen, genug Geld aufzutreiben, um das riesige US- Defizit finanzieren zu können. Das erklärt auch, warum sich seit dem Sommer 2011 die Angriffe auf den Euro und Euroland zahlreicher und schwerer wurden. Ein Konkurrent soll aus dem Weg geschafft werden. In der kommenden, 61. Ausgabe des GEAB werden wir herausarbeiten, dass 2012 ein Wendepunkt am Markt für US-Staatsanleihen erreicht wird. Und die neue Lage wird für die US- Staatsfinanzierung eine wahre Katastrophe sein (11). Wir hatten schon 2009 anhand einer erstmaligen Berechnung der sich in der Krise in Luft auflösenden Scheinwerte vorhergesagt, dass in den kommenden Jahren weltweit nicht mehr genug Sparvermögen zur Verfügung stehen werde, um die Defizite der westlichen Staaten zu finanzieren. Inzwischen bestätigt uns die OECD in dieser Auffassung (12). Das erklärt, warum Großbritannien und die USA in ihren Versuchen, an das verbleibende Kapital zu kommen, immer aggressivere Methoden anwenden. Euroland, das nach objektiven Kriterien für Investoren attraktiver sein müsste, ist dabei der Wettbewerber, der aus dem Weg geräumt werden muss.  Die US- Todesspirale aus Rezession, Depression und Inflation wird daher in den USA ein politisches und soziales Chaos von einem Ausmaß und Wucht auslösen wie nie zuvor in der modernen Geschichte Amerikas. Wir sind davon überzeugt, dass das politische System Washingtons keine Ahnung hat, welcher Sturm sich in Richtung USA bewegt. Wir wollen ein Beispiel für die Unfähigkeit des politischen Apparats, die Wirklichkeit wahrzunehmen, präsentieren: Das Pentagon will nicht akzeptieren, sein Budget in den kommenden fünf Jahren um fünf Prozent zu kürzen. Den Verantwortlichen ist also überhaupt nicht ersichtlich, was auf sie in Wirklichkeit an Budgetkürzungen zukommt. Angesichts der institutionellen Lähmung des Landes und insbesondere des wirtschaftlichen und finanziellen Schocks des kommenden Jahres sollten sie sich auf eine Reduzierung ihres Budgets um 50% einstellen. Das ist jedoch außerhalb des Vorstellungsvermögens der hohen Offiziere und Beamten. Aber was undenkbar erscheint, muss nicht unmöglich sein. Wie hätten die Chefs von Lehman, AIG und der anderen großen Banken und Fonds an Wall Street wohl reagiert, wenn man sie 2007 gefragt hätte, ob Wall Street zusammenbrechen könne? Wie hätten wohl die Sowjetgeneräle reagiert, wenn man sie gefragt hätte, ob es möglich sei, dass die Sowjetunion in vier Jahren zu existieren aufgehört haben und ihr Budget auf fast Null reduziert sein wird? In einer Krise wird „unmöglich" und „undenkbar" häufig verwechselt. Und dann kommt der Moment, in dem die Wirklichkeit in Kollision mit dem Wunschdenken gerät und das „Unmögliche" sich lediglich als „bisher undenkbar" entpuppt. Da ist es dann unvermeidlich, dass auch die US-Banken 2012 einem neuen Blutbad ausgesetzt sein werden. Wie wir schon in der 58. Ausgabe ausführten, werden, genau wie in Japan und Europa, zwischen 10% und 20% von ihnen in Konkurs gehen (13). Die Finanzderivate in ihren Bilanzen werden ihren Zusammenbruch verursachen, wenn die europäische Schuldenkrise zuerst die City in die Knie zwingen wird und anschließend auch die „Werte" der US-Banken als reine Makulatur entlarven wird. Für die USA ist im Jahr 2013 (14) Hyperinflation eine sehr realistische Eventualität , wenn der Regierung in Washington und in die Bundesstaaten jegliche Mittel zur Umsetzung staatlicher Maßnahmen fehlen werden und das Finanzsystem zusammenbricht, weil niemand , weder die öffentliche Hand noch die privaten Haushalte aufgrund ihrer Überschuldung mehr in der Lage ist, seinen finanziellen Verpflichtungen nachzukommen. -------- Noten: (1) Wie schrieb doch Rudyard Kipling in seinem wunderbaren Gedicht « Wenn »: „Kannst du die Wahrheit sehn, die du gesprochen, Verdreht als Köder für den Pöbelhauf; Dir treu sein kannst, wenn alle dich verlassen /Und dennoch ihren Wankelmut verzeih'n/ Läßt dich mit Lügnern nie auf Lügen ein / Kannst du dem Hasser deinen Haß versagen/Und doch dem Unrecht unversöhnlich sein / Dein ist die Erde dann mit allem Gut... „ (übertragen ins Deutsche von Lothar Sauer) Dieser Rat gilt nicht nur für Einzelne, sondern auch für Gesellschaften. Und ein Literaturfreund in unserem Team zitierte diese Passage des Gedichts angesichts einer Diskussion über die Berichterstattung der angelsächsischen Medien zu Euroland und Eurokrise. Aber mit der Isolierung Großbritanniens in der EU und der sich beschleunigenden Integration Eurolands (wie wir es vorhergesehen hatten), können wir feststellen, dass in Euroland eine psychologische Barriere durchbrochen wurde: Jetzt muss nicht mehr Rücksicht auf die besonderen Wünsche unsere angelsächsischen „Verbündeten" genommen werden; es geht jetzt darum, sich gegen die Angriffe der angelsächsischen Gegner Eurolands und des Euros zur Wehr zu setzen. Im Gegensatz zu den großen Medien und Experten in den Diensten von Wall Street und City verschwenden die Euroländer keine Zeit damit, „Worte als Köder für den Pöbelhauf" zu verdrehen. Vielmehr nehmen sie die Wirklichkeit, wie sie ist, gehen beharrlich ihren Weg und kappen eine Leine nach der anderen, mit der sie an die angelsächsischen Finanzzentren gebunden sind; bald werden sie auch die politischen Leinen kappen. Wir wollen uns nicht des Vergnügens berauben, unseren Lesern ein weiteres Beispiel der Meinungsmache der angelsächsischen Medien zu präsentieren, die inzwischen eine Spezialität der meisten britischen und amerikanischen Medien geworden ist. In unserer Rubrik „verdrehte Worte der Lügner für den Pöbelhauf" stellen wir einen Artikel von MarketWatch vom 14.12.2011 mit dem Titel Money mangager fear eurozone breakup vor. Was aber liest man in dem Artikel? Dass sie überwiegend (75% von ihnen) von der Sorge getrieben waren, dass die US-Bonitätsnote herabgestuft werden könnte, wobei 48% von ihnen damit im nächsten Jahr rechneten, während nur 44% von ihnen meinten, dass das Risiko bestände, dass eines Tages (ohne konkretes Datum!) ein Land aus der Eurozone ausscheren könnte. Eine ehrliche Schlagzeile hätte also lauten müssen: Geldmanager fürchten Herabstufung der US-Staatsanleihen. Aber wie heißt es doch: Im Krieg und in der Liebe ist jedes Mittel Recht. (2) Gleichzeitig wuchs die US-Gesamtbevölkerung um 30 Millionen, also um 10%. Quelle: Washington Post, 02/12/2011 (3) Wir gehen davon aus, dass in den Jahren 2013/2014 sich für den Kongress dank einer massiven Unterstützung der öffentlichen Meinung die bisher undenkbare Möglichkeit bieten wird, die Zerschlagung der Fed durchzusetzen. Die Gegnerschaft der Tea-Party-Bewegung zu den Bundesinstitutionen und die Proteste der OWS gegen Wall Street überlappen sich in dieser Frage in wunderbarer Weise. (4) Quelle: New York Times, 24/11/2011 (5) Auch hier haben wieder einmal die Rating-Agenturen, allen voran Moody's, nichts vorhergesehen. Denn bis Sommerende 2011 erhielt MF Global noch Höchstnoten, während in Wirklichkeit die Verantwortlichen schon die Konten ihrer Kunden anzapften, um die Zahlungsunfähigkeit hinauszuschieben. Vielleicht ist dieses Detail für diejenigen, die glauben, ihr Vermögen werde an Wall Street und in der City bestmöglich verwaltet, „food for thought". (6) Quellen: MSNBC, 11/2011; RT, 08/12/2011 (7) Das sind Zahlen, die man eigentlich nur in Ländern der Dritten Welt erwarten würde. Zur Lage von obdachlosen Kindern ein Video auf Beforeitsnews, 29/11/2011 (8) Das Land hat seine Fähigkeit zum Wirtschaftswachstum verloren, erklärt Gregor McDonald in SeekingAlpha vom 05/12/2011. (9) Quelle: Washington Post, 29/11/2011 (10) In Wahrheit ist das Land seit 2008 nie aus der Rezession gekommen, auch wenn dank der makro-ökonomischen Maßnahmen die Zahlen anderes aussagen. Aber von Makro-Ökonomie können sich eben nur Wirtschaftswissenschaftler ernähren. (11) Wer glauben mag, dass die Fed mit den anderen Zentralbanken vor einem Monat mit ihren Maßnahmen beabsichtigte, Euroland unter die Arme zu greifen, kennt schlecht die Motive typischer US-Einsätze: Die USA engagieren sich außerhalb ihrer Landesgrenzen nur, wenn sie der Auffassung sind, dass ihre unmittelbaren Interessen es erfordern. Bei den Maßnahmen der Fed ging es allein darum, die eigenen Banken und Finanzinstitute zu schützen, die mit ihren Bilanzen voller toxischer Forderungen und Finanzderivaten, von denen niemand den Marktwert bestimmen kann, am Rande des Abgrunds wanken. Allein die Fed steht schützend vor Wall Street und verhindert ihren Zusammenbruch. Die Fed weiß sehr wohl, dass Euroland und seine „Schuldenkrise" die Zündschnur an der britischen und US-Schuldenbombe ist. Also schüttet sie nach Möglichkeit Wasser darauf. (12) Quelle: Financial Times, 11/12/2011 (13) Darüber hinaus häufen sich Klagen gegen die Banken. Quelle: Le Monde, 04/12/2011 (14) Insbesondere wenn, wovon wir ausgehen, Euroland gegen Ende 2012 immer mehr dazu übergehen wird, mit Nachdruck zu versuchen, den Euro als Zahlungsmittel all seiner Außenhandelsgeschäfte durchzusetzen, einschließlich der Bezahlung von Energielieferungen. Die Entscheidung der euroländischen Banken, ihre Geschäftstätigkeiten in Dollar zu reduzieren, nachdem die Banken der Wall Street und der City ihnen ohne Vorwarnung den Dollarhahn zugedreht hatten (sie haben ihren Bedarf von 1.300 Milliarden Dollar auf nunmehr 800 Milliarden gesenkt und dürften 2012 wohl nur noch 500 Milliarden benötigen), wird ab Ende 2012 zweierlei bewirken: Ein starker Rückgang der Dollarnachfrage weltweit und eine Zunahme der Kreditvergabe in Euro. Da auch zunehmend der Handel zwischen den BRICS in deren Währungen abgewickelt wird und gleichzeitig im asiatischen Raum der Yuan immer stärkere Verbreitung findet, werden 2012 zwei weitere große Währungsräume entstehen. Der Zusammenbruch der Nachfrage nach Dollar für den weltweiten Handel wird dazu führen, dass unvorstellbare Dollarmassen in die USA zurückfließen werden und zu der Hyperinflation beitragen, die wir für 2013 vorhersagen. Quelle: New York Times, 01/12/2011 |

| Posted: 02 Apr 2012 12:40 AM PDT - Excerpt GEAB N°60 (December 16, 2011) -  In fact, the United States ends 2011 in a state of weakness unmatched since the Civil War. They practice no significant leadership at international level. The confrontation between geopolitical blocs is sharpening and they find themselves confronted by almost all the world's major players: China, Russia, Brazil (and in general almost all of South America) and now Euroland (1). Meanwhile, they cannot control unemployment where the true rate stagnates at around 20% against the backdrop of an unabated and unprecedented reduction in the labour force (which has now fallen to its 2001 level (2)). Real estate, the foundation of US household wealth along with the stock market, continues to see prices drop year after year despite desperate attempts by the Fed (3) to facilitate lending to the economy through its zero interest rate policy. The stock market has resumed its downward path artificially interrupted by two Quantitative Easings in 2009 and 2010. US banks, whose balance sheets are much more heavily loaded with financial derivative products than their European counterparts (4), are dangerously approaching a new series of bankruptcies of which MF Global is a but a precursor, indicating the absence of procedural controls or alarms three years after the collapse of Wall Street in 2008 (5). Poverty is gradually increasing in the country every day, where one in six Americans now depend on food stamps (6) and one in five children has experienced periods of living on the streets (7). Public services (education, social, police, highways...) have been significantly reduced across the country to avoid city, county, or state bankruptcies. The success with which the revolt of the middle class and the young (TP and OWS) has met is explained by these objective developments. And the coming years will see these trends get worse. The weakness of the 2011 US economy and society is, paradoxically, the result of the "rescue" attempts carried out in 2009/2010 (stimulus plans, QE ...) and the worsening of a pre-2008 "normal" situation. 2012 will mark the first year of deterioration from an already badly impaired situation (8). SMEs, households, local authorities (9), public services,... have no more "padding" to soften the blow of the recession into which the country has fallen again (10). We anticipated that 2012 would see a 30% drop in the Dollar against major world currencies. In this economy, which imports the bulk of its consumer goods, this will result in a corresponding decrease in US household purchasing power against a backdrop of double-digit inflation. The TP and OWS have, therefore, a bright future ahead of them since the wrath of 2011 will become the rage in 2012/2013. And according to LEAP/E2020, nothing is less certain than the ability of a general in uniform to master such a rage. For the great financial issue in 2012 (which is why the attacks on Euroland have multiplied and intensified since the end of summer 2011) is simply the financing of the huge "black hole" of US deficits. In the next GEAB issue, we will develop a clearer-cut analysis on why 2012 marks a catastrophic turning point for the US Treasury Bond market, but what we are talking about here was already officially recorded by the OECD: in 2012, there will no longer be enough money available to finance Western deficits (11). It's an anticipation that we made in 2009 by, for the first time quantifying what we called the disappearance of "ghost-assets" that this crisis is turning into smoke, shock after shock. The OECD confirms this prognosis and this explains the increasingly open warfare conducted by the UK and the US to try and appropriate the remaining financial resources, particularly at the expense of Euroland, capable of being a greater attraction on its own (12).  The unstoppable US spiral of recession/depression/inflation is, therefore, the harbinger of turbulences without modern equivalent for the United States, both in their scale and speed. Our team considers the players of the "Beltway" are unable to imagine this shock and its consequences. Thus, to take one telling example: when the Pentagon works with difficulty on a possible 5% reduction of its budget over the next five years, it's totally mistaken in terms of the magnitude in budget cuts. Between the institutional deadlock and the 2012 economic and financial shocks especially, it should be working on cutting its budget by 50%. "Impossible!" say the officers and military experts. In fact they mean "Unthinkable!" This isn't quite the same thing. They should ask the bosses of Lehman Brothers, AIG and the big Wall Street players if, in 2007, they thought a widespread collapse of their financial markets "possible" a year later? They should ask the Soviet generals of 1987 whether they thought it "possible" that the USSR would have disappeared four years later and that their budget would have fallen to almost zero? In an historic crisis, the "impossible" is in fact generally limited to the "unthinkable"... until the moment when suddenly reality imposes its choice which, in only a few cases, is what the players involved think. Besides US banks will face a new massacre in 2012. As mentioned in the GEAB N°58, between 10% and 20% of them will go bankrupt (13) following the example of their European and Japanese counterparts. It's the derivative products swilling around their balance sheets that will lead them there, the direct result of the European debt crisis and the direct hit of the shock that will affect the City first of all, the last bastion of Wall Street. Hyperinflation is a very real possibility for the United States (14) in 2013, against the backdrop of federal (and local) governments lacking the means of action and a banking system suffocated by the sudden rise of all the unpaid domestic (household debt, local authorities...) and external (sovereign debt) dues. --------- Notes: (1) In his marvellous poem « If », Rudyard Kipling wrote "… If you can bear to hear the truth you've spoken/ Twisted by knaves to make a trap for fools/ Or, being lied about/ Don't deal in lies/ Yours is the Earth and everything that's in it". And this advice applies to communities as well as individuals because the reading of the Anglo-Saxon press about the Euro and Euroland irresistibly makes our team think of this passage from the poem. However, with the marginalization of the United Kingdom within the EU and faster Euroland integration (as per our anticipations), we note the crossing of a psychological barrier in Euroland: it's no longer the time to avoid offending the sensibilities of our Anglo-Saxon "allies", but simply to protect ourselves from the attacks of our Anglo-Saxon opponents. Unlike the media and "mainstream" experts of Wall Street and the City, Euroland isn't wasting time "to twist the words to make a trap for fools", it satisfies itself in taking reality into account, to move forward "grinning and bearing it" and cut, one by one, the ties that bind it to the British and US financial centres (and the political ones later). Our team cannot resist the temptation to provide a further illustration of the daily "spinning" of information of which most of the British and US media have made a specialty. Thus, in the section of our heading "twisted by knaves to make a trap for fools", MarketWatch published an article on 14/12/2011 entitled "Fund managers fear a Eurozone break-up" Yet what did we discover in the article? That their main concern (75% of them) was a further US downgrade (48% think it will happen in 2012) and only 44% of them thought there was a risk that one day a country would leave the Eurozone, without mentioning a timeframe. An honest title should, therefore, have been "Fund managers fear a further US downgrade". But as they say in French: "A la guerre comme la guerre (make do with what you've got)!". (2) Whereas in the same time, the US population has increased by 30 million, a 10% rise. Source: Washington Post, 02/12/2011 (3) Our team thinks 2013/2014 will provide, via the Congress and due to massive public support, an unprecedented opportunity to demand a dismantling of the Fed. The anti-federal beliefs of the Tea Parties and those anti-Wall Street of the OWS will find a compelling focal point here. (4) Source: New York Times, 24/11/2011 (5) In this connection it is interesting to note that the rating agencies, led by Moody's, saw nothing coming once again since, until the end of summer 2011, MF Global had a positive rating from these agencies... even while the company was already tapping its clients' accounts in an attempt to survive. May those who believe that their investments are better protected on Wall Street or in the City reflect on this "detail". (6) Sources: MSNBC, 11/2011; RT, 08/12/2011 (7) These are the numbers that henceforth rank the country fully in the "Third World" category in social matters. Source: Beforeitsnews, 29/11/2011 (8) Gregor McDonald says the country can no longer generate growth. Source: SeekingAlpha, 05/12/2011 (9) Source: Washington Post, 29/11/2011 (10) In fact, it has never left it since 2008, except technically due to macro-economic measures. But no one eats macroeconomics... except economists. (11) Source: Financial Times, 11/12/2011 (12) Here, if some believe that the Fed intervened with other major central banks a month ago to come to the "rescue" of Euroland, they know little about the motivations of US interventionism: the United States intervene outside their borders only if they feel their direct interests are at stake. Their late arrival in two world wars illustrates this very well. In this case, as we have analyzed and as the MF Global case shows, it's quite simply to save their own banks and financial institutions that they intervened. They fluctuate on empty, with their balance sheets swollen with derivatives of which no one knows the exact content; and only the Fed in these last three years has prevented the widespread bankruptcy of Wall Street. As anticipated in several GEABs, the Fed is well aware that Euroland is the detonator "par excellence" that will trigger Wall Street and the City's explosion, then it douses the wick as long as it can. (13) Without even mentioning the growing number of court cases in which the are enmeshed. Source: Le Monde, 04/12/2011 (14) All the more since, according to LEAP/E2020, at the end of 2012 Euroland will put in place a proactive policy promoting the use of Euros inall exchanges, including in the field of energy. The decisions made by Euroland banks to stop lending money in USD (knowing the need for that fell from 1,300 billion USD to 800 billion, and probably down to less than 500 billion in 2012), as a result of the asphyxia attempt perpetrated against them by their Wall Street and City partners, will automatically result in two opposite phenomena at the end of 2012: a sharp fall in the global demand for USDs; and, on the opposite, a strengthened lending activity in Euros. Given that China, as well as its BRICS partners, continues to increase the amount of its exchanges in Yuan (or in other BRICS currencies), 2012 will therefore be characterized by the emergence of two big monetary zones next to the Dollar zone. This collapse in the global need for USDs in trade transactions will in turn generate a massive return of USDs to the United States, thus contributing to the episode of hyper-inflation that we anticpate in 2013. Source: New York Times, 01/12/2011 |

| Posted: 02 Apr 2012 12:20 AM PDT - Extrait GEAB N°60 (15 décembre 2011) -  En effet, les Etats-Unis terminent l'année 2011 dans un état de faiblesse sans équivalent depuis la Guerre de Sécession. Ils n'exercent plus aucun leadership significatif au niveau international. Les divergences entre blocs géopolitiques s'aiguisent et ils se trouvent confrontés à presque tous les grands acteurs du monde : Chine, Russie, Brésil (et, plus généralement, quasiment toute l'Amérique du Sud) et désormais l'Euroland (1). Parallèlement, ils n'arrivent pas à maîtriser un chômage dont le taux réel stagne autour de 20% sur fond d'une réduction continue et sans précédent de la population active (qui est tombée désormais à son niveau de 2001 (2)). L'immobilier, fondement de la richesse des ménages US avec la Bourse, continue à voir ses prix chuter année après année malgré les tentatives désespérées de la Fed (3) de faciliter les prêts à l'économie via son taux zéro. La Bourse a repris sa baisse interrompue artificiellement par les deux Quantitative Easing de 2009 et 2010. Les banques américaines, dont les bilans sont beaucoup plus chargés en produits financiers dérivés que ceux de leurs homologues européennes (4), s'approchent dangereusement d'une nouvelle série de faillites dont MF Global est un signe avant-coureur, démontrant l'inexistence des procédures de contrôle ou d'alerte trois ans après l'effondrement de Wall Street en 2008 (5). La pauvreté s'étend chaque jour un peu plus dans le pays où un Américain sur six dépend désormais des bons d'alimentation (6) et où un enfant sur cinq connaît des épisodes de vie dans la rue (7). Les services publics (éducation, social, police, voirie,…) ont été considérablement réduits dans tout le pays pour éviter les faillites de villes, comtés ou Etats. Le succès rencontré par la révolte des classes moyennes et des jeunes (TP et OWS) s'explique par ces évolutions objectives. Et les années à venir vont voir ces tendances s'aggraver. L'état de faiblesse de l'économie et de la société US de 2011 est paradoxalement le résultat des tentatives de « sauvetage » conduites en 2009/2010 (plans de stimulation, QE, …) et de la dégradation d'une situation « normale » pré-2008. 2012 va marquer la première année de dégradation à partir d'une situation déjà très détériorée (8). Les PME, les ménages, les collectivités locales (9), les services publics, … n'ont plus de « matelas » pour atténuer le choc de la récession dans laquelle le pays est à nouveau tombé (10). Nous avons anticipé que l'année 2012 allait voir une baisse de 30% du Dollar US par rapport aux principales devises mondiales. Dans cette économie qui importe l'essentiel de ses biens de consommation, cela se traduira par une baisse quasiment équivalente du pouvoir d'achat des ménages US sur fond d'inflation à deux chiffres. TP et OWS ont donc de beaux jours devant eux car la colère de 2011 va devenir de la rage en 2012/2013. Et selon LEAP/E2020, rien n'est moins certain que la capacité d'un général en uniforme à maîtriser une telle rage. Car le grand enjeu financier de 2012 (qui explique pourquoi les attaques sur l'Euroland se sont multipliées et intensifiées depuis la fin de l'été 2011), c'est tout simplement le financement de l'immense « trou noir » des déficits américains. Dans le GEAB N°61, nous développerons une analyse plus précise sur le fait que 2012 marquera un tournant catastrophique pour le marché des Bons du Trésor US ; mais ce que nous rappelons ici est déjà acté par l'OCDE : en 2012, il n'y aura plus assez d'argent disponible pour financer les déficits occidentaux (11). C'est une anticipation que nous avons faite dès 2009 en chiffrant pour la première fois ce que nous avons appelé la disparition des « actifs-fantômes » que cette crise transforme en fumée, choc après choc. L'OCDE confirme donc ce pronostic et cela explique la guerre de plus en plus ouverte que conduisent le Royaume-Uni et les Etats-Unis pour tenter de s'approprier les ressources financières restantes, notamment au détriment de l'Euroland, seule capable d'une attractivité plus grande (12).  La spirale infernale US récession/dépression/inflation est donc porteuse de turbulences sans équivalent moderne pour les Etats-Unis, à la fois par leur ampleur et leur vitesse. Pour notre équipe, les acteurs de la « Beltway » sont incapables d'imaginer ce choc et ses conséquences. Ainsi, pour prendre un exemple parlant : quand le Pentagone planche avec difficulté sur une éventuelle réduction de 5% de son budget sur les cinq années à venir, il se trompe totalement de magnitude en matière de coupes budgétaires. Entre le blocage institutionnel et surtout le choc économique et financier de 2012, c'est sur une baisse de 50% de son budget qu'il devrait travailler. « Impossible ! » disent les gradés et experts militaires. En fait ils veulent dire « Impensable ! », ce qui n'est pas tout-à-fait la même chose. Qu'ils demandent aux patrons de Lehman Brothers, d'AIG et aux grands opérateurs de Wall Street s'ils estimaient « possible » en 2007 un effondrement généralisé de leur place financière un an plus tard ? Qu'ils demandent aux généraux soviétiques de 1987 s'ils croyaient « possible » que l'URSS ait disparu quatre ans plus tard et que leur budget tombe à quasiment zéro ? Dans une crise historique, l' « impossible » se limite en effet généralement à l' « impensable »… jusqu'au moment où soudain la réalité impose son choix qui ne fait que peu de cas de ce que pensent les acteurs concernés. D'ailleurs les banques US vont affronter en 2012 une nouvelle hécatombe. Comme nous l'indiquions dans le GEAB N°58, entre 10% et 20% d'entre elles vont faire faillite (13) à l'instar de leurs homologues européennes et japonaises. Ce sont les produits dérivés peuplant leurs bilans qui vont les entraîner, conséquence directe de la crise des dettes européennes et contre-coup direct du choc qui affectera d'abord la City, dernier rempart de Wall Street. L'hyper-inflation est donc une possibilité très réaliste pour 2013 aux Etats-Unis (14), sur fond de gouvernement fédéral (et de gouvernements locaux) dépourvu de moyens d'action et d'un système bancaire asphyxié par la remontée soudaine de tous les impayés intérieurs (dettes des ménages, des collectivités,…) et extérieurs (dettes souveraines). -------- Notes: (1) Dans son superbe poème « Tu seras un Homme, mon filsème) », Rudyard Kipling écrivait « … Si tu peux supporter d'entendre tes paroles / Travesties par des gueux pour exciter des sots, / Et d'entendre mentir sur toi leurs bouches folles / Sans mentir toi-même d'un mot... Alors les Rois, les Dieux, la Chance et la Victoire / Seront à tous jamais tes esclaves soumis ». Et ce conseil vaut pour les collectivités aussi bien que pour les individus car la lecture de la presse anglo-saxonne à propos de l'Euro et de l'Euroland fait irrésistiblement penser à notre équipe à ce passage du poème. Cependant, avec la marginalisation du Royaume-Uni au sein de l'UE et l'accélération de l'intégration de l'Euroland (conformément à nos anticipations), nous constatons le franchissement d'une barrière psychologique dans l'Euroland : le temps n'est plus à ménager les susceptibilités de nos « alliés » anglo-saxons, mais tout simplement à se protéger des attaques de nos adversaires anglo-saxons. A la différence des médias et experts « mainstream » de Wall Street et la City, les Eurolandais ne perdent pas de temps « à travestir les paroles pour exciter des sots » ; ils se contentent de prendre en compte la réalité, d'avancer en faisant le « gros dos » et de couper une à une les cordes qui les reliaient aux places financières (et demain politiques) britanniques et américaines. Notre équipe ne peut pas résister au plaisir de présenter une nouvelle illustration de la manipulation quotidienne d'information dont se sont fait une spécialité la plupart des médias britanniques et américains. Ainsi, dans le cadre de notre rubrique « les gueux parlent aux sots », MarketWatch publiait un article le 14/12/2011 intitulé « Les gestionnaires de fonds craignent une dislocation de la zone Euro ». Or, que découvrait-on à l'intérieur de l'article ? Que leur principale crainte (pour 75% d'entre eux) était une nouvelle dégradation de la note US (48% pensant que cela arrivera en 2012) alors que seulement 44% d'entre eux pensaient qu'il y avait un risque qu'un pays sorte un jour de la zone Euro, sans mention de délai. Un titrage honnête aurait donc dû être « Les gestionnaires de fond craignent une nouvelle dégradation de la note US ». Mais comme on dit en Français: « à la guerre, comme à la guerre ! » (2) Alors que, dans le même temps, la population US s'est accrue de 30 millions de personnes, soit une hausse de 10%. Source : Washington Post, 02/12/2011 (3) Pour notre équipe, 2013/2014 va offrir, via le Congrès et du fait d'un soutien massif dans l'opinion publique, une occasion sans précédent de réclamer un démantèlement de la Fed. Les convictions anti-fédérales des Tea Parties et celles anti-Wall Street d'OWS trouveront là un irrésistible point de convergence. (4) Source : New York Times, 24/11/2011 (5) A ce sujet, il est particulièrement intéressant de constater que les agences de notation, Moody's en tête, n'ont à nouveau rien vu venir puisque, jusqu'à la fin de l'été 2011, MF Global était recommandé par ces agences … alors même que la société était déjà en train de ponctionner les comptes de ses clients pour tenter de survivre. Que ceux qui croient que leurs investissements sont mieux protégés à Wall Street ou la City méditent sur ce « détail ». (6) Sources : MSNBC, 11/2011 ; RT, 08/12/2011 (7) Ce sont des chiffres qui classent dorénavant le pays intégralement dans la catégorie « tiers-monde » en matière sociale. Source : Beforeitsnews, 29/11/2011 (8) Le pays ne parvient plus à générer de la croissance comme l'explique Gregor McDonald dans SeekingAlpha du 05/12/2011. (9) Source : Washington Post, 29/11/2011 (10) En fait, il ne l'a jamais quittée depuis 2008, sauf techniquement du fait des mesures macro-économiques. Mais personne ne se nourrit de macro-économie… sauf les économistes. (11) Source : Financial Times, 11/12/2011 (12) A ce propos, si certains croient que la Fed est intervenue avec les autres grandes banques centrales il y a un mois pour venir au « secours » de l'Euroland, c'est qu'ils connaissent mal les motivations de l'interventionnisme US : les Etats-Unis interviennent hors de leurs frontières uniquement s'ils estiment que leurs intérêts directs sont en jeu. Leurs interventions à retardement dans les deux guerres mondiales illustrent très bien cette réalité. En l'occurrence, comme nous l'avions analysé et comme le montre le cas MF Global, c'est tout simplement pour sauver leurs propres banques et institutions financières qu'ils sont intervenus. Elles oscillent au bord du vide, avec leurs bilans gonflés de produits dérivés dont personne ne connaît la teneur exacte; et seule la Fed empêche depuis trois ans la faillite généralisée de Wall Street. Comme anticipé dans plusieurs GEAB, la Fed sait très bien que l'Euroland est LE détonateur par excellence qui déclenchera l'explosion de Wall Street et la City ; alors elle arrose la mèche tant qu'elle peut le faire. (13) Sans même mentionner le nombre croissant de procédures judiciaires dans lesquelles elles sont entraînées. Source : Le Monde, 04/12/2011 (14) Surtout que selon LEAP/E2020, la fin 2012 verra l'Euroland mettre en place une politique pro-active d'utilisation de l'Euro pour tous ses échanges y compris énergétiques. La décision prise par les banques eurolandaises de cesser leurs activités de prêt en Dollars US (elles sont passées d'un besoin de 1 300 milliards USD à 800 Milliards USD en 2011 et probablement moins de 500 milliards USD en 2012), suite à la tentative d'asphyxie dont elles ont été victimes par leurs partenaires de Wall Street et de la City, va automatiquement se traduire par un double phénomène dès la fin 2012 : une forte baisse de la demande mondiale de Dollars US ; et au contraire, une activité renforcée de prêts en Euro. Comme la Chine continue, avec ses partenaires BRICS, à accroître les échanges en Yuan (ou dans les autres monnaies BRICS), 2012 va donc être caractérisée par l'émergence de deux grandes zones monétaires à côté de la zone Dollar. Cet effondrement de la demande mondiale de Dollars pour les transactions commerciales va générer un retour massif de Dollars vers les Etats-Unis et contribuer à l'épisode hyper-inflationniste que nous anticipons pour 2013. Source : New York Times, 01/12/2011 |

| Brics Bank to Rival World Bank, IMF & Dollar Posted: 02 Apr 2012 12:03 AM PDT Gold traded volatile in Asia with quick gains seen at the open prior to determined selling which saw a drop to $1,663.77/oz. in late Asian trading and European trading saw further weakness. |

| View From the Turret: The Beat Goes On… Posted: 01 Apr 2012 11:09 PM PDT

Barron's noted that this was the best quarterly start to the year since 1998 with the Dow rising 8% and the S&P 500 gaining 12%. It's interesting to note that more speculative issues have been stronger as investors willingly take on risk to boost returns. The Nasdaq Composite rose 18.7%, driven not only by strong performance from AAPL, but also renewed optimism in the technology sector. Bull markets often climb a "wall of worry" and this period is no exception. There are a number of key issues that economists are concerned with:

But as Jack discussed on Thursday, overbought markets tend to stay overbought and we have not yet seen any signs of volatility that typically accompany a change in direction. As we kick off a brand new quarter, the Mercenary trading book has a relatively balanced assortment of exposure, with bullish positions in technology, shipping, consumer staples and biotechnology – offset by bearish positions in metals, for-profit education, domestic drillers and the Australian dollar. The second quarter promises to be a dynamic period, with earnings season offering clarity as to whether investors have become too optimistic, or if the recovery really is propelling robust corporate earnings. Below are a few of the key areas we are watching this week…

Get your 14-day Free Trial to the Live Feed See our trading book in real-time. Trade setups, execution reports and real time market commentary. Claim your 14-day trial to the Mercenary Live Feed. Long Bonds Peak After multiple promises of low interest rates, ample liquidity, and multiple quantitative easing programs, 20-year treasuries have been sitting at historically high prices (bond prices obviously trade opposite to interest rates). But as economic growth finally begins to pick up momentum, Fed officials are becoming less committed to an era of permanently low rates. The fear of inflation is becoming a more serious issue and bond traders are taking note. The UltraShort Lehman 20+ Yr Treasury (TBT) ETF trades inversely to long-bond prices. So as long-dated treasuries come under pressure, TBT is breaking out of its slump and could turn out to be a tremendous trade for us this quarter. On February 17th, the Mercenary Live Feed took an initial position in the ETF as the price action appeared to be ready to break out of a multi-month consolidation. Our initial entry was just a bit premature as bonds didn't actually end up breaking down until midway through March. But after a significant break on March 14th, and mild two-week consolidation, long bonds are breaking down again heading into the second quarter. We used the action on Friday to pyramid our position – adding more exposure and tightening our risk point on the entire position. As long-term interest rates naturally adjust higher, long bonds should continue to fall – giving us opportunity to capitalize on a new emerging trend with plenty of room to run.  Natural Gas Slide Natural gas prices have been under pressure for years now. This is not "new" news, but it still surprises me to hear how many traders are bullish on gas – simply because prices are the lowest we have seen in decades. Let's think about this for a second… there is a reason natural gas prices are so low. Fracking technology has opened up vast reserves that were previously unable to be produced, leading to a domestic glut. An article in Barron's this weekend noted that as oil producers ramp up drilling for liquids, the production of gas as a bi-product continues. So even though major producers like Chesapeake are shutting down vast amounts of production (due to lower prices), the gas glut continues to rise. Tack on a historically warm winter (very low natural gas consumption) and the glut gets even worse. The Barron's article noted that there is a distinct possibility that the US will run out of storage capacity for natural gas by October this year. So given the dynamics it is pretty tough to make a bullish argument for natty… As part of Global Trend Capture – our trend following service – Nathan O. has been consistently short the United States Natural Gas Fund (UNG). His most recent position was entered on 3/1 at a price of $19.84. We're trading from a position of strength, with our current risk point locking in a solid profit – and UNG appears to be accelerating lower as we enter a new quarter. Managed Care Reacts to Supreme Court Debate Towards the end of last week, the managed care (or health insurance) industry got a boost from the Supreme Court discussion of Obama's healthcare mandate. Below is an excerpt from a Thesis Notes penned over the weekend as part of the Mercenary Live Feed.

Managed care stocks spiked sharply higher when it became apparent that the court understood the economic implications of not allowing the insurers to consider pre-existing conditions. From a trading perspective, we're not interested in buying into the hype initially. Purchasing an over-bought stock is a recipe for getting shaken out and sustaining losses. But if the managed care companies pull back for a few days and then continue their bullish trend, it would give us a chance to enter a few of these names with reasonable risk points – allowing us to profit from a continuation of the bullish action. An hour before the opening bell, markets look relatively tame with traders waiting for the ISM factory index to be released later this morning. We'll be watching the flows carefully as portfolio managers put new capital to work. The broad market is in a very stable trend, but various sectors and groups have plenty of shifting dynamics in play. Trade 'em well this week! |

| April 2, 1792 : The US Coinage Act Posted: 01 Apr 2012 10:00 PM PDT History of Gold |

| Gold is Manipulated (But That's Okay) Posted: 01 Apr 2012 09:30 PM PDT The price of gold has always been an object of interest for governments and central bankers. The reason is simple enough to understand: Gold is an objective measure of the degree to which fiat money is being managed well or managed poorly. |

| Jim Grant: ‘gold price is the reciprocal of faith in central banks’ Posted: 01 Apr 2012 09:15 PM PDT Up, down, and back up again: that about sums up the action in the gold and silver markets last week, though neither bulls nor bears were strong enough to move the gold price out of its trading ... |

| GOLD: 2012 Will Be The Year Of Delivery Posted: 01 Apr 2012 09:04 PM PDT Gold paper to physical ratio is a stunning 100:1, 2012 will be the year of delivery from commodityonline.com: If gold traders of the futures markets need any more convincing to invest in physical gold, Ned Naylor-Leyland has one- the paper to physical ratio. Simply put- the number of open positions for just 1 bar of gold. Ned Naylor-Leyland is the investment director at Cheviot Asset Management In an interview with CNBC, Ned says that there is about a 100 open positions in the gold paper market for just 1 bar of physical gold. "The numbers are pretty frightening". This means that there are a 100 people who have electronically "bought" gold but there is just 1 bar of gold. Need any more reason to switch to physical. Ned goes on to add that he believes 2012 will be the year of delivery. As people start to realize the importance of owning gold, more and more investors will put their money in the physical gold. Keep on reading @ commodityonline.com |

| Gold Rush: What Happened To Bling? Posted: 01 Apr 2012 09:02 PM PDT

from guardian.co.uk: It may be more desirable than ever, but gold is so expensive that more of us are selling jewellery rather than buying it. Emma John goes on the trail of the precious metal and discovers who's getting their fingers on it. It's not much bigger than a Wispa bar and it certainly doesn't glister. David Merry, who has been working with gold for more than 40 years, drops the ingot into my hand. It's deceptively heavy. It's also worth more than a Jaguar XF. The Assay Office in the City of London is an intriguing blend of ancient and modern. At one station, workers sit engraving hallmarks into silver plate by hand; at another, they're scanning pieces of jewellery with an x-ray machine to work out their gold content. Nestled within Goldsmiths' Hall, the Assay Office's history dates back to 1327 when it was created to test the quality of the precious metals crafted by gold- and silversmiths. Keep on reading @ guardian.co.uk |

| Eric Sprott talks with Ellis Martin Posted: 01 Apr 2012 08:40 PM PDT In this exclusive feature, Ellis Martin interviews Sprott Money CEO Eric Sprott for a wide-based discussion of today and tomorrow's commodity market issues: gold vs silver, stocks and bullion, recession or is it depression, recovery or collapse supply and demand and the virtual reality purveyance of the banks and the Fed, the media and the politicos. Mr. Sprott predicted early on the market collapse of 2008. Listen to his current observations. from opportunityshow: ~TVR |

| Posted: 01 Apr 2012 06:09 PM PDT If you rode gold from $800 to $1,900, oil, from $35 to $110, and Apple rom $200 to $610, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it does now? |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The first quarter of 2012 is now in the books – and it was quite a strong period for equities…

The first quarter of 2012 is now in the books – and it was quite a strong period for equities…

No comments:

Post a Comment